Chilean Universities and Universal Gratuity: Suggestions for a Model to Evaluate the Effects on Financial Vulnerability

Abstract

1. Introduction

2. Literature Review

2.1. Financial Vulnerability and Non-Profit Institutions

2.2. Higher Education as Non-Profit Institutions

2.3. Higher Education in Chile and Its Financing

2.4. Hypotheses

3. Methodology

3.1. Model and Data Utilised

- (a)

- To classify higher education institutions as vulnerable or not vulnerable, we followed the model proposed in [6].

- (b)

- The model proposed in [6] was modified by incorporating variables of the higher education system itself.

- (c)

- The probability of vulnerability was determined for higher education institutions.

- (d)

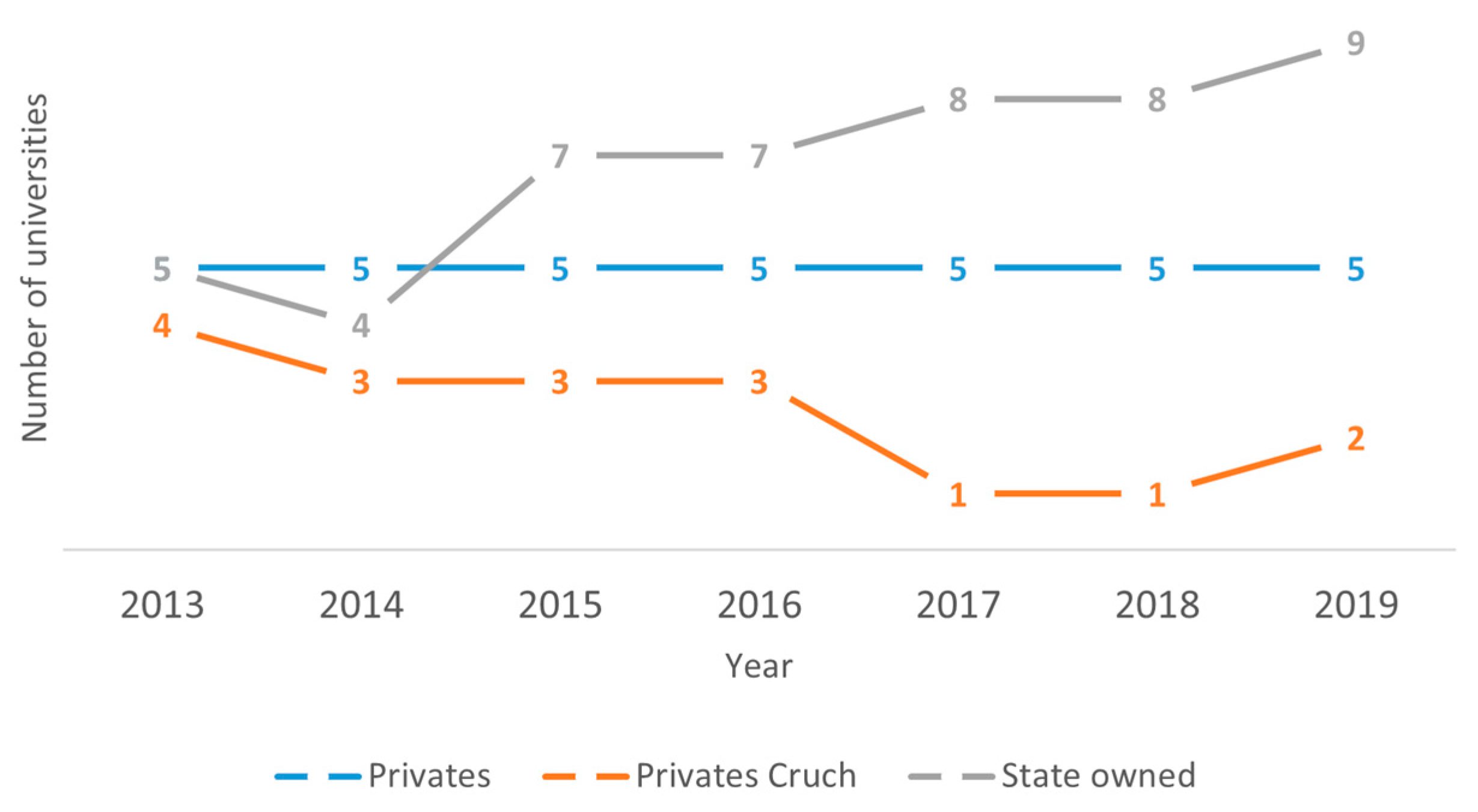

- We classified higher education institutions as public or private, institutions belonging to the CRUCH, and private institutions not belonging to the CRUCH.

3.2. Data Utilised

3.3. Variables

- The popularity or use in the literature of variables that permit an adequate classification of success or failure among NPOs.

- An incorporated variable that measures the proportion of students with gratuity among the total enrolment (Mat_Grat), which indicates the relative volume of students with gratuity and whether the university is affiliated with gratuity.

- Additionally, variables were considered to capture each university’s institutional and structural characteristics. Property (D1_Privada) is a fictional variable that takes a value of zero if the university’s property belongs to the state and one if it is private. D2_Cruch is a fictional variable that takes a value of zero if the higher education institution does not belong to the CRUCH and one if it does. D3_Tamaño is a fictional variable that takes a value from one to five according to the range of the total number of students enrolled.

4. Results and Discussion

4.1. Statistical Description of the Data

4.2. Regression Results and Discussion

4.3. Application of the Model to Universities Affiliated with Gratuity

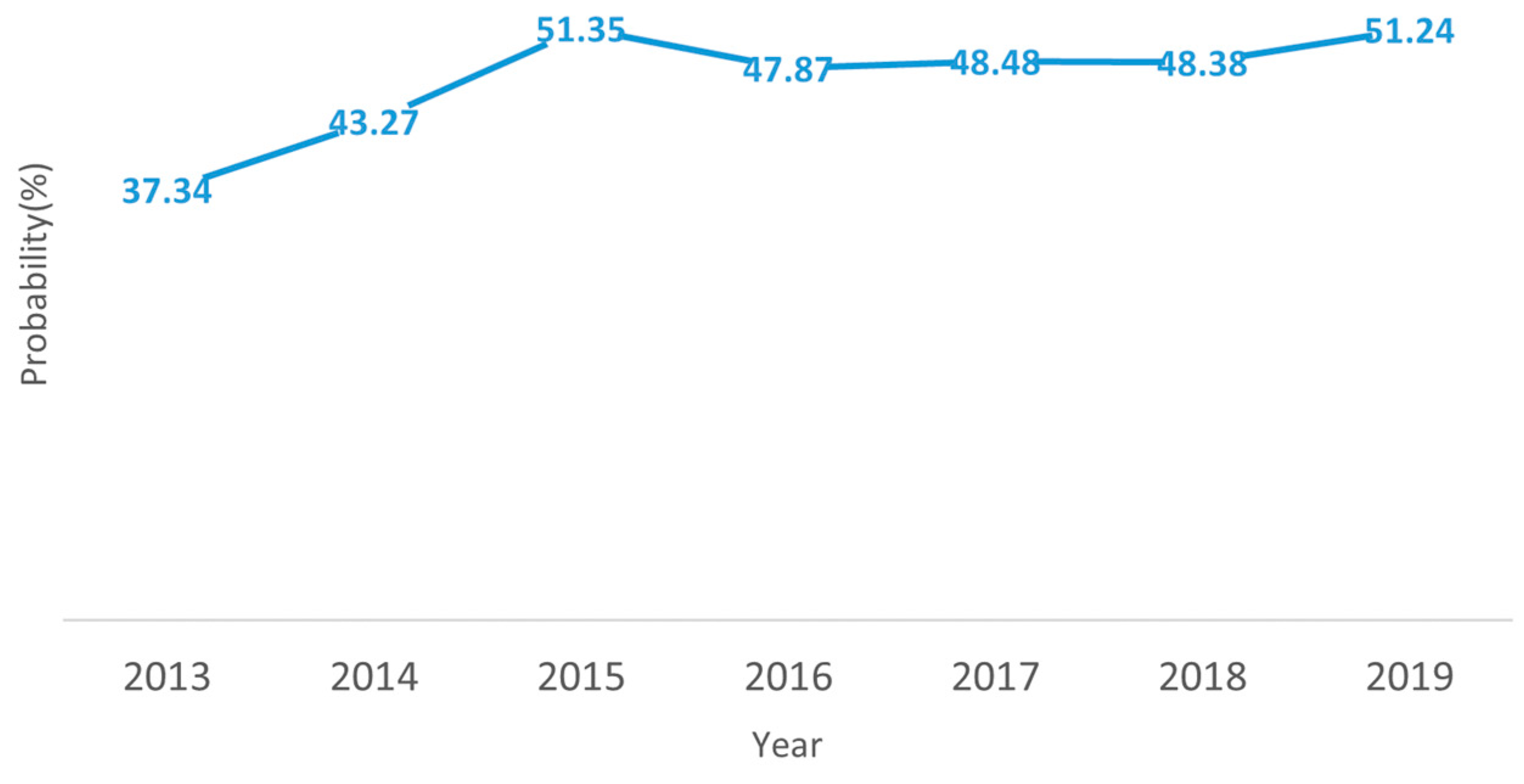

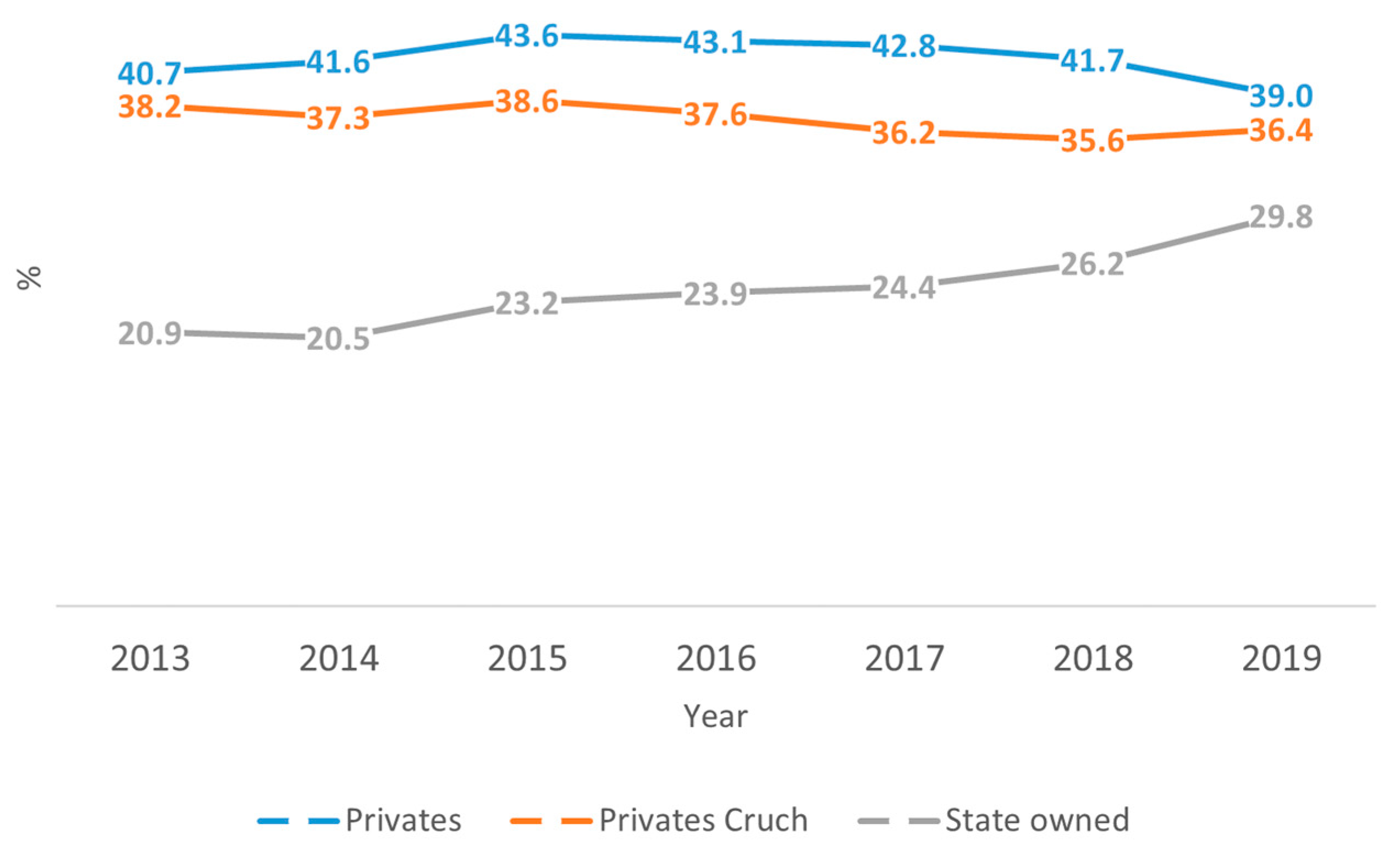

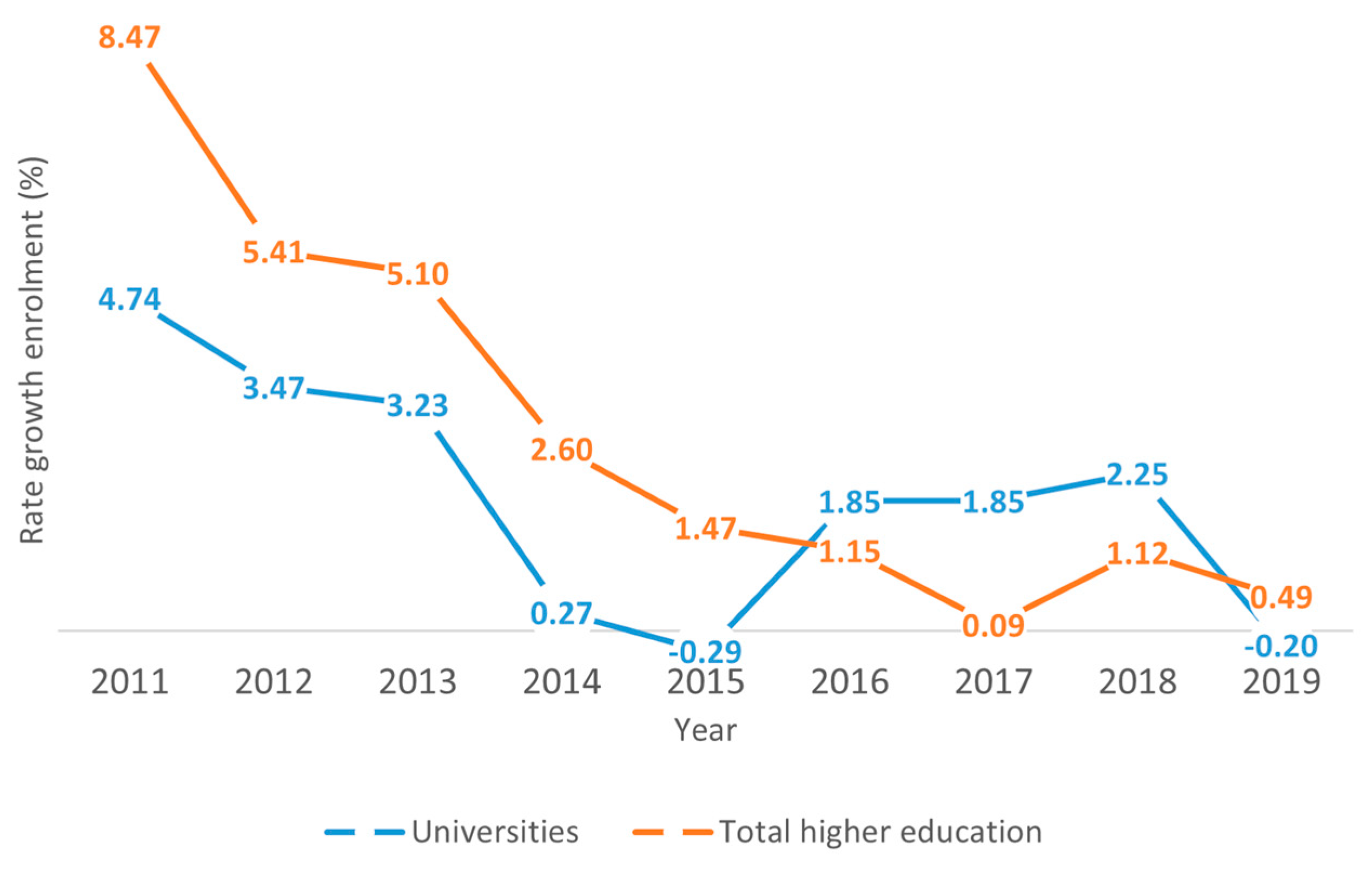

4.4. Comparison Probability of Vulnerability between Periods before (2013 to 2015) and after (2016 to 2019) the Implementation of Gratuity

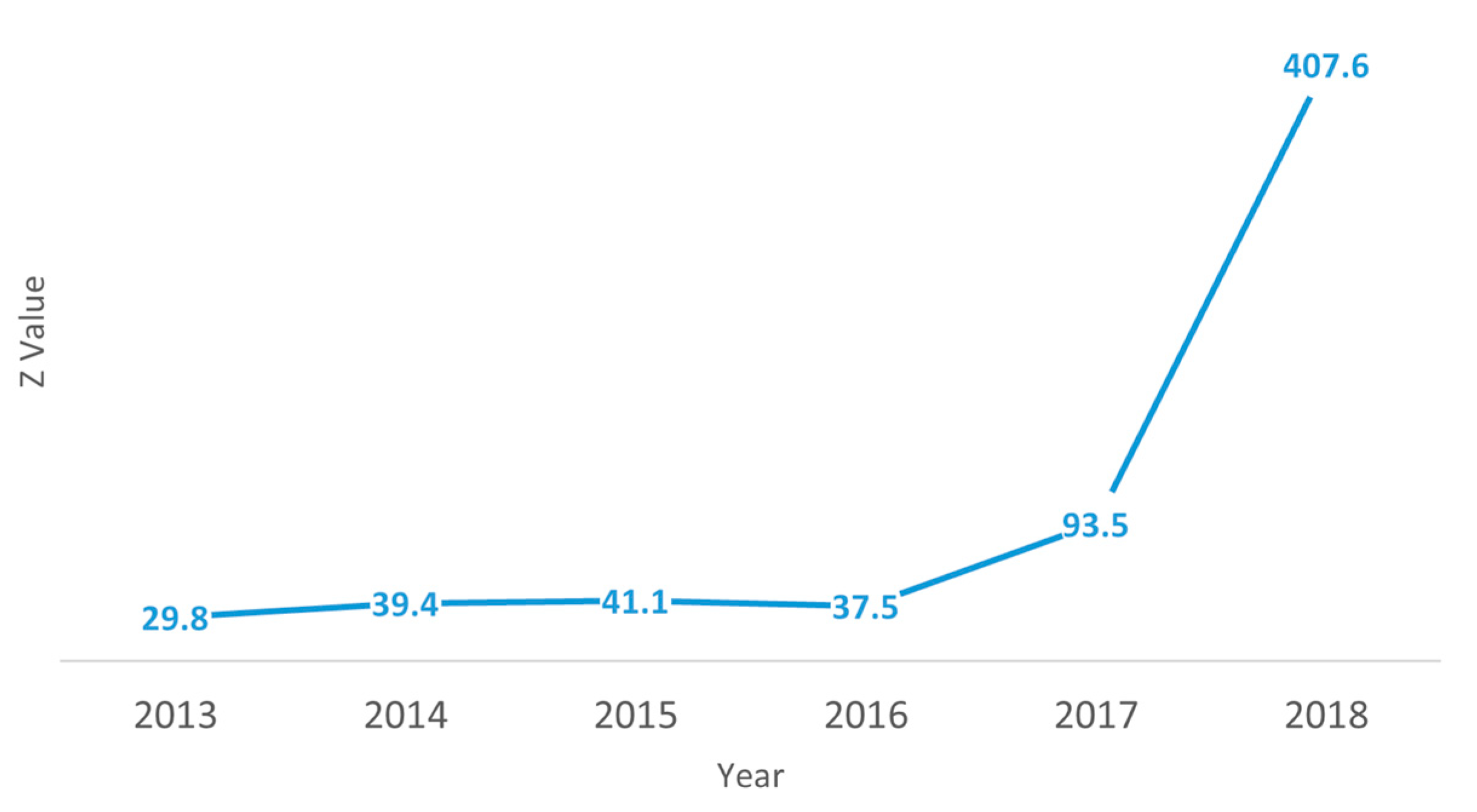

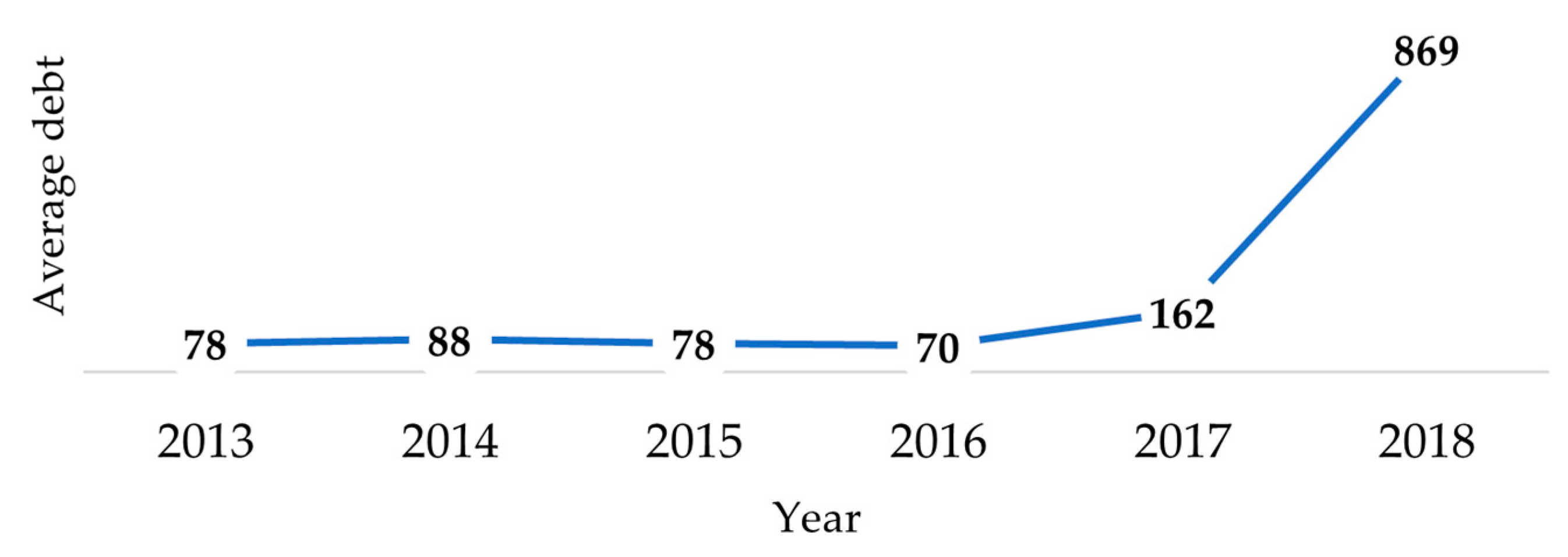

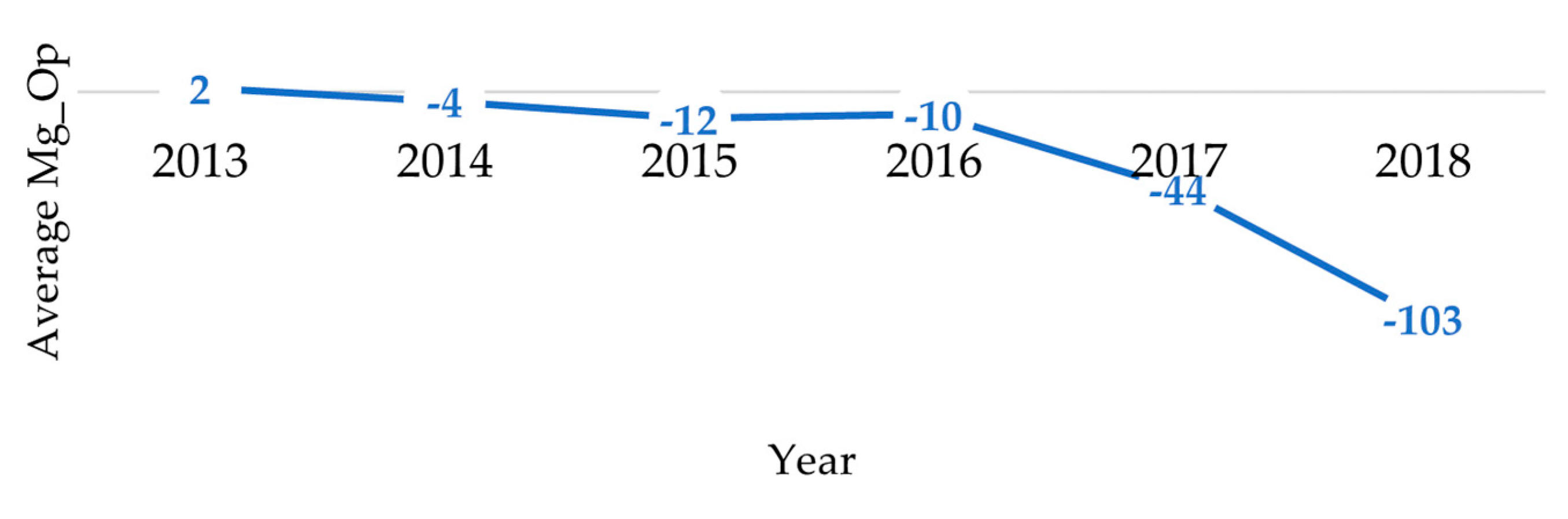

4.5. Application of the Proposed Model in Higher Education Institutions That Lost Their Recognition as Universities in the Period of 2013–2018

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Abbreviation | Detail |

|---|---|---|

| Operational dimension | ||

| Rotation of assets | Rot_Act | Total income to total assets |

| Operating margin | Mg_Op | Operating margin to total operating income |

| Income concentration | Conc | Calculated using Herfindahl and Hirschman index |

| Asset size | Size | Natural logarithm of total assets |

| Square metres of rooms per student | Al_m2salas | Total students/total square metres of classrooms |

| Leverage dimension | ||

| Debt | Debt | Total debt to total assets |

| Leverage | Apal_Total | Total liabilities to patrimony |

| Liquidity dimension | ||

| Liquidity | Liq | Circulating assets to circulating liabilities |

| Organisational performance dimension | ||

| Administration costs | Adm | Administration costs to total operational income |

| Enrolment efficiency | Ef_Matric | Total students/total academics |

| Years of over-duration | Sobred | Years studied/nominal duration of program |

| Years of accreditation | A_Acred | Years of accreditation granted by the CNA |

| Annual variation in enrolment | Var_Matric | Percentage of variation in enrolment with respect to previous year |

| Students with benefit of gratuity | Mat_Grat | Percentage of students benefitting from gratuity |

| Retention first year | Ret_1er | Total student enrolments at end of first year/total student enrolments at beginning of first-year |

| Prestige/reputation dimension | ||

| Academic quality | Cal_Acad | Academics with post graduate studies/total academics |

| Average entry score | PSU | Average entry score to the institution |

| Property and institutional characteristics dimension | ||

| Property | D1_Privada | Takes value 0 if state-owned or public; takes value 1 if private |

| Affiliation with the CRUCH | D2_Cruch | Takes value 0 if it does not belong to the CRUCH; takes value 1 if it does |

| Enrolment size | D3_Tamaño | Takes value 1 if enrolment is less than 1500; takes value 2 if enrolment is above 1501 and less than 5000; takes value 3 if enrolment is above 5001 and less than 10,000; takes value 4 if enrolment is above 10,001 and less than 20,000; takes value 5 if enrolment is above 20,001 |

References

- Bowman, W. Financial capacity and sustainability of ordinary nonprofits. Nonprofit Manag. Leadersh. 2011, 22, 37–51. [Google Scholar] [CrossRef]

- López-Arceiz, F.; Bellostas, A.; Rais, A. Inactividad fundacional y posibles factores que contribuyen a su generación. Asociación Española de Contabilidad y Administración de Empresas. AECA. 2017. Available online: http://www.aeca1.org/xixcongresoaeca/cd/9i.pdf (accessed on 5 May 2023).

- Gordon, T.P.; Greenlee, J.S.; Nitterhouse, D. TaxExempt Organization Financial Data: Availability and Limitations. Account. Horiz. 1999, 13, 113–128. [Google Scholar] [CrossRef]

- Greenlee, J.S.; Trussel, J.M. Predicting the financial vulnerability of charitable organization. Nonprofit Manag. Leadersh. 2000, 11, 199–210. [Google Scholar] [CrossRef]

- Keating, E.K.; Fischer, M.; Gordon, T.P.; Greenlee, J. Assessing Financial Vulnerability in the Nonprofit Sector. Faculty Research Working Papers Series: Hauser Center for Nonprofit Organizations, Paper No. 27. 2005. Available online: http://ssrn.com/abstract=647662 (accessed on 5 May 2023).

- Trussel, J.M. Revisiting the prediction of financial vulnerability. Nonprofit Manag. Leadersh. 2002, 13, 17–31. [Google Scholar] [CrossRef]

- Ye, S.; Gong, X. Funding the present and the future: Drivers of NPO’s financial sustainability. Nonprofit Manag. Leadersh. 2021, 32, 197–218. [Google Scholar] [CrossRef]

- Brass, J.N. Why do NGOs go Where They Go? Evidence from Kenya; World Development; Elsevier: Amsterdam, The Netherlands, 2012; Volume 40, pp. 387–401. [Google Scholar]

- Hall, M.; O’Dwyer, B. Accounting, non-governmental organizations and civil society: The importance of nonprofit organizations to understanding accounting, organizations and society. Account. Organ. Soc. 2017, 63, 1–5. [Google Scholar] [CrossRef]

- Lewis, D.; Kanji, N. Non-Governmental Organizations and Development; Routledge: Abingdon, UK, 2009. [Google Scholar]

- Gilbert, L.R.; Menon, K.; Schwartz, K.B. Predicting bankruptcy for firms in financial distress. J. Bus. Financ. Account. 1990, 17, 161–171. [Google Scholar] [CrossRef]

- Bridgeland, L.M.; Dunkelman, M.; McNaught, M.; Reed, B. The Quiet Crisis: The Impact of the Economic Downturn on the Nonprofit Sector; W.K. Kellogg Foundation, 2009. Available online: https://files.eric.ed.gov/fulltext/ED513451.pdf (accessed on 31 March 2023).

- Choi, N.G.; DiNitto, D.M. Predictors of time volunteering, religious giving, and secular giving: Implications for nonprofit organizations. J. Soc. Soc. Welfare 2012, 39, 93. [Google Scholar] [CrossRef]

- Dietz, N.; McKeever, B.; Brown, M.; Koulish, J.; Pollak, T. The Impact of the Great Recession on the Number of Charities by Subsector and Revenue Range; Urban Institute: Washington, DC, USA, 2014. [Google Scholar]

- Reich, R.; Wimer, C. Charitable Giving and the Great Recession; The Russell Sage Foundation the Stanford Center on Poverty and Inequality: Palo Alto, CA, USA, 2012. [Google Scholar]

- Salamon, L.M.; Geller, S.L.; Spence, K.L. Impact of the 2007–2009 economic recession on nonprofit organizations. John Hopkins Listening Post Proj. 2009, 14, 1–33. [Google Scholar]

- Hung, C.; Hager, M.A. The impact of revenue diversification on nonprofit financial health: A meta-analysis. Nonprofit Volunt. Sect. Q. 2019, 48, 5–27. [Google Scholar] [CrossRef]

- Hager, M. Financial vulnerability among Arts Organizations: A test of the Tuckman-Chang Measures. Nonprofit Volunt. Sect. Q. 2001, 30, 376–392. [Google Scholar] [CrossRef]

- Trussel, J.M.; Greenlee, J.S. A financial rating system for charitable nonprofit organizations. Res. Gov. Nonprofit Account. 2004, 11, 105–127. [Google Scholar]

- Trussel, J.; Greenlee, J.S.; Brady, T. Predicting Financial Vulnerability in charitable organizations. CPA J. 2002, 72, 66. [Google Scholar]

- Lin, W.; Wang, Q. What helped nonprofits weather the great recession? Evidence from human services and community improvement organizations. Nonprofit Manag. Leadersh. 2016, 26, 257–276. [Google Scholar] [CrossRef]

- Modugno, G.; Di Carlo, F. Financial sustainability of higher education institutions: A challenge for the accounting system. In Financial Sustainability of Public Sector Entities; Palgrave Macmillan: Cham, Switzerland, 2019; pp. 165–184. [Google Scholar]

- Bowl, M.; Hughes, J. Fair access and fee setting in English universities: What do institutional statements suggest about university strategiesin a stratified quasi-market? Stud. High. Educ. 2016, 41, 269–287. [Google Scholar] [CrossRef]

- Ahrens, T.; Ferry, L. Newcastle City Council and the grassroots: Accountability and budgeting under austerity. Account. Audit. Account. J. 2015, 28, 909–933. [Google Scholar] [CrossRef]

- Bracci, E.; Humphrey, C.; Moll, J.; Steccolini, I. Public sector accounting, accountability and austerity: More than balancing the books? Account. Audit. Account. J. 2015, 28, 878–908. [Google Scholar] [CrossRef]

- Harney, S.; Dunne, S. More than nothing? Accounting, business, and management studies, and the research audit. Crit. Perspect. Account. 2013, 24, 338–349. [Google Scholar] [CrossRef]

- Rama, C. El largo ciclo de la reforma de la diferenciación de la educación superior en uruguay. de la universidad sistema al sistema universitario (1984–2013). Rev. Da Avaliação Da Educ. Super. 2014, 19, 509–530. [Google Scholar] [CrossRef]

- Araya-Castillo, L.; Escobar-Farfán, M.; Bertoló Moyano, E.; Barrientos Oradini, N. Propuesta de modelo para calidad de servicio en escuelas de negocios en Chile. Pensam. Gestión 2016, 41, 91–115. [Google Scholar]

- Brunner, J.J.; Uribe, D. Mercados Universitarios: El Nuevo Escenario de la Educación Superior; Ediciones universidad Diego Portales: Santiago, Chile, 2007; p. 318. [Google Scholar]

- Mardones, J.G.; Campos-Requena, N. Can higher education admission be more equitable? Evidence supporting the inclusion of relative ranking in the process. Econ. Res. -Ekon. Istraživanja 2021, 34, 2539–2554. [Google Scholar] [CrossRef]

- Thieme, C.; Araya-Castillo, L.; Olavarrieta, S. Grupos estratégicos de universidades y su relación con el desempeño: El caso de Chile. Innovar. Rev. De Cienc. Adm. Y Soc. 2012, 22, 105–116. [Google Scholar]

- Espinoza, Ó.; González, L.E. La educación superior en Chile y la compleja transición desde el régimen de autofinanciamiento hacia el régimen de gratuidad. Rev. Latinoam. De Educ. Comp. 2016, 7, 35–51. [Google Scholar]

- Paredes, M.R. Reflexiones sobre las propuestas de gratuidad para la educación superior en Chile. Cent. De Políticas Públicas UC 2014, 69, 1–22. [Google Scholar]

- de Andres-Alonso, P.; Garcia-Rodriguez, I.; Romero-Merino, M.E. Disentangling the financial vulnerability of nonprofits. Volunt. Int. J. Volunt. Nonprofit Organ. 2016, 27, 2539–2560. [Google Scholar] [CrossRef]

- Tevel, E.; Katz, H.; Brock, D.M. Nonprofit financial vulnerability: Testing competing models recommended improvements, and implications. Volunt. Int. J. Volunt. Nonprofit Organ. 2015, 26, 2500–2516. [Google Scholar] [CrossRef]

- Tamari, M. Financial ratios as a means of forecasting bankruptcy. Manag. Int. Rev. 1966, 6, 15–21. [Google Scholar]

- Beaver, W. Alternative accounting measures as predictors of failure. Account. Rev. 1967, 43, 113–122. [Google Scholar]

- Altman, E.I. Financial ratios, discriminant analysis and the prediction of the corporate bankruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Blum, M. Failing Company discriminant analysis. J. Account. Res. 1974, 12, 525. [Google Scholar] [CrossRef]

- Deakind, E. A discriminant analysis of predictors of business failure. J. Account. Res. 1972, 10, 167–179. [Google Scholar] [CrossRef]

- Ohlson, J.A. Financial ratios and the probabilistic prediction of bankruptcy. J. Account. Res. 1980, 18, 109–131. [Google Scholar] [CrossRef]

- Episcopos, A. Artificial Neural Networks in Financial Economics. A Brief Tutorial; Clarkson University: Potsdam, NY, USA; National Bank of Greece: Athens, Greece, 1998. [Google Scholar]

- Goldrick-Rab, S. Paying the price. In Paying the Price; University of Chicago Press: Chicago, IL, USA, 2016. [Google Scholar]

- Tuckman, H.P.; Chang, C.F. A Methodology for Measuring the Financial Vulnerability of Charitable Nonprofit Organizations. Nonprofit Volunt. Sect. Q. 1991, 20, 445–460. [Google Scholar] [CrossRef]

- Thomas, R.; Trafford, R. Were UK culture, sport and recreation charities prepared for the 2008 economic downturn? An application of Tuckman and Chang’s measures of financial vulnerability. Volunt. Int. J. Volunt. Nonprofit Organ. 2013, 24, 630–648. [Google Scholar] [CrossRef]

- Grizzle, C.; Sloan, M.F.; Kim, M. Financial factors that influence the size of nonprofit operating reserves. J. Public Budg. Account. Financ. Manag. 2015, 27, 67–97. [Google Scholar] [CrossRef]

- Clifford, D. Charitable organisations, the great recession and the age of austerity: Longitudinal evidence for England and Wales. J. Soc. Policy 2017, 46, 1–30. [Google Scholar] [CrossRef]

- Burde, G.; Rosenfeld, A.; Sheaffer, Z. Prediction of financial vulnerability to funding instability. Nonprofit Volunt. Sect. Q. 2017, 46, 280–304. [Google Scholar] [CrossRef]

- Lam, M.; McDougle, L. Community variation in the financial health of nonprofit human service organizations: An examination of organizational and contextual effects. Nonprofit Volunt. Sect. Q. 2016, 45, 500–525. [Google Scholar] [CrossRef]

- Chikoto-Schultz, G.L.; Neely, D.G. Exploring the nexus of nonprofit financial stability and financial growth. Volunt. Int. J. Volunt. Nonprofit Organ. 2016, 27, 2561–2575. [Google Scholar] [CrossRef]

- Irvine, H.; Ryan, C. The financial health of Australian universities: Policy implications in a changing environment. Account. Audit. Account. J. 2019, 32, 1500–1531. [Google Scholar] [CrossRef]

- Kallio, T.J.; Kallio, K.M.; Huusko, M.; Pyykkö, R.; Kivistö, J. Balancing between accountability and autonomy: The impact and relevance of public steering mechanisms within higher education. J. Public Budg. Account. Financ. Manag. 2022, 34, 46–68. [Google Scholar] [CrossRef]

- Pop-Vasileva, A.; Baird, K.; Blair, B. University corporatisation: The effect on academic work-related attitudes. Account. Audit. Account. J. 2011, 24, 408–439. [Google Scholar] [CrossRef]

- Harker, M.J.; Caemmerer, B.; Hynes, N. Management education by the French Grandes Ecoles de Commerce: Past, present, and an uncertain future. Acad. Manag. Learn. Educ. 2016, 15, 549–568. [Google Scholar] [CrossRef]

- Choudhary, M.; Paharia, P. Role of leadership in quality education in public and private higher education institutions: A comparative study. Gyanodaya-J. Progress. Educ. 2018, 11, 17–24. [Google Scholar] [CrossRef]

- Gittins, R. Our Universities Aren’t Earning the Money We Give Them. The Sydney Morning Herald. 2017. Available online: https://www.smh.com.au/business/companies/our-universities-arent-earning-the-money-we-give-them-20170527-gwem64.html (accessed on 5 May 2023).

- Almagtome, A.; Shaker, A.; Al-Fatlawi, Q.; Bekheet, H. The integration between financial sustainability and accountability in higher education institutions: An exploratory case study. Int. J. Innov. Creat. Change 2019, 8, 202–221. [Google Scholar]

- Warburton, M. Resourcing Australia’s Tertiary Education Sector. LH Martin Institute, For Tertiary Education Ledership and Management. 2016. Available online: https://www.voced.edu.au/content/ngv%3A74489 (accessed on 20 April 2023).

- Lastra, K.F.; Causa, M.D. Problemas y desafíos de la educación superior en perspectiva regional. In XII Jornadas de investigación, Docencia, Extensión y Ejercicio Profesional (La Plata, 18 al 22 de octubre de 2021); Repositorio Institucional de la UNPL: La Plata, Argentina, 2021. [Google Scholar]

- Pedraja-Rejas, L.; Brunner, J.J.; Rodríguez-Ponce, E.; Labraña, J. Capitalismo académico en una universidad chilena: Percepción de los actores. Rev. De La Educ. Super. 2021, 50, 47–68. [Google Scholar]

- Cheung, B. Higher education financing policy: Mechanisms and effects. Essays Educ. 2003, 5, 4. [Google Scholar]

- Ramírez, G. Education at a Glance 2019: Análisis de los resultados más relevantes para Chile. Centro de Estudios Mineduc, Cem, 2019. Available online: https://bibliotecadigital.mineduc.cl/bitstream/handle/20.500.12365/18870/E19-0013.pdf?sequence=1 (accessed on 10 April 2023).

- Selvaratnam, V. Innovations in Higher Education: Singapore at the Competitive Edge. World Bank Tech. Pap. N 1994, 222, 132. [Google Scholar]

- Slaughter, S.; Leslie, L.L. Academic Capitalism in the Enterprise University. J. Res. Adm. 2001, 33–35. [Google Scholar]

- Guthrie, J.; Newman, R. Economic and non-Financial performance indicators in universities: The case of the Australian University System and the Establishment of a performance driven university system. Public Manag. Rev. 2004, 9, 231–252. [Google Scholar] [CrossRef]

- Pedró, F. La Gratuidad de la Educación Superior ¿Qué Muestran las Tendencias Internacionales? Organización de las Naciones Unidas para la Educación, la Ciencia y la Cultura; Buenos Aires: Buenos Aires, Argentina, 2019. [Google Scholar]

- Iesalc, U. La Movilidad en la Educación Superior en América Latina y el Caribe: Retos y Oportunidades de un Convenio Renovado Para el Reconocimiento de Estudios, Títulos y Diplomas; Instituto Internacional de la UNESCO para la educación superior en América Latina y el Caribe (IESALC): Caracas, Venezuela, 2019; Volume 1. [Google Scholar]

- Flores, R.; Iglesias, C.; Paredes, R.; Valdés, N. Política de gratuidad y desempeño académico en educación superior técnica profesional. Lecciones a partir del caso de Duoc UC. Calid. En La Educ. 2020, 52, 239–262. [Google Scholar] [CrossRef]

- Lemaitre, M.J. Las experiencias de gratuidad universitaria internacional pueden dar lecciones a Chile. El Mercurio. 2016. Available online: https://accioneducar.cl/el-mercurio-las-experiencias-de-gratuidad-universitaria-internacional-pueden-dar-lecciones-a-chile/ (accessed on 5 December 2022).

- Rivera, J. La gratuidad de la educación superior y sus efectos sobre el acceso: Caso Ecuador. Educ. Policy Anal. Arch. 2019, 27, 29. [Google Scholar] [CrossRef]

- Gruber, T.; Fuß, S.; Voss, R.; Gläser-Zikuda, M. Examining student satisfaction with higher education services: Using a new measurement tool. Int. J. Public Sect. Manag. 2010, 23, 105–123. [Google Scholar] [CrossRef]

- Danjuma, I.; Rasli, A. Higher education and knowledge economy: A focus on Nigeria. Sains Hum. 2013, 64, 87–91. [Google Scholar] [CrossRef]

- Yeo, R.K.; Li, J. Beyond SERVQUAL: The competitive forces of higher education in Singapore. Total Qual. Manag. Bus. Excell. 2014, 25, 95–123. [Google Scholar] [CrossRef]

- Tamutienė, L.; Matkevičienė, R. Quality in the higher education sector: Comparison of communication of criteria for quality assurance in webpages of state universities in Lithuania and Latvia. Acta Prosper. 2019, 10, 109–130. [Google Scholar]

- Loomis, S.; Rodriguez, J. Institutional change and higher education. High. Educ. 2009, 58, 475–489. [Google Scholar] [CrossRef]

- Hota, P.; Sarangi, P. Quality revolution of higher education: A study in India. Srusti Manag. Rev. 2019, 12, 49–56. [Google Scholar]

- Degtjarjova, I.; Lapina, I.; Freidenfelds, D. Student as stakeholder: Voice of customer in higher education quality development. Mark. Manag. Innov. 2018, 388–398. [Google Scholar] [CrossRef]

- Kirby, E.C. Movimiento estudiantil en Chile 2011: Causas y características. Rev. De Hist. Y Geogr. 2016, 34, 109–134. [Google Scholar]

- Espinoza, R.; Urzúa, S. Gratuidad de la Educación Superior de Chile en Contexto. Serie Documentos de trabajo. Centro Latinoamericano de Políticas Económicas y Sociales, CLAPES UC, Pontificia Universidad Católica de Chile, Santiago, 2014. Available online: https://www.cooperativa.cl/noticias/site/artic/20150409/asocfile/20150409072733/su_papel_gratuidad_vfinal_2ok.pdf (accessed on 15 December 2022).

- Jiménez-Yañez, C. Chiledespertó: Causas del estallido social en Chile. Rev. Mex. De Sociol. 2020, 82, 949–957. [Google Scholar]

- OCDE La Educación Superior en Chile. Revisión de Políticas Nacionales de Educación. 2009. Available online: https://www.oecd.org/education/skills-beyond-school/43274174.pdf (accessed on 5 May 2023).

- OCDE Education at a Glance 2019. OECD Indicators (p.4); OECD: Paris, France, 2019. [Google Scholar]

- Oradini, N.B.; Araya-Castillo, L.; Duque, Á.A.; Jara, V.Y.; Acle, X.G.; Orellana, C.C. Gratuidad de la Educación Superior en Chile. Arandu Utic 2020, 7, 163–188. [Google Scholar]

- Espinoza, R.; Urzúa, S. Las Consecuencias Económicas de un Sistema de Educación Superior Gratuito en Chile. Rev. De Educ. 2015, 370, 10–44. [Google Scholar]

- Brunner, J.; Labraña, J. Financiamiento de la educación superior, gratuidad y proyecto de un nuevo crédito estudiantil. Debate De Políticas Públicas 2018, 31, 1–26. [Google Scholar]

- Vergara, M. Gratuidad y Financiamiento de la Educación Superior en Chile; Diálogos del Presente de la Universidad de Concepción: Concepción, Chile, 2019. [Google Scholar]

- Pérez García, J.I.; Lopera Castaño, M.; Vásquez Bedoya, F.A. Una Breve Aplicación a la Predicción de la Fragilidad de Empresas Colombianas, Mediante el Uso de Modelos Estadísticos. 2019. Available online: https://bibliotecadigital.udea.edu.co/bitstream/10495/12027/1/PerezJorge_2019_AplicacionPrediccionFragilidad.pdf (accessed on 1 April 2023).

- Šverko Grdić, Z.; Radolović, J.; Bagarić, L. Solventnost poduzeća u Republici Hrvatskoj iu Europskoj uniji. Ekon. Pregl. 2009, 60, 250–266. [Google Scholar]

- Siekelová, A.; Kliestik, T.; Adamko, P. Predictive ability of chosen bankruptcy models: A case study of Slovak republic. Econ. Cult. 2018, 15, 105–114. [Google Scholar] [CrossRef]

- Stroe, R.; Barbuta-Misu, N. Predicting the Financial Performance of the Building Sector Enterprises--Case Study of Galati County (Romania). Rev. Financ. Bank. 2010, 29–39. [Google Scholar]

- Zenzerović, R. Business′ Financial Problems Prediction-Croatian Experience. Econ. Res. -Ekon. Istraživanja 2009, 22, 1–15. [Google Scholar] [CrossRef]

- Jakubík, P.; Teplý, P. The Prediction of Corporate Bankruptcy and Czech Economy’s Financial Stability Through Logit Analysis; (No. 19/2008); IES Working Paper: Prague, Czech Republic, 2008. [Google Scholar]

- Tascón, M.T.; Castaño, F.J.; Castro, P. A new tool for failure analysis in small firms: Frontiers of financial ratios based on percentile differences (PDFR). Span. J. Financ. Account./Rev. Española De Financ. Y Contab. 2018, 47, 433–463. [Google Scholar] [CrossRef]

- Ecer, F. Comparing the bank failure prediction performance of neural networks and support vector machines: The Turkish case. Econ. Res. -Ekon. Istraživanja 2013, 26, 81–98. [Google Scholar] [CrossRef]

- Balaguer, T.; David, S.; Ihrai, T.; Cardot, N.; Daideri, G.; Lebreton, E. Histological staging and Dupuytren’s disease recurrence or extension after surgical treatment: A retrospective study of 124 patients. J. Hand Surg. (Eur. Vol.) 2009, 34, 493–496. [Google Scholar] [CrossRef]

- Belyaeva, E. On a New Logistic Regression Model for Bankruptcy Prediction in the IT Branch, 2014. Available online: https://www.diva-portal.org/smash/get/diva2:785084/FULLTEXT01.pdf (accessed on 1 April 2023).

- Zenzerović, R.; Peruško, T. Kratki osvrt na modele za predviđanje stečaja. Econ. Res. Ekon. Istraživanja 2006, 19, 132–151. [Google Scholar]

- Zdolšek, D.; Jagrič, T.; Kolar, I. Auditor’s going-concern opinion prediction: The case of Slovenia. Econ. Res. Ekon. Istraživanja 2022, 35, 106–121. [Google Scholar] [CrossRef]

- Berlanga-Silvente, V.; Vilà-Baños, R. Cómo obtener un modelo de regresión logística binaria con SPSS. Rev. D’innovació I Recer. En Educ. 2014, 7, 105–118. [Google Scholar]

- López-Roldán, P.; Fachelli, S. Metodología de la Investigación Social Cuantitativa. Bellaterra (Cerdanyola del Vallès): Dipòsit Digital de Documents; Universitat Autònoma de Barcelona: Barcelona, Spain, 2015. [Google Scholar]

- Pérez, J.; González, C.; Lopera, M. Modelos de predicción de la fragilidad empresarial: Aplicación al caso colombiano para el año 2011. Perf. De Coyunt. Económica 2013, 22, 205–228. [Google Scholar]

- Fernández, C.M.; Jimeno, I.; Flores-Jimeno, M.D.R. Marco Teórico de la Vulnerabilidad Financiera de las Entidades sin ánimo de Lucro. XVIII Congreso Internacional de Investigadores en Economía Social y Cooperativa. La Economía Social: Herramienta Para el Fomento del Desarrollo Sostenible y la Reducción de las Desigualdades, Barcelona, España, 2020. Available online: http://ciriec.es/wp-content/uploads/2020/09/COMUN-064-T17-FLORES-JIMENO-MIR-ok.pdf (accessed on 10 May 2023).

- de Andrés-Alonso, P.; García-Rodríguez, I.; Romero-Merino, M.E. The Dangers of Assessing the Financial Vulnerability of Nonprofits Using Traditional Measures: The Case of the Nongovernmental Development Organizatios in the United Kingdom. Nonprofit Manag. Leadersh. 2015, 25, 371–382. [Google Scholar] [CrossRef]

- Cordery, C.J.; Sim, D.; Baskerville, R.F. Three models, one goal: Assessing financial vulnerability in New Zealand amateur sports clubs. Sport Manag. Rev. 2013, 16, 186–199. [Google Scholar] [CrossRef]

- Santos, M.R.C.; Laureano, R.M.S.; Moro, S. Unveiling Research Trends for Organizational Reputation in the Nonprofit Sector. Volunt. Int. J. Volunt. Nonprofit Organ. 2019, 31, 56–70. [Google Scholar] [CrossRef]

- Martínez, E.S.; Sjoberg, O.G. Determinación de variables y dimensiones claves para el aseguramiento de la calidad y su impacto en la acreditación de las Universidades chilenas. Rev. Espac. 2020, 41, 20. [Google Scholar]

- Gallegos, J.; Campos, N.; Canales, K.Y.; González, E. Factores determinantes de la deserción universitaria. Caso Facultad de Ciencias Económicas y Administrativas de la Universidad Católica de la Santísima Concepción (Chile). Form. Univ. 2018, 11, 11–18. [Google Scholar] [CrossRef]

- Kleinbaum, D.G.; Kupper, L.L.; Muller, K.E. Applied Regression Analysis and Other Multivariable Methods; PSW-KENT Publishing Company: Boston, MA, USA, 1988. [Google Scholar]

- Belsley, D.A. Conditioning Diagnostic: Collinearity and Weak Data in Regression; John Willey Sons: New York, NY, USA, 1991. [Google Scholar]

- Pérez, J. Regresión logística como modelo de predicción del riesgo crediticio en las organizaciones de la economía social y solidaria. Rev. Cienc. Adm. 2017, 2, 232–243. [Google Scholar]

- de Dios Jiménez, J.; Salas, M. Análisis Económico de la Elección de Carrera Universitaria. Un Modelo Logit Binomial de Demanda Privada de Educación; IVIE, Instituto Valenciano de Investigaciones Económicas: Valencia, Spain, 1999. [Google Scholar]

- Berlanga, V.; Rubio Hurtado, M.J. Clasificación de pruebas no paramétricas. Cómo aplicarlas en SPSS. REIRE. Rev. D’innovació I Recer. Educ. 2012, 5, 101–113. [Google Scholar]

- Laderman, S.; Kunkle, K. SHEF: State Higher Education Finance, FY 2021; State Higher Education Executive Officers: Boulder, CO, USA, 2022. Available online: https://files.eric.ed.gov/fulltext/ED623743.pdf (accessed on 10 May 2023).

- Kane, T.J.; Orszag, P. Funding Restrictions at Public Universities: Effects and Policy Implications, Brookings Institution Working Paper, 2003. Available online: https://www.brookings.edu/wp-content/uploads/2016/06/20030910.pdf (accessed on 20 May 2023).

- Brunner, J. Matrícula de Estudiantes en la Educación Superior cae por Primera vez en 34 años. 2017. Available online: https://www.latercera.com/noticia/matricula-educacion-superior-cae/ (accessed on 30 April 2023).

| Variables | Vulnerable | Non-Vulnerable | Sample | |||

|---|---|---|---|---|---|---|

| Mean | Standard Deviation | Mean | Standard Deviation | Mean | Standard Deviation | |

| Mat_Grat | 0.19 | 0.25 | 0.42 | 0.20 | 0.27 | 0.26 |

| Debt | 0.47 | 0.22 | 0.26 | 0.12 | 0.40 | 0.22 |

| Apal_Total | 1.41 | 4.53 | 0.40 | 0.32 | 1.12 | 3.74 |

| Liq | 1.73 | 2.91 | 2.12 | 1.21 | 1.86 | 2.49 |

| Rot_Act | 0.73 | 0.37 | 0.50 | 0.13 | 0.65 | 0.33 |

| Mg_Op | 0.02 | 0.11 | 0.05 | 0.05 | 0.03 | 0.10 |

| Conc | 0.76 | 0.22 | 0.51 | 0.19 | 0.68 | 0.24 |

| Size | 24.34 | 1.28 | 25.90 | 0.72 | 24.86 | 1.35 |

| Adm | 0.29 | 0.10 | 0.23 | 0.09 | 0.27 | 0.10 |

| Ef_Matric | 28.13 | 13.79 | 22.70 | 5.44 | 26.32 | 11.96 |

| Sobred | 1.55 | 0.60 | 1.70 | 0.50 | 1.60 | 0.57 |

| A_Acred | 3.11 | 1.97 | 5.17 | 1.26 | 3.80 | 2.01 |

| Var_Matric | 0.03 | 0.19 | 0.04 | 0.05 | 0.03 | 0.16 |

| Cal_Acad | 0.59 | 0.17 | 0.70 | 0.13 | 0.63 | 0.16 |

| PSU | 477.06 | 176.72 | 574.54 | 47.00 | 509.55 | 153.84 |

| Al_m2salas | 1.27 | 0.84 | 0.86 | 0.38 | 1.14 | 0.74 |

| Ret_1er | 0.72 | 0.21 | 0.74 | 0.26 | 0.72 | 0.23 |

| Mean | |||

|---|---|---|---|

| Variables | Vulnerable | Non-Vulnerable | p-Value |

| Mat_Grat | 0.00 | 0.46 | 0.003 |

| Debt | 0.42 | 0.23 | 0.000 |

| Apal_Total | 0.72 | 0.30 | 0.000 |

| Liq | 1.16 | 1.64 | 0.002 |

| Rot_Act | 0.65 | 0.51 | 0.013 |

| Mg_Op | 0.039 | 0.035 | 0.620 |

| Conc | 0.81 | 0.45 | 0.000 |

| Size | 24.74 | 25.64 | 0.000 |

| Adm | 0.27 | 0.21 | 0.036 |

| Ef_Matric | 24.56 | 21.91 | 0.056 |

| Sobred | 1.42 | 1.68 | 0.322 |

| A_Acred | 4.00 | 5.00 | 0.000 |

| Var_Matric | 0.02 | 0.03 | 0.115 |

| Cal_Acad | 0.62 | 0.70 | 0.019 |

| PSU | 522.16 | 574.33 | 0.004 |

| Al_m2salas | 1.07 | 0.91 | 0.054 |

| Ret_1er | 0.80 | 0.83 | 0.158 |

| Test Equality Medians | t-Test Equality Means | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Variables | Median without Gratuity | Median with Gratuity | Mann–Whitney Statistic | Sig. (Bilateral) | Levene Test Sig. (Bilateral) | Mean without Gratuity | Mean with Gratuity | T-Statistic (Equal Variances) | Sig. (Bilateral) | T-Statistic (not Equal Variances) | Sig. (Bilateral) |

| Value Z | 12.56 | 13.35 | 5707 | 0.83 | 0.12 | 12.24 | 11.86 | 0.13 | 0.90 | 0.13 | 0.90 |

| P (vulnerable) | 0.99 | 0.99 | 5707 | 0.83 | 0.31 | 0.87 | 0.80 | 0.57 | 0.58 | 0.57 | 0.58 |

| D3_Tamaño | 3 | 3 | 5266.5 | 0.21 | 0.85 | 3.14 | 3.52 | –1.31 | 0.20 | –1.31 | 0.20 |

| Debt | 0.34 | 0.56 | 5044 | 0.10 | 0.86 | 0.39 | 0.45 | –1.24 | 0.24 | –1.24 | 0.24 |

| Mg | 0.03 | 0.04 | 5801 | 0.99 | 0.56 | 0.02 | 0.04 | –0.88 | 0.39 | –0.88 | 0.39 |

| Test Equality Medians | t-Test Equality Means | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Variables | Median without Gratuity | Median with Gratuity | Mann–Whitney Statistic | Sig. (Bilateral) | Levene Test Sig. (Bilateral) | Mean without Gratuity | Mean with Gratuity | T-Statistic (Equal Variances) | Sig. (Bilateral) | T-Statistic (not Equal Variances) | Sig. (Bilateral) |

| Value Z | –1.08 | –1.78 | 406 | 0.27 | 0 | 0.13 | –2.21 | 2.03 | 0.05 | 1.85 | 0.07 |

| P (vulnerable) | 0.25 | 0.14 | 406 | 0.27 | 0 | 0.44 | 0.26 | 1.93 | 0.06 | 1.83 | 0.07 |

| D3_Tamaño | 4 | 4.14 | 433.5 | 0.39 | 0.58 | 4 | 4.14 | –0.90 | 0.37 | –0.87 | 0.39 |

| Debt | 0.3 | 0.3 | 459 | 0.70 | 0.04 | 0.38 | 0.36 | 0.42 | 0.68 | 0.41 | 0.69 |

| Mg | 0.04 | 0.06 | 393 | 0.20 | 0.39 | 0.05 | 00.07 | –1.47 | 0.15 | –1.52 | 0.14 |

| Test Equality Medians | t-Test Equality Means | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Variables | Median without Gratuity | Median with Gratuity | Mann–Whitney Statistic | Sig. (Bilateral) | Levene Test Sig. (Bilateral) | Mean without Gratuity | Mean with Gratuity | T-Statistic (Equal Variances) | Sig. (Bilateral) | T-Statistic (not Equal Variances) | Sig. (Bilateral) |

| Value Z | –3.43 | 0.17 | 1170 | 0.03 | 0.79 | –2.78 | 0.32 | –2.21 | 0.03 | –2.19 | 0.03 |

| P (vulnerable) | 0.03 | 0.54 | 1170 | 0.03 | 0.02 | 0.35 | 0.39 | –1.72 | 0.09 | –174. | 0.09 |

| D3_Tamaño | 3 | 3 | 1490.5 | 0.78 | 0.78 | 3.38 | 3.42 | –0.28 | 0.78 | –0.28 | 0.78 |

| Debt | 0.18 | 0.24 | 1150 | 0.02 | 0.34 | 0.22 | 0.26 | –2.16 | 0.03 | –2.20 | 0.03 |

| Mg | 0.03 | 0.03 | 1258 | 0.10 | 0.38 | 0.04 | 0.01 | 0.48 | 0.63 | 0.45 | 0.63 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mardones, J.A.G.; Palacios, J.A.M. Chilean Universities and Universal Gratuity: Suggestions for a Model to Evaluate the Effects on Financial Vulnerability. Sustainability 2023, 15, 9961. https://doi.org/10.3390/su15139961

Mardones JAG, Palacios JAM. Chilean Universities and Universal Gratuity: Suggestions for a Model to Evaluate the Effects on Financial Vulnerability. Sustainability. 2023; 15(13):9961. https://doi.org/10.3390/su15139961

Chicago/Turabian StyleMardones, Juan Alejandro Gallegos, and Jorge Andrés Moraga Palacios. 2023. "Chilean Universities and Universal Gratuity: Suggestions for a Model to Evaluate the Effects on Financial Vulnerability" Sustainability 15, no. 13: 9961. https://doi.org/10.3390/su15139961

APA StyleMardones, J. A. G., & Palacios, J. A. M. (2023). Chilean Universities and Universal Gratuity: Suggestions for a Model to Evaluate the Effects on Financial Vulnerability. Sustainability, 15(13), 9961. https://doi.org/10.3390/su15139961