The Development of E-Banking Services Quality Measurement Instrument: MPQe-BS

Abstract

:1. Introduction

2. Literature Review

2.1. E-Service Quality

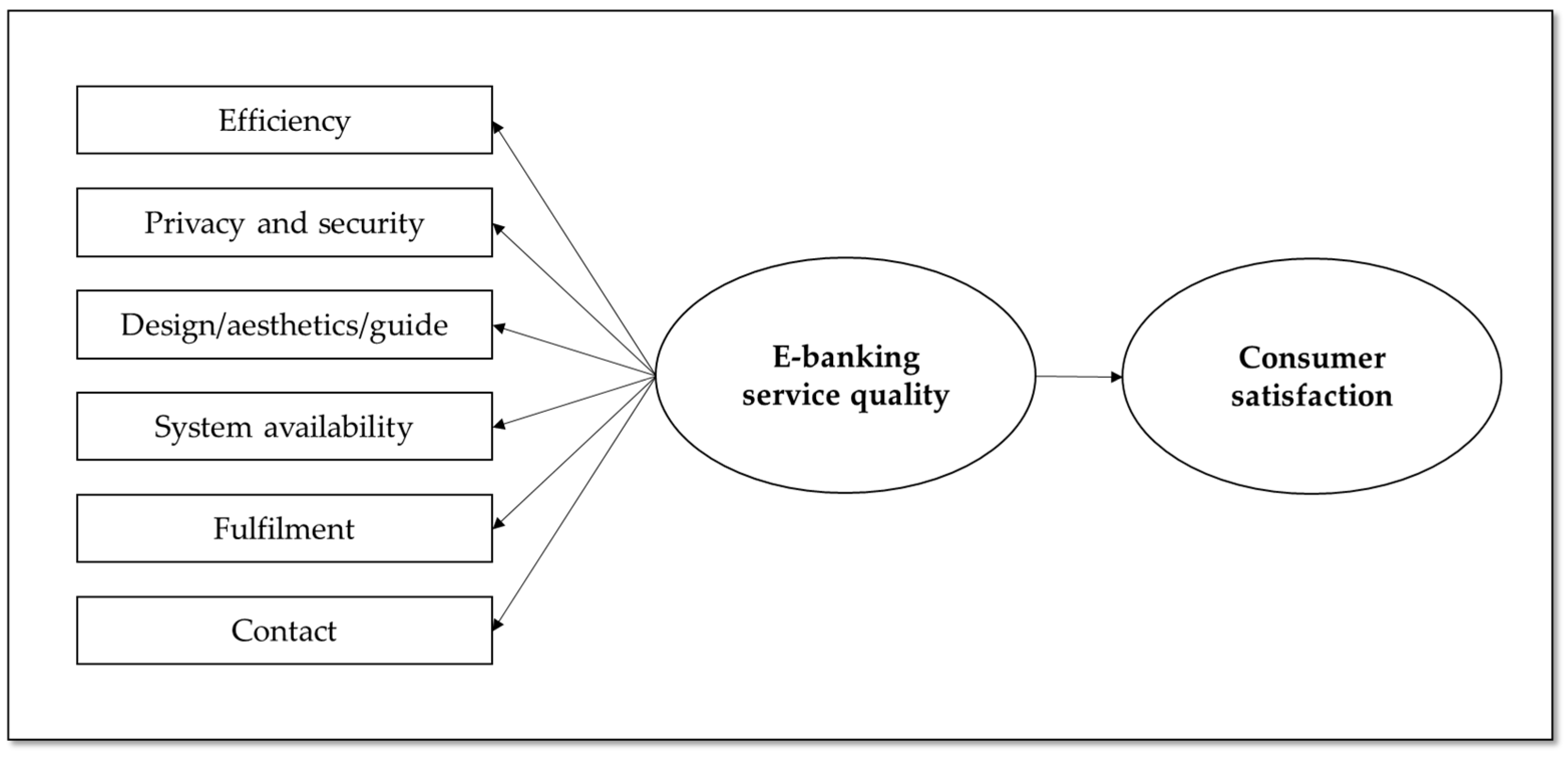

2.2. E-Banking Services and Perceived Service Quality

2.3. E-Banking Service Quality and Satisfaction

3. Materials and Methods

3.1. Specification of the Domain of the Scale

3.2. Item Generation—Preliminary Scale

3.3. Sample Design and Data Collection

4. Results

5. Discussion

5.1. Theoretical Implications

5.2. Managerial Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Malhotra, N.K.; Ulgado, F.M.; Agarwal, J.; Shainesh, G.; Wu, L. Dimensions of Service Quality in Developed and Developing Economies: Multi-Country Cross-Cultural Comparisons. Int. Mark. Rev. 2005, 22, 256–278. [Google Scholar] [CrossRef]

- Eurostat. Institutional Sector Accounts. Available online: https://ec.europa.eu/eurostat/web/sector-accounts/detailed-charts/introduction (accessed on 14 December 2022).

- Gupta, S.; Rhyner, J. Mindful Application of Digitalization for Sustainable Development: The Digitainability Assessment Framework. Sustainability 2022, 14, 3114. [Google Scholar] [CrossRef]

- Renn, O.; Beier, G.; Schweizer, P.-J. The Opportunities and Risks of Digitalisation for Sustainable Development: A Systemic Perspective. GAIA 2021, 30, 23–28. [Google Scholar] [CrossRef]

- Blut, M.; Chowdhry, N.; Mittal, V.; Brock, C. E-Service Quality: A Meta-Analytic Review. J. Retail. 2015, 91, 679–700. [Google Scholar] [CrossRef]

- Oliveira, P.; Aleda, V.R.; Gilland, W. Achieving Competitive Capabilities in E-Services. Technol. Forecast. Soc. Chang. 2002, 69, 721–739. [Google Scholar] [CrossRef]

- Statista. Number of Active online Banking Users Worldwide in 2020 with Forecasts from 2021 to 2024, by Region. Available online: https://www.statista.com/statistics/1228757/online-banking-users-worldwide/ (accessed on 6 December 2022).

- Angelakopoulos, G.; Mihiotis, A. E-Banking: Challenges and Opportunities in the Greek Banking Sector. Electron. Commer. Res. 2011, 11, 297–319. [Google Scholar] [CrossRef]

- Narayanasamy, K.; Rasiah, D.; Tan, T.M. The Adoption and Concerns of E-Finance in Malaysia. Electron. Commer. Res. 2011, 11, 383–400. [Google Scholar] [CrossRef]

- Amin, M. Internet Banking Service Quality and Its Implication on E-Customer Satisfaction and e-Customer Loyalty. Int. J. Bank Mark. 2016, 34, 280–306. [Google Scholar] [CrossRef]

- Nor, K.M.D.; Pearson, M.M. An Exploratory Study into the Adoption of Internet Banking in a Developing Country: Malaysia. J. Internet Commer. 2008, 7, 29–73. [Google Scholar] [CrossRef]

- Weir, C.S.; Anderson, J.N.; Jack, M.A. On the Role of Metaphor and Language in Design of Third Party Payments in EBanking: Usability and Quality. Int. J. Hum. Comput. Stud. 2006, 64, 770–784. [Google Scholar] [CrossRef]

- Yoon, H.S.; Steege, L.M.B. Development of a Quantitative Model of the Impact of Customers’ Personality and Perceptions on Internet Banking Use. Comput. Human Behav. 2013, 29, 1133–1141. [Google Scholar] [CrossRef]

- Laukkanen, T. Internet vs Mobile Banking: Comparing Customer Value Perceptions. Bus. Process Manag. J. 2007, 13, 788–797. [Google Scholar] [CrossRef]

- Ellahi, A.; Jillani, H.; Zahid, H. Customer Awareness on Green Banking Practices. J. Sustain. Financ. Investig. 2021, 13, 1377–1393. [Google Scholar] [CrossRef]

- Fonseca, J.R.S. E-Banking Culture: A Comparison of EU 27 Countries and Portuguese Case in the EU 27 Retail Banking Context. J. Retail. Consum. Serv. 2014, 21, 708–716. [Google Scholar] [CrossRef]

- Chen, R.-F.; Hsiao, J.-L.; Hwang, H.-G. Measuring Customer Satisfaction of Internet Banking in Taiwan: Scale Development and Validation. Total Qual. Manag. Bus. Excell. 2012, 23, 749–767. [Google Scholar] [CrossRef]

- Zhao, A.L.; Koenig-Lewis, N.; Hanmer-Lloyd, S.; Ward, P. Adoption of Internet Banking Services in China: Is It All about Trust. Int. J. Bank Mark. 2010, 28, 7–26. [Google Scholar] [CrossRef]

- Nitsure, R.R. E-Banking: Challenges and Opportunities. Econ. Political Wkly. 2003, 38, 5377–5381. [Google Scholar]

- Furst, K.; Lang, W.W.; Nolle, D.E. Internet Banking. J. Financ. Serv. Res. 2002, 22, 95–117. [Google Scholar] [CrossRef]

- Aracil, E.; Nájera-Sánchez, J.-J.; Forcadell, F.J. Sustainable Banking: A Literature Review and Integrative Framework. Financ. Res. Lett. 2021, 42, 101932. [Google Scholar] [CrossRef]

- United Nations General Assembly. Transforming Our Word: The 2030 Agenda for Sustainable Development; United Nations: New York, NY, USA, 2015. [Google Scholar]

- Sharma, M.; Choubey, A. Green Banking Initiatives: A Qualitative Study on Indian Banking Sector. Environ. Dev. Sustain. 2021, 24, 293–319. [Google Scholar] [CrossRef]

- Carlson, J.; O’Cass, A. Exploring the Relationships between E-Service Quality, Satisfaction, Attitudes and Behaviours in Content-Driven e-Service Web Sites. J. Serv. Mark. 2010, 24, 112–127. [Google Scholar] [CrossRef]

- Ayo, C.k.; Oni, A.A.; Adewoye, O.J.; Eweoya, I.O. E-Banking Users’ Behaviour: E-Service Quality, Attitude, and Customer Satisfaction. Int. J. Bank Mark. 2016, 34, 347–367. [Google Scholar] [CrossRef]

- Amin, M.; Isa, Z. An Examination of the Relationship between Service Quality Perception and Customer Satisfaction: A SEM Approach towards Malaysian Islamic Banking. Int. J. Islam. Middle East. Financ. Manag. 2008, 1, 191–209. [Google Scholar] [CrossRef]

- Anderson, E.W.; Sullivan, M.W. The Antecedents and Consequences of Customer Satisfaction for Firms. Mark. Sci. 1993, 12, 125–143. [Google Scholar] [CrossRef]

- Cronin, J.J.; Brady, M.K.; Hult, G.T.M. Assessing the Effects of Quality, Value, and Customer Satisfaction on Consumer Behavioral Intentions in Service Environments. J. Retail. 2000, 76, 193–218. [Google Scholar] [CrossRef]

- Cronin, J.J.; Taylor, S. Measuring Service Quality—A Reexamination and Extension. J. Mark. 1992, 56, 55–68. [Google Scholar] [CrossRef]

- Kashif, M.; Shukran, S.S.W.; Rehman, M.A.; Sarifuddin, S. Customer Satisfaction and Loyalty in Malaysian Islamic Banks: A PAKSERV Investigation. Int. J. Bank Mark. 2015, 33, 23–40. [Google Scholar] [CrossRef]

- Sheng, T.; Chunlin, L. An Empirical Study on the Effect of E-Service Quality on Online Customer Satisfaction and Loyalty. Nankai Bus. Rev. Int. 2010, 1, 273–283. [Google Scholar] [CrossRef]

- Zeithaml, V.A. Consumer Perceptions of Price, Quality, and Value: A Means-End Model and Synthesis of Evidence. J. Mark. 1988, 52, 2–22. [Google Scholar] [CrossRef]

- Zeithaml, V.A.; Schmalensee, P.; Hill, C.; Carolina, N. More on Improving Service Quality Measurement. J. Retail. 1993, 69, 140–147. [Google Scholar]

- Brady, M.K.; Cronin, J.J. Some New Thoughts on Conceptualizing Perceived Service Quality: A Hierarchical Approach. J. Mark. 2001, 34, 34–49. [Google Scholar] [CrossRef]

- Bahia, K.; Nantel, J. A Reliable and Valid Measurement Scale for the Perceived Service Quality of Banks. Int. J. Bank Mark. 2000, 18, 84–91. [Google Scholar] [CrossRef]

- Çalık, N.; Balta, N.F. Consumer Satisfaction and Loyalty Derived from the Perceived Quality of Individual Banking Services: A Field Study in Eskişehir from Turkey. J. Financ. Serv. Mark. 2006, 10, 135–149. [Google Scholar] [CrossRef]

- Choudhury, K. Service Quality Dimensionality: A Study of the Indian Banking Sector. J. Asia-Pac. Bus. 2007, 8, 21–38. [Google Scholar] [CrossRef]

- Shamdasani, P.; Mukherjee, A.; Malhotra, N. Antecedents and Consequences of Service Quality in Consumer Evaluation of Self-Service Internet Technologies. Serv. Ind. J. 2008, 28, 117–138. [Google Scholar] [CrossRef]

- Parasuraman, A.; Zeithaml, V.A.; Malhotra, A. E-S-QUAL a Multiple-Item Scale for Assessing Electronic Service Quality. J. Serv. Res. 2005, 7, 213–233. [Google Scholar] [CrossRef]

- Ariff, M.S.M.; Yun, L.O.; Zakuan, N.; Jusoh, A. Examining Dimensions of Electronic Service Quality for Internet Banking Services. Procedia Soc. Behav. Sci. 2012, 65, 854–859. [Google Scholar] [CrossRef]

- Gounaris, S.; Dimitriadis, S.; Stathakopoulos, V. An Examination of the Effects of Service Quality and Satisfaction on Customers’ Behavioral Intentions in e-Shopping. J. Serv. Mark. 2010, 24, 142–156. [Google Scholar] [CrossRef]

- Al-Hawari, M.A.A. Does Customer Sociability Matter? Differences in e-Quality, e-Satisfaction, and e-Loyalty between Introvert and Extravert Online Banking Users. J. Serv. Mark. 2014, 28, 538–546. [Google Scholar] [CrossRef]

- Bitner, M.J.; Brown, S.W.; Meuter, M.L. Technology Infusion in Service Encounters. J. Acad. Mark. Sci. 2000, 28, 138–149. [Google Scholar] [CrossRef]

- Dabholkar, P.A. Consumer Evaluations of New Technology-Based Self-Service Options: An Investigation of Alternative Models of Service Quality. Int. J. Res. Mark. 1996, 13, 29–51. [Google Scholar] [CrossRef]

- Parasuraman, P.A.; Zeithaml, V.A.; Berry, L.L. SERVQUAL: A multiple-item scale for measuring consumer perceptions of service quality. J. Retail. 1988, 64, 12–40. [Google Scholar] [CrossRef]

- Wolfinbarger, M.; Gilly, M.C. ETailQ: Dimensionalizing, Measuring and Predicting Etail Quality. J. Retail. 2003, 79, 183–198. [Google Scholar] [CrossRef]

- Loiacono, E.T.; Watson, R.T.; Goodhue, D.L. WebQual: An Instrument for Consumer Evaluation of Web Sites. Int. J. Electron. Commer. 2007, 11, 51–87. [Google Scholar] [CrossRef]

- Shankar, A.; Datta, B. Measuring E-Service Quality: A Review of Literature. Int. J. Serv. Technol. Manag. 2020, 26, 77–100. [Google Scholar] [CrossRef]

- Daniel, E. Provision of Electronic Banking in the UK and the Republic of Ireland. J. Bank Mark. 1999, 17, 72–82. [Google Scholar] [CrossRef]

- Raut, R.; Naoufel, C.; Kharat, M. Sustainability in the Banking Industry: A Strategic Multi-Criterion Analysis. Bus. Strategy Environ. 2017, 26, 550–568. [Google Scholar] [CrossRef]

- Bhalerao, K.; Mahale, P.; Jyothi, V.N.; Yelikar, B. Technology: A Pathway Towards Sustainability. Acad. Mark. Stud. J. 2021, 25, 1–9. [Google Scholar]

- Ho, C.T.B.; Lin, W.C. Measuring the Service Quality of Internet Banking: Scale Development and Validation. Eur. Bus. Rev. 2010, 22, 5–24. [Google Scholar] [CrossRef]

- DeYoung, R.; Lang, W.W.; Nolle, D.L. How the Internet Affects Output and Performance at Community Banks. J. Bank. Financ. 2007, 31, 1033–1060. [Google Scholar] [CrossRef]

- Ribbink, D.; van Riel, A.; Liljander, V.; Streukens, S. Comfort Your Online Customer: Quality, Trust and Loyalty on the Internet. J. Serv. Theory Pract. 2004, 14, 446–456. [Google Scholar] [CrossRef]

- Rod, M.R.M.; Ashill, N.J. The Effect of Customer Orientation on Frontline Employees Job Outcomes in a New Public Management Context. Mark. Intell. Plan. 2010, 28, 600–624. [Google Scholar] [CrossRef]

- Jayawardhena, C. Measurement of Service Quality in Internet Banking: The Development of an Instrument. J. Mark. Manag. 2004, 20, 185–207. [Google Scholar] [CrossRef]

- Zavareh, F.B.; Ariff, M.S.M.; Jusoh, A.; Zakuan, N.; Bahari, A.Z.; Ashourian, M. E-Service Quality Dimensions and Their Effects on E-Customer Satisfaction in Internet Banking Services. Procedia Soc. Behav. Sci. 2012, 40, 441–445. [Google Scholar] [CrossRef]

- Herington, C.; Weaven, S. E-Retailing by Banks: E-Service Quality and Its Importance to Customer Satisfaction. Eur. J. Mark. 2009, 43, 1220–1231. [Google Scholar] [CrossRef]

- Khan, M.A.; Alhumoudi, H.A. Performance of E-Banking and the Mediating Effect of Customer Satisfaction: A Structural Equation Model Approach. Sustainability 2022, 14, 7224. [Google Scholar] [CrossRef]

- Rod, M.; Ashill, N.J.; Shao, J.; Carruthers, J. An Examination of the Relationship between Service Quality Dimensions, Overall Internet Banking Service Quality and Customer Satisfaction: A New Zealand Study. Mark. Intell. Plan. 2009, 27, 103–126. [Google Scholar] [CrossRef]

- Siu, N.Y.M.; Mou, J.C.W. Measuring Service Quality in Internet Banking: The Case of Hong Kong. J. Int. Consum. Mark. 2005, 17, 99–116. [Google Scholar] [CrossRef]

- Sohail, S.M.; Shaikh, N.M. Internet Banking and Quality of Service Perspectives from a Developing Nation in the Middle East. Online Inf. Rev. 2008, 32, 58–72. [Google Scholar] [CrossRef]

- Zeithaml, V.A.; Parasuraman, P.A.; Malhotra, A. Service Quality Delivery through Web Sites: A Critical Review of Extant Knowledge. J. Acad. Mark. Sci. 2002, 30, 362–375. [Google Scholar] [CrossRef]

- Berry, L.L.; Parasuraman, P.A.; Zeithaml, V.A. The Service-Quality Puzzle. Bus. Horiz. 1988, 31, 35–43. [Google Scholar] [CrossRef]

- Zeithaml, V.A.; Parasuraman, P.A.; Malhotra, A. A Conceptual Framework for Understanding E-Service Quality: Implications for Future Research and Managerial Practice; Marketing Science Institute: Cambridge, MA, USA, 2000. [Google Scholar]

- Shankar, A.; Jebarajakirthy, C. The Influence of E-Banking Service Quality on Customer Loyalty: A Moderated Mediation Approach. Int. J. Bank Mark. 2019, 37, 1119–1142. [Google Scholar] [CrossRef]

- Wang, Y.S.; Wang, Y.M.; Lin, H.H.; Tang, T.I. Determinants of User Acceptance of Internet Banking: An Empirical Study. Int. J. Serv. Ind. Manag. 2003, 14, 501–519. [Google Scholar] [CrossRef]

- Marimon, F.; Petnji Yaya, L.H.; Casadesus Fa, M. Impact of E-Quality and Service Recovery on Loyalty: A Study of e-Banking in Spain. Total Qual. Manag. Bus. Excell. 2012, 23, 769–787. [Google Scholar] [CrossRef]

- Oliver, R.L. Satisfaction. A Behavioral Perspective on the Consumer; Irwin/McGraw-Hill: Boston, MA, USA, 1997. [Google Scholar]

- Rust, R.T.; Zahorik, A.J. Customer Satisfaction, Customer Retention, and Market Share. J. Retail. 1993, 69, 193–215. [Google Scholar] [CrossRef]

- Ariff, M.S.M.; Yun, L.O.; Zakuan, N.; Ismail, K. The Impacts of Service Quality and Customer Satisfaction on Customer Loyalty in Internet Banking. Procedia Soc. Behav. Sci. 2013, 81, 469–473. [Google Scholar] [CrossRef]

- Floh, A.; Treiblmaier, H. What Keeps the E-Banking Customer Loyal? A Multigroup Analysis of the Moderating Role of Consumer Characteristics on E-Loyalty in the Financial Service Industry. SSRN Electron. J. 2015, 7, 97–110. [Google Scholar] [CrossRef]

- George, A.; Kumar, G.S.G. Impact of Service Quality Dimensions in Internet Banking on Customer Satisfaction. Decision 2014, 41, 73–85. [Google Scholar] [CrossRef]

- Churchill, G.A. A Paradigm for Developing Better Measures of Marketing Constructs. J. Mark. Res. 1979, 16, 64. [Google Scholar] [CrossRef]

- Malhotra, N.K.; Nunan, D.; Birks, D. Marketing Research: An Applied Approach, 5th ed.; Pearson Education Limited: London, UK, 2017. [Google Scholar]

- Ledbetter, A.M. Measuring Online Communication Attitude: Instrument Development and Validation. Comun. Monogr. 2009, 76, 463–486. [Google Scholar] [CrossRef]

- Cheung, C.M.K.; Lee, M.K.O. Trust in Internet Shopping: Instrument Development and Validation through Classical and Modern Approaches. J. Glob. Inf. Manag. 2001, 9, 23–35. [Google Scholar] [CrossRef]

- Kim, J.K.; Sharman, R.; Rao, R.H.; Upadhyaya, S. Efficiency of Critical Incident Management Systems: Instrument Development and Validation. Decis. Support Syst. 2007, 44, 235–250. [Google Scholar] [CrossRef]

- Harrington, D. Confirmatory Factor Analysis; Oxford University Press: Oxford, UK, 2008. [Google Scholar]

- Raykov, T. Estimation of Composite Reliability for Congeneric Measures. Appl. Psychol. Meas. 1997, 21, 173–184. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A New Criterion for Assessing Discriminant Validity in Variance-Based Structural Equation Modeling. J. Acad. Mark. Sci. 2014, 43, 115–135. [Google Scholar] [CrossRef]

- Steenkamp, J.E.M.; Baumgartner, H. Assessing Measurement Invariance in Cross-National Consumer Research. J. Consum. Res. 1998, 25, 78–90. [Google Scholar] [CrossRef]

- Vandenberg, R.; Lance, C. A Review and Synthesis of the Measurement Invariance Literature: Suggestions, Practices, and Recommendations for Organizational Research. Organ. Res. Methods 2000, 3, 4–70. [Google Scholar] [CrossRef]

- Nova, KBM. ESG Poročilo Skupine Nove KBM in Nove KBM d.d. Za Leto 2021; Nova KBM: Maribor, Slovenia, 2021. [Google Scholar]

- Seele, P.; Lock, I. The Game-Changing Potential of Digitalization for Sustainability: Possibilities, Perils, and Pathways. Sustain. Sci. 2017, 12, 183–185. [Google Scholar] [CrossRef]

- van der Velden, M. Digitalisation and the UN Sustainable Development Goals: What Role for Design. Interacion Des. Archit. J. 2018, 37, 160–174. [Google Scholar] [CrossRef]

- Kuntsman, A.; Rattle, I. Towards a Paradigmatic Shift in Sustainability Studies: A Systematic Review of Peer Reviewed Literature and Future Agenda Setting to Consider Environmental (Un)Sustainability of Digital Communication. Environ. Commun. 2019, 13, 567–581. [Google Scholar] [CrossRef]

| Determinants | E-Services Quality | E-Retailing | E-Banking | Websites/Shopping Sites |

|---|---|---|---|---|

| Privacy and Security | 1 | 1 | 1 | 3 |

| Reliability | 2 | 6 | 9 | - |

| Efficiency | 3 | 5 | 2 | 8 |

| Website design | 4 | 3 | 7 | 1 |

| Responsiveness | 5 | - | 3 | 4 |

| System availability | 6 | 2 | 6 | 10 |

| Fulfilment | 7 | 4 | 8 | 9 |

| Ease of use | 8 | - | 5 | 7 |

| Assurance | 9 | - | 4 | 5 |

| Access | - | 7 | - | - |

| Credibility | - | 8 | - | - |

| Information | - | - | - | 2 |

| Content | - | - | - | 6 |

| Dimensions of E-Banking Service Quality | Studies |

|---|---|

| Efficiency/reliability | [25,40,57,58,61,66] |

| Security/privacy | [25,40,57,61,66] |

| Web interface/design/site organization/site aesthetics | [56,57,58,66] |

| Trust/Assurance | [56,57,66] |

| Responsiveness/contact/information provision | [25,40,58] |

| Ease of use/usability/user friendliness | [57,58] |

| System availability/Access | [25,40,56] |

| Credibility/Competence | [25,56,61] |

| Fulfilment | [40,57] |

| Customer service/support/problem handling | [61,66] |

| Personal needs/preferential treatment/incentives | [58] |

| Attention/Empathy | [56] |

| Service portfolio | [25] |

| Efficiency/reliability | [25,40,57,58,61,66] |

| Security/privacy | [25,40,57,61,66] |

| Web interface/design/site organization/site aesthetics | [56,57,58,66] |

| Trust/Assurance | [56,57,66] |

| Responsiveness/contact/information provision | [25,40,57] |

| Ease of use/usability/user friendliness | [57,58] |

| System availability/Access | [25,40,56] |

| Credibility/Competence | [25,56,61] |

| Fulfilment | [40,57] |

| Customer service/support/problem handling | [61,66] |

| Personal needs/preferential treatment/incentives | [58] |

| Attention/Empathy | [56] |

| Service portfolio | [25] |

| Dimension | Details |

|---|---|

| Efficiency | E-banking services are easy to use, efficient and well organized. |

| Privacy and security | E-banking service provides protection of personal and financial data and enables secure transactions. |

| Design/aesthetics/guide | Platform through which e-banking transactions are carried out is up-to-date, well organized, easy to navigate and aesthetic. |

| System availability | Consumers can access and carry out e-banking services when needed with no availability issues. |

| Fulfilment | E-banking services are delivered as promised and fulfil consumer demands and expectations. |

| Contact | Consumers can reach out to the e-banking service provider when they encounter issues with the platform. |

| Dimension | Items |

|---|---|

| Efficiency | This e-banking site makes it easy to find what I need. It makes it easy to get anywhere on the site. This e-banking site enables me to complete a transaction quickly. Information at this e-banking site is well organized. This e-banking site loads its pages fast. This e-banking site is simple to use. This e-banking site enables me to get on to it quickly. This site is well organized. |

| Privacy and security | My personal information is protected on this e-banking site. My financial information is protected on this e-banking site. The transactions over this e-banking site are secured. |

| Design/aesthetics/guide | The e-banking site is updated regularly. The e-banking site is well organized. The e-banking site includes interactive features. The e-banking site is easy to use. The e-banking site design is aesthetically attractive. The e-banking site design is visually pleasing. |

| System availability | This e-banking site is always available for business. This e-banking site launches and runs right away. This e-banking site does not crash. Pages at this e-banking site do not freeze after I enter the required information. This e-banking site always provides the services at the promised time. * |

| Fulfilment | This e-banking site makes services available within a suitable time frame. When the bank promises to do something by a certain time, it does so. It is truthful about its offerings. The bank makes accurate promises about the services being delivered. It takes care of problems promptly. |

| Contact | This e-banking site provides a telephone number to reach the company. This e-banking site has customer service representatives available online. Quickly resolves online transaction problems. This e-banking site offers the ability to speak to a live person if there is a problem. Customer service personnel are always willing to help me on matters relating to e-banking.* |

| Croatia | Slovenia | Total | |

|---|---|---|---|

| Sample size | 207 (62%) | 128 (38%) | 335 |

| Gender | |||

| Female | 132 (64%) | 98 (77%) | 230 (69%) |

| Male | 75 (36%) | 30 (23%) | 105 (31%) |

| Average age | 36.9 | 41.5 | 38.7 |

| Education | |||

| Primary school | 6 (3%) | 0 | 6 (2%) |

| High school | 174 (84% | 49 (38%) | 223 (67%) |

| Pre-graduate study | 27 (13%) | 48 (38%) | 75 (22%) |

| Graduate study | 0 | 27 (21%) | 27 (8%) |

| Postgraduate | 0 | 4 (3%) | 4 (1%) |

| Income | |||

| Up to 250 €/2000 HRK | 13 (6%) | 1 (1%) | 14 (4%) |

| 251–500 €/2001–3500 HRK | 20 (10%) | 7 (6%) | 27 (8%) |

| 501–1000 €/3501–7500 HRK | 117 (57%) | 35 (27%) | 152 (45%) |

| 1001–1500 €/7501–10,000 HRK | 49 (24%) | 43 (34%) | 92 (28%) |

| More than 1500 €/10,000 HRK | 8 (4%) | 42 (33%) | 50 (15%) |

| Factor Loadings | |||||||

|---|---|---|---|---|---|---|---|

| Items | F1 | F2 | F3 | F4 | F5 | F6 | Commu. |

| This e-banking site is simple to use. | 0.718 | 0.829 | |||||

| It is easy to get anywhere on this e-banking site. | 0.703 | 0.731 | |||||

| This e-banking site is easy to access. | 0.655 | 0.411 | 0.771 | ||||

| Information at this e-banking site is well organized. | 0.653 | 0.400 | 0.732 | ||||

| This e-banking site enables me to complete a transaction quickly. | 0.652 | 0.617 | |||||

| This e-banking site simplifies banking transactions. | 0.610 | 0.610 | |||||

| This e-banking site is well organized. | 0.599 | 0.422 | 0.808 | ||||

| This e-banking site launches and works without issues. | 0.738 | 0.719 | |||||

| This e-banking site does not crash. | 0.732 | 0.680 | |||||

| Pages at this e-banking site do not freeze after I enter the required information. | 0.693 | 0.670 | |||||

| This e-banking site is always available for business. | 0.576 | 0.615 | |||||

| This e-banking sites’ design is aesthetical. | 0.690 | 0.686 | |||||

| The e-banking site design is visually pleasing. | 0.578 | 0.637 | |||||

| The e-banking site includes interactive features. | 0.518 | 0.513 | |||||

| This e-banking site has online customer service available. | 0.836 | 0.647 | |||||

| This e-banking site offers the ability to speak to a live person if there is a problem. | 0.689 | 0.607 | |||||

| This e-banking site provides a telephone number to reach the company. | 0.599 | 0.509 | |||||

| Quickly resolves online transaction problems. | 0.531 | 0.628 | |||||

| My financial information is protected on this e-banking site. | 0.834 | 0.933 | |||||

| My personal information is protected on this e-banking site. | 0.812 | 0.900 | |||||

| The transactions over this e-banking site are secured. | 0.776 | 0.869 | |||||

| This e-banking site is truthful about its offerings. | 0.813 | 0.806 | |||||

| This e-banking site makes accurate promises about the services being delivered. | 0.758 | 0.804 | |||||

| When this e-banking site promises to do something by a certain time, it does so. | 0.617 | 0.611 | |||||

| This e-banking site takes care of problems promptly. | 0.617 | 0.660 | |||||

| F1 | F2 | F3 | F4 | F5 | F6 | Total | |

| Cronbach α | 0.94 | 0.88 | 0.84 | 0.85 | 0.97 | 0.91 | |

| Eigenvalue | 13.2 | 1.5 | 1.0 | 1.1 | 1.1 | 1.8 | 19.7 |

| Explained variance (%) | 52.6 | 6.0 | 4.0 | 4.6 | 4.4 | 7.0 | 78.6 |

| Construct | Item | Mean | SD | β | CR | AVE |

|---|---|---|---|---|---|---|

| Efficiency | This e-banking site is simple to use. | 4.21 | 0.768 | 0.925 | 0.936 | 0.680 |

| It is easy to get anywhere on this e-banking site. | 4.19 | 0.796 | 0.843 | |||

| This e-banking site is easy to access. | 4.31 | 0.725 | 0.870 | |||

| Information at this e-banking site is well organized. | 4.11 | 0.800 | 0.821 | |||

| This e-banking site enables me to complete a transaction quickly | 4.30 | 0.775 | 0.701 | |||

| This e-banking site simplifies banking transactions. | 4.39 | 0.742 | 0.680 | |||

| This e-banking site is well organized. | 4.18 | 0.768 | 0.901 | |||

| Availability | This e-banking site launches and works without issues. | 4.17 | 0.744 | 0.900 | 0.881 | 0.651 |

| This e-banking site does not crash. | 3.95 | 0.921 | 0.789 | |||

| Pages at this e-banking site do not freeze after I enter the required information. | 4.06 | 0.912 | 0.748 | |||

| This e-banking site is always available for business. | 4.22 | 0.732 | 0.784 | |||

| Design | This e-banking sites’ design is aesthetical. | 3.84 | 0.886 | 0.873 | 0.847 | 0.651 |

| The e-banking site design is visually pleasing. | 3.85 | 0.888 | 0.824 | |||

| The e-banking site includes interactive features. | 3.91 | 0.774 | 0.714 | |||

| Contact | This e-banking site has online customer service available. | 4.10 | 0.867 | 0.817 | 0.853 | 0.594 |

| This e-banking site offers the ability to speak to a live person if there is a problem. | 3.85 | 0.963 | 0.789 | |||

| This e-banking site provides a telephone number to reach the company. | 4.30 | 0.776 | 0.680 | |||

| Quickly resolves online transaction problems. | 3.99 | 0.821 | 0.791 | |||

| Security | My financial information is protected on this e-banking site. | 4.10 | 0.799 | 0.991 | 0.971 | 0.918 |

| My personal information is protected on this e-banking site. | 4.10 | 0.809 | 0.951 | |||

| The transactions over this e-banking site are secured. | 4.15 | 0.783 | 0.932 | |||

| Fulfilment | This e-banking site is truthful about its offerings. | 3.87 | 0.945 | 0.922 | 0.916 | 0.734 |

| This e-banking site makes accurate promises about the services being delivered. | 3.85 | 0.935 | 0.928 | |||

| When this e-banking site promises to do something by a certain time, it does so. | 3.96 | 0.924 | 0.764 | |||

| This e-banking site takes care of problems promptly. | 3.87 | 0.825 | 0.801 | |||

| χ2 = 675.970 (258); CFI = 0.945; SRMR = 0.051; RMSEA = 0.070; NFI = 0.915; IFI = 0.945 | ||||||

| Efficiency | Availability | Design | Contact | Security | Fulfilment | |

|---|---|---|---|---|---|---|

| Efficiency | 0.825 | |||||

| Availability | 0.787 *** | 0.807 | ||||

| Design | 0.748 *** | 0.674 *** | 0.807 | |||

| Contact | 0.627 *** | 0.558 *** | 0.580 *** | 0.771 | ||

| Security | 0.680 *** | 0.582 *** | 0.604 *** | 0.659 *** | 0.958 | |

| Fulfilment | 0.659 *** | 0.628 *** | 0.727 *** | 0.660 *** | 0.575 *** | 0.857 |

| Efficiency | Availability | Design | Contact | Security | Fulfilment | |

|---|---|---|---|---|---|---|

| Efficiency | - | |||||

| Availability | 0.710 | - | ||||

| Design | 0.678 | 0.611 | - | |||

| Contact | 0.566 | 0.488 | 0.502 | - | ||

| Security | 0.657 | 0.558 | 0.576 | 0.601 | - | |

| Fulfilment | 0.660 | 0.601 | 0.661 | 0.597 | 0.543 | - |

| Invariance Type | χ2 | df | IFI | TLI | CFI | RMSEA |

|---|---|---|---|---|---|---|

| Configural invariance | 1086.458 | 514 | 0.927 | 0.914 | 0.926 | 0.058 |

| Full metric invariance | 1127.239 | 533 | 0.924 | 0.914 | 0.924 | 0.058 |

| Partial metric invariance | 1117.909 | 530 | 0.925 | 0.914 | 0.924 | 0.058 |

| Full scalar invariance | 1201.709 | 555 | 0.917 | 0.910 | 0.917 | 0.059 |

| Partial scalar invariance | 1153.211 | 548 | 0.923 | 0.915 | 0.922 | 0.058 |

| Item | Slovenia | Croatia |

|---|---|---|

| EFFICIENCY | ||

| This e-banking site is simple to use. | 0.911 | 0.927 |

| It is easy to get anywhere on this e-banking site. | 0.816 | 0.852 |

| This e-banking site is easy to access. | 0.854 | 0.888 |

| Information at this e-banking site is well organized. | 0.804 | 0.852 |

| This e-banking site enables me to complete a transaction quickly.* | 0.544 | 0.757 |

| This e-banking site simplifies banking transactions. | 0.642 | 0.689 |

| This e-banking site is well organized. | 0.817 | 0.928 |

| AVAILABILITY | ||

| This e-banking site launches and works without issues. | 0.886 | 0.899 |

| This e-banking site does not crash. | 0.742 | 0.838 |

| Pages at this e-banking site do not freeze after I enter the required information. | 0.741 | 0.759 |

| This e-banking site is always available for business. | 0.765 | 0.796 |

| DESIGN | ||

| This e-banking sites’ design is aesthetical. | 0.790 | 0.929 |

| The e-banking site design is visually pleasing. | 0.737 | 0.902 |

| The e-banking site includes interactive features. | 0.597 | 0.722 |

| CONTACT | ||

| This e-banking site has online customer service available. * | 0.708 | 0.869 |

| This e-banking site offers the ability to speak to a live person if there is a problem. * | 0.674 | 0.865 |

| This e-banking site provides a telephone number to reach the company. | 0.679 | 0.670 |

| Quickly resolves online transaction problems. | 0.804 | 0.781 |

| SECURITY | ||

| My financial information is protected on this e-banking site. | 0.986 | 0.991 |

| My personal information is protected on this e-banking site. | 0.951 | 0.952 |

| The transactions over this e-banking site are secured. | 0.946 | 0.930 |

| FULFILMENT | ||

| This e-banking site is truthful about its offerings. | 0.886 | 0.933 |

| This e-banking site makes accurate promises about the services being delivered. | 0.884 | 0.945 |

| When this e-banking site promises to do something by a certain time, it does so. | 0.719 | 0.777 |

| This e-banking site takes care of problems promptly. | 0.716 | 0.827 |

| Measurement Model Item | Construct Loadings (Combined) | Construct Loadings (Slovenia) | Construct Loadings (Croatia) |

|---|---|---|---|

| E-BANKING SERVICE QUALITY | |||

| Efficiency | 0.865 | 0.767 | 0.911 |

| Availability | 0.775 | 0.751 | 0.788 |

| Fulfilment | 0.785 | 0.812 | 0.764 |

| Contact | 0.685 | 0.641 | 0.714 |

| Security | 0.746 | 0.738 | 0.763 |

| Design | 0.785 | 0.781 | 0.785 |

| CONSUMER SATISFACTION | |||

| Satisfaction with transaction processing. | 0.861 | 0.900 | 0.906 |

| Satisfaction with the decision to use e-banking site. | 0.875 | 0.856 | 0.887 |

| High satisfaction with e-banking site. | 0.904 | 0.865 | 0.862 |

| E-banking site exceeded expectations. | 0.788 | 0.760 | 0.830 |

| Dependent construct | Coefficient (combined) | Coefficient (Slovenia) | Coefficient (Croatia) |

| Consumer satisfaction | |||

| E-banking service quality | 0.883 | 0.834 | 0.907 |

| R2 | 0.780 | 0.696 | 0.823 |

| Goodness-of-fit statistics | Combined | Group analysis | |

| χ2 | 112.695 | 196.042 | |

| df | 34 | 77 | |

| CFI | 0.968 | 0.953 | |

| IFI | 0.968 | 0.953 | |

| TLI | 0.958 | 0.954 | |

| NFI | 0.955 | 0.925 | |

| SRMR | 0.033 | 0.079 | |

| RMSEA | 0.083 | 0.068 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Malc, D.; Dlačić, J.; Pisnik, A.; Milfelner, B. The Development of E-Banking Services Quality Measurement Instrument: MPQe-BS. Sustainability 2023, 15, 12659. https://doi.org/10.3390/su151612659

Malc D, Dlačić J, Pisnik A, Milfelner B. The Development of E-Banking Services Quality Measurement Instrument: MPQe-BS. Sustainability. 2023; 15(16):12659. https://doi.org/10.3390/su151612659

Chicago/Turabian StyleMalc, Domen, Jasmina Dlačić, Aleksandra Pisnik, and Borut Milfelner. 2023. "The Development of E-Banking Services Quality Measurement Instrument: MPQe-BS" Sustainability 15, no. 16: 12659. https://doi.org/10.3390/su151612659

APA StyleMalc, D., Dlačić, J., Pisnik, A., & Milfelner, B. (2023). The Development of E-Banking Services Quality Measurement Instrument: MPQe-BS. Sustainability, 15(16), 12659. https://doi.org/10.3390/su151612659