Sustainability of Entrepreneurship: An Empirical Study on the Impact Path of Corporate Social Responsibility Based on Internal Control

Abstract

1. Introduction

2. Theoretical Foundation and Research Hypotheses

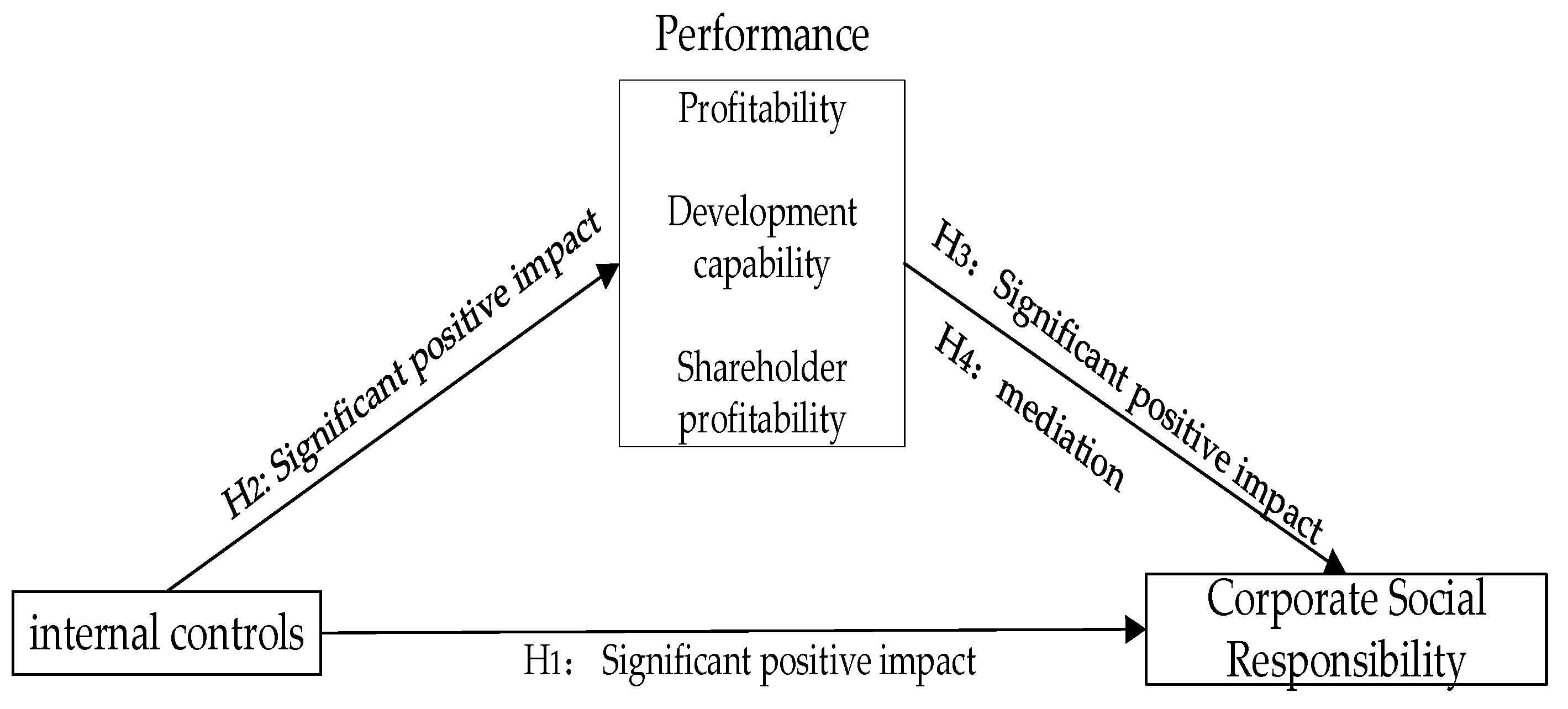

2.1. Analysis of the Relationship between Internal Control and Corporate Social Responsibility

2.2. Analysis of the Relationship between Internal Control and Financial Performance

2.3. Analysis of the Relationship between Corporate Social Responsibility and Financial Performance

2.4. The Mediating Role of Financial Performance

3. Methodology

3.1. Sample Selection and Data Sources

3.2. Variable Design

3.2.1. The Dependent Variable

3.2.2. The Dependent Variable and Explanatory Variables

3.2.3. Mediating Variables and Control Variables

3.3. Model Construction

4. Correlation Analysis, Regression Analysis, and Property Rights Grouping Test

4.1. Correlation Analysis

4.2. Regression Analysis

4.3. Property Rights Grouping Inspection

5. Robustness Test

6. Discussions and Implications

7. Conclusions and Recommendation

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Imran, T.; Ahmed, R.R.; Streimikiene, D.; Soomro, R.H.; Parmar, V.; Vveinhardt, J. Assessment of Entrepreneurial Traits and Small-Firm Performance with Entrepreneurial Orientation as a Mediating Factor. Sustainability 2019, 11, 5301. [Google Scholar] [CrossRef]

- Wang, J.; Chen, R.; Zhang, S. The Mediating and Moderating Effect of Organizational Resilience on Competitive Advantage: Evidence from Chinese Companies. Sustainability 2022, 14, 13797. [Google Scholar] [CrossRef]

- Oh, H.M.; Park, S.B.; Ma, H.Y. Corporate Sustainability Management, Earnings Transparency, and Chaebols. Sustainability 2020, 12, 4222. [Google Scholar] [CrossRef]

- Mueller, B. Corporate Digital Responsibility. Bus. Inf. Syst. Eng. 2022, 64, 689–700. [Google Scholar] [CrossRef]

- Makosa, L.; Yang, J.; Sitsha, L.; Jachi, M. MandatoryCSRdisclosure and Firm Investment Behavior: Evidence from Aquasi-Naturalexperiment in China. J. Corp. Account. Finance 2020, 31, 33–47. [Google Scholar] [CrossRef]

- Govindan, K.; Kilic, M.; Uyar, A.; Karaman, A.S. Drivers and Value-Relevance of CSR Performance in the Logistics Sector: A Cross-Country Firm-Level Investigation. Int. J. Prod. Econ. 2021, 231, 107835. [Google Scholar] [CrossRef]

- Hui, Z. Corporate Social Responsibilities, Psychological Contracts and Employee Turnover Intention of SMEs in China. Front. Psychol. 2021, 12, 754183. [Google Scholar] [CrossRef]

- Ouyang, Z.; Lv, R.; Liu, Y. Can Corporate Social Responsibility Protect Firm Value during Corporate Environmental Violation Events? Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1942–1952. [Google Scholar] [CrossRef]

- Lu, Y. The Current Status and Developing Trends of Industry 4.0: A Review. Inf. Syst. Front. 2021. [Google Scholar] [CrossRef]

- Wu, X.; Zeng, S. R&D Investment, Internal Control and Enterprise Performance-An Empirical Study Based on the Listed Companies in China of the Core Industry of the Digital Economy. Sustainability 2022, 14, 16700. [Google Scholar] [CrossRef]

- Li, Y.; Ye, F.; Dai, J.; Zhao, X.; Sheu, C. The Adoption of Green Practices by Chinese Firms: Assessing the Determinants and Effects of Top Management Championship. Int. J. Oper. Prod. Manag. 2019, 39, 550–572. [Google Scholar] [CrossRef]

- Meng, X.; Chen, L.; Gou, D. The Impact of Corporate Environmental Disclosure Quality on Financing Constraints: The Moderating Role of Internal Control. Environ. Sci. Pollut. Res. 2023, 30, 33455–33474. [Google Scholar] [CrossRef]

- Wali, S.; Masmoudi, S.M. Internal Control and Real Earnings Management in the French Context. J. Financ. Report. Account. 2020, 18, 363–387. [Google Scholar] [CrossRef]

- Ngo, H.T.; Luu, D.H.; Truong, T.T. The Relationship Between Internal Control and Accounting Information Quality: Empirical Evidence from Manufacturing Sector in Vietnam. J. Asian Finance Econ. Bus. 2021, 8, 353–359. [Google Scholar] [CrossRef]

- Chen, L.; Li, Y.; Liu, B. Study on the Negative Effect of Internal-Control Willingness on Enterprise Risk-Taking. Front. Psychol. 2022, 13, 894087. [Google Scholar] [CrossRef]

- Tang, Y.; Akram, A.; Cioca, L.-I.; Shah, S.G.M.; Qureshi, M.A.A. Whether an Innovation Act as a Catalytic Moderator between Corporate Social Responsibility Performance and Stated Owned and Non-State Owned Enterprises’ Performance or Not? An Evidence from Pakistani Listed Firms. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1127–1141. [Google Scholar] [CrossRef]

- Wang, K.; Liu, L.; Deng, M.; Feng, Y. Internal Control, Environmental Uncertainty and Total Factor Productivity of Firms-Evidence from Chinese Capital Market. Sustainability 2023, 15, 736. [Google Scholar] [CrossRef]

- Zhai, L.; Feng, Y.; Li, F.; Zhai, L. Tax Preference, Financing Constraints and Enterprise Investment Efficiency-Experience, of China’s Enterprises Investment. PLoS ONE 2022, 17, e0274336. [Google Scholar] [CrossRef]

- Zhang, H.; An, R.; Zhong, Q. Anti-Corruption, Government Subsidies, and Investment Efficiency. China J. Account. Res. 2019, 12, 113–133. [Google Scholar] [CrossRef]

- Pakurar, M.; Haddad, H.; Nagy, J.; Popp, J.; Olah, J. The Impact of Supply Chain Integration and Internal Control on Financial Performance in the Jordanian Banking Sector. Sustainability 2019, 11, 1248. [Google Scholar] [CrossRef]

- Xue, C.; Ying, Y. Financial Quality, Internal Control and Stock Price Crash Risk. Asia-Pac. J. Account. Econ. 2022, 29, 1671–1691. [Google Scholar] [CrossRef]

- Jia, F.; Wang, D.; Li, L. Decision Analysis of International Joint Prevention and Control of Public Health Emergencies. Environ. Dev. Sustain. 2022. [Google Scholar] [CrossRef] [PubMed]

- Radu, C.; Smaili, N. Corporate Performance Patterns of Canadian Listed Firms: Balancing Financial and Corporate Social Responsibility Outcomes. Bus. Strateg. Environ. 2021, 30, 3344–3359. [Google Scholar] [CrossRef]

- Lu, Y.; Zheng, X. 6G: A Survey on Technologies, Scenarios, Challenges, and the Related Issues. J. Ind. Inf. Integr. 2020, 19, 100158. [Google Scholar] [CrossRef]

- Liao, F.-N.; Ji, X.-L.; Wang, Z.-P. Firms’ Sustainability: Does Economic Policy Uncertainty Affect Internal Control? Sustainability 2019, 11, 794. [Google Scholar] [CrossRef]

- Xu, L.D.; Lu, Y.; Li, L. Embedding Blockchain Technology Into IoT for Security: A Survey. IEEE Internet Things J. 2021, 8, 10452–10473. [Google Scholar] [CrossRef]

- Li, Z.; Wang, B.; Wu, T.; Zhou, D. The Influence of Qualified Foreign Institutional Investors on Internal Control Quality: Evidence from China. Int. Rev. Financ. Anal. 2021, 78, 101916. [Google Scholar] [CrossRef]

- Shen, H.; Xiong, H.; Zheng, S.; Hou, F. Chief Executive Officer (CEO)’s Rural Origin and Internal Control Quality. Econ. Model. 2021, 95, 441–452. [Google Scholar] [CrossRef]

- Gregory, R.P. ESG Activities and Firm Cash Flow. Glob. Finance J. 2022, 52, 100698. [Google Scholar] [CrossRef]

- Ermasova, N.; Haumann, C.; Burke, L. The Relationship between Culture and Tax Evasion across Countries: Cases of the USA and Germany. Int. J. Public Adm. 2021, 44, 115–131. [Google Scholar] [CrossRef]

- Watanabel, N.; Yamauchi, S.; Sakawa, H. The Board Structure and Performance in IPO Firms: Evidence from Stakeholder-Oriented Corporate Governance. Sustainability 2022, 14, 8078. [Google Scholar] [CrossRef]

- Ali, H.Y.; Danish, R.Q.; Asrar-ul-Haq, M. How Corporate Social Responsibility Boosts Firm Financial Performance: The Mediating Role of Corporate Image and Customer Satisfaction. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 166–177. [Google Scholar] [CrossRef]

- Talaulicar, T. The Concept of the Balanced Company and Its Implications for Corporate Governance. Soc. Bus. Rev. 2010, 5, 232–244. [Google Scholar] [CrossRef]

- Gao, Q.; Wu, Y.; Zhang, J.; Bu, Y. Internal Control Index and Enterprise Growth: An Empirical Study of Chinese Listed-Companies in the Automobile Manufacturing Industry. Appl. Math. Nonlinear Sci. 2022, 8, 2291–2300. [Google Scholar] [CrossRef]

- Ye, Z.; Lu, Y. Quantum Science: A Review and Current Research Trends. J. Manag. Anal. 2022, 9, 383–402. [Google Scholar] [CrossRef]

- Zhang, R.; Lin, Y.; Kuang, Y. Will the Governance of Non-State Shareholders Inhibit Corporate Social Responsibility Performance? Evidence from the Mixed-Ownership Reform of China’s State-Owned Enterprises. Sustainability 2022, 14, 527. [Google Scholar] [CrossRef]

- Lu, Y. Implementing Blockchain in Information Systems: A Review. Enterp. Inf. Syst. 2022, 16, 2008513. [Google Scholar] [CrossRef]

- Raji, R.A.; Rashid, S.; Ishak, S. The Mediating Effect of Brand Image on the Relationships between Social Media Advertising Content, Sales Promotion Content and Behaviuoral Intention. J. Res. Interact. Mark. 2019, 13, 302–330. [Google Scholar] [CrossRef]

- Syapsan, S. The Effect of Service Quality, Innovation towards Competitive Advantages and Sustainable Economic Growth Marketing Mix Strategy as Mediating Variable. Benchmarking 2019, 26, 1336–1356. [Google Scholar] [CrossRef]

| Primary Indicators | Secondary Indicators | Indicator Calculation and Explanation | Indicator Symbol |

|---|---|---|---|

| Profitability | Net profit margin on total assets | Net profit/average total assets | U1 |

| Net asset profit margin | Net profit/average net assets | U2 | |

| Shareholder profitability | Earnings per share | Net profit/total number of shares at the end of the period | U3 |

| Development capability | Operating revenue growth rate | (Current year’s operating revenue—previous year’s operating revenue)/previous year’s operating revenue | U4 |

| Eigenvalue | Variance Contribution Rate (%) | Cumulative Variance Contribution Rate (%) | |

|---|---|---|---|

| First principal component | 2.079 | 51.958% | 51.958% |

| Second principal component | 1.001 | 25.042% | 77.000% |

| KMO value | 0.625 | ||

| Bartlett test chi-square value | 11,664.842 *** | ||

| Variable Type | Variable | Symbol | Definition Description |

|---|---|---|---|

| Explained variable | Corporate social responsibility | Csr | Social responsibility rating scores of listed companies released by Hexun.com. |

| Explanatory variable | Internal controls | Ic | DiBo—Internal Control Index of Chinese Listed Companies. |

| Mediating variable | Enterprise performance | F | Comprehensive variables obtained from principal component analysis of U1–U4 variables. |

| Control variable | Enterprise size | Size | Natural logarithm of total assets at the end of the period. |

| Leverage | Lev | Current asset-liability ratio. | |

| Ownership concentration | Cr1 | Shareholding ratio of the largest shareholder. | |

| Growth | Growth | Tobin Q value. | |

| Property nature | State | Virtual variable, 1 when belonging to a state-owned holding enterprise, otherwise 0. | |

| Industry | Ind | Virtual variable, set according to the secondary industry of manufacturing in the 2012 version. | |

| Time | Year | Virtual variable belongs to a certain year, take 1, otherwise take 0. |

| Inspection Items | Model 1 | Model 2 | Model 3 | Conclusion | Best Model |

|---|---|---|---|---|---|

| F-test | 210.41 *** (0.00) | 108.26 *** (0.00) | 246.09 *** (0.00) | Reject the original hypothesis. | Fixed-effects model |

| Hausman test | 687.52 *** (0.00) | 272.87 *** (0.00) | 581.08 *** (0.00) | Reject the original hypothesis. |

| Variable | Csr | Ic | F | Size | Lev | Cr1 | State | Growth |

|---|---|---|---|---|---|---|---|---|

| Csr | 1.000 | |||||||

| Ic | 0.211 *** | 1.000 | ||||||

| F | 0.445 *** | 0.306 *** | 1.000 | |||||

| Size | 0.198 *** | 0.033 *** | 0.062 *** | 1.000 | ||||

| Lev | 0.042 *** | 0.138 *** | 0.183 *** | 0.552 *** | 1.000 | |||

| Cr1 | 0.104 *** | 0.051 *** | 0.113 *** | 0.159 *** | 0.058 *** | 1.000 | ||

| Growth | 0.061 *** | 0.121 *** | 0.216 *** | 0.024 ** | 0.018 * | 0.052 *** | 1.000 | |

| State | 0.073 *** | 0.033 *** | 0.098 *** | 0.348 *** | 0.271 *** | 0.209 *** | 0.134 *** | 1.000 |

| Variable | Model (1) Dependent Variable: Csr | VIF | Model (2) Dependent Variable: F | VIF | Model (3) Dependent Variable: Csr | VIF |

|---|---|---|---|---|---|---|

| Constant | −43.99957 *** (−15.23) | −2.02015 *** (−22.64) | −18.88818 *** (−6.91) | |||

| Ic | 0.01488 *** (17.23) | 1.07 | 0.00071 *** (26.47) | 1.07 | 0.00605 *** (7.41) | 1.14 |

| F | 12.43049 *** (42.58) | 1.35 | ||||

| Size | 2.60831 *** (22.21) | 1.80 | 0.07721 *** (21.28) | 1.80 | 1.64859 *** (14.89) | 1.88 |

| Lev | −12.85556 *** (−18.18) | 1.74 | −0.62006 *** (−28.38) | 1.74 | −5.14787 *** (−7.60) | 1.87 |

| Cr1 | 0.05160 *** (6.40) | 1.14 | 0.00306 *** (12.29) | 1.14 | 0.01353 * (1.80) | 1.16 |

| Growth | 1.17607 *** (4.05) | 1.09 | 0.18201 *** (20.28) | 1.09 | −1.08642 *** (−3.97) | 1.13 |

| State | 0.52317 ** (2.03) | 1.43 | −0.051309 *** (−6.44) | 1.43 | 1.16098 *** (4.87) | 1.44 |

| Ind | control | control | control | |||

| Year | control | control | control | |||

| N | 10570 | 10570 | 10570 | |||

| Adj R2 | 0.2627 | 0.2525 | 0.3714 | |||

| F | 45.84 *** | 43.51 *** | 74.46 *** |

| Effect Value | Standard Error | Z Statistic | p Value | |

|---|---|---|---|---|

| Indirect effect | 0.00883 | 0.0004 | 22.4789 | 0.0000 |

| Direct effect | 0.00605 | 0.0008 | 7.41264 | 0.0000 |

| Total effect | 0.01488 | 0.0008 | 17.2327 | 0.0000 |

| The proportion of media effect = 59.341% | ||||

| Effect Value | Bootstrap SE | 95% Confidence Interval | |

|---|---|---|---|

| Indirect effect | 0.00883 | 0.00056 | (0.00766, 0.00989) |

| Direct effect | 0.00605 | 0.00086 | (0.00443, 0.00778) |

| Total effect | 0.01488 | 0.00100 | (0.01291, 0.01685) |

| The proportion of media effect = 59.341% | |||

| Variable | Model (1) Dependent Variable: Csr | VIF | Model (2) Dependent Variable: F | VIF | Model (3) Dependent Variable: Csr | VIF |

|---|---|---|---|---|---|---|

| Constant | −53.17728 *** (−10.68) | −2.11954 *** (−16.05) | −26.88507 *** (−5.53) | |||

| Ic | 0.01355 *** (9.12) | 1.10 | 0.00060 *** (15.38) | 1.10 | 0.00611 *** (4.21) | 1.17 |

| F | 12.40467 *** (21.21) | 1.43 | ||||

| Size | 2.93611 *** (13.85) | 1.81 | 0.08046 *** (14.31) | 1.81 | 1.93800 *** (9.42) | 1.91 |

| Lev | −15.77923 *** (−11.69) | 1.76 | −0.64741 *** (−18.08) | 1.76 | −7.74832 *** (−5.83) | 1.92 |

| Cr1 | 0.018526 (1.22) | 1.24 | 0.00152 *** (3.75) | 1.24 | −0.00028 (−0.02) | 1.25 |

| Growth | 1.70852 *** (2.86) | 1.08 | 0.19839 *** (12.54) | 1.08 | −0.75245 (−1.31) | 1.13 |

| Ind | control | control | control | |||

| Year | control | control | control | |||

| N | 3779 | 3779 | 3779 | |||

| AdjR2 | 0.3192 | 0.2868 | 0.3927 | |||

| F | 24.61 *** | 21.26 *** | 33.15 *** |

| Variable | Model (1) Dependent Variable: Csr | VIF | Model (2) Dependent Variable: F | VIF | Model (3) Dependent Variable: Csr | VIF |

|---|---|---|---|---|---|---|

| Constant | −34.78410 *** (−9.55) | −2.12534 *** (−16.95) | −8.07310 ** (−2.41) | |||

| Ic | 0.01554 *** (14.82) | 1.08 | 0.00078 *** (21.49) | 1.08 | 0.00574 *** (5.92) | 1.16 |

| F | 12.56785 *** (39.30) | 1.34 | ||||

| Size | 2.42865 *** (17.01) | 1.60 | 0.08411 *** (17.11) | 1.60 | 1.37161 *** (10.43) | 1.67 |

| Lev | −11.22069 *** (−13.87) | 1.61 | −0.60314 *** (−21.66) | 1.61 | −3.64051 *** (−4.82) | 1.72 |

| Cr1 | 0.06952 *** (7.42) | 1.08 | 0.00403 *** (12.51) | 1.08 | 0.01884 ** (2.21) | 1.10 |

| Growth | 1.11417 ** (3.52) | 1.08 | 0.16785 *** (15.42) | 1.08 | −0.99528 *** (−3.43) | 1.12 |

| Ind | control | control | control | |||

| Year | control | control | control | |||

| N | 6791 | 6791 | 6791 | |||

| AdjR2 | 0.2362 | 0.2438 | 0.3790 | |||

| F | 27.92 *** | 29.07 *** | 53.46 *** |

| Sobel Media Effect Test Results for State-Owned Holding Enterprises | ||||

| Effect value | Standard error | Z Statistic | p Value | |

| Indirect effect | 0.00744 | 0.00060 | 12.4528 | 0.00000 |

| Direct effect | 0.00611 | 0.00144 | 4.21422 | 0.00000 |

| Total effect | 0.00611 | 0.00148 | 9.16857 | 0.00000 |

| The proportion of the media effect = 54.908% | ||||

| Sobel Media Effect Test Results for Non-State-Owned Holding Enterprises | ||||

| Effect value | Standard error | Z Statistic | p Value | |

| Indirect effect | 0.00980 | 0.00052 | 18.85500 | 0.00000 |

| Direct effect | 0.00574 | 0.00098 | 5.92348 | 0.00000 |

| Total effect | 0.01554 | 0.00104 | 14.81660 | 0.00000 |

| The proportion of the media effect = 63.063% | ||||

| Test Results of the Bootstrap Media Effect for State-Owned Holding Enterprises | |||

| Effect value | Bootstrap SE | 95% confidence interval | |

| Indirect effect | 0.00744 | 0.000780 | (0.00595, 0.00901) |

| Direct effect | 0.00611 | 0.001362 | (0.00340, 0.00873) |

| Total effect | 0.01355 | 0.001581 | (0.01045, 0.01665) |

| The proportion of the media effect = 54.908% | |||

| Test Results of the Bootstrap Media Effect for Non-State-Owned Holding Enterprises | |||

| Effect value | Bootstrap SE | 95% confidence interval | |

| Indirect effect | 0.00980 | 0.00064 | (0.00850, 0.01106) |

| Direct effect | 0.00574 | 0.00104 | (0.00376, 0.00783) |

| Total effect | 0.01554 | 0.00126 | (0.01308, 0.01800) |

| The proportion of the media effect = 63.063% | |||

| Variable | Model (1) Dependent Variable: Csr | Model (2) Dependent Variable: F | Model (3) Dependent Variable: Csr |

|---|---|---|---|

| Constant | −43.79732 *** (−13.29) | −2.665401 *** (−16.89) | −14.25315 (−2.37) |

| Ic | 0.0187952 *** (5.20) | 0.0005428 *** (3.14) | |

| F | 5.000258 *** (5.49) | ||

| Size | 2.142162 *** (14.20) | 0.1047159 *** (14.50) | 1.604506 *** (6.76) |

| Lev | −12.58767 *** (−14.05) | −0.5948336 *** (−13.87) | −4.651724 *** (−3.11) |

| Cr1 | 0.0639169 *** (6.52) | 0.0026468 *** (5.64) | 0.0227243 *** (1.49) |

| Growth | 2.342715 *** (6.06) | 0.1872134 *** (10.12) | −1.125075 * (−1.87) |

| State | −0.5230725 * (−1.87) | 0.0088658 (0.66) | 1.370793 *** (3.01) |

| Ind | control | control | control |

| Year | control | control | control |

| DWH inspection | 3.3234 (0.0683) | 0.000216 (0.9883) | 20.8425 (0.0000) |

| Weak identification test | 105.498 (0.0000) | 105.498 (0.0000) | 1041.63 (0.0000) |

| Over identified | 1.17156 (0.2791) | 0.431631 (0.5112) | 1.50667 (0.2196) |

| N | 3583 | 3583 | 3583 |

| Adj R2 | 0.3141 | 0.2505 | 0.3279 |

| F(Wald chil2) | 1513.43 *** | 1035.88 *** | 1432.94 *** |

| Variable | Model (1) Dependent Variable: Csr | Model (2) Dependent Variable: F | Model (3) Dependent |

|---|---|---|---|

| Constant | −41.76498 *** (−9.99) | −2.334555 * (−11.37) | −13.30316 ** (−2.47) |

| Ic | 0.0122165 *** (2.96) | 0.0003751 *** (1.85) | |

| F | 12.19409 *** (7.01) | ||

| Size | 2.095333 *** (10.66) | 0.0919484 *** (9.52) | 0.9723636 *** (4.87) |

| Lev | −11.88508 *** (−9.47) | −0.5773983 *** (−9.36) | −4.833649 *** (−3.79) |

| Cr1 | 0.0480133 *** (3.67) | 0.0016873 ** (2.63) | 0.0274208 ** (2.51) |

| Growth | 2.890089 *** (5.48) | 0.176262 *** (6.81) | 0.7387463 (1.47) |

| Ind | control | control | control |

| Year | control | control | control |

| DWH inspection | 0.261003 (0.6094) | 0.071943 (0.7885) | 9.35791 (0.0022) |

| Weak identification | 64.3276 (0.0000) | 64.3276 (0.0000) | 435.088 (0.0000) |

| Over identified | 0.573254 (0.4490) | 0.151836 (0.6968) | 2.2185 (0.1364) |

| N | 1446 | 1446 | 1446 |

| Adj R2 | 0.4211 | 0.2775 | 0.6190 |

| F (Wald chil2) | 992.40 *** | 507.83 *** | 1617.51 *** |

| Variable | Model (1) Dependent Variable: Csr | Model (2) Dependent Variable: F | Model (3) Dependent Variable: Csr |

|---|---|---|---|

| Constant | −45.68472 *** (−8.53) | −3.003793 *** (−12.01) | −0.3759095 (−0.05) |

| Ic | 0.0248077 *** (4.00) | 0.0007219 ** (2.49) | |

| F | 6.056224 *** (5.46) | ||

| Size | 2.257265 *** (9.66) | 0.1234409 *** (11.30) | 1.341478 *** (4.41) |

| Lev | −12.64481 *** (−10.05) | −0.5992617 *** (−10.19) | −3.819738 ** (−2.12) |

| Cr1 | 0.0670371 *** (4.58) | 0.00311 *** (4.55) | 0.0135737 (0.70) |

| Growth | 1.691011 (0.004) | 0.1790916 *** (6.54) | 0.1330899 (0.19) |

| Ind | control | control | control |

| Year | control | control | control |

| DWH inspection | 3.24456 (0.0717) | 0.155202 (0.6936) | 13.5802 (0.0002) |

| Weak identification | 39.7413 (0.0000) | 39.7413 (0.0000) | 547.946 (0.0000) |

| Over identified | 0.614796 (0.4330) | 0.64297 (0.4226) | 0.246875 (0.6193) |

| N | 2137 | 2137 | 2137 |

| Adj R2 | 0.2745 | 0.2807 | 0.3046 |

| F (Wald chil2) | 766.57 *** | 724.38 *** | 704.86 *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guan, X.; Yao, C.; Zhang, W. Sustainability of Entrepreneurship: An Empirical Study on the Impact Path of Corporate Social Responsibility Based on Internal Control. Sustainability 2023, 15, 12180. https://doi.org/10.3390/su151612180

Guan X, Yao C, Zhang W. Sustainability of Entrepreneurship: An Empirical Study on the Impact Path of Corporate Social Responsibility Based on Internal Control. Sustainability. 2023; 15(16):12180. https://doi.org/10.3390/su151612180

Chicago/Turabian StyleGuan, Xiao, Chunli Yao, and Weimin Zhang. 2023. "Sustainability of Entrepreneurship: An Empirical Study on the Impact Path of Corporate Social Responsibility Based on Internal Control" Sustainability 15, no. 16: 12180. https://doi.org/10.3390/su151612180

APA StyleGuan, X., Yao, C., & Zhang, W. (2023). Sustainability of Entrepreneurship: An Empirical Study on the Impact Path of Corporate Social Responsibility Based on Internal Control. Sustainability, 15(16), 12180. https://doi.org/10.3390/su151612180