Towards Energy Transition: Use of Blockchain in Renewable Certificates to Support Sustainability Commitments

Abstract

:1. Background

2. Guarantees of Origin

3. Use and Complications of Guarantees of Origin

3.1. Lack of Transparency

3.2. Lack of Additionality

3.3. Administrative Complexity

4. The Blockchain Revolution

4.1. Benefits of Blockchain for Guarantees of Origin

4.1.1. Gain in Transparency

4.1.2. Gain in Additionality

4.1.3. Administrative Simplification

5. Possibilities for Blockchain-Enabled Guarantees of Origin

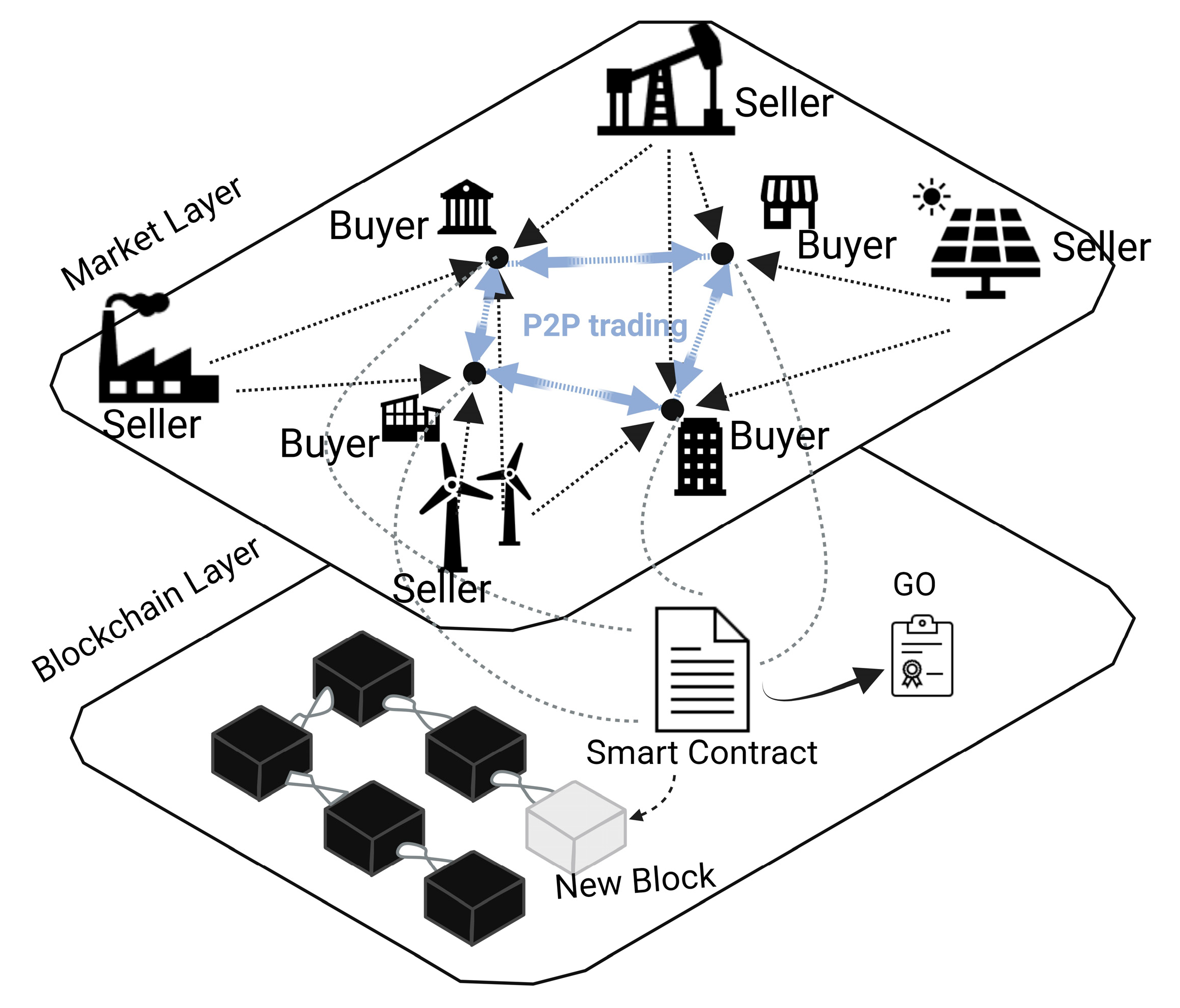

5.1. Smart Grids

5.2. Energy Trading Platforms and Decentralised Applications

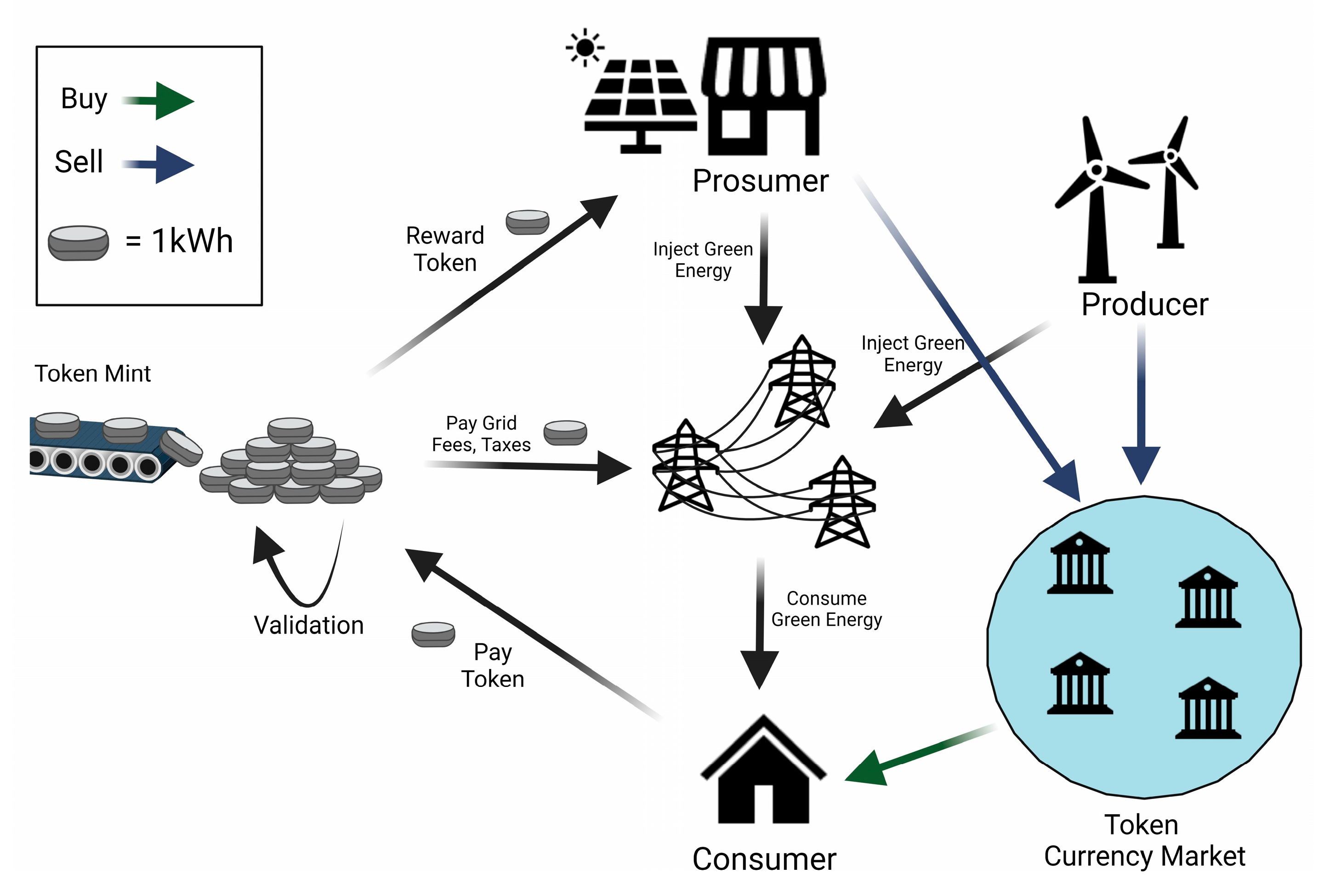

5.3. Energy Tokens

6. Considerations for Blockchain Implementation in Guarantees of Origin

6.1. Technical Challenges

6.2. Economic Challenges

7. Discussion

8. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- United Nations. United Nations Framework Convention on Climate Change; United Nations: New York, NY, USA, 1992. [Google Scholar]

- EU, Directive 2001/77/EC of the European Parliament and of the Council of 27 September 2001 on the Promotion of Electricity Produced from Renewable Energy Sources in the Internal Electricity Market. 2001. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32001L0077&from=FR (accessed on 11 September 2022).

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Ahsan, U.; Bais, A. Distributed big data management in smart grid. In Proceedings of the 2017 26th Wireless and Optical Communication Conference (WOCC), Newark, NJ, USA, 7–8 April 2017. [Google Scholar]

- EC. Electricity Market Design. Available online: https://energy.ec.europa.eu/topics/markets-and-consumers/market-legislation/electricity-market-design_en#:~:text=An%20integrated%20EU%20energy%20market%20is%20the%20most,EU%20country%20and%20delivered%20to%20consumers%20in%20another (accessed on 11 September 2022).

- EC. United Kingdom. Available online: https://energy.ec.europa.eu/topics/international-cooperation/key-partner-countries-and-regions/united-kingdom_en (accessed on 11 September 2022).

- AIB. Renewable Energy Guarantees of Origin. Association of issuing bodies. Available online: https://www.aib-net.org/certification/certificates-supported/renewable-energy-guarantees-origin (accessed on 11 September 2022).

- Ofgem. Renewable Energy Guarantees of Origin (REGO). 2022. Available online: https://www.ofgem.gov.uk/environmental-and-social-schemes/renewable-energy-guarantees-origin-rego (accessed on 11 September 2022).

- GHGP. GHG Protocol Scope 2 Guidance. Greenhouse Gas Protocol. Available online: https://ghgprotocol.org/sites/default/files/ghgp/standards/Scope%202%20Guidance_Final_0.pdf (accessed on 11 September 2022).

- UKGBC. Renewable Energy Procurement & Carbon Offsetting Guidance for Net Zero Carbon Buildings; UKGBC: London, UK, 2021. [Google Scholar]

- Bellini, E. France: EDF, Total and Engie ‘Really Bad’ Green Providers, Says Greenpeace. 2018. Available online: https://www.pv-magazine.com/2018/10/01/france-edf-total-and-engie-really-bad-green-providers-says-greenpeace/#:~:text=The%20association%20said%20several%20providers%20are%20currently%20practicing,is%20absolutely%20legal%2C%20in%20terms%20of%20European%20regulations (accessed on 11 September 2022).

- EUETS. Guarantee of Origin of Electricity from Renewable Energy Sources. 2014. Available online: https://www.emissions-euets.com/internal-electricity-market-glossary/556-guarantee-of-origin (accessed on 11 September 2022).

- Marchenko, O. Modeling of a green certificate market. Renew. Energy 2008, 33, 1953–1958. [Google Scholar] [CrossRef]

- Brander, M.; Gillenwater, M.; Ascui, F. Creative accounting: A critical perspective on the market-based method for reporting purchased electricity (scope 2) emissions. Energy Policy 2018, 112, 29–33. [Google Scholar] [CrossRef]

- Hamburger, Á.; Harangozó, G. Factors affecting the evolution of renewable electricity generating capacities: A panel data analysis of European countries. Int. J. Energy Econ. Policy 2018, 8, 161. [Google Scholar]

- Mulder, M.; Zomer, S.P. Contribution of green labels in electricity retail markets to fostering renewable energy. Energy Policy 2016, 99, 100–109. [Google Scholar] [CrossRef]

- Dagoumas, A.S. Price signal of tradable guarantees of origin for hedging risk of renewable energy sources investments. Int. J. Energy Econ. Policy 2017, 7, 59–67. [Google Scholar]

- NationalGridESO. Future Energy Scenarios; NationalGridESO: Warwick, UK, 2020. [Google Scholar]

- Mendicino, L.; Menniti, D.; Pinnarelli, A.; Sorrentino, N. Corporate power purchase agreement: Formulation of the related levelized cost of energy and its application to a real life case study. Appl. Energy 2019, 253, 113577. [Google Scholar] [CrossRef]

- S&PGlobal-Platts/Zeigo. European PPA Price Report. Available online: https://www.spglobal.com/commodityinsights/plattscontent/_assets/_files/downloads/infographics/ppa-series/20200116_ppa_platts-zeigo.pdf (accessed on 11 September 2022).

- Mathuria, P.; Bhakar, R. Large consumer’s purchase portfolio optimization in electricity market. In Proceedings of the 2016 IEEE 6th International Conference on Power Systems (ICPS), New Delhi, India, 4–6 March 2016; IEEE: Piscataway, NJ, USA, 2016. [Google Scholar]

- EC, on the Promotion of Electricity Produced from Renewable Energy Sources in the Internal Electricity Market. 2001, European Parliament and of the Council of 27 September 2001. Available online: https://www.legislation.gov.uk/eudr/2001/77/pdfs/eudr_20010077_adopted_en.pdf (accessed on 11 September 2022).

- Raadal, H.L. Guarantees of Origin (GOs) for Electricity: Legal Regulations and Application; Østfoldforskning Sustainable Innovation: Fredrikstad, Norway, 2012. [Google Scholar]

- AIB. EECS Rules. 2022. Available online: https://www.aib-net.org/eecs/eecsr-rules (accessed on 11 September 2022).

- OFGEM. Guarantees of Origin (GoOs). Available online: https://www.ofgem.gov.uk/environmental-programmes/rego/energy-suppliers/guarantees-origin-goos (accessed on 11 September 2022).

- Lamport, L. The Part-Time Parliament, in Concurrency: The Works of Leslie Lamport; Association for Computing Machinery: New York, NY, USA, 2019; pp. 277–317. [Google Scholar]

- Yaga, D.; Mell, P.; Roby, N.; Scarfone, K. Blockchain technology overview. arXiv 2019, arXiv:1906.11078. [Google Scholar]

- AlixPartners. The Race to Patent the Blockchain; AlixPartners: New York, NY, USA, 2016. [Google Scholar]

- Nakamoto, S. Bitcoin: A peer-to-peer electronic cash system. Decentralized Bus. Rev. 2008, 21260. [Google Scholar]

- Wang, S.; Ouyang, L.; Yuan, Y.; Ni, X.; Han, X.; Wang, F.Y. Blockchain-enabled smart contracts: Architecture, applications, and future trends. IEEE Trans. Syst. Man Cybern. Syst. 2019, 49, 2266–2277. [Google Scholar] [CrossRef]

- Mollah, M.B.; Zhao, J.; Niyato, D.; Lam, K.Y.; Zhang, X.; Ghias, A.M.; Koh, L.H.; Yang, L. Blockchain for future smart grid: A comprehensive survey. IEEE Internet Things J. 2020, 8, 18–43. [Google Scholar] [CrossRef]

- Erturk, E.; Lopez, D.; Yu, W. Benefits and risks of using blockchain in smart energy: A literature review. Contemp. Manag. Res. 2019, 15, 205–225. [Google Scholar] [CrossRef]

- Spinnell, J.J.; Zimberg, D. Renewable Energy Certificate Markets: Blockchain Applied; Energy System Engineering Institute, Lehigh University: Bethlehem, PA, USA, 2018. [Google Scholar]

- Li, Z.; Kang, J.; Yu, R.; Ye, D.; Deng, Q.; Zhang, Y. Consortium blockchain for secure energy trading in industrial internet of things. IEEE Trans. Ind. Inform. 2017, 14, 3690–3700. [Google Scholar] [CrossRef] [Green Version]

- Tan, S.; Wang, X.; Jiang, C. Privacy-preserving energy scheduling for ESCOs based on energy blockchain network. Energies 2019, 12, 1530. [Google Scholar] [CrossRef]

- Li, H.; Xiao, F.; Yin, L.; Wu, F. Application of blockchain technology in energy trading: A review. Front. Energy Res. 2021, 9, 671133. [Google Scholar] [CrossRef]

- Xiao, Y.; Niyato, D.; Wang, P.; Han, Z. Dynamic energy trading for wireless powered communication networks. IEEE Commun. Mag. 2016, 54, 158–164. [Google Scholar] [CrossRef]

- Zeng, Z.; Li, Y.; Cao, Y.; Zhao, Y.; Zhong, J.; Sidorov, D.; Zeng, X. Blockchain technology for information security of the energy internet: Fundamentals, features, strategy and application. Energies 2020, 13, 881. [Google Scholar] [CrossRef] [Green Version]

- Horta, J.; Kofman, D.; Menga, D.; Silva, A. Novel market approach for locally balancing renewable energy production and flexible demand. In Proceedings of the 2017 IEEE International Conference on Smart Grid Communications (SmartGridComm), Dresden, Germany, 23–26 October 2017; IEEE: Piscataway, NJ, USA, 2017. [Google Scholar]

- FlexyGrid. FlexyGrid, in a Few Words. 2022. Available online: https://www.flexygrid.com/who-we-are#technologies (accessed on 15 December 2022).

- UrbanChain. Peer-To-Peer Energy Exchange Products. 2022. Available online: https://www.urbanchain.co.uk/products (accessed on 15 December 2022).

- Deign, J. Iberdrola Uses Blockchain to Authenticate Clean Energy for Corporate Customers; Greentech Media: Boston, MA, USA, 2019. [Google Scholar]

- Gonzalez, P. Smart Grids. 2022. Available online: https://www.iea.org/reports/smart-grids (accessed on 22 November 2022).

- Iberdrola. Iberdrola Uses Blockchain to Guarantee That the Energy It Supplies to Consumers Is 100% Renewable. 2019. Available online: https://www.iberdrola.com/press-room/news/detail/iberdrola-uses-blockchain-guarantee-that-energy-supplies-consumers-100-renewable (accessed on 22 November 2022).

- PylonNetwork. Pylon Network Blockchain. 2022. Available online: https://pylon-network.org/pylon-network-blockchain (accessed on 22 November 2022).

- PylonNetwork. PYLON NETWORK. The Energy Blockchain Platform; PylonNetwork: Castellón, Spain, 2018. [Google Scholar]

- Bronski, P.; Arnone, N.; Leriche, N.; Ruddell, M. Blockchain: TEO (The Energy Origin) Is the First Application to Migrate onto the Energy Web Chain; Energy Web: Zug, Switzerland, 2019. [Google Scholar]

- Theodosiadis, V.; Roling, J.; Krishnan, N.; Revolutionizing Renewable Energy Certificate Markets with Tokenization. IBM Supply Chain and Blockchain Blog 2021. Available online: https://www.ibm.com/blogs/blockchain/2021/08/revolutionizing-renewable-energy-certificate-markets-with-tokenization/ (accessed on 22 November 2022).

- Mihaylov, M.; Razo-Zapata, I.; Nowe, A. NRGcoin—A blockchain-based reward mechanism for both production and consumption of renewable energy. In Transforming Climate Finance and Green Investment with Blockchains; Elsevier: Amsterdam, The Netherlands, 2018; pp. 111–131. [Google Scholar]

- Liu, C.; Zhang, X.; Chai, K.K.; Loo, J.; Chen, Y. A survey on blockchain—Enabled smart grids: Advances, applications and challenges. IET Smart Cities 2021, 3, 56–78. [Google Scholar] [CrossRef]

- Alt, R.; Wende, E. Blockchain technology in energy markets–An interview with the European Energy Exchange. Electron. Mark. 2020, 30, 325–330. [Google Scholar] [CrossRef]

- Zhang, R.; Xue, R.; Liu, L. Security and privacy on blockchain. ACM Comput. Surv. (CSUR) 2019, 52, 1–34. [Google Scholar] [CrossRef] [Green Version]

- Jayabalasamy, G.; Koppu, S. High-performance Edwards curve aggregate signature (HECAS) for nonrepudiation in IoT-based applications built on the blockchain ecosystem. J. King Saud Univ.-Comput. Inf. Sci. 2021; in press. [Google Scholar]

- BitcoinCore. Segregated Witness Benefits. 2016. Available online: https://bitcoincore.org/en/2016/01/26/segwit-benefits/#linear-scaling-of-sighash-operations (accessed on 22 November 2022).

- Bernabe, J.B.; Canovas, J.L.; Hernandez-Ramos, J.L.; Moreno, R.T.; Skarmeta, A. Privacy-preserving solutions for blockchain: Review and challenges. IEEE Access 2019, 7, 164908–164940. [Google Scholar] [CrossRef]

- Castellanos, J.A.F.; Coll-Mayor, D.; Notholt, J. Cryptocurrency as guarantees of origin: Simulating a green certificate market with the Ethereum Blockchain. In Proceedings of the 2017 IEEE International Conference on Smart Energy Grid Engineering (SEGE), Oshawa, ON, Canada, 14–17 August 2017. [Google Scholar]

- Erel, M.; Arslan, Z.; Özçevik, Y.; Canberk, B. Grade of service (gos) based adaptive flow management for software defined heterogeneous networks (sdhetn). Comput. Netw. 2015, 76, 317–330. [Google Scholar] [CrossRef]

- Jindal, A.; Aujla, G.; Kumar, N. SURVIVOR: A blockchain based edge-as-a-service framework for secure energy trading in SDN-enabled vehicle-to-grid environment. Comput. Netw. 2019, 153, 36–48. [Google Scholar] [CrossRef] [Green Version]

- Rüsch, S.; Messadi, I.; Kapitza, R. Towards low-latency byzantine agreement protocols using RDMA. In Proceedings of the 2018 48th Annual IEEE/IFIP International Conference on Dependable Systems and Networks Workshops (DSN-W), Luxembourg, 25–28 June 2018. [Google Scholar]

- Vukolić, M. The quest for scalable blockchain fabric: Proof-of-work vs. BFT replication. In International Workshop on Open Problems in Network Security; Springer: Berlin/Heidelberg, Germany, 2015. [Google Scholar]

- Mechkaroska, D.; Dimitrova, V.; Popovska-Mitrovikj, A. Analysis of the possibilities for improvement of blockchain technology. In Proceedings of the 2018 26th Telecommunications Forum (TELFOR), Belgrade, Serbia, 20–21 November 2018. [Google Scholar]

- PowerLedger, PowerLedger. 2022. Available online: https://www.powerledger.io/staking#:~:text=Powerledger’s%20Proof%2Dof%2DStake%20Energy,50%2C000%2B%20energy%20transactions%20per%20second (accessed on 22 November 2022).

- Rykwalder, E. The Math Behind the Bitcoin Protocol. Markets 2014. Available online: https://www.coindesk.com/markets/2014/10/19/the-math-behind-the-bitcoin-protocol/ (accessed on 17 December 2022).

- Evercooren, D.V. Will Blockchain Replace the Guarantee of Origin? Or Improve It? LinkedIn 2019 27/02/2019. Available online: https://www.linkedin.com/pulse/blockchain-replace-guarantee-origin-improve-dirk-van-evercooren/ (accessed on 22 November 2022).

- Islam, N.; Rahman, M.S.; Mahmud, I.; Sifat, M.N.A.; Cho, Y.Z. A Blockchain-Enabled Distributed Advanced Metering Infrastructure Secure Communication (BC-AMI). Appl. Sci. 2022, 12, 7274. [Google Scholar] [CrossRef]

- Moni, M.; Melo, W., Jr.; Peters, D.; Machado, R. When Measurements Meet Blockchain: On Behalf of an Inter-NMI Network. Sensors 2021, 21, 1564. [Google Scholar] [CrossRef]

- ICCS-NTUA; Emi, A. Study on cost benefit analysis of Smart Metering Systems in EU Member States. 2015. Available online: https://energy.ec.europa.eu/system/files/2015-11/AF%2520Mercados%2520NTUA%2520CBA%2520Final%2520Report%2520June%252015_0.pdf (accessed on 11 September 2022).

- De Oliveira-De Jesus, P.; Antunes, C.H. Economic valuation of smart grid investments on electricity markets. Sustain. Energy Grids Netw. 2018, 16, 70–90. [Google Scholar] [CrossRef]

- Gangale, F.; Vasiljevska, J.; Covrig, F.; Mengolini, A.; Fulli, G. Smart Grid Projects Outlook 2017; European Commission, Joint Research Centre: Ispra, Italy, 2017. [Google Scholar]

- Vasiljevska, J.; Gangale, F.; Covrig, L.; Mengolini, A.M. Smart Grids and Beyond: An EU Research and Innovation Perspective 2021; European Commission, Joint Research Centre: Ispra, Italy, 2021. [Google Scholar]

- Smit, S.; Tyreman, M.; Mischke, J.; Ernst, P.; Evers, M.; Hazan, E.; Novak, J.; Hieronimus, S. Securing Europe’s Future beyond Energy: Addressing Its Corporate and Technology Gap; McKinsey Global Institute: Washington, DC, USA, 2022. [Google Scholar]

- Zakeri, B.; Paulavets, K.; Barreto-Gomez, L.; Echeverri, L.G.; Pachauri, S.; Boza-Kiss, B.; Zimm, C.; Rogelj, J.; Creutzig, F.; Ürge-Vorsatz, D.; et al. Pandemic, War, and Global Energy Transitions. Energies 2022, 15, 6114. [Google Scholar] [CrossRef]

- Poh, J. Europe Power Firms’ Debt Soars to $1.7 Trillion on Energy Crisis; Bloomberg: London, UK, 2022. [Google Scholar]

| GO Challenges | Blockchain | |

|---|---|---|

| Solutions | Benefits | |

| Lack of Transparency |

|

|

| Lack of Additionality |

| |

| Administrative Complexity |

| |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Delardas, O.; Giannos, P. Towards Energy Transition: Use of Blockchain in Renewable Certificates to Support Sustainability Commitments. Sustainability 2023, 15, 258. https://doi.org/10.3390/su15010258

Delardas O, Giannos P. Towards Energy Transition: Use of Blockchain in Renewable Certificates to Support Sustainability Commitments. Sustainability. 2023; 15(1):258. https://doi.org/10.3390/su15010258

Chicago/Turabian StyleDelardas, Orestis, and Panagiotis Giannos. 2023. "Towards Energy Transition: Use of Blockchain in Renewable Certificates to Support Sustainability Commitments" Sustainability 15, no. 1: 258. https://doi.org/10.3390/su15010258