The Effects of Subsidies on MSW Treatment Companies: Financial Performance and Policy Implications

Abstract

:1. Introduction

2. Literature Review

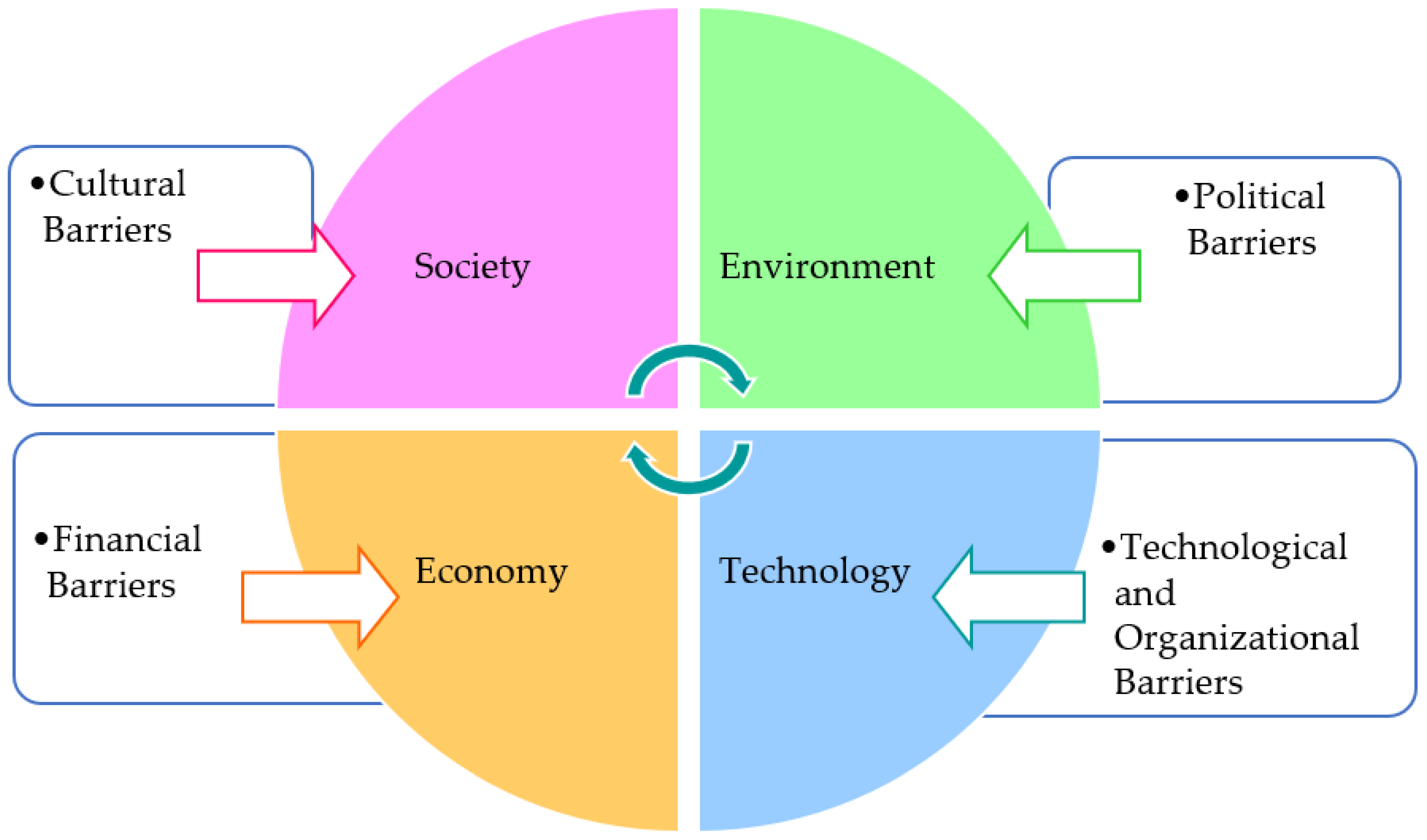

2.1. Barriers

2.2. Sustainability Policies and Financial Performance

3. Materials and Methods

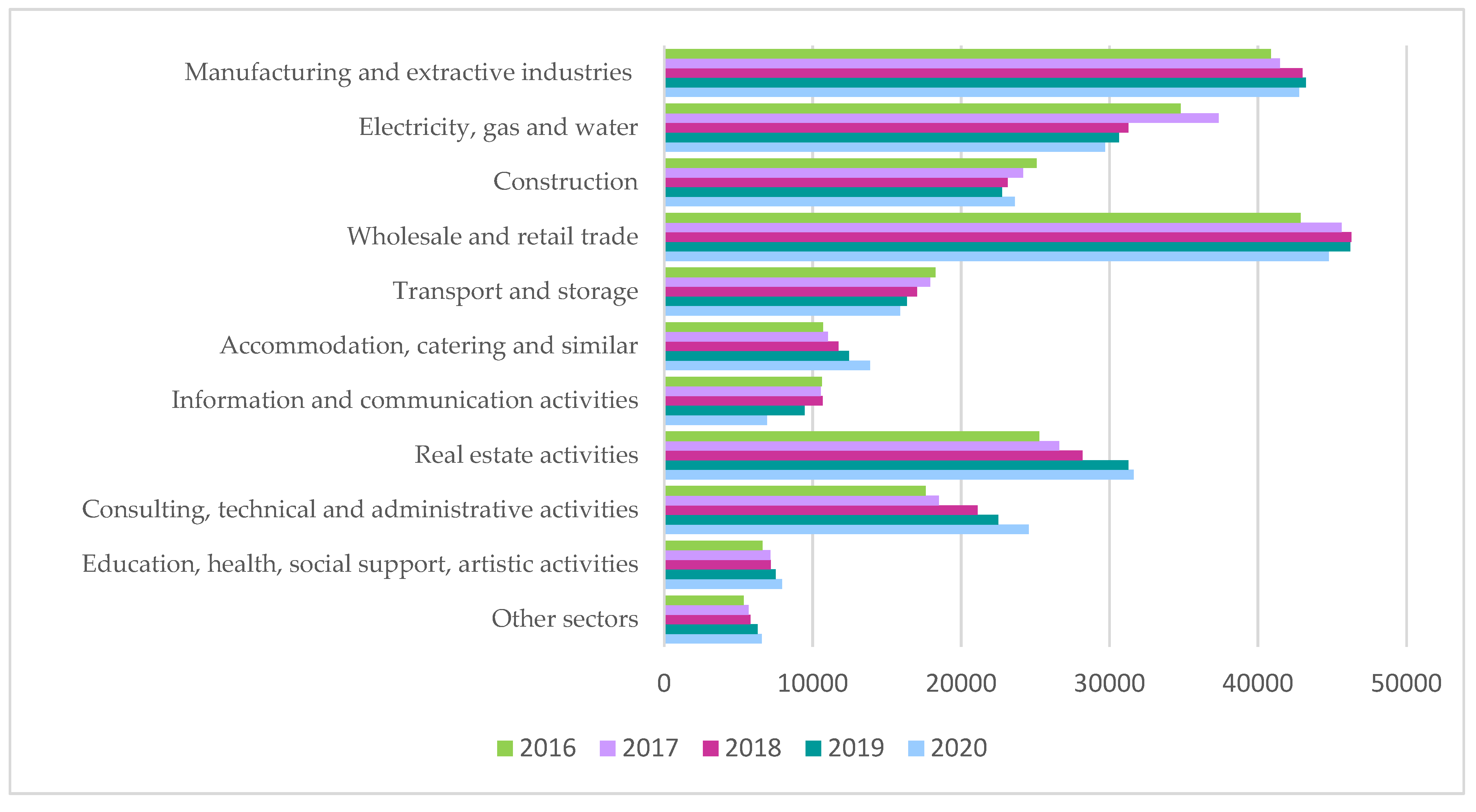

3.1. Data Collection

3.2. Method

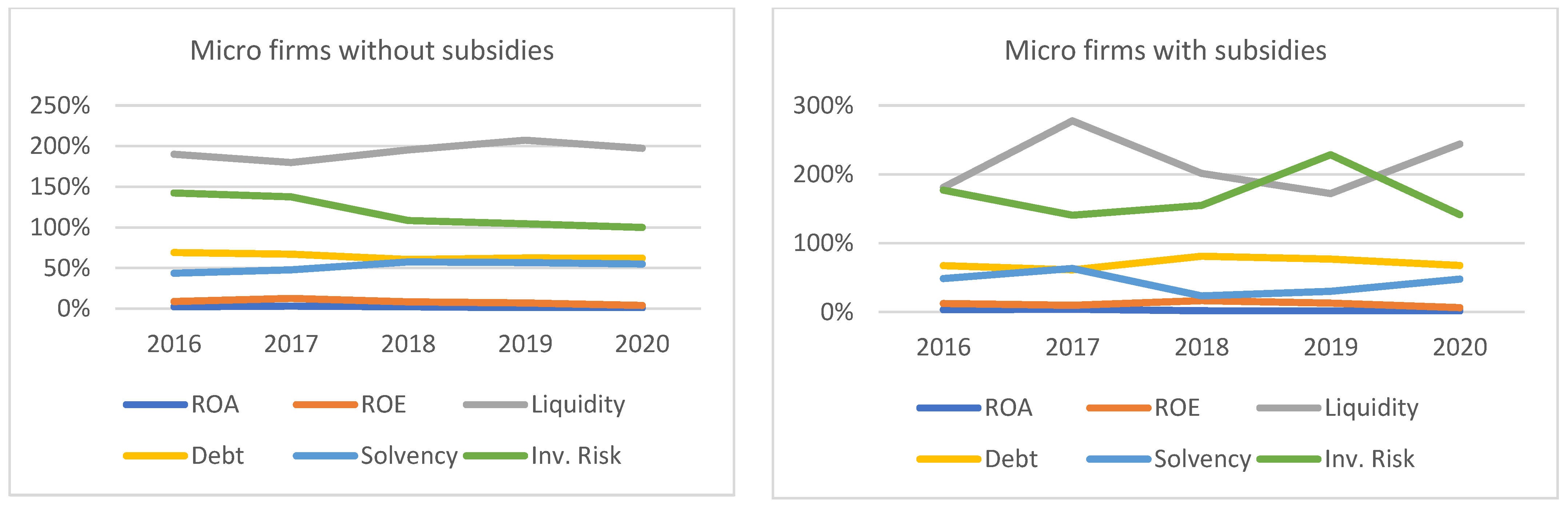

4. Results

5. Discussion

5.1. Barriers to Operating Activity and Corporate Indebtedness

5.2. Government Subsidies and Corporate Performance

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Vyas, S.; Prajapati, P.; Shah, A.V.; Varjani, S. Municipal solid waste management: Dynamics, risk assessment, ecological influence, advancements, constraints and perspectives. Sci. Total Environ. 2022, 814, 152802. [Google Scholar] [CrossRef] [PubMed]

- Alvarado, R.; Tillaguango, B.; Dagar, V.; Ahmad, M.; Işık, C.; Méndez, P.; Toledo, E. Ecological footprint, economic complexity, and natural resources rents in Latin America: Empirical evidence using quantile regressions. J. Clean. Prod. 2021, 318, 128585. [Google Scholar] [CrossRef]

- Kumar, S.R.; Prajapati, S.; Parambil, J.V. Sustainable Food Value Chains and Circular Economy. In Challenges and Opportunities of Circular Economy in Agri-Food Sector; Springer: Singapore, 2021; pp. 77–92. [Google Scholar]

- Sharma, H.B.; Vanapalli, K.R.; Samal, B.; Cheela, V.S.; Dubey, B.K.; Bhattacharya, J. Circular economy approach in solid waste management system to achieve UN-SDGs: Solutions for post-COVID recovery. Sci. Total Environ. 2021, 800, 149605. [Google Scholar] [CrossRef] [PubMed]

- Shooshtarian, S.; Maqsood, T.; Caldera, S.; Ryley, T. Transformation towards a circular economy in the Australian construction and demolition waste management system. Sustain. Prod. Consum. 2022, 30, 89–106. [Google Scholar] [CrossRef]

- Rodias, E.; Aivazidou, E.; Achillas, C.; Aidonis, D.; Bochtis, D. Water-energy-nutrients synergies in the agrifood sector: A circular economy framework. Energies 2021, 14, 159. [Google Scholar] [CrossRef]

- Baratsas, S.G.; Pistikopoulos, E.N.; Avraamidou, S. A system’s engineering framework for the optimization of food supply chains under circular economy considerations. Sci. Total Environ. 2021, 794, 148726. [Google Scholar] [CrossRef]

- Frishammar, J.; Parida, V. Circular business model transformation: A roadmap for incumbent firms. Calif. Manag. Rev. 2019, 61, 5–29. [Google Scholar] [CrossRef]

- Sposato, P.; Preka, R.; Cappellaro, F.; Cutaia, L. Sharing Economy and Circular Economy. How Technology and Collaborative Consumption Innovations Boost Closing the Loop Strategies. Environ. Eng. Manag. J. 2017, 16, 1797–1806. [Google Scholar] [CrossRef]

- Androniceanu, A.; Kinnunen, J.; Georgescu, I. Circular economy as a strategic option to promote sustainable economic growth and effective human development. J. Int. Stud. 2021, 14, 60–73. [Google Scholar] [CrossRef]

- Maranesi, C.; De Giovanni, P. Modern circular economy: Corporate strategy, supply chain, and industrial symbiosis. Sustainability 2020, 12, 9383. [Google Scholar] [CrossRef]

- Kuo, L.; Chang, B.G. The affecting factors of circular economy information and its impact on corporate economic sustainability-Evidence from China. Sustain. Prod. Consum. 2021, 27, 986–997. [Google Scholar] [CrossRef]

- Holzer, D.; Rauter, R.; Fleiß, E.; Stern, T. Mind the gap: Towards a systematic circular economy encouragement of small and medium-sized companies. J. Clean. Prod. 2021, 298, 126696. [Google Scholar] [CrossRef]

- APA. Produção e Gestão de Resíduos Urbanos. 2021. Available online: https://rea.apambiente.pt/content/produ%C3%A7%C3%A3o-e-gest%C3%A3o-de-res%C3%ADduos-urbanos (accessed on 25 December 2021).

- Van Buren, N.; Demmers, M.; Van Der Heijden, R.; Witlox, F. Towards a Circular Economy: The Role of Dutch Logistics Industries and Governments. Sustainability 2016, 8, 647. [Google Scholar] [CrossRef] [Green Version]

- Shahbazi, S.; Wiktorsson, M.; Kurdve, M.; Jönsson, C.; Bjelkemyr, M. Material efficiency in manufacturing: Swedish evidence on potential, barriers and strategies. J. Clean. Prod. 2016, 127, 438–450. [Google Scholar] [CrossRef]

- Mont, O.; Plepys, A.; Whalen, K.; Nußholz, J.L. Business Model Innovation for a Circular Economy: Drivers and Barriers for the Swedish Industry—The Voice of REES Companies; Mistra REES: Linköping, Sweden, 2017. [Google Scholar]

- De Jesus, A.; Mendonça, S. Lost in Transition? Drivers and Barriers in the Eco-innovation Road to the Circular Economy. Ecol. Econ. 2018, 145, 75–89. [Google Scholar] [CrossRef] [Green Version]

- Kirchherr, J.; Piscicelli, L.; Bour, R.; Kostense-Smit, E.; Muller, J.; Huibrechtse-Truijens, A.; Hekkert, M. Barriers to the circular economy: Evidence from the European Union (EU). Ecol. Econ. 2018, 150, 264–272. [Google Scholar] [CrossRef] [Green Version]

- Ormazabal, M.; Prieto-Sandoval, V.; Puga-Leal, R.; Jaca, C. Circular Economy in Spanish SMEs: Challenges and opportunities. J. Clean. Prod. 2018, 185, 157–167. [Google Scholar] [CrossRef]

- Ritzén, S.; Sandström, G.Ö. Barriers to the Circular Economy—Integration of Perspectives and Domains. Procedia CIRP 2016, 64, 7–12. [Google Scholar] [CrossRef]

- Ranta, V.; Aarikka-Stenroos, L.; Ritala, P.; Mäkinen, S.J. Exploring institutional drivers and barriers of the circular economy: A cross-regional comparison of China, the US, and Europe. Resour. Conserv. Recycl. 2018, 135, 70–82. [Google Scholar] [CrossRef]

- Shi, H.; Peng, S.Z.; Liu, Y.; Zhong, P. Barriers to the implementation of cleaner production in Chinese SMEs: Government, industry and expert stakeholders’ perspectives. J. Clean. Prod. 2008, 16, 842–852. [Google Scholar] [CrossRef]

- Pheifer, A.A.G. Barriers & Eenablers to Circular Business Models; Centre for European Policy Studies: Brielle, The Netherlands, 2017; Available online: https://www.circulairondernemen.nl/uploads/4f4995c266e00bee8fdb8fb34fbc5c15.pdf (accessed on 25 December 2021).

- Fitzpatrick, C.; Kissling, R.; Coughlan, D.; Fitzpatrick, C.; Boeni, H.; Luepschen, C.; Dickenson, J. Success factors and barriers in re-use of electrical and electronic equipment Resources, Conservation and Recycling. Resour. Conserv. Recycl. 2013, 80, 21–31. [Google Scholar]

- Nordin, N.; Ashari, H.; Hassan, M.G. Drivers and barriers in sustainable manufacturing implementation in Malaysian manufacturing firms. In Proceedings of the 2014 IEEE International Conference on Industrial Engineering and Engineering Management, Selangor, Malaysia, 9–12 December 2014; pp. 687–691. [Google Scholar]

- Van Eijk, F. Barriers & Drivers towards a Circular Economy—A Literature Review; European Union: Naarden, The Netherlands, 2015; pp. 1–138. Available online: https://circulareconomy.europa.eu/platform/sites/default/files/e00e8643951aef8adde612123e824493.pdf (accessed on 25 December 2021).

- Bakker, C.A.; den Hollander, M.C.; van Hinte, E.; Zijlstra, Y. Products That Last: Product Design for Circular Business Models; TU Delft Library: Delft, The Netherlands, 2014. [Google Scholar]

- Frei, R.; Jack, L.; Krzyzaniak, S.A. Sustainable reverse supply chains and circular economy in multichannel retail returns. Bus. Strategy Environ. 2020, 29, 1925–1940. [Google Scholar] [CrossRef]

- Liu, Y.; Bai, Y. An exploration of firms’ awareness and behaviour of developing circular economy: Empirical research in China. Resour. Conserv. Recycl. 2014, 87, 145–152. [Google Scholar] [CrossRef]

- Masi, D.; Kumar, V.; Garza-Reyes, J.A.; Godsell, J. Towards a more circular economy: Exploring the awareness, practices, and barriers from a focal firm perspective. Prod. Plan. Control 2018, 29, 539–550. [Google Scholar] [CrossRef]

- Agyemang, M.; Kusi-Sarpong, S.; Khan, S.A.; Mani, V.; Rehman, S.T.; Kusi-Sarpong, H. Drivers and barriers to circular economy implementation: An explorative study in Pakistan’s automobile industry. Manag. Decis. 2019, 57, 971–994. [Google Scholar] [CrossRef]

- Hart, J.; Adams, K.; Giesekam, J.; Tingley, D.D.; Pomponi, F. Barriers and drivers in a circular economy: The case of the built environment. Procedia Cirp 2019, 80, 619–624. [Google Scholar] [CrossRef]

- Kumar, V.; Sezersan, I.; Garza-Reyes, J.A.; Gonzalez, E.D.; Moh’d Anwer, A.S. Circular economy in the manufacturing sector: Benefits, opportunities and barriers. Manag. Decis. 2019, 57, 1067–1086. [Google Scholar] [CrossRef] [Green Version]

- Bilal, M.; Khan KI, A.; Thaheem, M.J.; Nasir, A.R. Current state and barriers to the circular economy in the building sector: Towards a mitigation framework. J. Clean. Prod. 2020, 276, 123250. [Google Scholar] [CrossRef]

- Mangla, S.K.; Luthor, S.; Mishra, N.; Singh, A.; Rana, N.P.; Dora, M.; Dwivedi, Y. Barriers to effective circular supply chain management in a developing country context. Prod. Plan. Control 2018, 29, 551–569. [Google Scholar] [CrossRef] [Green Version]

- Garcés-Ayerbe, C.; Rivera-Torres, P.; Suárez-Perales, I.; Leyva-de la Hiz, D.I. Is it possible to change from a linear to a circular economy? An overview of opportunities and barriers for European small and medium-sized enterprise companies. Int. J. Environ. Res. Public Health 2019, 16, 851. [Google Scholar] [CrossRef] [Green Version]

- García-Quevedo, J.; Jové-Llopis, E.; Martínez-Ros, E. Barriers to the circular economy in European small and medium-sized firms. Bus. Strategy Environ. 2020, 29, 2450–2464. [Google Scholar] [CrossRef]

- Bui, T.D.; Tseng, M.L. Understanding the barriers to sustainable solid waste management in society 5.0 under uncertainties: A novelty of socials and technical perspectives on performance driving. Environ. Sci. Pollut. Res. 2021, 29, 16265–16293. [Google Scholar] [CrossRef]

- Casazza, M.; Gioppo, L. A playwriting technique to engage on a shared reflective enquiry about the social sustainability of robotization and artificial intelligence. J. Clean. Prod. 2020, 248, 119201. [Google Scholar] [CrossRef]

- Keogh, J.G.; Dube, L.; Rejeb, A.; Hand, K.J.; Khan, N.; Dean, K. The Future Food Chain: Digitization as an Enabler of Society 5.0. In Building the Future of Food Safety Technology; Detwiler, D., Ed.; Elsevier: London, UK; Oxford, UK; San Diego, CA, USA; Cambridge, MA, USA, 2020. [Google Scholar]

- Murayama, A. Institutional instruments for urban systems design from the planner’s perspective. In Urban Systems Design: Creating Sustainable Smart Cities on the Internet of Things Era; Elsevier: London, UK, 2020; Chapter 14; pp. 409–427. [Google Scholar] [CrossRef]

- Tabaa, M.; Monteiro, F.; Bensag, H.; Dandache, A. Green Industrial Internet of Things from a smart industry perspective. Energy Rep. 2020, 6, 430–446. [Google Scholar] [CrossRef]

- Tanaka, M. Sustainable society and municipal solid waste management. In Municipal Solid Waste Management in Asia and the Pacific Islands; Springer: Singapore, 2014; pp. 1–14. [Google Scholar]

- Onoda, H. Smart approaches to waste management for post- COVID-19 smart cities in Japan. IET Smart Cities 2020, 2, 89–94. [Google Scholar] [CrossRef]

- Ikhlayel, M. Indicators for establishing and assessing waste management systems in developing countries: A holistic approach to sustainability and business opportunities. Bus. Strategy Dev. 2018, 1, 31–42. [Google Scholar] [CrossRef]

- Tsai, F.M.; Bui, T.D.; Tseng, M.L.; Lim, M.K.; Wu, K.J.; Mashud, A.H.M. Assessing a hierarchical sustainable solid waste management structure with qualitative information: Policy and regulations drive social impacts and stakeholder participation. Resour. Conserv. Recycl. 2020, 168, 105285. [Google Scholar] [CrossRef]

- Mohanty, R.; Kumar, B.P. Urbanization and smart cities. In Solving Urban Infrastructure Problems Using Smart City Technologies; Elsevier: Amsterdam, The Netherlands, 2021; pp. 143–158. [Google Scholar]

- Dubey, S.; Singh, P.; Yadav, P.; Singh, K.K. Household Waste Management System Using IoT and Machine Learning. Procedia Comput. Sci. 2020, 167, 1950–1959. [Google Scholar] [CrossRef]

- Bui, T.D.; Tsai, F.M.; Tseng, M.L.; Ali, M.H. Identifying sustainable solid waste management barriers in practice using the fuzzy Delphi method. Resour. Conserv. Recycl. 2020, 154, 104625. [Google Scholar] [CrossRef]

- Sharma, M.; Joshi, S.; Kannan, D.; Govindan, K.; Singh, R.; Purohit, H.C. Internet of things (IoT) adoption barriers of smart cities’ waste management: An Indian context. J. Clean. Prod. 2020, 270, 122047. [Google Scholar] [CrossRef]

- Mavrodieva, A.V.; Shaw, R. Disaster and climate change issues in Japan’s society 5 0—A discussion. Sustainability 2020, 12, 1893. [Google Scholar] [CrossRef] [Green Version]

- Bui, T.D.; Tsai, F.M.; Tseng, M.L.; Wu, K.J.; Chiu, A.S. Effective municipal solid waste management capability under uncertainty in Vietnam: Utilizing economic efficiency and technology to foster social mobilization and environmental integrity. J. Clean. Prod. 2020, 259, 120981. [Google Scholar] [CrossRef]

- Anagnostopoulos, T.; Zaslavsky, A.; Kolomvatsos, K.; Medvedev, A.; Amirian, P.; Morley, J.; Hadjieftymiades, S. Challenges and opportunities of waste management in IoT-enabled smart cities: A survey. IEEE Trans. Sustain. Comput. 2017, 2, 275–289. [Google Scholar] [CrossRef]

- Ferreira, C.M.; Serpa, S. Society 5.0 and social development. Manag. Organ. Stud. 2018, 5, 26–31. [Google Scholar]

- Foresti, R.; Rossi, S.; Magnani, M.; Bianco, C.G.L.; Delmonte, N. Smart society and artificial intelligence: Big data scheduling and the global standard method applied to smart maintenance. Engineering 2020, 6, 835–846. [Google Scholar] [CrossRef]

- Gunasekaran, A.; Kobu, B. Performance measures and metrics in logistics and supply chain management: A review of recent literature (1995–2004) for research and applications. Int. J. Prod. Res. 2007, 45, 2819–2840. [Google Scholar] [CrossRef]

- Mirhedayatian, S.M.; Azadi, M.; Saen, R.F. A novel network data envelopment analysis model for evaluating green supply chain management. Int. J. Prod. Econ. 2014, 147, 544–554. [Google Scholar] [CrossRef]

- Wei, Y.S.; Samiee, S.; Lee, R.P. The influence of organic organizational cultures. market responsiveness. and product strategy on firm performance in an emerging market. J. Acad. Mark. Sci. 2014, 42, 49–70. [Google Scholar] [CrossRef]

- Chand, M.B.; Hatia, N.; Singh, R.K. ANP-MOORA-based approach for the analysis of selected issues of green supply chain management. Benchmarking Int. J. 2018, 25, 642–659. [Google Scholar] [CrossRef]

- Diab, D.L.; Highhouse, S. Test of an impression formation model: An illustration with two well-known companies. Corp. Reput. Rev. 2015, 18, 156–173. [Google Scholar] [CrossRef]

- Alshehhi, A.; Nobanee, H.; Khare, N. The impact of sustainability practices on corporate financial performance: Literature trends and future research potential. Sustainability 2018, 10, 494. [Google Scholar] [CrossRef] [Green Version]

- Molina-Moreno, V. Leyva-Díaz, J.C.; Sánchez-Molina, J.; Peña-García, A. Proposal to foster sustainability through circular economy-based engineering: A profitable chain from waste management to tunnel lighting. Sustainability 2017, 9, 2229. [Google Scholar] [CrossRef] [Green Version]

- Walker, A.M.; Opferkuch, K.; Lindgreen, E.R.; Simboli, A.; Vermeulen, W.J.; Raggi, A. Assessing the social sustainability of circular economy practices: Industry perspectives from Italy and the Netherlands. Sustain. Prod. Consum. 2021, 27, 831–844. [Google Scholar] [CrossRef]

- López Ruiz, L.A.; Ramón, X.R.; Domingo, S.G. The circular economy in the construction and demolition waste sector—A review and an integrative model approach. J. Clean. Prod. 2019, 248, 119238. [Google Scholar] [CrossRef]

- Yeo, J.Y.J.; How, B.S.; Teng, S.Y.; Leong, W.D.; Ng, W.P.Q.; Lim, C.H.; Lam, H.L. Synthesis of sustainable circular economy in palm oil industry using graph-theoretic method. Sustainability 2020, 12, 8081. [Google Scholar] [CrossRef]

- Lahti, T.; Wincent, J.; Parida, V. A definition and theoretical review of the circular economy. value creation. and sustainable business models: Where are we now and where should research move in the future? Sustainability 2018, 10, 2799. [Google Scholar] [CrossRef] [Green Version]

- Van Loon, P.; Van Wassenhove, L.N. Transition to the circular economy: The story of four case companies. Int. J. Prod. Res. 2020, 58, 3415–3422. [Google Scholar] [CrossRef]

- Ranta, V.; Aarikka-Stenroos, L.; Väisänen, J.M. Digital technologies catalysing business model innovation for circular economy—Multiple case study. Resour. Conserv. Recycl. 2021, 164, 105155. [Google Scholar] [CrossRef]

- Pieroni, M.P.P.; McAloone, T.C.; Pigosso, D.C.A. Business model innovation for circular economy and sustainability: A review of approaches. J. Clean Prod. 2019, 215, 198–216. [Google Scholar] [CrossRef]

- Lieder, M.; Rashid, A. Towards circular economy implementation: A comprehensive review in context of manufacturing industry. J. Clean. Prod. 2016, 115, 36–51. [Google Scholar] [CrossRef]

- Endrikat, J.; Guenther, E.; Hoppe, H. Making sense of conflicting empirical findings: A meta-analytic review of the relationship between corporate environmental and financial performance. Eur. Manag. J. 2014, 32, 735–751. [Google Scholar] [CrossRef]

- Buallay, A. Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Manag. Environ. Qual. Int. J. 2019, 30, 98–115. [Google Scholar] [CrossRef]

- Singh, S.K.; Chen, J.; Del Giudice, M.; El-Kassar, A.N. Environmental ethics, environmental performance, and competitive advantage: Role of environmental training. Technol. Forecast. Soc. Change 2019, 146, 203–211. [Google Scholar] [CrossRef]

- Xie, X.; Huo, J.; Zou, H. Green process innovation, green product innovation, and corporate financial performance: A content analysis method. J. Bus. Res. 2019, 101, 697–706. [Google Scholar] [CrossRef]

- Xie, J.; Nozawa, W.; Yagi, M.; Fujii, H.; Managi, S. Do environmental, social, and governance activities improve corporate financial performance? Bus. Strategy Environ. 2019, 28, 286–300. [Google Scholar] [CrossRef] [Green Version]

- Bhaskaran, R.K.; Ting, I.W.; Sukumaran, S.K.; Sumod, S.D. Environmental, social and governance initiatives and wealth creation for firms: An empirical examination. Manag. Decis. Econ. 2020, 41, 710–729. [Google Scholar] [CrossRef]

- Zhang, D.; Rong, Z.; Ji, Q. Green innovation and firm performance: Evidence from listed companies in China. Resour. Conserv. Recycl. 2019, 144, 48–55. [Google Scholar] [CrossRef]

- Delmas, M.A.; Nairn-Birch, N.; Lim, J. Dynamics of environmental and financial performance: The case of greenhouse gas emissions. Organ. Environ. 2015, 28, 374–393. [Google Scholar] [CrossRef]

- Misani, N.; Pogutz, S. Unraveling the effects of environmental outcomes and processes on financial performance: A non-linear approach. Ecol. Econ. 2015, 109, 150–160. [Google Scholar] [CrossRef]

- Alexopoulos, I.; Kounetas, K.; Tzelepis, D. Environmental and financial performance. Is there a win-win or a win-loss situation? Evidence from the Greek manufacturing. J. Clean. Prod. 2018, 197, 1275–1283. [Google Scholar] [CrossRef] [Green Version]

- Hou, T.C.T. The relationship between corporate social responsibility and sustainable financial performance: Firm-level evidence from Taiwan. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 19–28. [Google Scholar] [CrossRef] [Green Version]

- Dewatripont, M.; Tirole, J. The Prudential Regulation of Banks; MIT Press: Cambridge, MA, USA, 1994; Volume 6. [Google Scholar]

- Du, J.; Mickiewicz, T. Subsidies, rent seeking and performance: Being young, small or private in China. J. Bus. Ventur. 2016, 31, 22–38. [Google Scholar] [CrossRef] [Green Version]

- Datta-Chaudhuri, M. Market failure and government failure. J. Econ. Perspect. 1990, 4, 25–39. [Google Scholar] [CrossRef]

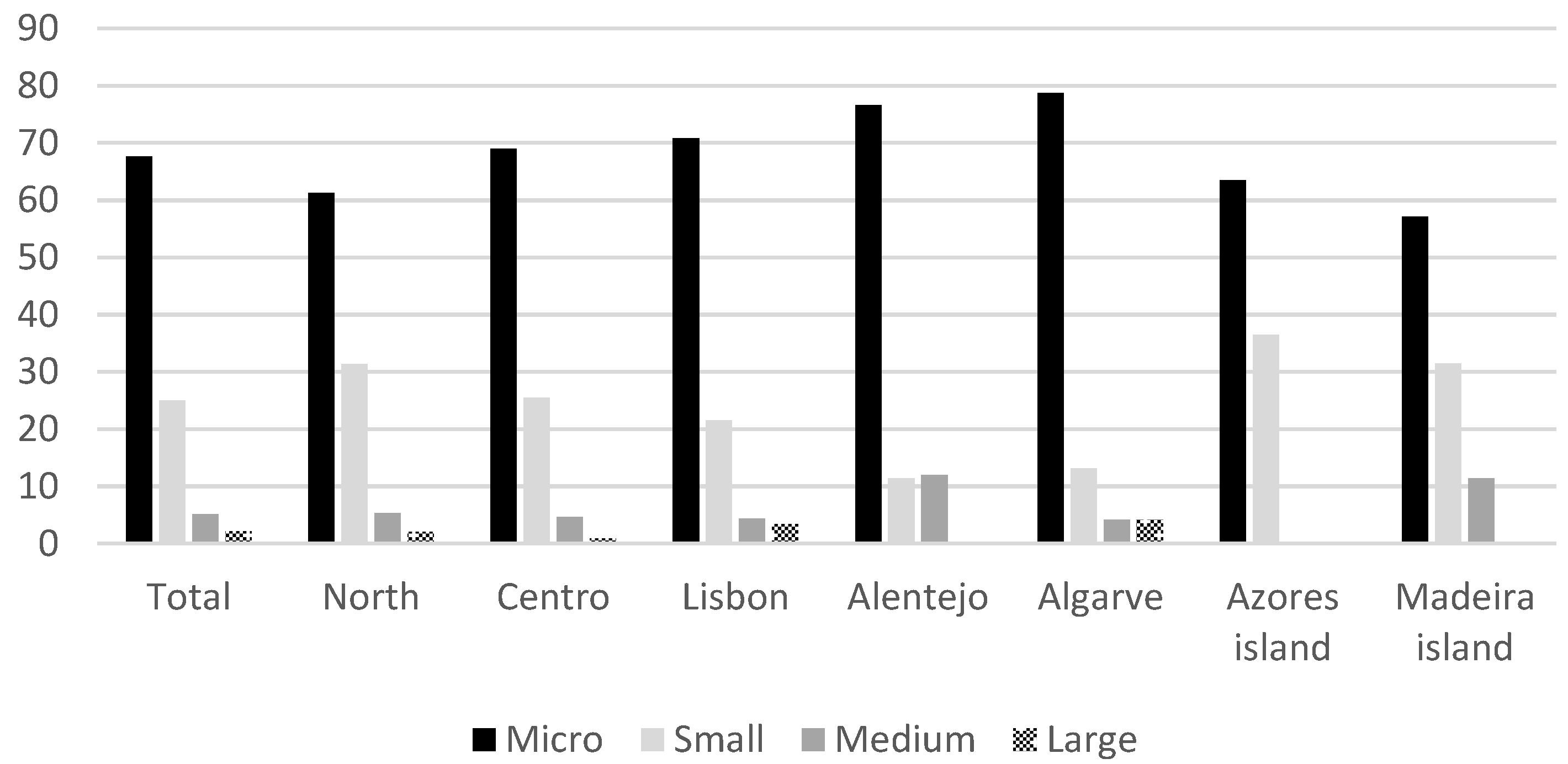

| Region | # Companies | # Observations | % Regional Structure | Population Density Per km2 |

|---|---|---|---|---|

| North | 213 | 944 | 32.4 | 167.8 |

| Centro | 124 | 542 | 26.0 | 78.8 |

| Lisbon | 253 | 1097 | 25.4 | 950.6 |

| Alentejo | 34 | 158 | 7.7 | 22.2 |

| The Algarve | 28 | 122 | 4.7 | 87.7 |

| The Azores | 13 | 63 | 2.1 | 104.4 |

| Madeira | 15 | 70 | 1.7 | 317.2 |

| Total | 680 | 2996 | 100 | 1728.7 |

| Statistics | Mean | Median | St. Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| # Employees | 25.9 | 5.0 | 111.2 | 0.0 | 1917.00 |

| Wages | 468,796.2 | 68,834.0 | 1,834,157.3 | 0.0 | 28,159,647.1 |

| Fuel Costs | 16,344.8 | 14,404.8 | 11,204.0 | 0.0 | 282,996.8 |

| Turnover | 2,427,554.80 | 358,451.90 | 7,130,767.70 | 0 | 77,924,553.10 |

| Subsidies | 29,438.20 | 0 | 458,422.90 | 0 | 11,461,870.20 |

| Total Assets | 1,626,417.80 | 237,856.70 | 5,041,062.60 | 2.6 | 129,151,553.40 |

| Capex | 192,100.70 | 9230.70 | 2,197,156.20 | −78,900,196.00 | 16,414,264.60 |

| Total Equity | 2,331,827.00 | 147,914.10 | 13,232,180.80 | −5,626,967.10 | 349,460,206.50 |

| Net Income | 292,853.90 | 10,885.80 | 3,611,749.20 | −17,531,217.60 | 91,197,716.90 |

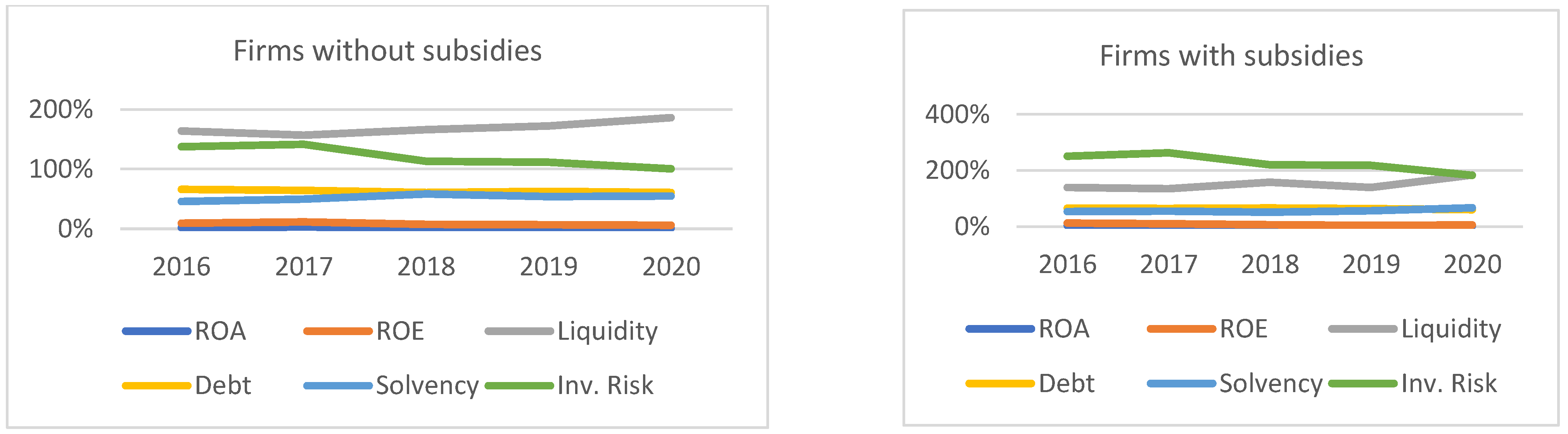

| Statistics | ROA | ROE | Liquidity | Debt | Solvency | Investment Risk |

|---|---|---|---|---|---|---|

| Mean | 85.5 | 12.4 | 1310.6 | 183.8 | 371.5 | 423.7 |

| Median | 2.4 | 8.3 | 172.1 | 62.2 | 59.6 | 140.4 |

| St. Deviation | 4945.3 | 893.5 | 23,300.1 | 4647.7 | 3703.7 | 2739.5 |

| Minimum | −7589.0 | −38,694.9 | −578.5 | 0.0 | −100.0 | −28,574.4 |

| Maximum | 270,540.4 | 27,357.2 | 1,137,108. 2 | 254,013.5 | 153,854.3 | 73,220.1 |

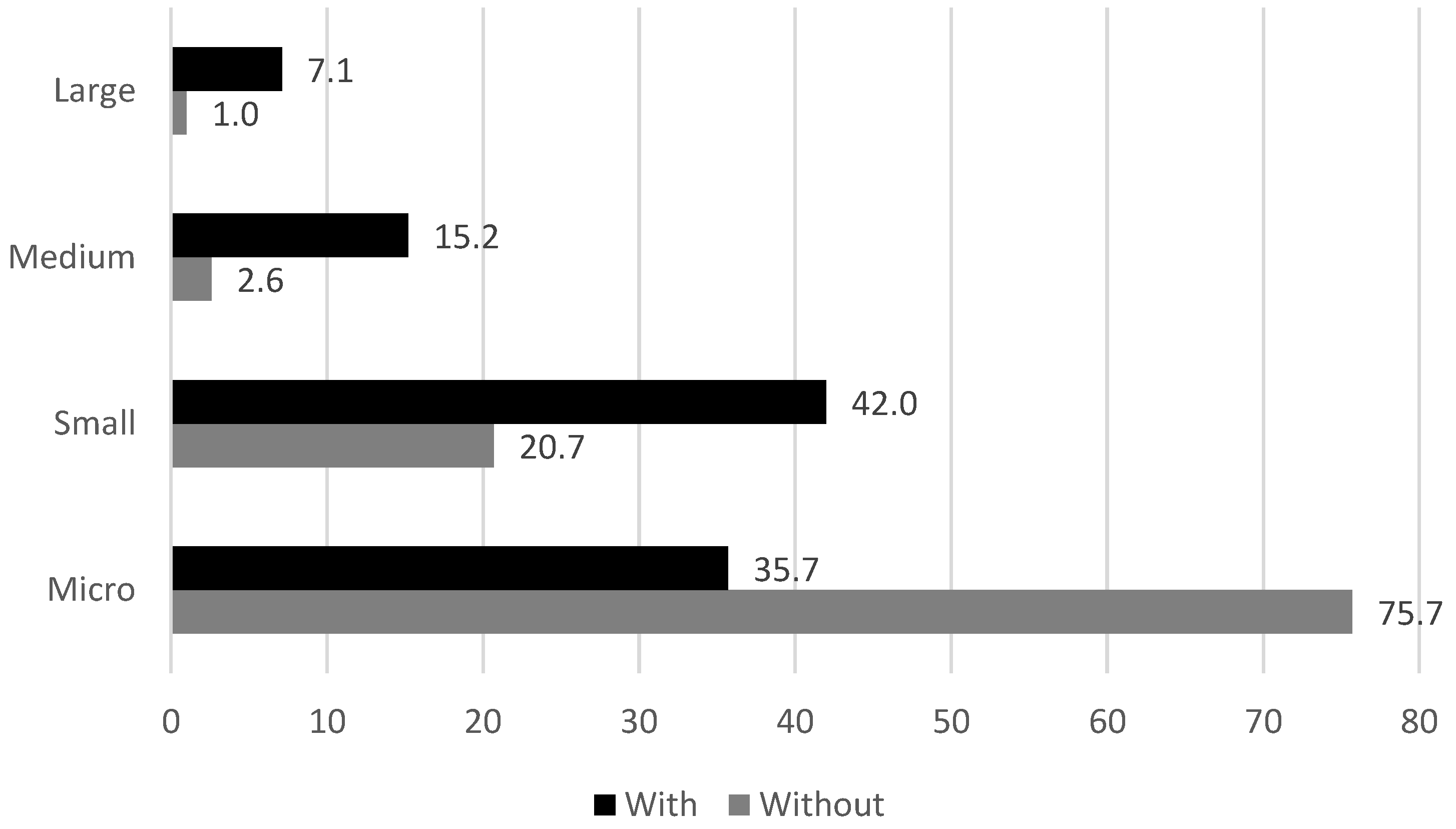

| Variable | Subsidies | Mean | Median | St. Dev. | Minimum | Maximum | Mw Test |

|---|---|---|---|---|---|---|---|

| Employees | Without | 15.0 | 4.0 | 79.8 | 0.0 | 1751.0 | 0.000 |

| With | 69.1 | 16.0 | 183.8 | 1.0 | 1917.0 | ||

| Turnover | Without | 1,833,330.9 | 237,259.4 | 6,450,244.5 | 0.0 | 77,924,553.1 | 0.000 |

| With | 4,775,967.0 | 1,336,323.9 | 8,976,692.2 | 0.0 | 61,284,438.4 | ||

| Fuel Cost | Without | 51,623.9 | 5992.4 | 210,866.3 | 0.0 | 3,913,382.3 | 0.000 |

| With | 182,915.6 | 30,366.3 | 384,549.2 | 0.0 | 2,733,156.4 | ||

| Wages | Without | 288,950.7 | 51,105.6 | 1,424,591.8 | 0.0 | 27,709,193.5 | 0.000 |

| With | 1,179,557.3 | 263,956.1 | 2,831,409.2 | 866.3 | 28,159,647.1 | ||

| Net Income | Without | 509,677.7 | 23,546.0 | 4,480,877.2 | −10,078,566.8 | 110,271,342.7 | 0.000 |

| With | 789,889.1 | 150,101.6 | 1,690,023.4 | −1,475,649.0 | 19,985,561.7 | ||

| Total Equity | Without | 1,256,487.9 | 181,975.5 | 4,702,012.0 | 2.6 | 129,151,553.4 | 0.000 |

| With | 3,088,405.1 | 844,149.2 | 5,986,910.5 | 2990.5 | 83,668,002.9 | ||

| Total Assets | Without | 315,960.2 | 8589.7 | 4,024,146.4 | −17,531,217.6 | 91,197,716.9 | 0.000 |

| With | 201,536.5 | 34,588.0 | 771,575.4 | −4,270,435.0 | 13,241,014.9 | ||

| Capex | Without | 85,698.3 | 3815.1 | 2,256,119.4 | −78,900,196.0 | 16,414,264.6 | 0.000 |

| With | 602,020.6 | 85,204.1 | 1,900,213.6 | −15,390,718.0 | 16,002,918.0 | ||

| ROA | Without | 106.8 | 2.5 | 5535.8 | −7589.0 | 270,540.4 | 0.416 |

| With | 1.3 | 2.1 | 26.9 | −555.7 | 67.6 | ||

| ROE | Without | 2.9 | 8.7 | 827.7 | −38,694.9 | 3702.5 | 0.014 |

| With | 50.2 | 6.8 | 1116.4 | −1750.8 | 27,357.2 | ||

| Liquidity | Without | 1542.3 | 177.2 | 26,073.1 | −578.5 | 1,137,108.2 | 0.004 |

| With | 419.1 | 156.4 | 3916.6 | 1.1 | 96,013.7 | ||

| Debt | Without | 213.5 | 61.9 | 5202.2 | 0.0 | 254,013.5 | 0.892 |

| With | 66.2 | 63.3 | 66.2 | 3.9 | 1433.3 | ||

| Solvency | Without | 435.0 | 60.2 | 4148.9 | −100.0 | 153,854.3 | 0.622 |

| With | 124.7 | 58.0 | 237.5 | −93.0 | 2482.1 | ||

| Inv. Risk | Without | 372.0 | 128.6 | 2782.0 | −28,574.4 | 73,220.1 | 0.000 |

| With | 623.3 | 211.2 | 2561.3 | −4560.0 | 48,206.3 |

| Region | Subsidies | Wages | Fuel Cost |

|---|---|---|---|

| North | without | 61,826.4 | 6628.3 |

| with | 296,979.3 | 28,921.9 | |

| Centro | without | 60,060.6 | 8519.5 |

| with | 236,459.8 | 24,662.1 | |

| Lisbon | without | 48,360.6 | 5436.2 |

| with | 657,047.6 | 67,386.6 | |

| Alentejo | without | 13,727.8 | 3392.8 |

| with | 122,782.1 | 26,680.0 | |

| The Algarve | without | 29,631.5 | 4766.1 |

| with | 152,504.2 | 46,517.3 | |

| The Azores | without | 19,861.6 | 98.1 |

| with | 108,779.9 | 12,666.8 | |

| Madeira | without | 0.0 | 161.8 |

| with | 396,040.7 | 16,624.8 |

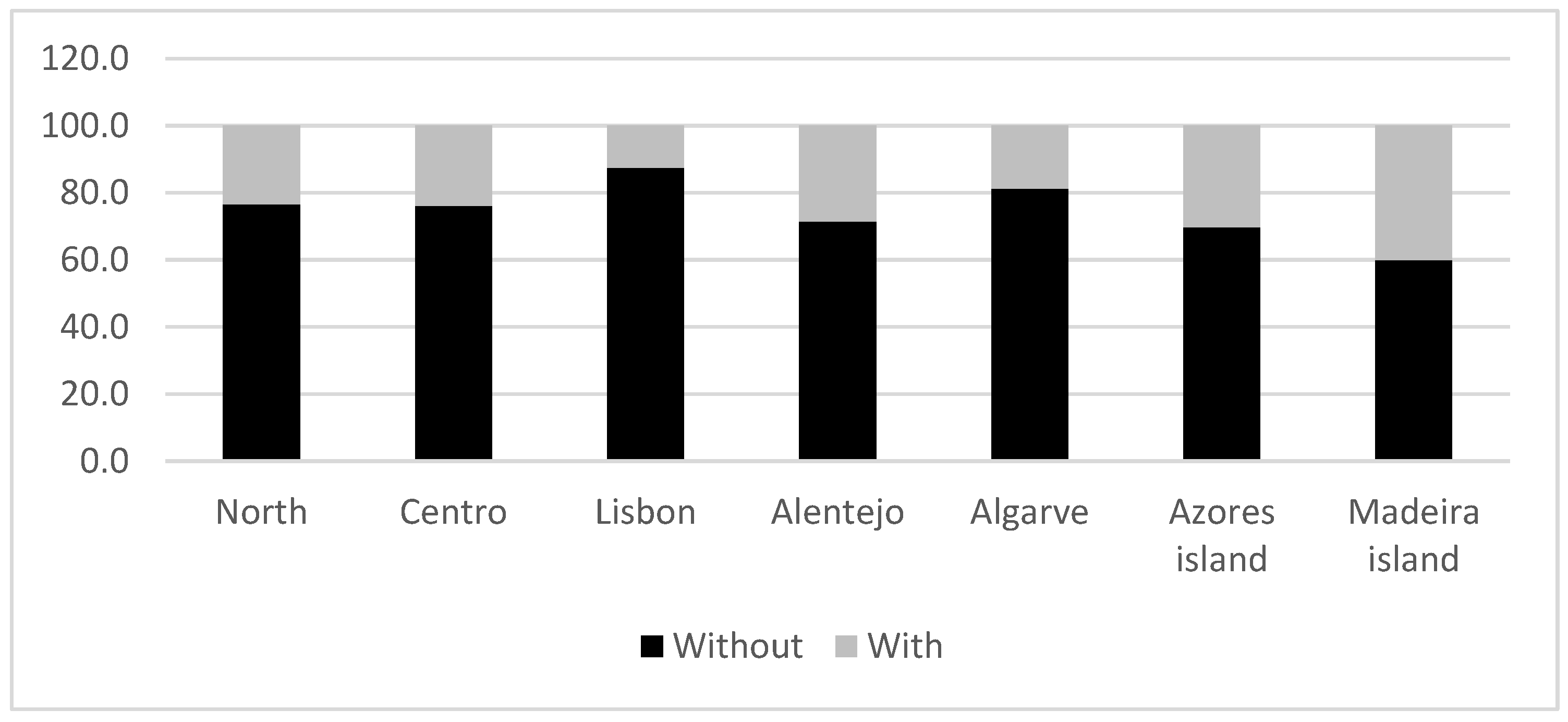

| Region | Subsidies | ROA | ROE | Liquidity | Debt | Solvency | Inv. Risk |

|---|---|---|---|---|---|---|---|

| North | Without | 2.2% | 7.8% | 163.7% | 66.1% | 49.6% | 136.0% |

| With | 1.8% | 6.3% | 152.0% | 65.8% | 52.0% | 222.4% | |

| Centro | Without | 2.9% | 8.4% | 219.3% | 52.5% | 88.3% | 140.8% |

| With | 2.2% | 7.5% | 181.6% | 58.6% | 70.7% | 195.3% | |

| Lisbon | Without | 2.7% | 9.9% | 171.9% | 63.1% | 56.0% | 125.1% |

| With | 3.1% | 9.9% | 157.0% | 62.5% | 60.1% | 214.6% | |

| Alentejo | Without | 0.3% | 4.3% | 142.0% | 78.7% | 25.3% | 100.0% |

| With | 1.6% | 3.0% | 135.5% | 59.9% | 66.9% | 300.5% | |

| The Algarve | Without | 3.9% | 14.9% | 230.5% | 60.0% | 66.8% | 124.8% |

| With | 1.7% | 4.5% | 107.3% | 66.1% | 51.2% | 253.0% | |

| Azores Island | Without | 3.1% | 13.1% | 262.7% | 42.8% | 133.8% | 105.0% |

| With | 7.4% | 34.1% | 165.8% | 73.5% | 36.1% | 117.4% | |

| Madeira Island | Without | 1.9% | 5.2% | 170.9% | 35.8% | 176.3% | 102.3% |

| With | 1.2% | 2.5% | 178.5% | 36.8% | 171.6% | 163.3% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Santos, E.; Lisboa, I. The Effects of Subsidies on MSW Treatment Companies: Financial Performance and Policy Implications. Sustainability 2022, 14, 3076. https://doi.org/10.3390/su14053076

Santos E, Lisboa I. The Effects of Subsidies on MSW Treatment Companies: Financial Performance and Policy Implications. Sustainability. 2022; 14(5):3076. https://doi.org/10.3390/su14053076

Chicago/Turabian StyleSantos, Eleonora, and Inês Lisboa. 2022. "The Effects of Subsidies on MSW Treatment Companies: Financial Performance and Policy Implications" Sustainability 14, no. 5: 3076. https://doi.org/10.3390/su14053076

APA StyleSantos, E., & Lisboa, I. (2022). The Effects of Subsidies on MSW Treatment Companies: Financial Performance and Policy Implications. Sustainability, 14(5), 3076. https://doi.org/10.3390/su14053076