The Dynamic Evolution of the Structure of an Urban Housing Investment Niche Network and Its Underlying Mechanisms: A Case Study of 35 Large and Medium-Sized Cities in China

Abstract

1. Introduction

- (1)

- Unlike earlier studies that analysed investment data, this paper introduces niche theory into the field of urban housing investment research, constructs a comprehensive index of housing investment niches, and provides theoretical guidance for the efficient allocation of housing investment resources.

- (2)

- Due to the directionality of the spatial correlations within the housing investment network, the impacts of population flows, capital flows, traveling distance, and economic distance on the urban housing investment niche network are fully addressed.

- (3)

- Furthermore, regarding research methods, a TERGM (based on a static ERGM) containing endogenous structural effects, attribute effects, exogenous spatial effects, and temporal effects was constructed and dynamic network analysis was used to conduct an in-depth study of the mechanisms influencing the urban housing investment niche network.

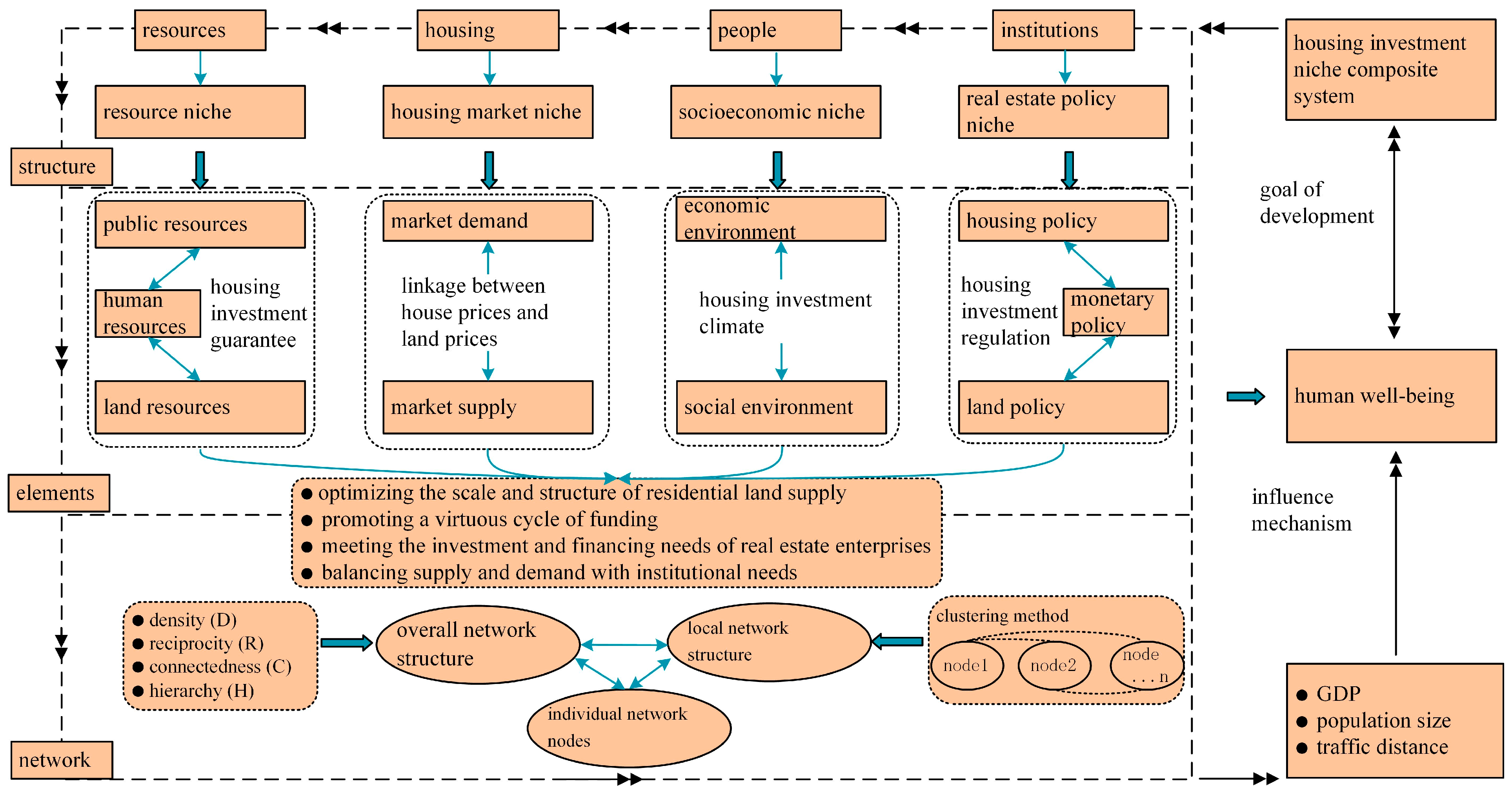

2. Theoretical Foundation and Research Model

2.1. Complex Urban Housing Investment Niche System

| Type of Urban Housing Investment Niche | Primary Index | Secondary Index (Unit) | Description of Secondary Indicators | Indicator Source |

|---|---|---|---|---|

| Urban resources niche | Public resources | Per capita area of urban green space (m2/person) | Urban green space/total population at year end | China Urban Statistical Yearbook |

| Per capita area of urban roads (m2/person) | Urban road area/population at year end | China Urban Statistical Yearbook | ||

| Number of hospital beds per 10,000 people (bed/104 persons) | (Total number of hospital beds/total population) × 10,000 | China Urban Statistical Yearbook | ||

| Human resources | Number of college students per 10,000 people (students/104 persons) | (Total number of college students/population) × 10,000 | China Urban Statistical Yearbook | |

| Number of employed persons in urban areas (103 persons) | Total number of employees | China Urban Statistical Yearbook | ||

| Land resources | Built area (km2) | Urban built area | China Urban Statistical Yearbook | |

| Residential land supply area (hectare) | Includes land for indemnificatory and commercial housing | Bureau Of Urban Planning and Natural Resources | ||

| Housing market niche | Market demand | Housing sales area (103 m2) | Commercial housing sales area | China Urban Statistical Yearbook |

| Natural population growth rate (‰) | Birth rate-death rate | China Urban Statistical Yearbook | ||

| Urbanization rate (%) | Urban population/permanent population | China Urban Statistical Yearbook | ||

| Market supply | Expected rate of return from real estate (%) | The average housing price growth rate over the previous three years | CEIC Macroeconomic Database | |

| Land area purchased by real estate enterprises (104 m2) | Land area purchased by real estate development firms | CEIC Macroeconomic Database | ||

| Number of real estate development firms (firms) | Number of real estate development firms | China Urban Statistical Yearbook | ||

| Social economic niche | Economic environment | Per capita GDP (yuan/person) | GDP/Total population at year end | CEIC Macroeconomic Database |

| Per capita disposable income of the urban population (yuan/person) | Per capita disposable income of the urban population | CEIC Macroeconomic Database | ||

| Balance of loans from financial institutions (104 yuan) | Balance of loans from financial institutions | China Urban Statistical Yearbook | ||

| Social environment | Infrastructure construction (108 yuan) | Fixed asset investment-real estate investment | China Urban Statistical Yearbook | |

| Share of the tertiary industry in GDP (%) | Tertiary industry output/GDP | China Urban Statistical Yearbook | ||

| Real estate policy niche | Housing policy | Weighted average interest rate on individual housing loans (%) | Converted to real interest rates with city-specific CPIs | CEIC Macroeconomic Database |

| Monetary policy | M2 growth rate-GDP growth rate-inflation rate (%) | M2 growth rate-GDP growth rate-inflation rate | CEIC Macroeconomic Database | |

| Land policy | Land price (yuan) | Average transaction price of land | CEIC Macroeconomic Database |

2.2. Comprehensive Index of Urban Housing Investment Niches: Niche Theory

2.3. Establishing Niche Networks for Urban Housing Investment: A Modified Gravity Model

2.4. Analysis of the Spatial Correlations in the Network Structure of the Urban Housing Investment Niche: A Temporal Exponential Random Graph Model (TERGM)

3. Urban Housing Investment Niche Network Construction and Impact Mechanism Design

3.1. Construction of the Urban Housing Investment Niche Network

- (1)

- Spatial characteristics of the network as a whole

- (2)

- Spatial characteristics of locally clustered networks

- (3)

- Spatial characteristics of individual networks

3.2. Description of the Mechanisms of Influence

- (1)

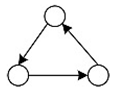

- Endogeneity of the network structure

- (2)

- Node attributes

- (3)

- External network effects

- (4)

- Temporal effect

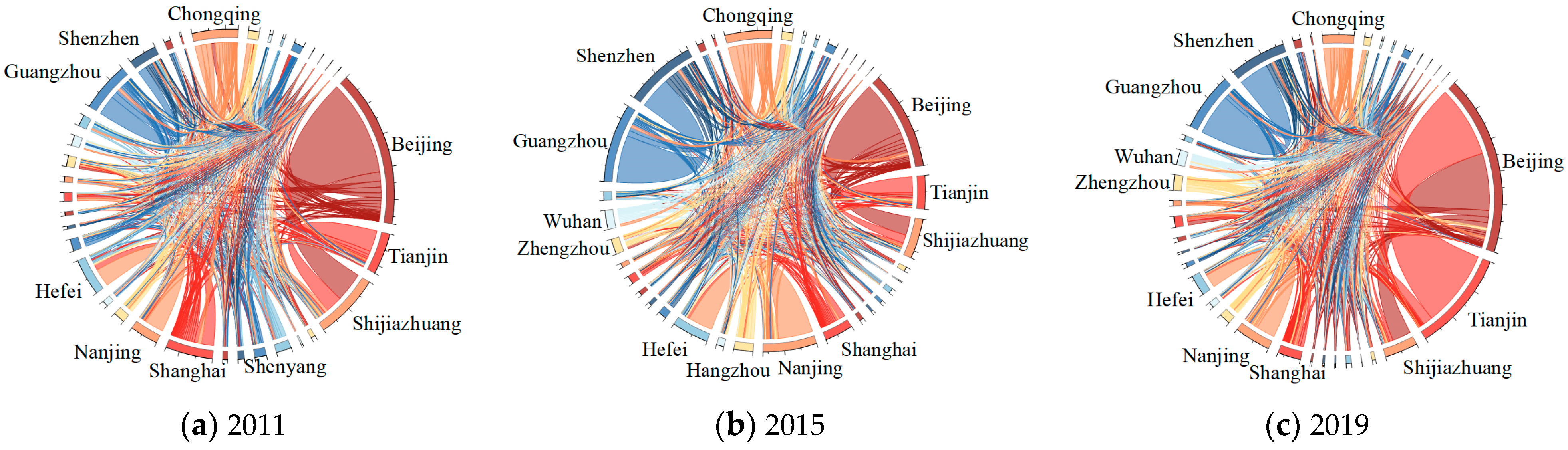

4. Characteristics of the Dynamic Changes in the Network Structure

4.1. Spatial Characteristics of the Network as a Whole

4.2. Spatial Characteristics of the Local Clustering Networks and Individual Networks

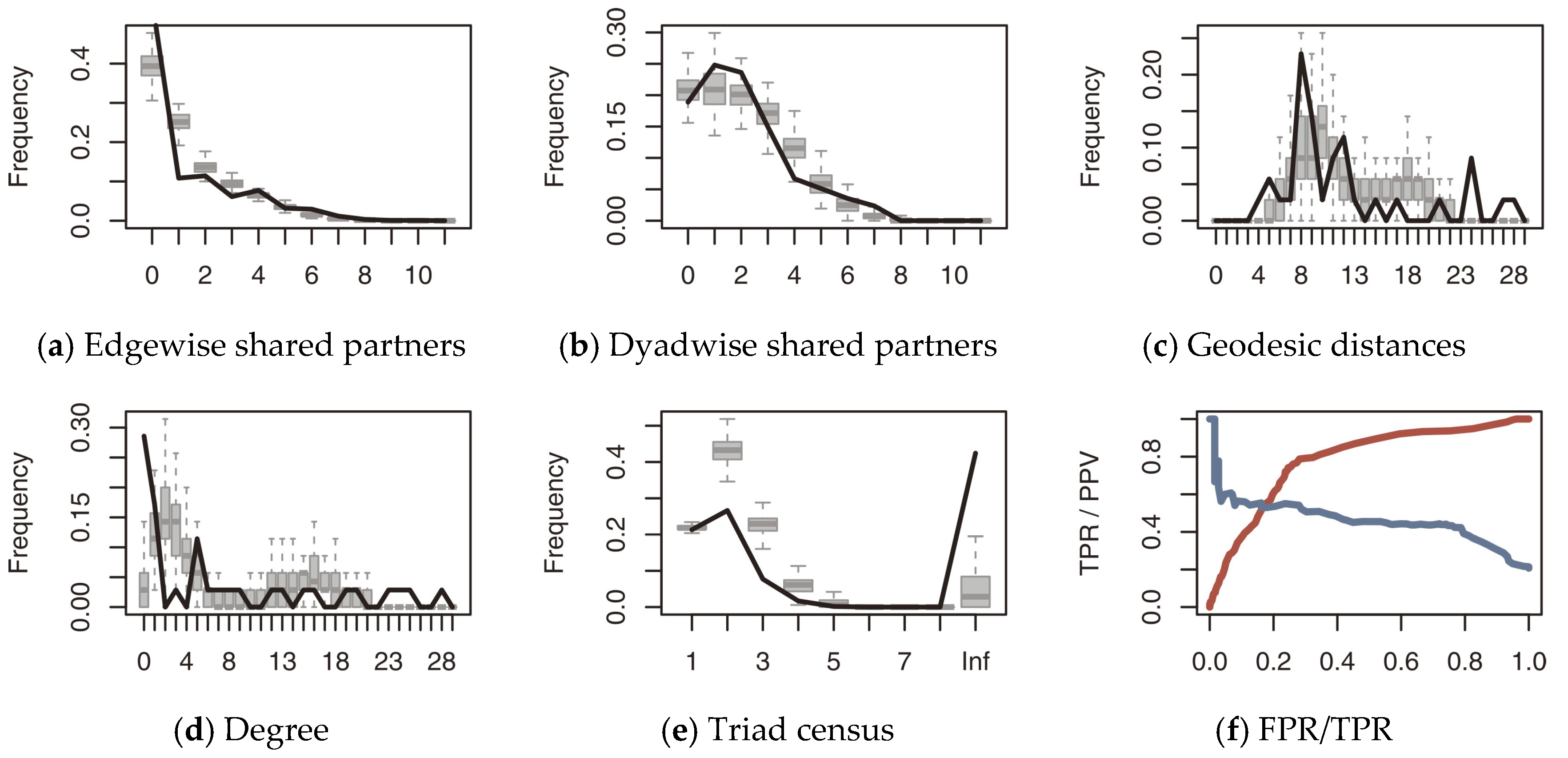

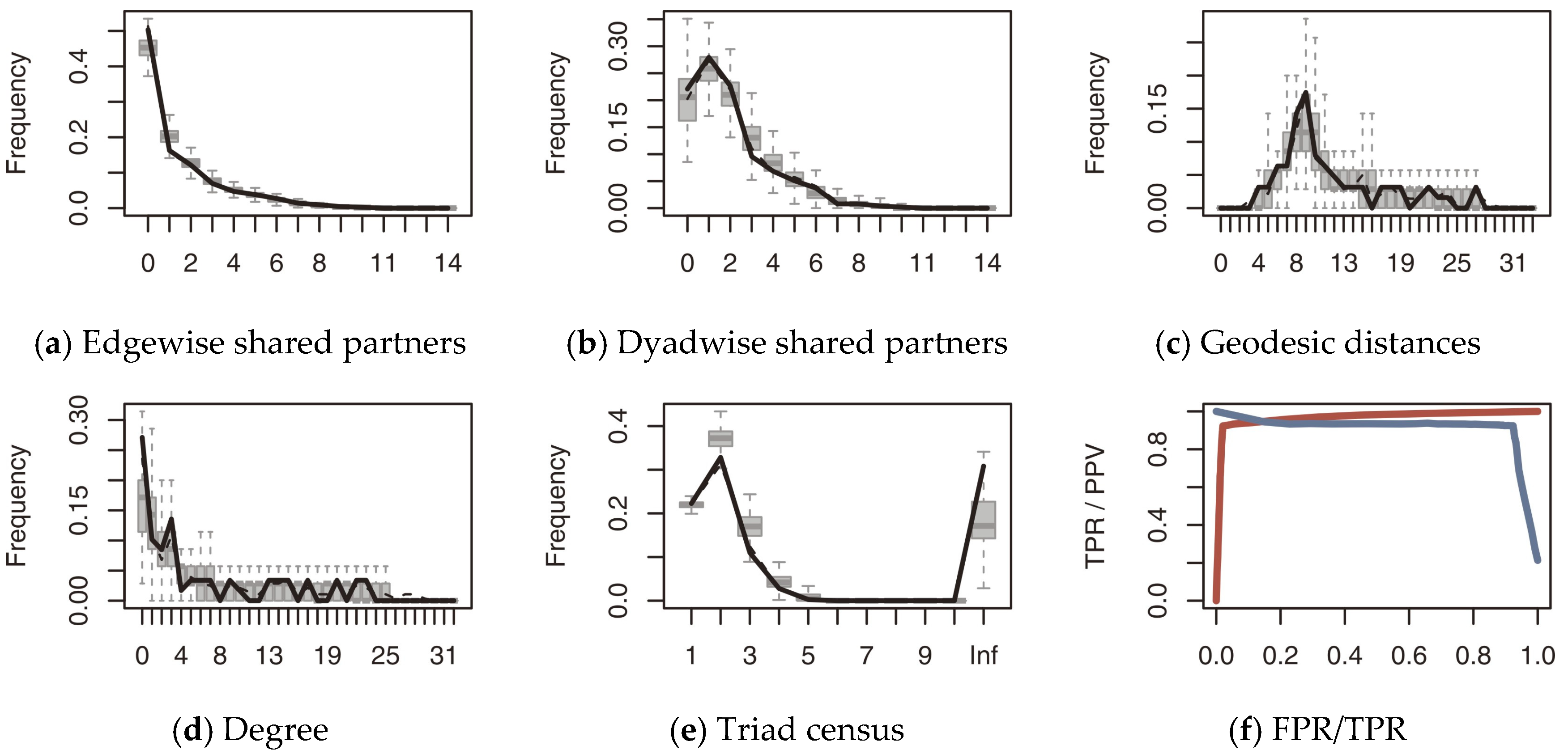

5. Mechanism Analysis

5.1. Results

5.2. Robustness Check

6. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| City | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|---|---|

| Beijing | 0.191 | 0.193 | 0.191 | 0.199 | 0.202 | 0.200 | 0.164 | 0.194 | 0.194 |

| Tianjin | 0.125 | 0.120 | 0.125 | 0.136 | 0.138 | 0.139 | 0.117 | 0.138 | 0.142 |

| Shijiazhuang | 0.064 | 0.060 | 0.064 | 0.058 | 0.055 | 0.066 | 0.051 | 0.061 | 0.067 |

| Taiyuan | 0.043 | 0.045 | 0.043 | 0.046 | 0.048 | 0.049 | 0.042 | 0.058 | 0.054 |

| Hohhot | 0.044 | 0.048 | 0.044 | 0.043 | 0.049 | 0.047 | 0.037 | 0.048 | 0.052 |

| Shenyang | 0.054 | 0.056 | 0.054 | 0.060 | 0.053 | 0.043 | 0.037 | 0.044 | 0.050 |

| Dalian | 0.052 | 0.055 | 0.052 | 0.049 | 0.041 | 0.054 | 0.036 | 0.047 | 0.053 |

| Changchun | 0.052 | 0.050 | 0.052 | 0.054 | 0.051 | 0.055 | 0.037 | 0.044 | 0.050 |

| Harbin | 0.041 | 0.045 | 0.041 | 0.038 | 0.040 | 0.041 | 0.031 | 0.041 | 0.042 |

| Shanghai | 0.086 | 0.081 | 0.086 | 0.079 | 0.082 | 0.083 | 0.067 | 0.091 | 0.095 |

| Nanjing | 0.142 | 0.138 | 0.142 | 0.144 | 0.141 | 0.143 | 0.124 | 0.149 | 0.145 |

| Hangzhou | 0.071 | 0.076 | 0.071 | 0.070 | 0.089 | 0.073 | 0.072 | 0.083 | 0.093 |

| Ningbo | 0.083 | 0.073 | 0.083 | 0.071 | 0.069 | 0.070 | 0.062 | 0.081 | 0.082 |

| Hefei | 0.056 | 0.058 | 0.056 | 0.055 | 0.054 | 0.053 | 0.048 | 0.065 | 0.065 |

| Fuzhou | 0.039 | 0.041 | 0.039 | 0.038 | 0.039 | 0.040 | 0.040 | 0.042 | 0.051 |

| Xiamen | 0.065 | 0.069 | 0.065 | 0.065 | 0.059 | 0.055 | 0.053 | 0.069 | 0.072 |

| Nanchang | 0.061 | 0.066 | 0.061 | 0.066 | 0.067 | 0.065 | 0.059 | 0.070 | 0.064 |

| Jinan | 0.046 | 0.047 | 0.046 | 0.058 | 0.053 | 0.050 | 0.040 | 0.054 | 0.053 |

| Qingdao | 0.047 | 0.054 | 0.047 | 0.052 | 0.053 | 0.052 | 0.043 | 0.055 | 0.061 |

| Zhengzhou | 0.049 | 0.050 | 0.049 | 0.058 | 0.070 | 0.073 | 0.054 | 0.071 | 0.080 |

| Wuhan | 0.059 | 0.058 | 0.059 | 0.068 | 0.076 | 0.072 | 0.064 | 0.076 | 0.078 |

| Changsha | 0.054 | 0.058 | 0.054 | 0.061 | 0.060 | 0.060 | 0.051 | 0.065 | 0.068 |

| Guangzhou | 0.084 | 0.086 | 0.084 | 0.088 | 0.090 | 0.090 | 0.074 | 0.110 | 0.114 |

| Shenzhen | 0.122 | 0.129 | 0.122 | 0.139 | 0.134 | 0.127 | 0.106 | 0.135 | 0.128 |

| Nanning | 0.077 | 0.082 | 0.077 | 0.083 | 0.086 | 0.090 | 0.082 | 0.092 | 0.078 |

| Haikou | 0.037 | 0.038 | 0.037 | 0.043 | 0.043 | 0.041 | 0.039 | 0.053 | 0.053 |

| Chongqing | 0.085 | 0.083 | 0.085 | 0.074 | 0.079 | 0.076 | 0.104 | 0.083 | 0.086 |

| Chengdu | 0.087 | 0.094 | 0.087 | 0.098 | 0.093 | 0.085 | 0.074 | 0.090 | 0.093 |

| Guiyang | 0.064 | 0.067 | 0.064 | 0.072 | 0.066 | 0.066 | 0.055 | 0.070 | 0.069 |

| Kunming | 0.046 | 0.051 | 0.046 | 0.055 | 0.060 | 0.051 | 0.050 | 0.056 | 0.056 |

| Xi’an | 0.058 | 0.061 | 0.058 | 0.063 | 0.064 | 0.060 | 0.054 | 0.065 | 0.067 |

| Lanzhou | 0.053 | 0.053 | 0.053 | 0.058 | 0.058 | 0.057 | 0.047 | 0.064 | 0.062 |

| Xining | 0.030 | 0.033 | 0.030 | 0.040 | 0.041 | 0.037 | 0.031 | 0.037 | 0.037 |

| Yinchuan | 0.032 | 0.032 | 0.032 | 0.033 | 0.035 | 0.030 | 0.031 | 0.039 | 0.038 |

| Urumqi | 0.050 | 0.050 | 0.050 | 0.050 | 0.045 | 0.045 | 0.044 | 0.062 | 0.075 |

References

- Camagni, R.; Capello, R.; Caragliu, A. Static vs. dynamic agglomeration economies. Spatial context and structural evolution behind urban growth. Pap. Reg. Sci. 2016, 95, 133–158. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Ponzetto, G.A.M.; Zou, Y. Urban networks: Connecting markets, people, and ideas. Pap. Reg. Sci. 2016, 95, 17–59. [Google Scholar] [CrossRef]

- Meijers, E.J.; Burger, M.J.; Hoogerbrugge, M.M. Borrowing size in networks of cities: City size, network connectivity and metropolitan functions in Europe. Pap. Reg. Sci. 2016, 95, 181–198. [Google Scholar] [CrossRef]

- Jiao, J.; Zhang, Q.; Wu, Y.; Jiang, R.; Wang, J.E. Change and influencing factors of China’s cross-regional investment network structure. Prog. Geogr. 2021, 40, 1257–1268. [Google Scholar] [CrossRef]

- Gabriel, F.; Abraham, T. Urbanization, housing and infrastructural facilities in lagos, nigeria. Dimens. J. Archit. Built Environ. 2009, 37, 9–14. [Google Scholar] [CrossRef]

- Aizenman, J.; Jinjarak, Y.; Zheng, H. Housing Bubbles, Economic Growth, and Institutions. Open Econ. Rev. 2019, 30, 655–674. [Google Scholar] [CrossRef]

- Hillebrand, M.; Kikuchi, T. A mechanism for booms and busts in housing prices. J. Econ. Dyn. Control 2015, 51, 204–217. [Google Scholar] [CrossRef]

- Afolabi, A.O.; Ojelabi, R.A.; Bukola, A.; Akinola, A.; Afolabi, A. Statistical exploration of dataset examining key indicators influencing housing and urban infrastructure investments in megacities. Data Brief 2018, 18, 1725–1733. [Google Scholar] [CrossRef]

- Alkay, E. Housing Choice Structure: Examples of Two Different-Size Cities from Turkey. Int. J. Strateg. Prop. Manag. 2015, 19, 123–136. [Google Scholar] [CrossRef][Green Version]

- Zang, H.; Yu, B.; Ju, L.X. Research on the Spatial Aggregation Changes and Affecting Factors of China’s Housing Development Investment. Oper. Res. Manag. Sci. 2016, 25, 197–202. [Google Scholar]

- Janoschka, M.; Alexandri, G.; Ramos, H.O.; Vives-Miro, S. Tracing the socio-spatial logics of transnational landlords’ real estate investment: Blackstone in Madrid. Eur. Urban Reg. Stud. 2020, 27, 125–141. [Google Scholar] [CrossRef]

- Bao, H.; Shan, L.; Wang, Y.; Jiang, Y.; Lee, C.; Cui, X. How Does Local Real Estate Investment Influence Neighborhood PM2.5 Concentrations? A Spatial Econometric Analysis. Land 2021, 10, 518. [Google Scholar] [CrossRef]

- Yang, H.; Wang, C.; You, Y. The Spatial Structure Evolution of China’s High-Speed Rail Network and Its Impacts on Real Estate Investment. Appl. Spat. Anal. Policy 2021, 15, 49–69. [Google Scholar] [CrossRef]

- Kim, H.M.; Han, S.S.; O’Connor, K.B. Foreign housing investment in Seoul: Origin of investors and location of investment. Cities 2015, 42, 212–223. [Google Scholar] [CrossRef]

- Lin, L.; Zhu, Y.; Ke, W.; Lin, C. The Characteristics and Determinants of the Floating Populations Housing Investment in the Places of Origin: Evidence from a Survey in Fujian Province. Sci. Geogr. Sin. 2020, 40, 401–408. [Google Scholar]

- Byrne, P.; Lee, S. Spatial concentration in industrial real estate: Institutional investment in England and Wales. J. Prop. Investig. Financ. 2010, 28, 6–23. [Google Scholar] [CrossRef]

- Liu, X.; Derudder, B. Analyzing urban networks through the lens of corporate networks: A critical review. Cities 2013, 31, 430–437. [Google Scholar] [CrossRef]

- Battiston, S.; Rodrigues, J.F. The network of inter-regional direct investment stocks across Europe. Adv. Complex Syst. 2007, 10, 29–51. [Google Scholar] [CrossRef]

- Grinnell, J. The niche-relationships of the California Thrasher. Auk 1917, 34, 427–433. [Google Scholar] [CrossRef]

- Hutchinson, G.E.; Deevey, E.S., Jr. Ecological studies on populations—Sciencedirect. Surv. Biol. Prog. 1949, 1, 325–359. [Google Scholar] [CrossRef]

- Frosch, A.; Gallopoulos, E. Strategies for Manufacturing. Sci. Am. 1989, 261, 601–602. [Google Scholar] [CrossRef]

- Li, J.; Yuan, W.; Wu, M.; Qiu, L. Measurement for Niche and Network Effect of Urban Cultural Industry. Econ. Geogr. 2018, 38, 116–123. [Google Scholar]

- Liu, S.; Sun, W.; Li, G. Advantage Location and Influencing Factors of Logistics Enterprises in Chongqing Based on Niche Theory. Sci. Geogr. Sin. 2020, 40, 393–400. [Google Scholar]

- Pan, F.; Bi, W.; Lenzer, J.; Zhao, S. Mapping urban networks through inter-firm service relationships: The case of China. Urban Stud. 2017, 54, 3639–3654. [Google Scholar] [CrossRef]

- Chen, S.; Lin, J.P.; Yang, L.J.; Zhang, H.O. Study on urban competition strategy based on the theory of niche. Hum. Geogr. 2006, 21, 72–76. [Google Scholar]

- Ye, J.P.; Zheng, W.H.; Lang, Y.; Shi, Y.N. Research on Health Evaluation of Housing Market of China: Empirical Analysis Based on 35 Metropolises. Price Theory Pract. 2021, 40, 31–36. [Google Scholar] [CrossRef]

- Wu, W.; Chen, M.; Chen, D.; Huang, J.X.; Zhong, S.X. Spatial-temporal Heterogeneity of Real Estate Market Health in Urban Agglomeration in Middle Reaches of Yangtze River. Manag. Rev. 2021, 33, 38–47. [Google Scholar] [CrossRef]

- Leifeld, P.; Cranmer, S.J. A theoretical and empirical comparison of the temporal exponential random graph model and the stochastic actor-oriented model. Netw. Sci. 2019, 7, 20–51. [Google Scholar] [CrossRef]

- Wang, X.Z.; Wu, Y.D. Differentiated Expectations, Policy Regulation and Housing Price Fluctuations: An Empirical Study of 35 Large and Medium-sized Cities in China. J. Financ. Econ. 2015, 41, 51–61. [Google Scholar] [CrossRef]

- Zhang, L.; Yin, H.; Wang, Q. Quantity Type or Price Type—Empirical Evidence from the “Non-Linear” Effectiveness of Monetary Policy. China Ind. Econ. 2020, 34, 61–79. [Google Scholar] [CrossRef]

- Ye, J.; Li, J. Study on Quaternity of Housing-Land-Fiscal-Finance Policies for Establishing the Long-term Real Estate Regulation Mechanism. China Soft Sci. 2018, 33, 67–86. [Google Scholar] [CrossRef]

- Zhu, C.Q. The niche ecostate-ecorole theory and expansion hypothesis. Acta Ecol. Sin. 1997, 17, 324–332. [Google Scholar]

- Robins, G.; Snijders, T.; Wang, P.; Handcock, M.; Pattison, P. Recent developments in exponential random graph (p*) models for social networks. Soc. Netw. 2007, 29, 192–215. [Google Scholar] [CrossRef]

- Hanneke, S.; Fu, W.; Xing, E.P. Discrete temporal models of social networks. Electron. J. Stat. 2010, 4, 585–605. [Google Scholar] [CrossRef]

- Snijders, T.A.B.; Pattison, P.E.; Robins, G.L. New specifications for exponential random graph models. Sociol. Methodol. 2010, 36, 99–153. [Google Scholar] [CrossRef]

- Desmarais, B.A.; Cranmer, S.J. Statistical mechanics of networks: Estimation and uncertainty. Phys.-Stat. Mech. Its Appl. 2012, 391, 1865–1876. [Google Scholar] [CrossRef]

- Carrington, P.J.; Scott, J. The SAGE Handbook of Social Network Analysis; Sage Publications: London, UK, 2011. [Google Scholar]

- Cranmer, S.J.; Heinrich, T.; Desmarais, B.A. Reciprocity and the structural determinants of the international sanctions net work. Soc. Netw. 2014, 36, 5–22. [Google Scholar] [CrossRef]

- Xu, H.L.; Sun, T.Y.; Cheng, L.H. Trade patterns and influence factors of high-end manufacturing on “One Belt and One Road”: A Study based on the exponential random graph models. Financ. Trade Econ. 2015, 12, 74–88. [Google Scholar] [CrossRef]

- Leifeld, P.; Cranmer, S.J.; Desmarais, B.A. Temporal Exponential Random Graph Models with btergm: Estimation and Bootstrap Confidence Intervals. J. Stat. Softw. 2018, 83, 1–36. [Google Scholar] [CrossRef]

- Schoeneman, J.; Zhu, B.; Desmarais, B.A. Complex dependence in foreign direct investment: Network theory and empirical analysis. Political Sci. Res. Methods 2020, 18, 1–17. [Google Scholar] [CrossRef]

- Guo, Q.Q.; Gao, C.D.; Sun, K.F.; Chen, S.; Jiang, D.; Hao, M.M. The construction of cyberspace elements hierarchical system based on man-land-network relationship. Geogr. Res. 2021, 40, 109–118. [Google Scholar] [CrossRef]

| Classification | Variable Name | Description | Configuration | Statistic | Definition |

|---|---|---|---|---|---|

| Endogenous network structures | Edge | Intercept |  | The intercept term is the same as that in a linear regression model | |

| Mutual | Reciprocity |  | Examines the reciprocity in the relationship between housing investment in two cities in the network | ||

| Ctriple | Cyclic triad |  | Examines whether there is a circular tripartite relationship in urban housing investment | ||

| Ttriple | Transitive triad |  | Examines whether there is a transitive tripartite relationship in urban housing investment | ||

| Node attributes | Homophily | Presence of the same attributes |  | Indicates whether cities with the same attributes tend to have investment relationships | |

| Sender | Sender effect |  | Indicates whether cities with certain attributes are more likely to invest in other cities | ||

| Receiver | Receiver effect |  | Indicates whether cities with certain attributes are more likely to attract investment from other cities | ||

| External network effects | Edgecov | Exogenous effect |  | Indicates whether spatial distance affects the tendency of cities to build housing investment relationships | |

| Time effect | Stability | Degree of stability |  | Indicates whether the network pattern in period t − 1 affects the network pattern in period t |

| Year | Cluster | City | Density |

|---|---|---|---|

| 2011 | Cluster 1 | Shanghai, Nanjing, Hangzhou, Ningbo, Hefei, Fuzhou, Xiamen, Nanchang, Xi’an, Urumqi | 0.533 |

| Cluster 2 | Beijing, Tianjin, Shijiazhuang, Taiyuan, Hohhot, Shenyang, Dalian, Changchun, Harbin, Jinan, Qingdao, Zhengzhou, Chongqing, Yinchuan | 0.528 | |

| Cluster 3 | Wuhan, Changsha, Guangzhou, Shenzhen, Chengdu, Nanning, Haikou, Guiyang, Kunming, Lanzhou, Xining | 0.582 | |

| 2015 | Cluster 1 | Beijing, Tianjin, Shijiazhuang, Taiyuan, Hohhot, Shenyang, Dalian, Changchun, Harbin, Jinan, Qingdao, Zhengzhou, Chongqing, Xi’an | 0.550 |

| Cluster 2 | Shanghai, Nanjing, Hangzhou, Ningbo, Hefei, Fuzhou, Xiamen, Nanchang, Wuhan, Changsha, Guangzhou, Shenzhen, Chengdu, Nanning, Guiyang, Kunming, Lanzhou, Xining, Yinchuan, Urumqi, Haikou | 0.448 | |

| 2019 | Cluster 1 | Nanjing, Hangzhou, Ningbo, Hefei, Fuzhou, Xiamen, Nanchang, Nanning | 0.607 |

| Cluster 2 | Beijing, Tianjin, Shijiazhuang, Taiyuan, Hohhot, Shenyang, Dalian, Changchun, Harbin, Shanghai, Jinan, Qingdao, Yinchuan | 0.474 | |

| Cluster 3 | Zhengzhou, Wuhan, Changsha, Guangzhou, Shenzhen, Chongqing, Chengdu, Xi’an, Guiyang, Kunming, Lanzhou, Xining, Urumqi, Haikou | 0.550 |

| Variable | ERGM | TERGM |

|---|---|---|

| Edges | −0.47 *** | −1.55 *** |

| (0.29) | (0.19) | |

| Mutual | 1.76 *** | 1.15 *** |

| (0.27) | (0.17) | |

| Ctriple | −0.46 *** | −0.28 *** |

| (0.12) | (0.06) | |

| Ttriple | −0.09 | −0.00 |

| (0.05) | (0.01) | |

| Homophily (GDPHigh) | 0.06 | −0.04 |

| (0.16) | (0.12) | |

| Homophily (PeopleHigh) | 0.17 | 0.05 |

| (0.17) | (0.12) | |

| Sender (GDPLow) | −0.34 | −0.16 |

| (0.25) | (0.15) | |

| Sender (PeopleLow) | 0.33 | 0.12 |

| (0.28) | (0.17) | |

| Receiver (GDPHigh) | 0.71 *** | 0.43 *** |

| (0.20) | (0.12) | |

| Receiver (PeopleHigh) | 2.65 *** | 1.35 *** |

| (0.30) | (0.14) | |

| Stability | 2.87 *** | |

| (0.06) |

| Variable | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| 2011–2019 | 2011–2015 | 2015–2019 | |

| Edges | −0.79 *** | −0.58 *** | −0.74 * |

| (0.06) | (0.15) | (0.36) | |

| Mutual | 0.95 *** | 1.14 *** | 0.70 * |

| (0.13) | (0.25) | (0.28) | |

| Ctriple | −0.29 *** | −0.40 *** | −0.26 ** |

| (0.06) | (0.11) | (0.10) | |

| Ttriple | −0.03 | −0.02 | −0.06 * |

| (0.02) | (0.03) | (0.03) | |

| Homophily (GDPHigh) | −0.03 | −0.34 | 0.04 |

| (0.11) | (0.26) | (0.18) | |

| Homophily (PeopleHigh) | 0.11 | −0.14 | 0.15 |

| (0.13) | (0.24) | (0.20) | |

| Sender (GDPLow) | −0.22 | −0.14 | −0.14 |

| (0.14) | (0.29) | (0.24) | |

| Sender (PeopleLow) | 0.27 | −0.03 | 0.26 |

| (0.17) | (0.34) | (0.27) | |

| Receiver (GDPHigh) | 0.43 *** | 1.55 *** | 0.43 * |

| (0.12) | (0.30) | (0.19) | |

| Receiver (PeopleHigh) | 1.53 *** | 0.91 ** | 1.57 *** |

| (0.15) | (0.28) | (0.23) | |

| Distance | −0.15 *** | −0.17 *** | −0.13 *** |

| (0.05) | (0.06) | (0.04) | |

| Stability | 2.81 *** | 3.12 *** | 2.62 *** |

| (0.06) | (0.12) | (0.09) |

| Variable | 2011–2019 | 2011–2015 | 2015–2019 |

|---|---|---|---|

| Edges | −1.02 * | −0.99 * | −0.76 * |

| [−1.41; −0.59] | [−1.34; −0.21] | [−1.16; −0.19] | |

| Mutual | 1.27 * | 1.76 * | 0.66 * |

| [0.78; 1.62] | [1.03; 2.18] | [0.56; 0.74] | |

| Ctriple | −0.33 * | −0.55 * | −0.20 * |

| [−0.45; −0.17] | [−0.66; −0.18] | [−0.26; −0.12] | |

| Ttriple | −0.01 | 0.02 | −0.06 |

| [−0.07; 0.03] | [−0.08; 0.09] | [−0.14; 0.01] | |

| Homophily (GDPHigh) | −0.02 | −0.30 * | 0.04 |

| [−0.21; 0.13] | [−0.54; −0.15] | [−0.12; 0.26] | |

| Homophily (PeopleHigh) | 0.12 | −0.19 | 0.15 |

| [−0.16; 0.29] | [−1.11; 0.33] | [−0.16; 0.35] | |

| Sender (GDPLow) | −0.17 | −0.11 | −0.09 |

| [−0.55; 0.31] | [−0.62; 0.68] | [−0.63; 0.44] | |

| Sender (PeopleLow) | 0.31 * | 0.03 | 0.25 |

| [0.04; 0.55] | [−0.85; 0.65] | [−0.12; 0.74] | |

| Receiver (GDPHigh) | 0.44 * | 1.65 * | 0.42 * |

| [0.18; 0.62] | [1.04; 1.93] | [0.11; 0.61] | |

| Receiver (PeopleHigh) | 1.54 * | 0.89 * | 1.57 * |

| [1.25; 1.79] | [0.34; 1.55] | [1.22; 1.86] | |

| Distance | −0.13 * | −0.15 * | −0.12 * |

| [−0.18; −0.07] | [−0.22; −0.08] | [−0.15; −0.07] | |

| Stability | 2.82 * | 3.18 * | 2.63 * |

| [2.61; 3.15] | [2.96; 4.27] | [2.50; 3.03] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, L.; Hu, H.; Wang, X. The Dynamic Evolution of the Structure of an Urban Housing Investment Niche Network and Its Underlying Mechanisms: A Case Study of 35 Large and Medium-Sized Cities in China. Sustainability 2022, 14, 3523. https://doi.org/10.3390/su14063523

Wang L, Hu H, Wang X. The Dynamic Evolution of the Structure of an Urban Housing Investment Niche Network and Its Underlying Mechanisms: A Case Study of 35 Large and Medium-Sized Cities in China. Sustainability. 2022; 14(6):3523. https://doi.org/10.3390/su14063523

Chicago/Turabian StyleWang, Linyan, Haiqing Hu, and Xianzhu Wang. 2022. "The Dynamic Evolution of the Structure of an Urban Housing Investment Niche Network and Its Underlying Mechanisms: A Case Study of 35 Large and Medium-Sized Cities in China" Sustainability 14, no. 6: 3523. https://doi.org/10.3390/su14063523

APA StyleWang, L., Hu, H., & Wang, X. (2022). The Dynamic Evolution of the Structure of an Urban Housing Investment Niche Network and Its Underlying Mechanisms: A Case Study of 35 Large and Medium-Sized Cities in China. Sustainability, 14(6), 3523. https://doi.org/10.3390/su14063523