Effects of Science, Technology, and Innovation Official Development Assistance on Foreign Direct Investment in Developing Countries

Abstract

1. Introduction

2. Literature Review

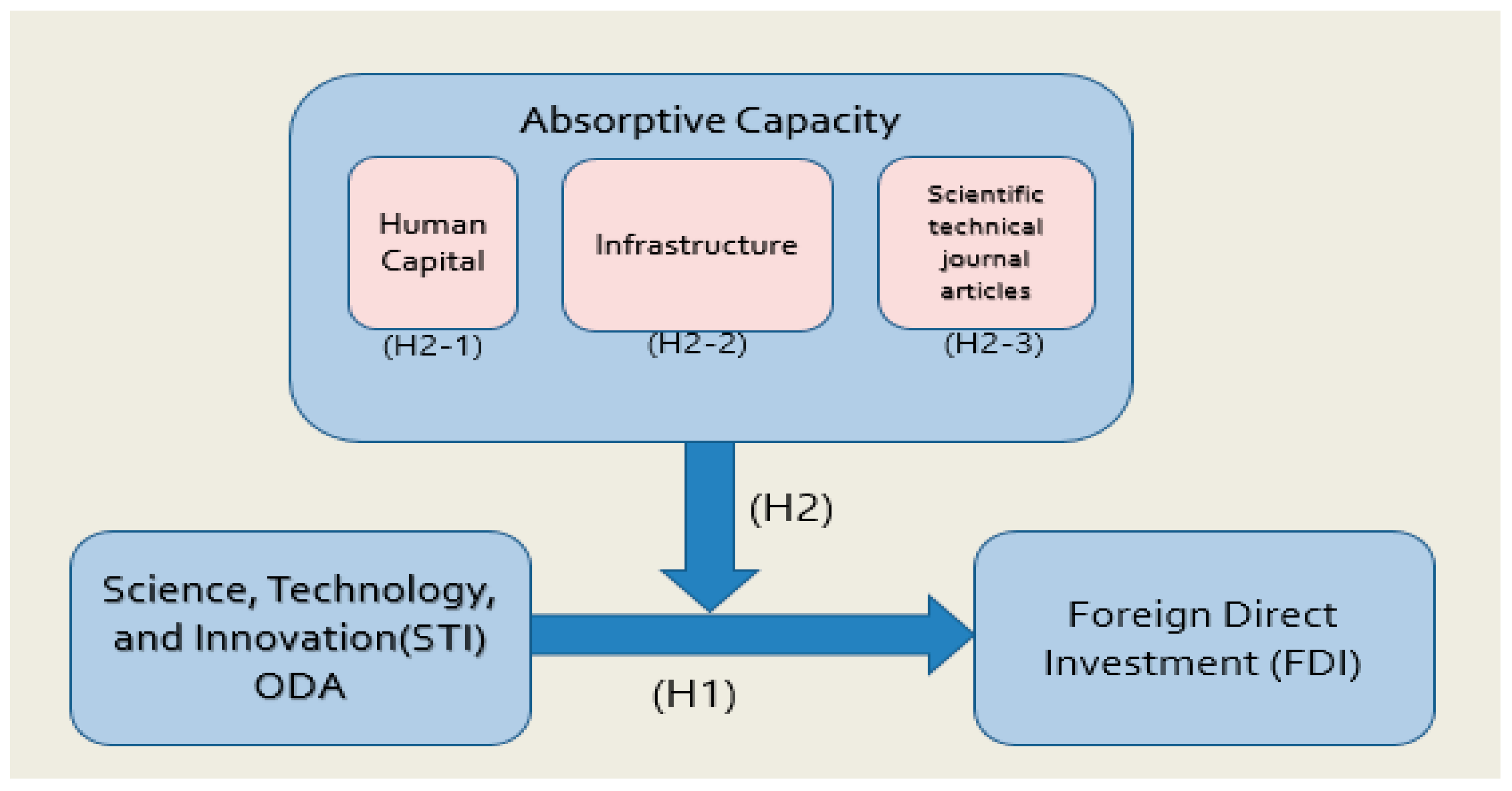

2.1. STI ODA and FDI

2.2. Absorptive Capacity and FDI

3. Research Methodology

3.1. Methodology

3.2. Variables and Data Collection

- (1)

- STI ODA (independent variable)

- (2)

- Human capital (moderator variable)

- (3)

- Infrastructure (second moderator variable)

- (4)

- Scientific and technical journal articles (third moderator variable)

- (5)

- FDI (dependent variable)

- (6)

- Data collection

4. Results

- (1)

- Descriptive statistical analysis

- (2)

- Correlation analysis

- (3)

- Panel regression analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- UNCTAD. United Nations Conference on Trade and Development. 2020. Available online: https://unctad.org/topic/science-technology-and-innovation (accessed on 11 May 2023).

- Walsh, P.P.; Enda, M.; David, H. The role of science, technology, and innovation in the UN 2030 agenda. Technol. Forecast. Soc. Chang. 2020, 154, 119957. [Google Scholar] [CrossRef]

- Ono, S.; Sekiyama, T. Re-Examining the Effects of Official Development Assistance on Foreign Direct Investment Applying the VAR Model. Economies 2022, 10, 236. [Google Scholar] [CrossRef]

- Cipollina, M.; Giovannetti, G.; Pietrovito, F.; Pozzolo, A.F. FDI and Growth: What Cross-country Industry Data Say. World Econ. 2012, 35, 1599–1629. [Google Scholar] [CrossRef]

- Belloumi, M.; Alshehry, A. The Impacts of Domestic and Foreign Direct Investments on Economic Growth in Saudi Arabia. Economies 2018, 6, 18. [Google Scholar] [CrossRef]

- Krkoska, L. Foreign Direct Investment Financing of Capital Formation in Central and Eastern Europe. European Bank for Reconstruction and Development. Working Paper No. 67. 2001. Available online: https://www.ebrd.com/downloads/research/economics/workingpapers/wp0067.pdf (accessed on 5 July 2023).

- Anetor, F.O.; Esho, E.; Verhoef, G. The impact of foreign direct investment, foreign aid and trade on poverty reduction: Evidence from Sub-Saharan African countries. Cogent Econ. Financ. 2020, 8, 1737347. [Google Scholar] [CrossRef]

- Park, K.R. Science, technology, and innovation in sustainable development cooperation: Theories and practices in South Korea. In International Development Cooperation of Japan and South Korea: New Strategies for an Uncertain World; Springer: Berlin/Heidelberg, Germany, 2022; pp. 179–208. [Google Scholar]

- Choi, H.; Cho, K. Effects of Science, Technology, and Innovation Official Development Assistance on Innovative Capacity in Developing Countries. Sustainability 2023, 15, 2906. [Google Scholar] [CrossRef]

- Harms, P.; Lutz, M. Aid, Governance and Private Foreign Investment: Some Puzzling Findings for the 1990s. Econ. J. 2006, 116, 773–790. [Google Scholar] [CrossRef]

- Available online: https://www.oecd.org/dac/financing-sustainable-development/development-finance-standards/official-development-assistance.htm (accessed on 5 May 2023).

- Kim, E. A Study on Sustainability of Science and Technology ODA- Absorptive Capacity and Leadership of Developing Countries. Ph.D. Thesis, Korea University Graduate School, Seoul, Republic of Korea, 2020. [Google Scholar]

- Kim, W.D.; Lee, J.W.; Yim, D.S.; Kim, K.K.; Sun, I.; Kim, E.; Gang, H.J.; Jeon, B.W.; Kwon, S.; Lee, S. Analysis and Strategic Direction of S&T ODA; STEPI: Sejong City, Republic of Korea, 2019. [Google Scholar]

- Kang, H.J.; Yim, D.S. A study on the method of calculating S&T ODA statistics. In Proceedings of the 2022 Portland International Conference on Management of Engineering and Technology (PICMET), Oregon, Portland, 7–11 August 2022. [Google Scholar]

- Miedzinski, M.; Kanehira, N.; Cervantes, M.; Mealy, S.; Kotani, R.; Bollati, E. Science, Technology, and Innovation (STI) for SDGs Roadmaps. Background paper: International STI Collaboration and Investment for Sustainable Development Goals. 2020. Available online: https://sdgs.un.org/sites/default/files/documents/269391_BP_Roadmaps_IntlCollaberation_final_7_09_20.pdf (accessed on 5 July 2023).

- Bhavan, T.; Xu, C.; Zhong, C. The Relationship between Foreign aid and FDI in South Asian Economies. Int. J. Econ. Financ. 2011, 3, 143–149. [Google Scholar]

- Carro, M.; Larrú, J.M. Flowing Together or Flowing Apart: An Analysis of the Relation between FDI and ODA Flows to Argentina and Brazil; Munich Personal RePEc Archive: Munich, Germany, 2010. [Google Scholar]

- Wang, C.; Balasubramanyam, V.N. Aid and foreign direct investment in Vietnam. J. Econ. Integr. 2011, 26, 721–739. [Google Scholar] [CrossRef]

- Burnside, C.; Dollar, D. Aid, the Incentive Regime, and Poverty Reduction; No. 1937; World Bank Publications: Washington, DC, USA, 1998. [Google Scholar]

- Blaise, S. On the link between Japanese ODA and FDI in China: A microeconomic evaluation using conditional logit analysis. Appl. Econ. 2005, 37, 51–55. [Google Scholar] [CrossRef]

- Asiedu, E.; Jin, Y.; Nandwa, B. Does foreign aid mitigate the adverse effect of expropriation risk on foreign direct investment? J. Int. Econ. 2009, 78, 268–275. [Google Scholar] [CrossRef]

- Castellani, D.; Castellani, D.; Zanfei, A. Multinational Firms, Innovation, and Productivity; Edward Elgar Publishing: Cheltenham, UK, 2006. [Google Scholar]

- Iamsiraroj, S. The foreign direct investment–economic growth nexus. Int. Rev. Econ. Financ. 2016, 42, 116–133. [Google Scholar] [CrossRef]

- Graham, E.M. Intra-industry direct foreign investment, market structure, firm rivalry, and technological performance. In Multinationals as Mutual Invaders; Routledge: New York, NY, USA, 2019; pp. 67–96. [Google Scholar]

- Vukov, V. European integration and weak states: Romania’s road to exclusionary development. Rev. Int. Politi Econ. 2020, 27, 1041–1062. [Google Scholar] [CrossRef]

- Janský, P. Aid and foreign direct investment: Substitutes, complements or neither? Int. J. Trade Glob. Mark. 2012, 5, 119–132. [Google Scholar] [CrossRef]

- Amusa, K.; Monkam, N.; Viegi, N. Foreign aid and Foreign direct investment in Sub-Saharan Africa: A panel data analysis. Econ. Res. South. Afr. (ERSA) 2016, 612, 1–23. [Google Scholar]

- Liao, H.; Chi, Y.; Zhang, J. Impact of international development aid on FDI along the Belt and Road. China Econ. Rev. 2020, 61, 101448. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Innovation and Learning: The Two Faces of R & D. Econ. J. 1989, 99, 569. [Google Scholar]

- Castellacci, F.; Natera, J.M. The dynamics of national innovation systems: A panel cointegration analysis of the coevolution between innovative capability and absorptive capacity. Res. Policy 2013, 42, 579–594. [Google Scholar] [CrossRef]

- Feeny, S.; de Silva, A. Measuring absorptive capacity constraints to foreign aid. Econ. Model. 2012, 29, 725–733. [Google Scholar] [CrossRef]

- Farkas, B. Absorptive Capacities and the Impact of FDI on Economic Growth. 2012. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2038182 (accessed on 5 July 2023).

- Girma, S. Absorptive Capacity and Productivity Spillovers from FDI: A Threshold Regression Analysis. Oxf. Bull. Econ. Stat. 2005, 67, 281–306. [Google Scholar] [CrossRef]

- Girma, S.; Görg, H. Foreign direct investment, spillovers and absorptive capacity: Evidence from quantile regressions. Spillovers and Absorptive Capacity: Evidence From Quantile Regressions. 2005. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2785099 (accessed on 5 July 2023).

- De Mello Luiz, R. Foreign direct investment-led growth: Evidence from time series and panel data. Oxf. Econ. Pap. 1999, 51, 133–151. [Google Scholar] [CrossRef]

- Blomström, M.; Kokko, A.; Mucchielli, J.-L. The Economics of Foreign Direct Investment Incentives; Springer: Berlin/Heidelberg, Germany, 2003. [Google Scholar]

- Li, X.; Liu, X. Foreign Direct Investment and Economic Growth: An Increasingly Endogenous Relationship. World Dev. 2005, 33, 393–407. [Google Scholar] [CrossRef]

- Narula, R.; Marin, A. FDI Spillovers, Absorptive Capacities and Human Capital Development: Evidence from Argentina; Department of International Economics and Management, Copenhagen Business School: Frederiksberg, Denmark, 2003. [Google Scholar]

- Feeny, S.; McGillivray, M. Scaling-up foreign aid: Will the ‘big push work? World Econ. 2011, 34, 54–73. [Google Scholar] [CrossRef]

- Barrios, S.; Strobl, E. Foreign direct investment and productivity spillovers: Evidence from the Spanish experience. Rev. World Econ. 2002, 138, 459–481. [Google Scholar] [CrossRef]

- Borensztein, E.; De Gregorio, J.; Lee, J.-W. How does foreign direct investment affect economic growth? J. Int. Econ. 1998, 45, 115–135. [Google Scholar] [CrossRef]

- Samir, S.; Mefteh, H. Empirical analysis of the dynamic relationships between transport, ICT and FDI in 63 countries. Int. Econ. J. 2020, 34, 448–471. [Google Scholar] [CrossRef]

- Kumari, R.; Sharma, A.K. Long-term relationship between population health, FDI and economic growth: New empirical evidence. Int. J. Bus. Glob. 2018, 20, 371–393. [Google Scholar] [CrossRef]

- Dang, V.C.; Nguyen, Q.K. Determinants of FDI attractiveness: Evidence from ASEAN-7 countries. Cogent Soc. Sci. 2021, 7, 2004676. [Google Scholar] [CrossRef]

- Kim, H.J. A Study on the Economic Effects of Regional Trade Agreements (RTA). Ph.D. Thesis, Korea University Graduate School, Seoul, Republic of Korea, 2005. [Google Scholar]

- Mitra, R.; Abedin, T. Population ageing and FDI inflows in OECD countries: A dynamic panel cointegration analysis. Appl. Econ. Lett. 2021, 28, 1071–1075. [Google Scholar] [CrossRef]

- Available online: https://uis.unesco.org/en/topic/international-standard-classification-education-isced (accessed on 5 July 2023).

- Available online: https://www.worldbank.org/en/topic/tertiaryeducation (accessed on 5 July 2023).

- International Telecommunication Union (ITU) World Telecommunication/ICT Indicators Database. Available online: https://data.worldbank.org/indicator/IT.NET.BBND.P2?view=chart (accessed on 5 May 2023).

- Kim, D.-U. Structural Equation Model Analysis; Hakhyeon Publish: Jecheon-si, South Korea, 2008. [Google Scholar]

- Hausman, J.A.; Taylor, W.E. Panel data and unobservable individual effects. Econom. J. Econom. Soc. 1981, 49, 1377–1398. [Google Scholar]

- Bae, B.-R. AMOS 19 Structural Equation Modeling: Principles and Practice; Cheongnam Publish: Seoul, Republic of Korea, 2011. [Google Scholar]

- Yasin, M. Official Development Assistance and Foreign Direct Investment Flows to Sub-Saharan Africa. Afr. Dev. Rev. 2005, 17, 23–40. [Google Scholar] [CrossRef]

- Donaubauer, J.; Meyer, B.; Nunnenkamp, P. Aid, Infrastructure, and FDI: Assessing the Transmission Channel with a New Index of Infrastructure. World Dev. 2016, 78, 230–245. [Google Scholar] [CrossRef]

- Mitra, R.; Abedin, M. Population ageing and FDI inflows in Japan: ARDL approach to cointegration analysis. Econ. Bull. 2020, 40, 1814–1825. [Google Scholar]

- Chang, Y.J.; Park, N.M. A study on the impact of ODA and the moderating impact of FDI on sustainable economic development in the ASEAN Region. Cent. Eur. Manag. J. 2023, 31, 810–817. [Google Scholar]

- Wehncke, F.C.; Marozva, G.; Makoni, P.L. Economic Growth, Foreign Direct Investments and Official Development Assistance Nexus: Panel ARDL Approach. Economies 2022, 11, 4. [Google Scholar] [CrossRef]

| Category | Minimum | Maximum | Mean | Standard Deviation | Skewness | Kurtosis |

|---|---|---|---|---|---|---|

| STI ODA | 1.04 | 8.87 | 6.16 | 1.08 | −0.29 | 0.23 |

| FDI | 4.74 | 11.46 | 9.03 | 0.88 | −0.35 | 1.51 |

| Human capital (male) | −0.48 | 2.10 | 1.27 | 0.50 | −0.80 | 0.13 |

| Human capital (female) | −0.21 | 2.08 | 1.28 | 0.37 | −0.82 | 0.97 |

| Infrastructure | 1.40 | 8.68 | 5.05 | 1.31 | −0.11 | −0.36 |

| Scientific and technical journal articles | −0.43 | 5.72 | 2.59 | 1.10 | 0.28 | −0.27 |

| Category | STI ODA | Human Capital (Male) | Human Capital (Female) | Infrastructure | Scientific and Technical Journal Articles | FDI |

|---|---|---|---|---|---|---|

| STI ODA | 1 | |||||

| Human capital (male) | −0.027 | 1 | ||||

| Human capital (female) | 0.010 | 0.940 ** | 1 | |||

| Infrastructure | 0.111 ** | 0.096 ** | 0.113 ** | 1 | ||

| Scientific and technical journal articles | 0.252 ** | 0.089 ** | 0.121 ** | 0.936 ** | 1 | |

| FDI | 0.265 ** | 0.120 ** | 0.146 ** | 0.814 ** | 0.920 ** | 1 |

| Dependent Variable: FDI | Coef. | Std. Err. | t | p > t | [95% Conf. Interval] | ||

|---|---|---|---|---|---|---|---|

| Fixed effect | STI ODA | 0.2749027 | 0.0238601 | 11.52 *** | 0.000 | 0.2280839 | 0.3217214 |

| _cons | 7.336131 | 0.1495448 | 49.06 | 0.000 | 7.042692 | 7.62957 | |

| sigma_e: 0.82975893 Prob > F = 0.0000, R-sq: 0.4041 | |||||||

| Random effect | STI ODA | 0.2650704 | 0.0233486 | 11.35 *** | 0.000 | 0.2193079 | 0.3108329 |

| _cons | 7.396865 | 0.1464272 | 50.52 | 0.000 | 07.109873 | 7.683857 | |

| sigma_e: 0.82975893, Wald chi2(1) = 0.000 R-sq: 0.1119 | |||||||

| Category | Coef. | Std. Err. | t | p > t | VIF | Prob > F/R-sq | |

|---|---|---|---|---|---|---|---|

| Model.1 | (Constant) | 6.156 | 0.146 | 42.209 | 0.000 | Prob > F = 0.0000, R-sq = 0.313 | |

| STI ODA | 0.299 | 0.021 | 14.542 *** | 0.000 | 1.009 | ||

| Human capital (M)* | 0.809 | 0.045 | 17.954 *** | 0.000 | 1.009 | ||

| Model.2 | (Constant) | 6.493 | 0.163 | 39.839 | 0.000 | Prob > F = 0.0000, R-sq = 0.325 | |

| STI ODA | 0.248 | 0.023 | 10.636 *** | 0.000 | 1.322 | ||

| Human capital (M)* | 0.766 | 0.046 | 16.772 *** | 0.000 | 1.055 | ||

| STI ODA*Human capital (M)* | 7.022 × 10−11 | 0.000 | 4.478 *** | 0.000 | 1.337 | ||

| Category | Coef. | Std. Err. | t | p > t | VIF | Prob > F/R-sq | |

|---|---|---|---|---|---|---|---|

| Model 1 | (Constant) | 5.834 | 0.151 | 38.536 | 0.000 | Prob > F = 0.0000, R-sq = 0.330 | |

| STI ODA | 0.285 | 0.020 | 14.054 *** | 0.000 | 1.003 | ||

| Human capital (F)* | 1.123 | 0.059 | 18.909 *** | 0.000 | 1.003 | ||

| Model 2 | (Constant) | 6.146 | 0.167 | 36.801 | 0.000 | Prob > F = 0.0000, R-sq = 0.340 | |

| STI ODA | 0.239 | 0.023 | 10.549 *** | 0.000 | 1.280 | ||

| Human capital (F)* | 1.075 | 0.060 | 17.938 *** | 0.000 | 1.038 | ||

| STI ODA*Human capital (F)* | 6.444 × 10−11 | 0.000 | 4.269 *** | 0.000 | 1.303 | ||

| Category | Coef. | Std. Err. | t | p > t | VIF | Prob > F/R-sq | |

|---|---|---|---|---|---|---|---|

| Model 1 | (Constant) | 0.106 | 0.017 | 6.192 | 0.000 | Prob > F = 0.0000, R-sq = 0.560 | |

| STI ODA | 0.471 | 0.014 | 33.240 *** | 0.000 | 1.086 | ||

| Infrastructure | 6.101 | 0.115 | 53.025 *** | 0.000 | 1.086 | ||

| Model 2 | (Constant) | 0.095 | 0.017 | 5.546 | 0.000 | Prob > F = 0.0000, R-sq = 0.565 | |

| STI ODA | 0.460 | 0.014 | 31.759 *** | 0.000 | 1.116 | ||

| Infrastructure | 0.000 | 0.000 | 3.596 *** | 0.000 | 1.143 | ||

| STI ODA*Infrastructure | 7.022 × 10−11 | 0.000 | 4.478 *** | 0.000 | 1.112 | ||

| Category | Coef. | Std. Err. | T | p > t | VIF | Prob > F/R-sq | |

|---|---|---|---|---|---|---|---|

| Model 1 | (Constant) | 6.929 | 0.102 | 68.142 | 0.000 | Prob > F = 0.0000, R-sq = 0.602 | |

| STI ODA | 0.097 | 0.017 | 5.777 *** | 0.000 | 1.087 | ||

| Scientific and technical | 0.581 | 0.017 | 34.624 *** | 0.000 | 1.087 | ||

| Model 2 | (Constant) | 6.967 | 0.105 | 66.046 | 0.000 | Prob > F = 0.0000, R-sq = 0.602 | |

| STI ODA | 0.092 | 0.017 | 5.421 *** | 0.000 | 1.128 | ||

| Scientific and technical | 0.576 | 0.017 | 33.353 *** | 0.000 | 1.151 | ||

| STI ODA*Scientific and technical | 3.611 × 10−15 | 0.000 | 1.334 | 0.183 | 1.133 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, J.; Cho, K. Effects of Science, Technology, and Innovation Official Development Assistance on Foreign Direct Investment in Developing Countries. Sustainability 2023, 15, 12293. https://doi.org/10.3390/su151612293

Lee J, Cho K. Effects of Science, Technology, and Innovation Official Development Assistance on Foreign Direct Investment in Developing Countries. Sustainability. 2023; 15(16):12293. https://doi.org/10.3390/su151612293

Chicago/Turabian StyleLee, Jeunghan, and Keuntae Cho. 2023. "Effects of Science, Technology, and Innovation Official Development Assistance on Foreign Direct Investment in Developing Countries" Sustainability 15, no. 16: 12293. https://doi.org/10.3390/su151612293

APA StyleLee, J., & Cho, K. (2023). Effects of Science, Technology, and Innovation Official Development Assistance on Foreign Direct Investment in Developing Countries. Sustainability, 15(16), 12293. https://doi.org/10.3390/su151612293