How Does the Carbon Tax Influence the Energy and Carbon Performance of China’s Mining Industry?

Abstract

:1. Introduction, Literature Review, and Motivation of the Paper

1.1. Introduction

1.2. Literature Review and Motivation of the Paper

2. Methodologies and Data

2.1. Calculation of the Price Elasticity

2.2. Calculation of ECP

2.3. Impact of the Carbon Tax on MI’s ECP

2.4. Data Processing

3. Empirical Results

3.1. Estimation Results of Energy Cost Share Equation and Input Cost Share Equation

3.2. The Price Elasticity of Energy and Input Factors

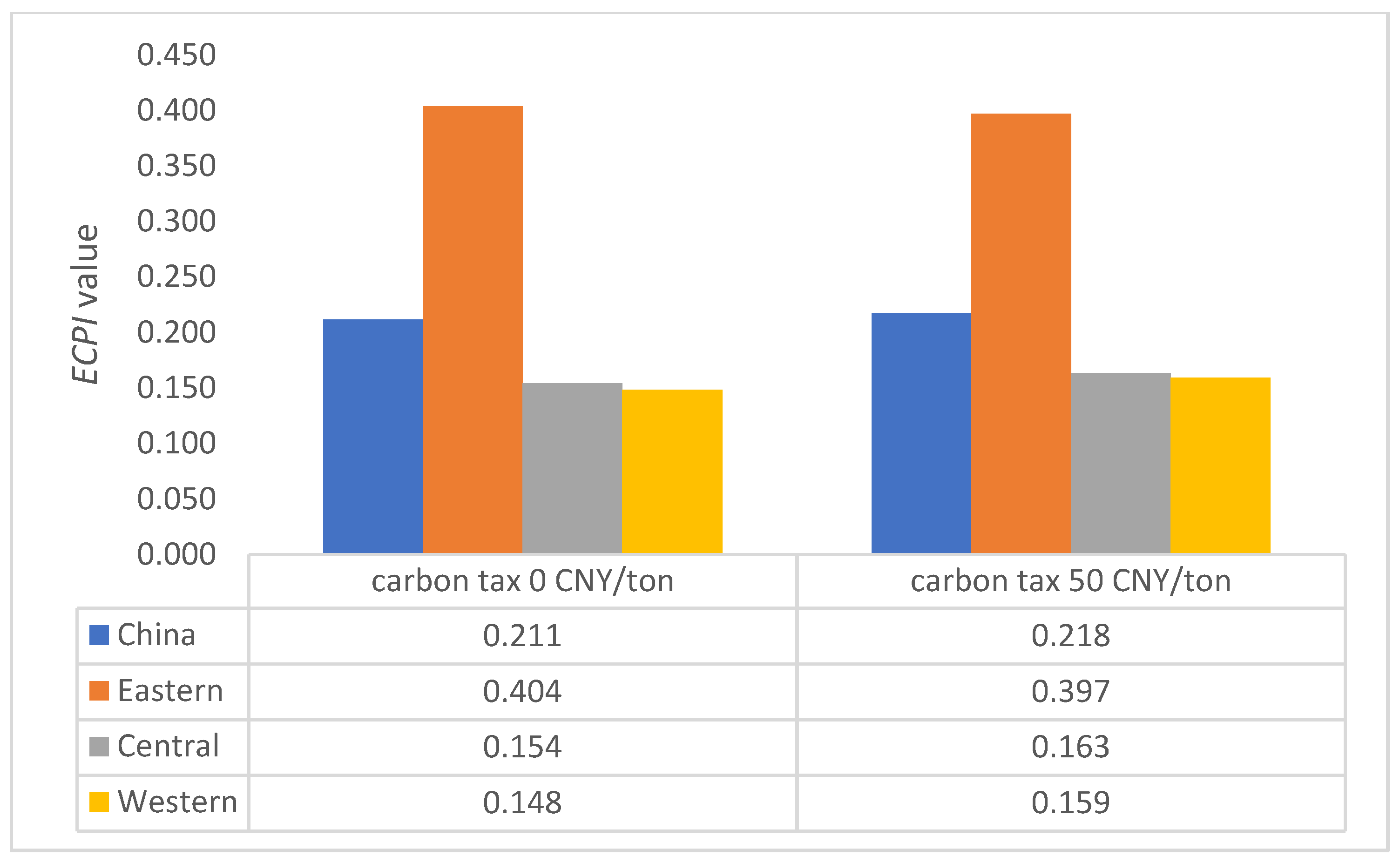

4. Results and Discussion

5. Conclusions and Policy Recommendations

5.1. Conclusions

5.2. Policy Recommendations

5.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Chen, B.; Zhang, H.; Li, W.; Du, H.; Huang, H.; Wu, Y.; Liu, S. Research on provincial carbon quota allocation under the background of carbon neutralization. Energy Rep. 2022, 8, 903–915. [Google Scholar]

- Looney, B. Statistical Review of World Energy; BP p.l.c.: London, UK, 2021. [Google Scholar]

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement; National Bureau of Economic Research: Cambridge, MA, USA, 1991. [Google Scholar]

- China Energy Statistical Yearbook. Available online: https://data.cnki.net/yearbook/Single/N2021050066 (accessed on 10 September 2021).

- Ouyang, X.; Fang, X.; Cao, Y.; Sun, C. Factors behind CO2 emission reduction in Chinese heavy industries: Do environmental regulations matter? Energy Policy 2020, 145, 111765. [Google Scholar]

- Zhou, C.; Zhou, S. China’s Carbon Emission Trading Pilot Policy and China’s Export Technical Sophistication: Based on DID Analysis. Sustainability 2021, 13, 14035. [Google Scholar]

- Xia, Q.; Li, L.; Dong, J.; Zhang, B. Reduction Effect and Mechanism Analysis of Carbon Trading Policy on Carbon Emissions from Land Use. Sustainability 2021, 13, 9558. [Google Scholar]

- Wu, Q.; Tambunlertchai, K.; Pornchaiwiseskul, P. Examining the Impact and Influencing Channels of Carbon Emission Trading Pilot Markets in China. Sustainability 2021, 13, 5664. [Google Scholar]

- Available online: http://www.hb.xinhuanet.com/2021–07/17/c_1127665800.htm (accessed on 10 September 2021).

- Wittneben, B.B.F. Exxon is right: Let us re-examine our choice for a cap-and-trade system over a carbon tax. Energy Policy 2009, 37, 2462–2464. [Google Scholar]

- Zhou, D.; An, Y.; Zha, D.; Wu, F.; Wang, Q. Would an increasing block carbon tax be better? A comparative study within the Stackelberg Game framework. J. Environ. Manag. 2019, 235, 328–341. [Google Scholar]

- Arthur, P. The Economics of Welfare; (3rd edition 1928); McMillan and Co.: London, UK, 1920. [Google Scholar]

- Tullock, G. Excess benefit. Water Resour. Res. 1967, 3, 643–644. [Google Scholar]

- Pearce, D. The role of carbon taxes in adjusting to global warming. Econ. J. 1991, 101, 938–948. [Google Scholar]

- Newell, R.G.; Pizer, W.A. Regulating stock externalities under uncertainty. J. Environ. Econ. Manag. 2003, 45, 416–432. [Google Scholar]

- Goulder, L.H.; Schein, A.R. Carbon taxes versus cap and trade: A critical review. Clim. Chang. Econ. 2013, 4, 1350010. [Google Scholar]

- Zhang, Z.; Baranzini, A. What do we know about carbon taxes? An inquiry into their impacts on competitiveness and distribution of income. Energy Policy 2004, 32, 507–518. [Google Scholar]

- Newell, R.G.; Pizer, W.A. Indexed regulation. J. Environ. Econ. Manag. 2008, 56, 221–233. [Google Scholar]

- Chen, J.-X.; Chen, J. Supply chain carbon footprinting and responsibility allocation under emission regulations. J. Environ. Manag. 2017, 188, 255–267. [Google Scholar]

- He, S.; Yin, J.; Zhang, B.; Wang, Z. How to upgrade an enterprise’s low-carbon technologies under a carbon tax: The trade-off between tax and upgrade fee. Appl. Energy 2018, 227, 564–573. [Google Scholar]

- Ghaith, A.F.; Epplin, F.M. Consequences of a carbon tax on household electricity use and cost, carbon emissions, and economics of household solar and wind. Energy Econ. 2017, 67, 159–168. [Google Scholar]

- Chen, W.; Hu, Z.-H. Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies. J. Clean. Prod. 2018, 201, 123–141. [Google Scholar]

- Brown, M.A.; Li, Y.; Soni, A. Are all jobs created equal? Regional employment impacts of a U.S. carbon tax. Appl. Energy 2020, 262, 114354. [Google Scholar]

- Denstadli, J.M.; Veisten, K. The flight is valuable regardless of the carbon tax scheme: A case study of Norwegian leisure air travelers. Tour. Manag. 2020, 81, 104150. [Google Scholar]

- Cheng, Y.; Sinha, A.; Ghosh, V.; Sengupta, T.; Luo, H. Carbon tax and energy innovation at crossroads of carbon neutrality: Designing a sustainable decarbonization policy. J. Environ. Manag. 2021, 294, 112957. [Google Scholar]

- Gokhale, H. Japan’s carbon tax policy: Limitations and policy suggestions. Curr. Res. Environ. Sustain. 2021, 3, 100082. [Google Scholar]

- Hammerle, M.; Best, R.; Crosby, P. Public acceptance of carbon taxes in Australia. Energy Econ. 2021, 101, 105420. [Google Scholar]

- Zhou, Y.; Fang, W.; Li, M.; Liu, W. Exploring the impacts of a low-carbon policy instrument: A case of carbon tax on transportation in China. Resour. Conserv. Recycl. 2018, 139, 307–314. [Google Scholar]

- Shi, Q.; Ren, H.; Cai, W.; Gao, J. How to set the proper level of carbon tax in the context of Chinese construction sector? A CGE analysis. J. Clean. Prod. 2019, 240, 117955. [Google Scholar]

- Li, X.; Yao, X.; Guo, Z.; Li, J. Employing the CGE model to analyze the impact of carbon tax revenue recycling schemes on employment in coal resource-based areas: Evidence from Shanxi. Sci. Total Environ. 2020, 720, 137192. [Google Scholar]

- Hu, H.; Dong, W.; Zhou, Q. A comparative study on the environmental and economic effects of a resource tax and carbon tax in China: Analysis based on the computable general equilibrium model. Energy Policy 2021, 156, 112460. [Google Scholar]

- Li, J.; Lin, B. Inter-factor/inter-fuel substitution, carbon intensity, and energy-related CO2 reduction: Empirical evidence from China. Energy Econ. 2016, 56, 483–494. [Google Scholar]

- Smyth, R.; Kumar Narayan, P.; Shi, H. Inter-fuel substitution in the Chinese iron and steel sector. Int. J. Prod. Econ. 2012, 139, 525–532. [Google Scholar]

- Lin, B.; Wesseh, P.K. Estimates of inter-fuel substitution possibilities in Chinese chemical industry. Energy Econ. 2013, 40, 560–568. [Google Scholar]

- Bloch, H.; Rafiq, S.; Salim, R. Economic growth with coal, oil and renewable energy consumption in China: Prospects for fuel substitution. Econ. Model. 2015, 44, 104–115. [Google Scholar]

- Cho, W.G.; Nam, K.; Pagán, J.A. Economic growth and interfactor/interfuel substitution in Korea. Energy Econ. 2004, 26, 31–50. [Google Scholar]

- Pindyck, R.S. Interfuel substitution and the industrial demand for energy: An international comparison. Rev. Econ. Stat. 1979, 61, 169–179. [Google Scholar]

- Liu, K.; Bai, H.; Yin, S.; Lin, B. Factor substitution and decomposition of carbon intensity in China’s heavy industry. Energy 2018, 145, 582–591. [Google Scholar]

- Ma, H.; Oxley, L.; Gibson, J.; Kim, B. China’s energy economy: Technical change, factor demand and interfactor/interfuel substitution. Energy Econ. 2008, 30, 2167–2183. [Google Scholar]

- Lin, B.; Tian, P. Energy conservation in China’s light industry sector: Evidence from inter-factor and inter-fuel substitution. J. Clean. Prod. 2017, 152, 125–133. [Google Scholar]

- Wang, X.; Lin, B. Factor and fuel substitution in China’s iron & steel industry: Evidence and policy implications. J. Clean. Prod. 2017, 141, 751–759. [Google Scholar]

- Tan, R.; Lin, B. The influence of carbon tax on the ecological efficiency of China’s energy intensive industries—A inter-fuel and inter-factor substitution perspective. J. Environ. Manag. 2020, 261, 110252. [Google Scholar]

- Lin, B.; Xu, M. Exploring the green total factor productivity of China’s metallurgical industry under carbon tax: A perspective on factor substitution. J. Clean. Prod. 2019, 233, 1322–1333. [Google Scholar]

- Yang, M.; Fan, Y.; Yang, F.; Hu, H. Regional disparities in carbon dioxide reduction from China’s uniform carbon tax: A perspective on interfactor/interfuel substitution. Energy 2014, 74, 131–139. [Google Scholar]

- Liu, H.; Lin, B. Energy substitution, efficiency, and the effects of carbon taxation: Evidence from China’s building construction industry. J. Clean. Prod. 2017, 141, 1134–1144. [Google Scholar]

- Du, Z.; Lin, B.; Li, M. Is factor substitution an effective way to save energy and reduce emissions? Evidence from China’s metallurgical industry. J. Clean. Prod. 2021, 287, 125531. [Google Scholar]

- Ma, H.; Oxley, L.; Gibson, J. Substitution possibilities and determinants of energy intensity for China. Energy Policy 2009, 37, 1793–1804. [Google Scholar]

- Li, J.; Sun, C. Towards a low carbon economy by removing fossil fuel subsidies? China Econ. Rev. 2018, 50, 17–33. [Google Scholar]

- Berndt, E.R.; Wood, D.O. Technology, Prices, and the Derived Demand for Energy. Rev. Econ. Stat. 1975, 57, 259–268. [Google Scholar]

- Zha, D.; Zhou, D.; Ding, N. The determinants of aggregated electricity intensity in China. Appl. Energy 2012, 97, 150–156. [Google Scholar]

- Floros, N.; Vlachou, A. Energy demand and energy-related CO2 emissions in Greek manufacturing: Assessing the impact of a carbon tax. Energy Econ. 2005, 27, 387–413. [Google Scholar]

- Zhou, P.; Ang, B.W.; Wang, H. Energy and CO2 emission performance in electricity generation: A non-radial directional distance function approach. Eur. J. Oper. Res. 2012, 221, 625–635. [Google Scholar]

- Agostini, P.; Botteon, M.; Carraro, C. A carbon tax to reduce CO2 emissions in Europe. Energy Econ. 1992, 14, 279–290. [Google Scholar]

- Chen, S. Estimation of China’s Industrial Sub-industry Statistics: 1980–2008. China Econ. Q. 2011, 10, 735–776. (In Chinese) [Google Scholar]

- China Industry Statistical Yearbook. Available online: https://data.cnki.net/yearbook/Single/N2022010304 (accessed on 10 September 2021).

- CEIC Data Base. Available online: https://insights.ceicdata.com/ (accessed on 10 September 2021).

- China Labor Statistical Yearbook. Available online: https://data.cnki.net/yearbook/Single/N2021020042 (accessed on 10 September 2021).

- Zhu, R.; Lin, B. Energy and carbon performance improvement in China’s mining Industry: Evidence from the 11th and 12th five-year plan. Energy Policy 2021, 154, 112312. [Google Scholar]

- Lin, B.; Zhu, R. How does market-oriented reform influence the rebound effect of China’s mining industry? Econ. Anal. Policy 2022, 74, 34–44. [Google Scholar]

- China State Taxation Administration. Notice on Comprehensively Promoting the Reform of Resource Tax. Available online: http://www.chinatax.gov.cn/n810341/n810755/c2132534/content.html (accessed on 10 September 2021).

- China National Development and Reform Commission. Notice on Improving the Step Price Policy of Electrolytic Aluminum Industry. Available online: https://www.ndrc.gov.cn/xwdt/tzgg/202108/t20210827_1294890.html?code=&state=123 (accessed on 10 September 2021).

| Variables | Unit | N | Mean | Sd | Min | Max |

|---|---|---|---|---|---|---|

| C | 104 tons | 400 | 4430.00 | 5890.00 | 34.44 | 32,419.00 |

| Y | 108 CNY | 400 | 953.50 | 971.70 | 43.69 | 5249.00 |

| L | 104 persons | 400 | 25.95 | 23.62 | 1.24 | 108.40 |

| K | 108 CNY | 400 | 1541.00 | 1344.00 | 21.07 | 6441.00 |

| E | 104 tons of standard coal | 400 | 1624.00 | 2140.00 | 28.62 | 11,680.00 |

| / | 400 | 0.16 | 0.02 | 0.10 | 0.25 | |

| CNY/person | 400 | 49,821.00 | 26,875.00 | 10,838.00 | 144,803.00 | |

| CNY/104 KW·h | 400 | 6981.00 | 1243.00 | 3640.00 | 9300.00 | |

| CNY/ton | 400 | 6841.00 | 1512.00 | 4095.00 | 12,895.00 | |

| CNY/ton | 400 | 679.20 | 207.10 | 242.20 | 1361.00 |

| Variables | ||

|---|---|---|

| 0.114 *** | 0.245 *** | |

| (3.394) | (7.117) | |

| 0.0261 | −0.359 *** | |

| (0.718) | (−11.08) | |

| −0.140 *** | 0.114 *** | |

| (−2.681) | (3.394) | |

| t | 0.0259 *** | −0.000751 |

| (6.577) | (−0.273) | |

| Constant | 0.274 ** | 0.470 *** |

| (2.112) | (5.531) | |

| Control variables | Yes | Yes |

| Observations | 400 | 400 |

| R-squared | 0.166 | 0.217 |

| Variables | SK | SL |

|---|---|---|

| lnPK | 0.151 *** | −0.0744 *** |

| (5.619) | (−5.313) | |

| lnPE | −0.0765 *** | 0.0329 ** |

| (−2.957) | (2.213) | |

| lnPL | −0.0744 *** | 0.0414 *** |

| (−5.313) | (2.740) | |

| lnY | −0.0537 *** | 0.0201 *** |

| (−6.833) | (4.769) | |

| t | 0.0182 *** | −0.00749 *** |

| (6.632) | (−3.584) | |

| Constant | 2.038 *** | −0.648 *** |

| (7.561) | (−4.341) | |

| Control variables | Yes | Yes |

| Observations | 400 | 400 |

| R-squared | 0.457 | 0.224 |

| Own-Price Elasticity | Cross-Price Elasticity | ||

|---|---|---|---|

| −1.058 | 0.385 | ||

| −0.093 | 0.140 | ||

| 0.879 | 0.580 | ||

| −1.019 | |||

| 0.369 | |||

| −1.781 | |||

| Own-Price Elasticity | Cross-Price Elasticity | ||

|---|---|---|---|

| −0.216 | 0.168 | ||

| −0.532 | 0.048 | ||

| −0.592 | 0.221 | ||

| 0.312 | |||

| 0.100 | |||

| 0.493 | |||

| Region | Provinces |

|---|---|

| Eastern | Tianjin, Hebei, Liaoning, Fujian, Shandong, Guangdong |

| Central | Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, Hunan |

| Western | Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, R.; Lin, B. How Does the Carbon Tax Influence the Energy and Carbon Performance of China’s Mining Industry? Sustainability 2022, 14, 3866. https://doi.org/10.3390/su14073866

Zhu R, Lin B. How Does the Carbon Tax Influence the Energy and Carbon Performance of China’s Mining Industry? Sustainability. 2022; 14(7):3866. https://doi.org/10.3390/su14073866

Chicago/Turabian StyleZhu, Runqing, and Boqiang Lin. 2022. "How Does the Carbon Tax Influence the Energy and Carbon Performance of China’s Mining Industry?" Sustainability 14, no. 7: 3866. https://doi.org/10.3390/su14073866

APA StyleZhu, R., & Lin, B. (2022). How Does the Carbon Tax Influence the Energy and Carbon Performance of China’s Mining Industry? Sustainability, 14(7), 3866. https://doi.org/10.3390/su14073866