1. Introduction

The Russia–Ukraine conflict is a significant event with far-reaching global implications. The decision and the inflation, energy price increases, and impact on energy security that it has triggered have sparked global concern and created important food for thought [

1] and research needs for a significant global energy consumer such as China. In the current landscape of international relations, oil demand is influenced by various factors, including geopolitical changes [

2,

3,

4]. Volatility and tensions in the international political landscape can lead to uncertainty and volatility in oil markets. Geopolitical events, such as conflicts, sanctions, or trade disputes, can lead to disruptions or restrictions on oil supply, affecting global energy markets and prices [

5,

6]. As one of the world’s largest oil importers, China must pay close attention to the potential impact of geopolitical risks on oil supplies and take measures to ensure the stability of energy supplies.

In addition, the international relations landscape also has important implications for the achievement of the Sustainable Development Goals (SDGs). The SDGs aim to achieve sustainable economic, social, and environmental development. However, tensions and instability in international relations can lead to resource competition, environmental damage, and impediments to sustainable development efforts. As a major global energy consumer, China needs to balance energy supply and demand while actively promoting sustainable energy development, reducing dependence on traditional oil-based energy sources, improving energy efficiency, and adopting environmental protection and carbon reduction measures to advance the achievement of the SDGs [

7].

Therefore, an in-depth study of the impact of the international relations landscape on oil demand and sustainable development goals is of great importance to China. Such research can help Chinese policymakers and relevant stakeholders better understand the impact of the international environment on energy supply and demand; anticipate and respond to potential challenges; and develop corresponding policies and strategies to achieve the goals of energy security, sustainable development, and environmental protection. It also helps to enhance international cooperation and joint efforts to promote sustainable development and action against climate change globally.

Existing literature has provided insights into international relations, energy security, and achieving SDGs. Zhao believes that resources are only one of the factors triggering conflicts, and resources cannot be controlled [

8]. Overseas investments do not equate to controlling another country’s resources. Furthermore, energy security cannot be equated with a “self-sufficiency” type of energy independence. Countries should establish a perspective of interdependent energy, emphasizing the impact of global integration and marketization on global energy allocation and development. Chapman et al. emphasize the importance of culture and education, highlighting the significance of raising awareness about more than just energy transitions and higher education levels in fostering positive attitudes towards environmental improvement [

9]. It is also suggested that targeted education can align behavior, desires, and expectations with the vision of a more equitable future energy system in advanced economies [

10]. Fang et al. constructed a model for assessing China’s sustainable energy security, identifying availability and developability as the most crucial factors [

11]. They found that while availability declined, developability exhibited an inverted U-shaped pattern, particularly around 2010, indicating fluctuations in China’s sustainable energy security level. Hosan et al. discovered a significant cointegration relationship between energy subsidies and technology innovation, suggesting that removing energy subsidies can stimulate innovation and the adoption of renewable-based multi-energy poly-generation systems [

12]. Eras-Almeida et al. highlighted challenges in disadvantaged regions such as small islands and rural areas in developing countries, where energy security is limited by fuel dependence, leading to higher electricity prices or limited access to electricity [

13]. Achieving SDG 7 requires involving more people, applying diverse business models, embracing technological innovations, and using technical quality procedures, offering a path to address energy, environmental, and societal challenges.

However, the current literature still lacks comprehensive quantitative and economic analyses, especially directly addressing the intersection of geopolitical events, energy security, and sustainable development goals. The focus in sustainable development has been mainly on reducing carbon emissions, enhancing energy efficiency, and promoting renewable energy utilization. There is a lack of exploration in the literature on how international political events affect the achievement of sustainable development goals, particularly concerning energy supply and demand. This highlights the need for further research and analysis in these areas.

This study aims to address the gaps in the existing literature concerning the interplay between international relations, energy security, and sustainable development, particularly in the context of employing quantitative analytical methods. While some studies have initiated the exploration of the impact of international geopolitical events on energy supply and demand, there remains a lack of systematic quantitative analysis, and the examination within the framework of sustainable development goals remains relatively limited. Hence, the uniqueness of this research lies in thoroughly examining how international relations events affect China’s energy supply and demand, while also investigating how to balance energy security and environmental protection within the context of sustainable development goals.

2. Materials and Methods

2.1. Data Screening and Variable Selection

For monthly data, we found Brent crude oil futures closing price data and international conflict scare data for each month from January 1994 to December 2019 [

14]. The year 1994 was chosen as the starting year because data availability was considered, and China’s engagement with the world deepened after Deng Xiaoping officially launched his southern tour in 1992. Furthermore, the data for China’s new energy sources are available only after 1994. The year 2019 was chosen as the endpoint because the famous COVID-19 pandemic broke out in 2020, which was too drastic a shock to the entire international economy and energy consumption, resulting in data that are no longer representative in the years following.

We used the B.P. Statistical Yearbook to find annual data on China’s crude oil imports, Middle East crude oil exports, China’s carbon emissions, and China’s new energy consumption [

15]. We then took the 12-month average of the geopolitical risk (GPR) index and Brent as annual data for one year [

16]. We found China’s GDP data through the World Bank database. The further treatment of variables will be illustrated in

Section 3.1 and 3.2.

2.2. Research Methodology

We mainly used the time series analysis method widely used in macroeconomic analysis. In the energy field, it can be used to study and forecast energy demand, price fluctuations, supply trends, and the functioning of energy markets. In particular, we focus on using the Hodrick–Prescott (H.P.) filter method and the cointegration analysis.

The H.P. filter is a commonly used time series analysis method that separates the long-term trend from the short-term fluctuation component of economic data [

17,

18]. Its purpose is to separate the cyclical component from the raw data of a time series, resulting in a smoothed representation that is more responsive to long-term trends than short-term fluctuations.

The methodology of the Hodrick–Prescott filter draws inspiration from the decomposition of time series. The time series variable

, representing the logarithms of the data, is assumed to consist of a trend component

, a cyclical component

, and an error component

. Mathematically, this is represented as

. The objective is to find a trend component that minimizes the sum of squared deviations between the observed data and the trend while penalizing variations in the cyclical component and the growth rate of the trend component. A multiplier controls the filter’s sensitivity to short-term fluctuations

λThe H.P. filter is defined by an equation that involves the lag operator

L. The exact formulation of the filter can be derived from the first-order condition of the minimization problem.

The H.P. filter, along with several other filtering methods such as the Baxter–King filter [

19], Christiano–Fitzgerald filter [

20], and Hamilton filter [

21], are commonly used techniques in the fields of economics and finance for time series analysis. They are designed to extract trend and cyclical components from raw data to facilitate a better understanding of economic or financial phenomena.

These filters all aim to decompose time series data into trend and cyclical components, enabling a more insightful examination and analysis of the data’s underlying structure. However, these filters employ distinct mathematical algorithms to separate trends from cycles. For instance, the H.P. filter employs quadratic regularization for smoothing to balance trends and fluctuations, while the Baxter–King filter utilizes band-pass filtering to capture cycles.

Different filters may require the adjustment of varying parameters, such as smoothing parameters or the frequency of cyclical components. The choice of these parameters can impact the filtering results. The strengths of the H.P. filter lie in its simplicity and broad applicability, allowing a partial balance between trends and fluctuations. Nevertheless, its drawback is its sensitivity to high-frequency noise during trend and fluctuation separation, potentially leading to noise contamination in the fluctuation component.

The use of the H.P. filter has also sparked some controversy, most notably in Hamilton [

21]. Hamilton suggests using autoregression (A.R.) as an alternative to the H.P. filter. However, some recent empirical studies have even provided more support for using the H.P. filter than Hamilton [

22,

23]. While the H.P. filter might be sensitive to high-frequency noise, in some instances, its ability to balance trends and fluctuations is beneficial for observing long-term trends in data. Furthermore, to conduct H.P. analysis, monthly data with a lower frequency mitigate this sensitivity. Following the research’s objectives, data characteristics, and the necessity to study trend and cyclical components, the H.P. filter was ultimately selected.

In addition, cointegration is a statistical concept that applies to a set of time series variables

[

24]. It refers to the property that, if all the series are integrated of the same order (d) and a linear combination of these variables is integrated of a lower order than d, then the series are considered cointegrated. Cointegration implies a long-term relationship between the variables, even if they individually exhibit trends or stochastic behavior.

The notion of cointegration has gained significant importance in modern time series analysis. Many economic variables, such as GNP, wages, and employment, often exhibit trends that may be deterministic or stochastic. A seminal paper by Nelsonet et al. [

25] provided empirical evidence suggesting that several macroeconomic time series in the United States display stochastic trends. This finding underscores the significance of cointegration in understanding the underlying relationships among these variables.

In the energy sector, cointegration analysis can be used to study the long-run equilibrium relationship between energy prices and the long-run relationship between energy supply and economic growth.

3. Results

3.1. The H.P. Filter Analysis

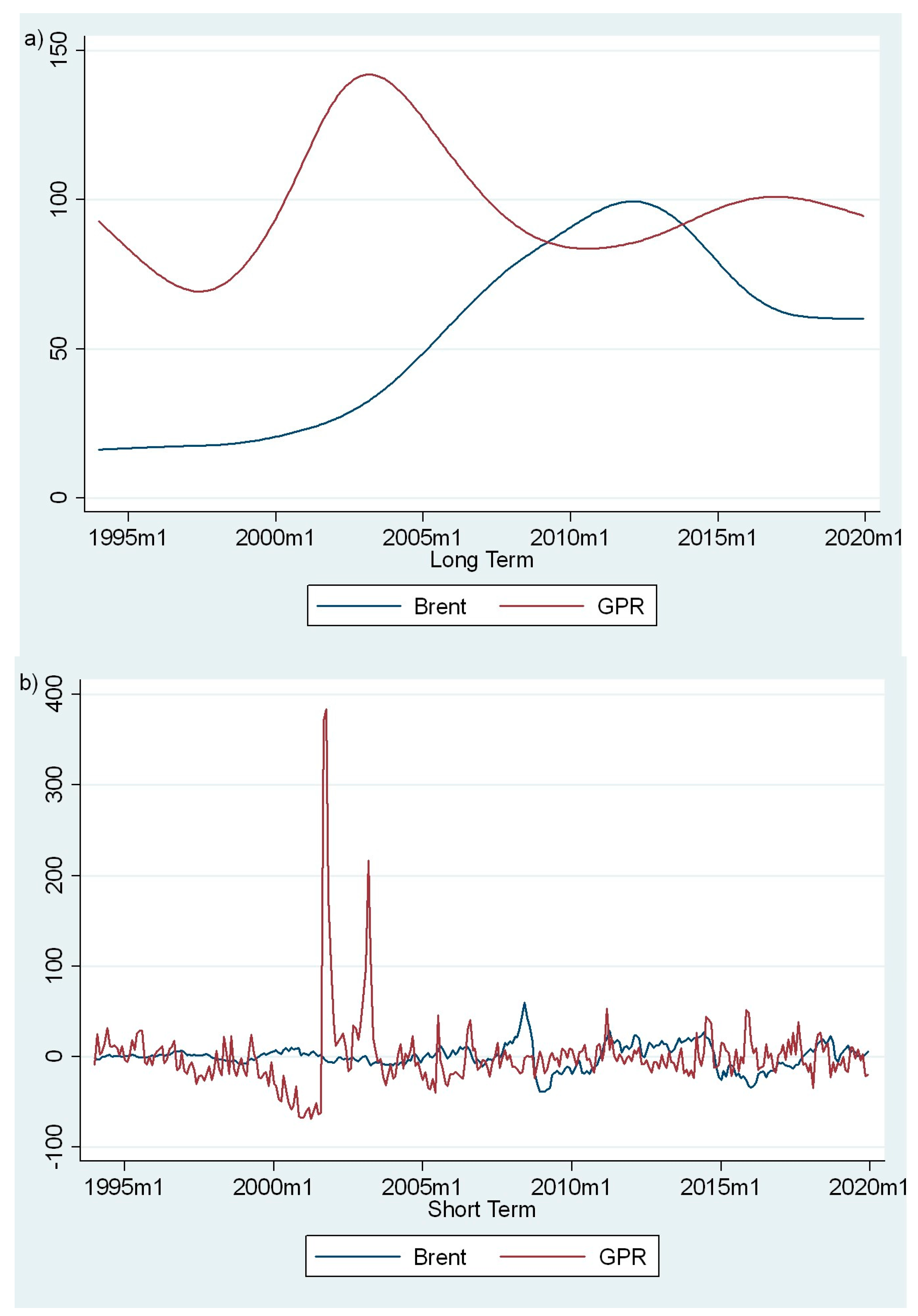

We use Stata 15.1 and the command “hprescott” to perform H.P. filter decomposition for Brent and GPR, with λ taking the value of 129,600 as recommended in Ravn et al. [

26], and surprisingly, crude oil prices do not appear to be strongly linked to the international panic index in the long run. The results are shown in

Figure 1. Especially in the 2010s, crude oil prices seem to be progressively coupled with international tensions.

We further made cross-correlation plots between two discrete Brent and GPR time series. See

Figure 2. Cross-correlation measures how similar one time series is to a delayed version of another time series [

27]. This type of correlation can be used to predict the future value of another time series, i.e., the current time series is a prior indicator of another time series. The specific results are shown below and, graphically, it is true that Brent and GPR are not sequentially related in the time series.

Scholars reached a similar conclusion, deciding that the main reasons for this were as follows [

16,

28,

29]: the impact of geopolitical events in the crude oil market is not always material and sometimes even leads to lower crude oil prices. For example, the Crimea incident in 2014 did not materially affect the market but instead prompted the United States to increase production to depress oil prices and counterbalance Russia. In addition, the U.S. shale oil revolution has made it one of the world’s crucial crude oil producers and, unlike OPEC countries, the United States is not subject to quotas and production cut agreements, thus largely offsetting the geopolitical premium in the crude oil market. In addition, crude oil is denominated in U.S. dollars, and the gradual reduction in U.S. demand for crude oil from outside the country has resulted in the price of U.S.-dollar-denominated crude oil not needing to move significantly.

Thus, the impact of geopolitical events on the crude oil market requires a combination of several factors, and there are dynamics in the market that could diminish the material impact of geopolitics.

3.2. Cointegration Analysis

We choose the annual imports of Chinese crude oil as the dependent variable to characterize China’s energy dependence and the impact of international geopolitics on China’s energy security. We logarithmized all of the variables. We consider several factors to portray the impact on China’s energy supply and demand in the choice of independent variables. The following are the independent variables chosen and the influences they represent:

- (1)

Annual export data from the Middle East: The Middle East is one of the world’s major oil-producing regions, and its export data can reflect the supply situation of the major oil-producing regions in the oil market. This indicator can help us understand the impact of oil supply from the Middle East on China’s energy supply and demand.

- (2)

Renewable energy generation and carbon emissions: Renewable energy generation measures the extent of renewable energy use, while carbon emissions reflect how energy consumption contributes to climate change. These two indicators can help us assess the impact of renewable energy policies on China’s energy supply and demand and the achievement of sustainable development goals.

- (3)

China GDP data: China’s level of economic development has a significant impact on energy demand. By examining China’s GDP data, we can understand the impact of China’s economic development on energy demand and analyze the relationship between economic growth and energy consumption.

- (4)

Annualized GPR (geopolitical risk index): GPR can indicate the extent to which international geopolitical conflicts affect energy markets [

26]. Choosing the annualized GPR can help us portray the impact of international geopolitical factors on China’s energy supply and demand.

- (5)

Brent oil price: Brent oil price is one of the vital reference prices in the global crude oil market. By observing the movement of Brent oil prices, we can understand the impact of the global oil market on China’s energy supply and demand.

These independent variables are selected considering energy markets, renewable energy policies, economic development, and geopolitical factors. Analyzing these independent variables allows us to study and assess their impact on China’s energy supply and demand and provides important references for formulating relevant policies and strategies. Because we logarithmically treat all variables in our study, the regression coefficients of the independent variables can be interpreted as the elasticity between the independent and dependent variables, with the percentage change of the dependent variable relative to the independent variable, holding other variables constant. Stata 15.1 suggests that the choice of variable lag should be second order. Refer to

Table 1 for the specific results and analysis.

To test the stability of this VECM system, the results are shown in

Figure 3. The findings indicate that, apart from the unit root assumed by the VECM model itself, all companion matrix eigenvalues fall within the unit circle, confirming its stability.

Regarding endogeneity issues, it is common for time series data to be non-stationary and to have a certain degree of interdependence among the series. A set of time series is said to be cointegrated when there exists a long-term equilibrium relationship among these series, making it nearly unavoidable to address endogeneity issues in macroeconomic research. However, considering that we utilize quasi-maximum likelihood estimation (QMLE) in estimating the cointegration equation, it remains valid even under weaker non-normal conditions [

30]. The non-normality of residuals has minimal impact on the estimation of the VECM. In other words, the ordinary least squares (OLS) estimates of the cointegration equation remain consistent even in the presence of endogenous explanatory variables. Therefore, we believe that endogeneity concerns in this study can be alleviated.

We are mainly interested in the long-run equilibrium relationship represented by the cointegrating equation [

31]. According to the information in the table, the export of the Middle East crude oil is instead hostile to China’s crude oil imports in the long run, which is because the Middle East is the leading oil exporting region, and its supply can meet China’s demand, thus reducing China’s dependence on crude oil from other regions. As a major energy-consuming country, China is committed to diversifying its supply channels to ensure energy security and sustainable development. China is gradually reducing its dependence on crude oil from the Middle East by expanding domestic energy production, improving energy efficiency, and developing clean energy sources. This has resulted in a negative long-term impact of Middle East crude oil exports on China’s crude oil imports, as China prefers to meet its energy needs by diversifying its energy supply rather than relying solely on crude oil from the Middle East [

32].

The coefficient of new energy consumption on oil imports is positive, as the demand for economic development positively influences long-term new energy consumption and oil consumption. As China’s economy grows and energy demand increases, consumption of new energy sources will also increase, while oil remains the primary energy source. Thus, there is a positive correlation between the two.

China’s GDP negatively impacts oil imports in the long run because, as the economy grows and undergoes structural transformation, China may promote energy efficiency and diversify its energy mix, thereby reducing its dependence on oil. This may include promoting the development of clean energy and improving energy efficiency. Furthermore, structural transformation may lead to optimizing the energy mix, further diminishing the reliance on oil. Therefore, the negative correlation between China’s GDP and oil imports reflects the country’s efforts to promote sustainable development.

A positive GPR coefficient indicates that international tensions positively impact China’s crude oil owing to geopolitical factors and international conflicts that could lead to supply disruptions and price volatility, directly impacting China’s crude oil supply and energy security. As a significant participant in the global energy market, China needs to closely monitor changes in the international landscape and respond promptly to potential supply risks. By actively engaging in international cooperation and multilateral mechanisms, China can play a more substantial role in global energy governance. This proactive involvement safeguards its own energy interests and contributes to enhancing stability and fostering sustainable development in the global energy market.

A negative Brent coefficient indicates the dampening effect of world oil prices on China’s crude oil imports. When international oil prices rise, China’s crude oil import costs increase, which may lead to reducing import volumes or finding alternative energy sources. In order to cope with the fluctuations in international oil prices, China needs to comprehensively consider factors such as market prices, energy supply security, and optimization of the energy mix, and formulate a flexible energy import strategy. Additionally, China can mitigate the impact of international oil prices on energy imports by diversifying energy supply channels and enhancing domestic production capacity.

4. Discussion

4.1. China’s Energy Security Must Take into Account International Geopolitical Influences

Unlike the United States, however, China must always be aware of the impact of the international political landscape on the energy market. As one of the world’s largest energy consumers, China has an inverse formation relationship with the energy market, leading to growth in its energy demand and security of supply that has important implications for the energy market [

33].

First, China’s growing energy demand has led to a gradual increase in its dependence on international energy markets. China’s rapid economic development and large population size have led to growing energy demand, especially for traditional energy sources such as oil, natural gas, and coal, which continue to increase. This makes it necessary for China to purchase large amounts of energy resources from the international market to meet its domestic demand, giving it a more significant influence on the supply and price of the global energy market. China is an oil-poor country with relatively limited energy resources [

34]. China’s relatively tiny shale oil resources and environmental and sustainability concerns prevent it from investing as much resources into shale oil development as the United States.

Second, the impact of the international political landscape on the energy market directly affects China’s energy supply and price stability. Geopolitical events, international energy cooperation, trade disputes, and other factors can all significantly impact the energy market, affecting China’s energy supply chain and price system. China must always be aware of changes in these factors and the relationships and interactions among energy suppliers to ensure a stable energy supply and sustainable development.

Therefore, China needs to pay close attention to changes in the international situation and anticipate and respond in advance to possible energy supply disruptions, price fluctuations, and geopolitical risks. This requires China to actively participate in international energy cooperation and multilateral mechanisms and establish stable cooperative relationships with energy-supplying countries to ensure a stable supply of energy and the smooth operation of energy markets.

4.2. China’s Energy Security Must Take into Account the Impact of U.S.-Dollar-Denominated Energy Assets

The impact of the U.S. dollar denomination must be considered when studying China’s foreign energy security for the following reasons:

- (1)

Oil price impact: Oil is one of the world’s primary energy resources, and its price is usually denominated in U.S. dollars [

35]. Fluctuations in oil prices directly affect the energy market and the balance of energy supply and demand. Therefore, when studying China’s external energy security, it is essential to consider the impact of dollar-denominated prices on oil prices to assess China’s energy import costs and the stability of the energy supply.

- (2)

Foreign exchange market volatility: The U.S. dollar is one of the world’s most important reserve currencies, and exchange rate fluctuations significantly impact international trade and energy transactions. As an energy importer, China’s energy import costs and supply stability are influenced by foreign exchange markets. Therefore, understanding and considering the impact of the U.S. dollar denomination on foreign exchange markets is critical to studying China’s foreign energy security.

- (3)

Monetary policy and financial risk: Dollar-denominated prices affect energy prices and foreign exchange markets and are closely related to monetary policy and financial risk. Changes in the dollar exchange rate may lead to fluctuations in China’s import costs, which may have implications for China’s energy supply and security. Therefore, when studying China’s external energy security, it is crucial to consider the impact of the dollar denomination on monetary policy and financial risk.

In summary, dollar-denominated prices have essential impacts on oil prices, foreign exchange markets, and monetary policy and, therefore, the impact of dollar denomination must be fully considered when studying China’s external energy security in order to comprehensively assess China’s energy supply and energy security situation [

36].

4.3. China Should Play a More Significant Role in Safeguarding Energy Trade Liberalization and Advancing Global Energy Governance, Particularly for Emerging Economies and Numerous Energy-Exporting Countries

The clean energy cooperation between China and the United States is facing substantial challenges, and global energy governance is encountering more severe obstacles. In the past, the success of the shale revolution and a slowdown in energy consumption turned the United States into a major energy exporter, leading to a notable decrease in its demand for energy supply security and attention to this matter. Simultaneously, the European Union’s energy demand growth has gradually decelerated since the mid-1990s and even exhibited a declining trend, significantly reducing its concerns about energy security. In this context, the focus of attention in global energy governance has shifted towards climate negotiations and reduction in global emissions, with energy security taking a secondary position.

However, following the Ukraine crisis, some of the positive progress achieved in global energy governance has regressed to some extent, influencing the prioritization of the climate change agenda. In recent years, the rapid growth in energy demand of many developing countries, particularly emerging economies, has continuously increased the Asia-Pacific region’s share of global energy consumption. Nevertheless, the existing global governance framework has failed to fully reflect the shifting balance of international power dynamics. The current energy governance structure remains primarily dominated by developed countries, limiting the influence and voice of emerging market nations and developing countries.

Given this new scenario, China must actively support developing countries and emerging economies in their participation in transforming the global energy governance system. China should wield more significant influence on global platforms to ensure these nations can gain more significant influence and a stronger voice in energy trade liberalization and global energy governance. This approach will contribute to establishing a more equitable, inclusive, and balanced global energy governance system, better meeting the energy demands of diverse countries and regions and promoting sustainable development goals.

5. Conclusions

We discussed China’s external energy security in-depth and explore the linkages with international relations, geopolitics, and sustainable development. We discussed the impact of major events on energy supply and demand and the importance of new energy sources, technological advances, and dollar-denominated factors for China’s energy security.

We highlighted China’s challenges as one of the world’s largest energy consumers, particularly in balancing energy supply and demand with sustainable development. We discussed China’s energy policies and efforts, including promoting new energy sources, reducing energy consumption, and cutting carbon emissions. We also touched on the impact of geopolitics and the international political situation on energy markets and the impact of the U.S. dollar denomination on energy prices and foreign exchange markets.

This study aims to address the existing gaps in the literature concerning the relationship between international relations, energy security, and sustainable development, particularly in the context of quantitative analysis methods. While some research has focused on the impact of international geopolitical events on energy supply and demand, there is a lack of systematic quantitative analysis, and exploration within the framework of sustainable development goals remains limited. Therefore, the innovation of this study lies in conducting an in-depth analysis of how international relations events affect China’s energy supply and demand, while also investigating how to balance energy security and environmental protection within the framework of sustainable development goals.

In the methodology section, we chose to utilize the Hodrick–Prescott filter and cointegration analysis to address the methodological gaps present in the existing literature. While some studies have explored the impact of international relations events on energy markets, there is a lack of in-depth quantitative analysis. We chose these methods because they allow us to separate long-term trends from short-term fluctuations, enabling a more accurate understanding of how international relations influence energy supply and demand. Additionally, the indicators and variables we explored, such as Middle East crude oil exports and new energy consumption, contribute to a more comprehensive perspective, filling gaps in the previous literature that did not consider these factors extensively.

Our analysis derived novel insights into the relationship between international geopolitical events and China’s energy supply and demand. We found that while international geopolitical events can impact energy markets, their effects are moderated by various factors within the complex energy market landscape. This finding offers a fresh perspective that enhances our understanding of how international relations influence energy markets.

While we acknowledge the limitations of our study, such as data availability and model constraints, as well as potential endogeneity issues, future research can expand on other countries’ and regions’ energy supply and demand under international relations events, achieving a more global perspective. Moreover, further methodological development to attain more accurate results could involve more complex models and the inclusion of additional factors.

In conclusion, this study’s innovation lies in addressing gaps in the literature related to international relations, energy security, and sustainable development and providing new insights through quantitative analysis methods. By selecting appropriate methods and variables, we have delved into how international geopolitical events impact China’s energy supply and demand, offering valuable information for policy formulation and strategic planning. Future research can build upon this foundation to deepen our understanding of these relationships.

Author Contributions

Conceptualization, Y.Y. and S.Z.; data curation, S.Z.; methodology, Y.Y. and S.Z.; formal analysis, S.Z.; writing—original draft preparation, S.Z.; writing—review and editing, Y.Y. project administration, Z.M.; resources, C.D. and S.Z.; software, Y.Y.; visualization, Y.Y. and S.Z.; investigation, S.Z. and C.D.; validation, Y.Y.; S.Z., C.D. and Z.M. collected and analyzed data, contributing in equal measure as the second authors. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by “Science and Technology Project Funding of SGCC: Study on Cascade Mechanism, Coupling Model and Key Scenario Construction of Energy Power Development in China by International Geo-Relations”, grant number 5108-202218280A-2-432-XG.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All data are included in the paper or could be openly obtained.

Acknowledgments

The authors would like to extend thanks for the constructive comments and engagement with the paper from our reviewers regarding significance to the world and choice of variables.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Astrov, V.; Ghodsi, M.; Grieveson, R.; Holzner, M.; Kochnev, A.; Landesmann, M.; Pindyuk, O.; Stehrer, R.; Tverdostup, M.; Bykova, A. Russia’s invasion of Ukraine: Assessment of the humanitarian, economic, and financial impact in the short and medium term. Int. Econ. Econ. Policy 2022, 19, 331–381. [Google Scholar] [CrossRef]

- Levitsky, S.; Way, L.A. Linkage versus leverage. Rethinking the international dimension of regime change. Comp. Politics 2006, 38, 379–400. [Google Scholar] [CrossRef]

- Brooks, S.G.; Wohlforth, W.C. World Out of Balance: International Relations and the Challenge of American Primacy; Princeton University Press: Princeton, NJ, USA, 2008. [Google Scholar]

- Shaffer, B. Energy Politics; University of Pennsylvania Press: Philadelphia, PA, USA, 2011. [Google Scholar]

- Glaser, C.L. How oil influences US national security. Int. Secur. 2013, 38, 112–146. [Google Scholar] [CrossRef]

- Kalantzakos, S. China and the Geopolitics of Rare Earths; Oxford University Press: Oxford, UK, 2017. [Google Scholar]

- Kåberger, T. Progress of renewable electricity replacing fossil fuels. Glob. Energy Interconnect. 2018, 1, 48–52. [Google Scholar]

- Zhao, H. The Economics and Politics of China’s Energy Security Transition; Academic Press: Cambridge, MA, USA, 2018. [Google Scholar]

- Chapman, A.; Shigetomi, Y.; Karmaker, S.C.; Saha, B.B.; Huff, K.; Brooks, C.; Stubbins, J. The cultural dynamics of energy: The impact of lived experience, preference and demographics on future energy policy in the United States. Energy Res. Soc. Sci. 2021, 80, 102231. [Google Scholar] [CrossRef]

- Chapman, A.; McLellan, B.; Mabon, L.; Yap, J.; Karmaker, S.; Sen, K. The Just Transition in Japan: Awareness and desires for the future. Energy Res. Soc. Sci. 2023, 103, 103228. [Google Scholar] [CrossRef]

- Fang, D.; Shi, S.; Yu, Q. Evaluation of sustainable energy security and an empirical analysis of China. Sustainability 2018, 10, 1685. [Google Scholar] [CrossRef]

- Hosan, S.; Rahman, M.M.; Karmaker, S.C.; Saha, B.B. Energy subsidies and energy technology innovation: Policies for polygeneration systems diffusion. Energy 2023, 267, 126601. [Google Scholar] [CrossRef]

- Eras-Almeida, A.A.; Egido-Aguilera, M.A. What is still necessary for supporting the SDG7 in the most vulnerable contexts? Sustainability 2020, 12, 7184. [Google Scholar] [CrossRef]

- “Crude Oil-Futures Contracts-Prices”. Available online: https://zh.tradingeconomics.com/commodity/crude-oil (accessed on 18 July 2023).

- “Browse All bp Global Press Releases Issued Since 2010”. Available online: https://www.bp.com/en/global/corporate/news-and-insights/press-releases.html (accessed on 18 July 2023).

- Caldara, D.; Iacoviello, M. Measuring geopolitical risk. Am. Econ. Rev. 2022, 112, 1194–1225. [Google Scholar] [CrossRef]

- Hodrick, R.J.; Prescott, E.C. Postwar US business cycles: An empirical investigation. J. Money Credit. Bank. 1997, 29, 1–16. [Google Scholar] [CrossRef]

- Yamada, H. A smoothing method that looks like the Hodrick–Prescott filter. Econom. Theory 2020, 36, 961–981. [Google Scholar] [CrossRef]

- Murray, C.J. Cyclical properties of Baxter-King filtered time series. Rev. Econ. Stat. 2003, 85, 472–476. [Google Scholar] [CrossRef]

- Nilsson, R.; Gyomai, G. Cycle extraction: A comparison of the phase-average trend method, the Hodrick-Prescott and Christiano-Fitzgerald filters. OECD Stat. Work. Pap. 2011, 4, 1–26. [Google Scholar]

- Hamilton, J.D. Why you should never use the Hodrick-Prescott filter. Rev. Econ. Stat. 2018, 100, 831–843. [Google Scholar] [CrossRef]

- Phillips, P.C.; Shi, Z. Boosting: Why you can use the HP filter. Int. Econ. Rev. 2021, 62, 521–570. [Google Scholar] [CrossRef]

- Mei, Z.; Phillips, P.C.; Shi, Z. The boosted HP filter is more general than you might think. arXiv 2022, arXiv:2209.09810. [Google Scholar] [CrossRef]

- Granger, C.W.J. Time series analysis, cointegration, and applications. Am. Econ. Rev. 2004, 94, 421–425. [Google Scholar] [CrossRef]

- Nelson, C.R.; Plosser, C.R. Trends and random walks in macroeconmic time series: Some evidence and implications. J. Monet. Econ. 1982, 10, 139–162. [Google Scholar] [CrossRef]

- Ravn, M.O.; Uhlig, H. On adjusting the Hodrick-Prescott filter for the frequency of observations. Rev. Econ. Stat. 2002, 84, 371–376. [Google Scholar] [CrossRef]

- Scargle, J.D. Studies in astronomical time series analysis. III-Fourier transforms, autocorrelation functions, and cross-correlation functions of unevenly spaced data. Astrophys. J. 1989, 343 Pt 1, 874–887. [Google Scholar] [CrossRef]

- Greenley, H.L. The World Oil Market and US Policy: Background and Select Issues for Congress; Congressional Research Service: Washington, DC, USA, 2019. [Google Scholar]

- Li, S.; Tu, D.; Zeng, Y.; Gong, C.; Yuan, D. Does geopolitical risk matter in crude oil and stock markets? Evidence from disaggregated data. Energy Econ. 2022, 113, 106191. [Google Scholar] [CrossRef]

- Lütkepohl, H. New Introduction to Multiple Time Series Analysis; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2005; p. 297. [Google Scholar]

- Etokakpan, M.U.; Solarin, S.A.; Yorucu, V.; Bekun, F.V.; Sarkodie, S.A. Modeling natural gas consumption, capital formation, globalization, CO2 emissions and economic growth nexus in Malaysia: Fresh evidence from combined cointegration and causality analysis. Energy Strategy Rev. 2020, 31, 100526. [Google Scholar] [CrossRef]

- Wang, W.; Fan, L.; Zhou, P. Evolution of global fossil fuel trade dependencies. Energy 2022, 238, 121924. [Google Scholar] [CrossRef]

- Lee, C.-C.; Xing, W.; Lee, C.-C. The impact of energy security on income inequality: The key role of economic development. Energy 2022, 248, 123564. [Google Scholar] [CrossRef]

- Jiang, Y. Legacy of the Mao Era and China’s Modernization. In A New World is Possible: The Modernization of China; Springer: Berlin/Heidelberg, Germany, 2023; pp. 143–175. [Google Scholar]

- Frankel, J.A. The Natural Resource Curse: A Survey; National Bureau of Economic Research: Cambridge, MA, USA, 2010. [Google Scholar]

- Zhang, H.J.; Dufour, J.-M.; Galbraith, J.W. Exchange rates and commodity prices: Measuring causality at multiple horizons. J. Empir. Financ. 2016, 36, 100–120. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).