1. Introduction

Since the 1990s, the Internet has experienced rapid development, leading to a significant boost in the flexibility of enterprises and residents [

1]. Enterprises located in remote areas can communicate with companies in any city worldwide via the Internet. Residents can consume and work where they prefer through e-commerce and online jobs. This has therefore stimulated widespread academic attention in exploring the spatial impact of the Internet, while the findings remain mixed and even contradictory. Many scholars argue that the Internet would diminish the importance of geography to economic activity, proposing a series of conjectures like the death of the city, the death of distance, and the end of geography [

2,

3,

4]. Numerous empirical studies confirm that the Internet has facilitated the decentralization of economic activity [

5,

6,

7], supporting these conjectures to some extent. However, it can be observed that the rapid development of the Internet since the beginning of the new millennium has been accompanied by the emergence of new agglomeration economies, such as Silicon Valley in the United States [

8], and Taobao villages in Zhejiang and Guangdong, China [

9]. Some empirical studies also confirm that the Internet promotes the concentration of economic activities. This hence calls for further exploration of the spatial impact of the Internet.

The spatial organization of economic activity evolves in response to technological change [

10], and such evolution is particularly evident in the spatial distribution of manufacturing. For instance, the concentration of the handicraft industry in America lasted until the early 20th century. However, in the middle of the 20th century, this concentration gradually disappeared due to the increased power of mechanization and the accessibility of fuel [

11]. In the digital age, the emergence of Internet technologies, like e-commerce and the Internet of Things (IoT), has significantly transformed the business patterns and production organization within the manufacturing industry [

12]. While these advancements have the potential to reshape the spatial organization of manufacturing, existing effort on this question remains rather scant. Some studies, based on data samples predating 2010, suggest that the Internet has contributed to the dispersion of manufacturing [

6,

13]. However, given the globally significant advancements in Internet technology in the last 10 years [

5], these studies may not fully capture the current effects of the Internet on manufacturing agglomeration. In addition, the rapid development of the Internet has led to new socio-economic impacts, such as network effects [

14] (Network effects mean that the network value or the network user welfare depends on the number of network users [

15]. For example, when only one user uses the Internet, there are insufficient users to form a network, resulting in the low welfare of the Internet user and Internet value). Recent literature confirms the network effects of the Internet in terms of productivity [

14,

16]. These studies show that the Internet has an increasing marginal effect on productivity in the context of rapid adoption rate and the pervasiveness of Internet-based technologies. By far, there is no consensus on the role of the Internet in spatial organization, which therefore necessitates an in-depth analysis of the relationship and the underlying mechanisms. Several specific questions remain to be answered. How does the Internet affect the spatial distribution of manufacturing? Further, does the Internet have a non-linear effect on manufacturing agglomeration? These questions have been relatively neglected in the literature.

To this end, we use the panel data of prefecture-level cities from 2003 to 2019 as a research sample. Employing a panel two-way fixed effects (FE) model and an instrumental variable (IV) approach, we examine the causal links between the Internet and manufacturing agglomeration. We find that the Internet first leads to manufacturing dispersion and then promotes manufacturing agglomeration, while a U-shaped relationship is formed between the Internet and manufacturing agglomeration.

In light of the existing literature, the sources of the Internet’s force on agglomeration include, but are not limited to, the communication cost reduction effect, the information-matching effect, and the innovation effect. Firstly, the communication cost reduction effect of the Internet generates a centrifugal force of agglomeration. With the Internet enabling online communication to replace face-to-face interaction, the lower cost of remote communication reduces the importance of geographical proximity [

5,

6]. Additionally, Internet technology expands the scope of knowledge spillovers by encoding and transmitting knowledge online, which enhances the flexibility of firms and individuals in selecting locations [

5]. Secondly, the information-matching effect of the Internet creates both centrifugal and centripetal forces of agglomeration. On the one hand, the Internet facilitates firms to identify market entry opportunities by improving the information matching of the industrial chain [

17,

18,

19], thus enhancing the centripetal force of agglomeration. On the other hand, the Internet allows for better alignment of supply and demand on online platforms by improving the matching of product market information [

20], thereby diminishing the importance of geography agglomeration and leading to dispersion. Thirdly, the innovation effect of the Internet acts as a centripetal force for agglomeration. The Internet gives rise to new industries and provides new entry opportunities for enterprises [

10,

21,

22], thus attracting firms to concentrate. In addition, Internet-driven innovations generate tacit knowledge that cannot be easily transferred online [

10,

23]. Instead, they rely on face-to-face communication, fostering agglomeration centripetal forces [

10,

23]. The above explanations provide much insight, but most of the relevant research assumes that the centripetal and centrifugal forces formed by the Internet develop linearly. A recent working paper by Glaeser (2020) [

24] also points out that early technological changes are mainly dispersion forces, whereas those in recent years have largely been agglomeration forces. Wang et al. (2022) [

10] argue that the Internet exhibits a decreasing marginal impact on communication costs, creating a decreasing centrifugal force, and that the Internet has a linear impact on innovation, creating a linear centripetal force, which results in a U-shaped relationship between the Internet and urban hierarchy. Overall, the explanation of the non-linear relationship between the Internet and agglomeration is insufficient.

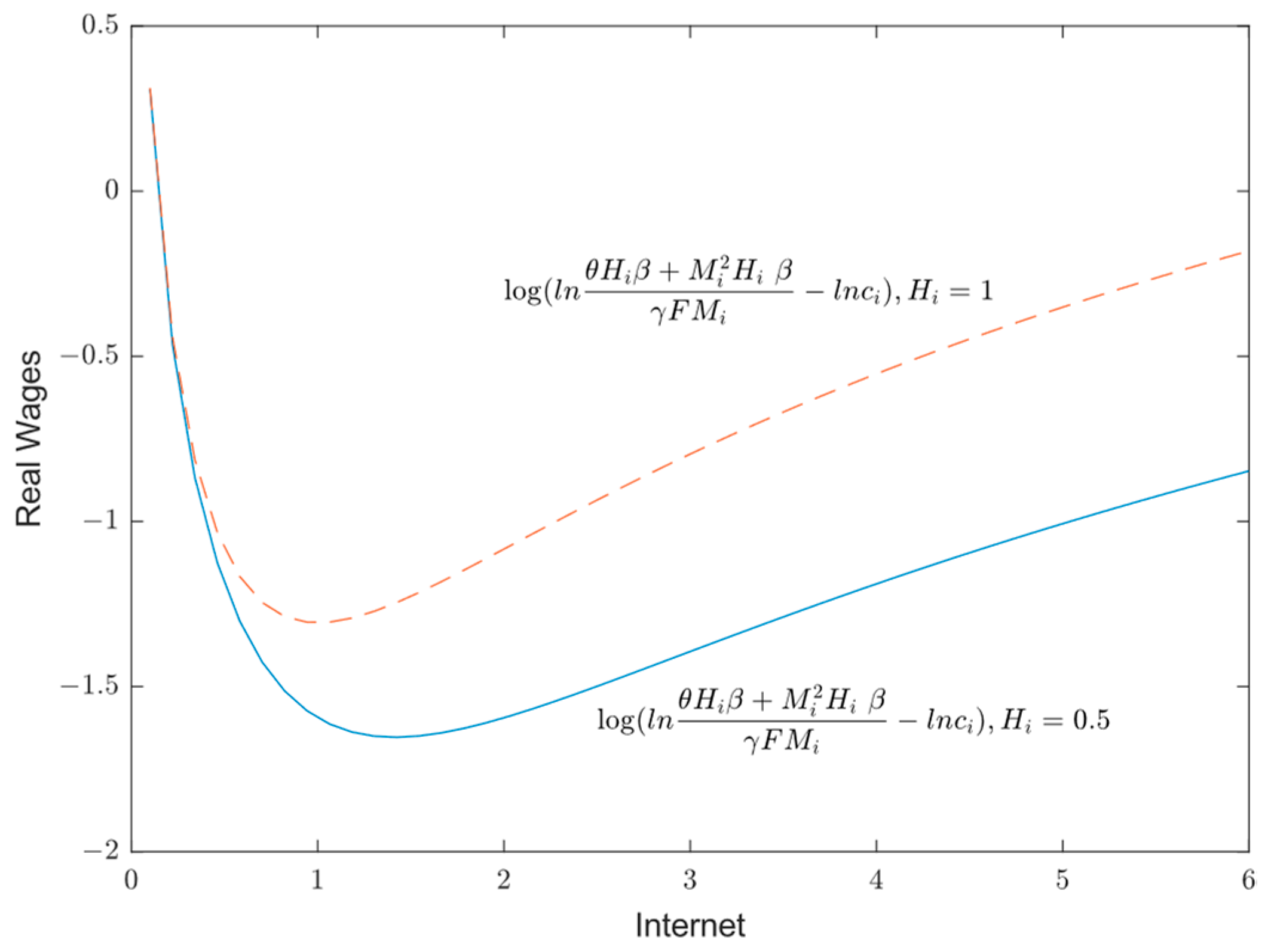

To fill this research gap, we use the theoretical framework of new economic geography to construct a partial equilibrium model to explore the non-linear mechanism of the Internet’s effect on manufacturing agglomeration. Based on related studies [

14,

16,

25], we assume that there is a marginal increasing effect of the Internet on the productivity of manufacturing firms, which creates an incremental centripetal force. We also assume that there is a linear effect of the Internet on firm costs, which creates a linear centrifugal force. The tug-of-war between the two forces results in a U-shaped relationship between the Internet and manufacturing agglomeration. Further, we incorporate human capital and market potential into the theoretical model, given the close association of the Internet with human capital and market potential. The mechanism analysis in this paper shows that the complementarity between human capital and the Internet reinforces the centripetal force of the Internet on manufacturing agglomeration. The Internet can influence manufacturing agglomeration through the market potential channel.

Compared with the previous literature, the contribution of this paper is mainly threefold. First, we provide new evidence that the Internet affects the spatial layout from the perspective of manufacturing agglomeration, while most of the existing literature focuses on the role of the Internet on the overall spatial structure [

1,

10,

20,

26]. However, these studies ignore the industry heterogeneity of the Internet’s impact on agglomeration. The effect of the Internet on different industries depends largely on industry characteristics, including different factor structures and the level of market responsiveness required [

21].

Second, this paper deepens the understanding of the Internet’s impact on manufacturing agglomeration. The previous literature has paid more attention to the linear effect of the Internet on manufacturing agglomeration [

6,

27]. However, the current rapid diffusion and penetration of Internet technology have triggered network effects, making its non-linear impact on economic activities more pronounced [

14]. By focusing on the non-linear role of the Internet, our findings can reflect the U-shaped relationship between Internet development and manufacturing agglomeration, thus providing a more comprehensive understanding of how the Internet affects manufacturing agglomeration.

Third, this paper provides a new analytical framework based on the new economic geography theory. The existing literature offers many explanations, but few studies approach the issue from the theoretical framework of new economic geography [

28]. Instead, we incorporate human capital, market potential, and the Internet into the theoretical framework of new economic geography, taking into account the complementarity between human capital and the Internet [

29], as well as the impact of the Internet on market potential [

19]. This provides a new analytical framework for exploring how the Internet affects manufacturing agglomeration.

The remainder of this paper is organized as follows.

Section 2 presents the theory model and research hypothesis.

Section 3 introduces research methods, variable descriptions, and data.

Section 4 presents the empirical results. The final section offers the conclusion and policy implications.

5. Conclusions and Policy Implications

Using panel data of Chinese prefecture-level cities from 2003 to 2019, we explore the impact of the Internet on manufacturing agglomeration. This paper finds that the Internet first leads to manufacturing fragmentation and then promotes manufacturing agglomeration. On this basis, we further explore the mechanism of the Internet’s impact on manufacturing agglomeration. We find that the Internet influences manufacturing agglomeration through the market potential channel. Moreover, there exists a complementary role of human capital with the Internet, which reinforces the U-shaped influence of the Internet on manufacturing agglomeration.

On average, the Internet is closely linked to manufacturing agglomeration. Wang et al. (2022) [

10] examine the impact of the Internet on agglomeration using panel data of 139 countries. The findings show that the Internet first leads to fragmentation and then promotes agglomeration, revealing a U-shaped relationship between the Internet and agglomeration. Although this paper samples panel data of 281 prefecture-level cities in China, our findings confirm those of Wang et al. (2022) [

10]. This non-linear effect of the Internet on spatial structure may hold for both developing and developed countries.

Based on data samples from before 2010, Hong and Fu (2011) [

13] and Zhang et al. (2022) [

6] suggest that the Internet has contributed to the decentralization of manufacturing. However, since 2010, the Internet in China has experienced rapid development. The average download rate of broadband networks has increased by nearly 40 times, and the scale of 4G base stations has accounted for more than half of the global total [

58]. Consequently, the low level of the Internet before 2010 led to manufacturing fragmentation. This finding supports our conclusion that the Internet contributes to manufacturing fragmentation when it is at a low level. In addition, when the level of the Internet exceeds a certain level, the network effect of the Internet strengthens its centripetal force on agglomeration, which leads to an incremental marginal effect on manufacturing agglomeration. Related literature confirms the network effect of the Internet from the perspective of productivity [

16]. This paper confirms the network effect from the perspective of agglomeration, adding new evidence for the network effect of the Internet.

The mechanism analysis finds that human capital strengthens the centripetal force of the Internet on agglomeration. Many studies suggest that the complementarity between the Internet and human capital promotes firm entry and new construction [

21]. The findings of this paper provide new macro evidence on the complementarity between human capital and the Internet. We also find that the Internet promotes agglomeration through market potential, which is consistent with findings in the related literature [

44].

Obviously, the Internet does not linearly link to the spatial structure of cities. China, one of the developing countries with the fastest Internet development in the world, is a good reference for the impact of the Internet on manufacturing agglomeration. First, developing countries should pay attention to the impact of the Internet on the spatial layout of cities when planning or laying out industries. Particularly in the context of the prevailing global regional imbalance in the world, the Internet may decentralize the crowded big cities temporarily in the short term, but the sustained development of the Internet may make the factors flow back to the big cities, strengthening the agglomeration of big cities again. Second, the moderating role of human capital also gives a lot of inspiration. Human capital will reinforce the role of the Internet in promoting agglomeration. Big cities tend to have a higher stock of human capital, so the inter-city imbalance may be further amplified by the Internet and human capital differences. Although the expansion in big cities follows the economic laws and allows factors to be utilized more efficiently, the gap between big and small cities can exacerbate inequality and cause various economic and social problems. Therefore, the use of the Internet to regulate the size difference between big and small cities should be considered in future policy making.

This study strides in the direction of a more robust research agenda, but much work remains to be done. First, the subsequent research can subdivide the manufacturing industry and study the heterogeneity of the Internet on the spatial distribution of industries with different characteristics, so as to understand the impact of the Internet on the spatial layout of manufacturing industries in a more in-depth manner. Second, this paper only performed a preliminary investigation into the mechanism of the Internet affecting manufacturing agglomeration, and the following research can be based on a new economic geography model for more expansion. Third, with the rapid development of intelligent manufacturing, the study of the impact of intelligent manufacturing on the spatial layout of manufacturing is a problem worthy of attention.