Abstract

The carbon emission trading market is an important policy tool to promote the realization of China’s carbon peaking and carbon neutrality goals. Research on the relationship between the carbon market and other related ones supports policy formulation and risk aversion. Firstly, we construct the Carbon–Energy–Stock system to compare the information spillover between the three subsystems under a unified framework. Secondly, we adopt the connectedness network to identify the role and status of the carbon, energy, and stock markets. Thirdly, through the rolling window approach, we explore the dynamic evolution of the information spillover. The results show that (1) the information spillover effect between China’s pilot carbon markets, the energy market, and the stock market is relatively low; (2) in the Carbon–Energy–Stock system, China’s pilot carbon markets behave as the information transmitters, and the Guangdong pilot and Beijing pilot are core pilots. The coal market is the top information recipient, while the new energy industry is the top information transmitter; (3) the system connectivity shows the characteristics of increasing first and then decreasing. For investors and policymakers, looking at each market from a systems point of view will present a more accurate understanding of them and their interconnections.

1. Introduction

The carbon emission trading market is an effective means to obtain low-cost emission reduction through a market economy and is a powerful way to reduce greenhouse gas emissions, improve energy efficiency, and respond to global climate change. Today, there are 24 carbon emission trading systems in operation worldwide, covering 16% of the world’s total carbon emissions, and the areas where carbon trading is implemented account for about 54% of the global GDP and one-third of the population (ICAP: Emissions Trading Worldwide Status Report 2021).

China is the largest carbon emitter worldwide, and its emission reduction policies attract international attention. China’s economic development and natural endowment vary greatly among different regions, so it is vital to balance their interest relations when selecting the pilot areas. The pilots should be similar to national economic development and natural conditions to accumulate valuable experience for China’s national carbon market. Therefore, the selection of pilot areas should be in line with the overall economic development level and a certain breadth of geographical scope. Moreover, the pilot areas should have a location advantage for energy production and energy-intensive industries so that the pilot carbon markets can be more nondestructive to local economics. Furthermore, the emission transfer should be avoided or alleviated, and the market should have sufficient capacity and trading subjects. In October 2011, the National Development and Reform Commission of China announced a carbon emission trading plan, establishing Beijing, Shanghai, Tianjin, Chongqing, Hubei, Guangdong, and Shenzhen as pilots. In June 2013, Shenzhen founded the first pilot in China. By the end of June 2021, the cumulative transaction volume of the pilots had reached 480 million tons of carbon dioxide equivalent, and the cumulative transaction amount had been about 11.4 billion yuan. On 16 July 2021, the national carbon market opened. By 31 December 2021, the cumulative transaction volume of the national one had been 179 million tons, with a total transaction amount of 7.661 billion yuan. Carbon markets have become a vital tool for China to achieve its goal of carbon peaking and carbon neutrality, and the role and value of the carbon market will become more prominent. As China’s national carbon market construction starts from the pilots, the exploration of the pilots has provided empirical support for the establishment and expansion of the national one. As a result, the continuous research on the pilots can provide positive references for the national one and provide targeted guidance for pilot areas to promote green and low-carbon transformation.

The carbon market is one commodity market whose prices are affected by the economic environment and energy prices. With the internationalization of carbon markets and carbon finance, carbon markets provide investors with another asset investment channel. Therefore, research on the relationship between the carbon market and other related ones offers support for policy formulation and a basis for investors to avoid risks [1,2,3,4].

Although the research on the connection between carbon markets and other related ones is abundant, there are problems worthy of further study. (1) Most research focuses on Carbon–Energy or Carbon–Stock systems, and the research that puts the carbon market, energy market, and stock market into one research framework (Carbon–Energy–Stock) is inadequate [5,6,7,8]. (2) The existing research pays close attention to the EU ETS [8,9,10,11,12,13,14,15], and the research on China’s carbon market is still insufficient. Although some studies focus on China’s carbon market, most of them choose one pilot [6,7,16,17,18]. At present, there are eight pilots in different regions in China, and no one can fully represent China’s carbon market. Furthermore, the information transmission among the pilots is worthy of study, which is still lacking. (3) Most of the existing studies adopt GARCH models [6,7,12,13,19,20], empirical mode decomposition (EMD) [9,15], and the wavelet analysis method [21], which consider the relationship between the variables and lack the measurement of the entire system.

To fill these gaps, we make three main contributions to the literature. First, we study the information spillover of the Carbon–Energy–Stock system, which provides a comprehensive insight into the information transmission between China’s pilot carbon markets, the energy markets, and the stock markets. Existing studies have confirmed the relationship between carbon, energy, and stock markets, and measuring the relationship between the three can compare their closeness under a unified framework. Further, carbon, energy, and stock markets are all in a complex external environment, and looking at each subsystem from a systems point of view will present a more accurate understanding of them and their interconnections.

Second, we put seven pilots into the carbon market subsystem. Therefore, we can not only understand the status and role of each pilot in the Carbon–Energy–Stock system but also analyze the information spillover among pilots in the context of the energy market and economic environment.

Finally, we introduce the new energy index and power index of China into the stock market subsystem. Under the goal of carbon neutrality, the increasing power demand will be met mainly by new energy power to effectively curb the rebound in coal power supply and coal consumption, and the new energy industry will develop rapidly. Moreover, the power industry is the primary industrial sector participating in the carbon markets [22]. Carbon emission constraints and fluctuations in carbon prices will affect the decisions of the power industry. At the same time, the electricity price is also one of the main factors affecting carbon price. Understanding the information spillover evolution between the new energy industry, power industry, and the carbon market will provide ideas for the national carbon market construction and the goal of carbon neutrality.

We adopt the connectedness measures proposed by Diebold and Yilmaz [23] and the rolling window approach, which can not only point out the direction and amount of information spillover but also measure the entire system connectivity systematically, dynamically, and networked [8,14,24].

2. Literature Review

The connection between carbon markets and energy markets, between carbon markets and stock markets, and between different carbon markets is a hot topic, which provides a basis for investors’ decision-making and asset allocation and theoretical support for policymakers to formulate policies.

2.1. The Connection between Carbon Market and Energy Market

Fossil energy consumption is the dominating source of carbon emissions, and the carbon market can affect the demand for fossil energy through a reasonable carbon price. At the same time, energy prices will affect carbon prices. There is a close relationship between carbon markets and energy markets [7].

The current studies focus on the correlations and spillovers between carbon markets and coal, oil, natural gas, and electricity markets. Some studies point out the correlation and spillovers between them. Kim and Koo find that coal price is the main factor affecting U.S. carbon trading in the long run, and changes in crude oil price, natural gas price, and coal price have a significant impact on the carbon market in the short run [25]. Hammoudeh et al. show that when the price of crude oil is at a high level, its increase leads to a rapid decline in the U.S. carbon price; when the price of natural gas is at a high level, it has a positive impact on the carbon price, while at a low level the opposite is true [26]. Wang and Guo also conclude that the oil market and the natural gas market have a strong spillover effect on the carbon market [24]. Keppler and Mansanet-Bataller find that coal and gas prices impact EU carbon prices [11]. Balcilar et al. show the significant volatility and time-varying risk transmission from energy markets to the EU ETS [10]. Marimoutou and Soury also reach similar conclusions [27]. Some studies show the connection between China’s pilot carbon market and the energy markets. Lin and Chen find a significant time-varying correlation between the Beijing pilot and the coal market [6]. Ma et al. confirm that the dynamic correlation between the Guangdong pilot and the energy market has significant time-varying and persistent characteristics [7].

Some researchers present different conclusions. Yu et al. believe that the EU carbon price and crude oil price are irrelevant under the original data level [9]. Zhang and Sun [12] and Reboredo [28] also support such conclusions. Regarding China’s pilot carbon market, Zeng et al. show that the Beijing carbon pilot price, crude oil price, natural gas price, and economic development have positive but not significant correlations [16]. Fan and Todorova attribute the reason to the weak relationship between price and market fundamentals and the low information efficiency of the pilot carbon market [5].

2.2. The Connection between Carbon Market and Stock Market

The stock market may reflect the economic conditions of an economy. Better economic development leads to higher energy consumption and carbon emissions, thereby pushing up carbon prices. On the other side, carbon prices may change the manufacturers’ economic incentives, which will be reflected in the stock market [13].

Existing research pays a lot of attention to the interaction between the carbon market and the stock market. Researchers usually select one of China’s pilot carbon markets for their studies. Ma et al. explain that a negative dynamic correlation between the Guangdong pilot and the capital market is related to the unreasonable carbon quotas [7]. Wen et al. take the Shenzhen pilot as an example to quantitatively analyze the impact of the carbon market on company stock returns: the carbon market has a positive influence on the excess returns of companies participating in carbon trading, and the carbon premium on stock returns shows a steady upward trend [17]. Wen et al. show a long-term and short-term asymmetric relationship between the Shenzhen pilot and the stock market. The carbon price increase has more impact on the stock price than its decline, while the stock index has no significant influence on carbon prices [18]. There is causality from the stock market on the EU ETS [13]. Creti et al. and Koch et al. support the conclusion that stock indexes are significant in explaining the EU carbon price [29,30], while Hintermann reaches the opposite result [31].

Some studies explore the relationship between carbon prices and stock prices of power companies and between carbon prices and stock prices of new energy companies. Oberndorfer points out that the EU carbon price returns have a positive effect on the stock returns of the top European power companies [32]. Ji et al. confirm a strong information dependence between EU carbon price returns and electricity stock returns, where the carbon market acts as the information recipient, and top power companies provide more information to the carbon market than small power companies [14]. Kumar et al. indicate no significant correlation between the EU ETS and the clean energy stock market [33], while Lin and Chen find a significant time-varying correlation between the Beijing pilot and the new energy stock market [6].

2.3. The Connection between Carbon Markets

Due to the nature of the carbon markets, any related policy will affect their carbon prices. Therefore, there may be some linkage between different carbon markets, which will provide references for the carbon market construction [34].

The existing research focuses on the correlation between different carbon trading systems and the comparison between them. Mizrach discusses the relationship between the EU ETS and the North American Regional Greenhouse Gas Initiative (RGGI). There is a co-integration relationship between the RGGI prices and the EU carbon prices, and the former is the Granger reason for the latter [35]. Zhang et al. compare China’s carbon market with the EU ETS, and there is no evidence to show which one has absolute advantages [36]. Xiong et al. compare China’s pilot with the EU ETS and the California one [37]. Narassimhan et al. evaluate the carbon markets in the U.S., European Union, Switzerland, California in the United States, Quebec in Canada, New Zealand, the Republic of Korea, and China according to environmental effectiveness, market management, revenue management, economic efficiency, and stakeholder engagement [38].

China has eight pilot carbon markets in operation, and they will co-exist after the national carbon market operates. The researchers analyze their similarities and differences and compare them in regard to market design, operation, effectiveness, maturity, dispersion, and liquidity. Zhou et al. believe the pilots have operated successfully after systematically reviewing the design and the operation in the short term [39]. However, some studies point out that the pilots’ effectiveness and maturity are generally low [40,41]. High market dispersion, insufficient quota trading, long trading intervals, and poor information transparency may be the main reasons for it [39,42].

The existing research provides more knowledge and understanding of the relationship between the carbon markets and the related ones. Although some studies have pointed out that exploring the dynamic correlation mechanism among the carbon market, the energy market, and the stock market is conducive to promoting the coordinated linkage of policies among them [5,6,7,8], the research in this area is still insufficient. We explore the magnitude and direction of the information spillover between any two markets in the three subsystems under a unified framework and measure the information connectivity of the Carbon–Energy–Stock system. Moreover, we investigate the roles and status of each market from a systematic perspective. In particular, we show the information spillover and system connectivity dynamically and networked.

3. Methods and Data

3.1. Methods

Connectedness is central to risk measurement, and it features prominently in key aspects of market risk (return connectedness), systemic risk (system-wide connectedness), and so on [23]. Diebold and Yilmaz propose several connectedness measures to describe the directional connectedness of variables. These connectedness measures can effectively identify the magnitude and direction of information flow and measure the magnitude of system integration [14,23]. Here, we adopt this method to measure the directional connectedness of the Carbon–Energy–Stock system.

First, we construct a covariance stationary 13-dimensional VAR(p) model:

where Rt, a 13-dimensional vector, represents the return vector of the carbon prices of the Beijing, Guangdong, Chongqing, Shanghai, Tianjin, Shenzhen, and Hubei pilots, the coal prices, the oil prices, the natural gas prices, and three stock indexes. Φi is a 13 × 13 autoregressive coefficient matrix, and εt is the error vector assumed to be serially uncorrelated. , where the coefficient matrix Ai satisfies the recurrence relationship , A0 is the identity matrix, Ai = 0, i < 0. Ai’ is the transposition of Ai. We measure the volatility contribution of each variable to the others and to the system based on the generalized variance decomposition [43,44].

H-step generalized variance decomposition matrix has elements:

where denotes the variance contribution of variable j to variable i, B is the covariance matrix of ε, and σjj is the standard deviation of εj. ei is a selection vector with the ith element unity and zeros elsewhere, and ei’ is the transposition of ei. We normalize each element in the matrix to ensure that the sum of each row is equal to 1; that is,. In Section 4, “VARIABLE J TO VARIABLE I” determined by measures the information spillover from variable j to variable i.

Moreover, some information spillover indicators are constructed as follows [14,23]:

where is recorded as . Fi←• measures the total directional connectedness from other variables to variable i, indicating the information spillover from others to it. T•←j measures the total directional connectedness from variable j to other variables, which indicates the information spillover from it to others. NCi measures the net connectedness of variable i, which represents its net contribution to the system. Finally, TC measures the total connectedness of the system, representing the information or risk transmission of the Carbon–Energy–Stock system.

The rolling window approach analyzes the data of each period in chronological order to obtain the characteristics of the research objects in the corresponding period. In this way, the data changes can be obtained from continuous periods. The rolling window can frame the time series according to the specified unit length, which is equivalent to a slider with a specified length rolling on the scale, and the data in the slider can be fed back for each rolling unit.

Some statistics and statistical tests used in our analysis are described below. Skewness measures the asymmetry of data distribution. Quantitatively, negative skewness means that most values lie to the right of the mean, indicating that the variable has a downside risk with a higher probability. Positive skewness means that most values lie to the left of the mean, and zero skewness means that the data is distributed on both sides of the mean evenly.

Kurtosis measures the height of the peak at the mean value of the distribution curve. If the kurtosis is greater than 3, the distribution curve shows the leptokurtosis and fat-tail feature.

The Jarque–Bera test is a goodness-of-fit test for whether the sample data have skewness and kurtosis that conform to a normal distribution. The null hypothesis is that the variables follow a normal distribution.

A unit root test must be performed on each variable before constructing a VAR model. The ADF test tests whether there is a unit root in the series. If there is a unit root, the series is a non-stationary time series, which will lead to spurious regression in regression analysis. The null hypothesis of the ADF test is that the series has a unit root. If the null hypothesis is rejected, the series does not have a unit root and is a stationary series.

We adopt the connectedness measures and the rolling window approach to investigate the roles and status of each market, understand information spillover between different markets, and measure the system connectivity systematically, dynamically, and networked.

3.2. Data

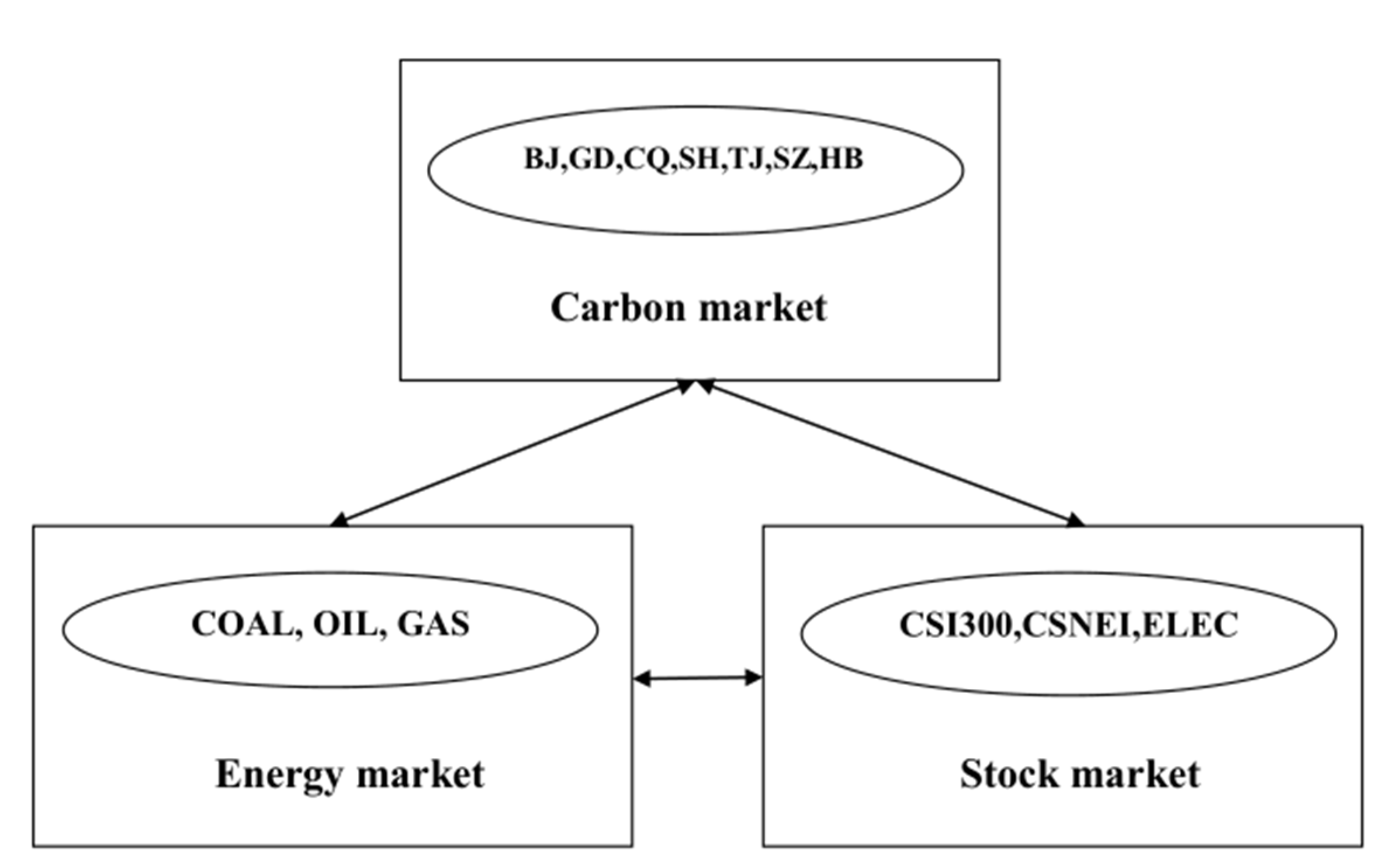

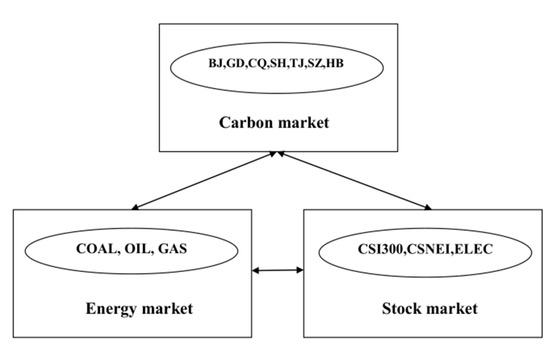

We incorporate the Beijing, Guangdong, Chongqing, Shanghai, Tianjin, Shenzhen, and Hubei pilots as the carbon market subsystem (we do not select the Fujian pilot, which does not operate for very long), and their transaction prices are denoted by BJ, GD, CQ, SH, TJ, SZ, and HB (http://www.tanpaifang.com, accessed on 22 September 2020), respectively. Coal is the dominant energy for China, and it depends mainly on domestic supply. The thermal coal futures market of the Zhengzhou Commodity Exchange represents the coal market, and its closing prices represent the coal prices (COAL, http://choice.eastmoney.com, accessed on 24 September 2020). The rapid growth of energy consumption in China has resulted in domestic production failing to meet the demand [45]. According to the BP Statistical Review of World Energy 2019, China’s dependence on foreign oil reached 72%, and natural gas dependence reached 43% in 2018. The Brent oil market is adopted to represent the oil market, and the Brent oil spot prices represent oil prices (OIL, www.wind.com.cn, accessed on 24 September 2020). The NYMEX natural gas futures market represents the natural gas market, and NYMEX natural gas futures closing prices represent natural gas prices (GAS, http://www.wind.com.cn, accessed on 24 September 2020). The coal market, oil market, and natural gas market make up the energy market subsystem. The stock market is the typical form of the capital market, reflecting the country’s economy, and the economic activities and the carbon market is related [13]. Therefore, we select the Shanghai and Shenzhen 300 index to represent the economic performance (CSI300, http://choice.eastmoney.com, accessed on 24 September 2020), reflecting the overall picture of the entire A-share market and mainstream investment. The carbon market will inevitably affect energy consumption, thereby promoting the innovation of new energy technologies. The connection between the carbon market and the new energy industry is also crucial [6]. We select the CSI new energy index as a representative indicator of the development of new energy companies (CSNEI, http://choice.eastmoney.com, accessed on 24 September 2020), which reflects the performance of listed companies in renewable energy production and new energy applications. The power industry is a primary participant in the carbon markets, and we select the CSI power index to reflect the operation of power companies (ELEC, http://choice.eastmoney.com, accessed on 24 September 2020). Here, the Shanghai and Shenzhen 300 index, the CSI new energy index, and the CSI power index make up the stock market subsystem. The Carbon–Energy–Stock system is shown in Figure 1. Due to the data availability of each market, the sample range is from 19 June 2014 to 31 December 2019 (1282 observations for each market).

Figure 1.

Carbon–Energy–Stock system.

4. Results

We calculate the logarithmic returns of 13 indicators based on lnpt-lnpt-1 and list their descriptive statistics in Table 1.

Table 1.

Descriptive statistics of daily returns.

In the seven pilots, BJ and SH have positive average returns, and the others’ are all negative, with average returns from −0.00108 to 0.000378; the average returns of CSI300, CSNEI, and ELEC are all positive, and the returns are from 0.000046 to 0.000334; moreover, the average returns of the three energy prices are all negative, from −0.00072 to −0.000007. The standard deviation of the carbon returns of CQ is the largest, 0.095092, and that of HB is the smallest, 0.041175; the standard deviation of the stock price returns is not much different, around 0.02; the standard deviation of coal price returns is 0.014857, and those of oil price returns and natural gas price returns are 0.021794 and 0.026115, respectively. As a whole, the standard deviation of carbon price returns is higher than those of stock price returns and energy price returns, which indicates that the carbon pilots have high volatility; that is, higher risk. The negative skewness of BJ, GD, CQ, and HB implies the markets have a downside risk with a higher probability, and the skewness of SH, TJ, and SZ is positive. The stock index returns are all negatively skewed. Moreover, COAL has negative skewness, while OIL and GAS have positive ones. Except for OIL, the kurtosis coefficients of other indicators are more than three, reflecting the leptokurtosis and fat-tail distribution. This conclusion is consistent with the Jarque–Bera test results. The ADF test shows that all the return series are stationary because the null hypothesis of a unit root is rejected at the 5% level.

4.1. Static Connectedness Analysis

Based on the VAR (2) model, we adopt a 5-step-ahead generalized variance decomposition to measure the variance contribution of each variable to others and the system (we have selected different H for experiments, and the results show that ours are robust). The information spillover indicators calculated according to Equations (3)–(6) are listed in Table 2.

Table 2.

Return connectedness matrix.

4.1.1. Static Connectedness Analysis of Carbon–Energy–Stock System

The total connectedness of the Carbon–Energy–Stock system is 16.9%, indicating a low information spillover effect between China’s carbon markets, energy markets, and stock markets. The result is different from that of the EU Carbon–Energy–Finance system [8].

Our findings show that the volatility of the carbon price returns of each pilot is explained by more than 96% by itself, and other markets only contribute 0.93% to 3.45% of the volatility. The result implies all the pilots have a low information spillover effect with others and is consistent with Fan and Todorova [5]. Tan et al. show the volatility of EU carbon price returns explained by the energy market and capital market reaches 40.61% [8], which indicates a big gap between China’s pilots and EU ETS. China’s pilots do not cover a wide range of industries, and carbon prices have been at a low level for a long time, resulting in the inactive participation of emission control companies. As a result, ineffective carbon prices harm the effectiveness of information transmission. Specifically, in the stock markets, CSNEI has the highest variance contribution to BJ, GD, SZ, and HB, followed by ELEC. The impact of the new energy industry on the carbon market cannot be ignored, which is supported by Lin and Chen [6] and Wang and Zhao [46]. In the energy markets, different from the results that Brent oil prices play an important role in affecting carbon prices [4], COAL contributes most to HB, and GAS contributes most to other pilots, which is supported by Zhang and Sun [12]. This finding also provides evidence that natural gas is a vital influencing factor on carbon markets [24]. Increasing natural gas consumption is a crucial path for China to advance the energy revolution and build a clean, low-carbon, and efficient modern energy system, which inevitably makes natural gas have a more profound impact on the carbon market. In general, the information spillover effect of the energy market on the carbon market is higher than that of the stock market on the carbon market, and the information spillover effect of energy stock on the carbon market is higher than that of non-energy stock on the carbon market, which is consistent with Tan et al. [8].

The volatility of the three stock indexes’ returns explained by other variables is more than 50%. For example, other stock indexes, the energy markets, and the pilots explain 63.06% of the CSI300’s return volatility, 61.1% of the ELEC’s, and 53.39% of the CSNEI’s. The contribution of other stock indexes is relatively high, indicating strong information linkages. For instance, ELEC has the highest contribution to CSNEI, reaching 24.65%. At the same time, CSNEI has the highest one to ELEC, reaching 30.68%. The close mutual influence between CSNEI and ELEC indicates sufficient information and risk transmission between them. Moreover, we cannot ignore information transmission from the pilots to ELEC and CSNEI. For instance, BJ and GD contribute 1.21% and 1.43%, respectively, to CSNEI and 0.72% and 0.98% to ELEC, respectively. These results support that the carbon markets have imposed carbon constraints on the development of the power industry and the optimization of the energy consumption structure to promote the new energy industry [6,47]. In the energy market, OIL is the top contributor to the volatility of the three stock indexes, followed by COAL, and this finding is consistent with the fact that oil and coal are the dominating energy sources promoting China’s economic development.

The volatility explained by itself is 85.93% for COAL, 92.6% for OIL, and 96.31% for GAS. As we adopt international market data for oil and natural gas, this conclusion means that international oil prices and natural gas prices are less affected by China’s pilots and the stock market. For the energy market, the pilots’ impact is more than that of the stock market. For instance, BJ and GD contribute 1.37% and 4.59% to COAL, respectively. Carbon emission reduction policies require optimization of the energy structure, and carbon prices tend to affect the energy prices through the changes in energy demands. Moreover, due to the substitution between different energy sources, different energy markets also influence each other. For example, OIL explains 1.2% of the volatility of COAL, and GAS explains 1.13% of the volatility of OIL.

In general, the information spillover effect of the energy market on the carbon market is higher than that of the stock market on the carbon market. The information spillover effect of the energy stock on the carbon market is higher than that of the non-energy stock in the stock market.

The information spillover effect of the carbon market, especially the Beijing and Guangdong carbon pilots, on the stock market is higher than that of the energy market on the stock market. In the energy market, the oil and the coal market show a higher spillover effect on the stock market.

The carbon market, especially the Beijing and Guangdong carbon pilots, has a higher information spillover effect on the energy market than the stock market has.

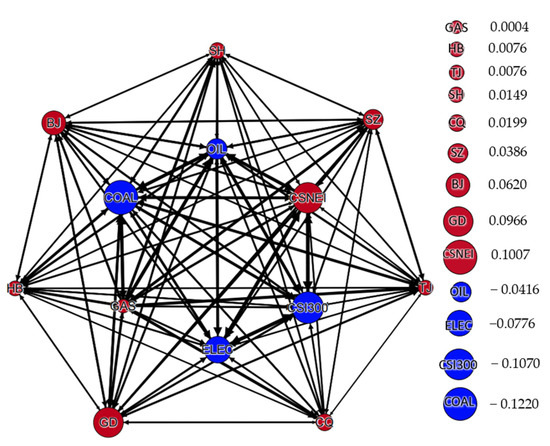

We calculate the net connectedness of each indicator. The pilots’ net connectedness is positive, indicating that China’s carbon pilots are information transmitters in the Carbon–Energy–Stock system. CSNEI is the largest information transmitter, and GAS is the smallest one in the system. COAL is the top information recipient, followed by CSI300, ELEC, and OIL. Ji et al. construct the carbon–electricity system, where the EU ETS is an information recipient [14]. Moreover, in the Carbon–Energy–Finance system of Tan et al., the EU ETS is an information recipient, OIL and Coal are information transmitters, and GAS is an information recipient [8]. Our different findings indicate the markets in different systems may play diverse roles, and they are also a supplement to the related research on China’s carbon markets.

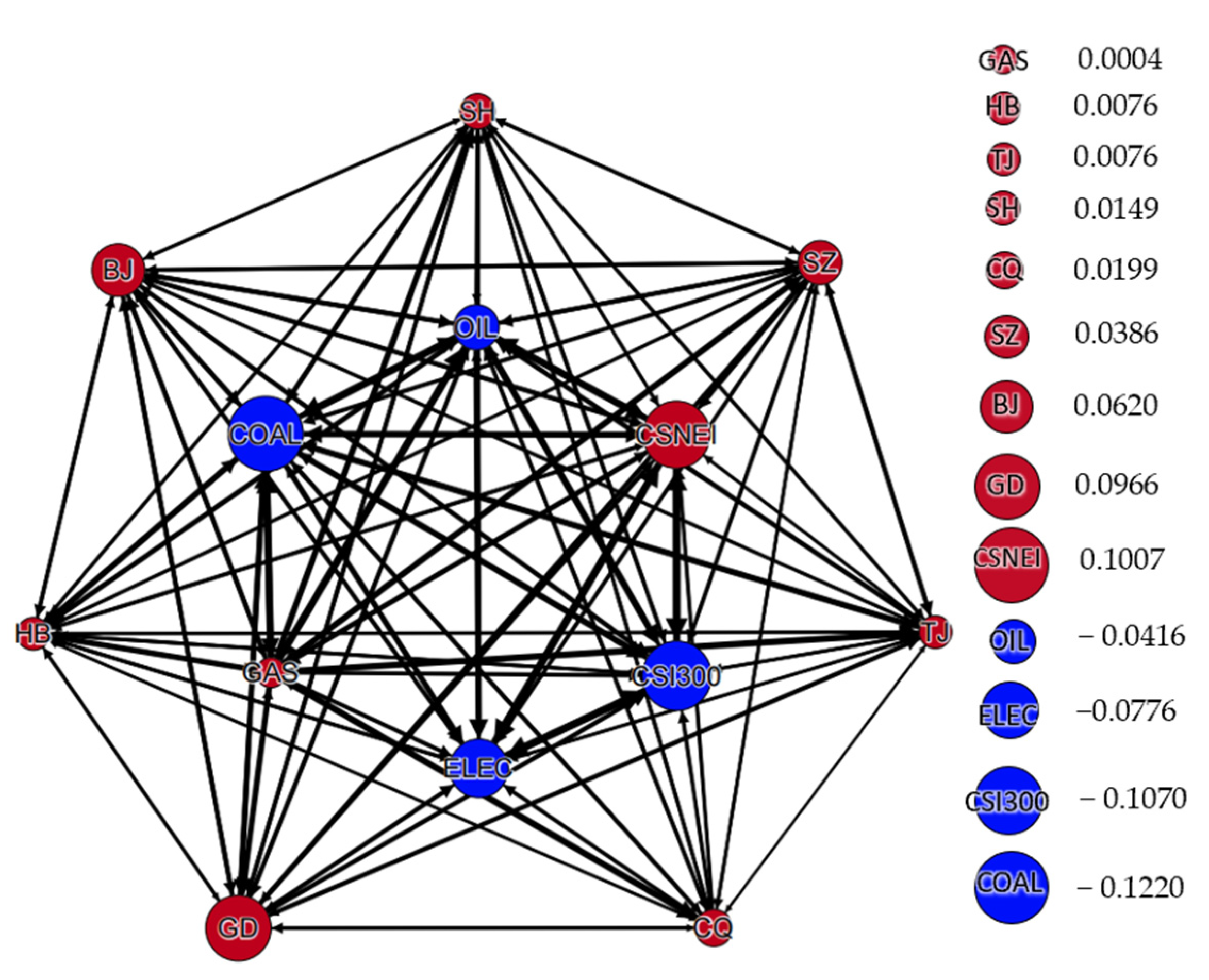

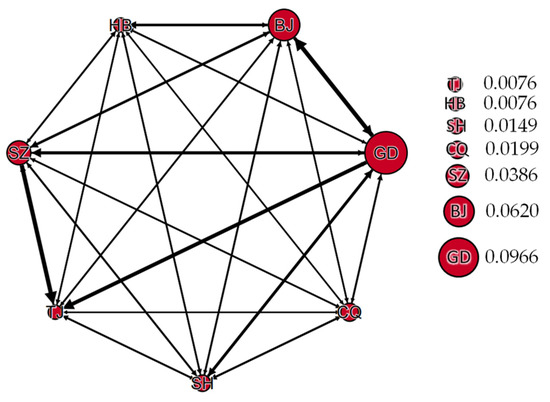

Figure 2 shows the directional return connectedness network over the entire sample interval, where the red nodes represent the information transmitters, and the blue ones are the information recipients. The size of the node determined by its net connectedness NC shows its status in the system. A large node means more information transmission with others. The directed edge from one node to another represents the directed information spillover between the corresponding nodes, and the thickness of the line and the arrow determined by reflects the variance contribution. The thick line indicates the strong information spillover relationship between nodes. In the Carbon–Energy–Stock system, COAL is the top information recipient. As the most used fossil energy in China, the coal market is most vulnerable to economic transformation, adjustment of energy consumption structure, and carbon prices under the pressure of emission reduction. CSNEI is the top information transmitter. The new energy industry reflects the economic conditions and the changes in carbon emission reduction policies and then passes them to the carbon market and the energy market. The stock indexes have a strong information spillover effect with others in the system, and they are crucial information transmitters or recipients, which is consistent with Tan et al. [8]. Among the pilots, the information spillover effect between GD and BJ is higher than that between other pilots, which may be related to the higher trading volume, turnover, average price, and trading activity. In the Carbon–Energy–Stock system, GD and BJ are the second and third largest information transmitters, respectively, indicating that some successful pilots significantly affect the Carbon–Energy–Stock system, so the construction experience of these pilots can provide a scientific basis for the construction of the national carbon market.

Figure 2.

Directional return connectedness network.

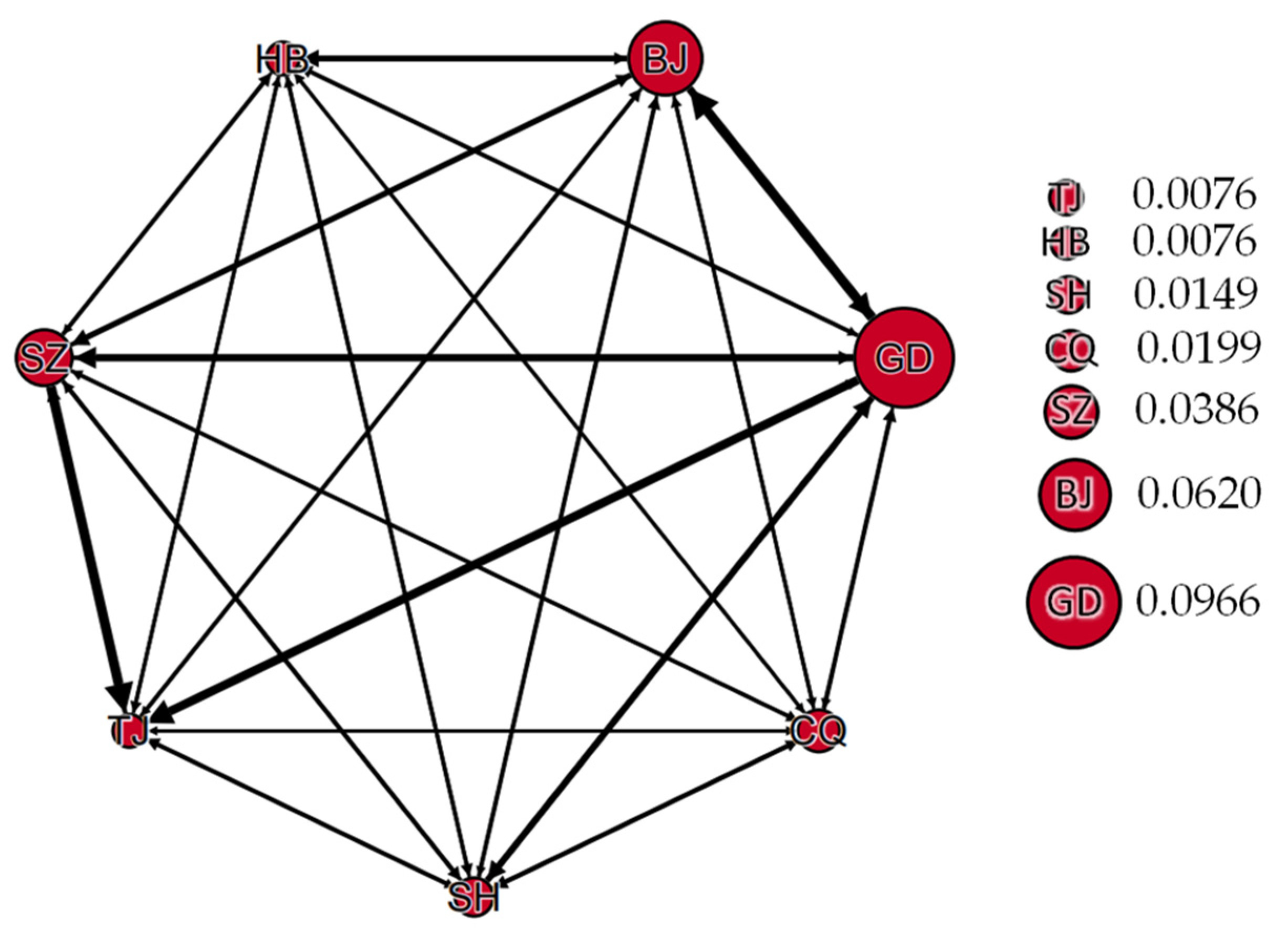

4.1.2. Static Connectedness Network Analysis of the Pilot Carbon Markets

Here, we concentrate on the characteristics of information spillover among pilots in the context of the energy market and economic environment (shown in Figure 3). In Figure 3, the size of the node is determined by its net connectedness, NC shows its status in the system, and the thickness of the line and the arrow determined by reflects the variance contribution. GD and BJ rank as the top two in the variance contribution and are also the two top information transmitters in the carbon market subsystem. GD has a high two-way spillover effect with BJ, and the information spillover to SH, TJ, and SZ is also high. BJ also shows a strong information spillover relationship with others. These results are consistent with the development of the Guangdong pilot and the Beijing pilot. In recent years, the trading prices of the Beijing pilot are higher than those of other pilots, and the trading volume and turnover of the Guangdong pilot rank first. Yin et al. propose that the Beijing pilot is the market most relevant to other pilots and is the core market based on entropy [34], and Zhao et al. also point out the dominant role of the Guangdong pilot [48]. Our findings indicate that the Guangdong pilot and the Beijing pilot have become core pilots from the perspective of information transmission, which supplements the results of Yin et al. and Zhao et al. [34,48]. In comparison, other pilots have low information spillover and are more affected by core ones.

Figure 3.

Directional return connectedness network of carbon markets.

4.2. Dynamic Connectedness Analysis

4.2.1. Dynamic Connectedness Analysis of the Carbon, Energy, and Stock Markets

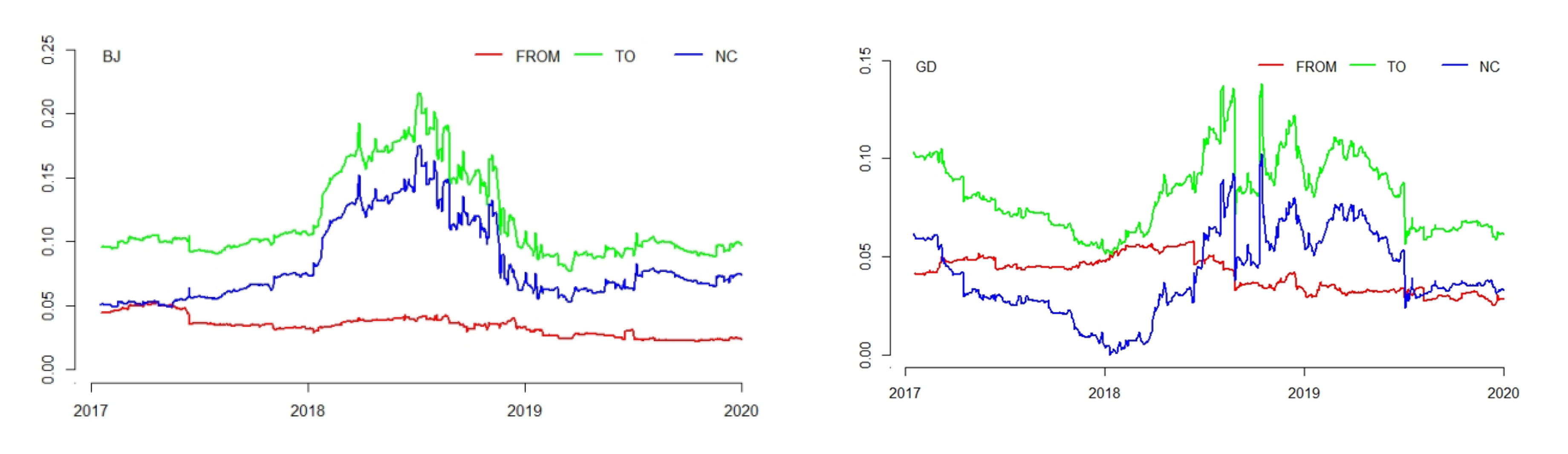

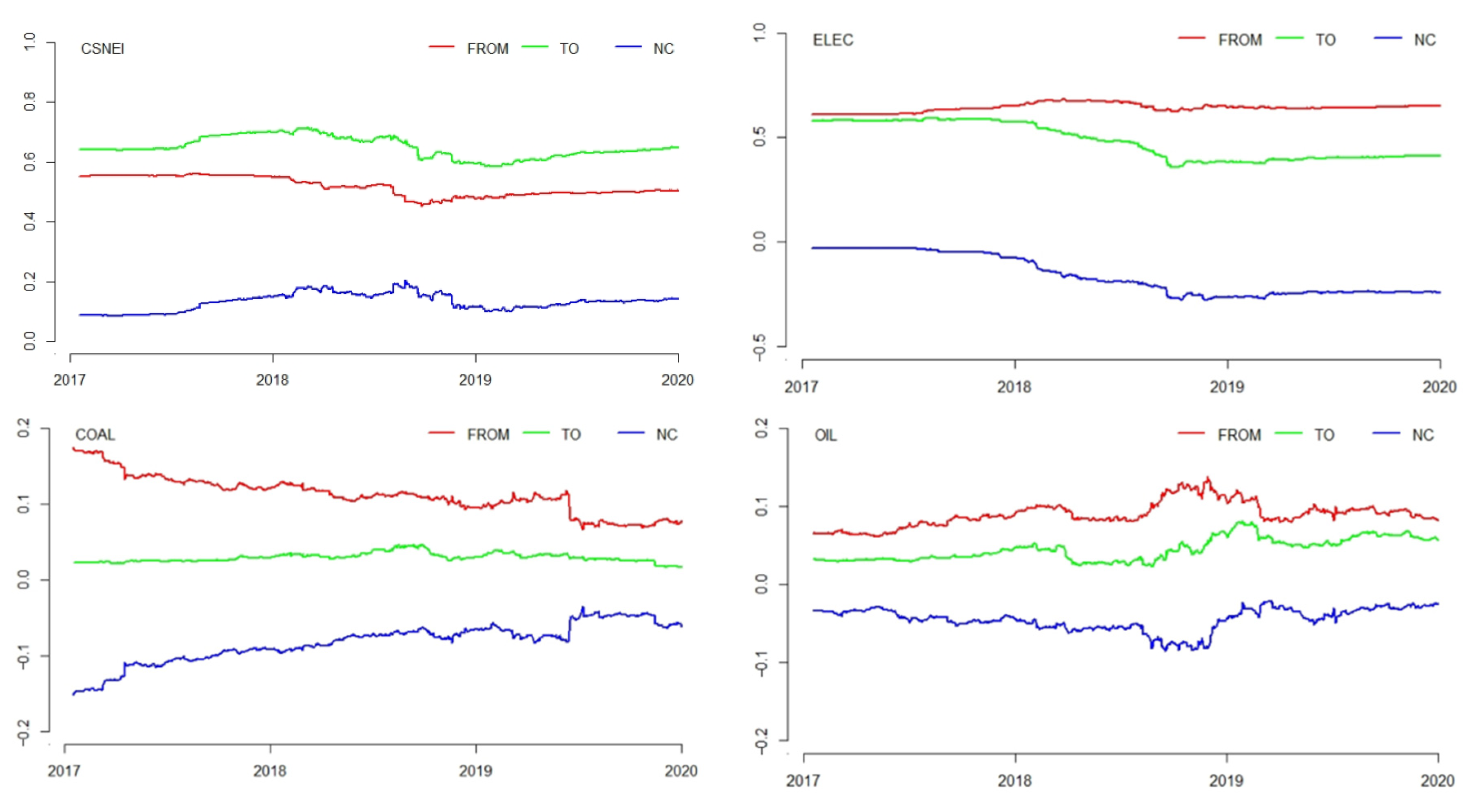

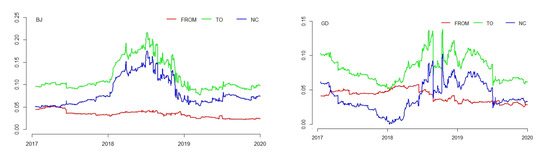

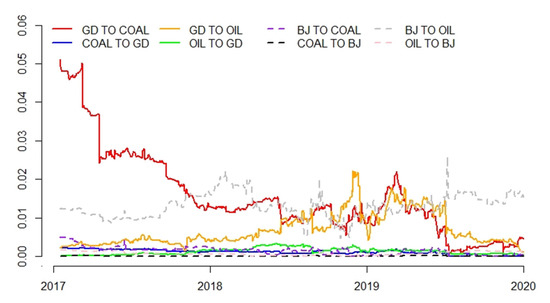

By the rolling window approach described in Section 3.1, we obtain the dynamic return connectedness through which we can understand the dynamic characteristics of the markets’ information spillover in the Carbon–Energy–Stock system. There are significant differences in the evolution of the return connectedness of different markets (shown in Figure 4), which means that each market has respective evolution modes and influence mechanisms.

Figure 4.

Dynamic return connectedness.

In the carbon market subsystem, as the successful pilots will provide a scientific basis for the national carbon market policymaking, we concentrate on BJ and GD. BJ is always an information transmitter with positive net connectedness over time. Its information spillover to the system presents the characteristics of “increasing first and then decreasing”: the return connectedness to the system remained at about 10% before 2018; since 2018, it continues to rise to the maximum of more than 20%, and then gradually decreases in June 2018, until it drops to about 10% in 2019. On the other hand, the return connectedness from the system is below 5%. The evolution of information transmission between GD and the system also shows “increasing first and then decreasing” from 2018. In December 2017, China began to launch the national carbon market plan, which promotes carbon pilots. However, imperfect carbon market mechanisms and functions have caused market uncertainty. Furthermore, the national carbon market had not officially operated, leading to more wait-and-see attitudes toward the pilots. These reasons may cause the information spillover to increase first and then decrease.

In the stock market subsystem, we pay much attention to CSNEI and ELEC. CSNEI is an information transmitter over time. The return connectedness to the system is stable at 60–70%, and the return connectedness from the system is around 40–60%. ELEC is an information recipient. The return connectedness to the system drops from 60% to about 40%, and the return connectedness from the system stabilizes at about 70%. These two have a high two-way information spillover effect on the system, so mastering their dynamics has positive significance in reducing system risks.

In the energy market subsystem, we focus on the two dominant energies: coal and oil. COAL is an information recipient. The return connectedness to the system is below 5%, and the return connectedness from the system slowly drops from 18% to about 8%. Coal is always China’s dominating fossil energy source. Under the constraint of emission reduction, China has steadily adjusted the energy structure and implemented total coal consumption control, which has achieved remarkable results. The proportion of coal in primary energy consumption fell below 60% for the first time in 2018. However, the continuous breakthrough is still a longer-term process. OIL is also an information recipient. The information transmission between OIL and other markets in the system is relatively small and maintains small volatility, which may be related to the relatively stable proportion of China’s oil consumption in recent years.

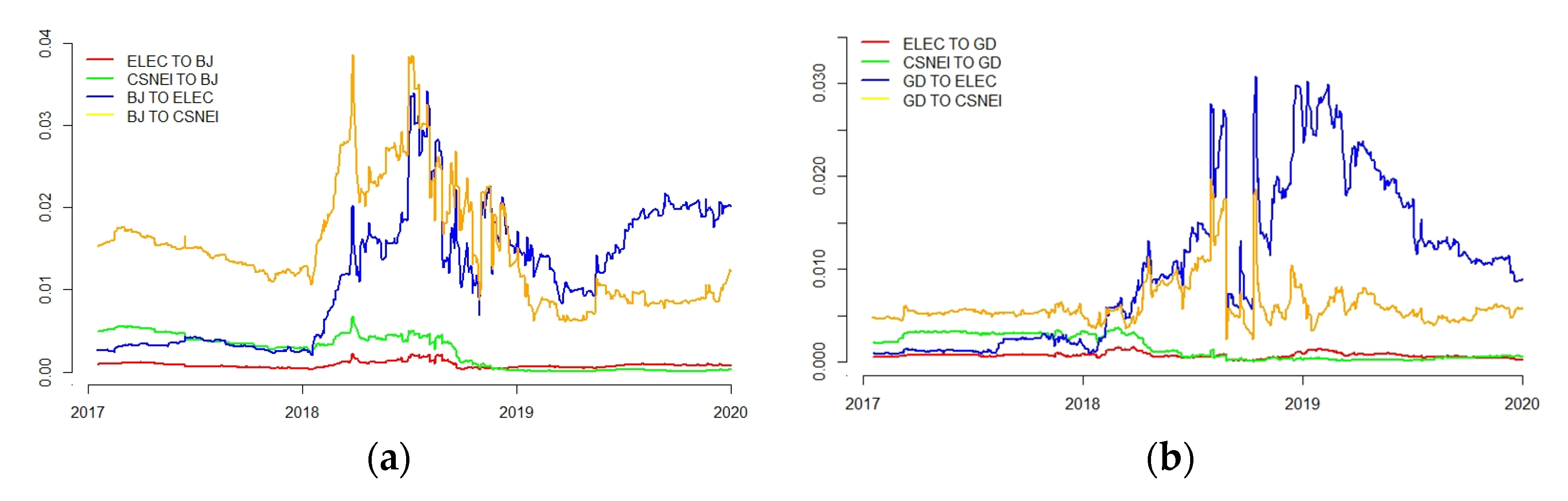

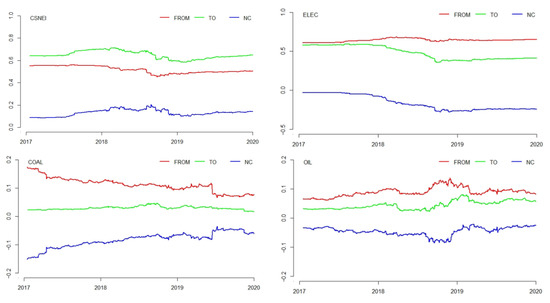

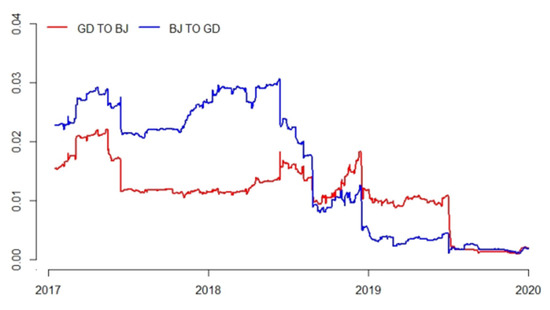

4.2.2. Analysis of the Dynamic Connectedness between the Carbon Markets and the Stock Markets

We take the core BJ and GD as examples to analyze the evolution of information transmission between the carbon market and the new energy industry, also between the carbon market and the power industry.

Figure 5a shows that the information spillover from BJ to ELEC is more than that from ELEC to BJ, so BJ is always an information transmitter to ELEC. The result provides support to the conclusion of Liu and Jin [3]. Specifically, starting in 2018, the information spillover from BJ to ELEC shows a fluctuating upward trend. Although the information spillover declined in the second half of 2018, it has a growth trend from 2019, indicating that the information transmission from the carbon market to the power industry has experienced fluctuation and then has an increasing trend. GD is also an information transmitter to ELEC. After experiencing a fluctuating rise in 2018, the return connectedness from GD to ELEC shows a declining trend in 2019 (shown in Figure 5b). Meanwhile, the spillover trend between the pilots and CSNEI is similar to that between the pilots and ELEC. BJ and GD are always information transmitters to CSNEI over time.

Figure 5.

(a) The dynamic connectedness between BJ and ELEC, and BJ and CSNEI (b). The dynamic connectedness between GD and ELEC, and GD and CSNEI.

With the operation of the carbon markets, the carbon constraints and carbon prices integrate the low-carbon development into the economic activities of the power industry. Moreover, the carbon markets have made fossil energy costs higher, bringing benefits to the energy transition and providing more support for the new energy industry. The carbon markets have had a non-negligible impact on the power industry and the new energy industry.

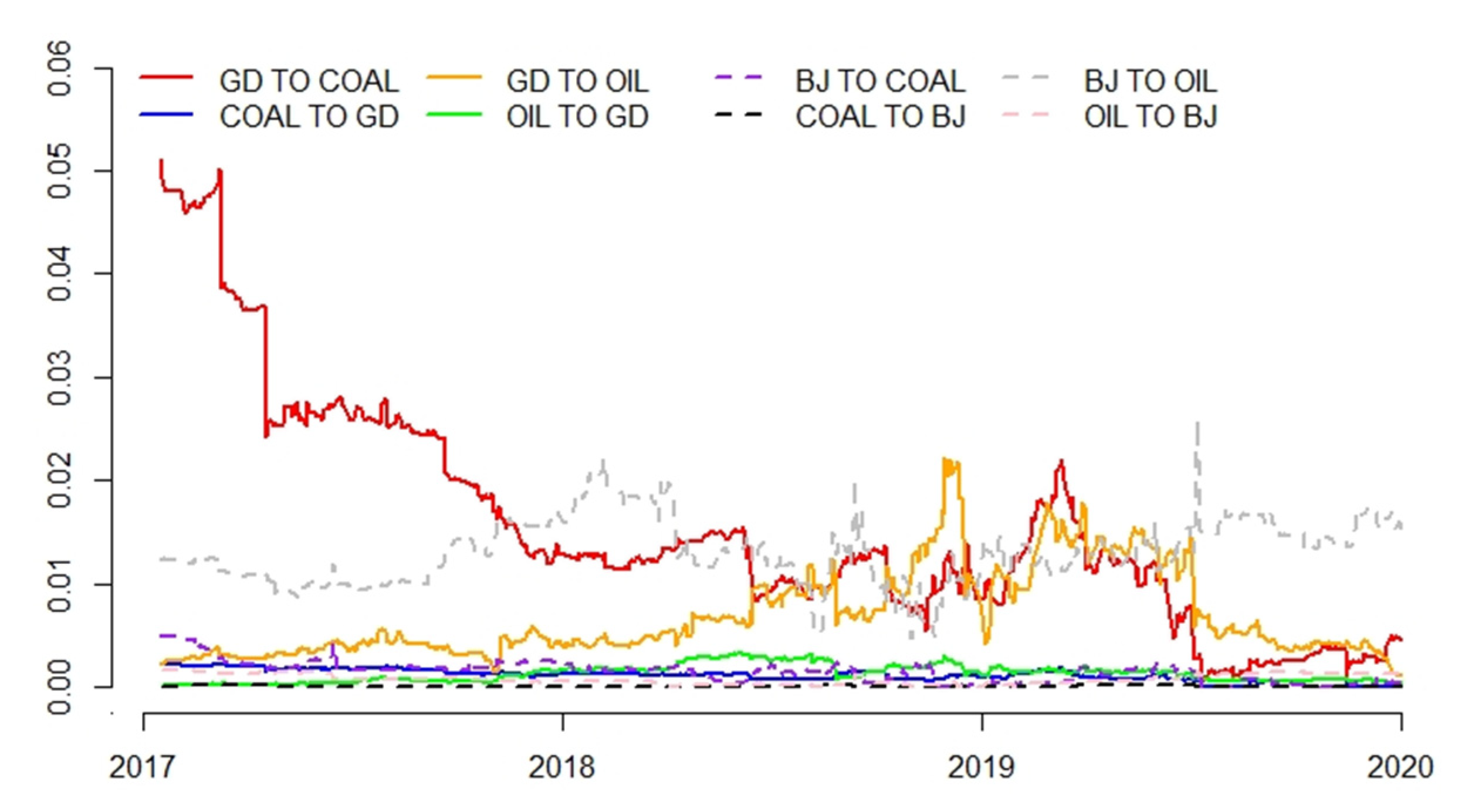

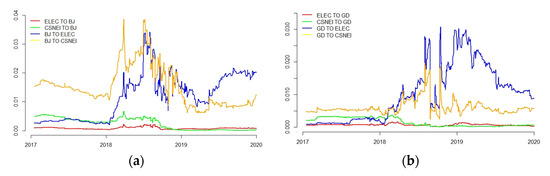

4.2.3. Analysis of the Dynamic Connectedness between the Carbon Markets and the Energy Markets

Figure 6 shows that the information spillover effect of BJ on OIL is higher than that of OIL on BJ, so BJ always plays the role of information transmitter to OIL. Similarly, BJ is also an information transmitter to COAL, but its spillover effect on COAL is lower than that on OIL. GD is also an information transmitter to both OIL and COAL. There is no significant difference between GD and BJ in the spillover effect on OIL, while the spillover from GD to COAL declines considerably. The information spillover from BJ to OIL is more than that from BJ to COAL, while the information spillover from GD to COAL is more than that from GD to OIL on average. This result may be related to the energy consumption structure of Beijing and Guangdong. Among various energy sources, Beijing consumes the highest proportion of oil, while Guangdong consumes the highest proportion of coal.

Figure 6.

The dynamic connectedness between the carbon markets and the energy markets.

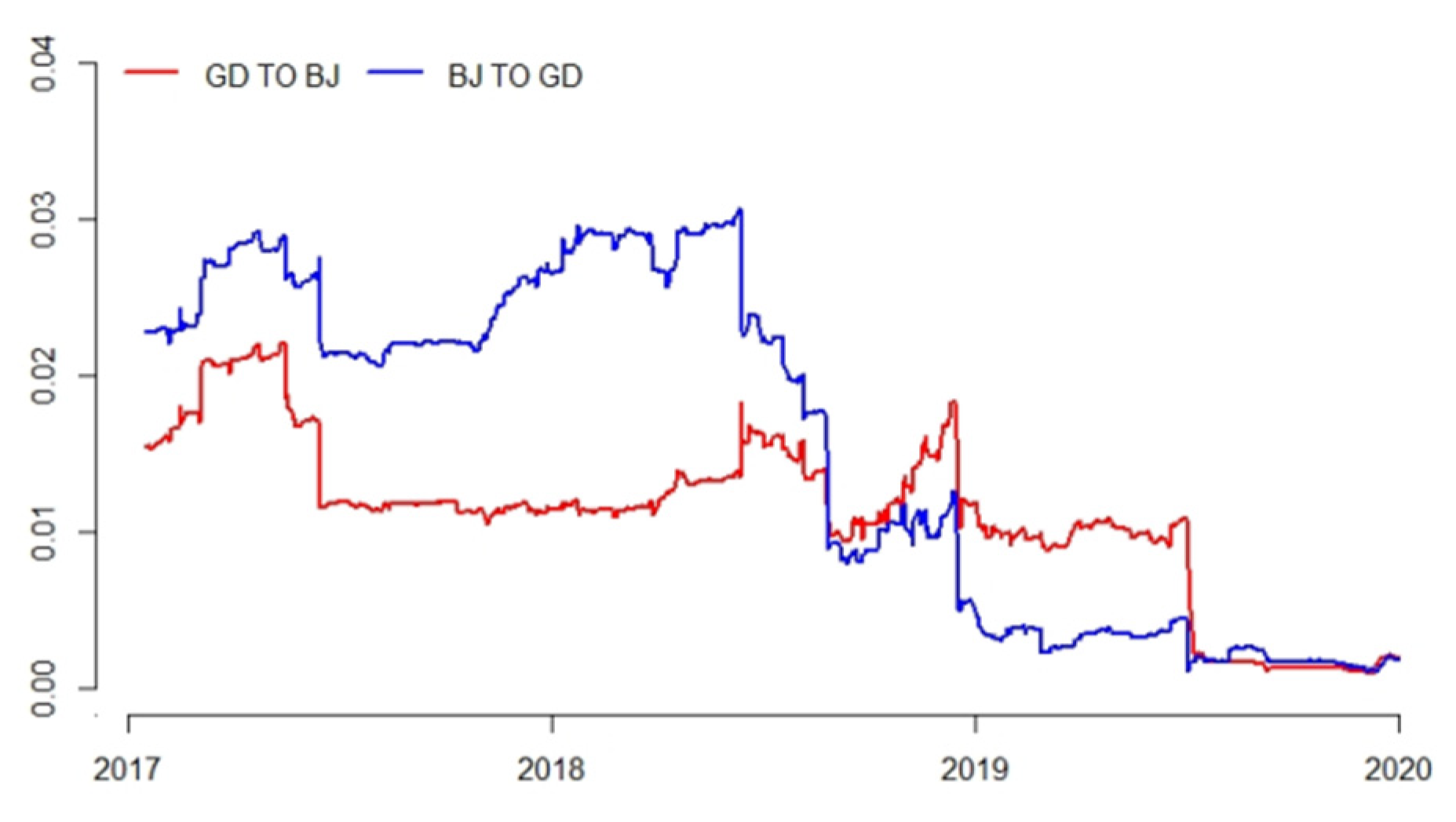

4.2.4. Analysis of the Dynamic Connectedness between the Carbon Markets

Figure 7 shows the dynamic evolution of information spillover between BJ and GD, the two core carbon markets. In the Carbon–Energy–Stock system, the information spillover effect between BJ and GD is higher than that between other pilots, indicating that more successful pilots have some common mature measures in market mechanisms and operations, and the information spillover effect between them is also higher. However, since the second half of 2018, the return connectedness index has decreased to different degrees. In particular, the return connectedness from BJ to GD fluctuates between 20% and 30% before the second half of 2018 and then continues to decline to a low level.

Figure 7.

Dynamic connectedness between GD and BJ.

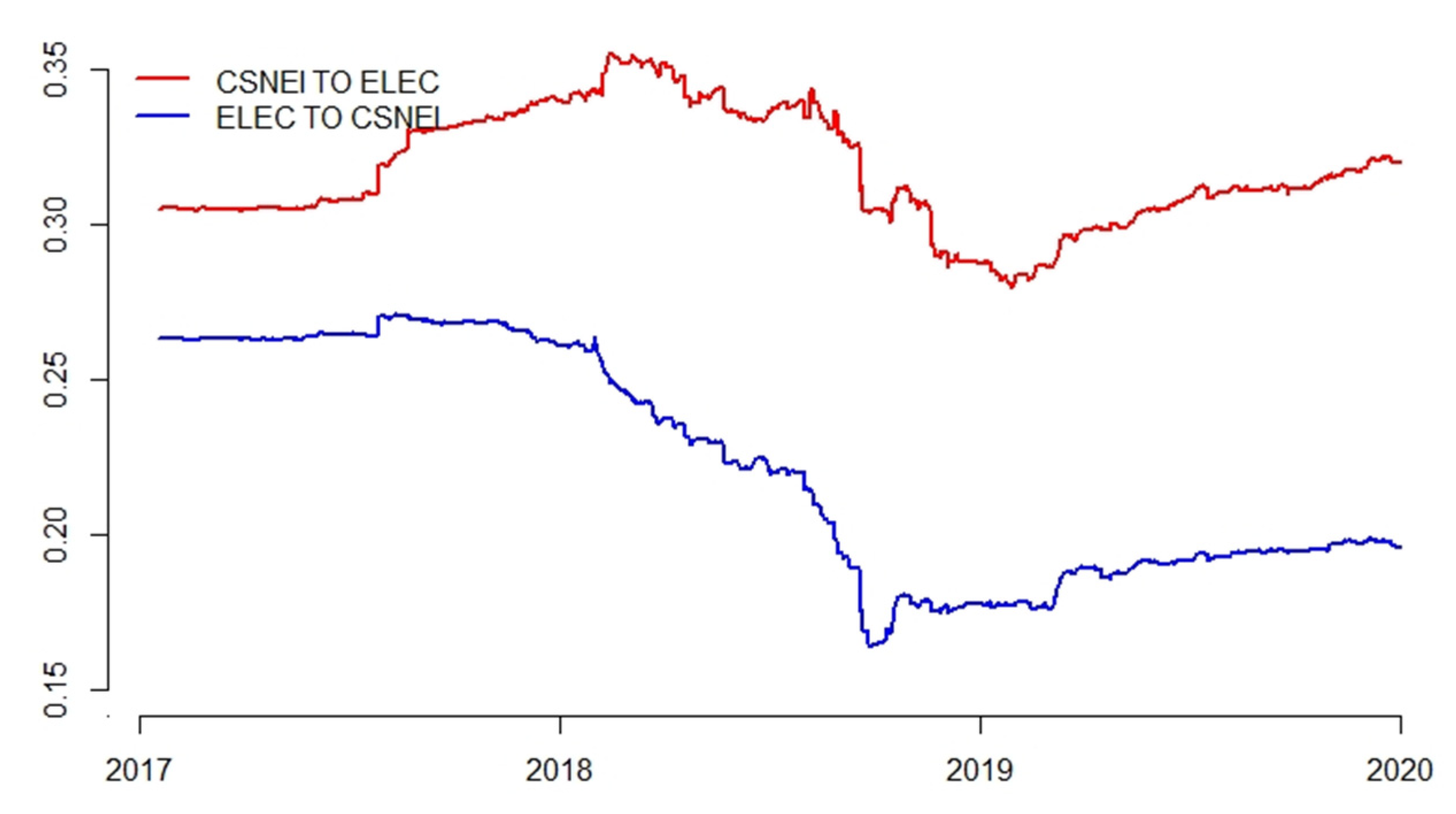

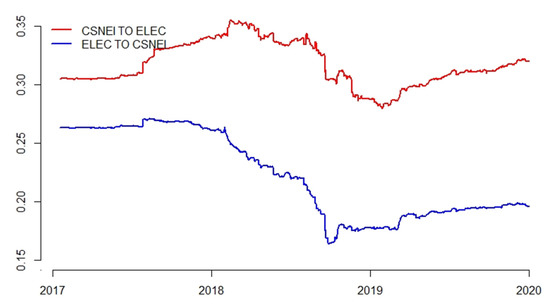

4.2.5. Analysis of the Dynamic Connectedness between the Power Industry and the New Energy Industry

CSNEI is always an information transmitter to ELEC over time. Starting in 2018, the return connectedness from CSNEI to ELEC dits previous gradual increase, and its value has a trend of fluctuating downward from about 35%. It does not show an increasing trend until 2019. The evolution of the return connectedness from ELEC to CSNEI is also roughly the same (shown in Figure 8). The weakened interaction in 2018 may be related to the decline in the power index and the new energy index this year. Due to the carbon constraints, the new energy power will meet the increasing power demand, so the new energy industry has maintained a relatively high level of information transmission to the power industry with a trend of enhancement. Although the power industry has a weaker influence on the new energy industry, the low-carbon requirements of its increasing power demand also push new energy power generation into a stage of large-scale growth. The strong interaction between them also indicates the close interdependence of their development.

Figure 8.

The dynamic connectedness between ELEC and CSNEI.

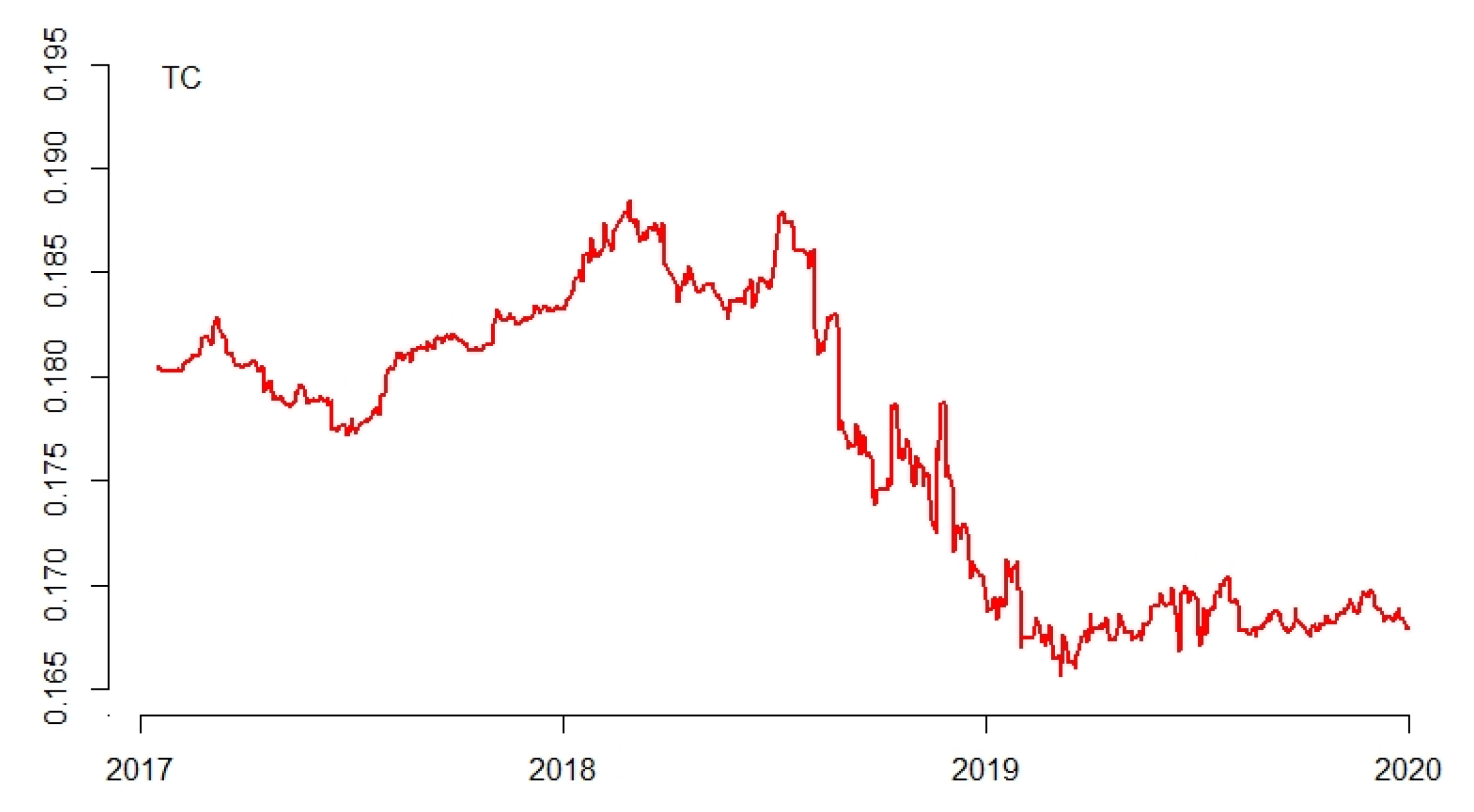

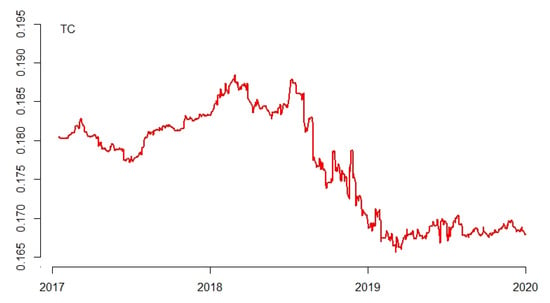

4.2.6. Dynamic Analysis of Total Return Connectedness

Figure 9 displays the total return connectedness of the Carbon–Energy–Stock system over time. The total return connectedness index is under 20%, which indicates the low information spillover effect between China’s pilot carbon markets, the energy markets, and the stock markets. This finding confirms the conclusion on China’s carbon markets [5]. The total return connectedness also presents the characteristics of “increasing first and then decreasing”: before 2018, the total return connectedness is around 18%. From the beginning of 2018, the total return connectedness index fluctuates up, and then it keeps dropping from the second half of 2018. From 2019, it stabilizes at around 17%. China announced the launch of the national carbon market plan in December 2017, which promotes information transmission. However, the national carbon market has not been officially launched, which has disrupted information transmission. As a result, this finding verifies that policy changes may lead to more information spillover fluctuation of the Carbon–Energy–Stock system [24].

Figure 9.

The dynamic total return connectedness.

5. Discussion

We put China’s pilot carbon markets, the energy markets, and the stock markets within the Carbon–Energy–Stock framework to discuss the information spillover among them from a systematic perspective. We point out the role and status of each market and measure the entire system connectivity. Moreover, through the rolling window approach, we explore the dynamic evolution of the information spillover, which may provide economic implications for market participants and policymakers in decision-making.

Compared with the EU ETS, the information spillover effect between China’s pilots and the other markets is relatively low. Specifically, the information spillover effect of the energy market on the carbon market is higher than that of the stock market on the carbon market, and the information spillover effect of energy stock on the carbon market is higher than that of non-energy stock on the carbon market. Furthermore, the information spillover effects of the pilots on various energy markets are also different, which may be related to their energy consumption structure.

Different from the results of existing studies that the EU ETS is an information recipient, China’s carbon pilots always play the role of information transmitters in the Carbon–Energy–Stock system, which indicates that the markets may play diverse roles in the respective systems and is also a complement to the relevant studies on China’s carbon markets. The Guangdong and Beijing pilots are core pilots in terms of information transmission, which matches their trading volume, turnover, average price, and trading activity. Furthermore, the coal market is the top information recipient, indicating that China’s coal market is vulnerable to economic conditions and easily restricted by carbon emission policies. The new energy industry is the top information transmitter, affecting the carbon and the energy markets.

The new energy index and power index show a high spillover effect between them, indicating their closer interdependence. Under the carbon constraints, the new energy industry has more impact on the power industry, and the information spillover between them shows a fluctuating upward trend. These two also show a strong information spillover relationship with the system, which means mastering their dynamics is crucial in reducing system risks.

Based on these conclusions, several suggestions are as follows.

China’s carbon market needs a unified access system and strives to cover more industries. China’s national carbon market should disclose market information to ensure that market participants can obtain information timely. Simultaneously, reasonable carbon allowances and the market-based carbon pricing mechanism are critical to send a clear carbon price signal and further promote market participation.

The information spillover from China’s national carbon market to others should be strengthened, and emission reduction requirements should be transmitted to relevant markets through market-based means to obtain low-cost emission reduction. For example, the carbon pilots have a strong spillover relationship with the energy markets, especially with the coal and oil markets, so China’s national carbon market may optimize the energy structure and improve energy efficiency through constraints and incentives. Similarly, the information spillover from the carbon market to the power industry and the new energy industry is relatively high, so a reasonable carbon price can strengthen the awareness of carbon costs in the power industry to optimize the fossil energy structure of the power industry and promote the development of the new energy industry.

The Guangdong and Beijing pilots occupy the core market position from the perspective of information transmission, and their operation experience can provide positive guidance and reference for building China’s national carbon market.

With the continuous development of China’s national carbon market, the characteristics of the national carbon market will be further studied in the future.

Author Contributions

Conceptualization, Y.Y.; methodology, Y.Y.; software, Y.Y.; writing—original draft preparation, Y.Y.; writing—review and editing, G.C.; supervision, L.T.; project administration, L.T.; funding acquisition, L.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Key Research and Development Program of China, grant number 2020YFA0608601 and the National Natural Science Foundation of China, grant number 72174091.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Zachmann, G.; von Hirschhausen, C. First evidence of asymmetric cost pass-through of EU Emissions Allowances: Examining wholesale electricity prices in Germany. Econ. Lett. 2008, 99, 465–469. [Google Scholar] [CrossRef] [Green Version]

- Aatola, P.; Ollikainen, M.; Toppinen, A. Impact of the carbon price on the integrating European electricity market. Energy Pol. 2013, 61, 1236–1251. [Google Scholar] [CrossRef]

- Liu, X.; Jin, Z. An analysis of the interactions between electricity, fossil fuel and carbon market prices in Guangdong, China. Energy Sustain. Dev. 2020, 55, 82–94. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, D.; Geng, J. Information linkage, dynamic spillovers in prices and volatility between the carbon and energy markets. J. Clean. Prod. 2018, 198, 972–978. [Google Scholar] [CrossRef]

- Fan, J.; Todorova, N. Dynamics of China’s carbon prices in the pilot trading phase. Appl. Energy 2017, 208, 1452–1467. [Google Scholar] [CrossRef] [Green Version]

- Lin, B.; Chen, Y. Dynamic linkages and spillover effects between CET market, coal market and stock market of new energy companies: A case of Beijing CET market in China. Energy 2019, 172, 1198–1210. [Google Scholar] [CrossRef]

- Ma, Y.; Wang, L.; Zhang, T. Research on the dynamic linkage among the carbon emission trading, energy and capital markets. J. Clean. Prod. 2020, 272, 122717. [Google Scholar] [CrossRef]

- Tan, X.; Sirichand, K.; Vivian, A.; Wang, X. How connected is the carbon market to energy and financial markets?A systematic analysis of spillovers and dynamics. Energy Econ. 2020, 90, 104870. [Google Scholar] [CrossRef]

- Yu, L.; Li, J.; Tang, L.; Wang, S. Linear and nonlinear granger causality investigation between carbon market and crude oil market: A multi-scale approach. Energy Econ. 2015, 51, 300–311. [Google Scholar] [CrossRef]

- Balcilar, M.; Demirer, R.; Hammoudeh, S.; Nguyen, D.K. Risk spillovers across the energy and carbon markets and hedging strategies for carbon risk. Energy Econ. 2016, 54, 159–172. [Google Scholar] [CrossRef] [Green Version]

- Keppler, J.H.; Mansanet-Bataller, M. Causalities between CO2, electricity, and other energy variables during phase I and phase II of the EU ETS. Energy Pol. 2010, 38, 3329–3341. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Y.; Sun, Y. The dynamic volatility spillover between European carbon trading market and fossil energy market. J. Clean. Prod. 2016, 112, 2654–2663. [Google Scholar] [CrossRef]

- Jiménez-Rodríguez, R. What happens to the relationship between EU allowances prices and stock market indices in Europe? Energy Econ. 2019, 81, 13–24. [Google Scholar] [CrossRef]

- Ji, Q.; Xia, T.; Liu, F.; Xu, J.H. The information spillover between carbon price and power sector returns: Evidence from the major European electricity companies. J. Clean. Prod. 2019, 208, 1178–1187. [Google Scholar] [CrossRef]

- Zhu, B.; Huang, L.; Yuan, L.; Ye, S.; Wang, P. Exploring the risk spillover effects between carbon market and electricity market: A bi-dimensional empirical mode decomposition based conditional value at risk approach. Int. Rev. Econ. Financ. 2020, 67, 163–175. [Google Scholar] [CrossRef]

- Zeng, S.; Nan, X.; Chao, L.; Chen, J. The response of the Beijing carbon emissions allowance price (BJC) to macroeconomic and energy price indices. Energy Pol. 2017, 106, 111–121. [Google Scholar] [CrossRef]

- Wen, F.; Wu, N.; Gong, X. China’s carbon emissions trading and stock returns. Energy Econ. 2020, 86, 104627. [Google Scholar] [CrossRef]

- Wen, F.; Zhao, L.; He, S.; Yang, G. Asymmetric relationship between carbon emission trading market and stock market: Evidences from China. Energy Econ. 2020, 91, 104850. [Google Scholar] [CrossRef]

- Yuan, N.; Yang, L. Asymmetric risk spillover between financial market uncertainty and the carbon market: A GAS-DCS-copula approach. J. Clean. Prod. 2020, 259, 120750. [Google Scholar] [CrossRef]

- Elsayed, A.H.; Nasreen, S.; Tiwari, A.K. Time-varying co-movements between energy market and global financial markets: Implication for portfolio diversification and hedging strategies. Energy Econ. 2020, 90, 104847. [Google Scholar] [CrossRef]

- Sousa, R.; Aguiar-Conraria, L.; Soares, M.J. Carbon financial markets: A time–frequency analysis of CO2 prices. Physica A 2014, 414, 118–127. [Google Scholar] [CrossRef]

- Ma, C.; Ren, Y.; Zhang, Y.; Sharp, B. The allocation of carbon emission quotas to five major power generation corporations in China. J. Clean. Prod. 2018, 189, 1–12. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. On the network topology of variance decompositions: Measuring the connectedness of financial firm. J. Econ. 2014, 182, 119–134. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.; Guo, Z. The dynamic spillover between carbon and energy markets: New evidence. Energy 2018, 149, 24–33. [Google Scholar] [CrossRef]

- Kim, H.S.; Koo, W.W. Factors affecting the carbon allowance market in the US. Energy Pol. 2010, 38, 1879–1884. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Nguyen, D.K.; Sousa, R.M. Energy prices and CO2 emission allowance prices: A quantile regression approach. Energy Pol. 2014, 70, 201–206. [Google Scholar] [CrossRef] [Green Version]

- Marimoutou, V.; Soury, M. Energy markets and CO2 emissions: Analysis by stochastic copula autoregressive model. Energy 2015, 88, 417–429. [Google Scholar] [CrossRef]

- Reboredo, J.C. Volatility spillovers between the oil market and the European Union carbon emission market. Econ. Model. 2014, 36, 229–234. [Google Scholar] [CrossRef]

- Creti, A.; Jouvet, P.A.; Mignon, V. Carbon price drivers: Phase I versus Phase II equilibrium? Energy Econ. 2012, 34, 327–334. [Google Scholar] [CrossRef] [Green Version]

- Koch, N.; Grosjean, G.; Fuss, S.; Edenhofer, O. Causes of the EU ETS price drop: Recession, CDM, renewable policies or a bit of everything? New evidence. Energy Pol. 2014, 73, 676–685. [Google Scholar] [CrossRef] [Green Version]

- Hintermann, B. Allowance price drivers in the first phase of the EU ETS. J. Environ. Econ. Manag. 2010, 59, 43–56. [Google Scholar] [CrossRef] [Green Version]

- Oberndorfer, U. EU Emission Allowances and the stock market: Evidence from the electricity industry. Ecol. Econ. 2009, 68, 1116–1126. [Google Scholar] [CrossRef] [Green Version]

- Kumar, S.; Managi, S.; Matsuda, A. Stock prices of clean energy companies, oil and carbon markets: A vector autoregressive analysis. Energy Econ. 2012, 34, 215–226. [Google Scholar] [CrossRef]

- Yin, J.; Su, C.; Fan, X. Which emissions trading pilot is most relevant to others? Evidence from entropy-based correlations. J. Clean. Prod. 2019, 239, 117982. [Google Scholar] [CrossRef]

- Mizrach, B. Integration of the global carbon markets. Energy Econ. 2012, 34, 335–349. [Google Scholar] [CrossRef]

- Zhang, M.; Liu, Y.; Su, Y. Comparison of carbon emission trading schemes in the European Union and China. Climate 2017, 5, 70. [Google Scholar] [CrossRef]

- Xiong, L.; Shen, B.; Qi, S.; Price, L.; Ye, B. The allowance mechanism of China’s carbon trading pilots: A comparative analysis with schemes in EU and California. Appl. Energy 2017, 185, 1849–1859. [Google Scholar] [CrossRef] [Green Version]

- Narassimhan, E.; Gallagher, K.S.; Koester, S.; Alejo, J.R. Carbon pricing in practice: A review of existing emissions trading systems. Clim. Policy 2018, 18, 967–991. [Google Scholar] [CrossRef] [Green Version]

- Zhou, Y.; Jiang, J.; Ye, B.; Zhang, Y.; Yan, J. Addressing climate change through a market mechanism: A comparative study of the pilot emission trading schemes in China. Environ. Geochem. Health 2020, 42, 745–767. [Google Scholar] [CrossRef]

- Fan, X.; Lv, X.; Yin, J.; Tian, L.; Liang, J. Multifractality and market efficiency of carbon emission trading market: Analysis using the multifractal detrended fluctuation technique. Appl. Energy 2019, 251, 113333. [Google Scholar] [CrossRef]

- Liu, X.; Zhou, X.; Zhu, B.; He, K.; Wang, P. Measuring the maturity of carbon market in China: An entropy-based TOPSIS approach. J. Clean. Prod. 2019, 229, 94–103. [Google Scholar] [CrossRef]

- Chang, K.; Chen, R.; Chevallier, J. Market fragmentation, liquidity measures and improvement perspectives from China’s emissions trading scheme pilots. Energy Econ. 2018, 75, 249–260. [Google Scholar] [CrossRef]

- Koop, G.; Pesaran, M.H.; Potter, S.M. Impulse response analysis in nonlinear multivariate models. J. Econom. 1996, 74, 119–147. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y. An autoregressive distributed-lag modelling approach to cointegration analysis. Econ. Sociol. Monog. 1998, 31, 371–413. [Google Scholar]

- Bai, Y.; Meng, J.; Meng, F.; Fang, G. Stochastic analysis of a shale gas investment strategy for coping with production uncertainties. Energy Pol. 2020, 144, 111639. [Google Scholar] [CrossRef]

- Wang, Z.; Zhao, L. The impact of the global stock and energy market on EU ETS: A structural equation modelling approach. J. Clean. Prod. 2021, 289, 125140. [Google Scholar] [CrossRef]

- Da Silva, P.P.; Moreno, B.; Figueiredo, N.C. Firm-specific impacts of CO2 prices on the stock market value of the Spanish power industry. Energy Pol. 2016, 94, 492–501. [Google Scholar] [CrossRef]

- Zhao, L.; Wen, F.; Wang, X. Interaction among China carbon emission trading markets: Nonlinear Granger causality and time-varying effect. Energy Econ. 2020, 91, 104901. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).