Unveiling the Connection among ESG, Earnings Management, and Financial Distress: Insights from an Emerging Market

Abstract

:1. Introduction

2. Literature Review and Hypothesis Development

2.1. Theoretical Underpinnings

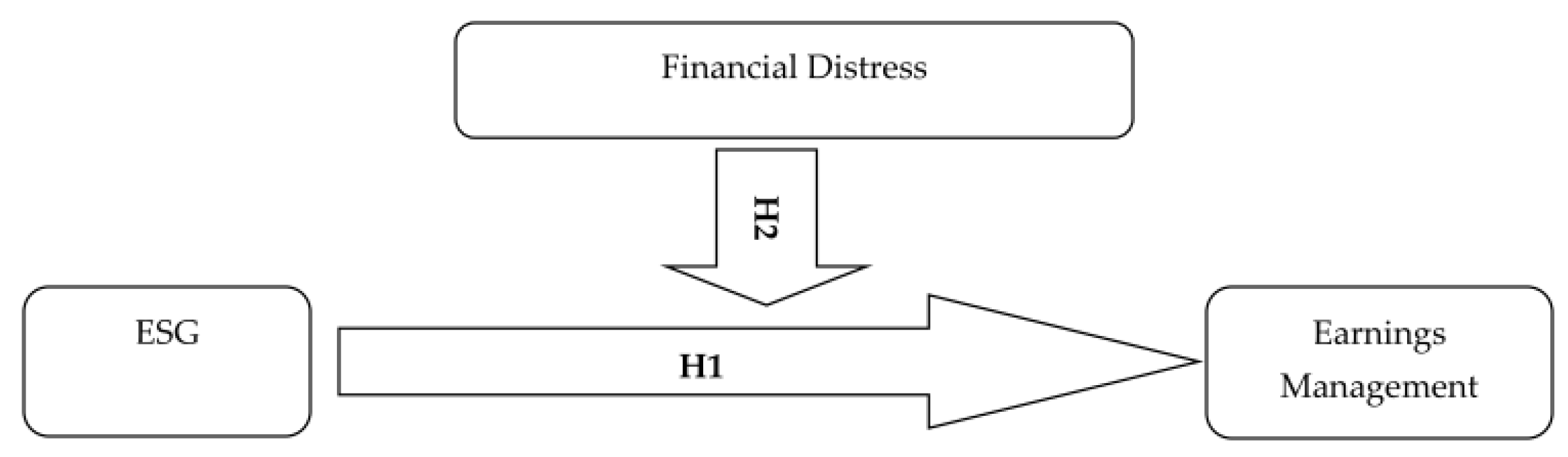

2.2. Direct Association between ESG and Earnings Management

2.3. Moderating Influence of Financial Distress on the ESG–Earnings Management Relationship

3. Study Methodology

3.1. Sample

3.2. Variables’ Measurement

3.2.1. Earnings Management Measurement

3.2.2. ESG Measurement

3.2.3. Moderator Measurement

3.2.4. Measurement of Control Variables

3.3. Model Specification

4. Empirical Results and Discussion

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Multivariate Analysis

4.3.1. Association between ESG and Earnings Management

4.3.2. Moderating Influence of Financial Distress on ESG–Earnings Management Relationship

5. Additional Analysis and Robustness Check

5.1. Additional Analysis

5.2. Robustness Check

6. Conclusions, Implications, Limitations, and Suggestions for Future Studies

6.1. Conclusions

6.2. Implications

6.2.1. Implications for Theory and Academics

6.2.2. Implications for Policymakers

6.2.3. Implications for Industry

6.3. Limitations and Suggestions for Future Studies

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Mutuc, E.B.; Lee, J.-S.; Tsai, F.-S. Doing Good with Creative Accounting? Linking Corporate Social Responsibility to Earnings Management in Market Economy, Country and Business Sector Contexts. Sustainability 2019, 11, 4568. [Google Scholar]

- Githaiga, P.N. Sustainability reporting, board gender diversity and earnings management: Evidence from East Africa community. J. Bus. Socio-Econ. Dev. 2023; ahead-of-print. [Google Scholar]

- Harymawan, I.; Putra, F.K.G.; Fianto, B.A.; Wan Ismail, W.A. Financially Distressed Firms: Environmental, Social, and Governance Reporting in Indonesia. Sustainability 2021, 13, 10156. [Google Scholar]

- Naffa, H.; Fain, M. A factor approach to the performance of ESG leaders and laggards. Financ. Res. Lett. 2022, 44, 102073. [Google Scholar] [CrossRef]

- Zhou, G.; Liu, L.; Luo, S. Sustainable development, ESG performance and company market value: Mediating effect of financial performance. Bus. Strategy Environ. 2022, 5, 1–17. [Google Scholar]

- Sustainable Stock Exchanges (SSE). Sustainable Stock Exchanges Initiative: Model Guidance on Reporting ESG Information to Investors. 2015. Available online: www.sseinitiative.org/wp-content/uploads/2015/09/SSE-Model-Guidance-on-Reporting-ESG.pdf (accessed on 4 July 2023).

- CFA Institute. ESG Integration in Asia Pacific: Markets, Practices, and Data. 2019. Available online: https://www.unpri.org/investor-tools/esg-integration-in-asia-pacific-markets-prac-tices-and-data/4452.article (accessed on 4 July 2023).

- PwC Report. 2022. Available online: https://www.pwc.com/gx/en/news-room/press-releases/2022/awm-revolution-2022-report.html (accessed on 4 July 2023).

- Amel-Zadeh, A.; Serafeim, G. Why and how investors use ESG information: Evidence from a global survey. Financ. Anal. J. 2018, 74, 87–103. [Google Scholar]

- Prior, D.; Surroca, J.; Tribó, J.A. Are socially responsible managers really ethical? Exploring the relationship between earnings management and corporate social responsibility. Corp. Gov. An. Int. Rev. 2008, 16, 160–177. [Google Scholar]

- Dechow, P.M. Accounting earnings and cash flows as measures of firm performance. J. Account. Econ. 1994, 18, 3–42. [Google Scholar]

- Francis, J.; Schipper, K.; Vincent, L. The Relative and Incremental Explanatory Power of Earnings and Alternative (to Earnings) Performance Measures for Returns. Contemp. Account. Res. 2003, 20, 121–164. [Google Scholar]

- Degeorge, F.; Patel, J.; Zeckhauser, R. Earnings Management to Exceed Thresholds. J. Bus. 1999, 72, 1–33. [Google Scholar] [CrossRef]

- Schipper, K. Earnings management. Account. Horiz. 1989, 3, 91–102. [Google Scholar]

- García, B.; Gill de Albornoz, B.; Gisbert, A. La investigacion sobre earnings management. Span. J. Financ. Account. Rev. Española Financ. Y Contab. 2005, 34, 1001–1034. [Google Scholar]

- Kaplan, S.E. Ethically related judgments by observers of earnings management. J. Bus. Ethics 2001, 32, 285–298. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–336. [Google Scholar]

- Garfatta, R. Corporate social responsibility and earnings management: Evidence from Saudi Arabia after mandatory IFRS adoption. J. Asian Financ. Econ. Bus. 2021, 8, 189–199. [Google Scholar]

- Al Shetwi, M. Earnings Management in Saudi Nonfinancial Listed Companies. Int. J. Bus. Soc. Sci. 2020, 11, 18–26. [Google Scholar]

- Habbash, M.; Alghamdi, S. Audit quality and earnings management in less developed economies: The case of Saudi Arabia. J. Manag. Gov. 2017, 21, 351–373. [Google Scholar]

- Al-Thuneibat, A.A.; Al-Angari, H.A.; Al-Saad, S.A. The effect of corporate governance mechanisms on earnings management: Evidence from Saudi Arabia. Rev. Int. Bus. Strategy 2016, 26, 2–32. [Google Scholar]

- Chebbi, K.; Ammer, M.A. Board Composition and ESG Disclosure in Saudi Arabia: The Moderating Role of Corporate Governance Reforms. Sustainability 2022, 14, 12173. [Google Scholar]

- Ammer, M.A.; Aliedan, M.M.; Alyahya, M.A. Do Corporate Environmental Sustainability Practices Influence Firm Value? The Role of Independent Directors: Evidence from Saudi Arabia. Sustainability 2020, 12, 9768. [Google Scholar]

- Petersen, H.L.; Vredenburg, H. Morals or economics? Institutional investor preferences for corporate social responsibility. J. Bus. Ethics 2009, 90, 1–14. [Google Scholar] [CrossRef]

- Tan, C.; Robinson, T.R. Asian Financial Statement Analysis: Detecting Financial Irregularities; John Wiley & Sons: Hoboken, NJ, USA, 2014. [Google Scholar]

- Chih, H.L.; Shen, C.H.; Kang, F.C. Corporate Social Responsibility, Investor Protection, and Earning Management: Some international evidence. J. Bus. Ethics 2008, 79, 179–198. [Google Scholar] [CrossRef]

- Velte, P. The bidirectional relationship between ESG performance and earnings management–empirical evidence from Germany. J. Glob. Responsib. 2019, 10, 322–338. [Google Scholar] [CrossRef]

- Ma, H.Y.; Yoo, J.Y. A study on the impact of sustainable management on earnings persistence and market pricing: Evidence from Korea. J. Bus. Econ. Manag. 2022, 23, 818–836. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. Account. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- Gargouri, M.; Shabou, R.; Francoeur, C. The relationship between corporate social performance and earnings management. Can. J. Adm. Sci. Rev. Can. Sci. L’administration 2010, 27, 320–334. [Google Scholar] [CrossRef]

- Habbash, M.; Haddad, L. The impact of corporate social responsibility on earnings management practices: Evidence from Saudi Arabia. Soc. Responsib. J. 2020, 16, 1073–1085. [Google Scholar] [CrossRef]

- Velte, P. Environmental performance, carbon performance and earnings management: Empirical evidence for the European capital market. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 42–53. [Google Scholar] [CrossRef]

- Hickman, L.E.; Iyer, S.R.; Jadiyappa, N. The effect of voluntary and mandatory corporate social responsibility on earnings management: Evidence from India and the 2% rule. Emerg. Mark. Rev. 2021, 46, 100750. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Hilscher, J.; Szilagyi, J. In search of distress risk. J. Financ. 2008, 63, 2899–2939. [Google Scholar] [CrossRef] [Green Version]

- Viana, D.B.C., Jr.; Lourenço, I.; Black, E.L. The Effect of Macroeconomic Instability on Earnings Management in Developed and Emerging Countries. American Accounting Association International Accounting Research Webinars Series 2021. Available online: https://aaahq.org/IA (accessed on 4 March 2023).

- Petrescu, A.G.; Bîlcan, F.R.; Petrescu, M.; Oncioiu, I.H.; Türkes, M.C.; Capusneanu, S. Assessing the Benefits of the Sustainability Reporting Practices in the Top Romanian Companies. Sustainability 2020, 12, 3470. [Google Scholar] [CrossRef] [Green Version]

- Okaz. 2023. Available online: https://www.okaz.com.sa/economy/saudi/2114722 (accessed on 4 July 2023).

- Gilson, S. Management Turnover and Financial Distress. J. Financ. Econ. 1989, 25, 241–262. [Google Scholar] [CrossRef]

- CMA. Companies with Accumulated Losses in the Saudi Financial Market. 2023. Available online: https://cma.org.sa/ResearchAndReports/Pages/Research.aspx (accessed on 4 July 2023).

- Grimaldi, F.; Caragnano, A.; Zito, M.; Mariani, M. Sustainability Engagement and Earnings Management: The Italian Context. Sustainability 2020, 12, 4881. [Google Scholar] [CrossRef]

- Velte, P. Corporate social responsibility and earnings management: A literature review. Corp. Ownersh. Control 2020, 17, 8–19. [Google Scholar] [CrossRef]

- Kolsi, M.C.; Al-Hiyari, A.; Hussainey, K. Does environmental, social, and governance performance mitigate earnings management practices? Evidence from US commercial banks. Environ. Sci. Pollut. Res. 2023, 30, 20386–20401. [Google Scholar] [CrossRef]

- Grougiou, V.; Leventis, S.; Dedoulis, E.; Owusu-Ansah, S. Corporate social responsibility and earnings management in US banks. Account. Forum 2014, 38, 155–169. [Google Scholar] [CrossRef] [Green Version]

- Kim, Y.; Park, M.S.; Wier, B. Is earnings quality associated with corporate social responsibility? Account. Rev. 2012, 87, 761–796. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The stakeholder theory of the corporation: Concepts, evidence, and implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Freeman, R.E. The politics of stakeholder theory: Some future directions. Bus. Ethics Q. 1994, 4, 409–421. [Google Scholar] [CrossRef]

- Ehsan, S.; Abbas, Q.; Nawaz, A. An inquiry into the Relationship between Earnings’ Management, Corporate Social Responsibility and Corporate Governance. Abasyn Univ. J. Soc. Sci. 2018, 11, 104–116. [Google Scholar]

- Gerged, A.M.; Albitar, K.; Al-Haddad, L. Corporate environmental disclosure and earnings management—The moderating role of corporate governance structures. Int. J. Financ. Econ. 2023, 28, 2789–2810. [Google Scholar] [CrossRef]

- Hong, Y.; Andersen, M.L. The relationship between corporate social responsibility and earnings management: An exploratory study. J. Bus. Ethics 2011, 104, 461–471. [Google Scholar] [CrossRef]

- Gonçalves, T.; Gaio, C.; Ferro, A. Corporate Social Responsibility and Earnings Management: Moderating Impact of Economic Cycles and Financial Performance. Sustainability 2021, 13, 9969. [Google Scholar] [CrossRef]

- Dawkins, C.E.; Fraas, J.W. Erratum to: Beyond acclamations and excuses: Environmental performance, voluntary environmental disclosure and the role of visibility. J. Bus. Ethics 2011, 99, 383–397. [Google Scholar] [CrossRef]

- Fadilah, F.; Uzliawati, L.; Mulyasari, W. The Effect of Firm Size and Firm Age on Sustainability Reporting and The Impact on Earnings Management. J. Ris. Akunt. Terpadu 2022, 15, 84–99. [Google Scholar] [CrossRef]

- Velayutham, E. Sustainability disclosure and earnings management. Res. Handb. Financ. Sustain. 2018, 532–549. [Google Scholar]

- Fombrun, C.J.; Gardberg, N.A.; Barnett, M.L. Opportunity platforms and safety nets: Corporate citizenship and reputational risk. Bus. Soc. Rev. 2000, 105, 85–106. [Google Scholar] [CrossRef]

- García-Sánchez, I.M.; Hussain, N.; Khan, S.A.; Martínez-Ferrero, J. Managerial entrenchment, corporate social responsibility, and earnings management. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1818–1833. [Google Scholar] [CrossRef] [Green Version]

- Salewski, M.; Zülch, H. The Association between Corporate Social Responsibility (CSR) and Earnings Quality—Evidence from European Blue Chips. SSRN Electron. J. 2012; HHL Working Paper Series No. 112. [Google Scholar] [CrossRef]

- Chouaibi, Y.; Zouari, G. The effect of corporate social responsibility practices on real earnings management: Evidence from a European ESG data. Int. J. Discl. Gov. 2021, 19, 11–30. [Google Scholar] [CrossRef]

- Fritzsche, D.J. A model of decision-making incorporating ethical values. J. Bus. Ethics 1991, 10, 841–852. [Google Scholar] [CrossRef]

- Belgacem, I.; Omri, A. Does corporate social disclosure affect earnings quality? Empirical evidence from Tunisia. Int. J. Adv. Res. 2015, 3, 73–89. [Google Scholar]

- Buertey, S.; Sun, E.J.; Lee, J.S.; Hwang, J. Corporate social responsibility and earnings management: The moderating effect of corporate governance mechanisms. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 256–271. [Google Scholar] [CrossRef]

- Zhang, Z.; Yap, T.L.; Park, J. Does voluntary CSR disclosure and CSR performance influence earnings management? Empirical evidence from China. Int. J. Discl. Gov. 2021, 18, 161–178. [Google Scholar] [CrossRef]

- Jordaan, L.A.; De Klerk, M.; De Villiers, C.J. Corporate social responsibility and earnings management of South African companies. S. Afr. J. Econ. Manag. 2018, 21, 1–3. [Google Scholar]

- Pasko, O.; Chen, F.; Proskurina, N.; Mao, R.; Gryn, V.; Pushkar, I. Are corporate social responsibility active firms less involved in earnings management? Empirical evidence from China. Bus. Theory Pract. 2021, 22, 504–516. [Google Scholar] [CrossRef]

- Yu, E.P.Y.; Van Luu, B.; Chen, C.H. Greenwashing in environmental, social and governance disclosures. Res. Int. Bus. Financ. 2020, 52, 101192. [Google Scholar] [CrossRef]

- Gonçalves, T.; Gaio, C.; Costa, E. Committed vs. opportunistic corporate and social responsibility reporting. J. Bus. Res. 2020, 115, 417–427. [Google Scholar] [CrossRef]

- Choi, J.H.; Kim, S.; Yang, D.-H.; Cho, K. Can Corporate Social Responsibility Decrease the Negative Influence of Financial Distress on Accounting Quality? Sustainability 2021, 13, 11124. [Google Scholar] [CrossRef]

- DeFond, M.L.; Jiambalvo, J. Debt covenant violation and manipulation of accruals. J. Account. Econ. 1994, 17, 145–176. [Google Scholar] [CrossRef]

- Jaggi, B.; Lee, P. Earnings Management Response to Debt Covenant Violations and Debt Restructuring. J. Account. Audit. Financ. 2002, 17, 295–324. [Google Scholar] [CrossRef]

- Ghazali, A.W.; Shafie, N.A.; Sanusi, Z.M. Earnings management: An analysis of opportunistic behaviour, monitoring mechanism and financial distress. Procedia Econ. Financ. 2015, 28, 190–201. [Google Scholar] [CrossRef] [Green Version]

- Leary, M.R.; Kowalski, R.M. Impression management: A literature review and two-component model. Psychol. Bull. 1990, 107, 34–47. [Google Scholar] [CrossRef]

- Merkl-Davies, D.; Brennan, N. Discretionary Disclosure Strategies in Corporate Narratives: Incremental Information or Impression Management? J. Account. Lit. 2007, 26, 116–196. [Google Scholar]

- Muljono, D.R.; Suk, K.S. Impacts of financial distress on real and accrual earnings management. J. Akunt. 2018, 22, 222–238. [Google Scholar] [CrossRef] [Green Version]

- Li, Y.; Li, X.; Xiang, E.; Djajadikerta, H.G. Financial distress, internal control, and earnings management: Evidence from China. J. Contemp. Account. Econ. 2020, 16, 100210. [Google Scholar] [CrossRef]

- Sweeney, A.P. Debt-covenant violations and managers’ accounting responses. J. Account. Econ. 1994, 17, 281–308. [Google Scholar] [CrossRef]

- Linck, J.S.; Netter, J.; Shu, T. Can Managers Use Discretionary Accruals to Ease Financial Constraints? Evidence from Discretionary Accruals Prior to Investment. Account. Rev. 2013, 88, 2117–2143. [Google Scholar] [CrossRef]

- Mecaj, A.; Bravo, M.I.G. CSR actions and financial distress: Do firms change their CSR behavior when signals of financial distress are identified? Mod. Econ. 2014, 2014, 259–271. [Google Scholar] [CrossRef]

- Jones, J. Earnings management during import relief investigations. J. Account. Res. 1991, 29, 193–223. [Google Scholar] [CrossRef]

- Dechow, P.; Sloan, R.; Sweeney, A. Detecting earnings management. Account. Rev. 1995, 70, 193–225. [Google Scholar]

- Kothari, S.P.; Leone, A.J.; Wasley, C.E. Performance matched discretionary accrual measures. J. Account. Econ. 2005, 39, 163–197. [Google Scholar] [CrossRef]

- Jaggi, B.; Leung, S.; Gul, F. Family control, board independence and earnings management: Evidence based on Hong Kong firms. J. Account. Public Policy 2009, 28, 281–300. [Google Scholar] [CrossRef]

- Habbash, M. Corporate governance mechanisms and earnings management: Evidence from Saudi Arabia. Account. Res. J. 2012, 11, 49–84. [Google Scholar]

- Xie, J.; Nozawa, W.; Yagi, M.; Fujii, H.; Managi, S. Do environmental, social, and governance activities improve corporate financial performance? Bus. Strategy Environ. 2019, 28, 286–300. [Google Scholar] [CrossRef] [Green Version]

- Campanella, F.; Serino, L.; Crisci, A.; D’Ambra, A. The role of corporate governance in environmental policy disclosure and sustainable development. Generalized estimating equations in longitudinal count data analysis. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 474–484. [Google Scholar] [CrossRef]

- Silva, P.P. Crash risk and ESG disclosure. Borsa Istanb. Rev. 2022, 22, 794–811. [Google Scholar] [CrossRef]

- Gong, G.; Louis, H.; Sun, A.X. Earnings management and firm performance following open-market repurchases. The J. Finance 2008, 63, 947–986. [Google Scholar] [CrossRef]

- Doyle, J.T.; Ge, W.; McVay, S. Accruals quality and internal control over financial reporting. Account. Rev. 2007, 82, 1141–1170. [Google Scholar] [CrossRef] [Green Version]

- Becker, C.L.; DeFond, M.L.; Jiambalvo, J.; Subramanyam, K.R. The Effect of Audit Quality on Earnings Management. Contemp. Account. Res. 1998, 15, 1–24. [Google Scholar] [CrossRef]

- Yip, E.; Van Staden, C.; Cahan, S. Corporate social responsibility reporting and earnings management: The role of political costs. Australas. Account. Bus. Financ. J. 2011, 5, 17–34. [Google Scholar]

- Uyagu, B.; Dabor, A.O. Earnings management and corporate social responsibility. Rom. Econ. J. 2017, 20, 70–87. [Google Scholar]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; Prentice Hall: Hoboken, NJ, USA, 2009. [Google Scholar]

- Adeneye, Y.; Kammoun, I. Real earnings management and capital structure: Does environmental, social and governance (ESG) performance matter? Cogent Bus. Manag. 2022, 9, 2130134. [Google Scholar] [CrossRef]

- Habbash, M.; Alghamdi, S. How do Saudi managers manipulate earning? A perception of earnings management techniques in Saudi Public firms. Account. Res. J. 2012, 2, 95–117. [Google Scholar]

- Hashed, A.; Almaqtari, F. The impact of corporate governance mechanisms and IFRS on earning management in Saudi Arabia. Accounting 2021, 7, 207–224. [Google Scholar] [CrossRef]

- Jensen, M. Value maximisation, stakeholder theory, and the corporate objective function. Eur. Financ. Manag. 2001, 7, 297–317. [Google Scholar] [CrossRef] [Green Version]

- Leuz, C.; Nanda, D.; Wysocki, P.D. Investor protection and earnings management: An international comparison. J. Financ. Econ. 2003, 69, 505–527. [Google Scholar] [CrossRef]

- Petrovits, C.M. Corporate-sponsored foundations and earnings management. J. Account. Econ. 2006, 41, 335–362. [Google Scholar] [CrossRef]

- Chen, C.L.; Huang, S.H.; Fan, H.S. Complementary association between real activities and accruals-based manipulation in earnings reporting. J. Econ. Policy Reform. 2012, 15, 93–108. [Google Scholar] [CrossRef]

- Park, Y.W.; Shin, H.H. Board composition and earnings man-agement in Canada. J. Corp. Financ. 2004, 10, 431–457. [Google Scholar] [CrossRef]

- Filip, A.; Raffournier, B. Financial crisis and earnings management: The European evidence. Int. J. Account. 2014, 49, 455–478. [Google Scholar] [CrossRef]

- Crisóstomo, V.L.; de Freitas Brandão, I.; López-Iturriaga, F.J. Large shareholders’ power and the quality of corporate governance: An analysis of Brazilian firms. Res. Int. Bus. Financ. 2020, 51, 101076. [Google Scholar] [CrossRef]

- Yoon, B.; Kim, B.; Lee, J.H. Is Earnings quality associated with corporate social responsibility? Evidence from the Korean market. Sustainability 2019, 11, 4116. [Google Scholar] [CrossRef] [Green Version]

- Ni, X. Does stakeholder orientation matter for earnings management: Evidence from non-shareholder constituency statutes. J. Corp. Financ. 2020, 62, 101606. [Google Scholar] [CrossRef]

- Wang, X.; Cao, F.; Ye, K. Mandatory corporate social responsibility (CSR) reporting and financial reporting quality: Evidence from a quasi-natural experiment. J. Bus. Ethics 2018, 152, 253–274. [Google Scholar] [CrossRef]

- Zang, A.Y. Evidence on the trade-off between real activities manipulation and accrual-based earnings management. Account. Rev. 2012, 87, 675–703. [Google Scholar] [CrossRef] [Green Version]

| Variables | N | Mean | STD | Median | 75th Percentile | 95th Percentile |

|---|---|---|---|---|---|---|

| DACC | 304 | 0.06 | 0.07 | 0.04 | 0.08 | 0.17 |

| ESG | 304 | 19.93 | 11.69 | 16.67 | 25.81 | 45.87 |

| ENV | 304 | 12.13 | 16.45 | 3.10 | 19.82 | 47.32 |

| SOC | 304 | 14.67 | 13.02 | 11.67 | 21.67 | 38.60 |

| GOV | 304 | 47.07 | 17.80 | 44.64 | 54.89 | 75.53 |

| DISTRESS | 304 | 0.27 | 0.45 | 0 | 1 | 1 |

| SIZE | 304 | 10.71 | 0.65 | 10.70 | 11.20 | 11.70 |

| ROA | 304 | 7.70 | 0.66 | 1.97 | 4.38 | 16.74 |

| OCF | 304 | 0.09 | 0.80 | 0.08 | 0.14 | 0.24 |

| LEV | 304 | 23.34 | 0.20 | 17.34 | 39.43 | 56.96 |

| BIG4 | 304 | 0.37 | 0.48 | 0 | 1 | 1 |

| Variables | DACC | ESG | ENV | SOC | GOV | DISTRESS | SIZE | ROA | OCF | LEV | BIG4 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DACC | 1 | ||||||||||

| ESG | 0.0689 * | 1 | |||||||||

| ENV | 0.0695 * | 0.3893 *** | 1 | ||||||||

| SOC | 0.0154 ** | 0.4481 *** | 0.7692 *** | 1 | |||||||

| GOV | 0.0344 ** | 0.5828 *** | −0.655 | −0.0199 | 1 | ||||||

| DISTRESS | 0.0124 ** | −0.0154 | −0.0285 | −0.2111 *** | 0.0037 | 1 | |||||

| SIZE | 0.0833 * | 0.1420 ** | 0.2039 *** | 0.1117 * | 0.1109 * | −0.0888 | 1 | ||||

| ROA | 0.0220 * | 0.0761 | −0.0212 | −0.0470 | 0.0827 | −0.0848 | −0.1486 ** | 1 | |||

| OCF | −0.0341 | 0.0634 | −0.0784 | −0.0142 ** | 0.0945 | −0.0301 | 0.0503 | −0.0221 | 1 | ||

| LEV | −0.0954 | 0.2230 *** | 0.1709 *** | 0.2646 *** | −0.0384 | −0.0402 | −0.4620 *** | −0.1000 | 0.0762 | 1 | |

| BIG4 | −0.0978 * | −0.0056 | −0.1788 *** | −0.1943 *** | 0.0496 | 0.0038 | 0.0475 | 0.0574 | 0.2047 *** | −0.0696 | 1 |

| Variables | DACC |

|---|---|

| INTERCEPT | 0.1763 ** (2.27) |

| ESG | 0.0044 ** (2.03) |

| SIZE | −0.0209 *** (−3.02) |

| ROA | −0.0019 *** (−2.74) |

| OCF | −0.0249 ** (−2.50) |

| LEV | 0.0003 *** (2.79) |

| BIG4 | −0.0109 (−1.33) |

| Year_FE | Yes |

| Industry_FE | Yes |

| Sample Size | 304 |

| F_statistic | 1.10 *** |

| Adjusted R2 | 0.268 |

| Breusch-Pagan LM test | 64.09 *** |

| Hausman Test | 228.48 *** |

| Variables | |

|---|---|

| INTERCEPT | 0.2124 (1.37) |

| ESG | 0.0028 ** (2.32) |

| DISTRESS | 0.1843 *** (2.43) |

| ESG × DISTRESS | 0.0549 ** (2.21) |

| SIZE | −0.0212 (−1.52) |

| ROA | −0.0027 ** (−2.30) |

| OCF | −0.0459 (−0.65) |

| LEV | 0.0002 (0.55) |

| BIG4 | −0.0081 (−1.08) |

| Year_FE | Yes |

| Industry_FE | Yes |

| Sample Size | 302 |

| F_statistic | 1.28 *** |

| Adjusted R2 | 0.1445 |

| Breusch-Pagan LM test | 60.56 *** |

| Hausman Test | 256.89 *** |

| Variables | ENV | SOC | GOV |

|---|---|---|---|

| INTERCEPT | 0.2346 (1.47) | 0.1655 (1.04) | −0.1452 * (−1.93) |

| ENV | 0.0034 ** (1.98) | ||

| SOC | 0.0049 *** (4.25) | ||

| GOV | −0.0011 ** (−3.81) | ||

| SIZE | −0.0251 * (−1.82) | −0.0177 (−1.21) | −0.0179 *** (−2.64) |

| ROA | −0.0029 * (−1.77) | −0.0022 (−0.87) | −0.0015 ** (−2.26) |

| OCF | −0.0396 (−0.57) | −0.0345 (−0.46) | −0.0256 (−0.52) |

| LEV | 0.0004 (1.40) | 0.0002 (0.51) | 0.0002 ** (2.26) |

| BIG4 | −0.0045 (−0.51) | −0.0144 * (−1.83) | −0.0089 (−0.09) |

| Year_FE | Yes | Yes | Yes |

| Industry_FE | Yes | Yes | Yes |

| Sample Size | 258 | 289 | 297 |

| F_statistic | 1.12 *** | 1.42 *** | 1.78 *** |

| Adjusted R2 | 0.0788 | 0.0845 | 0.0155 |

| Variables | DACC |

|---|---|

| INTERCEPT | 0.5115 (0.77) |

| ESG | 0.0048 ** (2.00) |

| SIZE | −0.0050 ** (−2.09) |

| ROA | −0.0044 (−0.81) |

| OCF | −0.4739 (−1.34) |

| LEV | 0.0012 ** (2.50) |

| BIG4 | −0.1036 (−1.03) |

| Year_FE | Yes |

| Industry_FE | Yes |

| Sample Size | 304 |

| F_statistic | 1.25 *** |

| Adjusted R2 | 0.0259 |

| Variables | DACC |

|---|---|

| INTERCEPT | 0.1798 (1.36) |

| ESG | 0.0006 ** (2.86) |

| DISTRESS | 0.0272 ** (2.84) |

| ESG × DISTRESS | 0.0086 ** (2.96) |

| SIZE | −0.0213 * (−1.85) |

| ROA | −0.0019 * (−1.79) |

| OCF | −0.0254 (−0.36) |

| LEV | 0.0003 (1.32) |

| BIG4 | −0.0108 * (−1.88) |

| Year_FE | Yes |

| Industry_FE | Yes |

| Sample Size | 304 |

| F_statistic | 1.20 *** |

| Adjusted R2 | 0.0517 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Almubarak, W.I.; Chebbi, K.; Ammer, M.A. Unveiling the Connection among ESG, Earnings Management, and Financial Distress: Insights from an Emerging Market. Sustainability 2023, 15, 12348. https://doi.org/10.3390/su151612348

Almubarak WI, Chebbi K, Ammer MA. Unveiling the Connection among ESG, Earnings Management, and Financial Distress: Insights from an Emerging Market. Sustainability. 2023; 15(16):12348. https://doi.org/10.3390/su151612348

Chicago/Turabian StyleAlmubarak, Wadhaah Ibrahim, Kaouther Chebbi, and Mohammed Abdullah Ammer. 2023. "Unveiling the Connection among ESG, Earnings Management, and Financial Distress: Insights from an Emerging Market" Sustainability 15, no. 16: 12348. https://doi.org/10.3390/su151612348