Centralized Decision Making in an Omnichannel Supply Chain with Stochastic Demand

Abstract

:1. Introduction

2. Literature Review

2.1. Dual-Channel Supply Chain

2.2. Omnichannel Supply Chain

2.3. Stochastic Demand in Omnichannel Retailing

3. Model Establishment for Omnichannel Supply Chain with Stochastic Demand

3.1. Assumptions

- (1)

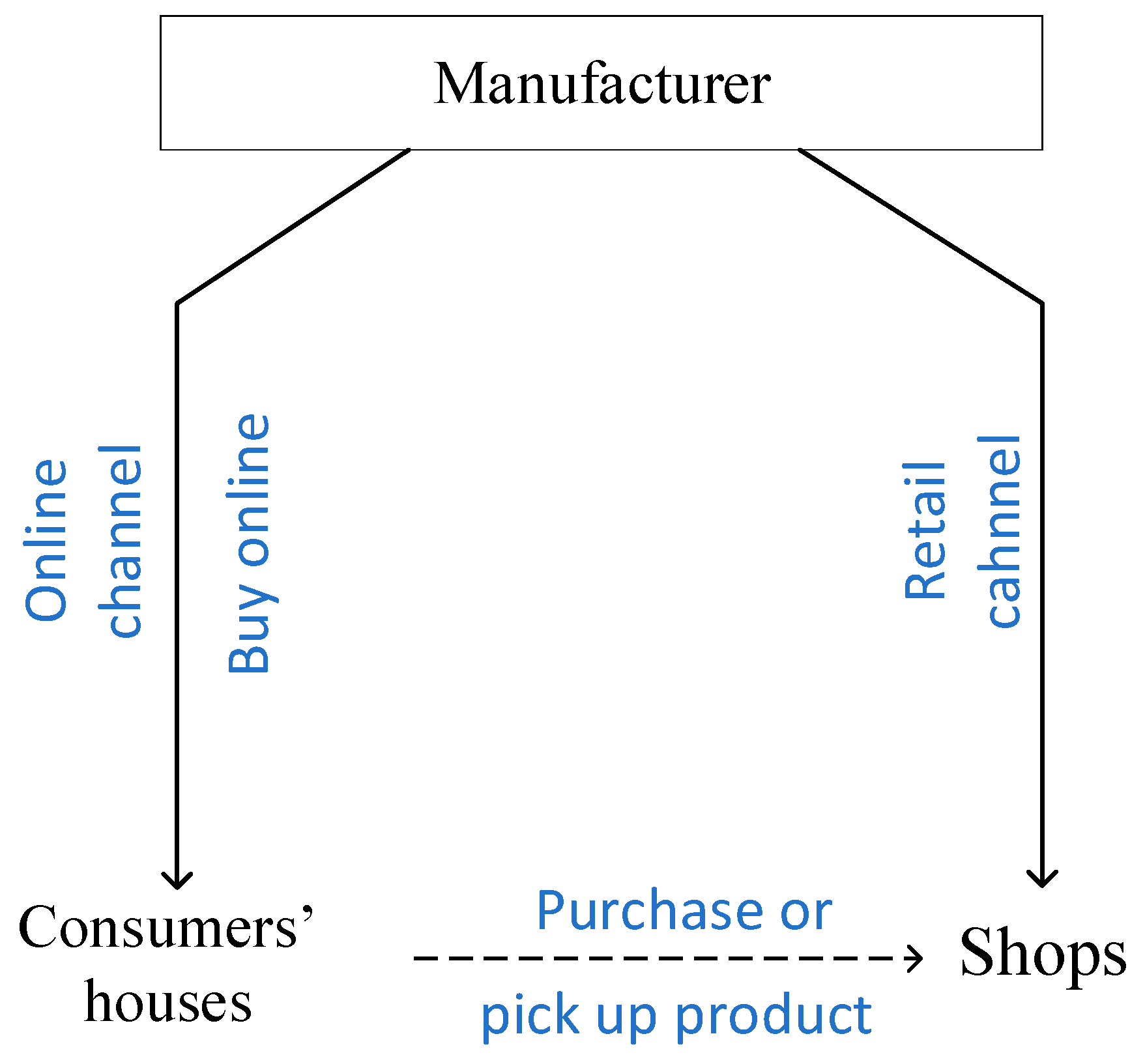

- In our models, the omnichannel supply chain is only for one single period and single product. The manufacture supplies the product to retailer and could also sell products for customers through the online channel and BOPS channel. Customers can choose online channel, retail channel or BOPS channel to purchase the product;

- (2)

- In this model, we assume that customers have the same distance to the pick-up point in store, which means that they are equally sensitive to the price in three channels;

- (3)

- Substitutability between similar products is not considered in this article;

- (4)

- The cost of operating the entire omnichannel retail system has not been considered in the profit function;

- (5)

- Prices of the product in the three channels are not always the same;

- (6)

- Demand in different channels is affected by product prices in respective channels and the lead time of the online channel;

- (7)

- The online channel will lose demand when its lead time increases, and some of that demand will transfer to the retail channel and BOPS channel.

3.2. Model Formulation

4. Effect Analysis on Lead Time and Price

4.1. Delivery Lead Time Sensitive Demand

4.2. Price Sensitive Demand

4.3. Decision Variables in the Integrated Decision

5. Numerical Illustration

5.1. Sensitivity Analysis

5.2. Managerial Insights

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| Cost parameters | |

| unit cost of the manufacturer | |

| per unit holding cost at the end of the period | |

| per unit shortage cost at the end of the period | |

| delivery-time-dependent cost parameters of the online channel, | |

| Demand parameters | |

| deterministic demand in the online channel | |

| stochastic demand in the online channel | |

| deterministic demand in the retail channel | |

| stochastic demand in the retail channel | |

| deterministic demand in the BOPS channel | |

| stochastic demand in the BOPS channel | |

| market potential of the product in the online channel | |

| market potential of the product in the retail channel | |

| total market potential of the product in three channels | |

| Sensitivity parameters | |

| price sensitivity in the online channel | |

| price sensitivity in the retail channel | |

| price sensitivity in the BOPS channel | |

| delivery time sensitivity of the demand in the online channel | |

| delivery time sensitivity of the demand in the retail channel | |

| delivery time sensitivity of the demand in the BOPS channel | |

| Decision variables and objectives | |

| ordered and produced quantity of the product to satisfy the stochastic demand in the online channel | |

| ordered and produced quantity of the product to satisfy the stochastic demand in the retail channel | |

| ordered and produced quantity of the product to satisfy the stochastic demand in the BOPS channel | |

| prices of the product in the online channel | |

| prices of the product in the retail channel | |

| prices of the product in the BOPS channel | |

| delivery lead time of the product in the online channel | |

| profit function of the integrated channel | |

| expected profit function | |

References

- UPS Online Shopping Study: Empowered Consumers Changing the Future of Retail. Available online: https://www.globenewswire.com/news-release/2015/06/03/741834/30428/en/UPS-Online-Shopping-Study-Empowered-Consumers-Changing-the-Future-of-Retail.html (accessed on 20 June 2022).

- Li, Z.; Yang, W.; Liu, X.; Li, S. Coupon strategies for competitive products in an omnichannel supply chain. Electron. Commer. Res. Appl. 2022, 55, 101189. [Google Scholar] [CrossRef]

- More than 50% of Large Retail Chains Offer Curbside Pickup. Available online: https://www.digitalcommerce360.com/2021/04/27/more-than-50-of-large-retail-chains-offer-curbside-pickup/ (accessed on 10 June 2022).

- BOPIS Orders: Kibo Clients Experienced 563% Surge during COVID. Available online: https://kibocommerce.com/blog/bopis-orders-covid-19/ (accessed on 10 June 2022).

- Ochoa, A.F.C.; Hernandez, J.R.C.; Portnoy, I. Throughput Analysis of an Amazon Go Retail under the COVID-19-related Capacity Constraints. Procedia Comput. Sci. 2022, 198, 602–607. [Google Scholar] [CrossRef]

- Szász, L.; Bálint, C.; Csíki, O.; Nagy, B.Z.; Rácz, B.G.; Csala, D.; Harris, L.C. The impact of COVID-19 on the evolution of online retail: The pandemic as a window of opportunity. J. Retail. Consum. Serv. 2022, 69, 103089. [Google Scholar] [CrossRef]

- Zheng, Q.; Wang, M.; Yang, F. Optimal Channel Strategy for a Fresh Produce E-Commerce Supply Chain. Sustainability 2021, 13, 6057. [Google Scholar] [CrossRef]

- Sarkar, B.; Dey, B.K.; Sarkar, M.; AlArjani, A. A Sustainable Online-to-Offline (O2O) Retailing Strategy for a Supply Chain Management under Controllable Lead Time and Variable Demand. Sustainability 2021, 13, 1756. [Google Scholar] [CrossRef]

- Shen, W.; Lei, A.H.; Cao, Q.Q. Evolution Process of Supply Chain Management Thoughts: A Strategy, System and Sustainability Based Review. Supply Chain. Manag. 2022, 3, 5–20. [Google Scholar]

- Ahi, P.; Searcy, C. A comparative literature analysis of definitions for green and sustainable supply chain management. J. Clean. Prod. 2013, 52, 329–341. [Google Scholar] [CrossRef]

- Prassida, G.F.; Hsu, P. The harmonious role of channel integration and logistics service in Omnichannel retailing: The case of IKEA. J. Retail. Consum. Serv. 2022, 68, 103030. [Google Scholar] [CrossRef]

- Fisher, M.; Gallino, S.; Xu, J. The value of rapid delivery in omnichannel retailing. J. Mark. Res. 2019, 56, 732–748. [Google Scholar] [CrossRef]

- Hua, G.; Wang, S.; Cheng, T.C.E. Price and lead time decisions in dual-channel supply chains. Eur. J. Oper. Res. 2010, 205, 113–126. [Google Scholar] [CrossRef]

- Chen, J.; Zhang, H.; Sun, Y. Implementing coordination contracts in a manufacturer Stackelberg dual-channel supply chain. Omega 2012, 40, 571–583. [Google Scholar] [CrossRef]

- Panda, S.; Modak, N.M.; Sana, S.S.; Basu, M. Pricing and replenishment policies in dual-channel supply chain under continuous unit cost decrease. Appl. Math. Comput. 2015, 256, 913–929. [Google Scholar] [CrossRef]

- Chen, J.; Liang, L.; Yao, D.; Sun, S. Price and quality decisions in dual-channel supply chains. Eur. J. Oper. Res. 2017, 259, 935–948. [Google Scholar] [CrossRef]

- Batarfi, R.; Jaber, M.Y.; Glock, C.H. Pricing and inventory decisions in a dual-channel supply chain with learning and forgetting. Comput. Ind. Eng. 2019, 136, 397–420. [Google Scholar] [CrossRef]

- Li, M.; Mizuno, S. Dynamic pricing and inventory management of a dual-channel supply chain under different power structures. Eur. J. Oper. Res. 2022, 303, 273–285. [Google Scholar] [CrossRef]

- Li, M.; Mizuno, S. Comparison of dynamic and static pricing strategies in a dual-channel supply chain with inventory control. Transp. Res. Part E Logist. Transp. Rev. 2022, 165, 102843. [Google Scholar] [CrossRef]

- Zhong, Y.; Yang, T.; Yu, H.; Zhong, S.; Xie, W. Impacts of blockchain technology with government subsidies on a dual-channel supply chain for tracing product information. Transp. Res. Part E Logist. Transp. Rev. 2023, 171, 103032. [Google Scholar] [CrossRef]

- Huang, S.; Wang, Y.; Zhang, X. Contracting with countervailing incentives under asymmetric cost information in a dual-channel supply chain. Transp. Res. Part E Logist. Transp. Rev. 2023, 171, 103038. [Google Scholar] [CrossRef]

- Zhao, Y.; Huang, W.; Xu, E.; Xu, X. Pricing and green promotion decisions in a retailer-owned dual-channel supply chain with multiple manufacturers. Clean. Logist. Supply Chain. 2023, 6, 100092. [Google Scholar] [CrossRef]

- Cao, J.; So, K.C.; Yin, S. Impact of an “online-to-store” channel on demand allocation, pricing and profitability. Eur. J. Oper. Res. 2016, 248, 234–245. [Google Scholar] [CrossRef]

- Jin, M.; Li, G.; Cheng, T.C.E. Buy online and pick up in-store: Design of the service area. Eur. J. Oper. Res. 2018, 268, 613–623. [Google Scholar] [CrossRef]

- MacCarthy, B.L.; Zhang, L.; Muyldermans, L. Best Performance Frontiers for Buy-Online-Pickup-in-Store order fulfilment. Int. J. Prod. Econ. 2019, 211, 251–264. [Google Scholar] [CrossRef]

- Kong, R.; Luo, L.; Chen, L.; Keblis, M.F. The effects of BOPS implementation under different pricing strategies in omnichannel retailing. Transp. Res. Part E Logist. Transp. Rev. 2020, 141, 102014. [Google Scholar] [CrossRef]

- Li, Q.; Wang, Q.; Song, P. Do customers always adopt buy-online-and-pick-up-in-store service? Consideration of location-based store density in omni-channel retailing. J. Retail. Consum. Serv. 2022, 68, 103072. [Google Scholar] [CrossRef]

- Abouelrous, A.; Gabor, A.F.; Zhang, Y. Optimizing the inventory and fulfillment of an omnichannel retailer: A stochastic approach with scenario clustering. Comput. Ind. Eng. 2022, 173, 108723. [Google Scholar] [CrossRef]

- Wang, L.; Chen, H. Optimization of a stochastic joint replenishment inventory system with service level constraints. Comput. Oper. Res. 2022, 148, 106001. [Google Scholar] [CrossRef]

- Scarf, H. A min max solution of an inventory problem. In Studies in the Mathematical Theory of Inventory and Production; Rand Corporation: Santa Monica, CA, USA, 1958. [Google Scholar]

- Gallego, G.; Moon, I. The distribution free newsboy problem: Review and extensions. J. Oper. Res. Soc. 1993, 44, 825–834. [Google Scholar] [CrossRef]

- Moon, I.; Choi, S. The distribution free continuous review inventory system with a service level constraint. Comput. Ind. Eng. 1994, 27, 209–212. [Google Scholar] [CrossRef]

- Vairaktarakis, G.L. Robust multi-item newsboy models with a budget constraint. Int. J. Prod. Econ. 2000, 66, 213–226. [Google Scholar] [CrossRef]

- Modak, N.M.; Kelle, P. Managing a dual-channel supply chain under price and delivery-time dependent stochastic demand. Eur. J. Oper. Res. 2019, 272, 147–161. [Google Scholar] [CrossRef]

- Feng, Y.; Zhang, J.; Feng, L.; Zhu, G. Benefit from a high store visiting cost in an omnichannel with BOPS. Transp. Res. Part E Logist. Transp. Rev. 2022, 166, 102904. [Google Scholar] [CrossRef] [PubMed]

| 26.9544 | 26.9551 | 26.9559 | ||

| 31.9788 | 31.9576 | 31.9575 | ||

| 29.8632 | 29.8630 | 29.8459 | ||

| 10.9293 | 10.8573 | 10.7728 | ||

| 136.5649 | 136.5985 | 136.6379 | ||

| 120.1155 | 119.4279 | 119.4226 | ||

| 132.2734 | 132.2631 | 131.4814 | ||

| 12766 | 12679 | 12600 |

| 6.6612 | 32.0243 | 32.0242 | 32.0240 | |

| 6.4296 | 6.4299 | 31.9575 | 31.9575 | |

| 6.4550 | 6.4553 | 6.4553 | 31.8770 | |

| 10.6453 | 10.7639 | 10.7798 | 10.7980 | |

| 123.3612 | 139.9757 | 139.9683 | 139.9598 | |

| 103.7860 | 103.7934 | 119.4230 | 119.4242 | |

| 115.0371 | 115.0456 | 115.0467 | 132.9120 | |

| 7790.7 | 9297.5 | 11275 | 13097 |

| 25.7275 | 26.9559 | 26.9559 | ||

| 30.5791 | 30.5791 | 31.9574 | ||

| 28.6850 | 28.6850 | 28.6850 | ||

| 10.7656 | 10.7710 | 10.7719 | ||

| 135.8795 | 136.6387 | 136.6383 | ||

| 118.5502 | 118.5506 | 119.4226 | ||

| 130.5975 | 130.5979 | 130.5980 | ||

| 13242 | 13021 | 12793 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Song, R.; Wu, Z. Centralized Decision Making in an Omnichannel Supply Chain with Stochastic Demand. Sustainability 2023, 15, 13113. https://doi.org/10.3390/su151713113

Song R, Wu Z. Centralized Decision Making in an Omnichannel Supply Chain with Stochastic Demand. Sustainability. 2023; 15(17):13113. https://doi.org/10.3390/su151713113

Chicago/Turabian StyleSong, Rui, and Zhongming Wu. 2023. "Centralized Decision Making in an Omnichannel Supply Chain with Stochastic Demand" Sustainability 15, no. 17: 13113. https://doi.org/10.3390/su151713113