The Controversial Link between CSR and Financial Performance: The Mediating Role of Green Innovation

Abstract

1. Introduction

- 1.

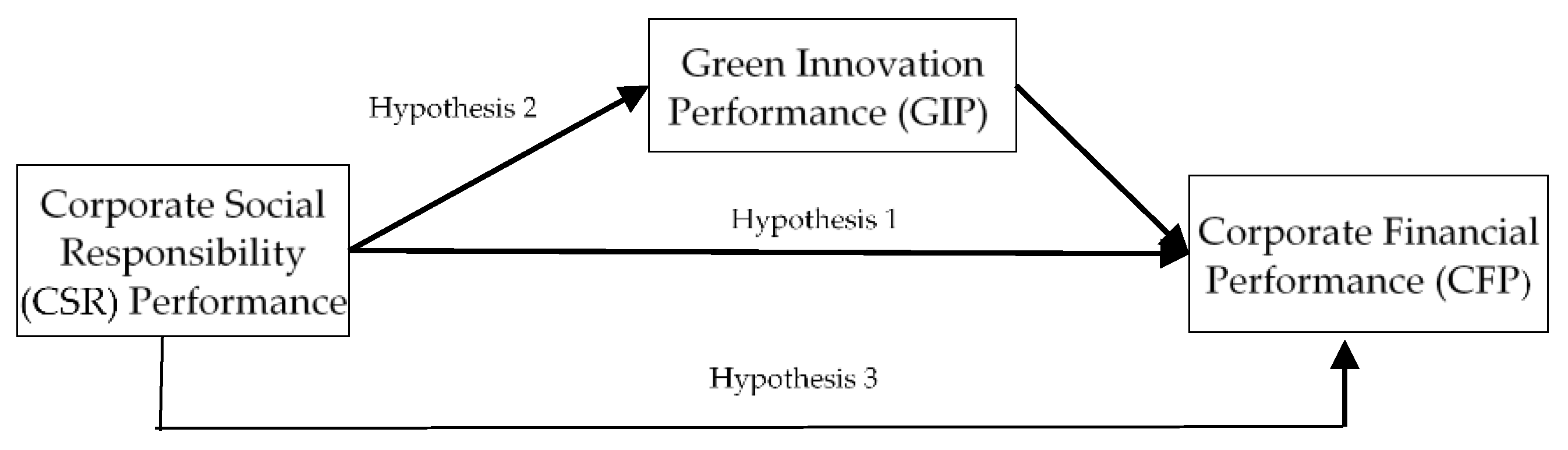

- How does a company’s social responsibility performance affect its financial performance?

- 2.

- How does a company’s social responsibility performance affect green innovation?

- 3.

- Is there a role for green innovation in the relationship between a company’s social responsibility and financial performance?

2. Literature Review and Hypothesis Development

2.1. Corporate Social Responsibility and Corporate Financial Performance

2.2. Corporate Social Responsibility and Green Innovation Performance

2.3. Corporate Financial Performance and Corporate Financial Performance: The Mediating Role of Green Innovation

3. Methodology

3.1. Data and Variables

3.2. Method

4. Results

4.1. Descriptive Statistics

4.2. Multivariate Analysis

4.3. Additional Tests

4.3.1. Alternative Measures of the Dependent Variable

4.3.2. Alternative Estimation Method

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Social Investment Forum. Report on Social Responsible Investing Trends in the United States 2010; Social Investment Forum: Washington, DC, USA, 2010. [Google Scholar]

- Dahlsrud, A. How corporate social responsibility is defined: An analysis of 37 definitions. Corp. Soc. Responsib. Environ. Manag. 2008, 15, 1–13. [Google Scholar] [CrossRef]

- KPMG International. The KPMG Survey of Corporate Responsibility Reporting 2013; KPMG: Amsterdam, The Netherlands, 2013. [Google Scholar]

- Qi, L.; Wang, L.; Li, W. Do mutual fund networks affect corporate social responsibility? Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1040–1050. [Google Scholar] [CrossRef]

- Frederick, W.C. Corporate Social Responsibility in the Reagan Era and Beyond. Calif. Manag. Rev. 1983, 25, 145–157. [Google Scholar] [CrossRef]

- Orlitzky, M.; Siegel, D.S.; Waldman, D.A. Strategic corporate social responsibility and environmental sustainability. Bus. Soc. 2011, 50, 6–27. [Google Scholar] [CrossRef]

- Kim, M.; Yin, X.; Lee, G. The effect of CSR on corporate image, customer citizenship behaviors, and customers’ long-term relationship orientation. Int. J. Hosp. Manag. 2020, 88, 102520. [Google Scholar] [CrossRef]

- Kim, Y.; Park, M.S.; Wier, B. Is earnings quality associated with corporate social responsibility? Account. Rev. 2012, 87, 761–796. [Google Scholar] [CrossRef]

- Lin, C.S.; Chang, R.Y.; Dang, V.T. An integrated model to explain how corporate social responsibility affects corporate financial performance. Sustainability 2015, 7, 8292–8311. [Google Scholar] [CrossRef]

- Watson, L. Corporate social responsibility research in accounting. J. Account. Lit. 2015, 34, 1–16. [Google Scholar]

- Cho, S.Y.; Lee, C.; Pfeiffer, R.J., Jr. Corporate social responsibility performance and information asymmetry. J. Account. Public Policy 2013, 32, 71–83. [Google Scholar] [CrossRef]

- Cruise, S. Investors Demand Improved Sustainability Reporting. Available online: http://www.reuters.com/article/2011/02/21/investorssustainability-idUSLDE71K0W120110221 (accessed on 15 January 2022).

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strateg. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef]

- Ağan, Y.; Kuzey, C.; Acar, M.F.; Açıkgöz, A. The relationships between corporate social responsibility, environmental supplier development, and firm performance. J. Clean. Prod. 2016, 112, 1872–1881. [Google Scholar] [CrossRef]

- Okafor, A.; Adeleye, B.N.; Adusei, M. Corporate social responsibility and financial performance: Evidence from US tech firms. J. Clean. Prod. 2021, 292, 126078. [Google Scholar] [CrossRef]

- Cho, S.J.; Chung, C.Y.; Young, J. Study on the relationship between CSR and financial performance. Sustainability 2019, 11, 343. [Google Scholar] [CrossRef]

- Oh, S.; Hong, A.; Hwang, J. An analysis of CSR on firm financial performance in stakeholder perspectives. Sustainability 2017, 9, 1023–1035. [Google Scholar] [CrossRef]

- Han, J.; Kim, H.J.; Yu, J. Empirical study on relationship between corporate social responsibility and financial performance in Korea. Asian J. Sustain. Soc. Responsib. 2016, 1, 61–76. [Google Scholar] [CrossRef]

- Zhu, Y. Empirical test on the relationship between corporate social responsibility and financial performance. Stat. Decis. 2009, 7, 135–137. [Google Scholar]

- Christensen, H.B.; Hail, L.; Leuz, C. Mandatory CSR and sustainability reporting: Economic analysis and literature review. Rev. Account. Stud. 2021, 26, 1176–1248. [Google Scholar] [CrossRef]

- Cohen, J.; Holder-Webb, L.; Nath, L.; Wood, D. Retail investors’ perceptions of the decision-usefulness of economic performance, governance, and corporate social responsibility disclosures. Behav. Res. Account. 2011, 23, 109–129. [Google Scholar] [CrossRef]

- Busch, T.; Schnippering, M. Corporate social and financial performance: Revisiting the role of innovation. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 635–645. [Google Scholar] [CrossRef]

- Lee, K.H.; Min, B. Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 2015, 108, 534–542. [Google Scholar]

- Buisson, B.; Silberzahn, P. Blue ocean or fast-second innovation? A four-breakthrough model to explain successful market domination. Int. J. Innov. Manag. 2010, 14, 359–378. [Google Scholar] [CrossRef]

- Chouaibi, S.; Chouaibi, J.; Rossi, M. ESG and corporate financial performance: The mediating role of green innovation: UK common law versus Germany civil law. EuroMed J. Bus. 2022, 17, 46–71. [Google Scholar] [CrossRef]

- Pan, X.; Sha, J.; Zhang, H.; Ke, W. Relationship between corporate social responsibility and financial performance in the mineral Industry: Evidence from Chinese mineral firms. Sustainability 2014, 6, 4077–4101. [Google Scholar] [CrossRef]

- Martinez-Conesa, I.; Soto-Acosta, P.; Carayannis, E.G. On the path towards open innovation: Assessing the role of knowledge management capability and environmental dynamism in SMEs. J. Knowl. Manag. 2017, 21, 553–570. [Google Scholar] [CrossRef]

- Ye, M.; Wang, H.; Lu, W. Opening the “black box” between corporate social responsibility and financial performance: From a critical review on moderators and mediators to an integrated framework. J. Clean. Prod. 2021, 313, 127919. [Google Scholar] [CrossRef]

- Rezaee, Z. Business sustainability research: A theoretical and integrated perspective. J. Account. Lit. 2016, 36, 48–64. [Google Scholar] [CrossRef]

- Dechow, P.M.; Sloan, R.G.; Zha, J. Stock prices and earnings: A history of research. Annu. Rev. Financ. Econ. 2014, 6, 343–363. [Google Scholar] [CrossRef]

- Fourati, Y.M.; Dammak, M. Corporate social responsibility and financial performance: International evidence of the mediating role of reputation. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1749–1759. [Google Scholar] [CrossRef]

- Jones, T.M. Instrumental stakeholder theory: A synthesis of ethics and economics. Acad. Manag. Rev. 1995, 20, 404–437. [Google Scholar] [CrossRef]

- Pedersen, E.R. Making corporate social responsibility (CSR) operable: How companies translate stakeholder dialogue into practice. Bus. Soc. Rev. 2006, 111, 137–163. [Google Scholar] [CrossRef]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Van Beurden, P.; Gössling, T. The worth of values—A literature review on the relation between corporate social and financial performance. J. Bus. Ethics 2008, 82, 407–424. [Google Scholar] [CrossRef]

- Friedman, M. A theoretical framework for monetary analysis. J. Political Econ. 1970, 78, 193–238. [Google Scholar] [CrossRef]

- Qiu, Y.; Shaukat, A.; Tharyan, R. Environmental and social disclosures: Link with corporate financial performance. Br. Account. Rev. 2016, 48, 102–116. [Google Scholar] [CrossRef]

- Servaes, H.; Tamayo, A. The impact of corporate social responsibility on firm value: The role of customer awareness. Manag. Sci. 2013, 59, 1045–1061. [Google Scholar] [CrossRef]

- Wang, D.H.-M.; Chen, P.-H.; Yu, T.H.-K.; Hsiao, C.-Y. The effects of corporate social responsibility on brand equity and firm performance. J. Bus. Res. 2015, 68, 2232–2236. [Google Scholar] [CrossRef]

- Wang, Z.; Sarkis, J. Corporate social responsibility governance, outcomes, and financial performance. J. Clean. Prod. 2017, 162, 1607–1616. [Google Scholar] [CrossRef]

- Mishra, S.; Suar, D. Does corporate social responsibility influence firm performance of Indian companies? J. Bus. Ethics 2010, 95, 571–601. [Google Scholar] [CrossRef]

- Lindgreen, A.; Swaen, V.; Campbell, T.T. Corporate social responsibility practices in developing and transitional countries: Botswana and Malawi. J. Bus. Ethics 2009, 90, 429–440. [Google Scholar] [CrossRef]

- DiSegni, D.M.; Huly, M.; Akron, S. Corporate social responsibility, environmental leadership and financial performance. Soc. Responsib. J. 2015, 11, 131–148. [Google Scholar] [CrossRef]

- Husted, B.W.; Montiel, I.; Christmann, P. Effects of local legitimacy on certification decisions to global and national CSR standards by multinational subsidiaries and domestic firms. J. Int. Bus. Stud. 2016, 47, 382–397. [Google Scholar] [CrossRef]

- Dobers, P.; Halme, M. Corporate social responsibility and developing countries. Corp. Soc. Responsib. Environ. Manag. 2009, 16, 237–249. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D.S.; Wright, P.M. Corporate social responsibility: Strategic implications. J. Manag. Stud. 2006, 43, 1–18. [Google Scholar] [CrossRef]

- Branco, M.C.; Rodrigues, L.L. Communication of corporate social responsibility by Portuguese banks: A legitimacy theory perspective. Corp. Commun. Int. J. 2006, 11, 232–248. [Google Scholar] [CrossRef]

- Mowery, D.C.; Oxley, J.E.; Silverman, B.S. Technological overlap and interfirm cooperation: Implications for the resource-based view of the firm. Res. Policy 1998, 27, 507–523. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The stakeholder theory of the corporation: Concepts, evidence, and implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Bekk, M.; Spörrle, M.; Hedjasie, R.; Kerschreiter, R. Greening the competitive advantage: Antecedents and consequences of green brand equity. Qual. Quant. 2016, 50, 1727–1746. [Google Scholar] [CrossRef]

- Brown, S.L.; Eisenhardt, K.M. Product development: Past research, present findings, and future directions. Acad. Manag. Rev. 1995, 20, 343–378. [Google Scholar] [CrossRef]

- Chen, Y.; Lai, S.; Wen, C. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Castilla-Polo, F.; Sánchez-Hernández, M.I.; Gallardo-Vázquez, D. Assessing the influence of social responsibility on reputation: An empirical Case-Study in agricultural cooperatives in Spain. J. Agric. Environ. Ethics 2017, 30, 99–120. [Google Scholar] [CrossRef]

- Yu, H.-C.; Kuo, L.; Kao, M.-F. The relationship between CSR disclosure and competitive advantage. Sustain. Account. Manag. Policy J. 2017, 8, 547–570. [Google Scholar] [CrossRef]

- Cuerva, M.C.; Triguero-Cano, Á.; Córcoles, D. Drivers of green and non-green innovation: Empirical evidence in Low-Tech SMEs. J. Clean. Prod. 2014, 68, 104–113. [Google Scholar] [CrossRef]

- Liu, Y.; Chen, Y.; Ren, Y.; Jin, B. Impact mechanism of corporate social responsibility on sustainable technological innovation performance from the perspective of corporate social capital. J. Clean. Prod. 2021, 308, 127345. [Google Scholar] [CrossRef]

- Wu, W.; Liu, Y.; Chin, T.; Zhu, W. Will green CSR enhance innovation? A perspective of public visibility and firm transparency. Int. J. Environ. Res. Public Health 2018, 15, 268. [Google Scholar] [CrossRef] [PubMed]

- Lins, K.V.; Servaes, H.; Tamayo, A. Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. J. Financ. 2017, 72, 1785–1824. [Google Scholar] [CrossRef]

- Kraus, S.; Rehman, S.U.; García, F.J.S. Corporate social responsibility and environmental performance: The mediating role of environmental strategy and green innovation. Technol. Forecast. Soc. Chang. 2020, 160, 120262. [Google Scholar] [CrossRef]

- Shahzad, M.; Qu, Y.; Javed, S.A.; Zafar, A.U.; Rehman, S.U. Relation of environment sustainability to CSR and green innovation: A case of Pakistani manufacturing industry. J. Clean. Prod. 2020, 253, 119938. [Google Scholar] [CrossRef]

- Thornhill, S. Knowledge, innovation and firm performance in high-and low-technology regimes. J. Bus. Ventur. 2006, 21, 687–703. [Google Scholar] [CrossRef]

- Jansen, J.J.P.; Van Den Bosch, F.A.J.; Volberda, H.W. Exploratory innovation, exploitative innovation, and performance: Effects of organizational antecedents and environmental moderators. Manag. Sci. 2006, 52, 1661–1674. [Google Scholar] [CrossRef]

- Ireland, R.D.; Webb, J.W. Strategic entrepreneurship: Creating competitive advantage through streams of innovation. Bus. Horiz. 2007, 50, 49–59. [Google Scholar] [CrossRef]

- Johannessen, J.; Olsen, B. Systemic knowledge processes, innovation and sustainable competitive advantages. Kybernetes 2009, 38, 559–580. [Google Scholar] [CrossRef]

- Liao, T.-S.; Rice, J. Innovation investments, market engagement and financial performance: A study among Australian manufacturing SMEs. Res. Policy 2010, 39, 117–125. [Google Scholar] [CrossRef]

- Capon, N.; Farley, J.U.; Hoenig, S. Determinants of financial performance: A meta-analysis. Manag. Sci. 1990, 36, 1143–1159. [Google Scholar] [CrossRef]

- Andries, P.; Faems, D. Patenting activities and firm performance: Does firm size matter? J. Prod. Innov. Manag. 2013, 30, 1089–1098. [Google Scholar] [CrossRef]

- Kostopoulos, K.; Papalexandris, A.; Papachroni, M.; Ioannou, G. Absorptive capacity, innovation, and financial performance. J. Bus. Res. 2011, 64, 1335–1343. [Google Scholar] [CrossRef]

- Baker, W.E.; Sinkula, J.M. Market orientation and the new product paradox. J. Prod. Innov. Manag. 2005, 22, 483–502. [Google Scholar] [CrossRef]

- Michelino, F.; Caputo, M.; Cammarano, A.; Lamberti, E. Inbound and outbound open innovation: Organization and performances. J. Technol. Manag. Innov. 2014, 9, 65–82. [Google Scholar] [CrossRef]

- Gök, O.; Peker, S. Understanding the links among innovation performance, market performance and financial performance. Rev. Manag. Sci. 2017, 11, 605–631. [Google Scholar] [CrossRef]

- El-Kassar, A.N.; Singh, S.K. Green innovation and organizational performance: The influence of big data and the moderating role of management commitment and HR practices. Technol. Forecast. Soc. Chang. 2019, 144, 483–498. [Google Scholar] [CrossRef]

- Padilla-Lozano, C.P.; Collazzo, P. Corporate social responsibility, green innovation and competitiveness—Causality in manufacturing. Compet. Rev. 2022, 32, 21–39. [Google Scholar] [CrossRef]

- Nirino, N.; Santoro, G.; Miglietta, N.; Quaglia, R. Corporate controversies and company’s financial performance: Exploring the moderating role of ESG practices. Technol. Forecast. Soc. Chang. 2021, 162, 120341. [Google Scholar] [CrossRef]

- Chijoke-Mgbame, A.M.; Mgbame, C.O.; Akintoye, S.; Ohalehi, P. The role of corporate governance on CSR disclosure and firm performance in a voluntary environment. Corp. Gov. Int. J. Bus. Soc. 2019, 20, 294–306. [Google Scholar] [CrossRef]

- Xie, X.; Hoang, T.T.; Zhu, Q. Green process innovation and financial performance: The role of green social capital and customers’ tacit green needs. J. Innov. Knowl. 2022, 7, 100165. [Google Scholar] [CrossRef]

- Al-Gamrh, B.; Al-Dhamari, R.; Jalan, A.; Jahanshahi, A.A. The impact of board independence and foreign ownership on financial and social performance of firms: Evidence from the UAE. J. Appl. Account. Res. 2020, 21, 201–229. [Google Scholar] [CrossRef]

- Wu, M. Corporate social performance, corporate financial performance, and firm size: A meta-analysis. J. Am. Acad. Bus. 2006, 8, 163–171. [Google Scholar]

- McWilliams, A.; Siegel, D. Corporate social responsibility: A theory of the firm perspective. Acad. Manag. Rev. 2001, 26, 117–127. [Google Scholar] [CrossRef]

- Galbreath, J. Is board gender diversity linked to financial performance? The mediating mechanism of CSR. Bus. Soc. 2018, 57, 863–889. [Google Scholar] [CrossRef]

- Roberts, R.W. Determinants of corporate social responsibility disclosure: An application of stakeholder theory. Account. Organ. Soc. 1992, 17, 595–612. [Google Scholar] [CrossRef]

- Jamil, M.N.; Rasheed, A.; Mukhtar, Z. Corporate Social Responsibility impacts sustainable organizational growth (firm performance): An empirical analysis of Pakistan stock exchange-listed firms. J. Environ. Sci. Econ. 2022, 1, 25–29. [Google Scholar] [CrossRef]

- Withisuphakorn, P.; Jiraporn, P. The effect of firm maturity on corporate social responsibility (CSR): Do older firms invest more in CSR? Appl. Econ. Lett. 2016, 23, 298–301. [Google Scholar] [CrossRef]

- Chowdhury, R.H.; Fu, C.; Huang, Q.; Lin, N. CSR disclosure of foreign versus US firms: Evidence from ADRs. J. Int. Financ. Mark. Inst. Money 2021, 70, 101275. [Google Scholar] [CrossRef]

- Clancey-Shang, D.; Fu, C. CSR Disclosure, Political Risk and Market Quality: Evidence from the Russia-Ukraine Conflict. 2022. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4181022 (accessed on 10 February 2023).

- Yoo, C.; Yeon, J.; Lee, S. Beyond “good company”: The mediating role of innovation in the corporate social responsibility and corporate firm performance relationship. Int. J. Contemp. Hosp. Manag. 2022, 34, 3677–3696. [Google Scholar] [CrossRef]

- Armstrong, C.; Kepler, J.D.; Samuels, D.; Taylor, D. Causality redux: The evolution of empirical methods in accounting research and the growth of quasi-experiments. J. Account. Econ. 2022, 74, 101521. [Google Scholar] [CrossRef]

- Leuz, C. Towards a design-based approach to accounting research. J. Account. Econ. 2022, 74, 101550. [Google Scholar] [CrossRef]

- Hansen, B. Econometrics; Princeton University Press: Princeton, NJ, USA, 2022. [Google Scholar]

- Roodman, D. A note on the theme of too many instruments. Oxf. Bull. Econ. Stat. 2009, 71, 135–158. [Google Scholar] [CrossRef]

- Oyedele, O. Human Capital and Economic Growth in Nigeria. Int. J. Innov. Sci. Res. 2014, 11, 291–294. [Google Scholar]

- Drukker, D.M. Testing for serial correlation in linear panel-data models. Stata J. 2003, 3, 168–177. [Google Scholar] [CrossRef]

- Sato, Y.; Soderbom, M. System GMM Estimation of Panel Data Models with Time Varying Slope Coefficients; School of Business, Economics, and Law Working papers in Economics, no 577; University of Gothenburg: Gothenburg, Sweden, 2013. [Google Scholar]

- Benson, K.L.; Brailsford, T.J.; Humphrey, J.E. Do socially responsible fund managers really invest differently? J. Bus. Ethics 2006, 65, 337–357. [Google Scholar] [CrossRef]

- Bollen, N.P.B. Mutual fund attributes and investor behavior. J. Financ. Quant. Anal. 2007, 42, 683–708. [Google Scholar] [CrossRef]

| Variables | ||

|---|---|---|

| Dependent Variable | CFP | Provided by ASSET4—assesses a company’s capacity for resource management that yields a high rate of return and sustainable growth. |

| Dependent Variable/Independent variable | GIP | Provided by ASSET4—measures company’s dedication to advancing eco-efficiency research and development, mirroring a business’s ability to lower environmental costs and create new markets with cutting-edge technologies. |

| Independent variable | CSP | Provided by ASSET4—assesses a company’s capacity to foster loyalty and trust among its workforce, clients, and the general public. |

| Control Variable | Size | Natural logarithm of total assets. |

| Control Variable | Age | Natural logarithm of years since foundation. |

| Control Variable | Leverage | Total liabilities to total assets. |

| Variable | N | Mean | S.D. | Min | Q1 | Q2 | Q3 |

|---|---|---|---|---|---|---|---|

| CFP | 2246 | 57.39957 | 27.90847 | 1.24 | 34.5875 | 62.165 | 82.002 |

| GIP | 2246 | 49.37335 | 30.07631 | 10.89 | 20.285 | 40.645 | 78.7575 |

| CSP | 2246 | 64.60864 | 24.91368 | 5.47 | 45.845 | 70.68 | 85.8825 |

| Size | 2246 | 14.44111 | 1.613974 | 9.943237 | 13.27233 | 14.30243 | 15.37664 |

| Age | 2246 | 2.924854 | 0.907338 | −0.3164 | 2.449232 | 3.075733 | 3.738257 |

| Leverage | 2246 | 0.376293 | 0.184421 | 0.004939 | 0.253214 | 0.352523 | 0.478328 |

| Variable | VIF | CFP | GIP | CSP | Size | Age | Leverage |

|---|---|---|---|---|---|---|---|

| CFP | - | 1.0 ** | |||||

| GIP | 1.29 | 0.33 ** | 1.0 ** | ||||

| CSP | 1.67 | 0.58 ** | 0.4 ** | 1.0 ** | |||

| Size | 1.43 | 0.38 ** | 0.29 ** | 0.46 ** | 1.0 ** | ||

| Age | 1.22 | 0.32 ** | 0.23 ** | 0.32 ** | 0.16 ** | 1.0 ** | |

| Leverage | 1.24 | −0.05 * | −0.02 | 0.01 | −0.01 | −0.11 ** | 1.0 ** |

| Without Control Variables | With Control Variables | |||

|---|---|---|---|---|

| CFP | Coefficient (t-Value) | p-Value | Coefficient (t-Value) | p-Value |

| CSP | 0.5969 (27.48) | 0.000 | 0.4947 (21.08) | 0.000 |

| GIP | 0.1154 (6.66) | 0.000 | 0.0767 (4.49) | 0.000 |

| Size | - | 2.5802 (7.68) | 0.000 | |

| Age | - | 4.0396 (7.34) | 0.000 | |

| Leverage | - | −13.5950 (−4.97) | 0.000 | |

| Industry | Included | Included | ||

| Year | Included | Included | ||

| Constant | Included | Included | ||

| F-value | 58.52 | 0.000 | 60.87 | 0.000 |

| Adjusted R-squared | 0.3708 | 0.4095 | ||

| Observations | 2246 | 2246 | ||

| Without Control Variables | With Control Variables | |||

|---|---|---|---|---|

| GIP | Coefficient (t-Value) | p-Value | Coefficient (t-Value) | p-Value |

| CSP | 0.4592 (18.57) | 0.000 | 0.3368 (11.93) | 0.000 |

| Size | - | 2.9210 (7.09) | 0.000 | |

| Age | - | 3.1868 (4.69) | 0.000 | |

| Leverage | - | −8.0144 (−2.36) | 0.018 | |

| Industry | Included | Included | ||

| Year | Included | Included | ||

| Constant | Included | Included | ||

| F-value | 24.77 | 0.000 | 25.93 | 0.000 |

| Adjusted R-squared | 0.1889 | 0.2173 | ||

| Observations | 2246 | 2246 | ||

| Without Control Variables | With Control Variables | |||

|---|---|---|---|---|

| CFP (Measured by ROA) | Coefficient (t-Value) | p-Value | Coefficient (t-Value) | p-Value |

| CSP | 0.0146 (5.91) | 0.000 | 0.0139 (5.04) | 0.000 |

| GIP | 0.0048 (2.42) | 0.016 | 0.0048 (2.38) | 0.018 |

| Size | - | −0.0189 (−0.48) | 0.631 | |

| Age | - | 0.1071 (1.66) | 0.097 | |

| Leverage | - | 0.6318 (1.97) | 0.049 | |

| Industry | Included | Included | ||

| Year | Included | Included | ||

| Constant | Included | Included | ||

| F-value | 4.05 | 0.000 | 3.82 | 0.000 |

| Adjusted R-squared | 0.0303 | 0.0317 | ||

| Observations | 2246 | 2246 | ||

| Without Control Variables | With Control Variables | |||

|---|---|---|---|---|

| CFP (Measured by Tobin’s Q) | Coefficient (t-Value) | p-Value | Coefficient (t-Value) | p-Value |

| CSP | 0.0030 (0.93) | 0.354 | 0.0208 (6.04) | 0.000 |

| GIP | 0.0060 (2.33) | 0.020 | 0.0129 (5.16) | 0.000 |

| Size | - | −0.6215 (−12.59) | 0.000 | |

| Age | - | −0.2501 (−3.10) | 0.002 | |

| Leverage | - | 3.5261 (8.77) | 0.000 | |

| Industry | Included | Included | ||

| Year | Included | Included | ||

| Constant | Included | Included | ||

| F-value | 2.00 | 0.0032 | 11.51 | 0.000 |

| Adjusted R-squared | 0.0101 | 0.1085 | ||

| Observations | 2246 | 2246 | ||

| CFP | Coefficient (Z-Statistic) | p-Value |

|---|---|---|

| Lag (CFP, 1) | 0.2780 (7.6072) | 0.000 |

| CSP | 0.6314 (13.9796) | 0.000 |

| GIP | 0.1167 (3.1845) | 0.001 |

| Size | 5.6495 (5.3668) | 0.000 |

| Age | −1.8296 (−1.2579) | 0.208 |

| Leverage | −39.0763 (−4.3126) | 0.000 |

| Industry | Included | |

| Year | Included | |

| Constant | Included | |

| AR(1) p-value | 0.000 | |

| AR(2) p-value | 0.46 | |

| Sargan p-value | 0.31 | |

| Wald chi2 coef. p-value | 0.000 | |

| Wald chi2 time dummies p-value | 0.000 | |

| Observations | 2246 |

| GIP | Coefficient (Z-Statistic) | p-Value |

|---|---|---|

| Lag (GIP, 1) | 0.6323 (32.8587) | 0.000 |

| CSP | 0.1655 (5.7050) | 0.000 |

| Size | 0.2822 (0.4124) | 0.68 |

| Age | 1.3459 (1.8656) | 0.06 |

| Leverage | 2.2536 (0.4943) | 0.6211 |

| Industry | Included | |

| Year | Included | |

| Constant | Included | |

| AR(1) p-value | 0.000 | |

| AR(2) p-value | 0.051 | |

| Sargan p-value | 0.15 | |

| Wald chi2 coef. p-value | 0.000 | |

| Wald chi2 time dummies p-value | 0.000 | |

| Observations | 2246 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Homayoun, S.; Mashayekhi, B.; Jahangard, A.; Samavat, M.; Rezaee, Z. The Controversial Link between CSR and Financial Performance: The Mediating Role of Green Innovation. Sustainability 2023, 15, 10650. https://doi.org/10.3390/su151310650

Homayoun S, Mashayekhi B, Jahangard A, Samavat M, Rezaee Z. The Controversial Link between CSR and Financial Performance: The Mediating Role of Green Innovation. Sustainability. 2023; 15(13):10650. https://doi.org/10.3390/su151310650

Chicago/Turabian StyleHomayoun, Saeid, Bita Mashayekhi, Amin Jahangard, Milad Samavat, and Zabihollah Rezaee. 2023. "The Controversial Link between CSR and Financial Performance: The Mediating Role of Green Innovation" Sustainability 15, no. 13: 10650. https://doi.org/10.3390/su151310650

APA StyleHomayoun, S., Mashayekhi, B., Jahangard, A., Samavat, M., & Rezaee, Z. (2023). The Controversial Link between CSR and Financial Performance: The Mediating Role of Green Innovation. Sustainability, 15(13), 10650. https://doi.org/10.3390/su151310650