1. Introduction

There is continuing interest in how the sustainable business model (SBM) literature can offer new insights into how business models may act as a catalyst for sustainability transitions [

1,

2,

3]. Such sustainability transitions are large-scale, complex, multi-actor, and trans-institutional change processes that require systems of organizations and institutions to simultaneously change their means of operation and the way they create and exchange value, therefore leading to the necessity for business model innovation and realignment within value networks. As such, businesses have an essential role to play in realizing transitions.

Scholars from both sustainability transition studies and SBM research have repeatedly called for research at their intersection. Some sustainability transition authors have expressed the need to include an organizational perspective and business model thinking in transition frameworks [

3,

4,

5]. Others have focused on how a business can evolve in line with emerging sustainability transitions [

6,

7]. For its part, the SBM literature focuses explicitly on making societal impact and considers a wide range of stakeholder interests related to environmental and societal aspects [

8], similar to sustainability transition frameworks. Some scholars have studied the different roles of SBMs in sustainability transitions [

9,

10] while others have argued that SBMs might be a key driver in accelerating transitions [

11].

However, in these pioneering studies, an organization-centric perspective was taken, while in transitions, multiple organizations have to change simultaneously toward sustainability. This calls for the need to thoroughly understand the interdependencies between organizations and reshape their value creation and capture system toward sustainability [

12]. Thus, both sustainability transition and the SBM literature focus primarily on how an individual organization can change toward sustainability and how this might contribute to a sustainability transition, but lack a description of how SBMs can actually reshape an entire system toward sustainability, creating a transition. It is clear that multi-stakeholder collaboration to realign business models and value networks is essential, but it is less clear on how to orchestrate such realignment in the context of sustainability transitions. In short, a network perspective is missing.

Gorissen et al. [

13] and Aagaard et al. [

14] identified collaborative sustainable business modeling (CSBMing) (note that CSBM refers to a collaborative sustainable business model, and CSBMing refers to the process with the aim to develop such a business model) as a potential powerful approach in integrating a network perspective in the intersection of sustainability transition and SBM research. CSBMing is able to organize necessary realignment among large groups of stakeholders through its inter-organizational design approach with the aim of creating multiple types of value for the whole value network [

15]. Nevertheless, the advantages that CSBMing can offer are insufficiently leveraged in the intersection of sustainability transition and SBM research and corresponding existing approaches [

13]. Improved interaction between the fields can lead to new insights for more successful sustainability transition strategies and policies including more effective support to organizations and their network in contributing to sustainability transitions. We address this gap and systematically explore the interrelation between CSBMing and sustainability transitions by answering the following research question: How can collaborative sustainable business modeling accelerate sustainability transitions?

We address this research question by systematically positioning CSBMing into the well-established multi-level perspective, first introduced by Geels [

16], and into transition management, an actionable approach introduced by Kemp et al. [

17] and Loorbach [

6] to orchestrate transitions. More specifically, we used a three-step approach. First, we used a number of overview papers and literature reviews [

2,

7,

18,

19,

20,

21] to derive the main factors in governing sustainability transitions and the role of business models in such transitions [

1,

3,

6,

9,

22], in order to discuss how these literature fields interpret system change and how system change can be steered according to each field (

Section 2). Second, we combined these literature fields to describe how sustainability transitions can be explained in terms of business modeling and discuss the potential role of CSBMing in accelerating sustainability transitions (

Section 3). Third, we linked our research to practice by presenting two illustrative cases from Dutch sustainability transitions in which CSBMs (aim to) accelerate a (local) transition. We also qualitatively examined if the concepts hypothesized in step 2 could be observed in the case studies (

Section 4). The discussion, limitations, and conclusions can be found in

Section 5,

Section 6 and

Section 7.

3. Linking Collaborative Sustainable Business Modeling and Transition Theory

In this section, we start from a static perspective and position the cascading levels of business models, value networks, and ecosystems in the multi-level perspective. We then argue how CSBMing can bring a network perspective into the four key activities necessary to shape transitions as stated by transition management scholars.

3.1. Positioning Business Models, Value Networks, and Ecosystems in the Multiple Levels of the MLP

The multi-level perspective (MLP) sees the meso-level as a patchwork of regimes and the micro-level as a corresponding patchwork of niches that can influence regimes. Each regime consists of a set of rules, businesses, institutions, and technological developments that are common practice in a certain subsector, where each niche consists of a sheltered place where innovation takes place [

16]. The MLP focuses on describing changing subsystems for the benefit of society [

17]. As such, in many sustainability transitions, organizations play an important role by actually changing their business models and consequently changing the subsystem: they need to adopt new practices, standards, implement new technologies, use different resources, change behaviors, meet new requirements, and comply with new regulations, which almost always requires a change in their business model and their interaction with the value network [

56]. Although the phrasing of the dominant processes and concepts described in

Section 2.1 do not always refer directly to the concept of individual organizations, it is clear that it is intended to promote change by guiding organizations to organize in a new way [

56,

57].

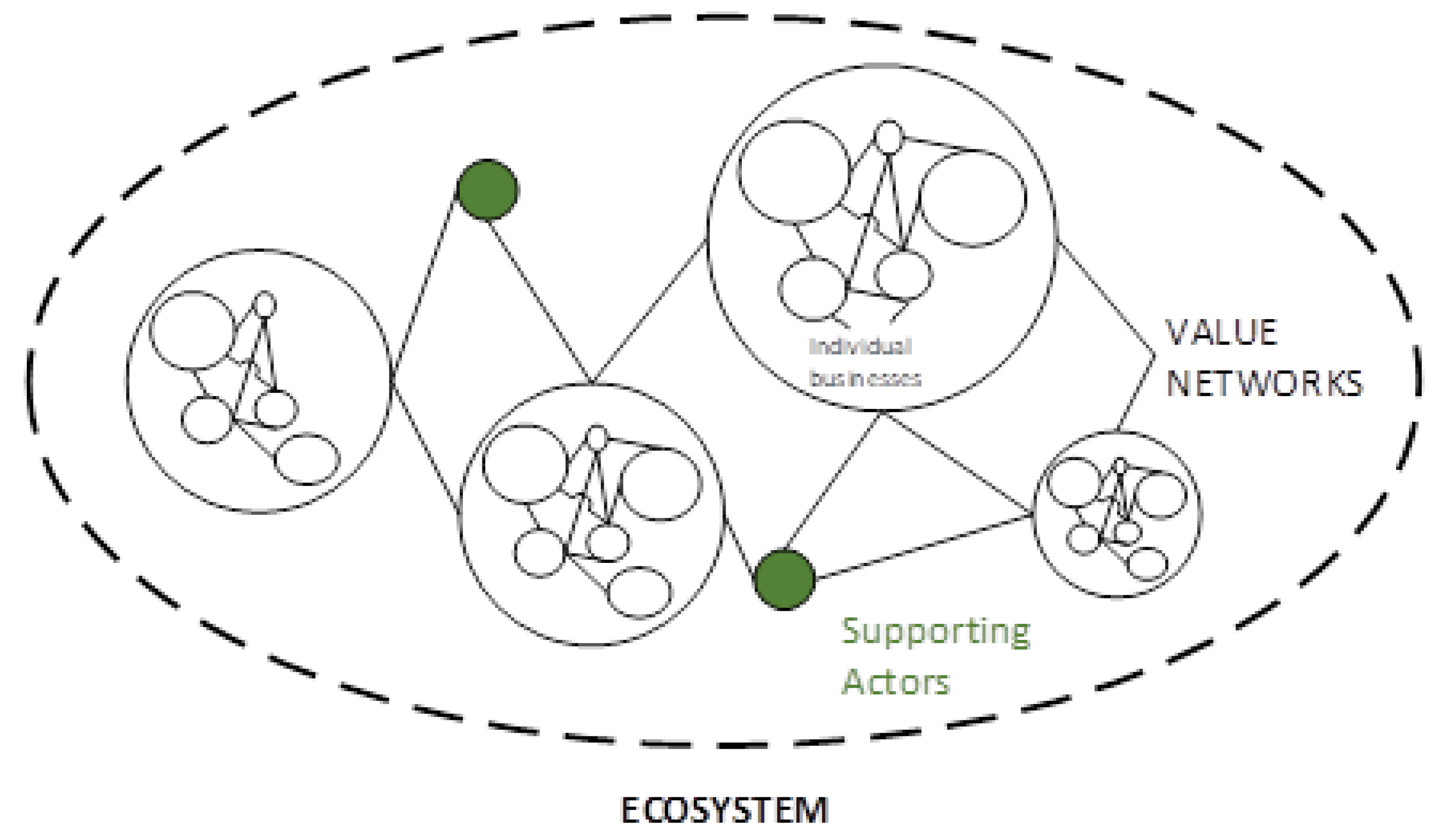

The SBM literature, however, does not make a distinction between niche, regime, and landscape, but identifies business ecosystems as coevolving economic communities that produce goods and services of value to customers, who are themselves members of the ecosystem. These communities are supported by a foundation of interacting organizations, supporting actors (e.g., research institutes, government echelons, investors, labor unions and trade organizations), and individuals [

36]. An ecosystem may include competing value networks. For the materialization of a focal value proposition, it is more likely that both regime and niche actors need to interact. Ecosystems and value networks thus cut through the regime and niche planes and comprise actors of both niche and regime, as depicted in

Figure 2 and

Figure 3.

Actively shaping the ecosystem might be almost impossible due to the large number and independence of value networks. The value network is the level where innovation in and between organizations can be shaped. It forms the bridge between the individual organizational perspective and the targeted ecosystem level. Scaling of a value network (i.e., aiming to expand or replicate the value network’s value creation logic) can influence other value networks and eventually the whole ecosystem (e.g., by means of scaling mechanisms such as voluntary or enforced standards, diffusion of technology, diffusions of business models, non-competitive collaborations and provisions), and thus bring about substantial change, eventually changing the wider ecosystem. Consequently, an ecosystem change can thus be induced by scaling value networks. Value networks can scale organically, for example, as a result of popular value propositions. Value networks can also change deliberately through strategic collaborations of actors that want to help their value network evolve faster and more deliberately toward sustainability [

58].

Deliberate change of value networks can be induced by collaborative sustainable business modeling, specifically in contexts where multiple organizations are subject to change as is the case in sustainability transitions. CSBMing is an inter-organizational participatory design approach with the aim of creating multiple types of value for multiple actors, both regime and niche, that span the value network [

44].

3.2. The Role of CSBMing in Scaling Value Network to Change the Ecosystem

Transformation of one value network may not automatically scale to lead to ecosystem change. Some CSBMs may be sufficiently disruptive in nature and break through the incumbent regime, whereas others will not be disruptive or at the desired scale to challenge the regime directly. Scaling, through replication or diffusion to influence other value networks, break through the regime, and thus change the wider ecosystem, leading to a transition, needs to be established. The four key dynamics of the MLP discussed in

Section 2.1.1. can help us frame the contribution of CSBMing.

In the first dynamic, the regime forms an inhibiting factor. This may be lessened if regime actors are actively involved and benefit from the CSBM surrounding the innovation. Pressure is internalized for regime players and depends on the extent the regime players can accommodate different value creation logics in parallel to their business as usual, or the extent to which they can change to a new value creation logic.

In the second dynamic, there is convergence toward a dominant design. Herein, convincing more and more actors to join is key [

59]. This means co-innovating the business model, for example, by adopting new practices, standards, implementing new technologies, using different resources, changing behaviors, meeting new requirements, and complying with new regulations. The CSBM may span the value network of a large scale, involving all key actors in niche and regime levels. Herein, the CSBM already is the dominant design among a large group of actors, potentially leading to increased participation or replication. In other cases, still influencing other value networks to realize a transition is needed. Since the value creation and capture logic is clearly articulated through the CSBM, it is clear to new actors how they will benefit, which will increase the adoption speed of other actors [

9]. Bidmon and Knab [

9] indeed pointed out that viable business models from which the value created and captured is clear to all stakeholders, facilitating and accelerating scale-up. Furthermore, this joint perspective on value creation, delivery, and capture between actors supports the convergence of shared rules and structures needed for the innovation to potentially break through the regime [

9].

In the third dynamic, a novel innovation breaks through the regime through top–down landscape pressure and tension among regime actors. This may take place if regime actors that participate in the CSBM can put more pressure on other regime actors to change.

In the fourth dynamic, the new regime begins to form and gradually replaces the old regime. Here, CSBMing can assist in aligning the business models of other actors to fit within the new system surrounding the innovation.

Activities outside the scope of CSBMing may be needed to realize a transition within the ecosystem such as activities regarding legal frameworks, financial and physical infrastructure as well as long-term strategy development.

3.3. Contributions of CSBMing to Transition Management Activities

Transition management (TM) identifies activities on a strategic, tactical, operational, and reflexive level to shape transitions. However, TM lacks focus on how organizations need to adapt to implement TM activities. CSBMing can play an important role in integrating a business network perspective into TM. Below, we discuss how the CSBMing process might address the key activities identified in TM (i.e., strategic, tactical, operational, and reflexive activities [

2]) from a system of organizations perspective.

CSBMing can contribute to strategic TM activities in two ways. One, by formulating the complex societal problem as a CSBM inspired value network analysis, as suggested by Brehmer et al. [

53] and adapted for ecosystems by Derks et al. [

60]. Through CSBMing, the interdependencies between individual actors and complete value networks are made explicit, leading to a greater understanding of the required changes for actors in other value networks, in order to adopt and scale the innovation [

53]. This ensures a system view, as future visions and scenarios can be expressed in a network of actors including roles and relations in the context of value creation, capture, and delivery systems. This allows one to derive more concrete goals, action agendas, and so on. In this way, the CSBM inspired ecosystem analysis can be assessed from both an ecosystem, value network, and individual actor’s perspective, thus realizing alignment between the various system levels. Two, CSBMing focuses on identifying possibilities for joint value creation capture, concretizing to new actors in other value networks what value can be created and captured upon joining. CSBMing thus provides an articulation of the vision in concrete business terms to potential partners [

9,

61].

For tactical TM activities, the contribution of CSBMing can be summarized in three points. First, the CSBM inspired ecosystem analysis [

60] is well positioned to identify regulation that should be adjusted as well as the need for the buildup of necessary physical and financial infrastructures. Second, the CSBM inspired ecosystem analysis emphasizes the collective dependency on favorable preconditions. Unfavorable preconditions preventing the transitioning value network from materializing and scaling may come from powerful incumbent regime actors and competitive value networks that may take measures to maintain the status quo. Third, CSBMing might contribute to regime breakdown. A CSBM might empower governments to have sufficient legitimacy to adapt regulations to allow for new practices, if endorsed by a coherent collective of organizations, as opposed to individual interests. Additionally, the aggregated power and collective creativity, instigated and shaped through CSBMing, may also serve for the shaping of better options for the new value network to materialize. The strength and understandability of a new value creation logic can thus play an important role in regime breakthrough, but it cannot ensure it as it largely depends on the power balance between value networks and regime versus niche players in the ecosystem.

Operational TM activities typically revolve around experimentation [

62]. During experimentation, critical assumptions can be tested to guarantee that the envisioned ecosystem will actually lead to the desired impact on a system level. It needs to be clear how the value creation and capture of the value network is expected to lead to the desired ecosystem change, thus impact as well as which critical assumptions, intermediate benefits, and disbenefits might occur [

63]. CSBMing can contribute to this in two ways. First, CSBMing can help to ideate, concretize, evaluate, and select potential business models surrounding the proposed innovations. Potential solutions can be formulated as a system of intertwined business models including the design of potential future value networks that expresses value creation and value capture for each actor using the core concepts of the experiment. These value network scenarios can then be evaluated from a multi-actor multi-value perspective to determine to what extent the proposed scenarios require an acceptable change in the way key actors interact as well as identify ways to improve the scenarios and resulting business models [

64,

65]. Second, CSBMing can help to identify the critical assumptions that should be tested by detailing the perceived causal path from the go-to-market toward mid- and full-scale adoption toward full impact [

66,

67,

68]. Identification of critical assumptions leads to new experiments being executed [

69]. Furthermore, new experiments lead to new expected performance data of the scenarios and add to the detailing of these. Therefore, the CSBM design and evaluation can help to guide which experiments to conduct and help the identification of critical assumptions from a business model and impact perspective.

Applying CSBMing to reflexive learning, monitoring, and evaluation activities seems logical. As extensively discussed by Unruh, interdependent processes and value networks as a result of co-evolution of technological, social, organizational, and institutional factors hinder the breakthrough of niche innovations into the existing regime [

70,

71]. This implies that reflexive activities need to have a view on the ecosystem (i.e., the direct external context of the envisaged value network). CSBMing would readily organize actors and other stakeholders in a participative process along CSBMing driven plans and identify and execute actions on strategic, tactical, and operational levels of transition management. The reflexive activities should then be focused on the materialization and scaling of the transformed value network (i.e., the development of the system of intertwined business models) and should be tested to changes and events in the regime.

In summary, above, we illustrated how the participative process of developing CSBMs may express visions as value networks and derive coherent actions for a transition agenda. It helps in identifying necessary preconditions in regulations and infrastructure. It also allows for deriving the individual actors’ motives. Its inherent system view may also support the identification of a coherent set of critical assumptions, which guides the necessary experimentation. Additionally, the CSBMing process helps to organize key actors in a participative process to plan, execute, reflect, and adapt.

Figure 4 depicts how we see these four transition management activities cascade and revolve around the concept of a CSBM.

Although the CSBMing process seems suitable to inform transition management activities, the collective actors may not be in a position to actively shape dominant regime value networks or enforce necessary change in regulation, infrastructure, or availability of finance. In other words, CSBMing complements and operationalizes transition management activities rather than replacing them.

4. Illustrative Examples from the Dutch Energy Transitions

To understand how the three key concepts of

Section 3 accelerate transitions in practice, we conducted a small cross case analysis of two illustrative cases. The key concepts from

Section 3 are (i) position of business models, value networks and the ecosystem in the MLP; (ii) how scaling value networks leads to ecosystem change; and (iii) the contributions of CSBMing in more effectively executing transition management activities. By analyzing the cases post hoc through this CSBM perspective, we hope to identify how the focus of the cases on business modeling, actor relations within the value network, and joint value creation and capture systems may have contributed to successful implementation and transition management activities, and therefore accelerated the envisioned transition goal. It should be noted that while both cases have not deliberately deployed a CSBMing approach, they have, however, implemented a CSBM. The case studies are explorative in nature and based on information from secondary documents and semi-structured interviews with representatives from involved organizations. For each of the cases, data collection focused on collecting:

- -

information on the CSBM, the goal of the CSBM, the joint value creation and capture system, the value network and the ecosystem;

- -

interaction between actors within the value network;

- -

the scaling strategy to influence the wider ecosystem, thus creating a transition; and

- -

the types of transition management activities executed by the case and how a CSBM perspective contributed to these activities.

For each case, we describe the case, the collaborative value proposition that is created, and the activities they engage in to transition their value network toward sustainability. Then, following the outline of the previous chapter, we first position the business model, value network, and ecosystem level in the cases. Second, we discuss how scaling the value network leads to systemic change in the ecosystem, thus creating a transition. Third, we illustrate how the CSBM mindset of each case (i.e., the focus on business modeling, actor relations within the value network and joint value creation and capture systems) has contributed to executing transition management activities, therefore accelerating the transition.

The cases focus on two value networks in the Dutch energy transition: (i) green hydrogen production and carbon capture and storage; and (ii) as-a-service business model for industrial park utilities.

4.1. Green Hydrogen Production and Carbon Capture and Storage at the North Sea

Offshore natural gas production in the Netherlands yields approximately 11 billion m3 of natural gas per year. The infrastructure to support this production is enormous; thousands of wells, thousands of kilometers of offshore pipelines, and approximately 150 platforms are present on the Dutch continental shelf of the North Sea to support this production. However, offshore gas production is in a steep decline and a large part of the production and transport infrastructure will reach its economic end of life before 2040. Government and society put pressure on companies to decommission even sooner to reduce emissions. The build-up of offshore wind assets and the need for carbon capture, transport, and storage offers an opportunity to give new life to the existing infrastructure such as: (i) large-scale green hydrogen production with electricity coming from offshore wind energy; green hydrogen can then be stored in wells and transported to the coast via existing pipelines, and (ii) underground carbon storage in depleted natural gas wells, which is transported from the coast via existing pipelines.

However, it is almost impossible for an individual actor to implement any of these opportunities by themselves, since it requires multiple actors in the current value network to significantly change their activities: the owner of the pipelines is not always the same as the exploiter of an oil platform, nor is this the same as for the wells. Adjusting the pipelines and wells to be suited for either green hydrogen or carbon storage is costly and only economically viable if there are enough users of the pipelines and wells to transport the aforementioned carriers. Additionally, if there is no market for green hydrogen or availability of carbon, then there is no business case. Furthermore, the technologies for carbon capture and storage, and for green hydrogen production are quite specific and might require experienced parties to implement and exploit. In short, there are substantial dependencies and risks for individual actors to transition, leading to the need for a CSBM in which individual actor’s business models are aligned and intertwined to create, capture, and deliver value for the whole system.

To address this gap, an ambitious consortium of over 30 European parties has been working together since 2017 to transform the North Sea into a pioneering region for the European energy transition, starting with the south-eastern part of the North Sea, which is largely situated on the Dutch continental shelf. The consortium has the goal to develop and implement joint opportunities for value creation and capture at the North Sea. The program is currently in the implementation phase, wherein multiple opportunities are explored in detail by various subsets of the total consortium in their respective part of the value network.

4.1.1. Positioning Business Models, Value Networks, and Ecosystems in the Multiple Levels of the MLP

The business model actually varies per innovation, and there are two opportunities currently being explored: carbon capture and storage, and hydrogen production. For carbon capture and storage, the business model is service-based. A subset of the total consortium will provide the service of transporting and storing CO2 for a fee. The value network includes the platform, well, and pipeline owner, the technology exploiter (which can be one of the aforementioned parties), the energy supplier, equipment suppliers, financiers, and industry parties wanting to store their CO2 for a fee. The overarching ecosystem is defined by the same roles and includes the whole industry at the North Sea, not only the Dutch continental shelf, and other actors such as governments, fishermen, societal groups, and so on. For hydrogen production, the business model is product-oriented and is provided by a subset of the consortium who will make and sell green hydrogen. The value network surrounding this product-oriented business model involves the platform, well and pipeline owner, the technology exploiter (which can be one of the aforementioned parties), the wind farm operator, the electricity grid operator, energy supplier, equipment suppliers, financiers, and industry parties wanting to buy green hydrogen.

4.1.2. Scaling the Value Network to Change the Ecosystem

The program focuses on transforming a very large and interconnected value network in the south-eastern part of the North Sea: the Dutch continental shelf. This is the value network level. Whereas, in order to transition the North Sea, the ecosystem and the consortium need to focus on scale. In the program, innovations are planned to be implemented in small-scale pilots to serve as proof-of-concept and then replicated throughout the value network. The value network is already at quite a large scale. Many regime actors present in the value network hold stakes in the wider ecosystem. The premise of the program is that once the current value network has adopted the innovations, this will also gradually scale to other connected value networks starting with value networks in which actors of this consortium also participate then scale to other value networks through leading examples. The hypothesis is that key hampering transition dynamics such as the regime forming an inhibiting factor and the need to converge toward a dominant design are addressed because all relevant regime actors are part of the consortium and develop a joint value creation and capture opportunities that will benefit them. For example, for gas and oil well, pipeline, or platform exploiters, participation will prevent their assets from being decommissioned, and for wind park operators, it will mean a steady outlet for their electricity production and reduced transport costs. These actors will thus not try to fight off new threatening developments but will embrace and promote them, leading to a dominant design in an already large and influential value network.

4.1.3. Contributions of the CSBM Perspective to Transition Management Activities

Applying the CSBM perspective on strategic transition management activities revealed that the consortium took a value network and business model focus that helped to concretize and detail long-term goals. In the predevelopment phase, this perspective helped to identify new roles of existing and new actors that were needed to implement their shared vision. These actors were then successfully persuaded to become part of the consortium. The focus on joint value creation and capture has resulted in a transition agenda and roadmap for 2050 with a large focus on co-creation and aligning investment agendas, thus making the transition goals more concrete.

The tactical activities related to the CSBM include analyzing (and lobbying to change) the European Union legal framework applicable to industrial activities at the North Sea and detailing the optimal design for the necessary physical and financial infrastructures. The value network focus taken by the consortium helped to analyze the current European Union (EU) legal framework and identify gaps in current EU regulation that will hinder various joint value creation opportunities. The hope is that the combined power of the consortium consisting of many large regime actors, and thus scaling potential, will help in lobbying to adapt policy to create the necessary legal framework. The value network focus also helps to design necessary physical and financial infrastructure, preventing partial solutions best suited for one actor but do not lead to optimal solutions for the whole system. For example, studies have been executed on what the cost-optimal route for an electricity network is on the North Sea, and which wells are best suited to start hydrogen storage with.

Operational activities that are related to business modeling include identifying joint value creation opportunities, carrying out feasibility studies and making agreements between subsets of the consortium on how to implement, finance, and scale certain value creation opportunities. The focus on joint business modeling helped to properly assess an opportunity’s potential for a sustainable and economically viable overall business model and how actors need to collaborate in order to make it work.

Since the program is still in the implementation phase, it is difficult to assess whether the joint business modeling focus helped to execute reflexive activities that relate to continuous evaluation, monitoring, and learning. The hope is that because of the value network focus, lessons learned by a few partners that are shared among the consortium in regular stakeholder meetings will lead to cross-learning and prevention of repeating the same mistakes.

4.2. An As-A-Service Business Model for Industrial Park Utilities

In the Netherlands, there are over 3500 industrial parks. Fairly little is known about the energy consumption of these parks, however, their joint potential for CO2 reduction has been estimated to be more or less equal to disconnecting all civil residential areas from the natural gas grid.

In one specific industrial park, a regional development agency and an energy supplier have jointly set up a business that serves a pay per use utility-as-a-service to the tenants of the industrial park. Included in this service are utilities including heat, cooling, electricity, and water as well as specialized industrial supplies such as pressured air, demi water, and nitrogen. The business now manages a power plant, heat power cogeneration, and solar panels. This ensures that the industrial park is fully disconnected from the natural gas grid. The business also supports tenants in turning individual operations more sustainable as well as establishing industrial symbiosis (e.g., utilization of excess heat). The company is also providing tenants with energy consumption analytics. Future plans for additional services include the energy storage and grid congestion management.

To make this business work, alignment of the business models of the land owner of the industrial park, the cooperative of tenants, an energy supplier, the grid distribution system operator (DSO), and financiers was needed and set up following a DBFMO (design-build-finance-maintain and operate) construction. The business aims to establish a leading example for the sustainability transition of industrial parks and attract new tenants by its leading innovative and sustainable profile.

In this business, the split incentive paradox is addressed. This paradox states that the benefits of establishing sustainability lie with the tenants, whereas much of the investments lie with the owner of the site.

4.2.1. Positioning Business Models, Value Networks, and Ecosystems in the Multiple Levels of the MLP

The business model is an on-site utility-as-a-service provided by a joint venture of an energy provider and a regional development agency to tenants of an industrial park. The value network in which this business model creates and captures value centers around the land owner of the industrial park and its tenants and also includes the cooperation of tenants, an energy supplier, renewable energy equipment suppliers, the grid DSO, and financiers. The overarching ecosystem is defined by these same roles and includes all industrial parks (e.g., in the region, the Netherlands, and Europe).

4.2.2. Scaling the Value Network to Change the Ecosystem

This value network can scale in several directions. First, by the founders of the business model. The regional development agency has stakes in other regional industrial parks and the energy supplier is a global player. Second, the stakeholders in the business model aim to set a leading example for industrial parks that want to transition to sustainability and disconnect from the natural gas grid. In terms of transition dynamics, this business model takes place in a niche. However, key actors in the business model such as the energy provider and the regional development agency have positions in the regime with national and regional scopes. Consequently, they may scale within the regime as well as influence other regime players to do so.

4.2.3. Contributions of the CSBMing Process to Transition Management Activities

Applying the CSBM perspective on strategic transition management activities reveals that actors identified the paradox of the split incentive between the land owner and tenant when it comes to investments for sustainability. These actors have adopted the vision that sustainability investments should not be framed as a project and as a cost, but rather as an as-a-service business model. Although the owners saw the business model as a leading example to be followed by other industrial parks, no explicit plan for scaling or replication was identified. For scaling, this might be necessary, as here is a market failure at play. The knowledge to develop such business is not widely available and financiers are still reluctant to invest in energy service companies. In fact, in the Netherlands, a best-practice movement aimed at turning 250 industrial parks energy positive (bepositief.nl).

The tactical activities related to the business model include the arrangement of sufficient grid capacity from the related DSO. This is necessary to be able to deal with electricity peaks following increased renewable power generation capacities. Furthermore, on this level, contracts and guarantees for both the delivery and usage of services were also developed. This is in fact the DBFMO contract that was developed.

Operational activities that are related to business modeling include the design of the overarching utility-as-a-service business model and the identification of the partners joining the CSBM. The realization of the business model was performed in several phases, each adding new services. It started with temporary provisions for infrastructure and power generation, then a power plant was realized. In the year after, solar panels were installed and data analytics functions were realized. Future services are related to energy storage through batteries and congestion management for the electricity grid.

On the part of reflexive activities, the actors identified several business model related learnings. These include that all actors need to be involved from the get-go, to be able to align their business models. Second, it was identified that the complete DBFMO package needed to also include insurance, contracts, and finance. This was necessary to smoothen the process of adoption. On the part of the end-users of the utility service, security of supply was a critical requirement as their primary processes depend on it. The business model was realized in several phases, each leading to a brief evaluation and update of the roadmap. We did not identify scaling indicators such as the number of businesses on the park transformed to sustainable operations, number of cases of industrial symbiosis established, number of industrial parks provided with an on-site utility-as-a-service business model, etc.

4.3. Case Comparison

In each of the cases, the reason to develop a CSBM was different. In the first case, a large number of actors engaged in a collaborative process because the intended opportunities for value creation could not be realized for an individual actor while for the second case, each individual actor is capable of ensuring its own energy security, however, by collectively joining the as-a-service model, the necessary investments can be justified. Thus, for the second case, the reason of the CSBM is to offer a service that both offers a transition toward sustainability and a price advantage to customers compared to business-as-usual, and a more sustainable and attractive profile for the industrial park as a whole.

The scale and type of actors also differ greatly per case. The first case focuses on transforming a large scale value network (the whole Dutch continental shelf of the North Sea). This value network is dominated by regime actors that also hold stakes in the wider ecosystem (the rest of the industrial areas in the North Sea). Although transforming the value network will take quite some time due to the large amount of actors involved (30+) and the high amount of financial and physical infrastructure needed, once the value network is transformed, it will be able to directly influence the wider ecosystem, creating a transition. For the second case, the approach was quite different. The second case chose to focus on one industrial park, and setting up a successful CSBM that can then serve as an example to other industrial parks, thus scaling through replication and slowly influencing the wider ecosystem.

The CSBM perspective on transition management activities has revealed that there are both similarities and differences in how the focus on business modeling, actor relations within the value network, and joint value creation and capture systems has helped to execute transition management activities more effectively. In both cases, the CSBM perspective has helped to concretize and detail the vision and goals (strategic activities). Both cases have focused on developing the necessary physical and financial infrastructure collaboratively (tactical activities). While for the operational activities, the focus was more on executing various types of experiments and developing potential business model alignment strategies for each, while for the second case, the focus was more on realizing one business model in phases. The reflexive activities were more prominent in the last case, since the first case was still in the implementation phase.

By analyzing the two cases through the CSBM perspective developed in the previous section, we showed a clearer pathway of how sustainability transitions might be accelerated through developing CSBMs that reshape the value network and scale toward the ecosystem. These cases illustrate that the optimal scaling strategy depends on the size and composition of the value network, the position of the value network in relation to the wider ecosystem, and the type of actors within the value network.

5. Discussion

Aagaard et al. [

14] and Gorissen et al. [

13] suggested collaborative sustainable business modeling as an approach that could incorporate a much needed value network perspective in sustainability transitions. However, their insights are not yet incorporated in the literature and practice on SBM and sustainability transition research nor at its emerging intersection. Pioneering works are organization-centric, focusing on how to transform an organization’s business model toward a sustainability transition, and only then possibly engaging in alliances or partnerships [

3,

9]. This poses a great risk since the success of a transition depends on value network actors to adapt their business model in accordance with a sustainability objective and individual prospective benefits [

12].

Our study contributes to closing this gap and provides a better understanding of how system change can be shaped through CSBMing. Sustainability transition research can gain substantially from the link to collaborative sustainable business modeling. First, the concept of CSBMs links the macro perspective of transition studies to the micro level of business model innovation. CSBMs span the whole value network, which forms the bridge between individual organizations and the wider ecosystem and, upon scaling, changes the ecosystem, leading to transition. Given this boundary-spanning nature, CSBMs are perfectly suited to study the role of organizations in changing value networks and accelerating transitions, without losing sight of the bigger picture. Second, CSBMing brings a much needed organizational focus to transition management [

3,

33], since ultimately, transitions toward sustainability will require organizations to reinvent their business models while still capturing adequate value.

Business model innovation research also benefits from this study. Existing research considers the external environment of an organization as a source of opportunities and threats [

72], instead of something that can be actively influenced and shaped. We have shown that instead of accepting one’s ecosystem as a given, organizations can actively influence their ecosystem by redesigning and scaling their value networks and contributing to sustainability transitions. CSBMing can provide organizations with a concrete set of tools to accelerate system change, which might result in a competitive advantage for the organizations participating in the CSBM. The case studies show that reshaping and scaling the value network should be a strategic objective to create the desired system change. The two cases illustrate that the scaling strategy best suited to reach the transition goal will depend on the size and composition of the value network, the position of the value network in relation to the wider ecosystem, and the type of actors within the value network.

In addition, we also contribute to the emerging intersection of the fields. Transition research distinguishes regime and niche, but not organizations, value networks, and ecosystems and their cascading relations. On their part, SBM research focuses on sustainability, but not explicitly on orchestrating (sub)system change, while implementing sustainability objectives typically takes multi-actor collaboration [

73]. By proposing CSBMing as an approach to implement multi-actor collaboration to facilitate (sub)system change, we have laid the theoretical groundwork for the intersection. The two illustrative cases show that in practice, there is no clear distinction between the niche and regime levels. Value networks consist of both niche and regime players. The distinction might still hold value, since the influence and power of an actor in the wider ecosystem can be an important factor for the scaling strategy. In the first case, the value network consists of key regime actors that have the power to influence the wider ecosystem directly, while the value network in the second case with relatively few key regime actors might need to rely much more on standard market dynamics (i.e., replication) to result in ecosystem change.

7. Conclusions

Our work is motivated by the observation that transition studies rarely take a value network perspective, although sustainability transitions typically require radically new configurations of value networks and realignment of business models. Business model literature has largely been focused on the role of individual organizations and have neglected the potential influence value networks can have at the macro level. We contributed to filling this gap by positioning CSBMing as a linking pin between the level of individual organizations (micro) and the systemic transitions level (macro). In this way, we propose CSBMing as a potential powerful approach to accelerate sustainability transitions.

Our findings provide a solid theoretical backbone for future research, both theoretical and empirical, on the role of CSBMing in accelerating sustainability transitions, in three ways. First, we linked the sustainability transitions and business model literature on a conceptual level and found that in terms of business modeling, transitions can be considered as ecosystem changes induced by value network innovation, which can be shaped through CSBMing. Through the dynamics of the MLP, we showed how CSBMing can lead to wider ecosystem change by (i) reducing the threatening factor of the incumbent regime; (ii) convincing more actors to join, thus scaling the innovation and creating convergence towards a dominant design; (iii) strengthen the pressure on regime actors outside of the value network(s) surrounding the innovation to change; and (iv) assist in business model alignment within the new regime, which gradually replaces the old. Second, we showed how CSBMing can add a value network perspective to transition management activities. CSBMing can accelerate strategic activities by articulating visions and goals based on value network representations, tactical activities by communicating the benefit of joining a value network to other actors, and by identifying the regulations, physical, and financial infrastructure that are needed to implement or scale a value network and to ideate operational activities by concretizing and evaluating experiments in terms of value networks and business model innovations. Third, we illustrated the potential of a CSBM perspective in two cases. The cases revealed that the scale of the value network seems to matter quite significantly for the scaling tactic chosen to influence the wider ecosystem and create a transition. Additionally, the cases revealed that the CSBM perspective seems to contribute most clearly in shaping tactical and operational transition management activities.

For managers and organizations who want to be frontrunners in sustainability transitions, our findings (1) suggest that organizations should innovate toward sustainability, together with their wider value network to realize systemic change, requiring a mind-set change; (2) focus on scaling mechanisms to expand the impact beyond individual value networks; and (3) shape transition management activities by incorporating a CSBM perspective. Doing so is likely to help organizations and their value networks to implement and scale innovations toward sustainability more effectively by leveraging the strengths of other value network actors.

Our findings suggest that there is great untapped potential for accelerating sustainability transitions by incorporating a CSBM and value network perspective into the intersection of SBM and sustainability transition research, in order to redesign and realign value creation and capture systems in value networks, which can influence the wider ecosystem and thus create system change in the regime.