A Framework of the Value Co-Creation Cycle in Platform Businesses: An Exploratory Case Study

Abstract

:1. Introduction

2. Literature Review

2.1. Platform Economy Model

2.2. Value Co-Creation

2.2.1. Consumers Evolve Gradually from Users to Participants in Value Creation

2.2.2. Higher Levels of Consumer Need and Satisfaction Are the Key Source of Power in Value Co-Creation

2.2.3. The Level of Consumer Participation Affects Value Cocreation and Firm Competitiveness

2.2.4. Sharing among Consumers Gives Rise to New Value Creation Models

2.3. Summary and Research Gap

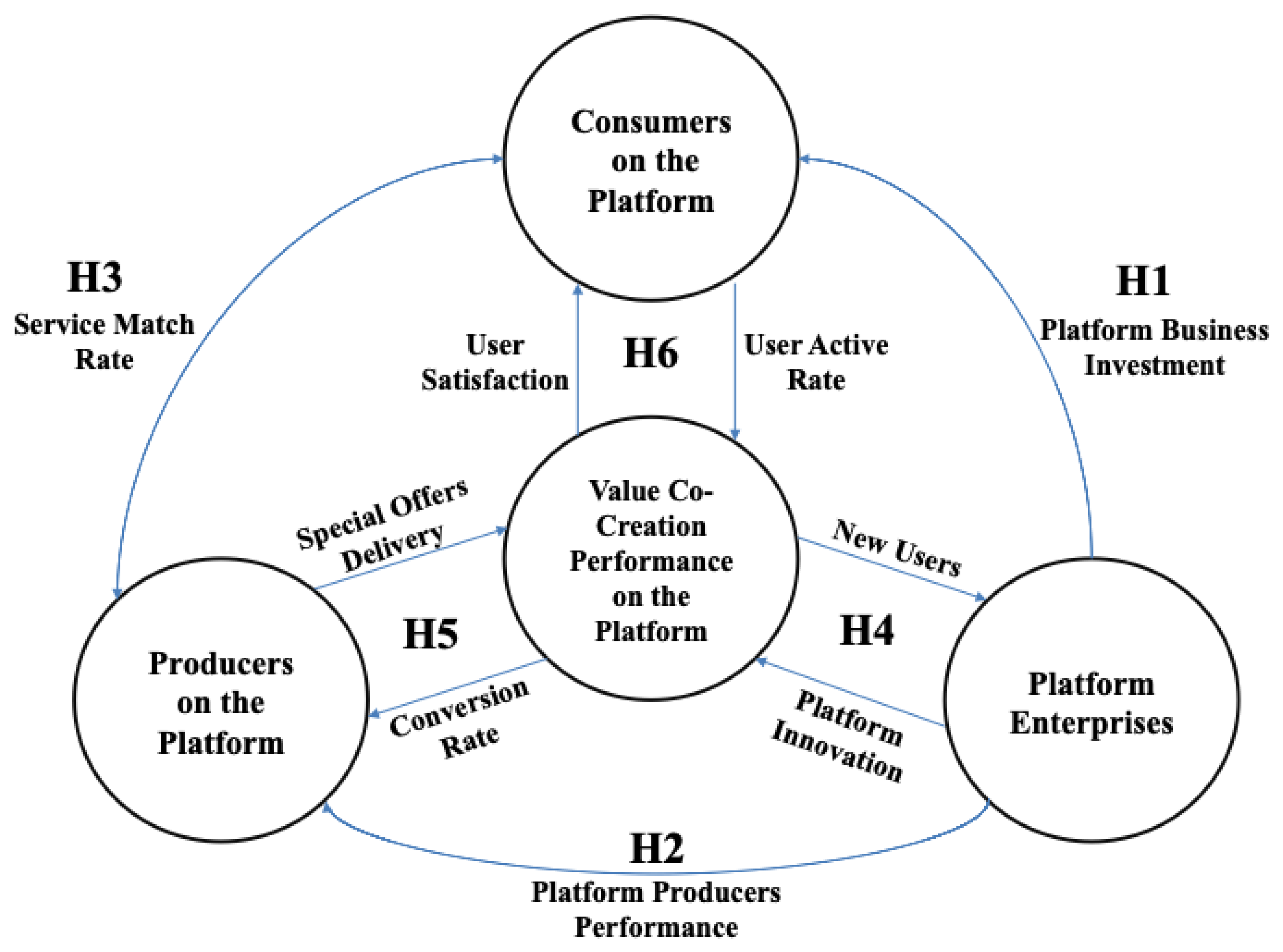

2.4. Development of Hypotheses

2.4.1. Platform Business and Platform Consumers

2.4.2. Platform Businesses and Platform Producers

2.4.3. Platform Producers and Platform Consumers

2.4.4. Value Co-Creation Performance and Platform Businesses

2.4.5. Value Co-Creation Performance and Platform Producers

2.4.6. Value Co-Creation Performance and Platform Consumers

3. Research Framework

4. Research Methods

4.1. Research Design

4.2. Case Background

4.3. Sources and Collection of Data

4.4. Google Analytics

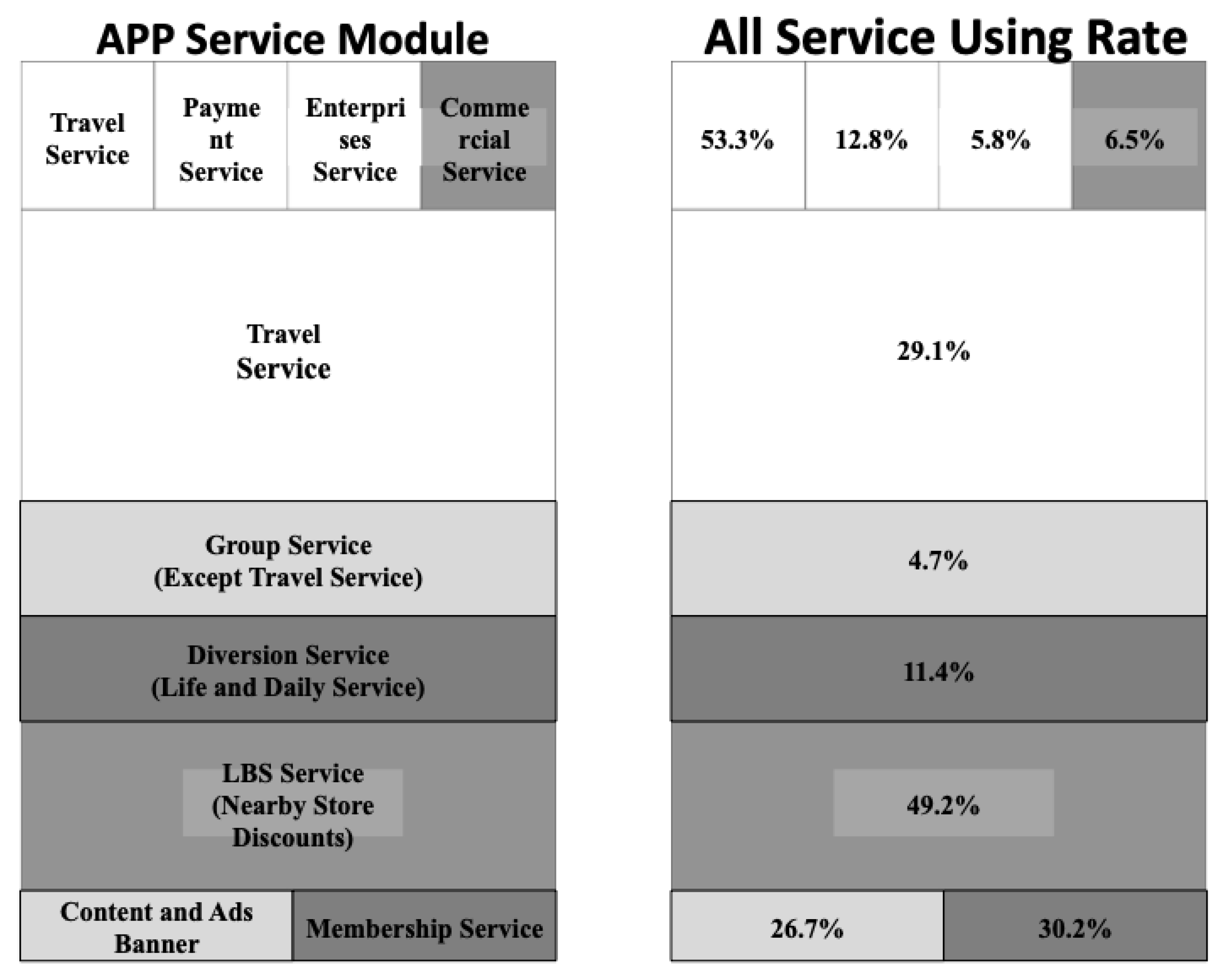

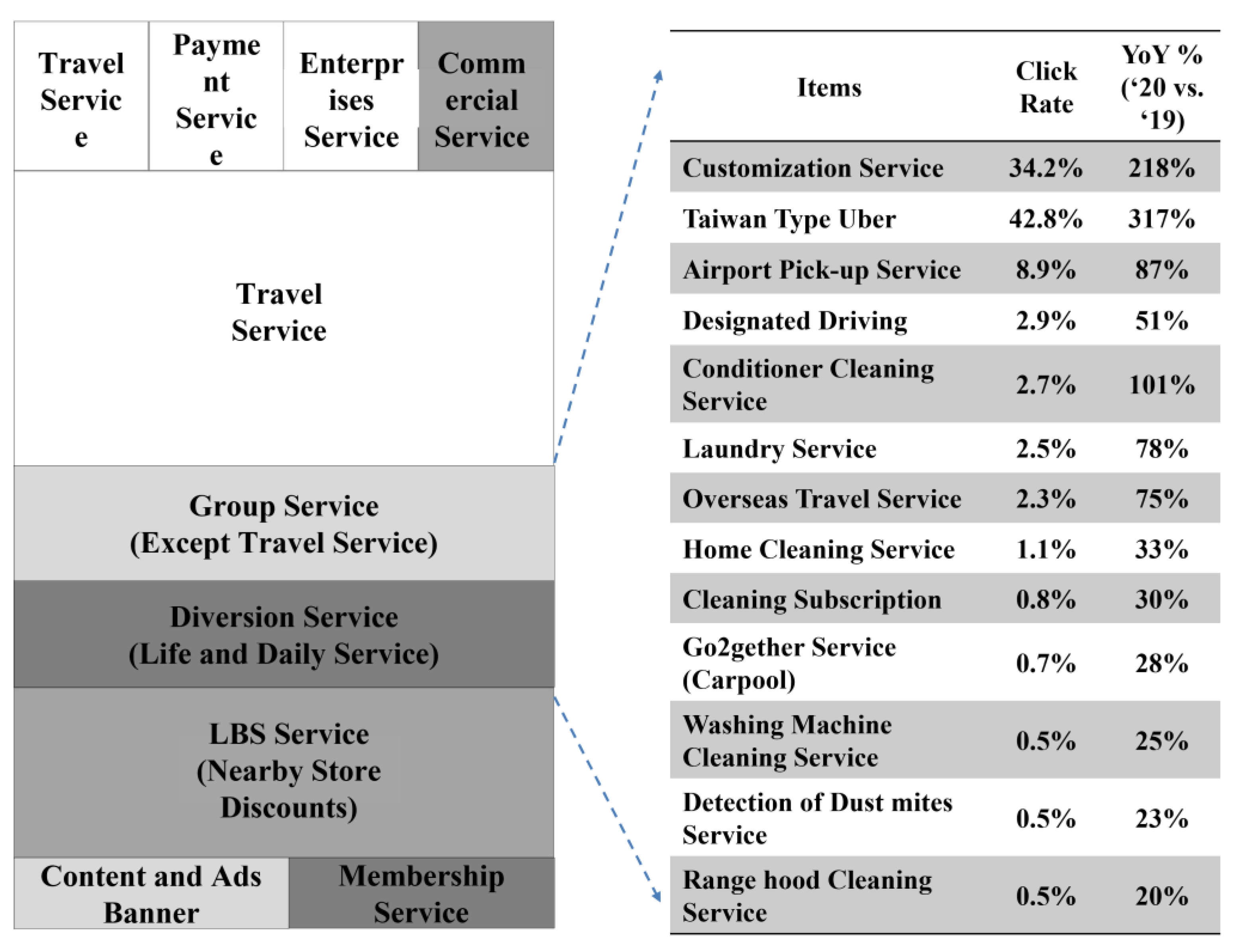

4.4.1. Relevant Data on 55688 Application Performance

4.4.2. Basic Information on 55688 Application Users

4.4.3. Data on New Users of the 55688 Application

4.4.4. Application Data on Value Conversion

4.5. Measures and Analysis

5. Results and Discussion

5.1. Platform Businesses and Platform Consumers

5.2. Platform Businesses and Platform Producers

5.3. Platform Producers and Platform Consumers

5.4. Platform Businesses and Value Cocreation Performance

5.5. Platform Producers and Value Cocreation Performance

5.6. Platform Consumers and Value Cocreation Performance

5.7. Discussion

5.7.1. All-Around Interactions in Platform Businesses Make Sense

5.7.2. Interaction Is Critical and Is a Part of Value Co-Creation Process

6. Conclusions and Implications

6.1. Data Tracking Such as GA and Behavioral Analysis Facilitate the Understanding of the Services That Platform Consumers Require

6.2. Increase Platform Loyalty through Service Innovation

6.3. Platform Businesses, Platform Producers, and Platform Consumers Should All Contribute to Value Creation, Transference, and Acquisition

6.4. Gain Sustained Advantage with the Facilitation of AI-Based Machine Learning Techniques

- (1)

- Examine various types of platform businesses

- (2)

- Broaden interview scope

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- French, A.M.; Shim, J.P. The digital revolution: Internet of things, 5G, and beyond. Commun. Assoc. Inform. Syst. 2016, 38, 38–40. [Google Scholar] [CrossRef] [Green Version]

- Van Alstyne, M.W.; Parker, G.G.; Choudary, S.P. Pipelines, platforms, and the new rules of strategy. Harv. Bus. Rev. 2016, 2016, 54–60. [Google Scholar]

- Payne, E.H.M.; Peltier, J.; Barger, V.A. Enhancing the value co-creation process: Artificial intelligence and mobile banking service platforms. J. Res. Interact. Market. 2021, 15, 68–85. [Google Scholar] [CrossRef]

- Prahalad, C.K.; Ramaswamy, V. Co-creation experiences: The next practice in value creation. J. Interact. Market. 2004, 18, 5–14. [Google Scholar] [CrossRef] [Green Version]

- Vargo, S.L.; Lusch, R.F. Evolving to a new dominant logic for marketing. J. Market. 2004, 68, 1–17. [Google Scholar] [CrossRef] [Green Version]

- Payne, A.; Storbacka, K.; Frow, P. Managing the co-creation of value. J. Acad. Market. Sci. 2008, 36, 83–96. [Google Scholar] [CrossRef]

- De Oliveira, D.T.; Cortmiglia, M.N. Value co-creation in web-based multisided platforms: A conceptual framework and implications for business model design. Bus. Horiz. 2017, 60, 747–758. [Google Scholar] [CrossRef]

- Tse, Y.K.; Zhang, M.; Doherty, B.; Chappell, P.; Garnett, P. Insight from the horsemeat scandal: Exploring the consumers’ opinion of tweets toward Tesco. Indus. Manag. Data Syst. 2016, 116, 1178–1200. [Google Scholar] [CrossRef]

- Hajli, N.; Wang, Y.; Tajvidi, M.; Hajli, M.S. People, technologies, and organizations interactions in a social commerce era. IEEE Trans. Eng. Manag. 2017, 64, 594–604. [Google Scholar] [CrossRef] [Green Version]

- Cayla, J.; Arnould, E.J. A cultural approach to branding in the global marketplace. J. Interact. Market. 2008, 16, 88–114. [Google Scholar] [CrossRef] [Green Version]

- Wang, C.; Zhang, P. The evolution of social commerce: The people, management, technology, and information dimensions. Commun. Assoc. Inform. Syst. 2012, 31, 105–127. [Google Scholar] [CrossRef]

- Cova, B.; Salle, R. Marketing solutions in accordance with the S-D logic: Co-creating value with customer network actors. Indus. Market. Manag. 2008, 37, 270–277. [Google Scholar] [CrossRef]

- Payne, A.; Storbacka, K.; Frow, P.; Know, S. Co-creating brands: Diagnosing and designing the relationship experience. J. Bus. Res. 2009, 62, 379–389. [Google Scholar] [CrossRef]

- Roberts, D.; Hughes, M.; Kertbo, K. Exploring consumers’ motivations to engage in innovation through co-creation activities. Eur. J. Market. 2014, 48, 147–169. [Google Scholar] [CrossRef] [Green Version]

- Xie, C.; Bagozzi, R.P.; Troye, S.V. Trying to prosume: Toward a theory of consumers as co-creators of value. J. Acad. Market. Sci. 2008, 36, 109–122. [Google Scholar] [CrossRef]

- Schreieck, M.; Wiesche, M. How Established Companies Leverage IT Platforms for Value Co-creation- Insights from Banking. In Proceedings of the 25th European Conference on Information Science (ECIS), Guimaracs, Portugal, 5–10 June 2017. [Google Scholar]

- Fu, W.; Wang, Q.; Zhao, X. The influence of platform service innovation on value co-creation activities and the network effect. J. Serv. Manag. 2017, 28, 348–388. [Google Scholar] [CrossRef]

- Yu, C.H.; Tsai, C.C.; Wang, Y.; Lai, K.K.; Tajvidi, M. Towards building a value co-creation circle in social commerce. Comput. Hum. Behav. 2020, 108, 105476. [Google Scholar] [CrossRef] [Green Version]

- Hatch, M.J.; Schultz, M. Toward a theory of brand co-creation with implications for brand governance. J. Brand Manag. 2010, 17, 590–604. [Google Scholar] [CrossRef]

- Ramaswamy, V.; Ozcan, K. Brand value co-creation in a digitalized world: An integrative framework and research implications. Int. J. Res. Market. 2016, 33, 93–106. [Google Scholar] [CrossRef]

- Schau, H.J.; Muñiz, A.M., Jr.; Arnould, E.J. How brand community practices create value. J. Market. 2009, 73, 30–51. [Google Scholar] [CrossRef]

- Nadeem, W.; Al-Imamy, S. Do ethics drive value co-creation on digital sharing economy platforms? J. Retail. Consum. Serv. 2020, 55, 102095. [Google Scholar] [CrossRef]

- Díaz-Chao, A.; Sainz-González, J.; Torrent-Sellens, J. The competitiveness of small network-firm: A practical tool. J. Bus. Res. 2016, 69, 1769–1774. [Google Scholar] [CrossRef]

- Shy, O. The Economics of Network Industries; Cambridge University Press: Cambridge, UK, 2001. [Google Scholar]

- Viktor, M.S.; Kenneth, C. Big Data: A Revolution That Will Transform How We Live, Work, and Think; Eamon Dolan/Mariner Books: London, UK, 2014. [Google Scholar]

- Eisenmann, T.; Parker, G.; van Allstyne, W. Strategies for two-sided markets. Harv. Bus. Rev. 2006, 84, 92–101. [Google Scholar]

- Ali, S.A.; Wang, S.; Ming, X. Platform enterprise business model: Their essence and particularity. J. Res. Bus. Econom. Manag. 2018, 10, 1882–1889. [Google Scholar]

- Cusumano, A.; Gawer, A.; Yoffie, D.B. The Businesses of Platforms: Strategy in the Age of Digital Competition, Innovation, and Power; Harper Business School: Boston, MA, USA, 2019. [Google Scholar]

- Rietveld, J.; Schilling, M.; Bellavitis, C. Platform strategy: Managing ecosystem value through selective promotion of complements. Organ. Sci. 2019, 6, 1125–1163. [Google Scholar] [CrossRef]

- Basoleand, R.C.; Karta, J. On the evolution of mobile platform ecosystem: Structure and strategy. Bus. Inform. Syst. Eng. 2011, 5, 313–322. [Google Scholar] [CrossRef]

- Gawer, A. Building different perspectives on technological platforms: Towards an integrative framework. Res. Policy 2014, 43, 1239–1249. [Google Scholar] [CrossRef] [Green Version]

- Zhu, F. Friends or foes? Examining platform owners’ entry into complementors’ spaces. J. Econom. Manag. Strat. 2019, 28, 23–28. [Google Scholar] [CrossRef] [Green Version]

- Boudreau, K. Open platform strategies and innovation: Granting access vs. devolving control. Manag. Sci. 2020, 56, 1849–1872. [Google Scholar] [CrossRef] [Green Version]

- Ramírez, R. Value co-production: Intellectual origins and implications for practice and research. Strateg. Manag. J. 1999, 20, 49–65. [Google Scholar] [CrossRef]

- Grönroos, C.; Voima, P. Critical service logic: Making sense of value creation and co-creation. J. Acad. Market. Sci. 2013, 41, 133–150. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. Service-dominant logic: Continuing the evolution. J. Acad. Market. Sci. 2008, 36, 1–10. [Google Scholar] [CrossRef]

- Prahalad, C.K.; Ramaswamy, V. Co-opting customer competence. Harv. Bus. Rev. 2000, 78, 79–90. [Google Scholar]

- Sheth, J.N. Customer value propositions: Value co-creation. Indus. Market. Manag. 2019, 87, 312. [Google Scholar] [CrossRef]

- Maslow, A.H. Theory Z. J. Trans. Psychol. 1969, 1, 31–47. [Google Scholar] [CrossRef] [Green Version]

- Lovelock, C.; Wirtz, J. Services Marketing: People, Technology, Strategy, 5th ed.; Prentice-Hall: Englewood Cliffs, NJ, USA, 2004. [Google Scholar]

- Basole, R.C.; Rouse, W.B. Complexity of service value networks: Conceptualization and empirical investigation. IBM Syst. J. 2008, 47, 53–68. [Google Scholar] [CrossRef]

- Zeithaml, V.; Rust, R.; Lemon, K. The customer pyramid: Creating and serving profitable customers. Calif. Manag. Rev. 2001, 43, 118–142. [Google Scholar] [CrossRef]

- Dolan, R.; Seo, Y.; Kemper, J. Complaining practices on social media in tourism: A value co-creation and co-destruction perspective. Tour. Manag. 2019, 73, 35–45. [Google Scholar] [CrossRef]

- Islam, J.U.; Rahman, Z. The impact of online brand community characteristics on customer engagement: An application of Stimulus-Organism-Response paradigm. Telemat. Inform. 2017, 34, 96–109. [Google Scholar] [CrossRef]

- Lin, K.Y.; Lu, H.P. Why people use social networking sites: An empirical study integrating network externalities and motivation theory. Comput. Hum. Behav. 2011, 27, 1152–1161. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. From repeat patronage to value co-creation in service ecosystems: A transcending conceptualization of relationship. J. Bus. Market Manag. 2010, 4, 169–179. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. It’s all B2B…and beyond: Toward a systems perspective of the market. Indus. Market. Manag. 2011, 40, 181–187. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. Service-Dominant Logic: Premises, Perspectives, Possibilities; Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

- Vargo, S.L.; Lusch, R.F. Institutions and axioms: An extension and update of service-dominant logic. J. Acad. Market. Sci. 2016, 4, 5–23. [Google Scholar] [CrossRef]

- Matthyssens, P.; Vandenbempt, K.; Berghman, L. Value innovation in business markets: Breaking the industry recipe. Indus. Market. Manag. 2006, 356, 751–761. [Google Scholar] [CrossRef]

- Kim, C.; Oh, E.; Shin, N. An empirical investigation of digital content characteristics, value, and flow. J. Comput. Inform. Syst. 2010, 50, 79–87. [Google Scholar] [CrossRef]

- Agrawal, A.; Choudhary, A. Perspective: Materials informatics and big data: Realization of the fourth paradigm of science in materials science. APL Mater. 2016, 4, 053208. [Google Scholar] [CrossRef] [Green Version]

- Edvardsson, B.; Tronvoll, B.; Gruber, T. Expanding understanding of service exchange and value co-creation: A social construction approach. J. Acad. Market. Sci. 2011, 39, 327–339. [Google Scholar] [CrossRef] [Green Version]

- Lusch, R.F.; Vargo, S.L. Service-dominant logic: Reactions, reflections and refinements. Market. Theory 2006, 6, 281–288. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research, Design & Methods, 4th ed.; Sage Publication: London, UK, 2009. [Google Scholar]

- Eisenhardt, K.M. Building theories from case study research. Acad. Manag. Rev. 1989, 14, 68–101. [Google Scholar] [CrossRef]

- Patton, M.Q. Qualitative Evaluation and Research Methods, 2nd ed.; Sage Publication: London, UK, 1990. [Google Scholar]

- Strauss, A.; Corbin, J. Grounded Theory in Practice; Sage Publication: London, UK, 1997. [Google Scholar]

- Jick, T.D. Mixing qualitative and quantitative methods: Triangulation in action. Admin. Sci. Q. 1979, 24, 602–611. [Google Scholar] [CrossRef] [Green Version]

- Nicholas, C.D.; Jamali, H. Evaluating information seeking and use in the changing virtual world: The emerging role of Google analytics. Learn. Publ. 2014, 27, 185–194. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.; Kung, L.; Wang, W.Y.C.; Cegielski, C.G. An integrated big data analytics-enabled transformation model: Application to health care. Inform. Manag. 2018, 55, 64–79. [Google Scholar] [CrossRef] [Green Version]

- Choi, J.P.; Thum, M. Market structure and the timing of technology adoption with network externalities. Eur. Econom. Rev. 1998, 42, 225–244. [Google Scholar] [CrossRef] [Green Version]

- Clifton, B. Successful Analytics: Gain Business Insights by Managing Google Analytics, 1st ed.; Advanced Web Metrics Ltd.: Brighton, UK, 2016. [Google Scholar]

- Fabiani, S.; Schivardi, F.; Trento, S. ICT adoption in Italian manufacturing: Firm-level evidence. Ind. Corp. Chang. 2005, 14, 225–249. [Google Scholar] [CrossRef]

- Frambach, R.T.; Schillewaert, N. Organizational innovation adoption: A multi-level framework of determinants and opportunities for future research. J. Bus. Res. 2002, 55, 163–176. [Google Scholar] [CrossRef]

- Wang, E.T.G.; Seidmann, A. Electronic data interchange: Competitive externalities and strategic implementation policies. Manag. Sci. 1995, 41, 401–418. [Google Scholar] [CrossRef]

- Zena, M.S.; Hadisumarto, A. The study of the relationships among experiential marketing, service quality, customer satisfaction and customer loyalty. ASEAN Market. J. 2013, 4. [Google Scholar] [CrossRef]

- Yang, H.E.; Wu, C.C.; Wang, K.C. An empirical analysis of online game service satisfaction and loyalty. Exp. Syst. Appl. 2009, 36, 1816–1825. [Google Scholar] [CrossRef]

- Biemer, P.P.; Dowd, K.; Webb, M.B. Study Design and Methods; Oxford UP: New York, NY, USA, 2010. [Google Scholar]

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|

| Application team workforce | 2 | 2 | 2 | 2 | 10 | 20 | 25 |

| APP upgrade frequency | 6 | 7 | 11 | 23 | 42 | 58 | 65 |

| Ratio of taxi-booking via APP | 20% | 30% | 32% | 35% | 60% | 73% | 75% |

| Level of satisfaction (scale of 1 to 5) | 3.1 | 3.1 | 3.2 | 3.4 | 4.5 | 4.6 | 4.7 |

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|

| Number of APP Members (‘000) | 700 | 1000 | 1350 | 1750 | 3100 | 4000 | 4600 |

| Increase in Number of APP Members (‘000) | -- | 300 | 350 | 400 | 1350 | 900 | 600 |

| Number of Taxi-Booking made via APP (‘000) | 12,000 | 21,000 | 25,600 | 31,500 | 60,000 | 87,600 | 100,600 |

| Number of Credit-Card Bound by APP (‘000) | -- | -- | -- | -- | 250 | 350 | 650 |

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|

| APP active # (‘000) | 70 | 180 | 330 | 550 | 2100 | 3000 | 3500 |

| APP active % | 10% | 18% | 24% | 30% | 68% | 75% | 76% |

| Average number of rides per person | 1.8 | 2.3 | 2.8 | 3.5 | 8.7 | 9.6 | 10.1 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, F.-S.; Tsai, C.-C. A Framework of the Value Co-Creation Cycle in Platform Businesses: An Exploratory Case Study. Sustainability 2022, 14, 5612. https://doi.org/10.3390/su14095612

Wu F-S, Tsai C-C. A Framework of the Value Co-Creation Cycle in Platform Businesses: An Exploratory Case Study. Sustainability. 2022; 14(9):5612. https://doi.org/10.3390/su14095612

Chicago/Turabian StyleWu, Feng-Shang, and Chia-Chang Tsai. 2022. "A Framework of the Value Co-Creation Cycle in Platform Businesses: An Exploratory Case Study" Sustainability 14, no. 9: 5612. https://doi.org/10.3390/su14095612