Revisiting the Missing Link: An Ecological Theory of Money for a Regenerative Economy

Abstract

1. Introduction

2. Methods

3. Revisiting the Missing Link

3.1. An Ecological Ontology of Money

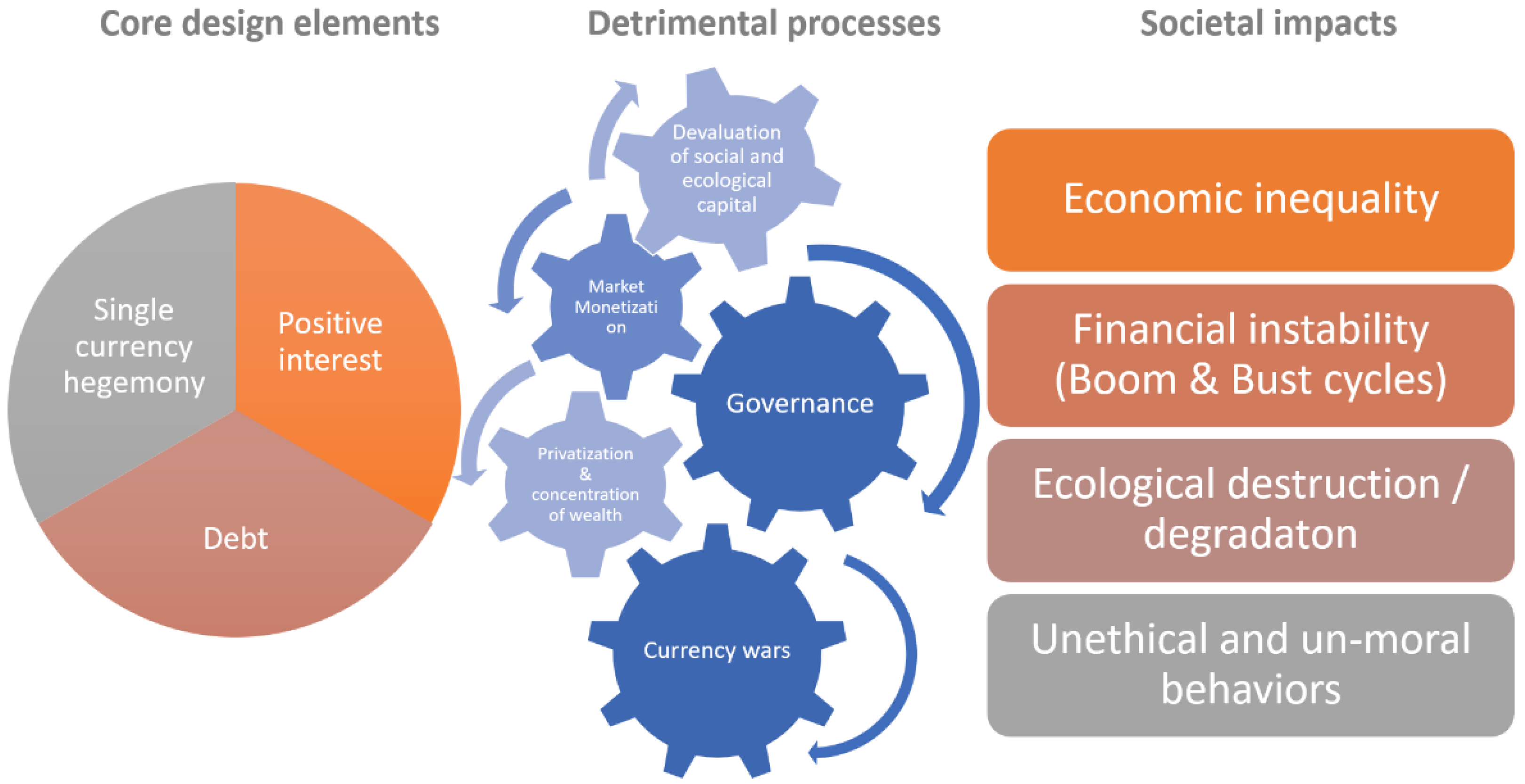

3.2. The Critique of the Current System: Structural Design and Detrimental Processes

3.3. Establishing Priorities for Monetary Reform

4. New Developments for Ecological Monetary Theory

4.1. An Ecological Theory of Value

4.2. A Monetary Socioecological Transition

5. A Monetary Ecosystem beyond Sustainability

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Alves, F.M.; Kovasna, A.; Penha-Lopes, G. Alternative monetary narratives and experiments—Systematizing the necessary societal transition. J. Stud. Citizsh. Sustain. 2019, 4, 77–94. [Google Scholar]

- Lietaer, B.; Dunne, J. Rethinking Money: How New Currencies Turn Scarcity into Prosperity; Berret-Koehler Publishers, Inc.: San Francisco, CA, USA, 2013. [Google Scholar]

- Lietaer, B.; Arnsperger, C.; Goerner, S.; Brunnhuber, S. Money and Sustainability—The Missing Link; Triarchy Press: Bridport, UK, 2013. [Google Scholar]

- Hornborg, A. How to turn an ocean liner: A proposal for voluntary degrowth by redesigning money for sustainability, justice and resilience. J. Political Ecol. 2017, 24, 624–634. [Google Scholar] [CrossRef]

- Simms, A. Tackling the ‘triple crunch’ of financial crisis, climate change and soaring enery prices with a Green New Deal. In Triple Crunch—Joined-Up Solutions to Financial Chaos, Oil Decline and Climate Change to Transform the Economy; Potts, R., Ed.; New Economics Foundation: London, UK, 2009; pp. 3–6. [Google Scholar]

- Mellor, M. The Future of Money: From Financial Crisis to Public Resource; Pluto Press: London, UK, 2010. [Google Scholar]

- Arnsperger, C.; Bendell, J.; Slater, M. Monetary Adaptation to Planetary Emergency: Addressing the Monetary Growth Imperative; Institute for Leadership and Sustainability: Cumbria, UK, 2021; Unpublished. [Google Scholar]

- Turner, A. Between Debt and the Devil: Money, Credit and Fixing Global Finance; Princeton University Press: Princeton, NJ, USA, 2016. [Google Scholar]

- Hellwig, M. Twelve Years after the Financial Crisis—Too-big-to-fail is still with us. J. Financ. Regul. 2021, 7, 175–187. [Google Scholar] [CrossRef]

- Seyfang, G.; Gilbert-Squires, A. Move your money? Sustainability Transitions in Regimes and Practices in the UK Retail Banking Sector. Ecol. Econ. 2018, 156, 224–235. [Google Scholar] [CrossRef]

- OECD. OECD Data. Retrieved from OECD Data—Houselhold Debt. Available online: https://data.oecd.org/hha/household-debt.htm (accessed on 6 December 2021).

- de la Cuesta-González, M.; Ruaz, C.; Rodriguez-Fernandez, J. Rethinking the Income Inequality and Financial Development Nexus. A Study of Nine OECD Countries. Sustainability 2020, 12, 5449. [Google Scholar] [CrossRef]

- UNEP. Global Environmental Outlook 6; Cambridge University Press: Cambridge, UK, 2019. [Google Scholar]

- World Economic Forum. Global Risks Report, 16th ed.; WEF: Geneva, Switzerland, 2021. [Google Scholar]

- Ranjbari, M.; Esfandabadi, Z.S.; Zanetti, M.C.; Scagnelli, S.D.; Siebers Peer-Olaf Aghbashlo, M.; Peng, W.; Quatraro, F.; Tabatabaei, M. Three pillars of sustainability in the wake of COVID-19: A systematic review and future research agenda for sustainable development. J. Clean. Production. 2021, 297, 126660. [Google Scholar] [CrossRef]

- Svartzman, R.; Dron, D.; Espagne, E. From ecological macroeconomics to a theory of endogenous money for a finite planet. Ecol. Econ. 2019, 162, 108–120. [Google Scholar] [CrossRef]

- Meadows, D. Leverage Points—Places to Intervene in a System; Sustainability Institute: Hartland, VT, USA, 1999. [Google Scholar]

- Graeber, D. Debt: The First 5000 Years; Penguin: London, UK, 2012. [Google Scholar]

- Mäki, U. Reflections on the Ontology of Money. J. Soc. Ontol. 2020, 6, 245–263. [Google Scholar] [CrossRef]

- Fuller, E.W. A Source Book on Early Monetary Thought—Writings on Money before Adam Smith; Edward Elgar Publishing: Palo Alto, CA, USA, 2020. [Google Scholar]

- Aspinall, N.G.; Jones, S.R.; McNeill, E.; Werner, R.A.; Zalk, T. Sustainability and the financial system—Review of literature 2015. Br. Actuar. J. 2015, 23, 1–21. [Google Scholar] [CrossRef]

- Dodd, N. The Social Life of Money; Princeton University Press: Princeton, NJ, USA, 2014. [Google Scholar]

- Ajili, W. Do We Have to Rethink Sovereign Debt of Developing Countries? In Handbook of Research on Institutional, Economic, and Social Impacts of Globalization and Liberalization; Bayar, Y., Ed.; IGI Global: Bandırma, Turkey, 2021; pp. 337–355. [Google Scholar]

- Ibrahim Ari, M.K. Sustainable Financing for Sustainable Development: Understanding the Interrelations between Public Investment and Sovereign Debt. Sustainability 2018, 10, 3901. [Google Scholar]

- Duffie, D. Financial Regulatory Reform After the Crisis: An Assessment. ECB Forum on Central Banking; European Central Bank: Sintra, Portugal, 2016; pp. 1–70. [Google Scholar]

- Quaglia, L. Financial regulation and supervision in the European Union after the crises. J. Econ. Policy Reform 2013, 16, 17–30. [Google Scholar] [CrossRef]

- Fiscus, D. Life, Money, and the Deep Tangled Roots of Systemic Change for Sustainability. World Futures 2013, 69, 555–571. [Google Scholar] [CrossRef]

- Raworth, K. Doughnut Economics: Seven Ways to Think Like a 21st-Century Economist; Penguin Random House UK: London, UK, 2017. [Google Scholar]

- Arestis, P.; Sawyer, M. A Handbook of Alternative Monetary Economics; Edward Elgar Publishing Limited: Cheltenham, UK, 2017. [Google Scholar]

- Laevan, L.; Valencia, F. Systemic Banking Crises Database: An Update; Working Paper WF/12/163; IMF: Washington, DC, USA, 2012. [Google Scholar]

- Ament, J. Towards an Ecological Monetary Theory. Sustainability 2019, 11, 923. [Google Scholar] [CrossRef]

- Ament, J. Towards an Ecological Monetary Theory 2020. Available online: https://www.sciencedirect.com/science/article/abs/pii/S0921800919306962 (accessed on 16 December 2021).

- Erickson, J.G. The approach of ecological economics. Camb. J. Econ. 2005, 29, 207–222. [Google Scholar]

- Tymoigne, É.; Wray, L.R. Money: An alternative story. In A Handbook of Alternative Monetary Economics; Arestis, P., Sawyer, M., Eds.; Edward Elgar Publishing Limited: Cheltenham, UK, 2007; pp. 1–17. [Google Scholar]

- Glenda Amaral, T.P. Towards a Reference Ontology of Money: Monetary Objects, Currencies and Related Concepts. In 14th International Workshop on Value Modelling and Business Ontologies; VMBO: Brussels, Belgium, 2020. [Google Scholar]

- Searle, J.R. Money: Ontology and Deception. Camb. J. Econ. 2017, 41, 1453–1470. [Google Scholar] [CrossRef]

- Zelizer, V.A. The Social Meaning of Money: Pin Money, Paychecks, Poor Relief, and Other Currencies; Princeton University Press: Princeton, NJ, USA, 2017. [Google Scholar]

- Blanc, J.; Desmedt, L.; Le Maux, L.; Marques-Pereira, J.; Ahmed, P.O.; Theret, B. Monetary Plurality in Economic Theory. In Monetary Plurality in Local, Regional and Global Economies; Gómez, G.M., Ed.; Routledge: London, UK, 2018; pp. 18–46. [Google Scholar]

- Desan, C. The constitutional approach to money. In Money Talks: Explaining How Money Really Works; Bandelj, N., Wherry, F.F., Zelizer, V.A., Eds.; Princeton University Press: Princeton, NJ, USA, 2017; pp. 109–130. [Google Scholar]

- Aglietta, M.; Ahmed, O.P.; Ponsot, J. La Monnaie, Entre Dettes et Souveraineté; Odile Jacob: Paris, French, 2016. [Google Scholar]

- Douthwaite, R. The Ecology of Money; Green Books for the Schumacher Society: Bristol, UK, 1999. [Google Scholar]

- Kuzminski, A. The Ecology of Money: Debt, Growth and Sustainability; Lexington Books: Plymouth, UK, 2013. [Google Scholar]

- Inglis, D.; Pascual, U. On the links between nature’s values and language. People Nat. 2021, 1–17. [Google Scholar] [CrossRef]

- Brooks, S. How green is Your Money? Mapping the relationship between monetary systems and the environment. Int. J. Community Curr. Res. 2015, 19, 12–18. [Google Scholar]

- Bullough, O. Moneyland; Profile Books: London, UK, 2018. [Google Scholar]

- Ferguson, N. The Ascent of Money: A Financial History of the World; Penguin Press: New York, NY, USA, 2008. [Google Scholar]

- Loorbach, D.; Frantzeskaki, N.; Avelino, F. Sustainability Transtions Research: Transforming Science and Practice for Societal Change. Annu. Rev. Environ. Resour. 2017, 42, 599–626. [Google Scholar] [CrossRef]

- Amato, M.; Fantacci, L. Handbook of the History of Money and Currency; Springer: Singapore, 2020. [Google Scholar]

- Blanc, J. Unpacking Monetary Complementarity and Competition: A Conceptual Framework. Camb. J. Econ. 2017, 41, 239–257. [Google Scholar] [CrossRef]

- Gómez, G.M. Monetary Plurality in Local, Regional and Global Economies; Routledge: New York, NY, USA, 2019. [Google Scholar]

- Mouatt, S. The case for Monetary Diversity. Int. J. Community Curr. Res. 2010, 14, 17–28. [Google Scholar]

- Hayek, F.A. Denationalization of Money; Institute of Economic Affairs: London, UK, 1976. [Google Scholar]

- Dyson, B.; Hodgson, G.; van Lerven, F. Sovereign Money; Positive Money UK: London, UK, 2016. [Google Scholar]

- Larue, L. The Ecology of Money: A Critical Assessment. Ecol. Econ. 2020, 178, 106823. [Google Scholar] [CrossRef]

- Hardt, L.; O’Neill, D.W. Ecological Macroeconomic Models: Assessing Current Developments. Ecol. Econ. 2017, 134, 198–211. [Google Scholar] [CrossRef]

- Macchione Saes, B.; Ribeiro Romeiro, A. Ecological macroeconomics: A methodological review. Econ. Soc. 2018, 28, 365–392. [Google Scholar] [CrossRef]

- Pirgmaier, E. The value of value theory for ecological economics. Ecol. Econ. 2021, 179, 106790. [Google Scholar] [CrossRef]

- Douai, A. Value Theory in Ecological Economics: The Contribution of a Political Economy of Wealth. Environ. Values 2009, 18, 257–284. [Google Scholar] [CrossRef]

- Schumpeter, J.A. History of Economic Analysis; Routledge: London, UK, 1987. [Google Scholar]

- Berndt, E.R. From Technocracy to Net Energy Analysis: Engineers, Economists and Recurring Energy Theories of Value; Studies in Energy and the American Economy (MIT); Discussion paper N.11; Massachussets Institute of Technology: Cambridge, MA, USA, 1982. [Google Scholar]

- Contanza, R. Embodied energy and economic valuation. Science 1980, 210, 1219–1224. [Google Scholar] [CrossRef]

- Foster, J.B.; Holleman, H. The theory of unequal ecological exchange: A Marx-Odum dialectic. J. Peasant Stud. 2014, 41, 199–233. [Google Scholar] [CrossRef]

- Judson, D.H. The convergence of neo-Ricardian and embodied energy theories of value and Price. Ecol. Econ. 1989, 1, 261–281. [Google Scholar] [CrossRef]

- Renner, A.; Daly, H.; Mayumi, K. The dual nature of money: Why monetary systems matter for equitable bioeconomy. Environ. Econ. Policy Stud. 2021, 23, 749–760. [Google Scholar] [CrossRef]

- Karakatsanis, G. A Thermodynamic Theory of Money. Ecological Economics and Rio+20: Contributions and Challenges for a Green Economy; International Society for Ecological Economics: Rio de Janeiro, Brazil, 2012. [Google Scholar]

- Kang, J. Energy Coin: A Universal Digital Currency Based on Free Energy. Am. J. Mod. Energy 2020, 6, 95–100. [Google Scholar]

- Ryan-Collins, J.; Schusterand, L.; Greenham, T. Energizing Money—An Introduction to Energy Currencies and Accounting; New Economics Foundation: London, UK, 2012. [Google Scholar]

- Rotmans, J.; Loorbach, D. Complexity and Transition Management. J. Ind. Ecol. 2019, 13, 184–196. [Google Scholar] [CrossRef]

- Fath, B.D.; Fiscus, D.A.; Goerner, S.J.; Berea, A.; Ulanowicz, R.E. Measuring regenerative economics: 10 principles and measures undergirding systemic economic health. Glob. Transit. 2019, 1, 15–27. [Google Scholar] [CrossRef]

- Hascott, L. A Banker’s Guide to Transforming Finance; The Finance Innovation Lab: London, UK, 2020. [Google Scholar]

- Bendell, J.; Greco, T. Currencies of Transition—Transforming Money to Unleash Sustainability. In The Necessary Transition: The Journey towards the Sustainable Enterprise Economy; McIntosh, M., Ed.; Greenleaf Publishing Limited: London, UK, 2013; pp. 221–242. [Google Scholar]

- Markard, J.; Truffer, B. Sustainability transitions: An emerging field of research and its prospects. Res. Policy 2012, 41, 955–967. [Google Scholar] [CrossRef]

- Hanegraaf, R.; Jonker, N.; Mandley, S.; Miedema, J. Life Cycle Assessment of Cash Payments; DNB Working Paper n°610; SSRN: Amesterdam, The Netherlands, 2018. [Google Scholar]

- Sid, J.L.; Englesson, N. How Eco Friendly Is Our Money and Is There an Alternative. Netrogenic. 2017. Available online: https://papers.netrogenic.com/sid/eco-friendly-money.pdf (accessed on 5 January 2022).

- Shonfield, P. Carbon Footprint Assessment: Paper vs. Polymer £5 & £10 Bank Notes; Thinkstep: London, UK, 2017. [Google Scholar]

- Cleancoin. Cleancoins. Retrieved from Cleancoins. Available online: http://www.cleancoins.io/#/info (accessed on 6 December 2021).

- Caré, R. Sustainability in Banks: Emerging Trends. In Sustainable Banking: Issues and Challenges; Caré, R., Ed.; Palgrave Pivot: London, UK, 2018; pp. 93–130. [Google Scholar]

- NGFS. Press Releases. Retrieved from Networking for Greening the Financial Systems. Available online: https://www.ngfs.net/en/communique-de-presse/ngfs-publishes-ngfs-glasgow-declaration-and-continues-foster-climate-action-central-banks-and (accessed on 16 December 2021).

- TEG. EU Green Bond Standard: Usability Guide; EU Technical Group on Sustainable Finance: Brussels, Belgium, 2020; Available online: https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance/european-green-bond-standard_en (accessed on 16 December 2021).

- Truby, J. Decarbonizing Bitcoin: Law and policy choices for reducing the energy consumption of Blockchain technologies and digital currencies. Energy Res. Soc. Sci. 2018, 44, 399–410. [Google Scholar] [CrossRef]

- Stoll, C.; Klaaßen, L.; Gallersdörfer, U. The Carbon Footprint of Bitcoin. Joule 2019, 3, 1647–1661. [Google Scholar] [CrossRef]

- Clarke, D. The Future of Cash: Protecting Access to Payments in the Digital Age; Positive Money UK: London, UK, 2018. [Google Scholar]

- Van Hove, L. On the War on Cash and its spoils. Int. J. Eletronic Bank. 2008, 1, 36–45. [Google Scholar] [CrossRef]

- Burcak Inel 2008, R. P. 2021. European Bank Practices in Implementing and Supporting the SDG’s. European Banking Federation and KPMG Spain. Available online: https://www.ebf.eu/wp-content/uploads/2021/06/European-bank-practices-in-supporting-and-implementing-the-UN-Sustainable-Development-Goals.pdf (accessed on 31 March 2022).

- ECB. Research & Publications. Retrieved from European Central Bank. Available online: https://www.ecb.europa.eu/pub/html/index.en.html#/search/sustainability/1 (accessed on 16 December 2021).

- Uğurlu, E.N.; Epstein, G. The Public Banking Movement in the United States: Networks, Agenda, Initiatives, and Challenges; Political Economy Research Institute: Amherst, MA, USA, 18 March 2021; pp. 1–46. [Google Scholar]

- UNEP. Aligning the Financial System with Sustainable Development: The Coming Financial Climate; United Nations Environment Programme: Nairobi, Kenya, 2015. [Google Scholar]

- Kedward, K.; Buller, A.; Ryan-Collins, J. Quantitative Easing and Nature Loss: Exploring Nature-Related Financial Risks and Impacts in the European Central Bank’s Corporate Bond Portfolio; Institute for Innovation and Public Purposes: London, UK, 2021. [Google Scholar]

- Barnes, M. Shadow banking: The next financial crisis? Co. Lawyer 2021, 42, 136–145. [Google Scholar]

- Jourdan, S.; Kalinowski, W. Aligning Monetary Policy with the EU’s Climate Targets; Veblen Institute for Economics Reforms & Positive Money Europe: Brussels, Belgium, 2019. [Google Scholar]

- Uzsoki, D.; Guerdat, P. Impact Tokens—A Blockchain-based Solution for Impact Investing; International Institute for Sustainable Development: Winnipeg, MB, Canada, 2019. [Google Scholar]

- Joachain, H.; Klopfert, F. Emerging Trends of Complementary Currencies Systems as Policy Instruments for Environmental Purposes: Changes Ahead? Int. J. Community Curr. Res. 2012, 16, 156–168. [Google Scholar]

- Seyfang, G. Carbon Currencies: A New Gold Standard for Sustainable Consumption? Centre for Social and Economic Research on the Global Environment 2009, 1, 1–16. [Google Scholar]

- Seyfang, G.; Longhurst, N. Growing green money? Mapping community currencies for sustainable development. Ecol. Econ. 2013, 86, 65–77. [Google Scholar] [CrossRef]

- Michel, A.; Hudon, M. Community currencies and sustainable development: A systematic review. Ecol. Econ. 2015, 116, 160–171. [Google Scholar] [CrossRef]

- Wahl, D. Designing Regenerative Cultures; Triarchy Press: Bridport, UK, 2016. [Google Scholar]

- Fullerton, J. Finance for a Regenerative World; Capital Institute: New York, NY, USA, 2018. [Google Scholar]

- CIA. People Powered Money—Designing, Developing & Delivering Community Currencies; New Economics Foundation: London, UK, 2015. [Google Scholar]

- Zeller, S. Economic Advantages of Community Currencies. J. Risk Financ. Manag. 2020, 13, 271. [Google Scholar] [CrossRef]

- Niepelt, D. Central Bank Digital Currency: Considerations, Projects, Outlook; Centre for Economic Policy Research: London, UK, 2021. [Google Scholar]

- Serra, F.L. Manual de Diseño de Monedas Locales de Iniciativa Municipal; ADER: La Palma, Spain, 2015. [Google Scholar]

- Davis, T. Corporates Using Crypto: Conducting Business with Digital Assets; Deloitte: London, UK, 2021. [Google Scholar]

- Motta, W.; Dini, P.; Sartori, L. Self-Funded Social Impact Investment: An Interdisciplinary Analysis of the Sardex Mutual Credit System. J. Soc. Entrep. 2017, 8, 149–164. [Google Scholar] [CrossRef]

- Gibbons, L.V. Regenerative—The New Sustainable? Sustainability 2020, 12, 5483. [Google Scholar] [CrossRef]

- Huntjens, P. (Ed.) Towards a Natural Social Contract. In Towards a Natural Social Contract—Transformative Social-Ecological Innovation for a Sustainable, Healthy and Just Society; Springer: Berlin/Heidelberg, Germany, 2021; pp. 27–79. [Google Scholar]

- Mazzucato, M. The Value of Everything—Making and Taking in the Modern Economy; Public Affairs: New York, NY, USA, 2018. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alves, F.M.; Santos, R.; Penha-Lopes, G. Revisiting the Missing Link: An Ecological Theory of Money for a Regenerative Economy. Sustainability 2022, 14, 4309. https://doi.org/10.3390/su14074309

Alves FM, Santos R, Penha-Lopes G. Revisiting the Missing Link: An Ecological Theory of Money for a Regenerative Economy. Sustainability. 2022; 14(7):4309. https://doi.org/10.3390/su14074309

Chicago/Turabian StyleAlves, Filipe Moreira, Rui Santos, and Gil Penha-Lopes. 2022. "Revisiting the Missing Link: An Ecological Theory of Money for a Regenerative Economy" Sustainability 14, no. 7: 4309. https://doi.org/10.3390/su14074309

APA StyleAlves, F. M., Santos, R., & Penha-Lopes, G. (2022). Revisiting the Missing Link: An Ecological Theory of Money for a Regenerative Economy. Sustainability, 14(7), 4309. https://doi.org/10.3390/su14074309