1. Introduction

Natural hazards occur frequently, and the costs associated with these events run well into billions of dollars [

1]. During the last century, from 1900 to 1999, a total of 1248 destructive earthquakes have been estimated to have caused, in sum, more than USD 1 trillion in damage at modern values [

2]. What needs to be noticed is the fact that, with earthquakes, modern technology has not made it possible to prevent them or give forewarning [

3]. However, proper preparation and mitigation strategies can help decrease the losses generated from earthquakes, and these require improved assessment of the performance of the engineering, social and economic systems after the shocks.

In 1986, the National Science Foundation established a national center to promote earthquake studies at the State University of New York, Buffalo (Multidiscipline Center for Earthquake Engineering Research, MCEER). The objective was to conduct research using a multidisciplinary approach to provide an integrated understanding of the factors that can result in resilience within a community in response to an earthquake. To this end, economists at the center started by quantifying the direct and indirect losses, then turned to further developing methods to assess resilience for economic systems. Economic resilience was defined by Rose [

4] as being the inherent and adaptive capacity to respond to hazards that allows communities to avoid potential loss and/or to recover from shocks more quickly.

Over the years, research testbeds such as the Memphis Metropolitan Area (New Madrid Seismic Zone) and the Portland Metropolitan Area (ocean floor Cascadian Subduction Zone) have been created. Studies on economic losses are back-ended, and probability distributions of the states of damage to existing structures and infrastructure corresponding to an earthquake is on the front end. However, due to multiple types of physical damages, integrated estimation is rare. Against this background, in 2014, the National Institute of Standards and Technologies (NIST) funded a ten-year grant to create a Center for Risk-Based Community Resilience Planning (CRBCRP). The center was unique in merging the disciplines of civil engineering, sociology, and economics to model community resilience comprehensively. Different from the MCEER center mentioned above, CRBCRP worked on multiple types of disasters, from earthquake to tornado, hurricane and flood. What remained unchanged was the testbed for projected earthquakes, which was the largest major population center potentially affected by major earthquakes in the New Madrid Seismic Zone. The regional boundary in the hazardous zone now extends outward from the city of Memphis to the whole county: Shelby County. The New Madrid Seismic Zone is the most active seismic zone in the central and eastern United States [

5]; historically, very large earthquakes have occurred in this zone, such as the 1811–1812 sequence, and they are likely to occur in the future [

6,

7,

8]. These facts make it urgent to assess the losses and understand the mechanisms of the losses in Shelby County relative to potential earthquakes.

As mentioned earlier, methods and models typically used to estimate the impact of earthquakes or other kinds of disasters have rarely managed to integrate all types of physical damages. Recent work has been performed in CRBCRP by engineers, including simulated outcomes in Shelby County, making such data readily available and internally consistent for such an integration. Additionally, current studies in disaster loss estimations have made improvements in incorporating dynamic or spatial features [

9,

10,

11,

12]. Nonetheless, the spatial feature for the model of the moment is inadequate regarding the spatial adjustment of workers and consumers in the aftermath of the shock.

Hence, this paper fills the gaps mentioned above. Work performed in this paper has the following contributions: firstly, it builds a spatial general equilibrium model (SCGE) for Shelby County, and improves the spatial aspect in the model to a larger extent, with behavior changes of firms prompting substitution of the same types of intermediate input materials among regions, and the behavior changes of households working and consuming among regions, given post-disaster conditions; secondly, it provides more detailed and more comprehensive descriptions of the means that integrate engineering and the economic model; thirdly, it examines jointly the economic impact from building damages, electricity transmission and water/wastewater pipeline damages, and transportation network disruptions, given the limitations of previous studies which only looked at one type of these physical damages at a time.

Results in this paper suggest that modeling the above behaviors allows the model to better mimic the real-world responses of the agents after external shocks. Adjusting to the spatial damages and shifting demand/supply to areas that are less damaged helps to reduce the loss for the economy. Moreover, such behaviors echo the concept of inherent resilience that was brought up by Rose [

4], through which the local communities have their potential to avoid additional losses after any external shocks.

Meanwhile, when looking at the joint impact from building, utility and transportation network damages, the results suggest that the total impact could be overestimated by examining the impacts individually and then summing the losses together. The intuitive response is the Leontief production function, which reduces the efficiency level of a second and third type of physical damages. Trying to estimate the losses from one aspect of the damages in natural disasters by assuming other conditions stay the same would not provide the most accurate representation of the influences from such external shocks.

This paper is organized as follows:

Section 2 reviews the current literature on economic impact analysis due to natural hazards;

Section 3 describes the corresponding SCGE model;

Section 4 illustrates steps transforming engineering outputs into economic inputs to simulate our SCGE model for short-run influences;

Section 5 presents the simulated results concerning changes in major economic variables after the earthquake,

Section 6 discusses the implications of the results, the limitations of the model and possible studies in the future; and

Section 7 concludes the paper.

2. Literature Review

The history of measuring economic losses due to earthquakes started with the work accomplished by Cochrane et al. [

13]. He used an input–output model to study the economic impact of a hypothetical earthquake in California. In such models, industries or firms are linearly linked with intermediate inputs based on the input–output (I–O) coefficients, coefficients that describe the value of inputs required from all industries to produce a certain value of outputs in each industry. When industries are directly damaged by the earthquake, it creates a supply bottleneck to other undamaged industries. Cochrane calculated this additional loss to be about

$4 billion, followed by the direct loss of

$10 billion worth of outputs. Following this direction, researchers have extended the context of the model under spatial and dynamic scenarios [

14,

15,

16]. For instance, Hallegatte [

16] developed an adaptive regional I–O mode to analyze both the reduction and recovery in capital stock after Hurricane Katrina.

Downsides to I–O models include linearity, rigidity and lack of behavior content. For example, I–O models do not allow for substitution between factor inputs or consumption outputs. Some researchers then transitioned to a computable general equilibrium (CGE) model; among them, one of the most representative works was from Adam Rose and his team. In Rose and Liao [

17], the authors specified that there are several advantages of using a CGE model to analyze the economic impact of natural hazards.

First, CGE models not only contain features from other modeling techniques such as the input–output model or linear programming, but also allow for substitution between inputs (intermediate inputs, land, labor, and capital). In other words, CGE models can be disaggregated to different industries or production sectors in a manner similar to that of an I–O model, allowing industries to adjust between various types of inputs. Second, CGE models can address the roles of price and scarcity, which are used by firms and consumers to adjust their behavior accordingly. Last, CGE models are better in evaluating the roles of lifelines and infrastructure by placing a valuation on such services. Hence, CGE models are more realistic than I–O models because of the former’s behavioral adjustments and valuation processes for lifeline and infrastructure.

One limitation of Rose’s work is that it only provides losses from one aspect of the adverse condition after disasters, such as water and electricity outage, and other conditions like building damages or transportation network damages are not considered. Part of the limitation is resolved by Chang and Chamberlin [

18], where they were able to integrate the building damages and water and electricity outages in an index called “Business Disruptiveness.” Still, the adverse impact from road network damages was not included, and, for areas such as Los Angeles that are densely populated, the normal functioning of the road network is essential.

Even though improvements have been made under the different categories discussed above, there have been few models that could consider how physical, economic, and social infrastructure systems interact and affect the responses to external shocks. To further facilitate integrated analysis in natural disasters, the NIST-funded Center for Risk-Based Community Resilience Planning has generated research that merges the disciplines of engineering, social sciences and economics [

19]. Additionally, the types of disasters have extended from earthquakes to other risks such as tornados, hurricanes and tsunamis (see: Alam et al. [

20]; Nofal et al. [

21]; and Wang and van de Lindt, [

22]). The work from the NIST-funded center mentioned above has created a platform called “IN-CORE” that allows multidisciplinary collaboration to happen (see: Attary et al. [

23]; Roohi et al. [

24]; and Wang et al. [

25]). Using data from the engineering team at NIST, methods to jointly estimate the economic losses from building, utility and transportation damages can be developed. Nevertheless, multidisciplinary collaboration involves the complex work required to translate and transform the inputs and outputs for both the engineering and economic models, and the detailed description for this work has not been updated since Cutler et al. [

19].

In the meantime, CGE studies on the topic of natural disasters have been improved in four categories: the first one is validating key model parameters using real-world observations [

9]; the second one is building a spatial CGE model to better capture multiplier/spillover impacts due to business interruption [

26]; the third one is the extension in natural hazards type (such as flooding or extreme weather events) [

27,

28,

29] or damage type (from lifeline disruption to road/highway damages) [

30]; the last one is extending the CGE model to a dynamic framework, so that both immediate damage and the long-run recovery process can be studied [

11,

12]. What is worth noticing is the concept of a spatial model. Most studies have extended the model to include intra-regional trade flows [

10,

27,

31,

32,

33], but they neglect the intra-regional labor flows and their associated consumption behaviors. One possible explanation is the scope of the study areas; specifically, study areas are often spatially connected at the province or city level, where intra-provincial labor flows are rare. For metropolitan areas that are at high levels of mobility in commuting and consumption, though, further research is required in incorporating such behaviors.

In light of the limitations in the literature, our study introduced a novel approach to capture the spatial substitution behavior of firms and households, given post-disaster conditions. In addition, our work provides a detailed and comprehensive theoretical framework that can be translated, both to engineers and economists, regarding how bridges are built, allowing it to transform output from engineering models to economic models in hazard loss assessment. Its comprehensiveness in integrating building, water and electricity, and road network damages to disturbances in the regional economy has offered an opportunity to reveal the mechanisms within the general equilibrium model.

5. Results

This section has two subsections.

Section 5.1 focuses on the simulation results due to building damages using the current model and compares it to either the old model in Cutler et al. [

19], or the old model in the present study. Current specifications consider the spatial behavior of firms purchasing intermediate inputs from different regions, and the commuting behavior at sub-county-level as well as the spatial consumption behavior of households in different regions. Detailed differences between the two models are listed in

Table 3 below. The comparation between the two reveals the resilience behind these behaviors.

Section 5.2 provides the simulation results under both building functionality loss and transportation network damage using the new model.

5.1. Results with Current Model and the Old Model

Table 4 presents the simulation results in terms of major economic variables in Shelby County, with damages to buildings/capital stock. (Detailed numbers on the level of damage can be found in

Appendix A Table A5 and

Table A6.) Before comparing the differences between our current model with the old model, the common, or general, theme indicates that, when Shelby County experiences an earthquake, the total output produced/domestic supply falls, as well as the employment and household income. People also migrate out of the county due to housing damages. When looking at the magnitude of the impact, the percentage loss in total output is the largest and the percentage loss in household income is the smallest. The intuition is that there are offsetting effects from wages and the rental rate of capital. When the buildings are damaged and the households are forced to leave, capital and labor inputs both become more expensive for firms. The rise in wage rates and the rate of return on capital offsets the drops of employment and capital regarding household income.

Generally speaking, if firms and households could adjust their behavior accordingly after the earthquake, then these behavior adjustments, or the idea of inherent resiliencies defined in Rose [

4], could reduce losses to some extent. Comparing column (2) versus column (1) of

Table 4, as we expected, the inclusion of the behavior adjustment for firms to substitute their input demand as to the same type of product from more damaged regions to less damaged regions helped to reduce the total loss in firms’ output and employment. The rise in the unemployment rate for households is also smaller in the new model compared to the original model. Unlike what one might expect, though, the current model comes with a larger fall in household income (from USD 482 million to USD 574 million.).

To understand the additional income loss, recall the fact that both the rise in wages and the rental rate of capital offsets the loss in household income. With the current model, the re-adjustment that workers flow to regions where they can maintain the level of labor demand as much as possible makes firms able to more easily obtain labor inputs. This has two impacts: when firms find it easier to hire workers, the wage rate will not go up as much compared to the conventional model; meanwhile, it allows firms to substitute easily into labor, which offsets some of the negative impact from losses in capital, and the rental rate of capital will rise by a smaller amount. (For the original model, the weighted rise in rental rate of capital and wage rate are 3.74% and 13%, but the rise in rental rate of capital and wage rate in the new model are 3.69% and 12%, smaller than the rise compared to the original model.) Therefore, when the wage and rental rate rise at a smaller pace, the current model brings a larger fall in household income, which is more realistic.

Table 5 continues with the distributional impacts on total output and household income by PUMA regions. First, we can observe that larger capital stock damages come with a larger fall in total output produced, and larger capital stock damages imply larger household income fall.

An interesting result in

Table 5 column (3) is that, while households in region A and H experience the largest income fall, households in region F experience an income rise after the simulation. For households, their income comes from both labor and capital income;

Appendix A Table A7 suggests that the regional difference in household income losses mainly comes from the difference in capital incomes.

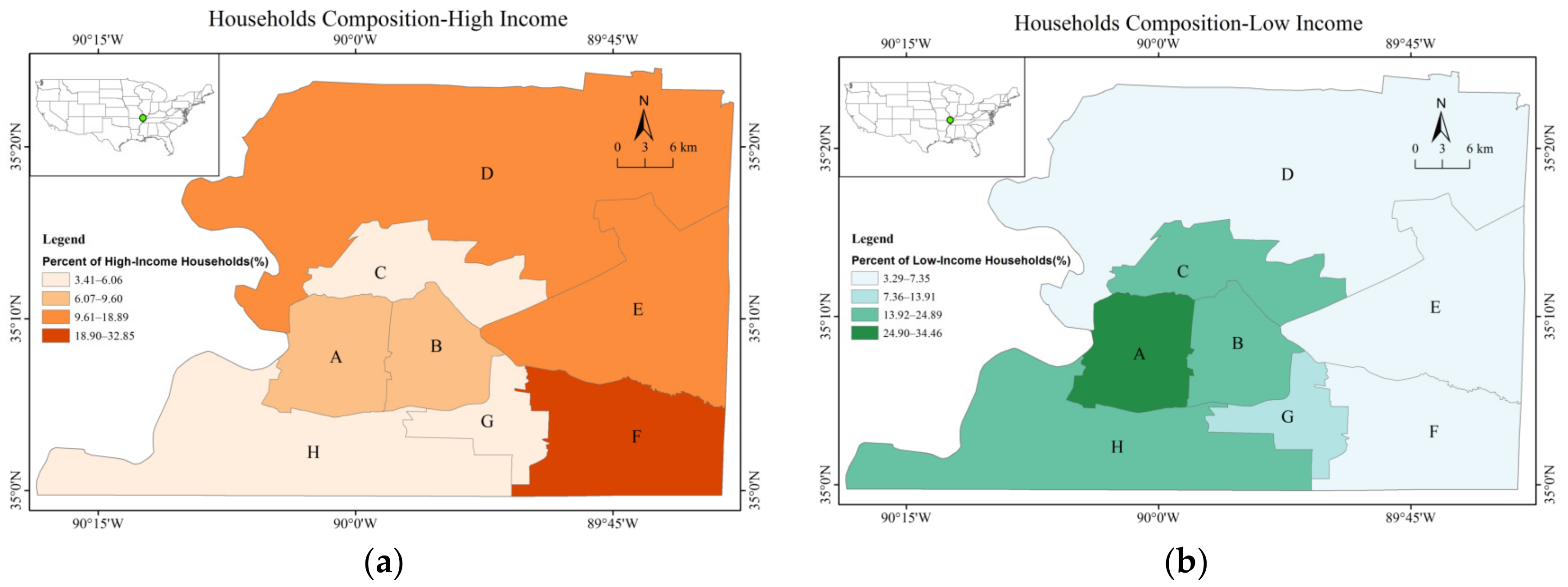

For capital income,

Figure 4 presents the distributions for low-income and high-income households by each region before the earthquake. It indicates that region F is a rich community with more high-income households whose income relies heavily on the return on capital. When capital is damaged, the rate of return for the remaining capital skyrockets. This leads to a rise in nominal capital income, and households in region F benefit the most from this rise, as they owned more capital stock than households in other regions. For labor income, since PUMA region F is the region with the smallest extent of damage in both commercial and residential capital, its total net-outmigration (about 2%) is the smallest. Meanwhile, the wage rate rises after the earthquake because of the reduction in labor supply. With the average wage rise around 8 percent, the combination of a smaller loss in employment and a larger rise in wages produced a small labor income rise instead of fall in region F.

Column (4) of

Table 3 provides the employment loss by region; unlike the output and income losses, in which their correlation coefficient with respect to the damage in capital stock is over 0.9, the correlation coefficient of loss in employment with respect to damages in capital stock is only 0.5. This can be explained by the substitution effect between labor and capital. Specifically, Equations (20) and (21) solve for the optimal level of labor demand using the cost minimization problem expressed in Equations (5)–(7) in

Section 3.2.2When capital (

) is damaged, firm’s level of output (

) is reduced and this is the output loss we see in column (2) of

Table 3. The loss in output leads to a reduction in labor demand. Meanwhile, the price of the rest of the available capital stock (

) goes up to reflect scarcity. Then the change in relative costs of factor inputs will drive firms to substitute capital into labor, and this leads to an increase in labor demand. This substitution effect can make the final employment loss, in general, to be smaller compared to total output loss, and the larger the capital stock damage is, the larger the substitution effect will be to offset the negative employment loss.

When looking at the losses in employment, initial capital stock damage can only partially explain the outcome. Other features, such as mobility of workers and the commuting patterns among regions, will also impact firms’ ability to maintain their level of labor demanded after the earthquake shock.

5.2. Results from Joint Estimation

Now with the model developed in this paper, we run two additional simulations in this subsection, which are the simulations that only consider the transportation network damages or the building damages (column (3) in

Table 6). Column (1) in

Table 6 presents the previous results of the simulation which only considered the capital stock destructions, which is also listed here for comparison.

When summing column (1) and column (2) in

Table 6, the estimated loss is larger than the results in column (3). This implies that the joint impact from building functionality loss and transportation network damages doesn’t simply equal to the sum of running the two simulations individually. Adding the two individual simulation results would lead to a small overestimation of the negative impact.

An explanation for the above situation is that, recall from

Figure 2, at the upper level of the production tier, the technology is a Leontief Type, which suggests that the production capacity is determined not by total resources available, but by the scarcest resource (limiting factor inputs). When the road network is damaged, trade flow across regions is limited, and as a result, firms will also reduce their demand for capital and labor due to their Leontief Type production technology. When adding additional restrictions due to building damage, the efficient level of reduction in capital stock is smaller, as firms’ demand on capital has already been reduced due to the road-network damages. As mentioned in the literature review, previous studies often focused on one type of physical damage, and few papers would consider these impacts jointly. The results here imply that it is worthwhile to consider all channels of the negative impacts that an earthquake can bring at the same time, to avoid overestimation when considering these impacts individually.

6. Discussion

When the spatial behavior responses are included in the new model, results compared with the old model indicate the total damages are smaller in most variables, as suggested by

Table 4. We interpreted this finding as a property called “resilience”. Since 1973, when Hollings introduced resilience in Ecology to represent the ability to absorb the disturbance in the system [

45], up to recently when scholars have extended the understanding of resilience to represent the ability to resist, adapt and transform [

46], the understanding and the definition of resilience are more profound and comprehensive.

The disturbance here to the economic systems is the reduction in production factors in terms of labor force and capital. Given this, Rose [

47] proposed that resilience can be attained by means such as input substitution and relocation. More importantly, the spatially-distributed disturbances provided some level of intra-regional unevenness, which can then be used by firms and households to efficiently allocate the resources remaining after the disaster. For instance, PUMA region E and F experienced the least relative losses in capital; with the adjustment we made in the model, agents can now shift to purchase intermediate inputs, find job opportunities, and increase consumption in these regions. This is consistent with resistance, resourcefulness, flexibility and even the redundancy feature in resilience [

48]. Additionally, the spatial feature of the model and the adjustment mechanism can be viewed as an extension to the definition and concept of resilience regarding its dimension in space, when a system/organization is unevenly shocked, spatial connectivity is a way to release resources to a larger boundary.

Although most economic variables have exhibited a smaller magnitude of losses within the current model’s specification, household income variable is the outlier. As we impose a current level of disturbances/shocks to the economy, the general equilibrium feature inherently within both the old and current model will allow the rental rate of capital to rise accordingly, in order to satisfy market-clearing conditions where quantity supplied and demanded are equal. Additionally, there is no upper bound limit in this rise. Therefore, the rise in the return of capital offsets the income fall, and this effect is especially stronger when the possibility of resilience is not fully considered in the old model. This has two implications, firstly, the new model is more realistic in mimicking real-world responses, even though these responses have trade-offs that are unexpected. Secondly, with respect to how far the price skyrocketing process can proceed, both models have limitations in taking the market shortage as a closing condition. In fact, several studies found the phenomenon of price gouging, in disasters such as Hurricane Katrina or COVID-19 [

49,

50], but government intervention and regulation, company reputation and other factors may impose restrictions or price-ceiling to regional economy, and future studies can improve the model in such manners.

Interestingly, the distributional impacts in

Table 5 suggest that regions with the least relative disturbances witnessed a rise in household income; coincidentally, these regions are where the rich reside. In other words, earthquakes have made the rich richer. This partially comes from the fact the rich communities are geographically further away from the epicenter, plus the fact that the rich own more in capital. However, the current setting of the earthquake does not allow us to test if the opposite were to happen, i.e., if the rich reside in areas that are closer to the epicenter, the disproportionate effect remains unchanged. The current literatures has not reached consensus in the relationship between natural disaster and income inequality. For example, Mutter [

51] found that Hurricane Katrina widened the rich-poor gap, with New Orleans’s poorest district being the slowest to recover. In developing countries such as Myanmar, Warr and Aung [

52] found that cyclone reduced inequality between regions. Here, the outcome of this model offered an insight from the perspective of the rental rate of capital, to facilitate future studies in this topic.

Understanding the instantaneous impacts where the economy managed to limit the immediate losses is the first step. Resilience literature has recognized that the dynamic features, or the ability to undergo adaptation and transformation, is equally important [

51]. While we have focused on the static responses of an economy facing external shocks, extending current model to a dynamic pattern is necessary. Especially for the concept of transformation, future studies can possibly alter the equilibrium defined to include other routes for the growth and change of reginal economy. Except for CGE models, dynamic stochastic general equilibrium (DSGE) models are another set of general equilibrium models with infinitely-lived households and household-owned firms, and monetary authorities, who make decisions over time [

52]. The major differences between the two are the level of aggregation and the aims. While CGE models can make heterogeneous the households by income, residence, or race, the DSGE model is often operated under one representative agent. Additionally, DSGE models focused on analyzing macroeconomic policies such as monetary policy [

53]. For studies that examined country-wide disasters, for example, the mitigation monetary policy for COVID-19, DSGE would be a good choice, but for other studies that examined localized hazards, the dynamic CGE model would be more appropriate.

Finally, the usefulness of this study may be gauged in two separate ways. First, the general equilibrium model and the analytical framework in integrating physical damages to the economic system could be applied to other hazards and other geographical areas. Second, the results in this study have policy implications that are associated with the spatial feature of natural disasters. From the findings above, policy makers will want to allocate resources to protect key sectors in regions where the relative building damages are the largest, and in this special case, would be leveraging mitigation efforts in PUMA region A. Moreover, a highly spatialized model would be the foundation of goal setting to distinguish between primary and secondary urgency when designing coping strategies.

7. Conclusions

In this paper, a SCGE model was developed based on the model in Cutler et al. [

19], and it extended the spatial feature of the model by considering two behavioral changes, with the first one being the firms’ substitution among the same type of intermediate input produced in different regions and the second one being households’ decision of where to work and consume based on endogenous changes in labor demand conditions after the earthquake. Then we described both in theory and in practice how the physical damages from an earthquake can be used to simulate the economic losses in the SCGE model.

When applying our new model with the two behavior changes, we find that the losses to firms and households are reduced concerning the total output and unemployment rate. We also find that regions with less damage, or regions that are more resilient to damage, would have better performance from modeling these two behavioral changes. Both findings are consistent with the fact that communities have the potential to reduce the losses after the natural hazards, or the idea of inherent resilience brought up by Rose [

4].

In addition, when we simulate jointly the impact from the combinations of building, utility, and transportation network damage, we find that the total losses are smaller than the sum of the simulations by the damage types individually. This implies that the economy is working together to cope with different damages, and all components in the economy are impacting each other to produce the best results for the whole economy when facing external shocks.

We also find that when different regions within the economy are damaged differently by the earthquake, some economic variable and associated consequences are highly correlated with the level of capital stock damages to each region, such as regional output, while other types of losses are less correlated with the level of capital stock damage to each region, such as employment, because of the substitution between labor and capital due to relative change in factor prices.

Finally, policy makers and regional planners should pay special attention in preparing and utilizing the redundant resources in the aftermath of natural disasters, to ensure smaller influences to the economy. Future studies may want to extend the current framework developed in this paper to other types of external shocks, ranging from different types of natural hazards to man-made hazards.