Quantile Dependence between Crude Oil and China’s Biofuel Feedstock Commodity Market

Abstract

:1. Introduction

2. Literature Review

3. Methodology

3.1. Quantile-On-Quantile Regression

3.2. Causality-In-Quantiles Test

4. Data and Empirical Results

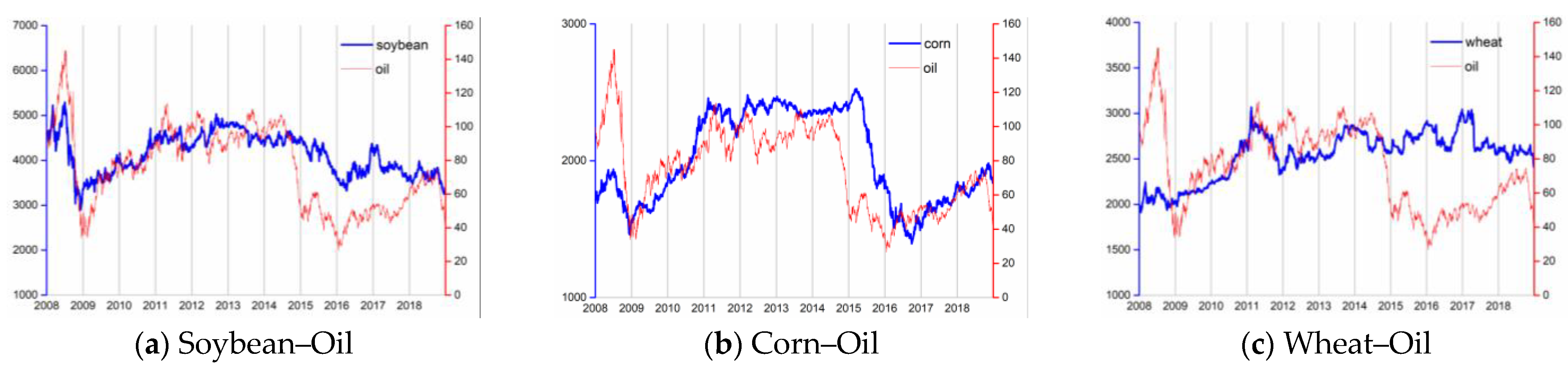

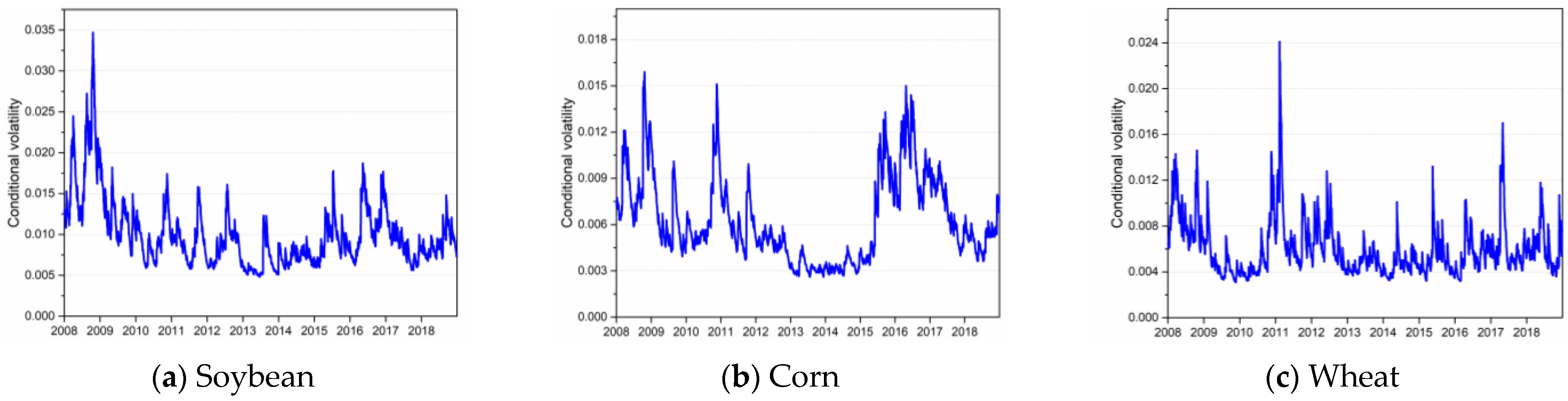

4.1. Data and Descriptive Analysis

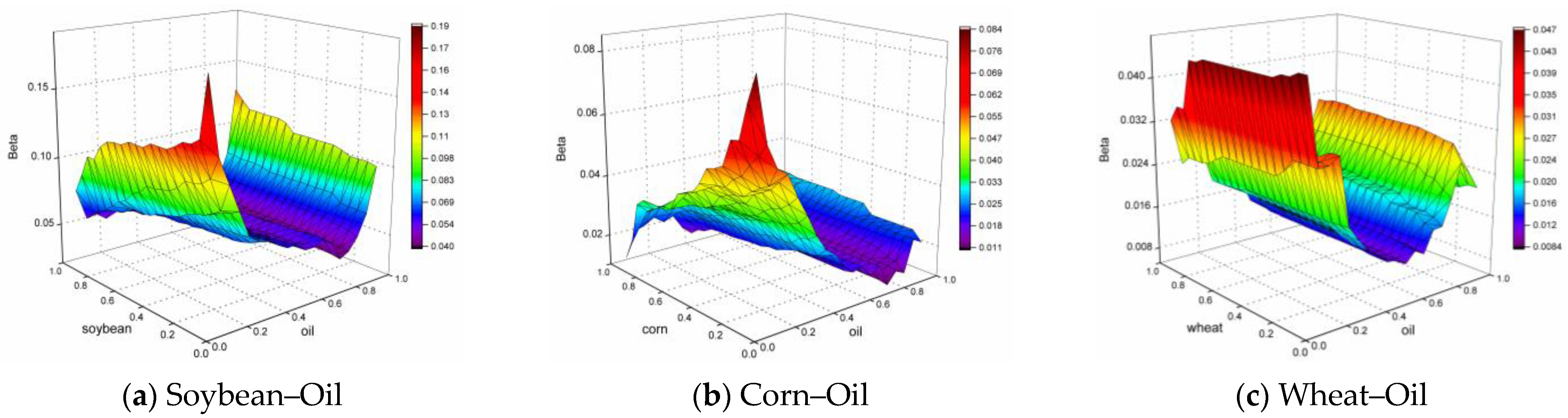

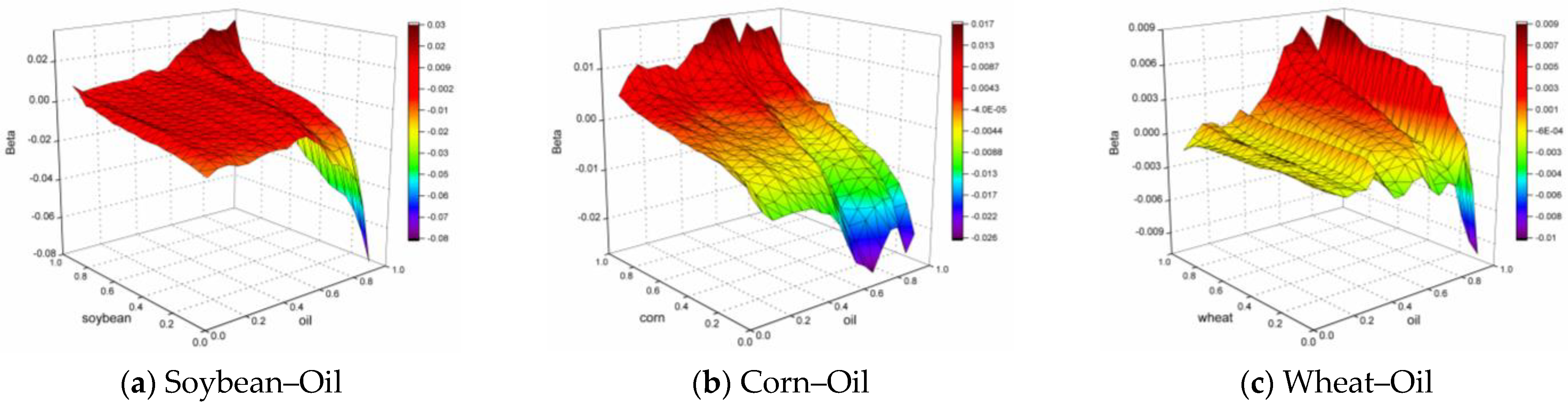

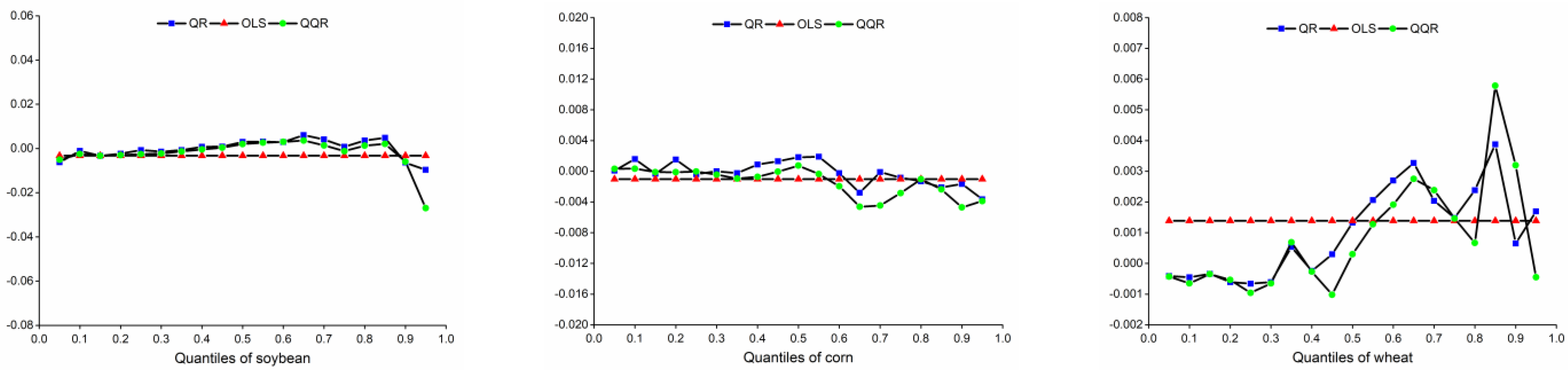

4.2. Quantile-On-Quantile Regression

4.3. Validity Test

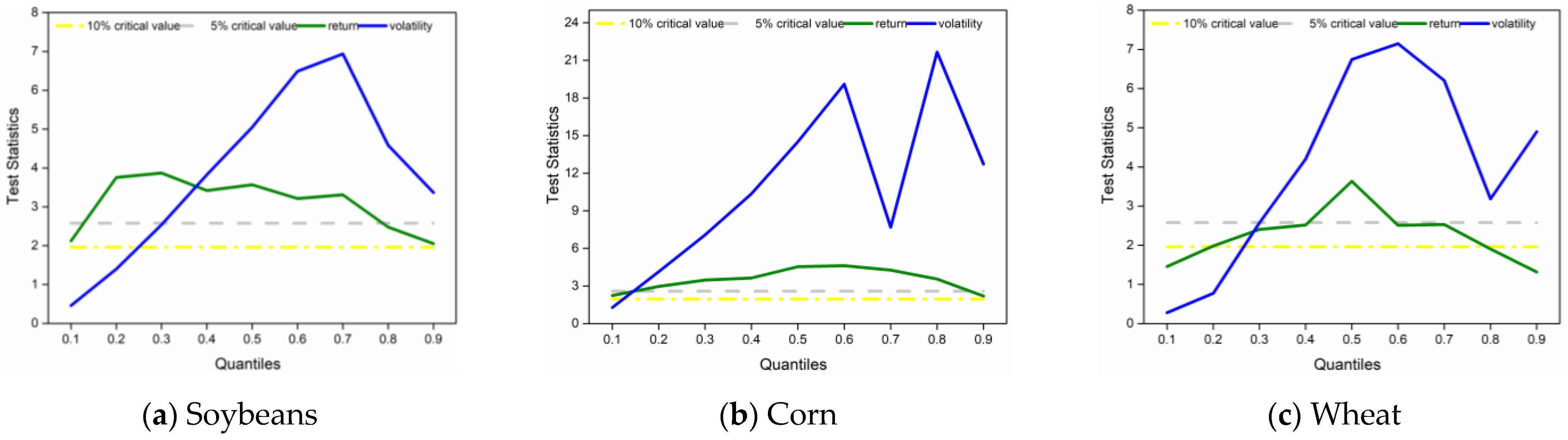

4.4. Causality-In-Quantiles Test

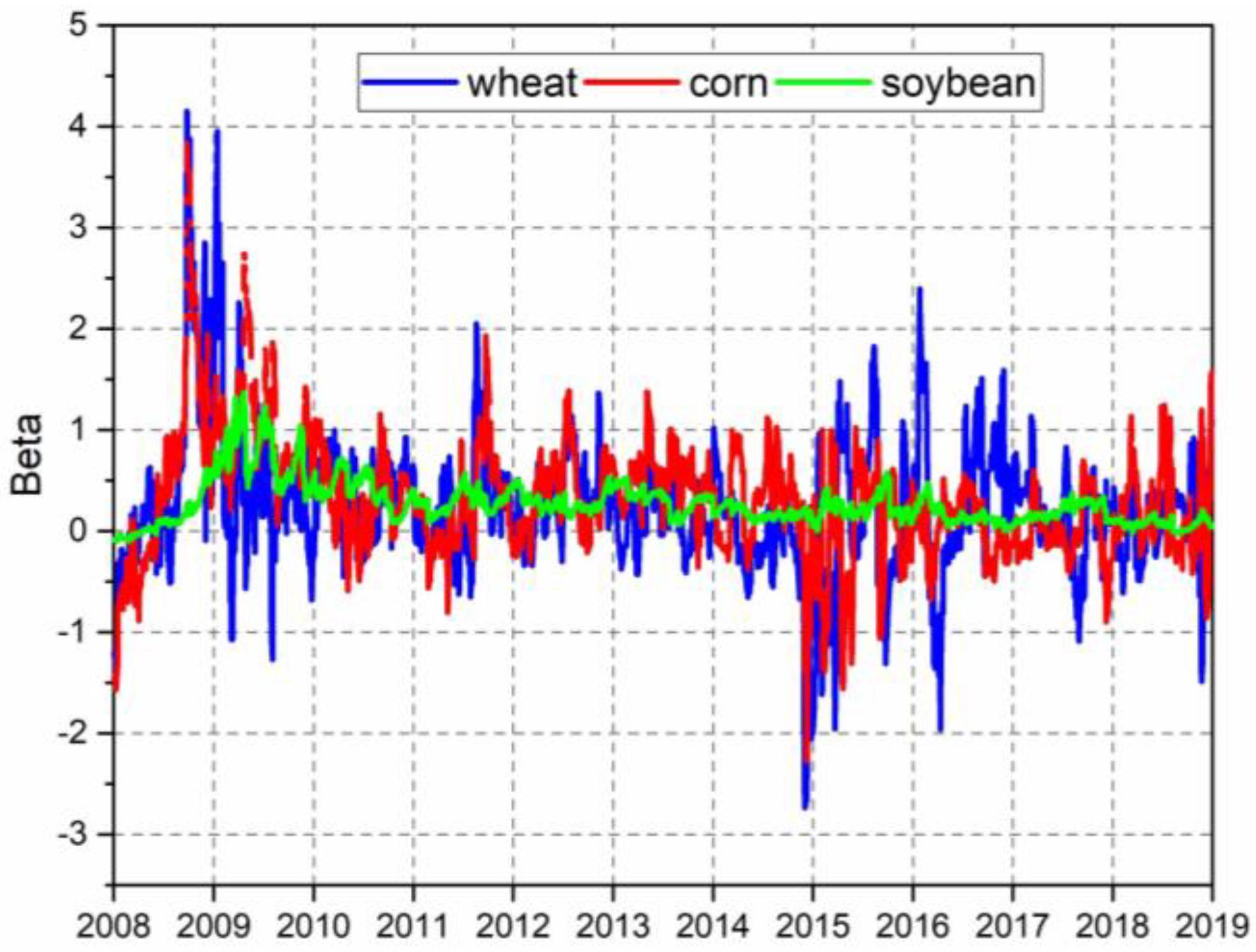

4.5. Portfolio Hedging Analysis and Policy Implications

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Statistics | F-Statistic | p-Value | Order of VAR (p) |

|---|---|---|---|

| Null hypothesis (1): Crude oil does not Granger cause agricultural commodities returns | |||

| Soybean | 19.4243 | 0.0000 | 1 |

| Corn | 1.04568 | 0.3066 | 1 |

| Strong Wheat | 0.01437 | 0.9046 | 1 |

| Null hypothesis (2): Crude oil does not Granger cause agricultural commodities volatility | |||

| Soybean | 0.69472 | 0.4046 | 1 |

| Corn | 5.70888 | 0.0170 | 1 |

| Strong Wheat | 0.63805 | 0.4245 | 1 |

References

- Raschke, A.; Hernandez-Suarez, J.S.; Nejadhashemi, A.P.; Deb, K. Multidimensional Aspects of Sustainable Biofuel Feedstock Production. Sustainability 2021, 13, 1424. [Google Scholar] [CrossRef]

- Dumortier, J.; Carriquiry, M.; Elobeid, A. Where does all the biofuel go? Fuel efficiency gains and its effects on global agricultural production. Energy Policy 2021, 148, 111909. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Abakah, E.J.A.; Adewuyi, A.O.; Lee, C.C. Quantile risk spillovers between energy and agricultural commodity markets: Evidence from pre and during COVID-19 outbreak. Energy Econ. 2022, 113, 106235. [Google Scholar] [CrossRef]

- Guo, J.; Tanaka, T. Energy security versus food security: An analysis of fuel ethanol-related markets using the spillover index and partial wavelet coherence approaches. Energy Econ. 2022, 112, 106142. [Google Scholar] [CrossRef]

- Cao, B.; Bai, C.; Zhang, M.; Lu, Y.; Gao, P.; Yang, J.; Xue, Y.; Li, G. Future landscape of renewable fuel resources: Current and future conservation and utilization of main biofuel crops in China. Sci. Total Environ. 2022, 806, 150946. [Google Scholar] [CrossRef]

- Zhang, J.; Lin, Z.; Li, J. Analyzing the risk spillovers of international crude oil on China’s corn and biofuel ethanol markets: A transition toward green economy and environmental sustainability. Energy Environ. 2022, 0958305X221140566. [Google Scholar] [CrossRef]

- El Montasser, G.; Belhoula, M.M.; Charfeddine, L. Co-explosivity versus leading effects: Evidence from crude oil and agricultural commodities. Resour. Policy 2023, 81, 103331. [Google Scholar] [CrossRef]

- McKnight, C.; Qiu, F.; Luckert, M.; Hauer, G. Prices for a second-generation biofuel industry in Canada: Market linkages between Canadian wheat and US energy and agricultural commodities. Can. J. Agric. Econ. /Rev. Can. D’agroeconomie 2021, 69, 337–351. [Google Scholar] [CrossRef]

- Cui, J.; Goh, M.; Zou, H. Coherence, extreme risk spillovers, and dynamic linkages between oil and China’s commodity futures markets. Energy 2021, 225, 120190. [Google Scholar] [CrossRef]

- Jiang, Y.; Lao, J.; Mo, B.; Nie, H. Dynamic linkages among global oil market, agricultural raw material markets and metal markets: An application of wavelet and copula approaches. Phys. A Stat. Mech. Its Appl. 2018, 508, 265–279. [Google Scholar] [CrossRef]

- Mokni, K.; Ben-Salha, O. Asymmetric causality in quantiles analysis of the oil-food nexus since the 1960s. Resour. Policy 2020, 69, 101874. [Google Scholar] [CrossRef]

- Youssef, M.; Mokni, K. On the nonlinear impact of oil price shocks on the world food prices under different markets conditions. Int. Econ. J. 2021, 35, 73–95. [Google Scholar] [CrossRef]

- Ciaian, P.; Kancs, D. Food, energy and environment: Is bioenergy the missing link? Food Policy 2011, 36, 571–580. [Google Scholar] [CrossRef] [Green Version]

- Serra, T.; Zilberman, D.; Gil, J.M.; Goodwin, B.K. Nonlinearities in the US corn-ethanol-gasoline price system. Agric. Econ. 2011, 42, 35–45. [Google Scholar] [CrossRef]

- Wu, F.; Guan, Z.; Myers, R.J. Volatility Spillover Effects and Cross Hedging in Corn and Crude Oil Futures. J. Futures Mark. 2011, 31, 1052–1075. [Google Scholar] [CrossRef]

- Myers, R.J.; Johnson, S.R.; Helmar, M.; Baumes, H. Long-run and Short-run Co-movements in Energy Prices and the Prices of Agricultural Feedstocks for Biofuel. Am. J. Agric. Econ. 2014, 96, 991–1008. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Hernandez, J.A.; Al-Yahyaee, K.H.; Jammazi, R. Asymmetric risk spillovers between oil and agricultural commodities. Energy Policy 2018, 118, 182–198. [Google Scholar] [CrossRef]

- Mensi, W.; Tiwari, A.; Bouri, E.; Roubaud, D.; AI-Yahyaee, K.H. The dependence structure across oil, wheat, and corn: A wavelet-based copula approach using implied volatility indexes. Energy Econ. 2017, 66, 122–139. [Google Scholar] [CrossRef]

- Umar, Z.; Gubareva, M.; Naeem, M.; Akhter, A. Return and volatility transmission between oil price shocks and agricultural commodities. PLoS ONE 2021, 16, e0246886. [Google Scholar] [CrossRef] [PubMed]

- Lucotte, Y. Co-movements between crude oil and food prices: A post-commodity boom perspective. Econ. Lett. 2016, 147, 142–147. [Google Scholar] [CrossRef]

- Kang, S.H.; Tiwari, A.K.; Albulescu, C.T.; Yoon, S.M. Exploring the time-frequency connectedness and network among crude oil and agriculture commodities V1. Energy Econ. 2019, 84, 104543. [Google Scholar] [CrossRef]

- Kumar, S.; Tiwari, A.K.; Raheem, I.D.; Hille, E. Time-varying dependence structure between oil and agricultural commodity markets: A dependence-switching CoVaR copula approach. Resour. Policy 2021, 72, 102049. [Google Scholar] [CrossRef]

- Umar, Z.; Jareño, F.; Escribano, A. Agricultural commodity markets and oil prices: An analysis of the dynamic return and volatility connectedness. Resour. Policy 2021, 73, 102147. [Google Scholar] [CrossRef]

- Naeem, M.A.; Karim, S.; Hasan, M.; Lucey, B.M.; Kang, S.H. Nexus between oil shocks and agriculture commodities: Evidence from time and frequency domain. Energy Econ. 2022, 112, 106148. [Google Scholar] [CrossRef]

- Wang, K.H.; Kan, J.M.; Qiu, L.; Xu, S. Climate policy uncertainty, oil price and agricultural commodity: From quantile and time perspective. Econ. Anal. Policy 2023, 78, 256–272. [Google Scholar] [CrossRef]

- Sim, N.; Zhou, H. Oil prices, US stock return and the dependence between their quantiles. J. Bank. Financ. 2015, 55, 1–8. [Google Scholar] [CrossRef]

- Bonato, M. Realized correlations, betas and volatility spillover in the agricultural commodity market: What has changed? J. Int. Financ. Mark. Inst. Money 2019, 62, 184–202. [Google Scholar] [CrossRef]

- Filip, O.; Janda, K.; Kristoufek, L.; Zilberman, D. Food versus fuel: An updated and expanded evidence. Energy Econ. 2019, 82, 152–166. [Google Scholar] [CrossRef] [Green Version]

- Hanson, K.; Robinson, S.; Schluter, G. Sectoral effects of a world oil price shock: Economywide linkages to the agricultural sector. J. Agric. Resour. Econ. 1993, 18, 96–116. [Google Scholar]

- Zhang, Z.; Lohr, L.; Escalante, C.; Wetzstein, M. Food versus fuel: What do prices tell us? Energy Policy 2010, 38, 445–451. [Google Scholar] [CrossRef]

- Gohin, A.; Chantret, F. The long-run impact of energy prices on world agricultural markets: The role of macro-economic linkages. Energy Policy 2010, 38, 333–339. [Google Scholar] [CrossRef] [Green Version]

- Nazlioglu, S.; Soytas, U. World oil prices and agricultural commodity prices: Evidence from an emerging market. Energy Econ. 2011, 33, 488–496. [Google Scholar] [CrossRef]

- Chen, P. Global oil prices, macroeconomic fundamentals and China’s commodity sector co-movements. Energy Policy 2015, 87, 284–294. [Google Scholar] [CrossRef]

- Fernandez-Diaz, J.M.; Morley, B. Interdependence among agricultural commodity markets, macroeconomic factors, crude oil and commodity index. Res. Int. Bus. Financ. 2019, 47, 174–194. [Google Scholar] [CrossRef] [Green Version]

- Natanelov, V.; McKenzie, A.M.; Huylenbroeck, G.V. Crude oil-corn-ethanol—Nexus: A contextual approach. Energy Policy 2013, 63, 504–513. [Google Scholar] [CrossRef]

- Fowowe, B. Do oil prices drive agricultural commodity prices? Evidence from South Africa. Energy 2016, 104, 149–157. [Google Scholar] [CrossRef]

- Gomes, G.; Hache, E.; Mignon, V.; Paris, A. On the current account—Biofuels link in emerging and developing countries: Do oil price fluctuations matter? Energy Policy 2018, 116, 60–67. [Google Scholar] [CrossRef] [Green Version]

- Hau, L.; Zhu, H.; Huang, R.; Ma, X. Heterogeneous dependence between crude oil price volatility and China’s agriculture commodity futures: Evidence from quantile-on- quantile regression. Energy 2020, 213, 118781. [Google Scholar] [CrossRef]

- Fernandez-Perez, A.; Frijns, B.; Tourani-Rad, A. Contemporaneous interactions among fuel, biofuel and agricultural commodities. Energy Econ. 2016, 58, 1–10. [Google Scholar] [CrossRef]

- Pal, D.; Mitra, S.K. Diesel and soybean price relationship in the United States: Evidence from a quantile autoregressive distributed lag model. Empir. Econ. 2017, 52, 1609–1626. [Google Scholar] [CrossRef]

- Su, C.W.; Wang, X.-Q.; Tao, R.; Oana-Ramona, L. Do oil prices drive agricultural commodity prices? Further evidence in a global bio-energy context. Energy 2019, 172, 691–701. [Google Scholar] [CrossRef]

- Yoon, S.M. On the interdependence between biofuel, fossil fuel and agricultural food prices: Evidence from quantile tests. Renew Energy 2022, 199, 536–545. [Google Scholar] [CrossRef]

- Haixia, W.; Shiping, L. Volatility spillovers in China’s crude oil, corn and fuel ethanol markets. Energy Policy 2013, 62, 878–886. [Google Scholar] [CrossRef]

- Luo, J.; Ji, Q. High-frequency volatility connectedness between the US crude oil market and China’s agricultural commodity markets. Energy Econ. 2018, 76, 424–438. [Google Scholar] [CrossRef]

- Spencer, S.; Bredin, D.; Conlon, T. Energy and agricultural commodities revealed through hedging characteristics: Evidence from developing and mature markets. J. Commod. Mark. 2018, 9, 1–20. [Google Scholar] [CrossRef]

- Mo, B.; Chen, C.; Nie, H.; Jiang, Y. Visiting effects of crude oil price on economic growth in BRICS countries: Fresh evidence from wavelet-based quantile-on-quantile tests. Energy 2019, 178, 234–251. [Google Scholar] [CrossRef]

- Balcilar, M.; Gupta, R.; Kyei, C.; Wohar, M.E. Does economic policy uncertainty predict exchange rate returns and volatility? Evidence from a nonparametric causality-in-quantiles test. Open Econ. Rev. 2016, 27, 229–250. [Google Scholar] [CrossRef] [Green Version]

- Nishiyama, Y.; Hitomi, K.; Kawasaki, Y.; Jeong, K. A consistent nonparametric test for nonlinear causality—Specification in time series regression. J. Econom. 2011, 165, 112–127. [Google Scholar] [CrossRef] [Green Version]

- Chiu, F.-P.; Hsu, C.-S.; Ho, A.; Chen, C.-C. Modeling the price relationships between crude oil, energy crops and biofuels. Energy 2016, 109, 845–857. [Google Scholar] [CrossRef]

- Luo, J.; Zhang, Q. Risk contagions between global oil markets and China’s agricultural commodity markets under structural breaks. Appl. Econ. 2021, 53, 628–649. [Google Scholar] [CrossRef]

- Jena, S.K.; Tiwari, A.K.; Hammoudeh, S.; Roubaud, D. Distributional predictability between commodity spot and futures: Evidence from nonparametric causality-in- quantiles tests. Energy Econ. 2019, 78, 615–628. [Google Scholar] [CrossRef]

- Hernandez, J.A.; Shahzad, S.J.H.; Uddin, G.S.; Kang, S.H. Can agricultural and precious metal commodities diversify and hedge extreme downside and upside oil market risk? An extreme quantile approach. Resour. Policy 2019, 62, 588–601. [Google Scholar] [CrossRef]

- Zhang, C.; Qu, X. The effect of global oil price shocks on China’s agricultural commodities. Energy Econ. 2015, 51, 354–364. [Google Scholar] [CrossRef]

| Stats | Crude Oil | Wheat | Corn | Soybean |

|---|---|---|---|---|

| Mean | −0.0003 | 0.0001 | 0.0000 | −0.0002 |

| Maximum | 0.1641 | 0.0720 | 0.0419 | 0.0648 |

| Minimum | −0.1307 | −0.0357 | −0.0550 | −0.0607 |

| Std. Dev. | 0.0244 | 0.0063 | 0.0067 | 0.0109 |

| Skewness | 0.1283 | 0.6273 | −0.4032 | −0.2393 |

| Kurtosis | 7.6591 | 14.3404 | 9.8713 | 7.7046 |

| Jarque–Bera | 2346.0740 | 14,026.8400 | 5157.4770 | 2409.5340 |

| p-value | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| DF-GLS | −53.3531 | −3.2769 | −5.1562 | −3.9426 |

| p-value | 0.0000 | 0.0011 | 0.0000 | 0.0001 |

| ARCH (12) | 58.8673 | 10.5443 | 14.2800 | 45.9604 |

| p-value | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Return | Volatility | ||||||

|---|---|---|---|---|---|---|---|

| Soybean Return | Corn Return | Wheat Return | Soybean Volatility | Corn Volatility | Wheat Volatility | ||

| 0.05 | 0.05 | 0.1857 *** | 0.0838 *** | 0.0465 ** | −0.0138 *** | −0.0054 *** | −0.0001 |

| 0.05 | 0.10 | 0.1435 *** | 0.0751 *** | 0.0465 ** | −0.0124 *** | −0.0029 *** | −0.0001 |

| 0.10 | 0.05 | 0.1325 *** | 0.0637 *** | 0.0316 ** | −0.0112 *** | −0.0083 *** | −0.0009 |

| 0.10 | 0.10 | 0.1173 *** | 0.0597 *** | 0.0316 ** | −0.0086 *** | −0.0055 *** | −0.0009 |

| 0.05 | 0.90 | 0.0892 *** | 0.0185 | 0.0352 | 0.0051 ** | 0.0041 *** | −0.0010 |

| 0.05 | 0.95 | 0.0755 *** | 0.0124 | 0.0324 | 0.0079 *** | 0.0049 *** | −0.0014 |

| 0.10 | 0.90 | 0.0600 *** | 0.0275 ** | 0.0254 * | 0.0025 | 0.0063 *** | −0.0005 |

| 0.10 | 0.95 | 0.0528 *** | 0.0206 * | 0.0239 * | 0.0043 ** | 0.0083 *** | −0.0004 |

| 0.50 | 0.50 | 0.0551 *** | 0.0204 *** | 0.0120 *** | 0.0029 | 0.0010 | 0.0004 |

| 0.90 | 0.05 | 0.0673 *** | 0.0229 * | 0.0244 ** | −0.0493 *** | −0.0245 *** | −0.0037 |

| 0.90 | 0.10 | 0.0680 *** | 0.0229 * | 0.0267 ** | −0.0285 *** | −0.0202 *** | −0.0017 |

| 0.95 | 0.05 | 0.1000 *** | 0.0212 | 0.0214 | −0.0781 *** | −0.0211 *** | −0.0100 |

| 0.95 | 0.10 | 0.1017 *** | 0.0243 | 0.0214 | −0.0638 *** | −0.0155 ** | −0.0092 |

| 0.90 | 0.90 | 0.0783 *** | 0.0307 ** | 0.0282 ** | 0.0187 ** | 0.0094 | 0.0072 |

| 0.90 | 0.95 | 0.0783 *** | 0.0307 ** | 0.0282 ** | 0.0258 *** | 0.0144 ** | 0.0079 |

| 0.95 | 0.90 | 0.1218 *** | 0.0288 | 0.0084 | 0.0141 | 0.0051 | 0.0022 |

| 0.95 | 0.95 | 0.1284 *** | 0.0288 | 0.0084 | 0.0304 | 0.0104 | 0.0045 |

| Commodity | m = 2 | m = 3 | m = 4 | m = 5 | m = 6 |

|---|---|---|---|---|---|

| Strong wheat–crude oil | 8.9721 (0.0000) | 11.6308 (0.0000) | 12.8260 (0.0000) | 14.1440 (0.0000) | 15.6290 (0.0000) |

| Corn–crude oil | 9.7627 (0.0000) | 11.8639 (0.0000) | 13.6839 (0.0000) | 15.7347 (0.0000) | 17.4378 (0.0000) |

| Soybean–crude oil | 8.4444 (0.0000) | 10.5052 (0.0000) | 11.9044 (0.0000) | 13.3646 (0.0000) | 15.2567 (0.0000) |

| Quantile | 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 |

|---|---|---|---|---|---|---|---|---|---|

| Panel A: Return series | |||||||||

| Soybean | 2.1253 (0.0168) | 3.7575 (0.0001) | 3.8715 (0.0001) | 3.4177 (0.0003) | 3.5704 (0.0002) | 3.2153 (0.0007) | 3.3093 (0.0005) | 2.4788 (0.0066) | 2.0531 (0.0200) |

| Corn | 2.2438 (0.0124) | 2.9667 (0.0015) | 3.4712 (0.0003) | 3.6351 (0.0001) | 4.5470 (0.0000) | 4.6271 (0.0000) | 4.2650 (0.0000) | 3.5558 (0.0002) | 2.1951 (0.0141) |

| Wheat | 1.4569 (0.0726) | 1.9828 (0.0237) | 2.4027 (0.0081) | 2.5160 (0.0059) | 3.6321 (0.0001) | 2.5080 (0.0061) | 2.5304 (0.0057) | 1.9031 (0.0285) | 1.3152 (0.0942) |

| Panel B: Volatility series | |||||||||

| Soybean | 0.4595 (0.3229) | 1.4008 (0.0806) | 2.5371 (0.0056) | 3.8287 (0.0001) | 5.0473 (0.0000) | 6.4913 (0.0000) | 6.9388 (0.0000) | 4.5854 (0.0000) | 3.3668 (0.0004) |

| Corn | 1.2827 (0.0998) | 4.1392 (0.0000) | 7.0703 (0.0000) | 10.3565 (0.0000) | 14.5056 (0.0000) | 19.1041 (0.0000) | 7.6828 (0.0000) | 21.6686 (0.0000) | 12.7312 (0.0000) |

| Strong Wheat | 0.2771 (0.3909) | 0.7751 (0.2191) | 2.5714 (0.0051) | 4.1992 (0.0000) | 6.7443 (0.0000) | 7.1475 (0.0000) | 6.2050 (0.0000) | 3.1839 (0.0007) | 4.9007 (0.0000) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hau, L.; Zhu, H.; Shahbaz, M.; Huang, K. Quantile Dependence between Crude Oil and China’s Biofuel Feedstock Commodity Market. Sustainability 2023, 15, 8980. https://doi.org/10.3390/su15118980

Hau L, Zhu H, Shahbaz M, Huang K. Quantile Dependence between Crude Oil and China’s Biofuel Feedstock Commodity Market. Sustainability. 2023; 15(11):8980. https://doi.org/10.3390/su15118980

Chicago/Turabian StyleHau, Liya, Huiming Zhu, Muhammad Shahbaz, and Ke Huang. 2023. "Quantile Dependence between Crude Oil and China’s Biofuel Feedstock Commodity Market" Sustainability 15, no. 11: 8980. https://doi.org/10.3390/su15118980