The Case of South Korean Airlines-Within-Airlines Model: Helping Full-Service Carriers Challenge Low-Cost Carriers

Abstract

:1. Introduction

2. Literature Review

3. Methodology

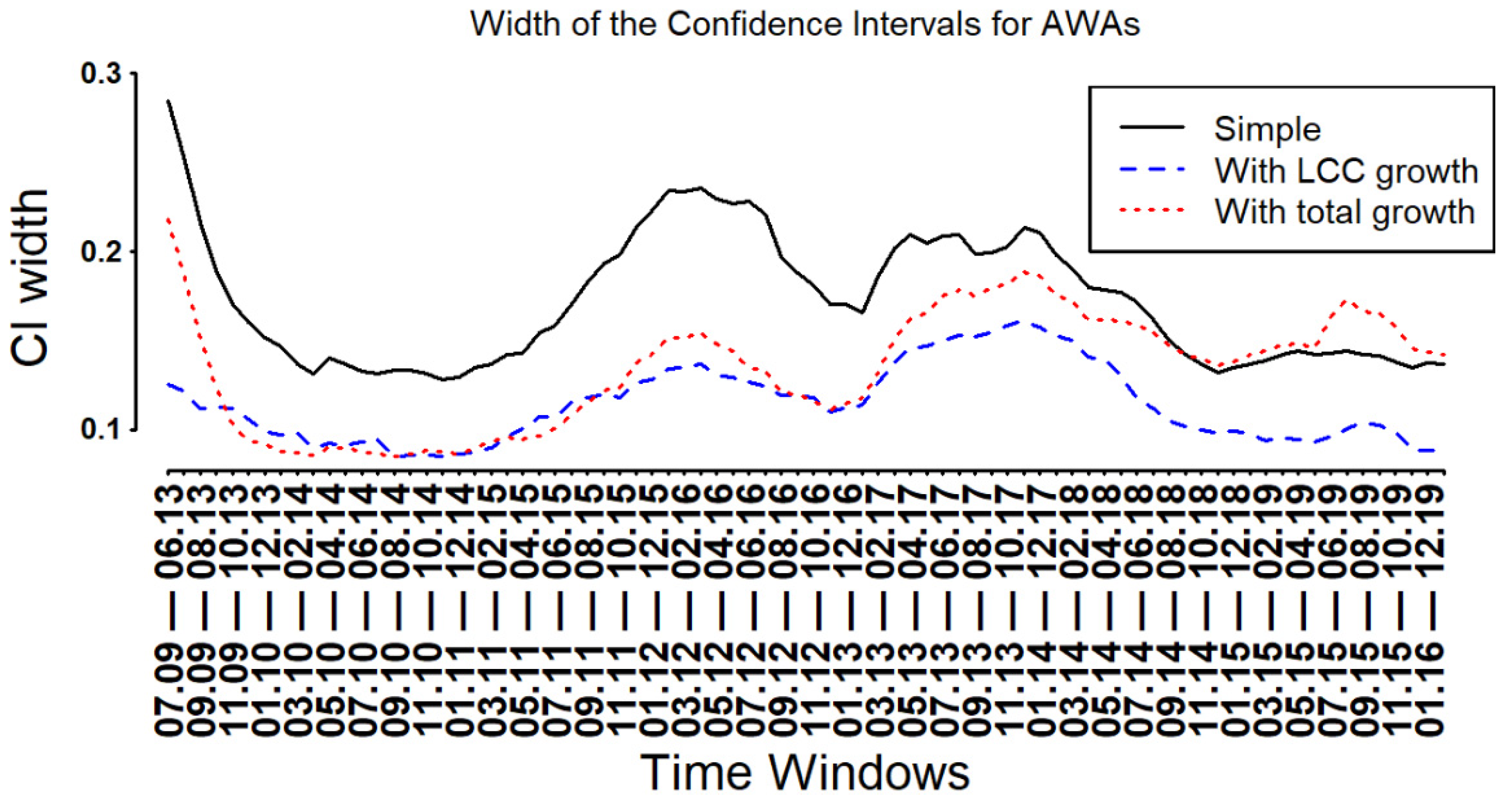

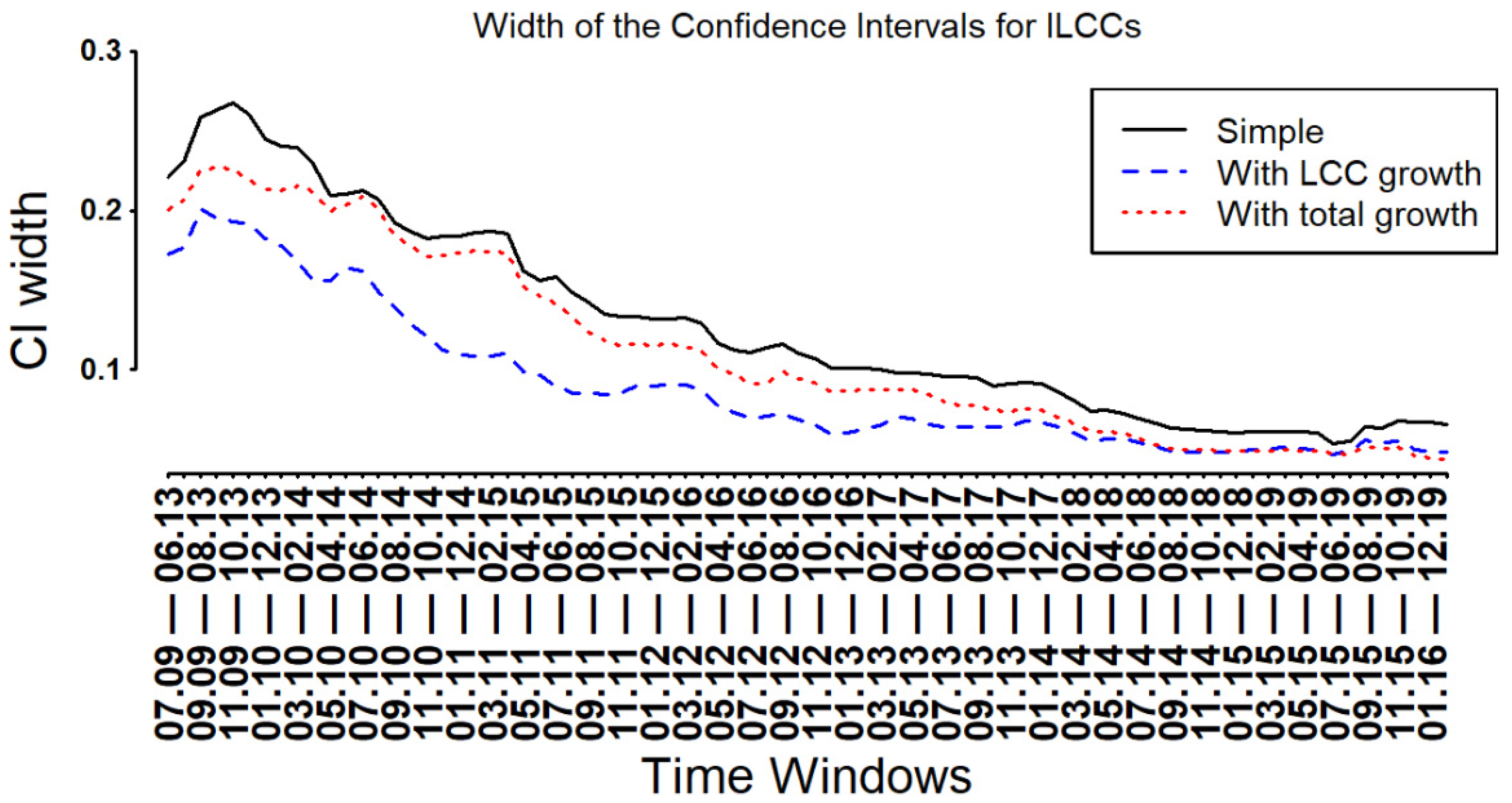

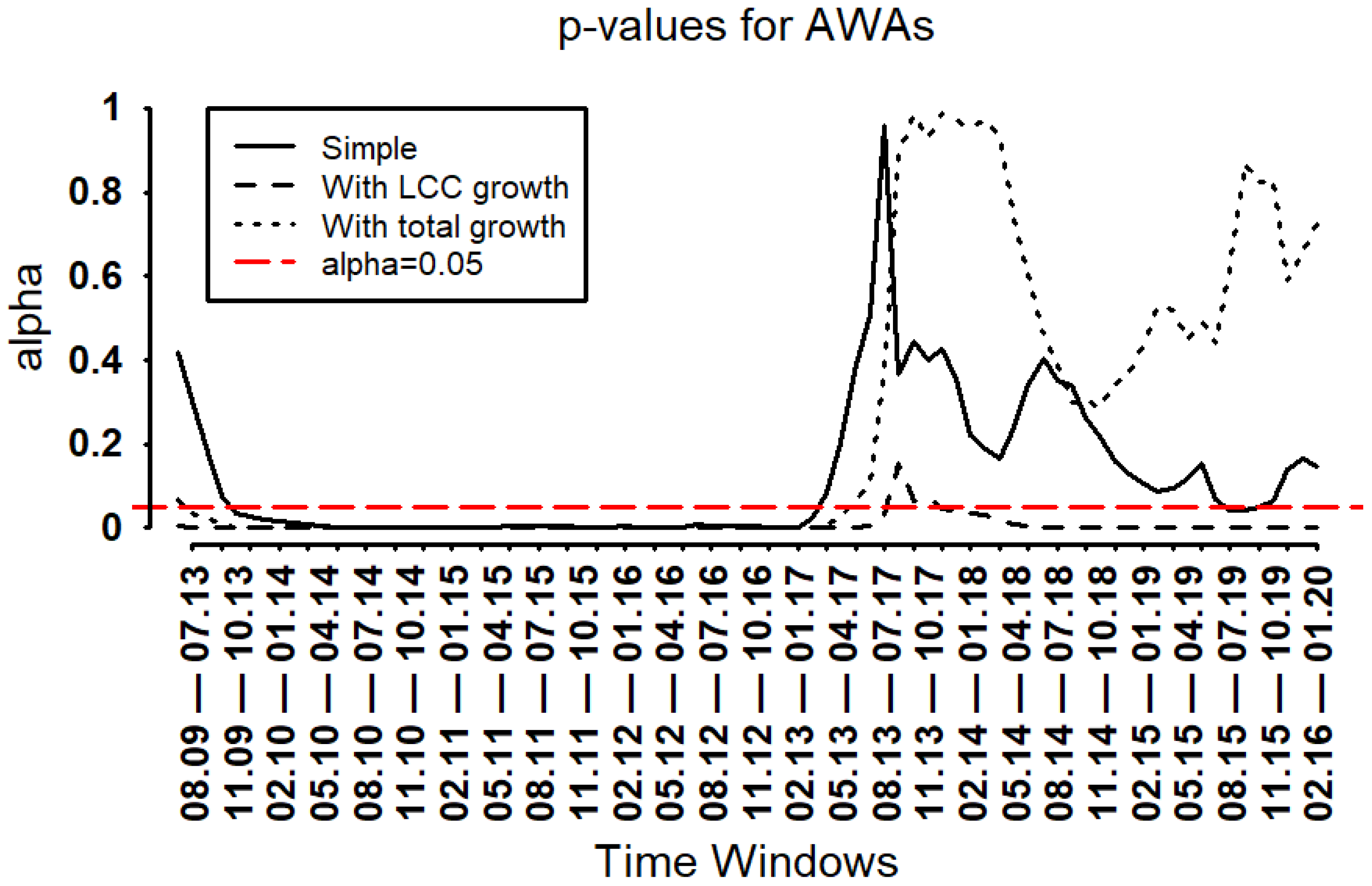

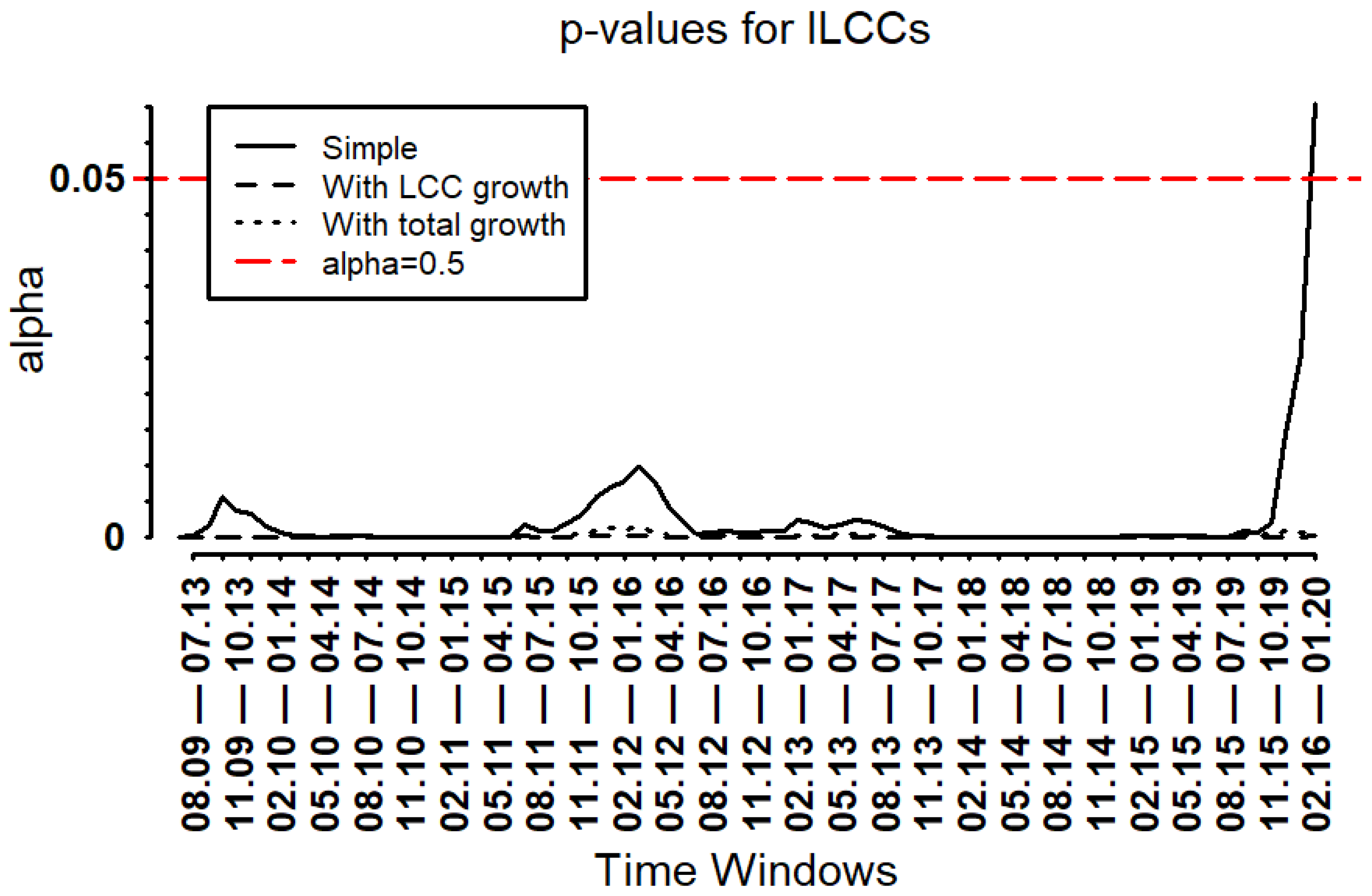

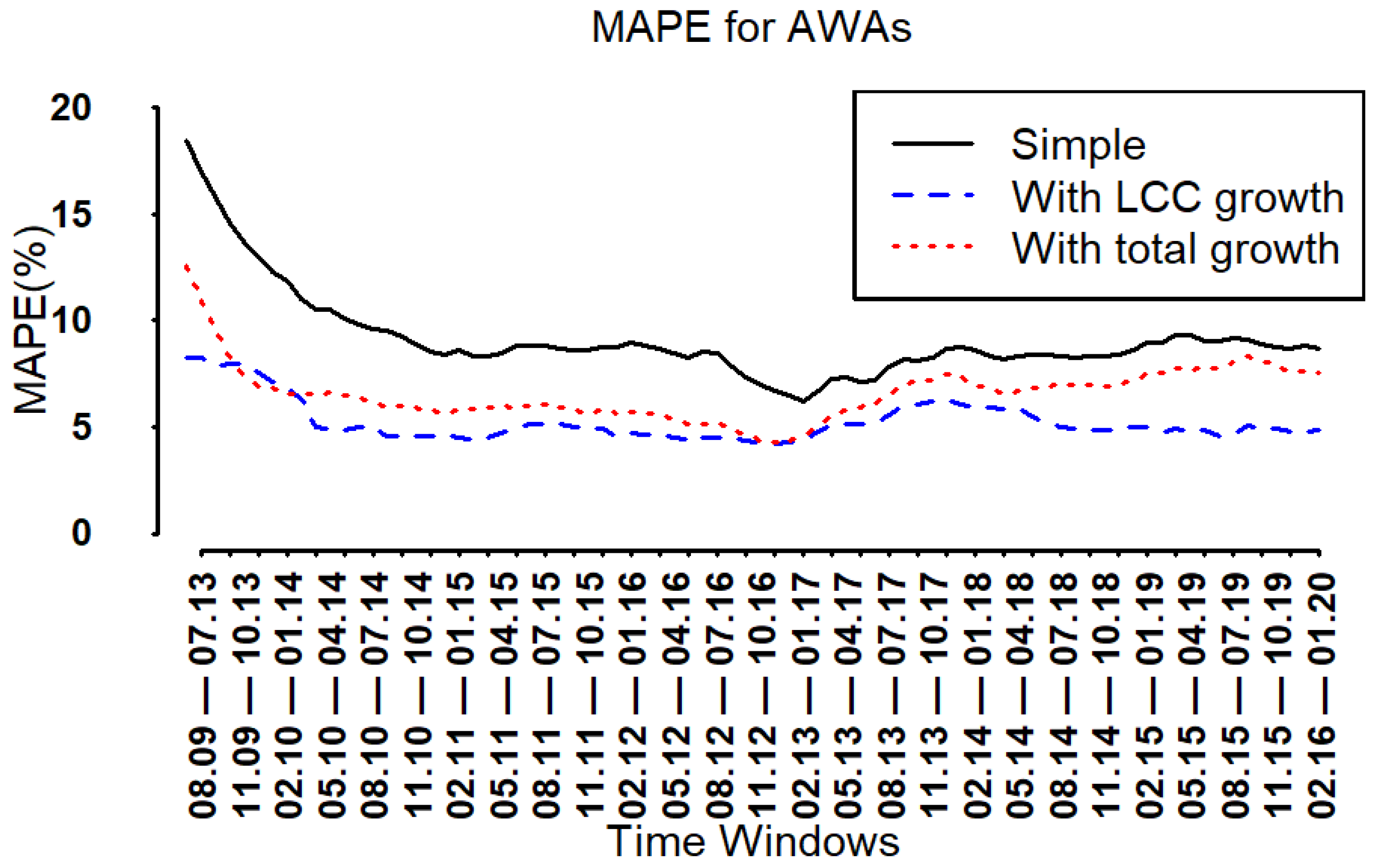

4. Experiment and Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Graham, B.; Vowles, T.M. Carriers within Carriers: A Strategic Response to Low-Cost Airline Competition. Transp. Rev. 2006, 26, 105–126. [Google Scholar] [CrossRef]

- Gillen, D.; Gados, A. Airlines within airlines: Assessing the vulnerabilities of mixing business models. Res. Transp. Econ. 2008, 24, 25–35. [Google Scholar] [CrossRef]

- Lin, M.H. Airlines-within-airlines strategies and existence of low-cost carriers. Transp. Res. Part E Logist. Transp. Rev. 2012, 48, 637–651. [Google Scholar] [CrossRef]

- Raynes, C.; Tsui, K.W.H. Review of Airline-within-Airline strategy: Case studies of the Singapore Airlines Group and Qantas Group. Case Stud. Transp. Policy 2019, 7, 150–165. [Google Scholar] [CrossRef] [PubMed]

- Morrell, P. Airlines within airlines: An analysis of US network airline responses to Low Cost Carriers. J. Air Transp. Manag. 2005, 11, 303–312. [Google Scholar] [CrossRef] [Green Version]

- Pearson, J.; Merkert, R. Airlines-within-airlines: A business model moving East. J. Air Transp. Manag. 2014, 38, 21–26. [Google Scholar] [CrossRef]

- Khan, N.T.; Kim, Y.H.; Kim, Y.B. The dynamic impact of low-cost carriers on full-service carriers and the tourism industry of South Korea: A competitive analysis using the Lotka–Volterra model. Asia Pac. J. Tour. Res. 2018, 23, 656–666. [Google Scholar] [CrossRef]

- Khan, N.T.; Jung, G.; Kim, J.; Kim, Y.B. Evolving competition between low-cost carriers and full-service carriers: The case of South Korea. J. Transp. Geogr. 2019, 74, 1–9. [Google Scholar] [CrossRef]

- Smith, O. World’s Busiest Routes; the Busiest Route in the World Will Surprise You. 2016. Available online: http://www.traveller.com.au/ (accessed on 10 May 2017).

- Lo, S.-C. Dynamic Analyses for Passenger Volume of Domestic Airline and High Speed Rail. Int. J. Math. Comput. Sci. 2012, 6, 106–110. [Google Scholar]

- Small, K.A. A discrete choice model for ordered alternatives. Econom. J. Econom. Soc. 1987, 55, 409–424. [Google Scholar] [CrossRef]

- Soetevent, A.R.; Kooreman, P. A discrete-choice model with social interactions: With an application to high school teen behavior. J. Appl. Econom. 2007, 22, 599–624. [Google Scholar] [CrossRef] [Green Version]

- Kornstad, T.; Thoresen, T.O. A discrete choice model for labor supply and childcare. J. Popul. Econ. 2007, 20, 781–803. [Google Scholar] [CrossRef] [Green Version]

- Gracia, A.; De Magistris, T. The demand for organic foods in the South of Italy: A discrete choice model. Food Policy 2008, 33, 386–396. [Google Scholar] [CrossRef]

- Talluri, K.; Van Ryzin, G. Revenue management under a general discrete choice model of consumer behavior. Manag. Sci. 2004, 50, 15–33. [Google Scholar] [CrossRef]

- Márquez, L.; Cantillo, V.; Arellana, J. Assessing the influence of indicators’ complexity on hybrid discrete choice model estimates. Transportation 2020, 47, 373–396. [Google Scholar] [CrossRef]

- Chorus, C.G.; Pudāne, B.; Mouter, N.; Campbell, D. Taboo trade-off aversion: A discrete choice model and empirical analysis. J. Choice Model. 2018, 27, 37–49. [Google Scholar] [CrossRef]

- Coldren, G.M.; Koppelman, F.S.; Kasturirangan, K.; Mukherjee, A. Modeling aggregate air-travel itinerary shares: Logit model development at a major US airline. J. Air Transp. Manag. 2003, 9, 361–369. [Google Scholar] [CrossRef]

- Hsiao, C.-Y.; Hansen, M. A passenger demand model for air transportation in a hub-and-spoke network. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 1112–1125. [Google Scholar] [CrossRef]

- Birolini, S.; Besana, E.; Cattaneo, M.; Redondi, R.; Sallan, J.M. An integrated connection planning and passenger allocation model for low-cost carriers. J. Air Transp. Manag. 2022, 99, 102160. [Google Scholar] [CrossRef]

- Gatabazi, P.; Mba, J.C.; Pindza, E.; Labuschagne, C. Grey Lotka–Volterra models with application to cryptocurrencies adoption. Chaos Solitons Fractals 2019, 122, 47–57. [Google Scholar] [CrossRef]

- Liu, H.; He, J.; Chen, X. Research on Enterprise Monopoly Based on Lotka–Volterra Model. In Proceedings of the International Conference on Human Systems Engineering and Design: Future Trends and Applications, Munich, Germany, 16–18 September 2019; Springer: Berlin/Heidelberg, Germany, 2019. [Google Scholar]

- Wu, X.; Sun, M.; Chen, X.; Wang, J.; Guo, B. Empirical study of particle swarm optimization inspired by Lotka–Volterra model in Ecology. Soft Comput. 2019, 23, 5571–5582. [Google Scholar] [CrossRef]

- Xu, F.; Gan, W. On a Lotka–Volterra type competition model from river ecology. Nonlinear Anal. Real World Appl. 2019, 47, 373–384. [Google Scholar] [CrossRef]

- Zhang, G.; Allaire, D.; McAdams, D.A.; Shankar, V. System evolution prediction and manipulation using a Lotka–Volterra ecosystem model. Des. Stud. 2019, 60, 103–138. [Google Scholar] [CrossRef]

- Danylchuk, H.; Kovtun, O.; Kibalnyk, L.; Sysoiev, O. Monitoring and modelling of cryptocurrency trend resistance by recurrent and R/S-analysis. E3S Web Conf. 2020, 136, 13030. [Google Scholar] [CrossRef] [Green Version]

- Huang, Q.; Lin, M.Y.; Coffman, R.L.; Campbell, J.D.; Traquina, P.; Lin, Y.J.; Liu, L.T.C.; Cheng, J.; Wu, Y.C.; Wu, C.C.; et al. The impact of Microplastic particles on population Dynamics of predator and prey: Implication of the Lotka-Volterra Model. Sci. Rep. 2020, 10, 1–10. [Google Scholar] [CrossRef]

- Muhammad, Z.M.Z.; Özkaynak, F. A Cryptographic Confusion Primitive Based on Lotka–Volterra Chaotic System and Its Practical Applications in Image Encryption. In Proceedings of the 2020 IEEE 15th International Conference on Advanced Trends in Radioelectronics, Telecommunications and Computer Engineering (TCSET), IEEE, Lviv-Slavske, Ukraine, 25–29 February 2020. [Google Scholar]

- Homsombat, W.; Lei, Z.; Fu, X. Competitive effects of the airlines-within-airlines strategy–Pricing and route entry patterns. Transp. Res. Part E Logist. Transp. Rev. 2014, 63, 1–16. [Google Scholar] [CrossRef]

- Hyun, R. ‘Jin Air’, the Cheapest Airline Who Celebrated Its 9th Anniversary. 2017. Available online: http://sagunin.com/sub_read.html?uid=17884§ion=sc62§ion2=%EC%9D%BC%EB%B0%98. (accessed on 9 December 2021).

- Beads, C. Korean Air vs. Asiana Airlines: The opposite LCC strategy ‘Eye-Track’. 2016. Available online: http://biz.chosun.com/site/data/html_dir/2016/07/20/2016072002565.html?rsMobile=false (accessed on 9 December 2021).

- Whyte, R.; Lohmann, G. The carrier-within-a-carrier strategy: An analysis of Jetstar. J. Air Transp. Manag. 2015, 42, 141–148. [Google Scholar] [CrossRef] [Green Version]

- Joo, H.; Maskery, B.A.; Berro, A.D.; Rotz, L.D.; Lee, Y.K.; Brown, C.M. Economic impact of the 2015 MERS outbreak on the Republic of Korea’s tourism-related industries. Health Secur. 2019, 17, 100–108. [Google Scholar] [CrossRef]

- Huang, E. China Inflicted a World of Pain on South Korea in 2017. 2017. Available online: https://qz.com/1149663/china-south-korea-relations-in-2017-thaad-backlash-and-the-effect-on-tourism/#:~:text=The%20number%20of%20Chinese%20tourists%20to%20South%20Korea%20plunged%20in%202017&text=Relations%20between%20the%20two%20countries,threat%20to%20its%20national%20security. (accessed on 9 December 2021).

- Yonhap, Number of Chinese Tourists to S. Korea Dips 30% over THAAD Row. 2020. Available online: https://en.yna.co.kr/view/AEN20200702003700320 (accessed on 9 December 2021).

- Herald, T.K. Korean Air’s Asiana Acquisition: What Is Happening? 2021. Available online: https://www.aviationpros.com/airlines/news/21241569/korean-airs-asiana-acquisition-what-is-happening (accessed on 9 December 2021).

- Klophaus, R.; Conrady, R.; Fichert, F. Low cost carriers going hybrid: Evidence from Europe. J. Air Transp. Manag. 2012, 23, 54–58. [Google Scholar] [CrossRef]

- Borenstein, S. Hubs and high fares: Dominance and market power in the US airline industry. RAND J. Econ. 1989, 20, 344–365. [Google Scholar] [CrossRef]

- Dresner, M.; Lin, J.-S.C.; Windle, R. The impact of low-cost carriers on airport and route competition. J. Transp. Econ. Policy 1996, 30, 309–328. [Google Scholar]

- Lotka, A.J. Elements of physical biology. Sci. PlProg. Twent. Century (1919–1933) 1926, 21, 341–343. [Google Scholar]

- Volterra, V. Variazioni e Fluttuazioni del Numero d’Individui in Specie Animali Conviventi. Ferrari, C., Ed.; 1927. Available online: https://www.liberliber.it/online/autori/autori-v/vito-volterra/variazioni-e-fluttuazioni-del-numero-dindividui-in-specie-animali-conviventi/ (accessed on 3 January 1989).

- Plank, M. Hamiltonian structures for the n-dimensional Lotka–Volterra equations. J. Math. Phys. 1995, 36, 3520–3534. [Google Scholar] [CrossRef]

- Jones, E.W.; Shankin-Clarke, P.; Carlson, J.M. Navigation and Control of Outcomes in a Generalized Lotka–Volterra Model of the Microbiome. 2020. Available online: https://arxiv.org/abs/2003.12954 (accessed on 6 March 2022).

- He, M.; Li, Z.; Chen, F.; Zhu, Z. Dynamic Behaviors of an N-species Lotka–Volterra Model with Nonlinear Impulses. IAENG Int. J. Appl. Math. 2020, 50, 1–9. [Google Scholar]

- Korobeinikov, A.; Wake, G.C. Global properties of the three-dimensional predator-prey Lotka–Volterra systems. Adv. Decis. Sci. 1999, 3, 155–162. [Google Scholar] [CrossRef] [Green Version]

- Hovsepian, K.; Anselmo, P.; Mazumdar, S. Supervised inductive learning with Lotka–Volterra derived models. Knowl. Inf. Syst. 2011, 26, 195–223. [Google Scholar] [CrossRef]

- Lv, J.; Zou, X.; Tian, L. A geometric method for asymptotic properties of the stochastic Lotka–Volterra model. Commun. Nonlinear Sci. Numer. Simul. 2019, 67, 449–459. [Google Scholar] [CrossRef]

- Volterra, J.V. Variations and fluctuations of the number of individuals in animal species living together. In Animal Ecology; Chapman, R.N., Ed.; McGraw–Hill: New York, NY, USA, 1931. [Google Scholar]

- Goodwin, R.M. A Growth Cycle. Socialism, Capitalism and Economic Growth; Cambridge University Press: Cambridge, UK, 1967; pp. 54–58. [Google Scholar]

- Noszticzius, Z.; Noszticzius, E.; Schelly, Z. Use of ion-selective electrodes for monitoring oscillating reactions. 2. Potential response of bromide-iodide-selective electrodes in slow corrosive processes. Disproportionation of bromous and iodous acids. A Lotka–Volterra model for the halate driven oscillators. J. Phys. Chem. 1983, 87, 510–524. [Google Scholar]

- Gatabazi, P.; Mba, J.; Pindza, E. Fractional gray Lotka–Volterra models with application to cryptocurrencies adoption. Chaos Interdiscip. J. Nonlinear Sci. 2019, 29, 073116. [Google Scholar] [CrossRef] [PubMed]

- Gatabazi, P.; Mba, J.; Pindza, E. Modeling cryptocurrencies transaction counts using variable-order Fractional Grey Lotka-Volterra dynamical system. Chaos Solitons Fractals 2019, 127, 283–290. [Google Scholar] [CrossRef]

- Casado-Vara, R.; Canal-Alonso, A.; Martin-del Rey, A.; De la Prieta, F.; Prieto, J. Smart Buildings IoT Networks Accuracy Evolution Prediction to Improve Their Reliability Using a Lotka–Volterra Ecosystem Model. Sensors 2019, 19, 4642. [Google Scholar] [CrossRef] [Green Version]

- Fečkan, M.; Pačuta, J. Data approximation using Lotka–Volterra models and a software minimization function. J. Appl. Math. Stat. Inform. 2019, 15, 5–14. [Google Scholar] [CrossRef] [Green Version]

- Hung, H.-C.; Chiu, Y.C.; Huang, H.C.; Wu, M.C. An enhanced application of Lotka–Volterra model to forecast the sales of two competing retail formats. Comput. Ind. Eng. 2017, 109, 325–334. [Google Scholar] [CrossRef]

- Tannenbaum, A.R.; Georgiou, T.T.; Deasy, J.O.; Norton, L. Control and the Analysis of Cancer Growth Models. bioRxiv 2018, 244301. [Google Scholar] [CrossRef]

- Lee, S.-J.; Lee, D.-J.; Oh, H.-S. Technological forecasting at the Korean stock market: A dynamic competition analysis using Lotka–Volterra model. Technol. Forecast. Soc. Chang. 2005, 72, 1044–1057. [Google Scholar] [CrossRef]

- Li, M.; Yi, Z.; Zhu, M. Solving TSP by using Lotka–Volterra neural networks. Neurocomputing 2009, 72, 3873–3880. [Google Scholar] [CrossRef]

- Wu, L.; Liu, S.; Wang, Y. Grey Lotka–Volterra model and its application. Technol. Forecast. Soc. Chang. 2012, 79, 1720–1730. [Google Scholar] [CrossRef]

- Modis, T. Technological forecasting at the stock market. Technol. Forecast. Soc. Chang. 1999, 62, 173–202. [Google Scholar] [CrossRef] [Green Version]

- Aryal, G.; Ciliberto, F.; Leyden, B. Public Communication and Collusion in the Airline Industry; Centre for Economic Policy Research: London, UK, 2018. [Google Scholar]

- Kumar, N. Strategies to fight low-cost rivals. Harv. Bus. Rev. 2006, 84, 104–112. [Google Scholar]

- Hong, S.-J.; Domergue, F. Estimations Viability of LCCs Business Model in Korea. J. Int. Logist. Trade 2018, 16, 11–20. [Google Scholar] [CrossRef]

- Lo, S.-C.; Liao, Y.-P. External Effects on Dynamic Competitive Model of Domestic Airline and High Speed Rail. Int. J. Econ. Manag. Eng. 2012, 6, 1724–1728. [Google Scholar]

- Dodgson, J. Predatory behaviour and the airline industry. Built Environ. 1996, 22, 167–176. Available online: https://www.jstor.org/stable/23288560 (accessed on 25 February 2020).

- Kahn, A.E. Thinking about predation—A personal diary. Rev. Ind. Organ. 1991, 6, 137–146. [Google Scholar]

- Forsyth, P. Low-cost carriers in Australia: Experiences and impacts. J. Air Transp. Manag. 2003, 9, 277–284. [Google Scholar] [CrossRef]

- Gillen, D.; Lall, A. Competitive advantage of low-cost carriers: Some implications for airports. J. Air Transp. Manag. 2004, 10, 41–50. [Google Scholar] [CrossRef]

- Chavan, M. The balanced scorecard: A new challenge. J. Manag. Dev. 2009, 28, 393–406. [Google Scholar] [CrossRef] [Green Version]

- Abbink, K.; Brandts, J. Collusion in growing and shrinking markets: Empirical evidence from experimental duopolies. Exp. Compet. Policy 2009, 34–60. Available online: https://www.nottingham.ac.uk/cedex/documents/papers/2005-03.pdf (accessed on 25 February 2020).

- Yonhap. Budget Carriers Stand against Asiana’s LCC. 2015. Available online: http://www.koreaherald.com/view.php?ud=20150322000222 (accessed on 10 September 2019).

- Kim, D. The Effects of Airline Deregulation: A Comparative Analysis. J. Bus. Econ. Environ. Stud. 2016, 6, 5–10. [Google Scholar] [CrossRef]

- Sun, J.Y. Airline deregulation and its impacts on air travel demand and airline competition: Evidence from Korea. Rev. Ind. Organ. 2017, 51, 343–380. [Google Scholar] [CrossRef]

- Ahmed, F.; Siddiqui, D.A. Impact of Debt Financing on Performance: Evidence from Textile Sector of Pakistan. 2019. Available online: https://ssrn.com/abstract=3384213 (accessed on 22 August 2021).

| Relationship | General Explanation | Fit to the Airline Industry |

|---|---|---|

| Mutualism (Cooperation) | c1 and c2 both are positive. Both species benefit from each other. This is an evolutionary process that peacefully tolerates the creation of a new population, without harming the old one. | In the airline industry, direct cooperation is rarely observed and the phenomenon of cooperation refers to tacit collusion [61] |

| Competition | c1 and c2 are both negative. This indicates a negative relationship; both species suffer from the existence of the other species and fight for the same resources. | A phenomenon where both competitors reduce their prices to compete and the market is free for new entrants [62]. |

| Commensalism | c1 is positive c2 is zero. Parasitic type of relationship; one benefits from the other, who remains unaffected. One population shares its resources with the other for self-interest. | A perfect example of this behavior is the relationship between AWA and the mother companies. Where the mother companies can use the resources of the subsidiary [63]. |

| Amensalism | c1 is negative and c2 is zero. One is inhibited by the existence of the other, while the other remains unaffected. One population does not get any benefit, but its presence only harms the other population. | For example, Taiwan’s domestic aviation and high-speed rail have a relationship where rail is not affected by the aviation industry; however, the aviation industry suffers from rail [64]. |

| Predator–Prey | One species feeds off the other; the victim species does not affect the other. One population highly depends on the other and relies on the other’s resources. If the resources of the victim population decline, the reliant population also declines. | Predatory behavior refers to a firm that reduces its own profit to drive a competitor out of the market by cutting its prices and/or increasing its output. As a result, the competitor loses money and is forced to leave the market. Such predatory behavior keeps new entrants from entering the market. For example, the unsuccessful entry of Compass airlines into the newly deregulated Australian domestic market [65], or the demise of Laker’s Sky Train transit–Atlantic service, was the predatory response of the established carriers [66]. |

| Neutralism | c1 and c2 both are zero. No relationship. |

| AWA | FSCs | ILCCs | LCCs | |

|---|---|---|---|---|

| Mean | 306,811.13 | 735,438.83 | 445,970.92 | 752,782.05 |

| Std. Dev | 90,175.61 | 92,473.51 | 129,428.99 | 212,648.57 |

| Min | 153,695 | 529,690 | 161,603 | 317,251 |

| Median | 311,374 | 730,128 | 465,769 | 783,734 |

| Max | 493,708 | 921,986 | 677,404 | 1,105,247 |

| N.Valid | 127 | 127 | 127 | 127 |

| Parameter | Value | p Value | Factor (Parameter Value) | Relationship |

|---|---|---|---|---|

| c1 (ILCC) | 8.78 × 10−7 | 1.67 × 10−6 | None | Apparently mutualism (Not significant) |

| c2 (AWA) | 3.95 × 10−8 | 0.87 | None | |

| c3 (ILCC) | 8.65 × 10−7 | 7.20 × 10−8 | LCC growth (53,990) | Mutualism (Significant) |

| c4 (AWA) | 5.02 × 10−7 | 0.00894 | LCC Growth (87,910) | |

| c5 (ILCC) | 8.50 × 10−7 | 4.36 × 10−8 | Overall Growth (258,300) | Mutualism (Significant) |

| c6 (AWA) | 4.77 × 10−7 | 0.0106 | Overall Growth (402,700) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khan, N.T.; Aslam, J.; Rauf, A.A.; Kim, Y.B. The Case of South Korean Airlines-Within-Airlines Model: Helping Full-Service Carriers Challenge Low-Cost Carriers. Sustainability 2022, 14, 3468. https://doi.org/10.3390/su14063468

Khan NT, Aslam J, Rauf AA, Kim YB. The Case of South Korean Airlines-Within-Airlines Model: Helping Full-Service Carriers Challenge Low-Cost Carriers. Sustainability. 2022; 14(6):3468. https://doi.org/10.3390/su14063468

Chicago/Turabian StyleKhan, Nokhaiz Tariq, Javed Aslam, Ateeq Abdul Rauf, and Yun Bae Kim. 2022. "The Case of South Korean Airlines-Within-Airlines Model: Helping Full-Service Carriers Challenge Low-Cost Carriers" Sustainability 14, no. 6: 3468. https://doi.org/10.3390/su14063468