Enhancing Operating Efficiency in China’s High-End Equipment Manufacturing Industry: Insights from Listed Enterprises

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Study Sample Selection and Classification

3.2. Variable Selection

3.2.1. Selection of Input–Output Indicators for Operating Efficiency Evaluation

3.2.2. Influencing Factor Variables

- Core explanatory variables: Government subsidies

- Control variables

- Firm age. Longer-established companies tend to accumulate more capital and expertise in resource allocation, which can positively impact their operational efficiency [37]. However, as companies grow in size and age, they may also face institutional reform and technical innovation challenges that can hinder their efficiency.

- Enterprise equity concentration. A higher concentration of equity provides firms with advantages when making critical decisions and also gauges the firm’s stability, with a significant positive linear link to the firm’s business performance [38].

- Regional economic development level. Various regional governments implement different policies to support the growth of their local high-end equipment manufacturing industry. In addition, geographical location and transportation conditions can also have an impact on the efficiency of businesses. Furthermore, the high-end equipment manufacturing industry can act as a catalyst for industrial transformation and upgrading and has a positive impact on regional economic development [39].

- Regional openness level. The high-end equipment manufacturing industry highly internationalized, and its growth is closely tied to international market demand and competition. Therefore, a higher degree of regional openness can expand the market size of the local high-end equipment manufacturing industry and encourage international cooperation and exchange, which can contribute to the development of the industry by introducing more foreign technology and capital [40]. However, a higher level of regional openness may also intensify competitive pressure on the local high-end equipment manufacturing industry, requiring local businesses to continuously improve their technical level and product quality to remain competitive.

- The regional level of technological development. Higher regional R&D investment funding indicates that local businesses have greater resources and capabilities for technological innovation, which can lead to the faster development and launch of new products and technologies, increasing their market competitiveness. This also indicates an improvement in the region’s technology and innovation capabilities, which can foster an innovative culture and atmosphere within the local business community [41]. Furthermore, increased in R&D investment can encourage collaboration between industry, academia, and research, achieving synergistic development of the industrial chain, creating an industrial ecosystem, and further enhancing the competitiveness and influence of the high-end equipment manufacturing industry throughout the entire region.

- Regional foreign investment amount. Foreign investment is pivotal in advancing technological advancements in China’s manufacturing industry. Huang and Zhang’s research shows that OFDI has increased the productivity of Chinese manufacturing firms [42].

3.3. Data Source

3.4. Model Setting

3.4.1. Super-Efficient SBM Model

3.4.2. Tobit Regression Model

4. Results and Discussion

4.1. Operating Efficiency Measurement

4.1.1. Overall Operating Efficiency Analysis

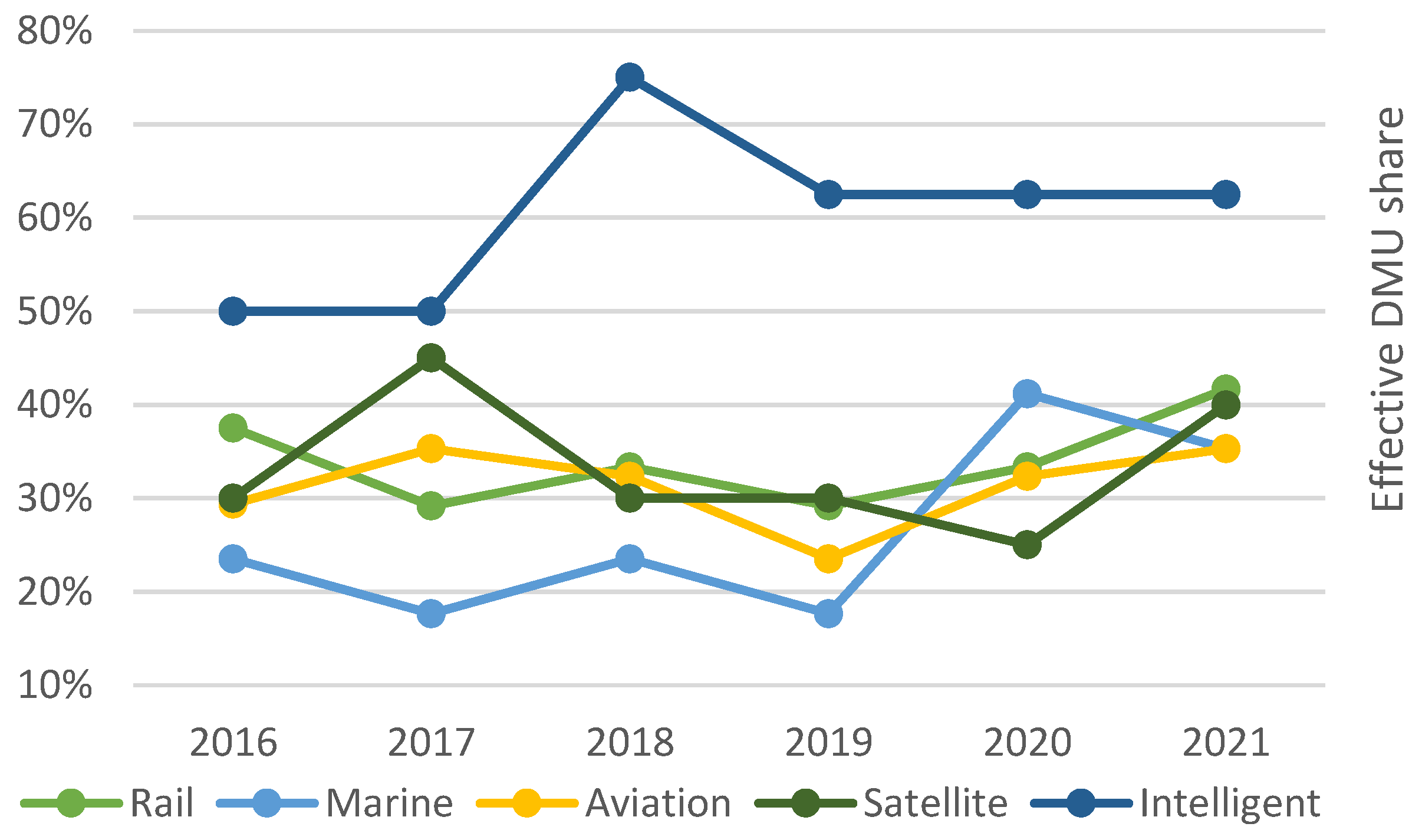

4.1.2. Operating Efficiency Statistics by Industry

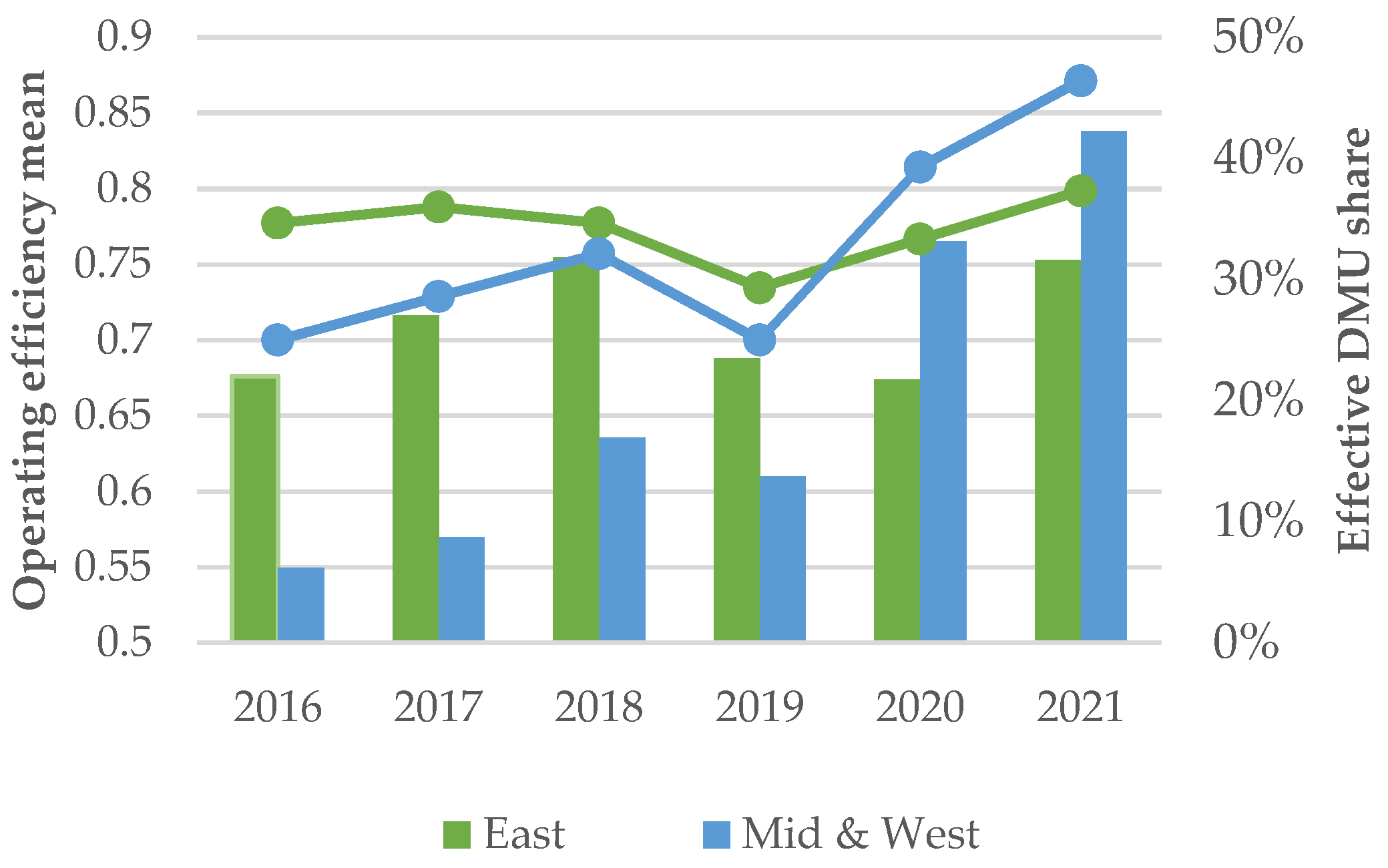

4.1.3. Operating Efficiency Statistics by Region

4.1.4. Analysis of Slack Variables

4.2. Analysis of Factors Influencing Operating Efficiency

4.2.1. Variable Descriptive Statistics

4.2.2. Person Correlation Analysis

4.2.3. Baseline Regression Results

- The level of government support is positively correlated with operating efficiency and significant at the 1% level of confidence. This suggests that the provision of government support, such as indirect tax subsidies and incentive funds, can aid firms in mitigating the expenses and uncertainties involved in research and development, thereby spurring technological innovation and product development. Nevertheless, it is imperative that the level of government assistance is measured and moderate. Overbearing government intervention may impede the market’s self-governing regulatory mechanism, impairing firms’ autonomous innovation and operational prowess.

- At the 1% level of confidence, both the age of the business and the concentration of equity statistically significant. Given the nature of high-end equipment, which often involves high technology and high-value products, enterprises must possess advanced technological innovation and management capabilities as well as a deep reservoir of R&D experience and knowledge. Furthermore, the employees of the business must be capable of comprehending market demand and customer needs, skills that usually require a long period of accumulation and practice. In enterprises with a higher concentration of equity, minority shareholders typically wield more influence and decision-making power, which enables businesses to make decisions more swiftly and respond more quickly to market changes. Additionally, companies with a higher concentration of ownership generally possess more stable and long-term growth strategies than those with fragmented ownership, allowing them to better plan and manage their resources, and ultimately improve their operating efficiency.

- The regional GDP is significantly and positively correlated at the 5% level of confidence. The GDP of a region reflects the overall level of economic development, and governments in high GDP regions typically invest more resources in supporting the local businesses. This may include better infrastructure, more policy support and a better talent pool, all of which contribute to improving the operating efficiency of businesses. Additionally, a higher GDP implies a greater demand in the market, which may help increase the sales volume and revenue of the businesses.

- The degree of regional openness is significantly and positively correlated with the operating efficiency of high-end equipment manufacturing enterprises, as confirmed at a confidence level of 1%. The relationship reflects the level of communication and trade between a region and the outside world. Given the necessity of high-end equipment manufacturers to compete in the global market, an open market environment can bring about more competition, opportunities, and potential partners, all of which can promote the development and growth of high-end equipment manufacturing enterprises. Moreover, high-end equipment manufacturing also requires numerous critical raw materials and technologies, which are typically imported from overseas. Thus, the higher the degree of openness in a region, the easier it is for these enterprises to acquire essential resources and technologies, thereby facilitating their development and growth.

- The regional level of technological development has been found to be significant at the 1% confidence level, but with a negative correlation. If an area increases its R&D expenditure, it may encourage high-end equipment manufacturing enterprises to increase their efforts in technological research and development. However, due to the relatively long production cycle of high-end equipment manufacturing and the complex components and technologies involved in the production process, a large amount of R&D investment and time is required to obtain new technologies and improve product quality. Investments in innovation and R&D often take a long time to yield returns, so even with more R&D investment, it may not immediately translate into an improvement in operational efficiency. In this process, enterprises need to bear considerable costs and risks. Therefore, excessive regional R&D investment may lead to a decrease in overall operational efficiency of the enterprise.

4.2.4. Heterogeneity Analysis

5. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wang, L.; Zhao, H. Comparative Analysis on Development and Policy in Intelligent Manufacturing Industry Among China, the United States, Japan and Germany. In Proceedings of the 2022 2nd International Conference on Economic Development and Business Culture (ICEDBC 2022), Dublin, Ireland, 28–30 July 2022; pp. 760–765. [Google Scholar]

- Lu, Y. The current status and developing trends of Industry 4.0: A Review. Inf. Syst. Front. 2021, 1–20. [Google Scholar] [CrossRef]

- Huang, Q. Technological Innovation in Manufacturing Industry. In Understanding China’s Manufacturing Industry; Springer: Berlin/Heidelberg, Germany, 2022; pp. 91–110. [Google Scholar]

- Jian, L.; Ding, T.; Ma, W. Research on China-EU equipment manufacturing Trade dependence in intra-industry specialization view. PLoS ONE 2022, 17, e0278119. [Google Scholar] [CrossRef] [PubMed]

- Wang, C.; Li, G.; Cai, Y. Research on the Efficiency Stability of Independent Technological Innovation of China’s High-end Equipment Manufacturing. Sci. Technol. Prog. Policy 2021, 38, 58–67. [Google Scholar]

- Yang, J.; Xue, C. Transformation and Upgrading of High-end Equipment Manufacturing Industry in an Open Innovation Environment Mechanism of Action. Soft Sci. 2022, 36, 37–44. [Google Scholar] [CrossRef]

- Lu, H.; Elahi, E.; Sun, Z. Empirical Decomposition and Forecast of Carbon Neutrality for High-End Equipment Manufacturing Industries. Front. Environ. Sci. 2022, 10, 757. [Google Scholar] [CrossRef]

- Chen, J.; He, N. The upgrading path and countermeasures of China’s manufacturing industry under the high quality development-taking the equipment manufacturing industry as an example. Enterp. Econ. 2018, 37, 44–52. [Google Scholar]

- Agency, X.N. Outline of the Fourteenth Five-Year Plan for National Economic and Social Development of the People’s Republic of China and Vision 2035. 2021. Available online: https://www.12371.cn/2021/03/13/ARTI1615598751923816.shtml#d3 (accessed on 2 April 2023).

- Li, F. The Implementation of Manufacturing Support Policies is Expected to Bring about New Developments in the High-End Equipment Field. 2023. Available online: http://www.ce.cn/cysc/newmain/yc/jsxw/202302/15/t20230215_38394755.shtml (accessed on 2 April 2023).

- Li, Y.; Zhang, H.; Liu, Y.; Huang, Q. Impact of embedded global value chain on technical complexity of industry export—An empirical study based on China’s equipment manufacturing industry panel. Sustainability 2020, 12, 2694. [Google Scholar] [CrossRef]

- Xiao, Z.; Shi, J.; Tan, R.; Shen, J. Prediction Algorithm of Collaborative Innovation Capability of High-End Equipment Manufacturing Enterprises Based on Random Forest. Mob. Inf. Syst. 2021, 2021, 8378274. [Google Scholar] [CrossRef]

- Cao, Y.; Jiang, H. Comparative analysis of China’s equipment manufacturing enterprises and world-class enterprises based on case study. In Proceedings of the 2021 2nd International Conference on E-Commerce and Internet Technology (ECIT), Hangzhou, China, 5–7 March 2021; pp. 79–82. [Google Scholar]

- Tian, Q.; Zhang, S.; Yu, H.; Cao, G. Exploring the factors influencing business model innovation using grounded theory: The case of a Chinese high-end equipment manufacturer. Sustainability 2019, 11, 1455. [Google Scholar] [CrossRef]

- Meng, F.; Xu, Y.; Zhao, G. Reaearch on the transformation process of high-end equipment manufacturing enterpaises to intelligent manufacturing: Based on digital powerment perspective. Sci. Decis. Mak. 2019, 11, 1–24. [Google Scholar]

- He, X.; Ping, Q.; Hu, W. Does digital technology promote the sustainable development of the marine equipment manufacturing industry in China? Marine Policy 2022, 136, 104868. [Google Scholar] [CrossRef]

- Li, T.; Liang, L.; Han, D. Research on the efficiency of green technology innovation in China’s provincial high-end manufacturing industry based on the RAGA-PP-SFA model. Math. Probl. Eng. 2018, 2018, 9463707. [Google Scholar] [CrossRef]

- Yang, X.; Tan, Q. Research on intelligent operation of high-end equipment manufacturing enterprises based on block chain technology. Commer. Res. 2018, 11, 12–17. [Google Scholar]

- Li, X. Research on Talent Ecosystem of High-end Equipment Manufacturing Industry in Zhenjiang High-tech Zone. In Proceedings of the IOP Conference Series: Materials Science and Engineering; IOP Publishing: Bristol, UK, 2019; p. 032023. [Google Scholar]

- Jiang, X.-G.; Liu, F.-Y. The “Going out” Layout and Countermeasures of China’s High-End Equipment Manufacturing in the Background of “the Belt and Road Initiative”. Econ. Rev. J. 2017, 5, 26–31. [Google Scholar] [CrossRef]

- Wang, Q.; Wang, J.; Li, H. Research on financing efficiency and influencing factors of equipment manufacturing industry—Regression model based on SFA panel data. J. Intell. Fuzzy Syst. 2021, 40, 8117–8126. [Google Scholar] [CrossRef]

- Chen, X.; Wang, Y. Research on financing efficiency of China’s strategic emerging industries based on super efficiency DEA and tobit model. Int. J. Emerg. Mark. 2022, 17, 485–504. [Google Scholar] [CrossRef]

- Xia, E. Transformation and promotion path of high-end equipment manufacturing industry in China. J. Inf. Manag. 2018, 37, 38–50. [Google Scholar]

- Liu, F.; Huang, M.; Yang, Q.; Wang, Y. Research on sustainable development performance evaluation of China’s high end equipment manufacturing enterprises. In Proceedings of the IOP Conference Series: Earth and Environmental Science, Surakarta, Indonesia, 24–25 August 2021; p. 052027. [Google Scholar]

- Arbelo-Pérez, M.; Arbelo, A.; Pérez-Gómez, P. Impact of quality on estimations of hotel efficiency. Tour. Manag. 2017, 61, 200–208. [Google Scholar] [CrossRef]

- Zhang, D.; Shu, B. An empirical study on the efficiency of China’s star-rated hotel and its influencing factors: Based on stochastic frontier analysis. Bus. Manag. J. 2018, 40, 138–154. [Google Scholar]

- Yilmaz, M.K.; Kusakci, A.O.; Aksoy, M.; Hacioglu, U. The evaluation of operational efficiencies of Turkish airports: An integrated spherical fuzzy AHP/DEA approach. Appl. Soft Comput. 2022, 119, 108620. [Google Scholar] [CrossRef]

- Briongos, F.; Platero, C.A.; Sánchez-Fernández, J.A.; Nicolet, C. Evaluation of the operating efficiency of a hybrid wind–hydro powerplant. Sustainability 2020, 12, 668. [Google Scholar] [CrossRef]

- Ju, S.; Tang, H. Competition and operating efficiency of manufacturing companies in E-commerce environment: Empirical evidence from Chinese garment companies. Appl. Econ. 2023, 55, 2113–2128. [Google Scholar] [CrossRef]

- Atta Mills, E.F.E.; Baafi, M.A.; Liu, F.; Zeng, K. Dynamic operating efficiency and its determining factors of listed real-estate companies in China: A hierarchical slack-based DEA-OLS approach. Int. J. Financ. Econ. 2021, 26, 3352–3376. [Google Scholar] [CrossRef]

- Zhou, L.; Li, W.; Teo, B.S.-X.; Yusoff, S.K.M. The effect of green transformation on the operating efficiency of green M&A enterprises: Evidence from China. J. Asian Financ. Econ. Bus. 2022, 9, 299–310. [Google Scholar]

- Guan, C.; Fan, Y. The impact of social networks on the operating efficiency of Chinese technology business incubators. Sustainability 2020, 12, 2727. [Google Scholar] [CrossRef]

- Qiao, L.; Fei, J. Government subsidies, enterprise operating efficiency, and “stiff but deathless” zombie firms. Econ. Model. 2022, 107, 105728. [Google Scholar] [CrossRef]

- Xu, S.; Ye, H. Evaluation on the Operating Efficiency of Cross-border E-commerce Listed Enterprises—Based on Three-stage DEA. Technol. Econ. Manag. Res. 2019, 10, 75–81. [Google Scholar]

- National Statistical Office Order No. 23. 2018. Available online: https://www.gov.cn/zhengce/zhengceku/2018-12/31/content_5433037.htm (accessed on 2 April 2023).

- Teng, L.; Su, H.; Qin, Y. The influence of government R&D subsidy on innovation efficiency of high-tech enterprises: Analysis of threshold effect based on heterogeneity. Fisc. Sci. 2023, 1, 118–135. [Google Scholar] [CrossRef]

- Park, S.; Kim, P. Operational performance evaluation of Korean ship parts manufacturing industry using dynamic network SBM model. Sustainability 2021, 13, 13127. [Google Scholar] [CrossRef]

- Song, J. Research on the Relationship between the Ownership Structure and Business Performance of Listed Companies. Int. J. Front. Sociol. 2021, 3, 14–20. [Google Scholar]

- Chen, L.; Ye, W.; Huo, C.; James, K. Environmental regulations, the industrial structure, and high-quality regional economic development: Evidence from China. Land 2020, 9, 517. [Google Scholar] [CrossRef]

- Kong, Q.; Peng, D.; Ni, Y.; Jiang, X.; Wang, Z. Trade openness and economic growth quality of China: Empirical analysis using ARDL model. Financ. Res. Lett. 2021, 38, 101488. [Google Scholar] [CrossRef]

- Yao, L.; Gu, G. Regional technical innovation, spillover effect and regional high-tech industry level. Forum Sci. Technol. China 2015, 1, 91–95. [Google Scholar] [CrossRef]

- Huang, Y.; Zhang, Y. How does outward foreign direct investment enhance firm productivity? A heterogeneous empirical analysis from Chinese manufacturing. China Econ. Rev. 2017, 44, 1–15. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of super-efficiency in data envelopment analysis. Eur. J. Oper. Res. 2002, 143, 32–41. [Google Scholar] [CrossRef]

- Boulter, J. China’s Supply-Side Structural Reform, Bulletin–December 2018; Reserve Bank of Australia: Sydney, NSW, Australia, 2018. [Google Scholar]

- Yu, Q.; Wang, S. Cooperative Innovation of Strategic Emerging Industries within Province under Multi-dimensional Proximity—Empirical Analysis Based on High-end Equipment Manufacturing Industry in Hubei Province. J. Beijing Univ. Posts Telecommun. Soc. Sci. Ed. 2020, 22, 41–51. [Google Scholar] [CrossRef]

- Nashier, T.; Gupta, A. Ownership concentration and firm performance in India. Glob. Bus. Rev. 2023, 24, 353–370. [Google Scholar] [CrossRef]

| Type | Indicator | Indicator Explanation |

|---|---|---|

| Input indicators | operating cost (X1) | Capital investment: reflecting the capital invested in the production and operation of the enterprise. |

| net fixed assets (X2) | Asset inputs: The provision of basic production materials constitutes a fundamental requirement for enterprise development. In particular, high-end equipment manufacturing enterprises rely heavily on specialized equipment, which commands a significant market value. | |

| payroll payable to employees (X3) | Labor input: employee remuneration serves as quantifiable indicators of a company’s investment in its labor force. Furthermore, the cultivation of research and development and management personnel constitutes a vital driver of high-end equipment manufacturing development. | |

| R&D input amount (X4) | Technology investment: The high-end equipment manufacturing industry is characterized by advanced technology and high value-added features. In this context, investment in research and development to foster new technological products and innovative solutions represents a crucial source of future efficiency enhancement for enterprises. | |

| Output indicators | operating income (Y1) | Monetary output: The monetary revenue generated by an enterprise through the sale of goods or provision of services during a given period represents a key indicator of the enterprise’s profitability and sustainability. |

| the number of patent applications (Y2) | Technical output: The expression of a company’s innovation capacity and technological proficiency to a certain extent embodies the high-end equipment manufacturing industry’s aptitude for inventiveness and its consciousness in seeking technological or aesthetic exclusivity. |

| Variable Name | Variable Symbols | Variable Description | |

|---|---|---|---|

| Explained variables | Operating efficiency | Efficiency | Operating efficiency values measured by the super-efficient SBM model |

| Core explanatory variables | Government subsidies | GOV | Various forms of government subsidies received by enterprises |

| Control variables | Firm age | AGE | Time of establishment of the enterprise + 1 |

| Enterprise equity concentration | CON | Number of shares held by top three shareholders/total number of shares | |

| Regional economic development level | GDP | Ln (regional GDP) | |

| Regional openness level | RTV | Total regional import/export/regional economic output | |

| Regional level of technological development | R&D | Ln (regional R&D investment funds for industrial enterprises above the scale) | |

| Regional foreign investment amount | INVEST | Ln (total investment of foreign enterprises in the region) |

| Efficiency Interval | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Q | P | Q | P | Q | P | Q | P | Q | P | Q | P | ||

| Low efficiency | [0,0.2) | 20 | 19.42% | 20 | 19.42% | 8 | 7.77% | 9 | 8.74% | 12 | 11.65% | 10 | 9.71% |

| [0.2,0.4) | 20 | 19.42% | 26 | 25.24% | 24 | 23.30% | 27 | 26.21% | 29 | 28.16% | 15 | 14.56% | |

| [0.4,0.6) | 20 | 19.42% | 9 | 8.74% | 19 | 18.45% | 28 | 27.18% | 16 | 15.53% | 18 | 17.48% | |

| Medium efficiency | [0.6,0.8) | 9 | 8.74% | 7 | 6.8% | 15 | 14.56% | 9 | 8.74% | 9 | 8.74% | 12 | 11.65% |

| High efficiency | [0.8,1) | 1 | 0.97% | 6 | 5.83% | 2 | 1.94% | 1 | 0.97% | 1 | 0.97% | 7 | 6.80% |

| Super efficiency | [1,4) | 33 | 32.04% | 35 | 33.98% | 35 | 33.98% | 29 | 28.16% | 36 | 34.95% | 41 | 39.81% |

| Under-Redundant Variables for Effective DMUs | Under-Redundant Variables for Non-Effective DMUs | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| R | DMU | RA | Y1 | Y2 | X1 | X2 | X3 | X4 | R | DMU | RA | Y1 | Y2 | X1 | X2 | X3 | X4 |

| 1 | 300173 | s− | −10.59 | −1 | 601890 | s− | −20.86 | −44.58 | |||||||||

| s+ | 8.39 | s+ | 999.9 | ||||||||||||||

| 2 | 601766 | s− | −66.05 | −56.56 | −77.04 | −73 | −2 | 002520 | s− | −82.31 | −48.34 | ||||||

| s+ | 69.69 | s+ | 999.9 | ||||||||||||||

| 3 | 600850 | s− | −999.9 | −94.34 | −84.7 | −62.72 | −3 | 600592 | s− | −15.21 | −5.98 | −35.05 | −15.53 | ||||

| s+ | 93.38 | 79.94 | s+ | 927.76 | |||||||||||||

| 4 | 000063 | s− | −140.38 | −74.9 | −81.49 | −4 | 300424 | s− | −42.12 | ||||||||

| s+ | 24.3 | 10.01 | s+ | 778.33 | |||||||||||||

| 5 | 600973 | s− | −58.55 | −24.75 | −23.7 | −5 | 600151 | s− | −23.1 | −63.11 | −12.02 | 0 | |||||

| s+ | 21.55 | 5.58 | s+ | 381.79 | |||||||||||||

| 6 | 300095 | s− | −118.73 | −6 | 002369 | s− | −6.06 | −32.65 | −65.9 | ||||||||

| s+ | 39.88 | 9.44 | 150.06 | 4.02 | s+ | 284 | |||||||||||

| 7 | 000039 | s− | −53.58 | −67.31 | −62.07 | −7 | 000880 | s− | −17 | −19.42 | −71.45 | −45.76 | |||||

| s+ | 56.78 | s+ | 184.48 | ||||||||||||||

| 8 | 600406 | s− | 0 | 0 | 0 | 0 | 0 | −24.92 | −8 | 002480 | s− | 0 | 0 | −27.37 | −49.58 | −55.47 | −52.37 |

| s+ | 0 | 0 | 15.46 | 20.25 | 0 | 0 | s+ | 0 | 69.71% | 0 | 0 | 0 | 0 | ||||

| Variable | Unit | Sample Size | Average | SD | Min | Max |

|---|---|---|---|---|---|---|

| GOV | Billion CNY | 618 | 1.02262 | 3.3803 | 0.00002 | 34.98 |

| AGE | Year | 618 | 19.70 | 5.24 | 9 | 36 |

| CON | % | 618 | 43.57 | 14.21 | 6.10 | 83 |

| GDP | Billion CNY | 618 | 58,089.35 | 32,813.87 | 11,477.2 | 124,719.5 |

| RTV | % | 618 | 0.4801 | 0.2775 | 0.0270 | 0.9765 |

| R&D | Billion CNY | 618 | 1068.507 | 872.6531 | 55.6853 | 2902.185 |

| INVEST | Billion CNY | 618 | 52.20388 | 29.23975 | 1 | 101 |

| GOV | AGE | CON | GDP | RTV | R&D | INVEST | |

|---|---|---|---|---|---|---|---|

| GOV | 1.0000 | ||||||

| AGE | 0.0459 | 1.0000 | |||||

| CON | 0.0305 | 0.0504 | 1.0000 | ||||

| GDP | 0.0436 | 0.0294 | −0.1396 | 1.0000 | |||

| RTV | 0.0349 | −0.2359 | −0.0837 | 0.2471 | 1.0000 | ||

| R&D | 0.0479 | 0.0652 | −0.1584 | 0.2440 | 0.3172 | 1.0000 | |

| INVEST | −0.0093 | 0.1895 | −0.0594 | −0.2526 | −0.5618 | −0.2179 | 1.0000 |

| Variable | 1 | 2 | 3 | 4 |

|---|---|---|---|---|

| GOV | 0.0438 *** (8.44) | 0.0361 *** (6.64) | ||

| AGE | 0.0109 *** (2.74) | 0.0133 *** (3.14) | 0.0099 ** (2.46) | |

| CON | 0.0039 *** (2.71) | 0.0073 *** (5.29) | 0.0049 *** (3.43) | |

| GDP | 0.2390 ** (2.30) | 0.2400 ** (2.25) | 0.2315 ** (2.19) | |

| RTV | 0.2857 *** (3.10) | 0.3835 *** (4.11) | 0.3013 *** (3.20) | |

| R&D | −0.2018 *** (−3.02) | −0.2084 *** (−3.04) | −0.1930 *** (−2.84) | |

| INVEST | −0.0009 (−1.09) | −0.0011 (−1.30) | −0.0009 (−1.08) | |

| GOVA | 10.6772 *** (3.23) | |||

| LNGOV | 0.0706 *** (4.76) | |||

| Year | Y | Y | Y | Y |

| Industry | Y | Y | Y | Y |

| N | 618 | 618 | 618 | 618 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

|---|---|---|---|---|---|---|---|

| GOV | 0.0159 * (1.87) | 0.0504 ** (2.52) | 0.1381 ** (2.37) | 0.0430 *** (5.35) | −0.0428 (−0.99) | 0.0364 *** (6.23) | 0.1279 (1.44) |

| Control | Y | Y | Y | Y | Y | Y | Y |

| Year | Y | Y | Y | Y | Y | Y | Y |

| Industry | N | N | N | N | N | Y | Y |

| N | 144 | 102 | 204 | 120 | 48 | 450 | 168 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zheng, Y.; Luo, M. Enhancing Operating Efficiency in China’s High-End Equipment Manufacturing Industry: Insights from Listed Enterprises. Sustainability 2023, 15, 8694. https://doi.org/10.3390/su15118694

Zheng Y, Luo M. Enhancing Operating Efficiency in China’s High-End Equipment Manufacturing Industry: Insights from Listed Enterprises. Sustainability. 2023; 15(11):8694. https://doi.org/10.3390/su15118694

Chicago/Turabian StyleZheng, Yi, and Min Luo. 2023. "Enhancing Operating Efficiency in China’s High-End Equipment Manufacturing Industry: Insights from Listed Enterprises" Sustainability 15, no. 11: 8694. https://doi.org/10.3390/su15118694

APA StyleZheng, Y., & Luo, M. (2023). Enhancing Operating Efficiency in China’s High-End Equipment Manufacturing Industry: Insights from Listed Enterprises. Sustainability, 15(11), 8694. https://doi.org/10.3390/su15118694