Too Much of a Good Thing? The Impact of Serial M&A on Innovation Performance

Abstract

:1. Introduction

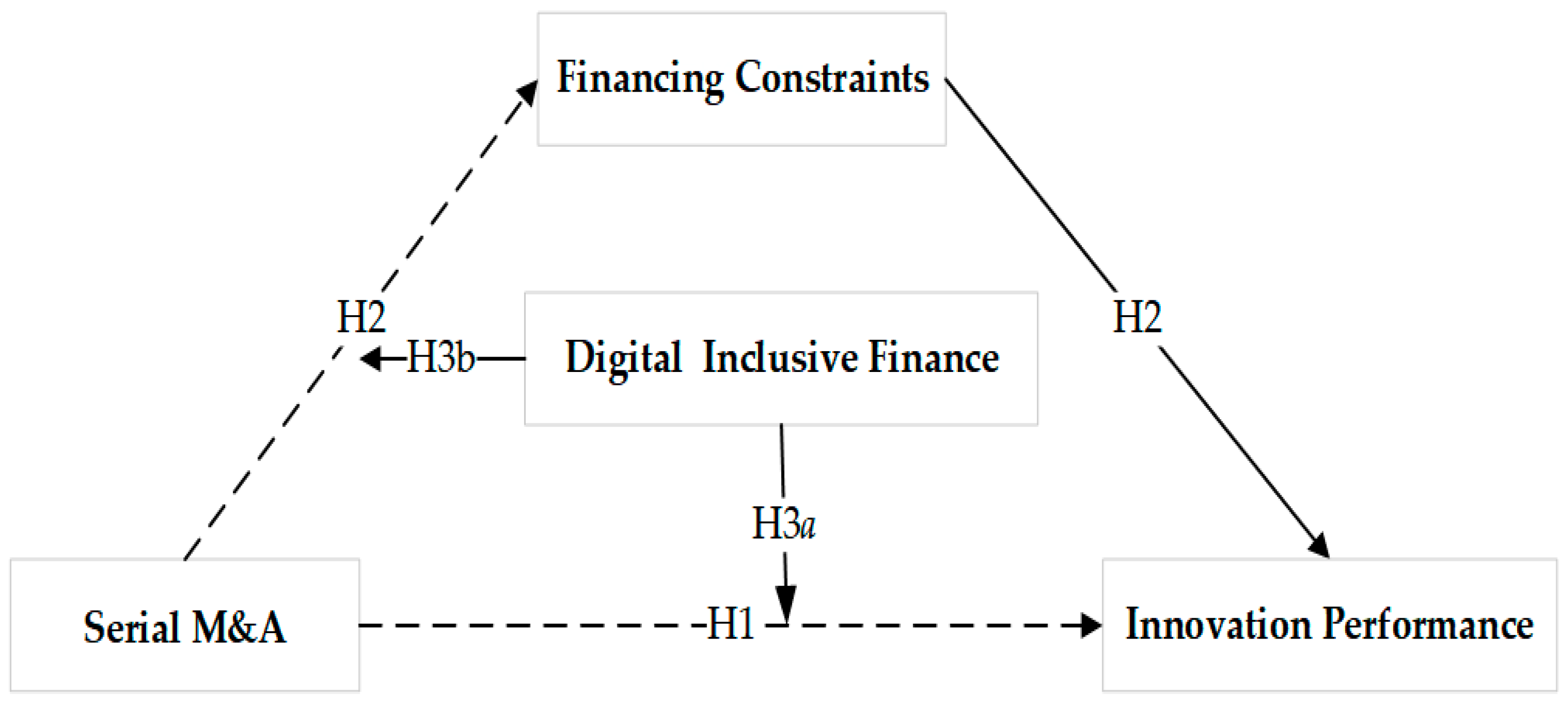

2. Theoretical Analysis and Research Hypothesis

2.1. Serial M&A and Corporate Innovation Performance

2.2. The Mediation Mechanisms of Financing Constraints

2.3. The Moderating Effect of DIF

3. Data Selection, Model Design & Variable Definition

3.1. Data Selection

3.2. Model Design

- (1)

- According to Hypothesis 1, the non-linear relationship between serial M&A and innovation performance is tested, and the baseline model is set as follows:

- (2)

- Based on Hypothesis 2, we examine how the financing constraint mediates the nonlinear relationship between serial M&A and innovation performance. Referring to Baron and Kenny (1986) [83], Zhang and Du (2023) [84], and based on model (1)—financing constraints—a mediating variable is introduced and the model is set as follows:

- (3)

- Under Hypothesis 3, the moderating role of DIF development in the non-linear relationship between serial M&A and innovation performance, and its moderation of the mediating variable financing constraints was tested. Based on models (1), (2a), and (2b), the moderating variable DIF index is introduced and the model is set as follows:

3.3. Variable Definition

- (1)

- Explained Variable: Innovation Performance (). The reasons for using the number of patent applications as the most direct indicator of a firm’s innovation performance are as follows. First, there is uncertainty between R&D investment and the conversion of technological achievements. Second, compared to the number of granted patents, the number of patent applications can more accurately reflect the level of innovation in a firm [85]. Referring to Wu, Yu, and Khan (2023) [60], Kutieshat and Farmanesh (2022) [86], Tang (2022) [87], and others, the total number of invention patents, utility models, and designs plus one is measured by logarithm.

- (2)

- Explanatory variable: serial M&A (). It is measured using the number of M&A that occurred in firm i in year t.

- (3)

- Moderating variable: Financing constraints (). With reference to the method drawn from Hadlock et al. [77], the financing constraint is measured using the SA index, which is derived using two variables (firm size and firm age) that do not vary much over time and are highly exogenous, and is calculated as follows:

- (4)

- Mediator variable: Digital Inclusive Finance Index (). Digital inclusive finance, as an important tool for measuring the high-quality development of a country’s financial sector, aims to drive financial innovation through technological means. The sources of statistical data for the DIF are diverse. Among them, Peking University’s Digital Finance Research Center has utilized data from Ant Group (China’s largest digital finance company) to construct a set of DIF indicators that reflect the actual development of digital finance in China. This index has been widely referenced in studies analyzing the development of digital finance in China and carries a high level of authority. Referring to Lee, Lou, and Wang (2023) [88], Peng and Mao (2023) [89], and others, the Digital Inclusive Finance Index compiled by the Institute of Digital Finance, Peking University was used to measure the degree of DIF in 31 provincial tiers (autonomous regions and municipalities) in mainland China. Since the numerical financial index in the sample takes values in the range of 10 to 500, the natural logarithm of the DIF index plus one is used as a measure to eliminate the effect of the magnitude.

- (5)

- Control variable: This includes firm size, financial leverage, operating revenue growth rate, intensity of R&D investment, government subsidies, board size, shareholding concentration, and executive salary. Considering the effects of year and industry, they are under control in empirical studies. The specific variable descriptions are shown in Table A1 of Appendix A.

4. Empirical Analysis

4.1. Descriptive Statistics and Correlation Analysis

4.2. The Analysis of Empirical Results

4.2.1. Benchmark Analysis and the Mediating Effect of Financing Constraints

4.2.2. U-Test and the Application of Schumpeterian Theory of Innovation

4.2.3. The Moderating Effect of DIF

4.3. Heterogeneity Analysis

4.3.1. Ownership Property Heterogeneity

4.3.2. Business Environment Heterogeneity

4.3.3. Firm Size Heterogeneity

5. Robustness Tests

5.1. Tobit Model Test

5.2. Substitution of Variables

5.3. Narrowing down the Sample Test

5.4. Endogeneity Test

5.5. Bootstrap Test

6. Conclusions and Discussion

6.1. New Findings and Conclusions

6.2. Managerial Implication and Contribution to Practice

6.3. Limitation and Further Development

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Type | Name | Symbol | Description |

|---|---|---|---|

| Dependent variable | Innovation Performance | the natural logarithm of the total number of inventions, utility models, and designs plus one | |

| Independent variable | Serial M&A | represents the number of M&A that occurred in firm i in year t | |

| Mediator variable | Financing Constraint | refer to Model (4) | |

| Moderating variable | Digital Inclusive Finance | the natural logarithm of the digital financial index plus one | |

| Control variable | Firm Size | the natural logarithm of the total asset size of firm i in year t | |

| Financial Leverage | total liabilities divided by total assets | ||

| Operating Revenue Growth Rate | operating income growth divided by total operating income in the previous year | ||

| R&D Investment Intensity | R&D expenditure divided by operating income | ||

| Government Subsidy | the natural logarithm of the total amount of government grants plus one | ||

| CEO Duality | if the Chairman and CEO are the same person, it equals 1, otherwise it equals 0. | ||

| Board Size | total number of directors on board | ||

| Shareholding Concentration | percentage of shares held by the largest shareholder | ||

| Executive Salary | the natural logarithm of executive salary plus one |

References

- González-Torres, T.; Rodríguez-Sánchez, J.-L.; Pelechano-Barahona, E.; García-Muiña, F.E. A systematic review of research on sustainability in mergers and acquisitions. Sustainability 2020, 12, 513. [Google Scholar] [CrossRef] [Green Version]

- Junni, P.; Teerikangas, S. Mergers and acquisitions. In Oxford Research Encyclopedia of Business and Management; Oxford University Press: Oxford, UK, 2019. [Google Scholar]

- David, J.M. The aggregate implications of mergers and acquisitions. Rev. Econ. Stud. 2021, 88, 1796–1830. [Google Scholar] [CrossRef]

- Li, Q.; Guo, J.-J.; Liu, W.; Yue, X.-G.; Duarte, N.; Pereira, C. How knowledge acquisition diversity affects innovation performance during the technological catch-up in emerging economies: A moderated inverse u-shape relationship. Sustainability 2020, 12, 945. [Google Scholar] [CrossRef] [Green Version]

- Zhang, X.; Yao, H.; Du, X. The Peer Effect of Serial Mergers and Acquisitions and the Internal Control of Enterprises. J. Northeast. Univ. Soc. Sci. 2021, 23, 22. [Google Scholar]

- Mingwei, Z.; Jiachun, Y.; Yuju, L.; Yitao, M. A Study of M&A Performance Based on Enterprise Capability Measurement Model: Taking Shanghai RAAS Serial M&A in 2014 as an Example. In Proceedings of the 2020 16th Dahe Fortune China Forum and Chinese High-educational Management Annual Academic Conference (DFHMC), Zhengzhou, China, 4–6 December 2020; pp. 189–193. [Google Scholar]

- Tanna, S.; Yousef, I. Mergers and acquisitions: Implications for acquirers’ market risk. Manag. Financ. 2019, 45, 545–562. [Google Scholar] [CrossRef]

- Golubov, A.; Yawson, A.; Zhang, H. Extraordinary acquirers. J. Financ. Econ. 2015, 116, 314–330. [Google Scholar] [CrossRef] [Green Version]

- Xu, W.; Gao, X.; Li, D.; Zhuang, M.; Yang, S. Serial acquirers and stock price crash risk: International evidence. J. Int. Financ. Mark. Inst. Money 2022, 78, 101538. [Google Scholar] [CrossRef]

- Hossain, M.M.; Pham, M.D.M.; Islam, N. The performance and motivation of serial acquisitions: Evidence from Australia. Int. Rev. Financ. Anal. 2021, 77, 101827. [Google Scholar] [CrossRef]

- Papa, A.; Dezi, L.; Gregori, G.L.; Mueller, J.; Miglietta, N. Improving innovation performance through knowledge acquisition: The moderating role of employee retention and human resource management practices. J. Knowl. Manag. 2020, 24, 589–605. [Google Scholar] [CrossRef]

- Awan, U.; Arnold, M.G.; Gölgeci, I. Enhancing green product and process innovation: Towards an integrative framework of knowledge acquisition and environmental investment. Bus. Strategy Environ. 2021, 30, 1283–1295. [Google Scholar] [CrossRef]

- Cappa, F.; Collevecchio, F.; Oriani, R.; Peruffo, E. Banks responding to the digital surge through Open Innovation: Stock market performance effects of M&As with fintech firms. J. Econ. Bus. 2022, 121, 106079. [Google Scholar]

- Lee, Y.J.; Shin, K.; Kim, E. The influence of a firm’s capability and dyadic relationship of the knowledge base on ambidextrous innovation in biopharmaceutical M&As. Sustainability 2019, 11, 4920. [Google Scholar]

- Li, J.; Wu, X. Technology-driven cross-border M&A, CSR, and enterprise innovation performance—Evidence from China. Sustainability 2022, 14, 4169. [Google Scholar]

- Denicolò, V.; Polo, M. Duplicative research, mergers and innovation. Econ. Lett. 2018, 166, 56–59. [Google Scholar] [CrossRef]

- Rhodes-Kropf, M.; Robinson, D.T. The market for mergers and the boundaries of the firm. J. Financ. 2008, 63, 1169–1211. [Google Scholar] [CrossRef]

- Makri, M.; Hitt, M.A.; Lane, P.J. Complementary technologies, knowledge relatedness, and invention outcomes in high technology mergers and acquisitions. Strateg. Manag. J. 2010, 31, 602–628. [Google Scholar] [CrossRef]

- Chen, F.; Meng, Q.; Li, X. Cross-border post-merger integration and technology innovation: A resource-based view. Econ. Model. 2018, 68, 229–238. [Google Scholar] [CrossRef]

- Ning, Y.; Ju, Y.; Wang, S.-S. The Impact of Technological Relevance on Innovation Performance in Overseas M&A—An Empirical Study Based on Technology Sourcing Overseas M&A. J. Northeast. Univ. Soc. Sci. 2020, 22, 42. [Google Scholar]

- Sarala, R.M.; Vaara, E. Cultural differences, convergence, and crossvergence as explanations of knowledge transfer in international acquisitions. J. Int. Bus. Stud. 2010, 41, 1365–1390. [Google Scholar] [CrossRef]

- Xiao, H.; Shi, Y.; Yang, T. The Impacts Of Board Faultlines On Innovation Performance In Cross-Border Mergers and Acquisitions. Int. J. Innov. Manag. 2023, 26, 2250073. [Google Scholar] [CrossRef]

- Buckley, P.J.; Buckley, P.J.; Cross, A.; Tan, H.; Liu, X.; Voss, H. Historic and emergent trends in Chinese outward direct investment. In Foreign Direct Investment, China and the World Economy; Palgrave Macmillan: London, UK, 2010; pp. 119–162. [Google Scholar]

- Bae, Y.; Lee, K.; Roh, T. Acquirer’s absorptive capacity and firm performance: The perspectives of strategic behavior and knowledge assets. Sustainability 2020, 12, 8396. [Google Scholar] [CrossRef]

- Ahuja, G.; Katila, R. Technological acquisitions and the innovation performance of acquiring firms: A longitudinal study. Strateg. Manag. J. 2001, 22, 197–220. [Google Scholar] [CrossRef]

- Federico, G.; Langus, G.; Valletti, T. Horizontal mergers and product innovation: An economic framework. Int. J. Ind. Organ. 2018, 59, 1–23. [Google Scholar] [CrossRef] [Green Version]

- Haucap, J.; Rasch, A.; Stiebale, J. How mergers affect innovation: Theory and evidence. Int. J. Ind. Organ. 2019, 63, 283–325. [Google Scholar] [CrossRef]

- Zollo, M.; Singh, H. Deliberate learning in corporate acquisitions: Post-acquisition strategies and integration capability in US bank mergers. Strateg. Manag. J. 2004, 25, 1233–1256. [Google Scholar] [CrossRef]

- Del Giudice, M.; Maggioni, V. Managerial practices and operative directions of knowledge management within inter-firm networks: A global view. J. Knowl. Manag. 2014, 18, 841–846. [Google Scholar] [CrossRef]

- Carayannis, E.G.; Grigoroudis, E.; Del Giudice, M.; Della Peruta, M.R.; Sindakis, S. An exploration of contemporary organizational artifacts and routines in a sustainable excellence context. J. Knowl. Manag. 2017, 21, 35–56. [Google Scholar] [CrossRef]

- Wubben, E.F.; Batterink, M.; Kolympiris, C.; Kemp, R.G.; Omta, O.S. Profiting from external knowledge: The impact of different external knowledge acquisition strategies on innovation performance. Int. J. Technol. Manag. 2015, 69, 139–165. [Google Scholar] [CrossRef]

- Xue, H.; Zeng, S.; Sun, D. Radical or Incremental? Impacts of Mergers and Acquisitions on Firms’ Innovation. IEEE Trans. Eng. Manag. 2022, 1–17. [Google Scholar] [CrossRef]

- Duan, Y.; Jin, Y. Financial constraints and synergy gains from mergers and acquisitions. J. Int. Financ. Manag. Account. 2019, 30, 60–82. [Google Scholar] [CrossRef] [Green Version]

- Khatami, S.H.; Marchica, M.-T.; Mura, R. Corporate acquisitions and financial constraints. Int. Rev. Financ. Anal. 2015, 40, 107–121. [Google Scholar] [CrossRef] [Green Version]

- Erel, I.; Jang, Y.; Weisbach, M.S. Do acquisitions relieve target firms’ financial constraints? J. Financ. 2015, 70, 289–328. [Google Scholar] [CrossRef]

- Jiang, Z.; Ma, G.; Zhu, W. Research on the impact of digital finance on the innovation performance of enterprises. Eur. J. Innov. Manag. 2022, 25, 804–820. [Google Scholar] [CrossRef]

- Tang, D.; Chen, W.; Zhang, Q.; Zhang, J. Impact of Digital Finance on Green Technology Innovation: The Mediating Effect of Financial Constraints. Sustainability 2023, 15, 3393. [Google Scholar] [CrossRef]

- Feng, S.; Zhang, R.; Li, G. Environmental decentralization, digital finance and green technology innovation. Struct. Chang. Econ. Dyn. 2022, 61, 70–83. [Google Scholar] [CrossRef]

- Kong, T.; Sun, R.; Sun, G.; Song, Y. Effects of digital finance on green innovation considering information asymmetry: An empirical study based on Chinese listed firms. Emerg. Mark. Financ. Trade 2022, 58, 4399–4411. [Google Scholar] [CrossRef]

- Zhang, L.; Chen, J.; Liu, Z.; Hao, Z. Digital Inclusive Finance, Financing Constraints, and Technological Innovation of SMEs—Differences in the Effects of Financial Regulation and Government Subsidies. Sustainability 2023, 15, 7144. [Google Scholar] [CrossRef]

- Xie, H.; Wen, J.; Wang, X. Digital Finance and High-Quality Development of State-Owned Enterprises—A Financing Constraints Perspective. Sustainability 2022, 14, 15333. [Google Scholar] [CrossRef]

- Pierce, J.R.; Aguinis, H. The too-much-of-a-good-thing effect in management. J. Manag. 2013, 39, 313–338. [Google Scholar] [CrossRef] [Green Version]

- Britton, W.B. Can mindfulness be too much of a good thing? The value of a middle way. Curr. Opin. Psychol. 2019, 28, 159–165. [Google Scholar] [CrossRef]

- Gong, Y.; Yao, Y.; Zan, A. The too-much-of-a-good-thing effect of digitalization capability on radical innovation: The role of knowledge accumulation and knowledge integration capability. J. Knowl. Manag. 2022. [Google Scholar] [CrossRef]

- Turner, K.; Harris, M.C.; Crook, T.R.; Ranft, A.L. Too much of a good thing? An assessment of the effects of competitive and cooperative action repertoires on firm performance. Manag. Decis. 2022, 60, 123–145. [Google Scholar] [CrossRef]

- Li, J.; Liang, B.; Yan, Z. Too Much of a Good Thing? The Impact of Government Subsidies on Incubator Services: Empirical Evidence from China. Sustainability 2022, 14, 14387. [Google Scholar] [CrossRef]

- Haleblian, J.; Kim, J.-Y.; Rajagopalan, N. The influence of acquisition experience and performance on acquisition behavior: Evidence from the US commercial banking industry. Acad. Manag. J. 2006, 49, 357–370. [Google Scholar] [CrossRef] [Green Version]

- Puranam, P.; Srikanth, K. What they know vs. what they do: How acquirers leverage technology acquisitions. Strateg. Manag. J. 2007, 28, 805–825. [Google Scholar] [CrossRef]

- Sahoo, S.; Kumar, A.; Upadhyay, A. How do green knowledge management and green technology innovation impact corporate environmental performance? Understanding the role of green knowledge acquisition. Bus. Strategy Environ. 2023, 32, 551–569. [Google Scholar] [CrossRef]

- Grant, M.; Nilsson, F.; Nordvall, A.-C. Pre-merger acquisition capabilities: A study of two successful serial acquirers. Eur. Manag. J. 2022, 40, 932–942. [Google Scholar] [CrossRef]

- Weber, M.; zu Knyphausen-Aufseß, D.; Schweizer, L. Improving the M&A decision-making process: Learning from serial acquirers. Schmalenbach Bus. Rev. 2019, 71, 295–342. [Google Scholar]

- Bresman, H.; Birkinshaw, J.; Nobel, R. Knowledge transfer in international acquisitions. J. Int. Bus. Stud. 1999, 30, 439–462. [Google Scholar] [CrossRef]

- Deng, P.; Lu, H. Transnational knowledge transfer or indigenous knowledge transfer: Which channel has more benefits for China’s high-tech enterprises? Eur. J. Innov. Manag. 2022, 25, 433–453. [Google Scholar] [CrossRef]

- Yu, H.; Zhang, J.; Zhang, M.; Fan, F. Cross-national knowledge transfer, absorptive capacity, and total factor productivity: The intermediary effect test of international technology spillover. Technol. Anal. Strateg. Manag. 2022, 34, 625–640. [Google Scholar] [CrossRef]

- Kozhakhmet, S.; Nurgabdeshov, A. Knowledge acquisition of Chinese expatriates: Managing Chinese MNEs in Kazakhstan. J. Int. Manag. 2022, 28, 100919. [Google Scholar] [CrossRef]

- Schuhmacher, A.; Gassmann, O.; Bieniok, D.; Hinder, M.; Hartl, D. Open innovation: A paradigm shift in pharma R&D? Drug Discov. Today 2022, 27, 2395–2405. [Google Scholar] [PubMed]

- Tomita, K. Open innovation and drug discovery startups in Japan: The importance of communication in licensing. Asia Pac. Manag. Rev. 2022, 27, 282–291. [Google Scholar] [CrossRef]

- Keenan, L.; Monteath, T.; Wójcik, D. Patents over patients? Exploring the variegated financialization of the pharmaceuticals industry through mergers and acquisitions. Compet. Chang. 2022, 27, 472–494. [Google Scholar] [CrossRef]

- Hanif, N.; Wu, J.; Babar, A.B. Linking ownership acquired in Chinese firms to post-acquisition innovation performance: Role of institutional distance. Chin. Manag. Stud. 2022, 16, 1043–1065. [Google Scholar] [CrossRef]

- Wu, J.; Yu, L.; Khan, Z. How Do Mutual Dependence and Power Imbalance Condition the Effects of Technological Similarity on Post-acquisition Innovation Performance Over Time? Br. J. Manag. 2023, 34, 195–219. [Google Scholar] [CrossRef]

- Liang, Y.; Giroud, A.; Rygh, A. Strategic asset-seeking acquisitions, technological gaps, and innovation performance of Chinese multinationals. J. World Bus. 2022, 57, 101325. [Google Scholar] [CrossRef]

- Hong, X.; Lin, X.; Fang, L.; Gao, Y.; Li, R. Application of machine learning models for predictions on cross-border merger and acquisition decisions with ESG characteristics from an ecosystem and sustainable development perspective. Sustainability 2022, 14, 2838. [Google Scholar] [CrossRef]

- Strobl, A.; Bauer, F.; Degischer, D. Contextualizing deliberate learning from acquisitions: The role of organizational and target contexts. J. Bus. Res. 2022, 139, 194–207. [Google Scholar] [CrossRef]

- Li, J. Can technology-driven cross-border mergers and acquisitions promote green innovation in emerging market firms? Evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 27954–27976. [Google Scholar] [CrossRef] [PubMed]

- Dagaev, N.; Roads, B.D.; Luo, X.; Barry, D.N.; Patil, K.R.; Love, B.C. A too-good-to-be-true prior to reduce shortcut reliance. Pattern Recognit. Lett. 2023, 166, 164–171. [Google Scholar] [CrossRef]

- Jones, C.I.; Williams, J.C. Too much of a good thing? The economics of investment in R&D. J. Econ. Growth 2000, 5, 65–85. [Google Scholar]

- Vătămănescu, E.-M.; Mitan, A.; Cotîrleț, P.C.; Andrei, A.G. Exploring the mediating role of knowledge sharing between informal business networks and organizational performance: An insight into SMEs internationalization in CEE. Sustainability 2022, 14, 3915. [Google Scholar] [CrossRef]

- Brown, J.R.; Petersen, B.C. Cash holdings and R&D smoothing. J. Corp. Financ. 2011, 17, 694–709. [Google Scholar]

- Alkhataybeh, A. Working capital and R&D smoothing: Evidence from the Tel Aviv stock exchange. J. Appl. Econ. 2021, 24, 91–102. [Google Scholar]

- Liu, D.; Li, Z.; He, H.; Hou, W. The determinants of R&D smoothing with asset sales: Evidence from R&D-intensive firms in China. Int. Rev. Econ. Financ. 2021, 75, 76–93. [Google Scholar]

- Nemlioglu, I.; Mallick, S. Effective innovation via better management of firms: The role of leverage in times of crisis. Res. Policy 2021, 50, 104259. [Google Scholar] [CrossRef]

- Hall, B.H.; Moncada-Paternò-Castello, P.; Montresor, S.; Vezzani, A. Financing constraints, R&D investments and innovative performances: New empirical evidence at the firm level for Europe. Econ. Innov. New Technol. 2016, 25, 183–196. [Google Scholar]

- Hall, B.H.; Lerner, J. The financing of R&D and innovation. In Handbook of the Economics of Innovation; Elsevier: Amsterdam, The Netherlands, 2010; Volume 1, pp. 609–639. [Google Scholar]

- Hall, B.H. The financing of innovative firms. Rev. Econ. Inst. 2010, 1, 1. [Google Scholar] [CrossRef]

- Bae, K.H.; Kang, J.K.; Kim, J.M. Tunneling or value added? Evidence from mergers by Korean business groups. J. Financ. 2002, 57, 2695–2740. [Google Scholar] [CrossRef]

- Baker, M.; Stein, J.C.; Wurgler, J. When does the market matter? Stock prices and the investment of equity-dependent firms. Q. J. Econ. 2003, 118, 969–1005. [Google Scholar] [CrossRef] [Green Version]

- Hsu, P.-H.; Tian, X.; Xu, Y. Financial development and innovation: Cross-country evidence. J. Financ. Econ. 2014, 112, 116–135. [Google Scholar] [CrossRef] [Green Version]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Lee, I.; Shin, Y.J. Fintech: Ecosystem, business models, investment decisions, and challenges. Bus. Horiz. 2018, 61, 35–46. [Google Scholar] [CrossRef]

- Zhang, D.; Jin, Y. R&D and environmentally induced innovation: Does financial constraint play a facilitating role? Int. Rev. Financ. Anal. 2021, 78, 101918. [Google Scholar]

- Wu, Y.; Huang, S. The effects of digital finance and financial constraint on financial performance: Firm-level evidence from China’s new energy enterprises. Energy Econ. 2022, 112, 106158. [Google Scholar] [CrossRef]

- Schipper, K.; Thompson, R. Evidence on the capitalized value of merger activity for acquiring firms. J. Financ. Econ. 1983, 11, 85–119. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Zhang, X.; Du, X. Industry and Regional Peer Effects in Corporate Digital Transformation: The Moderating Effects of TMT Characteristics. Sustainability 2023, 15, 6003. [Google Scholar] [CrossRef]

- Griliches, Z. Patent statistics as economic indicators: A survey. In R&D and Productivity: The Econometric Evidence; University of Chicago Press: Chicago, IL, USA, 1998; pp. 287–343. [Google Scholar]

- Kutieshat, R.; Farmanesh, P. The impact of new human resource management practices on innovation performance during the COVID 19 crisis: A new perception on enhancing the educational sector. Sustainability 2022, 14, 2872. [Google Scholar] [CrossRef]

- Tang, H. The effect of ESG performance on corporate innovation in China: The mediating role of financial constraints and agency cost. Sustainability 2022, 14, 3769. [Google Scholar] [CrossRef]

- Lee, C.-C.; Lou, R.; Wang, F. Digital financial inclusion and poverty alleviation: Evidence from the sustainable development of China. Econ. Anal. Policy 2023, 77, 418–434. [Google Scholar] [CrossRef]

- Peng, P.; Mao, H. The Effect of Digital Financial Inclusion on Relative Poverty Among Urban Households: A Case Study on China. Soc. Indic. Res. 2023, 165, 377–407. [Google Scholar] [CrossRef]

- Schumpeter, J.A., II. Capitalism, Socialism, and Democracy, 1942; Routledge: London, UK, 1976. [Google Scholar]

- Nemlioglu, I.; Mallick, S.K. Do managerial practices matter in innovation and firm performance relations? New evidence from the UK. Eur. Financ. Manag. 2017, 23, 1016–1061. [Google Scholar] [CrossRef]

- Dang, C.; Li, Z.F.; Yang, C. Measuring firm size in empirical corporate finance. J. Bank. Financ. 2018, 86, 159–176. [Google Scholar] [CrossRef]

- Smyth, D.J.; Boyes, W.J.; Peseau, D.E. The measurement of firm size: Theory and evidence for the United States and the United Kingdom. Rev. Econ. Stat. 1975, 57, 111–114. [Google Scholar] [CrossRef]

| Variable | Mean | Std.Dev. | Min | Max | ||||

|---|---|---|---|---|---|---|---|---|

| 1.014 | 1.949 | 0 | 11.211 | 1 | ||||

| 1.242 | 1.909 | 0 | 40 | 0.0472 *** | 1 | |||

| −3.817 | 0.274 | −4.786 | 0 | 0.061 *** | −0.090 *** | 1 | ||

| 4.838 | 1.593 | 0 | 6.019 | 0.131 *** | 0.170 *** | −0.269 *** | 1 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Model (1) | Model (1) | Model (2a) | Model (2b) | |

| 0.039 *** (2.98) | 0.025 * (1.93) | −0.005 *** (−2.92) | 0.028 ** (2.23) | |

| −0.001 ** (−2.31) | −0.001 *** (−3.02) | 0.0005 *** (4.21) | −0.002 *** (−3.56) | |

| - | - | - | 0.725 *** (9.66) | |

| Yes | Yes | Yes | Yes | |

| Year | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes |

| Constant | −0.364 *** (−6.00) | −6.597 *** (−19.58) | −3.935 *** (−53.05) | −3.744 *** (−10.26) |

| Observation Value | 12,367 | 12,367 | 12,367 | 12,367 |

| R2 | 0.1250 | 0.1886 | 0.2197 | 0.1966 |

| F | 102.10 *** | 73.46 *** | 82.32 *** | 71.50 *** |

| Lower Bound | Upper Bound | |

|---|---|---|

| Interval | 0 | 40 |

| Slope | 0.086 | −0.198 |

| t-value | 6.362 | −3.029 |

| p > |t| | 0.000 | 0.001 |

| Extreme point | 12.076 | |

| Overall test of presence of the inverse U-shape | t-value = 2.12; p > |t| = 0.017 | |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| Full Samples | Lower DIF Group | Higher DIF Group | |||||||

| Model (3a) | Model (3b) | Model (3c) | Model (1) | Model (2a) | Model (2b) | Model (1) | Model (2a) | Model (2b) | |

| 0.030 (1.35) | −0.009 *** (−3.18) | 0.035 (1.62) | 0.021 (1.31) | −0.003 (−1.49) | 0.024 (1.48) | ||||

| −0.0016 * (−1.70) | 0.0005 *** (3.79) | −0.0019 ** (−2.02) | −0.0013 ** (−2.18) | 0.004 *** (2.93) | −0.0016 *** (−2.58) | ||||

| 0.005 * (1.95) | −0.001 ** (−2.55) | 0.005 ** (2.21) | |||||||

| −0.00028 *** (−3.02) | 0.0001 *** (3.96) | −0.0003 *** (−3.48) | |||||||

| 0.512 *** (6.00) | 0.027 * (1.81) | 0.496 *** (5.83) | |||||||

| 0.724 *** (9.01) | 0.599 *** (5.25) | 0.808 *** (7.17) | |||||||

| Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −8.482 *** (−17.88) | −4.199 *** (−46.10) | −5.444 *** (−11.07) | −6.104 *** (−12.47) | −3.614 *** (−32.57) | −3.939 *** (−8.04) | −7.300 *** (−13.52) | −4.692 *** (−50.57) | −3.509 *** (−5.22) |

| N | 11,302 | 11,302 | 11,302 | 5078 | 5078 | 5078 | 6224 | 6224 | 6224 |

| R2 | 0.1895 | 0.2026 | 0.1970 | 0.1610 | 0.1711 | 0.1655 | 0.1890 | 0.1963 | 0.1973 |

| F | 69.69 *** | 66.09 *** | 68.31 *** | 31.76 *** | 50.18 *** | 32.78 *** | 54.99 *** | 31.25 *** | 53.62 *** |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Group of State-Owned Enterprises | Group of Non-State-Owned Enterprises | |||||

| Model (1) | Model (2a) | Model (2b) | Model (1) | Model (2a) | Model (2b) | |

| 0.016 (0.68) | −0.007 ** (−2.16) | 0.021 (0.89) | 0.038 ** (2.34) | −0.005 ** (−2.42) | 0.042 *** (2.58) | |

| −0.002 (−0.85) | 0.001 (1.33) | −0.002 (−1.07) | −0.0019 *** (−3.24) | 0.001 *** (4.42) | −0.0023 *** (−3.76) | |

| - | - | 0.675 *** (5.95) | - | - | 0.770 *** (7.42) | |

| Yes | Yes | Yes | Yes | Yes | Yes | |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −6.829 *** (−14.12) | −4.799 *** (−49.11) | −3.589 *** (−5.75) | −5.997 *** (−12.82) | −3.101 *** (−29.17) | −3.610 *** (−7.76) |

| N | 6262 | 6262 | 6262 | 6105 | 6105 | 6105 |

| R2 | 0.2151 | 0.3674 | 0.2210 | 0.1777 | 0.1954 | 0.1864 |

| F | 38.78 *** | 89.71 *** | 38.29 *** | 40.89 *** | 33.62 *** | 40.54 *** |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Group of High Business Environment Index | Group of Low Business Environment Index | |||||

| Model (1) | Model (2a) | Model (2b) | Model (1) | Model (2a) | Model (2b) | |

| 0.027 * (1.66) | −0.005 ** (−2.21) | 0.031 * (1.91) | 0.021 (0.87) | −0.004 (−1.28) | 0.024 (0.97) | |

| −0.0016 *** (−2.76) | 0.0004 *** (3.65) | −0.002 *** (−3.24) | −0.002 (−0.97) | −0.0001 (0.49) | −0.002 (−1.00) | |

| - | - | 0.772 *** (8.57) | - | - | 0.663 *** (5.45) | |

| Yes | Yes | Yes | Yes | Yes | Yes | |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −6.856 *** (−15.33) | −4.230 *** (−39.29) | −3.588 *** (−7.43) | −6.098 *** (−11.99) | −3.453 *** (−44.34) | −3.809 *** (−6.95) |

| N | 7532 | 7532 | 7532 | 4835 | 4835 | 4835 |

| R2 | 0.1957 | 0.2342 | 0.2053 | 0.1824 | 0.2766 | 0.1875 |

| F | 51.09 *** | 48.11 *** | 49.64 *** | 27.83 | 61.05 *** | 27.28 *** |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| Group of 25% Firm Size | Group of 25%~75% Firm Size | Group of 75% Firm Size | |||||||

| Model (1) | Model (2a) | Model (2b) | Model (1) | Model (2a) | Model (2b) | Model (1) | Model (2a) | Model (2b) | |

| −0.009 (−0.25) | −0.005 (−1.00) | −0.002 (−0.06) | 0.030 (1.62) | −0.004 (−1.61) | 0.033 * (1.78) | 0.045 (1.63) | −0.005 ** (−2.32) | 0.051 * (1.87) | |

| 0.004 (0.67) | 0.002 ** (2.41) | 0.001 (0.25) | −0.002 ** (−2.25) | 0.001 *** (3.39) | −0.002 *** (−2.77) | −0.002 ** (−1.97) | 0.001 (1.10) | −0.002 ** (−2.08) | |

| - | - | 1.336 *** (9.62) | - | - | 0.690 *** (6.28) | - | - | 1.107 *** (4.92) | |

| Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −4.258 *** (−7.49) | 0.865 *** (4.48) | −5.413 *** (−9.52) | −6.426 *** (−13.60) | −4.069 *** (−42.75) | −3.617 *** (−6.70) | −9.819 *** (−8.16) | −9.431 *** (−80.40) | 0.620 (0.26) |

| N | 3092 | 3092 | 3092 | 6184 | 6184 | 6184 | 3091 | 3091 | 3091 |

| R2 | 0.1805 | 0.5498 | 0.2107 | 0.1770 | 0.2253 | 0.1840 | 0.2429 | 0.7105 | 0.2494 |

| F | 17.19 *** | 49.04 *** | 17.37 *** | 36.73 *** | 43.87 *** | 35.31 *** | 33.26 *** | 153.81 *** | 32.08 *** |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| Tobit Model | Change the Variables | Change the Samples | Samples during the COVID-19 Pandemic | |||||

| 0.317 *** (5.04) | 0.145 ** (2.46) | 0.044 *** (5.01) | 0.016 * (1.84) | 0.045 *** (3.30) | 0.030 ** (2.23) | 0.045 (1.51) | 0.017 * (1.95) | |

| −0.017 *** (−2.77) | −0.013 ** (−2.23) | −0.002 *** (−3.93) | −0.001 *** (−2.90) | −0.001 *** (−2.68) | −0.002 *** (−3.17) | −0.003 (−0.98) | - | |

| NO | Yes | NO | Yes | NO | Yes | Yes | Yes | |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −4.166 *** (−31.77) | −23.562 *** (−19.48) | 0.186 *** (3.46) | −3.387 *** (−14.08) | −0.347 *** (−5.18) | −6.427 *** (−17.15) | −9.010 *** (−17.14) | −8.940 *** (−18.25) |

| N | 12,367 | 12,367 | 12,367 | 12,367 | 10,253 | 10,253 | 4854 | 4854 |

| R2 | 0.0676 | 0.1216 | 0.1273 | 0.1864 | 0.2697 | 0.2659 | ||

| F | 112.37 | 64.73 | 83.43 *** | 61.31 *** | 71.32 *** | 74.25 *** | ||

| Left Intercept Number | 9 329 | 9 329 | ||||||

| Log-likelihood | −13,831.55 | −13,326.785 | ||||||

| 31.30 *** | 1040.83 *** | |||||||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Lag Test | GMM Test | |||||

| Model (1) | Model (2a) | Model (2b) | Model (1) | Model (2a) | Model (2b) | |

| 0.025 * (1.70) | −0.008 *** (−4.49) | 0.031 ** (2.13) | 0.114 ** (2.29) | −0.082 *** (−10.82) | 0.164 *** (3.21) | |

| −0.002 *** (−3.58) | 0.001 *** (5.80) | −0.002 *** (−4.17) | −0.004 *** (−2.80) | 0.002 *** (9.22) | −0.005 *** (−3.58) | |

| - | - | 0.723 *** (8.75) | - | - | 0.613 *** (8.34) | |

| Yes | Yes | Yes | Yes | Yes | Yes | |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −6.915 *** (−18.70) | −4.172 *** (−55.93) | −3.897 *** (−9.36) | −4.667 *** (−14.36) | −4.357 *** (−88.07) | −1.994 *** (−4.29) |

| N | 10,929 | 10,929 | 10,929 | 10,929 | 10,929 | 10,929 |

| R2 | 0.1889 | 0.2128 | 0.1962 | |||

| F | 67.75 *** | 66.70 *** | 65.95 *** | |||

| LM statistic | 7.279 | 7.279 | 27.119 | |||

| Cragg-Donald Wald F statistic | 465.853 | 465.853 | 443.961 | |||

| Mediation Path | Coefficient | Deviation | Standard Error | Lower Limit | Upper Limit | |

|---|---|---|---|---|---|---|

| Indirect effect | −0.006 | −0.0001 | 0.001 | −0.0084 | −0.0037 | (P) |

| −0.0083 | −0.0036 | (BC) | ||||

| Direct effect | 0.054 | −0.0005 | 0.010 | 0.035 | 0.076 | (P) |

| 0.035 | 0.075 | (BC) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, X.; Song, Y.; Liu, H. Too Much of a Good Thing? The Impact of Serial M&A on Innovation Performance. Sustainability 2023, 15, 9829. https://doi.org/10.3390/su15129829

Zhang X, Song Y, Liu H. Too Much of a Good Thing? The Impact of Serial M&A on Innovation Performance. Sustainability. 2023; 15(12):9829. https://doi.org/10.3390/su15129829

Chicago/Turabian StyleZhang, Xiaoxu, Yu Song, and Hongyu Liu. 2023. "Too Much of a Good Thing? The Impact of Serial M&A on Innovation Performance" Sustainability 15, no. 12: 9829. https://doi.org/10.3390/su15129829

APA StyleZhang, X., Song, Y., & Liu, H. (2023). Too Much of a Good Thing? The Impact of Serial M&A on Innovation Performance. Sustainability, 15(12), 9829. https://doi.org/10.3390/su15129829