Return Strategy of E-Commerce Platform Based on Green and Sustainable Development

Abstract

1. Introduction

- (1)

- With the enhancement of consumers’ environmental protection awareness, consumers’ purchase and return behaviors change. How should e-commerce platforms decide the optimal environmental protection publicity and the optimal return strategy?

- (2)

- The secondary packaging and transportation caused by consumers’ return behaviors greatly increase the waste of resources. Which return strategy is suitable to ensure the effective use of resources, as well as the social benefits of manufacturers and e-commerce platforms?

- (3)

- What are the changes in the supply chain’s decisions, profits, and environmental impact under different return strategies?

2. Literature Review

2.1. Environmental Protection Publicity

2.2. Return Freight Insurance

2.3. Green and Sustainable Supply Chain

2.4. Research Gap

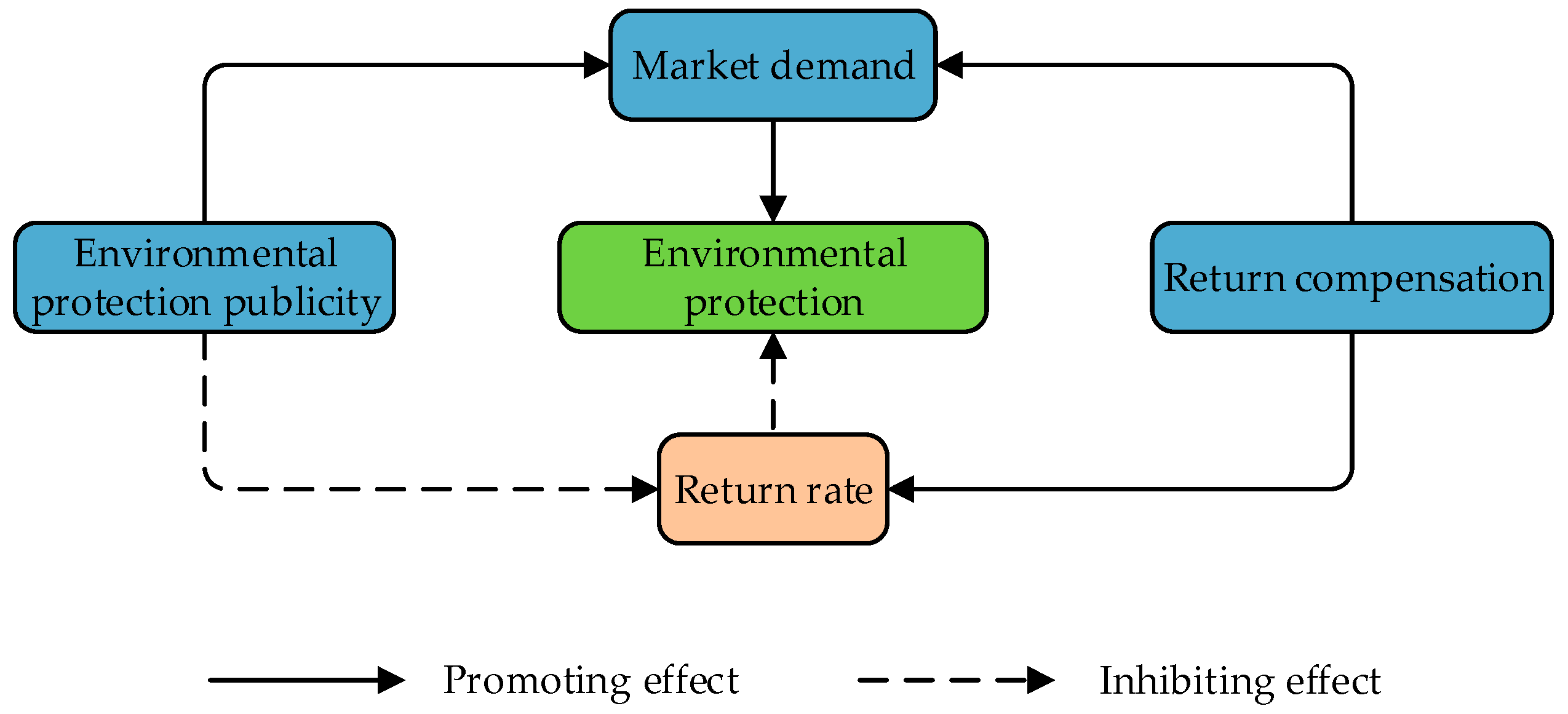

3. System Description

3.1. Problem Description

3.2. Parameter Setting and Definition

4. Model Establishment and Analysis

4.1. Seller’s Return Freight Insurance Market

4.2. Buyer’s Return Freight Insurance Market

4.3. No Return Freight Insurance Market

4.4. Comparative Analysis of Different Return Freight Insurance Market Models

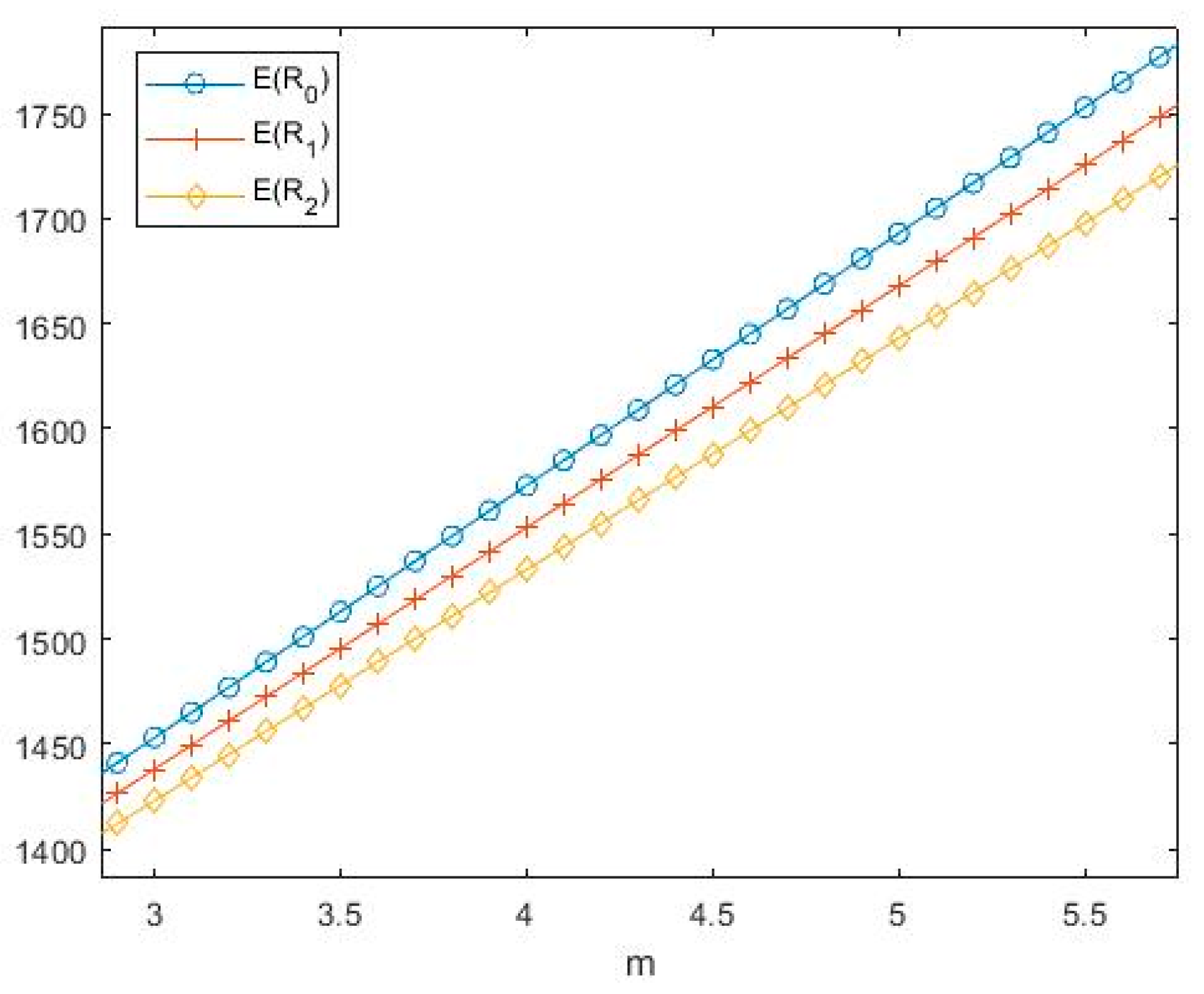

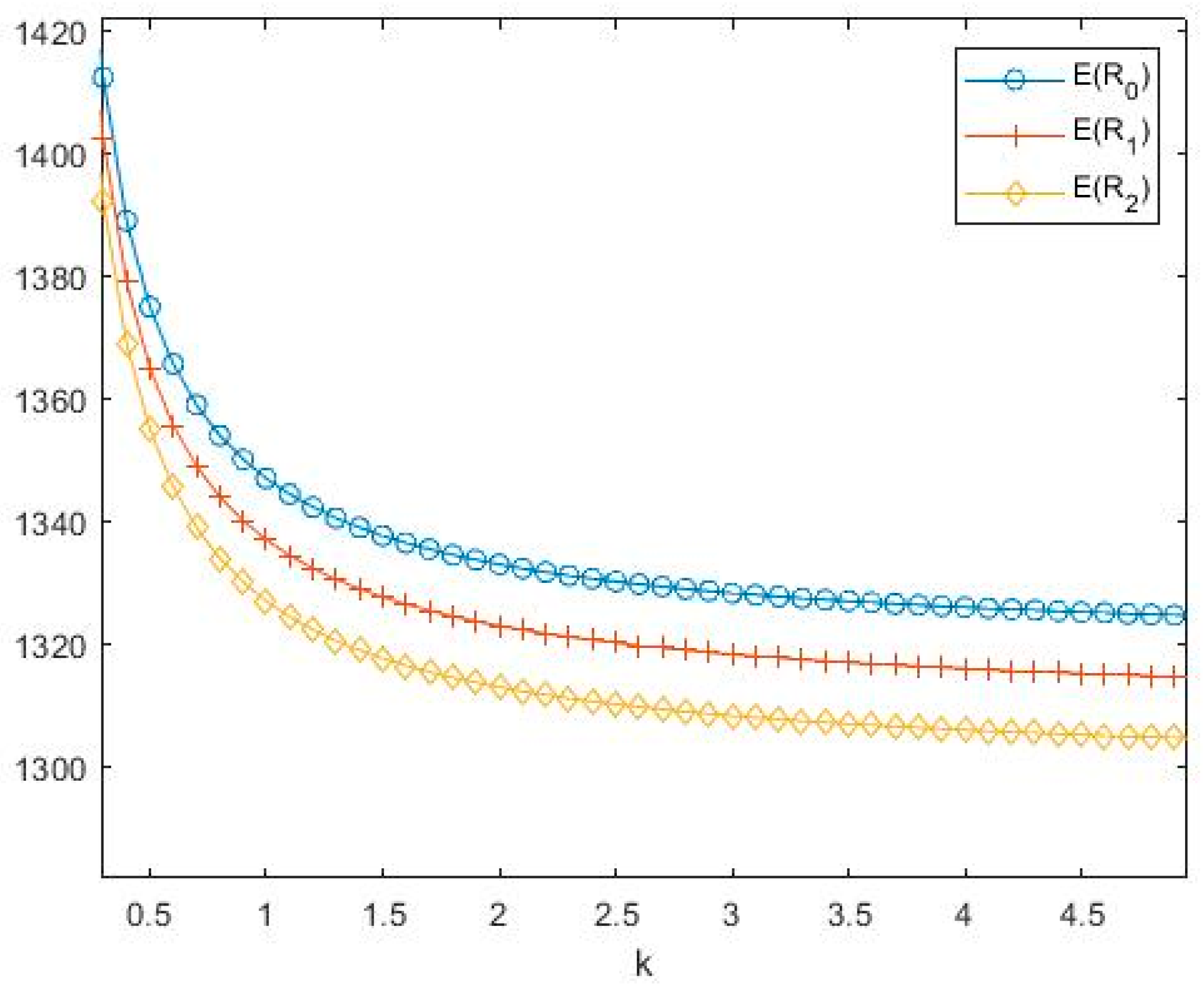

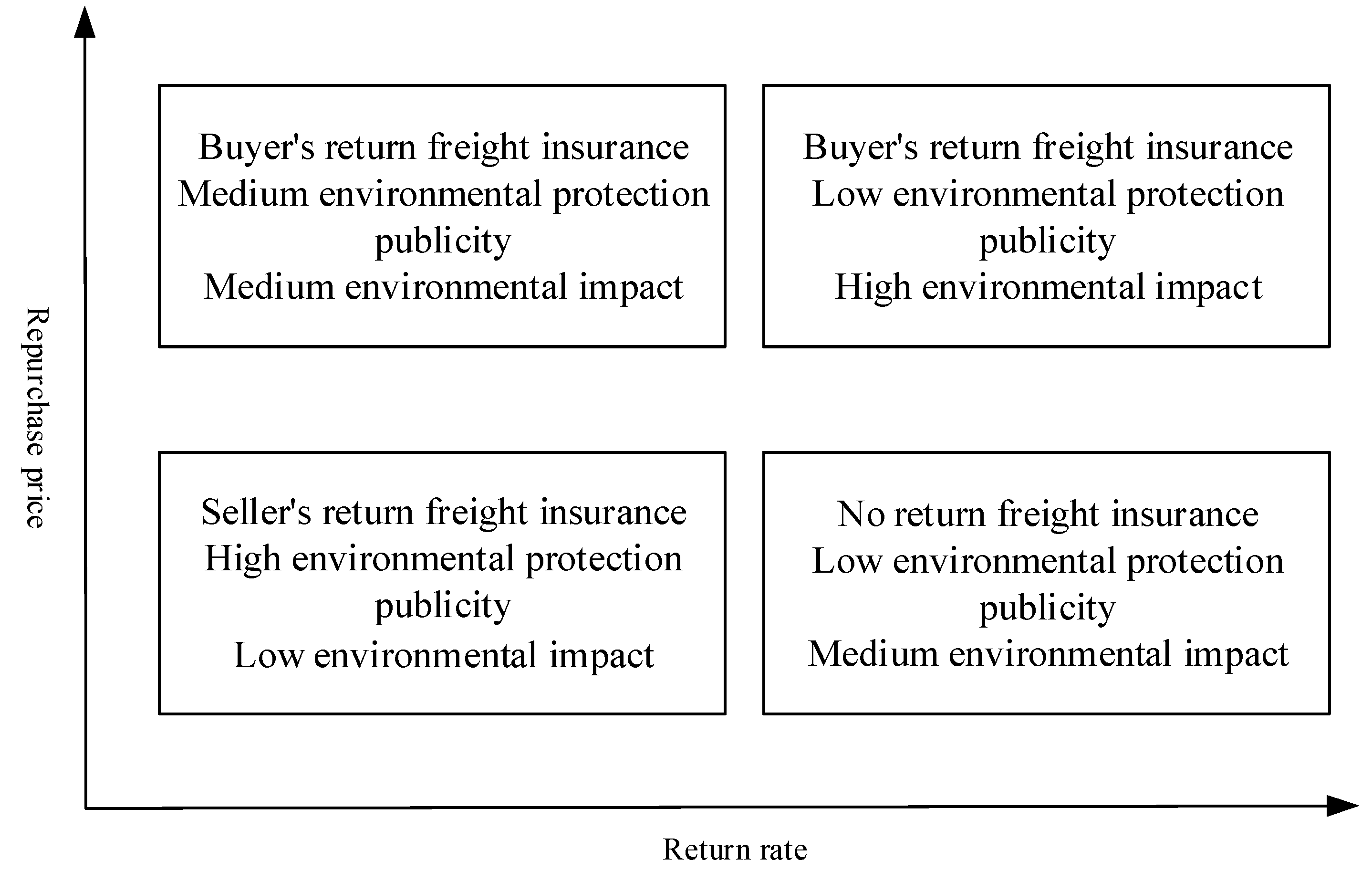

5. Numerical Simulation Analysis

6. Conclusions

- (1)

- The increase in environmental publicity subsidies can cushion the decrease of environmental publicity of e-commerce platforms caused by the high return rate. Therefore, the government should strengthen the investment in the manufacturing of environmental protection products and, at the same time, increase the policy publicity to improve consumers’ environmental awareness and guide non-environmental protection consumers to transform into environmental protection consumers.

- (2)

- Consumers with high environmental awareness show great willingness to pay for environmental protection products, and such consumers often do not participate in products return. Thus, e-commerce platforms can arouse consumers’ environmental protection awareness through advertising, promotion, and other encouraging ways, to reduce the products′ return rate and achieve green and sustainable development.

- (3)

- Environmental products are expensive to manufacture and develop; manufacturers and e-commerce platforms should cooperate with each other and share fixed costs with a certain percentage in order to incentivize manufacturers to improve products innovation and produce more environmental protection products; therefore, the overall benefits of the supply chain can be improved while the demand of consumers with environmental protection awareness can be met.

- (4)

- This paper only studies the supply chain composed of manufacturers and e-commerce platforms, but in practice, there are multiple manufacturers of the same type of products, and manufacturers can improve their competitive advantages only through continuous innovation [49]. Future research may consider adding competition and innovation factors into the model and study the return supply chain decision-making considering innovation strategy under the competitive environment of manufacturers. This has important research value for enhancing a sustainable innovation ecosystem and promoting digital transformation [50].

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

References

- Taherdoost, H.; Madanchian, M. Blockchain-Based E-Commerce: A Review on Applications and Challenges. Electronics 2023, 12, 1889. [Google Scholar] [CrossRef]

- Fülöp, M.T.; Topor, D.I.; Căpușneanu, S.; Ionescu, C.A.; Akram, U. Utilitarian and Hedonic Motivation in E-Commerce Online Purchasing Intentions. East. Eur. Econ. 2023, in press. [Google Scholar] [CrossRef]

- Fan, H.; Khouja, M.; Zhou, J. Design of Win-Win Return Policies for Online Retailers. Eur. J. Oper. Res. 2022, 301, 675–693. [Google Scholar] [CrossRef]

- Zhang, X.; Chen, H.; Hu, J.; Ma, C.; Shi, W. Optimal Showroom Service Strategy and Power Structure for Retailers Considering Consumer Return. Discret. Dyn. Nat. Soc. 2021, 2021, 4598341. [Google Scholar] [CrossRef]

- Tao, F.; Zhou, Y.; Bian, J.; Lai, K.K. Optimal Channel Structure for a Green Supply Chain with Consumer Green-Awareness Demand. Ann. Oper. Res. 2023, 324, 601–628. [Google Scholar] [CrossRef]

- Qiao, A.; Choi, S.H.; Pan, Y. Multi-Party Coordination in Sustainable Supply Chain under Consumer Green Awareness. Sci. Total Environ. 2021, 777, 146043. [Google Scholar] [CrossRef]

- Wang, D.; Wang, K.; Chen, Y. Optimal Return Policies and Micro-Plastics Prevention Based on Environmental Quality Improvement Efforts and Consumer Environmental Awareness. Water 2021, 13, 1537. [Google Scholar] [CrossRef]

- Cao, Y.; Tao, L.; Wu, K.; Wan, G. Coordinating Joint Greening Efforts in an Agri-Food Supply Chain with Environmentally Sensitive Demand. J. Clean. Prod. 2020, 277, 123883. [Google Scholar] [CrossRef]

- Wang, J.; Huang, X. The Optimal Carbon Reduction and Return Strategies under Carbon Tax Policy. Sustainability 2018, 10, 2471. [Google Scholar] [CrossRef]

- Guo, P.; Jia, Y.; Gan, J.; Li, X. Optimal Pricing and Ordering Strategies with a Flexible Return Strategy under Uncertainty. Mathematics 2021, 9, 2097. [Google Scholar] [CrossRef]

- Wagner, K. Environmental Preferences and Consumer Behavior. Econ. Lett. 2016, 149, 1–4. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. Supply Chain Analysis under Green Sensitive Consumer Demand and Cost Sharing Contract. Int. J. Prod. Econ. 2015, 164, 319–329. [Google Scholar] [CrossRef]

- Heydari, J.; Govindan, K.; Aslani, A. Pricing and Greening Decisions in a Three-Tier Dual Channel Supply Chain. Int. J. Prod. Econ. 2019, 217, 185–196. [Google Scholar] [CrossRef]

- Januardi; Widodo, E. Response Surface Methodology of Dual-Channel Green Supply-Chain Pricing Model by Considering Uncertainty. Supply Chain Forum 2020, 22, 16–27. [Google Scholar] [CrossRef]

- Mondal, C.; Giri, B.C.; Maiti, T. Pricing and Greening Strategies for a Dual-Channel Closed-Loop Green Supply Chain. Flex. Serv. Manuf. J. 2020, 32, 724–761. [Google Scholar] [CrossRef]

- Yu, Y.; Han, X.; Hu, G. Optimal Production for Manufacturers Considering Consumer Environmental Awareness and Green Subsidies. Int. J. Prod. Econ. 2016, 182, 397–408. [Google Scholar] [CrossRef]

- Walter, J.; Chang, Y.-M. Green Certification, Heterogeneous Producers, and Green Consumers: A Welfare Analysis of Environmental Regulations. J. Regul. Econ. 2017, 52, 333–361. [Google Scholar] [CrossRef]

- Xue, M.; Zhang, J. Impacts of Heterogeneous Environment Awareness and Power Structure on Green Supply Chain. RAIRO-Oper. Res. 2018, 52, 143–157. [Google Scholar] [CrossRef]

- Yalabik, B.; Fairchild, R.J. Customer, Regulatory, and Competitive Pressure as Drivers of Environmental Innovation. Int. J. Prod. Econ. 2011, 131, 519–527. [Google Scholar] [CrossRef]

- Zhang, T.; Guo, X.; Wu, T. An Analysis of Cross-Channel Return Processing with Return-Freight Insurance for Live Streaming Platforms. Comput. Ind. Eng. 2022, 174, 108805. [Google Scholar] [CrossRef]

- Fan, Z.-P.; Chen, Z. When Should the E-Tailer Offer Complimentary Return-Freight Insurance? Int. J. Prod. Econ. 2020, 230, 107890. [Google Scholar] [CrossRef]

- Lin, J.; Zhang, J.; Cheng, T.C.E. Optimal Pricing and Return Policy and the Value of Freight Insurance for a Retailer Facing Heterogeneous Consumers with Uncertain Product Values. Int. J. Prod. Econ. 2020, 229, 107767. [Google Scholar] [CrossRef]

- Shi, S.; Liu, G.; Shi, P. Choice and Influence of Return Policy and Remanufacture in a Dual-Channel Supply Chain. Discret. Dyn. Nat. Soc. 2022, 2022, 6859282. [Google Scholar] [CrossRef]

- Li, X.; Zhou, S.; Ji, G.; Shi, W. Optimal Return Freight Insurance Policies in a Competitive Environment. Sustainability 2022, 14, 11748. [Google Scholar] [CrossRef]

- Hua, Z.; Hou, H.; Bian, Y. Optimal Shipping Strategy and Return Service Charge Under No-Reason Return Policy in Online Retailing. IEEE Trans. Syst. Man. Cybern. Syst. 2017, 47, 3189–3206. [Google Scholar] [CrossRef]

- Radhi, M.; Zhang, G. Optimal Cross-Channel Return Policy in Dual-Channel Retailing Systems. Int. J. Prod. Econ. 2019, 210, 184–198. [Google Scholar] [CrossRef]

- Li, X.; Gao, J.; Bian, Y. Return Freight Insurance Strategies for the Online Retailer and Insurance Company. Int. J. Prod. Econ. 2023, 256, 108752. [Google Scholar] [CrossRef]

- Chen, T.; Ma, K.; Zheng, C. Does Freight Insurance Really Work? Effect of Freight Insurance on Consumers’ Attitude in Online Shopping. IJIMA 2018, 12, 209. [Google Scholar] [CrossRef]

- Li, Y.; Li, G.; Tayi, G.K.; Cheng, T.C.E. Return Shipping Insurance: Free versus for-a-Fee? Int. J. Prod. Econ. 2021, 235, 108110. [Google Scholar] [CrossRef]

- Mandal, A.; Pal, B. Investigating Dual-Channel Green Supply Chain Considering Refurbishing Process and Product Recycling with Environmental Awareness Effort. Math. Comput. Simul. 2023, 204, 695–726. [Google Scholar] [CrossRef]

- Shen, J.; Shi, J.; Gao, L.; Zhang, Q.; Zhu, K. Uncertain Green Product Supply Chain with Government Intervention. Math. Comput. Simul. 2023, 208, 136–156. [Google Scholar] [CrossRef]

- Qi, J.; Ling, Y.; Ji, B.; Liu, Y.; Shen, Z.; Xu, B.; Xue, Y.; Sun, Y. Research on a Collaboration Model of Green Closed-Loop Supply Chains towards Intelligent Manufacturing. Multimed. Tools Appl. 2022, 81, 40609–40634. [Google Scholar] [CrossRef]

- Barman, A.; De, P.K.; Chakraborty, A.K.; Lim, C.P.; Das, R. Optimal Pricing Policy in a Three-Layer Dual-Channel Supply Chain under Government Subsidy in Green Manufacturing. Math. Comput. Simul. 2023, 204, 401–429. [Google Scholar] [CrossRef]

- Liu, G.; Chen, J.; Li, Z.; Zhu, H. Green Supply Chain Innovation Strategies, Considering Government Subsidy and Altruistic Preference. Math. Probl. Eng. 2022, 2022, 5495374. [Google Scholar] [CrossRef]

- Shi, W.; Hu, J.; Sun, S.; Meng, Q.; Zhang, X. Green Supply Chain Decision-Making Considering Retailer’s Fairness Concerns and Government Subsidy Policy. Math. Probl. Eng. 2022, 2022, 6009764. [Google Scholar] [CrossRef]

- Barman, A.; Das, R.; De, P.K.; Sana, S.S. Optimal Pricing and Greening Strategy in a Competitive Green Supply Chain: Impact of Government Subsidy and Tax Policy. Sustainability 2021, 13, 9178. [Google Scholar] [CrossRef]

- Wang, W.; Zhang, R. Green Supply Chain Operations Decision and Government Subsidy Strategies under R & D Failure Risk. Sustainability 2022, 14, 15307. [Google Scholar] [CrossRef]

- Xing, G.; Xia, B.; Guo, J. Sustainable Cooperation in the Green Supply Chain under Financial Constraints. Sustainability 2019, 11, 5977. [Google Scholar] [CrossRef]

- Feng, Q.; Liu, T. Selection Strategy and Coordination of Green Product R&D in Sustainable Competitive Supply Chain. Sustainability 2022, 14, 8884. [Google Scholar] [CrossRef]

- Cai, J.; Sun, H.; Shang, J.; Hegde, G.G. Information Structure Selection in a Green Supply Chain: Impacts of Wholesale Price and Greenness Level. Eur. J. Oper. Res. 2023, 306, 34–46. [Google Scholar] [CrossRef]

- Meng, Q.; Wang, Y.; Zhang, Z.; He, Y. Supply Chain Green Innovation Subsidy Strategy Considering Consumer Heterogeneity. J. Clean. Prod. 2021, 281, 125199. [Google Scholar] [CrossRef]

- Yi, Y.; Wang, Y.; Fu, C.; Li, Y. Taxes or Subsidies to Promote Investment in Green Technologies for a Supply Chain Considering Consumer Preferences for Green Products. Comput. Ind. Eng. 2022, 171, 108371. [Google Scholar] [CrossRef]

- Meng, Q.; Li, M.; Liu, W.; Li, Z.; Zhang, J. Pricing Policies of Dual-Channel Green Supply Chain: Considering Government Subsidies and Consumers’ Dual Preferences. Sustain. Prod. Consum. 2021, 26, 1021–1030. [Google Scholar] [CrossRef]

- Wang, L.; Song, Q. Pricing Policies for Dual-Channel Supply Chain with Green Investment and Sales Effort under Uncertain Demand. Math. Comput. Simul. 2020, 171, 79–93. [Google Scholar] [CrossRef]

- Hosseini-Motlagh, S.-M.; Ebrahimi, S.; Jokar, A. Sustainable Supply Chain Coordination under Competition and Green Effort Scheme. J. Oper. Res. Soc. 2021, 72, 304–319. [Google Scholar] [CrossRef]

- Rahmani, K.; Yavari, M. Pricing Policies for a Dual-Channel Green Supply Chain under Demand Disruptions. Comput. Ind. Eng. 2019, 127, 493–510. [Google Scholar] [CrossRef]

- Guo, H.; Wang, S.; Zhang, Y. Supply Interruption Supply Chain Network Model with Uncertain Demand: An Application of Chance-Constrained Programming with Fuzzy Parameters. Discret. Dyn. Nat. Soc. 2021, 2021, e6686992. [Google Scholar] [CrossRef]

- Xie, X.; Dai, B.; Du, Y.; Wang, C. Contract Design in a Supply Chain With Product Recall and Demand Uncertainty. IEEE Trans. Eng. Manag. 2023, 70, 232–248. [Google Scholar] [CrossRef]

- Costa, J.; Matias, J.C.O. Open Innovation 4.0 as an Enhancer of Sustainable Innovation Ecosystems. Sustainability 2020, 12, 8112. [Google Scholar] [CrossRef]

- Abbate, S.; Centobelli, P.; Cerchione, R. The Digital and Sustainable Transition of the Agri-Food Sector. Technol. Forecast. Soc. Chang. 2023, 187, 122222. [Google Scholar] [CrossRef]

| Parameter | Description |

|---|---|

| Wholesale price | |

| Sales price | |

| Products’ average value obtained by consumers | |

| Impact of return compensation on demand | |

| Impact of environmental protection publicity on demand | |

| Impact of environmental protection publicity on cost | |

| Fixed market demand | |

| Repurchase price | |

| Processing cost of returned products | |

| Proportion of consumers purchasing return freight insurance | |

| Production cost | |

| Reduction coefficient of environmental impact | |

| Unit environmental impact | |

| Seller’s return freight insurance cost | |

| Buyer’s return freight insurance cost | |

| Unit product’s environmental impact | |

| The expected sales volume | |

| Environmental impact | |

| Profit of e-commerce platform | |

| Profit of manufacturer | |

| Consumer surplus | |

| Decision Variable | Description |

| Order quantity | |

| Environmental protection publicity | |

| Environmental protection publicity subsidy |

| E(e0) | E(e1) | E(e2) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 10 | 13.5 | 13.5 | 13.5 | 11 | 11 | 11 | 1679 | 1669 | 1664 | 17,194 | 17,048 | 16,975 | |

| 20 | 13.5 | 13.5 | 13.5 | 9 | 9 | 9 | 1683.3 | 1673.3 | 1668.3 | 33,557 | 33,273 | 33,131 | |

| 30 | 13.5 | 13.5 | 13.5 | 7 | 7 | 7 | 1687.5 | 1677.5 | 1672.5 | 49,787 | 49,367 | 49,157 | |

| 10 | 7 | 7 | 7 | 22 | 22 | 22 | 1608.2 | 1598,2 | 1593.2 | 19,052 | 18,880 | 18,794 | |

| 20 | 7 | 7 | 7 | 18 | 18 | 18 | 1618.8 | 1608.8 | 1603.8 | 36,693 | 36,365 | 36,201 | |

| 30 | 7 | 7 | 7 | 14 | 14 | 14 | 1629 | 1619 | 1614 | 54,192 | 53,712 | 53,472 | |

| 10 | 0.5 | 0.5 | 0.5 | 33 | 33 | 33 | 1520.8 | 1510.8 | 1505.8 | 20,031 | 19,834 | 19,734 | |

| 20 | 0.5 | 0.5 | 0.5 | 27 | 27 | 27 | 1541.3 | 1531.3 | 1526.3 | 38,528 | 38,156 | 37,970 | |

| 30 | 0.5 | 0.5 | 0.5 | 21 | 21 | 21 | 1560.4 | 1550.4 | 1545.4 | 57,100 | 56,560 | 56,290 |

| E(πR0) | E(πR1) | E(πR2) | E(πM0) | E(πM1) | E(πM2) | E(πC0) | E(πC1) | E(πC2) | ||

|---|---|---|---|---|---|---|---|---|---|---|

| 10 | 213,250 | 213,170 | 213,130 | 27,192 | 27,002 | 26,907 | 31,798 | 30,944 | 30,229 | |

| 20 | 214,905 | 214,815 | 214,770 | 25,534 | 25,334 | 25,234 | 35,448 | 35,148 | 30,331 | |

| 30 | 216,560 | 216,460 | 216,410 | 23,852 | 23,652 | 23,552 | 35,562 | 35,262 | 30,430 | |

| 10 | 193,630 | 193,670 | 193,690 | 24,182 | 24,002 | 23,912 | 26,585 | 25,247 | 24,040 | |

| 20 | 197,160 | 196,960 | 196,860 | 21,047 | 20,847 | 20,747 | 33,561 | 33,261 | 24,281 | |

| 30 | 200,349 | 200,149 | 200,049 | 17,834 | 17,634 | 17,534 | 33,870 | 33,570 | 24,508 | |

| 10 | 174,920 | 175,080 | 175,160 | 20,917 | 20,747 | 20,662 | 21,245 | 19,533 | 17,940 | |

| 20 | 179,990 | 179,790 | 179,690 | 16,555 | 16,355 | 16,255 | 31,071 | 30,771 | 18,373 | |

| 30 | 184,580 | 184,380 | 184,280 | 11,998 | 11,798 | 11,698 | 31,722 | 31,422 | 18,762 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, S.; Ding, Q.; Ding, J. Return Strategy of E-Commerce Platform Based on Green and Sustainable Development. Sustainability 2023, 15, 11188. https://doi.org/10.3390/su151411188

Zhang S, Ding Q, Ding J. Return Strategy of E-Commerce Platform Based on Green and Sustainable Development. Sustainability. 2023; 15(14):11188. https://doi.org/10.3390/su151411188

Chicago/Turabian StyleZhang, Shuiwang, Qianlan Ding, and Jingcheng Ding. 2023. "Return Strategy of E-Commerce Platform Based on Green and Sustainable Development" Sustainability 15, no. 14: 11188. https://doi.org/10.3390/su151411188

APA StyleZhang, S., Ding, Q., & Ding, J. (2023). Return Strategy of E-Commerce Platform Based on Green and Sustainable Development. Sustainability, 15(14), 11188. https://doi.org/10.3390/su151411188