Sustainability Management Model Based on Risk Analysis and Implementation of the Model

Abstract

:1. Introduction

2. Risk Assessment in Business Processes

2.1. Business Process Management Concept

2.2. Risk Definition in Business Process Management

3. Sustainability and Risk Management

4. Failure Mode and Effects Analysis in Risk Assessment

5. Application of Stated Model

- 1.

- Defining Business Processes

- 2.

- Analysis of Business Processes

- 3.

- Management by Objectives and the Implementation of Risk Management in Business Processes

- 4.

- Development of Business Processes

5.1. Risk Analysis Model

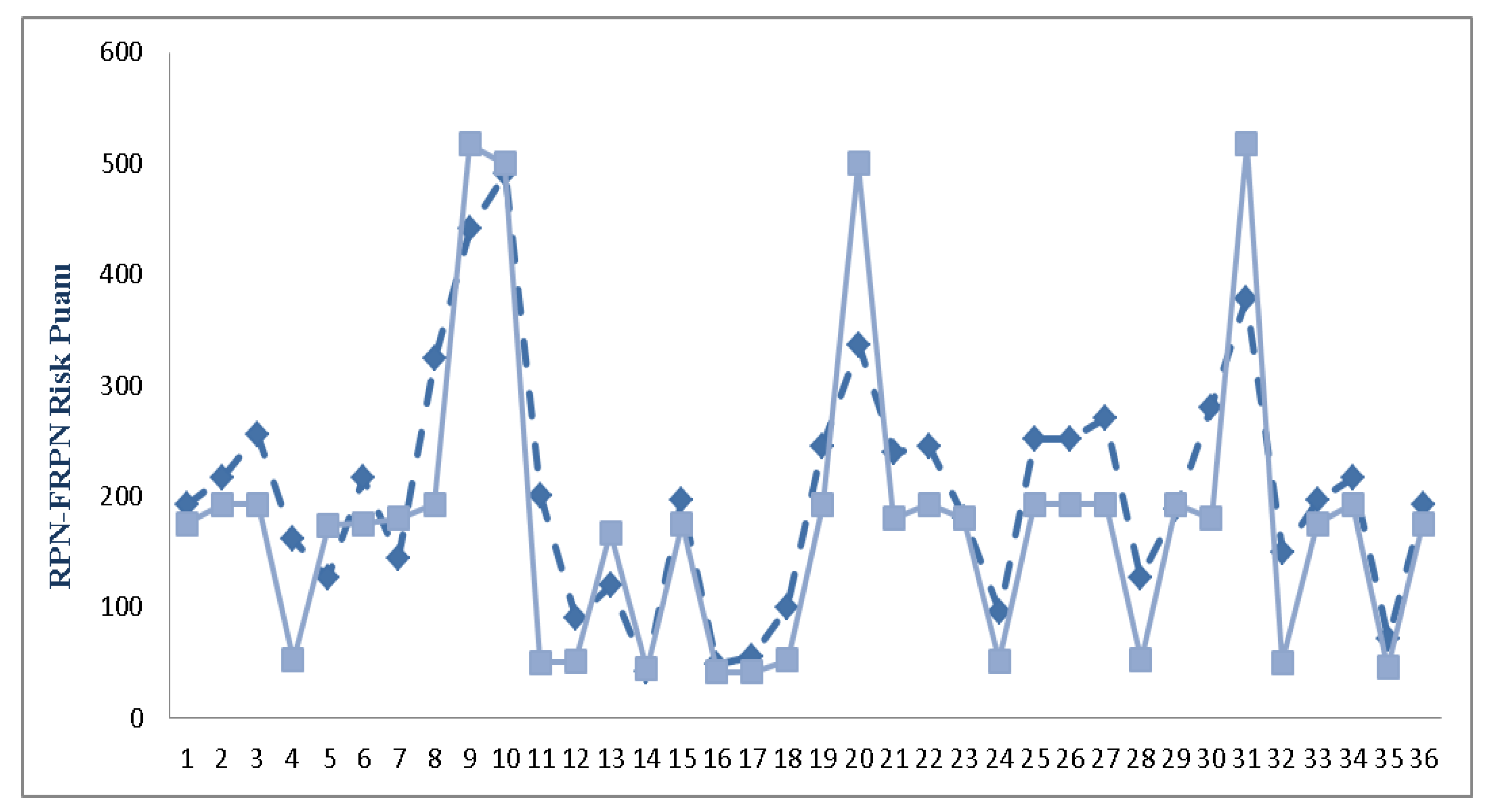

5.2. Implementation of the Model by Classical Failure Mode Effects Risk Analysis

5.3. Implementation of the Model by Fuzzy Failure Mode Effects Risk Analysis

- If R = [0–0.30], no/weak correlation between variances

- If R = [0.30–0.60], moderate correlation between variances

- If R = [0.60–0.75], strong correlation between variances

- If R = [0.75–1], very strong correlation between variances

5.4. Improved Situation Fuzzy and Non-Fuzzy FMEA Risk Assessment Method

6. Results and Suggestions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Gardner, T.A. Transparency and sustainability in global commodity supply chains. World Dev. 2019, 121, 163–177. [Google Scholar] [CrossRef] [PubMed]

- Qorri, A. A conceptual framework for measuring sustainability performance of supply chains. J. Clean. Prod. 2018, 189, 570–584. [Google Scholar] [CrossRef]

- Muthu, S. Sustainable Fibres and Textiles; Woodhead Publishing: Oxford, UK, 2017. [Google Scholar]

- Teymur, İ. İşletmelerde Süreçlerin Analizi, İyileştirilmesi ve Süreçlerle Yönetim Yapısının Kurulması: Karaman’da Bir Gıda Sanayi İşletmesinde Süreç İyileştirme Projesinin Sonuçlarının Değerlendirilmesi Üzerine Bir Çalışma. Master’s Thesis, Gazi Üniversitesi, Ankara, Turkey, 2009. [Google Scholar]

- Küçük, O.; Korucu, S. Süreç Yönetimi; Detay Yayıncılık: Ankara, Turkey, 2018. [Google Scholar]

- Frandsen, S.; Morsing, M.; Valletin, S. Adopting sustainability in the organization: Managing processes of productive loose coupling towards internal legitimacy. J. Manag. Dev. 2013, 32, 236–246. [Google Scholar] [CrossRef]

- Johnson, W.C.; McCormack, K.P. Business Process Orientation: Gaining the E-Business Competitive Advantage; CRC Press: Boca Raton, FL, USA, 2021; p. 208. [Google Scholar]

- Lisovsky, A.L. Integration of Planning Systems with Risk Management Systems on Large Enterprises. Strateg. Decis. Risk Manag. 2019, 10, 228. [Google Scholar] [CrossRef]

- Hedman, J.; Henningsson, S. Three Strategies for Green IT. IT Prof. 2010, 13, 54–57. [Google Scholar] [CrossRef]

- Harmon, P.; The State of Business Process Management. A BPTrends Report. Available online: https://www.bptrends.com/bpt/wp-content/uploads/2015-BPT-Survey-Report.pdf (accessed on 4 April 2022).

- Gallotta, B.; Garza-Reyes, J.; Anosike, A. A conceptual framework for the implementation of sustainability business processes. In Proceedings of the 27th Production and Operations Management Society (POMS) Conference, Orlando, FL, USA, 6–8 May 2016; pp. 6–8. [Google Scholar]

- Leymann, F.; Nowak, A.; Schumm, D. The Differences and Commonalities between Green and Conventional Business Process Management, Autonomic and Secure Computing. In Proceedings of the Ninth International Conference on Dependable, Sydney, Australia, 12–14 December 2011; IEEE: Sydney, Australia, 2011; pp. 12–14. [Google Scholar]

- Tütüncü, Ö.; İpekgil Doğan, Ö.; Topoyan, M. Süreçlerle Yönetim ve Bir Hizmet İşletmesi Uygulaması; Dokuz Eylul Unıversity: İzmir, Turkey, 2004. [Google Scholar]

- Opitz, N.; Krüp, H.; Kolbe, L. Green Business Process Management–A Definition and Research Framework. In Proceedings of the 47th Hawaii International Conference on 2014, Waikoloa, HI, USA, 6–9 January 2014; pp. 3808–3817. [Google Scholar]

- COSO. Enterprise Risk Management. In Aligning Risk and Strategy with Performance; COSO: New York, NY, USA, 2016. [Google Scholar]

- Bakker, P.; Sustainability and Enterprise Risk Management. World Business Council for Sustainable Development. 2020. Available online: https://www.wbcsd.org/ (accessed on 4 April 2022).

- Schulte, J.; Hallstedt, S.I. Company Risk Management in Light of the Sustainability Transition. Sustainability 2018, 7, 4137. [Google Scholar] [CrossRef] [Green Version]

- Marhavilas, P.; Koulouriotis, D. Risk Analysis and Assessment Methodologies in the Work Sites: On a Review, Classification and Comparative Study of the Scientific Literature of the Period 2000–2009. J. Loss Prev. Process 2011, 477–523. [Google Scholar] [CrossRef]

- Ağgül, H. Finans Dışı Şirketlerde Kurumsal Risk Yönetimi ve Örnek Bir Risk Matrisi Uygulaması. Master’s Thesis, Beykent Üniversitesi Sosyal Bilimler Enstitüsü, İstanbul, Turkey, 2019. [Google Scholar]

- Birgören, B. Fine Kinney Risk Analizi Yönteminde Risk Analizi Yönteminde Risk Faktörlerinin Hesaplama Zorlukları ve Çözüm Önerileri. Uluslararası Mühendislik Araştırma Geliştirme Derg. 2017, 9, 20. [Google Scholar]

- Usman, Ö. İşletmelerde Kurumsal Risk Yönetim Süreci ve Bir Uygulama. Master’s Thesis, Uludağ Üniversitesi Sosyal Bilimler Enstitüsü: Bursa, Turkey, 2018. [Google Scholar]

- Mandal, S.; Jyotirmoy, M. Risk Analysis Using FMEA: Fuzzy Similarity Value and Possibility Theory Based Approach. Expert Syst. Appl. 2014, 41, 3527–3537. [Google Scholar] [CrossRef]

- Ünlü Tok, E. Risk Değerlendirmesinde FMEA Yöntemine Bulanık Mantık Yaklaşımı: Deney ve Kalibrasyon Laboratuvarları Uygulaması. Master’s Thesis, Hacettepe Üniversitesi, Ankara, Turkey, 2019. [Google Scholar]

| FMEA Risk Assessment Rank | ||

|---|---|---|

| Risk Precaution Rank | RPN Value | Regulatory Preventive Activity |

| (1) Negligible | RPN 10 | Additional check processes may not be necessary to eliminate risks. |

| (2) Low | 10 < RPN ≤ 40 | The current checks should be maintained, and their sustainability must be inspected. |

| (3) Moderate | 40 < RPN ≤ 100 | Activities should be commenced without losing time to mitigate risks. |

| (4) High | 100 < RPN < 400 | Urgent precautions should be taken for risks, and the continuity of the activities should be decided upon those precautions. |

| (5) Take Precaution | RPN ≤ 400 | Activity should be maintained until the risks are decreased to an acceptable level. |

| The Process Goal/Goals | Achievement Time | The Relevant Management System Goal/Goal No | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 1. Achieving Uster Quality Standards Values | 1 Year | Our Quality Policy L5.2.G001/5 | |||||||

| 2. Decreasing The Number of Barré Bobbins to 0 | 1 Year | Our Product Safety Policy L8.1.K006/2 | |||||||

| 3. Providing a Moisture Value Over 7%. | 1 Year | Our Product Safety Policy L8.1.K006 / 2 | |||||||

| The Performance Indicators of the Process | Goal No | Influence on the Goal (%) | 2020-1 | 2020-2 | 2021-1 | 2021-2 | 2022-1 | 2022-2 | Tracking Method |

| 1. Uster Quality Values | 1 | 100% | 12.5% | 11.61% | 10.96% | Access | |||

| 2 The Number of Barré Bobbins | 2 | 100% | 11.61% | 0.5% | - | Excel | |||

| 3. Moisture Values | 3 | 100% | 6.4% | 6.21% | 7.73% | Access | |||

| Risks and Risk Numbers | Risk Assessment Method | Effect | Probability | Detectability | RISK NUMBER |

|---|---|---|---|---|---|

| 1. Comparison of Organic Cotton with Other Cotton Types | ☑Quantitative Assessment | 4 | 6 | 9 | 216 |

| ☐Qualitative Assessment | |||||

| ☐Group Decision | |||||

| ☐Individual Decision | |||||

| 2. Forming of Customer Complaints | ☐Quantitative Assessment | 6 | 4 | 3 | 72 |

| ☑Qualitative Assessment | |||||

| ☐Group Decision | |||||

| ☐Individual Decision | |||||

| 3. Weak Yarn and Breaking of Yarn | ☑Quantitative Assessment | 6 | 4 | 8 | 192 |

| ☐Qualitative Assessment | |||||

| ☐Group Decision | |||||

| ☐Individual Decision | |||||

| PROCESS DEVELOPMENT STRATEGIES/ACTIVITIES | The Relevant Goal/Risk No | ||||

| 1. Measuring the quality values at the beginning of each process and at certain intervals | Goal No/1 | ||||

| 2. Maintaining visual inspections during manufacturing by raising the awareness of all operators | Goal No/2 Risk No/ 1 | ||||

| 3. Keeping the business environment conditions at an optimum level | Goal No/3 Risk No/ 2.3 | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Coşkun, S.; Akgül, E. Sustainability Management Model Based on Risk Analysis and Implementation of the Model. Sustainability 2022, 14, 4396. https://doi.org/10.3390/su14084396

Coşkun S, Akgül E. Sustainability Management Model Based on Risk Analysis and Implementation of the Model. Sustainability. 2022; 14(8):4396. https://doi.org/10.3390/su14084396

Chicago/Turabian StyleCoşkun, Semih, and Elif Akgül. 2022. "Sustainability Management Model Based on Risk Analysis and Implementation of the Model" Sustainability 14, no. 8: 4396. https://doi.org/10.3390/su14084396

APA StyleCoşkun, S., & Akgül, E. (2022). Sustainability Management Model Based on Risk Analysis and Implementation of the Model. Sustainability, 14(8), 4396. https://doi.org/10.3390/su14084396