Insurance as an Alternative for Sustainable Economic Recovery after Natural Disasters: A Systematic Literature Review

Abstract

:1. Introduction

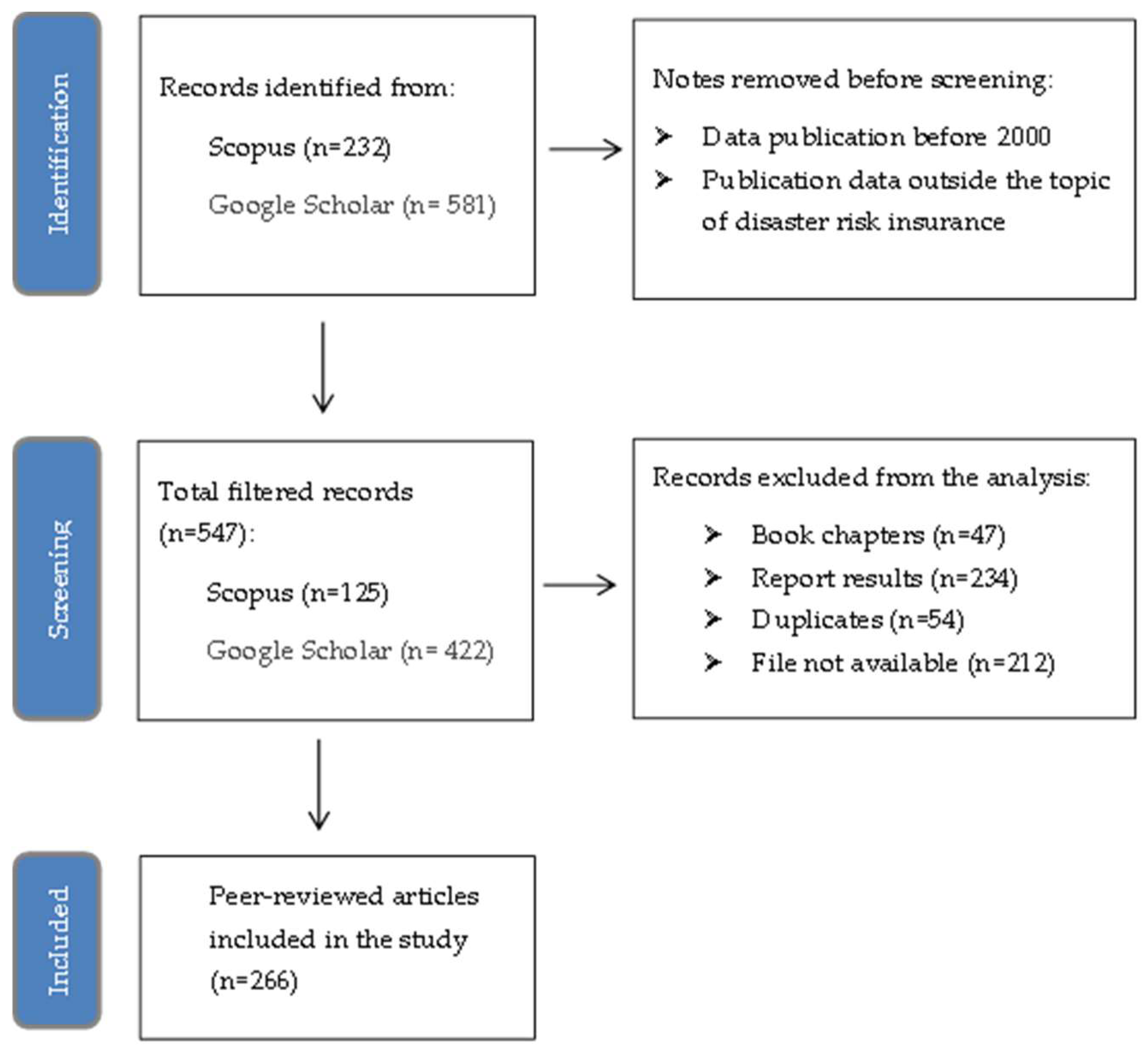

2. Materials and Methods

2.1. Scientific Article Data

2.2. Selection of Literature Database

2.3. Methods and Systematic Data Analysis

3. Results

3.1. Article Data Visualization

3.2. Development of Disaster Risk Insurance

3.3. Types of Disaster Insurance

3.4. Methodology Used in Disaster Risk Insurance Studies

4. Discussion

4.1. Trends in Disaster Risk Insurance Studies

4.2. Sustainable Disaster Risk Insurance

4.3. Types of Disaster Insurance Based on Geographical Conditions

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wiegmann, M.; Kersten, J.; Senaratne, H.; Potthast, M.; Klan, F.; Stein, B. Opportunities and risks of disaster data from social media: A systematic review of incident information. Nat. Hazards Earth Syst. Sci. 2021, 21, 1431–1444. [Google Scholar] [CrossRef]

- Kron, W.; Eichner, J.; Kundzewicz, Z.W. Reduction of flood risk in Europe–Reflections from a reinsurance perspective. J. Hydrol. 2019, 576, 197–209. [Google Scholar] [CrossRef]

- Petrucci, O.; Aceto, L.; Bianchi, C.; Bigot, V.; Brázdil, R.; Pereira, S.; Kahraman, A.; Kılıç, Ö.; Kotroni, V.; Llasat, M.C.; et al. Flood Fatalities in Europe, 1980–2018: Variability, Features, and Lessons to Learn. Water 2019, 11, 1682. [Google Scholar] [CrossRef] [Green Version]

- Alfieri, L.; Feyen, L.; Salamon, P.; Thielen, J.; Bianchi, A.; Dottori, F.; Burek, P. Modelling the socio-economic impact of river floods in Europe. Nat. Hazards Earth Syst. Sci. 2016, 16, 1401–1411. [Google Scholar] [CrossRef] [Green Version]

- Paprotny, D.; Sebastian, A.; Morales-Nápoles, O.; Jonkman, S.N. Trends in flood losses in Europe over the past 150 years. Nat. Commun. 2018, 9, 1985. [Google Scholar] [CrossRef]

- Zanardo, S.; Nicotina, L.; Hilberts, A.G.J.; Jewson, S.P. Modulation of Economic Losses From European Floods by the North Atlantic Oscillation. Geophys. Res. Lett. 2019, 46, 2563–2572. [Google Scholar] [CrossRef]

- Li, Z.; Chen, M.; Gao, S.; Gourley, J.J.; Yang, T.; Shen, X.; Kolar, R.; Hong, Y. A multi-source 120-year US flood database with a unified common format and public access. Earth Syst. Sci. Data 2021, 13, 3755–3766. [Google Scholar] [CrossRef]

- Zúñiga, E.; Magaña, V.; Piña, V. Effect of Urban Development in Risk of Floods in Veracruz, Mexico. Geosciences 2020, 10, 402. [Google Scholar] [CrossRef]

- Young, A.F.; Papini, J.A.J. How can scenarios on flood disaster risk support urban response? A case study in Campinas Metropolitan Area (São Paulo, Brazil). Sustain. Cities Soc. 2020, 61, 102253. [Google Scholar] [CrossRef]

- Baxter, P.; Bettucci, L.S.; Costa, C.H. Assessing the earthquake hazard around the Río de la Plata estuary (Argentina and Uruguay): Implications for risk assessment. J. S. Am. Earth Sci. 2021, 112, 103509. [Google Scholar] [CrossRef]

- Perez-Oregon, J.; Varotsos, P.K.; Skordas, E.S.; Sarlis, N.V. Estimating the Epicenter of a Future Strong Earthquake in Southern California, Mexico, and Central America by Means of Natural Time Analysis and Earthquake Nowcasting. Entropy 2021, 23, 1658. [Google Scholar] [CrossRef] [PubMed]

- Assumpção, M.; Veloso, A.V. The 1885 M 6.9 Earthquake in the French Guiana–Brazil Border: The Largest Midplate Event in the Nineteenth Century in South America. Seism. Res. Lett. 2020, 91, 2497–2510. [Google Scholar] [CrossRef]

- Ramírez-Rojas, A.; Flores-Márquez, E.L.; Sarlis, N.V.; Varotsos, P.A. The complexity measures associated with the fluctuations of the entropy in natural time before the deadly México M8. 2 earthquake on 7 September 2017. Entropy 2018, 20, 477. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Durage, S.W.; Wirasinghe, S.C.; Ruwanpura, J. Comparison of the Canadian and US tornado detection and warning systems. Nat. Hazards 2013, 66, 117–137. [Google Scholar] [CrossRef]

- Raker, E.J. Natural Hazards, Disasters, and Demographic Change: The Case of Severe Tornadoes in the United States, 1980–2010. Demography 2020, 57, 653–674. [Google Scholar] [CrossRef] [PubMed]

- Strader, S.M.; Roueche, D.B.; Davis, B.M. Unpacking Tornado Disasters: Illustrating Southeastern US Tornado Mobile and Manufactured Housing Problem Using March 3, 2019 Beauregard-Smith Station, Alabama, Tornado Event. Nat. Hazards Rev. 2021, 22, 04020060. [Google Scholar] [CrossRef]

- Mirus, B.B.; Jones, E.S.; Baum, R.L.; Godt, J.W.; Slaughter, S.; Crawford, M.M.; Lancaster, J.; Stanley, T.; Kirschbaum, D.B.; Burns, W.J.; et al. Landslides across the USA: Occurrence, susceptibility, and data limitations. Landslides 2020, 17, 2271–2285. [Google Scholar] [CrossRef]

- Carrera, A.C.V.; Mendoza, M.E.; Allende, T.C.; Macías, J.L. A review of recent studies on landslide hazard in Latin America. Phys. Geogr. 2021, 1–44. [Google Scholar] [CrossRef]

- Yulihastin, E.; Nuryanto, D.E.; Trismidianto; Muharsyah, R. Improvement of Heavy Rainfall Simulated with SST Adjustment Associated with Mesoscale Convective Complexes Related to Severe Flash Flood in Luwu, Sulawesi, Indonesia. Atmosphere 2021, 12, 1445. [Google Scholar] [CrossRef]

- Wang, X.; Xia, J.; Dong, B.; Zhou, M.; Deng, S. Spatiotemporal distribution of flood disasters in Asia and influencing factors in 1980–2019. Nat. Hazards 2021, 108, 2721–2738. [Google Scholar] [CrossRef]

- Jamalullail, S.N.R.; Sahari, S.; Shah, A.A.; Batmanathan, N. Preliminary analysis of landslide hazard in Brunei Darussalam, SE Asia. Environ. Earth Sci. 2021, 80, 512. [Google Scholar] [CrossRef]

- Pasang, S.; Kubíček, P. Landslide susceptibility mapping using statistical methods along the Asian Highway, Bhutan. Geosciences 2020, 10, 430. [Google Scholar] [CrossRef]

- Kurniasari, Z.; Nieamah, K.F.; Arum, W.F. Live Recovery After Post Earthquake and Tsunami: Economic Review Case Studies of Earthquake and Tsunami in Japan and Indonesia. In IOP Conference Series: Earth and Environmental Science; IOP Publishing: Bristol, UK, 2021; Volume 704, p. 012005. [Google Scholar] [CrossRef]

- Parwanto, N.B.; Oyama, T. A statistical analysis and comparison of historical earthquake and tsunami disasters in Japan and Indonesia. Int. J. Disaster Risk Reduct. 2014, 7, 122–141. [Google Scholar] [CrossRef]

- Soden, R.; Lallemant, D.; Hamel, P.; Barns, K. Becoming Interdisciplinary: Fostering Critical Engagement With Disaster Data. Proc. ACM Hum.-Comput. Interact. 2021, 5, 168. [Google Scholar] [CrossRef]

- Hirabayashi, Y.; Mahendran, R.; Koirala, S.; Konoshima, L.; Yamazaki, D.; Watanabe, S.; Kim, H.; Kanae, S. Global flood risk under climate change. Nat. Clim. Change 2013, 3, 816–821. [Google Scholar] [CrossRef]

- CRED (Centre for Research on the Epidemiology of Disasters); UNDRR (United Nations Office for Disaster Risk Reduction). Human Cost of Disasters. An Overview of the Last 20 Years 2000–2019; United Nations: New York, NY, USA, 2020; Available online: https://www.emdat.be/publications (accessed on 13 December 2021).

- Banholzer, S.; Kossin, J.P.; Donner, S.D. The Impact of Climate Change on Natural Disasters. In Reducing Disaster: Early Warning Systems For Climate Change; Springer: Dordrecht, The Netherlands, 2014; pp. 21–49. [Google Scholar]

- Frame, D.J.; Rosier, S.M.; Noy, I.; Harrington, L.J.; Carey-Smith, T.; Sparrow, S.N.; Stone, D.A.; Dean, S.M. Climate change attribution and the economic costs of extreme weather events: A study on damages from extreme rainfall and drought. Clim. Change 2020, 162, 781–797. [Google Scholar] [CrossRef]

- Chen, Y.; Li, J.; Chen, A. Does high risk mean high loss: Evidence from flood disaster in southern China. Sci. Total Environ. 2021, 785, 147127. [Google Scholar] [CrossRef]

- Luu, C.; von Meding, J.; Mojtahedi, M. Analyzing Vietnam’s national disaster loss database for flood risk assessment using multiple linear regression-TOPSIS. Int. J. Disaster Risk Reduct. 2019, 40, 101153. [Google Scholar] [CrossRef]

- Daly, P.; Mahdi, S.; McCaughey, J.; Mundzir, I.; Halim, A.; Nizamuddin; Ardiansyah; Srimulyani, E. Rethinking relief, reconstruction and development: Evaluating the effectiveness and sustainability of post-disaster livelihood aid. Int. J. Disaster Risk Reduct. 2020, 49, 101650. [Google Scholar] [CrossRef]

- Malawani, A.D.; Nurmandi, A.; Purnomo, E.P.; Rahman, T. Social media in aid of post disaster management. Transform. Gov. People Process Policy 2020, 14, 237–260. [Google Scholar] [CrossRef]

- Fan, C.; Zhang, C.; Yahja, A.; Mostafavi, A. Disaster City Digital Twin: A vision for integrating artificial and human intelligence for disaster management. Int. J. Inf. Manag. 2021, 56, 102049. [Google Scholar] [CrossRef]

- Ravankhah, M. Earthquake Disaster Risk Assessment for Cultural World Heritage Sites: The Case of “Bam and Its Cultural Landscape” in Iran. Ph.D. Thesis, BTU Cottbus-Senftenberg, Cottbus, Germany, 2019. [Google Scholar]

- Etinay, N.; Egbu, C.; Murray, V. Building Urban Resilience for Disaster Risk Management and Disaster Risk Reduction. Procedia Eng. 2018, 212, 575–582. [Google Scholar] [CrossRef]

- Cuthbertson, J.; Rodriguez-Llanes, J.M.; Robertson, A.; Archer, F. Current and Emerging Disaster Risks Perceptions in Oceania: Key Stakeholders Recommendations for Disaster Management and Resilience Building. Int. J. Environ. Res. Public Health 2019, 16, 460. [Google Scholar] [CrossRef] [Green Version]

- Behera, J.K. Role of Social Capital In Disaster Risk Management: A Theoretical Review. Int. J. Manag. (IJM) 2021, 12, 221–233. [Google Scholar]

- Astuti, V.W.; Rimawati, R. Kelud Community Activities in Disaster Management. J. Qual. Public Health 2021, 5, 339–343. [Google Scholar] [CrossRef]

- Dube, E.; Wedawatta, G.; Ginige, K. Building-Back-Better in Post-Disaster Recovery: Lessons Learnt from Cyclone Idai-Induced Floods in Zimbabwe. Int. J. Disaster Risk Sci. 2021, 12, 700–712. [Google Scholar] [CrossRef]

- Zhang, Y.-Y.; Ju, G.-W.; Zhan, J.-T. Farmers using insurance and cooperatives to manage agricultural risks: A case study of the swine industry in China. J. Integr. Agric. 2019, 18, 2910–2918. [Google Scholar] [CrossRef]

- Kousky, C. The Role of Natural Disaster Insurance in Recovery and Risk Reduction. Annu. Rev. Resour. Econ. 2019, 11, 399–418. [Google Scholar] [CrossRef]

- Bao, X.; Zhang, F.; Deng, X.; Xu, D. Can Trust Motivate Farmers to Purchase Natural Disaster Insurance? Evidence from Earthquake-Stricken Areas of Sichuan, China. Agriculture 2021, 11, 783. [Google Scholar] [CrossRef]

- Afroz, R.; Akhtar, R.; Farhana, P. Willingness to pay for crop insurance to adapt flood risk by Malaysian farmers: An empirical investigation of Kedah. Int. J. Econ. Financ. Issues 2017, 7, 1–9. [Google Scholar]

- Yucemen, M.S. Probabilistic Assessment of Earthquake Insurance Rates for Turkey. Nat. Hazards 2005, 35, 291–313. [Google Scholar] [CrossRef]

- Athavale, M.; Avila, S.M. An Analysis of the Demand for Earthquake Insurance. Risk Manag. Insur. Rev. 2011, 14, 233–246. [Google Scholar] [CrossRef]

- Thistlethwaite, J.; Henstra, D.; Brown, C.; Scott, D. Barriers to Insurance as a Flood Risk Management Tool: Evidence from a Survey of Property Owners. Int. J. Disaster Risk Sci. 2020, 11, 263–273. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. Citation-based clustering of publications using CitNetExplorer and VOSviewer. Scientometrics 2017, 111, 1053–1070. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Meng, L.; Wen, K.-H.; Brewin, R.; Wu, Q. Knowledge Atlas on the Relationship between Urban Street Space and Residents’ Health—A Bibliometric Analysis Based on VOSviewer and CiteSpace. Sustainability 2020, 12, 2384. [Google Scholar] [CrossRef] [Green Version]

- Arshad, M.; Amjath-Babu, T.; Kächele, H.; Mueller, K. What drives the willingness to pay for crop insurance against extreme weather events (flood and drought) in Pakistan? A hypothetical market approach. Clim. Dev. 2016, 8, 234–244. [Google Scholar] [CrossRef]

- Mutaqin, D.J.; Usami, K. Smallholder Farmers’ Willingness to Pay for Agricultural Production Cost Insurance in Rural West Java, Indonesia: A Contingent Valuation Method (CVM) Approach. Risks 2019, 7, 69. [Google Scholar] [CrossRef] [Green Version]

- Kunreuther, H. Disaster Mitigation and Insurance: Learning from Katrina. Ann. Am. Acad. Politi-Soc. Sci. 2006, 604, 208–227. [Google Scholar] [CrossRef] [Green Version]

- Raschky, P.; Weck-Hannemann, H. Charity hazard—A real hazard to natural disaster insurance? Environ. Hazards 2007, 7, 321–329. [Google Scholar] [CrossRef] [Green Version]

- Lodree, E.J., Jr.; Taskin, S. An insurance risk management framework for disaster relief and supply chain disruption inventory planning. J. Oper. Res. Soc. 2008, 59, 674–684. [Google Scholar] [CrossRef]

- Miranda, M.; Vedenov, D.V. Innovations in Agricultural and Natural Disaster Insurance. Am. J. Agric. Econ. 2001, 83, 650–655. [Google Scholar] [CrossRef]

- Deryugina, T. The Fiscal Cost of Hurricanes: Disaster Aid versus Social Insurance. Am. Econ. J. Econ. Policy 2017, 9, 168–198. [Google Scholar] [CrossRef] [Green Version]

- Ganderton, P.T.; Brookshire, D.S.; McKee, M.; Stewart, S.; Thurston, H. Buying Insurance for Disaster-Type Risks: Experimental Evidence. J. Risk Uncertain. 2000, 20, 271–289. [Google Scholar] [CrossRef]

- Glauber, J.W.; Collins, K.J.; Barry, P.J. Crop insurance, disaster assistance, and the role of the federal government in providing catastrophic risk protection. Agric. Financ. Rev. 2002, 62, 81–101. [Google Scholar] [CrossRef] [Green Version]

- Schwarze, R.; Wagner, G.G. The political economy of natural disaster insurance: Lessons from the failure of a proposed compulsory insurance scheme in Germany. Eur. Environ. 2007, 17, 403–415. [Google Scholar] [CrossRef] [Green Version]

- Picard, P. Natural Disaster Insurance and the Equity-Efficiency Trade-Off. J. Risk Insur. 2008, 75, 17–38. [Google Scholar] [CrossRef]

- Clarke, G.; Wallsten, S. Do remittances act like insurance? Evidence from a natural disaster in Jamaica. Evid. A Nat. Disaster Jam. Available SSRN 2003, 1–27. [Google Scholar] [CrossRef] [Green Version]

- Lee, C.H.; Lin, S.H.; Kao, C.L.; Hong, M.Y.; Mr, P.C.H.; Shih, C.L.; Chuang, C.C. Impact of climate change on disaster events in metropolitan cities-trend of disasters reported by Taiwan national medical response and preparedness system. Environ. Res. 2020, 183, 109186. [Google Scholar] [CrossRef]

- Zandalinas, S.I.; Fritschi, F.B.; Mittler, R. Global Warming, Climate Change, and Environmental Pollution: Recipe for a Multifactorial Stress Combination Disaster. Trends Plant Sci. 2021, 26, 588–599. [Google Scholar] [CrossRef]

- Tesselaar, M.; Botzen, W.W.; Robinson, P.J.; Aerts, J.C.; Zhou, F. Charity hazard and the flood insurance protection gap: An EU scale assessment under climate change. Ecol. Econ. 2022, 193, 107289. [Google Scholar] [CrossRef]

- Ivčević, A.; Statzu, V.; Satta, A.; Bertoldo, R. The future protection from the climate change-related hazards and the willingness to pay for home insurance in the coastal wetlands of West Sardinia, Italy. Int. J. Disaster Risk Reduct. 2021, 52, 101956. [Google Scholar] [CrossRef]

- Hudson, P.; Botzen, W.W.; Aerts, J.C. Flood insurance arrangements in the European Union for future flood risk under climate and socioeconomic change. Glob. Environ. Change 2019, 58, 101966. [Google Scholar] [CrossRef] [Green Version]

- Doherty, E.; Mellett, S.; Norton, D.; McDermott, T.K.; Hora, D.O.; Ryan, M. A discrete choice experiment exploring farmer preferences for insurance against extreme weather events. J. Environ. Manag. 2021, 290, 112607. [Google Scholar] [CrossRef] [PubMed]

- Adeel, Z.; Alarcón, A.M.; Bakkensen, L.; Franco, E.; Garfin, G.M.; McPherson, R.A.; Méndez, K.; Roudaut, M.B.; Saffari, H.; Wen, X. Developing a comprehensive methodology for evaluating economic impacts of floods in Canada, Mexico and the United States. Int. J. Disaster Risk Reduct. 2020, 50, 101861. [Google Scholar] [CrossRef]

- Marcillo-Delgado, J.C.; Alvarez-Garcia, A.; García-Carrillo, A. Analysis of risk and disaster reduction strategies in South American countries. Int. J. Disaster Risk Reduct. 2021, 61, 102363. [Google Scholar] [CrossRef]

- Azzam, A.; Walters, C.; Kaus, T. Does subsidized crop insurance affect farm industry structure? Lessons from the U.S. J. Policy Model. 2021, 43, 1167–1180. [Google Scholar] [CrossRef]

- Molina, M.J.; Allen, J.T. Regionally-stratified tornadoes: Moisture source physical reasoning and climate trends. Weather Clim. Extremes 2020, 28, 100244. [Google Scholar] [CrossRef]

- Meze-Hausken, E.; Patt, A.; Fritz, S. Reducing climate risk for micro-insurance providers in Africa: A case study of Ethiopia. Glob. Environ. Change 2009, 19, 66–73. [Google Scholar] [CrossRef]

- Awondo, S.N. Efficiency of region-wide catastrophic weather risk pools: Implications for African Risk Capacity insurance program. J. Dev. Econ. 2019, 136, 111–118. [Google Scholar] [CrossRef]

- Kaushalya, H.; Karunasena, G.; Amarathunga, D. Role of Insurance in Post Disaster Recovery Planning in Business Community. Procedia Econ. Financ. 2014, 18, 626–634. [Google Scholar] [CrossRef] [Green Version]

- Alam, A.S.A.F.; Begum, H.; Masud, M.M.; Al-Amin, A.Q.; Filho, W.L. Agriculture insurance for disaster risk reduction: A case study of Malaysia. Int. J. Disaster Risk Reduct. 2020, 47, 101626. [Google Scholar] [CrossRef]

- Hasan, T. Prospects of Weather Index-Based Crop Insurance in Bangladesh. Int. J. Agric. Econ. 2019, 4, 32. [Google Scholar] [CrossRef] [Green Version]

- Seko, M. Perceived preparedness and attitude of Japanese households toward risk mitigation activities following the great East Japan earthquake: Earthquake insurance purchase and seismic retrofitting. In Housing Markets and Household Behavior in Japan; Springer: Singapore, 2019; pp. 231–249. [Google Scholar]

- Xu, D.; Liu, E.; Wang, X.; Tang, H.; Liu, S. Rural Households’ Livelihood Capital, Risk Perception, and Willingness to Purchase Earthquake Disaster Insurance: Evidence from Southwestern China. Int. J. Environ. Res. Public Health 2018, 15, 1319. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Marquis, F.; Kim, J.J.; Elwood, K.J.; Chang, S.E. Understanding post-earthquake decisions on multi-storey concrete buildings in Christchurch, New Zealand. Bull. Earthq. Eng. 2017, 15, 731–758. [Google Scholar] [CrossRef]

- McAneney, J.; Timms, M.; Browning, S.; Somerville, P.; Crompton, R. Normalised New Zealand natural Disaster insurance losses: 1968–2019. Environ. Hazards 2021, 21, 58–76. [Google Scholar] [CrossRef]

- Ding, Y.; Wang, P.; Liu, X.; Zhang, X.; Hong, L.; Cao, Z. Risk assessment of highway structures in natural disaster for the property insurance. Nat. Hazards 2020, 104, 2663–2685. [Google Scholar] [CrossRef]

- Jiang, Y.; Luo, Y.; Xu, X. Flood insurance in China: Recommendations based on a comparative analysis of flood insurance in developed countries. Environ. Earth Sci. 2019, 78, 93. [Google Scholar] [CrossRef]

- Yanli, Z. An Introduction to the Development and Regulation of Agricultural Insurance in China. Geneva Pap. Risk Insur.-Issues Pract. 2009, 34, 78–84. [Google Scholar] [CrossRef] [Green Version]

- Zhang, H.; Dolan, C.; Jing, S.M.; Uyimleshi, J.; Dodd, P. Bounce Forward: Economic Recovery in Post-Disaster Fukushima. Sustainability 2019, 11, 6736. [Google Scholar] [CrossRef] [Green Version]

- Peng, R.; Zhao, Y.; Elahi, E.; Peng, B. Does disaster shocks affect farmers’ willingness for insurance? Mediating effect of risk perception and survey data from risk-prone areas in East China. Nat. Hazards 2021, 106, 2883–2899. [Google Scholar] [CrossRef]

- Aidi, Z.; Farida, H. Natural disaster insurance for Indonesia disaster management. Adv. Environ. Sci. 2020, 12, 137–145. [Google Scholar]

- Dubelmar, D.; Kartini, M.A.D.; Mareli, S.; Soedarno, M. Natural Disaster Insurance Policy in Indonesia: Proposing an Institutional Design. In Asia-Pacific Research in Social Sciences and Humanities Universitas Indonesia Conference (APRISH 2019); Atlantis Press: Amsterdam, The Netherlands, 2021; pp. 277–284. [Google Scholar]

- Shi, P.J.; Tang, D.; Liu, J.; Chen, B.; Zhou, M.Q. Natural disaster insurance: Issues and strategy of China. Asian Catastr. Insur. 2008, 79–93. [Google Scholar]

- Wang, F.; Yin, H. A new form of governance or the reunion of the government and business sector? A case analysis of the collaborative natural disaster insurance system in the Zhejiang Province of China. Int. Public Manag. J. 2012, 15, 429–453. [Google Scholar]

- Ma, S.; Jiang, J. Discrete dynamical Pareto optimization model in the risk portfolio for natural disaster insurance in China. Nat. Hazards 2018, 90, 445–460. [Google Scholar] [CrossRef]

- Shen, G.; Hwang, S.N. A spatial risk analysis of tornado-induced human injuries and fatalities in the USA. Nat. Hazards 2015, 77, 1223–1242. [Google Scholar] [CrossRef]

| Author | Indexed Database | Keywords | Citation | Focus |

|---|---|---|---|---|

| Kunreuther (2006) [52] | Scopus | Disaster insurance, building codes, homeowner motivation, community planning, disaster mitigation, risk assessment | 339 | Insurance, Hurricane Katrina, post-disaster economic recovery |

| Raschky and Weck-Hannemann (2007) [53] | Scopus | Natural hazard insurance, market failure, government assistance | 214 | Insurance, flood disaster, risk of economic loss |

| Lodree and Taskin (2008) [54] | Scopus | Inventory, news seller, emergency response, supply chain disruption | 190 | Risk management, insurance, insurance premium |

| Miranda and Vedenov (2001) [55] | Scopus | Agricultural insurance, natural disasters, weather, risk of loss | 178 | Extreme weather, agricultural risk, index-based insurance |

| Deryugina (2017) [56] | Scopus | Disaster relief, hurricane fiscal costs, social insurance | 168 | Hurricane, climate, risk of loss, insurance |

| Ganderton et al. (2000) [57] | Scopus | Disaster, risk, insurance | 166 | Natural disasters, risk of loss, insurance |

| Glauber et al. (2002) [58] | Scopus | Disaster risk protection, crop insurance, climate change, disaster relief | 159 | Extreme weather, crop loss, crop Insurance |

| Schwarze and Wagner (2007) [59] | Scopus | Political economy, natural hazards, flood insurance, Germany, EU | 114 | Flood disaster, insurance, economic loss |

| Picard (2008) [60] | Scopus | Equity–efficiency trade-off, natural disaster insurance | 111 | Natural disasters, risk of loss, insurance |

| Clarke and Wallsten (2003) [61] | Google Scholar | Insurance, Jamaica, altruism, natural disasters, migration | 100 | Hurricane, loss, insurance |

| Country | Type of Insurance and Number of Articles in the Database | |||||||

|---|---|---|---|---|---|---|---|---|

| China | 8 | 3 | 1 | 5 | 6 | 1 | ||

| U.S.A. | 3 | 3 | 6 | 2 | 3 | |||

| Indonesia | 3 | 3 | 1 | 6 | ||||

| Korea | 3 | 2 | 3 | 6 | ||||

| Japan | 1 | 3 | 2 | |||||

| New Zealand | 7 | 1 | ||||||

| Australia | 1 | 1 | Description: | |||||

| England | 1 | 1 | ||||||

| Malaysia | 1 | 2 | Agricultural insurance | |||||

| France | 1 | 1 | ||||||

| Bangladesh | 2 | 1 | Flood insurance | |||||

| India | 1 | 2 | ||||||

| Ethiopia | 1 | Property insurance | ||||||

| Kenya | 1 | |||||||

| Hungary | 1 | Earthquake insurance | ||||||

| Georgia | 1 | |||||||

| Nigeria | 1 | Natural disaster insurance | ||||||

| Netherlands | 3 | |||||||

| Honduras | 1 | Plant insurance | ||||||

| Colombia | 1 | |||||||

| Mongolia | 2 | |||||||

| Caribbean | 1 | |||||||

| Mexico | 1 | |||||||

| Jamaica | 1 | |||||||

| Ghana | 1 | |||||||

| Poland | 1 | |||||||

| German | 1 | |||||||

| Egypt | 1 | |||||||

| Italy | 1 | |||||||

| Uganda | 1 | |||||||

| Georgia | 1 | |||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kalfin; Sukono; Supian, S.; Mamat, M. Insurance as an Alternative for Sustainable Economic Recovery after Natural Disasters: A Systematic Literature Review. Sustainability 2022, 14, 4349. https://doi.org/10.3390/su14074349

Kalfin, Sukono, Supian S, Mamat M. Insurance as an Alternative for Sustainable Economic Recovery after Natural Disasters: A Systematic Literature Review. Sustainability. 2022; 14(7):4349. https://doi.org/10.3390/su14074349

Chicago/Turabian StyleKalfin, Sukono, Sudradjat Supian, and Mustafa Mamat. 2022. "Insurance as an Alternative for Sustainable Economic Recovery after Natural Disasters: A Systematic Literature Review" Sustainability 14, no. 7: 4349. https://doi.org/10.3390/su14074349