Influence of Customer Perception Factors on AI-Enabled Customer Experience in the Ecuadorian Banking Environment

Abstract

:1. Introduction

2. Literature Review and Hypotheses Development

2.1. AI in the Banking Environment

2.2. AI-Enabled Customer Experience

2.2.1. AI-Hedonic Customer Experience

2.2.2. AI-Recognition Customer Service

2.3. Customer Perception Factors and AI-Enabled Customer Experience

2.3.1. Convenience in Use

2.3.2. Personalization

2.3.3. Trust

2.3.4. Customer Loyalty

2.3.5. Customer Satisfaction

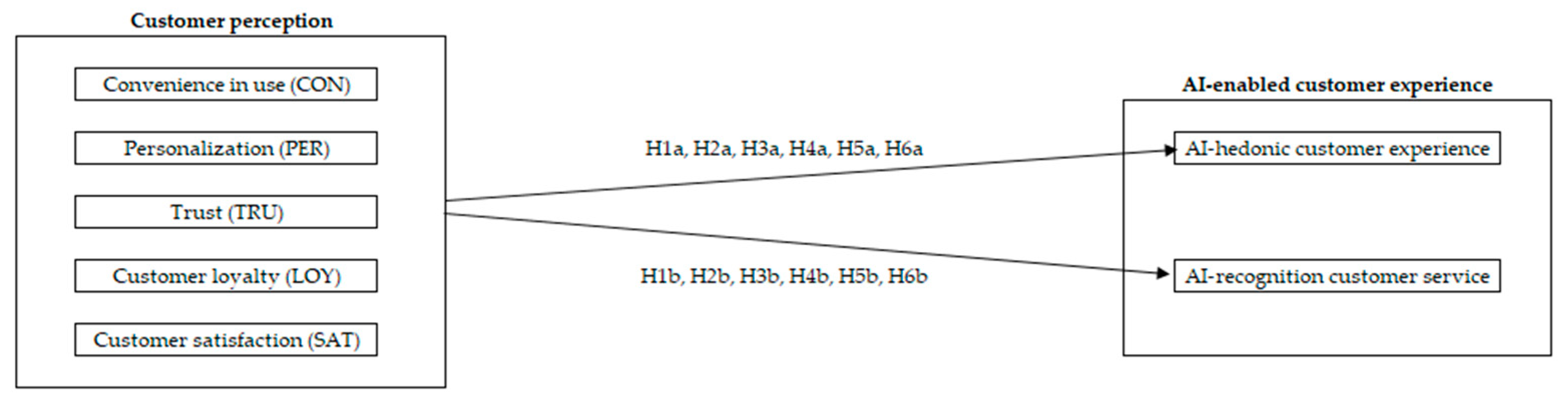

2.3.6. Research Model

3. Methodology

3.1. Instrument and Data

3.2. Procedure

3.3. Measurement of Constructs

4. Empirical Results

4.1. Demographic Analysis

4.2. Exploratory Factor Analysis, Reliability, and Validity

4.3. Discriminant Validity Analysis

4.4. Regression Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Millinium Consulttants. Benefits of Artificial Intelligence in the Banking Sector; Millinium Consulttants: Kuala Lumpur, Malaysia, 2022. [Google Scholar]

- Noreen, U.; Shafique, A.; Ahmed, Z.; Ashfaq, M. Banking 4.0: Artificial Intelligence (AI) in Banking Industry & Consumer’s Perspective. Sustainability 2023, 15, 3682. [Google Scholar] [CrossRef]

- Tulcanaza-Prieto, A.B.; Aguilar-Rodríguez, I.E.; Lee, C.W. Customer Perception and Its Influence on the Financial Performance in the Ecuadorian Banking Environment. Sustainability 2022, 14, 6960. [Google Scholar] [CrossRef]

- Wen, H.; Zhang, L.; Sheng, A.; Li, M.; Guo, B. From ‘Human-to-Human’ to ‘Human-to-Non-human’—Influence Factors of Artificial Intelligence-Enabled Consumer Value Co-creation Behavior. Front. Phychol. 2022, 13, 863313. [Google Scholar] [CrossRef] [PubMed]

- Kaartemo, V.; Helkkula, A. A systematic review of artificial intelligence and robots in value co-creation: Current status and future research avenues. Creat. Value J. 2018, 4, 211–218. [Google Scholar] [CrossRef]

- Leone, D.; Schiavone, F.; Appio, F.P.; Chiao, B. How does artificial intelligence enable and enhance value co-creation in industrial markets? An exploratory case study in the healthcare ecosystem. J. Bus. Res. 2021, 129, 849–859. [Google Scholar] [CrossRef]

- Kucharska, W. Online brand communities’ contribution to digital business models: Social drivers and mediators. J. Res. Interact. Mark. 2019, 13, 437–463. [Google Scholar] [CrossRef]

- Jarek, K.; Mazurek, G. Marketing and artificial intelligence. Cent. Eur. Bus. Rev. 2019, 8, 46–56. [Google Scholar] [CrossRef]

- Mogaji, E.; Balakrishnan, J.; Nwoba, A.C.; Nguyen, N.P. Emerging-market consumers’ interactions with banking chatbots. Telemat. Inform. 2021, 65, 101711. [Google Scholar] [CrossRef]

- Mogaji, E.; Nguyen, N.P. Managers’ understanding of artificial intelligence in relation to marketing financial services: Insights from a cross-country study. Int. J. Bank Mark. 2022, 40, 1272–1298. [Google Scholar] [CrossRef]

- Breeden, J.L.; Leonova, E. Creating Unbiased Machine Learning Models by Design. J. Risk Financ. Manag. 2021, 14, 565. [Google Scholar] [CrossRef]

- Curto, G.; Jojoa, M.; Comin, F.; Garcia-Zapirain, B. Are AI systems biased against the poor? A machine learning analysis using Word2Vec and GloVe embeddings. Nat. Public Health Emercency Collect. 2022; in press. [Google Scholar] [CrossRef]

- Oh, L.-B.; Teo, H.-H.; Sambamurthy, V. The effects of retail channel integration through the use of information technologies on firm performance. J. Oper. Manag. 2012, 30, 368–381. [Google Scholar] [CrossRef]

- Saponaro, M.; Le Gal, D.; Gao, M.; Guisiano, M.; Maniere, I.C. Challenges and Opportunities of Artificial Intelligence in the Fashion World. In Proceedings of the 2018 International Conference on Intelligent and Innovative Computing Applications (ICONIC), Mon Tresor, Mauritius, 6–7 December 2018; pp. 1–5. [Google Scholar]

- Lin, R.-R.; Lee, J.-C. The supports provided by artificial intelligence to continuous usage intention of mobile banking: Evidence from China. Aslib J. Inf. Manag. 2023; ahead of print. [Google Scholar] [CrossRef]

- Keiningham, T.; Ball, J.; Moeller, S.B.; Bruce, H.L.; Buoye, A.; Dzenkovska, J.; Nasr, L.; Ou, Y.-C.; Zaki, M. The interplay of customer experience and commitment. J. Serv. Mark. 2017, 31, 148–160. [Google Scholar] [CrossRef]

- Lam, S. The effects of store environment on shopping behaviors: A critical review. Adv. Consum. Res. 2001, 28, 190–197. [Google Scholar]

- Ladhari, R.; Souiden, N.; Dufour, B. The role of emotions in utilitarian service settings: The effects of emotional satisfaction on product perception and behavioral intentions. J. Retail. Consum. Serv. 2017, 34, 10–18. [Google Scholar] [CrossRef]

- Foroudi, P.; Gupta, S.; Sivarajah, U.; Broderick, A. Investigating the effects of smart technology on customer dynamics and customer experience. Comput. Hum. Behav. 2018, 80, 271–282. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Lemon, K.N.; Parasuraman, A.; Roggeveen, A.; Tsiros, M.; Schlesinger, L.A. Customer Experience Creation: Determinants, Dynamics and Management Strategies. J. Retail. 2009, 85, 31–41. [Google Scholar] [CrossRef]

- Montemayor, C.; Halpern, J.; Fairweather, A. In principle obstacles for empathic AI: Why we can’t replace human empathy in healthcare. AI Soc. 2022, 37, 1353–1359. [Google Scholar] [CrossRef] [PubMed]

- Song, M.; Xing, X.; Duan, Y.; Cohen, J.; Mou, J. Will artificial intelligence replace human customer service? The impact of communication quality and privacy risks on adoption intention. J. Retail. Consum. Serv. 2022, 66, 102900. [Google Scholar] [CrossRef]

- Ashfaq, M.; Yun, J.; Yu, S.; Loureiro, S.M.C. I, Chatbot: Modeling the determinants of users’ satisfaction and continuance intention of AI-powered service agents. Telemat. Inform. 2020, 54, 101473. [Google Scholar] [CrossRef]

- Rose, S.; Clark, M.; Samouel, P.; Hair, N. Online Customer Experience in e-Retailing: An empirical model of Antecedents and Outcomes. J. Retail. 2012, 88, 308–322. [Google Scholar] [CrossRef]

- Li, K. Product and service innovation with customer recognition. Decis. Sci. 2021; in press. [Google Scholar] [CrossRef]

- Ameen, N.; Tarhini, A.; Reppel, A.; Anand, A. Customer experience in the age of artificial intelligence. Comput. Hum. Behav. 2021, 114, 106548. [Google Scholar] [CrossRef]

- Cheriyan, A.; Kumar, R.; Joseph, A.; Raju, S. Consumer acceptance towards AI-enabled chatbots: Case of travel and tourism industries. J. Posit. Sch. Psychol. 2022, 6, 3880–3889. [Google Scholar]

- Colwell, S.R.; Aung, M.; Kanetkar, V.; Holden, A.L. Toward a measure of service convenience: Multiple-item scale development and empirical test. J. Serv. Mark. 2008, 22, 160–169. [Google Scholar] [CrossRef]

- Saniuk, S.; Grabowska, S.; Gajdzik, B. Personalization of Products in the Industry 4.0 Concept and Its Impact on Achieving a Higher Level of Sustainable Consumption. Energies 2020, 13, 5895. [Google Scholar] [CrossRef]

- Zhen, J.; Zhao, L.; Yan, J. Why would people purchase personalized products online? An exploratory study. J. Inf. Technol. Manag. 2017, 28, 18–30. [Google Scholar]

- Berry, L.L.; Seiders, K.; Grewal, D. Understanding service convenience. J. Mark. 2002, 66, 1–17. [Google Scholar] [CrossRef]

- Roy, S.K.; Balaji, M.S.; Sadeque, S.; Nguyen, B.; Melewar, T.C. Constituents and consequences of smart customer experience in retailing. Technol. Forecast. Soc. Chang. 2018, 124, 257–270. [Google Scholar] [CrossRef]

- Van Doorn, J.; Lemon, K.N.; Mittal, V.; Nass, S.; Pick, D.; Pirner, P.; Verhoef, P.C. Customer engagement behavior: Theoretical foundations and research directions. J. Serv. Res. 2010, 13, 253–266. [Google Scholar] [CrossRef]

- Roy, S.K.; Lassar, W.M.; Shekhar, V. Convenience and satisfaction: Mediation of fairness and quality. Serv. Ind. J. 2016, 36, 239–260. [Google Scholar] [CrossRef]

- Bilgihan, A.; Kandampully, J.; Zhang, T. Towards a unified customer experience in online shopping environments: Antecedents and outcomes. Int. J. Qual. Serv. Sci. 2016, 8, 102–119. [Google Scholar] [CrossRef]

- Kim, Y.-K.; Lee, M.-Y.; Park, S.-H. Shopping value orientation: Conceptualization and measurement. J. Bus. Res. 2014, 67, 2884–2890. [Google Scholar] [CrossRef]

- Grzeskowiak, S.; Sirgy, M.J.; Foscht, T.; Swoboda, B. Linking retailing experiences with life satisfaction. Int. J. Retail. Distrib. Manag. 2016, 44, 124–138. [Google Scholar] [CrossRef]

- Zanker, M.; Rook, L.; Jannach, D. Measuring the impact of online personalisation: Past, present and future. Int. J. Hum.-Comput. Stud. 2019, 131, 160–168. [Google Scholar] [CrossRef]

- Komiak, S.Y.; Benbasat, I. The Effects of Personalization and Familiarity on Trust and Adoption of Recommendation Agents. MIS Q. 2006, 30, 941–949. [Google Scholar] [CrossRef]

- Aguirre, E.; Mahr, D.; Grewal, D.; de Ruyter, K.; Wetzels, M. Unraveling the Personalization Paradox: The Effect of Information Collection and Trust-Building Strategies on Online Advertisement Effectiveness. J. Retail. 2015, 91, 34–49. [Google Scholar] [CrossRef]

- Shen, A.; Ball, A.D. Is personalization of services always a good thing? Exploring the role of technology-mediated personalization (TMP) in service relationships. J. Serv. Mark. 2009, 23, 79–91. [Google Scholar] [CrossRef]

- Ngo, A.; Duong, H.; Nguyen, T.; Nguyen, L. The effects of ownership structure on dividend policy: Evidence from seasoned equity offerings (SEOs). Glob. Financ. J. 2018, 44, 100440. [Google Scholar] [CrossRef]

- Ponder, N.; Holloway, B.B.; Hansen, J.D. The mediating effects of customers’ intimacy perceptions on the trust-commitment relationship. J. Serv. Mark. 2016, 30, 75–87. [Google Scholar] [CrossRef]

- Tulcanaza-Prieto, A.B.; Morocho-Cayamcela, M.E. The Evolution and Takeoff of the Ecuadorian Economic Groups. Economies 2021, 9, 188. [Google Scholar] [CrossRef]

- Siau, K.; Wang, W. Building trust in artificial intelligence, machine learning, and robotics. Cut. Bus. Tecnhol. J. 2018, 31, 47–53. [Google Scholar]

- Lee, J.; See, K. Trust in automation: Designing for appropriate reliance. Hum. Factors 2004, 46, 50–80. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Hengstler, M.; Enkel, E.; Duelli, S. Applied artificial intelligence and trust—The case of autonomous vehicles and medical assistance devices. Technol. Forecast. Soc. Chang. 2016, 105, 105–120. [Google Scholar] [CrossRef]

- Khadka, K.; Maharjan, S. Value, satisfaction and customer loyalty. Mark. Entrep. SMEs 2017, 12, 467–480. [Google Scholar]

- Puntoni, S.; Reczek, R.W.; Giesler, M.; Botti, S. Consumers and artificial intelligence: An experiential perspective. J. Mark. 2020, 85, 131–151. [Google Scholar] [CrossRef]

- Chen, Y.; Prentice, C.; Weaven, S.; Hisao, A. The influence of customer trust and artificial intelligence on customer engagement and loyalty—The case of the home-sharing industry. Front. Psychol. 2022, 13, 912339. [Google Scholar] [CrossRef]

- Chen, Q.; Lu, Y.; Gong, Y.; Xiong, J. Can AI chatbots help retain customers? Impact of AI service quality on customer loyalty. Internet Res. 2023; ahead of print. [Google Scholar] [CrossRef]

- Yau, K.-L.A.; Saad, N.M.; Chong, Y.-W. Artificial Intelligence Marketing (AIM) for Enhancing Customer Relationships. Appl. Sci. 2021, 11, 8562. [Google Scholar] [CrossRef]

- Xu, Y.; Goedegebuure, R.; Van der Heijden, B. Customer perception, customer satisfaction, and customer loyalty within Chinese securities business. J. Relatsh. Mark. 2007, 5, 79–104. [Google Scholar] [CrossRef]

- Krystallis, A.; Chrysochou, P. The effects of service brand dimensions on brand loyalty. J. Retail. Consum. Serv. 2014, 21, 139–147. [Google Scholar] [CrossRef]

- Javed, F.; Cheema, S. Customer satisfaction and customer perceived value and its impact on customer loyalty: The mediational role of customer relationship management. J. Internet Bank. Commer. 2017, 8, 1–14. [Google Scholar]

- Sayani, H. Customer satisfaction and loyalty in the United Arab Emirates banking industry. Int. J. Bank Mark. 2015, 33, 351–375. [Google Scholar] [CrossRef]

- Spence, A. Competitive and optimal responses to signals: An analysis of efficiency and distribution. J. Econ. Theory 1974, 7, 296–332. [Google Scholar] [CrossRef]

- van Esterik-Plasmeijer, P.W.; van Raaij, W.F. Banking system trust, bank trust, and bank loyalty. Int. J. Bank Mark. 2017, 35, 97–111. [Google Scholar] [CrossRef]

- Anderson, R.E.; Srinivasan, S.S. E-satisfaction and e-loyalty: A contingency framework. Psychol. Mark. 2003, 20, 123–138. [Google Scholar] [CrossRef]

- Ishaq, M. Perceived value, service quality, corporate image and customer loyalty: Empirical assessment from Pakistan. Serbian J. Manag. 2012, 7, 25–36. [Google Scholar] [CrossRef]

- Sarigiannidis, L.; Maditinos, D. Customer satisfaction, loyalty and financial performance: A holistic approach of the Greek banking sector. Int. J. Bank Mark. 2013, 31, 259–288. [Google Scholar]

- Teeroovengadum, V. Service quality dimensions as predictors of customer satisfaction and loyalty in the banking industry: Moderating effects of gender. Eur. Bus. Rev. 2020, 34, 1–19. [Google Scholar] [CrossRef]

- Longoni, C.; Cian, L. Artificial intelligence in utilitarian vs. hedonic contexts: The ‘world-of-machine’ effect. J. Mark. 2020, 86, 91–108. [Google Scholar] [CrossRef]

- Sujata, J.; Aniket, D.; Mahasingh, M. Artificial intelligence tools for enhancing customer experience. Int. J. Recent Technol. Eng. 2019, 8, 700–706. [Google Scholar] [CrossRef]

- Hair, J.; Black, W.; Babin, B.; Anderson, R. Multivariate Data Analysis, 7th ed.; Prentice-Hall: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Chin, W. The partial least squares approach to structural equation modeling. In Modern Methods for Business Research; Marcoulides, G.A., Ed.; Lawrence Erlbaum Associates: London, UK, 1998; pp. 295–336. [Google Scholar]

- Juwaheer, T.D.; Pudaruth, S.; Ramdin, P. Factors influencing the adoption of internet banking: A case study of commercial banks in Mauritius. World J. Sci. Technol. Sustain. Dev. 2012, 9, 204–234. [Google Scholar] [CrossRef]

- Tulcanaza-Prieto, A.B.; Salazar, P.A.B.; Aguilar-Rodríguez, I.E. Determinants of Youth Unemployment in Ecuador in 2019. Economies 2023, 11, 59. [Google Scholar] [CrossRef]

| Constructs | Items | Label | Related Literature |

|---|---|---|---|

| Socio-demographic information | Gender, age, marital status, level of education, occupation, monthly income, banking entity. | Nominal scale | |

| AI-enabled customer experience (AIK) | Are you familiarized with the definition of AI? Do you think your bank uses AI to design the financial products and services? | AIK1, AIK2 | [8,26] |

| Convenience in use (CON) | I can use the services of the virtual/mobile app of my bank whenever I want. | CON1 | [27,28] |

| The virtual/mobile app of my bank is available continuously and permanently. | CON2 | ||

| I value the possibility of using the virtual/mobile app of my bank from the comfort of my home. | CON3 | ||

| I am disturbed about the loss of control when I use the virtual/mobile app of my bank. | CON4 | ||

| I am concerned about the loss of confidentiality when I use the virtual/mobile app of my bank. | CON5 | ||

| Personalization (PER) | The virtual/mobile app of my bank is personalized. | PER1 | [26,29,30] |

| The financial products and services of my bank are designed in concordance with my consumption preferences. | PER2 | ||

| The virtual/mobile app of my bank detects human errors in financial operations. | PER3 | ||

| Most of the financial processes in my bank are automated. | PER4 | ||

| The virtual/mobile app of my bank meets my expectations. | PER5 | ||

| Trust (TRU) | The virtual/mobile app of my bank is reliable. | TRU1 | [26,58,59] |

| I am pleased with the electronic security of my bank. | TRU2 | ||

| The virtual/mobile app of my bank is secure. | TRU3 | ||

| The staff of my bank help me to solve problems with confidence. | TRU4 | ||

| The virtual/mobile app of my bank has good technical features. | TRU5 | ||

| Customer loyalty (LOY) | I have an emotional link with my bank. | LOY1 | [60,61,62,63] |

| I feel recognized with my bank. | LOY2 | ||

| It is very difficult to change my bank. | LOY3 | ||

| I mention attributes of my bank. | LOY4 | ||

| I am a faithful client of my bank. | LOY5 | ||

| Customer satisfaction (SAT) | Overall, I am content with the quality of service of my bank. | SAT1 | [62,63] |

| My bank is positioned at least in the third position in the national financial system. | SAT2 | ||

| Kindness and client’s attention are qualities of the staff of my bank. | SAT3 | ||

| When the staff of my bank answers my questions, they show knowledge and experience. | SAT4 | ||

| My bank offers individualized and personalized attention. | SAT5 | ||

| AI-hedonic customer experience (HCE) | Using the virtual/mobile app of my bank is a memorable experience | HCE1 | [26,50,64] |

| The use of the virtual/mobile app of my bank is entertaining. | HCE2 | ||

| The use of the virtual/mobile app of my bank is exciting. | HCE3 | ||

| I feel comfortable using the virtual/mobile app of my bank. | HCE4 | ||

| I increase my learning activity when I use the virtual/mobile app of my bank. | HCE5 | ||

| AI-recognition customer service (RCS) | The virtual/mobile app of my bank is the most important tool for all financial services. | RCS1 | [26,50,65] |

| The virtual/mobile app of my bank is designed in a respectful way toward the customer. | RCS2 | ||

| A welcome message is displayed when I use the virtual/mobile app of my bank. | RCS3 | ||

| The virtual/mobile app of my bank is secure. | RCS4 | ||

| The virtual/mobile app of my bank is well aesthetic and designed. | RCS5 | ||

| Variable | Classification | Percentage |

|---|---|---|

| Gender | Women | 60.8% |

| Men | 39.2% | |

| Age | 26–35 years old | 41.5% |

| 36–45 years old | 31.5% | |

| 18–25 years old | 10.8% | |

| 46–55 years old | 8.5% | |

| Higher than 56 years old | 7.7% | |

| Marital status | Married | 43.8% |

| Single | 38.5% | |

| Free union | 10.0% | |

| Divorced or separated | 6.9% | |

| Widower | 0.8% | |

| Academic trajectory | Masters and doctorate degrees | 49.2% |

| Junior college graduates | 31.5% | |

| College graduates | 17.7% | |

| Primary education | 1.5% | |

| Occupation | Private employees | 56.9% |

| Public employees | 25.4% | |

| Own job and entrepreneur | 12.3% | |

| Housewives and students | 5.4% | |

| Monthly income | USD 450.00–USD 1200.00 | 50.8% |

| More than USD 2000.00 | 24.6% | |

| USD 1200.01–USD 2000.00 | 20.8% | |

| Lower than 450.00. | 3.8% | |

| Baking entity | Ecuadorian private bank | 91.5% |

| Ecuadorian public bank | 8.5% |

| Constructs | Label | Factor Loadings | AVE | Composite Reliability | Cronbach’s Alpha | Std. Deviation | Variance |

|---|---|---|---|---|---|---|---|

| CON | CON4 | 0.915 | 0.817 | 0.899 | 0.782 | 1.295 | 1.676 |

| CON5 | 0.892 | 1.339 | 1.794 | ||||

| PER | PER1 | 0.717 | 0.519 | 0.759 | 0.736 | 0.641 | 0.411 |

| PER2 | 0.844 | 0.959 | 0.920 | ||||

| PER5 | 0.573 | 0.840 | 0.705 | ||||

| TRU | TRU4 | 0.790 | 0.587 | 0.740 | 0.630 | 1.005 | 1.009 |

| TRU5 | 0.742 | 0.721 | 0.520 | ||||

| LOY | LOY1 | 0.784 | 0.562 | 0.865 | 0.897 | 1.257 | 1.579 |

| LOY2 | 0.757 | 1.170 | 1.368 | ||||

| LOY3 | 0.710 | 1.189 | 1.415 | ||||

| LOY4 | 0.745 | 1.167 | 1.362 | ||||

| LOY5 | 0.750 | 1.159 | 1.344 | ||||

| SAT | SAT3 | 0.790 | 0.583 | 0.806 | 0.881 | 1.062 | 1.128 |

| SAT4 | 0.813 | 0.947 | 0.896 | ||||

| SAT5 | 0.681 | 1.067 | 1.139 | ||||

| HCE | HCE2 | 0.805 | 0.608 | 0.756 | 0.659 | 1.124 | 1.264 |

| HCE4 | 0.754 | 1.013 | 1.027 | ||||

| RCS | RCS1 | 0.698 | 0.521 | 0.812 | 0.780 | 1.001 | 1.002 |

| RCS2 | 0.799 | 0.878 | 0.770 | ||||

| RCS3 | 0.702 | 1.035 | 1.070 | ||||

| RCS5 | 0.681 | 0.843 | 0.710 | ||||

| Kaiser–Meyer–Olkim (KMO) = 0.894 Significance of Bartlett’s Test of Sphericity = 0.000 Extraction Sums of Squared Loadings (Cumulative Variance %) = 71.053%. | |||||||

| Var | Items | Mean | SD | Correlations | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| CON | PER | TRU | LOY | SAT | HCE | RCS | ||||

| CON | 2 | 3.669 | 1.194 | (0.904) | ||||||

| PER | 3 | 4.272 | 0.666 | 0.291 *** | (0.720) | |||||

| TRU | 2 | 4.042 | 0.747 | 0.221 *** | 0.620 *** | (0.766) | ||||

| LOY | 5 | 3.520 | 1.000 | 0.217 *** | 0.459 *** | 0.504 *** | (0.749) | |||

| SAT | 3 | 3.846 | 0.923 | 0.323 *** | 0.528 *** | 0.694 *** | 0.561 *** | (0.763) | ||

| HCE | 2 | 3.577 | 0.924 | 0.310 *** | 0.549 *** | 0.568 *** | 0.640 *** | 0.591 *** | (0.780) | |

| RCS | 4 | 4.138 | 0.731 | 0.346 *** | 0.557 *** | 0.629 *** | 0.426 *** | 0.618 *** | 0.618 *** | (0.722) |

| Variables | AIK | HCE | RCS | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CON | 0.149 *** | 0.083 ** | 0.085 ** | 0.018 ** | 0.212 *** | 0.158 *** | ||||||||||||

| (2.770) | (2.386) | (2.255) | (2.159) | (4.167) | (4.268) | |||||||||||||

| [1.945] | [3.023] | [1.421] | [2.732] | [4.682] | [3.126] | |||||||||||||

| PER | 0.686 *** | 0.258 *** | 0.761 *** | 0.276 ** | 0.611 *** | 0.239 *** | ||||||||||||

| (8.786) | (3.182) | (7.429) | (2.474) | (7.589) | (2.769) | |||||||||||||

| [3.333] | [2.558] | [2.135] | [5.614] | [1.727] | [1.205] | |||||||||||||

| TRU | 0.659 *** | 0.203 ** | 0.702 *** | 0.150 ** | 0.616 *** | 0.256 *** | ||||||||||||

| (9.950) | (2.406) | (7.801) | (2.290) | (9.161) | (2.844) | |||||||||||||

| [1.980] | [5.177] | [1.823] | [1.181] | [2.658] | [1.260] | |||||||||||||

| LOY | 0.452 *** | 0.177 *** | 0.591 *** | 0.353 *** | 0.312 *** | 0.002 ** | ||||||||||||

| (8.612) | (3.451) | (9.419) | (4.975) | (5.335) | (2.040) | |||||||||||||

| [5.179] | [2.059] | [2.059] | [1.118] | [2.688] | [2.461] | |||||||||||||

| SAT | 0.053 *** | 0.207 *** | 0.592 *** | 0.187 ** | 0.490 *** | 0.228 *** | ||||||||||||

| (10.191) | (3.131) | (8.292) | (2.044) | (8.886) | (3.228) | |||||||||||||

| [2.732] | [2.688] | [5.614] | [2.380] | [1.900] | [3.169] | |||||||||||||

| Constant | 1.403 *** | 0.926 *** | 1.193 *** | 2.268 *** | 0.210 *** | 0.817 ** | 3.890 *** | 0.325 * | 0.738 ** | 1.495 *** | 1.299 *** | 0.942 ** | 4.916 *** | 1.527 *** | 1.648 *** | 3.041 *** | 2.255 *** | 1.777 *** |

| (21.281) | (2.741) | (4.382) | (11.820) | (8.466) | (2.561) | (14.824) | (1.732) | (1.995) | (6.509) | (4.599) | (2.324) | (25.075) | (4.383) | (5.964) | (14.214) | (10.349) | (5.222) | |

| Adj. R2 | 0.249 | 0.371 | 0.432 | 0.362 | 0.444 | 0.608 | 0.212 | 0.296 | 0.317 | 0.405 | 0.344 | 0.515 | 0.213 | 0.305 | 0.391 | 0.275 | 0.377 | 0.536 |

| F | 17.673 *** | 77.190 *** | 99.008 *** | 74.166 *** | 103.852 *** | 41.017 *** | 17.575 *** | 55.185 *** | 60.854 *** | 88.722 *** | 68.757 *** | 28.382 *** | 17.364 *** | 57.591 *** | 83.927 *** | 28.458 *** | 78.960 *** | 30.858 *** |

| Variables | HCE | RCS | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CUP | 1.066 *** | 0.652 *** | ||||||||||

| (9.734) | (6.606) | |||||||||||

| CON | 0.085 ** | 0.047 * | 0.029 ** | 0.011 ** | 0.018 ** | 0.212 *** | 0.182 *** | 0.165 *** | 0.162 *** | 0.158 *** | ||

| (2.255) | (1.820) | (2.527) | (2.225) | (2.159) | (4.167) | (4.304) | (4.296) | (4.223) | (4.268) | |||

| PER | 0.754 *** | 0.442 *** | 0.301 *** | 0.276 ** | 0.582 *** | 0.290 *** | 0.269 *** | 0.239 *** | ||||

| (7.314) | (3.584) | (2.677) | (2.474) | (7.668) | (3.331) | (3.025) | (2.769) | |||||

| TRU | 0.452 *** | 0.265 ** | 0.150 ** | 0.424 *** | 0.397 *** | 0.256 *** | ||||||

| (4.093) | (2.567) | (2.290) | (5.441) | (4.846) | (2.844) | |||||||

| LOY | 0.398 *** | 0.353 *** | 0.058 ** | 0.002 ** | ||||||||

| (5.838) | (4.975) | (2.066) | (2.040) | |||||||||

| SAT | 0.187 ** | 0.228 *** | ||||||||||

| (2.044) | (3.228) | |||||||||||

| Constant | 0.550 ** | 0.890 * | 0.530 ** | 0.435 ** | 0.643 ** | 0.942 ** | 1.614 *** | 4.916 *** | 2.322 *** | 1.793 *** | 1.777 *** | 1.777 *** |

| (2.283) | (1.824) | (2.041) | (2.069) | (2.321) | (2.324) | (4.180) | (5.075) | (6.187) | (5.081) | (5.035) | (5.222) | |

| R2 | 0.225 | 0.012 | 0.305 | 0.387 | 0.518 | 0.534 | 0.254 | 0.119 | 0.398 | 0.513 | 0.517 | 0.554 |

| Var. R2 | 0.012 | 0.293 | 0.082 | 0.131 | 0.016 | 0.119 | 0.279 | 0.115 | 0.004 | 0.037 | ||

| Adj. R2 | 0.21 | 0.004 | 0.294 | 0.372 | 0.503 | 0.515 | 0.248 | 0.113 | 0.389 | 0.501 | 0.502 | 0.536 |

| F | 94.744 *** | 1.575 *** | 27.859 *** | 26.462 *** | 33.579 *** | 28.382 *** | 43.635 *** | 17.364 *** | 41.998 *** | 44.170 *** | 33.448 *** | 30.858 *** |

| Var. F | 1.575 | 53.496 | 16.755 | 34.086 | 4.180 | 17.364 | 58.792 | 29.600 | 1.137 | 10.417 | ||

| Hypothesis Statements | Decisions | ||

|---|---|---|---|

| H1: Convenience in use will have a positive effect on the AI-enabled customer experience. | Fully supported (at least at the 1% level) | ||

| H1a: Convenience in use will have a positive effect on the AI-hedonic customer experience. | Supported (at least at the 5% level) | ||

| H1b: Convenience in use will have a positive effect on the AI-recognition customer experience. | Fully supported (at least at the 1% level) | ||

| H2: Personalization will have a positive effect on the AI-enabled customer experience. | Fully supported (at least at the 1% level) | ||

| H2a: Personalization will have a positive effect on the AI-hedonic customer experience. | Fully supported (at least at the 1% level) | ||

| H2b: Personalization will have a positive effect on the AI-recognition customer experience. | Fully supported (at least at the 1% level) | ||

| H3: Trust will have a positive effect on the AI-enabled customer experience. | Fully supported (at least at the 1% level) | ||

| H3a: Trust will have a positive effect on the AI-hedonic customer experience. | Fully supported (at least at the 1% level) | ||

| H3b: Trust will have a positive effect on the AI-recognition customer experience. | Fully supported (at least at the 1% level) | ||

| H4: Customer loyalty will have a positive effect on the AI-enabled customer experience. | Fully supported (at least at the 1% level) | ||

| H4a: Customer loyalty will have a positive effect on the AI-hedonic customer experience. | Fully supported (at least at the 1% level) | ||

| H4b: Customer loyalty will have a positive effect on the AI-recognition customer experience. | Fully supported (at least at the 1% level) | ||

| H5: Customer satisfaction will have a positive effect on the AI-enabled customer experience. | Fully supported (at least at the 1% level) | ||

| H5a: Customer satisfaction will have a positive effect on the AI-hedonic customer experience. | Fully supported (at least at the 1% level) | ||

| H5b: Customer satisfaction will have a positive effect on the AI-recognition customer experience. | Fully supported (at least at the 1% level) | ||

| H6: Customer perception factors will have a positive effect on the AI-enabled customer experience. | Supported (at least at the 5% level) | ||

| H6a: Customer perception factors will have a positive effect on the AI-hedonic customer experience. | Supported (at least at the 5% level) | ||

| H6b: Customer perception factors will have a positive effect on the AI-recognition customer experience. | Supported (at least at the 5% level) | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tulcanaza-Prieto, A.B.; Cortez-Ordoñez, A.; Lee, C.W. Influence of Customer Perception Factors on AI-Enabled Customer Experience in the Ecuadorian Banking Environment. Sustainability 2023, 15, 12441. https://doi.org/10.3390/su151612441

Tulcanaza-Prieto AB, Cortez-Ordoñez A, Lee CW. Influence of Customer Perception Factors on AI-Enabled Customer Experience in the Ecuadorian Banking Environment. Sustainability. 2023; 15(16):12441. https://doi.org/10.3390/su151612441

Chicago/Turabian StyleTulcanaza-Prieto, Ana Belen, Alexandra Cortez-Ordoñez, and Chang Won Lee. 2023. "Influence of Customer Perception Factors on AI-Enabled Customer Experience in the Ecuadorian Banking Environment" Sustainability 15, no. 16: 12441. https://doi.org/10.3390/su151612441

APA StyleTulcanaza-Prieto, A. B., Cortez-Ordoñez, A., & Lee, C. W. (2023). Influence of Customer Perception Factors on AI-Enabled Customer Experience in the Ecuadorian Banking Environment. Sustainability, 15(16), 12441. https://doi.org/10.3390/su151612441

_Li.png)