Abstract

Currently, sustainability is a vital aspect for every nation and organization to accomplish Sustainable Development Goals (SDGs) by 2030. Environmental, social, and governance (ESG) metrics are used to evaluate the sustainability level of an organization. According to the statistics, 53% of respondents in the BlackRock survey are concerned about the availability of low ESG data, which is critical for determining the organization’s sustainability level. This obstacle can be overcome by implementing Industry 4.0 technologies, which enable real-time data, data authentication, prediction, transparency, authentication, and structured data. Based on the review of previous studies, it was determined that only a few studies discussed the implementation of Industry 4.0 technologies for ESG data and evaluation. The objective of the study is to discuss the significance of ESG data and report, which is used for the evaluation of the sustainability of an organization. In this regard, the assimilation of Industry 4.0 technologies (Internet of Things (IoT), artificial intelligence (AI), blockchain, and big data for obtaining ESG data by an organization is detailed presented to study the progress of advancement of these technologies for ESG. On the basis of analysis, this study concludes that consumers are concerned about the ESG data, as most organizations develop inaccurate ESG data and suggest that these digital technologies have a crucial role in framing an accurate ESG report. After analysis a few vital conclusions are drawn such as ESG investment has benefited from AI capabilities, which previously relied on self-disclosed, annualized company information that was susceptible to inherent data issues and biases. Finally, the article discusses the vital recommendations that can be implemented for future work.

Keywords:

ESG; sustainability; SDGs; Industry 4.0; IoT; artificial intelligence; big data; ESG reporting 1. Introduction

The United Nations laid out the SDGs in 2015 to achieve global sustainability by 2030 [1]. States, individuals, and investors are increasingly aware that firms can play a significant role in addressing societal issues, and the world still is on track to meet the UN SDGs for 2030 [2]. ESG factors are progressively being infused into investment and business management because of their potential to develop superior productivity and longer-term profit growth [3]. The performance of any organization related to its contribution and progress towards sustainability in terms of environmental, social, and governance can be evaluated with the assistance of the ESG approach [4]. The author claimed that the traditional Fama-French three-factor model, which establishes market, size, and value components to describe average returns, is the foundation upon which the role of ESG is built [5,6]

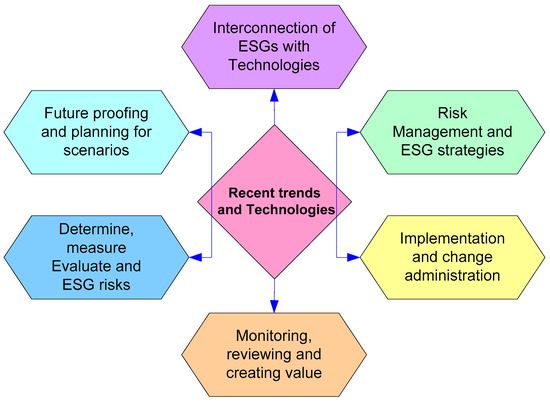

Figure 1 shows the ESG framework which consists of stakeholders and standards. The ESG strategies and risk management will deploy change management through which value creation monitoring so that the organization can identify and assess ESG risks, it will help in futureproofing and scenario planning [7,8]. Three main tensions are examined in the study such as control and creativity, standardization and variation, and individual and group [9].

Figure 1.

ESG Framework.

Meanwhile, worldwide involvement in ESG investments is intensifying. Traditional investment paradigms are gradually shifting to investments that emphasize environmental, social, and corporate responsibility [10]. Currently, the field of digital transformation is limited in its analysis of sustainability factors. Along with this, there are several issues with the contemporary approach to gathering and analyzing environmental data, which is inadequate and irregular [11,12,13]. In addition, the diversity and complexity of environmental controls can have a significant impact on data accuracy, dependability, and impartiality. Industry 4.0 has the potency to be a substantial possibility for assimilating SDGs with advanced technology digital transformation and it can evaluate the ESG metrics of an organization [14]. These industrial 4.0 technologies enable real-time energy management, waste management, automatic carbon footprint calculation, improving human well-being, supply chain resiliency, real-time operational performance of production, and so on [15]. According to the statistics, 53% of respondents to the BlackRock survey are concerned about the availability of low-quality ESG data, which is impeding the adoption of sustainable investing [16]. Based on this motivation, this study examined the different previous studies that have addressed the role of Industry 4.0 for ESG. Ref [14] developed a conceptual model of impact factors that integrates the notion of “Industry 4.0” to the Morgan Stanley Capital ESG to examine vital difficulties in the energy sector. Ref [17] applied computer-aided textual analysis was used to evaluate the implications of corporate transformation toward Industry 4.0 (CTTI4.0) data on financial effectiveness and observed that companies with stronger ESG performance are quite involved in CTTI4.0 disclosure and have better financial at the same time. Ref [18] developed an innovative approach to empower Chinese energy companies will obtain real-time environmental data to improve the efficiency of ESG reporting. According to the findings of these studies, there are a limited number of studies that discuss the implementation of Industry 4.0 technologies such as IoT, AI, blockchain, big data, and digital twins for ESG data. The study is first to discuss the significance of Industry 4.0 enabling technologies for framing the appropriate and accurate ESG data is the novelty of this study. This study has discussed future research directions based on previous studies that focused on the ESG data and report.

The study has applied different keywords such as ESG, sustainability, sustainable development goals, Industry 4.0, Internet of Things for ESG, AI for ESG, blockchain for ESG, and big data for ESG, in the Scopus database by applying the Boolean operations “AND” and “OR”. The articles which are obtained through the above methods are utilized to carry out the study for presenting the significance of Industry 4.0 for ESG in different aspects. The contribution of the study is as follows:

- In this study, the significance of the ESG data and reporting for sustainability is detailed and presented with concepts and terminology.

- The integration of IoT, AI, blockchain, and big data for ESG are discussed with architecture to provide an opportunity to investors for effective planning before the investment.

- The article discusses the vital recommendations that can be implemented for future work.

The structure of the article is as follows: Section 2 covers the overview of ESG and sustainability in detail; Section 3 presents the technology integration for ESG to obtain real-time data, and enhance data transparency, and authentication with prediction; Section 4 addresses future recommendations.

2. Overview of ESG and Sustainability

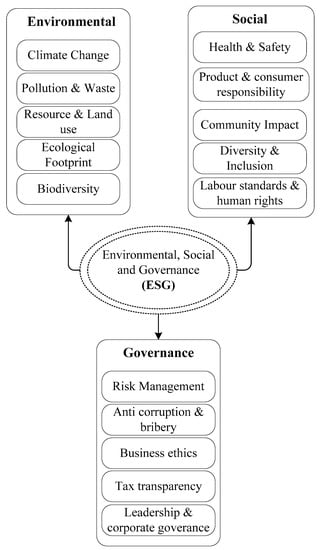

In this section, we will discuss the significance and different elements involved in the environment, social, and governance towards sustainability. Figure 2 illustrates different metrics, in which ESG data are collected for the evaluation of sustainability. The discussion of these parameters is detailed discussed in below:

Figure 2.

Metrics involved in ESG.

2.1. Terminology of ESG

Environment: Several interconnected environmental problems, such as soil, water pollution, climate change, air pollution, biodiversity loss, and overuse of natural resources, have gotten worse as technology has advanced. Since the term “sustainable development” was coined, a large number of market players, including institutional and private investors, have expressed a desire to take environmental sustainability into account when making investment decisions [19]. Social: Worldwide awareness of ESG risks like those related to the environment, society, and governance has grown over the past several years, and non-financial investments are now taken into account when making investment decisions [20]. The focus is on the environment, and investments in bio and health are becoming more popular as a result of recent technological advancements, while new investments and decisions are being made in the direction of the sequential termination or withdrawal of existing firms [21]. Human behavior in the social domain is obtained in real-time using data from social networks and smart cities [22]. These increase the intelligence of the ecosystem and create an intelligent space to sense our activities or actions [23]. Based upon this significance there is an increased number of managers, who are prioritizing sustainability and combating climate change in their investment portfolios.

Governance: Corporate governance refers to the “rules and processes by which organizations are controlled or run.” Corporate governance has its roots in a variety of ideologies. The agency hypothesis is one of the fundamental theories. The definition of an agency relationship given by Jensen is “a contract whereby one or more persons engage another person to perform some service on their behalf and whereby the principal delegate some decision-making authority to the agent [24].

2.2. ESG Investing

ESG investing is the practice of prioritizing the best ESG aspects or outcomes. It is also known as socially responsible investing, impact investing, and sustainable investing [25]. ESG investing is frequently referred to as a technique of “sustainably” investing, wherein investments are made while taking the economy, the environment, and human welfare into account [26]. We put forth a theory in which the ESG score of each stock influences investor preferences in addition to providing information on the firm’s fundamentals. An ESG-efficient frontier, which displays the maximum possible Sharpe ratio for each ESG, is the defining feature of the solution to the investor’s portfolio problem.

ESG or Corporate Social Responsibility (CSR) is a common term used to describe corporate behavior in this area [27]. ESG demonstrates the financial markets’ commitment to considering ESG factors when making investment decisions [28]. The Governance & Accountability Institute reported in 2018 that 86 percent of S&P 500 corporations submitted sustainability or corporate responsibility reports compared to just under 20 percent in 2011. This indicates interest in ESG/CSR from a corporate standpoint [29]. It is based on the growing premise that environmental and social problems are that had a great effect on an organization’s financial productivity [30]. Institutional frameworks that promote spending on government initiatives that improve social equality and natural capital as a means of accelerating the transition to ESG.

Many businesses are looking for ways to enhance their ESG standards in light of the rise of stakeholder capitalism and responsible investment. Business leaders in this new era need to focus more intently on factors other than their company’s short-term operations and financial results to better understand how underlying social, economic, political, environmental, and technological conditions are changing and potentially affecting their firm’s operations and prospects [30]. A firm is more than just a wealth-producing economic entity. As a component of the larger social system, it satisfies human and societal objectives. Performance must be evaluated based on how well an organization fulfills its environmental, social, and good governance goals in addition to its return to shareholders. Stakeholder responsibility should be reflected in executive compensation [31].

Responsible Investing—A strategy for investing that takes into account. ESG considerations as well as the market’s overall long-term stability and health are referred to as “responsible investing.” It acknowledges that sound social, environmental, and economic systems are necessary for long-term, sustainable results. In most parts of the world, institutional and individual investors are becoming more interested in socially responsible investing [14]. Though the notion of sustainable investing is complicated and frequently misinterpreted, three primary strands may be found. Initially, it was known as Socially Responsible Investment (SRI). The Quaker movement and other religious movements of the 20th century served as the foundation for SRI and provided it with an ethical orientation [32].

The study takes into account a network of equity mutual funds that exhibit varying degrees of adherence to ESG factors. They assess the effects of portfolio liquidation under stress on several ESG-rated funds [33]. The study shows fundamental reforms in government reporting and accountability. The current government reporting structure cannot keep up with the public’s growing need for accountability in light of the accessibility of Big Data and the development of technologies. The requirement for the government to update its reporting model and suggest possible routes to analytics-based, data-driven, immediate, and proactive reporting. They visualize a continuous monitoring and reporting environment that is real-time and includes non-financial data such as ESG and infrastructure. This updated reporting paradigm emphasizes the purpose of government reporting, which is to hold officials accountable to the people [34]. In response to growing investor demand for non-financial information from corporations, a multitude of environmental accounting frameworks have surfaced to advertise standardized disclosure of ESG information. These frameworks have improved the consistency, accessibility, and readability of the data that investors can use to evaluate the sustainability implications of capital allocation decisions [35]

2.3. ESG for Sustainability

ESG methodologies should benefit sustainability in all three ways. If every consequence suggested by the ESG approaches is undeniably true, we could assume that a synergistic effect manifests and effectively enhances our economic and social systems. We must ensure that each effect is understood [12,36]. ESG methodologies first attempt to calculate welfare losses in terms of numbers and values. The outcome is anticipated to shield the world’s communities from serious disasters. Second, ESG schemes unleash the potential for rivalry and collaboration in local and international societies. In other words, the ESG framework could direct local and international communities toward sustainability. Thirdly, social innovation is sparked by ESG methodologies.

The incorporation of some stakeholders’ evaluations in the articulations could increase the corporation’s receptivity to risks and innovations. ESG initiatives could significantly advance the future fourth industrial revolution and sharing economies. A variety of investments for social requirements should be cultivated during the development process using the ESG scheme [37]. Sustainability reporting is the disclosure of information about the environment, society, and corporate governance. Its goal, as with all disclosures, is to bring attention to a company’s ESG initiatives, enhance investor transparency, and encourage other businesses to follow suit. Reporting is a powerful tool for proving that your ESG efforts are real and not just lip service or greenwashing and that you are on track to reach your objectives.

3. Technology Intervention for ESG

In this section, we discuss the impact of current digital technology in the implementation of projects for ESG/sustainable development. ESG conversations often center on topics like pollution management, biodiversity, health and safety, corporate ethics, and boardroom diversity in the majority of businesses. Consumers concerned about ESG have become increasingly with companies that make inaccurate, or even completely false, statements about their ESG policies. Fact-checking is made simpler by the internet, and social media allows for quick denunciation. Investors will increasingly demand definite, verifiable proof that ESG factors are explicitly included in a manager’s investment process, as well as evidence to back up such assertions through stock selection, reporting, and portfolio structure [38].

3.1. IoT for ESG

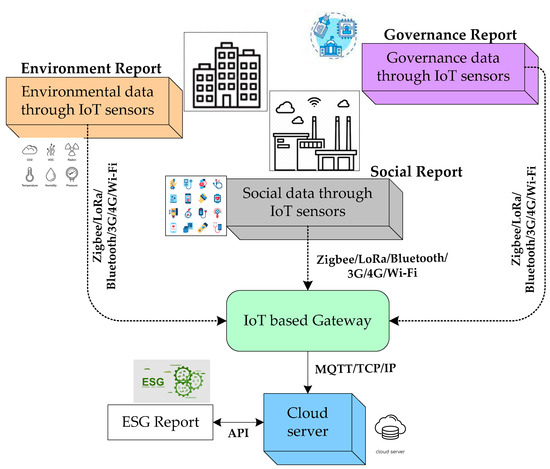

A study proposes an architecture of a smart ESG reporting platform leveraging blockchain technology and IoT to enable corporate crowd-sensing for environmental data and improve the transparency, security, and creditability of the ESG reporting procedure [39]. Multidimensional environmental data are being produced in ever-increasing amounts by weather forecast models and high-resolution climate as well as regional and worldwide sensor networks. To be useful, the information must be kept, managed, and made accessible to a global group of academics, policymakers, and others [40].

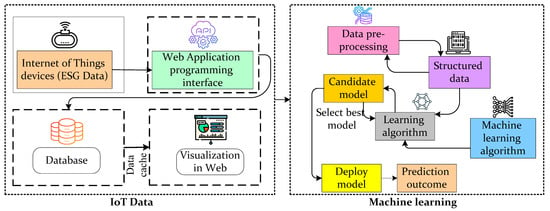

Figure 3 illustrates an architecture that is implemented for ESG based on IoT. IoT is based on the networking of things where smart devices communicate with each other by sending and receiving data. Fundamentally the IoT comprises five layers such as perception layer, network layer, and application layer. Data acquisition through wireless sensors with the computing unit is available in the perception layer. Oxygen, Catalytic gas sensors, PM2.5, PM10, ozone (O3), carbon monoxide (CO), carbon dioxide (CO2), sulphur dioxide (SO2), nitrogen dioxide (NO2), Formaldehyde (HCHO), Total volatile organic compounds (TVOCs), temperature, noise, humidity sensors, and ultraviolet radiation index, etc. are used to measure carbon footprint and air quality (Indoor/outdoor) of any premises and location [41,42,43]. These sensors assist to obtain the environmental data in real-time and it concludes its impact on the sustainability parameter. The quality environment boosts the standard of living in terms of health can be achieved. Airflow, Pressure, Oxygen, Temperature, Humidity, Magnetic, Thermistor, Barcode, Force, Pulse, heart rate (HR), electromyography (EMG), Electrocardiogram (ECG), Electroencephalography (EEG), blood pressure (BP), Pulsoxymetrie, Photoplethysmography (PPG), Glucose, Gyroscope, motion tracker sensor is integrated with IoT devices to obtain the real-time data for the one of parameter social in ESG [44].

Figure 3.

IoT framework for ESG.

These sensors assist to enhance health monitoring and maintain the health of a person by alerting frequently. Vision cameras, motion sensors, radio frequency identification (RFID), barcodes, a global positioning system (GPS), ultrasonic sensor, proximity sensors, infrared (IR) sensors, pressure sensors, touch sensors, vibration sensors, piezo sensors, are other sensors and identification technologies that have boosted the monitoring of an organization in its supply chain and operational functions through real-time data (social reporting). This sensor data is processed and communicated to the application layer through the network layer. The network layer establishes the networking between the perception layer and application layer through different communication protocols such as Bluetooth low energy (BLE), Bluetooth 5, Zigbee, Long range (LoRa), wireless fidelity (Wi-Fi), Narrowband-IoT(NB-IoT), Sigfox, Advanced Message Queuing Protocol (AMQP), Data Distribution Service (DDS), Message Queue Telemetry Transport (MQTT), etc. [45].

3.2. Blockchain for ESG

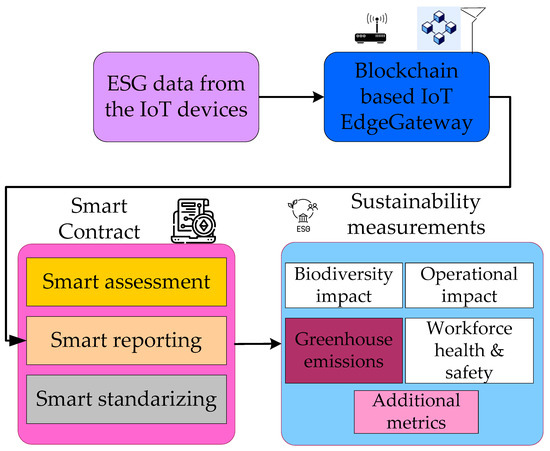

Blockchain has completely changed the financial industry with its distributed ledger technology [46,47]. Asset management and peer-to-peer networks for the open interchange of data are promising applications of blockchain [48]. These new developments in financial technology will be particularly advantageous for international climate finance [49]. Currently, there is a lack of a standardized reporting framework to empower the information to be scalable and comparable [50]. Due to the market’s large variety of ESG rating models, reporting practices have constructed the ESG reporting system as obvious, discontinuous, inconstant, and complicated to compare data disclosures [51]. By developing agile, transparent, and automated data collection processes, blockchain can streamline the processing and packaging of ESG reports.

Figure 4 illustrates an architecture that is used to implement the blockchain for ESG reports and evaluation of the sustainability in a firm. ESG data from the different IoT devices are collected and transmitted to the blockchain gateway through a wireless communication protocol. Blockchain-based IoT edge gateway empowers to overcome the authentication concerns in the IoT data. This gateway acts as a node to transmit the data of IoT devices to the blockchain network, which satisfies both transparency and privacy. The smart contract notion automates the implementation of a contract to ensure that all participants can be sure of the results instantly, without the participation of a middleman or time failure [52]. Furthermore, smart contracts are used to assess the continuity between the raw data and the final ESG report. In the final, sustainability measurements obtained through the smart contract are used for evaluation and behaviors of firms.

Figure 4.

Blockchain for ESG reporting.

Table 1 illustrates the studies that focused on implementing blockchain technology for ESG in different aspects. In the majority of the studies, blockchain is implemented for enhancing transparency, security, credibility, and data authentication. The majority of studies have proposed token and coin-based mechanisms for the assessment of ESG reports. For the authenticity of data, blockchain technology is also leveraged with IoT and AI, where obtained data is verified and cleaned for further assessment. It is also observed from the studies that the blockchain has been implemented majorly for energy trading, to monitor carbon emissions transparently. Few studies have conducted a pilot study to evaluate the significance of blockchain for automatic data collection.

Table 1.

Studies of blockchain technology implementation for ESG.

3.3. AI for ESG

Alan Turing first advocated for AI research in the 1950s, and John McCarthy first used the term “artificial intelligence” in 1955. The influence of AI has been significant in several industries, including marketing, finance, engineering, healthcare, and education. AI creates objects that extract, analyze, and react instinctively like the human mind, and does so with greater accuracy, speed, and correctness [58]. ESG analyses as resources for AI auditing that is ethical- It has become clear that AI-based systems need to be effectively controlled to prevent, or at least limit, possible dangers and harms as the usage of AI increases throughout sectors and communities [59]. The inclusion of AI within ESG assessments may be warranted given that it is acknowledged as a potential material concern for many different industries and businesses. Standardized measures for AI accountability are required, and it’s also important to address asymmetric knowledge relations and crucial bottlenecks [60].

Both portfolio managers and individual investors are looking for effective asset allocation models that express investor behavioral biases as well as ESG factors. Despite investor biases for ESG sustainability, loss aversion, and cognitive dissonance. The five different experiments in this paper’s integrated AI approach to the ESG datasets are suggested [61]. The study also concentrates on using NLP algorithms to analyze governance and social statistics and offers a simple way of forecasting a particular firm’s ESG rankings [62].

To evaluate the significance of ESG criteria for investment decisions and how they affect financial performance, a methodology is implemented for conducting statistical analysis and applying machine learning techniques. Companies with the strongest ESG ratings outperformed the others in terms of return on equity [63]. The governance and auditing of AI systems hold the promise of bridging the gap between the ethical principles guiding AI and the ethical application of AI systems, but they also call for evaluation tools and metrics [64]. Organizations can try to go above legal obligations by proactively analyzing the risks inherent in their AI systems. Effective AI governance is not just about complying with the law. This also identifies three broad categories of finance scholarship that are broadly equal for both types of study, including sentiment inference, forecasting, and planning, valuation, portfolio construction, investor behavior, financial fraud, and distress. The author also highlights trends and future research topics for ML and AI in finance research using co-occurrence and confluence studies [65]. ESG investment, which frequently relied on self-disclosed, annualized company information susceptible to inherent data issues and biases, has proven to benefit from AI capabilities. The pressure on investment managers to incorporate ESG factors into their portfolios is growing. AI can offer a solution in this case by acting as the trigger for scaled sustainable investing through analysis technologies that filter important data [66].

Figure 5 illustrates the AI implementation for ESG, where the environmental, social, and governance data are combined to form a dataset. The architecture shows the flow of IoT data for generating a dataset. IoT data is obtained from the devices through different sensors, communication protocols, and actuators. These data are transferred to the database through Web API. Once data is received from the IoT devices undergoes for preprocessing stage, where the data is filtered and cleaned. Pre-processing of data enables standardized data, i.e., structured data that is feasible to form a dataset and easy to apply to the program. Once the dataset is formed, the AI/ML model will be selected and trained with previous data with different learning algorithms for identifying the best algorithm for the dataset. After training, the dataset is tested with a selected learning algorithm for identifying the unhidden patterns and predicting the opportunities for the future. These AI framework act as a catalyst for humans to evaluate the necessary data in the ESG metrics so that the investors can have an idea of which organizations they have invested in. In sentiment analysis, and natural language processing, the AI algorithms apply and analyze the context, texture, and tone and identify the patterns at which top executives follow strategies in implementing the ESG in their organization. The same techniques can be applied by other organizations in effectively implementing ESG criteria.

Figure 5.

ML implementation for ESG.

Table 2 presents the studies that have implemented AI in ESG reporting. The majority of the studies have studied and implemented AI for evaluating ESG’s impact on the firm’s performance. In addition to this, for the prediction of ESG rating the following three models such as feedforward neural networks, gradient-boosted trees (xgboost), and categorical gradient-boosted trees(catboost) are implemented on the fundamental data. Few studies have implemented AI for risk assessment and valuation.

Table 2.

Studies of AI implementation for ESG.

3.4. Big Data for ESG

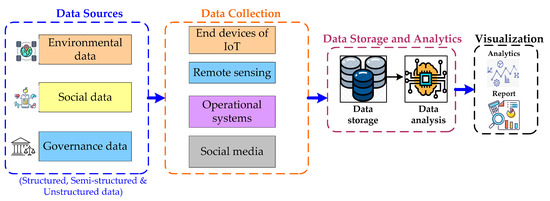

Figure 6 illustrates the basic big data architecture that can be implemented for ESG reporting. The architecture comprises data sources, data collection, data storage & analytics, and data visualization. Generally, in ESG reporting, the data sources are primarily from remote sensing (geospatial) data, end devices of IoT, operational systems, and social media. The amount of data generated from these sources is huge. The identification of hidden patterns, unidentified correlations, uncovered trends, and customer preferences. Environmental data comprise air quality, weather data, forest data, water resources data, waste management, etc. Remote sensing data make up a major percentage of big data, and its volume is expanding quickly—at least by 20% annually [49]. The researcher examines the benefits and difficulties that geospatial big data has offered us in this study. Several case examples are advantages of geographic big data analytics, including time and fuel savings, revenue growth, urban planning, and health care. Then, they introduce brand-new technologies that are now in development for distributing amassed geospatial big data and monitoring human motion using mobile devices [72].

Figure 6.

Big data architecture.

Social data comprises health, diversity, freedom of expression, human rights, etc. [73]. The governance data comprises data transparency, taxes, policies of the administration, etc. Data collection is obtained from the data source through IoT gateway, web application programming interface, and Node.js (it is javascript that allows running on the server). In big data, the main issue with the data ingestion process flow is keeping data in the correct location based on usage. Relational databases that we have been successful at storing our data lack the consistency in data ingestion for being relational. However, the polygot persistence method can separate the data across multiple databases by leveraging the combined power. The data analytics layer is key in big data, where different analytical models can be used not only for identifying current patterns but also to predict the future. Some of the techniques are data mining, predictive analytics, and deep learning. Data mining is applied to detect relationships and patterns through anomalies and data clusters. Predictive analytics works on previous data to realize predictions and upcoming opportunities. Deep learning utilizes AI and machine learning to layer algorithms for identifying patterns in complex and abstract data. In the visualization, the results are visualized in the form of analytics and reports.

4. Discussion and Recommendations

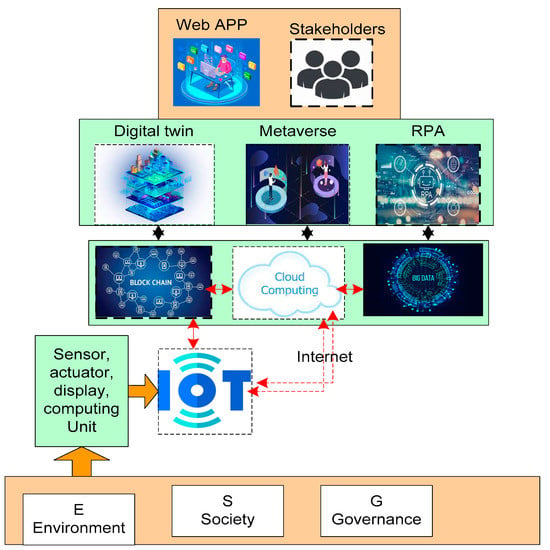

ESG became a significant element to evaluate the sustainability level of an organization. Sustainability measurements are evaluated based on ESG data obtained by an organization in its process flow. The integration of Industry 4.0 technology is highly valuable in achieving the best ESG reports. Figure 7 illustrates a framework in which all the Industry 4.0 enabling technologies are amalgamated to obtain the ESG data and also presents an intelligent platform for an evaluation of ESG reports and metrics. Based on the above analysis, the below we have addressed the few limitations and recommendations that can be implemented as a part of the research work.

Figure 7.

Emerging ESG technology phase.

- According to previous research, there is a lack of consistency in ESG, and the standards of various dimensions are measured by various database metrics for an organization [74]. This is due to the majority of evaluation systems being based on expert scoring, there is some subjectivity. Simultaneously, the database lacks applicability and feasibility due to differences in industry backgrounds and national systems [75]. A consistent and developed ESG evaluation framework provides the premise for the investigation of corporate sustainable development [76,77]. The integration of AI and big data technologies can empower to implementation effective ESG evaluation system that maintains uniformity in its evaluation due to its intelligent algorithms and data analysis [78,79].

- Blockchain technology has proved its capability in terms of transparency, immutability, and security based on hash cryptographic algorithms. Generally, during the processing of supply chain tracking energy trading, monitoring of greenhouse gas emissions, financial transactions, etc., the data generated by the respective devices need to be protected by blockchain for obtaining standard data concerning the environment of the particular nation. The distributed ledger and different consensus mechanisms in the blockchain empower allow the parties to visualize the data and standards that followed during the collection of data for ESG evaluation [80,81]. A recent study proposed a blockchain-enabled design for obtaining generic ESG data in the field of energy, in which a carboncoin is assigned to tokenize energy producers’ right to emit carbon [56]. The study also concluded that using ESG data and on-chain assets, blockchain-based carbon markets can be built more comprehensively, but at the expense of lower performance. Along with this study, another study [39] leveraged the IoT, and blockchain technologies to enable corporate crowdsourcing for environmental data and improve the security, credibility, and transparency of the ESG reporting process.

- There are many issues around ESG data, as three dimensions such as environment, social, and governance are merely different due to their nature [82]. In the scenario of environmental data, they are more quantitative with better standardized. However, natural calamities and pandemics are unpredictable. The social and governance data are unstandardized and qualitative as they emphasize more on the social sciences. Social and governance parameters are different for every nation [83,84]. The implementation of the same kind of approach for ESG data collection merely causes a challenge in terms of accuracy [85,86]. To overcome these challenges, deep learning and natural language processing can be adopted to minimize noise during obtaining the unstructured data present in public companies such as regulatory filing, government studies, and industry publications [87,88]. A study evaluated governance and social datasets utilizing NLP algorithms to introduce a simple method for predicting a specialized firm’s ESG rankings [89].

- Currently, IoT is generating a large amount of data, in which the majority of the data is stored in a cloud server [62,90]. The storage of large amounts of data indeed increases the burning of carbon per year, and it affects the climate. However, the evolution of the digital twin has provided an opportunity to use IoT data for minimizing carbon emissions and simultaneously strengthening the management of an organization. Moreover, the digital twins identify which data need to be collected, stored, and applied for the organization to form ESG data [91,92]. Along with this, it also identifies which IoT data is missing and suggests the appropriate sensors which can be deployed sustainably. The implementation of a digital twin with IoT is costly because it necessitates highly skilled employees such as data scientists and software engineers.

5. Conclusions

The significance of sustainability and ESG are increasing in a wide range so that the organization meets SDGs effectively. The lack of high-accuracy ESG data has caused challenges to evaluate the ESG report. However, Industry 4.0 technologies are capable of overcoming the challenges in ESG data and reports. These facts have inspired this study to present the significance of ESG for sustainability and implementation of Industry 4.0 technologies for obtaining the high accurate ESG data. automatic data collection. The objective of the study is to discuss the significance of ESG data and report, which is used for evaluation of sustainability of an organization. The findings of the study are AI framework serves as a driving force for humans to evaluate the necessary data in ESG metrics so that investors can understand which organisations they have decided to invest in; In any case, AI can provide a solution by acting as a catalytic for scaled sustainable investing via analysis technologies that filter important data; data mining is used to explore relationships and patterns in data by using anomalies and data clusters. Predictive analytics utilises historical data to make predictions and identify new opportunities; deep learning layers algorithms for identifying patterns in complex and abstract data using AI and machine learning. Currently, there is a lack of a standardized reporting framework to empower the information to be scalable and comparable. Due to the market’s large variety of ESG rating models, reporting practices have constructed the ESG reporting system as obvious, dis-continuous, inconstant, and complicated to compare data disclosures. By developing agile, transparent, and automated data collection processes, blockchain can streamline the processing and packaging of ESG reports. Based upon the analysis this study identified valuable findings such as there is a lack of consistency in the overall ESG, and the standards of various dimensions measured by various databases, blockchain allows to track of sustainable efforts carried out by the organization with an aim responsible to the sustainability, and implementation of the same kind of approach for ESG data collection merely cause a challenge in terms of accuracy. In future work, the study likes to evaluate the other Industry 4.0 technologies such as robotic, digital twin, edge computing for ESG.

Author Contributions

Conceptualization, A.G.; methodology, R.S.; validation, A.S. (Aman Singh)., and E.C.M., formal analysis, N.P.; investigation, A.S. (Aman Singh); resources, B.T.; data curation, A.S. (Archana Saxena); writing—original draft preparation, A.S. (Archana Saxena); writing—review and editing, A.G; visualization, S.V.A.; supervision, R.S.; project administration, B.T.; funding acquisition, B.T. All authors have read and agreed to the published version of the manuscript.

Funding

The APC was funded by Tshwane University of Technology, South Africa.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- THE 17 GOALS|Sustainable Development. Available online: https://sdgs.un.org/goals (accessed on 28 December 2020).

- Boffo, R. ESG Investing: Practices, Progress an d C Hallenges; OECD: Paris, France, 2020. [Google Scholar]

- ESG Framework|McKinsey. Available online: https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/five-ways-that-esg-creates-value (accessed on 13 October 2022).

- Naffa, H.; Fain, M. Performance Measurement of ESG-Themed Megatrend Investments in Global Equity Markets Using Pure Factor Portfolios Methodology. PLoS ONE 2020, 15, e0244225. [Google Scholar] [CrossRef] [PubMed]

- Reber, B.; Gold, A.; Gold, S. ESG Disclosure and Idiosyncratic Risk in Initial Public Offerings. J. Bus. Ethics 2022, 179, 867–886. [Google Scholar] [CrossRef]

- Hill, J. Environmental, Social, and Governance (ESG) Investing: A Balanced Analysis of the Theory and Practice of a Sustainable Portfolio; Academic Press: Cambridge, MA, USA, 2020; ISBN 0128186933. [Google Scholar]

- Odell, J.; Ali, U. ESG Investing in Emerging and Frontier Markets. J. Appl. Corp. Financ. 2016, 28, 96–101. [Google Scholar]

- Cort, T.; Esty, D. ESG Standards: Looming Challenges and Pathways Forward. Organ Environ. 2020, 33, 491–510. [Google Scholar] [CrossRef]

- Li, T.-T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research Progress and Future Prospects. Sustainability 2021, 13, 11663. [Google Scholar] [CrossRef]

- Zaccone, M.C.; Pedrini, M. ESG Factor Integration into Private Equity. Sustainability 2020, 12, 5725. [Google Scholar] [CrossRef]

- Taliento, M.; Favino, C.; Netti, A. Impact of Environmental, Social, and Governance Information on Economic Performance: Evidence of a Corporate ‘Sustainability Advantage’from Europe. Sustainability 2019, 11, 1738. [Google Scholar] [CrossRef]

- Ragazou, K.; Passas, I.; Garefalakis, A.; Zafeiriou, E.; Kyriakopoulos, G. The Determinants of the Environmental Performance of EU Financial Institutions: An Empirical Study with a GLM Model. Energies 2022, 15, 5325. [Google Scholar] [CrossRef]

- Saini, N.; Antil, A.; Gunasekaran, A.; Malik, K.; Balakumar, S. Environment-Social-Governance Disclosures Nexus between Financial Performance: A Sustainable Value Chain Approach. Resour Conserv Recycl 2022, 186, 106571. [Google Scholar] [CrossRef]

- Nitlarp, T.; Kiattisin, S. The Impact Factors of Industry 4.0 on ESG in the Energy Sector. Sustainability 2022, 14, 9198. [Google Scholar] [CrossRef]

- Dye, J.; McKinnon, M.; Van der Byl, C. Green gaps: Firm ESG disclosure and financial institutions’ reporting Requirements. J. Sustain. Res. 2021, 3, e210006. [Google Scholar] [CrossRef]

- BlackRock Sustainability Survey|BlackRock. Available online: https://www.blackrock.com/corporate/about-us/blackrock-sustainability-survey (accessed on 13 October 2022).

- Almeyda, R.; Darmansya, A. The Influence of Environmental, Social, and Governance (ESG) Disclosure on Firm Financial Performance. IPTEK J. Proc. Ser. 2019, 278–290. [Google Scholar] [CrossRef]

- Yu, W.; Gu, Y.; Dai, J. Industry 4.0-Enabled ESG Reporting: A Case from a Chinese Energy Company. J. Emerg. Technol. Account. 2022, 1–29. [Google Scholar] [CrossRef]

- Senadheera, S.S.; Withana, P.A.; Dissanayake, P.D.; Sarkar, B.; Chopra, S.S.; Rhee, J.H.; Ok, Y.S. Scoring Environment Pillar in Environmental, Social, and Governance (ESG) Assessment. Sustain. Environ. 2021, 7, 1960097. [Google Scholar] [CrossRef]

- ESG Is Essential for Companies to Maintain Their Social License|McKinsey. Available online: https://www.mckinsey.com/capabilities/sustainability/our-insights/does-esg-really-matter-and-why (accessed on 13 October 2022).

- United Nations. Financing for Sustainable Development Report 2021 Report of the Inter-Agency Task Force on Financing for Development Financing for Sustainable Development Report 2021; United Nations: Manhattan, NY, USA, 2021; ISBN 9789211014426. [Google Scholar]

- Paul, A.; Ahmad, A.; Rathore, M.M.; Jabbar, S. Smartbuddy: Defining Human Behaviors Using Big Data Analytics in Social Internet of Things. IEEE Wirel Commun. 2016, 23, 68–74. [Google Scholar] [CrossRef]

- Rehman, A.; Paul, A.; Ahmad, A. A Query Based Information Search in an Individual’s Small World of Social Internet of Things. Comput. Commun. 2020, 163, 176–185. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. In Corporate Governance; Gower: Aldershot, UK, 2019; pp. 77–132. ISBN 1315191156. [Google Scholar]

- Sulkowski, A.; Jebe, R. Evolving ESG Reporting Governance, Regime Theory, and Proactive Law: Predictions and Strategies. Am. Bus. Law J. 2022, 59, 449–503. [Google Scholar] [CrossRef]

- Daugaard, D. Emerging New Themes in Environmental, Social and Governance Investing: A Systematic Literature Review. Account. Financ. 2020, 60, 1501–1530. [Google Scholar] [CrossRef]

- Zerbib, O.D. The Effect of Pro-Environmental Preferences on Bond Prices: Evidence from Green Bonds. J. Bank Financ. 2019, 98, 39–60. [Google Scholar] [CrossRef]

- Albertini, E. Does Environmental Management Improve Financial Performance? A Meta-Analytical Review. Organ Environ. 2013, 26, 431–457. [Google Scholar] [CrossRef]

- Abdul Rahman, R.; Alsayegh, M.F. Determinants of Corporate Environment, Social and Governance (ESG) Reporting among Asian Firms. J. Risk Financ. Manag. 2021, 14, 167. [Google Scholar] [CrossRef]

- Unlocking ESG Potential-Five Actions for Business Leaders | World Economic Forum. Available online: https://www.weforum.org/agenda/2021/09/five-actions-business-leaders-can-take-to-unlock-esg-potential/ (accessed on 23 November 2022).

- Deutsche Bank. Big Data Shakes up ESG Investing Cover Story Big Data Shakes up ESG Investing. 2018. Available online: https://www.dbresearch.com/PROD/RPS_EN-PROD/PROD0000000000478852/Big_data_shakes_up_ESG_investing.pdf?undefined&realload=uxZZ/~37~w9Pixg9IYXKxT7Qk4/FJidgFgqiDm2n4UxEPxdAPXadi30egjoKQ9sW (accessed on 23 November 2022).

- Revelli, C. Socially Responsible Investing (SRI): From Mainstream to Margin? Res. Int. Bus. Financ. 2017, 39, 711–717. [Google Scholar] [CrossRef]

- Cerqueti, R.; Ciciretti, R.; Dalò, A.; Nicolosi, M. ESG Investing: A Chance to Reduce Systemic Risk. J. Financ. Stab. 2021, 54, 100887. [Google Scholar] [CrossRef]

- Bora, I.; Duan, H.K.; Vasarhelyi, M.A.; Zhang, C.; Dai, J. The Transformation of Government Accountability and Reporting. J. Emerg. Technol. Account. 2021, 18, 1–21. [Google Scholar] [CrossRef]

- Bose, S. Evolution of ESG Reporting Frameworks. In Values at Work; Springer: Berlin/Heidelberg, Germany, 2020; pp. 13–33. [Google Scholar]

- Popescu, C.; Hysa, E.; Kruja, A.; Mansi, E. Social Innovation, Circularity and Energy Transition for Environmental, Social and Governance (ESG) Practices—A Comprehensive Review. Energies 2022, 15, 9028. [Google Scholar] [CrossRef]

- Tanaka, H. The Sustainability Theorem in the ESG Mechanism; Long Finance and London Accord: London, UK, 2016; pp. 1–29. [Google Scholar]

- Mascotto, G. ESG Outlook: Five Key Trends Are Driving Momentum in 2020. American Century Investors—Institutional, March 2020. Available online: https://globalfundsearch.com/wp-content/uploads/2019/09/esg-outlook-five-trends-2020.pdf (accessed on 10 October 2022).

- Wu, W.; Fu, Y.; Wang, Z.; Liu, X.; Niu, Y.; Li, B.; Huang, G.Q. Consortium Blockchain-Enabled Smart ESG Reporting Platform with Token-Based Incentives for Corporate Crowdsensing. Comput. Ind. Eng. 2022, 172, 108456. [Google Scholar] [CrossRef]

- Montella, R.; Foster, I. Using Hybrid Grid/Cloud Computing Technologies for Environmental Data Elastic Storage, Processing, and Provisioning. In Handbook of Cloud Computing; Springer: Berlin/Heidelberg, Germany, 2010; pp. 595–618. [Google Scholar]

- Shafique, K.; Khawaja, B.A.; Sabir, F.; Qazi, S.; Mustaqim, M. Internet of Things (IoT) for next-Generation Smart Systems: A Review of Current Challenges, Future Trends and Prospects for Emerging 5G-IoT Scenarios. IEEE Access 2020, 8, 23022–23040. [Google Scholar] [CrossRef]

- Zanella, A.; Bui, N.; Castellani, A.; Vangelista, L.; Zorzi, M. Internet of Things for Smart Cities. IEEE Internet Things J. 2014, 1, 22–32. [Google Scholar] [CrossRef]

- Simonetti, V.C.; Frascareli, D.; Gontijo, E.S.J.; Melo, D.S.; Friese, K.; Silva, D.C.C.; Rosa, A.H. Water Quality Indices as a Tool for Evaluating Water Quality and Effects of Land Use in a Tropical Catchment. Int. J. River Basin Manag. 2021, 19, 157–168. [Google Scholar] [CrossRef]

- Landaluce, H.; Arjona, L.; Perallos, A.; Falcone, F.; Angulo, I.; Muralter, F. A Review of IoT Sensing Applications and Challenges Using RFID and Wireless Sensor Networks. Sensors 2020, 20, 2495. [Google Scholar] [CrossRef] [PubMed]

- Montori, F.; Bedogni, L.; Di Felice, M.; Bononi, L. Machine-to-Machine Wireless Communication Technologies for the Internet of Things: Taxonomy, Comparison and Open Issues. Pervasive Mob. Comput. 2018, 50, 56–81. [Google Scholar] [CrossRef]

- Ali, O.; Jaradat, A.; Kulakli, A.; Abuhalimeh, A. A Comparative Study: Blockchain Technology Utilization Benefits, Challenges and Functionalities. IEEE Access 2021, 9, 12730–12749. [Google Scholar] [CrossRef]

- Javaid, M.; Haleem, A.; Singh, R.P.; Khan, S.; Suman, R. Blockchain Technology Applications for Industry 4.0: A Literature-Based Review. Blockchain: Res. Appl. 2021, 2, 100027. [Google Scholar] [CrossRef]

- Yaga, D.; Mell, P.; Roby, N.; Scarfone, K. Blockchain Technology Overview. arXiv 2019, arXiv:1906.11078. [Google Scholar]

- Schulz, K.; Feist, M. Leveraging Blockchain Technology for Innovative Climate Finance under the Green Climate Fund. Earth Syst. Gov. 2021, 7, 100084. [Google Scholar] [CrossRef]

- Liu, X.; Wu, H.; Wu, W.; Fu, Y.; Huang, G.Q. Blockchain-Enabled ESG Reporting Framework for Sustainable Supply Chain. In Sustainable Design and Manufacturing 2020; Springer: Berlin/Heidelberg, Germany, 2021; pp. 403–413. [Google Scholar]

- Christidis, K.; Devetsikiotis, M. Blockchains and Smart Contracts for the Internet of Things. IEEE Access 2016, 4, 2292–2303. [Google Scholar] [CrossRef]

- Shammar, E.A.; Zahary, A.T.; Al-Shargabi, A.A. A Survey of IoT and Blockchain Integration: Security Perspective. IEEE Access 2021, 9, 156114–156150. [Google Scholar] [CrossRef]

- Jiang, L.; Gu, Y.; Yu, W.; Dai, J. Blockchain-Based Life Cycle Assessment System for ESG Reporting. 2022. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4121907 (accessed on 23 November 2022).

- Gu, Y.; Jiang, L.; Yu, W.; Dai, J. Towards Blockchain-Enabled ESG Reporting and Assurance: From the Perspective of P2P Energy Trading. 2022. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4121798 (accessed on 23 November 2022).

- Cerchiaro, D.; Leo, S.; Landriault, E.; de Vega, P. DLT to Boost Efficiency for Financial Intermediaries. An Application in ESG Reporting Activities. Technol. Anal. Strateg. Manag. 2021, 1–14. [Google Scholar] [CrossRef]

- Golding, O.; Yu, G.; Lu, Q.; Xu, X. Carboncoin: Blockchain Tokenization of Carbon Emissions with ESG-Based Reputation. In Proceedings of the 2022 IEEE International Conference on Blockchain and Cryptocurrency (ICBC), Online, 2–5 May 2022; IEEE: New York, NY, USA, 2022; pp. 1–5. [Google Scholar]

- Wu, W.; Chen, W.; Fu, Y.; Jiang, Y.; Huang, G.Q. Unsupervised Neural Network-Enabled Spatial-Temporal Analytics for Data Authenticity under Environmental Smart Reporting System. Comput. Ind. 2022, 141, 103700. [Google Scholar] [CrossRef]

- Jha, B.; Giri, P.; Jha, D.; Badhera, U. Unlocking IoT: AI-Enabled Green FinTech Innovations. In AI-Enabled Agile Internet of Things for Sustainable FinTech Ecosystems; IGI Global: Hershey, PA, USA, 2022; pp. 1–22. [Google Scholar]

- Gasser, U.; Almeida, V.A.F. A Layered Model for AI Governance. IEEE Internet Comput. 2017, 21, 58–62. [Google Scholar] [CrossRef]

- Minkkinen, M.; Niukkanen, A.; Mäntymäki, M. What about Investors? ESG Analyses as Tools for Ethics-Based AI Auditing. AI Soc. 2022, 1–15. [Google Scholar] [CrossRef]

- Dash, G.H.; Kajiji, N. Behavioral Portfolio Management with Layered ESG Goals and Ai Estimation of Asset Returns. 2021. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3953440 (accessed on 23 November 2022).

- Lee, O.; Joo, H.; Choi, H.; Cheon, M. Proposing an Integrated Approach to Analyzing ESG Data via Machine Learning and Deep Learning Algorithms. Sustainability 2022, 14, 8745. [Google Scholar] [CrossRef]

- Gupta, A.; Sharma, U.; Gupta, S.K. The Role of ESG in Sustainable Development: An Analysis Through the Lens of Machine Learning. In Proceedings of the 2021 IEEE International Humanitarian Technology Conference (IHTC), Online, 2–4 December 2021; IEEE: New York, NY, USA, 2021; pp. 1–5. [Google Scholar]

- Theodorou, A.; Dignum, V. Towards Ethical and Socio-Legal Governance in AI. Nat. Mach. Intell. 2020, 2, 10–12. [Google Scholar] [CrossRef]

- Goodell, J.W.; Kumar, S.; Lim, W.M.; Pattnaik, D. Artificial Intelligence and Machine Learning in Finance: Identifying Foundations, Themes, and Research Clusters from Bibliometric Analysis. J. Behav. Exp. Finance 2021, 32, 100577. [Google Scholar] [CrossRef]

- Macpherson, M.; Gasperini, A.; Bosco, M. Implications for Artificial Intelligence and ESG Data. 2021. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3863599 (accessed on 23 November 2022).

- Sætra, H.S. The AI ESG Protocol: Evaluating and Disclosing the Environment, Social, and Governance Implications of Artificial Intelligence Capabilities, Assets, and Activities. Sustain. Dev. 2022. [Google Scholar] [CrossRef]

- Sætra, H.S. A Framework for Evaluating and Disclosing the ESG Related Impacts of AI with the SDGs. Sustainability 2021, 13, 8503. [Google Scholar] [CrossRef]

- Twinamatsiko, E.; Kumar, D. Incorporating ESG in Decision Making for Responsible and Sustainable Investments Using Machine Learning. In Proceedings of the 2022 International Conference on Electronics and Renewable Systems (ICEARS), Tuticorin, India, 16–18 March 2022; pp. 1328–1334. [Google Scholar]

- Krappel, T.; Bogun, A.; Borth, D. Heterogeneous Ensemble for ESG Ratings Prediction. arXiv 2021, arXiv:2109.10085. [Google Scholar]

- D’Amato, V.; D’Ecclesia, R.; Levantesi, S. ESG Score Prediction through Random Forest Algorithm. Comput. Manag. Sci. 2022, 19, 347–373. [Google Scholar] [CrossRef]

- Lee, J.-G.; Kang, M. Geospatial Big Data: Challenges and Opportunities. Big Data Res. 2015, 2, 74–81. [Google Scholar] [CrossRef]

- Mazhar Rathore, M.; Ahmad, A.; Paul, A.; Hong, W.-H.; Seo, H. Advanced Computing Model for Geosocial Media Using Big Data Analytics. Multimed. Tools Appl. 2017, 76, 24767–24787. [Google Scholar] [CrossRef]

- Bhandari, K.R.; Ranta, M.; Salo, J. The Resource-based View, Stakeholder Capitalism, ESG, and Sustainable Competitive Advantage: The Firm’s Embeddedness into Ecology, Society, and Governance. Bus Strategy Environ. 2022, 31, 1525–1537. [Google Scholar] [CrossRef]

- Folqué, M.; Escrig-Olmedo, E.; Corzo Santamaría, T. Sustainable Development and Financial System: Integrating ESG Risks through Sustainable Investment Strategies in a Climate Change Context. Sustain. Dev. 2021, 29, 876–890. [Google Scholar] [CrossRef]

- Mansouri, S.; Momtaz, P.P. Financing Sustainable Entrepreneurship: ESG Measurement, Valuation, and Performance. J. Bus Ventur. 2022, 37, 106258. [Google Scholar] [CrossRef]

- Singhania, M.; Saini, N. Institutional Framework of ESG Disclosures: Comparative Analysis of Developed and Developing Countries. J. Sustain. Financ. Invest. 2021, 1–44. [Google Scholar] [CrossRef]

- Duan, Y.; Edwards, J.S.; Dwivedi, Y.K. Artificial Intelligence for Decision Making in the Era of Big Data–Evolution, Challenges and Research Agenda. Int. J. Inf. Manag. 2019, 48, 63–71. [Google Scholar] [CrossRef]

- Roh, Y.; Heo, G.; Whang, S.E. A Survey on Data Collection for Machine Learning: A Big Data-Ai Integration Perspective. IEEE Trans. Knowl. Data Eng. 2019, 33, 1328–1347. [Google Scholar] [CrossRef]

- Sulkowski, A.J. Sustainability (or ESG) Reporting: Recent Developments and the Potential for Better, More Proactive Management Enabled by Blockchain. 2021. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3948654 (accessed on 23 October 2021).

- Stein Smith, S. ESG & Other Emerging Technology Applications. In Blockchain, Artificial Intelligence and Financial Services; Springer: Berlin/Heidelberg, Germany, 2020; pp. 175–191. [Google Scholar]

- Friede, G.; Busch, T.; Bassen, A. ESG and Financial Performance: Aggregated Evidence from More than 2000 Empirical Studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Fatemi, A.; Glaum, M.; Kaiser, S. ESG Performance and Firm Value: The Moderating Role of Disclosure. Glob. Financ. J. 2018, 38, 45–64. [Google Scholar] [CrossRef]

- van Duuren, E.; Plantinga, A.; Scholtens, B. ESG Integration and the Investment Management Process: Fundamental Investing Reinvented. J. Bus. Ethics 2016, 138, 525–533. [Google Scholar] [CrossRef]

- Berg, F.; Koelbel, J.F.; Rigobon, R. Aggregate Confusion: The Divergence of ESG Ratings. Forthcom. Rev. Financ. 2019, 26, 1315–1344. [Google Scholar] [CrossRef]

- Amel-Zadeh, A.; Serafeim, G. Why and How Investors Use ESG Information: Evidence from a Global Survey. Financ. Anal. J. 2018, 74, 87–103. [Google Scholar] [CrossRef]

- Deng, L. Artificial Intelligence in the Rising Wave of Deep Learning: The Historical Path and Future Outlook [Perspectives]. IEEE Signal Process. Mag. 2018, 35, 177–180. [Google Scholar] [CrossRef]

- Deng, L.; Liu, Y. Deep Learning in Natural Language Processing; Springer: Berlin/Heidelberg, Germany, 2018. ISBN 981105 2093.

- Minerva, R.; Lee, G.M.; Crespi, N. Digital Twin in the IoT Context: A Survey on Technical Features, Scenarios, and Architectural Models. Proc. IEEE 2020, 108, 1785–1824. [Google Scholar] [CrossRef]

- Jiang, Z.; Guo, Y.; Wang, Z. Digital Twin to Improve the Virtual-Real Integration of Industrial IoT. J. Ind. Inf. Integr. 2021, 22, 100196. [Google Scholar] [CrossRef]

- Saad, A.; Faddel, S.; Mohammed, O. IoT-Based Digital Twin for Energy Cyber-Physical Systems: Design and Implementation. Energies 2020, 13, 4762. [Google Scholar] [CrossRef]

- Hofmann, W.; Branding, F. Implementation of an IoT-and Cloud-Based Digital Twin for Real-Time Decision Support in Port Operations. IFAC-PapersOnLine 2019, 52, 2104–2109. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).