1. Introduction

The dynamics of the worldwide market have led large industrial companies to become increasingly concerned with new strategic guidelines and ways of managing physical assets to improve their competitiveness in an increasingly demanding world where organizations are required to assume a decisive role in crucial agendas such as sustainable development. (For example, Ref. [

1] argue that the introduction of Agenda 2030 and SDGs encouraged companies to play a central role in promoting sustainable development. On this topic, see also [

2,

3,

4]). Their traditional problems have now been joined by issues such as those related to energy savings, maintenance, social responsibility, and the environment. Therefore, in today’s globalized economy, the survival of organizations depends on their capability to understand the changes taking place in the world and to have the ability to innovate.

For obvious reasons, public transport companies are strongly associated with sustainability, making urban passenger transport buses an important alternative to the use of individual transport. It should be noted that sustainable transport must be able to meet long-term and, simultaneously, environmental, social, and economic needs and impacts [

5].

Similarly to any other company, industrial organizations, including public transport companies, must be financially viable. In this context, physical asset management assumes great importance, even having been recently considered to be one of the most important sources of competitive advantage for organizations [

6]. They seek to improve the value of their assets by investing in asset management in order to obtain better returns for their business [

7].

In this perspective, it is inferred that the use of a physical asset management system is one of the tools that enables companies to improve financial performance, decision-making processes, risk management, services and results, organizational reputation, and sustainability [

8]. In fact, the literature shows that there is a strong linkage between physical asset management (PAM) and sustainability; in fact, the maximization of the asset’s life cycle represents less waste and, by consequence, increases sustainability. In this sense, Ref. [

9] show that there are some PAM areas on which managers should focus in order to optimize costs, performance, and risk exposures concerning the physical assets and, therefore, enhance sustainability performance.

For [

10], PAM is multidisciplinary and involves multifunctional processes, people, and technologies that contribute to the good performance of companies. It should be noted that the literature includes several studies that relate to the management of physical assets with a systematic and coordinated effort in terms of strategic, operational, and economic processes [

6,

11]. PAM also plays an important role in the management of the life cycle of an asset (LCA) as a whole, pursuing economic and physical performance [

9]. (When determining the value of assets over their life cycle, it is important to have information about the different stages of their lives. Ref. [

12] presents the stages of a physical asset’s life cycle from the moment the organization makes a decision about acquisition until Renewal/Withdrawal. Later, the author also presents the concept of life-cycle investment (LCI); this is a transition from life-cycle cost (LCC), which represents a change in the concept of cost, which is traditionally assumed to be a loss. The author also argues that when investing in assets, a question must be asked: “Will the value of the asset increase?” This increase can be seen in different ways, such as a reduction in product rejection or an increase in product production in manufacturing. On the other hand, it can be carried out through a renewal that can extend the life cycle of the product [

2]).

The LCA of physical assets is indeed assumed to be crucial for many different companies, including transport companies. For example, Refs. [

13,

14] present and discuss a model for condition monitoring. Using data from the oil in the diesel engines of a fleet of urban buses, the authors study the evolution of degradation and develop a predictive maintenance policy for oil replacement. Based on the analysis of the oil condition, the intervals for oil replacement can be expanded, allowing increased availability. This exercise can be expanded to include other variables, and the model has the potential to be applied to other physical assets to achieve the best availability based on a condition monitoring policy.

Ref. [

15] present an interesting study with the objective of applying new methods of econometric models to the LCA of physical assets. These authors highlight a method to evaluate asset depreciation using different variables, with an emphasis on investments in technology and sustainability.

Given the increasing interest in this subject and based on the scarcity of studies that explain the constructs that determine the economic management of physical assets, the objective of this paper is to contribute to the literature by analyzing these aspects in the specific case of the urban transport company in one of the biggest cities in Portugal. In this sense, it assesses, from a strictly economic point of view, the influence of exogenous variables on the cost of money, namely the inflation rate, the cost of money, and the costs associated with fuel, whose prices have undergone considerable changes, both positive and negative, over the years, presenting analysis models that make it possible to determine the influence of those variables on the time of sale and the size of the reserve fleet. (The value of money is directly linked to time, so it is correct to say that the longer the time of ownership of a physical asset, the greater the action of external agents or even the influence of macroeconomic factors in relation to the purchasing power of the specific currency. On the other hand, inflation is a determining factor in the relationship between money and time; there is a need to take into account the inflation rates to which capital is subject).

This paper is structured as follows:

Section 2 presents a brief literature review regarding physical asset management;

Section 3 presents the research methodology and the models;

Section 4 presents the case study and discusses the estimated results; and

Section 5 presents the main conclusions.

2. Literature Review: Physical Asset Management

Increased competition, deregulation, external pressures, and technological advances have encouraged companies to monetarize their investments and design new strategies that allow them to survive in the long term [

16]. In this context, the management of physical assets has been gaining importance in the field of scientific research, with companies seeking to identify new competitive factors that make their investments profitable [

17,

18].

For [

6], physical assets, also known as engineering assets, are important for creating tangible value for an organization, namely in transport services, electricity supply, water supply, construction, and mining, among other sectors. There is also a strong linkage between physical asset management (PAM) practices and the sustainability performance of companies. For example, using data collected from different organizations operating in six European countries, namely Greece, Poland, Slovakia, Slovenia, Sweden, and Turkey, Ref. [

9] show that PAM practices positively influence sustainability performance outcomes, namely economic, environmental, and employee-related social performance. In the same perspective, using statistics and resorting to facts extracted from over 2800 journal articles, Ref. [

19] present a systematic review regarding physical asset management as a key resource in achieving competitive advantage in the framework of sustainable development.

An adequate management of available resources also enables companies to obtain advantages over their competitors [

16,

20,

21]. Indeed, companies can obtain important advantages when they prioritize the development of their resources through the management of physical assets, namely by determining the economic life of their equipment. This is also a reality for urban transport companies.

It should be noted that the maintenance management of passenger transport buses is a strategic activity to guarantee compliance with their life cycle, which implies combining management, technical, and economic actions in order to obtain high availability at rational costs [

13,

22]. In fact, poor maintenance management contributes to a significant financial cost [

23].

The theoretical basis of this subject shows that the life-cycle cost (LCC) of an asset is the sum of all the capital expended to support the asset, from design and manufacture through operation until the end of its useful life. In other words, this concept represents the capital spent on supporting that asset, from its conception and manufacture through its operation until the end of its useful life [

24]. We can also consider it a prediction of the future, and, as such, different methods are generally used to make cost estimates, such as activity-based costing (ABC). For [

25], since ABC is crucial to activity-based LCA, some explanation of ABC is pertinent. ABC is a full-absorption costing method that is gaining more and more support over conventional methods.

In an ABC system, it is assumed that cost objects (products, services, and so forth) consume activities, while a conventional system assumes that cost objects consume resources. There are several implications of this difference, but the most important is that ABC acknowledges that one cannot manage costs; one can only manage what is being carried out, i.e., activities.

An ABC system utilizes drivers on several levels (unit, batch, product, and factory level), while a conventional system uses only unit-level characterizations called location bases, which, roughly speaking, are an arbitrary unit-level driver. Hence, ABC is much more accurate [

25,

26].

The LCC can be significantly higher than the initial investment value, and, in many cases, it is defined right at the design stage. (For example, Ref. [

27] goes further and reinforces this idea, noting that from 70% to 90% of these total LCC costs are defined in the design and manufacturing phases). The initial investment costs are usually the most commonly used as a primary criterion and, sometimes, the only one in the purchase decision. Despite the obvious long-term benefits of LCC analysis, its adoption has been relatively slow. Possible reasons for this include the lack of standard or formal guidelines and the absence of reliable past data. The number of cross-case studies in the field of life-cycle costing is extremely low, and most of them are limited to a single industry [

28,

29]. (It should also be noted that, in order to support the life-cycle cost analysis, there are some standards and related documents that are good sources as guidelines for asset management, such as [

30]), i.e., [

31,

32,

33], which can be applied in any sector [

34].

Ref. [

35] illustrate how, throughout the life cycle of equipment, mastery of concepts and some economic calculation tools become essential for maintenance managers and organizations. However, the systematized study in this area remains underdeveloped, with the need to apply and create new equipment management models that can bring added value to companies in the sense of improving their productivity and quality of service, taking into account aspects of environmental sustainability, including quality, environment, safety, maintenance, and energy management standards [

12]. It is also noted that many companies keep equipment in operation even when their operation is no longer economically viable because they do not follow their economic cycle, which has exogenous implications, namely in the size of the reserve fleet in the case of bus fleets (idem).

Ref. [

36] refer to technological change as a motivator for replacing equipment. In scientific references, it is commonly assumed that technology continuously develops according to a well-defined function. On the other hand, [

37] demonstrate that, combining continuous and discrete-time models, the equipment replacement period is shorter when the incorporated technology is greater.

According to [

35], “the valuation of an asset is established by the expected future benefits of the cash flows referred to the present value, through a discount rate that reflects the risk of the decision”. Consequently, methods that consider the time value of money are the most suitable.

According to [

38], the Equivalent Uniform Annual Cost method is adequate in the analysis of the company’s operational activities, with investments that can be repeated. The Equivalent Uniform Annual Cost method is similar to the value uniform annual equivalent, but the first makes a comparison between the costs of investment projects, while the second compares all cash flow components of the alternatives. By transforming all costs of the asset into equivalent annual costs with the application of a certain interest rate corresponding to the cost of capital on the investment or the minimum attractive rate, the objective is to determine in which year the lowest equivalent annual cost occurs, thus determining the ideal period of replacement of the depreciable asset, that is, its economic life.

In addition, the standardization of investment results for equivalent annual values means that the analysis of these results facilitates decision-making. The purpose of using this method is to determine in which year the lowest equivalent annual cost occurs, which indicates the best replacement period for the physical asset (idem).

The calculation of the equivalent annual cost is due to the use of the Capital Recovery Factor; it is through it that two or more investment opportunities can be compared and the ideal time to replace the equipment can be determined, taking into account information such as investment or acquisition value, resale value or residual value at the end of each year, operating costs, cost of capital, or the attractive minimum rate [

39].

In this context, the literature identifies the following four main reasons that lead to equipment replacement [

40]:

- (i).

When the asset becomes inadequate for the activity;

- (ii).

When the asset reaches the limit of its useful life;

- (iii).

When the asset becomes obsolete due to technological advances;

- (iv).

When more efficient methods prove to be more economical.

Within this replacement process, it is relevant to take into account the following aspects [

12,

41]:

- -

The availability of new technologies;

- -

Compliance with safety standards or other mandatory standards;

- -

The availability of spare parts;

- -

Obsolescence that may limit the asset’s use.

It is also important to note that specific calculation methods are available to determine when the asset should be replaced. For this purpose, several variables must be taken into account, such as acquisition value, assignment value, operating costs, maintenance costs, running costs, inflation rate, and capitalization rate. The values of most of these variables are obtained through historic valuation, with the exception of the assignment value. In this case, it will be necessary to obtain the market value for each specific piece of equipment, which may be difficult for several assets. As an alternative, various types of devaluation can be simulated, such as the following [

12,

41,

42]:

- -

Linear method of depreciation—the aging of the value of the equipment is constant over the years;

- -

Sum-of-digits method—annual devaluation is non-linear;

- -

Exponential method—the annual depreciation charge decreases over the life of the equipment.

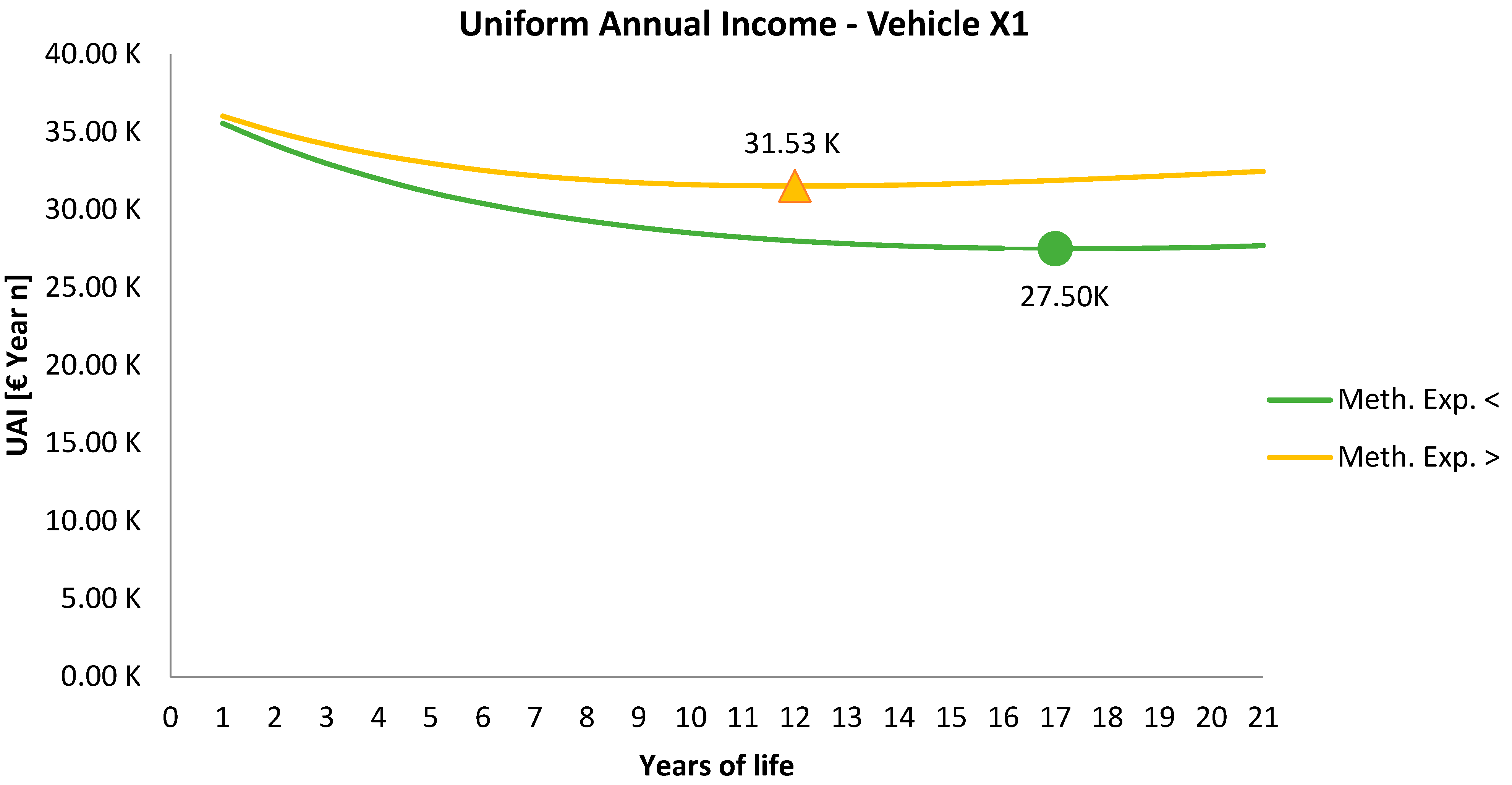

Another additional method involves using the “useful life”, which defines that the life of an asset ends when its maintenance costs exceed the maintenance costs plus the capital amortization of equivalent new equipment. There are several methods for determining the economic cycle of replacing equipment. The most common ones are the following [

12]:

- -

The Uniform Annual Income Method;

- -

The Total Average Cost Minimization Method;

- -

The Total Average Cost Minimization Method with Present Value Reduction.

In turn, Ref. [

43] proposes a policy for optimal replacement intervals for programming technical systems based only on the maintenance cost parameter: a system that is replaced by a new one as soon as the maintenance cost within a replacement cycle reaches or exceeds a certain level. Ref. [

44] present a new approach to economic models for determining the most appropriate time for replacing equipment in services, which permits the evaluation of the life cycle of the equipment by the managers. Several studies consider the adoption of reliability parameters and maintenance costs to help evaluate more rational replacement decisions [

44,

45].

Ref. [

46] adopted a model for a transit fleet replacement problem with various types of buses. However, many costs were highly oversimplified or not based on real data, and variability in vehicle characteristics uses market fluctuations that were not studied. The cost of replacing, remanufacturing, and rehabilitating a bus has been a focus of research by [

47], as has the optimal allocation proposed by the Federal Transit Administration (FTA) of the United States of America (USA). Other lines of research have focused on statistical analyses of fleet data and on the relationships among age, utilization, and costs [

48].

A numerical solution was proposed and illustrated by [

49] using data from a given fleet. The authors considered a two-cycle replacement model, with decision variables based on the replacement age of the current fleet and the size of the new fleet. The optimal values for the decision variables can be found by minimizing the total discounted cost per unit of time or the equivalent income value.

Regarding predictive maintenance versus equipment replacement, and specifically oil analysis, some mathematical models and concepts have been used [

12,

13,

14,

22,

24,

41,

44]. On the other hand, many studies have considered reliability parameters and maintenance costs to help evaluate more rational replacement decisions [

13,

14,

22,

24,

44,

45]. It should, however, be noted that there are other tools that may contribute to the development of a new vehicle replacement optimization model, such as fuzzy logic (Fuzzy logic is a form of many-valued logic in which the truth value of variables may be any real number between 0 and 1. It is employed to handle the concept of partial truth, where the truth value may range between completely true and completely false. Fuzzy logic is based on the observation that people make decisions based on imprecise and non-numerical information. Fuzzy models or fuzzy sets are mathematical ways of representing vagueness and imprecise information (hence the term fuzzy). These models have the capability of recognizing, representing, manipulating, interpreting, and using data and information that are vague and lack certainty.) and Support Vector Machines (Support Vector Machines are supervised learning models with associated learning algorithms that analyze data for classification and regression analysis. SVMs are one of the most robust prediction methods, being based on statistical learning frameworks or VC theory) [

24].

5. Conclusions

In this paper, we analyze the determinants of the economic management of physical assets in the specific case of an urban passenger transport company in one of the biggest cities in Portugal. Given the difficulty in encountering research that explains the impact of the factors that govern the economic management of physical assets in organizations, it was decided to carry out a qualitative study with a practical case, which involved the analysis of models designed to calculate the replacement year of this type of urban transport asset.

During the initial phase of the research, connection points were built between the models and the methods that they reflect, as well as the determinants that influence the economic management of a company’s physical assets, including urban transport.

Then, it was possible to conclude that the economic management of physical assets is oriented by relevant indicators, including, for example, the costs associated with acquisition, maintenance, and operation. This paper makes a relevant contribution to monitoring the life cycle of equipment, enabling a more efficient and effective management of the physical assets of urban passenger transport companies. Furthermore, by confirming, for the first time, the importance of certain specific factors for the economic management of physical assets in the case of an urban passenger transport company, we make an important contribution to the literature on the subject.

However, it is also important to emphasize that the facts presented in this study are not the only ones that affect the economic management of physical assets. There is a need to carry out future research with the aim of contributing to the promotion of a more accessible and understandable management of physical assets. We must also draw attention to the fact that an evident limitation of this study lies in the fact that we are only dealing with one specific case. Therefore, it is suggested that, in the future, more case studies be carried out on equipment replacement models, identifying possible correlations between certain determinants within the scope of forecast models that are suitable for the management of physical assets, especially for other transport companies. Therefore, we believe that this paper can open up new research avenues in the area of physical asset management.