An Asymmetric Nexus: Remittance-Led Human Capital Development in the Top 10 Remittance-Receiving Countries: Are FDI and Gross Capital Formation Critical for a Road to Sustainability?

Abstract

:1. Background of the Study

2. Literature Review

2.1. Remittance and Human Capital Development

2.2. Foreign Direct Investment and Human Capital Development

2.3. Remittances and Gross Capital Formation

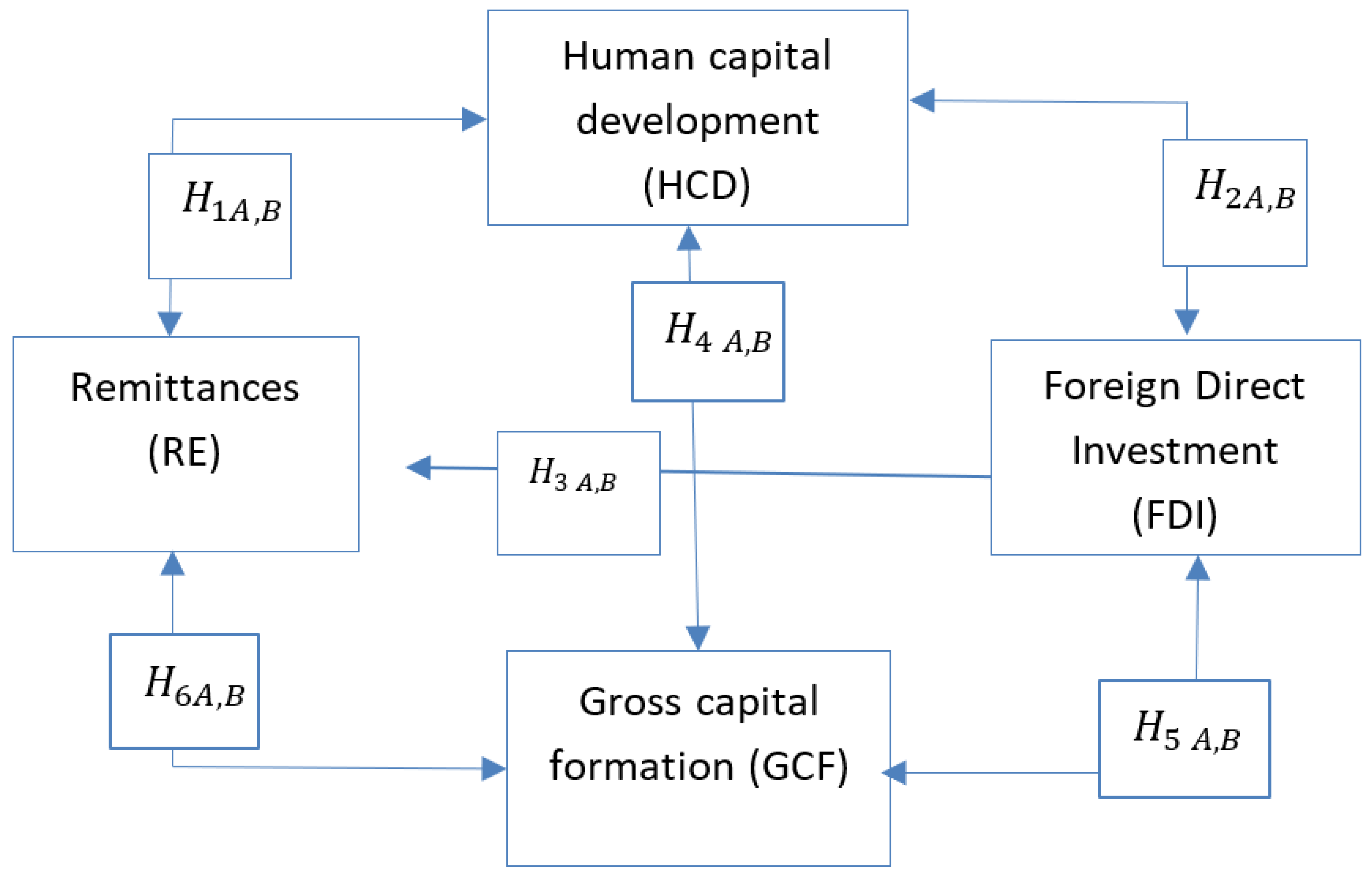

2.4. Research Gap, Conceptual Model and Proposed Hypothesis

3. Data and Methodology of the Study

3.1. Mode Specification

3.2. Variables Definition and Data Sources

3.3. Methodology of the Study

Panel ARDL

3.4. Nonlinear ARDL

4. Estimation and Interpretation

4.1. Results of Cross-Sectional Dependency

4.2. CIPS Panel Unit Root Test

4.3. Results of Panel Cointegration Test

4.4. Long-Run and Short-Run Symmetric Assessment

5. Discussion of the Findings

6. Conclusions and Policy Suggestions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Odia, L.O.; Omofonmwan, S.I. Educational System in Nigeria Problems and Prospects. J. Soc. Sci. 2007, 14, 81–86. [Google Scholar] [CrossRef]

- Omojimite, B.U. Building human capital for sustainable economic development in Nigeria. J. Sustain. Dev. 2011, 4, 183. [Google Scholar] [CrossRef]

- Shuaibu, M. Determinants of human capital development in Africa: A panel data analysis. Oeconomia Copernic. 2016, 7, 523–549. [Google Scholar] [CrossRef] [Green Version]

- De Muro, P.; Tridico, P. The role of institutions for human development. In Proceedings of the HDCA Conference, New Delhi, India, August 2003. [Google Scholar]

- Arora, R.U. Financial inclusion and human capital in developing Asia: The Australian connection. Third World Q. 2012, 33, 177–197. [Google Scholar] [CrossRef] [Green Version]

- Tsaurai, K. Investigating the determinants of human capital development in emerging markets. Int. J. Educ. Econ. Dev. 2018, 9, 172–181. [Google Scholar] [CrossRef]

- Gundlach, E. Human capital and economic development: A macroeconomic assessment. Intereconomics 1997, 32, 23–35. [Google Scholar] [CrossRef] [Green Version]

- Ratha, D. The impact of remittances on economic growth and poverty reduction. Policy Brief 2013, 8, 1–13. [Google Scholar]

- Inoue, T.; Hamori, S. Financial access and economic growth: Evidence from Sub-Saharan Africa. Emerg. Mark. Financ. Trade 2016, 52, 743–753. [Google Scholar] [CrossRef]

- Petrou, K.; Connell, J. Food, Morality and Identity: Mobility, remittances and the translocal community in Paama, Vanuatu. Aust. Geogr. 2017, 48, 219–234. [Google Scholar] [CrossRef]

- Adams, R.H., Jr.; Cuecuecha, A.; Page, J. The impact of remittances on poverty and inequality in Ghana. World Bank Policy Res. Work. Pap. 2008, 4732, 1–41. [Google Scholar]

- Hassan, M.U.; Mehmood, H.; Hassan, M.S. Consequences of worker s remittances on human capital: An in-depth investigation for a case of Pakistan. Middle-East J. Sci. Res. 2013, 14, 443–452. [Google Scholar]

- Ngoma, A.L.; Ismail, N.W. Do migrant remittances promote human capital formation? Evidence from 89 developing countries. Migr. Dev. 2013, 2, 106–116. [Google Scholar] [CrossRef]

- Salas, V.B. International remittances and human capital formation. World Dev. 2014, 59, 224–237. [Google Scholar] [CrossRef]

- Azam, M.; Raza, S.A. Do workers’ remittances boost human capital development? Pak. Dev. Rev. 2016, 55, 123–149. [Google Scholar] [CrossRef] [Green Version]

- Arshad, M.; Abbas, F.; Kächele, H.; Mehmood, Y.; Mahmood, N.; Mueller, K. Analyzing the Impact of Government Social Spending, Population Growth and Foreign Remittances on Human Development in Pakistan: Implications for Policy. Eur. J. Dev. Res. 2021, 1–20. [Google Scholar] [CrossRef]

- Gao, X.; Kikkawa, A.; Kang, J. Evaluating the Impact of Remittances on Human Capital Investment in the Kyrgyz Republic. In Asian Development Bank Economics Working Paper Series; Asian Development Bank: Mandaluyong, Filipine, 2021; 42p. [Google Scholar] [CrossRef]

- Aregbeshola, R.A. Interplay of poverty, remittances and human capital development: Panel evidence from selected Sub-Saharan African countries. Int. Migr. 2022, 40. [Google Scholar] [CrossRef]

- Yildirim, D.Ç.; Tosuner, Ö. The effects of FDI on human capital stock in Central Asian Turkic Republics. Eurasian J. Bus. Econ. 2014, 7, 51–60. [Google Scholar] [CrossRef]

- Henok, W.; Kaulihowa, T. The impact of FDI on human capital development in SACU countries. Int. J. Soc. Econ. 2021. [Google Scholar] [CrossRef]

- Ibarra-Olivo, J.E. Foreign direct investment and youth educational outcomes in Mexican municipalities. Econ. Educ. Rev. 2021, 82, 102123. [Google Scholar] [CrossRef]

- Noorbakhsh, F.; Paloni, A.; Youssef, A. Human Capital and FDI Inflows to Developing Countries: New Empirical Evidence. World Dev. 2001, 29, 1593–1610. [Google Scholar] [CrossRef]

- Nunnenkamp, P. Determinants of FDI in Developing Countries: Has Globalization Changed the Rules of the Game? Kiel Working Paper; Kiel Institute for World Economics (IfW): Kiellinie, Germany, 2002. [Google Scholar]

- Yang, Y.; Qamruzzaman, M.; Rehman, M.Z.; Karim, S. Do Tourism and Institutional Quality Asymmetrically Effects on FDI Sustainability in BIMSTEC Countries: An Application of ARDL, CS-ARDL, NARDL, and Asymmetric Causality Test. Sustainability 2021, 13, 9989. [Google Scholar] [CrossRef]

- Dutta, N.; Kar, S.; Saha, S. Human capital and FDI: How does corruption affect the relationship? Econ. Anal. Policy 2017, 56, 126–134. [Google Scholar] [CrossRef]

- Skeldon, R. International Migration as a Tool in Development Policy: A Passing Phase? Popul. Dev. Rev. 2008, 34, 1–18. [Google Scholar] [CrossRef]

- Taylor, J.E.; Arango, J.; Hugo, G.; Kouaouci, A.; Massey, D.S.; Pellegrino, A. International Migration and Community Development. Popul. Index 1996, 62, 397–418. [Google Scholar] [CrossRef]

- Adams, R.H., Jr.; Page, J. Do international migration and remittances reduce poverty in developing countries? World Dev. 2005, 33, 1645–1669. [Google Scholar] [CrossRef]

- Boucher, S.; Stark, O.; Taylor, J.E. A Gain with a Drain? Evidence from Rural Mexico on the New Economics of the Brain Drain. In Corruption, Development and Institutional Design; Kornai, J., Mátyás, L., Roland, G., Eds.; Palgrave Macmillan: London, UK, 2009; pp. 100–119. [Google Scholar]

- Rapoport, H.; Docquier, F. The economics of migrants’ remittances. Handb. Econ. Giv. Altruism Reciprocity 2006, 2, 1135–1198. [Google Scholar] [CrossRef]

- Adams, R.H.; Cuecuecha, A. Remittances, Household Expenditure and Investment in Guatemala. World Dev. 2010, 38, 1626–1641. [Google Scholar] [CrossRef] [Green Version]

- De, P.K.; Ratha, D. Impact of remittances on household income, asset and human capital: Evidence from Sri Lanka. Migr. Dev. 2012, 1, 163–179. [Google Scholar] [CrossRef] [Green Version]

- Mansuri, G. Migration, Sex Bias, and Child Growth in Rural Pakistan; The World Bank: Washington, DC, USA, 2006. [Google Scholar]

- Elizabeth, A.; Kwabena, G.B. Effect of the Liberalization of Investment Policies on Employment and Investment of Multinational Corporations in Africa; UNU-WIDER: Helsinki, Finland, 2007; Volume 2007. [Google Scholar]

- Huay, C.S.; Bani, Y. Remittances, poverty and human capital: Evidence from developing countries. Int. J. Soc. Econ. 2018, 45, 1227–1235. [Google Scholar] [CrossRef]

- Koska, O.A.; Saygin, P.Ö.; Çağatay, S.; Artal-Tur, A. International migration, remittances, and the human capital formation of Egyptian children. Int. Rev. Econ. Financ. 2013, 28, 38–50. [Google Scholar] [CrossRef] [Green Version]

- Adenutsi, D.E. Do International Remittances Promote Human Development in Poor Countries? Empirical Evidence from Sub-Saharan Africa; University Library of Munich: München, Germany, 2010. [Google Scholar]

- Mohamed Aslam, A.L.; Sivarajasingham, S. Testing cointegration between workers’ remittances and human capital formation in Sri Lanka. J. Econ. Adm. Sci. 2021. [Google Scholar] [CrossRef]

- Lucas, R. Why Doesn’t Capital Flow from Rich to Poor Countries? Am. Econ. Rev. 1990, 80, 92–96. [Google Scholar]

- Zhang, K.H.; Markusen, J.R. Vertical multinationals and host-country characteristics. J. Dev. Econ. 1999, 59, 233–252. [Google Scholar] [CrossRef] [Green Version]

- Teixeira, A.A.C. Measuring aggregate human capital in Portugal: 19602001. Port. J. Soc. Sci. 2005, 4, 101–120. [Google Scholar] [CrossRef]

- Zeqiri, N.; Bajrami, H. Foreign Direct Investment (FDI) Types and Theories: The Significance of Human Capital. In Proceedings of the Edmond HajriziUBT International Conference, Durres, Albania, 28–30 October 2016; pp. 43–58. [Google Scholar]

- Puig, N.; Álvaro-Moya, A. The long-term effects of foreign investment on local human capital: Four American companies in Spain, 1920s–1970s. Bus. Hist. Rev. 2018, 92, 425–452. [Google Scholar] [CrossRef] [Green Version]

- Bačić, K.; Račić, D.; Ahec Šonje, A. FDI and Economic Growth in Central and Eastern Europe: Is There a Link? 2004. Available online: https://mpra.ub.uni-muenchen.de/83136 (accessed on 12 May 2021).

- Kar, S. Exploring the causal link between FDI and human capital development in India. Decision 2013, 40, 3–13. [Google Scholar] [CrossRef]

- Zhuang, H. Does Fdi Diminish Local Education Spending Inequality? An Analysis Of Us Panel Data 1992–2002. Reg. Sect. Econ. Stud. 2008, 8, 51–72. [Google Scholar]

- Kaulihowa, T.; Adjasi, C. Non-linearity of FDI and human capital development in Africa. Transnatl. Corp. Rev. 2019, 11, 133–142. [Google Scholar] [CrossRef]

- Henri, N.; Luc, N.N.; Larissa, N. The Long-run and Short-run Effects of Foreign Direct Investment on Financial Development in African Countries. Afr. Dev. Rev. 2019, 31, 216–229. [Google Scholar] [CrossRef] [Green Version]

- Majeed, M.T.; Ahmad, E. Human Capital Development and FDI in Developing Countries; MPRA Paper, No. 3; University Library LMU Munich: Munich, Germany, 2008. [Google Scholar]

- Chami, R.; Fullenkamp, C.; Jahjah, S. Are Immigrant Remittance Flows a Source of Capital for Development? International Monetary Fund: Washington, DC, USA, 2003. [Google Scholar]

- Plaza, S.; Navarrete, M.; Ratha, D. Migration and Remittances Household Surveys in Sub-Saharan Africa: Methodological Aspects and Main Findings; World Bank: Washington, DC, USA, 2011. [Google Scholar]

- Yiheyis, Z.; Woldemariam, K. The Effect of Remittances on Domestic Capital Formation in Select African Countries: A Comparative Empirical Analysis. J. Int. Dev. 2016, 28, 243–265. [Google Scholar] [CrossRef]

- Ratha, D. Workers’ remittances: An important and stable source of external development finance. Glob. Dev. Financ. 2003, 5, 25–55. [Google Scholar]

- Aggarwal, R.; Demirgüç-Kunt, A.; Pería, M.S.M. Do remittances promote financial development? J. Dev. Econ. 2011, 96, 255–264. [Google Scholar] [CrossRef]

- Bjuggren, P.; Dzansi, J.; Shukur, G. Remittances and Investment; Centre for Excellence for Science and Innovation Studies (CESIS): Stockholm, Sweden, 2010. [Google Scholar]

- Nasim, A. The Effect of Remittances on Domestic Capital Formation Evidence from Selected SAARC Countries. Ph.D. Thesis, Capital University, Bexley, OH, USA, 2019. [Google Scholar]

- Muneeb, M.A.; Md, Q.; Ayesha, S.; Asad, A.L.I. The Role of Remittances in Financial Development: Evidence from Nonlinear ARDL and Asymmetric Causality. J. Asian Financ. Econ. Bus. 2021, 8, 139–154. [Google Scholar] [CrossRef]

- Miao, M.; Qamruzzaman, M. Dose Remittances Matter for Openness and Financial Stability: Evidence from Least Developed Economies. Front. Psychol. 2021, 12, 696600. [Google Scholar] [CrossRef] [PubMed]

- Liu, J.; Qamruzzaman, M. An asymmetric Investigation of Remittance, Trade Openness Impact on Inequality: Evidence from Selected South Asian Countries. Front. Psychol. 2021, 4022. [Google Scholar] [CrossRef]

- Hakimi, A.; Hamdi, H. Trade liberalization, FDI inflows, environmental quality and economic growth: A comparative analysis between Tunisia and Morocco. Renew. Sustain. Energy Rev. 2016, 58, 1445–1456. [Google Scholar] [CrossRef] [Green Version]

- Ustubici, A.; Irdam, D. The impact of remittances on human development: A quantitative analysis and policy implications. Sociology 2012, 5, 74–95. [Google Scholar] [CrossRef]

- Breusch, T.S.; Pagan, A.R. The Lagrange multiplier test and its applications to model specification in econometrics. Rev. Econ. Stud. 1980, 47, 239–253. [Google Scholar] [CrossRef]

- Pesaran, M.H. General Diagnostic Tests for Cross Section Dependence in Panels. Empir. Econ. 2021, 60, 13–50. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Ullah, A.; Yamagata, T. A bias-adjusted LM test of error cross-section independence. Econom. J. 2008, 11, 105–127. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Yamagata, T. Testing slope homogeneity in large panels. J. Econom. 2008, 142, 50–93. [Google Scholar] [CrossRef] [Green Version]

- Pedroni, P. Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econom. Theory 2004, 20, 597–625. [Google Scholar] [CrossRef] [Green Version]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Westerlund, J. Testing for error correction in panel data. Oxf. Bull. Econ. Stat. 2007, 69, 709–748. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, M.H.; Shin, Y.; Smith, R.P. Pooled mean group estimation of dynamic heterogeneous panels. J. Am. Stat. Assoc. 1999, 94, 621–634. [Google Scholar] [CrossRef]

- Qamruzzaman, M.; Jianguo, W. The asymmetric relationship between financial development, trade openness, foreign capital flows, and renewable energy consumption: Fresh evidence from panel NARDL investigation. Renew. Energy 2020, 159, 827–842. [Google Scholar] [CrossRef]

- Qamruzzaman, M.; Karim, S. Do Remittance and Financial Innovation causes stock price through Financial Development: An Application of Nonlinear Framework. Fourrages 2020, 242, 38–68. [Google Scholar]

- Kim, D.H.; Lin, S.C.; Suen, Y.B. Dynamic effects of trade openness on financial development. Econ. Model. 2010, 27, 254–261. [Google Scholar] [CrossRef]

- Andriamahery, A.; Qamruzzaman, M. A Symmetry and Asymmetry Investigation of the Nexus Between Environmental Sustainability, Renewable Energy, Energy Innovation, and Trade: Evidence From Environmental Kuznets Curve Hypothesis in Selected MENA Countries. Front. Energy Res. 2022, 9, 872–885. [Google Scholar] [CrossRef]

- Shahbaz, M.; Sharma, R.; Sinha, A.; Jiao, Z. Analyzing nonlinear impact of economic growth drivers on CO2 emissions: Designing an SDG framework for India. Energy Policy 2021, 148, 111965. [Google Scholar] [CrossRef]

- Qamruzzaman, M. Nexus between Remittance, Trade openness and inequality in South Asian countries: New evidence from the nonlinear unit root, nonlinear OLS, and NARDL, and asymmetry causality test. Contaduría Y Adm. 2021, 66, 1–27. [Google Scholar]

- Shin, Y.; Yu, B.; Greenwood-Nimmo, M. Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt; Springer: New York, NY, USA, 2014; pp. 281–314. [Google Scholar]

- Akkemik, K.A.; Göksal, K. Energy consumption-GDP nexus: Heterogeneous panel causality analysis. Energy Econ. 2012, 34, 865–873. [Google Scholar] [CrossRef]

- He, S.; Yu, S.; Wang, L. The nexus of transport infrastructure and economic output in city-level China: A heterogeneous panel causality analysis. Ann. Reg. Sci. 2021, 66, 113–135. [Google Scholar] [CrossRef]

- Dumitrescu, E.I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef] [Green Version]

- Rahman, M.M. The dynamic nexus of energy consumption, international trade and economic growth in BRICS and ASEAN countries: A panel causality test. Energy 2021, 229, 120679. [Google Scholar] [CrossRef]

- Fahimi, A.; Akadiri, S.S.; Seraj, M.; Akadiri, A.C. Testing the role of tourism and human capital development in economic growth. A panel causality study of micro states. Tour. Manag. Perspect. 2018, 28, 62–70. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef] [Green Version]

- Pedroni, P. Purchasing power parity tests in cointegrated panels. Rev. Econ. Stat. 2001, 83, 727–731. [Google Scholar] [CrossRef] [Green Version]

- Pedroni, P. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf. Bull. Econ. Stat. 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Azizi, S. The impacts of workers’ remittances on human capital and labor supply in developing countries. Econ. Model. 2018, 75, 377–396. [Google Scholar] [CrossRef]

- Ambrosius, C.; Cuecuecha, A. Remittances and the use of formal and informal financial services. World Dev. 2016, 77, 80–98. [Google Scholar] [CrossRef]

- Mansour, W.; Chaaban, J.; Litchfield, J. The Impact of Migrant Remittances on School Attendance and Education Attainment: Evidence from Jordan. Int. Migr. Rev. 2011, 45, 812–851. [Google Scholar] [CrossRef]

- Amuedo-Dorantes, C.; Pozo, S. Accounting for Remittance and Migration Effects on Children’s Schooling. World Dev. 2010, 38, 1747–1759. [Google Scholar] [CrossRef]

- Gul, S.; Zeb, A.; Ullah, O.; Mingyan, G. Impact of foreign remittances on school enrolment and educational expenditures in district Peshawar, Pakistan. Lib. Arts Soc. Sci. Int. J. 2021, 5, 209–221. [Google Scholar] [CrossRef]

- Medina, C.; Cardona, L. The effects of remittances on household consumption, education attendance and living standards: The case of Colombia. Lect. Econ. 2010, 12, 11–43. [Google Scholar]

- Alcaraz, C.; Chiquiar, D.; Salcedo, A. Remittances, schooling, and child labor in Mexico. J. Dev. Econ. 2012, 97, 156–165. [Google Scholar] [CrossRef] [Green Version]

- Yang, D. International Migration, Remittances and Household Investment: Evidence from Philippine Migrants’ Exchange Rate Shocks. Econ. J. 2008, 118, 591–630. [Google Scholar] [CrossRef] [Green Version]

- Contreras, S. The influence of migration on human capital development. Int. Econ. J. 2013, 27, 365–384. [Google Scholar] [CrossRef]

- Azam, M.; Haseeb, M.; Samsudin, S. The impact of foreign remittances on poverty alleviation: Global evidence. Econ. Sociol. 2016, 9, 264. [Google Scholar] [CrossRef]

- Baghirzade, N. The Impact of Foreign Direct Investment on Human Development Index in Commonwealth of Independent States; Eastern Mediterranean University: Gazimağusa, North Cyprus (EMU), 2012. [Google Scholar]

- Colen, L.; Maertens, M.; Swinnen, J. Foreign direct investment as an engine for economic growth and human development: A review of the arguments and empirical evidence. Hum. Rts. Int. Leg. Discourse 2009, 3, 177. [Google Scholar]

- Khafidzin, H.L.P. Determinants Foreign Direct Investment (FDI) Inflow in ASEAN-8. Media Trend 2021, 16, 12–18. [Google Scholar] [CrossRef]

- Qamruzzaman, M. Determinants of foreign direct investment (FDI): Evidence from Bangladesh. Pac. Bus. Rev. Int. 2015, 7, 97–105. [Google Scholar]

- Willem te Velde, D.; Nair, S. Foreign direct investment, services trade negotiations and development: The case of tourism in the Caribbean. Dev. Policy Rev. 2006, 24, 437–454. [Google Scholar] [CrossRef]

- Mughal, M.; Vechiu, N. The Role of Foreign Direct Investment in Higher Education in the Developing Countries. Rev. Économique 2015, 66, 369–400. [Google Scholar] [CrossRef]

| HC | REM | FDI | GCF | GEX | FD | SES | |

|---|---|---|---|---|---|---|---|

| Mean | 0.711682 | 0.645568 | −0.025772 | 3.181915 | 2.312946 | 3.476066 | 4.013990 |

| Median | 0.687905 | 1.117530 | 0.373190 | 3.123107 | 2.398158 | 3.356079 | 4.140200 |

| Maximum | 1.301656 | 2.679880 | 1.822431 | 4.492909 | 3.183286 | 4.840871 | 4.672151 |

| Minimum | 0.179283 | −5.259146 | −7.057022 | 2.613241 | 0.198966 | 1.600906 | 2.824363 |

| Std. Dev. | 0.290743 | 1.620231 | 1.409125 | 0.326166 | 0.566585 | 0.742415 | 0.504647 |

| Skewness | 0.186316 | −1.345366 | −2.057372 | 0.948588 | −1.379856 | −0.143068 | −0.627875 |

| Kurtosis | 2.358259 | 4.536041 | 8.219565 | 4.334258 | 5.675182 | 2.595166 | 2.395885 |

| Jarque–Bera | 6.286988 | 109.5939 | 504.3310 | 61.41620 | 168.6539 | 2.805812 | 22.16961 |

| Probability | 0.043132 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.245881 | 0.000015 |

| Observations | 274 | 274 | 274 | 274 | 274 | 274 | 274 |

| Variables | Notation | Measurement | Sources | Sign |

|---|---|---|---|---|

| Human Capital Development | HDC | Human Capital Development Index | PWT | |

| Secondary-school enrollment | WDI | |||

| Remittances | REM | Personal remittances received (% of GDP) | WDI | + |

| Foreign direct investment | FDI | Foreign direct investment, inflow (% of GDP) | WDI | + |

| Financial development | FD | Domestic credit to the private sector (% of GDP) | WDI | +/− |

| Government expenditure | GEX | General government final consumption expenditure (% of GDP) | WDI | + |

| ∆ | Adj.∆ | |||||

|---|---|---|---|---|---|---|

| lnHCD | 232.88 *** | 18.645 *** | 220.333 *** | 50.252 *** | 49.806 *** | 121.033 *** |

| lnSSE | 298.795 *** | 23.482 *** | 183.635 *** | 15.567 *** | 77.276 | 57.655 *** |

| inREM | 162.763 *** | 37.697 *** | 245.114 *** | 9.591 *** | 25.01 *** | 94.323 *** |

| lnFDI | 408.999 *** | 17.359 *** | 155.211 *** | 39.682 *** | 79.959 *** | 139.602 *** |

| lnFD | 297.782 *** | 16.043 *** | 135.943 *** | 52.327 *** | 41.866 *** | 141.461 |

| lnGCF | 388.186 *** | 31.906 *** | 124.924 *** | 55.658 *** | 93.453 *** | 77.532 |

| lnGEX | 376.282 *** | 28.723 *** | 180.494 *** | 55.175 *** | 25.527 *** | 144.007 *** |

| CIPS | CADF | |||||||

|---|---|---|---|---|---|---|---|---|

| At level | ∆ | At level | ∆ | |||||

| C | C&T | C | C&T | C | C&T | C | C&T | |

| lnHCD | −1.281 | −2.675 * | −3.475 *** | −6.694 *** | −2.874 * | −2.889 * | −4.649 *** | −3.533 *** |

| lnSSE | −2.954 ** | −2.36 | −4.641 *** | −5.512 *** | −1.649 | −2.939 | −7.18 *** | −6.049 *** |

| inREM | −2.545 | −1.744 | −4.831 *** | −6.113 *** | −1.969 | −1.25 | −6.195 *** | −2.705 *** |

| lnFDI | −2.854 ** | −2.315 | −6.907 *** | −6.443 *** | −2.706 | −1.545 | −6.024 *** | −3.502 *** |

| lnFD | −2.477 | −1.523 | −7.177 *** | −7.849 *** | −1.309 | −1.682 | −6.857 *** | −5.158 *** |

| lnGCF | −1.345 | −2.334 | −7.462 *** | −4.372 *** | −2.142 | −1.437 | −7.502 *** | −5.904 *** |

| lnGEX | −1.537 | −2.131 | −7.665 *** | −2.887 ** | −1.497 | −2.078 | −4.462 *** | −4.273 *** |

| [1] | [2] | |||

|---|---|---|---|---|

| Statistic | Weighted Statistic | Statistic | Weighted Statistic | |

| Alternative hypothesis: Common AR coefs. (within dimension) | ||||

| Panel v-Statistic | 1.21 | −0.253 | 2.736 * | −1.076 |

| Panel rho-Statistic | −4.13 | −7.768 | −6.213 | −9.155 *** |

| Panel PP-Statistic | −9.808 *** | −9.428 *** | −8.219 *** | −8.952 *** |

| Panel ADF-Statistic | −5.851 *** | −11.083 *** | −2.067 | −7.649 *** |

| Alternative hypothesis: Individual AR coefs. (between dimension) | ||||

| Group rho-Statistic | −10.696 *** | −10.022 *** | ||

| Group PP-Statistic | −8.06 *** | −8.187 *** | ||

| Group ADF-Statistic | −3.507 ** | −4.418 *** | ||

| ADF | −2.9726 *** | −1.5814 *** | ||

| DIV: Human Capital Development Index | DIV: Secondary-School Enrolment | |||||||

|---|---|---|---|---|---|---|---|---|

| Coefficient | Std. Error | t-Statistic | p-Value | Coefficient | Std. Error | t-Statistic | p-Value | |

| Panel-A: Long-run coefficients | ||||||||

| REM | 0.13814 | 0.044883 | 3.07774 | 0.0023 | 0.051549 | 0.028372 | 1.816897 | 0.0707 |

| FDI | 0.01698 | 0.007362 | 2.30686 | 0.0219 | 0.02106 | 0.00924 | 2.27933 | 0.0275 |

| GCF | 0.042915 | 0.006727 | 6.37961 | 0.5241 | 0.09676 | 0.083747 | 1.155385 | 0 |

| GEX | 0.279363 | 0.07242 | 3.857528 | 0.0001 | 0.465801 | 0.147707 | 3.153547 | 0.0019 |

| FD | 0.028975 | 0.0034803 | 8.32539 | 0.4059 | 0.208892 | 0.113753 | 1.836365 | 0.0678 |

| Panel-B: Short-run Equation | ||||||||

| ECT(-1) | −0.08893 | 0.04082 | −2.17859 | 0.0303 | −0.05824 | 0.029406 | −1.98068 | 0.049 |

| D(REM) | 0.0326 | 0.01553 | 2.099163 | 0.0368 | 0.0915 | 0.009468 | −9.66413 | 0.335 |

| D(FDI) | 0.0554 | 0.0112 | 4.946429 | 0.2016 | −0.01303 | 0.00659 | −1.97724 | 0.8435 |

| D(GCF) | −0.02002 | 0.003069 | −6.5233 | 0.5148 | −0.02033 | 0.057253 | −0.35504 | 0.7229 |

| D(GEX) | −0.00808 | 0.00291 | −2.77663 | 0.8979 | 0.05252 | 0.057738 | 0.909626 | 0.9276 |

| D(FD) | 0.00619 | 0.00171 | 3.619883 | 0.8675 | 0.027249 | 0.108152 | 0.251951 | 0.8013 |

| C | 0.09842 | 0.001656 | 59.43237 | 0 | 0.044005 | 0.014039 | 3.134483 | 0.002 |

| H-test | 0.571 | 0.812 | ||||||

| Variable | DIV: Human Capital Development Index | DIV: Secondary-School Enrolment | ||||

|---|---|---|---|---|---|---|

| Panel A: Long-Run coefficients | ||||||

| Coefficient | Std. Error | t-Statistic | Coefficient | Std. Error | ||

| REM_POS | 0.066991 | 0.009756 | 6.866646 | 0.08333 | 0.019897 | 4.188111 |

| REM_NEG | 0.074555 | 0.006029 | 12.36606 | 0.236404 | 0.077294 | 3.058504 |

| FDI_POS | 0.017507 | 0.002545 | 6.878978 | −0.0689 | 0.033802 | −2.03819 |

| FDI_NEG | 0.019953 | 0.002938 | 6.791355 | −0.24766 | 0.100521 | −2.46371 |

| GCF_POS | −0.09682 | 0.023602 | −4.10219 | 0.15531 | 0.039304 | 3.95158 |

| GCF_NEG | −0.10296 | 0.018137 | −5.67663 | 0.208851 | 0.047941 | 4.356435 |

| GEX | 0.184335 | 0.015899 | 11.59413 | 0.080437 | 0.034146 | 2.355679 |

| FD | −0.01965 | 0.010947 | −1.79456 | 0.15435 | 0.026059 | 5.923098 |

| 0.7841 | 0.5722 | |||||

| 0.5122 | 0.4331 | |||||

| 0.3711 | 0.7522 | |||||

| Panel B: Short-Run Equation | ||||||

| COINTEQ01 | −0.09176 | 0.022774 | −4.02916 | −0.15468 | 0.013085 | −11.8212 |

| D(REM_POS) | 0.018574 | 0.004139 | 4.487557 | 0.02998 | 0.0066 | 4.542424 |

| D(REM_NEG) | 0.025242 | 0.00513 | 4.920468 | −0.01594 | 0.00431 | −3.69768 |

| D(FDI_POS) | 0.02671 | 0.00174 | 15.35057 | 0.06299 | 0.015043 | 4.18733 |

| D(FDI_NEG) | −0.00257 | 0.00209 | −1.22727 | −0.02447 | 0.022229 | −1.10086 |

| D(GCF_POS) | 0.02252 | 0.009627 | 2.339254 | 0.101445 | 0.00969 | 10.46904 |

| D(GCF_NEG) | −0.02428 | 0.014498 | −1.67464 | 0.014184 | 0.005789 | 2.450164 |

| D(GEX) | −0.02798 | 0.005554 | −5.03781 | 0.041778 | 0.03477 | 1.201553 |

| D(FD) | 0.02899 | 0.006394 | 4.533938 | 0.015467 | 0.00709 | 2.181523 |

| C | 0.027239 | 0.015563 | 1.750241 | |||

| 0.6234 | 0.1132 | |||||

| 0.2243 | 0.44.12 | |||||

| 0.3316 | 0.5112 | |||||

| 0.2251 | 0.1283 | |||||

| Hausman test | 2.845 (0.1522) | 1.622 (0.4824) | ||||

| HCD | REM | FDI | GCF | GEX | FD | ||

|---|---|---|---|---|---|---|---|

| Panel A: Human capital development measured by HDI | |||||||

| HBD | (2.151) [0.0293] | (3.3971) ** [1.7512] | (5.8713) *** [4.7272] | (5.0458) *** [4.0589] | (3.8918) *** [2.4529] | HCD←→REM; HCD←→FDI; GCF←→HCD; | |

| REM | (3.9544) *** [2.5381] | (4.7117) *** [3.5689] | (3.1476) [1.2191] | (5.0975) *** [4.1261] | (3.4496) [1.8239] | ||

| FDI | (4.4939) *** [3.2714] | (1.8826) [−0.3489] | (3.916) ** [2.4831] | (5.5577) *** [4.2808] | (5.363) *** [4.071] | ||

| GCF | (10.1308) *** [10.2102] | (7.5511) *** [6.8833] | (2.0155) [−0.2426] | (4.4666) *** [3.2336] | (5.3574) *** [4.0637] | ||

| GEX | (5.3857) *** [4.532] | (3.2144) [1.5075] | (3.6145) ** [2.0525] | (4.3309) [2.7429] | (3.3011) [1.6307] | ||

| FD | (6.6976) *** [6.3579] | (5.403) *** [4.5509] | (2.1767) [0.0596] | (3.9204) ** [2.2147] | (2.3352) [0.2863] | ||

| Panel B: Human capital development measured by secondary-school enrollment | |||||||

| HCD | (4.0387) *** [5.7966] | (2.2982) ** [2.3933] | (3.2964) *** [4.3291] | (2.376) ** [2.5456] | (6.3426) *** [9.8773] | REM←→HCD; FDI→HCD; GCF←→HCD | |

| REM | (2.1204) ** [2.0424] | (1.8778) [1.6511] | (3.4374) [4.7796] | (8.6266) *** [14.5227] | (1.0418) [−0.0809] | ||

| FDI | (1.6669) [1.1567] | (1.6759) [1.2439] | (1.9778) [1.853] | (2.5513) *** [3.001] | (0.7826) [−0.5596] | ||

| GCF | (2.6748) *** [3.1159] | (1.404) [0.6897] | (1.1995) [0.2793] | (4.3093) *** [6.5613] | (1.2523) [0.3192] | ||

| GEX | (4.3488) *** [6.41] | (3.0245) *** [3.9645] | (6.371) *** [10.7233] | (2.4034) ** [2.7023] | (4.9874) *** [7.5182] | ||

| FD | (4.0574) *** [5.5736] | (1.3438) [0.5001] | (4.0096) *** [5.635] | (1.833) [1.4335] | (3.7281) [5.0928] | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xia, C.; Qamruzzaman, M.; Adow, A.H. An Asymmetric Nexus: Remittance-Led Human Capital Development in the Top 10 Remittance-Receiving Countries: Are FDI and Gross Capital Formation Critical for a Road to Sustainability? Sustainability 2022, 14, 3703. https://doi.org/10.3390/su14063703

Xia C, Qamruzzaman M, Adow AH. An Asymmetric Nexus: Remittance-Led Human Capital Development in the Top 10 Remittance-Receiving Countries: Are FDI and Gross Capital Formation Critical for a Road to Sustainability? Sustainability. 2022; 14(6):3703. https://doi.org/10.3390/su14063703

Chicago/Turabian StyleXia, Chengjuan, Md. Qamruzzaman, and Anass Hamadelneel Adow. 2022. "An Asymmetric Nexus: Remittance-Led Human Capital Development in the Top 10 Remittance-Receiving Countries: Are FDI and Gross Capital Formation Critical for a Road to Sustainability?" Sustainability 14, no. 6: 3703. https://doi.org/10.3390/su14063703

APA StyleXia, C., Qamruzzaman, M., & Adow, A. H. (2022). An Asymmetric Nexus: Remittance-Led Human Capital Development in the Top 10 Remittance-Receiving Countries: Are FDI and Gross Capital Formation Critical for a Road to Sustainability? Sustainability, 14(6), 3703. https://doi.org/10.3390/su14063703