Abstract

In the era of the intelligent economy, to achieve business development, companies have shifted from focusing on physical resources to intangible resources and increasingly rely on investment in intangible assets. This phenomenon is a consensus. Intellectual capital is a skill that is difficult for competitors to replicate and is the most significant intangible asset of modern firms. Research on intellectual capital mainly focuses on the impact of companies’ performance; however, this study focuses on the sustainable development effects of companies. Taking manufacturing companies from Chinese A-share listings from 2015 to 2020 as the sample space and adding innovation capital based on the traditional intellectual capital model, a two-way fixed-effects model was used to conduct empirical research on the relationship between companies’ intellectual capital and corporate sustainable development. Meanwhile, research was conducted to test whether investor confidence innovatively played an intermediary role. This study showed that intellectual capital was positively correlated with the sustainable development of companies and investor confidence. In general, investor confidence was a bridge that connected intellectual capital and sustainable development. The results provided an empirical basis for companies that can enhance their sustainable development capabilities through intellectual capital investment. Managers should focus on the development of activities that have a positive impact on companies’ intellectual capital, increase the investment of intellectual capital, and achieve high-quality, sustainable development.

1. Introduction

“Survival of the fittest” is the natural law of the market economy. Sustainable development is a critical component that all countries need to consider and a hot spot that every company pays attention to during the development process. According to McKinsey’s 2010 survey of 2000 executives, corporate sustainable development is essential [1]. Specifically, corporate sustainable development has a considerable weight in a company’s future strategy; it reflects the company’s potential for survival and development, and it affects the company’s future financial performance [2]. In 2002, China set “continuously enhancing the capacity for sustainable development” as one of its goals for all-round social construction and development [3]. Enterprises are no exception, as they actively respond to national slogans and are committed to enhancing the capacity of corporate sustainable development. Existing research mostly focuses on the short-term profitability of companies, and there is little research on the long-term development of companies [4,5,6]. Therefore, this research focuses on improving a company’s competitiveness and sustainable development capabilities.

Enterprises need to plan future development strategies, and only correct corporate strategic investment will have a competitive advantage and better achieve the goal of sustainable development. Under the background of globalization, companies have begun to focus on the accumulation of knowledge and technology. The development of intelligent manufacturing is an important means to improve the competitiveness of a country’s manufacturing industry. It is the inevitable choice of the modern manufacturing industry to pursue a knowledge advantage; digitalization is gradually proved to be the key factor of sustainable development. Using intelligentization and digitization can create value, which helps to identify new value enhancement driving factors in the value creation process [7,8]. Looking back at the transformation of the agricultural economy to the intelligent economy, the value of intangible assets is in sharp contrast with the era when physical capital was the power of enterprises. Intellectual capital in the form of intangible assets plays a huge role and is highly recognized. It is regarded as the origin of competitive advantage and wealth creation [7,9]. The conception of intellectual capital was originally published in 1969. However, it has not been taken seriously until this generation. Currently, both the number of scholars studying intellectual capital and the number of published papers in this area have demonstrated a trend of rapid growth, but existing research on intellectual capital mainly focuses on the concept, composition, and function of intellectual capital [10,11,12]. Compared with China, developed countries have formulated a complete system and have more theoretical and practical results in intellectual capital research. China’s research on intellectual capital still has a gap, and there is currently not a comprehensive theoretical analysis framework for this area of research. Therefore, intellectual capital has become the object of attention of many scholars [10,13]. At the same time, Chinese enterprises do not pay enough attention to the investment of intellectual capital, thus we hope to prove the importance of intellectual capital to enhance the corporate sustainable development ability and the importance of Chinese enterprises on intellectual capital through research.

This paper takes the manufacturing industry as a research sample. Compared with other industries, the manufacturing industry is a pioneer industry that has more economies of scale, and it is easier to achieve technological progress. Furthermore, its capital accumulation is easier to achieve, and the rate of return on capital is also higher. Moreover, it plays an important role in global economic development [14]. Prior research primarily focused on the performance of the compositional dimensions of intellectual capital on corporate sustainable development [15,16,17]. Innovation ability plays an intermediary role, and organized learning plays a moderating role [18,19,20,21]. However, the role played by investors has not attracted attention as an indispensable part of the development process of a company. The psychology of investors will affect the behavior of investors. The stronger the investor’s confidence, the more confident they are in the development of the company. This will increase the purchase of stocks and affect the development of the company to a certain degree. Why is there a lack of research on investor confidence as an intermediary between intellectual capital and corporate sustainable development? Can investor confidence play an intermediary role?

Therefore, this research examines how companies can improve their sustainability, the importance of intellectual capital and the role of investor confidence in the relationship between the intellectual capital and corporate sustainable development. The contributions of this research are as follows: in terms of data selection, this manuscript collected manufacturing data in traditional industries. In terms of measuring intellectual capital, this research added innovation capital as a new variable in addition to human capital, structural capital, and social capital. In terms of empirical methods, using a fixed-effects model verified the hypotheses presented in the article. In terms of content, this research deeply studied the relationship between intellectual capital and corporate sustainable development. Moreover, it emphasized innovation and tested the mediating effect of investor confidence.

2. Literature Review and Research Hypotheses

The literature review section is divided into four sections. The first section focuses on the definition of related concepts. Section 2 focuses on the relationship between intellectual capital (IC) and sustainable development (SGR). Section 3 focuses on the relationship between IC and investor confidence (IE). The last section focuses on the link between IE and SGR.

2.1. Definition of Related Concepts

2.1.1. Intellectual Capital

In 1969, American scholar Kenneth Galbraith began to use the term “intellectual capital”. Stewart was the first scholar to make a systematic study of intellectual capital and published a number of books on intellectual capital. IC aims to emphasize the importance of intelligence for growth and development, knowledge plays a key role in achieving economic sustainable development [22]. Sofian et al., (2004) believed that IC refers to specialized knowledge, experience, and the capability of attaining technical knowledge. When these assets are properly used, they can generate competitive advantages [23]. Khan, S. Z. et al., (2019) believed that IC belongs to the category of intangible assets, consisting of technology, goodwill, brand, customer knowledge, and culture organization, all of which are components that can lead companies to achieve high-quality competitiveness [24].

There are many ways to measure IC, such as the VAIC method, the financial indicator method, and the questionnaire method. Among them, VAIC is still the most commonly used method to measure the IC of companies. From previous research, two aspects are needed to measure IC: (1) The first aspect consists of two parts: structural capital and human capital; (2) The second aspect contains three parts: structural capital, human capital, and social capital. There is no obvious difference in the understanding of the nature of IC [25,26,27,28]. This research divides IC into four parts: structure-centered, customer-centered, people-centered, and R&D-centered IC [29]. Among them, human capital is closely correlated with personal and comprehensive labor results, which is prominently reflected in the knowledge, skills, and qualities of workers. Structural capital is defined as the structure and process of an organization, and employees follow these structures and processes to perform business affairs [30]. Social capital refers to responding to many changes. The success of an organization depends on its ability to effectively and dynamically communicate with customers, suppliers, and strategic partners [31]. Innovation capital is the enterprise innovation ability that condenses through innovation and related investment, and it is the booster of the enterprise’s continuous development. This paper analyzes the differences in the intellectual capital of companies through the four aforementioned aspects.

2.1.2. Sustainable Development

Corporate sustainability is not only ethical and moral, but also historical. Redclift, M. (2018) put forward that “sustainable development” is a concept full of contradictions [32]. Through the changes of the times, it adapts to the changes of social and economic crises [32]. It is worth exploring. At this stage, there are broad and narrow definitions of SGR. In a broad sense, SGR can be defined as environmental, social, and regional economic corners that focus on ecological issues. Rahdari, A. et al., (2016) proposed that sustainable development in a broad sense is the coupling effect of the environment, economy, and society [33]. Sustainable development was first proposed in 1987. The Norwegian Prime Minister, Mrs. Brunlandt, published the report “Our Common Future”, which gave a detailed definition and systematic elaboration of the connotation of SGR. She emphasized the sustainable development of the environment [34]. Bijl, R. (2011) proposed from a socially sustainable development perspective that sustainable development is about life, the future of society, people’s well-being, the continuation of society, and ensuring that contemporary people leave enough for generations and people in other parts of the world to enjoy a quality life [35]. Raszkowski, A. et al., (2018) researched the sustainable development of the Polish regional economy. They proposed that sustainable development covers many components that provide incentives for regional development, such as the expected increase in GDP, the increase in R&D expenditures, the reduction of the unemployment rate and employment growth, poverty prevention, the attention to natural environmental issues, etc. [36]. Sustainable development, in a narrow sense, namely corporate sustainable development, refers to the process of continuously pursuing business goals and ensuring core competitiveness. The company must not only ensure that it can obtain continuous and uninterrupted profitability in the professional field but also ensure a sustainable competitive advantage.

This research focuses on corporate sustainable development, i.e., the capability of achieving corporate sustainable development. The capability of corporate sustainable development is the guarantee of realizing long-term business and the material requirement needed for national economic purposes [37]. American financial scientist Robert C. Higgins conducted in-depth research on the issue of corporate SGR and put forward a sustainable growth model in 1977, which better reflects corporate’s sustainable development capabilities. In 2000, James C. Van Horne developed a steady-state equilibrium and dynamic non-equilibrium sustainable growth model based on the definition provided by Robert C. Higgins to better emphasize the operating conditions of the company. Jones et al., (2018) established a sustainable competition model based on resource-based view theory from a stakeholder management perspective [38]. Chinese scholars believe that the ability to attain corporate sustainable development means that every company should consider business objectives and improve their market competitive position. At the same time, they always maintain the long-term prosperity of the enterprise in the already leading competitive field.

2.1.3. Investor Confidence

Research on the capital market is mostly combined with psychology, which has become a new research development trend. The growth of investors is closely linked to the maturity of the market. Zweig (1973) first proposed a clearer definition of investor sentiment, which describes the deviation between the true value of the corporate market and the investor’s valuation [39]. Johnson and Tversky (1983) proposed an emotional generalization theory based on related experiments. They believed that people’s emotions greatly affect their decision-making process [40]. China’s securities market presents the basic characteristics of a high degree of retail investment, and this situation will continue for a long time. This development state means that many individual investors are immature and have a low-risk tolerance in the stock market, and the performance of their cognitive psychology and behavioral deviations is particularly outstanding in the market. Irrational factors such as investors’ cognitive bias, self-confidence, and emotional fluctuations will affect investor behavior, which will affect the stock market and stock price [41]. This article does not choose investor sentiment but picks investor confidence for research. Black and McMillan (2004) believed that investor sentiment includes a positive investment attitude and negative investment propensity [42]. The measurement of investor sentiment is difficult to define clearly, but investor confidence refers specifically to the investor’s degree of optimism, and the definition is more explicit. Baker and Wurgler (2006) proposed that investor confidence is one of the important factors affecting the stock price and the operation of the capital market [43]. Investor confidence can affect investors’ decision-making behavior through psychological emotions and rational expectations. However, investors’ confidence is mostly affected by the country’s economic situation, macroeconomic policies, others’ behavior and information security [44], etc. Investors encounter situations such as insufficient investment confidence and excessive confidence. The “herding effect” is common in China’s securities market. Therefore, importance should be placed on the impact of investor confidence in the development of the capital market.

2.2. The Link between Intellectual Capital and Sustainable Development

Intangible resources play an irreplaceable role in the growth of companies that are scarce and inimitable [45]. Prahalad and Hamel (1997) first discovered the close relationship between intellectual capital and core competitiveness in intangible assets, a necessary driving force for improving corporate competitiveness and value creation [46]. For companies, it is essential to effectively understand, identify, exploit, and use intellectual capital. Suppose a company wants to have good sustainable growth efficiency. It must maintain a competitive advantage by using IC and adjust the investment of IC with the dynamic changes of the business environment. In other words, by incorporating IC into company strategy, every company will significantly improve performance and enhance its capabilities of achieving sustainable development [6]. Wang, B. and Xu, J. (2018) used Vaictmt and SGR models to demonstrate the direct impact of IC on the financial performance of Korean manufacturing and the sustainable growth of companies [47]. Xu and Liu (2019) studied the impact of new energy companies’ IC on SGR from the perspective of a life cycle. They proposed that IC is a vital source of the corporate SGR, and companies should reinforce the management and exploitation of IC [27]. If IC is appropriately used, it will improve the organization’s absorptive capacity and speed up knowledge creation and management [48].

Existing research results verified the relationship between the elements of IC and corporate SGR. Andrey N. Petrov (2017) expounded on the relationship between human capital accumulation and regional sustainable development from the concept of nature. He suggested the impact of human capital on economic growth and performance can help strengthen a country or enterprise [49]. At the same time, social capital, structural capital, and innovation capital can also generate competitiveness in organizations. Cogan, M. L. et al., (2014) revealed that enterprises gain their competitive advantage by using available intangible assets, especially social capital. Matos et al., (2017) emphasized the role of structural capital in improving the sustainability and competitiveness of corporate companies. Santos-Rodrigues, H. et al., (2010) proposed that the survival of an organization depends on its ability to learn and innovate, which is derived from IC [50,51,52]. Most studies put forward the view that the investment of intellectual capital can promote corporate sustainable development, but few scholars have also proposed that the relationship between intellectual capital and corporate development cannot be established [53].

Based on the above analysis, Hypothesis H1 is put forward:

Hypothesis 1 (H1).

Increased investment in intellectual capital can promote corporate sustainable development.

2.3. The Link between Intellectual Capital and Investor Confidence

Zavertiaeva, M. (2017) proposed that during exogenous shocks, intellectual capital is essential for companies’ survival and economic benefits and can make market value drop lower and recover faster [8]. When companies in the market are affected by exogenous shocks, intellectual capital prevents a significant decline in the market value of companies, allowing investors to identify potential profitability before the company grows, which is becoming more and more important to investors [8]. According to signal transmission theory, to better demonstrate the prospects of potential economic performance and competitive advantage, companies should find a method to show their advantages to attract potential investors, among which intellectual capital can convey to investors information on corporate characteristics in terms of human resources, innovation, society, and structure and have a positive impact on investor decision-making, attract potential investors or reduce stock volatility [54]. Francesca Battaglia, Francesco Busato, and Maria Manganiello (2020) studied 191 raw data collected on the Italian platform, and the results showed that intellectual capital is regarded as a quality signal by external investors. As a company strategy to improve financial performance and information transparency, the disclosure of intellectual capital is necessary, which is known as intelligent capital disclosure [55]. Sugumar Mariappanadar (2017) added value to mainstream theoretical research on the beneficial effects of intellectual capital on investor psychology through empirical research [56]. Alvino, F. et al., (2020) also emphasized the importance of monitoring and measuring intellectual capital to promote market confidence [26].

At the same time, relevant research conclusions indicate that human capital, which is an important part of IC, has an impact on investors’ decision-making standards. To attract investors, companies must find a reliable signal that reflects the inherent quality of their companies, of which human capital is a vital factor that investors need to consider before investing in a company [57]. Pena (2002), an American scholar, studied the relationship between intellectual capital and corporate growth and found that social capital, structural capital and human capital were all positively correlated with investment returns [58]. In 2020, China has emphasized the importance of innovation in development. In this context, exploratory innovation strategy can help investors attract more eyes. For investors, the theory of psychological cognitive bias holds that innovation corporate often attracted more attention. Most scholars have proposed that intellectual capital has a positive impact on behaviors and emotions of investors.

Based on the above analysis, the four dimensions of intellectual capital (human capital, structural capital, social capital, and innovation capital) have a positive effect on investors’ sentiment. Thus, Hypothesis H2 is put forward:

Hypothesis 2 (H2).

Increasing investment in intellectual capital can increase investor confidence.

2.4. The Link between Investor Confidence and Sustainable Development

Some factors affect corporate sustainable development both inside and outside. The management master Peter F. Drucker once wrote in the first chapter of his famous book The Practice of Management: “In a competitive system with fierce competition, whether a company can succeed and whether it will survive depends entirely on the quality of the manager and the performance of the company”. March, J. G. (1991) proposed that companies can respond to the ever-changing external environment by improving short-term financial performance to achieve long-term and orderly development [59]. There are few results on the relationship between investor confidence and corporate sustainable development. More research exists on the relationship between investor confidence and the performance and value of corporate companies, but both performance and value of corporate companies are closely related to corporate sustainable development. Investor sentiment affects stock prices, which in turn affects the development of corporate companies [60]. In terms of influencing corporate value, Malandri et al., (2018) divided investor sentiment into three ratings: positive, negative, and neutral. Results showed that investor sentiment has a robust contribution to the value of corporate companies [61]. Uygur et al., (2014) used the EGARCH model test procedure to examine the function of investor confidence on the market value of companies, and research showed that the effect of investor confidence in different industries on the market value of a company is different [62]. In terms of influencing corporate performance, the investor relationship management theory believes that corporate information was disclosed voluntarily and fully. Strengthening the communication between managers and investors will promote investors’ understanding and trust in corporate. This kind of situation will increase investment confidence and improve corporate performance. In terms of impression sustainable development, Mustafa Sayim et al., (2014) conducted an empirical test on a sample from Turkey from 2004 to 2010. They inferred the value of the company was obtained, and future development will be affected by investor confidence [63]. Nguyen et al., (2018) used the OLS model to study two alternative indicators of IE, and there was an interaction between IE and continuity of performance [64].

Through 2.2 analysis of the relationship between intellectual capital and sustainable development, most scholars believe that intellectual capital can enhance corporate competitiveness and value creation. Intellectual capital improves corporate performance and ability of corporate sustainable development significantly. Through 2.3 analysis of the relationship between intellectual capital and investor confidence, analysis shows that intellectual capital is a signal of corporate development and can promote market confidence. 2.4 analysis of the relationship between investors’ confidence and sustainable development shows that investors’ sentiment is crucial to the development of corporate. Investors’ investment in enterprises is closely related to their emotions. When investors have confidence in the development of enterprises, enterprises will develop vigorously and achieve sustainable development. Therefore, the intellectual capital information will convey the ability of corporate to the market. The higher the quality of the information disclosed by corporate, the better the sustainability of corporate value creation. Investors will also better understand the real operation strength of corporate and have a better grasp of corporate future development.

To sum up, based on the concept and relationship analysis of IC, IE, and corporate SGR, this study puts forward Hypothesis H3:

Hypothesis 3 (H3).

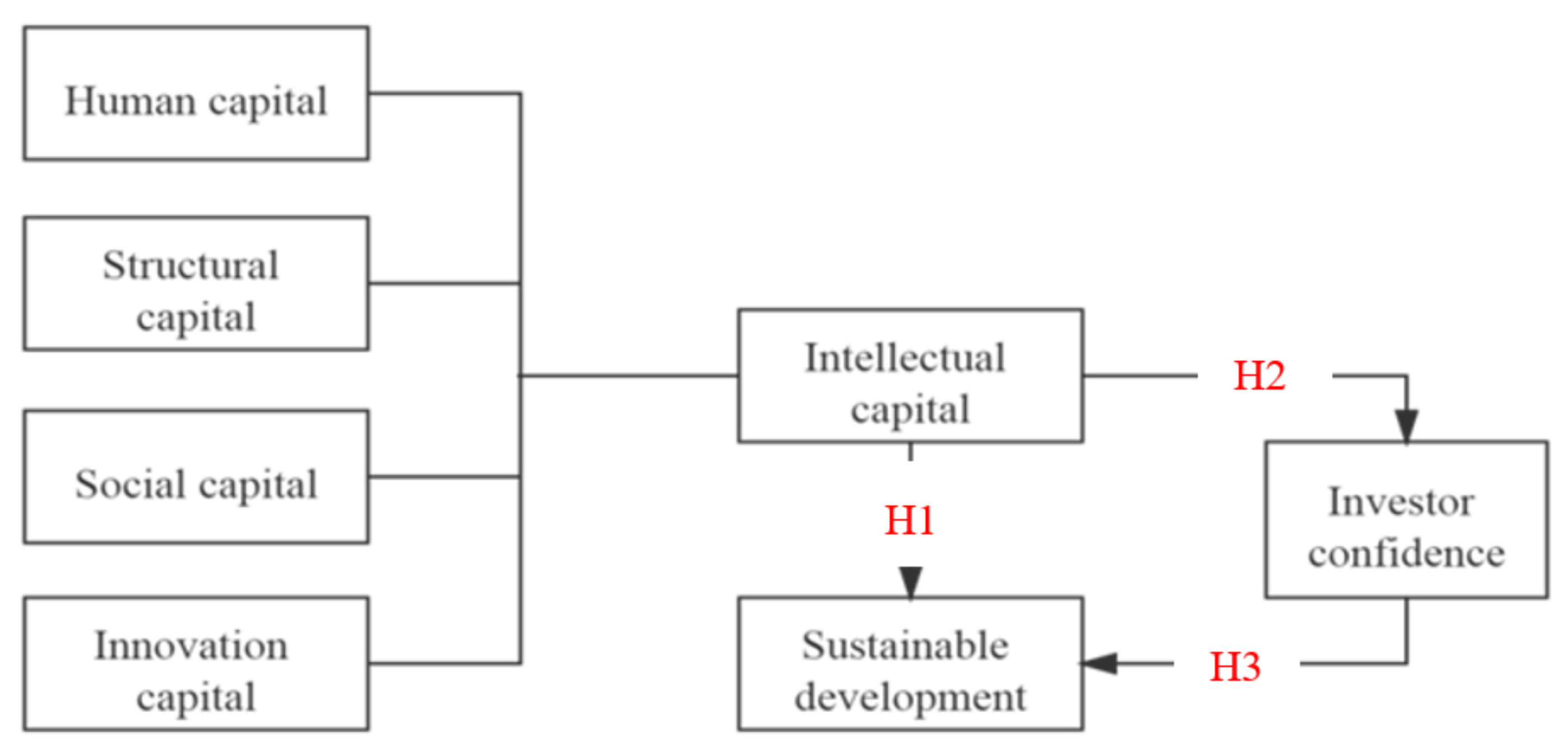

Investor confidence plays an intermediary role in the relationship between IC and corporate SGR (Figure 1).

Figure 1.

The conceptual framework of this study.

3. Research Design

The above sections have analyzed the relationship between intellectual capital, investor confidence, and corporate sustainable development. This section will select the manufacturing companies that have been listed on the Shanghai and Shenzhen A-shares in China as the sample and use the fixed-effects model to conduct regression analysis.

This paper adopts a fixed-effects model for regression for three reasons: (1) Taking into account unobservable individual effects; (2) Fixed-effects models can keep their estimates consistent under assumptions; (3) The fixed-effects model can alleviate the endogeneity problem of the model. Therefore, we perform a Hausman test to determine whether a fixed-effects model can be used. The results passed the Hausman test, so we chose a fixed-effects model for regression analysis.

3.1. Data Collection

Manufacturing companies that have been listed on the Shanghai and Shenzhen A-shares in China from 2015 to 2020 were selected. The types of companies included food, tobacco, alcohol, textiles, wood processing, petrochemical processing, metal manufacturing, and pharmaceutical manufacturing industries. In addition, the data were filtered according to two conditions. Condition one: the ST, *ST, and PT of the companies were deleted; condition two: the companies with missing demand variables were deleted. Finally, 8387 data points from 2023 companies were selected. To reduce the effect of outliers, a Winsorize was implemented to all continuous variables at the 1% quantile position on both tail sides. The financial data of the sample companies were mainly derived from the CSMAR database, the RES database, and the annual reports of listed companies. STATA 15.0 software was used for data processing and measurement analysis.

3.2. Variable Definition

3.2.1. Dependent Variables

This section uses Robert C. Higgins’ sustainable growth model to evaluate corporate sustainable development. The model can be described as follows:

SGR stands for the capability of corporate sustainable development. A high SGR signifies high sustainable development capability. P is the net profit margin on sales, R is the retention ratio, A is the asset turnover, and T is the equity multiplier. These four indicators determine the financial factors of sustainable development of a company. Although the structural and static assumptions of the model may be slightly different from the actual situation, Robert C. Higgins believed that the model could fit the development of most companies. The SGR model reflects the future development of companies, and the specific definitions of each indicator are shown in Table 1.

Table 1.

The details of corporate sustainable development.

3.2.2. Independent Variable

Intellectual capital can be described in four parts: human capital, structural capital, social capital, and innovation capital. The calculation method of Pulic’s VAIC intellectual capital appreciation coefficient model is presented as follows:

VAIC represents the IC efficiency of the company, HCE is the human capital efficiency, SCE is the structural capital efficiency, SOCE is the social capital efficiency, and ICE is the innovation capital efficiency. VA refers to the value-added of the company value, and VA = net profit + depreciation expenses + financial expenses + income tax + employee wage. Human capital investment (HUC) uses cash paid to and for employees in the cash flow statement as a proxy variable. Structured capital investment (STC) selects management expenses in the income statement as a proxy variable. Innovative capital investment (INC) uses the R&D expenditure of companies to express. Social capital investment (SOC) uses sales expenses as a proxy variable. The specific definition of each index is shown in Table 2.

Table 2.

The details of intellectual capital.

3.2.3. Mediating Variable

Baker and Stein (2004) used the VAR model when investigating investor confidence and selected liquidity indicators for empirical research. Among the liquidity indicators, the annual stock turnover rate is the most widely used indicator. The annual stock turnover rate is the frequency of a listed company’s stock trading in the securities market within a given period. It is an essential indicator for measuring liquidity and can evaluate investors’ buying intentions well. In general, the higher the stock exchange rate, the better the stock’s liquidity and the more active the trading market, which means investors have a more vital willingness to hold. On the contrary, the lower the stock exchange rate, the less a stock is concerned. Therefore, this article chooses the turnover rate as the positive proxy variable of investor confidence. The specific definitions of each indicator are shown in Table 3.

Table 3.

The details of Investor confidence.

3.2.4. Control Variable

Based on the existing research, this paper selects the company size, board size, asset-liability ratio, and ownership concentration as control variables to establish a fixed-effect model to ensure the accuracy of the results. Table 4 describes the definitions of the specific indicators.

Table 4.

The details of Control Variable.

3.3. Regression Model

According to the hypothesis, this section establishes the following three models for research:

Model 1 is used to verify the relationship between IC and the capability of corporate SGR in hypothesis one. If the model’s result is significantly positive, then IC has a significantly positive impact on the capability of corporate SGR. Therefore, Hypothesis 1 would be validated.

Model 2 is used to study the impact of IC on IE in hypothesis two. If the model result shows a significant positive correlation, then IC has a significant positive impact on IE. Therefore, Hypothesis 2 would be validated.

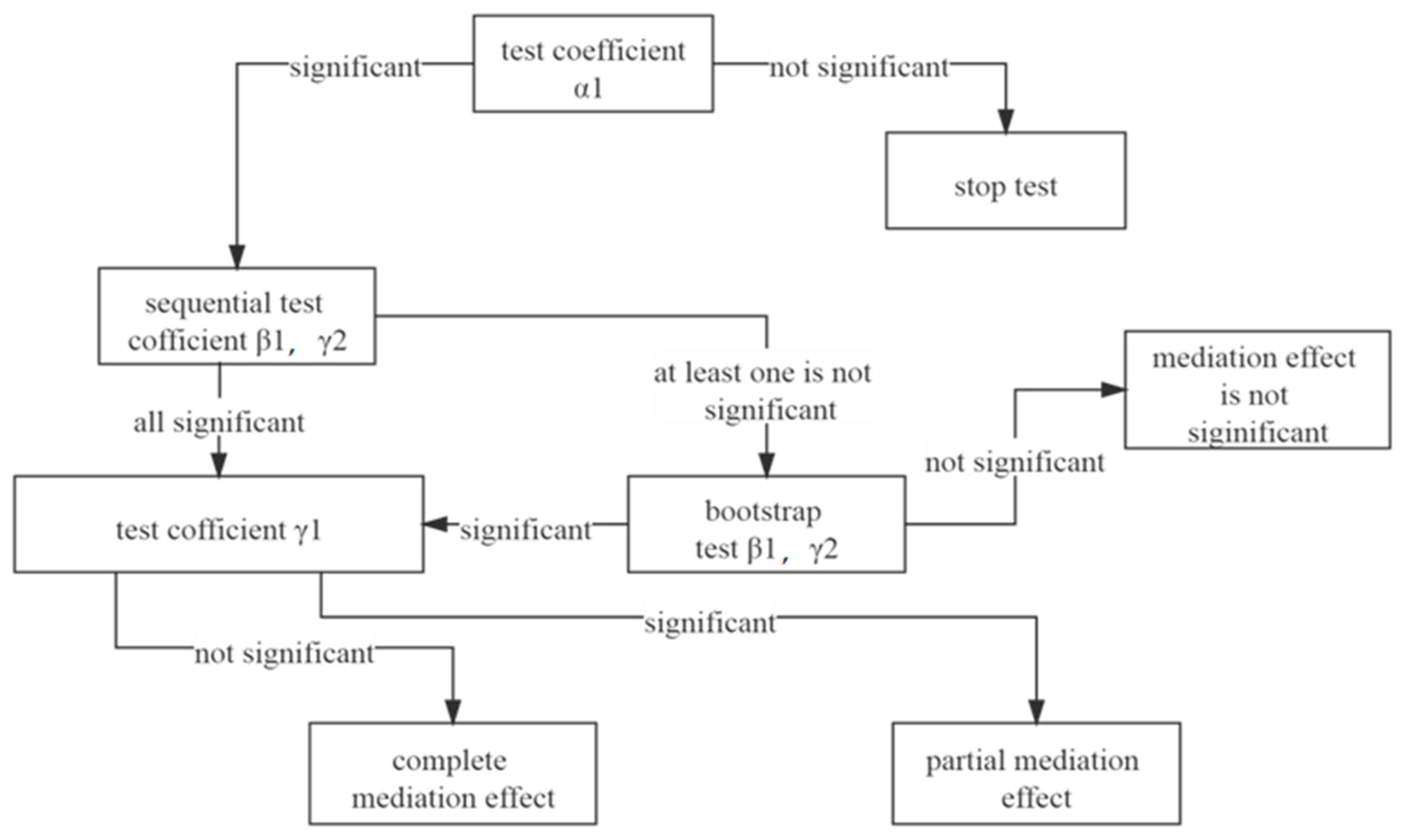

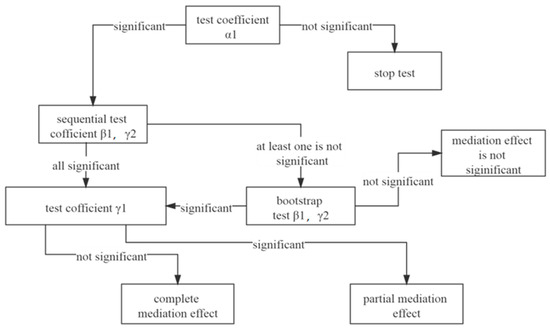

Hypothesis 3 declares that investor confidence plays an intermediary role. To test Hypothesis 3, the result from models 1 and 2 are used to verify the mediating effect in Hypothesis 3, as shown in Figure 2.

Figure 2.

Mediation effect test process.

After implementing the Hausman test, the results showed that the p-value was less than 0.05. Therefore, the fixed-effects model was chosen to perform regression analysis on the above three models. The results will show the significance of the influence coefficient of IC and IE on the capability of corporate SGR after adding IE as a new variable into the model. As shown in Figure 2, if the coefficient is not significant but is significant, then IE plays a completely intermediary effect in the relationship between IC and the capability of corporate SGR. If the coefficient and the coefficient are both significant and the coefficient decreases compared with coefficient , then IE plays an intermediary effect in the aforementioned relationship.

4. Empirical Analysis and Discussion

4.1. Descriptive Statistics

According to the regression model constructed in the previous article, the theoretical analysis results after substituting the sample data were tested, and the descriptive statistics obtained are shown in Table 5.

Table 5.

Descriptive statistics of all variables.

Table 5 shows that the mean of SGR was 0.0599, and its standard deviation was 0.044. However, the minimum value of SGR was negative, which signified that some companies lacked sustainable development capabilities. One can also see that the difference between the minimum value and maximum of IC was quite extensive. This difference shows that most companies did not attach importance to intellectual capital. The mean of IE was 0.0238, which signified that investors’ confidence was generally low. Control variable (1): The mean value of company size was 22.0479, and the standard deviation was 1.089, which signified the selected companies in this study had a similar size. Control variable (2): The average asset-liability ratio was 36.87%, indicating that the asset-liability ratio of these companies was at a reasonable level. Control variable (3): Statistics on the board size showed that the directors of the board size in these selected companies were similar. Control variable (4): The maximum value of ownership concentration was 65.8436, and the minimum value was 10.716. There was a large gap between the two. This showed that there was still a situation where the company’s largest shareholder had too high of rights. A high concentration of equity can improve decision-making efficiency, but such power cannot be restrained. Therefore, decision-making lacks democracy, and decision-making errors are prone to occur.

4.2. Regression Analysis

This research took corporate sustainable development (SGR) as the dependent variable and IC and IE as an independent variable and intermediary variable, respectively. This research used Stata 15.0 to implement a double fixed-effects model. The empirical results are presented as follows:

Model 1 from Table 6 shows the relationship between IC and corporate SGR. The F-statistic was 7.398, which indicated the regression analysis was significant. The coefficient of intellectual capital was 0.0001252, and the t-value was 5.63. The coefficient of IC at the level of 1% was significant in model (1). This result can prove that there was a significant positive correlation between IC and the SGR. Therefore, H1 of this paper was verified. This showed that the more a company invests in intellectual capital, the stronger the capability of corporate sustainable development. The study found that the company size, board size, and the degree of ownership concentration had no significant relationship with the capability of corporate sustainable development, but the relationship between the asset-liability ratio and capability of corporate sustainable development were significant at the 1% level.

Table 6.

Regression results.

Model 2 from Table 6 shows the regression analysis results of intellectual capital and investor confidence. The F-statistic was 59.305, which indicated the regression analysis was significant. The coefficient of intellectual capital was 0.0000445, and the t-value was 3.10. The coefficient of IE at the level of 1% was significant in model (2). This showed that there was a significant positive correlation between IC and IE. Thus, the more a company invests in intellectual development, the stronger the investor confidence. This may be because companies publish their investment in intelligence and technology in their annual reports. Passing this information to investors through the annual report can reduce information asymmetry, thereby causing investor confidence to also increase. Therefore, H2 of this article was verified. The regression analysis found that company size, asset-liability ratio, board size, and ownership concentration were all significantly related to investor confidence. Company size and asset-liability ratio were significant at the 1% level, and board size and equity concentration were significant at the 5% level.

Model 3 from Table 6 shows investor confidence in the intermediary role of the relation between IC and corporate SGR. The F-statistic was 7.012, which indicated this regression analysis was significant. The coefficient of intellectual capital was 0.0001235, and the t-value was 5.58. The coefficient of investor confidence was 0.0377253, and the t-value was 2.79. Both of these values were significant at the 1% level. The results show that there was a significant positive correlation between investor confidence and corporate sustainable development. The results from model 1 show that the regression coefficient of intellectual capital was 0.0001252. After adding investor confidence as a new variable to model 1, the regression coefficient became 0.0001235. Since 0.0001235 < 0.0001252, investor confidence played an intermediary role in the relationship between intellectual capital and corporate sustainable development. Thus, H3 in this article was verified. The asset-liability ratio still played an essential role in the impact of the corporate sustainable development, which was significant at the 1% level. There was no significant correlation between the company size and corporate sustainable development. This may be because the large manufacturing scale did not signify the advancement of technology, thus it did not play a significant role in promoting corporate sustainable development.

4.3. Robustness Test

To examine the robustness of the above conclusions, James C. Van Horne’s sustainable development measurement method was implemented on models 1 and 3 to verify whether investor confidence played an intermediary role in intellectual capital and corporate sustainable development. The robustness results are shown in Table 7. After implementing James C. Van Horne’s model, one can see that there was still a significant positive correlation between IC and SGR. Investor confidence played an intermediary role in IC and corporate SGR. Therefore, the results of the robustness test were not significantly different from the previous regression test.

Table 7.

Robustness results.

4.4. Discussion

As mentioned above, IC is an important determinant of SGR. The factors that constitute intellectual capital (human capital, structural capital, social capital, and innovative capital) are all components that can guide a company to achieve competitiveness. The existing studies mostly focus on the influence of IC on corporate performance, but seldom consider the influence of IC on ability of corporate SGR. IC is an important part of enhancing the corporate SGR ability. The corporate development strategy focuses on IC, which can significantly improve performance and enhance the corporate sustainable development ability. In terms of investor confidence, the investment of intellectual capital can attract potential investors, who can distinguish the investment of intellectual capital and the future development potential of the corporate according to the signal transmission. When investors have confidence in the corporate development, they will increase investment in corporate. This situation will improve corporate performance. When the corporate performance is in a stable or steady growth state, the corporate sustainable development ability will show a trend of rapid improvement. Existing literature does not take IE as the intermediary variable of the relationship between IC and corporate SGR. However, this research verifies that corporate can increase investor interest by increasing intellectual investment and successfully achieve the goal of corporate SGR.

Today’s manufacturing industry in China is mainly based on mass production, but there are still problems with using old methods. The lack of investment in intelligence has led to a low production efficiency that is unable to achieve high-speed levels. This study provides strong evidence that IC can affect the SGR of corporate. It was found that the relationship between IC and the SGR of corporate was positive, thereby supporting the first hypothesis proposed in this study. It also confirmed the research results of Hormiga, E. et al. and Francesca et al. They affirmed that companies with sufficient intellectual capital can better survive and resist market competitors [55,65]. Therefore, both governance of national and corporate contribute significantly to the achievement of each of the SGR [66].To promote corporate SGR, companies should increase intelligence input, the level of intelligence, and production efficiency.

In addition, this study discovered the mediating effect of investor psychology and doings in the relationship between IC and corporate SGR. The research results proved that investor confidence played an intermediary role, providing a new perspective for studying the intellectual capital impact on corporate sustainable development. The investment of intellectual capital can thereby stimulate companies to develop new technologies. When traditional manufacturing gradually shifts to technological manufacturing, companies’ production efficiency and product quality will improve. At the same time, the company’s technology will develop, and its reputation will become well-known to the public. This will also increase investors’ confidence in the company’s development. In signal theory, intellectual capital can be used to transmit market signals to improve the image of a company [54]. Lee and Guthrie (2010) showed that portfolio managers recognize the importance of IC, so intellectual capital plays an important role in improving investor confidence [67]. Anifowose et al., (2017) showed that a correlation exists between the IC and the market value of corporate companies. Some of these studies have shown that intellectual capital can reduce stock investment risk [68]. With the increase in the investment of IC and the continuous improvement of investor confidence, companies will have good development prospects.

However, at the same time, there is also a problem that cannot be ignored: the appropriateness of investor confidence. The investment intentions of individual investors are often overly dependent on self-awareness, such as personality bias, self-attribution bias, and overconfidence [56]. Although people have different levels of confidence in the process of judgment and decision-making, on average, people are more likely to overestimate their abilities and demonstrate overconfidence. Securities investments are usually full of high risks and uncertainties. Excessive confidence will often harm judgment and decision-making and lead to investment failure. Only sane confidence will have a positive impact.

As mentioned earlier, Chinese manufacturing companies should actively seek sustainable development methods. How can they improve their competitiveness and achieve sustainable development? The key is to increase intellectual investment and not solely develop human resources but also increase structure, society, and innovation resources. The research deepens the importance of IC to the improvement of corporate SGR ability, and clarifies the importance of each part of IC, which provides a reference for the future focus of corporate SGR. Meanwhile, we find IE in the new perspective of mediation in the relation between IC and corporate SGR ability. We emphasize the importance of IC and the role of IE, providing a new perspective for the reader and make reading more interesting. We found the role of investors between the relationship of IC and corporate SGR. It provides new ideas and references for later scholars to consider the mediating role of investor confidence.

5. Conclusions

Corporate sustainable development is not only the key to improving the competitiveness of a company, but it can also increase a country’s sustainable development ability and enhance its international competitiveness. This research studies the importance of intellectual capital to improve corporate sustainable development ability and the role of investor confidence in the relationship between intellectual capital and corporate sustainable development. Through literature review, this research proposes three hypotheses: (1) Enhancing the investment in intellectual capital of corporate can promote their sustainable development capability; (2) Enhancing investment in intellectual capital of corporate can improve investor confidence; (3) Investor confidence acts as an intermediary role in the relationship between intellectual capital and corporate sustainable development. The above hypotheses are verified through empirical research, and the following conclusions are drawn: (1) Intellectual capital, investor confidence, and corporate sustainable development had a significant positive correlation. Encouraging the intellectual capital of corporate, they can maintain competitiveness. Competing with competitors, corporate will create sustainable competitive advantages. Meanwhile, the enhancement of investor confidence has a positive effect on the corporate sustainable development ability. The higher the investor confidence, the stronger the corporate sustainable development ability; (2) Intellectual capital influenced the sustainable development of companies through investor confidence. The investment in intellectual capital can improve a company’s technological innovation capabilities, enhance investor confidence, and promote corporate sustainable development. When the Robert C. Higgins model was used to measure the capability of corporate sustainable development, results showed that investor confidence played an intermediary role in intellectual capital and corporate sustainable development. When we performed the robustness test, the James C. Van Horne model was used to measure the capability of corporate sustainable development and the results were consistent with the above conclusions.

Through the above conclusions, manufacturing companies that have been listed in China should increase their investment in intellectual capital and increase their attention on intellectual development, thereby accelerating their manufacturing efficiency, increasing investor confidence, and promoting sustainable development. Listed companies, especially those with high efficiency in the operation of intellectual capital, should actively explore the development, management, and information disclosure of intellectual capital, strengthen internal and external knowledge sharing, and improve the market’s evaluation of companies. In terms of human capital, the company should improve team management, strengthen the training of employees, and augment their welfare. Company management should be maintained in terms of structural capital, ensuring each department has corresponding responsibilities, and ensuring each department’s cost management and expenditure complies with regulations. In terms of social capital, communication with company partners should be strengthened, and the cooperation between the two should be increased. In terms of innovation capital, companies should increase investment in R&D in science and technology. Increasing investment in R&D is conducive to the formation of results and ensures the success rate of R&D.

Although this research has contributed to the field of intellectual capital data collection, empirical methods, and mediating factors, this study still has limitations. First, in terms of industry selection, only research on the manufacturing industry may have affected the generality of the research results. Second, some data points were missing in terms of data collection, and the company’s statement disclosure was not comprehensive. Third, research was conducted in the context of China, which may limit the generality of the research results. Still, the authors believe that these limitations will be resolved in the future. Therefore, future scholars can collect data from other industries and other countries, innovate empirical methods, discover new relevant variables, and verify the conclusions of this study.

Author Contributions

Software, Y.W.; writing—original draft, Y.W. and J.Z.; writing-review and editing, Y.W. and J.Z.; supervision, J.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Natural Science Foundation of Heilongjiang Province, grant number LH2019G018.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Brown, B.; Sikes, J.; Willmott, P. Bullish on Digital: McKinsey Global Survey Results; Mckinsey & Company, 2013; Volume 12, pp. 1–8. Available online: https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/bullish-on-digital-mckinsey-global-survey-results (accessed on 11 February 2022).

- Xu, X.L.; Li, J.; Wu, D.; Zhang, X. The intellectual capital efficiency and corporate sustainable growth nexus: Comparison from agriculture, tourism and renewable energy sector. Environ. Dev. Sustain. 2021, 23, 16038–16056. [Google Scholar] [CrossRef]

- Xin, Z. Documents of the 16th National Congress of the Communist Party of China; Foreign Languages Press: Beijing, China, 2002; ISBN 7119032267. [Google Scholar]

- Nick, B. Intellectual capital: An exploratory study that develops measures and models Nick. Manag. Decis. 1998, 32, 63–76. [Google Scholar]

- Secundo, G.; Dumay, J.; Schiuma, G.; Passiante, G. Managing intellectual capital through a collective intelligence approach: An integrated framework for universities. J. Intellect. Cap. 2016, 17, 298–319. [Google Scholar] [CrossRef]

- Widodo. Grand theory model of strategy quality: Strategic asset approach at industry. Acad. Strateg. Manag. J. 2018, 17, 163–173. [Google Scholar]

- De Castro, G.M.; Sáez, P.L.; López, J.E.N. The role of corporate reputation in developing relational capital. J. Intellect. Cap. 2004, 5, 575–585. [Google Scholar] [CrossRef]

- Zavertiaeva, M. Portfolio forming decisions: The role of intellectual capital. J. Intellect. Cap. 2016, 17, 439–456. [Google Scholar] [CrossRef]

- Bontis, N. Managing Organizational Knowledge by Diagnosing Intellectual Capital: Framing and Advancing the State of the Field. Int. J. Technol. Manag. 1999, 18, 433–462. [Google Scholar] [CrossRef]

- Arenas, T.; Lavanderos, L. Intellectual capital: Object or process? J. Intellect. Cap. 2008, 9, 77–85. [Google Scholar] [CrossRef]

- Hariyono, A.; Tjahjadi, B. The Role of Intellectual Capital in the Development of Financial Technology in the New Normal Period in Indonesia. J. Asian Finance Econ. Bus. 2021, 8, 217–224. [Google Scholar] [CrossRef]

- Guthrie, J.; Ricceri, F.; Dumay, J. Reflections and projections: A decade of Intellectual Capital Accounting Research. Br. Account. Rev. 2012, 44, 68–82. [Google Scholar] [CrossRef]

- Jordão, R.V.D.; Novas, J.; Gupta, V. The role of knowledge-based networks in the intellectual capital and organizational performance of small and medium-sized enterprises. Kybernetes 2020, 49, 116–140. [Google Scholar] [CrossRef]

- Haraguchi, N.; Cheng, C.F.C.; Smeets, E. The Importance of Manufacturing in Economic Development: Has This Changed? World Dev. 2017, 93, 293–315. [Google Scholar] [CrossRef]

- Beigzade, Y.; Ghadami, M.; Salehi Amiri, S.R. A Model for Assessing the Effect of Social Capital on Sustainable Development. SSRN Electron. J. 2010, 1–9. [Google Scholar] [CrossRef]

- Obim, N.; Anake, F.; Awara, F. Relationship between capital structure and firm’ s performance: A theoretical review Relationship between Capital Structure and Firm’ s Performance. Theor. Rev. 2018, 5, 72–77. [Google Scholar]

- Coccia, M. Measuring the impact of sustainable technological innovation. Int. J. Technol. Intell. Plan. 2009, 5, 276–288. [Google Scholar] [CrossRef]

- Leitner, K.H. Intellectual Capital, Innovation, and Performance: Empirical Evidence from SMEs. Int. J. Innov. Manag. 2015, 19, 255–282. [Google Scholar] [CrossRef]

- Wang, Y.; Su, X.; Wang, H.; Zou, R. Intellectual capital and technological dynamic capability: Evidence from Chinese enterprises. J. Intellect. Cap. 2019, 20, 453–471. [Google Scholar] [CrossRef]

- Darvish, H.; Ahmadi, A.A.; Kafashzadeh, A.R.; Farid, S.; Nejatizadeh, N. Investigating the effects of intellectual capital on organizational performance measurement through organizational learning capabilities. Manag. Sci. Lett. 2013, 4, 165–172. [Google Scholar] [CrossRef]

- Badrabadi, H.H.; Akbarpour, T. A study on the effect of intellectual capital and organizational learning process on organizational performance. Afr. J. Bus. Manag. 2013, 7, 1470–1485. [Google Scholar] [CrossRef]

- Meramveliotakis, G.; Manioudis, M. History, knowledge, and sustainable economic development: The contribution of john stuart mill’s grand stage theory. Sustainability 2021, 13, 1468. [Google Scholar] [CrossRef]

- Sofian, S.; Tayles, M.E.; Pike, R.H. Intellectual Capital: An Evolutionary Change in Management Accounting Practices; CWL Publishing Enterprises, Inc.: Madison, WI, USA, 2004; Volume 2004, pp. 1–25. [Google Scholar]

- Khan, S.Z.; Yang, Q.; Waheed, A. Investment in intangible resources and capabilities spurs sustainable competitive advantage and firm performance. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 285–295. [Google Scholar] [CrossRef]

- Mubarik, M.S.; Naghavi, N.; Mahmood, R.T. Intellectual capital, competitive advantage and the ambidexterity liaison. Hum. Syst. Manag. 2019, 38, 267–277. [Google Scholar] [CrossRef]

- Alvino, F.; Di Vaio, A.; Hassan, R.; Palladino, R. Intellectual capital and sustainable development: A systematic literature review. J. Intellect. Cap. 2021, 22, 76–94. [Google Scholar] [CrossRef]

- Xu, X.L.; Liu, C.K. How to keep renewable energy enterprises to reach economic sustainable performance: From the views of intellectual capital and life cycle. Energy Sustain. Soc. 2019, 9, 7. [Google Scholar] [CrossRef]

- Chahal, H.; Bakshi, P. Examining intellectual capital and competitive advantage relationship: Role of innovation and organizational learning. Int. J. Bank Mark. 2015, 33, 376–399. [Google Scholar] [CrossRef]

- Liao, P.C.; Chan, A.L.C.; Seng, J.L. Intellectual capital disclosure and accounting standards. Ind. Manag. Data Syst. 2013, 113, 1189–1205. [Google Scholar] [CrossRef]

- Khalique, M.; Mansor, S.A. Intellectual capital in Malaysian hotel industry: A case study of Malacca. Int. J. Bus. Perform. Manag. 2016, 17, 103–116. [Google Scholar] [CrossRef]

- Teece, D.J. Managing Intellectual Capital: Organizational, Strategic and Policy Dimensions. Pers. Psychol. 2006, 59, 767. [Google Scholar] [CrossRef]

- Redclift, M. Sustainable Development in the Age of Contradictions. Dev. Change 2018, 49, 695–707. [Google Scholar] [CrossRef]

- Rahdari, A.; Sepasi, S.; Moradi, M. Achieving sustainability through Schumpeterian social entrepreneurship: The role of social enterprises. J. Clean. Prod. 2016, 137, 347–360. [Google Scholar] [CrossRef]

- Brundtland, G.H. Our common future—Call for action. Environmental Conservation. Camb. Univ. Press J. Digit. Arch. 1987, 14, 291–294. [Google Scholar]

- Bijl, R. Never Waste a Good Crisis: Towards Social Sustainable Development. Soc. Indic. Res. 2011, 102, 157–168. [Google Scholar] [CrossRef]

- Raszkowski, A.; Bartniczak, B. Towards sustainable regional development: Economy, society, environment, good governance based on example of Polish regions. Transform. Bus. Econ. 2018, 17, 225–245. [Google Scholar]

- Kaygusuz, K. Green chemistry and green energy technologies for environmental friendly sustainable development. J. Eng. Res. Appl. Sci. 2019, 8, 1013–1024. [Google Scholar]

- Jones, T.M.; Harrison, J.S.; David, W.; Chair, R.; Felps, W. How applying instrumental stakeholder theory can provide sustainable competitive advantage. Acad. Manag. Rev. 2018, 43, 371–391. [Google Scholar] [CrossRef] [Green Version]

- Zweig, M.E. An Investor Expectations Stock Price Predictive Model Using Closed-End Fund Premiums. J. Finance 1973, 28, 67–78. [Google Scholar] [CrossRef]

- Johnson, E.J.; Tversky, A. Affect, generalization, and the perception of risk. J. Personal. Soc. Psychol. 1983, 45, 20. [Google Scholar] [CrossRef]

- Polk, C.; Sapienza, P. The stock market and corporate investment: A test of catering theory. Rev. Financ. Stud. 2009, 22, 187–217. [Google Scholar] [CrossRef] [Green Version]

- Black, A.J.; McMillan, D.G. Non-linear predictability of value and growth stocks and economic activity. J. Bus. Finance Account. 2004, 31, 439–474. [Google Scholar] [CrossRef]

- Baker, M.; Wurgler, J. Investor Sentiment and the Cross-Section of Stock Returns Malcolm. J. Finance 2006, 61, 1645–1680. [Google Scholar] [CrossRef] [Green Version]

- Ali, S.E.A.; Lai, F.W.; Hassan, R.; Shad, M.K. The long-run impact of information security breach announcements on investors’ confidence: The context of efficient market hypothesis. Sustainability 2021, 13, 1066. [Google Scholar] [CrossRef]

- Si, K.; Xu, X.L.; Chen, H.H. Examining the interactive endogeneity relationship between R&D investment and financially sustainable performance: Comparison from different types of energy enterprises. Energies 2020, 13, 2332. [Google Scholar] [CrossRef]

- Prahalad, C.K.; Hamel, G. The core competence of the corporation. Strateg. Unternehm. Strateg. Unternehm. 1997, 969–987. [Google Scholar] [CrossRef]

- Xu, J.; Wang, B. Intellectual capital, financial performance and companies’ sustainable growth: Evidence from the Korean manufacturing industry. Sustainability 2018, 10, 4651. [Google Scholar] [CrossRef] [Green Version]

- Schiuma, G.; Lerro, A. Knowledge-based capital in building regional innovation capacity. J. Knowl. Manag. 2008, 12, 121–136. [Google Scholar] [CrossRef]

- Petrov, A.N. Human Capital and Sustainable Development in the Arctic: Towards Intellectual and Empirical Framing. In Northern Sustainabilities: Understanding and Addressing Change in the Circumpolar World; Springer Polar Sciences: Cham, Switzerland, 2017; pp. 203–220. [Google Scholar] [CrossRef]

- Gogan, M.L.; Duran, D.C.; Draghici, A. The Impact of Relational Capital on Competitiveness of the Organization. Netw. Intell. Stud. 2014, 2, 233–240. [Google Scholar]

- Matos, F.; Vairinhos, V.M.; Dameri, R.P.; Durst, S. Increasing smart city competitiveness and sustainability through managing structural capital. J. Intellect. Cap. 2017, 18, 693–707. [Google Scholar] [CrossRef]

- Santos-Rodrigues, H.; Dorrego, P.F.; Jardon, C.F. The Influence Of Human Capital On The Innovativeness of Firms. Int. Bus. Econ. Res. J. 2010, 9, 53–64. [Google Scholar] [CrossRef]

- Ståhle, P.; Ståhle, S.; Aho, S. Value added intellectual coefficient (VAIC): A critical analysis. J. Intellect. Cap. 2011, 12, 531–551. [Google Scholar] [CrossRef]

- Guthrie, J.; Petty, R. Intellectual Capital: Australian Annual Reporting Practices. J. Intellect. Cap. 2000, 1, 241–251. [Google Scholar] [CrossRef]

- Battaglia, F.; Busato, F.; Manganiello, M. A cross-platform analysis of the equity crowdfunding Italian context: The role of intellectual capital. Electron. Commer. Res. 2021, 1–41. [Google Scholar] [CrossRef]

- Mariappanadar, S.; Kairouz, A. Influence of human resource capital information disclosure on investors’ share investment intentions: An Australian study. Pers. Rev. 2017, 46, 551–571. [Google Scholar] [CrossRef]

- Vrontis, D.; Christofi, M.; Battisti, E.; Graziano, E.A. Intellectual capital, knowledge sharing and equity crowdfunding. J. Intellect. Cap. 2020, 22, 95–121. [Google Scholar] [CrossRef]

- Peña, I. Intellectual capital and business start-up success. J. Intellect. Cap. 2002, 3, 180–198. [Google Scholar] [CrossRef]

- March, J.G. Exploration and Exploitation in Organizational Learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Sul, H.K.; Dennis, A.R.; Yuan, L. Trading on twitter: The financial information content of emotion in social media. In Proceedings of the Annual Hawaii International Conference on System Sciences, Waikoloa, HI, USA, 6–9 January 2014; IEEE Computer Society: Washington, DC, USA, 2014; pp. 806–815. [Google Scholar]

- Malandri, L.; Xing, F.Z.; Orsenigo, C.; Vercellis, C.; Cambria, E. Public Mood–Driven Asset Allocation: The Importance of Financial Sentiment in Portfolio Management. Cogn. Comput. 2018, 10, 1167–1176. [Google Scholar] [CrossRef]

- Uygur, U.; Taş, O. The impacts of investor sentiment on different economic sectors: Evidence from Istanbul Stock Exchange. Borsa Istanb. Rev. 2014, 14, 236–241. [Google Scholar] [CrossRef] [Green Version]

- Aygun, M.; Ic, S.; Sayim, M. The Effects of Corporate Ownership Structure and Board Size on Earnings Management: Evidence from Turkey. Int. J. Bus. Manag. 2014, 9, 123. [Google Scholar] [CrossRef] [Green Version]

- Nguyen, A.N.; Shahid, M.S.; Kernohan, D. Investor confidence and mutual fund performance in emerging markets: Insights from India and Pakistan. J. Econ. Stud. 2018, 45, 1288–1310. [Google Scholar] [CrossRef] [Green Version]

- Hormiga, E.; Batista-Canino, R.M.; Sánchez-Medina, A. The role of intellectual capital in the success of new ventures. Int. Entrep. Manag. J. 2011, 7, 71–92. [Google Scholar] [CrossRef]

- Glass, L.-M.; Newig, J. Governance for achieving the Sustainable Development Goals: How important are participation, policy coherence, reflexivity, adaptation and democratic institutions? Earth Syst. Gov. 2019, 2, 100031. [Google Scholar] [CrossRef]

- Lock Lee, L.; Guthrie, J. Visualising and measuring intellectual capital in capital markets: A research method. J. Intellect. Cap. 2010, 11, 4–22. [Google Scholar] [CrossRef]

- Anifowose, M.; Abdul Rashid, H.M.; Annuar, H.A. Intellectual capital disclosure and corporate market value: Does board diversity matter? J. Account. Emerg. Econ. 2017, 7, 369–398. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).