Fresh Insight through a Keynesian Theory Approach to Investigate the Economic Impact of the COVID-19 Pandemic in Pakistan

Abstract

:1. Introduction

2. The Macroeconomic Effects of a Pandemic in Pakistan

2.1. Spillover to Gross Domestic Product (GDP)

2.2. Spillover to Import and Export of Pakistan

2.3. The Effect on Remittances and Interest Rates

2.4. Foreign Direct Investment (FDI) Impact

2.5. Poverty, Unemployment, and Underemployment

2.6. The Effect on the Travel and Tourism Industry

2.7. The Effect on the Health Sector

3. Methodology

4. Keynesian Theory and the 2020 Great Economic Recession

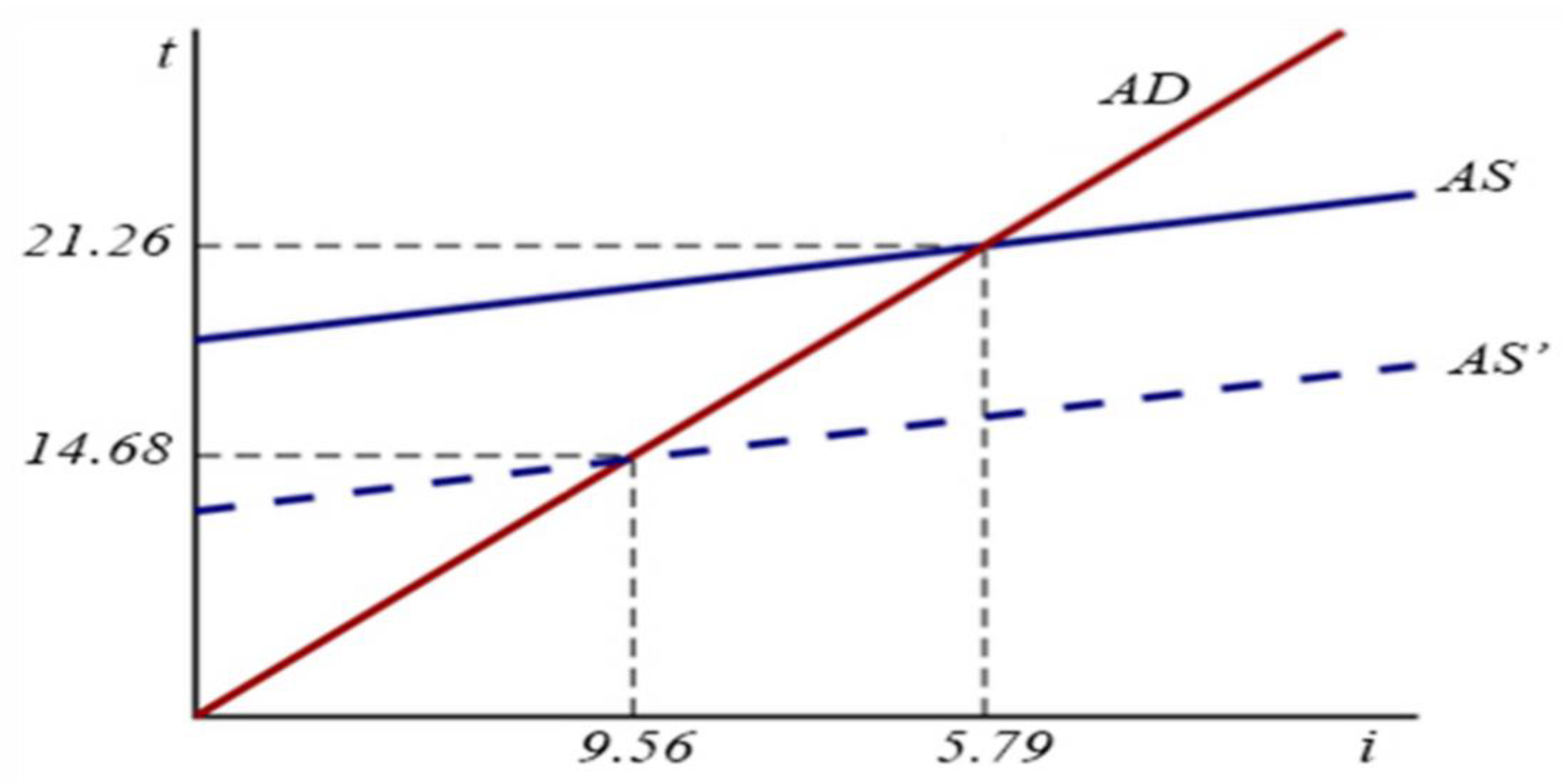

4.1. Coronavirus’s Impact on Aggregate Demand (A.D.)

4.2. The Supply–Demand Doomsday Cycle

4.3. Animal Spirits and Stagnation Traps

4.4. Stabilization Policy under Keynesian Theory during Pakistan’s Unsteady Economy

4.4.1. Keynesian Policy Stabilization to Mitigate the Worse Effects of COVID-19

4.4.2. Pakistan’s Fiscal Policy in the Keynesian Legacy

4.4.3. Increased Government Spending

5. Development of a Proposed Study Framework

Policy Challenges

- How do national governments negotiate and collaborate to overcome sharp drops in income, putting a strain on their public finances, and the looming possibility of sovereign (government) evasions and a 2021–2025 recession?

- How can Pakistan and Canada leverage global cooperation to avoid a sudden drop in income, a strain on their public finances, and an increase in the likelihood of sovereign (government) evasions?

6. The Future Study Recommendation

6.1. Significant Economic Development

6.2. Policy Implications for Selected Sectors

- In this emergency, supportive macroeconomic policies are required to restore trust and demand recovery. Hence, the enterprise tax credit may be provided to employers for collecting wages. Interest-free loans to companies may help address the lost income situation.

- The healthcare industry has made a significant amount of money by mass-producing masks, hand sanitizers, and surgical supplies in large quantities, despite its many shortcomings. The other industry facing a recession could step forward to produce medical equipment. Furthermore, it does not have anywhere near enough hospitals and quarantine facilities, which are urgently needed [79,100,101]. Transmission of the virus can only be controlled by updating and distributing the required medical facilities. For both arrivals and departures, Pakistan needs more screening facilities [77,102].

- Online shopping can be in vogue and will grow further, keeping in mind the prevailing unpredictable situation. In addition, the tourism industry is now largely redundant, and many people will be unemployed because COVID-19 has natural and long-lasting ramifications for social interaction and entertainment.

- A decline in the textile sector’s trade flow among China, the U.S., and the E.U. can be of great advantage to Pakistan, as Pakistan can manipulate some of the low-cost articles according to her choice.

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Begum, H.; Alam, A.S.A.F.; Er, A.C.; Ghani, A.B.A. Environmental sustainability practices among palm oil millers. Clean Technol. Environ. Policy 2019, 21, 1979–1991. [Google Scholar] [CrossRef]

- Alam, F.; Begum, H.; Masud, M.M.; Al Amin, A.K.; Filho, W.L. Agriculture Insurance for Disaster Risks Reduction: A case study of Malaysia. Int. J. Disaster Risk Reduct. 2020, 47, 101626. [Google Scholar] [CrossRef]

- Masud, M.M.; Azam, M.N.; Mohiuddin, M.; Banna, H.; Akhtar, R.; Alam, A.S.A.F.; Begum, H. Adaptation barriers and strategies towards climate change: Challenges in the agricultural sector. J. Clean. Prod. 2017, 156, 698–706. [Google Scholar] [CrossRef]

- Masud, S.; Torraca, V.; Meijer, A.H. Modeling infectious diseases in the context of a developing immune system. Curr. Top. Dev. Biol. 2017, 124, 277–329. [Google Scholar]

- Nattrass, B.; Altomare, M. The Natural Step for Business: Wealth, Ecology & the Evolutionary Corporation; New Society Publishers: Gabriola Island, BC, Canada, 2009. [Google Scholar]

- Miladi, M.; Abdellaoui, K.; Hamouda, A.B.; Boughattas, I.; Mhafdhi, M.; Acheuk, F.; Halima-Kamel, M.B. Physiological, histopathological, and cellular immune effects of Pergularia tomentosa extract on Locusta migratoria nymphs. J. Integr. Agric. 2019, 18, 2823–2834. [Google Scholar] [CrossRef]

- Rees, M.J. Our Final Hour: A Scientist’s Warning: How Terror, Error, and Environmental Disaster Threaten Humankind’s Future in This Century—On Earth and Beyond; Basic Books (AZ): International Society for the Study of Religion, Nature & Culture: Delaware, OH, USA, 2003. [Google Scholar]

- Steinfeld, J.L. Changes at HEW. Science 1969, 166, 819. [Google Scholar] [CrossRef] [PubMed]

- The World Bank in China. An Overview; Retrieved 1 June 2020. Available online: https://www.worldbank.org/en/country/china/overview (accessed on 10 December 2020).

- Maliszewska, M.; Mattoo, A.; Van Der Mensbrugghe, D. The Potential Impact of COVID-19 on GDP and Trade: A Preliminary Assessment; The World Bank: Bretton Woods, NH, USA, 2020. [Google Scholar]

- Malik, Y.S.; Singh, R.K.; Yadav, M.P. Recent Advances in Animal Virology; Springer: Singapore, 2019; Volume XVII, p. 471. ISBN 978-981-13-9072-2. [Google Scholar] [CrossRef]

- Malik, Y.S.; Sircar, S.; Bhat, S.; Sharun, K.; Dhama, K.; Dadar, M.; Chaicumpa, W. Emerging novel coronavirus (2019-nCoV)—current scenario, evolutionary perspective based on genome analysis and recent developments. Vet. Q. 2020, 40, 68–76. [Google Scholar] [CrossRef]

- Yadav, M.P.; Singh, R.K.; Malik, Y.S. Emerging and Transboundary Animal Viral Diseases: Perspectives and Preparedness. Livestock Diseases and Management; Springer: Singapore, 2020; pp. 1–25. ISBN 978-981-15-0401-3. [Google Scholar] [CrossRef] [Green Version]

- Malik, Y.S.; Dhama, K. Zika Virus–An Imminent Risk to the World. J. Immunol. Immunopathol. 2015, 17, 57–59. [Google Scholar] [CrossRef]

- Munjal, A.; Khandia, R.; Dhama, K.; Sachan, S.; Karthik, K.; Tiwari, R.; Malik, Y.S.; Kumar, D.; Singh, R.K.; Iqbal, H.M.N.; et al. Advances in developing therapies to combat Zika virus: Current knowledge and future perspectives. Front. Microbiol. 2017, 8, 1469. [Google Scholar] [CrossRef]

- Singh, R.K.; Dhama, K.; Malik, Y.S.; Ramakrishnan, M.A.; Karthik, K.; Khandia, R.; Tiw Ruchi, A.; Munjal, A.; Saminathan, M.; Sachan, S.; et al. Ebola virus–epidemiology, diagnosis, and control: Threat to humans, lessons learnt, and preparedness plans–an udate on its 40 year’s journey. Vet. Q. 2017, 37, 98–135. [Google Scholar] [CrossRef]

- Sylvia Black. Coronavirus Is Not a Death Sentence—There Is Hope for Those in Grief in Times of This Pandemic; Sylvia Black: New York, NY, USA, 2020; ISBN 9798639290039. [Google Scholar]

- Worldometers, Worldometers, COVID-19 Coronavirus Pandemic. 2020. Available online: https://www.worldometers.info/coronavirus/ (accessed on 5 June 2020).

- World Health Organization. Novel Coronavirus (2019-nCoV) Advice for the Public. World Health Organization. 2020. Available online: https://www.who.int/emergencies/diseases/novel-coronavirus-2019 (accessed on 19 June 2020).

- Li, G.; De Clercq, E. Comment: Therapeutic options for the 2019 novel coronavirus (2019-nCoV). Nat. Rev. Drug Discov. 2020, 19, 149. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Varona, L.; Gonzales, J.R. Dynamics of the impact of COVID-19 on the economic activity of Peru. PLoS ONE 2021, 16, e0244920. [Google Scholar] [CrossRef] [PubMed]

- Lipsitch, M.; Swerdlow, D.L.; Finelli, L. Defining the epidemiology of Covid-19—studies needed. N. Engl. J. Med. 2020, 382, 1194–1196. [Google Scholar] [CrossRef]

- Clarke, L. An introduction to economic studies, health emergencies, and COVID-19. J. Evid.-Based Med. 2020, 13, 161–167. [Google Scholar] [CrossRef] [PubMed]

- Raga, S.; Te Velde, D.W. Economic vulnerabilities to health pandemics: Which countries are most vulnerable to the impact of coronavirus. Supporting Econ. Transform. 2020, 32. Available online: https://set.odi.org/wp-content/uploads/2020/02/Economic-Vulnerability.pdf (accessed on 11 November 2020).

- Wang, C.; Cheng, Z.; Yue, X.-G.; McAleer, M. Risk management of COVID-19 by universities in China. J. Risk Financ. Manag. 2020, 13, 36. [Google Scholar] [CrossRef] [Green Version]

- Wang, Q.; Shi, N.; Huang, J.; Cui, T.; Yang, L.; Ai, J.; Jin, H. Effectiveness, and cost-effectiveness of public health measures to control COVID-19: A modeling study. medRxiv 2020. [Google Scholar] [CrossRef] [Green Version]

- Glassman, A.; Chalkidou, K.; Sullivan, R. Does One Size Fit All? Realistic Alternatives for COVID-19 Response in Low-Income Countries; Blog. Center for Global Development: London, UK, 2020; Available online: www.cgdev.org/blog/does-one-size-fit-all-realistic-alternatives-Covid-19-response-low-income-countries (accessed on 10 December 2020).

- Peters, D.H.; Hanssen, O.; Gutierrez, J.; Abrahams, J.; Nyenswah, T. Financing common goods for health: Core government functions in health emergency and disaster risk management. Health Syst. Reform 2019, 5, 307–321. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Callaway, E.J.N. Time to use the p-word? Coronaviruses enter dangerous new phase. Nature 2020, 579, 1038. [Google Scholar]

- Azzopardi, P.J.; Upshur, R.E.; Luca, S.; Venkataramanan, V.; Potter, B.K.; Chakraborty, P.K.; Hayeems, R.Z. Healthcare providers’ perspectives on uncertainty generated by variant forms of newborn screening targets. Genet. Med. 2020, 22, 566–573. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Guerrieri, V.; Lorenzoni, G.; Straub, L.; Werning, I. Macroeconomic Implications of COVID-19: Can Negative Supply Shocks Cause Demand Shortages? National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

- Kickbusch, I.; Leung, G.M.; Bhutta, Z.A.; Matsoso, M.P.; Ihekweazu, C.; Abbasi, K. COVID-19: How a virus is turning the world upside down. BMJ 2020, 369, m1336. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- World Health Organization. Novel Coronavirus (2019-nCoV) Situation Reports. 2020. Available online: https://www.who.int/emergencies/diseases/novel-coronavirus2019/situation-reports/ (accessed on 10 December 2020).

- Government of Pakistan COVID-19 Official Portal. Available online: http://covid.gov.pk/stats/pakistan (accessed on 5 August 2020).

- Malik, K.; Meki, M.; Morduch, J.; Ogden, T.; Quinn, S.; Said, F. COVID-19 and the Future of Microfinance: Evidence and Insights from Pakistan. Oxf. Rev. Econ. Policy 2020, 36 (Suppl. S1), S138–S168. [Google Scholar] [CrossRef]

- Sutradhar, S.R. The impact of remittances on economic growth in Bangladesh, India, Pakistan, and Sri Lanka. Int. J. Econ. Policy Stud. 2020, 14, 275–295. [Google Scholar] [CrossRef] [Green Version]

- Salik, K.M. Policy Review Remittances and COVID-19: Is Pakistan Ready for a Likely Decline in Flows? Sustainable Development Policy Institute: Tokyo, Japan, 2020. [Google Scholar]

- UNDP. COVID-19: The Looming Crisis in Developing Countries Threatens to Devastate Economies and Ramp Up Inequality. Retrieved 30 April 2020. Available online: https://www.undp.org/content/undp/en/home/news-centre/news/2020/COVID19_Crisis_in_developing_countries_threatens_devastate_economies.html (accessed on 2 May 2020).

- Robinson, L.A.; Hammitt, J.K.; Jamison, D.T.; Walker, D.G. Conducting benefit-cost analysis in low-and middle-income countries: Introduction to the special issue. J. Benefit-Cost Anal. 2019, 10, 1–14. [Google Scholar] [CrossRef] [Green Version]

- Mamun, M.A.; Ullah, I. COVID-19 suicides in Pakistan, dying off not COVID-19 fear but poverty? The forthcoming economic challenges for a developing country. Brain Behav. Immun. 2020, 87, 163. [Google Scholar] [CrossRef]

- Kabir, M.; Afzal, M.S.; Khan, A.; Ahmed, H. COVID-19 economic cost; impact on forcibly displaced people. Travel Med. Infect. Dis. 2020, 35, 101661. [Google Scholar] [CrossRef] [PubMed]

- Chohan, U.W. Forecasting the Economic Impact of Coronavirus on Developing Countries: Case of Pakistan (28 March 2020). CASS Working Papers on Economics & National Affairs, Working Paper ID: EC016UC (2020). 2020. Available online: https://ssrn.com/abstract=3563616orhttp://dx.doi.org/10.2139/ssrn.3563616 (accessed on 28 March 2020).

- McKibbin, W.J.; Fernando, R. The global macroeconomic impacts of COVID-19: Seven scenarios. Asian Econ. Pap. 2021, 20, 1–30. [Google Scholar] [CrossRef]

- Elgin, C.; Basbug, G.; Yalaman, A. Economic policy responses to a pandemic: Developing the COVID-19 economic stimulus index. Covid Econ. 2020, 1, 40–53. [Google Scholar]

- Shahbazov, F. China–Pakistan Economic Corridor: An Opportunity for Central Asia? Central Asia-Caucasus Institute. 2017. Available online: http://cacianalyst.org/publications/analytical-articles/item/13449-china-%E2,80 (accessed on 11 November 2020).

- World Bank Group. Pandemic Preparedness Financing-Status Update. June 2019. Commissioned Paper by the GPMB. 2019. Available online: https://www.who.int/gpmb (accessed on 5 November 2020).

- MOC. Ministry of Commerce, Pakistan. 2019. Available online: http://www.commerce.gov.pk/ (accessed on 14 December 2020).

- Nasir, M.; Faraz, N.; Khalid, M. Sectoral analysis of the vulnerably employed: COVID-19 and the Pakistan’s labour market. COVID-19 2020, 50, 90. [Google Scholar]

- World Bank National Accounts Data, and OECD National Accounts Data Files. Available online: https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?end=2020&locations=PK&start=2010 (accessed on 14 November 2021).

- Hassan, S.A.; Zaman, K. RETRACTED: Effect of oil prices on trade balance: New insights into the cointegration relationship from Pakistan. Econ. Model. 2012, 29, 2125–2143. [Google Scholar] [CrossRef]

- Chohan, U.W.; The Trouble with Economics. Daily Times. 25 January 2020. Available online: https://dailytimes.com.pk/545600/the-trouble-with-economics/ (accessed on 5 December 2020).

- MOPDSI. Ministry of Planning Development & Special Initiatives, Pakistan. 2019. Available online: https://www.pc.gov.pk/ (accessed on 14 December 2020).

- Zhang, D.; Hu, M.; Ji, Q. Financial markets under the global pandemic of COVID-19. Financ. Res. Lett. 2020, 36, 101528. [Google Scholar] [CrossRef]

- Alam, A.S.A.F.; Siwar, C.; Talib, B.; Islam, R. The analysis of international migration towards economic growth. Am. J. Appl. Sci. 2011, 8, 782–788. [Google Scholar] [CrossRef] [Green Version]

- Alam, A.S.A.F.; Siwar, C.; TaliIb, B.; Islam, R. Impacts on international migration and remittances growth. Am. J. Environ. Sci. 2011, 7, 20–25. [Google Scholar] [CrossRef] [Green Version]

- Alam, A.S.A.F.; Siwar, C.; Begum, H.; Er, A.C.; Talib, B.; Elfithri, R. Local Economic Impacts of Human Capital Migration. Mediterr. J. Soc. Sci. 2015, 6, 563–569. [Google Scholar] [CrossRef] [Green Version]

- Amiti, M.; Itskhoki, O.; Konings, J. Importers, exporters, and exchange rate disconnect. Am. Econ. Rev. 2014, 104, 1942–1978. [Google Scholar] [CrossRef]

- SBP. SBP Looks Back on Tough Year for Pakistan. Central Banking Newsdesk. 4 November 2019. Available online: https://www.centralbanking.com/central-banks/economics/macroeconomics/4527276/sbp-looks-back-on-tough-year-for-pakistan (accessed on 4 March 2020).

- Chohan, U.W. Public Value and Budgeting: International Perspectives; Routledge: England, UK, 2019. [Google Scholar]

- Chohan, U.W. The FATF in the Global Financial Architecture: Challenges and Implications; CASS Working Papers on Economics & National Affairs, EC001UC (2019); SSRN Electronic Journal: Rochester, NY, USA, 2019. [Google Scholar]

- The World Bank Group. 2020. Available online: https://www.worldbank.org/en/who-we-are/news/coronavirus-covid19 (accessed on 30 March 2020).

- OECD. Global Economy Faces the Gravest Threat Since the Crisis as Coronavirus Spreads. 2 March 2020. Available online: http://www.oecd.org/economy/global-economy-faces-gravest-threat-since-the-crisis-as-coronavirus-spreads.htm (accessed on 19 March 2020).

- Jabbour, C.J.C.; Fiorini, P.D.C.; Wong, C.W.; Jugend, D.; Jabbour, A.B.L.D.S.; Seles, B.M.R.P.; Pinheiro, M.A.; da Silva, H.M.R. First-mover firms in the transition towards the sharing economy in metallic natural resource-intensive industries: Implications for the circular economy and emerging industry 4.0 technologies. Resour. Policy 2020, 66, 101596. [Google Scholar] [CrossRef]

- Abi-Habib, M.; Ur-Rehman, Z.; Mehsud, I.T. God Will Protect Us’: Coronavirus Spreads Through an Already Struggling Pakistan. New York Times. 2020. 26 March 2020, Updated 26 June 2020. Available online: https://www.nytimes.com/2020/03/26/world/asia/pakistan-coronavirus-tablighi-jamaat.html (accessed on 26 March 2020).

- Ahmed, S.H. Pakistan’s Economy Battling a Host of Challenges. Express Tribune. 10 February 2020. Available online: https://tribune.com.pk/story/2153367/pakistans-economy-battling-host-challenges (accessed on 5 July 2020).

- Ahmad, I. COVID-19 and Labour Law: Pakistan. Ital. Labour Law J. 2020, 13. [Google Scholar] [CrossRef]

- Alfaro, L.; Chen, M.X. Surviving the global financial crisis: Foreign ownership and establishment performance. Am. Econ. J. Econ. Policy 2012, 4, 30–55. [Google Scholar] [CrossRef] [Green Version]

- Desai, M.A.; Foley, C.F.; Forbes, K.J. Financial constraints and growth: Multinational and local firm responses to currency depreciations. Rev. Financ. Stud. 2008, 21, 2857–2888. [Google Scholar] [CrossRef] [Green Version]

- Employment Trends Reported by the Pakistan Bureau of Statistics Pakistan Tourism Revenue. 2018. CEIC Data. Available online: https://www.ceicdata.com/en/indicator/pakistan/tourism-revenue (accessed on 5 April 2020).

- Sareen, S. COVID-19 and Pakistan: The economic fallout. Obs. Res. Found. Occas. Pap. No 2020, 251, 8. [Google Scholar]

- Ministry of Finance, Pakistan. Available online: http://www.finance.gov.pk/ (accessed on 15 March 2020).

- Begum, H.; Er, A.C.; Alam, A.S.A.F.; Sahazali, N. Tourist’s perceptions towards the role of stakeholders in sustainable tourism. Procedia-Soc. Behav. Sci. 2014, 144, 313–321. [Google Scholar] [CrossRef] [Green Version]

- Ozdemir, A.I.; Ar, I.M.; Erol, I. Assessment of blockchain applications in the travel and tourism industry. Qual. Quant. 2020, 54, 1549–1563. [Google Scholar] [CrossRef]

- Israr, M.; Shafi, M.M.; Ahmad, N.; Khan, N.; Baig, S.; Khan, Z.H. Eco tourism in Northern Pakistan and challenges perspective of stakeholders. Sarhad J. Agric. 2009, 25, 113–120. [Google Scholar]

- Asgary, A.; Anjum, M.I.; Azimi, N. Disaster recovery and business continuity after the 2010 flood in Pakistan: Case of small businesses. Int. J. Disaster Risk Reduct. 2012, 2, 46–56. [Google Scholar] [CrossRef]

- Saqlain, M.; Abbas, Q.; Lee, J.Y. A Deep Convolutional Neural Network for Wafer Defect Identification on an Imbalanced Dataset in Semiconductor Manufacturing Processes. IEEE Trans. Semicond. Manuf. 2020, 33, 436–444. [Google Scholar] [CrossRef]

- Waris, A.; Khan, A.U.; Ali, M.; Ali, A.; Baset, A. COVID-19 outbreak current scenario of Pakistan. New Microbes New Infect. 2020, 35, 100681. [Google Scholar] [CrossRef]

- Sethi, B.A.; Sethi, A.; Ali, S.; Aamir, H.S. Impact of Coronavirus disease (COVID-19) pandemic on health professionals. Pak. J. Med. Sci. 2020, 36, S6. [Google Scholar] [CrossRef] [PubMed]

- Raza, S.; Rasheed, M.A.; Rashid, M.K. Transmission potential and severity of COVID-19 in Pakistan. Preprints 2020. [Google Scholar] [CrossRef]

- Gali, J. Introduction to Monetary Policy, Inflation, and the Business Cycle: An Introduction to the New Keynesian Framework [Monetary Policy, Inflation, and the Business Cycle: An Introduction to the New Keynesian Framework]; Princeton University Press: Princeton, NJ, USA, 2008. [Google Scholar]

- Fornaro, L.; Wolf, M. Covid-19 Coronavirus and Macroeconomic Policy, Working Papers 1168, Barcelona Graduate School of Economics. 2020. Available online: https://ideas.repec.org/p/bge/wpaper/1168.html (accessed on 10 June 2020).

- Lorenzoni, G. A theory of demand shocks. Am. Econ. Rev. 2009, 99, 2050–2084. [Google Scholar] [CrossRef] [Green Version]

- Kilic, K.; Marin, D. How Is COVID-19 Transforming the World Economy? 10 May 2020. Available online: https://voxeu.org/article/how-covid-19-transforming-world-economy (accessed on 5 December 2020).

- Baker, S.; Bloom, N.; Davis, S.; Terry, S. COVID-Induced Economic Uncertainty and Its Consequences. 13 April 2020. Available online: https://voxeu.org/article/covid-induced-economic-uncertainty-and-its-consequences (accessed on 5 December 2020).

- The State Bank of Pakistan. 2020. Available online: https://www.sbp.org.pk/m_policy/index.asp (accessed on 25 March 2021).

- Mahmood, A.; Wang, X.; Shahzad, A.N.; Fiaz, S.; Ali, H.; Naqve, M.; Javaid, M.M.; Mumtaz, S.; Naseer, M.; Dong, R. Perspectives on Bioenergy Feedstock Development in Pakistan: Challenges and Opportunities. Sustainability 2021, 13, 8438. [Google Scholar] [CrossRef]

- Sharif, S. Impact of COVID-19 Pandemic: Government Relief Package and the Likely Misallocation of Loans in Pakistan; State Bank of Pakistan: Islamabad, Pakistan, 2020. [Google Scholar]

- Shafi, M.; Liu, J.; Ren, W. Impact of COVID-19 pandemic on micro, small, and medium-sized Enterprises operating in Pakistan. Res. Glob. 2020, 2, 100018. [Google Scholar] [CrossRef]

- Sawada, Y. Sustainable Economic Development in the Post-Covid Era in Asia and the Pacific; Insitute of Business Administration (IBA): Karachi, Pakistan, 2021. [Google Scholar]

- Manzoor, R.; Maken, A.M.; Ahmed, V.; Javed, A. Reforming Trade and Transport Connectivity in Pakistan. Sukkur IBA J. Manag. Bus. 2019, 6, 45–65. [Google Scholar] [CrossRef] [Green Version]

- Sohail, S. Pakistan Employment Trends-2018. Islamabad, Pakistan: Pakistan Bureau of Statistics, Ministry of Statistics, Government of Pakistan. 2019. Available online: https://www.pbs.gov.pk/sites/default/files//Pakistan%20Employment%20Trend%20%20Reprt%202018%20Final.pdf (accessed on 5 December 2020).

- Augustine, B.D. COVID-19 to Slowdown Pakistan’s Economic Growth: Asian Development Bank. 30 April 2020. Available online: https://gulfnews.com/business/covid-19-to-slowdown-pakistans-economic-growth-asian-development-bank-1.70803457 (accessed on 9 March 2020).

- Anderson, R.M.; Heesterbeek, H.; Klinkenberg, D.; Hollingsworth, T.D. How will country-based mitigation measures influence the course of the COVID-19 epidemic? Lancet 2020, 395, 931–934. [Google Scholar] [CrossRef]

- Dar, M.S.; Ahmed, S.; Raziq, A. Small and medium-sized enterprises in Pakistan: Definition and critical issues. Pak. Bus. Rev. 2017, 19, 46–70. [Google Scholar]

- Bénassy-Quéré, A.; Marimon, R.; Pisani-Ferry, J.; Reichlin, L.; Schoenmaker, D.; Di Mauro, B.W. 16 COVID-19: Europe Needs a Catastrophe Relief Plan. Europe in the Time of COVID-19. 2020, Volume 103. Available online: https://voxeu.org/article/covid-19-europe-needs-catastrophe-relief-plan (accessed on 9 March 2020).

- Johnson, H.C.; Gossner, C.M.; Colzani, E.; Kinsman, J.; Alexakis, L.; Beauté, J.; Ekdahl, K. Potential scenarios for the progression of a COVID-19 epidemic in the European Union and the European Economic Area, March 2020. Eurosurveillance 2020, 25, 2000202. [Google Scholar] [CrossRef] [PubMed]

- Kickbusch, I.; Leung, G. Response to the Emerging Novel Coronavirus Outbreak; BMI Publishing Group: London, UK, 2020. [Google Scholar]

- Nicola, M.; Alsafi, Z.; Sohrabi, C.; Kerwan, A.; Al-Jabir, A.; Iosifidis, C.; Agha, M.; Agha, R. The socio-economic implications of the coronavirus pandemic (COVID-19): A review. Int. J. Surg. 2020, 78, 185–193. [Google Scholar] [CrossRef]

- Fernandes, N. Economic Effects of Coronavirus Outbreak (COVID-19) on the World Economy. 22 March 2020. Available online: http://dx.doi.org/10.2139/ssrn.3557504 (accessed on 22 March 2020).

- Begum, H.; Alam, A.S.A.F.; Filho, W.L.; Awang, A.H.; Ghani, A.B.A. The Covid-19 Pandemic: Are There Any Impacts on Sustainability? Sustainability 2021, 13, 11956. [Google Scholar] [CrossRef]

- Gatto, A.; Sadik-Zada, E.R. Revisiting the East Asian Financial Crises: Lessons from Ethics and Development Patterns. In Economic Growth and Financial Development; Springer: Cham, Switzerland, 2021; pp. 23–31. [Google Scholar]

- Gatto, A. A pluralistic approach to economic and business sustainability: A critical meta-synthesis of foundations, metrics, and evidence of human and local development. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1525–1539. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abbass, K.; Begum, H.; Alam, A.S.A.F.; Awang, A.H.; Abdelsalam, M.K.; Egdair, I.M.M.; Wahid, R. Fresh Insight through a Keynesian Theory Approach to Investigate the Economic Impact of the COVID-19 Pandemic in Pakistan. Sustainability 2022, 14, 1054. https://doi.org/10.3390/su14031054

Abbass K, Begum H, Alam ASAF, Awang AH, Abdelsalam MK, Egdair IMM, Wahid R. Fresh Insight through a Keynesian Theory Approach to Investigate the Economic Impact of the COVID-19 Pandemic in Pakistan. Sustainability. 2022; 14(3):1054. https://doi.org/10.3390/su14031054

Chicago/Turabian StyleAbbass, Kashif, Halima Begum, A. S. A. Ferdous Alam, Abd Hair Awang, Mohammed Khalifa Abdelsalam, Ibrahim Mohammed Massoud Egdair, and Ratnaria Wahid. 2022. "Fresh Insight through a Keynesian Theory Approach to Investigate the Economic Impact of the COVID-19 Pandemic in Pakistan" Sustainability 14, no. 3: 1054. https://doi.org/10.3390/su14031054

APA StyleAbbass, K., Begum, H., Alam, A. S. A. F., Awang, A. H., Abdelsalam, M. K., Egdair, I. M. M., & Wahid, R. (2022). Fresh Insight through a Keynesian Theory Approach to Investigate the Economic Impact of the COVID-19 Pandemic in Pakistan. Sustainability, 14(3), 1054. https://doi.org/10.3390/su14031054