Abstract

Collaborative networks in the logistics sector have proven to be a solution that both meets environmental footprint reduction goals and addresses the impact of rising fuel prices on logistics companies, especially for small- and medium-sized enterprises. Despite these benefits, these collaborative networks have not received the desired amount of participation due to reputational risk. This paper develops a framework for assessing and managing reputational risk to encourage logistics companies’ participation in collaborative networks. To this end, customer satisfaction factors were correlated with logistics operations, and this correlation was then modeled using the Bowtie method, fault trees, event trees, reliability theory, and the Monte Carlo model. The results show that it is possible to implement a structured model that can be easily put into practice. Using an illustrative case study, it is also possible to prioritize three companies according to their reputational risk as assessed by the proposed model. The developed model can promote the sustainability of collaborative networks in the logistics industry by assessing and consistently reducing reputational risk, thus supporting the strengthening of the relationship between suppliers, logistics service providers, and end customers.

1. Introduction

Collaborative networks in the logistics sector have proven to be a solution that meets the goal of reducing both the environmental footprint and the impact of rising fuel prices on logistics companies, especially for small- and medium-sized enterprises. Despite these benefits, these networks have not received the desired amount of participation due to reputational risk. This fact has in some ways limited the capacity of these collaborative networks and reduced their effectiveness in contributing to the sustainability of societies.

Sustainability can be described as a set of strategies to meet the present needs of society without compromising the ability of future generations to meet their own needs [1]. This concern for future generations has grown in recent years as a result of active societal awareness and regulatory initiatives aimed at promoting sustainability.

The main fields of action for sustainable development are the reduction in the consumption of raw materials and products, the increase in the reusing and recycling of products, and the reduction in waste in the most diverse sectors of industry, especially from energy consumption, which improves natural resources’ sustainability and reduces the carbon footprint [2].

In fact, the negative impact of excessive energy consumption due to technological development and economic growth is the main cause that led to the creation of various environmental initiatives around the world. These impacts range from global warming to the environmental burdens of extracting and transporting fossil fuels [3].

To mitigate these impacts, regulators have established standards to reframe industry thinking and strategies, sometimes resulting in additional efforts for companies. For example, limiting emissions from internal combustion engines has challenged automakers to develop new, more fuel-efficient and environmentally friendly engines to replace engine models that are still in the early stages of their life cycle and have a high level of reliability. This fact has a negative impact on these companies, as the expected life cycle of the engines is shorter than estimated, which reduces the financial return on investment from development and production [4].

Another example is taxes on fuels. The tax burden on fuels in Europe varies between 50.8% and 66.5% depending on the country and the type of fuel, which are very high taxes aimed at reducing fuel consumption in order to reduce CO2 emissions. However, these strategies have a negative economic impact on companies, end users, and society in general, so alternative strategies are needed to mitigate or avoid these types of impacts as a result of regulatory initiatives, especially for small- and medium-sized enterprises (SMEs). These companies play an important role in the economy of societies. In many countries, SMEs represent around 87% of companies, playing a key role in the economy, creating jobs, promoting economic growth, and contributing significantly to gross domestic product (GDP). However, despite their important role in the economy, these companies have some weaknesses and are very sensitive to market fluctuations and regulatory adjustments. In addition to these external factors, SMEs have some internal weaknesses such as difficulties accessing financing, a lack of manpower, a lack of efficient management, inadequate infrastructure, and obsolete technology, among others. Due to the limitations faced by SMEs, support and incentive programs have been created over the last few years to promote the growth of these companies by encouraging smart growth (industry 4.0), the implementation of sustainable strategic decisions, and the adoption of inclusive policies [5].

On the one hand, these incentives are intended to support SMEs, but on the other hand, regulatory initiatives that aim to promote sustainable development create additional challenges for these companies. The solution is not to eliminate regulatory initiatives, but instead to create solutions to overcome these additional challenges.

For example, the transport industry has a major impact on the ecological footprint, contributing heavily to the greenhouse effect, and due to this fact, it is directly affected by regulatory initiatives. The continuous increase in fuel prices and taxes on the acquisition and maintenance of vehicles has reduced the profit margins of these companies. On the other hand, alternative vehicles powered by electricity or hydrogen still do not offer operating conditions compatible with the operational needs of this industry. As a result, these companies are under pressure to reduce their contribution to the ecological footprint, but the existing alternatives are not operationally viable, especially in the land freight sector.

Taking the case of Portugal as an example, small- and medium-sized companies in the land transport sector represent around 1.6% of Portuguese SMEs with a pre-pandemic turnover of around 7.5 billion euros, according to a Bank of Portugal report published in 2020 [6]. According to the same report, when comparing the financial autonomy of SMEs in the transport sector with other SMEs in Portuguese industry, it can be seen that, over the last decade, the ability of these companies to meet their financial commitments through equity (financial autonomy) was always lower than that of SMEs from other sectors, indicating that this sector has lower profit margins compared to others.

However, from 2011 to 2017, SMEs in the freight transport sector followed the other sectors in a growing trend towards increased financial autonomy, despite still having a lower degree of autonomy. After 2017, this trend diverged significantly; the other sectors continued to show a positive growth rate, and the transport sector started to show a negative growth rate. Between 2017 and 2020, the financial autonomy of these companies was 29.4% in 2017, 28.6% in 2018, 27.19% in 2019, and 13.14% in 2020, respectively. The results for 2020 were the lowest values recorded in the decade 2010–2020. This decrease in financial autonomy results from the change in the trend of the price of diesel in 2016; since 2012, the annual trend in the price of this fuel had been decreasing, but in 2016, this trend was reversed, moving to a positive price change rate [7].

In practice, the freight transport sector is very sensitive to changes in fuel prices, which can jeopardize the survival of small- and medium-sized companies in this sector. Despite the importance of the freight transport sector for the proper functioning of the economy, government aid to these SMEs in the form of reduced taxes on fuels cannot directly solve the problem, because, in this way, they would be promoting an increase in the ecological footprint and going against the UN’s 2030 Agenda. This can be considered an industrial problem with negative impacts both on the sustainability of the sector and on the growth of the economy in general. The development of sustainable solutions to eliminate or mitigate these impacts is of the utmost importance [8].

To solve this logistical problem and reduce operating costs, researchers have proposed new management models based on collaborative approaches which meet one of the 17 objectives of the UN, namely the development of partnerships in the implementation of the UN goals. The main objective of these models is to reduce waste in the transport of goods, also known as “empty running” [9,10].

According to the UK Department of Transport, capacity utilization between 2006 and 2016 was 68%, and freight transport efficiency was 48%. The same report indicates that “empty running” waste has been gradually increasing. One of the reasons for this increase is the concern of suppliers for final customer satisfaction. High levels of satisfaction promote customer loyalty, and in this sense, suppliers have pressured logistics operators for faster deliveries. This in turn promotes “empty running” waste because the time to guarantee the “full running” condition is increasingly reduced [11].

The development of collaborative models in logistics intends to face this problem through the creation of virtual companies that manage collaborative logistics networks. These companies aim to manage information related to the participants of the collaborative network by evaluating the available transport space and respective routes, optimizing route selection according to the logistics mission, and selecting the match between the mission and the logistics operator that results in the best performance of the network.

For these collaborative networks to be efficient, it is necessary that the network has as many participants as possible, so that the size of the network’s resources has a dimension that allows for the sustainability of the network. The problem is that the participation in these collaborative networks has been relatively low, making it difficult to create coalitions, particularly for small- and medium-sized enterprises, as they are relatively vulnerable to negative impacts; it is because of this that they tend not to adopt strategies of great uncertainty [12]. These facts have been reinforced by the strong competition verified in the sector; therefore a strong strategy is necessary to promote trust between the participating entities in the collaborative network, since for the correct functioning of these collaborative networks, it is necessary to share sensitive information such as costs, needs, and the cost/benefit ratio, among other information [13]. In this sense, the development of risk analysis and management models that make it possible to assess and manage uncertainty in the selection of the match between entities for a given mission is of great importance to promote trust between existing participating entities in the network and to promote the participation of new entities in the collaborative network.

This work fills the research gap on collaborative networks in the logistics sector, where reputational risk has negatively affected logistics companies’ participation in these networks. To this end, a model of reputational risk was developed to encourage the participation of potential companies in collaborative logistics networks, with a focus on small- and medium-sized enterprises to increase the capacity of these networks. This model aims to evaluate and manage the reliability of the decisions made in selecting the most suitable companies for a given task. The selection of the right partner within the network is extremely important to minimize the risks for both the participants and the collaborative network. This selection cannot be completed in the same way for all missions. A range of events must be considered that vary over time, such as political, social, economic, technical, and financial events. The proposed model is a quantitative model and is developed using reliability theory along with the Monte Carlo model. The approach to developing the model focuses on the key risk factors identified based on the typical business models that are seen in collaborative logistics networks. To illustrate the application of the model, a case study was developed to analyze and discuss the robustness of the model.

2. Literature Review

In this section, a literature review is conducted on two knowledge areas. One focuses on collaborative networks, and the other on risk analysis and management tools. At the end, some risk factors related to collaborative networks are identified and analyzed to be used in the proposed reputational risk model.

2.1. Collaborative Networks

Collaborative networks are organizational systems capable of bringing together individuals and institutions in a participatory manner for related purposes. They are flexible structures and are horizontally structured [14]. Originally, they were created with the aim of reducing uncertainty and risk and organizing economic activities through coordination and cooperation between companies. The implementation of collaborative processes has accelerated in recent years due to new business challenges, rapid socioeconomic change, and new developments in information and communication technology [15].

There are different types of collaborative networks, the most common of which are social networks that focus on relationships between social entities; virtual organizations, which include a number of independent organizations that share resources and capabilities to achieve a common goal; virtual enterprises, which emerge from a temporary alliance of organizations that share capabilities and resources to respond more efficiently to market opportunities; agile enterprises, where the organization’s ability to continuously adapt in an environment of unpredictable change results from cooperative strategies; joint ventures, in which several companies temporarily combine into a single entity to jointly carry out an economic activity; and finally, the collaborative network of the cluster type, in which there is a geographical concentration of interrelated companies operating in the same sector and sharing not only the location but also the responsibility for the development of products and services [16].

For collaborative networks to be successful, they must meet a number of requirements to ensure network sustainability. In particular, the companies that are part of the network must be willing to share information, make synchronized decisions, promote the fair sharing of profits, update and share their capacities, have integration policies, align their goals with those of the other companies in the network, plan strategies and objectives together, foster trusting relationships, and maintain open and fair communication. All of these requirements have a certain level of risk that may negatively affect the companies that participate in the network [17].

On the other hand, there are a number of factors that can hinder the effective functioning of collaborative networks or jeopardize their sustainability, namely, lack of trust, impersonal and poor relationships, inconsistent business strategies, a mentality limited to processes without considering a holistic view, inaccurate information, and poor communication channels. Of these factors, a lack of trust has the greatest impact on the collaboration network, as it strongly encourages network collaborators to leave the network. In the majority of cases, this factor increases the sense of risk regarding the company’s participation in the network [18].

The benefits of membership in collaborative networks depend on the network’s area of activity. However, there are some benefits that can be considered universal and independent of the area of activity. For example, belonging to a collaborative network can increase the efficiency and effectiveness of the company, promote its expansion, improve its communication, increase the quality of its work processes, increase the reliability of the company’s operations, increase its creativity and productivity, and, most importantly, promote the financial profit of the company [19].

The literature is replete with work addressing the inherent risks of collaborative networks in a variety of domains, such as works promoting sustainable systems related to innovation in collaborative networks [20], modeling risks related to collaborative networks to determine the likelihood and impact of projects [21], modeling risks related to information sharing, information management, and knowledge [22], incorporating heuristic models to analyze and manage risks in collaborative networks [23], and identifying the benefits of applying risk models in collaborative networks [24]. Despite the extensive amount of work in the literature and to the best of the authors’ knowledge, no reputational risk model developed for collaborative networks in the logistics sector can be found in the literature. In this sense, the work developed in this study is innovative and fills a knowledge gap in risk assessment and management of collaborative networks.

2.2. Risk Assessment and Management

According to the International Organization for Standardization’s 31000 standard (ISO 31000), organizations of all types and sizes face internal and external factors that can jeopardize the achievement of their goals and expectations. These factors always have an associated level of uncertainty and impact, and their aggregate assessment represents the so-called risk that organizations face [25].

Risk assessment aims to support decision making in all activities of an organization. All activities involve a certain level of risk, and its management intends to control this level through logical and systematic treatment actions. Although the interpretation and management of risk is an intrinsic human capacity, it is limited when several risk factors are simultaneously involved in decision making, i.e., aggregate risk assessment requires the use of appropriate tools as well as a logical and systematic framework in order to make possible the correct interpretation of decision making.

Organizations benefit greatly from the application of risk analysis and management practices in their most varied activities. For example, it increases the likelihood of achieving their objectives, improves the identification of opportunities and threats, improves governance, increases confidence, minimizes losses, improves the efficiency of operations, and so on [26].

Despite the benefits inherent to risk analysis and management methods, their application to collaborative networks is somehow limited, especially for collaborative networks in logistics. In the literature, one can find a reasonable number of works related to collaborative networks in logistics, but there are few works that include collaborative risk analysis and management as an integral part of their model proposals; in this sense, there is limited knowledge in this area of investigation.

However, collaborative risk management has begun to gain a modest momentum in the literature. According to [27], in a time window of 21 years, from 1996 to 2017, 53 articles on collaborative risk management were published outside the scope of supply chain and operations management, and only 23 focused on this topic, demonstrating a modest growth trend. The most important research topics covered have been on sharing information, standardization procedures, decision synchronization, incentive alignment, supply chain and process integration, and collaborative system performance.

According to the same authors, and despite the inherent advantages of collaborative risk assessment and management, a clear and effective definition of collaborative risk management as well as a clear demonstration of its respective advantages is lacking in most of the works published in this time window; this fact may be at the origin of the trend found.

Another possible reason could be the fact that collaborative networks are complex systems whose risk is modeled through the selection of models that best suit the scenario, or a tailor-made approach. In this sense, there is no “one-size-fits-all” solution to assess the risk inherent to systems, and this fact may also be at the origin of the aforementioned trend.

In the literature, a wide range of risk assessment and management models can be found alongside strong evidence of their acceptance in academia [28]. These models can be divided into three broad categories, namely, quantitative models, qualitative models, and mixed models employing both qualitative and quantitative approaches. In practice, quantitative models are more appropriate for scenarios where it is not possible to have statistical data, while quantitative models need statistical data to be used. Mixed models take advantage of the inherent advantages of both approaches. The analysis and risk management of systems, due to its multidisciplinary nature, normally needs to use the three approaches to assess the aggregate risk, which increases the complexity of the problem [29].

The most well-known and used qualitative model in the industry is Failure Mode and Effects Analysis, or in short, FMEA. This model was developed by the US Army in the decade following World War II, the 1950s, and was first developed as a structured technique for failure analysis in order to increase the reliability of military equipment. Nowadays, its application is almost universal, verifying its applicability from the nuclear industry to health care. Despite this great success, this risk management method has many limitations inherent in its qualitative nature and inherent to its function of prioritizing failure modes, also known as the Risk Priority Number (RPN). Its success is due to its ease of being learned and applied to real cases, and many of the limitations pointed out in the literature are usually overcome through alternative methods [30,31,32].

On the opposite side, on the side of quantitative models, we have the Monte Carlo model, which is derived from Buffon’s needle problem as stated in the 18th century. In 1940, Stanislaw Ulam developed the modern version of the Monte Carlo method that makes use of random experiments to determine the parameters of the statistical distribution that models a given event [33]. The method, like the FMEA, is well known in the industry, with practical applications from finance to the nuclear industry. It has a slower learning curve and requires prior knowledge of statistics to be used, which is not the case with FMEA. However, this model makes it possible to assess the aggregate risk of a given system, regardless of its complexity.

Another quantitative model widely used in the assessment of aggregate risk is called Failure Tree Analysis (FTA) [34], a method invented in 1961 at Bell Laboratories. This model makes use of the reliability block theory to assess the aggregated probability of systems failure. In a similar way, Event Tree Analysis (ETA) [35], another quantitative method invented in 1974 during the WASH-1400 nuclear power plant safety study, assesses the probability of a given impact considering all possible paths that lead to that impact.

These models seem similar but have different paradigms: fault tree analysis characterizes the system from the perspective of preventing a given event from occurring, while event tree analysis characterizes the system from the perspective of avoiding impacts given that an event has already occurred.

In practice, these two methods have been used together as a way to assess the aggregate risk of systems through the Bowtie model [36]. This model is a diagram that establishes a relationship between basic events and the impacts of the respective top event. It takes into account prevention and mitigation barriers, and because of that, it is one of the most robust frameworks for risk assessment and management.

An example of a risk assessment and management tool that allows the assessment of aggregate risk through a mixed approach (quantitative and qualitative) is the fuzzy logic method [37]. This method began to be studied in 1920 by the authors Lukassiewicz and Tarski and was later introduced in the literature in 1965 by Lotfi Zadeh. It uses the human interpretive paradigm to model the behavior of systems. It uses linguistic variables, membership functions, and rules of inference, evaluated qualitatively, to infer about the system’s outputs as a result of the aggregated contribution of each system component. It is a method that has proven itself in the most varied areas of industry, from artificial intelligence to medical decision making.

2.3. Risk Factors in Logistics

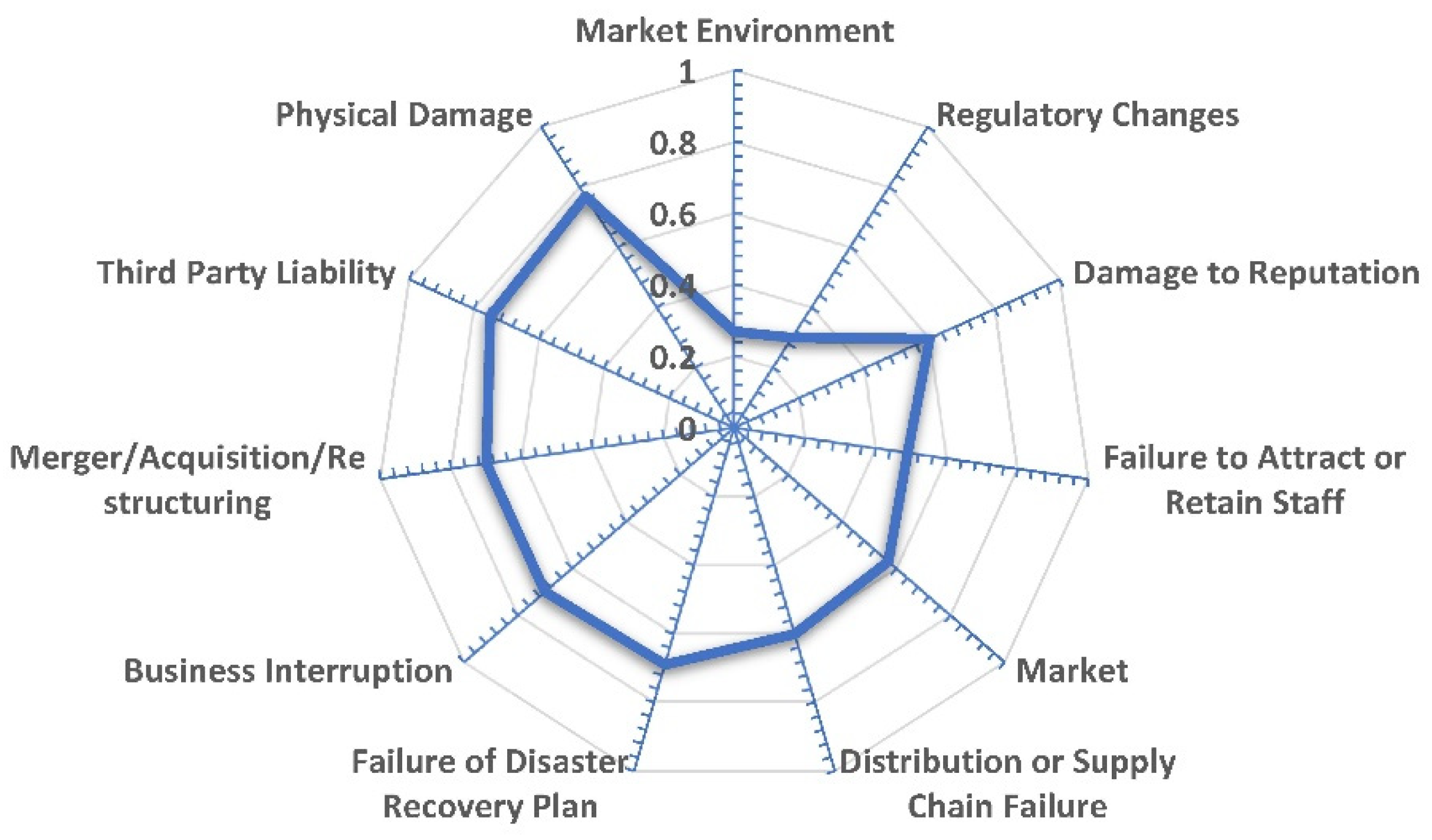

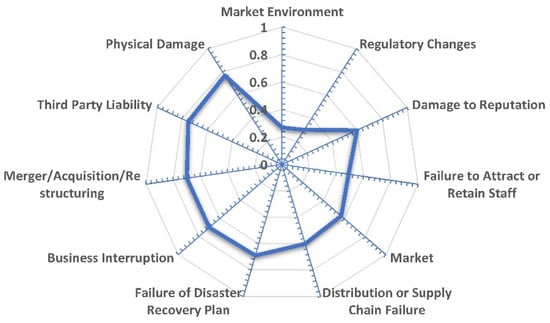

The literature mentions that participation in collaborative networks in the field of logistics has had little appeal due to uncertainty about the quality of the services provided by network operators [38]. This uncertainty results, in part, from the lack of indicators showing the quality level of operators. In collaborative networks, the choice of a particular operator for a given logistical task is essentially based on operational parameters such as cost and time [39]. However, this strategy does not take into account the fundamental concerns of the companies that need the logistics service and of the companies that provide the logistics services. Figure 1 shows several factors that cause concern among logistics companies. These results show that reputational damage and third-party responsibility in the provision of logistics services are two factors of real concern for companies and play an important role in their decisions.

Figure 1.

Risk factors identified by logistics companies and their respective weightings, evaluated according to their impact on the companies’ objectives, with information gathered from [40].

In a sense, these two factors can be combined, because the lack of third-party liability affects the reputation of the company that contracts other companies. In this way, the sum of the liability factor and the reputational damage factor results in a factor with the highest weight among the factors shown in Figure 1.

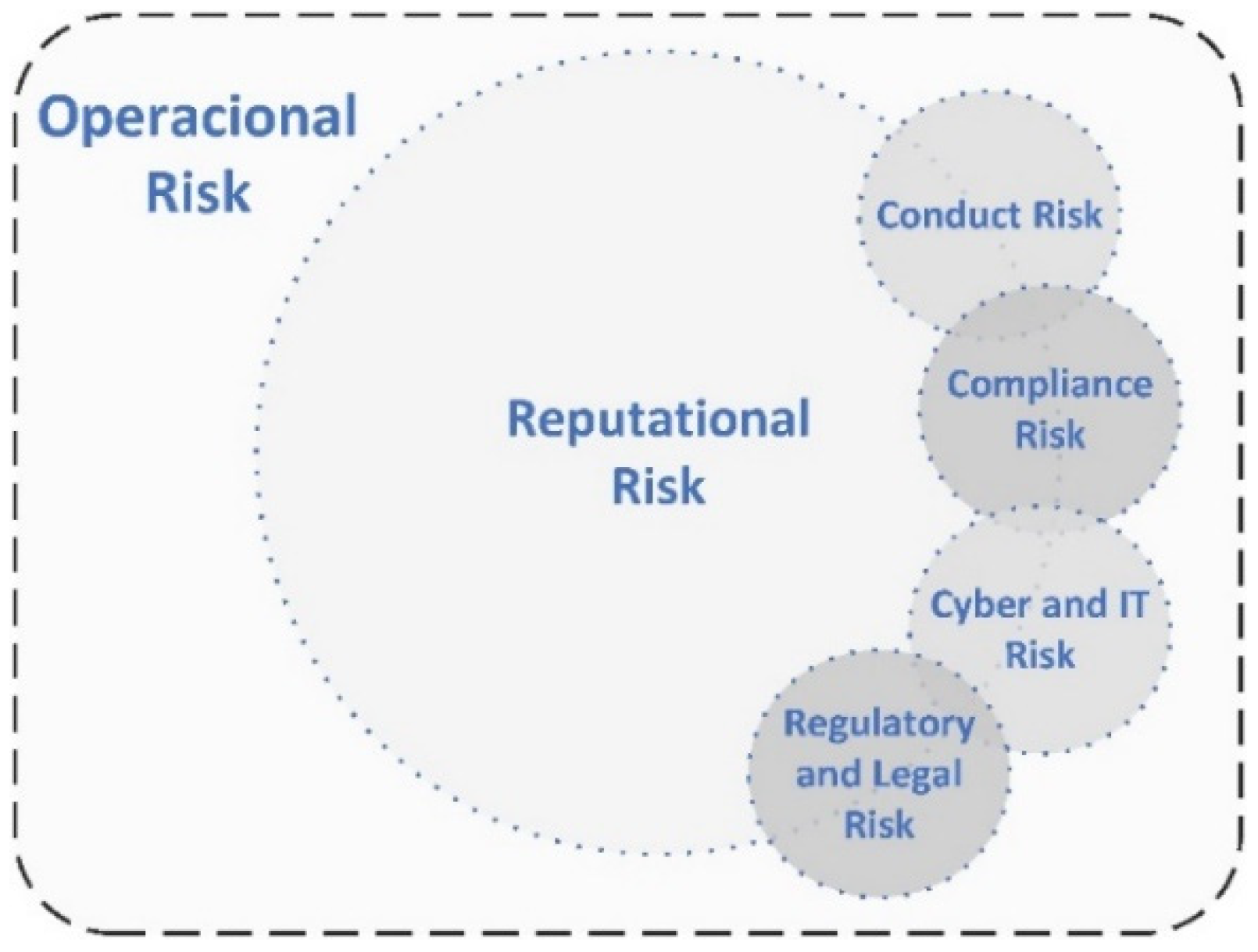

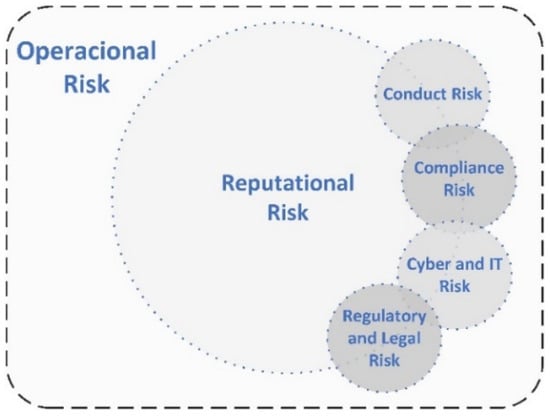

The impact on reputation extends to very different areas of logistics, as Figure 2 summarizes. In this sense, the assessment of reputational risk becomes essential for the decision making of companies in their interactions with third-party companies and also for the assessment of the quality of the services provided by the company itself.

Figure 2.

Logistic risk areas.

In this sense, it is important to develop a model for assessing reputational risk in order to support decision making and to promote the participation of companies in collaborative networks. The benefits of such participation are widely discussed in the literature and have been shown to be positive in practice [41]. However, the participation of small- and medium-sized enterprises in collaborative logistics networks is low, despite the benefits that can result from such participation. In this work, we intend to develop a reputational risk assessment framework to reduce uncertainty in the participation of small- and medium-sized enterprises in collaborative logistics networks. The expected outcome of applying the framework is an increase in the number of participants in collaborative logistics networks as well as the further participation of companies that are already part of the network.

3. Research Methodology

This section presents the step-by-step process for developing the proposed reputational risk model.

3.1. Collaborative Networks in Logistics and Their Relationship with Reputational Risk

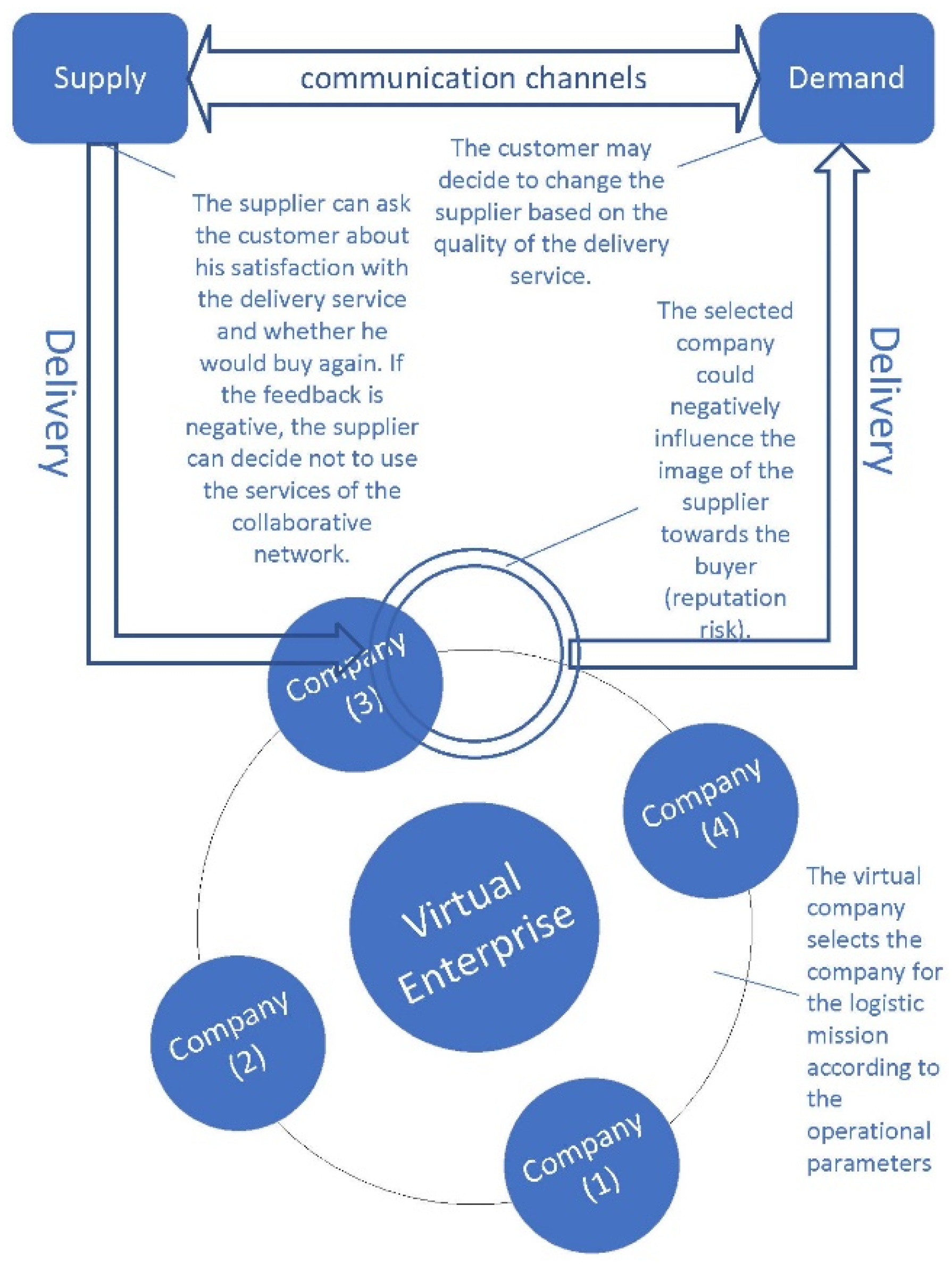

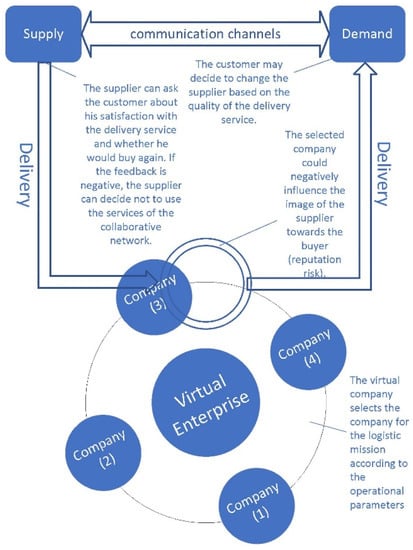

Several business models for collaborative logistics networks have been proposed in the literature [42]. Essentially, in its most general form, a network is managed by a virtual enterprise that manages the information provided by its participants. The virtual enterprise is responsible for ensuring the security and confidentiality of this information. It is also responsible for selecting the most appropriate network participant for a given logistics mission. Logistics missions can be brought to the network in two ways: first, by external customers who need the service; and second, by network participants who have a service order from their customers and offer this order to other network operators for execution. Figure 3 illustrates, in simplified form, the functional system of a collaborative network in logistics. The demand party asks the supplier to deliver goods via a logistics service provider selected by the virtual company responsible for managing the collaborative network.

Figure 3.

Collaborative network in logistics.

The relationship between the customer and the company that supplies the goods is strongly influenced by a number of factors that may or may not promote the continuity of this relationship. The most important factors are customer satisfaction, the trust that the supplier conveys to the customer, the loyalty between the supplier and the customer, the communication of feedback, and the publicity that customers give about the supplier. In general, these factors can be negatively affected by the services offered by the collaborative network. For example, customer satisfaction can be affected by delivery delays or the loss of goods during the logistics mission. If the logistics company does not report delays efficiently and does not have alternative mechanisms to mitigate these delays, or does not quickly recover lost goods, the customer may decide to switch suppliers. Although the supplier is not to blame for the poor logistics service, the negative impact is ultimately attributed to the supplier. After all, the supplier is responsible for selecting the logistics company that will deliver the product, and it is also responsible for assessing the quality of the transportation and delivery service that it offers to its customers. In this way, the supplier is ultimately strongly influenced by the quality of the services provided by the logistics company.

On the other hand, logistics companies with a loyal customer portfolio based on a history of trust and a high level of satisfaction find it difficult to outsource logistics tasks to third parties whose quality level is uncertain. For these logistics companies, the impact of negative third-party performances could also negatively affect their customer portfolio and threaten their survival as a business. Indeed, reputational risk has a transversal scope, with implications for the suppliers’ and customers’ sides as well as the logistics companies’ side, and ultimately for the sustainability of the collaborative network. In this sense, the framework developed in this work to assess reputational risk responds to a real need that exists in the practice of managing collaborative networks in logistics.

3.2. Proposed Approach

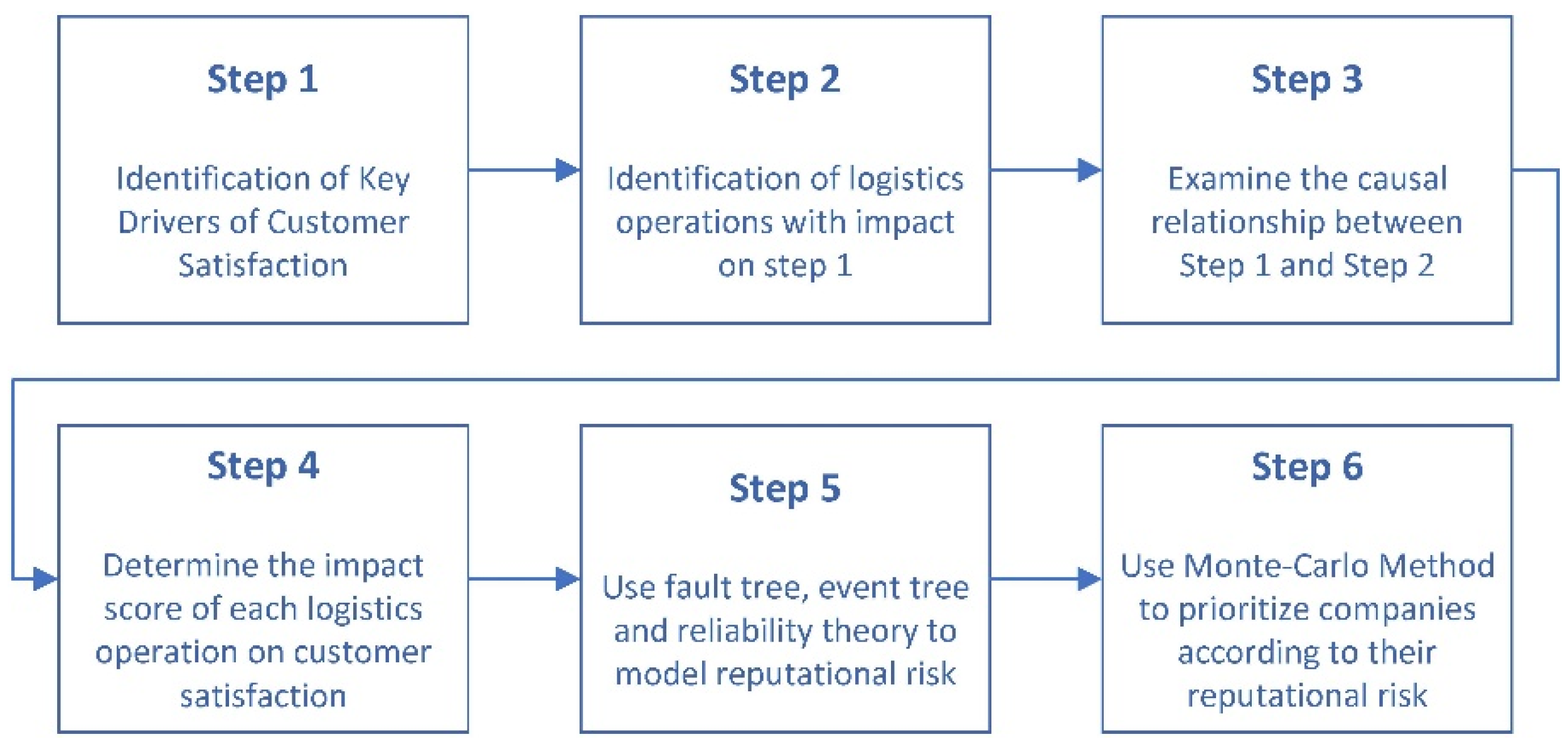

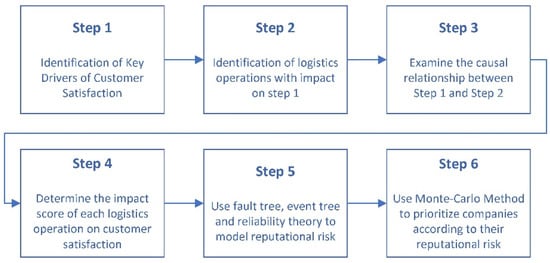

The approach taken in developing the reputational risk assessment framework begins by identifying the key drivers of customer satisfaction with respect to logistics services. It then identifies the logistics operations that may negatively impact these factors in some way. The next step is to examine the causal relationship between the customer satisfaction factors and logistics operations and determine the impact of each logistics operation on customer satisfaction. The causal relationship is modeled with the Bowtie method using the fault tree and event tree methods, and reliability theory is used to determine the aggregate reputational risk. Finally, the Monte Carlo method is used to prioritize companies based on their reputational risk. Figure 4 shows the diagram illustrating the approach used in developing the framework.

Figure 4.

Main steps of the implemented framework to prioritize logistics companies according to their reputational risk.

3.2.1. Framework Step 1—Identifying the Most Important Factors for Customer Satisfaction

The factors that have the greatest impact on customer satisfaction while still being sensitive to logistics operations were identified through a literature review [43,44,45,46,47]. Eleven factors were identified, which were divided into four categories, namely, information service, customer service, distribution service, and cross-border service. In the information service category, the factors of transparency, security, and customization of information were identified. These factors strengthen customer trust and loyalty.

In the distribution service category, the following factors were identified: accuracy, compliance with estimated delivery times, and the safety of transported goods (securing goods against theft). This category is directly related to the logistics services provided by the collaborative network and is sensitive to the level of quality in the provision of logistics services by the network collaborator. In the category of cross-border services, the factors international services and international relations were identified. This category refers to the ability of the logistics company to protect the interests of their customer.

Finally, in the customer service category, the factors of error correction, packaging (protecting goods against accidents), and value-added services were identified. This category refers to customer loyalty and customer recovery. Figure 5 shows the 4 categories mentioned above as well as the 11 factors distributed among the respective categories.

Figure 5.

Customer satisfaction factors that may be affected by logistics services.

3.2.2. Framework Step 2—Identify the Logistics Operations That Impact Customer Satisfaction

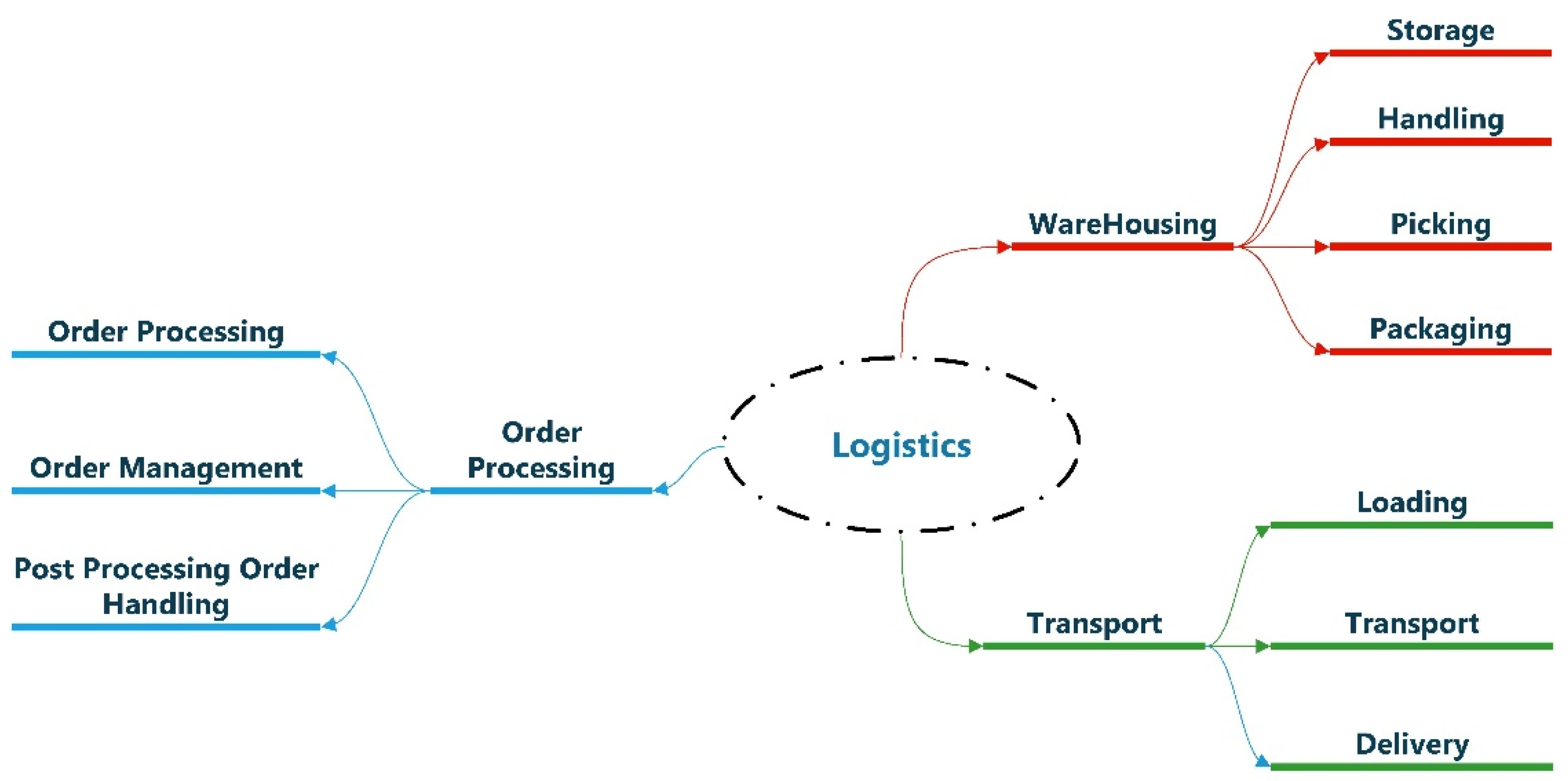

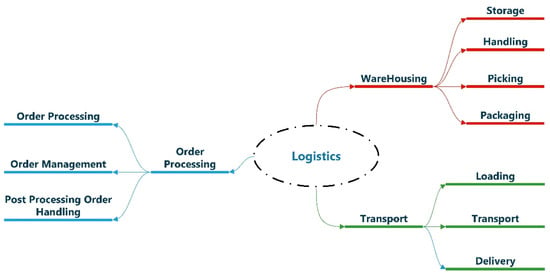

Similar to the identification of customer satisfaction factors, bibliographic research was also conducted to identify the logistics operations that may negatively affect the customer. The identified operations were classified into three categories, namely, order processing, warehousing and transportation [43,44,45,46,47].

In the order processing category, order processing (the process or workflow that occurs after a customer places an order), management (the process of entering, tracking, and fulfilling customer orders), and post-processing (the management of customer information and services provided for a particular logistics mission) were identified. This category refers to the interaction with customers, i.e., the end customer and the supplier. In the warehousing category, the operations of storage, handling (the loading and unloading of cargo within the warehouse), picking, and packaging were identified. This category is related to the integrity of the transported products and the reliability of the logistics company. Finally, in the transport category, the operations for loading, transport, and delivery were identified. This category is related to the quality of transport and delivery services. Figure 6 shows a schematic representation of the three categories of logistics operations and their respective processes.

Figure 6.

Logistic operations that may create negative impacts on customer satisfaction.

3.2.3. Framework Step 3—Identifying Causal Relationships between Customer Satisfaction and Logistics Operations

Having identified customer satisfaction factors and their associated logistics operations, the next step is to determine the causal relationship between these factors and logistics operations. Table 1 presents this relationship in the form of a matrix. The causal relationship was determined through an inferential analysis, together with the logical conclusions and appropriate consequences.

Table 1.

Causal relationships in matrix form between customer satisfaction and logistics operations.

The service processing of logistics operations (OP1) can negatively impact customer satisfaction in the categories of service quality (SQ), distribution quality (SDQ), and cross-border service quality (CBSQ). It can have a negative impact on the transparency of information (SQ1), the correctness of operations (DSQ1), and also on the measures required for cross-border legal processing (CBSQ2).

Service order management in logistics (OP2) has a direct impact on the security of customer information (SQ2), on the accuracy of logistics operations (DSQ1), on the timely delivery of goods (DSQ3), and also on cross-border operations (CBSQ2). Poorly managed service orders can lead to the disclosure of customer information and also cause delays in logistics processes at home and abroad.

Post-processing (OP3) affects all factors in the SQ and CBSQ categories. It also affects the customer service (CSQ2) and value-added (CSQ3) factors.

When analyzing the storage category (WH), it was found that storage can negatively affect the accuracy of logistics services (DSQ1) and the safety of goods (DSQ2). Handling can also affect the safety of the goods (DSQ2). The process of selecting goods can negatively affect the factors of accuracy (DSQ1) and packaging (CSQ1). Finally, packaging logistics may affect the packaging satisfaction factor (CSQ1).

In the last category of logistics operations (T), shown in Table 1, it was found that the logistics operation of loading (T1) can negatively affect the accuracy of operations (DSQ1) and the safety of transported goods (DSQ2). On the other hand, the transportation operation (T2) can negatively affect the timely delivery of the goods (DSQ3). Finally, the delivery operation (T3) may negatively affect the safety of the delivered goods (DSQ2).

3.2.4. Framework Step 4—Impact Score of Individual Logistics Operations on Customer Satisfaction

The basic definition of risk states that the magnitude of the impact of a given event must be determined and then related to its corresponding probability in order to evaluate the risk of that event [25]. In this sense, Table 2 shows the degree of impact that each logistics operation has on the different categories of customer satisfaction. These values were assigned qualitatively on a scale of 1 to 3.

Table 2.

Impact scores of individual logistics operations on customer satisfaction.

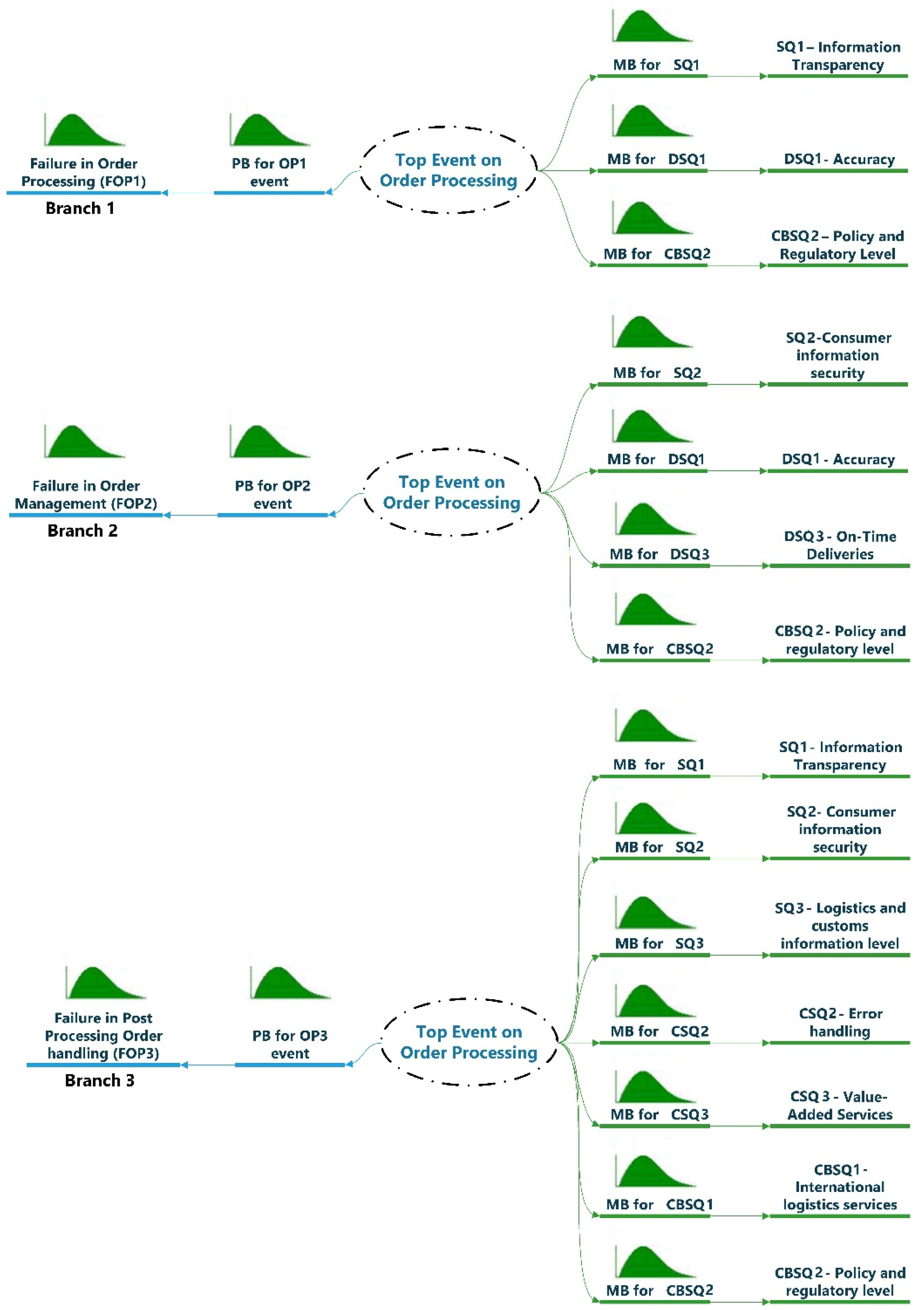

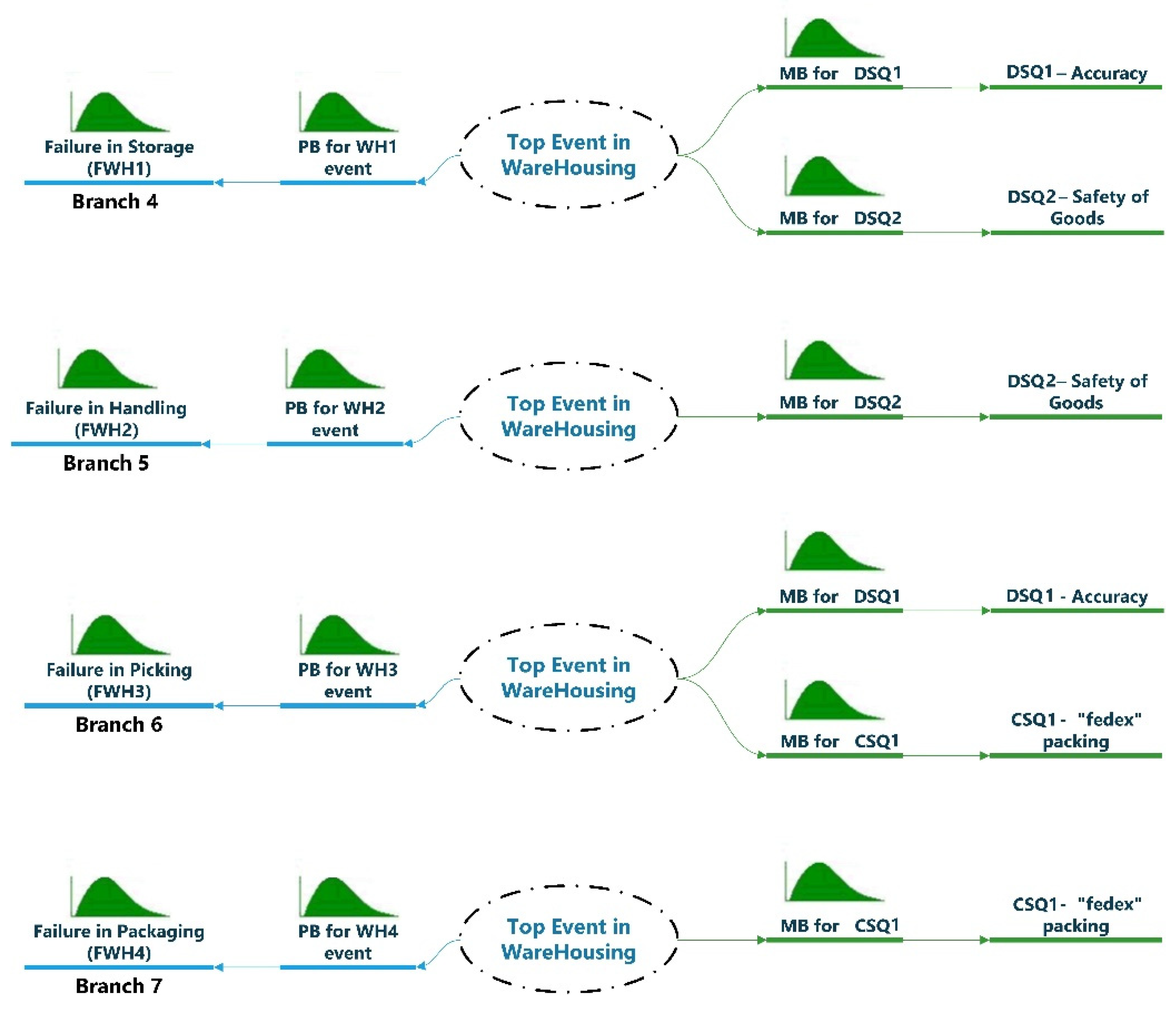

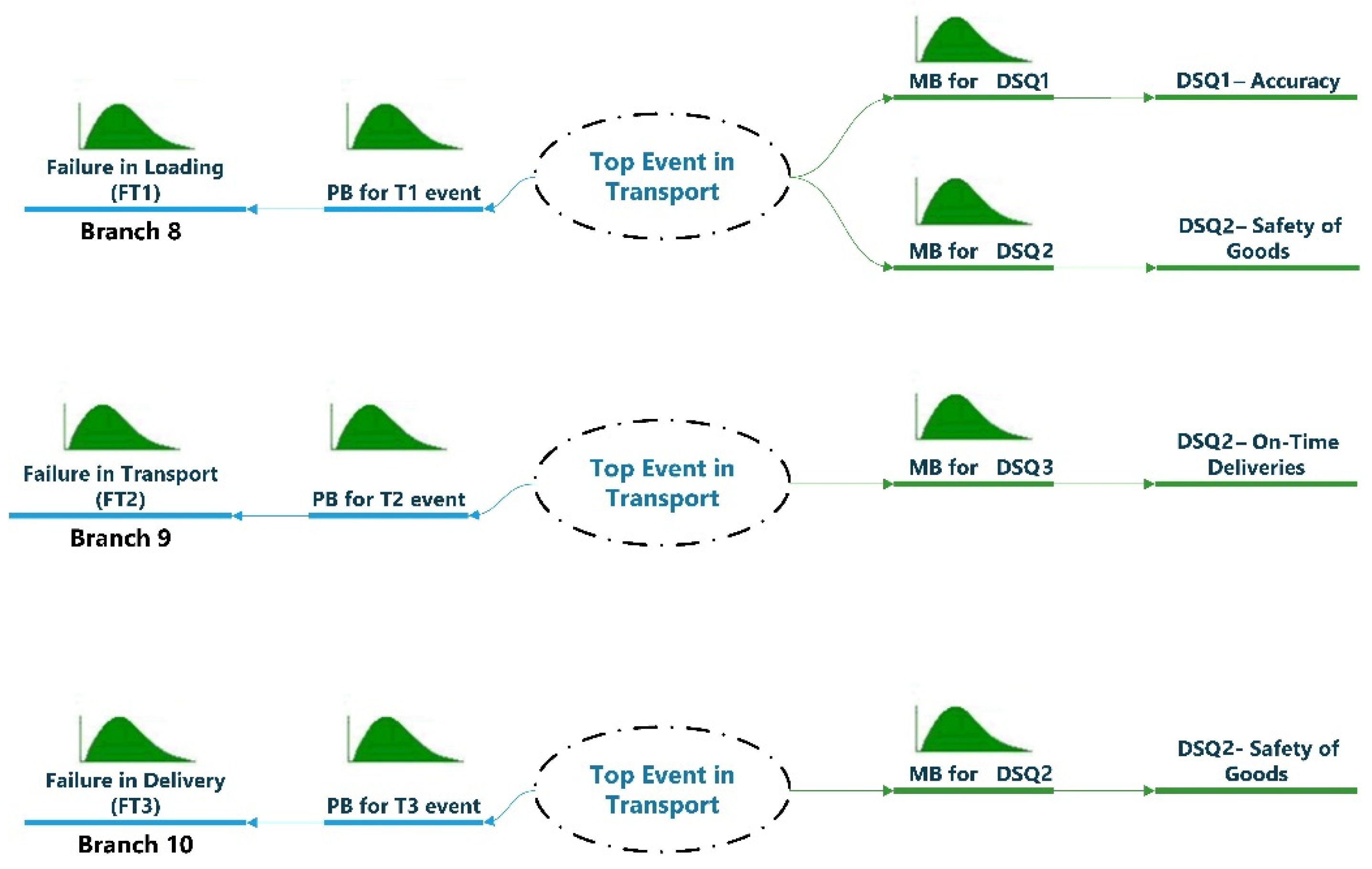

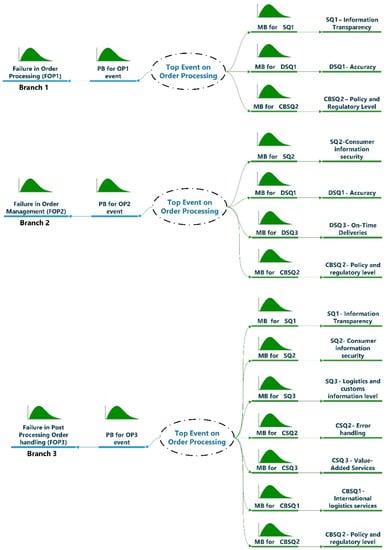

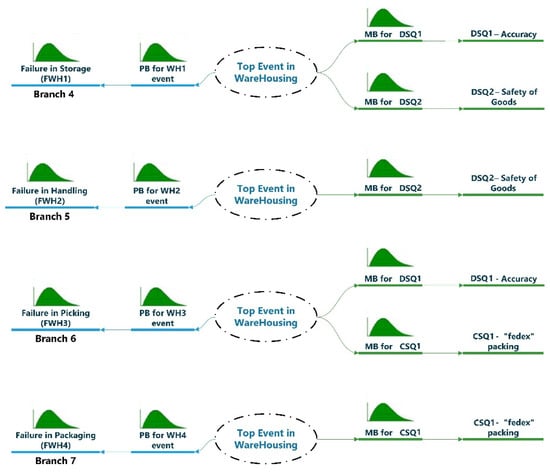

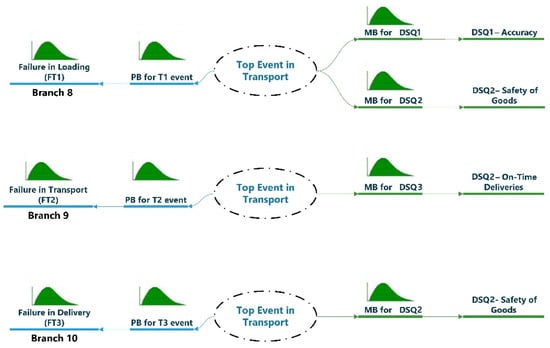

3.2.5. Framework Step 5—Modeling Reputational Risk with Bowtie, Event Trees, Fault Trees, and Reliability Theory

In this step, the causal relationship shown in Table 1 is represented by Bowtie diagrams for each of the 10 logistics operations listed in the second column of Table 1. Figure 7, Figure 8 and Figure 9 show the 10-operation bowtie schematically, considering the above causal relationship. For each bowtie, expressions of the risk associated with each logistics operation are generated considering the impact values presented in Table 2 and the overall probability determined by the methods of fault trees, event trees, and reliability theory.

Figure 7.

Bowtie diagrams for the processing order category. PB stands for preventive barrier, and MB stands for mitigation barrier.

Figure 8.

Bowtie diagrams for the warehousing category. PB stands for preventive barrier, and MB stands for mitigation barrier.

Figure 9.

Bowtie diagrams for the transport category. PB stands for preventive barrier, and MB stands for mitigation barrier.

Each bowtie starts with the probability of failure for a given logistics operation, and then the probability of failure for the prevention barriers is considered. The purpose of these barriers is to prevent a failure in the logistics operation from leading to an event with a negative impact on customer satisfaction. The evaluation of the probability that an event with a negative impact on customer satisfaction will occur is evaluated using the fault tree method and reliability theory. If the prevention barrier cannot prevent this event from occurring, then the mitigation barriers can mitigate or even eliminate this impact. These barriers also have a probability of failure and must be included in the overall risk assessment of each bowtie, where the probability of the event occurring is considered along with the event tree method and reliability theory to assess the overall risk of each bowtie.

Equation (1) represents the aggregate risk of logistics operations in the order processing category (OP). This equation is made up of three components. The first component represents the aggregate risk of logistics operation OP1, the second component represents the aggregate risk of logistics operation OP2, and the last component represents the aggregate risk of logistics operation OP3. The aggregated risk of the category OP results from the sum of these three components.

Figure 8 shows the four bowties developed for the warehouse category, and Equation (2) represents the overall risk for this category. Similar to what is described in Equation (1), Equation (2) is composed of four components that represent the aggregate risk of the four bowties developed for this category. In this sense, the first component represents the aggregate risk of the storage operation, the second component represents the aggregate risk of the handling operation, the third component represents the aggregate risk of the picking operation, and finally, the fourth component represents the aggregate risk of the packaging operation. The total risk of the warehouse category is also the result of adding together these four components.

Figure 9 shows the bowtie schematically when referring to the transport category, and Equation (3) represents the aggregate risk of this category. Similar to the previous two categories, this equation is composed of three aggregate risk components: the first for loading logistics, the second for transportation, and the third for delivery. The aggregate risk of this category is the sum of these three components.

The terms used in Expressions 1 through 3 are a combination of the terms listed in Table 1 and the terms “PB” and “MB”, which stand for preventive barrier and mitigating barrier, respectively. The combination of these terms can be found in Figure 7, Figure 8 and Figure 9. These combinations of terms are presented in Equations (1)–(3) for two situations: first, to indicate the probability of failure of a particular logistics operation, and second, to indicate the impact defined in Table 2. For example, PFOP2 represents the failure probability of “(2) Order Management” (see Table 1), PPB_OP2 represents the failure probability of the preventive barriers of “(2) Order Management”, and ISQ2_score represents the corresponding impact specified in Table 2 for “(2) Consumer Information Security”.

After evaluating the aggregate risk of logistics operations according to each category, it is possible to evaluate the reputational risk of the company providing logistics services using Equation (4). Here, the reputational risk is the sum of the aggregated risks for the categories of order processing, warehousing, and transportation.

3.2.6. Framework Step 6—Prioritization according to Reputational Risk Using the Monte Carlo Method

The previous steps presented the proposed framework for assessing reputational risk based on customer satisfaction factors and logistics operations. For each of the operations, the overall risk was determined by the probabilities of failure for each logistics operation, so the reputational risk evaluated by Equation (4) is highly dependent on these probabilities.

In practice, however, these probabilities may vary depending on the assumptions used to evaluate these same probabilities. To account for these variations when assessing reputational risk, the failure probabilities of the logistics operations and the prevention and mitigation barriers are represented by their expected value (average value, µ) and their respective variance (σ).

To evaluate the reputational risk taking into account this variance, the Monte Carlo method is used. In this method, the failure probabilities of the individual logistics operations fluctuate randomly around their mean value, which corresponds to the effect of the respective variance in each simulation. In this sense, to evaluate reputational risk, a large number of simulations are performed for Equation (4) to obtain the average value of the reputational risk and the corresponding variance. This result is later used to prioritize companies according to their reputational risk. This prioritization is performed by pairwise comparison, considering the probability that the average value of reputational risk for one company is higher than the average value for the other company. After this comparison is made between all the companies, the company with the lowest probability is selected because it is the company with the lowest reputational risk.

4. Illustrative Case Study, Results and Discussion

To illustrate the applicability of the proposed model, the case study of three freight transportation companies, Companies A, B, and C, operating within a collaborative logistics network was considered. The purpose of this case study is to evaluate the reputational risk of each of these three companies and prioritize them according to this risk. The company with the lowest risk in terms of customer satisfaction is selected as a candidate for the logistics mission under study. In practice, this prioritization is taken into account when selecting the company, along with other selection parameters such as the cost and time required for the logistics operation.

The first step in applying the model is to evaluate the probabilities of failure in each company’s logistical processes. The initial values of these probabilities are obtained through questionnaires given to the company by using fuzzy logic frameworks and are later updated through satisfaction surveys of the collaborative network’s customers. Table 3 shows the failure probabilities for the three companies according to the logistical processes already identified. It also shows the failure probabilities of the prevention barriers that each company has in each logistical process. These results are the first public results from the companies’ surveys. The value µ represents the average probability of failure and the standard deviation σ represents the variance of this probability, which is used to account for the uncertainty about the assumptions used to evaluate the average value of the probability.

Table 3.

Mean and standard deviation of failure probabilities in logistics operations and prevention barriers.

Table 4 shows the probability of failure of the barriers designed to mitigate or eliminate negative impacts on the elements indicated in the first column of Table 4. Similar to the determination of the data in Table 3, these values come from questionnaires sent to companies and must then be updated using satisfaction surveys of the customers of the cooperation network.

Table 4.

Mean and standard deviation of failure probabilities of mitigation barriers.

The next step is the application of the Monte Carlo method. The objective is to evaluate the reputational risk represented by Equation (4), taking into account the variation of the probabilities presented in Table 3 and Table 4. These probabilities may vary according to the operational uncertainties that logistics companies face in their operations. With this in mind, the variance of each mean value in Table 3 and Table 4 is intended to account for the impact of this uncertainty when evaluating the probability of failure.

Table 5 and Table 6 show the failure probabilities calculated in simulation number 10,000 of the Monte Carlo model implemented for this case study. In each simulation, the probabilities are evaluated for each element listed in the first column of Table 3 and Table 4. These probabilities are calculated using the mean values given in Table 3 and Table 4 and taking into account a random parameter that is used together with the variance to update the mean value in each simulation.

Table 5.

Failure probabilities of logistics processes and preventive barriers evaluated in simulation number 10,000 of the implemented Monte Carlo method.

Table 6.

Failure probabilities of mitigation barriers evaluated in simulation number 10,000 of the implemented Monte Carlo method.

For each Monte Carlo simulation, the risk of each branch shown in Figure 6, Figure 7 and Figure 8 is evaluated using Equations (1)–(3), where the first term of Equation (1) represents the risk of Branch 1, the second term represents the risk of Branch 2, and the third term represents the risk of Branch 3. This reasoning also applies to the other two equations if we continue the numbering of the branches up to branch number 10.

Table 7 shows the results for the risks calculated in Monte Carlo simulation number 10,000 for branches 1 to 10. The last row of Table 7 shows the reputational risk assessed for each company. This risk is evaluated using Equations (1)–(4).

Table 7.

Risk for each branch and reputational risk calculated in Monte Carlo simulation number 10,000.

The reputational risk assessed in each Monte Carlo simulation for each of the three companies is shown in Table 8. The mean value of each company’s reputational risk and its respective variance are determined by the respective values in each column of Table 8.

Table 8.

Reputational risk per iteration and by company analyzed.

Table 9 shows the mean values and respective variance of reputational risk obtained using the data presented in Table 8.

Table 9.

Reputational risk results for companies A, B and C.

It can be seen from Table 9 that the reputational risk of Company A is lower than the risk calculated for companies B and C. The risk value calculated for Company A is 2.731 compared to 2.897 and 3.238 for Company B and C, respectively. Based on these values, it can be concluded in an initial analysis that Company A is the candidate that should be selected.

However, the variance around the average value of reputational risk for these two companies (B and C) is high, 0.806 and 0.755, so the reputational risk for these two companies might be lower compared to company A. Based on these results, it seems necessary to calculate the probability that the risk of Company A is greater than the risk of the other two companies. Taking into account the mean values and the respective variance, Table 10 shows the probabilities for the results obtained for each company as presented in Table 9.

Table 10.

Relative probabilities of reputational risk between companies.

This table is intended to show a comparison between the probability that the reputational risk of the company indicated vertically is greater than the reputational risk of the company indicated in the horizontally. In this sense, in the first row, we have P (risk_reputation_A > risk_reputation_B) = 0.396 and P (risk_reputation_A > risk_reputation_C) = 0.209. In the second row, we have P (risk_reputation_B > risk_reputation_A) = 0.581 and P (risk_reputation_B > risk_reputation_C) = 0.336, and in the third row, we have P (risk_reputation_C > risk_reputation_A) = 0.749 and P (risk_reputation_C > risk_reputation_B) = 0.674.

From these results and by inspection, it can be concluded that the probability of reputational risk for Company A is lower than the probability of reputational risk for Company B and Company C. It can also be concluded that the probability of reputational risk for Company C is higher than that for Company B. According to this logic, companies can be prioritized by the probability of aggregate reputational risk, calculated as follows:

Aggregate_Risk_A = P (Reputation_Risk_A > Reputation_Risk_B) × P (Reputation_Risk_A > Reputation_Risk_C) = 0.083

Aggregate_Risk_B = P (Reputation_Risk_B > Reputation_Risk_A) ×P (Reputation_Risk_B > Reputation_Risk_C) = 0.195

Aggregate_Risk_C = P (Reputation_Risk_C > Reputation_Risk_A) × P (Reputation_Risk_C > Reputation_Risk_B) = 0.505

Based on these results, it is confirmed that Company A has the lowest reputational risk, followed by Company B and finally Company C. This prioritization of companies according to their reputational risk in conjunction with other optimization parameters, namely, cost and time parameters, enables the selection of the transportation company that minimizes reputational risk and maximizes financial return.

In this way, the sustainability of collaborative networks in the field of logistics should be promoted by creating trust among both collaborators and customers. This trust will also encourage the participation of new collaborators, as the collaborative approach has not attracted the desired number of collaborators due to the lack of trust in this type of approach. Attracting new collaborators and the continued participation of the current collaborators in the collaborative network are two fundamental factors for the growth of the network. This growth is extremely important to promote the sustainability of collaborative networks as well as their efficiency and optimization. On the other hand, the presence of a quality indicator such as reputational risk, as proposed in this study, will motivate companies to develop and implement quality programs to reduce reputational risk and, in this way, will increase their participation in collaborative network activities and, consequently, their revenue share.

The research limitations of this study are mainly related to the data acquisition approach used in the illustrative case study, i.e., to obtain the primary data used in the proposed model, it is necessary to apply a structured approach to capture the probabilities of failure along with their respective variance, which was not performed in this research as it has been reserved for future work. In addition to supporting decision making, it is also envisioned that the synergy of the proposed model with other supply chain models [48,49,50,51] can extend the applicability of the proposed model not only to partner selection, but also to supplier selection.

5. Managerial Insights

The implementation of the proposed model will make it possible to define a series of measures to evaluate the quality of the services provided by each company in the network. In this sense, it will be possible to identify points for continuous improvement. It will also strengthen the trust between suppliers, customers, and the collaborative network. It will also encourage the participation of new collaborators in the network, increasing the size of the collaborative network, which in turn will promote its sustainability. Logistics companies can thus lower their operating costs by reducing waste and increase customer satisfaction through shorter delivery times, which in turn strengthens the business relationship between customers and suppliers.

6. Conclusions

In this paper, a new methodology has been developed to support decision making when selecting operators in a collaborative network for the provision of logistics services. This methodology is based on a new reputational risk assessment model developed in this paper, which, together with cost and time parameters, allows the selection of the most suitable logistics service provider for a given logistics contract. The developed reputational risk model takes into account the expectations of customers demanding logistics services and the potential risk factors associated with the activities of logistics companies.

In addition to the prioritization of logistics companies, the proposed model of reputational risk also allows the creation of a quality index related to the services provided by logistics companies in the collaborative network. It allows the evaluation of the quality level of each operator in the most important areas and with regard to the impact on the customers of the collaborative network. This assessment is an important point of feedback that logistics companies can use to improve the quality assessment of their logistics operations by implementing quality programs.

Along with the above benefits, the collaborative network also benefits from the implementation of the proposed reputational risk model by increasing the trust of its customers and logistics service providers. The increase in trust promotes the continuity of the companies that are already part of the collaborative network and the participation of new companies, thus promoting the sustainability of the network. On the other hand, the sustainability of the network promotes the reduction of the sector’s environmental footprint, which is in line with the goals of the UN Agenda 2030.

As for future work, we propose to integrate the developed model into the multicriteria decision making models commonly used in collaborative logistics networks. We also propose the development of a framework to evaluate the level of satisfaction of the end customers with the logistics service providers to update the failure probabilities after each logistics mission. It is also planned to correlate the proposed model with other models in real case studies to identify operational problems, to and develop a structured approach to evaluate the failure probabilities in each logistics operation considered in the proposed model.

Author Contributions

Conceptualization, V.A. and A.A.; methodology, V.A.; software, V.A.; validation, A.A., A.D. and J.C.; formal analysis, A.D.; investigation, V.A.; resources, J.C.; data curation, V.A.; writing—original draft preparation, V.A.; writing—review and editing, A.D.; visualization, V.A.; supervision, A.A.; project administration, V.A.; funding acquisition, J.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by POLYTECHNIC INSTITUTE OF LISBON, grant number IPL/2021/ReEdIA_ISEL.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

This work was supported by the Polytechnic Institute of Lisbon through the Projects for Research, Development, Innovation and Artistic Creation (IDI&CA), within the framework of the project ReEdIA—Risk Assessment and Management in Open Innovation, IPL/2021/ReEdIA_ISEL.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Johnston, P.; Everard, M.; Santillo, D.; Robèrt, K.-H. Reclaiming the Definition of Sustainability. Environ. Sci. Pollut. Res. Int. 2007, 14, 60–66. [Google Scholar] [PubMed]

- Mikulčić, H.; Klemeš, J.J.; Vujanović, M.; Urbaniec, K.; Duić, N. Reducing Greenhouse Gasses Emissions by Fostering the Deployment of Alternative Raw Materials and Energy Sources in the Cleaner Cement Manufacturing Process. J. Clean. Prod. 2016, 136, 119–132. [Google Scholar] [CrossRef]

- Gaete-Morales, C.; Gallego-Schmid, A.; Stamford, L.; Azapagic, A. Life Cycle Environmental Impacts of Electricity from Fossil Fuels in Chile over a Ten-Year Period. J. Clean. Prod. 2019, 232, 1499–1512. [Google Scholar] [CrossRef]

- De Souza, L.L.P.; Lora, E.E.S.; Palacio, J.C.E.; Rocha, M.H.; Renó, M.L.G.; Venturini, O.J. Comparative Environmental Life Cycle Assessment of Conventional Vehicles with Different Fuel Options, Plug-in Hybrid and Electric Vehicles for a Sustainable Transportation System in Brazil. J. Clean. Prod. 2018, 203, 444–468. [Google Scholar] [CrossRef]

- Zamfir, A.-M.; Mocanu, C.; Grigorescu, A. Circular Economy and Decision Models among European SMEs. Sustainability 2017, 9, 1507. [Google Scholar] [CrossRef] [Green Version]

- Leão, J. Relatório de Estabilidade Financeira; Banco de Portugal: Lisbon, Portugal, 2020. [Google Scholar]

- Kpodar, K.; Imam, P.A. To Pass (or Not to Pass) through International Fuel Price Changes to Domestic Fuel Prices in Developing Countries: What Are the Drivers? Energy Policy 2021, 149, 111999. [Google Scholar] [CrossRef]

- Mucowska, M. Trends of Environmentally Sustainable Solutions of Urban Last-Mile Deliveries on the E-Commerce Market—A Literature Review. Sustainability 2021, 13, 5894. [Google Scholar] [CrossRef]

- Venegas Vallejos, M.; Matopoulos, A.; Greasley, A. Collaboration in Multi-Tier Supply Chains for Reducing Empty Running: A Case Study in the UK Retail Sector. Int. J. Logist. Res. Appl. 2020, 1–13. [Google Scholar] [CrossRef]

- Hvolby, H.-H.; Steger-Jensen, K.; Neagoe, M.; Vestergaard, S.; Turner, P. Collaborative Exchange of Cargo Truck Loads: Approaches to Reducing Empty Trucks in Logistics Chains. In Proceedings of the IFIP International Conference on Advances in Production Management Systems, Austin, TX, USA, 1–5 September 2019; Springer: Cham, Switzerland, 2019; pp. 68–74. [Google Scholar]

- Islam, S. Simulation of Truck Arrival Process at a Seaport: Evaluating Truck-Sharing Benefits for Empty Trips Reduction. Int. J. Logist. Res. Appl. 2018, 21, 94–112. [Google Scholar] [CrossRef]

- Herczeg, G.; Akkerman, R.; Hauschild, M.Z. Supply Chain Collaboration in Industrial Symbiosis Networks. J. Clean. Prod. 2018, 171, 1058–1067. [Google Scholar] [CrossRef]

- Benhayoun, L.; Ayala, N.F.; Le Dain, M.-A. SMEs Innovating in Collaborative Networks: How Does Absorptive Capacity Matter for Innovation Performance in Times of Good Partnership Quality? J. Manuf. Technol. Manag. 2021, 32, 1578–1598. [Google Scholar] [CrossRef]

- Camarinha-Matos, L.M.; Afsarmanesh, H. Collaborative Networks: A New Scientific Discipline. J. Intell. Manuf. 2005, 16, 439–452. [Google Scholar] [CrossRef]

- Durugbo, C. Collaborative Networks: A Systematic Review and Multi-Level Framework. Int. J. Prod. Res. 2016, 54, 3749–3776. [Google Scholar] [CrossRef]

- Kamenskikh, M. Assessment of Cluster and Network Collaboration Influence on Regional Economy. J. Adv. Res. Law Econ. JARLE 2018, 9, 510–515. [Google Scholar]

- Asadifard, R.; Chookhachi Zadeh Moghadam, A.; Goodarzi, M. A Model for Classification and Study of Success Factors in International Collaborative Networks. Innov. Manag. J. 2023, 5, 129–150. [Google Scholar]

- Li, J.; Bénaben, F.; Gou, J.; Mu, W. A Proposal for Risk Identification Approach in Collaborative Networks Considering Susceptibility to Danger. In Proceedings of the Working Conference on Virtual Enterprises, Cardiff, UK, 17–19 September 2018; Springer: Cham, Switzerland, 2018; pp. 74–84. [Google Scholar]

- Mulyana, M.; Wasitowati, W. The Improvement of Collaborative Networks to Increase Small and Medium Enterprises (SMEs) Performance. Serb. J. Manag. 2021, 16, 213–229. [Google Scholar] [CrossRef]

- Santos, R.; Abreu, A.; Dias, A.; Calado, J.M.; Anes, V.; Soares, J. A Framework for Risk Assessment in Collaborative Networks to Promote Sustainable Systems in Innovation Ecosystems. Sustainability 2020, 12, 6218. [Google Scholar] [CrossRef]

- Nunes, M.; Dias, A.; Abreu, A.; Martins, J.D.M. A Predictive Risk Model Based on Social Network Analysis. In Proceedings of the Modelling and Simulation 2020, Toulouse, France, 21–23 October 2020; pp. 82–88. [Google Scholar]

- Abreu, A.; Calado, J.M. Risk Model to Support the Governance of Collaborative Ecosystems. IFAC-PapersOnLine 2017, 50, 10544–10549. [Google Scholar] [CrossRef]

- Nunes, M.; Bagnjuk, J.; Abreu, A.; Saraiva, C.; Nunes, E.; Viana, H. Achieving Competitive Sustainable Advantages (CSAs) by Applying a Heuristic-Collaborative Risk Model. Sustainability 2022, 14, 3234. [Google Scholar] [CrossRef]

- Abreu, A.; Camarinha-Matos, L.M. A Benefit Analysis Model for Collaborative Networks. In Collaborative Networks: Reference Modeling; Springer: Berlin, Germany, 2008; pp. 253–276. [Google Scholar]

- Hutchins, G. ISO 31000: 2018 Enterprise Risk Management; CERM: Brussels, Belgium, 2018. [Google Scholar]

- Albery, S.; Borys, D.; Tepe, S. Advantages for Risk Assessment: Evaluating Learnings from Question Sets Inspired by the FRAM and the Risk Matrix in a Manufacturing Environment. Saf. Sci. 2016, 89, 180–189. [Google Scholar] [CrossRef]

- Friday, D.; Ryan, S.; Sridharan, R.; Collins, D. Collaborative Risk Management: A Systematic Literature Review. Int. J. Phys. Distrib. Logist. Manag. 2018, 48, 231–253. [Google Scholar] [CrossRef]

- Aven, T. Risk Assessment and Risk Management: Review of Recent Advances on Their Foundation. Eur. J. Oper. Res. 2016, 253, 1–13. [Google Scholar] [CrossRef] [Green Version]

- Hubbard, D.W. The Failure of Risk Management: Why It’s Broken and How to Fix It; John Wiley & Sons: Hoboken, NJ, USA, 2020. [Google Scholar]

- Huang, J.; Liu, H.-C.; Duan, C.-Y.; Song, M.-S. An Improved Reliability Model for FMEA Using Probabilistic Linguistic Term Sets and TODIM Method. Ann. Oper. Res. 2019, 1–24. [Google Scholar] [CrossRef]

- Liu, H.-C. Improved FMEA Methods for Proactive Healthcare Risk Analysis; Springer: Berlin, Germany, 2019. [Google Scholar]

- Liu, H.-C.; Liu, L.; Liu, N. Risk Evaluation Approaches in Failure Mode and Effects Analysis: A Literature Review. Expert Syst. Appl. 2013, 40, 828–838. [Google Scholar] [CrossRef]

- Rubinstein, R.Y.; Kroese, D.P. Simulation and the Monte Carlo Method; John Wiley & Sons: Hoboken, NJ, USA, 2016. [Google Scholar]

- Vesely, B. Fault Tree Analysis (FTA): Concepts and Applications; NASA HQ: Washington, DC, USA, 2002.

- Čepin, M. Event Tree Analysis. In Assessment of Power System Reliability: Methods and Applications; Čepin, M., Ed.; Springer: London, UK, 2011; pp. 89–99. ISBN 978-0-85729-688-7. [Google Scholar]

- De Ruijter, A.; Guldenmund, F. The Bowtie Method: A Review. Saf. Sci. 2016, 88, 211–218. [Google Scholar] [CrossRef]

- Gajović, V.; Kerkez, M.; Kočović, J. Modeling and Simulation of Logistic Processes: Risk Assessment with a Fuzzy Logic Technique. Simulation 2018, 94, 507–518. [Google Scholar] [CrossRef]

- Happonen, A.; Siljander, V. Gainsharing in Logistics Outsourcing: Trust Leads to Success in the Digital Era. Int. J. Collab. Enterp. 2020, 6, 150–175. [Google Scholar] [CrossRef]

- Vargas, A.; Fuster, C.; Corne, D. Towards Sustainable Collaborative Logistics Using Specialist Planning Algorithms and a Gain-Sharing Business Model: A UK Case Study. Sustainability 2020, 12, 6627. [Google Scholar] [CrossRef]

- Aon Risk Solutions. Global Risk Management Survey; Aon Risk Solutions: Chicago, IL, USA, 2015. [Google Scholar]

- Dolati Neghabadi, P.; Evrard Samuel, K.; Espinouse, M.-L. Systematic Literature Review on City Logistics: Overview, Classification and Analysis. Int. J. Prod. Res. 2019, 57, 865–887. [Google Scholar] [CrossRef]

- Tagarev, T.; Yanakiev, Y. Business Models of Collaborative Networked Organisations: Implications for Cybersecurity Collaboration. In Proceedings of the 2020 IEEE 11th International Conference on Dependable Systems, Services and Technologies (DESSERT), Kyiv, Ukraine, 14–18 May 2020; pp. 431–438. [Google Scholar]

- Meidutė-Kavaliauskienė, I.; Aranskis, A.; Litvinenko, M. Consumer Satisfaction with the Quality of Logistics Services. Procedia-Soc. Behav. Sci. 2014, 110, 330–340. [Google Scholar] [CrossRef] [Green Version]

- Fernandes, D.W.; Moori, R.G.; Vitorino Filho, V.A. Logistic Service Quality as a Mediator between Logistics Capabilities and Customer Satisfaction. Rev. Gestão 2018, 25, 358–372. [Google Scholar] [CrossRef] [Green Version]

- Choi, D.; Chung, C.Y.; Young, J. Sustainable Online Shopping Logistics for Customer Satisfaction and Repeat Purchasing Behavior: Evidence from China. Sustainability 2019, 11, 5626. [Google Scholar] [CrossRef] [Green Version]

- Rong, J.; Zhong, D. Influence Factors of Customer Satisfaction in Cross-Border e-Commerce. J. Discrete Math. Sci. Cryptogr. 2018, 21, 1281–1286. [Google Scholar] [CrossRef]

- Wei, R. Analysis on Influencing Factors of Customer Satisfaction of Cross-Border e-Commerce Logistics Service. Int. Core J. Eng. 2019, 5, 32–39. [Google Scholar]

- Mahapatra, A.S.; Soni, H.N.; Mahapatra, M.S.; Sarkar, B.; Majumder, S. A Continuous Review Production-Inventory System with a Variable Preparation Time in a Fuzzy Random Environment. Mathematics 2021, 9, 747. [Google Scholar] [CrossRef]

- Ullah, M.; Asghar, I.; Zahid, M.; Omair, M.; AlArjani, A.; Sarkar, B. Ramification of Remanufacturing in a Sustainable Three-Echelon Closed-Loop Supply Chain Management for Returnable Products. J. Clean. Prod. 2021, 290, 125609. [Google Scholar] [CrossRef]

- Ahmed, W.; Moazzam, M.; Sarkar, B.; Ur Rehman, S. Synergic Effect of Reworking for Imperfect Quality Items with the Integration of Multi-Period Delay-in-Payment and Partial Backordering in Global Supply Chains. Engineering 2021, 7, 260–271. [Google Scholar] [CrossRef]

- Khan, I.; Sarkar, B. Transfer of Risk in Supply Chain Management with Joint Pricing and Inventory Decision Considering Shortages. Mathematics 2021, 9, 638. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).