A Bibliometric Retrospection of CSR from the Lens of Finance and Economics: Towards Sustainable Development

Abstract

1. Introduction

- What are the major themes of CSR in finance and economics literature based on bibliometric coupling analysis?

- What are the influential aspects and conceptual structure of major themes of the literature on CSR in finance and economics?

- What are the theme specific research gaps in CSR literature?

- What future research directions are provided in the recent CSR literature?

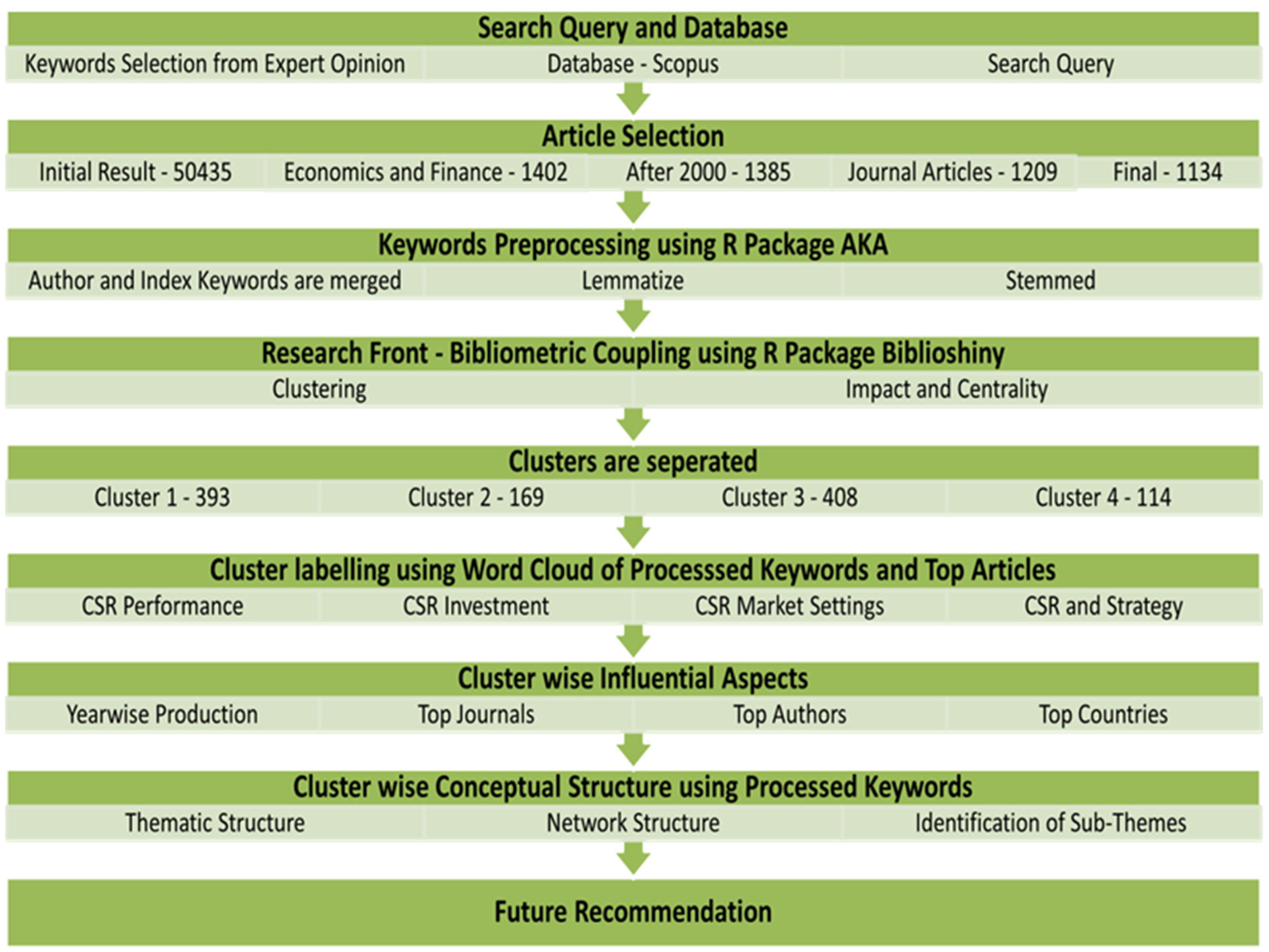

2. Materials and Methods

3. Results and Discussion

3.1. CSR and Performance (CSPR)

3.1.1. Influential Aspects of CSPR Theme

3.1.2. Conceptual Aspects of CSR and Performance (CSPR) Theme

3.2. CSR and Investments (CSRI)

3.2.1. Influential Aspects of CSRI

3.2.2. Conceptual Aspects of CSRI Theme

3.3. CSR and Market Settings (CSMS) Theme

3.3.1. Influential Aspects of CSMS Theme

3.3.2. Conceptual Aspects of CSMS Theme

3.4. CSR and Strategy (CSCS) Theme

3.4.1. Influential Aspects of CSCS Theme

3.4.2. Conceptual Aspects of CSCS Theme

4. Future Research Agenda

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Scopus Query

References

- Filene, E.A. A Simple Code of Business Ethics. Ann. Am. Acad. Political Soc. Sci. 1922, 101, 223–228. [Google Scholar] [CrossRef]

- Carroll, A.B.; Brown, J.A. Corporate Social Responsibility: A Review of Current Concepts, Research, and Issues. Corp. Soc. Responsib. 2018, 2, 39–69. [Google Scholar] [CrossRef]

- Carroll, A.B. Corporate social responsibility (CSR) and the COVID-19 pandemic: Organizational and managerial implications. J. Strategy Manag. 2021, 14, 315–330. [Google Scholar] [CrossRef]

- Nurunnabi, M.; Alfakhri, Y.; Alfakhri, D.H. CSR in Saudi Arabia and Carroll’s Pyramid: What is ‘known’ and ‘unknown’? J. Mark. Commun. 2020, 26, 874–895. [Google Scholar] [CrossRef]

- Frynas, J.G.; Yamahaki, C. Corporate social responsibility: Review and roadmap of theoretical perspectives. Bus. Ethics 2016, 25, 258–285. [Google Scholar] [CrossRef]

- Ji, Y.G.; Tao, W.; Rim, H. Theoretical Insights of CSR Research in Communication from 1980 to 2018: A Bibliometric Network Analysis. J. Bus. Ethics 2021, 177, 327–349. [Google Scholar] [CrossRef]

- Barauskaite, G.; Streimikiene, D. Corporate social responsibility and financial performance of companies: The puzzle of concepts, definitions and assessment methods. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 278–287. [Google Scholar] [CrossRef]

- Fernández-Gago, R.; Cabeza-García, L.; Godos-Díez, J.L. How significant is corporate social responsibility to business research? Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1809–1817. [Google Scholar] [CrossRef]

- Vărzaru, A.A.; Bocean, C.G.; Nicolescu, M.M. Rethinking corporate responsibility and sustainability in light of economic performance. Sustainability 2021, 13, 1–21. [Google Scholar] [CrossRef]

- Arora, S.; Sur, J.K.; Chauhan, Y. Does corporate social responsibility affect shareholder value? Evidence from the COVID-19 crisis. Int. Rev. Financ. 2021, 22, 325–334. [Google Scholar] [CrossRef]

- Aria, M.; Cuccurullo, C. bibliometrix: An R-tool for comprehensive science mapping analysis. J. Informetr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Liu, Y.; Rafols, I.; Rousseau, R. A framework for knowledge integration and diffusion. J. Doc. 2012, 68, 31–44. [Google Scholar] [CrossRef]

- Zupic, I.; Čater, T. Bibliometric Methods in Management and Organization. Organ. Res. Methods 2015, 18, 429–472. [Google Scholar] [CrossRef]

- Gu, Z.; Meng, F.; Farrukh, M. Mapping the Research on Knowledge Transfer: A Scientometrics Approach. IEEE Access 2021, 9, 34647–34659. [Google Scholar] [CrossRef]

- Lithin, B.M.; Chakraborty, S.; Kumar Ghosh, B.; Shenoy, U.R. Overview of bond mutual funds: A systematic and bibliometric review. Cogent Bus. Manag. 2021, 8, 1979386. [Google Scholar] [CrossRef]

- Pranckutė, R. Web of science (Wos) and scopus: The titans of bibliographic information in today’s academic world. Publications 2021, 9, 12. [Google Scholar] [CrossRef]

- Vladutz, G.; Cook, J. Bibliographic coupling and subject relatedness. Proc. Am. Soc. Inf. Sci. 1984, 21, 204–207. [Google Scholar]

- Moral-muñoz, J.A.; Herrera-viedma, E.; Santisteban-espejo, A.; Cobo, M.J.; Herrera-viedma, E.; Santisteban-espejo, A.; Cobo, M.J. Software tools for conducting bibliometric analysis in science: An upto-date review. Prof. Inf. 2020, 29, 1–20. [Google Scholar] [CrossRef]

- Cobo, M.J.; López-Herrera, A.G.; Herrera-Viedma; Herrera, F.E. Science Mapping Software Tools: Review, Analysis, and Cooperative Study Among Tools. J. Am. Soc. Inf. Sci. Technol. 2011, 7, 1382–1402. [Google Scholar] [CrossRef]

- Stemler, S. An overview of content analysis. Pract. Assess. Res. Eval. 2001, 7, 2000–2001. [Google Scholar] [CrossRef]

- Broadus, R.N. Toward a definition of “bibliometrics”. Scientometrics 1987, 12, 373–379. [Google Scholar] [CrossRef]

- Diodato, V. Dictionary of Bibliometrics; Routledge: Oxfordshire, UK, 1994. Available online: https://eric.ed.gov/?id=ED386214 (accessed on 3 February 2022).

- Sott, M.K.; Bender, M.S.; Furstenau, L.B.; Machado, L.M.; Cobo, M.J.; Bragazzi, N.L. 100 Years of Scientific Evolution of Work and Organizational Psychology: A Bibliometric Network Analysis from 1919 to 2019. Front. Psychol. 2020, 11. [Google Scholar] [CrossRef] [PubMed]

- Rodríguez-Fernández, M.; Gaspar-González, A.I.; Sánchez-Teba, E.M. Sustainable social responsibility through stakeholders engagement. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2425–2436. [Google Scholar] [CrossRef]

- Forliano, C.; De Bernardi, P.; Yahiaoui, D. Entrepreneurial universities: A bibliometric analysis within the business and management domains. Technol. Forecast. Soc. Change 2021, 165, 120522. [Google Scholar] [CrossRef]

- Yoo, S.; Managi, S. Disclosure or action: Evaluating ESG behavior towards financial performance. Financ. Res. Lett. 2021, 44, 102108. [Google Scholar] [CrossRef]

- Jiang, X.; Yang, J.; Yang, W.; Zhang, J. Do employees’ voices matter? Unionization and corporate environmental responsibility. Int. Rev. Econ. Financ. 2021, 76, 1265–1281. [Google Scholar] [CrossRef]

- Halkos, G.; Nomikos, S. Corporate social responsibility: Trends in global reporting initiative standards. Econ. Anal. Policy 2021, 69, 106–117. [Google Scholar] [CrossRef]

- Gao, F.; Faff, R.; Navissi, F. Corporate philanthropy: Insights from the 2008 Wenchuan Earthquake in China. Pac. Basin Financ. J. 2012, 20, 363–377. [Google Scholar] [CrossRef]

- Chen, J.; Dong, W.; Tong, J.Y.; Zhang, F.F. Corporate philanthropy and investment efficiency: Empirical evidence from China. Pac. Basin Financ. J. 2018, 51, 392–409. [Google Scholar] [CrossRef]

- Fu, Y.; Qin, Z. Institutional cross-ownership and corporate philanthropy. Financ. Res. Lett. 2021. [CrossRef]

- Yu, E.P.Y.; Luu, B.V. International variations in ESG disclosure–Do cross-listed companies care more? Int. Rev. Financ. Anal. 2021, 75, 101731. [Google Scholar] [CrossRef]

- Zhang, J.; Zi, S.; Shao, P.; Xiao, Y. The value of corporate social responsibility during the crisis: Chinese evidence. Pac. Basin Financ. J. 2020, 64, 101432. [Google Scholar] [CrossRef]

- Jawadi, F.; Jawadi, N.; Idi Cheffou, A. A statistical analysis of uncertainty for conventional and ethical stock indexes. Q. Rev. Econ. Financ. 2019, 74, 9–17. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Chan, K.; Cheng, L.T.W.; Wang, X. The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Financ. Res. Lett. 2021, 38, 101716. [Google Scholar] [CrossRef] [PubMed]

- Omura, A.; Roca, E.; Nakai, M. Does responsible investing pay during economic downturns: Evidence from the COVID-19 pandemic. Financ. Res. Lett. 2021, 42, 101914. [Google Scholar] [CrossRef]

- Erragraguy, E.; Revelli, C. Should Islamic investors consider SRI criteria in their investment strategies? Financ. Res. Lett. 2015, 14, 11–19. [Google Scholar] [CrossRef]

- Galema, R.; Plantinga, A.; Scholtens, B. The stocks at stake: Return and risk in socially responsible investment. J. Bank. Financ. 2008, 32, 2646–2654. [Google Scholar] [CrossRef]

- O’sullivan, M. The innovative enterprise and corporate governance. Camb. J. Econ. 2000, 24, 393–416. [Google Scholar] [CrossRef]

- Bauer, R.; Otten, R.; Rad, A.T. Ethical investing in Australia: Is there a financial penalty? Pac. Basin Financ. J. 2006, 14, 33–48. [Google Scholar] [CrossRef]

- Borgers, A.C.T.; Pownall, R.A.J. Attitudes towards socially and environmentally responsible investment. J. Behav. Exp. Financ. 2014, 1, 27–44. [Google Scholar] [CrossRef]

- Borgers, A.; Derwall, J.; Koedijk, K.; Ter Horst, J. Do social factors influence investment behavior and performance? Evidence from mutual fund holdings. J. Bank. Financ. 2015, 60, 112–126. [Google Scholar] [CrossRef]

- Geczy, C.C.; Stambaugh, R.F.; Levin, D. Investing in Socially Responsible Mutual Funds. Rev. Asset Pricing Stud. 2021, 11, 309–351. [Google Scholar] [CrossRef]

- Ielasi, F.; Rossolini, M.; Limberti, S. Sustainability-themed mutual funds: An empirical examination of risk and performance. J. Risk Financ. 2018, 19, 247–261. [Google Scholar] [CrossRef]

- Joliet, R.; Titova, Y. Equity SRI funds vacillate between ethics and money: An analysis of the funds’ stock holding decisions. J. Bank. Financ. 2018, 97, 70–86. [Google Scholar] [CrossRef]

- Renneboog, L.; Ter Horst, J.; Zhang, C. Socially responsible investments: Institutional aspects, performance, and investor behavior. J. Bank. Financ. 2008, 32, 1723–1742. [Google Scholar] [CrossRef]

- Doni, N.; Ricchiuti, G. Market equilibrium in the presence of green consumers and responsible firms: A comparative statics analysis. Resour. Energy Econ. 2013, 35, 380–395. [Google Scholar] [CrossRef]

- Kim, H.; Lee, J. Distributive fairness and the social responsibility of the representative of a group. Appl. Econ. 2021, 53, 1264–1279. [Google Scholar] [CrossRef]

- Kopel, M.; Brand, B. Socially responsible firms and endogenous choice of strategic incentives. Econ. Model. 2012, 29, 982–989. [Google Scholar] [CrossRef]

- Goering, G.E. Corporate social responsibility and marketing channel coordination. Res. Econ. 2012, 66, 142–148. [Google Scholar] [CrossRef]

- Ouchida, Y. Cooperative choice of corporate social responsibility in a bilateral monopoly model. Appl. Econ. Lett. 2019, 26, 799–806. [Google Scholar] [CrossRef]

- Fanti, L.; Buccella, D. Corporate social responsibility in unionised network industries. Int. Rev. Econ. 2021, 68, 235–262. [Google Scholar] [CrossRef]

- Elfenbein, D.W.; Fisman, R.; Mcmanus, B. Charity as a substitute for reputation: Evidence from an online marketplace. Rev. Econ. Stud. 2012, 79, 1441–1468. [Google Scholar] [CrossRef]

- Hoxby, C.M. All school finance equalizations are not created equal. Q. J. Econ. 2001, 116, 1189–1231. [Google Scholar] [CrossRef]

- Ntim, C.G.; Soobaroyen, T. Corporate governance and performance in socially responsible corporations in South Africa: New empirical insights from a multi-theoretical perspective. Corp. Gov. Int. Rev. 2013, 21, 468–484. [Google Scholar] [CrossRef]

- Gil Lafuente, A.M.; Barcellos Paula, L. Algorithms applied in the sustainable management of human resources. Fuzzy Econ. Rev. 2010, 15, 39–51. [Google Scholar] [CrossRef]

- Stubelj, I.; Dolenc, P.; Biloslavo, R.; Nahtigal, M.; Laporšek, S. Corporate purpose in a small post-transitional economy: The case of Slovenia. Econ. Res. Ekon. Istraz. 2017, 30, 818–835. [Google Scholar] [CrossRef]

- Málovics, G.; Csigéné, N.N.; Kraus, S. The role of corporate social responsibility in strong sustainability. J. Socio Econ. 2008, 37, 907–918. [Google Scholar] [CrossRef]

- Sawyer, M. Financialisation, industrial strategy and the challenges of climate change and environmental degradation. Int. Rev. Appl. Econ. 2021, 35, 338–354. [Google Scholar] [CrossRef]

- Khan, K.; Amin, I.U.; Ahmed, S. Management Decisions, Stock Prices and the Economy. Int. Res. J. Financ. Econ. 2011, 75, 7–13. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0–80054745401&partnerID=40&md5=78256cd0abd2854dcc86f9a7a173e3ec. (accessed on 15 March 2022).

- Iancu, A.; Popescu, L.; Popescu, V. Factors influencing social entrepreneurship intentions in Romania. Econ. Res. -Ekon. Istraz. 2021, 34, 1190–1201. [Google Scholar] [CrossRef]

- Mah, S.K. Earth, wind, and fire: Pace plays a vital esg role. J. Struct. Financ. 2021, 26, 73–85. [Google Scholar] [CrossRef]

- Qoyum, A.; Al Hashfi, R.U.; Zusryn, A.S.; Kusuma, H.; Qizam, I. Does an Islamic-SRI portfolio really matter? Empirical application of valuation models in Indonesia. Borsa Istanb. Rev. 2021, 21, 105–124. [Google Scholar] [CrossRef]

- Landi, G.C.; Iandolo, F.; Renzi, A.; Rey, A. Embedding sustainability in risk management: The impact of environmental, social, and governance ratings on corporate financial risk. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1096–1107. [Google Scholar] [CrossRef]

- Radu, C.; Smaili, N. Alignment Versus Monitoring: An Examination of the Effect of the CSR Committee and CSR-Linked Executive Compensation on CSR Performance. J. Bus. Ethics 2021, 180, 145–163. [Google Scholar] [CrossRef]

- Yang, J.; Basile, K. Communicating Corporate Social Responsibility: External Stakeholder Involvement, Productivity and Firm Performance. J. Bus. Ethics 2022, 178, 501–517. [Google Scholar] [CrossRef]

- Liao, L.; Chen, G.; Zheng, D. Corporate social responsibility and financial fraud: Evidence from China. Account. Financ. 2019, 59, 3133–3169. [Google Scholar] [CrossRef]

- Hunjra, A.I.; Boubaker, S.; Arunachalam, M.; Mehmood, A. How does CSR mediate the relationship between culture, religiosity and firm performance? Financ. Res. Lett. 2021, 39, 101587. [Google Scholar] [CrossRef]

- Beloskar, V.D.; Rao, S.V.D.N. Corporate Social Responsibility: Is Too Much Bad?—Evidence from India. In Asia-Pacific Financial Markets; Springer: Tokyo, Japan, 2021; Issue 0123456789. [Google Scholar] [CrossRef]

- Chahine, S.; Daher, M.; Saade, S. Doing good in periods of high uncertainty: Economic policy uncertainty, corporate social responsibility, and analyst forecast error. J. Financ. Stab. 2021, 56, 100919. [Google Scholar] [CrossRef]

- Zhao, T. Board network, investment efficiency, and the mediating role of CSR: Evidence from China. Int. Rev. Econ. Financ. 2021, 76, 897–919. [Google Scholar] [CrossRef]

- Kong, D.; Cheng, X.; Jiang, X. Effects of political promotion on local firms’ social responsibility in China. Econ. Model. 2021, 95, 418–429. [Google Scholar] [CrossRef]

- Wong, W.C.; Batten, J.A.; Ahmad, A.H.; Mohamed-Arshad, S.B.; Nordin, S.; Adzis, A.A. Does ESG certification add firm value? Financ. Res. Lett. 2021, 39, 101593. [Google Scholar] [CrossRef]

- Briscese, G.; Feltovich, N.; Slonim, R.L. Who benefits from corporate social responsibility? Reciprocity in the presence of social incentives and self-selection. Games Econ. Behav. 2021, 126, 288–304. [Google Scholar] [CrossRef]

- Lan, T.; Chen, Y.; Li, H.; Guo, L.; Huang, J. From driver to enabler: The moderating effect of corporate social responsibility on firm performance. Econ. Res. Ekon. Istraz. 2021, 34, 2240–2262. [Google Scholar] [CrossRef]

- Takahashi, H.; Yamada, K. When the Japanese stock market meets COVID-19: Impact of ownership, China and US exposure, and ESG channels. Int. Rev. Financ. Anal. 2021, 74, 101670. [Google Scholar] [CrossRef]

- Jost, S.; Erben, S.; Ottenstein, P.; Zülch, H. Does CSR impact mergers & acquisition premia? New international evidence. Financ. Res. Lett. 2021, 46, 102237. [Google Scholar] [CrossRef]

- Azmi, W.; Hassan, M.K.; Houston, R.; Karim, M.S. ESG activities and banking performance: International evidence from emerging economies. J. Int. Financ. Mark. Inst. Money 2021, 70, 101277. [Google Scholar] [CrossRef]

- Zhang, J.; Zi, S. Socially responsible investment and firm value: The role of institutions. Financ. Res. Lett. 2021, 41, 101806. [Google Scholar] [CrossRef]

- Cerqueti, R.; Ciciretti, R.; Dalò, A.; Nicolosi, M. ESG investing: A chance to reduce systemic risk. J. Financ. Stab. 2021, 54, 100887. [Google Scholar] [CrossRef]

- Díaz, V.; Ibrushi, D.; Zhao, J. Reconsidering systematic factors during the COVID-19 pandemic–The rising importance of ESG. Financ. Res. Lett. 2021, 38, 101870. [Google Scholar] [CrossRef]

- Bofinger, Y.; Heyden, K.J.; Rock, B.; Bannier, C.E. The sustainability trap: Active fund managers between ESG investing and fund overpricing. Financ. Res. Lett. 2021, 45, 102160. [Google Scholar] [CrossRef]

- Ferriani, F.; Natoli, F. ESG risks in times of COVID-19. Appl. Econ. Lett. 2021, 28, 1537–1541. [Google Scholar] [CrossRef]

- Janik, B.; Bartkowiak, M. Are sustainable investments profitable for investors in Central and Eastern European Countries (CEECs)? Financ. Res. Lett. 2021, 44, 102102. [Google Scholar] [CrossRef]

- Mehta, P.; Singh, M.; Mittal, M.; Singla, H. Is knowledge alone enough for socially responsible investing? A moderation of religiosity and serial mediation analysis. Qual. Res. Financ. Mark. 2021, 14, 413–432. [Google Scholar] [CrossRef]

- Umar, Z.; Gubareva, M. The relationship between the COVID-19 media coverage and the Environmental, Social and Governance leaders equity volatility: A time-frequency wavelet analysis. Appl. Econ. 2021, 53, 3193–3206. [Google Scholar] [CrossRef]

- Xu, L.; Lee, S.H. Corporate Profit Tax and Strategic Corporate Social Responsibility under Foreign Acquisition. B.E. J. Theor. Econ. 2021, 22, 123–151. [Google Scholar] [CrossRef]

- Breton, M.; Crettez, B.; Hayek, N. Corporate social responsibility, profits, and welfare in a duopolistic market. Appl. Econ. 2021, 53, 6897–6909. [Google Scholar] [CrossRef]

- Garcia, A.; Leal, M.; Lee, S.H. Competitive CSR in a strategic managerial delegation game with a multiproduct corporation. Int. Rev. Econ. 2021, 68, 301–330. [Google Scholar] [CrossRef]

- Fernández-Ruiz, J. Corporate social responsibility in a supply chain and competition from a vertically integrated firm. Int. Rev. Econ. 2021, 68, 209–233. [Google Scholar] [CrossRef]

- Leal, M.; García, A.; Lee, S.-H. Strategic CSR and merger decisions in multiproduct mixed markets with state-holding corporation. Int. Rev. Econ. Financ. 2021, 72, 319–333. [Google Scholar] [CrossRef]

- Xu, H.; Xu, X.; Yu, J. The Impact of Mandatory CSR Disclosure on the Cost of Debt Financing: Evidence from China. Emerg. Mark. Financ. Trade 2021, 57, 2191–2205. [Google Scholar] [CrossRef]

- Remišová, A.; Lašáková, A.; Stankovičová, I.; Stachová, P. Unethical practices in the slovak business environment. Ekon. Cas. 2021, 69, 59–87. [Google Scholar] [CrossRef]

- Alsahlawi, A.M.; Chebbi, K.; Ammer, M.A. The impact of environmental sustainability disclosure on stock return of saudi listed firms: The moderating role of financial constraints. Int. J. Financ. Stud. 2021, 9, 4. [Google Scholar] [CrossRef]

- Jakubik, P.; Uguz, S. Impact of green bond policies on insurers: Evidence from the European equity market. J. Econ. Financ. 2021, 45, 381–393. [Google Scholar] [CrossRef]

- Zhang, C.; Liu, Q.; Ge, G.; Hao, Y.; Hao, H. The impact of government intervention on corporate environmental performance: Evidence from China’s national civilized city award. Financ. Res. Lett. 2021, 39. [Google Scholar] [CrossRef]

- Novak, M. Social innovation and Austrian economics: Exploring the gains from intellectual trade. Rev. Austrian Econ. 2021, 34, 129–147. [Google Scholar] [CrossRef]

- Rey-Martí, A.; Díaz-Foncea, M.; Alguacil-Marí, P. The determinants of social sustainability in work integration social enterprises: The effect of entrepreneurship. Econ. Res. Ekon. Istraz. 2021, 34, 929–947. [Google Scholar] [CrossRef]

- Wang, C. Monopoly with corporate social responsibility, product differentiation, and environmental R&D: Implications for economic, environmental, and social sustainability. J. Clean. Prod. 2021, 287, 125433. [Google Scholar] [CrossRef]

- Ammar Ali, G.; Nazim, H.; Khan, S.A.; Khan, Z.; Saeed, A. Governing Corporate Social Responsibility Decoupling: The Effect of the Governance Committee on Corporate Social Responsibility Decoupling. J. Bus. Ethics 2022, 1–26. [Google Scholar] [CrossRef]

| Theme | Subtheme | Future Research Questions | Author |

|---|---|---|---|

| Theme I—CSPR | CSR-Perf-CG | 1. What is the impact of environmental strategies and corporate governance features on Firm performance mediated by CSR? | Hunjra et al., 2021 [68] |

| 2. What are the institutional infrastructural and regulatory environmental differences among different countries from CSR perspective? | Beloskar & Rao, 2021 [69] | ||

| 3. What is the impact of institutional investors on the quality of corporate governance in different institutional settings? | Chahine et al., 2021 [70] | ||

| 4. How does CSR mediate the relationship of complex social network among all stakeholders and investments or other corporate performance metrices? | Zhao, 2021 [71] | ||

| CSR-Perf-CP | 5. What is the impact of political incentives to specific CSR investment on employee welfare and charitable donations? | Kong et al., 2021 [72] | |

| 6. What is the relationship of ESG and firm-value in a comparative analysis in a capitalist and socialist context? | Wong et al., 2021 [73] | ||

| 7. Are the CSR philanthropic activities by corporations intended for social objectives or is it just a marketing tool? | Briscese et al., 2021 [74] | ||

| 8. What is the moderating effect of CSR on environmental management in climate change mitigation? | Lan et al., 2021 [75] | ||

| CSR-Value-crisis | 9. Does corporate philanthropy enhance firm performance and firm value in China? | Fu & Qin, 2021 [31] | |

| 10. Does ESG commitment and investor awareness impact of indirect ownership through the exchange-traded fund have a positive impact on abnormal returns in Japanese banks? | Takahashi & Yamada, 2021 [76] | ||

| 11. Are the ESG scores appropriate to explore CSR performance if controlled for firm-level reporting? | Jost et al., 2021 [77] | ||

| 12. Are the individual ESG activities by emerging market banks and their communities helping policy makers to develop better ESG strategy? | Azmi et al., 2021 [78] | ||

| Theme I CSRI | CSR-Invest-COVID | 13. How does the environmental pillar of ESG materialize the global stock markets? | Zhang et al., 2021 [79] |

| 14. During financial recession, are investments with higher levels of ESG compliance more resilient to contagion risk? | Cerqueti et al., 2021 [80] | ||

| 15. Are the environmental, social and governance pillars of ESG empirically and theoretically effective in resilient industries? | Díaz et al., 2021 [81] | ||

| 16. Are the fund managers effective in building any triangular relationship between fund mispricing, sustainability, and returns based on customer preferences? | Bofinger et al., 2021 [82] | ||

| Theme CSRI | CSR-SRI-CG | 17. What are the driving channels to investors’ sustainability preferences while making investment decisions? | Ferriani & Natoli, 2021 [83] |

| 18. Are sustainable investments profitable for investors using a comparative analysis? | Janik & Bartkowiak, 2021 [84] | ||

| 19. Are there any individual and social aspects that affect SRI intentions along with awareness? | Mehta et al., 2021 [85] | ||

| CSR-Eco-Growth | 20. Is there any alternative methodology to evaluate the relationship between media coverage and ESG leaders’ equity volatility? | Umar & Gubareva, 2021 [86] | |

| Is there any alternative methodology to evaluate the relationship between media coverage and ESG leaders’ equity volatility? | CSR-exp-market | 21. What is the relationship between CSR and distributive fairness of managers when they are offered material payoffs? To what extent does the systematic relationship survive? | Kim & Lee, 2021 [48] |

| 22. In an Stackelberg competition, what is the impact of demand and cost functions on strategic CSR decision firms under foreign acquisition? | Xu & Lee, 2021 [87] | ||

| CSR-Duop-Profit | 23. What is the impact of consumers’ awareness about firms’ social initiatives on pollution and profits? | Breton et al., 2021 [88] | |

| 24. Does the lack of consumers’ awareness impact firms’ commitment to CSR and production decisions? | Breton et al., 2021 [88] | ||

| 25. What is the impact of cultural differences on CSR disclosure using a comparative analysis? | Halkos & Nomikos, 2021 [28] | ||

| 26. What is the impact of environmental policies and governance on CSR disclosure in a comparative analysis? | Halkos & Nomikos, 2021 [28] | ||

| 27. Do the stringent legal framework impact CSR reporting of firms? | Halkos & Nomikos, 2021 [28] | ||

| CSR-Stkhold-strategy | 28. Is there a relationship between duopoly modelling at firms’ different managerial levels and R& D activities? | Garcia et al., 2021 [89] | |

| CSR-Mono-Model | 29. Is there a change in equilibrium CSR levels in a comparative analysis of Cournot and Bertrand competition? 30. Does the timing of the game affect the CSR equilibrium levels in Cournot and Bertrand competitions? | Fernández-Ruiz, 2021 [90] | |

| Theme III—CSMS | CSR-mixed-private | 31. Does foreign ownership holding affect the state holding corporation decision on strategic CSR and merger in mixed markets? | Leal et al., 2021 [91] |

| CSR-Isl-Cournot | 32. What is the effect of private ownership and foreign ownership on strategic CSR and partial privatization policy? 33. In a Stackelberg leadership competition, what is the impact of foreign penetration on privatization policy? | Xu et al., 2021 [92] | |

| Theme IV—CSCS | CSR-Strategy- Ethics | 34. Is unethical business practice a result of economic and development factors in an economy? 35. In a comparative analysis, is there a relationship between economic policies and unethical business practices? | Remišová et al., 2021 [93] |

| CSR-Sustain-Dev | 36. Does the sustainability disclosure have significant impact on stock returns? 37. Do the firms’ size and regulations moderate the relationship sustainability disclosure and stock returns? | Alsahlawi et al., 2021 [94] | |

| CSR-Eco-Growth | 38. Do the insurers as long-term investors naturally play a crucial role in green bond markets? | Jakubik & Uguz, 2021 [95] | |

| 39. Which tools are available to accurately show methods or dimensions for formal measurement, and what is informal institutions’ role in socially responsible investments and firm value? | Zhang & Zi, 2021 [96] | ||

| CSR-Social-Entre | 40. Can rigorous comparative studies of the relative advantages and disadvantages of non-state and state involvement help in social innovative activities? | Novak, 2021 [97] | |

| 41. How is social sustainability related to employees and management policies in comparative analysis? | Rey-Martí et al., 2021 [98] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hamid, S.; Saeed, A.; Farooq, U.; Alnori, F. A Bibliometric Retrospection of CSR from the Lens of Finance and Economics: Towards Sustainable Development. Sustainability 2022, 14, 16852. https://doi.org/10.3390/su142416852

Hamid S, Saeed A, Farooq U, Alnori F. A Bibliometric Retrospection of CSR from the Lens of Finance and Economics: Towards Sustainable Development. Sustainability. 2022; 14(24):16852. https://doi.org/10.3390/su142416852

Chicago/Turabian StyleHamid, Samreen, Asif Saeed, Umar Farooq, and Faisal Alnori. 2022. "A Bibliometric Retrospection of CSR from the Lens of Finance and Economics: Towards Sustainable Development" Sustainability 14, no. 24: 16852. https://doi.org/10.3390/su142416852

APA StyleHamid, S., Saeed, A., Farooq, U., & Alnori, F. (2022). A Bibliometric Retrospection of CSR from the Lens of Finance and Economics: Towards Sustainable Development. Sustainability, 14(24), 16852. https://doi.org/10.3390/su142416852