The Impact of Human Rights Reporting and Presentation Formats on Non-Professional Investors’ Perceptions and Intentions to Invest

Abstract

:1. Introduction

2. Background Literature and Theoretical Development

2.1. The Importance of Human Rights for Business

2.2. Human Rights Reporting

2.3. The Difference between Human Rights Information and Other Sustainability Information

2.4. The Effect of Human Rights Reporting on Non-Professional Investors’ Perceptions and Investment Decisions

2.5. The Effect of Presentation Format on Non-Professionals’ Reactions to Human Rights Reporting

3. Research Methodology

3.1. Design

3.2. Participants

3.3. Procedures

4. Results

4.1. Manipulation Checks

4.2. The Effect of Positive Human Rights Information on Non-Professional Investors’ Perceptions of the Company (H1)

4.3. The Effect of Less Positive Human Rights Reporting on Non-Professional Investors’ Investment Decisions (H2)

4.4. The Effect of Presentation Format on Non-Professional Investors’ Reactions to Human Rights Reporting (H3 and H4)

5. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Examples of Treatment Conditions

Appendix A.1. Positive—Numerical Condition

Appendix A.2. Less Positive—Numerical Condition

Appendix A.3. Positive—Qualitative Condition

Appendix A.4. Less Positive—Qualitative Condition

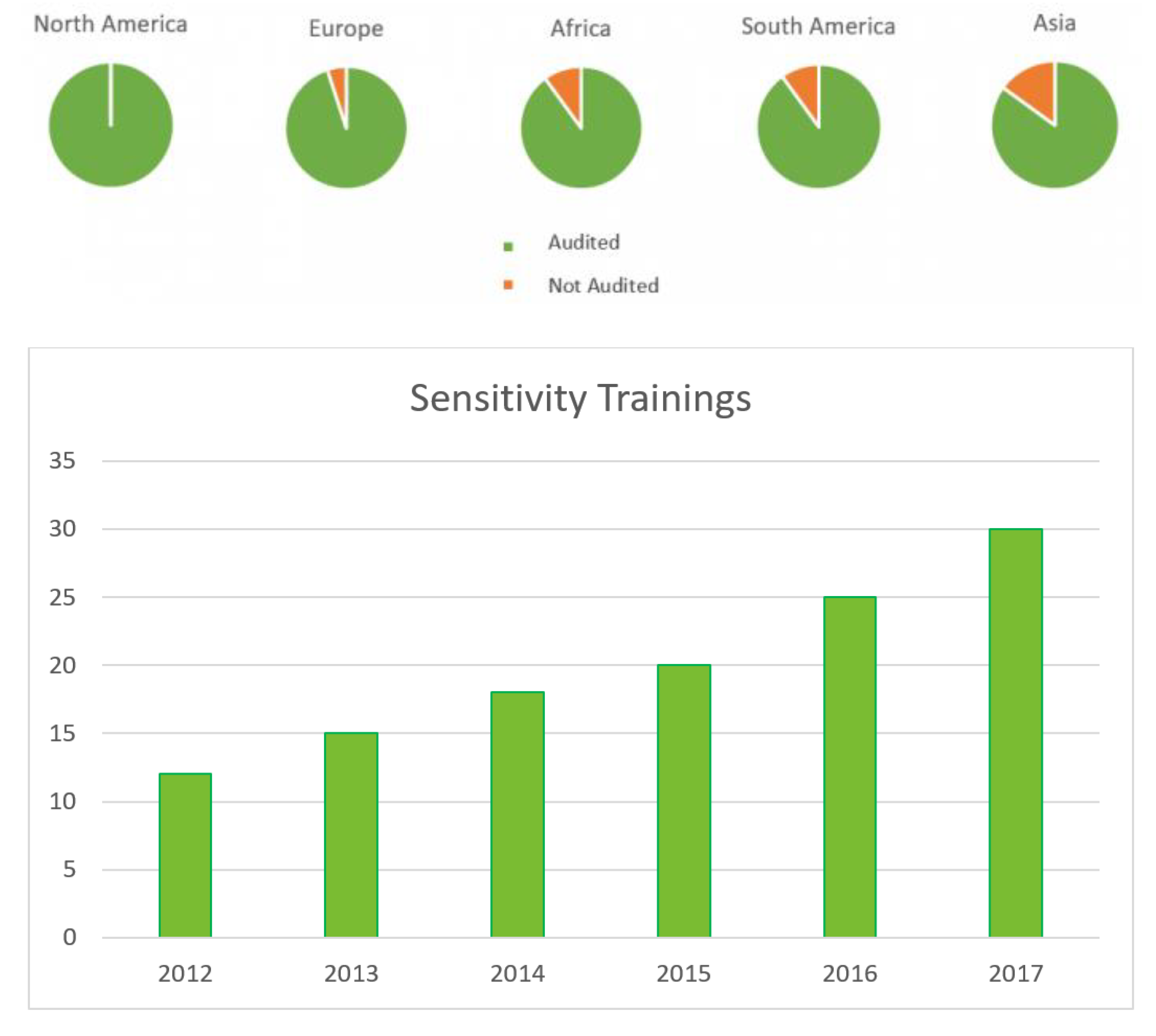

Appendix A.5. Positive—Graphs Condition

Appendix A.6. Less Positive—Graphs Condition

References

- Ballou, B.; Casey, R.J.; Grenier, J.H.; Heitger, D.L. Exploring the Strategic Integration of Sustainability Initiatives: Opportunities for Accounting Research. Account. Horizons 2012, 26, 265–288. [Google Scholar] [CrossRef]

- Campopiano, G.; de Massis, A. Corporate social responsibility reporting: A content analysis in family and non-family firms. J. Bus. Ethics 2015, 129, 511–534. [Google Scholar]

- Dhaliwal, D.; Li, O.Z.; Tsang, A.; Yang, Y.G. Corporate social responsibility disclosure and the cost of equity capital: The roles of stakeholder orientation and financial transparency. J. Account. Public Policy 2014, 33, 328–355. [Google Scholar] [CrossRef]

- KPMG. The KPMG Survey of Corporate Responsibility Reporting 2017. Available online: https://assets.kpmg/content/dam/kpmg/xx/pdf/2017/10/kpmg-survey-of-corporate-responsibility-reporting-2017.pdf. (accessed on 18 February 2022).

- Russo-Spena, T.; Tregua, M.; de Chiara, A. Trends and Drivers in CSR Disclosure: A Focus on Reporting Practices in the Automotive Industry. J. Bus. Ethics 2018, 151, 563–578. [Google Scholar] [CrossRef]

- Wang, X.; Cao, F.; Ye, K. Mandatory Corporate Social Responsibility (CSR) Reporting and Financial Reporting Quality: Evidence from a Quasi-Natural Experiment. J. Bus. Ethics 2018, 152, 253–274. [Google Scholar] [CrossRef]

- Chetty, K. From responsibility to accountability. Crit. Perspect. Account. 2011, 22, 759–761. [Google Scholar] [CrossRef]

- Frankental, P. No accounting for human rights. Crit. Perspect. Account. 2011, 22, 762–764. [Google Scholar] [CrossRef]

- Gallhofer, S.; Haslam, J.; van der Walt, S. Accountability and transparency in relation to human rights: A critical perspective reflecting upon accounting, corporate responsibility and ways forward in the context of globalisation. Crit. Perspect. Account. 2011, 22, 765–780. [Google Scholar] [CrossRef]

- Gray, R.; Gray, S. Accountability and human rights: A tentative exploration and a commentary. Crit. Perspect. Account. 2011, 22, 781–789. [Google Scholar] [CrossRef]

- McPhail, K.; Ferguson, J. The past, the present and the future of accounting for human rights. Account. Audit. Account. J. 2016, 29, 526–541. [Google Scholar]

- Edmans, A. Does Socially Responsible Investing Make Financially Sense? Available online: http://www.wsj.com/articles/does-socially-responsible-investing-make-financial-sense-1456715888. (accessed on 18 February 2022).

- Cahan, S.F.; de Villiers, C.; Jeter, D.C.; Naiker, V.; van Staden, C.J. Are CSR Disclosures Value Relevant? Cross-Country Evidence. Eur. Account. Rev. 2016, 25, 579–611. [Google Scholar] [CrossRef] [Green Version]

- Wang, K.T.; Li, D. Market Reactions to the First-Time Disclosure of Corporate Social Responsibility Reports: Evidence from China. J. Bus. Ethics 2016, 138, 661–682. [Google Scholar] [CrossRef]

- Kim, Y.; Park, M.S.; Wier, B. Is Earnings Quality Associated with Corporate Social Responsibility? Account. Rev. 2012, 87, 761–796. [Google Scholar] [CrossRef]

- McPhail, K.; Adams, C. Corporate respect for human rights: Meaning, scope, and the shifting order of discourse. Account. Audit. Account. J. 2016, 29, 650–678. [Google Scholar] [CrossRef] [Green Version]

- Adams, C.A.; Hill, W.; Roberts, C. Corporate social reporting practices in Western Europe: Legitimating corporate behavior. Br. Account. Rev. 1998, 30, 1–21. [Google Scholar] [CrossRef]

- Bénabou, R.; Tirole, J. Individual and corporate social responsibility. Economica 2010, 77, 1–19. [Google Scholar] [CrossRef] [Green Version]

- Arnold, D.G. Transnational Corporations and the Duty to Respect Basic Human Rights. Bus. Ethics Q. 2010, 20, 371–399. [Google Scholar] [CrossRef]

- Čertanec, A. The Connection between Corporate Social Responsibility and Corporate Respect for Human Rights. DANUBE: Law Econ. Soc. Issues Rev. 2019, 10, 103–127. [Google Scholar] [CrossRef]

- Cragg, W. Ethics, Enlightened Self-Interest, and the Corporate Responsibility to Respect Human Rights: A Critical Look at the Justificatory Foundations of the UN Framework. Bus. Ethics Q. 2012, 22, 9–36. [Google Scholar] [CrossRef]

- McCorquodale, R. Corporate Social Responsibility and International Human Rights Law. J. Bus. Ethics 2009, 87, 385–400. [Google Scholar] [CrossRef]

- Ramasastry, A. Corporate Social Responsibility Versus Business and Human Rights: Bridging the Gap Between Responsibility and Accountability. J. Hum. Rights 2015, 14, 237–259. [Google Scholar] [CrossRef]

- Wettstein, F.; Giuliani, E.; Santangelo, G.D.; Stahl, G.K. International business and human rights: A research agenda. J. World Bus. 2019, 54, 54–65. [Google Scholar] [CrossRef]

- United Nations General Assembly (UNGA). Universal Declaration on Human Rights. Available online: http://www.un.org/en/universal-declaration-human-rights/. (accessed on 18 February 2022).

- Connors, S.; Anderson-Macdonald, S.; Thomson, M. Overcoming the ‘Window Dressing’ Effect: Mitigating the Negative Effects of Inherent Skepticism Towards Corporate Social Responsibility. J. Bus. Ethics 2017, 145, 599–621. [Google Scholar] [CrossRef]

- Cooper, S.; Slack, R. Reporting practice, impression management and company performance: A longitudinal and comparative analysis of water leakage disclosure. Account. Bus. Res. 2015, 45, 801–840. [Google Scholar] [CrossRef] [Green Version]

- Lyon, T.P.; Maxwell, J.W. Greenwash: Corporate Environmental Disclosure under Threat of Audit. J. Econ. Manag. Strat. 2011, 20, 3–41. [Google Scholar] [CrossRef]

- Skarmeas, D.; Leonidou, C.N. When consumers doubt, Watch out! The role of CSR skepticism. J. Bus. Res. 2013, 66, 1831–1838. [Google Scholar] [CrossRef]

- Tata, J.; Prasad, S. CSR Communication: An Impression Management Perspective. J. Bus. Ethics 2015, 132, 765–778. [Google Scholar] [CrossRef]

- Elliott, W.B.; Jackson, K.E.; Peecher, M.E.; White, B.J. The Unintended Effect of Corporate Social Responsibility Performance on Investors’ Estimates of Fundamental Value. Account. Rev. 2014, 89, 275–302. [Google Scholar] [CrossRef] [Green Version]

- Iacoboni, M. Imitation, Empathy, and Mirror Neurons. Annu. Rev. Psychol. 2009, 60, 653–670. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Singer, T.; Klimecki, O. Empathy and compassion. Curr. Biol. 2014, 24, R875–R878. [Google Scholar] [CrossRef] [Green Version]

- von Harbou, F. The natural faculty of empathy as a basis for human rights. In Human Rights and Human Nature; Albers, M., Hoffman, T., Reinhardt, J., Eds.; Springer: Dordrecht, The Netherlands, 2014; pp. 95–108. [Google Scholar]

- Adams, C.A. The ethical, social and environmental reporting-performance portrayal gap. Account. Audit. Account. J. 2004, 17, 731–757. [Google Scholar] [CrossRef]

- Adams, C.A.; Frost, G.R. Managing Social and Environmental Performance: Do Companies Have Adequate Information? Aust. Account. Rev. 2008, 17, 2–11. [Google Scholar] [CrossRef]

- Arnold, M.; Hörner, C.; Martin, P.; Moser, D. Investment professionals’ use of corporate social responsibility disclosures. In Proceedings of the Hoosier Accounting Research Conference, Indiana University, Bloomington, IN, USA, 22 September 2020. [Google Scholar]

- Dilla, W.N.; Janvrin, D.J.; Jeffrey, C. The impact of graphical displays of pro forma earnings information on professional and non-professional investors’ earnings judgments. Behav. Res. Account. 2013, 25, 37–60. [Google Scholar] [CrossRef]

- Elliott, W.B.; Grant, S.M.; Rennekamp, K.M. How Disclosure Features of Corporate Social Responsibility Reports Interact with Investor Numeracy to Influence Investor Judgments. Contemp. Account. Res. 2017, 34, 1596–1621. [Google Scholar] [CrossRef]

- Fehrenbacher, D.; Soderstrom, N. Effect of CSR Information Presentation Order on Stakeholder Decision-Making. 2018. Available online: https://www.unsw.edu.au/business/sites/default/files/seminars-conferences/N-Soderstrom-Effect-of-CSR%2520Information-Presentation-Order-on-Stakeholder-Decision-Making.pdf. (accessed on 18 February 2022).

- Reimsbach, D.; Hahn, R.; Gürtürk, A. Integrated Reporting and Assurance of Sustainability Information: An Experimental Study on Professional Investors’ Information Processing. Eur. Account. Rev. 2018, 27, 559–581. [Google Scholar] [CrossRef] [Green Version]

- Robson, K. Accounting numbers as “inscription”: Action at a distance and the development of accounting. Account. Organ. Soc. 1992, 17, 685–708. [Google Scholar] [CrossRef]

- Chua, W.F. Experts, networks and inscriptions in the fabrication of accounting images: A story of the representation of three public hospitals. Account. Organ. Soc. 1995, 20, 111–145. [Google Scholar] [CrossRef]

- Porter, T.M. Quantification and the Accounting Ideal in Science. Soc. Stud. Sci. 1992, 22, 633–651. [Google Scholar] [CrossRef] [Green Version]

- Power, M. Counting, Control and Calculation: Reflections on Measuring and Management. Hum. Relat. 2004, 57, 765–783. [Google Scholar] [CrossRef]

- Power, M.; Laughlin, R. Habermas, law and accounting. Account. Organ. Soc. 1996, 21, 441–465. [Google Scholar] [CrossRef]

- Moore, S. Day Trading Surges in Popularity, This Won’t End Well. Available online: https://www.forbes.com/sites/simonmoore/2020/06/18/day-trading-surges-in-popularity-this-wont-end-well/?sh=38dbeb2e56c8. (accessed on 18 February 2022).

- Wursthorn, M.; Frankl-Duval, M.; Zuckerman, G. Everyone’s a Day Trader Now. Available online: https://www.wsj.com/articles/everyones-a-day-trader-now-11595649609. (accessed on 18 February 2022).

- McEvoy, Y. Here’s Why GameStop Excitement Is Surging Again on Reddit. Available online: https://www.forbes.com/sites/jemimamcevoy/2021/05/16/heres-why-gamestop-excitement-is-surging-again-on-reddit/?sh=459c1e9934c0. (accessed on 18 February 2022).

- Farkas, M.; Keshk, W. How Facebook influences non-professional investors’ affective reactions and judgments. J. Financial Rep. Account. 2019, 17, 80–103. [Google Scholar] [CrossRef] [Green Version]

- Victoravich, L.M. Overly Optimistic? Investor Sophistication and the Role of Affective Reactions to Financial Information in Investors’ Stock Price Judgments. J. Behav. Financ. 2010, 11, 1–10. [Google Scholar] [CrossRef]

- Driscoll, P. How We Protect Retail Investors. Available online: https://www.sec.gov/news/speech/speech-driscoll-042919. (accessed on 18 February 2022).

- Buhrmester, M.; Kwang, T.; Gosling, S. Amazon’s Mechanical Turk: A new source of inexpensive, yet high-quality, data? Perspect. Psychol. Sci. 2011, 6, 3–5. [Google Scholar] [CrossRef]

- Goodman, J.K.; Cryder, C.E.; Cheema, A. Data Collection in a Flat World: The Strengths and Weaknesses of Mechanical Turk Samples. J. Behav. Decis. Mak. 2013, 26, 213–224. [Google Scholar] [CrossRef]

- Litman, L.; Robinson, J.; Abberbock, T. TurkPrime.com: A versatile crowdsourcing data acquisition platform for the behavioral sciences. Behav. Res. Methods 2017, 49, 433–442. [Google Scholar] [CrossRef] [Green Version]

- Paolacci, G.; Chandler, J.; Ipeirotis, P. Running experiments on Amazon Mechanical Turk. Judgm. Decis. Mak. 2010, 5, 411–419. [Google Scholar]

- Rennekamp, K. Processing Fluency and Investors’ Reactions to Disclosure Readability. J. Account. Res. 2012, 50, 1319–1354. [Google Scholar] [CrossRef]

- Kelton, A.S.; Montague, N.R. The unintended consequences of uncertainty disclosures made by auditors and managers on non-professional investor judgments. Account. Organ. Soc. 2018, 65, 44–55. [Google Scholar] [CrossRef]

- Asay, H.S.; Hales, J. Disclaiming the Future: Investigating the Impact of Cautionary Disclaimers on Investor Judgments Before and After Experiencing Economic Loss. Account. Rev. 2018, 93, 81–99. [Google Scholar] [CrossRef]

- Cade, N.L. Corporate social media: How two-way disclosure channels influence investors. Account. Organ. Soc. 2018, 68–69, 63–79. [Google Scholar] [CrossRef]

- United Nations Human Rights Council (UNHRC). Guiding Principles on Business and Human Rights: Implementing the United Nations ‘Protect, Respect and Remedy Framework’. Available online: http://www.ohchr.org/Documents/Issues/Business/A-HRC-17-31_AEV.pdf. (accessed on 18 February 2022).

- OECD. OECD Guidelines for Multinational Enterprises; OECD Publishing: Paris, France, 2011. [Google Scholar]

- International Organization for Standardization. Guidance on Social Responsibility (ISO 26000). Available online: http://www.iso.org/iso-26000-social-responsibility.html (accessed on 18 February 2022).

- International Labour Organization. ILO Declaration on Fundamental Principles and Rights at Work and Its Follow-Up. Available online: http://www.ilo.org/wcmsp5/groups/public/---ed_norm/---declaration/documents/publication/wcms_467653.pdf. (accessed on 18 February 2022).

- Winston, A. Pepsi, United, and the Speed of Corporate Shame. Available online: http://hbr.org/2017/04/pepsi-united-and-the-speed-of-corporate-shame. (accessed on 18 February 2022).

- Shift & Mazars. UN Guiding Principles Reporting Framework. Available online: http://www.ungpreporting.org/wp-content/uploads/UNGPReportingFramework_2017.pdf. (accessed on 18 February 2022).

- European Union. EU Directive on Disclosure of Non-Financial and Diversity Information by Certain Large Undertakings and Groups. Available online: http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32014L0095. (accessed on 18 February 2022).

- Christensen, H.B.; Floyd, E.; Liu, L.Y.; Maffett, M. The real effects of mandated information on social responsibility in financial reports: Evidence from mine-safety records. J. Account. Econ. 2017, 64, 284–304. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary Nonfinancial Disclosure and the Cost of Equity Capital: The Initiation of Corporate Social Responsibility Reporting. Account. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- Avery, C. The difference between CSR and human rights. Corp. Citizsh. Brief. 2006, 89, 4. [Google Scholar]

- Tybout, A.; Roehm, M. Let the response fit the scandal: A step-by-step guide to tailoring your crisis response. Harv. Bus. Rev. 2009, 12, 82–88. [Google Scholar]

- Cho, C.H.; Laine, M.; Roberts, R.W.; Rodrigue, M. Organized hypocrisy, organizational façades, and sustainability reporting. Account. Organ. Soc. 2015, 40, 78–94. [Google Scholar] [CrossRef]

- Laufer, W.S. Social Accountability and Corporate Greenwashing. J. Bus. Ethics 2003, 43, 253–261. [Google Scholar] [CrossRef]

- Pinnuck, M.; Ranasinghe, A.; Soderstrom, N.; Zhou, J. Restatement of CSR Reports: Frequency, Magnitude, and Determinants. Contemp. Account. Res. 2021, 38, 2376–2416. [Google Scholar] [CrossRef]

- Cho, C.H.; Michelon, G.; Patten, D.M. Impression Management in Sustainability Reports: An Empirical Investigation of the Use of Graphs. Account. Public Interes. 2012, 12, 16–37. [Google Scholar] [CrossRef]

- Gallhofer, S.; Haslam, J. The aura of accounting in the context of a crisis: Germany and the first world war. Account. Organ. Soc. 1991, 16, 487–520. [Google Scholar] [CrossRef]

- Cardinaels, E. The interplay between cost accounting knowledge and presentation formats in cost-based decision-making. Account. Organ. Soc. 2008, 33, 582–602. [Google Scholar] [CrossRef]

- Cardinaels, E.; van Veen-Dirks, P.M. Financial versus non-financial information: The impact of information organization and presentation in a Balanced Scorecard. Account. Organ. Soc. 2010, 35, 565–578. [Google Scholar] [CrossRef]

- van der Heijden, H. Evaluation dual performance measures on information dashboards: Effects of anchoring and presentation format. J. Inf. Syst. 2013, 27, 21–34. [Google Scholar]

- Elliott, W.B. Are Investors Influenced by Pro Forma Emphasis and Reconciliations in Earnings Announcements? Account. Rev. 2006, 81, 113–133. [Google Scholar] [CrossRef]

- Frederickson, J.R.; Miller, J.S. The Effects of Pro Forma Earnings Disclosures on Analysts’ and Nonprofessional Investors’ Equity Valuation Judgments. Account. Rev. 2004, 79, 667–686. [Google Scholar] [CrossRef]

- Stoel, M.D.; Ballou, B.; Heitger, D.L. The Impact of Quantitative versus Qualitative Risk Reporting on Risk Professionals’ Strategic and Operational Risk Judgments. Account. Horizons 2017, 31, 53–69. [Google Scholar] [CrossRef]

- Dilla, W.; Janvrin, D.J. Voluntary Disclosure in Annual Reports: The Association between Magnitude and Direction of Change in Corporate Financial Performance and Graph Use. Account. Horizons 2010, 24, 257–278. [Google Scholar] [CrossRef]

- Kadous, K.; Koonce, L.; Towry, K.L.; Wright, A.M. Quantification and Persuasion in Managerial Judgement Discussion of “Quantification and Persuasion in Managerial Judgement”. Contemp. Account. Res. 2005, 22, 643–691. [Google Scholar] [CrossRef]

- Bettman, J.R.; Kakkar, P. Effects of Information Presentation Format on Consumer Information Acquisition Strategies. J. Consum. Res. 1977, 3, 233–240. [Google Scholar] [CrossRef]

- Sweller, J. Cognitive load during problem solving: Effects on learning. Cogn. Sci. 1988, 12, 257–285. [Google Scholar] [CrossRef]

- Paas, F.; Tuovinen, J.E.; Tabbers, H.; van Gerven, P. Cognitive Load Measurement as a Means to Advance Cognitive Load Theory. Educ. Psychol. 2003, 38, 63–71. [Google Scholar] [CrossRef]

- Shift. Human Rights Reporting: Are Companies Telling Investors What They Need to Know? Available online: http://www.shiftproject.org. (accessed on 18 February 2022).

- Kadous, K.; Zhou, Y. Maximizing the contribution of JDM-style experiments in accounting. In The Routledge Companion to Behavioural Research in Accounting; Routledge: Abingdon, UK, 2018. [Google Scholar]

- Farkas, M.; Murthy, U.S. Nonprofessional investors’ perceptions of the incremental value of continuous auditing and continuous controls monitoring: An experimental investigation. Int. J. Account. Inf. Syst. 2014, 15, 102–121. [Google Scholar] [CrossRef]

- Holt, T.P. An Examination of Nonprofessional Investor Perceptions of Internal and External Auditor Assurance. Behav. Res. Account. 2019, 31, 65–80. [Google Scholar] [CrossRef]

- Trinkle, B.S.; Crossler, R.E.; Belanger, F. Voluntary Disclosures via Social Media and the Role of Comments. J. Inf. Syst. 2015, 29, 101–121. [Google Scholar] [CrossRef]

- Brink, W.D.; Lee, L.S.; Pyzoha, J.S. Values of Participants in Behavioral Accounting Research: A Comparison of the M-Turk Population to a Nationally Representative Sample. Behav. Res. Account. 2019, 31, 97–117. [Google Scholar] [CrossRef]

- Farrell, A.; Grenier, J.H.; Leiby, J. Scoundrels or Stars? Theory and Evidence on the Quality of Workers in Online Labor Markets. Account. Rev. 2016, 92, 93–114. [Google Scholar] [CrossRef]

- Einhorn, H.J.; Hogarth, R. Behavioral Decision Theory: Processes of Judgment and Choice. J. Account. Res. 1981, 19, 1–31. [Google Scholar] [CrossRef]

- Brown-Liburd, H.; Cohen, J.; Zamora, V.L. CSR Disclosure Items Used as Fairness Heuristics in the Investment Decision. J. Bus. Ethics 2018, 152, 275–289. [Google Scholar] [CrossRef]

- Power, M. After calculation? Reflection on critique of economic reason by André Gorz. Account. Organ. Soc. 1992, 17, 477–499. [Google Scholar] [CrossRef]

- Manetti, G.; Becatti, L. Assurance Services for Sustainability Reports: Standards and Empirical Evidence. J. Bus. Ethics 2009, 87, 289–298. [Google Scholar] [CrossRef] [Green Version]

- O’Dwyer, B.; Owen, D.; Unerman, J. Seeking legitimacy for new assurance forms: The case of assurance on sustainability reporting. Account. Organ. Soc. 2011, 36, 31–52. [Google Scholar] [CrossRef]

- Perego, P.; Kolk, A. Multinationals’ Accountability on Sustainability: The Evolution of Third-party Assurance of Sustainability Reports. J. Bus. Ethics 2012, 110, 173–190. [Google Scholar] [CrossRef]

- Simnett, R.; Vanstraelen, A.; Chua, W.F. Assurance on Sustainability Reports: An International Comparison. Account. Rev. 2009, 84, 937–967. [Google Scholar] [CrossRef]

- Casey, R.J.; Grenier, J.H. Understanding and Contributing to the Enigma of Corporate Social Responsibility (CSR) Assurance in the United States. Audit. J. Pr. Theory 2015, 34, 97–130. [Google Scholar] [CrossRef]

- Cheng, M.M.; Green, W.J.; Ko, J.C.W. The Impact of Strategic Relevance and Assurance of Sustainability Indicators on Investors’ Decisions. Audit. J. Pr. Theory 2015, 34, 131–162. [Google Scholar] [CrossRef]

- Pflugrath, G.; Roebuck, P.; Simnett, R. Impact of Assurance and Assurer’s Professional Affiliation on Financial Analysts’ Assessment of Credibility of Corporate Social Responsibility Information. Audit. J. Pr. Theory 2011, 30, 239–254. [Google Scholar] [CrossRef]

- Adams, C.A.; Abhayawansa, S. Connecting the COVID-19 pandemic, environmental, social and governance (ESG) investing and calls for ‘harmonisation’ of sustainability reporting. Crit. Perspect. Account. 2021, in press. [Google Scholar] [CrossRef]

- Power, M. Auditing and the production of legitimacy. Account. Organ. Soc. 2003, 28, 379–394. [Google Scholar] [CrossRef]

- Axjonow, A.; Ernstberger, J.; Pott, C. The Impact of Corporate Social Responsibility Disclosure on Corporate Reputation: A Non-professional Stakeholder Perspective. J. Bus. Ethics 2018, 151, 429–450. [Google Scholar] [CrossRef]

| Group 1 | Group 2 | Variable | Mean Positive | Mean Less Positive | t | df | p |

|---|---|---|---|---|---|---|---|

| Positive Overall | Less Positive Overall | Favorable | 9.15 * | 5.36 * | 16.129 | 436 | <0.001 |

| Happy | 8.86 * | 5.10 * | 15.904 | 436 | <0.001 | ||

| Upset | 2.80 * | 6.51 * | 13.813 | 436 | <0.001 | ||

| Pleased | 8.69 * | 4.93 * | 15.311 | 436 | <0.001 | ||

| Positive Numerical | Less Positive Numerical | Favorable | 9.44 * | 5.53 | 10.829 | 147 | <0.001 |

| Happy | 9.08 * | 5.23 * | 10.133 | 147 | <0.001 | ||

| Upset | 2.89 * | 6.68 * | 8.336 | 147 | <0.001 | ||

| Pleased | 8.99 * | 5.12 * | 9.793 | 147 | <0.001 | ||

| Positive Qualitative | Less Positive Qualitative | Favorable | 8.88 * | 4.57 * | 9.883 | 144 | <0.001 |

| Happy | 8.49 * | 4.43 * | 9.340 | 144 | <0.001 | ||

| Upset | 3.16 * | 7.16 * | 8.312 | 144 | <0.001 | ||

| Pleased | 8.12 * | 4.21 * | 8.825 | 144 | <0.001 | ||

| Positive Graphical | Less Positive Graphical | Favorable | 9.11 * | 6.07 | 7.505 | 141 | <0.001 |

| Happy | 8.99 * | 5.71 | 8.152 | 141 | <0.001 | ||

| Upset | 2.38 * | 5.62 | 7.297 | 141 | <0.001 | ||

| Pleased | 8.93 * | 5.54 | 8.042 | 141 | <0.001 |

| n | Conditions | |||||||

|---|---|---|---|---|---|---|---|---|

| Control | Positive— Numerical | Less Positive— Numerical | Positive— Qualitative | Less Positive— Qualitative | Positive— Graphs | Less Positive— Graphs | ||

| 67 | 75 | 74 | 69 | 77 | 74 | 69 | ||

| Overall | Mean | 7.06 | 7.67 | 6.58 | 7.39 | 6.42 | 7.59 | 6.90 |

| Performance a | SD | 2.15 | 1.94 | 2.09 | 2.07 | 2.19 | 1.90 | 2.18 |

| Attractiveness b | Mean | 6.66 | 7.56 | 6.19 | 7.58 | 5.26 | 7.68 | 6.19 |

| SD | 2.34 | 2.40 | 2.33 | 2.22 | 2.70 | 2.07 | 2.40 | |

| Likelihood c | Mean | 6.49 | 7.31 | 5.97 | 7.19 | 5.18 | 7.41 | 5.86 |

| SD | 2.59 | 2.64 | 2.70 | 2.58 | 2.84 | 2.18 | 2.67 | |

| Investment d | Mean | USD 2408 | USD 3395 | USD 2495 | USD 2930 | USD 1719 | USD 3308 | USD 2029 |

| SD | USD 2114 | USD 2420 | USD 2307 | USD 2277 | USD 1939 | USD 2459 | USD 1906 | |

| Panel A—Positive Condition versus Control Condition | |||||

| Positive | Control | Mean Diff | T283 | p e | |

| Overall Performance a | 7.56 | 7.06 | 0.50 | 1.77 | 0.078 |

| Attractiveness b | 7.61 | 6.66 | 0.95 | 3.02 | 0.003 |

| Likelihood c | 7.30 | 6.49 | 0.81 | 2.33 | 0.021 |

| Investment d | USD 3218.26 | USD 2408.34 | USD 809.92 | 2.49 | 0.013 |

| Panel B—Less Positive Condition versus Control Condition | |||||

| Less Positive | Control | Mean Diff | T285 | p e | |

| Overall Performance | 6.62 | 7.06 | −0.44 | 1.46 | 0.147 |

| Attractiveness | 5.86 | 6.66 | −0.80 | 2.30 | 0.022 |

| Likelihood | 5.66 | 6.49 | −0.83 | 2.20 | 0.029 |

| Investment | USD 2077.03 | USD 2408.34 | −USD 331.31 | 1.14 | 0.256 |

| Panel A—Positive Conditions versus Control Conditions H3a–c | |||||||||

| Positive—Numerical versus Control: H3a | Positive—Graphs versus Control: H3b | Positive—Qualitative versus Control: H3c | |||||||

| Mean Diff | t140 | p e | Mean Diff | t139 | p e | Mean Diff | t134 | p e | |

| Overall Performance a | 0.61 | 1.770 | 0.079 | 0.53 | 1.570 | 0.119 | 0.33 | 0.918 | 0.360 |

| Attractiveness b | 0.90 | 2.268 | 0.025 | 1.02 | 2.741 | 0.007 | 0.92 | 2.361 | 0.020 |

| Likelihood c | 0.82 | 1.851 | 0.066 | 0.92 | 2.270 | 0.025 | 0.70 | 1.570 | 0.119 |

| Investment d | USD 986.35 | 2.573 | 0.011 | USD 899.54 | 2.318 | 0.022 | USD 522.02 | 1.385 | 0.168 |

| Panel B—Less Positive Conditions versus Control Conditions H4a–c | |||||||||

| Less Positive— Numerical versus Control: H4a | Less Positive—Graphs versus Control: H4b | Less Positive—Qualitative versus Control: H4c | |||||||

| Mean Diff | t139 | p e | Mean Diff | t134 | p e | Mean Diff | t142 | p e | |

| Overall Performance a | −0.48 | −1.342 | 0.181 | −0.16 | −0.434 | 0.665 | −0.64 | −1.777 | 0.078 |

| Attractiveness b | −0.47 | −1.188 | 0.268 | −0.47 | −1.151 | 0.252 | −1.40 | −3.292 | 0.001 |

| Likelihood c | −0.52 | −1.163 | 0.247 | −0.63 | −1.411 | 0.160 | −1.31 | −2.879 | 0.005 |

| Investment d | USD 86.30 | 0.231 | 0.818 | USD −379.72 | −1.101 | 0.273 | USD −689.26 | −2.041 | 0.043 |

| Panel C—Positive Conditions versus Less Positive Conditions—Supplemental | |||||||||

| Numerical Positive versus Less Positive | Graphs Positive versus Less Positive | Qualitative Positive versus Less Positive | |||||||

| Mean Diff | t147 | p e | Mean Diff | t141 | p e | Mean Diff | t144 | p e | |

| Overall Performance a | 1.09 | 3.289 | 0.001 | 0.69 | 2.036 | 0.044 | 0.97 | 2.760 | 0.007 |

| Attractiveness b | 1.37 | 3.543 | 0.001 | 1.49 | 3.969 | 0.001 | 2.32 | 5.631 | 0.001 |

| Likelihood c | 1.34 | 3.049 | 0.003 | 1.55 | 3.808 | 0.001 | 2.01 | 4.453 | 0.001 |

| Investment d | USD 900.05 | 2.323 | 0.022 | USD 1279.26 | 3.459 | USD 1211.28 | 3.471 | 0.001 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Brink, W.D.; De Meyst, K.; Eaton, T.V. The Impact of Human Rights Reporting and Presentation Formats on Non-Professional Investors’ Perceptions and Intentions to Invest. Sustainability 2022, 14, 2403. https://doi.org/10.3390/su14042403

Brink WD, De Meyst K, Eaton TV. The Impact of Human Rights Reporting and Presentation Formats on Non-Professional Investors’ Perceptions and Intentions to Invest. Sustainability. 2022; 14(4):2403. https://doi.org/10.3390/su14042403

Chicago/Turabian StyleBrink, William D., Karen De Meyst, and Tim V. Eaton. 2022. "The Impact of Human Rights Reporting and Presentation Formats on Non-Professional Investors’ Perceptions and Intentions to Invest" Sustainability 14, no. 4: 2403. https://doi.org/10.3390/su14042403