1. Introduction

Liberalising network services is a complex undertaking. Based on legislative proposals made by the European Commission, EU member states adopt their own national legislation, harmonising it with the recommendations of the EU or directly adopting the EU legislation. However, this is only the first step to liberalise market activities because the practical part starts when a new undertaking enters the market. The same happens in other network services, with subtle differences in practice. The impact of the state on the railway transport market is enormous due to the unprofitability of service provision. However, in a liberalised market, the freight railway incumbent should independently compete with new railway freight undertakings, providing services based on supply and demand. Instructure managers across the EU are single state-owned companies.

However, infrastructure managers must be legally separate from railway transport operators, providing railway services in a transparent and non-discriminatory manner. Still, the impact of the state remains strong as infrastructure managers are unable to cover the costs of providing services to railway undertakings. In a liberalised market, transport operators provide railway transport services while meeting the financial requirements of the infrastructure manager and service operators. More often than not, railway incumbents and services facilities operators are the same companies, which gives them an advantage over operators entering the market. Defining services and the charges thereof is one of the more important elements of transparency and non-discrimination in the railway market. Ensuring that requires independence, legality, and the supervision of regulatory bodies. However, the impact of the state is not to be disregarded because—as stated earlier—service provision does not cover the cost of infrastructure maintenance, construction, and management, which then leads to the question of the real effect of liberalisation and, ultimately, its contribution to the economy.

The paper examines the issues of liberalising railway market services. Due to the low emission of harmful gasses and the fact that it provides mass transport that does not cause congestion, the railway is one of the most acceptable modes of transport and has great potential in the overall transport market. On the other hand, infrastructure construction and maintenance are extremely costly for the state and the infrastructure manager. Railway operators pay charges to use railway services, and in a liberalised environment, the charges should be based on market demand. Defining those charges affects the use of railway services, the indicators of infrastructure use, and railway freight transport market development.

2. Liberalisation of Network Industries

The term liberalisation is omnipresent in market regulation as one of the fundamental terms of development. Over the last 30 years and the last 25 years in Croatia, liberalisation has become more frequent in all industries, particularly in network industries. According to the dictionary [

1], liberalisation is the act or process of making something such as a law or a political or religious system less strict. There are several aspects of liberalisation, but in the technical field of science, the authors [

2] state that liberalisation should be observed functionally in terms of how it is carried out in markets.

Author Karova [

3] define liberalisation as the process of removing or reducing the limitations that are set in economic activity. Armstrong [

4] believes liberalisation is a restructuring, a regulatory reform, and the development of competitive markets, that is, “creating or deepening a competitive market”, or simply, “opening up the market to competition”. However, [

5] define liberalisation as the transition from controlled to competitive markets where there is a strong normative dimension that reflects the implicit value judgment about the well-being of the market, with an optimal approach to economic and social structure, and there are some authors, such as [

6], who claim that liberalisation embodies the policy that helps expand the scope of individual freedom and reduce forceful state arrangements.

Research in network industry liberalisation is an important part of transport science that aims to improve the quality of living since network activities are a necessity and a need for better life quality. According to [

7], network activities include services that require a fixed infrastructural network, an example being the railway. When enterprises are privately owned, there is a need for strict and just regulation. However, long-lived enterprises are in state ownership due to political decisions, while new companies are private, which amplifies the need for strict regulation. According to [

8], services of general economic interest that used to be provided by the state, such as communication, postal, or railway services, are now provided in a competitive environment that ensures sustainable market competition. These market processes are part of the liberalisation of network services because they use a network infrastructure of greater or lesser technological complexity. According to [

9], the main guiding principle of liberalisation is to find a model of public policy that would incentivise network activities to be economically productive and in the public interest of taxpayers (subvention transparency), who then have the option to choose a service based on price and quality. Because of special technologies and different approaches to the market, [

10] believes that regulating liberalised public services should be performed based on sectors. For instance, a comparison between the railway and other public services makes it clear that the market itself does not always guarantee the level, scope, and quality needed to meet the demands of economic, social, and regional policy. In [

11] believes, market liberalisation is part of a regulatory, economic reform that is carried out to encourage entrepreneurship and internal market and increase competitiveness in many activities and professions. By achieving said reforms, economic productivity and innovation increase, prices are more competitive, service quality higher, and the rate at which new enterprises enter the market is higher as well.

The liberalisation in the EU is carried out in accordance with the following frameworks:

Treaty on the Functioning of the European Union [

12], which in Article 49 prohibits restrictions on the freedom of establishment of nationals of a Member State in the territory of another Member State, and Article 59, which requires freedom to provide services within the Union. Liberalisation should be carried out beyond the extent required by the directives, based on recommendations on reforms by the European Semester (Article 60).

Directive 2006/123/EC on services in the internal market (part some services and professions), and

EU single market strategy that stipulates freedom of providing services and a single market for services that provides recommendations for regulatory reform of professional services.

According to [

13], reforms can be looked at in a broader context of the so-called new public administration reforms, which began in the 1980s and are accepted as the “golden standard of administrative reform”.

The reforms include sectors that share the features of a natural monopoly—electrical energy, natural gas, telecommunications, water, and transport. State-owned companies saw the implementation of managerial tools and principles of the private sector to ensure macroeconomic stability, deficit reduction, and the reduction of the scope of government interventions. Changes in structure, regulation, and European network industries’ success are included in the Indicators of Product Market Regulation, put forward by the Organization for Economic Co-operation and Development (OECD) [

14]. They measure the extent of vertical integration, public ownership, access to the market, and market concentration in regulated markets. Indicators range from 0 (complete deregulation) to 6 (strictest competition conditions).

Figure 1 illustrates that deregulation is the highest degree of liberalisation in telecommunication, whereas the lowest market openness is found in the railway sector.

According to [

15], liberalisation in all its forms is vital in the advancement of consumer sovereignty which is beneficial to most. In particular, the liberalisation of networks of telecommunication, energy, and railway services—which are activities of general economic interest—plays a key role in the functioning of an economy. Network activities, which used to be entirely state-owned and provided no alternative due to the specific monopolistic network, are an essential tool in social development. They encompass a wide range of activities, and the way they are organised requires special legal regimes and state supervision. Society and development are based on communication, transport, and catering to fundamental energy needs essential to economic development. This must be examined through research on the liberalisation of railway services and their impacts.

3. Liberalisation of the Railway Services Market

According to EU policy [

16], one of the most important aspects is strengthening the role of railway transport, particularly its competitiveness in relation to road transport. Railway competitiveness can be ensured if railway operators provide efficient and appealing services while doing away with regulatory and market hindrances. This is also the aim of national regulation and EU programs. For instance, the National Reform Programme of Croatia [

17] focuses on the railway as one of the most important aspects of restructuring and constructing a sustainable transport system. The railway sector’s development is vital for economic and social growth and international and domestic connectivity, the realisation of strategic goals, and the positioning of Croatia in the network of European corridors. For this growth, particularly in the sense of adopting EU acquis, there needs to be a sector-based determination of the strategic guidelines for defining further advancement of the railway services market. Other strategic documents that aim to improve the financial and operational efficiency of state-owned railway companies and railway company management and business include the Sector Policy Letter [

18], which acts as a modernisation framework for the railway sector.

Furthermore, restructuring is necessary to increase competitiveness and efficiency and provide better services. Based on the available data, there is a market potential to revitalise the railway system, albeit with a substantial improvement in service quality and competitiveness compared to other modes of transport. Croatian legislation has been harmonised with the EU acquis, thus ensuring a framework for reforms and modernisation. The railway system must be more competitive and efficient in providing better services to passenger and freight transport users. This would, in turn, increase the country’s economic competitiveness.

As part of the national recovery program, Croatia continues to incentivise the low-charges policy for using the railway infrastructure to make the eco-friendly railway more competitive. Charges will become economically optimal only if there is a harmonisation between the railway and other means of transport. Defining a long-term contract on infrastructure management is planned, which would act as the main tool for managing railway infrastructure [

19]. In fact, the Government of Croatia plans to use the contract as the instrument of achieving transport policies with a clear distribution of responsibility between the state, which will define aims and measures and allocate funds, and the infrastructure manager, who will be in charge of making decisions and carrying out activities that will help to achieve said aims. A developed and sustainable public passenger system and an integrated transport system with the railway as the backbone of the entire transport network are the main objectives of sustainable railway transport in Croatia.

In a liberalised railway freight market [

20], improving market conditions for new companies and ensuring equal opportunities to all potential operators is one of the main harmonisation criteria, which Croatia has fulfilled during its legislative harmonisation with EU acquis. All this is in accordance with the White Paper on Transport objectives. By 2050, half of the road transport should transition to railway, maritime and inland water transport for intercity passenger and freight medium-distance transport. By 2030, a third of road freight transport covering distances of 300 km have to switch either to the railway or maritime (inland waters), and by 2050, more than 50% should do so. This is to be achieved by constructing more efficient and greener freight corridors. The Trans-European Transport Network is expected to be fully functional by 2030 and by 2050 ensuring high quality and capacity with corresponding IT service. By 2050 all airports on the basic network must be connected to the railway, if possible, by high-speed trains, and all seaports must be sufficiently connected with railway freight transport and—where possible—with the system of inland waterways. This can all be achieved by implementing competition in the railway transport market.

More than 30 years ago, most European countries had one state-owned railway company that was in charge of infrastructure management and railway transport [

21]. In many cases, that company had a research and development facility and was sometimes involved directly in production. Such a monopolistic company would make decisions on long-term railway development. Outstanding innovations that appeared (including the development of high-speed and tilting trains, Maglev) were beyond the grasp of the state-owned companies.

Today, most European countries separate railway infrastructure management and railway transport, while others—such as Germany—have retained the holding company structure. In most states, several companies manage transport, although in many cases, one state-owned company remains dominant, while its market share is usually reduced.

There are numerous obstacles to innovations in the railway and changes in the industry structure: separating infrastructure from transport, business fragmentation between various companies, and short timeframes, which are dictated by the length of franchise agreements and short regulatory inspection periods. A strong engagement of politics in the railway system adds to the growing number of challenges compared to other sectors that are dominated by purely commercial interests and competitiveness.

A potential tool for increasing railway competitiveness is liberalisation. Railway undertakings entering the market can have an impact on service quality and appeal, as well as technical and technological innovation. They provide users with choice, which ultimately ensures a positive quality-to-price ratio. Furthermore, according to [

13], market competition is found in only 15 EU member states, and in only 6 of them, railway undertakings provide both passenger and freight transport.

Railway reform of the EU comes in many forms in terms of institutional infrastructure, market participants, and system development. Each of the adopted models has been successful in some areas and less so in others. However, the degree of success was not consistent among similar reform approaches. Therefore, it is clear that there is no standardised model of railway reform which could be applied throughout the EU. Each member state adopts a model which is in accordance with both national and European regulations but at the same time ensures that the system is adequately funded so that the reform can be implemented successfully. For the liberalisation to be of quality and marketing conditions to be favourable, there is a need for a vertical separation, which comes in various forms:

Accounting separation, which requires separate accounts in case railway services and infrastructure management are part of the same legal entity

Organisational separation, which requires railway services and infrastructure management to be separated into subsidiaries within the same holding company, act independently when making decisions (along with having separate accounts)

Institutional separation requires services and infrastructure management to belong to two different companies—although both entities can share the owner, e.g., the state.

In the early stages of the reforms, the railway proved unready for liberalisation, particularly when compared to other sectors of network industries. Directive 91/440/EEC was the first important measure of the European Commission related to the railway system, but its impact was too small, as evidenced by the small number of new undertakings and services offered on the market. The four regulatory Railway Packages, approved in 2001, 2004, 2007, and 2016, respectively, were meant to tackle the lack of progress. They included the previously adopted directives, updated them, and sped up the railway market development. The Netherlands, Sweden, Germany, and Great Britain were the first EU states to liberalise the freight market in the mid-1990s. New market participants quickly started offering railway services in the newly liberalised market.

Liberalisation came to other countries somewhat later, in the 2000s, after the issuance of all railway packages. Countries acceding to the European Union, also known as Southeast European countries (Southeast Europe Transport), according to [

22], have not yet met the requirements for allowing new undertakings into their respective railway markets. One of the main reasons why is the fact that the restructuring of existing systems is mostly still in its infancy. In these countries, monopolistic companies are still in control, and the railway market has not opened up, despite laws having been passed to ensure open access to the implementation of relevant railway packages.

In some countries, as put forward by [

23], the system is still too concentrated and characterised by a small number of new companies and the prevalence of great market shares of incumbent operators. Moreover, most new companies abandon the market once they fail to sustain their activity, as was the case in Sweden, where eight companies left the market between 2000 and 2004, not long after the market was liberalised.

However, according to the research by [

24,

25,

26], railway market liberalisation facilitates competitiveness and improvement of the transport service. The transport market is slowly opening up, and operators compete to offer the transport service. Liberalisation of the international market should incentivise positive results in competitiveness, especially along international corridors. Furthermore, through market liberalisation, the railway should become more competitive compared to other transport modes. European institutions [

27] believe that liberalisation is one of the main means of ensuring sustainable transport because it reduces the transport’s carbon footprint. The internal railway services market requires an integrated approach to managing freight corridors and infrastructure charges. It is important to ensure efficient and non-discriminatory access to the railway infrastructure, including the services connected to the railway, by means of structurally separating the infrastructure management from service provision.

According to [

28], Europe has been at the helm of adopting change. Similar reforms were implemented in the USA, Latin America, and Asia, but nowhere have they been as consistent as in Europe. In fact, reforms were carried out to create a single, efficient, and competitive railway services market across the continent. National railway systems became inoperable, and European institutions defined corresponding regulatory and technical requirements for the development of the Single European Railway Area. The ultimate goal was to breathe new life into the railway system and make it more competitive. In addition, the entrance of the capital is seen even in Russia, where according to [

29], at the beginning of the 2000s, there was a lack of railway stocks in freight transport, which enabled shipowners to purchase railway cars. Having shipowners and private companies purchase railway wagons contributed to the development of the railway system, but independent freight undertakings, as they are legally defined, virtually do not exist. The Russian market is not liberalised, and there is still no competition since the only railway freight operator holds a monopoly.

The railway, a typical representative of natural monopoly and the system which, along with infrastructure management, also provided railway transport services, underwent substantial changes in numerous countries across the world by the end of the 20th century. As early as the 19th century, the first attempts at liberalisation took place, and at the end of the 1980s, the European Union opted for the liberalisation of railway services.

Since 1957, the European Union has defined its transport policy as an open and free transport market that includes all transport modes throughout the EU. According to [

30], it is clear that liberalisation, privatisation, and globalisation of the economy have led to a high level of competitiveness in the railway system. This system has been exponentially growing, which is indicated by annual data reports by railway services market regulators [

31,

32,

33,

34,

35,

36,

37,

38,

39] on the number of operators and reports about their business. Based on the conclusions by [

40,

41,

42,

43,

44,

45], regulations empower the development of the railway system by incentivising competitiveness and opening up markets, along with restructuring and liberalisation. This, in turn, leads to the productivity of infrastructural capacities.

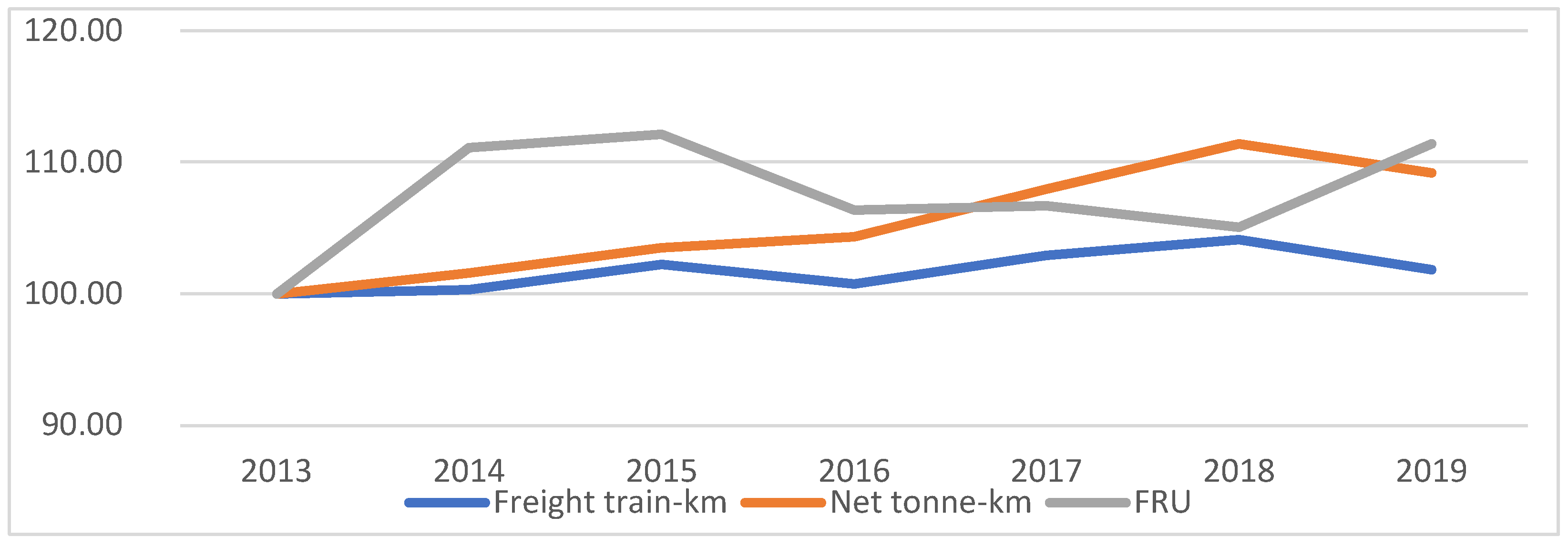

Figure 2 illustrates EU trends in train-km, net tonne-km, and the number of freight railway undertakings from 2013 to 2019. Efficient railway transport has a substantial impact on economic development and social growth. In fact, liberalisation has helped remove hindrances and improve competitiveness to ensure higher profit in the railway system.

On the other hand, found that railway reform led to different outcomes because serious issues arose, the most important of which is a substantial increase in cost based on, among other things, the lack of harmonisation between railway undertaking incentives and infrastructure management, and the short-term plans made by railway undertakings. The author [

46] proposes adopting long-term franchises, better contracts, distributing income and expenses equally among franchise users and infrastructure managers, and expanding commercial-only transport.

The railway is the most eco-friendly mode of transport for passengers and freight, and it is a socially sustainable system, which is why it should form the backbone of a sustainable transportation system. Railway transports account for 7 percent of all passengers and 11 percent of all freight while producing less than 0.5 percent of all transport-related carbon emissions. The EU plans to reduce carbon emissions from traffic by 90% by the year 2050 by, among other things, shifting most of the 75% of the mainland freight transport from the road to railway and inland waterways. The railway should serve as the pillar of the integrated passenger transport system and intermodal freight transport in a modern transport chain.

4. Impact of Liberalisation on Freight Railway Transport

Making railway services available for new undertakings contributes to better utilisation of the railway infrastructure and higher service quality. According to [

47,

48], the restructuring of the railway system has been going on for 30 years. Yet, most of the research reveals that railway liberalisation in various countries does not necessarily yield improvement. The European Union is perfect for railway freight transport, mainly due to its having the densest infrastructure in the world and a dynamic economy. Nevertheless, [

49] claims that the share of railway transport in the EU is lower than in Russia, the USA, and China. The share of European freight transport in 2000 was a mere 8% in ton-kilometre, compared to 38% in the USA. For this reason, there exists a need to utilise the unused potential. Liberalisation in this segment can contribute to a faster revitalisation, although, according to [

50], new undertakings are relatively insignificant compared to the existing ones. Nonetheless, the former seems to be operating more efficiently and offering more appealing services to users, particularly in the block train market. Relevant market development indicators see the relatively great number of new railway undertakings in the European market as a sign of increased competitiveness. However, this conclusion can be deceptive because the allocation of market shares between the incumbent and new undertakings based on various market segments must be taken into consideration. The market share of incoming undertakings is much more significant in assessing the power of new undertakings rather than the mere number of them. Therefore, the development of the railway freight market should not be analysed solely by looking at legislation but by looking at how legislation is applied. In other words, we must look at the market activity and the possibility of penetrating the market under real-world circumstances.

The analyses of the impact of liberalisation of railway freight transport in Europe [

47,

48,

49,

50] do not share a common conclusion. The number of new undertakings is on the rise, but international indicators, such as ton-kilometre and passenger-kilometre, are not correlated with said increase.

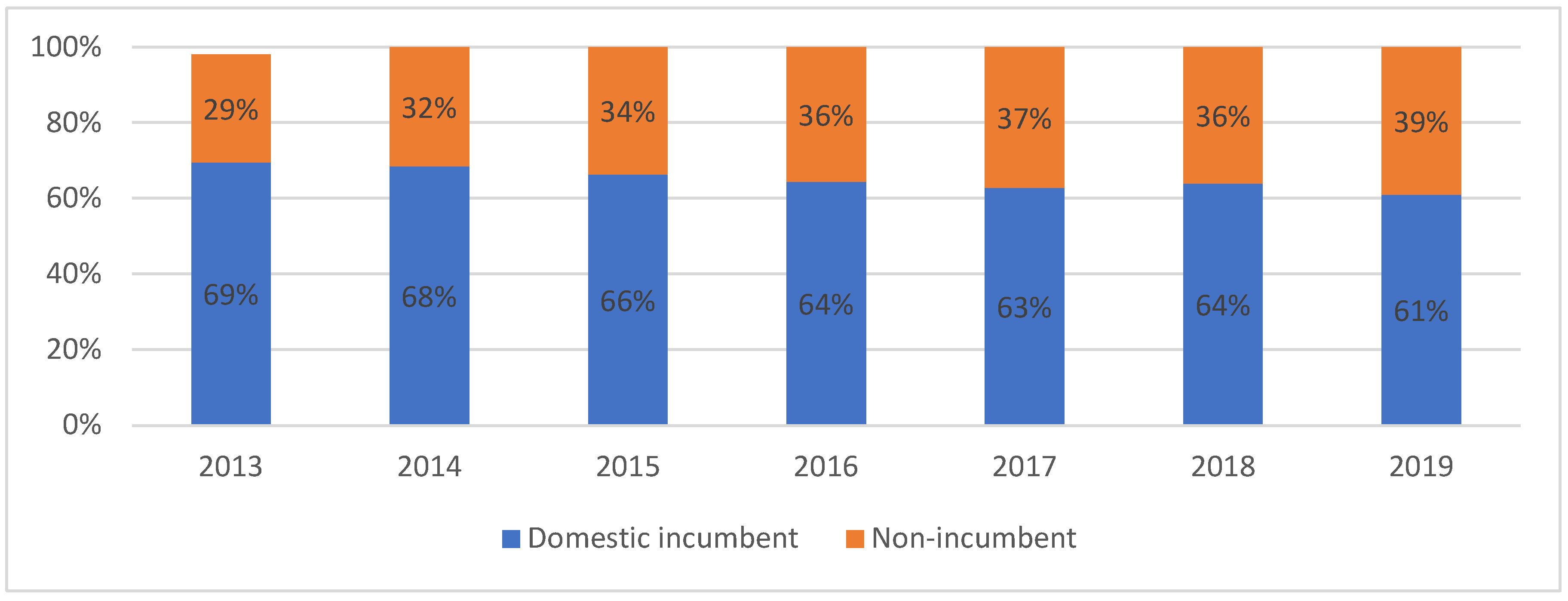

Figure 3 illustrates the share in net tonne-km of the domestic incumbent and non-incumbent in the EU from 2013 to 2019. Liberalisation has opened up the markets and infrastructure availability, but what needs to be determined are the transport and economic indicators, such as operation, the quantity of transported goods, the number of passengers, as well as the financial success of the undertakings.

Economic indicators include the influence of the state, that is, state interventions, the number of employees in the railway transport industry and their income, as well as the profit that these new undertakings make. There have yet been no relevant scientific articles examining the situation in Croatia, which is an opportunity to analyse the current state and outline the benefits of a liberalised market. Particularly important are the benefits of having liberalised freight transport for the economy as a whole. Relevant are societal benefits, including service availability, price for end-users, and railway worker income.

5. Impact of Charges on the Liberalisation of Railway Freight Transport

Before the liberalisation of the railway services market, the railway used to mean a single company with a complete monopoly over transport, infrastructure management, and service provision. There was no need for a charging system for using the infrastructure and accompanying services and facilities in such circumstances. As soon as the market opened up, this changed. It became necessary to define how charges are calculated and the services and prices. Right from the start, as stated by the European Commission [

16], it was clear that the system must be non-discriminatory and transparent.

Companies that existed prior to liberalisation usually become infrastructure managers and railway incumbents. To be able to do so, they keep separate accounts for infrastructure and transport and strictly adhere to all regulations enforced. The current legislation demands that infrastructure managers and undertakings have their own respective management. Numerous European countries (including Sweden and Great Britain) have made their infrastructure managers separate entities. Elsewhere, such as in Germany and France, incumbents are subsidiaries of the same holding company.

An important aspect of European policy is strengthening the role of rail transport. The railway needs to become more competitive compared to road transport. This can be achieved only if the railway offers efficient and quality transport services and eliminates regulatory and market shortcomings and the tedious administrative procedures that stifle its competitiveness and efficiency.

According to [

51], reorganising European railways means preparing for market competition, which requires a vertical separation of transport management and transport service provision. The allocation of infrastructure capacity and the charge for using it are key instruments in deregulated markets, in which various undertakings compete for capacity. All European countries strive to implement or increase undertaking competition, both in passenger and freight transport. This research shows that EU members states have adopted various reforms related to market organisation, vertical separation, competition, capacity allocation, and charges methodology.

However, most European railways are yet to develop and experiment with how capacity is allocated most efficiently and transparently. Opening up the railway services market to competition can, in principle, yield numerous societal benefits, partly because operators are more incentivised to become more profitable and responsible in their desire to attract users, but also in part because the evolutionary selection will ensure that some services are cancelled because the market may no longer be ready to pay for them.

Papers [

26,

52,

53] claim that track capacity and charges are two key factors that determine transport organisation in an open-access market. In paper [

28] believed that the fundamental objective of freight transport liberalisation is to improve the qualitative and quantitative indicators related to the number of transport goods and sustainable transport. Liberalisation has impacted a greater number of railway freight undertakings in countries such as Czechia, Slovakia, Poland, Hungary, and Austria. However, the issue of market indicators has not been examined in depth. Despite the liberalisation, the overall share of rail freight transport has not increased in said countries’ total freight transport market.

A modal comparison that looks at the number of operators per thousand kilometres found that a correlation between the aforementioned factors remains unclear; that is, there is no correlation. Research has shown that the lowest charges for using the infrastructure for a partially full train increase the utilisation of the multimodal chain as well as the share of rail freight transport in the transport market. On the other hand, [

54] claims that liberalisation fails to provide the desired impact. Countries have adjusted the way they charge for the use of infrastructure by harmonising with EU legislation, but the full impact of liberalisation was not seen in the period 2009–2013. A charging model was researched by [

55], who analysed and compared the railway infrastructures and charges in Germany, Poland, Austria, Czechia, and Slovakia for the first time. They found that a well-devised program of allocating capacity together with competitive undertakings will lead to a better transport balance between all transport models. They concluded that the use of various charges and other specific items in the model of infrastructure usage charging could increase the number of undertakings, railway transport performance, and mostly the modal share of the railway transport. Apart from that, they also pointed out that there is currently no method of charging for infrastructure use that considers the behaviour of the transport market or the current state of affairs therein.

Railway competitiveness and its modal share mainly depend on the supply and demand for transport services and the legal framework which defines the economic conditions of conducting business in the transport market [

56]. However, according to [

57], charges comprise a substantial part of the expenditure for railway undertakings, and they are crucial in establishing competition in the railway network. Another research [

58] looked at the economic model of infrastructure usage charges and the impact of such model on indicators such as number of undertakings, gross ton-kilometre, net ton-kilometre, number of passenger-kilometre, and others. The authors claim that in Great Britain, infrastructure charges are based on two economic methods—marginal cost and average cost. The marginal cost method can ensure greater charges along underutilised sections of the network, which affects regulatory processes that determine future funding and service level. Great Britain is, the authors say, the most radical example of railway reforms in the world because marginal costs are a key input in determining infrastructure usage charges. The authors describe all three methodological approaches to cost determination—the engineering, the economic, and the cost allocating method, and the research itself was carried out using the econometric method.

The econometric method or the top-down method requires past data based on which analyses are made and infrastructure charges defined. This ultimately impacts the cost of using railway infrastructure. Given the contribution of the paper to the existing body of literature on modelling the costs of railway infrastructure by looking at marginal costs, there is no added value in the difference in determining charges based on two variables—train-kilometre and average mass—compared to using a single variable, train mass. The authors state that assessing marginal costs varies across countries, and the median marginal costs for Great Britain far exceed others, but the reason is not given.

There are differences in definitions of maintenance, which causes a variety in costs, yet the authors [

57], believe that this is not the main reason. A part of the explanation is found in the fact that the British network may not be stable; it requires substantial funding for maintenance and reconstruction. The econometric approach leads to an overestimation of marginal costs for a not fully stable network (greater costs and activity than normal). The assessment also looked at outstanding costs of increased damage normally brought on by the poor condition of the tracks, by inefficient cost basis, and by the cost of reducing the impacts of current transport amount.

However, it is clear that even when railway networks are stable, the marginal costs in Great Britain are much larger than the ones in other countries. This is why more analyses are needed—to discover why. The authors have failed to deduce the actual reasons. The cost elasticity estimations are mostly in the range of previous econometric studies, which is in line with results obtained in previous research. Only through regular maintenance of the railway infrastructure can costs become stable, and the econometric model can retain the infrastructure charges level.

Otherwise, as the previous article concludes, a change that increases the infrastructure charges will lead to a reduction in the use. According to research [

59], there are various methodologies for determining infrastructure charges used in EU member states. The most common economic models are:

MC—Marginal cost model

MC+—Marginal cost model with additional charges

FC—Full cost model of total expenses with a discount

FC—Full costs of total expenses

The authors [

60] outline various methodologies of determining costs in 11 countries, showing that they are mostly the same (FC and MC with possible variants). Their research found that freight trains generate more maintenance and reconstruction costs than passenger trains. Furthermore, countries that have adopted full cost models (FC, such as Belgium, Germany, and Italy) charge higher prices based on the direct cost principle, thus ensuring the best maintenance-to-line cost ratio.

Countries adopting the marginal cost methodology (MC) cover the cost of maintenance and renewal at least for marginal costs. The authors agree on the fact that the share of costs covered by railway infrastructure charges is in all analysed countries extremely low. They conclude that there is no proven link between railway charges and maintenance/renewal costs when determining prices.

In the implementation of the European legislation in 2021, the European Commission, through its Directive 2012/34/ECC [

61], recommends adopting guidelines for the methodology of determining infrastructure charges, leaving a great leeway for the member states to define their own respective methodologies. The main things most authors analyse are the legal bases. The definitions put forward by the directive that the infrastructure charges result from trains operating on the infrastructure. Since this direct cost arises based on train operation, all countries should adopt the equal model of determining infrastructure charges. In other words, they should all have equal amounts for infrastructure maintenance and renewal.

Acknowledging the legal loopholes, the European Commission amended Directive 2012/34/ECC with the Commission Implementing Regulation (EU) 2015/909 [

62]. It defined the criteria that may be used to determine the methodology for calculating infrastructure charges. In spite of all that, not until 2015 was the EU able to harmonise methodologies for determining costs that are a direct result of carrying out railway services. This is why [

63] further develops the issue of defining costs and EU legislation, claiming that the latter had a limiting effect on market development, which is seen in the small number of operators entering the market.

However, some researchers [

64,

65] believe that railway market liberalisation and deregulation have a profound impact on cost efficiency but that regulations are key in the prevention of monopolisation. Nonetheless, liberalisation itself can increase the benefits for end-users by maintaining operator profitability only if variable costs and infrastructure charges are low. Furthermore, according to [

52], charges can lead to capacity overutilisation and a financial deficit for infrastructure managers, while high charges can result in underutilisation. Statistical analyses reveal that markets with low-capacity utilisation often have lower costs. Such lower charges can aim to increase capacity demand, but this reduces the income for infrastructure managers, thus increasing the deficit. All European countries aim to either introduce or increase competition among operators. Opening up the market can, in principle, lead to significant social benefits, partly because operators are encouraged to become more affordable and adapt to user demand, but also in part because market evolution determines what a service is worth.

The increase in social benefits does not necessarily indicate a reduction in operational costs. Quite the opposite [

66] claims that implementing an open market in the passenger sector increases operational costs in the railway system. These findings can be explained by a number of factors, including function duplicity, increased coordination costs, increased investments, and growing capacity limitations. In paper [

67], sharing this attitude, believing that opening up the market will not necessarily benefit railway service users (passenger and freight) because market access and privatisation are not always synonymous with lower prices. At the same time, the same author indicates that lower service cost is correlated with the presence of the state in the sector, but that is due to state subventions rather than efficiency.

Based on the analysis of the correlation between the indicators of market regulation and the observed quality of railway services, the authors fail to detect a significant correlation between the perception of quality and the policy of opening up the market. According to [

42], market liberalisation has had a negative impact on costs in Great Britain.

Infrastructure charges are essential in reforming markets and implementing liberalisation because low charges can facilitate the competition between railway operators that are willing to enter the market and face the incumbent operator. At the same time, they can limit the interest of new companies if the charges are not well devised. Infrastructure charges cannot cover the costs of track maintenance, and this will cause a lack of track capacity for railway freight transport, based on the research of Japanese railways [

68]. The case of insufficient capacity is also found in Croatia; as [

69] concludes, the Croatian market is not saturated, and there is sufficient room for a dynamic development under liberalised circumstances.

Liberalisation will contribute to the recruitment of new operators and better competitiveness of the railway transport in Croatia. However, the problem of road transport dominance persists. Railway market liberalisation will compete with other transport modes, and foreign operators will take up a part of the freight market. For the last few years, according to [

70], Croatia has seen dynamic changes in determining railway service charges. What is evident is that infrastructure usage charges increase linearly with distance category and train characteristics. The charges are an important segment of market liberalisation that makes it possible to determine market development [

71]. The current systems for determining charges are uneven, and market development is interpreted differently based on various transport and socio-economic parameters. There are no unified market solutions, and market growth and its impacts remain unknown in many countries, including Croatia. Hence, there is a lot of research space to analyse the situation before and after liberalisation, the state and impact of liberalisation in the EU and Croatia, in order to propose the most acceptable and successful models and determine infrastructure charges.

6. Conclusions

This paper has reviewed previous research on railway services market liberalisation, the impact of changes in railway services charges on the market, and the impact of liberalisation on freight transport, before suggesting points for further research. Shortcomings in said research were found to be related to the impact of liberalisation on the overall transport market and the economy. Furthermore, there is a lack of research related to Croatia. It is unknown what social and economic benefits liberalisation brings and how to define them, which leaves space for research and defining economic and transport parameters of liberalising railway freight transport.

In railway freight transport, there is space to optimise liberalisation processes and define infrastructure charges that affect the liberalisation of the railway services market. There is a need for defining unified charges with the aim of ensuring efficient liberalisation, which would take into consideration the social benefit and the socio-economic impacts. The analyses from this paper have looked at relevant articles in the field but have not been able to determine the impact of the state and the contribution of new undertakings working in liberalised circumstances and a competitive market environment. We have also analysed the transport indicator of railway freight undertakings in ton-kilometre and train-kilometre. These are the basic indicators of operator efficiency.

What remains unexplored are the share of transported goods, the share of railway transport in the overall transport, and the financial indicators of new operators, such as gross profit compared to the number of employees and services they provided. Apart from that, what also needs to be examined is the role of the state in subsidising railway transport, financing the railway infrastructure, and ensuring efficiency.

The question remains: Would the cost incurred by having the state involved in the railway sector be reduced if new undertakings entered the market and incumbent operators were restructured? The success of liberalisation ultimately depends on the reduction of the overall cost of the railway sector and the increase in its share in the total transport market. Furthermore, frequent changes in models and amounts of charges in the railway transport market and how that affects the market remain a completely unsearched field. The impact of the state is a relevant segment, as is the independence of an infrastructure manager. Managerial agreements should ensure dynamic and linear growth and market stability. Future analyses must look at the social and economic benefits but also at transport indicators and the contribution new operators make in a liberalised market. Previous research has helped to identify shortcomings in observing the impact of charges on liberalisation effects, as well as the total socio-economic impact of reducing the role of the state and increasing operator efficiency. In addition, it will be interesting for future research to investigate what is happening in countries such as China and Japan in comprise with European Union regarding railway freight transport market liberalisation.

The issue of charges, frequent changes, service access, and the role of the state are all closely linked to market development. The research quoted here often pointed to the need for seeing a broader picture of state interventions and infrastructure manager independence in the context of preventing market marginalisation. Defining clearer requirements, long-term planning of state incentives, and designing optimal infrastructure charges in freight transport must be viewed from maximising social benefit to prevent cases of marginalisation of new freight transport operators. There is a lot of space for future research that should look at market liberalisation and the problem of defining railway service charges in a transparent, market-friendly, and legal manner.