1. Introduction

The rapid expansion of the global economy has led to significant environmental challenges that are increasingly visible across the globe. Consequently, the issues surrounding economic growth and sustainable development have attracted considerable attention from various countries [

1]. Consequently, there has been a notable increase in research focused on sustainable development [

2,

3]. Sustainable development emphasizes the significance of sustainable finance and investment. As a result, the concepts of the green economy and green finance have emerged as a means to harmonize economic, social, and environmental progress, playing a crucial role in today’s era of economic advancement. The shift towards low-carbon green development has also become a global objective in environmental governance since the 21st United Nations Climate Change Conference of the Parties. This objective aims to transition the economy from a carbon-intensive model to a more environmentally friendly one.

The initiative for sustainable development began with the “Kyoto Protocol” in 1997, which mandated that industrialized countries and partners take measures to mitigate and reduce greenhouse gas (GHG) emissions. As part of this collective agreement, countries set individual targets. Subsequently, the Rio Conference in 2012 concluded by establishing a framework aimed at fostering a green economy that would facilitate sustainable development and alleviate poverty.

The participants agreed on a process to set global Sustainable Development Goals (SDGs). The 2015 Paris Agreement become the milestone for sustainable development, where the conference culminated the process of adopting the 2030 Agenda for Sustainable Development, with 17 SDGs at its core. The five key points of the conference were to limit temperature rise to “well below” 2 °C, to create the first universal climate agreement, to help poorer nations, to publish greenhouse gas reduction targets, and to become carbon neutral by 2050.

Under the UN Sustainable Development Goals (SDGs) and the Paris Agreement, global initiatives aim to balance economic growth with environmental stewardship by regulating carbon emissions and promoting renewable energy. However, implementing these frameworks requires substantial investments. The UNDP focuses on eradicating poverty, promoting peace and justice, and fostering sustainable growth (United Nations UN, 2015). The Paris Agreement aims to limit global temperature increases and secure funding for low-carbon development. To achieve the SDGs by 2030, an estimated annual investment of USD 5–7 trillion is needed (United Nations Conference on Trade and Development [

4], while USD 53 trillion in energy-related investments will be required by 2035 to uphold the 2 °C temperature threshold (United Nations Conference on Trade and Development UNCTAD, 2014). Mobilizing significant public and private capital is crucial for supporting these ambitious environmental agendas.

Climate actions refer to the measures taken by individuals, communities, governments, and organizations to address and mitigate the challenges of climate change. These actions encompass a wide range of strategies to reduce greenhouse gas emissions, promote renewable energy sources, conserve natural resources, and adapt to the changing climate. Climate actions may include implementing renewable energy projects, adopting energy-efficient technologies, promoting sustainable transportation, afforestation initiatives, and developing climate-resilient infrastructure. Additionally, climate actions involve raising awareness, advocating for policy changes, and fostering international cooperation to achieve global climate goals outlined in agreements such as the Paris Agreement.

Climate change and environmental degradation have become pressing global challenges that require urgent action to ensure a sustainable future for our planet. The international community has recognized the need for concerted efforts to mitigate climate change and promote sustainable development, leading to the formulation of the Sustainable Development Goals (SDGs) by the United Nations. SDG 13 [

5] specifically focuses on climate action, aiming to combat climate change and its impacts through various measures, including reducing greenhouse gas emissions and enhancing adaptive capacities [

6].

Green finance plays a vital role in the global financial system, as it focuses on investing in environmentally sustainable projects and promoting low-carbon technologies. It is seen as a significant change within the financial system, aiming to foster sustainable growth and address social and environmental challenges. Financial tools are expected to be crucial in achieving the United Nations’ Sustainable Development Goals by 2030. Countries worldwide recognize the importance of integrating these goals into their national development programs. The concept of a green financial system aligns with sustainable development principles and emphasizes the interdependence between human survival and the environment. It consists of institutions that use various financial instruments, such as green credit, bonds, stock indices, development funds, insurance, carbon finance, and policy incentives. The goal is to facilitate the transition to a more sustainable economy [

7].

Green finance refers to financial activities and investment strategies prioritizing environmental sustainability and promoting the transition to a low-carbon and climate-resilient economy. It encompasses various financial instruments, such as green bonds, green loans, and sustainable investment funds, which channel capital towards environmentally friendly projects and initiatives. Green finance aims to address environmental challenges while creating economic opportunities [

8,

9].

Green bonds play a crucial role in climate action due to their potential to mobilize capital toward environmentally sustainable projects. Green bonds have gained attention due to their unique features, as compared to other bonds, such as financing renewable energy and climate projects, scaling up climate-friendly investments, promoting transparency and accountability (use of proceeds and output of projects), and aligning financial markets with climate goals [

10].

In recent years, there has been a significant increase in the usage of green bonds as a financial tool. A notable development in corporate finance has been the emergence of corporate green bonds. These bonds allocate their proceeds towards financing environmentally friendly and climate-conscious projects, such as renewable energy initiatives, green buildings, resource conservation, and sustainable transportation. Although corporate green bonds have gained popularity in practice, there remains a limited understanding of this relatively new financial instrument. At first glance, it may appear complex for companies to opt for green bonds instead of conventional bonds, as the funds raised from green bonds are dedicated to specific green projects, thereby imposing restrictions on companies’ investment policies. Moreover, becoming a certified green bond issuer is no easy task, as companies must undergo third-party verification to ensure that the proceeds are indeed funding projects that generate environmental benefits. This verification process adds to the administrative and compliance costs for companies. Although this verification process adds to the administrative and compliance costs for companies, the literature found that there is always a positive impact of green bonds on firm performance. For example, Refs. [

11,

12] found that firms with green bonds not only improve their financial performance (decrease financing cost, increase firm value) but also their CSR performance and environmental rating.

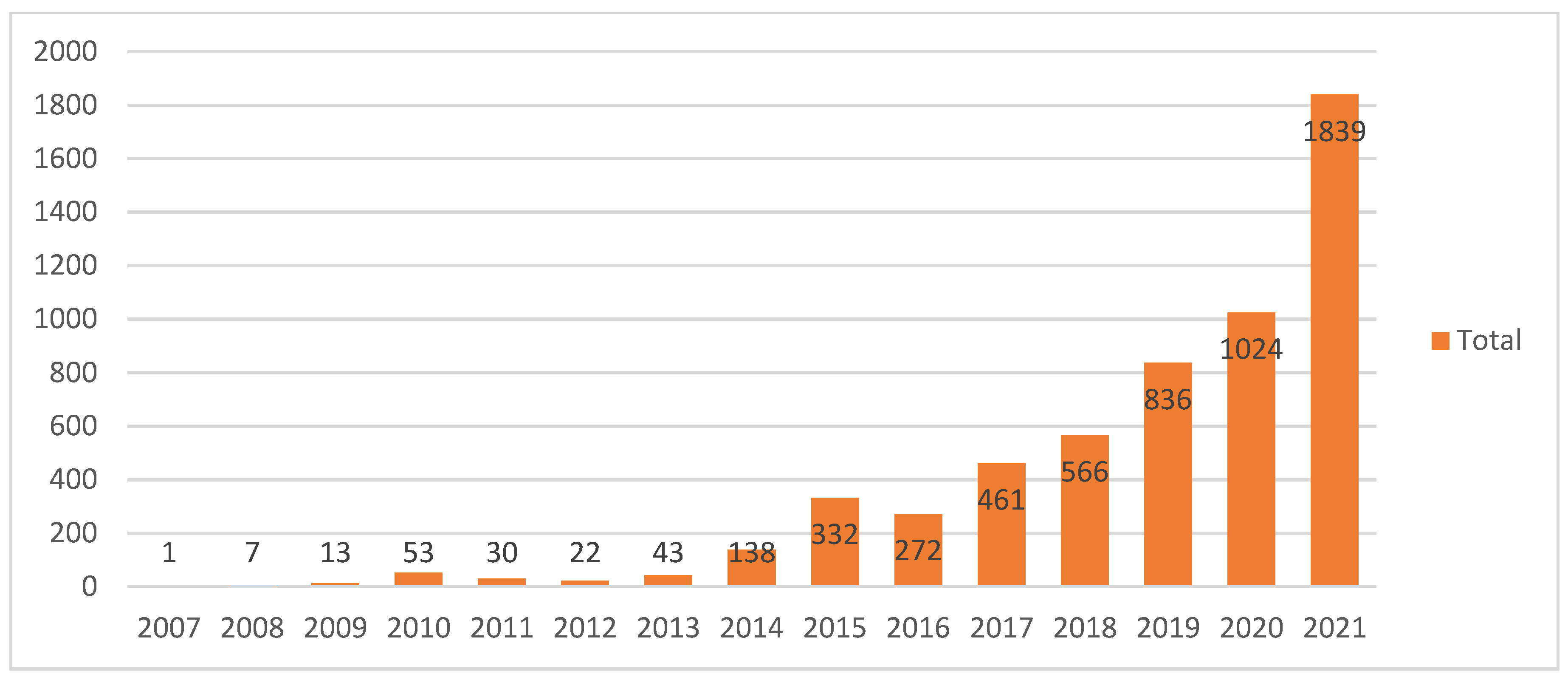

According to the “Climate Bonds Initiative” [

13] and their Green Bond Database, the green bond market has experienced a remarkable expansion, with an average growth rate of 54% over the past five years. As of the end of 2021, the total size of the green bond market amounted to USD 522.7 billion, with a total of 2089 green bond instruments issued. Following a decline in 2020, the green debt market experienced a resurgence, witnessing a 75% increase in volumes in 2021 compared to the previous year [

13]. Despite the rapid growth of the market, there has been a noticeable lack of standardization among green bonds. Insufficient disclosure and clarity at the asset and project level within green bond frameworks present ongoing challenges for investors.

In recent years, there has been a significant increase in the utilization of green bonds as a financial tool. A notable development in the field of corporate finance is the emergence of corporate green bonds. These bonds are specifically designed to finance environmentally friendly and climate-conscious projects, such as renewable energy initiatives, green building projects, resource conservation efforts, and eco-friendly transportation systems. While corporate green bonds have gained popularity, there is still a limited understanding of this innovative financial instrument.

Initially, it may seem complex for companies to opt for green bonds instead of conventional bonds. This is because the proceeds from green bonds are exclusively allocated to green projects, which imposes constraints on companies’ investment policies. Moreover, becoming a certified green bond issuer involves a non-straightforward process. Companies must undergo third-party verification to demonstrate that the funds raised are genuinely used for projects that generate environmental benefits. This verification process adds to the administrative and compliance costs incurred by companies.

According to the “Climate Bonds Initiative” and its Green Bond Database, the green bond market has witnessed substantial growth, averaging a remarkable rate of 54% over the past five years. As of the end of 2021, the total size of the green bond market reached USD 522.7 billion, with 2089 instruments issued. After a decline in 2020, the green debt market experienced a resurgence, with volumes increasing by 75% in 2021 compared to the previous year. Despite the rapid expansion of the market, there remains a notable lack of standardization among green bonds. Investors frequently encounter issues regarding inadequate disclosure and clarity at the asset and project level within green bond frameworks.

Another important concept introduced recently to fight against the increasing carbon emission is the concept of “Net Zero Emission”, which is aimed at reducing greenhouse gas emissions to the lowest possible level, which could be zero. The Paris Agreement, a significant agreement reached at the United Nations Climate Change Conference (COP21), introduced and popularized the concept of achieving net zero greenhouse gas (GHG) emissions. This landmark deal involved nearly 200 countries committing to limiting the impact of GHG emissions by striving to achieve a balance between the emissions produced by human activities and the removal of GHGs from the atmosphere through carbon removal methods. Net-zero emissions will be attained when all GHG emissions caused by human activities are offset by the removal of GHGs from the atmosphere, thereby achieving a state of equilibrium.

Carbon dioxide (CO

2) is the leading contributor to the emission of greenhouse gases (GHGs). Many environmentalists argue that previous environmental initiatives, such as the Kyoto Protocol and United Nations Framework Convention on Climate Change, are no longer adequate and call for new regulations to improve environmental quality. However, policymakers face the challenge of striking a balance between economic growth and reducing environmental harm. The key challenge lies in implementing policy changes that encourage the development of reliable and affordable energy sources while simultaneously reducing GHG emissions. Given that a significant portion of GHG emissions originates from energy production using fossil fuels, various practical policy changes have been suggested to design effective environmental regulations that can impact emissions. One such policy tool is the use of environmental taxes, which not only help mitigate GHG emissions but also incentivize the adoption of renewable energy sources [

14].

The Paris Agreement highlights the global issuance of green bonds through both governmental and corporate sectors as a means to compel corporations to adopt emission reduction policies and contribute to achieving Sustainable Development Goals (SDGs). Given that industries are major contributors to greenhouse gas emissions (GHG), collaboration between governments and industries becomes crucial in attaining SDG goals and net zero emission targets. Following the Paris Agreement, there has been a significant increase in the number of green bonds in the market, prompting numerous studies to explore their benefits for corporations, investors, and society. The majority of these green bonds are issued in sectors such as renewable energy, green transportation, eco-friendly housing, clean water, and electric batteries, among others. Nevertheless, the primary objective remains the reduction in carbon emissions and the promotion of renewable energy production.

In light of the growing importance of green bonds as a tool for climate action and sustainability, it is crucial to further explore their potential, evaluate their effectiveness, and identify ways to enhance their impact. This research aims to contribute to the existing body of knowledge by providing insights into the role of green bonds in achieving SDGs related to climate action and clean energy. Unlike previous studies, we will try to uncover whether there is a direct relationship between green bonds and sustainability in terms of CO2 emissions and renewable energy production. Previous studies only focused on an indirect relationship through qualitative studies or they only examined the policy implications in this regard. We will examine the achievement of sustainable development goals through green bond issuance worldwide. The study will focus on two SDGs: SDG 7, affordable and clean energy, and SDG 13, climate action. This study will try to examine how the issuance of green bonds is impacting carbon emissions and renewable energy production worldwide. The reason for using SDG 7 and 13 is their crucial importance for the achievement of sustainable development goals. As we know, the main aim of sustainability is to reduce emissions and increase renewable energy production. We also used environmental tax as the moderating variable and FDI (foreign direct investment) as the control variable to counter the impact of foreign investments and other sustainability policies.

Our findings yield compelling results, indicating a direct and significant relationship between green bonds and the achievement of sustainable development goals. Particularly noteworthy is the observation that the impact of green bonds became particularly pronounced after the adoption of the Paris Agreement in 2015. The post-2015 period marked a turning point where the influence of green bonds on sustainable development became increasingly evident.

Moreover, our study reveals a robust correlation between green bonds and the attainment of sustainable development goals, particularly in countries with higher levels of green bond issuance. In contrast, countries with lower issuance of green bonds face more challenges in advancing their sustainability objectives.

2. Literature Review

The European Investment Bank (EIB) issued the first green bond in 2007 to support renewable energy and energy efficiency projects. Since then, green bonds have gained significant popularity. Thereafter, the following years did not witness any significant growth in green financing; however, since 2013, there has been a remarkable worldwide surge in the issuance of green bonds after China entered the green bonds market. While the total issuance in 2008 was under USD 1 billion, it surged to USD 143 billion in 2018, a trend often referred to as the “green bond boom.” Experts predict that this trend will persist in the future [

15]. Green bonds are widely recognized as a promising instrument to tackle climate change, as highlighted by commentators and organizations such as Bloomberg [

16]. Green bonds carry the same position and nature in the market as conventional bonds but what makes them different from conventional bonds is the types of projects where funds from green bonds can be used.

At present, a universally accepted definition of green bonds within the global community is lacking, leading scholars to engage in comparative studies to establish consistent identification criteria for green bonds. The name green bond is a self-proclaimed name and regulators worldwide in each country develop their criteria for binding financing to green bonds [

17,

18]. Green bonds, similar to traditional bonds, are backed by the financial standing of the institution and are tied to specific assets. These bonds also possess credit ratings. Numerous researchers, including [

19,

20], have documented the favorable impact of green bonds on the environment, society, and the economy. As the awareness of the risks and uncertainties stemming from climate change and the long-term economic progress has grown among investors, the significance of sustainability, climate mitigation projects, and environmentally friendly investments, such as green bonds, has also increased [

21]. Consequently, over the past decade, governments and corporations in both developed and developing countries have increasingly turned to green bonds as a valuable form of fixed-income debt instrument [

22].

The literature on green bonds can be divided into three different categories. First is yields or pricing (labeling) [

23,

24,

25], second is the nexus between green bonds and other asset classes (as well as the dynamic spillover) [

26,

27], and third is the impact of green bonds on corporations and societies, which includes the most recent studies [

11,

28]. The existing body of literature on green bonds primarily emphasizes qualitative studies rather than quantitative analyses due to the limited period and variety of the sample [

11]. In a more recent study, Ref. [

28] examined global green bond data spanning from 2013 to 2018 and observed that companies experience enhancements in their environmental performance after issuing green bonds. These improvements are evident through higher environmental ratings and reduced emissions.

In today’s era, where sustainable development is considered a sign of success and those businesses who care about ESG (economic governance and social) measures are receiving positive responses from all stakeholders, including corporate and social sectors, such actions compel businesses to undertake projects which are counted as aiding sustainable development. A firm’s sustainable initiatives positively impact businesses, and it helps to start long-term and environmentally friendly projects [

29]. Several studies discuss the relationship between green bonds and CSR (corporate social responsibility). According to [

30], green bond issuance offers key benefits such as the potential to broaden the investor pool and attract environmentally conscious investors who value the environmental aspects of these bonds. Furthermore, Ref. [

18] highlights a growing interest in green finance from both individual and institutional investors, driven by the increasing awareness of environmental conservation and the impact of climate change. Ref. [

31] discovered a notable link between corporate social responsibility (CSR) levels and information asymmetry, indicating that companies can enhance investor perception by reducing information asymmetry.

Green bonds are issued by both governments and corporations. Therefore, there are different outcomes attached to the issuance of green bonds. There are a wide range of drivers that act as catalysts to the institutional pressure that can force organizations to undertake the issuance and development of green bonds [

19,

22,

32]. Several drivers can directly influence the decision to invest more in green bonds or sustainable development, including investors, standard setters, or strategic business partners, and some can influence businesses indirectly, such as government agencies and international bodies [

22,

32,

33,

34] discovered that macroeconomic determinates, such as trade openness and stock market capitalization, also act as drivers for green bond development.

Green bonds have emerged as a significant tool to mobilize funds for environmentally friendly projects. They offer several advantages. Firstly, green bonds enable issuers to access a broader pool of investors, including those with a specific interest in sustainability [

35]. Secondly, they can enhance the issuer’s reputation and signal their commitment to addressing environmental concerns [

36]. Thirdly, green bonds can contribute to the growth of the green finance market and promote the transition to a low-carbon economy [

37].

However, green bonds also come with certain limitations. One concern is the potential for “greenwashing” or the misallocation of funds, where projects may not deliver the intended environmental benefits [

38]. Ensuring transparency and robust reporting standards is crucial to mitigate this risk [

39]. Additionally, the green bond market may face challenges related to scalability and liquidity, as it remains a niche market compared to the overall bond market [

40].

2.1. Green Bonds and Carbon Emissions

Till now the literature has focused on green bonds and their impact on a firm’s financial performance. The limitation of the literature is due to access to green bond data. Currently, only a few studies discussed green bonds and their direct impact on society or sustainability. However, these studies did not use green bond data directly; in fact, they used the green bond index. Ref. [

41], for example, investigated the relationship between the global green bond index (GRBI) and the environmental and social responsibility index (ESRI) index. The results found that there is a positive relationship between GRBI and ESRI, but that the positive impact of green bonds later declined gradually. Additionally, Ref. [

42], investigated the role of green bond financing in economic growth and energy efficiency, and they found that green financing is very useful in economic recovery and producing efficient energy. However, no studies used green bond data directly in any research model, which was due to access to data regarding green bonds.

According to recent data, green bonds are issued by both government and corporate sectors. The corporate sector thus includes green energy or renewable energy, emission, green transportation, carbon emission, sustainable housing, clean waters, etc. Ref. [

43]. Renewable energy is attracting the most investment through green bonds as well as foreign direct investment [

44]. The increasing investment in clean energy is the result of countries planning to reduce carbon emissions and transfer most of their energy resources from carbon-based to clean and green energy. According to a study conducted by Sharma et al., in 2021, it was discovered that economic growth exhibited positive correlations with ecological footprint, non-renewable energy consumption, and carbon emissions.

Few studies demonstrated that the main aim of investing in green energies is to reduce emissions. Some initial studies focused on green finance and government support policies to make it efficient in promoting sustainable development. For instance, Ref. [

45] suggested that the green finance market should be mechanized and regulated to facilitate the flow of funds from institutions to achieve the effective management of environmental risk and the optimal allocation of environmental resources. They also argued that the construction of environmental protection should consider the mechanism of an efficient green finance system that coordinates the relationship between ecology and finance. Ref. [

46] studied the opportunities and challenges surrounding green finance (GF) and suggested effective and long-term policy interventions by the government to ensure the aim of reducing the risks perceived by financial institutions in funding biomass producers. In a study by [

47], it was suggested that implementing supportive policies to encourage the advancement of the renewable energy sector could yield dual benefits in the long run. These benefits include not only an increase in GDP growth but also a reduction in greenhouse gas (GHG) emissions. Ref. [

48] argued that increasing renewable energy (RE) by 1% led to a decline in GHG emissions in the interval (0.166103, 0.220551). Ref. [

49] found that investing in renewable energy can also contribute to decreasing missions.

Apart from financial benefits, there are also environmental benefits attached to green bonds and sustainable eco-friendly activities. Ref. [

28] found that green bond issuers improve their environmental performance post-issuance (i.e., higher environmental ratings and lower emissions) and experience an increase in ownership by long-term and green investors. Ref. [

11] analyzed the impact of green bond issuing announcements on corporate social responsibility (CSR) activities of the Chinese listed firms, which was further reciprocated by the social and environmental activities carried out by the firms [

27] stated that the positive environmental effect instigated by the green bonds trade eases the implementation and diffusion of renewable energy solutions across nations. Ref. [

50] stated that environmental finance can help in creating green financial tools, which in turn can control environmental pollution and optimize the structure of an industry.

Based on the above empirical literature, our first hypothesis is as follows:

H1: Green Bonds will negatively affect carbon dioxide emissions (CO2).

2.2. Green Bonds and Renewable Energy

When we talk about greenhouse gas (GHG) emissions or carbon emissions and sustainable development there is another important factor, namely renewable energy, that should be treated with the same importance. If renewable energy can be integrated into energy systems worldwide, it will decrease the level of GHG emissions. Increasing the deployment of renewable energy sources (RES) aligns with various countries’ policies aimed at achieving a primary outcome of minimizing greenhouse gas (GHG) emissions. Few studies demonstrated that the main aim of investing in green energies is to reduce these emissions. In 2019, Ref. [

47] put forth the proposition that strengthening supportive policies to foster the growth of the renewable energy sector can yield dual benefits in the long run, namely stimulating GDP growth and reducing greenhouse gas (GHG) emissions. They argued that by boosting renewable energy development, both economic and environmental advantages can be achieved simultaneously. Similarly, in 2019, Vasilyeva et al. contended that a mere 1% increase in renewable energy adoption corresponds to a reduction in GHG emissions within the range of 0.166103 to 0.220551. Their findings highlighted the significant potential of renewable energy sources in mitigating climate change and lowering emissions. Building on this research, Ref. [

49] further corroborated the notion that renewable energy plays a crucial role in decreasing emissions. Their study also provided additional evidence supporting the positive environmental impact of renewable energy, reinforcing the idea that transitioning to cleaner energy sources can contribute to emission reduction efforts.

Initial studies focused on the impact of renewable portfolio standards (RPS), feed-in-tariffs (FiTs), and other factors related to country economics that affect energy policies. Ref. [

51] found that investor-owned utilities invest more than publicly owned utilities in regard to RPS and that mandatory green power options (MGPO) lead to greater amounts of green electricity and installed renewable capacity. Ref. [

52] employed a difference-in-differences approach to evaluate the effects of renewable portfolio standards (RPS) on renewable energy (RE) generation, electricity prices, emissions linked to electricity production, and electricity demand. Their findings indicated that the implementation of RPS policies can increase electricity prices, which is in line with the previous studies by [

53,

54] However, Refs. [

55,

56] have the opposite stance on using RPS. Refs. [

57,

58] claim that FiTs are the most suitable policies of choice for spurring RE deployment. Ref. [

59] found that monetary, fiscal, and economic incentives, such as FiTs and direct investments, are the most impactful measures for investors in the wind, solar, and biomass sectors. Then, we have foreign direct investments (FDI), which are prominent factors in a country’s development, especially in the energy sector. Ref. [

44] stated that FDI improves clean energy usage and saves energy consumption by investing in more technologically efficient devices and instruments used to produce and transmit and distribute energy. Ref. [

60] examined data from Chinese renewable energy firms and uncovered the fact that green bonds strengthen investment in renewable energy, while oil price volatility negatively impacts investment in the renewable energy sector. Additionally, they argued that environmental taxes and regulations strengthen renewable or green energy investments in China.

Based on the empirical literature discussed, our second hypothesis is:

H2: Green bonds will positively affect renewable energy production.

2.3. Other Variables Affecting Sustainability

Several research studies have examined the role of environmental taxes and foreign direct investment (FDI) in the context of environmental sustainability. Environmental taxes and FDI are the two vital instruments currently helping to reduce carbon emissions. Environmental taxes force organizations to reduce emissions out of fear of tax costs, and FDIs have been considered a source of sustainable investment in recent years. Ref. [

61] highlighted the interplay between trade liberalization, corruption, and environmental policy formation. Ref. [

62] found evidence that FDI contributes to environmental improvements in Chinese cities. Ref. [

63] explored the impact of government corruption on lobbying for environmental cooperation under the Kyoto Protocol. Ref. [

64] investigated the relationship between environmental performance, regional innovation capacity, and economic growth in China. Ref. [

65] analyzed the link between carbon emissions and FDI in China. These studies provide insights into various aspects of the complex relationship between environmental taxes, FDI, and environmental sustainability, shedding light on the importance of policy frameworks, corruption, innovation, and economic growth in shaping environmental outcomes. Many studies argue that foreign investors prefer to invest in technology-oriented businesses, sustainable projects, or organizations with good ESG scores; as a result, the level of carbon emissions in countries with high FDI will be reduced. Ref. [

66] argued that environmental tax has a negative relationship with carbon emissions in the presence of FDI, while FDI itself also plays a role in decreasing carbon emissions. Ref. [

67] investigated the role of green growth in stimulating a sustainable environment. They found that environmental tax, human capital, and renewable energy use are found to decrease emissions. He et al. [

68] found that environmental taxes help to reduce pollutant emissions, both in OECD countries and China.

Extending the current literature, we will try to find a direct relationship between green bonds and sustainability. Earlier studies examined CO2 emissions and renewable energy in relation to other factors, such as green bonds and stock market/indices, green finance investment, sustainability policies, FDI, and GDP growth. However, the direct relationship of green bonds with sustainability, CO2 emissions, renewable energy, and other factors related to sustainability have not been examined previously. The recent development in the green bonds market has made it necessary to examine the impact of green bonds on sustainable development and policies related to it. The most important factors are CO2 emission and renewable energy.

This study will use green bonds, carbon emissions per capita, and renewable energy per capita data directly to identify whether green bonds play a role in reducing carbon emissions and increasing the production of renewable energy around the world. This study will add to the literature in many ways, as it will be the first study to examine the impact of the green bond on carbon emissions and renewable energy production. The study will also provide detailed information about the recent green bonds market and its categorization. The results will be very useful for evaluating the steps in creating sustainable societies, as green bonds are the most prominent source currently used as a sustainable development tool by both governments and corporations around the world.

3. Data and Methodology

The main variables of our data are “Green Bonds, Renewable Energy per Capita (renewable energy/electricity produced in kilowatt-hours (kWh) per capita refers to the average amount of electricity generated within a specific geographic area or country per person.)” and “carbon emissions per capita (carbon dioxide (CO2) emissions produced by an individual in a specific geographic area, typically measured in metric tons (tonnes) of CO2 per person.)”. “Green Bonds Data” were retrieved from Bloomberg Terminal from 2007 to 2021. Renewable energy (kWh) and emissions per capita (in tons) were retrieved from the Global Carbon Project through “Our World in Data”. Then, we used environmental tax as a moderate variable and “Foreign Direct Investment” as a control variable in our model. The data for environmental tax and FDI were retrieved from the IMF (International Monitory Fund) database. We used data from 67 countries around the world.

We included both supranational bonds and bonds from 67 countries in the category of green bonds. Therefore, the total number of green bond issuers in our dataset is 68. Because supranational bonds are not attached to any country, we placed them in the worldwide category. In the same way, we used worldwide data for other variables in the data to balance our panel. The most important criterium for a country selection is that it must have issued a green bond. Then, we searched for other economic data relevant to that country. The proxy used for “Green Bonds” is the number of “Green Bonds” issued each year and then the amount/worth of these bonds.

We used the one-step generalized method of moment (GMM-One-Step) and a simple “Dynamic panel data model” to estimate our variables with a one-step lag of the dependent variable. The generalized method of moments (GMM) was introduced by [

69]. GMM makes use of the orthogonality conditions to allow for efficient estimation in the presence of unknown heteroscedasticity. The application of the dynamic panel data (DPD) approach is often attributed to [

70] in their influential study published in the Review of Economic Studies in 1991. However, it should be noted that they played a crucial role in popularizing the earlier work of [

71] in the field of econometrics, specifically in the context of panel data analysis.

The GMM model is used to tackle the problems of the endogeneity of lagging dependent variables, heteroscedasticity, and serial correlation in the residuals, correlation, and previous checking of random effects. GMM also controls for the bias derived from omitted variables, because in our data, the number of bonds issued is different every year, and in some years, there were no bonds issued. To solve the problem of endogeneity we used the emissions lag as an instrumental variable to solve the problem of endogeneity. Our data structure also allows us to apply the GMM model, as the number of cross-sections is greater than periods (N > T). The basic equation for the models is as follows:

g(θ) represents the vector of moment conditions. These moment conditions capture the economic relationships.

θ represents the vector of unknown parameters to be estimated (dependent variable).

n represents the sample size.

m(Xi, θ) represents the individual moment conditions, which are functions of the observed data

(Xi) and the unknown parameters

(θ) (independent).

Zi represents the instrumental variables

(IVs) associated with each moment condition.

IVs are variables that are correlated with endogenous variables but not directly affected by the error term.

Our model is defined as follows:

The dependent variables in the model above are CO2 emissions, which represent the total amount of carbon emissions per capita, and renewable energy, which refers to the renewable energy produced per capita. The independent variable of interest is the annual number of green bonds issued by a country (G-bond Number), while the alternative independent variable is the value of green bonds issued (G-bond Value). A moderating variable, E-Tax, measured as the percentage of environmental tax per GDP, is introduced to assess the impact of environmental tax policies on the relationship. Additionally, a control variable, log-FDI, representing the logarithmic value of foreign direct investment in millions (USD), is included. The study aims to analyze how green bonds, environmental taxes, and FDI influence CO2 emissions and renewable energy production per capita.

5. Robustness

To check the robustness of our model and the validity of the data, we applied different tools. The first is econometrics, and the second is data splitting. As we know, the GMM model considers the autocorrelation of the variables. According to Roodman [

72] if AR2 > 0 means there is no second-order serial correlation, then the current conditions are correctly specified. The Hansen test was first implemented by Hansen [

69] and is concerned with over-identifying restrictions in a statistical model. All of our results tables mention the AR (1), AR (2), and Hansen test values, and the results for the Hansen test are significant, as for AR (2), since they are non-significant results which show that the model is fit and that our variables do not suffer from second-order serial correlation.

To check the robustness, we first conducted all our tests with and without control and moderating variables, i.e., FDI and E-Tax. The results are shown in

Table 3,

Table 4,

Table 5 and

Table 6. Additionally, we used the “number of bonds” and the “value of bonds”, which are both given in USD. Both variables provide significant results and do not change anywhere in our results.

Next, we split our data into two groups, namely 2007–2014 and 2015–2021, to further check the authority of our results. We ran the GMM model separately on both, using green bond numbers issued and amounts issued, as was carried out previously. We split the data before and after 2015, as the Paris Agreement was in 2015, and the boom in the number of green bonds issued occurred in 2015 and the year following. Before 2015, there was no such stress on green bonds from governments and institutions.

Table 7 and

Table 8 display results for the data before 2015. The results in

Table 7 show that green bonds have no significant relationship with emissions for both green bond number and the amount issued. However, in

Table 8, we can see that green bonds (numbers) have a positive and significant relationship with renewable energy. Meanwhile, when we applied the amount issued for green bonds instead of green bond numbers, the result was not significant. This means that green bonds do not affect the renewable energy produced, and green bonds have no significant impact on emissions.

Table 7 displays results for the GMM (one-step) model for 2007–2014. The left-hand side displays the result for green bonds (numbers) as the independent variable and emissions as the dependent variable. The right-hand display green bonds (value) as the independent variable and emissions per capita as the dependent variable. FDI (foreign direct investment) is the control variable proxied by the FDI log. E-tax is a moderating variable proxied by the percentage value of the environmental tax to GDP ratio.

Table 8 displays results for the GMM (one-step) model for 2007–2014. The left-hand side displays results for green bonds (numbers) as the independent variable and renewable energy produced per capita (kWh) as the dependent variable. The right-hand side displays green bonds (value) as the independent variable and renewable energy produced per capita (kWh) as the dependent variable. FDI (foreign direct investment) is the control variable proxied by the FDI log. E-tax is a moderating variable proxied by the percentage value of the environmental tax to GDP ratio.

Next, we applied our model to the data after 2015.

Table 9 and

Table 10 display the results for data after 2015.

Table 9 results show that there is a negative and significant relationship between green bonds and emissions. The result is the same for both green bond numbers and the amount issued.

Table 10 displays results for green bonds and renewable energy. The results show that there is a positive and significant relationship between green bonds and renewable energy. The results are holding the same nature for both green bond numbers and the amount issued. In conclusion, we can say that green bonds have had more impact on sustainable development after 2015. These results also indicate that increasing the number of green bonds increases green finance and can help to achieve sustainable development goals. Additionally, we can say that the initiative taken by the international community to achieve SDG goals is on the right track.

Table 9 displays results for the GMM (one-step) model for 2015–2021. The left-hand side displays the result for green bonds (numbers) as the independent variable and emissions as the dependent variable. The right-hand column displays green bonds (value) as the independent variable and emissions per capita as the dependent variable. FDI (foreign direct investment) is the control variable proxied by the FDI log. E-tax is a moderating variable proxied by the percentage value of the environmental tax to GDP ratio.

Table 10 displays results for the GMM (one-step) model for 2015–2021. The left-hand side displays results for green bonds (numbers) as the independent variable and renewable energy produced per capita (kWh) as the dependent variable. The right-hand side displays green bonds (value) as the independent variable and renewable energy produced per capita (kWh) as the dependent variable. FDI (foreign direct investment) is the control variable proxied by the FDI log. E-tax is a moderating variable proxied by the percentage value of the environmental tax to GDP ratio.

Country-Wide Tests

To verify our results, we identified the impact of green bonds in different countries by creating two groups.

Table 11 displays the list of the highest and lowest green bond issuers. The first group consists of fifteen (15) countries with the highest number of green bonds issued, and the second group consists of fifteen countries with the lowest number of green bonds issued.

Table 12,

Table 13,

Table 14 and

Table 15 display results generated from the group data.

Table 12 and

Table 13 show results for countries with the highest number of green bonds issued. The results in

Table 12 exhibit a negative and significant impact of green bonds on carbon emissions. The results are supported by both the number of green bonds and the value/amount of green bonds issued. Then, renewable energy is the dependent variable in

Table 13, where we can see that there is a positive and significant relationship between green bonds and renewable energy.

Table 14 and

Table 15 show the results for the countries with the lowest number of green bonds issued.

Table 14 shows that there is no significant relationship between green bonds and carbon emissions. In the same way, the results in

Table 15 also show that there is no significant relationship between green bonds and renewable energy. Although green bonds show a significant relationship at the 10% level in terms of the amount issued, the observed effect size is relatively small, indicating a weak impact.

Table 12 displays the results for the dynamic panel data model. The left-hand side displays the results for green bonds (numbers) as the independent variable and emissions per capita as the dependent variable. The right-hand side displays green bonds (value) as the independent variable and emissions per capita as the dependent variable. FDI (foreign direct investment) is the control variable proxied by the log of FDI. E-tax is a moderating variable proxied by the percentage value of the environmental tax to GDP ratio.

Table 13 displays the results for the dynamic panel data model. The left-hand side displays the results for green bonds (numbers) as the independent variable and renewable energy produced per capita (kWh) as the dependent variable. The right-hand side displays green bonds (value) as the independent variable and renewable energy produced per capita (kWh) as the dependent variable. FDI (foreign direct investment) is the control variable proxied by the log of FDI. E-tax is a moderating variable proxied by the percentage value of the environmental tax to GDP ratio.

Table 14 displays the results for the dynamic panel data model. The left-hand side displays the results for green bonds (numbers) as the independent variable and emissions per capita as the dependent variable. The right-hand side displays green bonds (value) as the independent variable and emissions per capita as the dependent variable. FDI (foreign direct investment) is the control variable proxied by the FDI log. E-tax is a moderating variable proxied by the percentage value of the environmental tax to GDP ratio.

Table 15 displays the results for the dynamic panel data model. The left-hand side displays the results for green bonds (numbers) as the independent variable and renewable energy produced per capita (kWh) as the dependent variable. The right-hand side displays green bonds (value) as the independent variable and renewable energy produced per capita (kWh) as the dependent variable. FDI (foreign direct investment) is the control variable proxied by the FDI log. E-tax is a moderating variable proxied by the percentage value of the environmental tax to GDP ratio.

Concluding the discussion, it can be seen that countries with the highest green bond-issuing are moving towards sustainability—thus, we can say that a positive impact of green financing and green projects is present—while the countries with the lowest level of green bond-issuing are having trouble achieving sustainability goals. Additionally, they are still facing the problems of high carbon emissions and use only limited renewable resources to produce power.