Economic Analysis of Renewable Power-to-Gas in Norway

Abstract

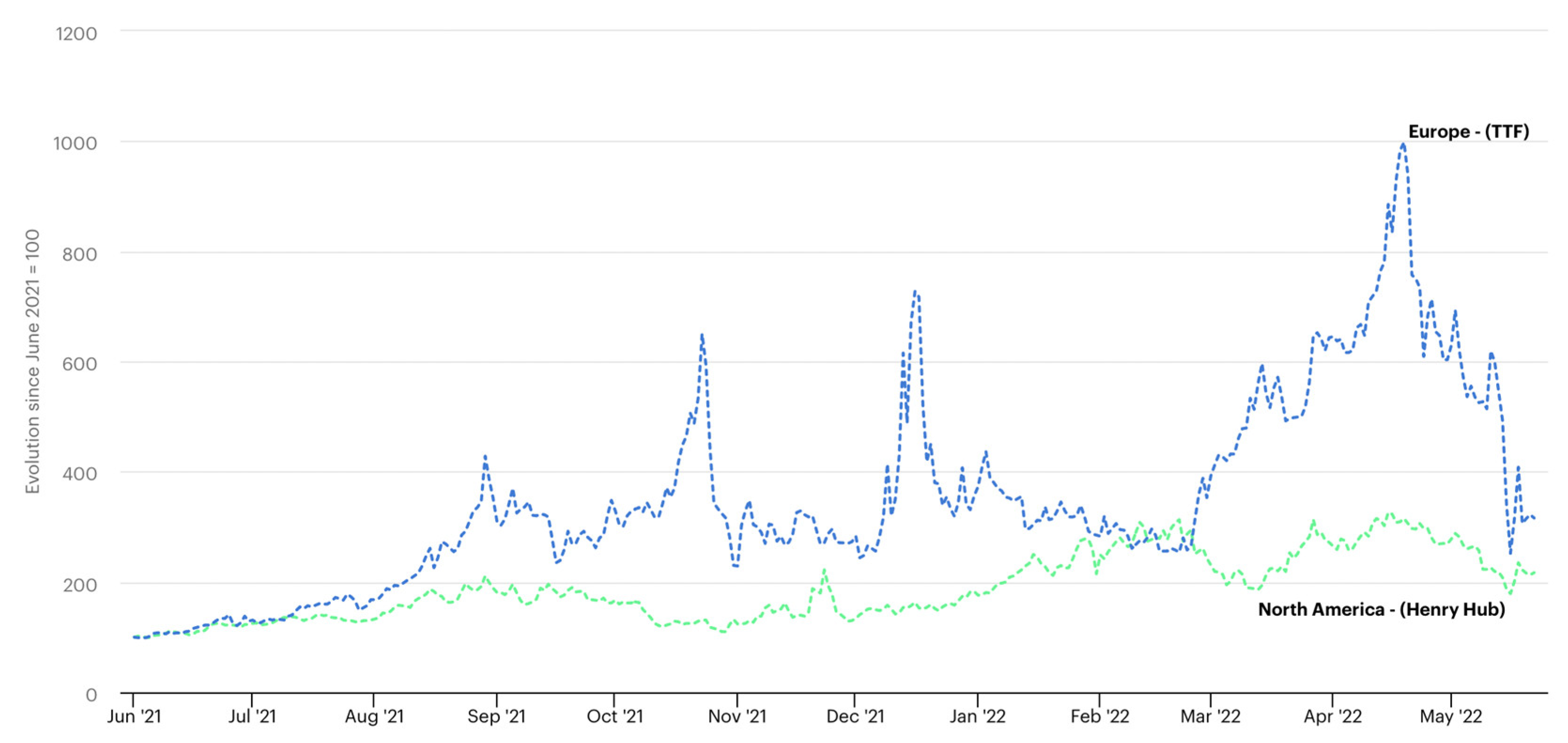

1. Introduction

2. Literature Review

2.1. Existing PtG Projects and Associated Studies

2.2. Norway as a Potential SNG Supplier for Europe

3. Materials and Methods

3.1. Methodology

3.2. PtG System Configuration

3.3. Principal Scenarios

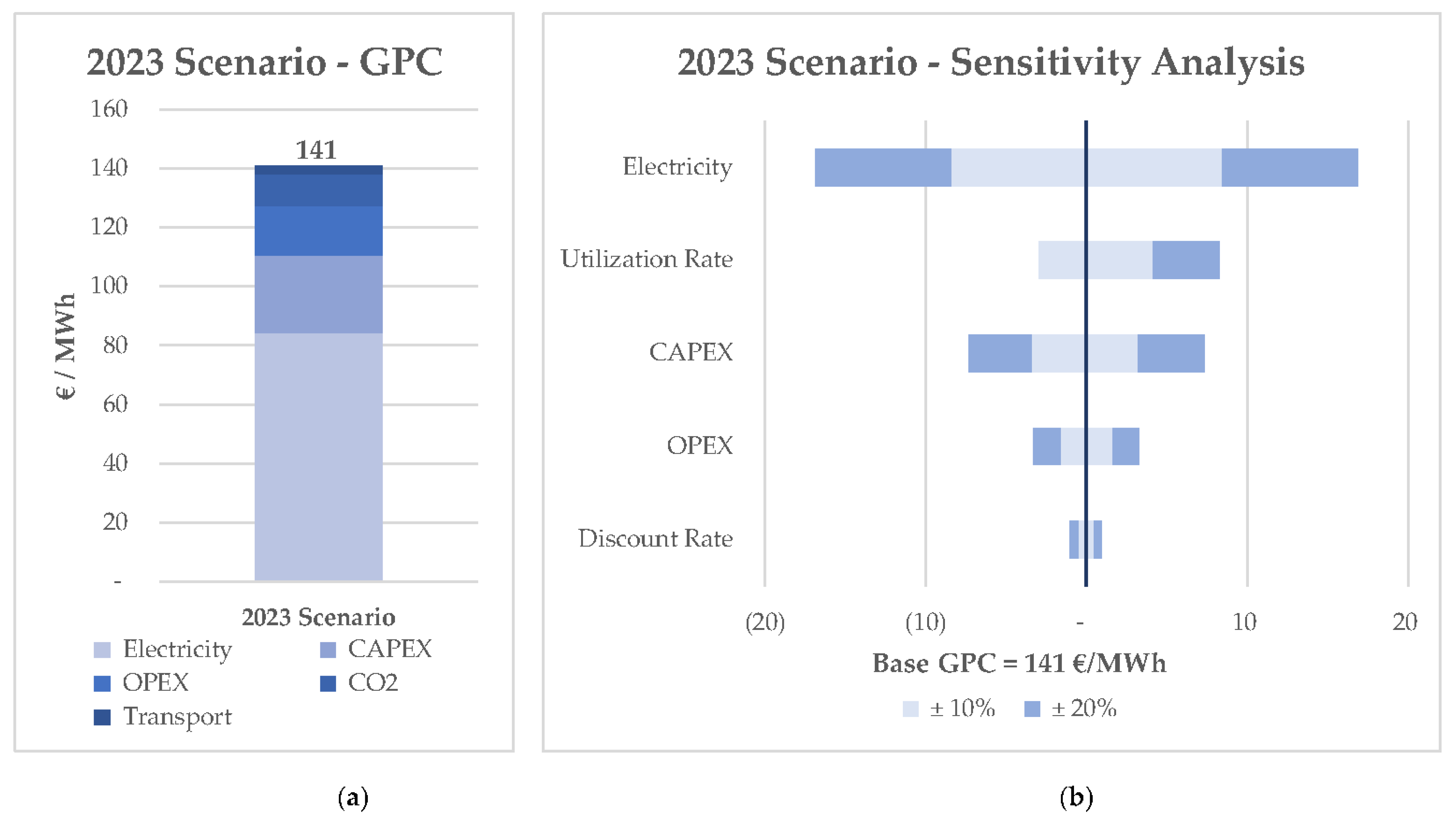

3.4. Sensitivity Analysis

- CAPEX: Both electrolyzers and methanation processes have high learning rates, due to which there is significant uncertainty in estimates of future equipment and construction pricing. Furthermore, it has a significant impact on GPC. CAPEX includes both the initial setup costs, as well as costs towards electrolyzer stack replacement.

- OPEX: The overall operating expenses are expected to decrease due to improving technology, but can also increase, depending on site-specific conditions, the labor market, land lease and other macroeconomic variables.

- Electricity Price: Electricity is the main energy input in the PtG process, and hence a key variable for the sensitivity analysis. Statnett’s long-term market analysis also states that Norway’s electricity pricing is expected to become more volatile over the coming years [50], which further highlights the necessity for a sensitivity analysis.

- Utilization Rate: The realized production of SNG is based on the overall utilization rate of the PtG facility, which can go up or down based on availability of electricity and system maintenance requirements. Since the base utilization rate is significantly high at 90%, a sensitivity range of only +10% to −20% is considered. The corresponding range of utilization rate is 72% to 99%.

- Discount Rate: The discount rate will be dependent on both market conditions and the individual investor. It is expected to be lower for state-owned utilities, and higher for private small companies. Additionally, a low interest rate regime is expected to decrease the discount rate. A sensitivity analysis has been carried out to isolate these impacts on GPC.

4. Results

4.1. 2023 Scenario

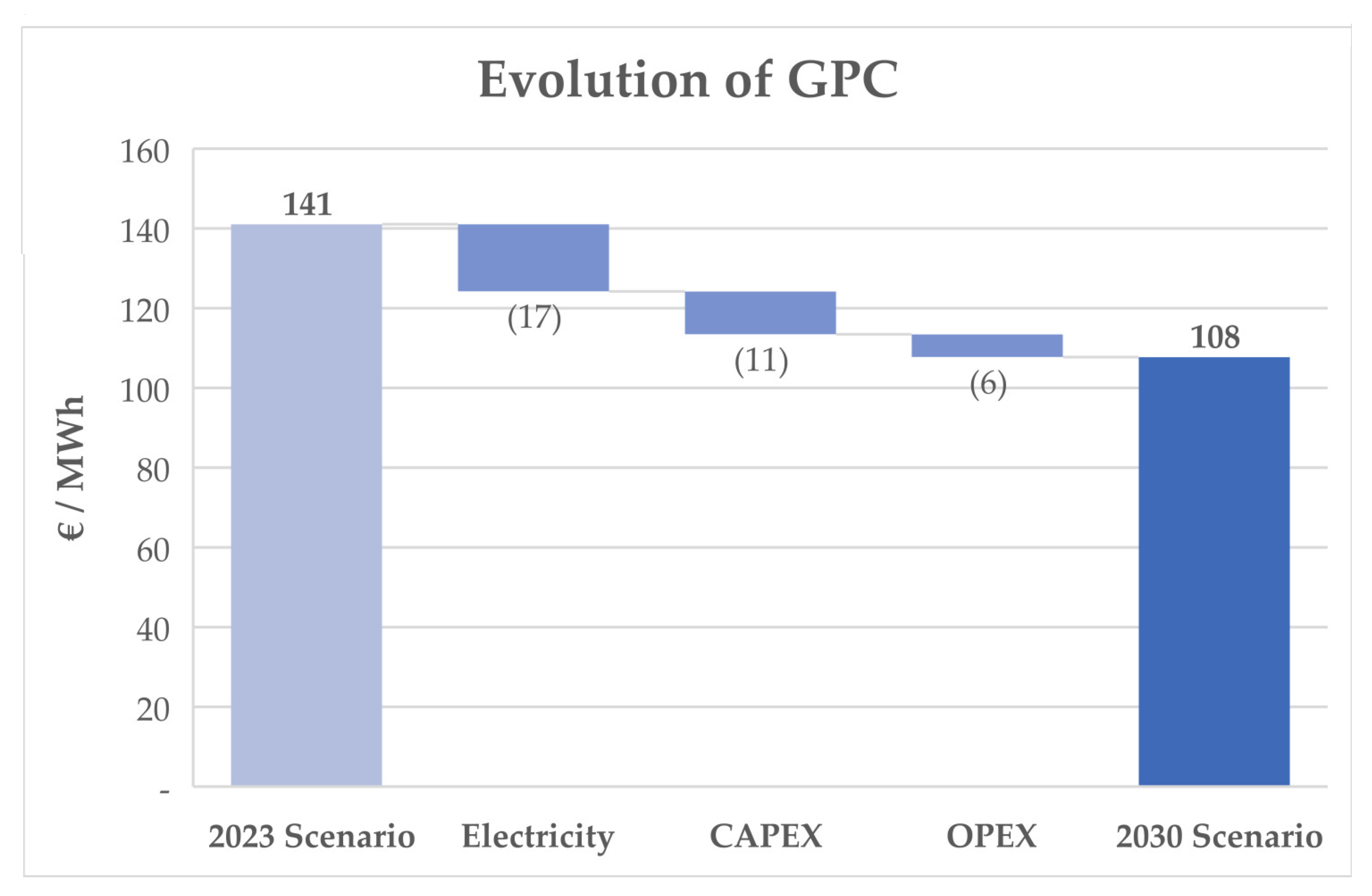

4.2. 2030 Scenario

5. Discussion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hall, S. 3 Charts that Show the State of Europe’s Energy Crisis Right Now. Available online: https://www.weforum.org/agenda/2022/10/europe-energy-crisis-gas-report-iea/ (accessed on 27 October 2022).

- Eurostat Shedding Light on Energy in the EU: Where Does Our Energy Come from? Available online: https://ec.europa.eu/eurostat/cache/infographs/energy/bloc-2a.html (accessed on 27 October 2022).

- Eurostat Shedding Light on Energy in the EU: From Where Do We Import Energy? Available online: https://ec.europa.eu/eurostat/cache/infographs/energy/bloc-2c.html (accessed on 27 October 2022).

- Trading Economics EU Natural Gas—2022 Data. Available online: https://tradingeconomics.com/commodity/eu-natural-gas (accessed on 27 October 2022).

- European Commission REPowerEU: Affordable, Secure and Sustainable Energy for Europe. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/repowereu-affordable-secure-and-sustainable-energy-europe_en (accessed on 20 October 2022).

- Delivering the European Green Deal. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/delivering-european-green-deal_en (accessed on 27 October 2022).

- Miranda, P.E. (Ed.) Application of Hydrogen by Use of Chemical Reactions of Hydrogen and Carbon Dioxide. In Science and Engineering of Hydrogen-Based Energy Technologies; Academic Press: Cambridge, MA, USA, 2019; Chapter 5.3.3; pp. 279–289. ISBN 978-0-12-814251-6. [Google Scholar]

- Wai, S.; Ota, Y.; Sugiyama, M.; Nishioka, K. Evaluation of a Sabatier Reaction Utilizing Hydrogen Produced by Concentrator Photovoltaic Modules under Outdoor Conditions. Appl. Sci. 2020, 10, 3144. [Google Scholar] [CrossRef]

- Maroufmashat, A.; Fowler, M. Transition of Future Energy System Infrastructure; through Power-to-Gas Pathways. Energies 2017, 10, 1089. [Google Scholar] [CrossRef]

- Wang, A.; van der Leun, K.; Peters, D.; Buseman, M. European Hydrogen Backbone: How a Dedicated Infrastructure Can Be Created; Guidehouse: Chicago, IL, USA, 2020. [Google Scholar]

- ACER. Transporting Pure Hydrogen by Repurposing Existing Gas Infrastructure: Overview of Existing Studies and Reflections on the Conditions of Repurposing; European Union Agency for the Cooperation of Energy Regulators (ACER): Ljubljana, Slovenia, 2021; p. 23. [Google Scholar]

- Agora Energiewende; AFRY Management Consulting. No-Regret Hydrogen: Charting Early Steps for H₂ Infrastructure in Europe; Agora: Baltimore, MD, USA, 2021; p. 92. [Google Scholar]

- IEA Evolution of Key Regional Natural Gas Prices, June 2021–October 2022. Available online: https://www.iea.org/topics/global-energy-crisis (accessed on 27 October 2022).

- Sterner, M. Bioenergy and Renewable Power Methane in Integrated 100% Renewable Energy Systems. Limiting Global Warming by Transforming Energy Systems; Kassel University Press GmbH: Kassel, Germany, 2009; ISBN 978-3-89958-799-9. [Google Scholar]

- Sterner, M.; Specht, M. Power-to-Gas and Power-to-X—The History and Results of Developing a New Storage Concept. Energies 2021, 14, 6594. [Google Scholar] [CrossRef]

- European Union HELMETH Project. Available online: http://www.helmeth.eu/ (accessed on 28 October 2022).

- European Union STORE&GO. Available online: https://www.storeandgo.info/ (accessed on 28 October 2022).

- Thema, M.; Bauer, F.; Sterner, M. Power-to-Gas: Electrolysis and methanation status review. Renew. Sustain. Energy Rev. 2019, 112, 775–787. [Google Scholar] [CrossRef]

- Blanco, H. Impact Analysis and Scenarios Design. Available online: https://www.storeandgo.info/fileadmin/downloads/deliverables_2020/Update/2018-05-29_STOREandGO_D6.3_RUG_accepted.pdf (accessed on 25 October 2022).

- Böhm, H.; Zauner, A.; Rosenfeld, D.C.; Tichler, R. Projecting cost development for future large-scale power-to-gas implementations by scaling effects. Appl. Energy 2020, 264, 114780. [Google Scholar] [CrossRef]

- Hoffman, M. Report on Economic Analysis of Test Cases. Available online: https://www.storeandgo.info/fileadmin/downloads/deliverables_2020/20200713-STOREandGO_D5.10_DBI_Report_on_economic_analysis_of_test_cases.pdf (accessed on 27 October 2022).

- Böhm, H.; Goers, S.; Zauner, A. Estimating future costs of power-to-gas – a component-based approach for technological learning. Int. J. Hydrogen Energy 2019, 44, 30789–30805. [Google Scholar] [CrossRef]

- Gorre, J.; Ortloff, F.; van Leeuwen, C. Production costs for synthetic methane in 2030 and 2050 of an optimized Power-to-Gas plant with intermediate hydrogen storage. Appl. Energy 2019, 253, 113594. [Google Scholar] [CrossRef]

- Agora Verkehrswende; Agora Energiewende and Frontier Economics. The Future Cost of Electricity-Based Synthetic Fuels; Agora: Baltimore, MD, USA, 2018; p. 96. [Google Scholar]

- Gorre, J.; Ruoss, F.; Karjunen, H.; Schaffert, J.; Tynjälä, T. Cost benefits of optimizing hydrogen storage and methanation capacities for Power-to-Gas plants in dynamic operation. Appl. Energy 2020, 257, 113967. [Google Scholar] [CrossRef]

- Ipsakis, D.; Varvoutis, G.; Lambropoulos, A.; Mandela, E.; Papaefthimiou, S.; Marnellos, G.E.; Konsolakis, M. A Circular Approach to Upgrade Cement-based CO2 and Renewable H2: Techno-economic Analysis of SNG Production. Chem. Eng. Trans. 2021, 88, 673–678. [Google Scholar] [CrossRef]

- Van Leeuwen, C.; Mulder, M. Power-to-gas in electricity markets dominated by renewables. Appl. Energy 2018, 232, 258–272. [Google Scholar] [CrossRef]

- Jiang, W.; Zhao, S.; Yang, T. Economic and Technical Analysis of Power to Gas Factory Taking Karamay as an Example. Sustainability 2022, 14, 5929. [Google Scholar] [CrossRef]

- Dominguez-Gonzalez, G.; Muñoz-Hernandez, J.I.; Bunn, D.; Garcia-Checa, C.J. Integration of Hydrogen and Synthetic Natural Gas within Legacy Power Generation Facilities. Energies 2022, 15, 4485. [Google Scholar] [CrossRef]

- BloombergNEF. Wind and Solar Corporate PPA Prices Rise Up To 16.7% Across Europe. Available online: https://about.bnef.com/blog/wind-and-solar-corporate-ppa-prices-rise-up-to-16-7-across-europe/ (accessed on 27 October 2022).

- IEA. Norway 2022: Energy Policy Review; IEA: Paris, France, 2022. [Google Scholar]

- NVE. Langsiktig Kraftmarkedsanalyse 2021–2040; NVE: Eden Prairie, MN, USA, 2021. [Google Scholar]

- Nowtricity. Available online: https://www.nowtricity.com/ (accessed on 27 October 2022).

- Jåstad, E.O.; Trotter, I.M.; Bolkesjø, T.F. Long term power prices and renewable energy market values in Norway—A probabilistic approach. Energy Econ. 2022, 112, 106182. [Google Scholar] [CrossRef]

- US Department of Energy. Levelized Cost of Energy (LCOE). Available online: https://www.energy.gov/sites/prod/files/2015/08/f25/LCOE.pdf/ (accessed on 25 October 2022).

- Van Leeuwen, C.; Zauner, A. Report on the Costs Involved with PtG Technologies and Their Potentials Across the EU. Available online: https://www.storeandgo.info/fileadmin/downloads/deliverables_2020/Update/20180424_STOREandGO_D8.3_RUG_accepted.pdf/ (accessed on 27 October 2022).

- L’Huby, T.; Gahlot, P.; Debarre, R. Hydrogen Applications and Business Models; Kearney Energy Transition Institute: Paris, France, 2020. [Google Scholar]

- Reksten, A.H.; Thomassen, M.S.; Møller-Holst, S.; Sundseth, K. Projecting the future cost of PEM and alkaline water electrolysers; a CAPEX model including electrolyser plant size and technology development. Int. J. Hydrogen Energy 2022, 47, 38106–38113. [Google Scholar] [CrossRef]

- Holst, M.; Aschbrenner, S.; Smolinka, T.; Voglstatter, C.; Grimm, G. Cost Forecast for Low-Temperature Electrolysis—Technology Driven Bottom-Up Prognosis for PEM and Alkaline Water Electrolysis Systems; Fraunhofer Institute for Solar Energy Systems ISE: Freiburg im Breisgau, Germany, 2021. [Google Scholar]

- Between Two Stacks: How a PEM Electrolyzer is More Cost-Effective Than an Alkaline Electrolyzer—Plug Power. Available online: https://www.plugpower.com/between-two-stacks-how-a-pem-electrolyzer-is-more-cost-effective-than-an-alkaline-electrolyzer/ (accessed on 2 November 2022).

- Agarwal, R. Transition to a Hydrogen-Based Economy: Possibilities and Challenges. Sustainability 2022, 14, 15975. [Google Scholar] [CrossRef]

- Thema, M.; Weidlich, T.; Hörl, M.; Bellack, A.; Mörs, F.; Hackl, F.; Kohlmayer, M.; Gleich, J.; Stabenau, C.; Trabold, T.; et al. Biological CO2-Methanation: An Approach to Standardization. Energies 2019, 12, 1670. [Google Scholar] [CrossRef]

- Götz, M.; Lefebvre, J.; Mörs, F.; McDaniel Koch, A.; Graf, F.; Bajohr, S.; Reimert, R.; Kolb, T. Renewable Power-to-Gas: A technological and economic review. Renew. Energy 2016, 85, 1371–1390. [Google Scholar] [CrossRef]

- Frontera, P.; Macario, A.; Ferraro, M.; Antonucci, P. Supported Catalysts for CO2 Methanation: A Review. Catalysts 2017, 7, 59. [Google Scholar] [CrossRef]

- Zauner, A.; Bohm, H.; Rosenfeld, D.C.; Tichler, R. Analysis on Future Technology Options and on Techno-Economic Optimization; Store&Go: Kassel, Germany, 2019. [Google Scholar]

- Lazard’s Levelized Cost of Hydrogen Analysis. 2021. Available online: https://www.lazard.com/media/451779/lazards-levelized-cost-of-hydrogen-analysis-vf.pdf (accessed on 1 November 2022).

- DeSantis, D.; James, B.D.; Houchins, C.; Saur, G.; Lyubovsky, M. Cost of long-distance energy transmission by different carriers. iScience 2021, 24, 103495. [Google Scholar] [CrossRef]

- Statistics Norway Electricity Prices August 2022. Available online: https://www.ssb.no/en/energi-og-industri/energi/statistikk/elektrisitetspriser (accessed on 1 November 2022).

- Statnett Long-Term Market Analysis. Available online: https://www.statnett.no/en/for-stakeholders-in-the-power-industry/our-analyses-and-assessments/long-term-market-analysis/ (accessed on 1 November 2022).

- Statnett. Long-term Market Analysis 2020–2050, Update Spring 20221; Statnett: Oslo, Norway, 2021. [Google Scholar]

- PEM Electrolyzer ME450: H-TEC SYSTEMS Products. Available online: https://www.h-tec.com/en/products/detail/h-tec-pem-electrolyser-me450/me450/ (accessed on 1 November 2022).

- Frank, E.; Gorre, J.; Ruoss, F.; Friedl, M.J. Calculation and analysis of efficiencies and annual performances of Power-to-Gas systems. Appl. Energy 2018, 218, 217–231. [Google Scholar] [CrossRef]

- Finbox WACC for Equinor ASA (DNQ). Available online: https://finbox.com/DB:DNQ/explorer/wacc (accessed on 1 November 2022).

- Bohm, H.; Zauner, A.; Goers, S.; Tichler, R.; Kroon, P. Report on Experience Curves and Economies of Scale. Available online: https://www.storeandgo.info/fileadmin/downloads/deliverables_2020/Update/20181031_STOREandGO_D7.5_EIL_accepted.pdf (accessed on 25 October 2022).

- Schoots, K.; Ferioli, F.; Kramer, G.J.; van der Zwaan, B.C.C. Learning curves for hydrogen production technology: An assessment of observed cost reductions. Int. J. Hydrogen Energy 2008, 33, 2630–2645. [Google Scholar] [CrossRef]

- Bristowe, G.; Smallbone, A. The Key Techno-Economic and Manufacturing Drivers for Reducing the Cost of Power-to-Gas and a Hydrogen-Enabled Energy System. Hydrogen 2021, 2, 273–300. [Google Scholar] [CrossRef]

- Saba, S.M.; Müller, M.; Robinius, M.; Stolten, D. The investment costs of electrolysis—A comparison of cost studies from the past 30 years. Int. J. Hydrogen Energy 2018, 43, 1209–1223. [Google Scholar] [CrossRef]

- Luo, Z.; Hu, Y.; Xu, H.; Gao, D.; Li, W. Cost-Economic Analysis of Hydrogen for China’s Fuel Cell Transportation Field. Energies 2020, 13, 6522. [Google Scholar] [CrossRef]

- Norwegian Petroleum Emissions to Air. Available online: https://www.norskpetroleum.no/en/environment-and-technology/emissions-to-air/ (accessed on 1 November 2022).

- IEA. Gas Market Report, Q2-2022; OECD: Paris, France, 2022. [Google Scholar]

- IEA. Gas Market Report, Q3-2022; OECD: Paris, France, 2022. [Google Scholar]

- IEA. Gas Market Report Q4-2022; OECD: Paris, France, 2022. [Google Scholar]

- Gebre, S.; Elkin, E. Europe’s Deepening Fertilizer Crunch Threatens Food Crisis. Available online: https://www.bloomberg.com/news/articles/2022-08-26/europe-s-fertilizer-crisis-deepens-with-70-of-capacity-hit#:~:text=Europe's%20fertilizer%20crunch%20is%20deepening,is%20hurting%20industries%20across%20Europe (accessed on 3 November 2022).

- Amaro, S. Goldman Sachs Expects European Natural Gas Prices to Tumble 30% in the Coming Months. Available online: https://www.cnbc.com/2022/11/02/goldman-sachs-expects-european-gas-prices-to-tumble-30percent.html (accessed on 3 November 2022).

- Schlautmann, R.; Böhm, H.; Zauner, A.; Mörs, F.; Tichler, R.; Graf, F.; Kolb, T. Renewable Power-to-Gas: A Technical and Economic Evaluation of Three Demo Sites Within the STORE&GO Project. Chem. Ing. Tech. 2021, 93, 568–579. [Google Scholar] [CrossRef]

- Tsafos, N. How Much Does U.S. LNG Cost in Europe? Available online: https://www.csis.org/blogs/energy-headlines-versus-trendlines/how-much-does-us-lng-cost-europe (accessed on 3 November 2022).

- Guilera, J.; Ramon Morante, J.; Andreu, T. Economic viability of SNG production from power and CO2. Energy Convers. Manag. 2018, 162, 218–224. [Google Scholar] [CrossRef]

- Wiser, R.; Rand, J.; Seel, J.; Beiter, P.; Baker, E.; Lantz, E.; Gilman, P. Expert elicitation survey predicts 37% to 49% declines in wind energy costs by 2050. Nat. Energy 2021, 6, 555–565. [Google Scholar] [CrossRef]

| Alkaline Electrolysis | Proton-Exchange Membrane (PEM) | Solid Oxide Electrolysis Cell (SOEC) | |

|---|---|---|---|

| Description | Alkaline technology is used extensively in the chlorine industry; a strong base such as potassium hydroxide is generally used as the electrolyte due to its high conductivity. | PEM uses a ionically conductive solid polymer; hydrogen ions travel through the polymer membrane toward the cathode. PEM has a very short reponse time of less than 2 s. | SOEC is based on steam water electrolysis at high temperatures, thereby reducing need for electrical power. Heat is only needed to vaporize water and can be obtained from waste industrial heat. |

| Capital Costs (stack-only, >1 MW, USD/kWe) | 270; <100 expected | 400; <100 expected | >2000; <200 expected |

| Efficiency (%, LHV) | 52–69% | 60–77% | 74–81% excluding heat to vaporize water) |

| Typical Plant Size (tpd H2) | 60; 100 expected | 50–80; 100–120 expected | <20; 80 expected |

| Stack Lifetime (in thousands of hours) | 60; 100 expected | 50–80; 100–120 expected | <20; 80 expected |

| Operating Temperature (°C) | 60–80 | 50–80 | 650–1000 |

| Operating Pressure (bar) | 1–30 | 20–50 | 1 |

| Expected R&D Improvements | Scaling benefits to reduce costs; improvement in lifetime; improved heat exchangers. | Scaling benefits to reduce costs; improvement in material and component lifetimes. | Improvement in component lifetime by improving the resistance to high temperatures and improving the response to fluctuating energy inputs. |

| Pros and Cons | Most mature technology; has the lowest capital cost but also the lowest efficiency. | Highly efficient but more expensive than alakaline electrolysis. | High future potential but still in the developmental stage. |

| Item | 2023 Scenario | 2030 Scenario |

|---|---|---|

| Electrolyzer Capacity | 10 MWel | 100 MWel |

| SNG Production | 33.2 GWhSNG/year | 344.4 GWhSNG/year |

| Electricity Consumption | 79.2 GWh/year | 788.7 GWh/year |

| Operations Lifetime | 20 years | 20 years |

| Item | 2023 Scenario | 2030 Scenario | Remarks | Reference(s) |

|---|---|---|---|---|

| CAPEX 1 | ||||

| PEM Electrolyzer Stack | 450 €/kWel | 245 €/kWel | See discussion below | [15,23,27,36,45,46], Assumption |

| Balance of System | 660 €/kWel | 535 €/kWel | ||

| Stack Replacement Cost | 225 €/kWel | 123 €/kWel | ||

| Stack Lifetime | 60,000 h | 70,000 h | ||

| Methanation Unit | 600 €/kWSNG | 275 €/kWSNG | [45] | |

| Contingency | 10% | 10% | % of Total Installed Cost | Assumption |

| OPEX | ||||

| Electrolyzer | 3% | 1.5% | % of Electrolyzer CAPEX | [23,46], Assumption |

| Methanation | 3% | 3% | % of Methanation CAPEX | [25] |

| Insurance | 0.5% | 0.5% | % of Total Installed Cost | Assumption |

| CO2 | 50 €/ton | 50 €/ton | Includes cost to capture and transport CO2. | [23,36] |

| Transportation | 2.3 €/MWh | 2.3 €/MWh | Assuming pipeline distance of 1000 km between Norway and Germany. | [47] |

| Energy Costs | ||||

| Electricity | 2022: 44 €/MWh 2030: 40 €/MWh 2035: 32 €/MWh 2040: 23 €/MWh | See discussion below | [34,48,49,50], Assumption | |

| Utilization and Efficiency | ||||

| Utilization Rate | 90% | 90% | High utilization is assumed due to continuous operation mode (See discussion below). | Assumption |

| Electrolyzer Efficiency (% HHV) | 75% | 78% | Electrolyzer efficiency is assumed to increase by 2030. | [25,51] |

| Methanation Efficiency | 85% | 85% | Assuming that surplus heat generated in methanation is used. | [52] |

| Financing | ||||

| Depreciation | Straight line depreciation over useful life | Assumed total plant life of 20 years, policy support through accelerated depreciation could improve returns. | Assumption | |

| Discount Rate | 9% | 9% | Based on the weighted average cost of capital for a large energy company in Norway. | [53] |

| Funding source | Equity | Equity | 100% equity is considered to simplify model. | Assumption |

| 2023 Scenario | Levelized Cost (€/MWhSNG) | % of Total Costs |

|---|---|---|

| Electricity | 84 | 60% |

| CAPEX | 26 | 19% |

| OPEX | 17 | 12% |

| CO2 | 11 | 8% |

| Transport | 3 | 2% |

| Total | 141 | 100% |

| 2030 Scenario | Levelized Cost (€/MWh) | % of Total Costs |

|---|---|---|

| Electricity | 67 | 63% |

| CAPEX | 16 | 15% |

| OPEX | 11 | 10% |

| CO2 | 11 | 10% |

| Transport | 3 | 2% |

| Total | 108 | 100% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Agarwal, R. Economic Analysis of Renewable Power-to-Gas in Norway. Sustainability 2022, 14, 16882. https://doi.org/10.3390/su142416882

Agarwal R. Economic Analysis of Renewable Power-to-Gas in Norway. Sustainability. 2022; 14(24):16882. https://doi.org/10.3390/su142416882

Chicago/Turabian StyleAgarwal, Rishabh. 2022. "Economic Analysis of Renewable Power-to-Gas in Norway" Sustainability 14, no. 24: 16882. https://doi.org/10.3390/su142416882

APA StyleAgarwal, R. (2022). Economic Analysis of Renewable Power-to-Gas in Norway. Sustainability, 14(24), 16882. https://doi.org/10.3390/su142416882