1. Introduction

In September 2020, President Xi Jinping announced at the 75th General Assembly of the United Nations that China aims to achieve peak carbon dioxide emissions by 2030 [

1]. The country is also working towards achieving the vision of carbon neutrality by 2060. Low-carbon development in enterprises is an effective way to achieve this dual carbon goal, and R&D investment in emission reduction technologies is a major starting point from which manufacturing enterprises can enhance their competitiveness in the low-carbon market. In business practice, R&D investment is often a long-term, continuous process [

2], and the effects of current R&D investment need to be demonstrated through a certain lag time [

3]. For example, the innovative R&D investment results of Hengrui Pharmaceuticals Co., Ltd. (Lianyungang, China) show a significant lag effect. At the same time, manufacturers are highly sensitive to the level of products’ emission reduction and the return on R&D investment. Related decisions are also influenced by subjective factors, such as human psychology, emotions, and human cognitive ability [

4]. Under the influence of the lag effect, manufacturers typically exhibit loss aversion behavior. This will not only directly affect the manufacturer’s optimal R&D investment in emission reduction but will also have an indirect impact on the product’s level of emission reduction. Therefore, investigating the mechanism of R&D investment in emission reduction under the context of the lag effect and manufacturers’ loss aversion is also important.

The research of many scholars on manufacturers’ emission reduction investments in the supply chain can be broadly divided into two categories. One is the research on manufacturers’ R&D investment in emission reduction that does not consider the influence of lag effect. The other is the research on the manufacturers’ R&D investment in emission reduction that does consider the influence of the lag effect. Without considering the influence of the lag effect, Du and colleagues [

5] studied the optimal emission reduction investment of manufacturers by considering the carbon emission trading mechanism and using the newsboy model. On this basis, Zhang and colleagues [

6] combined the sampled consumers’ low-carbon preferences and channel preferences, while also considering the impacts of carbon allowance restrictions and carbon trading prices on manufacturers’ investment in the emission reduction decisions and profits of each party. In contrast, Xu and colleagues [

7] first proposed the background of manufacturers’ emission reduction and retailers’ advertising cooperation; the study created an upstream and downstream cooperation model for emission reduction. The focus of the research was to explore the optimal emission reduction levels and benefit issues in a supply chain centered on manufacturers. Zhao and colleagues [

8] compared the optimal decisions of manufacturers’ emission reduction inputs and their respective optimal profits under cooperative and non-cooperative scenarios. Wang and colleagues [

9] proposed a retailer-centered supply chain model, in which part of the manufacturer’s carbon emission reduction costs are shared by the retailer. The study used differential game theory to investigate the manufacturer’s optimal abatement input decision and the retailer’s optimal promotion decision. Considering the impacts of the lag effect, Chen and colleagues [

10] investigated the optimal strategy of the manufacturers’ investments in emission reduction and retail pricing under two mechanisms. The study aimed to explore the impacts of lag time on the amount of emission reduction per unit of product and the decision-making mechanism of supply chain members. In addition, by incorporating government carbon subsidies, Zhuo and colleagues [

11] investigated the impacts of different emission reduction strategies on the profitability of supply chain members. Sun and colleagues [

12] studied the effects of lag time on government policies and manufacturers’ decisions with regard to emission reduction by incorporating consumers’ low-carbon preferences.

Loss aversion has long been introduced into the study of supply chain management. For example, Schweitzer and Cachon [

13] first explored the problem of newsboys under prospect theory and found that loss aversion led to under-ordering when out-of-stock losses were negligible. Meanwhile, Wang and Webster [

14] studied the loss aversion of newsboys when the reference point was zero and found that being out of stock can easily cause newsboys to place too many orders. However, few scholars have investigated the impacts of loss aversion on the manufacturers’ emission reduction investment decisions. Feng and colleagues [

4] used the Nash bargaining solution as a reference point for the manufacturers’ loss aversion to study the impacts of the manufacturers’ loss-aversion behavior on their optimal R&D investment in emission reduction under different mechanisms. In order to study the manufacturers’ and retailers’ emission reduction and cost-sharing decisions, Tan and colleagues [

15] developed a two-channel supply chain model based on the manufacturers’ Sharpeley values. The model was used to consider the manufacturers’ loss-aversion behavior. Lan [

16] proposed a cost-sharing model based on prospect theory to investigate the impacts of retailers’ loss-aversion behavior on the cost-sharing decisions of manufacturers’ R&D investment in emission reduction.

In summary, an in-depth discussion of the existing literature on manufacturers’ investment in emission reduction reveals two areas that need to be strengthened. Firstly, most studies on manufacturers’ investment in emission reduction assume that the effects of the manufacturers’ investment are immediate. In reality, the effect of investment on emission reduction has a lag effect. Secondly, studies on manufacturers’ emission reduction investments tend to ignore the loss aversion of the manufacturers themselves. What must be considered is that human psychology is susceptible to the influence of relevant factors, which in turn affects supply chain emission reduction decisions.

In view of the above, this paper introduces the lag effect of the manufacturers’ emission reduction investment and the manufacturers’ loss-aversion preferences into the supply chain emission reduction actions. In the context of the lag effect of emission reduction investment, using a differential game, manufacturers’ optimal R&D investment in emission reduction under centralized decision making and decentralized decision making are calculated separately. A numerical analysis is also conducted in terms of the lag time and the effects of the manufacturers’ loss-aversion factor on the manufacturers’ emission reduction investment. The aim is to verify the validity of the manufacturers’ optimal emission reduction investment decisions and make reasonable suggestions for the emission reduction decisions of supply chain manufacturing enterprises.

4. Model Analysis and Discussion

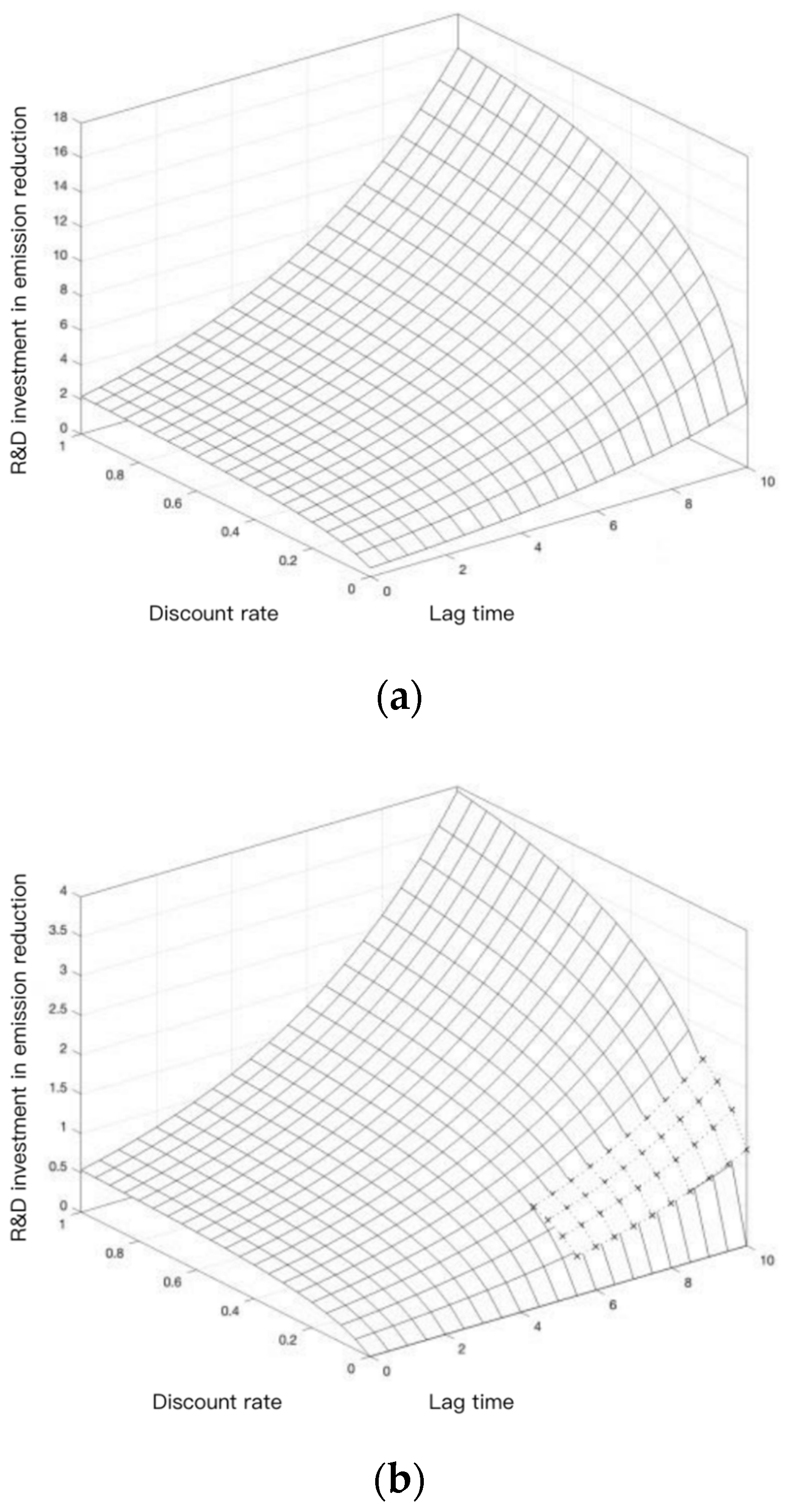

4.1. Analysis of the Impact of Lagging Time on Manufacturers’ Emissions Reductions and Profits

Proposition 1. Under centralized decision making, manufacturers’ R&D investment in emission reducing technologies increases over time, while optimal profits for the entire supply chain decrease over time.

Proposition 1 suggests that when the lag time increases within a certain range, the manufacturers’ upfront investment in R&D for emission reduction does not bring about an improvement in their economic performance. In order to avoid more R&D sunk costs, manufacturers want to increase their investment in emission reduction in return for prompt upfront returns on investment in emission reduction. At the same time, because higher investment by manufacturers in emissions reduction can improve environmental performance, but not their economic performance in the short term, the result is that the overall economic performance of the supply chain decreases in line with the growth of the lag time.

Proposition 2. Under the manufacturers’ rational preferences decision making, the extent of manufacturers’ R&D investment in emission reducing technologies increases over time. The manufacturers’ maximum profits decrease over time, while retailers’ maximum profits increase over time.

Proposition 2 suggests that when the lag time increases within a certain range, manufacturers aim to increase their investment in return for the investment of emission reduction returns as soon as possible. The increased cost of investment in emission reduction results in the manufacturers’ economic performance not being improved. However, higher investment in emission reduction can lead to some improvement in environmental performance, which can drive a degree of demand for low-carbon products in the market, allowing retailers to increase their profits.

4.2. Analysis of the Impacts of Lagging Time on Manufacturers’ Loss-Aversion Preference

Proposition 3. There is a threshold value for the lag time. When , the manufacturer’s loss-aversion reference point is greater than the manufacturer’s profit. Then, the manufacturer will exhibit loss-aversion behavior.

Proposition 3 suggests that the lag effect affects the psychology and behavior of supply chain members. When the lag time reaches a certain threshold, the negative utility of the investment of emission reduction cost to the manufacturer is greater than the positive utility of the investment of emission reduction performance to the manufacturer. This leads to a loss-aversion state of irrational psychology, and the manufacturer will act more to avoid losses and reduce costs in subsequent supply chain decisions, due to this loss-aversion psychology.

4.3. Analysis of the Impact of Loss-Aversion Preference on Manufacturers’ Emissions Reductions and Profits

Proposition 4. Under the decentralized decision based on the manufacturer’s loss-aversion preference, when the manufacturer’s loss-aversion factor is less than , the investment in emission reduction increases as the loss-aversion factor increases. When the manufacturer’s loss-aversion factor is greater than , the investment in emission reduction decreases as the loss-aversion factor increases.

Proposition 4 suggests that when a manufacturer’s loss aversion is high, the manufacturer is more concerned with the sunk costs of lagging emissions reductions, and they will reduce their investment in emission reduction, in order to avoid further sunk costs. Conversely, when a manufacturer’s loss aversion is low, they are more eager to reap the rewards of their investment in emission reduction and will, therefore, increase their investment in emission reduction. This suggests that manufacturers’ loss-aversion behavior plays an important role in the development of decarbonization and has either a positive or negative impact on the decarbonization of the supply chain.

4.4. Analysis of the Impact of Key Parameters on Manufacturers’ Emissions Reductions

Proposition 5. When , R&D investment in emission reduction of those manufacturers with loss aversion is a decreasing function of the natural decline rate δ of the product’s low-carbon level. When , R&D investment in emission reduction of those manufacturers with loss aversion is an increasing function of the natural decline rate δ of the product’s low-carbon level.

Proposition 5 suggests that when , the discount rate is fixed, and the natural decline rate of the low-carbon level of the product gradually increases, due to the ageing of the abatement equipment and inadequate maintenance operations. This leads to a reduction of emission reductions per unit of low-carbon products. In order to prevent the natural decline rate from continuing to rise, which increases the sunk costs, manufacturers invest more in emission reduction to update equipment, train operators and other work. When , the discount rate is fixed. Then, even if the carbon emissions per unit of low-carbon products are higher, manufacturers will still reduce their investment in emission reduction, in order to control their costs. This is because they are more concerned about the loss of emission reduction costs.

4.5. Comparative Analysis under the Models of Decision-Making

Proposition 6. This proposition holds that ,.

Proposition 6 suggests that manufacturers’ loss-aversion behavior is detrimental to product decarbonization, as manufacturers’ investment in emission reduction is lowest under manufacturers’ loss-aversion preference decentralization decisions. Compared to the manufacturers’ rational preference decentralization decisions, manufacturers’ loss-aversion behavior reduces their and retailers’ profits. This suggests that manufacturers’ loss-aversion preferences have a negative impact on the decarbonization of supply chains, not only harming retailers’ profits but also causing a loss of their profits.

6. Conclusions

On the basis of the lag effect, this paper considers an autonomous emission reduction supply chain consisting of manufacturers and retailers. We have come to some conclusions: the lag effect can encourage manufacturers to invest in the R&D of emission reduction technologies which are in line with Chen [

10] and Zhang [

20]’s conclusions. In contrast to this, the article further explores the relationship between the lag effect and loss aversion and concludes that there is a threshold for the lag time and that manufacturers exhibit loss aversion only when the lag time is above this threshold. It is important for supply chain firms’ emission reduction decisions.

6.1. Main Conclusions

(1) The lag time of the manufacturer’s emission reduction investment is the main factor affecting the manufacturer’s decision to invest in emission reduction. The lag time can encourage manufacturers to invest in emission reduction, but when the lag time is too long, the manufacturer’s profit will suffer. This reveals that the manufacturer can appropriately adjust the behavior related to emission reduction investment in order to ensure the profit of the main investment body.

(2) A threshold value exists for the lag time. When the lag time exceeds this threshold value within a certain range, the negative utility brought to the manufacturer by the cost of emission reduction investment is greater than the positive utility brought to the manufacturer by the performance of emission reduction investment. Then, loss-averse behavior begins to appear. The loss-averse behavior of the manufacturer damages the profits of the supply chain members. In addition, the manufacturer can only effectively maintain the profits of the supply chain members in the long term by causing a lag time of the emission reduction investment to be lower than the corresponding threshold value.

(3) When a manufacturer exhibits loss-averse behavior, the degree of the manufacturer’s loss aversion can have a significant impact on the manufacturer’s decision to invest in emission reduction. If the manufacturer’s loss-aversion level is low, the loss-averse behavior will have a reverse effect on the manufacturer’s emission reduction investment. Conversely, if the manufacturer’s loss-aversion level is high, the loss-averse behavior will have a positive effect on the manufacturer’s emission reduction investment.

6.2. Future Research

This paper only considers the second-level supply chain structure. In future research, the problem of low-carbon supply chain decision-making under the framework of three-level or multi-level supply chains can be studied, including the consideration of the lag effect and the irrationality of supply chain members. In addition, the optimization and coordination of low-carbon supply chains under the lag effect and irrationality of supply chain members can be explored in greater depth.