Abstract

The development of halal tourism in Indonesia is the focus of the Indonesian government and MSMEs have an important role in supporting the development of halal tourism in Indonesia. This study aims to examine the relationship between marketing communication and Islamic financial literacy on Islamic financial inclusion and MSME performance in the halal-tourism sector. A covariance-based SEM technique utilizing LISREL software was used to analyze the data from this investigation. Nonprobability sampling was employed to collect the data, and the sample consists of 152 halal-tourism entrepreneurs. This study found a positive and significant association between Islamic financial inclusion and business performance. This study also found that there is a positive and significant association between Islamic financial literacy and Islamic financial inclusion. Marketing communication and Islamic financial inclusion have a positive relationship, but it is insignificant. This study implies that to establish a halal-tourist ecosystem for long-term development in Indonesia, commercial actors must lend their full support. This study demonstrates that they can thrive when MSMEs in the halal-tourist ecosystem are backed by Islamic banking and Islamic rural banks. As a result, a more accommodating approach from Islamic banking is required to provide access to halal finance for business actors in Indonesia’s halal-tourism ecosystem.

1. Introduction

Tourism is one of the leading wheels of a country’s economy; several countries rely only on tourism to fuel their economy. Andorra is one of the few countries where tourism is the principal source of state revenue, accounting for 80 percent of the country’s GDP (gross domestic product). Not only do countries such as Andora lack superior resources except in the tourist industry, but tourism has also become a trend of economic development of countries around the world because it has a significant impact on a nation’s life. According to a World Travel and Tourism Council (WTTC) assessment of the global economic effects of traveling and tourism activities, the tourism and travel sector generated 3% of total global GDP in 2015. In 2019, this contribution increased to 10.3 percent of the total global GDP. The absorption of labor is the direct influence of tourism and traveling activities on GDP. In 2015, the number of workers directly absorbed (direct contribution) by the tourism and travel sector was 107.8 million (3.6 percent of the total workforce). In the meantime, the actual contribution (indirect impact) on employment reached 283.6 million (9.5 percent of the entire workforce), while the amount of labor absorbed in 2019 gained 330 million workers, or 10.4 percent of total employment [1]. During the COVID-19 pandemic, employment from the tour and travel sector increased from 271.3 million in 2020 to 289.5 million in 2021 [2].

The development of GDP and employment impacts the survival of the tourist and travel business. This GDP generation is due to a rise in the number of investments, with total investment in this industry reaching USD 774.6 billion in 2015, accounting for 4.3 percent of total global investment. It climbed by 4.5 percent in 2016, with a total investment value of USD 1.3 trillion. According to the survey, it is likewise dominated by vacationers (tourism). According to the report, overseas tourists account for 76.6 percent of all visitors. The remaining 23.4 percent, on the other hand, was due to official travel or business matters. Meanwhile, overall investment in 2019 totaled USD 948 billion, accounting for 4.8 percent of total global investment [1]. Indonesia ranks fourth in terms of the number of international tourists visiting the ASEAN area. The Ministry of Tourism said that 10.87 million foreign tourists visited Indonesia in 2016, exceeding the target of 12 million foreign tourists set for 2016. As a result, Thailand ranked first with 27 million international tourists, followed by Malaysia with 17.6 million. On the other hand, Singapore ranked third, with 12 million foreign visitors in that month. Meanwhile, foreign tourist arrivals in 2019 totaled 16.11 million, a 1.88 percent rise over the previous year [3].

They perceive the attractive function of tourism in boosting a country’s economy and the competitiveness of Indonesian tourism, which is still inferior to neighboring countries as a foreign tourist destination. As a result, through the Ministry of Tourism and Creative Industries, the Indonesian government conducts numerous efforts to enhance national tourism to expect many foreign tourists to visit. In addition, domestic tourists may also call, boosting the economy of the selected tourist destination. This national tourist development comprises enhancing facilities, increasing the promotion budget, and building infrastructure to host international events. Furthermore, in addition to expanding existing tourism, the government prioritizes halal or sharia tourism. The goal is to attract more tourists from Muslim-majority countries.

Halal tourism has recently received a lot of attention. Halal tourism is defined as tourism that complies with all criteria of Islamic law drawn from the Al-Qur’an and As-Sunah as guidelines [4]. Halal tourism is a tourist location that has been well-planned and chosen following sharia principles, as the atmosphere in this tourism environment is free of any banned contamination. Meanwhile, a halal tourist destination is a geographical area within one or more administrative regions that contains tourist attractions, religious and public facilities, tourism facilities, accessibility, and communities that are interconnected and complement the realization of a statement by the sharia principle. sharia tourism is separated into numerous components, including Islamic hotels, Islamic travel agents, halal restaurants, and Islamic tourism artifacts. Tourism growth has a substantial influence in terms of increased original local government revenue and investment in regional development. An increase in money from the tourism sector provides locals with more power in their lives since it opens them to more work alternatives. This strategy benefits investors because the government has made it easier to open new business opportunities in the tourism sector [5].

Halal tourism becomes a distinct trend for a country since the amount of foreign exchange it can bring in for the country is significant. This is attributable to an increase in the number of Muslim tourists worldwide. In 2016, the number of Muslim travelers increased to 121 million and is expected to expand to 156 million in 2020 (assuming no COVID-19 epidemic), with a total expenditure of USD 220 billion and expected to reach USD 300 billion in 2026 [6]. To capture the hearts of potential visitors and persuade them to visit a place, a systematic and measurable effort is required with the support of all stakeholders. The Indonesian government is working hard to compete worldwide in attracting foreign tourists by developing a sustainable halal-tourism ecosystem.

Increasing global interconnectedness and rapid environmental changes emphasize the importance of competition in attracting foreign tourists. Tourism is now seen as an important engine of economic growth and development in many countries. This condition will justify the allocation of resources to attract more visitors by increasing their competitive position [7]. The development strategy of the halal-tourist ecosystem in Indonesia employs a Penta helix strategy, with five factors intended to promote the growth and development of halal tourism in Indonesia. In halal tourism, the five elements are the government, media, academics, communities, and commercial actors. The Global Muslim Travel Index (GMTI) recognized Indonesia with the “World Best Halal Travel Destination” award in 2019 for the hard work of all these factors in the growth of halal tourism in Indonesia [8]. Tourist-object managers, transport or ticketing businesses, hotels, restaurants, gift stores, or goods are essential components of the halal tourism development ecosystem. However, despite its importance in absorbing labor and investment, the tourism industry, a subsector of the creative economy, has gotten less attention from the banking industry, particularly Islamic banking. In 2017, only 6% of tourism-sector actors used financial institutions, while 94% of tourism-sector company actors continued to rely on private finance [9].

Financial inclusion is very important in creating a country’s economic growth because every individual has the opportunity to access financial institutions [10]. It is important for MSMEs to increase financial inclusion because MSME development without the support of financial institutions will be difficult to realize [11]. Scholars have studied the potential of banking financing to boost rural tourism. Due to a drop in agricultural real income, a lack of genuine economic alternatives, and demographic difficulties, small local companies that valorize natural, cultural, and anthropological resources could contribute to rural sustainable development. However, the majority of them require financial assistance from private creditors (banks) [12]. Islamic banks are alternatives and solutions that can be utilized by business actors for business development because empirically Islamic banks are more resilient to crises and more efficient than conventional banks [13]. Islamic financial institutions also provide fairer financing for entrepreneurs [14].

With the engagement of Islamic banking in the tourism industry, halal business is predicted to promote growth in the sector and boost its market share and Islamic banking market share in Indonesia. To date, Islamic banking has only had a 6.1 percent market share. It is hoped that the penetration of this industry will boost the market share of Islamic banking and the incorporation of Islamic financing in the tourism sector. The performance of MSMEs in the tourism sector is arguably still low if the guidelines for their contribution to GDP have only reached 4.80 percent in 2019. However, there is a positive trend, namely an increase from the previous year, although in previous years the contribution was lower than in 2019. In 2015 the contribution of the tourism sector to Indonesia’s GDP reached 4.25 percent; then in 2016, it decreased to 4.13 percent, and in 2017 it decreased again to 4.11 percent. Although in 2018 it increased to 5.25 percent. Then in 2019, the contribution to GDP reached 4.7 percent, and in 2020 decreased to 4.05 percent [15]. Employment of MSMEs in halal tourism is also low when compared to other sectors. In 2018, the tourism sector was only able to absorb a workforce of 12.7 million workers. The COVID-19 pandemic in 2020 made the tourism sector suffer the biggest losses compared to other sectors in Indonesia. In a difficult situation such as this, the financial sector has a crucial role in helping to restore the tourism sector in Indonesia, including Islamic banking. Therefore, it is important for both individuals and MSMEs to increase financial inclusion.

Several studies highlight that the determinants of Islamic financial inclusion are financial literacy [16,17,18]. Apart from financial literacy, marketing communication is also an important element in promoting Islamic financial products to potential customers [18,19]. Ignorance of potential customers about the existence of Islamic financial products has resulted in little access to Islamic finance by entrepreneurs in the tourism sector in Indonesia. This study aims to investigate the role of marketing communication and Islamic financial literacy in creating financial inclusion for entrepreneurs in the halal-tourism sector in Indonesia.

In national policy, the government of Indonesia has a strategy on how to develop Islamic financing for the halal-tourism industry sector and small and medium-sized enterprises. Based on the 2019–2024 Indonesian Sharia Economic Masterplan published by the Indonesian National Development Planning Agency, the development of the halal industry in Indonesia cannot be separated from the development of the national halal supply chain. It is stated in the document, that the Islamic financing aspect has an opportunity to serve the halal tourism industry subsector. These opportunities include (1) the growing and varied Sharia financing, (2) collaborative opportunities to obtain financing from banks and the issuance of sukuk, and (3) the development and implementation of Sharia insurance schemes for commercial tourism. However, it is also suspected that there are challenges in financing the halal tourism industry subsector, namely Islamic financial institutions do not yet have specific financing targets for the halal industry, including halal tourism [20].

This research is an initial effort to explore the development of halal tourism from the supply side. To the author’s knowledge, investigating the role of Islamic financial institutions in developing MSMEs in the tourism sector (supply side) has never been carried out by previous researchers and this is the research gap and novel of this research. The author founds that studies on halal tourism are still dominated by the demand side, such as [21,22]. Several additional scholars, such as [23,24,25,26,27,28], also focus on the notion of halal tourism and the key difficulties associated with its development. The findings of this study are likely to contribute to the growth of halal tourism in Indonesia and the development of MSMEs in the Indonesian halal-tourism ecosystem. Furthermore, this research is expected to be able to help achieve the master plan of the Indonesian Islamic economy by examining the factors that influence the acceptance of Islamic banks in halal tourism SMEs.

This paper is organized into five sections. The first part discusses the research background which consists of phenomena and research gaps. In the second part, it discusses the literature review related to the role of Islamic financial literacy and marketing communications in creating Islamic financial inclusion and the performance of SMEs in the halal-tourism sector, as well as previous research. The third section discusses research methodology and the fourth section discusses research results and discussion. The last section discusses the research conclusions and policy recommendations.

2. Literature Review

2.1. Halal-Tourism Concept

Halal tourism is a novel approach to meeting the travel needs of Muslim travelers. Most Indonesians, however, misunderstand the concept of halal tourism because it is confused with religious tourism, even though the two are distinct [29]. Halal tourism is a novel concept. This is not religious tourism in the same way that Umrah and Hajj are. Instead, halal tourism is tourism that provides vacations and vacation styles that are tailored to the needs and desires of Muslim guests. In this scenario, the hotel can assist the Muslim guest with Islamic compliance, such as no alcohol at the hotel [30]. There are numerous words used to describe halal tourism, such as Islamic tourism [28,31,32] and halal tourism [25,26,27,31]. Halal tourism refers to the traveling activities of Muslims who are migrating from one location to another or who are residing in a location other than their regular residence for less than a year and engaging in activities with Islamic objectives. It should be mentioned that Islamic activities must adhere to universally accepted Islamic norms, i.e., halal [22]. Halal tourism refers to any activities related to tourism that must suit the needs of a Muslim traveler, such as the availability of places of worship, kosher food, or food that is classified as Muslim friendly [23,24,33]. Nonetheless, academics’ use of halal tourism or Muslim-friendly terminology is still contested and contradictory. As a result, standardization is required to use the same terms [34]. The Indonesian government defines halal tourism as an activity supported by a wide range of facilities and services supplied by communities, businesses, the government, and local governments that adhere to sharia law [23].

The Ministry of Tourism and the Creative Economy uses the penta helix concept as a halal-tourism ecosystem in establishing the notion of halal tourism. This halal-tourism ecosystem is predicted to hasten national tourism development, as seen by increasing the number of tourists visiting Indonesia. The penta helix concept evolved from the triple helix concept, including government, academia, and businesses [35]. Their essay stressed the importance of collaboration among government, academic, and corporate actors in creating and developing innovations on a national and regional scale.

Arif Yahya, Indonesia’s Minister of Tourism, announced the penta helix plan for tourism growth. The Republic of Indonesia’s Minister of Tourism Regulation (Permen) No. 14 of 2016 on Guidelines for Sustainable Tourism Destinations. The regulation aims to develop orchestrations to ensure the quality of activities, facilities, and services, and generate experiences and value for tourism benefits. The law also aims to give advantages and benefits to society and the environment. As a result, it is critical to promote the tourist system by maximizing business, government, community, academic, and media (BGCAM). Arif Yahya underlined that promoting Indonesian tourism is the responsibility of all stakeholders in the tourism ecosystem, not only the government [36].

According to the penta helix concept, the government is responsible for tourism infrastructure such as developing roads and airports as access to a tourism location via a GI rating. Furthermore, the government serves as a regulator and a facilitator for all stakeholders. Universities serve as drafters, putting together the findings of field studies and applied research to help accelerate the development of halal tourism. The research university will be given to the government in order for it to design policies and offer businesspersons opportunities to grow their businesses. Business actors, as the third component of the halal-tourist ecosystem, are at the heart of tourism activities. They provide tourist facilities by constructing a tourist-friendly region with Muslim passengers as a halal package, halal accommodation, halal food and beverage, and halal financial airport service [24]. Many people work in the halal-tourism industry, including providers of tourist attractions, hotels, restaurants, travel, transportation, and other supporting businesses such as gift shops and products. Meanwhile, the community is the fourth component of the penta helix. The community acts as a catalyst for the growth of halal tourism. They can mobilize their community to travel, resulting in a congested tourist area, which is critical in the development of halal tourism [22]. The final penta helix is mass media, which accelerates the development of halal tourism in Indonesia. This provides information that the concept of halal tourism is a concept that is in line with Islamic teachings, not contradictory to Islamic values.

2.2. Financial Literacy and Marketing Communication

Increasing the Islamic financial literacy of business actors is one strategy to improve financial inclusion in the MSMEs sector. Financial literacy is defined as the awareness, information, skills, attitude, and behavior required to make wise financial decisions and attain individual financial well-being [37]. The Indonesian Financial Services Authority (OJK) has developed an Islamic financial literacy strategy that focuses on target groups such as students, college students, communities, and business actors [38]. The goal of enhancing financial literacy is to understand Islamic finance and, of course, to be able to handle finances. Someone who is well versed in financial literacy is more likely to successfully manage their funds [39] and to make sensible financial judgments [40,41]. Business actors that understand financial literacy are more likely to successfully run their enterprises [11]. Furthermore, some researchers have found a favorable and significant association between financial literacy and financial inclusion [16,42,43,44].

In addition to financial literacy, Islamic financial inclusion in business actors can be caused by Islamic banking marketing communication. Marketing communication in Islamic banking can be defined by researchers as how Islamic banks communicate with their customers and potential customers to convey their corporate values, update information about the bank and products, and share their advantages or objectives through various communication channels [19]. The goal of marketing communication is to persuade potential customers to make financial purchases. They will create financial inclusion through financial transactions [18]. Advertising through various media such as billboards, television, banners, and social media is one form of marketing communication that Islamic banking can engage in. Advertisement in the financial services industry delivers essential information about products and services [19]. Relationship marketing is another type of marketing communication that Islamic banking might use.

Relationship marketing in the banking industry is defined as operations carried out by the bank to interact, communicate with, and retain more profitable or high net-worth customers [45]. It is envisaged that through implementing relationship marketing, marketing services will be able to persuade potential clients to undertake transactions with Islamic banks by delivering superior personal services [46,47]. Marketing communications are focused on four components: first, developing a comprehensive advertising campaign to promote bank credibility, reputation, and image to MSMEs. Second, encourage the introduction of new items and the modification of existing ones. The third entails ongoing public relations, regular interviews, and media events to keep MSMEs informed about bank activity. Employee skills and organizational knowledge were finally being scaled up [48]. Thus, it can be concluded that the concept of Islamic financial literacy refers to one’s understanding of various Islamic finance related to awareness, knowledge, skills, attitudes, and behavior. A good understanding of Islamic finance will make a person make consistent decisions about personal and family finances. On the other hand, marketing communications are activities carried out by a person or company to get closer to customers and potential customers.

2.3. Islamic Financial Inclusion and Business Performance

Islamic banking and Islamic rural banking, as halal finance, play an important part in the development of the Islamic economy. The presence of Islamic banking and Islamic rural banks is intended to make the greatest possible contribution to the real sector. Islamic banking and Islamic rural banks can play this function by providing finance to business players as well as other services such as deposits, transfers, online banking, and mobile banking to help enterprises in the real sector. As a result, the incorporation of Islamic finance for business actors in the halal-tourist ecosystem is a must. Financial inclusion is defined as “the process of ensuring vulnerable groups, such as weaker parts and low-income groups, access to financial services and timely and enough credit where needed at an affordable cost” [49]. The researcher can assess financial inclusion by examining access and impediments [10]. Access to Islamic banking for businesses is still being actively pursued by all stakeholders. However, due to the lack of accessibility in Indonesia, the Islamic banking and regulatory industries remain underdeveloped. The provinces of Jakarta have the highest level of inclusion, while the provinces of East Nusa Tenggara have the lowest [50]. In general, public access to banking is limited, with Indonesia ranking 75th out of 137 countries [10].

Since it is difficult to develop without financial inclusion, business actors’ access to formal financial institutions is likely to have an impact on their business development [11]. Financial inclusion can also increase the performance of businesses, according to empirical evidence [43,44,51,52]. The World Bank also urges every nation with a low degree of accessibility to develop financial inclusion for low-income people and micro, small, and medium enterprises (MSME) under the program financial inclusion support framework (FISF) (MSMEs). Through Minister of Finance Regulation No. 22/2010 on access to finance for micro- and small enterprises, the Indonesian government has also made different measures to ensure that business players, particularly MSMEs, can formally access financial institutions. This policy’s goal is to help business actors improve their business performance. One indicator of their success is the expansion of their firm, an increase in the number of employees, and an increase in financial and nonfinancial capability [53,54]. For this reason, the concept of Islamic financial inclusion is a concept in which a person conducts financial transactions with Islamic financial institutions, whether in the form of opening a savings account, financing, or using their products. Therefore, it is important for everyone, especially for business actors, to increase financial inclusion in order to be able to improve company performance.

2.4. Previous Studies and Hypothesis Development

The development of halal tourism in the last two decades has received attention from many parties, such as the government, business actors, and researchers. Researchers are interested in conducting studies related to halal tourism. Preliminary studies highlight the readiness of Muslim countries to implement the concept of halal tourism [29] and also highlight issues related to the concept of Islamic tourism [28,31,32], or Halal tourism [25,26,27,31]. The concepts of halal tourism, Islamic tourism, and Muslim tourist are concepts that were often used from 2004–2021 [55]. In the last decade (2012–2022) there has been more research on halal tourism in Indonesia from the demand side; for example, the interest of generation Z travelers to use halal-tourism applications in Indonesia and found the fact that the determining factor for generation Z for interest in using the application is the perceived ease of use and perceived usefulness [56]. Other researchers also highlight the determinants of Muslim travelers’ interest in visiting halal tourist attractions in Indonesia and the results show that perceived behavior control, perceived value, and trust are the main determinants of Muslim travelers in Indonesia to visit [57]. There are also highlights for Muslim millennials generation to make visits to halal tourism and showing the results that travel destinations, religiosity, travel motivation, and Islamic attributes are the main determinants of Muslim millennials’ interest in visiting tourism destinations [58]. There are also researchers who discuss the behavior of customer purchase intention on halal travel and tourism and the results show that halal marketing is the first aspect that is a priority to do. Halal awareness is also a key priority for the successful development of halal tourism in Indonesia [21]. Other topics from the demand side are perceptions of halal tourism [59], tourist experience in halal tourism [60], and Muslim tourism to revisit tourism destinations [61].

Several other researchers are interested in discussing government regulation in the development of halal tourism in Indonesia, including those related to halal product guarantees and the lack of comprehensive regulations in Indonesia [62]. Halal governance is also an interesting issue for researchers in Indonesia who disclose the existing halal certification process in Indonesia and also reveal that there are halal certification institutions in several countries in Asia, New Zealand and Australia, Europe, America, and South Africa that are approved by certification board for halal in Indonesia, namely LPPOM-MUI [63]. Meanwhile, discussion of halal tourism from the supply side is still very rare and the authors have not met those who discuss financial inclusion and Islamic financial literacy. Among those discussing halal tourism from the supply side is related to halal certification for food operators and it was found that knowledge of halal tourism is a driving factor for food operators to carry out certification [64]. Then, there are those who discuss halal certification in hospitality where hotel owners say halal certification has not become a priority due to the lack of effort to implement halal standards [65].

Several researchers have also discussed the development of halal tourism objects in Gorontalo, where tourism is generally able to contribute but there are still many aspects that need to be improved [66]. Other researchers promote the potential of Kudus as a new international pilgrimage destination for halal tourism by highlighting local wisdom [67]. Meanwhile, discussions regarding the role of financial institutions in developing MSMEs in the tourism sector in Indonesia are still rare. Among them is the development of halal tourism in rural areas in Bengkulu, Indonesia where this research recommends that Islamic banking develop a financing model by combining internal and external funding sources such as zakat, infaq, and alms [68]. However, there are several studies related to the financing of tourism destinations in several countries that can be used as a reference in this research. For example, the development of rural tourism in Romania, researchers found that there were two keys to success, namely government programs and the role of banks [12]. Research in Africa also found that the level of financial literacy has an impact on the success of MSMEs [11,43,44,45,52]. The following is resume of previous studies and research gaps (Table 1).

Table 1.

Previous Studies and Research Gaps.

2.4.1. Relationship between Islamic Financial Literacy and Islamic Financial Inclusion

The authors were unable to locate any research on the function of Islamic banking in fostering business growth in the tourism sector, but numerous academics have undertaken similar studies. For example, some reseacher have evaluated the association between Uganda’s financial literacy and financial inclusion. There is a positive and substantial association between financial Literacy and financial inclusion, according to a study including 169 samples and evaluated with ModGrap [45]. A study in Uganda involving 5000 respondents about the role of microfinance in increasing financial inclusion for the poor. The study was analyzed using SEM AMOS, where financial literacy among the poor has a positive impact on increasing financial inclusion in Uganda [44]. Another study also investigates the relationship between financial literacy with financial inclusion of the poor in the rural area of Uganda. With the 375 respondents, they found that there is a positive relationship [43]. In the context of MSMEs, a study in Indonesia investigated 198 entrepreneurs using the SEM Bootstrap approach and found the empirical fact that Islamic financial literacy has a positive relationship with Islamic financial inclusion but is insignificant [18]. Some studies also conducted an investigation into the creative economy sector where there is a positive and significant relationship between Islamic financial literacy and Islamic financial inclusion. This study involved 62 business owners in the creative economy sector and was analyzed using SEM GSCA [69]. Another researcher also investigated the relationship between financial literacy and financial inclusion in Kalimantan, Indonesia. Involving 100 MSMEs and analyzed using SEM-PLS, they found that there are positive and significant relationships for both [70]. This illustrates that financial literacy has an important and significant role in increasing MSME financial inclusion. Thus, following our hypothesis:

H1:

Islamic financial literacy positive impact on Islamic financial inclusion.

2.4.2. Relationship between Marketing Communication and Islamic Financial Inclusion

Marketing communication has a very vital role in promoting a product. The purpose of marketing communications is to motivate potential customers [18]. Prospective potential customers can be influenced through various appropriate promotional activities [71,72]. Islamic banking must increase the intensity of its marketing communications so that potential customers can become customers [11]. Empirical facts also show that it will influence someone in making decisions. Companies that do relationship marketing in the long term will be able to attract customers and retain customers [73]. Another scholar interviewed 198 people in Surakarta, Indonesia about purchasing Islamic banking products, and the most important aspects were product knowledge and social context [74]. Meanwhile, another study discovered that marketing communication influences the inclusivity of Islamic finance for business actors [18]. The results of this study illustrate the need for companies to promote marketing communication with customers and prospective customers in order to create financial inclusion. Based on the above explanation, the following is our next hypothesis:

H2:

Marketing communication’s positive impact on Islamic financial inclusion.

2.4.3. Relationship between Islamic Financial Literacy, Islamic Financial Inclusion, and Business Performance

Company performance can be influenced by several factors, including financial literacy and access to financial institutions. Some researchers have explored the influence of Islamic banking in promoting business actors in the creative economy sector. The study’s findings indicate that the varied incorporation of Islamic finance has a favorable and significant impact on the growth of enterprises in the creative economy sector. According to the findings of the preceding study, financial inclusion is critical to business development. What variables impact business players ready to buy products from formal financial institutions such as Islamic banking is no less essential. The study also found that entrepreneurs who have good financial literacy are able to develop their businesses well [69]. More precisely, a study discovered that business actors that have access to financial institutions are more likely to succeed in their endeavors. The study included 90 business actors in Malang, Indonesia’s MSMEs sector, and was analyzed using partial least squares (PLS). Another study discovered the same thing in Kalimantan, Indonesia where financial inclusion plays a critical role in the development of enterprises in the MSMEs sector [70]. Another study investigated 375 small creative businesses in Yogjakarta, Indonesia and the relationship between financial literacy and business performance. He found that there are positive relationships for both [75]. The results of this study provide an indication that financial literacy and financial inclusion are two important components that can help companies improve their performance. Based on the aforementioned description, the authors offer the following study hypotheses:

H3:

Islamic financial literacy’s positive impact on business performance.

H4:

Islamic financial inclusion’s positive impact on business performance.

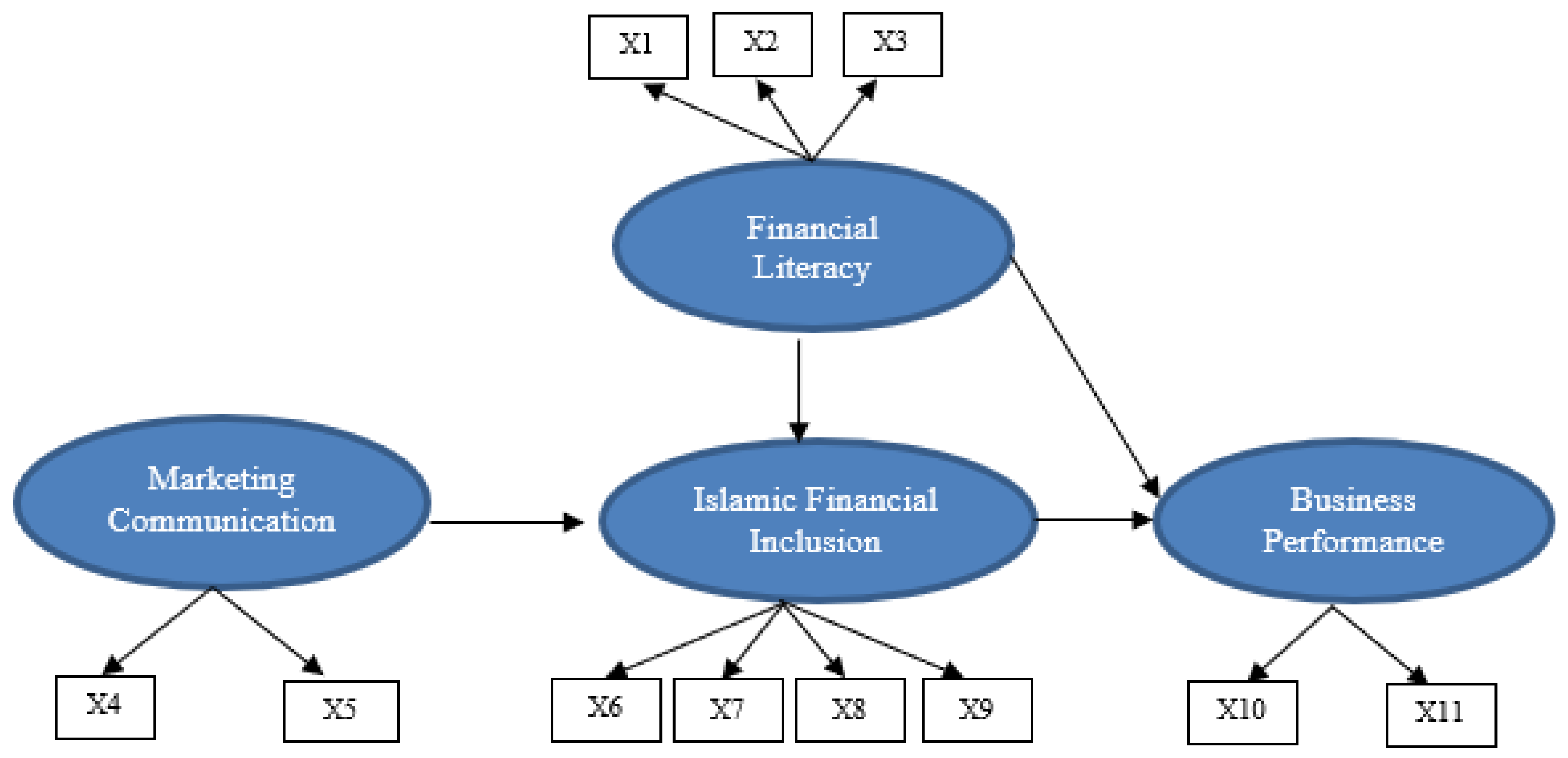

Based on the description above, the empirical framework in this study is as follows (Figure 1):

Figure 1.

Empirical Framework.

3. Method

This study refers to previous studies [42,43,44]. There are several stages in the methodology, namely the selected variable, data collection, and data analysis.

3.1. Variable Selection

This research aims to examine the role of Islamic banking in the development of MSMEs in Indonesia’s halal-tourist ecosystem. This contribution is visible at the level of Islamic financial inclusion for MSMEs which is projected to improve their business performance. Therefore, this study will investigate the relationship between financial inclusion and MSME business performance in Indonesia’s halal-tourism environment. In addition, this study will examine the causality of the relationship between exogenous variables, such as financial literacy, marketing communication, and financial inclusion, and endogenous variables, such as business performance.

We employed four variable delay variables and twelve indicator variables in this investigation. Financial literacy, marketing communication, financial inclusion, and company performance are the four latent variables. There are three indicator variables for financial literacy: awareness (X1), knowledge (X2), and skill (X3). Relationship marketing (X4) and advertising are two indicator variables in marketing communication (X5). Access (X6), utilization (X7), obstacles (X8), and quality are the four indicator variables for financial inclusion (X9). Finally, there are two indicator variables for business performance: sales growth (X10) and profit growth (X11).

3.2. Data Collection

This research was carried out at the time of the COVID-19 pandemic which was full of uncertainty. The government also imposed a ban on outdoor activities during the COVID-19 pandemic. Research conducted under uncertainty can have an impact on the accuracy of research data and results [76]. Under uncertainty, research data can be collected using artificial intelligence techniques such as using online questionnaires rather than using traditional data techniques because they are faster and more accurate [76]. This study was designed with a belief function theory approach. Belief function theory is a framework for collecting data under uncertainty [77]. For the accuracy of data collection, our research questionnaire was addressed to a community of entrepreneurs who support the halal tourism sector in Indonesia such as hotels and homestays, restaurants, tours and travel, transportation, and souvenirs and analyzed using the structural equation modeling (SEM) approach. The business community includes The Indonesian Hotel and Restaurant Association (IHRA), the Association Tourism Halal Indonesia (PPHI), the We Halal Consortium, Risen Muslim Entrepreneurs (BPM), and the Generation Entrepreneurs Professional (GenPro). Online questionnaires are distributed to the entrepreneur community through social media platforms such as WhatsApp, Facebook, Line, and Instagram. We get feedback from 274 respondents who completed the online questionnaires. After screening, there were only 152 responders who met the study’s criteria. The number of samples has fulfilled the analysis criteria using the SEM approach, which is between 100 and 200 samples [78].

3.3. Data Analysis

This research conducted SEM for the analysis method. SEM is a powerful method for estimating multiple and concurrent relationships involving several dependent and explanatory factors and it allows for the inclusion of latent variables that cannot be measured directly but may be described as a function of other measurable variables. This brief definition of SEM does not do credit to the intricacy of the processes needed in building a structural equation model, but it does highlight SEM’s distinction from statistical methodologies [79]. SEM is an appropriate method to examine the latent variables. A single dependent variable is related to one or more independent (explanatory) factors in linear regression, with the premise that these explanatory variables are fixed, independent of each other, and exogenous (which means that they are determined outside the relationship).

This study was evaluated with LISREL 8.7 software and a covariance-based structural equation model (SEM) technique (CB-SEM). Several researchers [80,81] indicate that research undertaken to test theory should utilize CB-SEM, whereas research conducted to forecast a construct should use PLS-SEM. This study employs CB-SEM with LISREL software to evaluate and corroborate assumptions concerning financial inclusion, financial literacy, marketing communication, and business success. There are two steps in CB-SEM analysis, namely confirmation of factor analysis (CFA), measurement evaluation, and structural evaluation. CFA consists of measurement evaluation (loading factor values for each construct) and the goodness of fit (GOF) models. The loading factor for each relationship between the latent variable and an indicator variable is 0.5 while the others criteria for the goodness of fit model is as shown at Table 2 below:

Table 2.

Goodness of Fit Model Criteria.

4. Results

4.1. Respondent Profile

Respondents in this study were dominated by men with a total of 87 or 57.24 percent and the level of education was dominated by college graduates who reached 81 or 53.29 percent with an average of very productive or mature age of 53 people or 34.87 percent. Hotels and homestays are essential components that must exist to accommodate guests on vacation. Respondents who tried on the field hotel and homestay reached 29 or 19.08 percent in this survey. Meanwhile, respondents with a restaurant company accounted for 85 people or 55.92 percent of the total. This is the highest amount among other firms. One of the key elements encouraging halal tourism is 12 or 07.89 percent of transportation, tour, and travel companies. In this analysis, companies involved in souvenirs accounted for 20 percent or 13.16 percent. Souvenirs are one of the key auxiliary goods in tourism that travelers can use as souvenirs. In Table 3, information on the number of workers is also shown, with the entire workforce successfully absorbed in the halal-tourist ecosystem reaching 713 persons, with six enterprises employing more than 20 people. Meanwhile, the number of enterprises employing 6–20 employees reached 19 (or 12.50). Table 3 further demonstrates that microscale organizations dominate this research’s respondents, accounting for 104 companies or 68.42 percent.

Table 3.

Respondent Profile.

4.2. Statistic Descriptive

Table 4 shows the data from this study where the mean value of all variables is greater than three and the standard deviation is more significant than 0.5. In the meantime, the minimum value is 0.912, and the maximum value is 5204. Table 4 also displays the p-value for each indicator variable’s skewness and kurtosis. These values are greater than 0.05, indicating that the data is regularly distributed. The data must be periodically distributed, which is one of the most important conditions in the CB-SEM analysis, in contrast to PLS-SEM, where data are not required to be regularly distributed [78,81].

Table 4.

Descriptive Statistic.

Meanwhile, Table 5 shows the covariance matrix for each latent variable, wherein the matrix shows a positive value for the whole relationship.

Table 5.

Covariance Matrix Among Latent Variables.

4.3. SEM Evaluation

4.3.1. Confirmatory Factor Analysis

The first step in conducting data analysis using SEM is to perform a confirmatory factor analysis (CFA). CFA evaluation can be seen from the value of the loading factor for each construct variable. Loading factor values are shown in Table 6, which all have a loading factor value greater than 0.5. Table 6 also shows the Cronbach alpha value’s reliability, with a composite Cronbach alpha value of 9.26, indicating that it is dependable with an explained variance of 41,197–46,912. The second step is to evaluate the goodness of fit model. The goodness of fit models can be seen in Table 7. In the first evaluation, not all criteria were met, so it was necessary to modify the model. After adjusting the model, Table 7 shows that all the requirements for the goodness of fit model have met the model’s feasibility test standard.

Table 6.

Loading Factor and Cronbach Alpha.

Table 7.

Goodness of Fit Statistic Evaluation.

4.3.2. Correlation Matrix of Latent Variables

Table 8 depicts the association between latent factors, with all latent variables having a positive relationship and a correlation value of 0.78 for the relationship between financial literacy and marketing communication. While the association between financial literacy variables and financial inclusion is 0.78, the relationship between financial literacy variables and company performance is 0.77. The association between marketing communication and financial inclusion is 0.62, and the link between marketing communication and business performance is 0.70. Financial inclusion and business performance have a 0.90 link.

Table 8.

Correlations Matrix Among Latent Variables.

4.3.3. Structural Model Evaluation

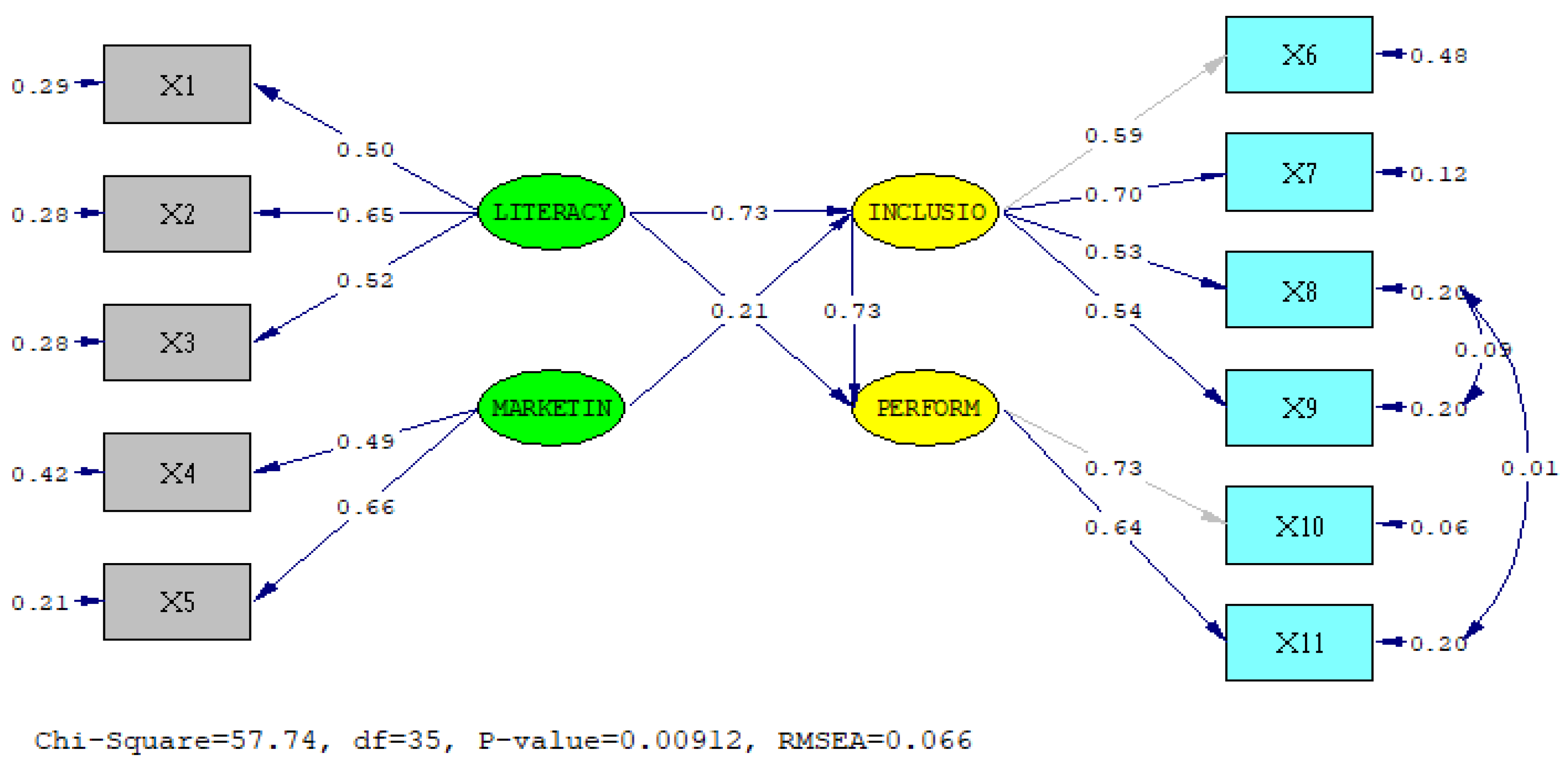

Table 9 displays the structural model findings so that you can see the effect of each variable. Table 9 demonstrates a positive and substantial link between financial literacy and financial inclusion variables. As a result, we accept H1. Meanwhile, marketing communication has a beneficial but nonsignificant impact on financial inclusion (β = 0.06, CR = 0.36) and hence on the beginning of H2. With a coefficient of 0.21, variable financial literacy has a positive but nonsignificant effect on variable business success and we reject H3. The following relationship is positive and significant between financial inclusion and business performance. H4 was also acceptable.

Table 9.

Structural Model.

Figure 2 below shown the relationship between laten variables and indicator variables and also relationship between exogen variables and endogen variables.

Figure 2.

Structural Model Evaluation. Green colour is the exogen variables and Yellow Colour is the Endogen varibales.

5. Discussions

Halal finance is one of the locomotives propelling Islamic finance’s genuine industry. The structural model results reveal that Islamic banking has a positive and significant association with the performance of MSME in the halal-tourism ecosystem. This study’s findings are consistent with [18,69,70]. Scholars also outlined the steps these enterprises must take to obtain financial resources from banks, namely the diversification of income sources, the association and adherence to recognized brands, and the maintenance of a sustainable leverage ratio [17]. In addition, it was discovered that the size of the bank is unimportant but the kind of bank capital is; private domestic banks are more ready to finance such firms.

This finding shows that MSMEs in Indonesia’s halal-tourism ecosystem require access to Islamic finance institutions to improve and expand their operations. Furthermore, MSMEs must be educated on the importance of company development through financial institutions. On the other side, Islamic banking must expand its operations in halal finance by focusing on the MSME market, particularly MSMEs in the halal-tourist ecosystem. Furthermore, due to the merging of three state banks, Bank Syariah Indonesia must become a locomotive committed to the development of halal tourism in Indonesia. This study also demonstrates a favorable and statistically significant association between financial literacy and financial inclusion. The outcomes of this study support earlier researchers’ conclusions [16,42,43,44]. As a result, both parties must increase their Islamic financial literacy. sharia banking can work with the entrepreneur community in the halal-tourist ecosystem to teach Islamic financial literacy, increasing the prospects for sharia financial inclusion.

The structural model also discovered a positive but insignificant association between financial literacy and business success. This finding contradicts the findings of [16,18,43,44,51,52]. Although not considerable, this association has had a favorable impact on incorporating Islamic finance and improving MSME business performance in Indonesia’s halal-tourist ecosystem. As a result, initiatives to improve Islamic financial literacy must be pursued indefinitely in order to have a greater impact. Improving Islamic financial literacy can be accomplished by honing Islamic financial skills, such as the notion of syirkah in building their business and enhancing their knowledge of halal financial products to have a stronger impact on the development of MSMEs in the Indonesian halal-tourism ecosystem. The findings of this study are at odds with a previous study [71], which found that characteristics related to financial literacy significantly and favorably affect the performance of small enterprises in East Kalimantan. The findings of this study also corroborate a previous study [82] that finds a link between financial literacy, entrepreneurial performance, and an entrepreneurial attitude. A creative venture performs better overall when its members are financially literate. The findings show a positive and significant moderating influence of financial literacy in the relationship between access to credit and the growth of SMEs in emerging economies, which is in accordance with the findings presented in previous studies [43,44,45]. Additionally, the development of SMEs in underdeveloped nations is significantly and favorably impacted by financial literacy and access to capital. The findings of this study concur with those of one previous study [16]. According to the ANP investigation, supply and demand are the two key factors that affect Indonesia’s level of Islamic financial inclusion.

This study also provides information that there is a positive but not significant relationship between marketing communication and financial inclusion. The results of this study are not in line with [47,69,78]. However, although not significant, the relationship is positive. This means that marketing communications run by Islamic banking as halal finance have attracted interest for MSMEs. For this reason, Islamic banking needs to improve marketing communication to the entrepreneurial community in the halal-tourism ecosystem because marketing communication is a pivotal strategy for banking industries. Customers are not only interested in the products offered but also in how they are offered, which is the most important thing in marketing communication [83]. Furthermore, ref. [84] said that banks must carry out integrated marketing communication so that prospective customers can buy the products offered. Scholars such as [71,72] said that potential customers are as important as existing customers; thus, an intense approach is needed. In Islamic banking, they must carry out integrated marketing communication through various programs and inform the media channels they have. Meanwhile, Ref. [85] recommends that marketing communication carried out by banks emphasizes more on adopting personal selling.

Therefore, to improve the performance of SMEs in halal tourism, it is necessary to pay attention to the above variables. The marketing communication variable is a variable that needs attention from Islamic banking. Islamic banking needs to improve its marketing communication through promotion to MSMEs on halal tourism by taking a more intensive approach so that they are interested and decide to use Islamic banking services. The decision of MSMEs to use services in Islamic banking will certainly make it easier for them to conduct business transactions, such as the use of financing, the use of e-banking, mobile banking, and internet banking. MSMEs in halal tourism also need to improve Islamic financial literacy in order to be able to manage finances well. Thus, their business performance can also improve as well. Financial knowledge and financial skills, which are part of financial literacy, seem to need special attention for them. Financial knowledge, such as knowledge about Islamic financial products, will help entrepreneurs in halal tourism to develop their business portfolios. Meanwhile, financial skills, such as the ability to manage debt and the ability to budget, will help them in maintaining the company and in developing their business.

The results of this study provide clear directions to develop halal tourism in Indonesia, especially for business actors in the halal-tourism ecosystem. Business actors need to be equipped with Islamic financial literacy. This study empirically proves that the theory of financial literacy has an impact on financial inclusion and business performance in the halal tourism sector; thus a good understanding of Islamic financial literacy for entrepreneurs needs attention. Entrepreneurs also need to improve access to Islamic financial institutions so that their businesses can develop properly and quickly. On one side, Islamic banking also needs to improve marketing communication with business actors so that it will enhance strong relationships with customers and potential customers.

6. Conclusions and Recommendations

6.1. Conclusions

Sustainable halal tourism necessitates concerted efforts and commitment from all stakeholders, including business actors and the financial industry, particularly halal finance. This study demonstrates that Islamic banking, as halal financing, has a meaningful contribution to the development of halal tourism in Indonesia. However, it is not optimal in terms of providing access to business actors involved in tourism for a variety of reasons. MSMEs have a significant duty to promote halal tourism in Indonesia as one of the components of the halal-tourism ecosystem in Indonesia; thus, they should have the bravery to build their business, even more, using various financing schemes supplied by Islamic banking. Halal finance, on the other hand, such as Islamic banking, Islamic rural banks, and Islamic microfinance, must be made available to MSMEs in the halal-tourist ecosystem. As a result, the role of Islamic finance in the development of MSMEs in the halal tourist ecosystem may be even more critical. This study has limitations; first, that this study has not included conventional financial institution variables as control variables. The results of this study may be different if the existence of conventional financial institutions is included in the model. We recommend further research to include conventional financial institution variables for more comprehensive research results. Second, we only took samples from two out of ten provinces in Indonesia that were designated as halal-tourism destinations. Therefore, we recommend further research to take samples from these ten provinces. Third, the research sample needs to be increased even more.

6.2. Recommendations

We recommend MSME development policies in the halal tourism sector in Indonesia. First, for Government or Regulator. The government can encourage Islamic financial institutions to penetrate the Halal Tourism MSME actors market in Indonesia. In this case, the government needs to provide rewards for Islamic financial institutions that focus on halal MSME actors. For example, a liquidity policy is more specific for Islamic banks with consumers who are SMEs. Second, for Islamic bankers. Islamic bankers should think about and implement strategies explicitly made for halal MSMEs because they have different socioeconomic conditions from other consumers and have their characteristics.

Author Contributions

Conceptualization, B.T. and S.M.; methodology, B.T. and E.F.C.; software, B.T.; validation, B.T., E.F.C. and R.; formal analysis, All Authors; investigation, All Authors; resources, S.M.; data curation, B.T. and R.; writing—original draft preparation, B.T., S.M. and E.F.C.; writing—review and editing, R.; Project administration, S.M. and R.; funding acquisition, S.M. and R. All authors have read and agreed to the published version of the manuscript.

Funding

This study was fully funded by Siti Mujiatun.

Institutional Review Board Statement

Not Applicable.

Informed Consent Statement

Informed consent was obstained from all subjects involved in this study.

Data Availability Statement

Unavailable data due to privacy and ethical restrictions.

Acknowledgments

We would like thank to reviewers, respondents, and all parties involved in this research.

Conflicts of Interest

The authors declare that this study has no conflict of interest.

References

- World Travel and Tourism Council. Global Economic Impact & Trend 2020. 2020. Available online: https://wttc.org/Portals/0/Documents/Reports/2020/Global%20Economic%20Impact%20Trends%202020.pdf?ver=2021-02-25-183118-360 (accessed on 1 November 2020).

- World Travel and Tourism Council. Travel and Tourism Economic Impact on 2022. Available online: https://wttc.org/Portals/0/Documents/Reports/2022/EIR2022-Global%20Trends.pdf?ver=GSU_IYwKgglGJcs7mt0-oA%3d%3d (accessed on 22 February 2023).

- BPS. The Number of Tourist Visits to Indonesia in December 2019 Reached 1.38 Visits. 2020. Available online: https://www.bps.go.id/pressrelease/2020/02/03/1711/sum-kunjungan-wisman-ke-indonesia-desember-2019-menreach-1-38-juta-kunjungan-.html (accessed on 1 November 2020).

- Mardianto, M.F.F.; Cahyono, E.F.; Syarifah, L.; Andriani, P. Prediction of the Number of Foreign Tourist Arrival in Indonesia Halal Tourism Entrance using Simultaneously Fourier Series Estimator. KnE Soc. Sci. 2019, 1093–1104. [Google Scholar] [CrossRef]

- Zaki, I.; Hamida, G.; Cahyono, E.F. Potentials of Implementation of Sharia Principles in the Tourism Sector of Batu City, East Java. Amwaluna J. Ekon. Dan Keuang. Syariah 2020, 4, 96–111. [Google Scholar] [CrossRef]

- Mastercard-Crescentating (GMTI). Global Muslim Travel Index 2019; Crescentrating Company: Singapore, 2019. [Google Scholar]

- Vasanicova, P.; Jancova, S.; Gavurova, B.; Bacik, R. Coopetition of European Union Countries within Destination Management. J. Tour. Serv. 2022, 13, 24. [Google Scholar] [CrossRef]

- Antara. Indoesian Named as the Wolrd’s Best Halal Tourist Destination. 2019. Available online: https://en.antaranews.com/news/123299/indonesia-named-as-the-worlds-best-halal-tourist-destination (accessed on 22 February 2023).

- Pikiran Rakyat. Ekonomi Kreatif Intangible Sulit Akses Perbankan. 2021. Available online: https://www.pikiran-rakyat.com/ekonomi/pr-01286464/ekonomi-kreatif-intangible-sulit-akses-perbankan-410021 (accessed on 11 August 2020).

- Camara, N.; Tuesta, D. Measuring Financial Inclusion: A Multidimensional Index. In Proceedings of the Bank of Morocco—CEMLA—IFC Satellite Seminar of The ISI World Statistics Congress on Financial Inclusion, Marrakech, Morocco, 14 July 2017. [Google Scholar]

- Abubakar, H.A. Entrepreneurship development and financial literacy in Africa. World J. Entrep. Manag. Sustain. Dev. 2015, 11, 281–294. [Google Scholar] [CrossRef]

- Badulescu, D.; Giurgiu, A.; Istudor, N.; Badulescu, A. Rural tourism development and financing in Romania: A sup-ply-side analysis. Agric. Econ. 2015, 61, 72–82. [Google Scholar] [CrossRef]

- Musa, H.; Natorin, V.; Musova, Z.; Durana, P. Comparison of the Efficiency Measurement of the Conventional and Islamic Bank. Oeconomia Copernic. 2020, 11, 29–58. [Google Scholar] [CrossRef]

- Masrizal, M.; Trianto, B. The Role of Pls Financing on Economic Growth: Indonesian Case. J. Islam. Monet. Econ. Financ. 2022, 8, 49–64. [Google Scholar] [CrossRef]

- Alinea. Kontribusi Sektor Pariwisata Terhadap PDB Tahun 2017–2021. 2022. Available online: https://data.alinea.id/kontribusi-sektor-pariwisata-terhadap-pdb-2017-2021-b2feX9CV9b (accessed on 22 February 2023).

- Ali, M.M.; Devi, A.; Furqani, H.; Hamzah, H. Islamic financial inclusion determinants in Indonesia: An ANP approach. Int. J. Islam. Middle East. Financ. Manag. 2020, 13, 727–747. [Google Scholar] [CrossRef]

- Janah, M. Minat Usaha Mikro Kecil Menengah Pasar Bawah Untuk Melakukan Pembiayaan Berbasis Konvensional Dan Berbasis Syariah. Doctoral Dissertation, Universitas Islam Negeri Sultan Syarif Kasim Riau, Riau, Indonesia, 2021. [Google Scholar]

- Trianto, B.; Rahmayati, R.; Yuliaty, T.; Sabiu, T.T. Determinant factor of Islamic financial inclusiveness at MSMEs: Evidence from Pekanbaru, Indonesia. J. Ekon. Keuang. Islam 2021, 7, 105–122. [Google Scholar] [CrossRef]

- Hoque, M.E.; Nik Hashim, N.M.H.; Azmi, M.H.B. Moderating effects of marketing communication and financial consideration on customer attitude and intention to purchase Islamic banking products: A conceptual framework. J. Islam. Mark. 2018, 9, 799–822. [Google Scholar] [CrossRef]

- BAPENAS (Badan Perencanaan Pembangunan Nasional or National Body of Development Planning). Masterplan Ekonomi Syariah Indonesia 2019–2024; BAPPENAS: Jakarta, Indonesia, 2018.

- Devi, A.; Firmansyah, I. Developing Halal Travel and Halal Tourism to Promote Economic Growth: A Confirmatory Analysis. J. Islam. Monet. Econ. Financ. 2019, 5, 193–214. [Google Scholar] [CrossRef]

- Zamani-Farahani, H.; Henderson, J.C. Islamic Tourism and Managing Tourism Development in Islamic Societies: The Case of Iran and Saudi Arabia. Int. J. Tour. Res. 2010, 12, 79–89. [Google Scholar] [CrossRef]

- Jaelani, A. Halal Tourism Industry in Indonesia: Pontential and Prospects. Munich Pers. RePEc 2017, 7, 76235. [Google Scholar] [CrossRef]

- Chianeh, R.H.; Kian, B.; Azgoomi, S.K.R. Islamic and Halal Tourism in Iran. Exp. Persian Herit. Bridg. Tour. Theory Pract. 2019, 10, 295–307. [Google Scholar] [CrossRef]

- Mohsin, A.; Ramli, N.; Alkhulayfi, B.A. Halal tourism: Emerging opportunities. Tour. Manag. Perspect. 2016, 19, 137–143. [Google Scholar] [CrossRef]

- Battour, M.; Ismail, M.N. Halal tourism: Concepts, practises, challenges and future. Tour. Manag. Perspect. 2016, 19, 150–154. [Google Scholar] [CrossRef]

- Rahman, R.F. Pengaruh Brand Image Bank Syariah Terhadap Minat Pinjaman Modal Umkm (Studi Kasus Pada Bank Kal-Sel Syariah Kota Banjarmasin. Doctoral Dissertation, Universitas Islam Kalimantan MAB, Kalimantan Selatan, Indonesia, 2021. [Google Scholar]

- El-Gohary, H. Halal tourism, is it really Halal? Tour. Manag. Perspect. 2016, 19, 124–130. [Google Scholar] [CrossRef]

- Din, K.H. Islam and tourism. Ann. Tour. Res. 1989, 16, 542–563. [Google Scholar] [CrossRef]

- Republika. People Still Misunderstand the Definition of Halal Tourism. 2019. Available online: https://www.republika.co.id/berita/gaya-Life/travelling/19/03/25/pox1lw459-Masyarakat-masih-salah-paham-pengertian-wisata-halal (accessed on 31 October 2020).

- Wuryasti, F. Halal Tourism, A New Concept of Tourism Activities in Indonesia. 2013. Available online: https://travel.detik.com/travel-news/d-2399509/wisata-halal-concept-baru-activity-wisata-di-indonesia (accessed on 22 February 2023).

- Jafari, J.Y.; Scott, N. Muslim world and its tourisms. Ann. Tour. Res. 2014, 44, 1–19. [Google Scholar] [CrossRef]

- Carboni, M.; Parelli, C.; Sistu, G. Is Islamic Tourism a Viable Option for Tunisian Tourism? Insight from Djerba. Tour. Manag. Perspect. 2014, 11, 1–9. [Google Scholar] [CrossRef]

- Bogan, E.; Sariisik, M. Halal Tourism: Conceptual and Practical Challenges. J. Islam. Mark. 2018, 10, 87–96. [Google Scholar] [CrossRef]

- Khan, F.; Callanan, M. The “Halilification” of Tourism. J. Islam. Mark. 2017, 8, 558–577. [Google Scholar] [CrossRef]

- Etzkowitz, H.; Leydesdorff, L. Triple Helix—University Industry Government Relations: A Laboratory for Knowledge Based Economy Development. EASST Rev. 1995, 14, 14–19. [Google Scholar]

- Bisnis. Minister of Tourism Emphasizes Penta Helix Collaboration. Here’s the Explanation. 2016. Available online: https://ekonomi.bisnis.com/read/20160725/12/568877/menteri-pariwisata-tekankan-kolaborasi-penta-helix.-begini-pencepatan (accessed on 1 November 2020).

- OECD INFE. Measuring Financial Literacy: Questionaire and Guidance Notes for Conducting an Internationally Comparable Survey of Financial Literacy; International Network on Financial Education: Paris, France, 2011. [Google Scholar]

- OJK. Indonesian Financial Literacy National Strategy (Revisit). 2017. Available online: https://www.ojk.go.id/id/berita-dan-activities/publikasi/Documents/Pages/Strategi-Nasional-Literasi-Keuangan-Indonesia-(Revisit-2017)-/SNLKI%20(Revisit%202017)-new.pdf (accessed on 28 June 2020).

- Pond, C. Financial Capability Strategy. In Taking Financial Literacy to the Next Level: Important Challenges and Promising Solutions, Proceedings of the OECD-US Treasury International Conference on Financial Education, Washington, DC, USA, 7–8 May 2008; US Treasury Department: Washington, DC, USA; OECD: Paris, France; Volume I.

- Van Rooij, M.; Lusardi, A.; Alessie, R. Financial Literacy and Stock Market Participation. 2007. Available online: https://www.dartmouth.edu/~alusardi/Papers/Literacy_StockMarket.pdf (accessed on 29 June 2020).

- Lusardi, A.; Mitchell, O.S. The Economic Importance of Financial Literacy: Theory and Evidence. J. Econ. Lit. 2014, 52, 5–44. [Google Scholar] [CrossRef] [PubMed]

- Bongomin, G.O.C.; Munene, J.C.; Ntayi, J.M.; Malinga, C.A. Nexus between financial Literacy and financial inclusion. Examining the moderating role of cognition from a developing country perspective. Int. J. Bank Mark. 2018, 36, 1190–1212. [Google Scholar] [CrossRef]

- Okello Candiya Bongomin, G.; Mpeera Ntayi, J.; Akol Malinga, C. Analyzing the relationship between financial Literacy and financial inclusion by microfinance in developing countries: Social network theoretical approach. Int. J. Sociol. Soc. Policy 2020, 40, 1257–1277. [Google Scholar] [CrossRef]

- Okello Candiya Bongomin, G.; Mpeera Ntayi, J.; Munene, J.C.; Akol Malinga, C. The Relationship Between Access to Finance and Growth of SMEs in Developing Economies: Financial Literacy as a Moderator. Rev. Int. Bus. Strategy 2017, 27, 520–538. [Google Scholar] [CrossRef]

- Walsh, S.; Gilmore, A.; Carson, D. Managing and Implementing Simultaneous Transaction and Relationship Marketing. Int. J. Bank Mark. 2004, 22, 468–483. [Google Scholar] [CrossRef]

- Eisingerich, A.B.; Bell, S.J. Relationship Marketing in the Financial Services Industry: The Importance of Customer Education, Participation and Problem Management for Customer Loyalty. J. Financ. Serv. Mark. 2006, 10, 86–97. [Google Scholar] [CrossRef]

- Laverin, A.; Liljander, V. Does Relationship Marketing Improve Customer Relationship Satisfaction and Loyalty? Int. J. Bank Mark. 2006, 24, 232–251. [Google Scholar] [CrossRef]

- El-Deeb, M.S.; Halim, Y.T.; Kamel, E.M. The pillars determining financial inclusion of SMEs in Egypt: Service awareness, access and usage metrics and macroeconomic policies. Future Bus. J. 2021, 7, 32. [Google Scholar] [CrossRef]

- Rangarajan, C. Report of The Committee on Financial Inclusion; The Government of India: New Delhi, India, 2008.

- Puspitasasi, S.; Mahri, A.J.W.; Utami, S.A. Inklusi Keuangan Syariah DI Indonesia Tahun 2015–2018. Amwaluna J. Islam. Econ. Financ. 2020, 4, 1. [Google Scholar] [CrossRef]

- Kalunda, E. Financial Inclusion Impact on Small-Scale Tea Farmers in Pain County, Kenya. In Proceedings of the 6th International Business and Social Sciences Research Conference, Dubai, United Arab Emirates, 3–4 January 2013. [Google Scholar]

- Ajide, F.M. Financial Inclusion in Africa: Does it Promote Entrepreneurship? J. Financ. Econ. Policy 2019, 12, 687–706. [Google Scholar] [CrossRef]

- Neely, A.; Gregory, M.J.; Platts, K. Performance measurement system design: A literature review and research agenda. Int. J. Oper. Prod. Manag. 1995, 15, 80–116. [Google Scholar] [CrossRef]

- Suban, S.A.; Madhan, K.; Shagirbasha, S. A bibliometric Analysis of Halal and Islamic Tourism. Int. Hosp. Rev. 2021; ahead of print. [Google Scholar] [CrossRef]

- Berakon, I.; Wibowo, M.G.; Nurdany, A.; Aji, H.M. An expansion of the technology acceptance model applied to the halal tourism sector. J. Islam. Mark. 2023, 14, 289–316. [Google Scholar] [CrossRef]

- Lestari, Y.D.; Saidah, F.; Aliya Putri, A.N. Effect of destination competitiveness attributes on tourists’ intention to visit halal tourism destination in Indonesia. J. Islam. Mark. 2023, 14, 937–965. [Google Scholar] [CrossRef]

- Juliana, J.; WMahri, A.J.; Salsabilla, A.R.; Muhammad, M.; Nusannas, I.S. The determinants of Muslim millennials’ visiting intention towards halal tourist attraction. J. Islam. Account. Bus. Res. 2023, 14, 473–488. [Google Scholar] [CrossRef]

- Vargas-Sanchez, A.; Hariani, D.; Wijayanti, A. Perceptions of Halal Tourism in Indonesia: Mental Constructs and Level of Support. Int. J. Relig. Tour. Pilgr. 2020, 8, 5. [Google Scholar] [CrossRef]

- Suhartanto, D.; Gan, C.; Andrianto, T.; Tuan Ismail, T.A.; Wibisono, N. Holistic tourist experience in halal tourism evidence from Indonesian domestic tourists. Tour. Manag. Perspect. 2021, 40, 100884. [Google Scholar] [CrossRef]

- Juliana, J.; Putri, F.F.; Wulandari, N.S.; Saripudin, U.; Marlina, R. Muslim tourist perceived value on revisit intention to Bandung city with customer satisfaction as intervening variables. J. Islam. Mark. 2022, 13, 161–176. [Google Scholar] [CrossRef]

- Effendi, D.; Rosadi, A.; Prasetyo, Y.; Susilawati, C.; Athoillah, M.A. Preparing Halal Tourism Regulations in Indonesia. Int. J. Relig. Tour. Pilgr. 2021, 9, 6. [Google Scholar] [CrossRef]

- Hudaefi, F.A.; Jaswir, I. Halal Governance in Indonesia: Theory, Current Practices, and Related Issues. J. Islam. Monet. Econ. Financ. 2019, 5, 89–116. [Google Scholar] [CrossRef]

- Katuk, N.; Ku-Mahamud, K.R.; Kayat, K.; Abdul Hamid, M.N.; Zakaria, N.H.; Purbasari, A. Halal certification for tourism marketing: The attributes and attitudes of food operators in Indonesia. J. Islam. Mark. 2021, 12, 1043–1062. [Google Scholar] [CrossRef]

- Rachmiatie, A.; Rahmafitria, F.; Suryadi, K.; Larasati, A.R. Classification of halal hotels based on industrial perceived value: A study of Indonesia and Thailand. Int. J. Tour. Cities 2022, 8, 244–259. [Google Scholar] [CrossRef]

- Izudin, A.; Sriharini, S.; Khuluq, L. Developing Halal Tourism: The Case of Bongo Village, Gorontalo, Indonesia. Int. J. Relig. Tour. Pilgr. 2022, 10, 5. [Google Scholar] [CrossRef]

- Kasdi, A.; Nashirudin, M.; Farida, U.; Praatmana, N.D. Potential of Kudus as a New International Pilgrimage Destination in Indonesia: Halal Tourism Optimising Local Wisdom. Int. J. Relig. Tour. Pilgr. 2021, 9, 9. [Google Scholar] [CrossRef]

- Ameraldo, F.; Saiful, S.; Husaini, H. Islamic Banking Strategies in Rural Area: Developing Halal Tourism and Enhancing the Local Welfare. Ikon. J. Ekon. Dan Bisnis Islam 2019, 4, 109–136. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. Linking the balanced scorecard to strategy (reprinted from the balanced scorecard). Calif. Manag. Rev. 1996, 39, 53–79. [Google Scholar] [CrossRef]

- Trianto, B.; Barus, E.E.; Sabiu, T.T. Relationship between Islamic financial Literacy, Islamic financial inlusion and business performance: Evidence from culinary cluster of creative economy. Ikon. J. Ekon. Dan Bisnis Islam 2021, 6, 19–38. [Google Scholar] [CrossRef]

- Sanistasya, P.A.; Rahardjo, K.; Iqbal, M. The Effect of Financial Literacy and Financial Inclusion on Small Entreprises Performance in East Kalimantan. J. Econ. 2019, 15, 48–59. [Google Scholar] [CrossRef]

- Sherril, G.W.; Kennedy, H.; Cheese, J.; Rushton, A. Maximizing Marketing Effectiveness. Manag. Decis. 1990, 28, 2. [Google Scholar] [CrossRef]

- Cheese, J.; Day, A.; Wills, G. Handbook of Marketing and Selling Bank Services. Int. J. Bank Mark. 1988, 6, 3–186. [Google Scholar] [CrossRef]

- Payne, A.; Frow, P. Relationship Marketing: Looking Backwards Towards Future. J. Serv. Mark. 2017, 31, 11–15. [Google Scholar] [CrossRef]

- Mehta, S. Personal Selling—A Strategy for Promoting Banking Marketing; State Bank of Indian: Hong Kong, 2001. [Google Scholar]

- Hariri, R.H.; Frederick, E.M.; Bowers, K.M. Uncertainty in Big Data Analytics: Survey, Opportunities, and Challenges. J. Big Data 2019, 6, 1–16. [Google Scholar] [CrossRef]

- Cuzzolin, F. (Ed.) Belief Functions: Theory and Applications; Springer International Publishing: Berlin, Germany, 2014. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.; Babin, B.; Anderson, R.; Tatham, R. Multivariate Data Analysis, 6th ed.; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 2006. [Google Scholar]

- Mazzocchi, M. Structural Equation Models. In Statistics for Marketing and Consumer Research; SAGE Publications, Ltd.: Newcastle upon Tyne, UK, 2008; pp. 316–336. [Google Scholar] [CrossRef]

- Wahyuni, S. Moslem Community Behavior in The Conduct of Islamic Bank: The Moderation Role of Knowledge and Pricing. In Procedia—Social and Behavioral Sciences, Proceedings of the International Conference on Asia Pacific Business Innovation and Technology Management, Pattaya, Thailand, 13–15 January 2012; Elsevier: Amsterdam, The Netherlands, 2012; Volume 59, pp. 290–298. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed.; Sage: Thousand Oaks, CA, USA, 2014. [Google Scholar]

- Purnomo, B.R. Artistic Orientation, Financial Literacy and Entrepreneurial Performance. J. Enterprising Communities People Place Glob. Econ. 2019, 13, 105–128. [Google Scholar] [CrossRef]

- Raji, R.A.; Rashid, S.; Ihhak, S. The Mediating Effect of Brand Image on The Relationship between Social Media Advertisemnet, Sales Promotion Content and Behavioral Intention. J. Res. Interact. Mark. 2019, 13, 302–330. [Google Scholar] [CrossRef]

- Manisha. Marketing Communication as a pivotal strategy for banking sector—A study literarute. Int. J. Eng. Res. Technol. 2017, 5, 1–6. [Google Scholar]

- Tantisaowaphap, K. Measuring Effectivenees of Integrated Marketing Communications Program in Services Business. Ph.D. Thesis, Chulalongkorn University, Bangkok, Thailand, 2001. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).