1. Introduction

The COVID-19 pandemic came as a big surprise to secure society. In the field of logistics, supply disruptions in global supply chains and the associated cost increases have become a serious problem. During the pandemic, the rates for shipping containers from Asia to Europe increased up to four times [

1,

2], and the quality of deliveries, measured by time and timeliness, deteriorated. It has been predicted that global supply chains may become shorter and more regional, that they may use multiple sources and increase inventories, and that there may be a greater share of automation and robotization of production, which will have an impact on the labor market [

3].

The pandemic is a challenge for companies, but it is also another crisis they have to face. Not long ago they had to deal with the global economic crisis that began in 2008. During this period, significant changes in the strategies of companies and supply chains were also anticipated. In fact, forecasts regarding the impact of the environment of supply chains on the possibility of reallocation of production have been formulated for years.

The author would like to note at this point that he conducted analyses of the transport services market already before the pandemic, and the results of these analyses indicated that the profitability of returning production to Europe would appear only if the rates for shipping containers by sea transport were increased several times [

4]. Therefore, taking into account both the disruptions caused by the pandemic and the increase in transport costs, especially by sea, the question arises here:

Could the changes predicted for years related to the shift away from global supply chains to regionalization take place right now?

How will this affect the applicability of the Just-In-Time system?

What could be the effects of these phenomena on the effectiveness of logistics processes, measured by both the costs of these processes and external costs?

The author tried to find an answer to this question in the course of his research, the results of which are presented in this article.

Many scientific and journalistic publications have discussed the future of the lean management concept since the beginning of the COVID-19 pandemic. The pandemic forced the use of solutions that favored safety—e.g., separating employees and workstations from each other. This made it difficult or even impossible to apply the form of production organization characteristic of lean management, which is the nest form. Of course, this impact depended on the degree of automation of production and the specificity of production in a given industry.

Even greater doubts as to the effectiveness of lean management during a pandemic concern the area of logistics, i.e., deliveries in the Just-In-Time system. As companies needed to build up inventories during the pandemic, predictions have been made that there will be a shift from “lean chains” to an Agile strategy.

The problem presented in the article is the impact of the pandemic on the possibility of implementing the lean management concept, with particular emphasis on the Just-In-Time system, and possible consequences for both enterprises and the natural environment.

The aim of the research was to identify the conditions in which the JIT system can be profitable from the point of view of enterprises without increasing negative impact on the natural environment.

In the article, the hypothesis was that there was no basis to claim that the current pandemic situation will contribute to a radical departure from the JIT concept in favor of, for example, Agile in supply chains. Contrary to the opinions recently presented in the literature, crises such as pandemics do not constitute obstacles in the implementation of the principles of lean management. The pandemic may contribute to the reallocation of supply sources, which in turn would create favorable conditions for the JIT system and “lean supply chains”. In case of the retreat from globalization, the negative impact on the natural environment would also decrease (lower external costs).

The article consists of several parts. The second section provides an overview of the literature on the Just-In-Time system, which is an important component of the lean management concept. The aim of this review was to present the essence of this concept in the context of the current pandemic situation.

Section 3 presents the applied research method, which was a simulation with a model developed by the author, and the assumptions for the conducted calculations.

Section 4 contains the results of the simulations carried out with the aforementioned model, which was used to simulate the efficiency of the strategies of deliveries to a warehouse and Just-In-Time deliveries in the context of a pandemic, based on the assumed parameters of logistics processes and their costs (4.1). Furthermore, simulations were conducted based on data contained in financial reports of several listed companies (4.21). The impact of the Just-In-Time system on the external costs of logistics processes was also simulated for two variants: when production was already located in Europe before the pandemic and when (as a result of a pandemic) there would be a reallocation of production from the Far East to Europe (4.3).

Then, in

Section 5, conclusions are presented about the conditions that would have to be met for the Just-In-Time system to be profitable for enterprises and not cause an excessive increase in external costs.

2. Literature Review

To assess the possible effects of the pandemic on the effectiveness of Lean Management, including Just-In-Time Delivery, one should first understand the essence of this management concept.

Womack and Jones defined lean production as a production practice that considers the expenditure of resources for any goal other than the creation of value for the end customer to be wasteful and thus a target for elimination [

5].

The definitions of Lean Management emphasize the aspect of eliminating waste. The Just-In-Time system is defined in a similar way, while emphasizing mainly the aspects of smooth flow and “having the exact amount of stock goods arriving at the exact time you need it” [

6]. This may mean minimum inventory necessary in the organization to keep the production line running. According to J. Czerska, lean management is more than just “leaning” and primarily means achieving efficiency, thanks to which a company can quickly and dynamically respond to changes in the environment [

7].

Other authors have also approached the role of inventories in JIT. For example, according to P. Walentynowicz, in lean management, the goal is to obtain the best possible results in the given technical and organizational conditions with the lowest possible expenditure [

8]. Blaming this concept for disruptions in supply chains during a pandemic and calling for it to be abandoned in favor of others results from a misunderstanding of its essence, which is not based on completely giving up inventories [

9,

10]. JIT is not about eliminating inventories but rationalizing them. Stock levels must be optimal. Their excess is a factor of worse economic efficiency, which has been shown by research [

11]. There are benefits and costs associated with maintaining stocks, as with the use of the Just-In-Time system. The solutions used, in both the fields of production and logistics, must simply be profitable, which requires taking into account the conditions in which they are implemented.

The application of the lean concept in the field of logistics takes into account the specificity of logistics processes that distinguish them from production processes. In the area of production, the close location of workstations allows increasing the fluidity of material flow and reducing interoperational inventories. Just-In-Time deliveries of production materials also allow reducing the level of inventory as well as the costs of system and storage operation. The number of activities is also reduced, because the materials are first delivered not to the warehouse but directly to production (where they are stored near production stations). Moreover, the warehouse receiving process may be simplified if control of incoming materials or components is eliminated.

On the other hand, there are problems specific to external transport processes that do not occur in the production. Just-In-Time delivery transportation costs can be very high. This cost depends on the transport technology used, vehicle load capacity, the degree of use of this capacity and the degree of use of vehicle mileage in both directions. The problem of the so-called empty runs can be particularly important in the case of long transport distances.

In order to increase the efficiency of deliveries, including reloading at the supplier and recipient of the given components, the vehicle structure is adapted to the parameters of the loads. This can be an additional cost factor.

Since stocks are eliminated in order to increase the certainty of deliveries on time, transport may be dedicated in the sense that some part of the rolling stock is dedicated only to serving a given customer, which may additionally deteriorate efficiency.

Companies that implement JIT force at least first-tier suppliers to move their production plants closer to the place where their products are consumed, which has a significant impact on the costs of the delivery process and the external costs of these processes. It should be borne in mind that at shorter distances, finding a return load is relatively less likely than at longer distances. This problem, typical of external transport, concerns all modes of transport, and even more “ecological” modes of transport than roads, e.g., rail and inland. In the vicinity of the place of delivery (for example, by train), there would have to be, for example, another large plant that also ships large batches of goods close to the place where the supplier is located.

It is interesting, however, that the contracts with logistics operators may include a provision that the operator undertakes to gradually reduce the price during the duration. This may seem surprising, given the high requirements as to the quality of services and the degree of integration with the client. However, constant cooperation favors the efficiency of the operator and the processes it carries out. There are many solutions, and it is difficult to point to regularities occurring here. It seems that this is a matter of an individual decision in a given company, although there are also differences in solutions in different regions of the world or countries.

A common view in the literature is that suppliers should be located close to the plant. However, according to other authors, closeness is not a necessary condition [

12,

13,

14,

15,

16,

17]. Some of the suppliers of one of the Opel plants in Eisenach were located in Spain. Moreover, rail transport was used in the deliveries. [

18]. Components (e.g., wheel rims) were delivered by trucks to the Spanish–French border and then loaded onto a train. So this was not direct but multimodal transport, and moreover, deliveries were made from several suppliers. Despite the presence of several factors posing a potential threat to the timeliness of deliveries (distance, transport technology), this solution turned out to be effective. Thus, economies of scale are visible here. A large company can reduce delivery costs by negotiating more favorable rates and terms of delivery (high timeliness of deliveries, which enables inventory minimization). A rail carrier can guarantee timely deliveries at low cost if it has a long-term contract with the customer to deliver goods in large quantities on a regular basis.

Modern transport infrastructure and high levels of logistics services create great opportunities. A study conducted in the USA showed no evidence that the lean manufacturing system influenced the location decisions of plants producing parts for the automotive industry [

19]. American supply chains are actually relatively longer than Japanese ones.

Kaneko and Nojiri [

20] provide interesting examples of delivery-to-plant solutions from Japan, where suppliers are located relatively far from the automotive companies (Toyota, Honda, Nissan, Suzuki, Daihatsu, Mitsubishi) they supply. To increase the efficiency of these deliveries, they are made not directly but via cross-docking centers. Moreover, stocks are also kept. Components are consolidated both on the main line and on the delivery and return sections (last mile). In Japan, auto parts suppliers were concentrated around the Ueda Basin, about 300–400 km from Toyota City and other car assembly sites. This solution allowed achieving benefits including scale and technological development of suppliers. However, deliveries can also be made over longer distances, e.g., 1000 km, and may take several days. The delivery process in the entire chain can be carried out by one operator that supports all suppliers and delivers to all recipients (assembly plants). It can also be shared among several operators.

The authors’ valuable remark is that apart from issues related to deliveries, there are other important criteria for selecting suppliers—e.g., the level of technological development of the supplier and the costs of their production. An advantageous solution may be to sign a contract with a supplier located far away. This strategy is favored by standardization (e.g., quality), a high degree of stability and predictability of demand, and an increase in the efficiency of logistics services. The pandemic, however, showed weaknesses in this strategy.

As noted by van Egeraat and Jacobson [

21], when suppliers expand their operations, transportation costs are an important localization factor, as evidenced by the return of production to Japan (for example, that in 1976, due to the increase in transportation costs owing to the oil shock). An important factor is the level of technological advancement of the supplier—automation in production allows compensating for the inconvenience related to the distance from the supplier, because production can be started immediately after receiving the order.

In fact, there is no single JIT model. At Toyota, many different solutions have been used over the years. There was a period when Toyota, like the aforementioned Opel in Europe, also used rail transport. It is worth noting, however, that the train traveled quite long distances (about 800 km from Toyota City, where suppliers were consolidated, to the plant in Iwate). Other authors have also pointed to rail transport as an interesting alternative to road transport in JIT [

22], especially over long distances, although road transport is generally considered to be the best fit for JIT deliveries [

23].

Although it may seem that the priority is to reduce inventories, the “operational foundation” is highly efficient transport operations [

24,

25]. This efficiency is significantly influenced by the scale of operations—suppliers must also assign the appropriate load weight for transport [

26]. Therefore, companies are looking for compromise solutions that allow them to achieve often contradictory goals [

27]. One of these solutions is cooperation with specialized logistics operators, as was the case in the electronics industry [

28].

An important factor in the efficiency of supply chains, including their costs, are the distances over which goods are moved [

29], because the efficiency of logistics processes, both in terms of costs and quality, plays a very important role in the implementation of the procurement strategy. If the flow of the material stream were to be as smooth as possible, then reallocation of supply sources would have to take place, which would create the conditions for the full application of the Just-In-Time delivery concept. On the other hand, such a reallocation would reduce not only costs of logistics processes, borne by enterprises, but external costs, borne by society. The use of deliveries in the Just-In-Time system, although it may be associated with an increase in the frequency of deliveries, the concept of lean management, and even JIT, can have positive effects on the natural environment [

30]. In fact between the concepts of lean and clean manufacturing there is the positive relationship thanks to the waste and pollution reduction and simplified implementation of proactive environmental practices [

31]. Also when it comes to JIT, there are examples where its implementation did not have a negative impact on the environment [

32]

The flexibility of production and logistics processes is very important due to unexpected events that may occur in the environment of these processes [

33].The pandemic is such a situation that creates uncertainty as to the functioning of supply chains, affecting costs in the area of production and logistics [

34]. An industry in which the strategy of global supply chains is applied is the clothing industry, especially in the case of the production of cheap clothing. Companies from this sector of the economy face two contradictory challenges: the need to quickly respond to market needs and the need to reduce production costs [

35].

According to some authors, the current crisis will result in the return of stocks (departure to JIT in favor of just in case) and the closing of borders [

36,

37]. Politicians are also calling for a reevaluation of supply chain strategies, which have resulted in overreliance on Asian suppliers, and possible political decisions may actually influence decisions regarding the location of production. Indeed, if border controls were to be reintroduced, it would be a serious obstacle to the implementation of the Just-In-Time delivery strategy.

According to a study by the McKinsey Global Institute [

38], 93% of the supply chain executives surveyed want to increase the resilience of their supply chains through activities such as increasing the number of suppliers and increasing the level of inventory of critical products, activities that would appear to be contrary to the principles of lean management. However, the reallocation of supply sources is also planned (nearshoring, regionalization of supply sources), which in turn favors the use of a flexible supply strategy in accordance with the demand. One may even ask whether this very situation does not (paradoxically) create conditions for the implementation of JIT.

A pandemic may force the use of proefficiency solutions in both the areas of logistics and production. Lean management companies such as Toyota obviously had to adapt their processes to the new situation created by the pandemic via means such as keeping distances between employees, visual management (e.g., workplace instructions, signposts, designated areas of employee movement), and control methods to help avoid contamination [

39]. However, one can ask if the idea of preventing waste is not gaining importance right now—for example, through fewer unnecessary activities, especially those that require contacts between employees [

40]. Traditional tools such as 5S can be modified and used as procedures for dealing with a pandemic situation [

41].

Therefore, as is clear from the literature review, research results, and case studies presented here, the solutions used in the Just-In-Time system can be very diverse. Specific solutions depend on various factors. Furthermore, deliveries in JIT, especially in the extreme form—i.e., often (every day, several times a day), with complete elimination of stocks—may in some cases be unprofitable. The transport distance is very important and, in many cases, should be shortened. Another problem is the profitability of the JIT system in the context of a possible reallocation of sources of supply and production, e.g., from the Far East to Europe as a result of the pandemic. If such a reallocation took place, the conditions would be favorable for the implementation of JIT, as distance plays a very important role here. This reallocation would also have consequences for the external costs of logistics processes. It can be assumed that these costs will be lower because of the shortening of the transport distance, despite the fact that road transport would probably be involved instead of the more “green” sea or rail transport. Therefore, the question arises: under what conditions can the Just-In-Time system can be profitable, in terms of both process implementation costs and external costs? The author tried to find an answer to this question using the calculations he made, the results of which are presented in the following parts of the article.

3. Materials and Methods

In order to estimate the possible benefits of deliveries under the Just-In-Time system, from the points of view of both profitability for the company and the natural environment, simulations were conducted of delivery processes under a system with deliveries to the warehouse (i.e., to stock) and under the Just-In-Time system. These simulations were carried out with simulation models developed by the author.

The following calculations were made:

the impact of the use of JIT deliveries on logistics costs in procurement based on the data assumed by the author for four product groups (4.1);

the benefits of the JIT system from the point of view of the company’s profitability, calculated on the basis of data published in reports of listed companies, not only in procurement but in the entire logistics chain (4.2);

the impact of the JIT supply strategy on the external costs of logistics processes for two cases: where a given company has produced in Europe so far and where production is reallocated from the Far East (4.3)

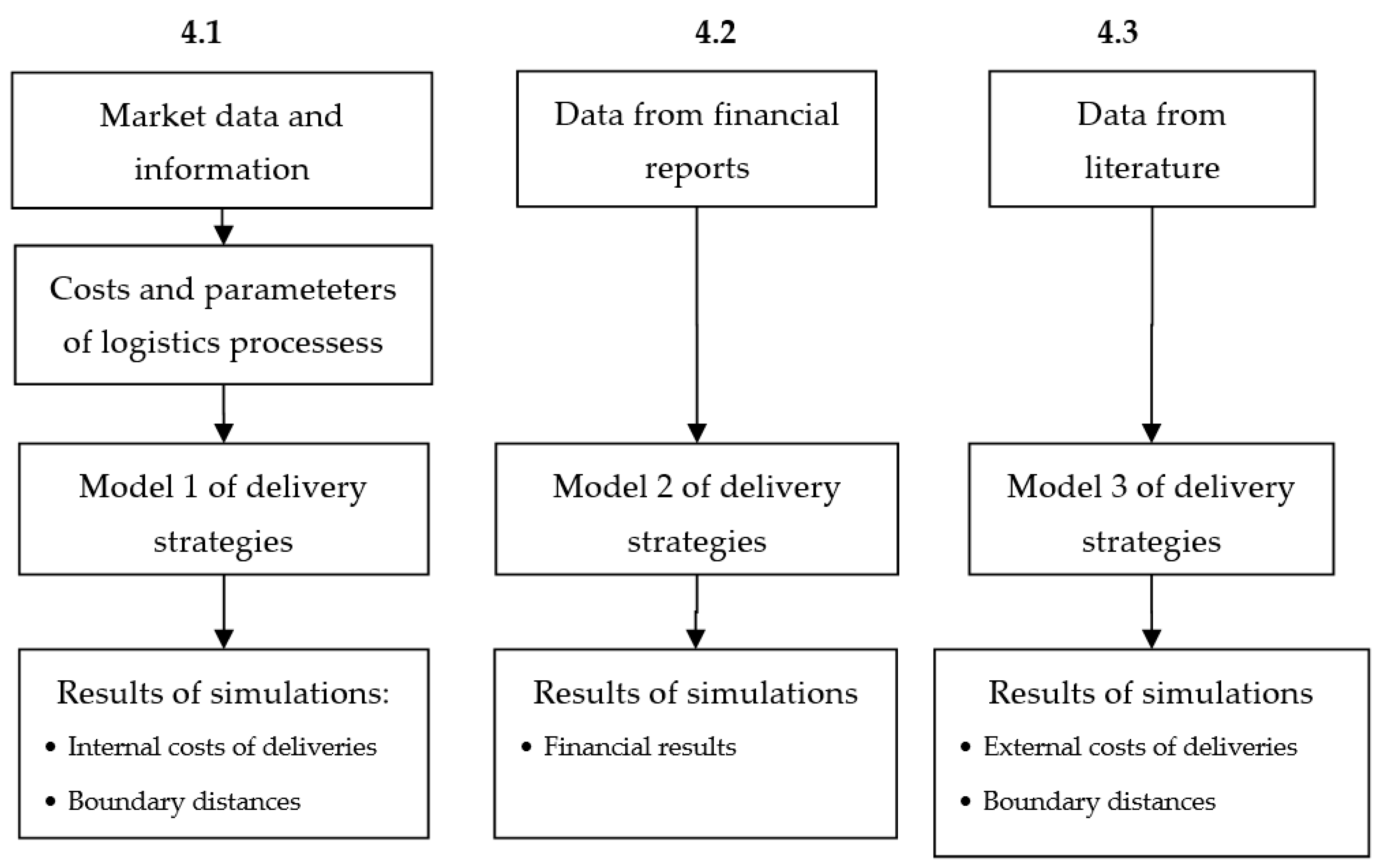

The methodology is explained in

Figure 1.

For the first calculations, assumptions and data on the efficiency of logistics processes used in the simulations are presented in

Table 1 and

Table 2.

The calculations were caried out for three variants (see

Figure 2):

deliveries to a warehouse at distances of 800 km if road transport is involved and 720 km for rail;

JIT deliveries over the same distances;

JIT deliveries over distances to which the total delivery costs are lower than in variant 1.

For each of these variants, simulations were carried out for two levels of production and annual sales, “lower sales” and “higher sales” (four times higher), to check whether the efficiency of these deliveries is influenced by the scale of operations.

Calculations were carried out for four types of consumer goods—food products, footwear, consumer electronics, and expensive mobile phones—leading to a total of 24 simulations

The products differ in terms of their value and loading parameters, which affect the costs of maintaining inventories, storage, and transport. Therefore, these simulations make it possible to present the benefits of using JIT for various product groups

In the case of lower sales and deliveries to the warehouse, deliveries were made by road with the use of vehicles with the highest load capacity. In a JIT system, these would be small, daily deliveries, and therefore, less efficient vans were used.

In the case of higher sales, if deliveries were made to the warehouse, rail transportation would be profitable, and large road vehicles would be involved in Just-In-Time (such as with lower sales for warehouse deliveries).

JIT deliveries were performed at distances that would ensure direct delivery from a supplier within one day (or more frequently) for a given mode of transport, which would allow for complete elimination of stocks in such a system. For road transport in Europe, the limit distance was 800 km (the average speed of a road vehicle in Europe is 70–90 km/h), and for rail transport, it was 720 km (the average speed of a train in Europe is 30 km/h).

The costs of logistics processes, including rates for logistics services (transport and storage services), were estimated on the basis of market data.

The levels of safety stocks and those resulting, for example, from incorrect forecasts or ineffective inventory management were 30% in the case of road transport deliveries, and 50% in the case of relatively more unreliable rail transport. In the case of JITs, inventories were completely eliminated.

In order to check the significance of the application of a specific supply strategy for a company’s profitability, simulations were carried out on the basis of data contained in the reports of listed companies (

Section 4.2). In addition, simulations were carried out under the assumption that JIT was used not only in the area of material supply but in the entire logistics chain, i.e., also in the area of distribution. In addition, the impact of JIT was taken into account not only in the costs of logistics processes (transport and inventory) but in sales. It was assumed that if the customer order improved as a result of the implementation of JIT, sales would also increase.

Simulations were also conducted to assess the impact of changing the supply strategy on external costs for two cases: 1—when suppliers have been located in Europe so far, 2—when so far supplies have been performed so far in global supply chains and, for example, as a result of a pandemic, the sources of supply were reallocated to Europe. (

Section 4.3).

4. Results

4.1. Efficiency of the JIT Strategy in Procurement

The assumptions for the first commodity group, i.e., food products are presented in

Table 3, and the simulation results for the “lower sales” variant are presented in

Table 4. The results for all groups are presented in

Table 5. For all groups, it was assumed that JIT deliveries took place every day (250 working days in year).

For the company that decided to make daily deliveries without the storing them, despite the elimination of stocks, the total costs of logistics processes in the case of smaller sales increased by over 120%. The reason was the very high share of transport costs for these products (transport costs increased by 134%). In order not to increase these costs, the source of supply would have to be reallocated closer to the customer, so that deliveries were not made at distances longer than 358 km. This would be a considerable change compared to the previous 800 km.

In the case of the same products, but with a larger scale of production and sales, the increase in the total delivery costs was much lower—only 5.7%—because of a much smaller increase in transport costs (−43%). As a consequence, the delivery distance was longer (689 km).

The increase in delivery costs also took place in the next two groups of goods (see

Table 5), footwear and electronics. However, this increase was lower than that in the case of food and decreased with the value of the products (88.7% and 34.5%, respectively), which means that this value was very important. In the case of mobile phones costs decreased significantly (56.8%).

The scale of production was also important—except for groceries, there was a decrease, and this decrease was the greater the more valuable the products were (−44.5%, −74.3%, and −92.8% for footwear, electronics, and mobile phones, respectively). The benefits of using the JIT system were therefore greater in the case of more expensive goods and a larger scale of operation. With higher sales, despite more frequent (daily) deliveries, highly efficient means of transport were used.

The results of these simulations confirmed the views expressed in the literature that relatively greater benefits from the implementation of the Just-In-Time system are achieved in larger enterprises [

41]

The limit distances from suppliers increased with the value of the delivered products. In the case of the most expensive mobile phones, it was 800 km in both the cases of smaller and larger sales. Without the assumed time limits (delivery within one day), these distances would be much longer—in the case of mobile phones, it could be thousands of kilometers. This explains the profitability of locating production in regions outside Europe, the more so if it would result in a reduction in production costs.

There are actually many more possible delivery options not included in the calculations presented here. Deliveries do not have to be made without stocks, i.e., every day (or even several times a day) directly to the production lines. JIT delivery efficiency can be increased by increasing the volume of deliveries (and reducing the frequency of these deliveries), which would reduce transport costs. This would result in a certain level of inventory resulting from the volumes of deliveries. However, if the timeliness of these deliveries were high, the safety stocks resulting from the low punctuality of deliveries in the traditional system with storage and the excess stocks resulting from inaccurate forecasts could be eliminated.

At this point, the following remark should be made: the elimination of stocks in the Just-In-Time system, even if deliveries are actually made, is often a kind of mental shortcut. There is always a certain level of inventory—if not on the premises of the factory to which the materials are delivered, at least on the vehicle that is waiting outside the factory gate to be unloaded. Inventory can also be held in the supply chain of a logistics operator, which, as a “third partner”, coordinates the flow of the stream between the supplier and the factory. As in the previously mentioned examples from Japan, an operator can transport materials from the supplier (or several suppliers) in full truckload sizes, collect them for some time in its terminal, and then deliver them in smaller batches directly to the production line. Such solutions can be very beneficial because transport costs are reduced and, at the same time, unnecessary stocks are eliminated, i.e., waste is eliminated, which is the main goal in Lean Management. With such a solution, even in the case of the cheapest products, cost savings are very large and exceed 70%.

When it comes to the share of logistics costs in sales, the tendency is opposite; this share decreased with increasing value. However, this does not mean that a JIT system would have less impact on profitability for these more expensive goods, as it depends on what the profit margin is in a given industry and even in a particular company. Moreover, the impact on sales in these calculations should be taken into account, which in JIT may be greater if we assume that it allows for better customer service. Besides, the performed calculations related only to the field of material supply. The JIT strategy could apply to processes carried out in the entire logistics and production chain, and even in the entire supply chain.

These factors were taken into account in the next calculations, which were based on the data of listed companies and are presented in the next section,

Section 4.2.

4.2. Profitability of the JIT Strategy (Listed Companies)

Few companies present data in their reports related to logistics processes. Only some companies report the value of inventories held, although some provide a fairly detailed breakdown into inventory of materials, raw materials, work in progress, and finished goods. However, it is difficult to estimate the cost of maintaining inventories from the value of inventories.

Even fewer companies publish data on the delivery costs. Exceptions include Coca-Cola and PepsiCo, which distinguish the “Shipping and Handling Costs” position in their reports. Analysis of the reports showed that these were costs related to the movement (transport and handling) of goods and to the field of distribution, which may seem understandable, taking into account that companies usually organize transport themselves in the distribution, while in the supply of materials usually suppliers are responsible for transport. However, this is not a rule—there are cases where the buyer also has the responsibility to transport, especially if it is a large company.

Table 6 and

Table 7 show the financial results of Coca-Cola [

42], PepsiCo [

43], and one pharmaceutical company, United-Guardian, Inc. [

44]. These were the only companies that published data on logistics costs included in the item “Shipping and Handling Costs” in their reports. On the basis of these data, the author simulated the hypothetical impact of the JIT strategy on the profitability of companies. The results of these simulations are presented in

Table 8. The data used were average data prepared on the basis of the financial statements of these companies for 2010-2019.

The share of shipping and handling costs in sales was surprisingly high compared to the previously presented calculation results for the food industry: 5.40% for Coca-Cola and 14.23% for PepsiCo. However, it was very small (0.61%) in United-Guardian, Inc.

It is also surprising that two competing companies, which would seem similar from a strategic and market point of view, had different shares of these costs, even if one takes into account that PepsiCo’s offer is wider than Coca-Cola’s (apart from drinks, e.g., salty snacks). The parameters of the distributed loads are similar.

The large share of these costs is difficult to explain. Deliveries are certainly made in full truck loads and by means of transport with high load capacity. So the question arises, what could be the reason for this, the more so because a large and well-known company has relatively greater opportunities to negotiate favorable prices for logistics services? Did it come from longer transport distances than assumed in previous simulations?

Perhaps these costs actually covered all logistic processes—not only in the area of finished goods distribution, but in those of supplies and, perhaps, storage costs. At this stage, this is, of course, only a presumption, and we have to rely on information officially provided by companies.

Assuming a similar method of calculating inventory costs as in the previous simulations, the cost level of logistics processes and the hypothetical impact of the JIT strategy on the profitability of these companies were estimated. This time, the impact of JIT on supply stocks as well as on production and distribution stocks was taken into account.

Therefore, the simulations were carried out for three variants:

Just-In-Time only in procurement (elimination of stocks of materials and raw materials);

Just-In-Time in the entire logistics chain of a given company (also work in progress and finished products);

Increase in sales due to better customer service in the JIT system.

As for the impact of JITs on transport costs, it was assumed, based on the simulation results from the previous section, that the transport costs increased by 43%.

The results of these simulations are presented in

Table 8.

The implementation of JIT only partially, and therefore only in the area of material supply, was unprofitable—at Coca-Cola, profits decreased by almost 5%, and at PepsiCo, by 34.1%. Profits at United-Guardian, inc. remained unchanged.

It would not even help to extend the JIT to the entire logistics chain—Coca-Cola saw an increase in profits, but only by 0.4%, and only slightly more was observed at United-Guardian (2%).

The increase in profits would take place only if the implementation of JIT in these companies resulted in an increase in sales by 5%. The greatest increase would be in Coca-Cola (25.5%), followed by United-Guardian (14%) and the minimal (less than 4%) increase in Pepsi. For the latter company, for a significant increase in profits (35%), sales would have to increase by 10%. The results of these calculations confirm the view that the greatest benefits of using given logistic strategies are increasing the level of logistic customer service.

They prove also the importance of transport costs, but the implementation of JIT would not have to, at least in large companies, result in an increase in these costs. Large-scale companies can afford deliveries in large batches, even if they are delivered according to current demand (for example, Opel and the use of rail transport).

The implementation of JIT may result in the reallocation of the source of supply in order to reduce the costs of logistics processes. If a company implementing JIT decided to reallocate the source of its supply, another positive effect would be reducing the external costs of transport, i.e., to reduce the negative impact on the environment. The environmental benefits of such a strategy were calculated in the next simulations (presented in

Section 4.3).

4.3. External Costs of Deliveries in the JIT System

The author simulated the impact of the JIT strategy on external costs for the following situations:

when suppliers have been located in Europe

when so far supplies have been performed in the global supply chains and, for example, as a result of a pandemic, the sources of supply were reallocated to Europe

The assumptions for the simulation are included in

Table 9 which presents the external costs of transport. The assumptions were similar to those in the previous simulations, i.e., if the deliveries were to be made in the JIT system, the maximum distance for road transport would be 800 km, and for rail transport, 720 km. The same technologies and means of transport were used as in

Section 4.1.

In the case of a lower level of sales (

Table 11), when deliveries are made by road transport, in order not to increase the external costs of JIT deliveries, the distances would have to be significantly shortened—to a greater extent than in the previous simulations (from 800 km to less than 163 km). Reducing the delivery distance from 800 km to 358 km would also result in a significant reduction in external costs from 49,400 EUR/year to 10,080 EUR/year. However, if a given company, as a result of the implementation of JIT, reallocated the source of supply closer to its customer, the external costs would also be lower. For example, in the case of food products and a lower level of sales (see

Section 4.1), the limit distance was 358 km. At this distance, the external costs are 22,117 EUR/year. Thus, solutions beneficial to enterprises can also contribute to the reduction in external costs of the logistical processes (transport, storage, transshipment). Therefore, realistic and compromise solutions can also contribute to the realization the goals of the European concept of “sustainable development”, i.e., optimal development.

The scale of production and sales is also conducive to finding this compromise. It is beneficial for enterprises, as demonstrated by the simulations in

Section 4.2, but also has a positive impact on the natural environment. Rail transport is used in deliveries to a warehouse, and road vehicles with the highest payload are used in JIT. These limit distances were 223 km (

Table 11) but were of course still shorter than almost 681 km for food and 720 km for others (see

Table 5).

However, this proves the high efficiency of heavy vehicles, which is worth emphasizing, as road transport is widely recognized as the main perpetrator of high external transport costs.

Table 12 presents yet another possible case, when deliveries to the warehouse were made not by direct rail transport but by multimodal transport, i.e., with the use of road transport in the delivery and exit sections. The use of such technology obviously increased the external costs and lengthened the border distance, which became 375 km.

The external costs were reduced in the case of companies that turned from their global sourcing strategy and shifted production to Europe. In order to calculate the consequences of changing the delivery strategy for such a case, it would be necessary to calculate the external costs for various modes of transport, both during the transport of loads and their transhipment at intermediate points. The external costs arising in seaports are presented in

Table 13. Assuming that the reallocation would favor the implementation of JIT, even with a higher frequency of deliveries, the external costs of logistics processes were thereby lower by almost 80% (

Table 14). These were very big benefits, despite the fact that the “ecological” modes of transport, sea and rail, were replaced by “nonecological” road transport even at distances of 800 km. The reason was, of course, the very long transport distances in the global deliveries. Moreover, road transport would also have to be used in the delivery to the final recipient (after reloading at the port or terminal).

5. Discussion and Conclusions

The aim of the research was to identify the conditions in which the Just-In-Time system, in which storage is completely eliminated and deliveries are performed frequently in small quantities, is profitable, from the points of view of the profitability of enterprises and of the natural environment.

These conditions (factors) are as follows:

transport distances;

the scale of operation (production and sales volumes);

transport technologies;

sizes of deliveries;

value of the goods transported;

load parameters (weights and volumes);

costs of logistics processes;

time and punctuality of deliveries.

The article presents the results of simulations regarding the limit distances at which the Just-In-Time system is beneficial, the costs resulting from the change of the system from storage to the JIT system, and the impact of JIT deliveries on external costs. The results of the simulations conducted herein confirmed the general views expressed in the literature on the profitability of deliveries in the JIT system. At the same time, to some extent, they helped to better understand which specific cases the solution was beneficial in. So far, no such calculations have been carried out, and in this respect, the simulations carried out by the author are a novelty and constitute his contribution to scientific research in this area.

Simulations of the impact of the Just-In-Time system on the economic efficiency of enterprises were carried out using two methods with different approaches. In the first method, the levels of logistics costs were estimated for various sectors of the economy (various consumer goods) and two levels of production and sales. These costs were estimated on the basis of the parameters of logistics processes and prices for logistics services. Calculations showed that Just-In-Time implementation, in the case of cheaper goods and low sales levels, increased the costs of logistics processes, which were influenced by a large share of transport costs. Therefore, in order not to increase these costs, the sources of supply must be reallocated.

JIT was beneficial for more expensive goods produced and sold by large companies—savings of up to 90%. However, in order to assess the actual benefits for enterprises resulting from such large cost savings, it would be necessary to relate them to the profitability of companies. For this reason, a second method was used that was based on data on the costs of these processes, which were already calculated and included in the financial reports published by listed companies as transport and handling costs. The share of these costs in sales was actually greater than it would appear from the simulations carried out with the first method. So the question was, what were the reasons for this? Are logistic processes in practice ineffective, or does handling customer orders require greater costs than it would appear from theoretical models? It was assumed that the benefits of applying a specific logistics strategy in practice could actually be much greater. Therefore, reducing the costs of logistics processes should have a significant impact on the profitability of enterprises. Assuming an increase in costs in the JIT system based on the results from previous simulations, i.e., over 40%, in the case of large sales, a decrease in profitability occurred that in some cases was very significant (over 30%). However, this impact was very diverse, even between companies that seemed similar in concept, i.e., Coca-Cola and PepsiCo. Their shares of the costs of logistics processes were different, and their profit margins were also different. Therefore, the impact of changing a supply strategy on profitability also differed. Thus, the impact of implementing a JIT system on profitability does not depend on the sector of the economy, but is an individual matter. However, the very high share of these costs in the value of sales may raise doubts as to the method of their calculation. If these costs included not only the costs of transport but those of storage, it would turn out that the benefits of JIT implementation would be even greater than it would seem from the present simulations. The benefits of using JIT for enterprises would also be even greater if the implementation of this system would result in an increase in the level of logistic customer service and, consequently, an increase in sales. Undoubtedly, however, increasing the efficiency of delivery processes and shortening the transport distances significantly improves financial results and reduces the costs of external logistics processes.

Simulations were also conducted of the impact of Just-In-Time deliveries on external costs for two cases. The first concerned a company that already sourced its production materials in Europe and moved the source of supply closer to the point of consumption. Here, too, the impact of the scale of operation was noticeable, mainly because various transport solutions can used in smaller and larger companies. Smaller companies tend to use road transport. Bigger companies have more possibilities and can efficiently transport their goods also by rail. In the case of a smaller company, as a result of the implementation of the Just-In-Time system, heavy vehicles (40 tons of GVW) that traveled 800 km were replaced with smaller delivery vehicles, and deliveries would have to be made up to 163 km in order not to increase external costs transport. In the case of a larger company that had so far transported goods to the warehouse by trains, this limit distance would be greater—up to 223 km. Thus, with regard to external costs, economies of scale were visible. Moreover, if a company had so far delivered loads not by direct rail but by multimodal transport, then road transport had to be involved (although at shorter distances), so the external costs were greater, and this limit distance increased to 375 km. These costs would actually be even lower when one takes into account the external costs generated in warehouses, where there are reloading and additional handling operations (eliminated in JIT). The multitude of available handling technologies, including energy sources (gas, electricity, fuels) and their different effectiveness, would require a case-by-case reference in a given company so that a full calculation could be made. Even greater benefits for the environment would be associated with relocating production from, for example, Asia to Europe (e.g., because of a pandemic). Deliveries within the European Union, even over long distances, generate lower external costs (reduction in external costs by 70–90%) than global deliveries using “green branches of transport” (sea, rail). However, these calculations were based on one of the methods of calculating external costs and average values have been used. The levels of these costs were estimated in different ways by different authors. They depended on various factors, including, for example, the country in which the transport processes were carried out. Therefore, in order to precisely calculate the levels of these costs, it would be necessary to relate them to a specific situation (specific transport connections and technologies used).

The hypothesis presented in the article was that there was no basis to claim that the current pandemic situation will contribute to a radical departure from the JIT concept in favor of, for example, Agile in supply chains. In the author’s opinion, this hypothesis was supported. First of all, the essence of the Just-In-Time system, as well as that of the whole concept of lean management, is not the complete elimination of stocks. The goal is to increase the efficiency of these processes by eliminating wastage such as excess inventory. The Just-In-Time system with complete stock-free (daily deliveries or several times a day directly to the production line), even before the pandemic, was not always profitable. Economic calculation has always determined whether and to what extent such a system should be implemented. Crisis situations such as a pandemic do not have to result in the abandonment of the lean management concept in favor of, for example, Agile. It is difficult to talk about using real Just-In-Time in global supply chains, even if air transport is involved. Paradoxically, if a pandemic were to shorten the lengths of supply chains, it would lead to favorable conditions for the implementation of the JIT system, with a higher degree of integration and flexibility than before. Moreover, if such a reallocation were to take place, it would also have a positive effect on the natural environment. This is another example that in the field of logistics, and especially in transport, there may be a convergence of business and social goals.

However, it should be borne in mind that the distance resulting from the location of the source of supply is not the only factor of supply certainty that is important in the Just-In-Time system. Even in case of local sources of supply, there may be disruptions due to a pandemic such as absenteeism of workers, lack of certain materials, packaging, machinery and also services like transport services. Such problems may even occur in industries that, because of their specificity, may be more local in nature than other industries, for example, the food industry, which is characterized by a high degree of vertical integration and is exposed to the influence of external factors. Even in this industry, however, the impact depends on the degree of import dependency, which can be high in some countries such as the UK [

47].

Taking into account the above conclusions, there is a need to continue research on these issues.