Abstract

The construction sector and the operation and maintenance of buildings largely contribute to energy consumption and emission of greenhouse gases (GHGs) in the European Union (EU). Therefore, it is of utmost importance to improve the energy performance of buildings. Yet, this frequently involves high short-term investments, which may not be compatible with owners’ budgetary constraints. In this research we analyze the importance of Energy Performance Contracting (EnPC) for the improvement of energy efficiency in buildings. These models allow bypassing budgetary restrictions of owners (public and private ones) and bring private capital to finance energy efficiency measures. The paper analyses different models of contracting Energy Service Companies (ESCOs), from traditional models to alternative models, and exposes the versatility of the new contracting models and the associated risks. Several applications of energy performance contracts implemented in European countries are presented to identify the main characteristics that lead to successful contracts. The paper also includes the discussion of energy performance contracts applied to a public building (a school) that seeks to reduce its annual energy consumption, by testing the use of three types of energy performance contracts. The results show that there is potential in the use of EnPC but it is critical to select the most adequate model, especially when defining the contract duration, to balance both owners’ and companies’ interests.

1. Introduction

Buildings represent around 40% of the European Union’s (EU) total energy consumption and generate approximately 36% of Europe’s greenhouse gases (GHGs), making it one of the most polluting sectors [1]. In 2016, the European Commission proposed an update directive on energy efficiency, based on, “putting energy efficiency (EE) first, achieving global leadership in renewable energy and providing a fair agreement to consumers”. The aim was to achieve the goal of reducing CO2 emissions by at least 40% by the year 2030 [2]. According to [3], in 2017, 75% of buildings were energy inefficient and, depending on the member state, only between 0.4% and 1.2% of the stock of buildings is renovated every year.

By 2040, total energy consumption in the world is expected to increase by about 40% and, despite developments in the field of alternative energy sources, fossil fuels are expected to continue to account for more than 75% of the energy used, which means that CO2 emissions will continue to increase [4]

Although new energy-efficient buildings can be built, existing builds will continue to account for most of the energy consumption, making it extremely important to improve the energy efficiency of these properties [5].

This creates an enormous challenge for investors, owners, and users. To improve the energy performance of the building, it is necessary to invest in saving measures, which often represent a significant financial effort in the short-term with relatively long pay-back periods. The market has identified this difficulty, and several new business models have emerged towards providing one-stop shops for renovations, as discussed by [6]

From the need to improve the energy efficiency of existing buildings, Energy Performance Contracts (EnPC) have emerged. To improve the energy performance of buildings and consequently decrease energy consumption and emissions of pollutant gases into the atmosphere, EnPC are being used as a tool to stimulate and encourage the adoption of energy saving actions [2] and monitor activities [7]. EnPC have the potential to increase the speed of energy renovation of existing buildings and foster the implementation of energy-efficient measures in buildings yet to be constructed [2]. These contracts are designed between the client and a private company acting as a service provider, frequently referred to as an “Energy Service Company” (ESCO) [8]. Put simply, the contracts establish that the ESCO will be responsible for designing and implementing the energy-saving measures, will be remunerated over the duration of the contract and will use distinct risk-sharing mechanisms, as will be presented and discussed in this paper.

The existence of different types of EnPC makes it necessary to carefully design and structure their business model so that it is possible to choose the type of contract that favors not only the customer but also the ESCO. The design of the energy management model is the main driver for unlocking the potential of improving energy efficiency [9].

The main objective of this paper is to discuss and analyze the various types of EnPCs. The methodology involves a state of the art EnPC, an international benchmark showing real examples of EnPC application and its results, and, finally, the simulation of using alternative EnPC models for a real case of a public school in Portugal. The paper provides a unique analysis that helps academics and practitioners to understand the financial impact of choosing different EnPC contracts.

2. State of the Art

2.1. Energy Performance Contracts (EnPC)

With its origins dating back to the oil crisis of the 1970s, the EnPC emerged as an innovative financing method to reduce energy consumption by recovering the costs of installing and managing energy-saving equipment [10,11].

In 2008, a serious financial crisis hit Europe, in particular in the Mediterranean countries, affecting national economies and causing market uncertainties [12]. Although financial resources have been limited since then, the EU’s energy efficiency policy, on the other hand, has become increasingly stringent, setting clear and ambitious energy efficiency and CO2 emissions targets, of which maximum energy conservation in existing buildings and reduction of CO2 emissions by 80% by the 2050 time horizon stand out.

According to the [13], an EnPC is defined as one: “Energy performance contract means a contractual agreement between the beneficiary and the supplier of an energy efficiency improvement measure, verified and monitored throughout the duration of the contract, where investments (work, supply or service) to that extent are paid in relation to a contractually agreed energy efficiency improvement level or other agreed energy performance criterion, financial savings”.

Today, EnPCs are seen as a market mechanism, or a financing tool, to encourage building owners, both public and private, to conduct energy rehabilitation [6,14]. Nevertheless, defining it as a purely financial tool is not entirely correct, because the contract also includes technical and maintenance dimensions. Therefore, the EnPC involves the final provision of energy services (lighting, heating, and driving energy), consisting of energy converted by secondary conversion equipment (e.g., radiators and heaters), which can thus be enjoyed directly by customers, without the need for additional conversion processes [15] (Hannon and Bolton, 2015). In Europe, EnPCs have spread widely through schools, hospitals, and government and residential buildings [3], and are certainly a model experiencing growth.

2.2. Energy Service Companies (ESCOs)

As mentioned earlier, EnPCs are signed between customers and providers, with the former consisting of public or private entities, and the latter typically consisting of private companies that are titled Energy Service Companies (ESCOs) [16].

According to the European Commission (2012), an ESCO is: “A natural or legal person that provides energy services and/or other energy efficiency improvement measures in a users’ facility or facilities, and accepts some degree of financial risk in doing so. Payment for the service provided is based (in whole or in part) on the achievement of energy efficiency improvements and compliance with other agreed performance criteria”. The type of service provided by ESCOs has been identified by several experts and scholars as a high-potential alternative for meeting consumers’ energy needs in a more sustainable way than is currently the case [15].

Typically, an ESCO (which must be selected through a public tendering procedure) is responsible for the implementation of measures providing the knowledge required for effective energy efficiency improvements, and also for monitoring the contract during the respective period. If it does not guarantee the energy savings set out in the contract between both parties, the ESCO may not receive payment for the services rendered [17]. The investment made by ESCOs can be made through funds from the companies themselves or through mechanisms provided by a financial institution [17].

2.3. Types of Models

EnPC can be organized on different types of models that can be divided in three distinct models, based on the risk-sharing agreement, namely: guaranteed savings, shared savings, and first-out. These contracting models establish a form of public–private partnership [18,19]. This section will present and discuss the theoretical basis of each type, but it will start by presenting the traditional acquisition model that provides the comparative base scenario for the remaining models.

2.3.1. Traditional Acquisition Model

The main attribute of the traditional acquisition model is that the public sector (central, regional, or local government, and public institutions) is fully responsible for providing energy improvement services, and this entity is also responsible for all phases of the project, from its inception to the construction, maintenance, and operational period of the project [2]. During the implementation of the project, the public sector is not only responsible for financing and acquiring the asset, but also for achieving technological and energy optimization throughout the life cycle of the enterprise. In applying the traditional model, the private sector has a very small influence, generally participating only during the construction period, so it is questionable whether the public sector has the knowledge and skills to optimally manage and operate the long-term project risks [2]. In this model, all risks associated with the project are fully supported by the public sector. In addition to the risks mentioned, budgetary constraints, the absence of efficient management, and the lack of technical skills are three of the main obstacles to public entities conducting projects of this nature [18].

2.3.2. Alternative Acquisition Models

Among the various barriers facing the public sector in conducting energy efficiency projects, public budgetary constraints, both in terms of cuts to public expenditure and contraction of available public funds, as well as the lack of effective and efficient technical and management skills in public administration, are the most important [19,20]. To overcome these barriers, alternative public procurement models are needed that increasingly exploit the skills of the private sector in delivering energy efficiency projects [2,21,22].

These alternative models assume the structure of typical public–private partnership (PPP) models that involve the financing, design, construction, operation, and maintenance of infrastructure, which are usually acquired and provided by the public sector, such as hospitals, schools, libraries, etc. [23]. Due to the fact that many public energy efficiency projects have some characteristics of PPPs, the provision of public services, transfer of construction risk, and risk of availability, among others, can be carried out through the PPPs model [24]. The main objective of the implementation of energy efficiency projects according to the PPP model is reflected in the provision of public services, and not only in the realization of energy savings, as is the case in the alternative models presented earlier [2].

In a typical PPP contractual model structure, the private sector bears risks related to construction and reconstruction, to which it associates at least one of the following risks: risk of availability or demand risk [25,26]. In addition, PPPs have better room for maneuver to transfer risks compared to traditional acquisition models and the alternative acquisition models mentioned above, such as the fact that public sector payments are not fixed, are not based on expected savings, and can be retained until assets are in operation, which motivates contractors to complete energy efficiency projects on time and on budget [26]. Consequently, public authorities can fully focus on defining results specifications and achieving the expected cost-benefit ratio [27].

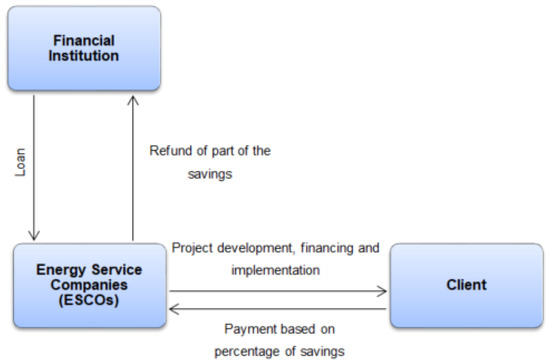

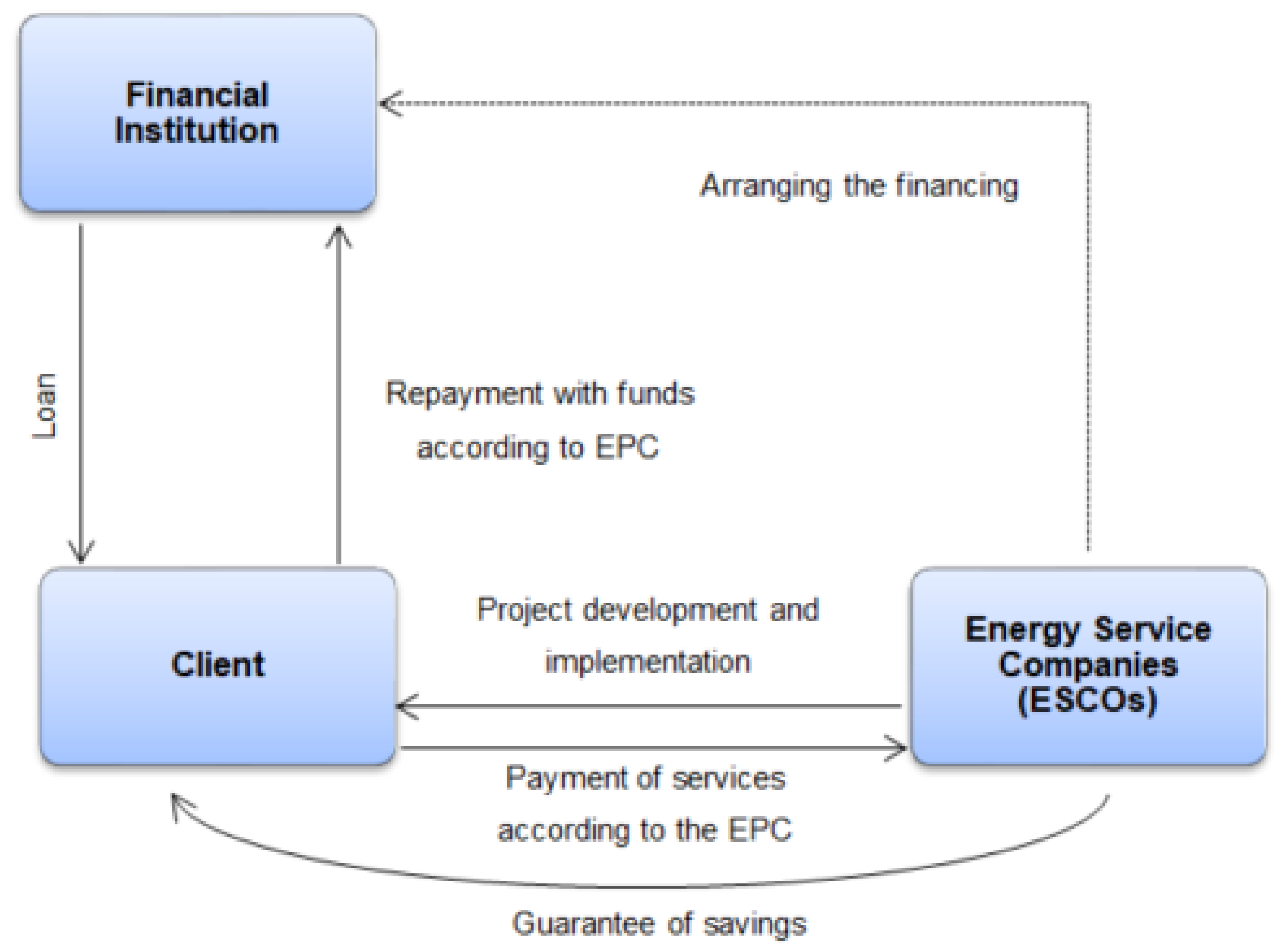

Guaranteed Savings Contracts

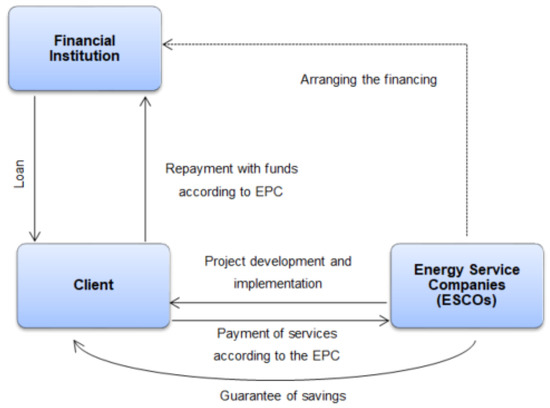

In Guaranteed Savings Contracts, ESCOs are responsible for “designing and implementing the project but not for financing” it, i.e., projects are financially supported, for the most part, by customers [18]. In this case, as the risks of savings performance are assumed by the ESCO, the EnPC should include clauses specifying the obligation of the ESCO to ensure energy savings and pay the difference in the event that it is not obtained, and it is recommended to require a guarantee of savings in energy costs at prices contained in the base year, comparing different proposals [17]. If the savings exceed the guaranteed level, the excess is divided between the customer and the ESCO according to the provisions specified in the contract (usually, the customer receives at least 50% of the excess savings) [17].

Figure 1 shows the structure of the relationships between the three main players (client, ESCO, and financial institution) when opting for a guaranteed savings contract.

Figure 1.

Guaranteed Saving Contract (adapted from [28]).

The main advantage of these contracts is the promotion of the growth and viability of newly established ESCOs with limited resources and a credit history [29]. In countries with an underdeveloped banking structure, insufficient technical knowledge, and little understanding of energy efficiency projects, the implementation of Guaranteed Savings Contracts can become a challenge [29].

In this case, there is no transfer of construction risk and financial risk to the private entity. These contracts must be considered “on-balance” with regard to public accounts, which represent a disadvantage for the public client [18], in the sense that they have to include the investment made into their balance sheet.

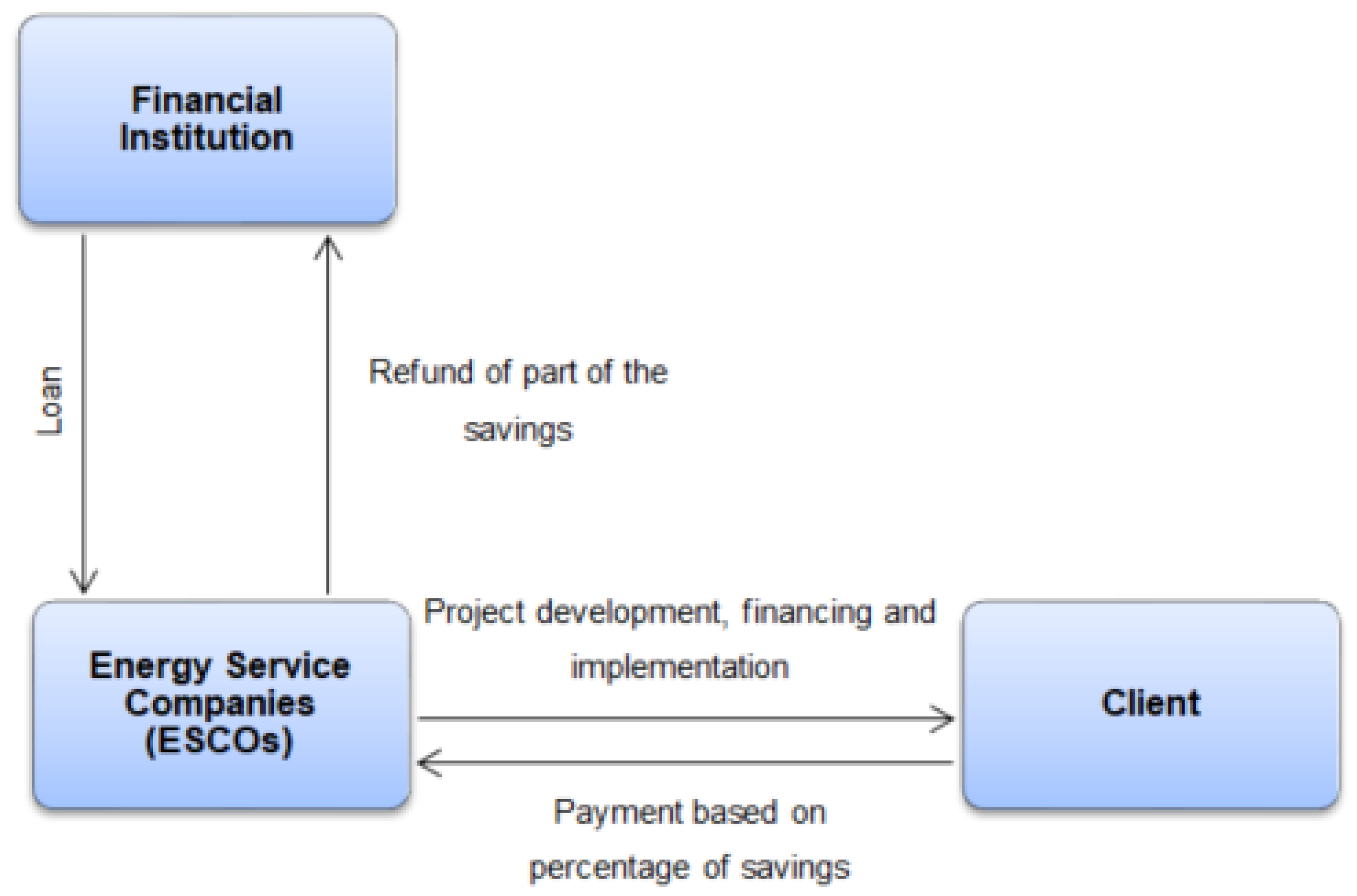

First-Out Contracts

First-Out Contracts stand out because the ESCO finances investments and retains all energy savings during a given contractual period [18]. Although the contractual period is defined at the time of the conclusion of the contract, if the EnPC covers the costs of the project and its profits in full before the end of the contract, it ends on that date, and the energy savings are retained thereafter by the customer [28]. Therefore, this type of contract has as its main characteristic the fact that its duration is influenced by the amount of savings achieved, and the greater the energy savings, the shorter the duration of the contract [18].

A variation of the First-Out Contract is the so-called “Chauffage”, which is an energy management contract in which ese provides the customer with an agreed set of energy services (such as space heating, lighting, driving energy, etc.) [32]. This variant includes energy performance operations, which consist of operating systems to ensure a certain level of comfort (such as balanced humidity and temperature levels) without, however, explicitly committing to making investments in energy efficiency [32].

2.3.3. Analysis of risks in EnPCs

The implementation of EnPCs by public authorities is seen as a means to influence changes in local energy systems, while allowing these entities to achieve policy objectives on this topic (Hannon and Bolton, 2015). Therefore, it is essential to account for the trade-off between exposure to risk by public authorities with regard to energy projects, and the control they can exercise over the development of the projects in question [15]. With the right contract design, EnPCs can mitigate the risks related to the energy savings provided for in the contracts [5]. This is a problem that falls within typical contract design theory, as extensively discussed by [33].

Despite growing worldwide, energy services markets are still far from realizing their potential. Previous studies show that some key barriers such as technological barriers (such as lack of knowledge and awareness), financial barriers (difficulty in finding adequate financing solutions), and political barriers (e.g., policy measures) must be broken down so that energy services markets can reach their full potential [7].

The risks associated with the EnPCs have to be properly considered and studied by both parties in the conclusion of these contracts, because the greater the knowledge about the risks, the easier the mitigation of the same. [20] identified critical risks in energy efficiency improvement projects, such as a possible lack of payment by the EU after project execution, errors in baseline measurement, and increased installation cost. In turn, [34] highlighted that the risks and uncertainties in these projects are largely related to energy prices, equipment utilization, unexpected events, and contractual risks, among others. In addition to the points mentioned above, it is important to highlight that the low knowledge and awareness in the development of this type of project, the technical barriers and risks, and insufficient political support for the implementation of this type of project are other risks that deserve consideration by decision-makers [35].

Reference [36] state that risks arising from such agreements can be grouped into five major groups (Figure 3): financial and market risks, operational and management risks, technological risks, client risks, and external environmental risks. Table 1 presents the main risks associated with the alternative contracting models.

Figure 3.

Relations between risks (Adapted from [36]).

Table 1.

Risks associated with alternative contracting models (adapted from [18]).

Unlike the traditional acquisition model, the use of alternative acquisition models for energy efficiency projects must be justified by various analytical techniques, with value-for-money (VfM) being one of the most recurrent techniques for this purpose [2,37,38]. VfM analysis is an analytical tool where all the values considered are in the form of “single unit rate”, which helps to compare different options, including in its calculation all the costs of possible energy efficiency projects throughout the life cycle [39].

3. International Benchmark of Energy Performance Contracting Cases

In order to understand the impact of energy performance contracts, we tried to analyze their application to specific cases, not only in buildings but also in public lighting. This task was limited by the information available, which, unfortunately is very limited. However, it was possible to find and study the application of the following cases, which were selected not only because they were the most complete in terms of available information and results, but also because they meet the case study (public school) that will be analyzed later.

3.1. Guidonia Montecelio, Italy

The Municipality of Guidonia Montecelio is located about 29 km from Rome in a northeasterly direction and has a surface area of 79.06 km2, consisting mostly of flat terrain and a hilly area just above 300 m. In this municipality, the largest energy consumption comes from civil heating and fuel production activities, fuel transport, and electricity use. Between 1990 and 2008, the per capita consumption of an inhabitant of this region for the use of electricity, thermal energy, and transport was 17.57 MWh/year. The average consumption of the same resources by a citizen living in Italy amounts 25.11 MWh/year, and as such, the consumption of an inhabitant of Guidonia Montecelio was lower than the national average [40].

To improve energy performance and renew the street lighting network, the municipality used public–private partnerships to conduct these interventions. To this end, the Municipal Administration published a public tender in 2008 for the concession of the municipality’s public lighting service. This service also included the implementation, management, and maintenance of an IT system to manage the entire network. The total amount to be paid to the concessionaire was estimated by the municipality at EUR 28,454.500 (plus VAT), to be paid over a contractual period of 20 years [41].

The selected consortium was then responsible for the economic and financial viability of the project, as well as for the planning and execution of the necessary works, operation, and maintenance of the facilities and financial provision. The ESCOs financed the investments from their own resources, recovering the investment through a shared savings contract lasting 20 years, where most of the energy savings were used to repay the investment [17]. With this intervention, it was possible to reduce electricity consumption by 45% and total installed power by 33%, allowing the municipality to achieve savings of 1.5 GWh/year of energy savings 1 [17].

A shared savings contract was also signed for the complete replacement of all lighting fixtures in the interior spaces of public buildings with more energy-efficient systems. This contract allowed the municipality energy savings of 57% (Table 2), and the reduction of all the electrical energy installed.

Table 2.

Main results from the study of the application of CDEs.

3.2. Koper-Slovenia

The Municipality of Koper occupies an area of 303.2 km2 along the coast of the Adriatic Sea, and is located in the Coastal-Karst region, which despite being one of the smallest regions in Slovenia, is classified as one of the most advanced regions concerning economic development [42].

In order to improve energy performance, reduce energy costs, and achieve a significant reduction in the use of primary energy in 31 public buildings, the municipality of Koper launched a public tender to select an ESCO to perform the necessary interventions. Under a 15-year shared savings contract, in which a 3% reduction in the final energy used for heating was expected to be achieved, the investment was fully financed by the contractor, and it was stipulated in advance that the municipality of Koper was entitled to receive 10% of the total savings achieved. If in any period the guaranteed savings are exceeded, the municipality receives 50% of the value of the additional savings [17].

The implementation of all the necessary interventions, good energy management, and the application of some additional technical measures has enabled the municipality of Koper to achieve an annual reduction of EUR 100.000 in energy costs [17].

3.3. Sant Gulat des Vallès-Spain

Located in Catalonia, more precisely in the comarca of Vallés Occidental, the municipality of Sant Gulat des Vallès has an area of 48.2 km2. According to Spain’s National Institute of Statistics, the municipality’s population reached 90.664 inhabitants in 2018, which translates into a population density of 1880.9 hab/km2.

In 2013, the municipality of Saint Gulat des Vallès launched a public tender for interventions to improve the energy performance and maintenance of the sports facilities of the High-Performance Centre of Saint Gulat des Vallès. This set of interventions was awarded to an energy services company called COMSA Service for the contract value of EUR 3,184,347, and included the energy renovation of the facilities, maintenance, and monitoring of consumption of the High-Performance Centre of Saint Gulat des Vallès, and the management of the facilities [43]. The 10-year shared savings contract between the parties involved, where the financing of all improvements and interventions was fully allocated to ESCO, has allowed the municipality to reduce electricity and thermal consumption by 39% [43].

3.4. Main Conclusions of the International Benchmarking

Table 2 summarizes the main conclusions of the presented case studies.

After analyzing the EnPC implementations, it is clear that the most used type of contract is the Shared Savings Contract. One of the main reasons why this type of contract is the most used may be the fact that both the design risk and the financial risk are rented to the company and not to the client. Thus, in addition to not having to invest any money, the client also gains more interesting solutions from a technical point of view.

For this type of contract, the contractual duration varies between 10 and 20 years, and the annual energy savings range between 24% and 57%. The contractual duration assumes these values because in this type of EnPC, the ESCO recovers its investment through part of the savings that is effectively obtained over time, which means that it has to install technical solutions capable of producing annual energy savings that ensure that the contractual savings level is achieved, thus making the greatest possible profit.

4. Application to a Case Study

4.1. Case Study Overview

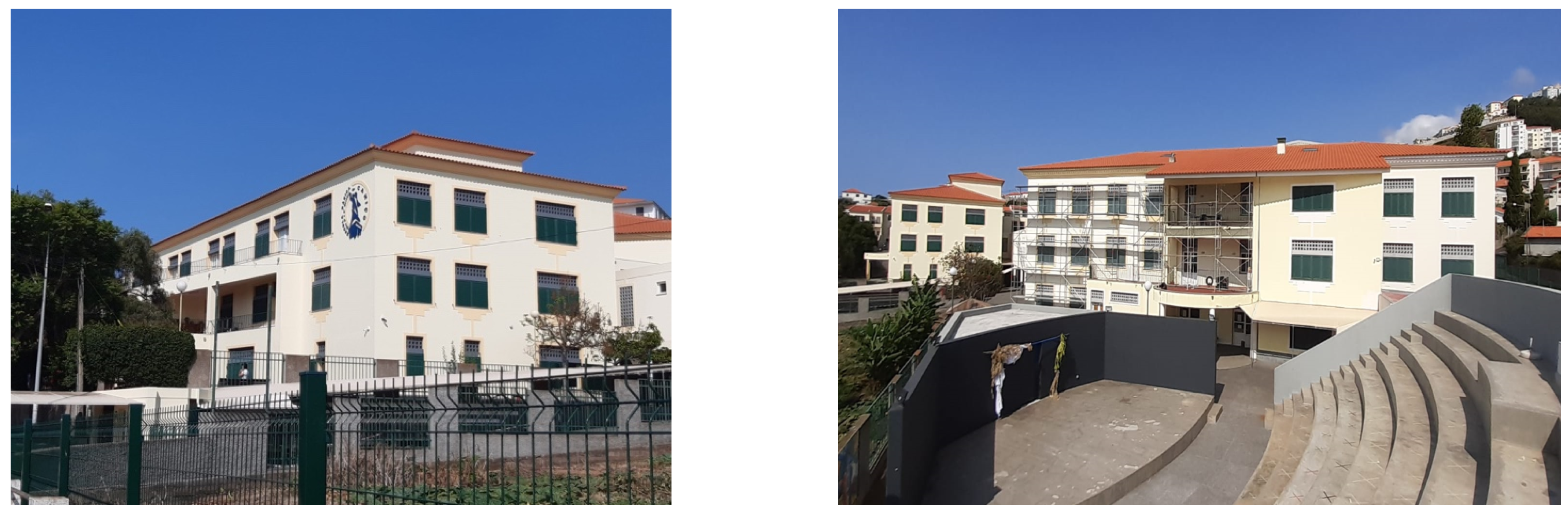

Located in the Autonomous Region of Madeira (RAM), in the municipality of Santa Cruz, Caniço Elementary School is a school that has 1172 students, 145 teachers, and 61 non-teaching staff members. Annually, this infrastructure has an average monthly energy bill of about EUR 2630. The island of Madeira has a subtropical oceanic climate. Rainfall is essentially concentrated in the winter months between October and February, with an annual rainfall around 700 mm. The island has an average of 90 rainy days per year and approximately 2450 h of sunshine. Maximum temperatures vary between 25 °C in summer and 20 °C in winter, while minimum temperatures vary between 20 °C in summer and 13 °C in winter.

This educational establishment, opened on 29 September 1999, serves a socially diverse population with rural and suburban characteristics. Over the years, in parallel with the growth of the population of the parish, there has been a gradual and systematic increase in the number of students and teaching and non-teaching staff in the school in question. In the school year of 1999/2000 there were 18 classes, 406 students, 29 employees, and 42 teachers, and in the school year 2020/2021 the school opened with 1172 students distributed in 56 classes (48 in day teaching and 8 in night school), 145 teachers, and 61 non-teaching staff members.

Figure 4 illustrates the two main buildings of the school.

Figure 4.

Building A (left) and B (right) of Escola do Caniço.

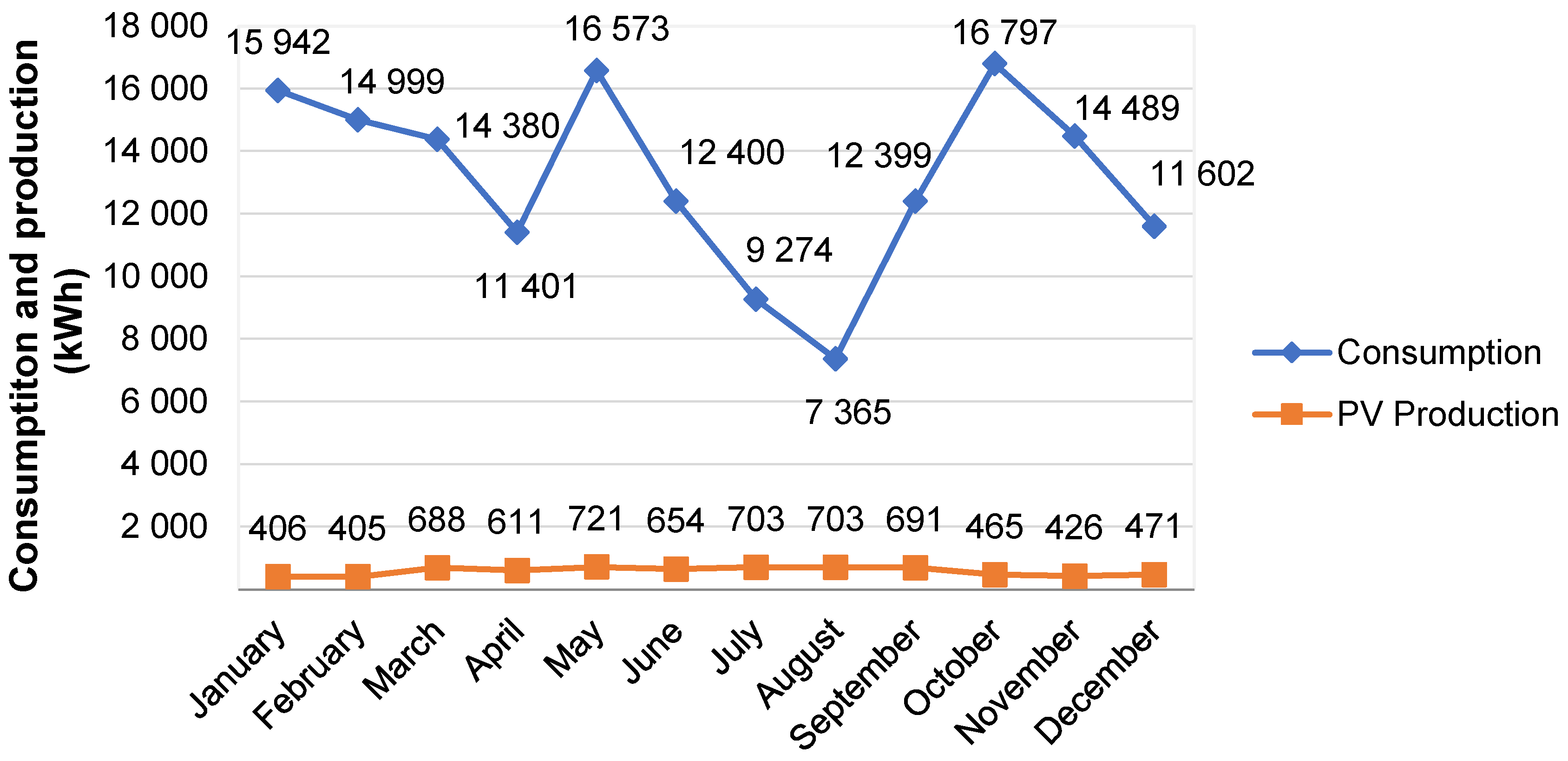

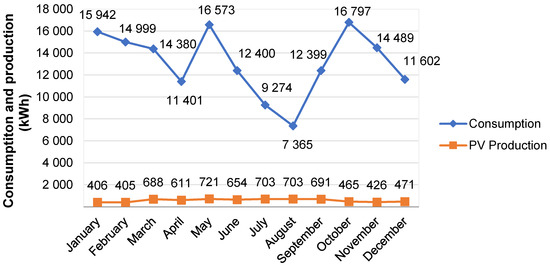

To simulate the level of potential savings, it was necessary to evaluate the existing level of energy consumption. Data were collected for the period from December 2018 to November 2019 (Table 3) and from December 2019 to November 2020. Due to the fact that in 2020 the school closed due to the confinement caused by the COVID-19 pandemic, this invoicing was not considered because the results achieved through its analysis would be misrepresentative of reality. In addition to this invoicing, three energy audits were made available, with their results and their solutions, which include the placement of photovoltaic panels in the infrastructure coverage. After data collection, the following is the study of the proposals prepared by three different entities, in order to conduct the analysis of the information obtained.

Table 3.

Electricity consumption of the Caniço School.

4.2. Photovoltaic Unit Installation

In order to reduce its annual energy consumption, the school used three ESCOs to perform energy audits to the buildings, so that they could collect all the necessary data to present the possible energy-efficient solutions to reduce energy consumption (Table 4).

Table 4.

Main results of the energy audits.

On the basis of the data and solutions obtained, the intention is to discover, through this paper, which of the three types of EnPCs is the best for this type of public building.

Given the observation that the highest consumption of electricity occurs between 7:30 a.m. and 7:00 p.m., it was found that there is potential for the installation of a photovoltaic panel system, because the time interval of higher energy consumption for the buildings coincides with the periods of higher production by the system. Given the fact that the installation would have to operate in different time periods, such as the school period on working days, the school period on non-working days (holidays), and weekends, AREAM defined that a necessary condition for the system not to produce more energy than that consumed would be to scale the photovoltaic solar system to the minimum output, which is about 6 kW. After data collection and analysis, AREAM studied energy, economic, and environmental viability for energy production for self-consumption. In calculating the investment, the costs of acquiring the equipment for the installation of photovoltaic solar energy systems were taken into consideration. These systems, according to the manufacturers, have a durability of 20 to 25 years, during which they regularly guarantee the desired values for the power supplied.

After performing all feasibility studies, AREAM (a private, non-profit association, recognized as being of public utility, whose mission is based on the promotion of knowledge, innovation, and cooperation in the fields of energy and the environment) suggested the installation of a solar photovoltaic system for self-consumption, without batteries, with a nominal power of 6 kW, which would occupy a roof area of between 45–50 sq. m, out of a total of 500 sq. m available. Another possible solution was the installation of an identical system with a higher power (between 15 kW and 30 kW), with the prior knowledge that there could be a surplus of energy produced that would have to be sold to the grid in certain situations (school and non-school operating periods). In addition to the implementation of the photovoltaic system, AREAM also found that the cost of active energy could be reduced by installing more efficient equipment, such as LED lighting in classrooms and other spaces, and that the possibility of using solar thermal panels to reduce energy consumption for hot water should also be looked into. The adoption of the proposed solution allows for a reduction in the energy costs in terms of the electricity bill. Figure 5 shows the comparison between total electricity consumption between December 2018 and November 2019, and the estimated production of the photovoltaic system.

Figure 5.

Total electricity consumption vs. production estimated by the photovoltaic system.

Table 4 features a summary of the study of economic feasibility and environmental impact studies for the system’s installation. The standard cost considered for the photovoltaic system was 1700 EUR/kW, and the prices charged by distributors may be lower than those considered in the AREAM analysis. The CO2 emission factor for avoided electricity corresponds to 0.426 kg/kWh (according to the ESIN 2018), and the average cost considered for avoided energy was EUR 0.1787/kWh.

4.3. Results of the Energy Audits

The option was made for the intermediate solution, which corresponds to a self-consumption production unit of about 30 kW. According to the RC Automação company, in order to achieve the desired power, it is necessary to install 90 panels of 330 W, which represents a total cost of EUR 36.000, and which includes the maintenance of the panels (EUR 375 per semester). Accordingly, for the sensitivity analysis, we also considered a profit margin for the ESCO of 15%, defining a total value of EUR 41.400 for the implementation of the 30 kW solution.

Analysis of Table 4 shows that the solution proposed by AREAM produces an annual savings of only EUR 1111, which corresponds in percentage to an annual energy saving of only 3.52%. If this solution is chosen, whilst it is financially advantageous for the client, it would be very difficult for both the school and AREAM to achieve satisfactory results from an economic point of view.

The other solutions presented, both by the RC Automação company and by the Factor Energia company, all guarantee annual energy savings higher than 20%, for very similar contract periods, of about 5 years. The 45 kW and 52.7 kW solutions, which are associated with larger investments on the part of the client, produce a power surplus that translates into an energy surplus, which may or may not be sold to the grid. All proposed solutions feature the installation of self-consumption units on the school roof, only varying in the power level of the panels installed and the roof area occupied.

4.4. Sensitivity Analysis

With a view to confirming which contract is the most viable for the parties involved, analysis criteria based on financial discounting must be taken into consideration, including the Net Present Value (NPV) and the Internal Rate of Return (IRR). These values result from calculations performed based on cash flows, represented by annual revenues and expenses updated over the project duration [44].

Once the sensitivity analyses and respective simulations have been performed for the various scenarios, namely in terms of contract duration and annual energy savings, a study is conducted to understand which energy efficiency contract is more beneficial for both parties involved.

The Guaranteed Savings Contract transpires to be attractive for the ESCO, because it receives as payment in year 0 the amount that covers its investment, also guaranteeing the desired profit. The only risk associated with this part is having to guarantee the annual energy savings defined in the contract, under penalty of paying an indemnity to the client if it does not comply with this condition. From the client’s perspective, it is observed that for different contract lengths (5, 10, and 15 years) and different energy savings (15%, 20%, and 25%), the results obtained for NPV and IRR are very favorable. The sensitivity analysis for this type of contract shows that increasing the length of the contract does not have much impact on the analysis parameters, with the NPV of the 5-year contracts in comparison to the NPV for the 15-year contracts suffering an increase of only EUR 4000 on average, and the IRR an increase of 1%. However, Guaranteed Savings Contracts carry a very high risk for the client, as they are fully responsible for the investment, and although the company must indemnify the client in case of breach of contract, this is a risk that ends up discouraging entities from opting for this type of contract; it would be a much more attractive contract if the investment risk is on the side of the company that presents the solution.

First-Out Contracts on the client’s side transpire to be quite attractive to the client, as the financial risk is totally assumed by the ESCO. Regarding the sensitivity analysis performed on this type of contract, it is worth highlighting the fact that during the contractual period the client does not receive any type of remuneration nor has any type of expense. The client only keeps the equipment, the total energy savings, and the responsibility of assuming the maintenance costs when the contract ends. The greater the energy savings defined in the contract, the shorter the duration of the contract, and the greater the NPVs obtained by the client. As far as the ESCO is concerned, First-Out Contracts are not as appealing as Guaranteed Savings Contracts, because they accumulate the financial and energy risk. If the ESCO does not guarantee the minimum energy savings specified in the contract, it will take the company much longer to recover the money invested. Furthermore, while the minimum NPV obtained for the client, which is associated with an energy savings of 15%, is EUR 19,317.44, the maximum NPV obtained by the company, which is associated with an energy savings of 25%, is only EUR 4900.40. Thus, this type of contract is not very advantageous for ESCOs, with the clients benefiting the most.

The type of energy efficiency contract that emerges as the best alternative for both parties involved transpires to be the Shared Savings Contract, which has the two parties sharing energy savings for their own benefit, with the financial and energy risk being, as with First-Out Contracts, linked to the energy service company. In the sensitivity analysis performed, it was considered during the contract period that the energy savings received by the ESCO would be 80% of the total savings, so that the ESCO would recover its investment, leaving the remaining 20% for the client. At the end of the contract, the client receives 100% of the savings, whilst also receiving the maintenance costs. An analysis of the tables in question shows that the client, by not having any expenses, always guarantees a positive NPV, whatever the energy savings or the contract period. However, it is of interest to the client that the contract duration be short because it is through such contracts that they can optimize their benefits. For example, in a 5-year contract with the most pessimistic savings scenario (15%), the client can guarantee an NPV of EUR 37,346.04, whereas for the most optimistic scenario, they can guarantee an NPV of EUR 60,946.61, for the same contract duration. By increasing the duration of the contract, this NPVs fall to EUR 16,854.64 and EUR 28,963.39, respectively, thus proving that shorter contracts represent a greater benefit for the client.

On the other hand, short contract durations are extremely detrimental to ESCOs for this type of contract. The analysis shows that, for a contract duration of 5 years, regardless of an optimistic or pessimistic scenario for energy savings, the company always obtains negative NPVs and IRRs, as it does not have enough time to recover its investment. Increasing the contract duration to 10 years, if one considers an energy-saving scenario of 20%, the medium level between the pessimistic (15%) and the optimistic (25%) scenarios, the NPV and IRR become positive, with the NPV amounting to EUR 3055.39. In comparison to the NPVs obtained by the client in this type of contract, the NPV obtained by the company is much smaller, and when one adds this aspect to the fact that the ESCO must assume the financial and energy risks, this type of contract again transpires to be attractive for companies. However, when one increases the duration of the contract to 15 years, it can be observed that the NPV values for the company and for the client begin to come closer to each other, especially in the most optimistic scenario, which is associated with an annual energy saving of 25%, whereby the client’s NPV is EUR 28,963.39 and the company’s NPV is EUR 28,191.37. Another aspect that reveals itself as an indicator of which is the most favorable energy efficiency contract for both parties is that for 15 years, considering the intermediate energy savings scenario (20%), the client and the company achieve NPVs that are quite advantageous for both sides, with the client’s NPV being EUR 22,909.02 and the company’s NPV being EUR 15,353.1. Table 5 and Table 6 summarize the main results obtained in this study.

Table 5.

Main results from sensitivity analysis—Guaranteed Savings and Shared Savings Contracts.

Table 6.

Main results of sensitivity analysis—First-Out Contracts.

5. Conclusions

Given that buildings consume about 40% of total energy consumption in the EU and generate approximately 36% of greenhouse gases in continental Europe, the EU has created various funding programs to support and promote research in the construction area, launching Framework Program 7 (which ended in 2013), Horizon2020 (which ended in 2020), and the Energy-efficient Buildings (EeB) cPPP project.

As a consequence, Energy Performance Contracts (EnPCs) emerged; these consist of a contractual agreement between a beneficiary and a supplier of an energy efficiency improvement service, which is supervised and monitored over the contractual period. Alongside these contracts, Energy Service Companies (ESCOs) have also emerged. These are entities that are contracted to implement the energy efficiency improvement measures. Of the EnPCs, Guaranteed Savings Contracts, Shared Savings Contracts, and First-Out Contracts are the most prominent.

However, EnPCs still face certain difficulties when it comes to implementation, namely the drafting of contracts and the launching of public tenders. The emergence of these contracts, associated with the new contracting models, has led to the need to adapt and improve the procedures for public tenders, including the possibility of energy audits by ESCOs before the initial bidding stage. In the particular case of energy efficiency, the specifications should attach special importance to the technical quality of the proposal and its value.

In addition to tendering and contracting difficulties, EnPCs carry other risks, namely financial and market risks, operational and management risks, technological risks, client risks, and external environmental risks.

Through analysis of the positive application of Green Public Procurement (GPP) in European countries, it was possible to perform a sensitivity analysis to verify which contract is the most appropriate for application to a school (Caniço Elementary School).

After selecting the most appropriate solution (30 kW), several simulations were performed with different values being defined for the critical input parameters. An analysis of the simulations results in the recommendation that a Shared Savings Contract be signed in this case study, as it allows both the client and the company to obtain high and balanced NPVs (EUR 28,963.39 for the company and EUR 28,191.37 for the client) for a 15-year contract. Furthermore, with the Shared Savings Contract, the client does not assume any type of financial or energy risk. Risks are thus mitigated for the company, which consequently receives greater remuneration during the contract period.

This research also provides all the foundations for the next step in terms of research, which would be to determine the optimal solution using software designed for that purpose. Other possible paths for studying EnPCs would be to take into consideration all aspects involved in the EnPCs that were not considered in the simulations in this paper, such as the case of having energy saving excesses or gaps in energy savings during the contract period, and what impacts these effects would generate for the client and the company.

Author Contributions

Conceptualization, C.O.C.; methodology, C.O.C. and C.M.S.; validation, C.O.C. and C.M.S.; formal analysis, J.N.; investigation, J.N. and C.O.C.; data curation, J.N.; writing—original draft preparation, J.N.; writing—review and editing, C.O.C. and C.M.S.; visualization, J.N.; supervision, C.O.C. and C.M.S.; All authors have read and agreed to the published version of the manuscript.

Funding

The authors are grateful for the Foundation for Science and Technology’s support through funding UIDB/04625/2020 from the research unit CERIS.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Acronyms and Nomenclature

| AREAM | Regional Agency for Energy and Environment of the Autonomous Region of Madeira |

| EE | Energy Efficiency |

| EeB | Energy-efficient Buildings |

| EnPC | Energy Performance Contract |

| ESCO | Energy Service Company |

| EU | European Union |

| GHGs | Greenhouse gases |

| GPP | Green Public Procurement |

| IRR | Internal Rate of Return |

| LED | Light Emitting Diode |

| NPV | Net Present Value |

| PPP | Public–Private Partnership |

| RAM | Autonomous Region of Madeira |

| VAT | Value Added Tax |

References

- ECTP. EeB PPP Project Review 2019; ECTP: Madrid, Spain, 2019. [Google Scholar]

- Lugarić, T.R.; Dodig, D.; Bogovac, J. Effectiveness of blending alternative procurement models and eu funding mechanisms based on energy efficiency case study simulation. Energies 2019, 12, 1612. [Google Scholar] [CrossRef] [Green Version]

- Boza-Kiss, B.; Bertoldi, P.; Economidou, M. Energy Service Companies in the EU: Status Review and Recommendations for Further Market Development with a Focus on Energy Performance Contracting; Joint Research Centre (JRC), European Commission: Brusssels, Belgium, 2017. [Google Scholar]

- International Energy Agency. WEO-2017 Special Report: Energy Access Outlook. 2017. Available online: https://www.iea.org/energyaccess/ (accessed on 5 January 2022).

- Tan, B. Design of balanced energy savings performance contracts. Int. J. Prod. Res. 2020, 5, 1401–1424. [Google Scholar] [CrossRef]

- Bertoldi, P.; Boza-Kiss, B.; Della Valle, N.; Economidou, M. The role of one-stop shops in energy renovation—A comparative analysis of OSSs cases in Europe. Energy Build. 2021, 250, 111273. [Google Scholar] [CrossRef]

- Liu, H.; Zhang, X.; Hu, M. Game-theory-based analysis of Energy Performance Contracting for building retrofits. J. Clean. Prod. 2019, 231, 1089–1099. [Google Scholar] [CrossRef]

- Piterou, A.; Coles, A.M. A review of business models for decentralised renewable energy projects. Bus. Strategy Environ. 2021, 30, 1468–1480. [Google Scholar] [CrossRef]

- Sučić, B.; Merše, S.; Kovač, M.; Tomšić, Ž. Challenges of combining different methods and tools to improve the performance monitoring in buildings: A case study of elementary schools and kindergartens. Energy Build. 2021, 231, 110608. [Google Scholar] [CrossRef]

- Okay, N.; Akman, U. Analysis of ESCO activities using country indicators. Renew. Sustain. Energy Rev. 2010, 14, 2760–2771. [Google Scholar] [CrossRef] [Green Version]

- Karakosta, C.; Papapostolou, A.; Vasileiou, G.; Psarras, J. Financial schemes for energy efficiency projects: Lessons learnt from in-country demonstrations. In Energy Services Fundamentals and Financing; Academic Press: Cambridge, MA, USA, 2021; pp. 55–78. [Google Scholar]

- Polychroni, E.; Androutsopoulos, A. Innovative financial schemes for buildings’ energy renovation. IOP Conf. Ser. Earth Environ. Sci. 2020, 410, 012055. [Google Scholar] [CrossRef]

- European Commission. Energy Efficiency Directive 2012/27/EU (EED); European Commission: Brusssels, Belgium, 2012. [Google Scholar]

- Xu, P.; Chan, E.H.W.; Qian, Q.K. Success factors of energy performance contracting (EPC) for sustainable building energy efficiency retrofit (BEER) of hotel buildings in China. Energy Policy 2011, 39, 7389–7398. [Google Scholar] [CrossRef]

- Hannon, M.J.; Bolton, R. UK Local Authority engagement with the Energy Service Company (ESCo) model: Key characteristics, benefits, limitations and considerations. Energy Policy 2015, 78, 198–212. [Google Scholar] [CrossRef]

- Bougrain, F. Turning energy data into actionable information: The case of energy performance contracting. In Integrating Information in Built Environments: From Concept to Practice; CRC Press: Boca Raton, FL, USA, 2017. [Google Scholar] [CrossRef]

- ENERJ. Guidelines for Actions towards Energy Efficiency; ENERJ: London, UK, 2017. [Google Scholar]

- Martiniello, L.; Morea, D.; Paolone, F.; Tiscini, R. Energy performance contracting and public-private partnership: How to share risks and balance benefits. Energies 2020, 13, 3625. [Google Scholar] [CrossRef]

- Panteli, C.; Klumbytė, E.; Apanavičienė, R.; Fokaides, P.A. An overview of the existing schemes and research trends in financing the energy upgrade of buildings in Europe. J. Sustain. Archit. Civ. Eng. 2020, 27, 53–62. [Google Scholar] [CrossRef]

- Lee, P.; Lam, P.T.I.; Lee, W.L. Risks in Energy Performance Contracting (EPC) projects. Energy Build. 2015, 92, 116–127. [Google Scholar] [CrossRef]

- Roshchanka, V.; Evans, M. Scaling up the energy service company business: Market status and company feedback in the Russian Federation. J. Clean. Prod. 2016, 112, 3905–3914. [Google Scholar] [CrossRef] [Green Version]

- Xu, P.; Chan, E.H.W. ANP model for sustainable Building Energy Efficiency Retrofit (BEER) using Energy Performance Contracting (EPC) for hotel buildings in China. Habitat Int. 2013, 37, 104–112. [Google Scholar] [CrossRef]

- Cruz, C.O.; Sarmento, J.M. Reforming traditional PPP models to cope with the challenges of smart cities. Compet. Regul. Netw. Ind. 2017, 18, 94–114. [Google Scholar] [CrossRef]

- Andrade, I.; Cruz, C.O.; Sarmento, J.M. Renegotiations of water concessions: Empirical analysis of main determinants. J. Water Resour. Plan. Manag. 2018, 144, 04018073. [Google Scholar] [CrossRef]

- Cruz, C.O.; Marques, R.C. Risk-sharing in highway concessions: Contractual diversity in Portugal. J. Prof. Issues Eng. Educ. Pract. 2013, 139, 99–108. [Google Scholar] [CrossRef]

- Neto, D.D.C.E.S.; Cruz, C.O.; Sarmento, J.M. Understanding the patterns of PPP renegotiations for infrastructure projects in Latin America: The case of Brazil. Compet. Regul. Netw. Ind. 2017, 18, 271–296. [Google Scholar] [CrossRef]

- Bing, L.; Akintoye, A.; Edwards, P.J.; Hardcastle, C. The allocation of risk in PPP/PFI construction projects in the UK. Int. J. Proj. Manag. 2005, 23, 25–35. [Google Scholar] [CrossRef]

- Taylor, R.P.; Govindarajalu, C.; Levin, J.; Meyer, A.S.; Ward, W.A. Financing Energy Efficiency: Lessons from Brazil, China, India, and Beyond; Energy Sector Management Assistance Programme: Washington, DC, USA, 2008. [Google Scholar]

- Pätäri, S.; Sinkkonen, K. Energy Service Companies and Energy Performance Contracting: Is there a need to renew the business model? Insights from a Delphi study. J. Clean. Prod. 2014, 66, 264–271. [Google Scholar] [CrossRef]

- Goldman, C.A.; Hopper, N.C.; Osborn, J.G. Review of US ESCO industry market trends: An empirical analysis of project data. Energy Policy 2005, 33, 387–405. [Google Scholar] [CrossRef] [Green Version]

- Hopper, N.; Goldman, C.; McWilliams, J.; Birr, D.; Stoughton McMordie, K. Public and Institutional Markets for ESCO Services: Comparing Programs, Practices and Performance. 2005. Available online: https://escholarship.org/content/qt4d40p3hv/qt4d40p3hv_noSplash_7a43d6c6c441a2f00eb72f7104819fde.pdf?t=lnq9py (accessed on 28 March 2022).

- Carbonara, N.; Pellegrino, R. Public-private partnerships for energy efficiency projects: A win-win model to choose the energy performance contracting structure. J. Clean. Prod. 2018, 170, 1064–1075. [Google Scholar] [CrossRef]

- Bolton, P.; Dewatripont, M. Contract Theory; MIT Press: Cambridge, MA, USA, 2005. [Google Scholar]

- Qian, D.; Guo, J. Research on the energy-saving and revenue sharing strategy of ESCOs under the uncertainty of the value of Energy Performance Contracting Projects. Energy Policy 2014, 73, 710–721. [Google Scholar] [CrossRef]

- Zhang, W.; Yuan, H. Promoting energy performance contracting for achieving urban sustainability: What is the research trend? Energies 2019, 12, 1443. [Google Scholar] [CrossRef] [Green Version]

- Wang, Z.; Xu, G.; Lin, R.; Wang, H.; Ren, J. Energy performance contracting, risk factors, and policy implications: Identification and analysis of risks based on the best-worst network method. Energy 2019, 170, 1–13. [Google Scholar] [CrossRef]

- Siemiatycki, M.; Farooqi, N. Value for money and risk in public–private partnerships: Evaluating the evidence. J. Am. Plan. Assoc. 2012, 78, 286–299. [Google Scholar] [CrossRef]

- Cruz, C.O.; Marques, R.C. Using probabilistic methods to estimate the public sector comparator. Comput. Aided Civ. Infrastruct. Eng. 2012, 27, 782–800. [Google Scholar] [CrossRef]

- European Public-Private Partnerships Expertise Centre. Value for Money Assessment Review of Approaches and Key Concepts. 2015, pp. 1–96. Available online: https://www.minfin.bg/upload/17040/epec_value_for_money_assessment_en.pdf (accessed on 28 March 2022).

- Cusano, M.; Barbabella, A. Piano di Azione per l’Energia Sostenible. 2011. Available online: http://www.comune.rignanoflaminio.rm.it/flex/cm/pages/ServeAttachment.php/L/IT/D/0%252F4%252F0%252FD.f3c63df0d0528ee6ffde/P/BLOB%3AID%3D127/E/pdf (accessed on 28 March 2022).

- Colella, M.; Tripaldi, G.; Rossi, L.; Mezzi, D.; Nutta, A.; Sebastianelli, G.; Vannini, N. Gli Impianti di Pubblica Illuminazione in Partenariato Pubblico Privato Manuale Operativo. 2013. Available online: https://www.rm.camcom.it/moduli/downloadFile.php?file=oggetto_pubblicazioni/18251009560O__OManualePPP_PubblicaIlluminazione.pdf (accessed on 28 March 2022).

- GOLEA. Akcijski Načrt za Trajnostno Energijo Mestne Občine Koper; GOLEA: Nova Gorica, Slovenia, 2019; Available online: https://visitkoper.si/wp-content/uploads/2021/06/SEAP_MOK_koncno_porocilo_april_2019.pdf (accessed on 28 March 2022).

- LEITAT. Roadmap towards Nearly Zero Energy Sport Buildings. 2015. Available online: https://projects.leitat.org/wp-content/uploads/2017/02/4_Roadmap-towards-NZE-Sports-Buildings-JesusFerreira-Consultores.pdf (accessed on 28 March 2022).

- Luheto, A.P.X. Evaluation of Investment Projects in Contexto Risk and Uncertainty. Ph.D. Thesis, Polytechnic Institute of Setúbal, Setúbal, Portugal, 2018. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).