Does the Construction of High-Speed Rail Change the Development of Regional Finance?

Abstract

:1. Introduction

2. Materials and Methods

2.1. Theoretical Analysis

2.1.1. Direct Effects

2.1.2. Indirect Effects

2.2. Extended Literature on Financial Development

3. Model Setting and Data Analysis

3.1. Model Setting

3.2. Variable Definitions

3.2.1. Dependent Variables

3.2.2. Independent Variables

4. Analysis of the Impact of HSR Construction on Financial Development

4.1. Regression Results

4.1.1. Results

4.1.2. Discussions

4.2. Robustness Test

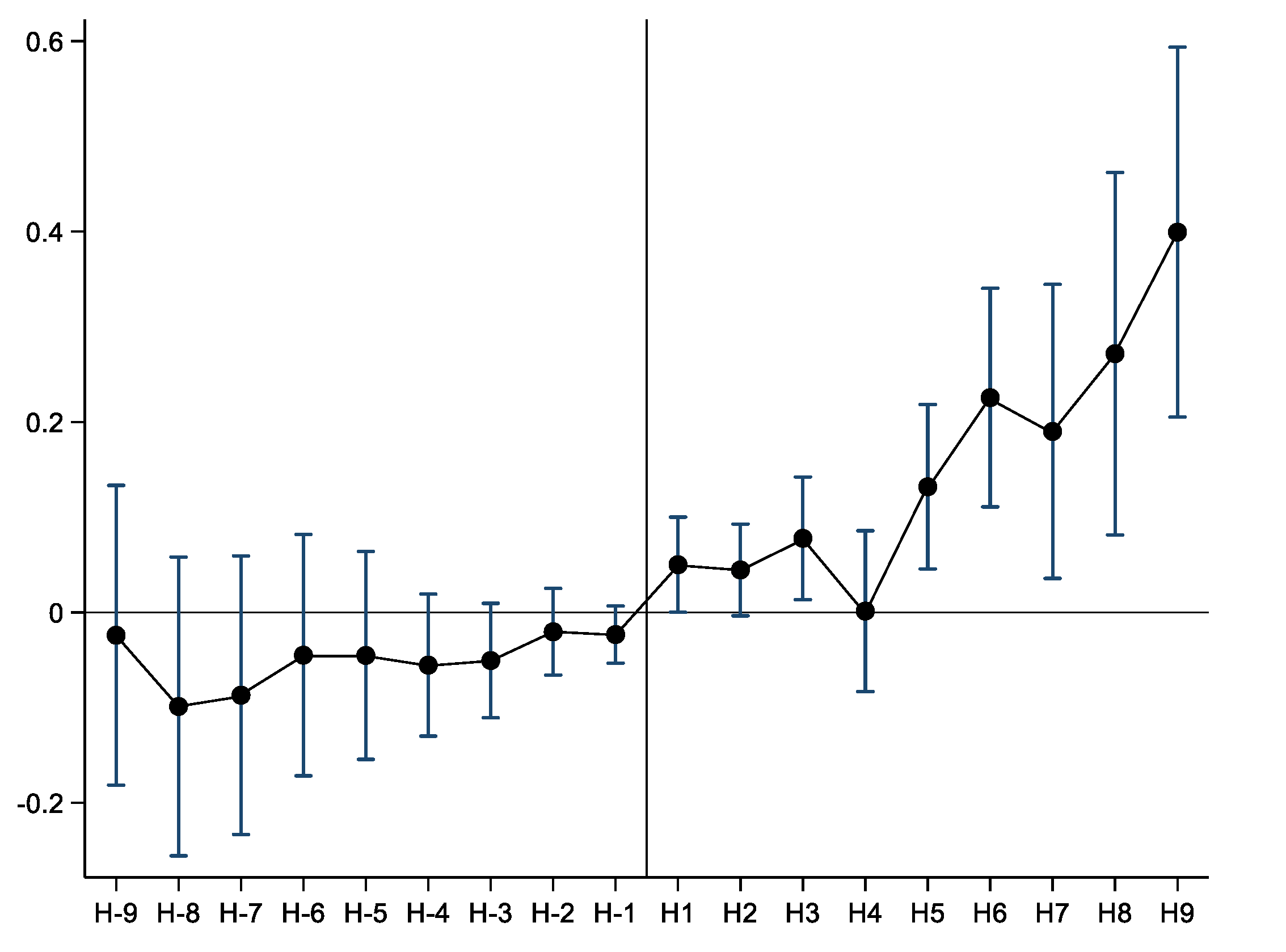

4.2.1. Parallel Trend Test

4.2.2. Regression of Non-Provincial Capitals and Non-Central Cities

4.2.3. Propensity Score Matching Test

4.2.4. Placebo Test

4.2.5. Difference-in-Differences Regression

Hub Cities

Median Division

4.3. Endogenous Test

5. Further Analysis

5.1. Heterogeneity Analysis

5.2. Indirect Mechanism Analysis

6. Conclusions and Policy Recommendations

6.1. Conclusions

6.2. Practical Implications

6.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lu, J.; Song, J.T.; Liang, Y.S.; Xu, J. The simulation of spatial distribution patterns of China’s HSR-economic zones based on the 2D time-space map. Acta Geogr. Sin. 2013, 68, 147–158. [Google Scholar]

- Liu, Y.Z.; Li, Y. High-speed rails and city economic growth in China. J. Financ. Res. 2017, 11, 18–33. [Google Scholar]

- Wang, C.; Meng, W.; Hou, X. The impact of high-speed rails on urban economy: An investigation using night lighting data of Chinese cities. Res. Transp. Econ. 2020, 80, 100819. [Google Scholar] [CrossRef]

- Goldsmith, R.W.; Raymond, W. Financial Structure and Development; Yale University Press: New Haven, CT, USA, 1969; Volume 2, pp. 193–194. [Google Scholar]

- Guiso, L.; Sapienza, P.; Zingales, L. Does Local Financial Development Matter? Q. J. Econ. 2004, 119, 929–969. [Google Scholar] [CrossRef]

- Banerjee, A.; Duflo, E.; Qian, N. On the road: Access to transportation infrastructure and economic growth in China. J. Dev. Econ. 2020, 145, 102442. [Google Scholar] [CrossRef] [Green Version]

- Ma, G.R.; Cheng, X.M.; Yang, E.Y. How does transportation infrastructure affect capital flows—A study from high-speed rail and cross-region investment of listed companies. China Ind. Econ. 2020, 6, 5–23. [Google Scholar]

- Wang, J.; Hu, G.H. The Evaluation of the Development of China’s Inclusive Finance and the Analysis of Factors. Financ. Forum 2013, 18, 31–36. [Google Scholar]

- Rajan, R.G.; Zingales, L. Financial Dependence and Growth. Am. Econ. Rev. 1998, 88, 559–586. [Google Scholar]

- Liu, C.; Liu, C.R.; Sun, T. Transportation infrastructure, financial constraint and county industry development: Evidence from China’s national trunk highway system. Manag. World 2019, 35, 78–88. [Google Scholar]

- Mckinnon, R. Money and Capital in Economic Development; Brookings Institution: Washington, DC, USA, 2010. [Google Scholar]

- Laulajainen, R. Financial Geography: A Banker’s View; Routledge: New York, USA, 2003. [Google Scholar]

- Wangtu, A.X.; Jiangping, Z.; Linchuan, Y.; Ling, L. The implications of high-speed rail for Chinese cities: Connectivity and accessibility. Transp. Res. Part A 2018, 116, 308–326. [Google Scholar]

- Zhao, J.; Huang, J.C. China high-speed railways and stock price crash risk. Manag. World 2018, 34, 157–168+192. [Google Scholar]

- Long, Y.; Zhao, H.L.; Zhang, X.D.; Li, Y. High-speed railway and venture capital investment. Econ. Res. J. 2017, 52, 195–208. [Google Scholar]

- Wang, Z.L.; Lin, X.Y.; Gao, H.W. A study on the impact of transportation infrastructure on financial agglomeration: An evidence based on railways and highways. Macroeconomics 2020, 12, 47–61+120. [Google Scholar]

- De Ureña, J.M. (Ed.) Territorial Implications of High Speed Rail: A Spanish Perspective; Routledge: New York, USA, 2016. [Google Scholar]

- Redding, S.J.; Turner, M.A. Transportation costs and the spatial organization of economic activity. Handb. Reg. Urban Econ. 2015, 5, 1339–1398. [Google Scholar]

- Chen, C.L.; Hall, P. The wider spatial-economic impacts of high-speed trains: A comparative case study of Manchester and Lille sub-regions. J. Transp. Geogr. 2012, 24, 89–110. [Google Scholar] [CrossRef]

- Heuermann, D.F.; Schmieder, J.F. The effect of infrastructure on worker mobility: Evidence from high-speed rail expansion in Germany. J. Econ. Geogr. 2019, 19, 335–372. [Google Scholar] [CrossRef]

- Ke, X.; Chen, H.; Hong, Y.; Hsiao, C. Do China’s high-speed-rail projects promote local economy?—New evidence from a panel data approach. China Econ. Rev. 2017, 44, 203–226. [Google Scholar] [CrossRef]

- Liu, S.; Wan, Y.; Zhang, A. Does China’s high-speed rail development lead to regional disparities? A network perspective. Transp. Res. Part A Policy Pract. 2020, 138, 299–321. [Google Scholar] [CrossRef]

- Li, X.; Wu, Z.; Zhao, X. Economic effect and its disparity of high speed rail in China: A study of mechanism based on synthesis control method. Transp. Policy 2020, 99, 262–274. [Google Scholar] [CrossRef]

- Meng, X.; Lin, S.; Zhu, X. The resource redistribution effect of high-speed rail stations on the economic growth of neighbouring regions: Evidence from China. Transp. Policy 2018, 68, 178–191. [Google Scholar] [CrossRef]

- Zhang, F.; Yang, Z.; Jiao, J.; Liu, W.; Wu, W. The effects of high-speed rail development on regional equity in China. Transp. Res. Part A Policy Pract. 2020, 141, 180–202. [Google Scholar] [CrossRef]

- Claessens, S.; Laeven, L. Financial development, property rights, and growth. J. Financ. 2003, 58, 2401–2436. [Google Scholar] [CrossRef] [Green Version]

- Madsen, J.B.; Islam, M.R.; Doucouliagos, H. Inequality, financial development and economic growth in the OECD, 1870–2011. Eur. Econ. Rev. 2018, 101, 605–624. [Google Scholar] [CrossRef]

- Clark, G.L. London in the European financial services industry: Locational advantage and product Complementarities. J. Econ. Geogr. 2002, 2, 433–453. [Google Scholar] [CrossRef]

- De Rus, G. Economic Analysis of High Speed Rail in Europe, Fundacion BBVA/BBVA Foundation. 2012. Available online: https://econpapers.repec.org/bookchap/fbbreport/2012126.htm (accessed on 30 June 2012).

- Bian, Y.C.; Wu, L.H.; Bai, J.H. Does high-speed rail improve regional innovation in China? J. Financ. Res. 2019, 6, 132–149. [Google Scholar]

- Agarwal, S.; Hauswald, R. Distance and private information in lending. Rev. Financ. Stud. 2010, 23, 2757–2788. [Google Scholar] [CrossRef]

- Cook, G.A.S.; Pandit, N.R.; Beaverstock, J.V.; Taylor, P.J.; Pain, K. The role of location in knowledge creation and diffusion: Evidence of centripetal and centrifugal forces in the City of London financial services agglomeration. Environ. Plan. A-Econ. Space 2007, 39, 1325–1345. [Google Scholar] [CrossRef]

- Zhao, S.X.B.; Zhang, L.; Wang, D.T. Determining factors of the development of a national financial center: The case of China. Geoforum 2004, 35, 577–592. [Google Scholar] [CrossRef] [Green Version]

- Liberti, J.M.; Petersen, M.A. Information: Hard and soft. Rev. Corp. Financ. Stud. 2019, 8, 1–41. [Google Scholar] [CrossRef] [Green Version]

- Chu, J.; Fang, J.X. Improvement of transport infrastructure and bank loan decision: Based on a quasi—Natural experiment of high-speed railway in China. Account. Econ. Res. 2019, 33, 38–60. [Google Scholar]

- Hollander, S.; Verriest, A. Bridging the gap: The design of bank loan contracts and distance. J. Financ. Econ. 2016, 119, 399–419. [Google Scholar] [CrossRef]

- Coto-Millán, P.; Inglada, V.; Rey, B. Effects of network economies in high-speed rail: The Spanish case. Ann. Reg. Sci. 2007, 41, 911–925. [Google Scholar] [CrossRef]

- Dong, Y.M.; Zhu, Y.M. Can high-speed rail construction reshape the layout of China’s economic space—Based on the perspective of regional heterogeneity of employment, wage and economic. China Ind. Econ. 2016, 10, 92–108. [Google Scholar]

- Taylor, A.; Beaverstock, J.V.; Cook, G.; Pandit, N.; Pain, K. Financial Services Clustering and Its Significance for London; Corporation of London: London, UK, 2003. [Google Scholar]

- Cheng, X.; Wang, M.Y.; Tian, X.; Kang, M.M. Spatial dynamic differences and influencing factors of China’s financial development level. Financ. Forum 2018, 23, 43–54. [Google Scholar]

- Joassart-Marcelli, P.; Stephens, P. Immigrant banking and financial exclusion in greater boston. J. Econ. Geogr. 2010, 10, 883–912. [Google Scholar] [CrossRef]

- Sarma, M.; Pais, J. Financial inclusion and development. J. Int. Dev. 2011, 23, 613–628. [Google Scholar] [CrossRef]

- Lu, J.; Jin, X.J. China’s regional financial development: Geographical environment and economic policy—An empirical analysis based on the perspective of financial geography. Financ. Theory Pract. 2007, 6, 7–9. [Google Scholar]

- Poncet, S.; Steingress, W.; Vandenbussche, H. Financial Constraints in China: Firm-Level Evidence. China Econ. Rev. 2010, 21, 411–422. [Google Scholar] [CrossRef] [Green Version]

- Song, Z.; Storesletten, K.; Zilibotti, F. Growing Like China. Am. Econ. Rev. 2009, 101, 196–233. [Google Scholar] [CrossRef] [Green Version]

- Allen, F.; Bartiloro, L.; Gu, X.; Kowalewski, O. Does economic structure determine financial structure? J. Int. Econ. 2018, 114, 389–409. [Google Scholar] [CrossRef]

- Zhao, Z.; Zheng, Y.; Chen, Y.; Ye, C.; He, Z. Research on the Impact of Innovative City Construction on Financial Development: Evidence from China. Discret. Dyn. Nat. Soc. 2021, 2021, 7541690. [Google Scholar] [CrossRef]

- Peng, Y.C.; Huang, X.J.; Shen, J. Real estate investment and financial efficiency: Regional variation in shifting financial resouces from real to fictitious sector. J. Financ. Res. 2018, 8, 51–68. [Google Scholar]

- Yu, Y.Z.; Xuan, Y.; Shen, Y.Y. The spatial spillover effect of financial agglomeration on the improvement of industrial efficiency. J. World Econ. 2013, 36, 93–116. [Google Scholar]

- Liu, T.S. A spatial panel econometric analysis of influencing factors in regional financial development. J. Financ. Econ. 2011, 7, 33–35. [Google Scholar]

- Russo, F. Which High-Speed Rail? LARG Approach between Plan and Design. Future Transp. 2021, 1, 202–226. [Google Scholar] [CrossRef]

- Behrens, K.; Lamorgese, A.R.; Ottaviano, G.I.; Tabuchi, T. Changes in transport and non-transport costs: Local vs global impacts in a spatial network. Reg. Sci. Urban Econ. 2007, 37, 625–648. [Google Scholar] [CrossRef] [Green Version]

- Li, H.C.; Tjia, L.; Hu, S.X. Agglomeration and equalization effect of high speed railway on cities in China. J. Quant. Tech. Econ. 2016, 33, 127–143. [Google Scholar]

- Faber, B. Trade integration, market size, and industrialization: Evidence from China’s National Trunk Highway System. Rev. Econ. Stud. 2014, 81, 1046–1070. [Google Scholar] [CrossRef] [Green Version]

- Qin, Y. ‘No county left behind?’ The distributional impact of high-speed rail upgrades in China. J. Econ. Geogr. 2017, 17, 489–520. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.F.; Ni, P.F. Economic growth spillover and spatial optimization of high-speed railway. China Ind. Econ. 2016, 2, 21–36. [Google Scholar]

- Du, X.Q.; Wei, P.M. Do high-speed trains motivate the flow of corporate highly educated talents? Bus. Manag. J. 2017, 39, 89–107. [Google Scholar]

- Feng, S.; Fan, H.Z.; Zhang, Y.H. Influences of high-speed railway on urban productivity. Urban Probl. 2018, 6, 14–19. [Google Scholar]

- Chen, Z.; Xue, J.; Rose, A.; Haynes, E.H. The impact of high-speed rail investment on economic and environmental change in China: A dynamic CGE analysis. Transp. Res. Part A Policy Pract. 2016, 92, 232–245. [Google Scholar] [CrossRef]

- Combes, P.P.; Mayer, T.; Thisse, J.F. Economic Geography: The Integration of Regions and Nations; Princeton University Press: Princeton, NJ, USA, 2008. [Google Scholar]

- Liu, J.F.; Zhao, Y. Can the high-speed rail construction promote the spatial equilibrium develpoment of urbanization? An analysis based on 163 prefectural level data of China’s middle west region. Urban Probl. 2018, 5, 15–25. [Google Scholar]

| Dependent Variables | Measurement |

|---|---|

| The financial scale of city in year is measured by the financial correlation rate. The calculation formula is: . | |

| The financial agglomeration of city in year is measured by the location entropy of residents’ deposits. Calculation formula is: . P represents the total population of the city at the end of the year. | |

| The financial leverage of city in year is measured by the ratio of the loan balance of the financial institution to the deposit balance. The calculation formula is: . | |

| The financial efficiency of city in year is measured by the ratio of GDP to the loan balance of financial institutions. The calculation formula is: . | |

| The financial depth of city in year is measured by per capita loans. The calculation formula is: . represents the total population of the city at the end of the year. | |

| The financial structure of city in year is measured by the proportion of deposits of urban and rural residents in deposits of financial institutions. The calculation formula is: . |

| Independent Variables | Measurement |

|---|---|

| The opening intensity of HSR in city in year is measured by the number of HSR lines, with a range of 0–7. | |

| GDP growth rate of city in year . | |

| Percentage of the gross industrial output value above designated size in the annual GDP of city in year . | |

| Highway passenger traffic of city in year . | |

| The natural population growth rate of city year . | |

| The proportion of the number of students in ordinary colleges and universities in the total population of city in year . | |

| Percentage of fiscal expenditure in GDP of city in year after deducting expenditure on science and education. | |

| The actual amount of foreign investment used in city in year . |

| Variables | Financial Broadening | Financial Deepening | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Financial Scale (FS) | Financial Agglomeration (FA) | Financial Leverage (FL) | Financial Efficiency (FE) | Financial Depth (FD) | Financial Structure (FC) | |||||||

| Regression (1) | Regression (2) | Regression (3) | Regression (4) | Regression (5) | Regression (6) | Regression (7) | Regression (8) | Regression (9) | Regression (10) | Regression (11) | Regression (12) | |

| HSR | −0.2435 *** (−3.94) | −0.2347 *** (−3.40) | −0.0418 ** (−2.12) | −0.0693 *** (−3.12) | −0.0392 *** (−4.05) | −0.0314 *** (−3.62) | 0.1317 *** (8.22) | 0.1044 *** (6.36) | 1.6672 *** (6.09) | 1.1428 *** (4.87) | −0.0026 (−0.71) | −0.0109 *** (−3.27) |

| GDPGR | 0.7084 ** (2.50) | 0.7977 *** (7.84) | −0.2835 ** (−2.20) | 0.4237 *** (4.24) | 9.9743 *** (3.02) | 0.3697 *** (9.60) | ||||||

| IND | −0.0298 (−0.40) | 0.0444 (1.21) | −0.0136 (−0.84) | −0.0141 (−0.78) | −0.5292 (−1.49) | −0.0013 (−0.44) | ||||||

| PAS | 0.1938 *** (3.32) | 0.0851 ** (2.11) | 0.0118 (1.15) | −0.0564 ** (−2.52) | −0.9453 * (−1.86) | 0.0028 (0.53) | ||||||

| NPGR | −0.0169 *** (−3.31) | −0.0024 * (−1.78) | −0.0039 ** (−2.14) | 0.0051 *** (3.19) | 0.0023 (0.07) | −0.0004 (−0.97) | ||||||

| EDU | −4.0486 (−0.50) | −0.2141 (−0.06) | 1.4252 (1.25) | 6.1749 *** (3.34) | 120.8834 *** (2.87) | −0.5766 (−1.49) | ||||||

| GOVE | 2.1424 * (1.87) | 0.1219 (1.39) | −0.3915 ** (−2.25) | −0.0617 (−0.21) | −0.3952 (−0.23) | −0.0324 (−0.72) | ||||||

| FORE | −0.0399 (−0.70) | −0.0203 ** (−2.21) | −0.0027 (−0.28) | −0.0050 (−0.39) | −0.0466 (−0.45) | −0.0085 *** (−3.22) | ||||||

| _cons | 2.0308 *** (61.97) | 0.5741 (0.74) | 0.9875 *** (75.14) | 0.2353 (0.65) | 0.6091 *** (96.96) | 0.6555 *** (5.12) | 1.6412 *** (107.19) | 1.9748 *** (8.22) | 2.8579 *** (14.95) | 8.1750 * (1.88) | 0.5827 *** (200.24) | 0.5804 *** (11.38) |

| City effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 2695 | 2563 | 2689 | 2560 | 2698 | 2566 | 2694 | 2562 | 2697 | 2565 | 2690 | 2561 |

| Cities | 270 | 270 | 270 | 270 | 270 | 270 | 270 | 270 | 270 | 270 | 270 | 270 |

| Variables | Financial Broadening | Financial Deepening | ||||

|---|---|---|---|---|---|---|

| Financial Scale (FS) | Financial Agglomeration (FA) | Financial Leverage (FL) | Financial Efficiency (FE) | Financial Depth (FD) | Financial Structure (FC) | |

| Regression (13) | Regression (14) | Regression (15) | Regression (16) | Regression (17) | Regression (18) | |

| HSR | −0.1784 * (−1.92) | −0.0749 *** (−2.70) | −0.0222 ** (−2.06) | 0.0778 *** (3.60) | 0.6578 ** (2.23) | −0.0110 ** (−2.45) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| _cons | −0.1228 (−0.14) | 0.0168 (0.05) | 0.5624 *** (4.58) | 2.3217 *** (8.85) | 11.9622 *** (2.82) | 0.5863 *** (10.21) |

| City effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 2272 | 2270 | 2274 | 2271 | 2273 | 2271 |

| Cities | 240 | 240 | 240 | 240 | 240 | 240 |

| Variables | Financial Broadening | Financial Deepening | ||||

|---|---|---|---|---|---|---|

| Financial Scale (FS) | Financial Agglomeration (FA) | Financial Leverage (FL) | Financial Efficiency (FE) | Financial Depth (FD) | Financial Structure (FC) | |

| Regression (19) | Regression (20) | Regression (21) | Regression (22) | Regression (23) | Regression (24) | |

| HSR | −0.1882 ** (−2.05) | −0.0527 *** (−3.48) | −0.0259 ** (−2.50) | 0.0773 *** (3.49) | 0.3238 ** (1.99) | −0.0100 ** (−2.36) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| _cons | 0.0360 (0.04) | 0.3195 ** (1.99) | 0.5366 *** (4.59) | 2.1738 *** (7.91) | 6.7893 *** (3.53) | 0.6144 *** (11.22) |

| City effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 2260 | 2257 | 2263 | 2259 | 2262 | 2258 |

| Cities | 253 | 252 | 254 | 253 | 254 | 252 |

| Variables | Financial Broadening | Financial Deepening | ||||

|---|---|---|---|---|---|---|

| Financial Scale (FS) | Financial Agglomeration (FA) | Financial Leverage (FL) | Financial Efficiency (FE) | Financial Depth (FD) | Financial Structure (FC) | |

| Regression (25) | Regression (26) | Regression (27) | Regression (28) | Regression (29) | Regression (30) | |

| HSR | −0.1757 * (−1.81) | −0.0422 *** (−3.26) | −0.0259 ** (−2.49) | 0.0723 *** (3.18) | 0.2737 * (1.90) | −0.0096 ** (−2.14) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| _cons | −0.2817 (−0.33) | 0.2675 * (1.66) | 0.4751 *** (4.21) | 2.3217 *** (8.47) | 7.6263 *** (4.14) | 0.6152 *** (11.16) |

| City effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 2197 | 2195 | 2199 | 2196 | 2198 | 2196 |

| Cities | 237 | 237 | 237 | 237 | 237 | 237 |

| Variables | Full Sample | Non-Provincial Capitals and Non-Central Cities | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Financial Broadening | Financial Deepening | Financial Broadening | Financial Deepening | |||||||||

| Financial Scale (FS) | Financial Agglomeration (FA) | Financial Leverage (FL) | Financial Efficiency (FE) | Financial Depth (FD) | Financial Structure (FC) | Financial Scale (FS) | Financial Agglomeration (FA) | Financial Leverage (FL) | Financial Efficiency (FE) | Financial Depth (FD) | Financial Structure (FC) | |

| Regression (31) | Regression (32) | Regression (33) | Regression (34) | Regression (35) | Regression (36) | Regression (37) | Regression (38) | Regression (39) | Regression (40) | Regression (41) | Regression (42) | |

| HSR | 0.0059 (0.05) | 0.0026 (0.12) | 0.0104 (0.66) | −0.0034 (−0.10) | −0.3218 (−1.24) | 0.0008 (0.21) | −0.0639 (−0.54) | −0.0114 (−0.56) | 0.0041 (0.24) | 0.0220 (0.61) | −0.0601 (−0.30) | −0.0006 (−0.15) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| _cons | 0.7997 (0.91) | 0.3639 (0.93) | 0.6705 *** (5.83) | 1.8585 *** (7.70) | 9.5839 *** (2.68) | 0.6275 *** (16.60) | −0.2810 (−0.29) | −0.0210 (−0.05) | 0.6783 *** (5.96) | 2.2194 *** (8.50) | 12.0395 *** (3.44) | 0.6425 *** (15.44) |

| City effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 2354 | 2353 | 2357 | 2353 | 2356 | 2354 | 2086 | 2084 | 2088 | 2085 | 2087 | 2085 |

| Cities | 270 | 270 | 270 | 270 | 270 | 270 | 240 | 240 | 240 | 240 | 240 | 240 |

| Variables | DID | PSM-DID | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Financial Broadening | Financial Deepening | Financial Broadening | Financial Deepening | |||||||||

| Financial Scale (FS) | Financial Agglomeration (FA) | Financial Leverage (FL) | Financial Efficiency (FE) | Financial Depth (FD) | Financial Structure (FC) | Financial Scale (FS) | Financial Agglomeration (FA) | Financial Leverage (FL) | Financial Efficiency (FE) | Financial Depth (FD) | Financial Structure (FC) | |

| Regression (43) | Regression (44) | Regression (45) | Regression (46) | Regression (47) | Regression (48) | Regression (49) | Regression (50) | Regression (51) | Regression (52) | Regression (53) | Regression (54) | |

| HSR | −0.3044 * (−1.79) | −0.1432 ** (−2.40) | −0.0615 *** (−3.08) | 0.2187 *** (5.52) | 2.5855 *** (3.53) | −0.0231 *** (−3.02) | −0.2341 *** (−3.07) | −0.0619 *** (−2.71) | −0.0327 *** (−3.45) | 0.1038 *** (5.73) | 0.9504 *** (4.29) | −0.0099 *** (−2.76) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| _cons | 0.7042 (0.91) | 0.2780 (0.79) | 0.6752 *** (5.36) | 1.9114 *** (8.12) | 7.4438 * (1.76) | 0.5874 *** (11.64) | 0.6571 (0.82) | 0.1974 (0.53) | 0.6522 *** (4.97) | 2.0033 *** (8.04) | 9.6914 ** (2.23) | 0.5707 *** (10.93) |

| City effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 2563 | 2560 | 2566 | 2562 | 2565 | 2561 | 2529 | 2526 | 2532 | 2528 | 2531 | 2527 |

| Cities | 270 | 270 | 270 | 270 | 270 | 270 | 269 | 269 | 269 | 269 | 269 | 269 |

| Variables | DID | PSM-DID | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Financial Broadening | Financial Deepening | Financial Broadening | Financial Deepening | |||||||||

| Financial Scale (FS) | Financial Agglomeration (FA) | Financial Leverage (FL) | Financial Efficiency (FE) | Financial Depth (FD) | Financial Structure (FC) | Financial Scale (FS) | Financial Agglomeration (FA) | Financial Leverage (FL) | Financial Efficiency (FE) | Financial Depth (FD) | Financial Structure (FC) | |

| Regression (55) | Regression (56) | Regression (57) | Regression (58) | Regression (59) | Regression (60) | Regression (61) | Regression (62) | Regression (63) | Regression (64) | Regression (65) | Regression (66) | |

| HSR | −0.9092 *** (−5.85) | −0.1823 *** (−2.74) | −0.1061 *** (−2.78) | 0.3739 *** (8.50) | 4.3697 *** (3.36) | −0.0302 *** (−3.41) | −0.9307 *** (−5.28) | −0.1544 ** (−2.30) | −0.0914 ** (−2.32) | 0.3526 *** (7.19) | 3.3278 *** (2.64) | −0.0200 ** (−2.23) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| _cons | 0.6444 (0.85) | 0.2572 (0.71) | 0.6651 *** (5.25) | 1.9437 *** (8.18) | 7.8376 * (1.75) | 0.5837 *** (11.30) | 0.8603 (0.99) | 0.1835 (0.43) | 0.5896 *** (4.45) | 2.0689 *** (7.68) | 9.7348 * (1.89) | 0.5949 *** (10.95) |

| City effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 2563 | 2560 | 2566 | 2562 | 2565 | 2561 | 2351 | 2348 | 2354 | 2350 | 2353 | 2349 |

| Cities | 270 | 270 | 270 | 270 | 270 | 270 | 267 | 267 | 267 | 267 | 267 | 267 |

| Variables | Financial Broadening | Financial Deepening | ||||

|---|---|---|---|---|---|---|

| Financial Scale (FS) | Financial Agglomeration (FA) | Financial Leverage (FL) | Financial Efficiency (FE) | Financial Depth (FD) | Financial Structure (FC) | |

| Regression (67) | Regression (68) | Regression (69) | Regression (70) | Regression (71) | Regression (72) | |

| HSR | −0.6145 ** (−2.25) | −0.1226 ** (−2.57) | −0.0643 ** (−2.39) | 0.1668 *** (2.68) | 2.0674 ** (2.51) | −0.0132 * (−1.67) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| City effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 1639 | 1635 | 1640 | 1638 | 1639 | 1636 |

| K-P LM statistic | 76.099 *** | 75.468 *** | 75.222 *** | 76.666 *** | 74.981 *** | 75.710 *** |

| Variables | Financial Broadening | Financial Deepening | ||||

|---|---|---|---|---|---|---|

| Financial Scale (FS) | Financial Agglomeration (FA) | Financial Leverage (FL) | Financial Efficiency (FE) | Financial Depth (FD) | Financial Structure (FC) | |

| Regression (7) | Regression (8) | Regression (9) | Regression (10) | Regression (11) | Regression (12) | |

| HSR | −0.3286 *** (−4.12) | −0.1507 *** (−4.29) | −0.0229 ** (−2.27) | 0.1415 *** (7.11) | 2.1798 *** (4.90) | −0.0162 *** (−3.84) |

| HSR×Middle | 0.2150 ** (2.07) | 0.1517 *** (4.20) | −0.0091 (−0.62) | −0.0895 *** (−2.89) | −1.9135 *** (−3.35) | 0.0045 (0.83) |

| HSR×West | −0.0328 (−0.32) | 0.1238 *** (3.49) | −0.0198 (−1.01) | −0.0158 (−0.47) | −2.0581 *** (−3.55) | 0.0104 * (1.87) |

| HSR×Northeast | 0.5671 * (1.80) | 0.1940 *** (4.54) | −0.0337 (−1.26) | −0.1051 (−1.00) | −0.8276 * (−1.90) | 0.0352 *** (2.83) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| _cons | 0.6646 (0.88) | 0.3917 (1.21) | 0.6470 *** (5.00) | 1.8995 *** (7.85) | 5.7261 (1.42) | 0.5811 *** (11.44) |

| City effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 2563 | 2560 | 2566 | 2562 | 2565 | 2561 |

| Cities | 270 | 270 | 270 | 270 | 270 | 270 |

| Variables | Financial Broadening | Financial Deepening | ||||

|---|---|---|---|---|---|---|

| Financial Scale (FS) | Financial Agglomeration (FA) | Financial Leverage (FL) | Financial Efficiency (FE) | Financial Depth (FD) | Financial Structure (FC) | |

| Regression (7) | Regression (8) | Regression (9) | Regression (10) | Regression (11) | Regression (12) | |

| HSR | 0.2226 * (1.83) | 0.0673 * (1.68) | −0.0191 (−1.50) | −0.0095 (−0.35) | −0.8363 ** (−2.56) | −0.0048 (−1.11) |

| HSR×PGDP | −0.0049 *** (−5.21) | −0.0015 ** (−2.51) | −0.0001 (−1.31) | 0.0012 *** (4.55) | 0.0216 *** (4.64) | −0.0001 ** (−2.29) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| _cons | −0.1228 (−0.14) | 0.0168 (0.05) | 0.5624 *** (4.58) | 2.3217 *** (8.85) | 11.9622 *** (2.82) | 0.5863 *** (10.21) |

| City effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 2558 | 2553 | 2558 | 2557 | 2558 | 2553 |

| Cities | 270 | 270 | 270 | 270 | 270 | 270 |

| Variables | Total Population (TP) | Financial Scale (FS) | Financial Agglomeration (FA) | Financial Leverage (FL) | Financial Efficiency (FE) | Financial Depth (FD) | Financial Structure (FC) |

|---|---|---|---|---|---|---|---|

| Regression (25) | Regression (26) | Regression (27) | Regression (28) | Regression (29) | Regression (30) | Regression (31) | |

| HSR | 6.8648 *** (3.78) | −0.2189 *** (−3.23) | −0.0582 *** (−3.23) | −0.0288 *** (−3.29) | 0.0960 *** (5.84) | 1.0031 *** (5.15) | −0.0093 *** (−2.94) |

| TP | −0.0030 * (−1.90) | −0.0021 ** (−2.32) | −0.0005 ** (−2.08) | 0.0016 *** (3.53) | 0.0252 * (1.77) | −0.0003 *** (−2.70) | |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| _cons | 442.8642 *** (24.11) | 1.8684 * (1.73) | 1.1536 *** (3.95) | 0.8591 *** (5.91) | 1.2884 *** (3.99) | −2.9095 (−0.56) | 0.7184 *** (10.74) |

| City effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, D.; Jiang, R.; Lu, Z.; Sun, S.; Wang, L. Does the Construction of High-Speed Rail Change the Development of Regional Finance? Sustainability 2023, 15, 10641. https://doi.org/10.3390/su151310641

Li D, Jiang R, Lu Z, Sun S, Wang L. Does the Construction of High-Speed Rail Change the Development of Regional Finance? Sustainability. 2023; 15(13):10641. https://doi.org/10.3390/su151310641

Chicago/Turabian StyleLi, Dongmei, Renai Jiang, Zheyuan Lu, Shanghong Sun, and Longguo Wang. 2023. "Does the Construction of High-Speed Rail Change the Development of Regional Finance?" Sustainability 15, no. 13: 10641. https://doi.org/10.3390/su151310641