EnergyAuction: IoT-Blockchain Architecture for Local Peer-to-Peer Energy Trading in a Microgrid

Abstract

:1. Introduction

- A thorough analysis of blockchain network design and market types/attributes for local peer-to-peer energy trading.

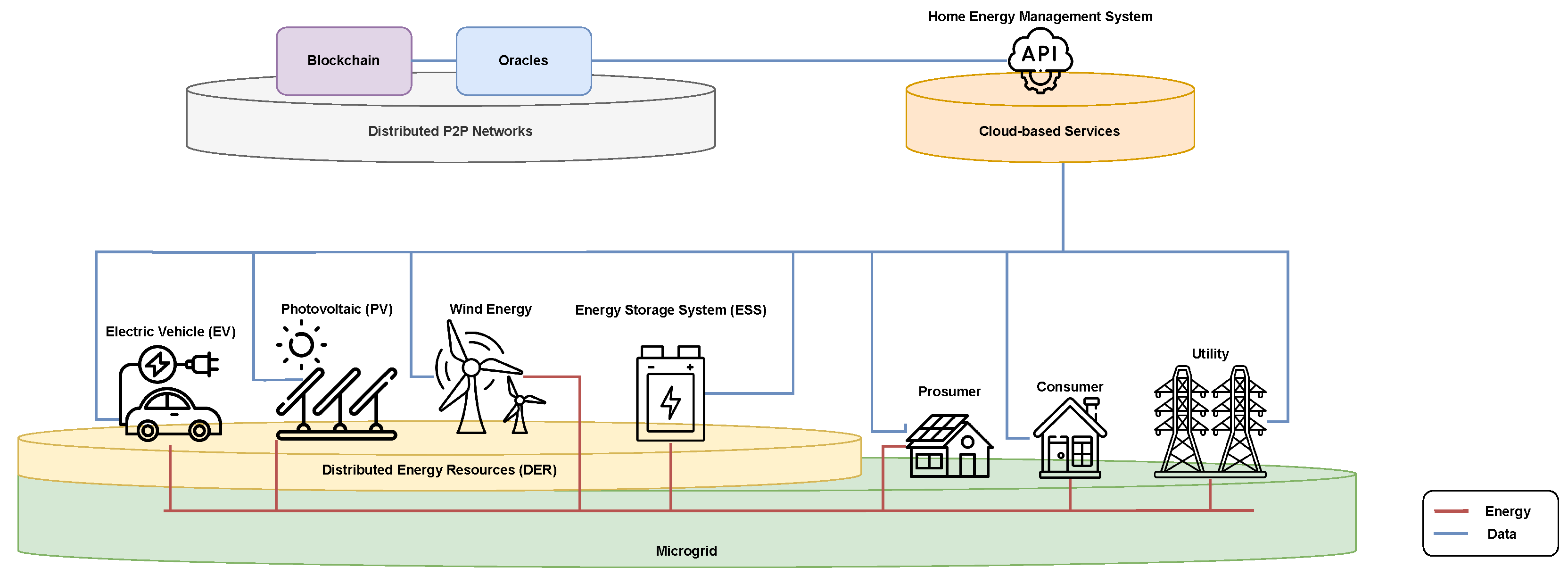

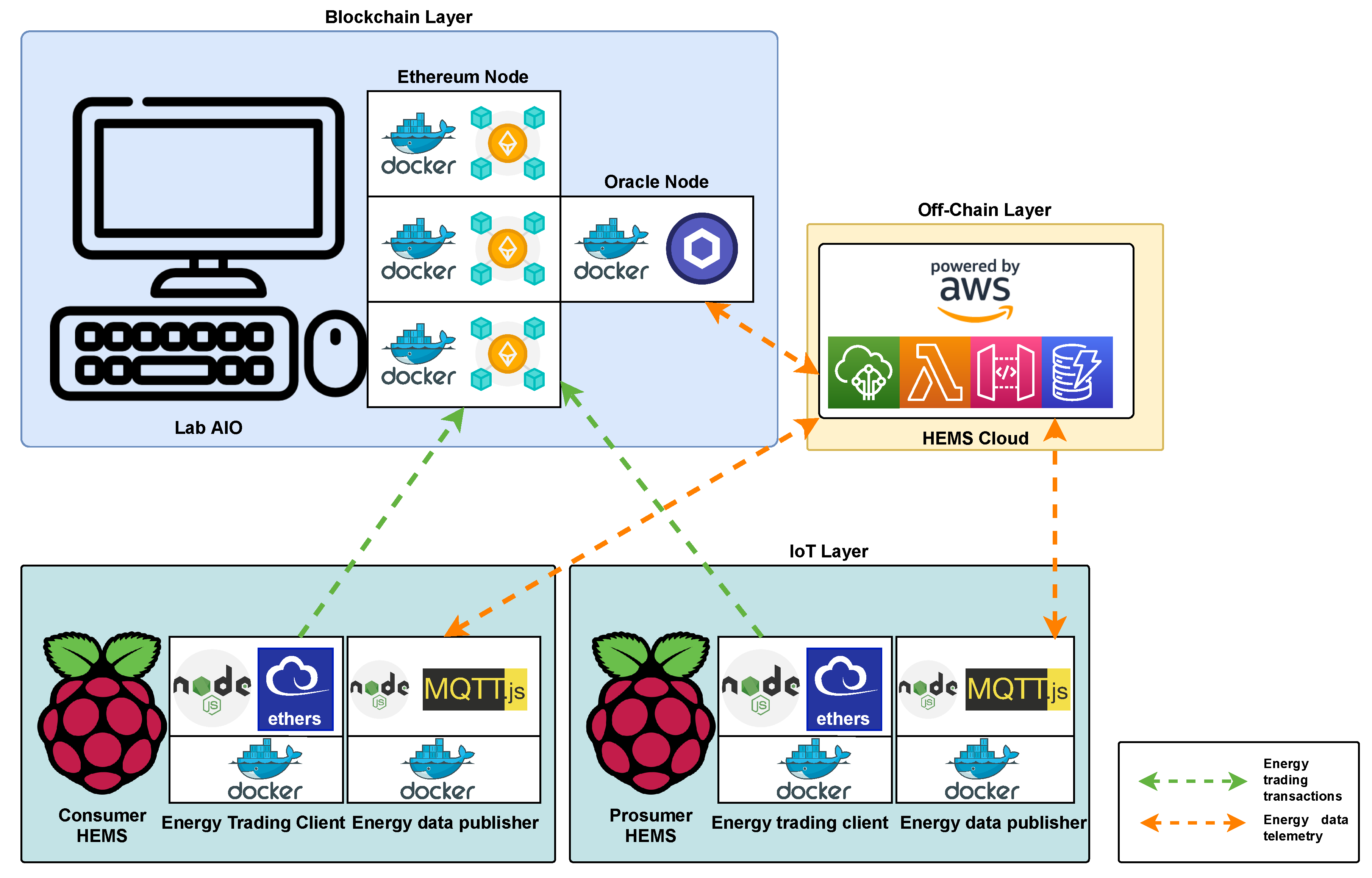

- Proposal of IoT–blockchain architecture for local P2P energy trading in a microgrid which consists of two layers: physical (IoT layer) and virtual (off-chain layer and blockchain layer).

- Development, deploying, and testing of four smart contracts for local peer-to-peer energy trading: data access contract, energy trading smart contract, Link Token contract, and oracle client contract.

- A testbed implementation (hardware/software) is carried out in a laboratory environment for one prosumer, one consumer, and a microgrid control center, where the off-chain layer of the HEMS is implemented on AWS platform and the blockchain layer is implemented using an AIO computer.

2. Related Work

2.1. Decentralization: Blockchain Technology

2.2. Blockchain Network Design

2.2.1. Network Selection

2.2.2. Consensus Mechanisms

2.2.3. Privacy and Network Access

2.3. Smart Contracts

2.4. oracle Networks

2.5. Pilots and Implementations

3. Local P2P Energy Trading

3.1. Market Type

- P2P Markets: Facilitate trading between users without the need for an intermediary. The primary objective of this market is to encourage active participation by energy users, providing them with an incentive to participate in the energy markets.

- Collective Source Connected (CSC) or Collaborative: Users tend to be co-located energy prosumers that trade their surplus energy in a market arrangement.

- Transactive Energy Markets: Maintain supply–demand equilibrium through autonomous management of DER using price signals, which ensures system stability. These markets offer services to the electricity system by optimizing the use of resources.

3.2. Archetypal Market Design

- Futures market is the most common market design, in which all the trading happens before the settlement period. When the settlement period arrives, the participants stick to their traded position. Any variation from the trading position is dealt with by the settlement.

- Real time market is where all the trading occurs at the settlement period, where participants contract with other participants to buy or sell the energy they are in the process of consuming or producing. This approach usually considers the usage of forecasted consumption or generation curves. One consideration found in this market design is that it is assumed that they are connected to larger traditional energy systems, which are able to provide or absorb an infinite excess supply or demand.

- Mixed decentralized/centralized market is a two-phase market design where initial decentralized trading is carried between participants looking to clear the market as far as possible, without intervention from a market operator. The second phase is performed by a centralized entity, which clears the remainder of the market.

- Mixed futures/real time market consists of two phases: An initial phase before the settlement, where participants trade based on predicted supply and demand for energy. During the settlement period, participants can adjust their position based on actual supply and demand curves in a real-time energy market.

- Multi-layer market starts from a local or bottom level for clearing the market. An aggregator is used for passing the uncleared supply or demand for energy to the next market level.

- Settlement after the fact is an uncommon scheme where no trading was carried out before the end of the settlement. Here, participants are charged or paid for the energy bought or sold after the settlement. A fixed price for buying or selling energy is defined by the system. Participants can purchase or sell the amount of energy they require.

3.3. Price Formation Mechanism

- Single auction: Only one party of the market is able to submit bids.

- Double auction: Allows sellers and buyers to submit bids.

- System-determined mechanisms: Usually defined by the system operator. Some of these mechanisms include uniform or fixed prices or cooperative game theory.

- Negotiation-based mechanisms: Automated transactions considered usually through the use of artificial intelligence (AI). Negotiating autonomous agents is one kind of negotiation-based mechanism.

- Equilibrium-based mechanisms: Use game theory to establish market equilibrium, which utilizes the bids and offers from the participants.

3.4. Market Participants

- Prosumers are participants that generate and consume energy at the same time using small-scale distributed energy resources (DERs) such as wind turbines and solar panels.

- Pure consumer are participants that only consume energy without any DERs.

- Pure generator are participants that only generate energy.

- Retailer is an entity that connects to other large markets.

- Market operator is a single agent that runs the market operation.

- Grid operator is an entity that operates the electricity network and interacts with the market.

- Aggregator is an actor that represents a small group of participants.

3.5. Market Value Proposition

- Market commodity corresponds to the traded commodity in the market. Electrical energy was the most found commodity traded. Other commodities include flexibility alongside the sale of energy or a flexibility-only market. Other forms of energy are also found, such as combined heat and power, combined power and gas, or combined heat, power, and gas.

- Benefits to market participants are mainly financial, like increasing the profit from the sale of energy. Other objectives can also be considered, such as increasing the total welfare, which implies multiple financial benefits to all market participants, reducing the grid imbalance, or reducing the electricity cost.

3.6. Market Scale

- Small scale: Considers residential or individual energy users.

- Building scale: Multiple buildings trade with each other.

- Microgrid/community scale: Energy users operate as a community, rather than as individual participants.

- Grid scale: The trading is at a distribution or transmission network level.

3.7. Market Operation

- Data shared: Price, volume, price and volume, demand and supply curve, controllable loads, the flexibility available, battery state of charge (SoC), distribution line distance, and discomfort level are some of the data parameters that can be shared for the energy trading.

- Settlement period and gate closure: The settlement period is a period of time in which the supply and demand of market participants are balanced. Gate closure is the period of time before the settlement, where bidding and offering can take place.

4. How Does Blockchain Enable Energy Trading?

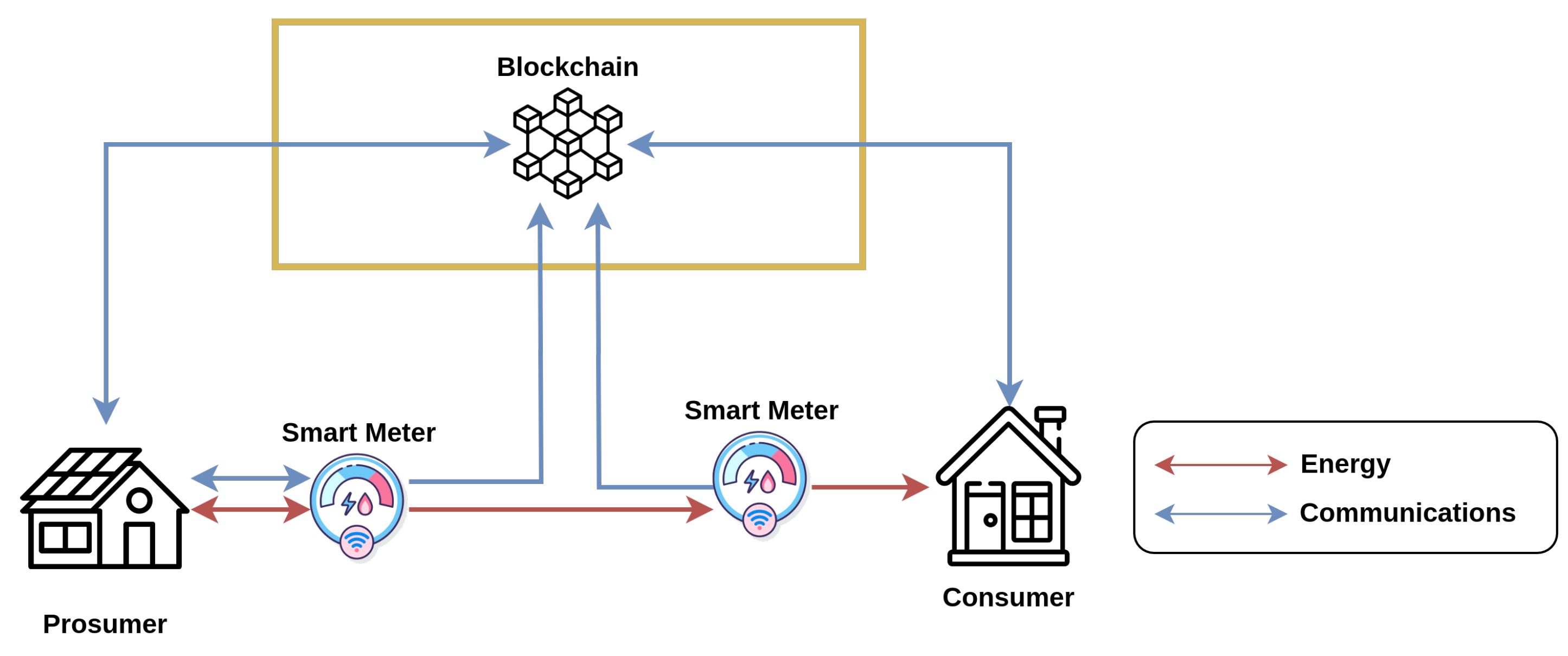

4.1. Physical Layer: IoT Layer

4.2. Virtual Layer: Off-Chain Layer

4.3. Virtual Layer: Blockchain Layer

5. Market Setup

- Market Type: It is set up as a peer-to-peer, meaning that the participants are able to exchange energy directly among each other without intermediaries. This allows for greater autonomy and more flexibility in energy trading.

- Market Design: It is selected as a future market design, which means that the participants trade for future delivery of energy. Such a design allows for greater predictability and flexibility in energy trading.

- Price Formation Mechanism: The market price is determined by the intersection of the energy offered by the prosumer and the energy demanded by the consumer. This mechanism ensures efficiency and fairness in the energy trading process.

- Market Participants: The participants in the market are defined as prosumers, pure consumers, and the microgrid control center (MCC). The MCC is responsible for the overall operation of the microgrid and acts as a combination of both the market operator and the grid operator. The decentralization of the system through the use of blockchain technology ensures more efficient management of the microgrid.

- Market Value Proposition: The commodity traded in the market is energy, and the main benefit of the model is to put prosumers at the forefront of energy production and supply to consumers. This allows for a more sustainable and decentralized energy system.

- Market Scale: The market is defined as small-scale, with participants confined to a single microgrid. This allows for more efficient and localized energy trading.

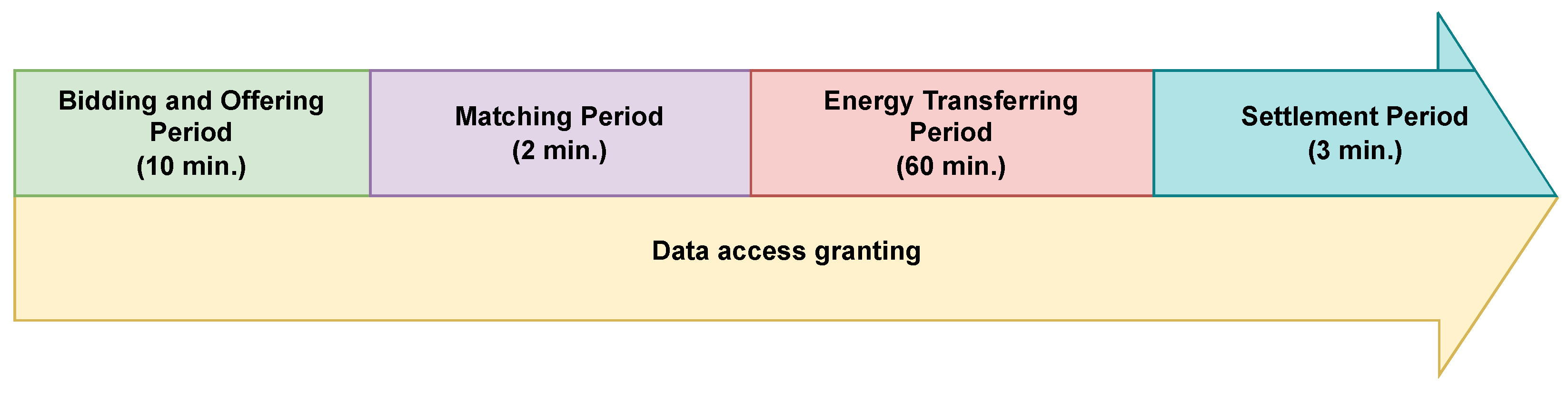

- Market Operation: The market operation involves two categories: data related, including state of charge (SoC) data from the battery energy storage system (BESS), energy consumption and generation data from IoT devices, and trade-related, including price and quantity. The settlement and gate closure procedures are defined in detail in a subsequent figure, promoting a transparent and fair energy trading system.

- Bidding and Offering Period: This is a 10 min phase in which consumers and prosumers can submit bidding and offer requests, respectively.

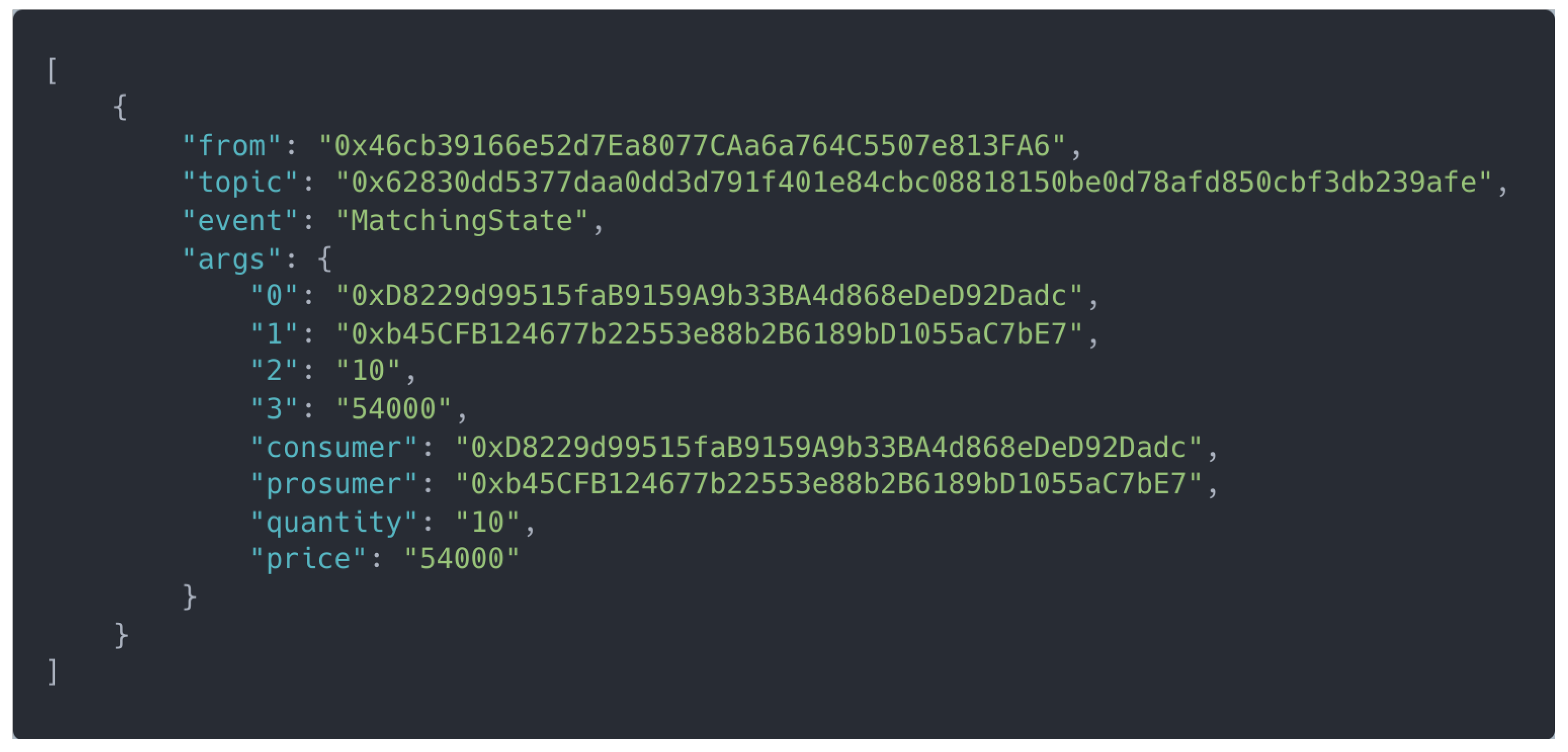

- Matching Period: This is a 2 min phase in which the bids and offers are processed to make a match between them.

- Energy Transfer Period: This is a 60 min phase during which energy is transferred from prosumers to consumers.

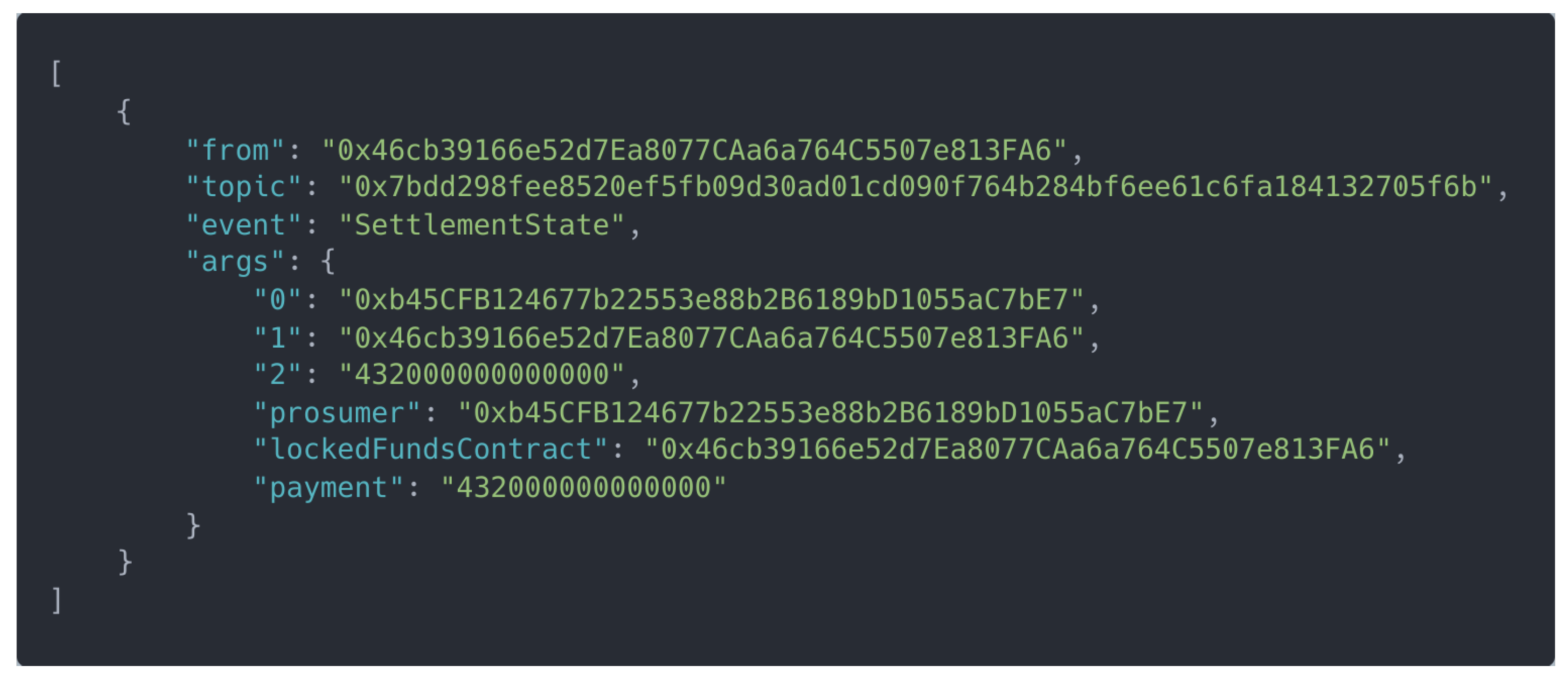

- Settlement Period: This is a 3 min phase in which the settlement of funds takes place. The settlement period verifies how much consumers should pay to prosumers based on the actual energy received.

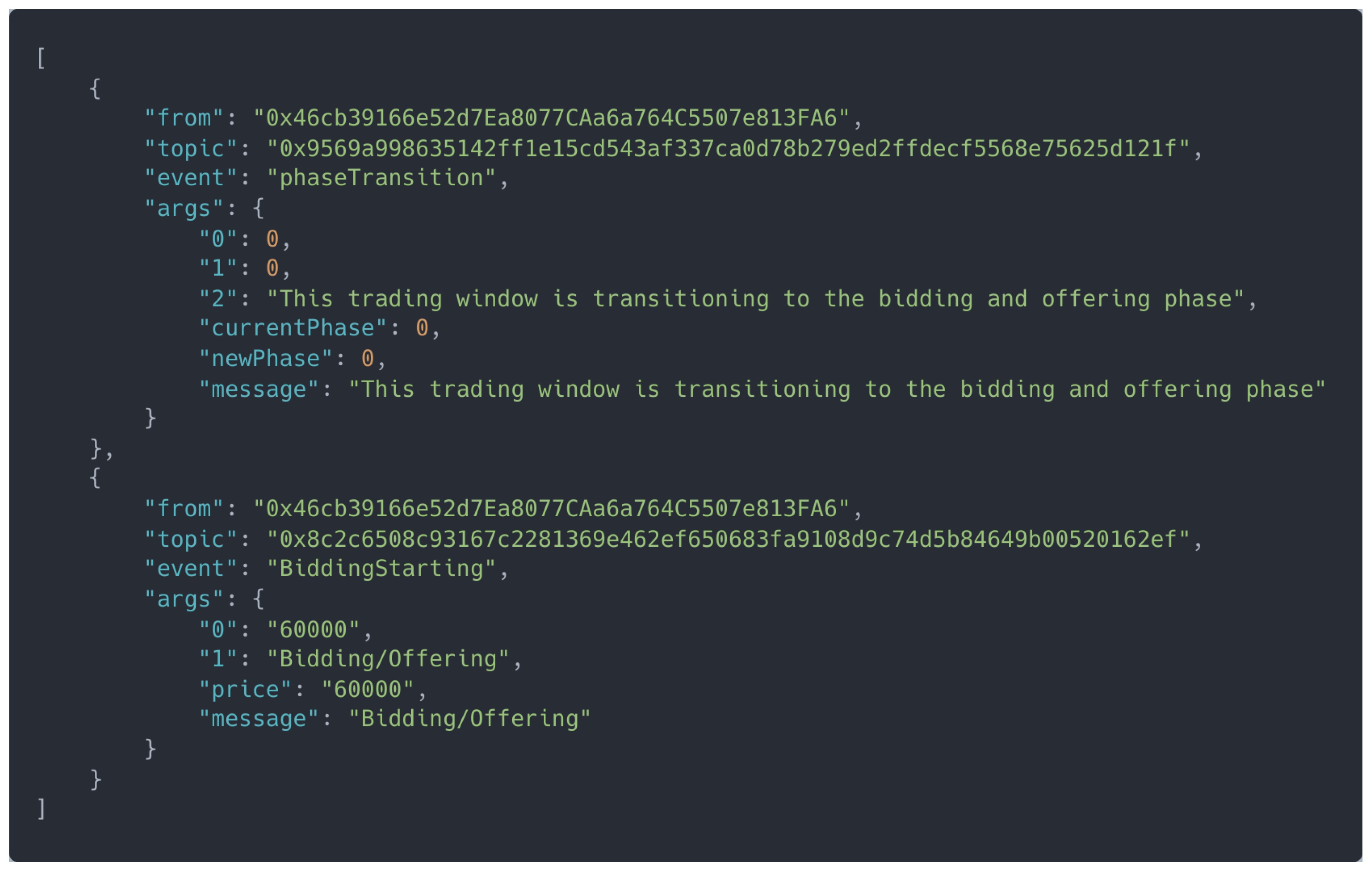

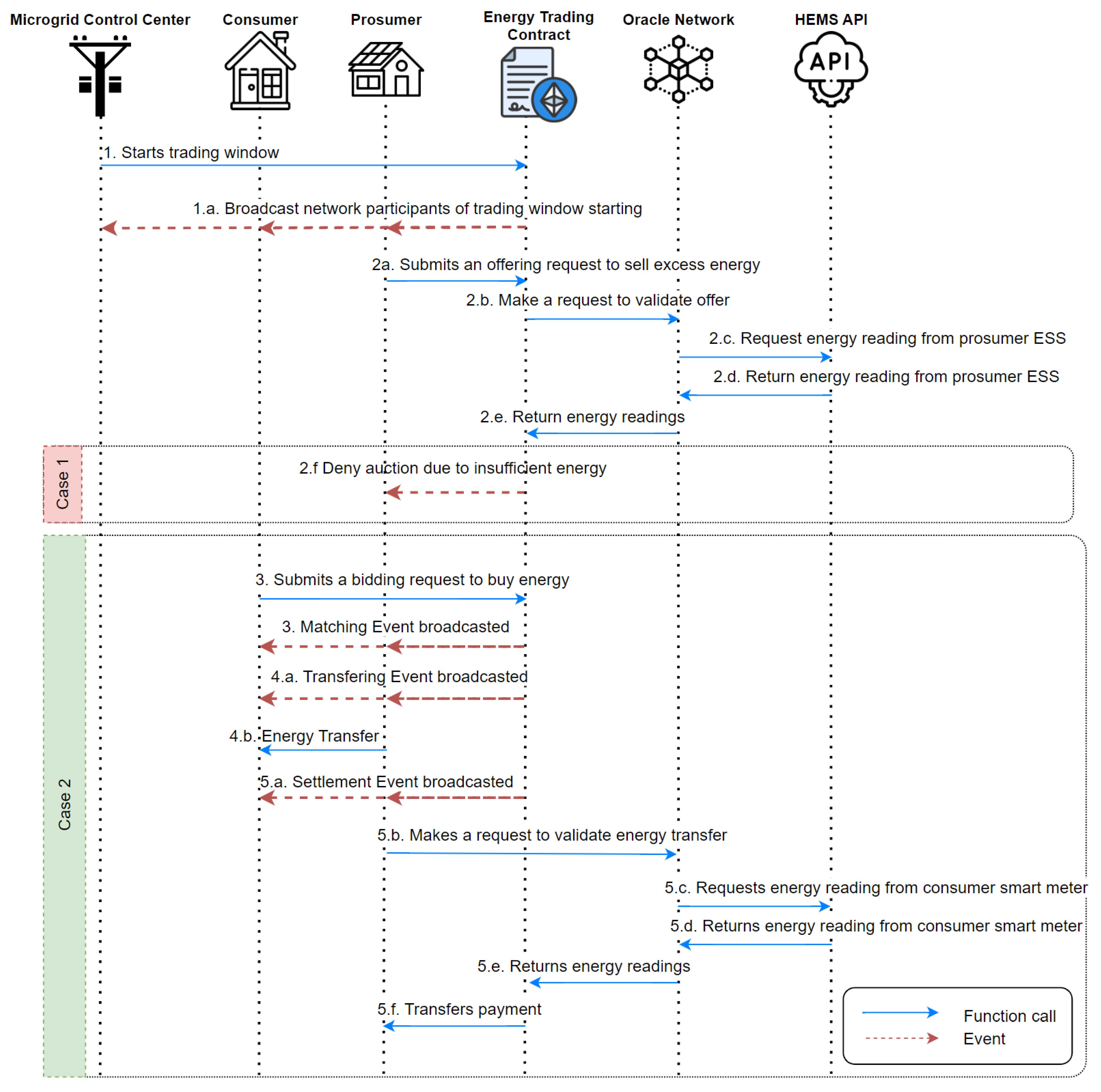

- The MCC starts a new energy trading window, which begins with the bidding and offering phase. This is broadcasted as an event in the blockchain network.

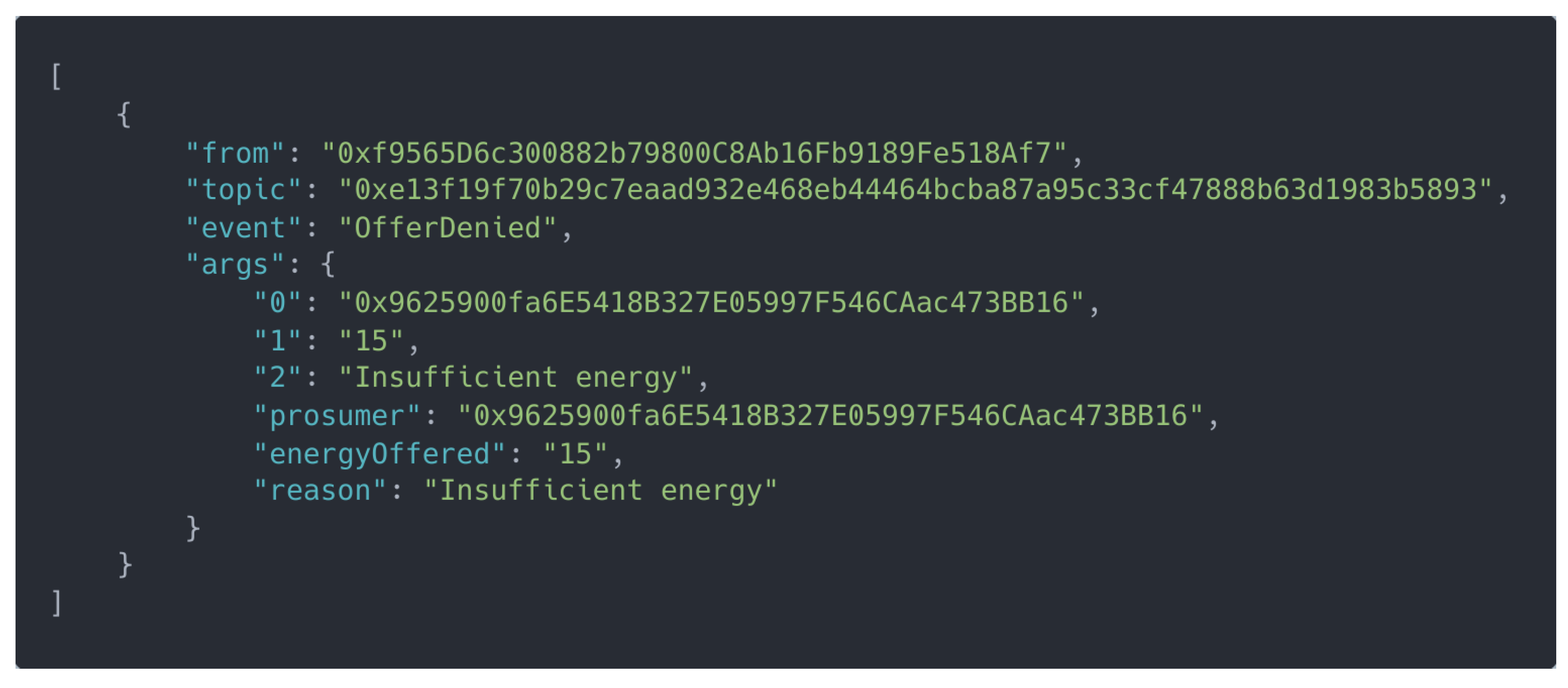

- The prosumer submits an offer to sell excess energy. The energy trading smart contract validates the offer request by obtaining energy readings from the HEMS through an oracle network. If the prosumer is unable to provide the offered energy, the smart contract emits an event to notify the prosumer that their offer will not be considered, and this is depicted in “Case 1”. This ensures fairness and transparency by preventing false offers. If the prosumer has enough energy, the smart contract records the energy offer as valid, and this is depicted in “Case 2”.

- A consumer submits a bid to buy energy, which is recorded in the record of bids. After 10 min, the smart contract matches available energy offerings with the record of bids, providing a match between prosumers and consumers for energy transfer.

- In the energy-transferring phase, which lasts for 60 min, the prosumer becomes the energy provider of the consumer who charges its ESS with the energy provided. A maximum of 10 kWh is set for this phase due to technological restrictions of a common residential system to transfer more than 10 kW over an hour to the battery.

- In the settlement phase, the energy trading smart contract obtains energy readings from the consumer smart meter on the HEMS API through an oracle network. If the consumer received less energy than they requested, funds are returned to cover the energy mismatch. The payment is then transferred to the prosumer based on the revenue generated from the sale of energy, which is determined by market demand through the use of bid pricing. The mathematical representation of this process can be represented as , where R represents the revenue, E represents the energy received by the consumer, and B represents the bid price.

6. Implementation

6.1. Off-Chain Layer

- /battery-soc/id: This endpoint returns an object with the readings from the last measurement of the state of charge (SoC) of a battery energy storage system (BESS). The readings are randomly generated each hour, and the id represents the identifier of the battery.

- /smartmeter/id: This endpoint returns the last hour energy consumption in kWh from a user’s smart meter. The id represents the identifier of the smart meter.

6.2. Blockchain Layer

6.2.1. Smart Contracts

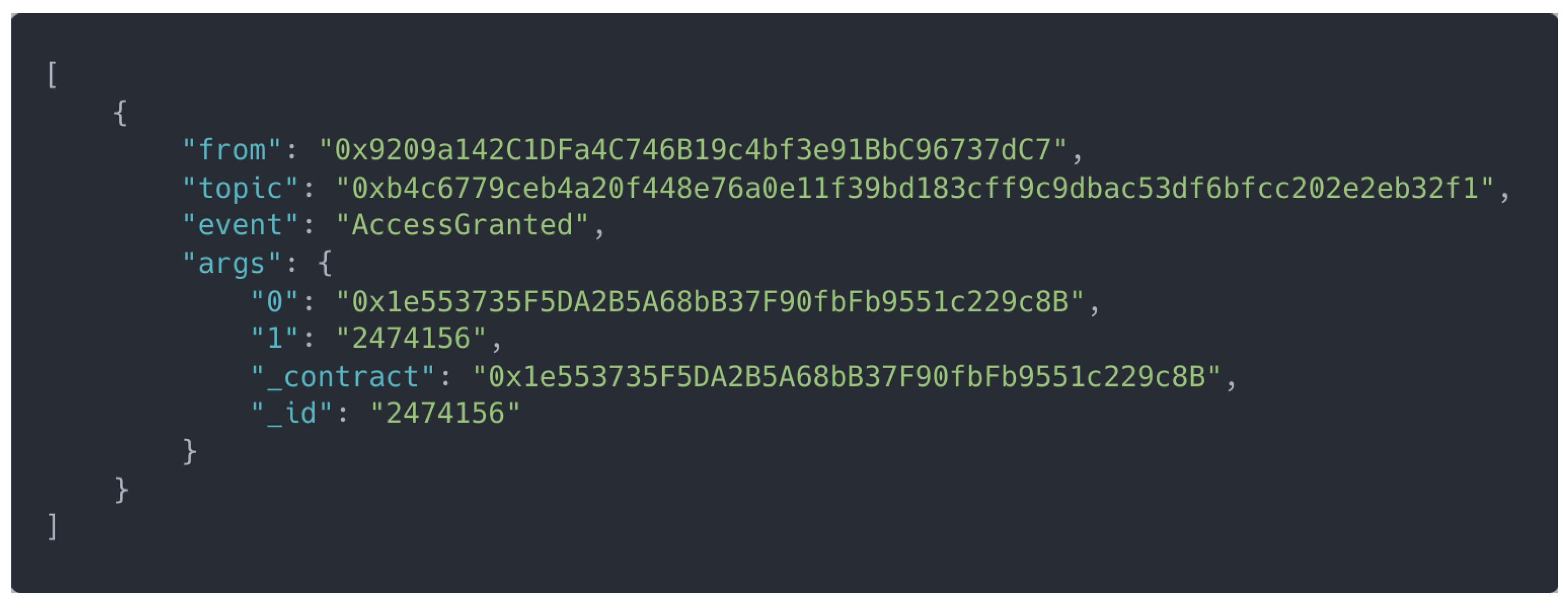

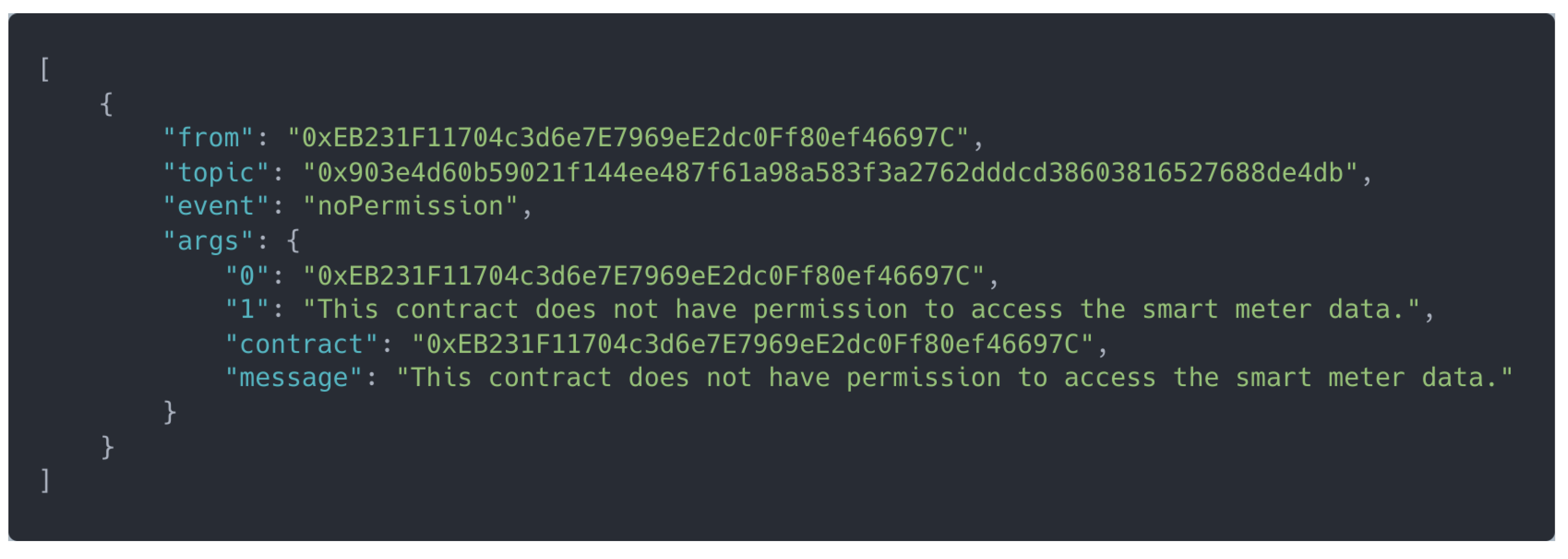

- In the privacy contract category, the data access contract was implemented to manage an access control list containing entities authorized to request energy data from a user’s HEMS. This permission is granted by the user. This smart contract helps ensure that the energy data are only accessible to authorized parties, which helps to protect the privacy and security of the energy data.

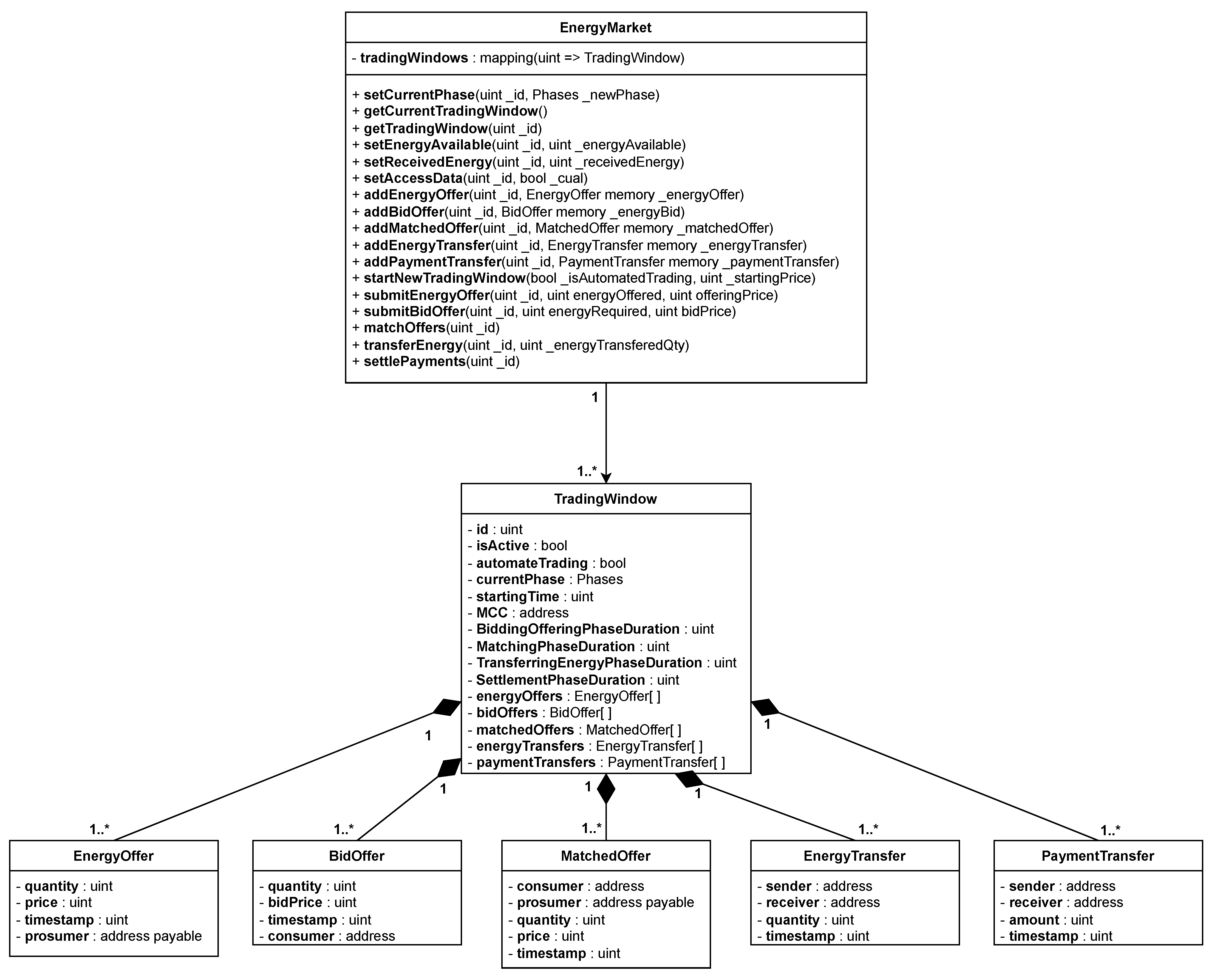

- In the trading contract category, the energy trade smart contract was developed, which contains the main business logic of the energy trading system. This smart contract implements a trading window consisting of four states: a bidding and offering state, a matching state, an energy-transferring state, and a settlement state. During the initial phase, the bidding and offering period is initialized when a new trading window is requested in the trading smart contract. Additionally, the trading window allows granting data access at any time, which is required to participate in a trading window. A class diagram is presented in Figure 11, where the solidity structures are presented as classes, that possess attributes and functions.

- In the oracle contracts category, two contracts were developed. The Link Token contract issues the ERC-20 Link Token, which is required to pay for data requests through the oracle network. The oracle client contract is used to request energy data using the HEMS APIs, and this request is handled by the oracle network, which processes the request and provides a callback with the results of the request. Both the Link Token contract and the oracle client contract can be found in the Chainlink official repository (https://github.com/smartcontractkit/chainlink/tree/develop/contracts/src accessed on 3 November 2022).

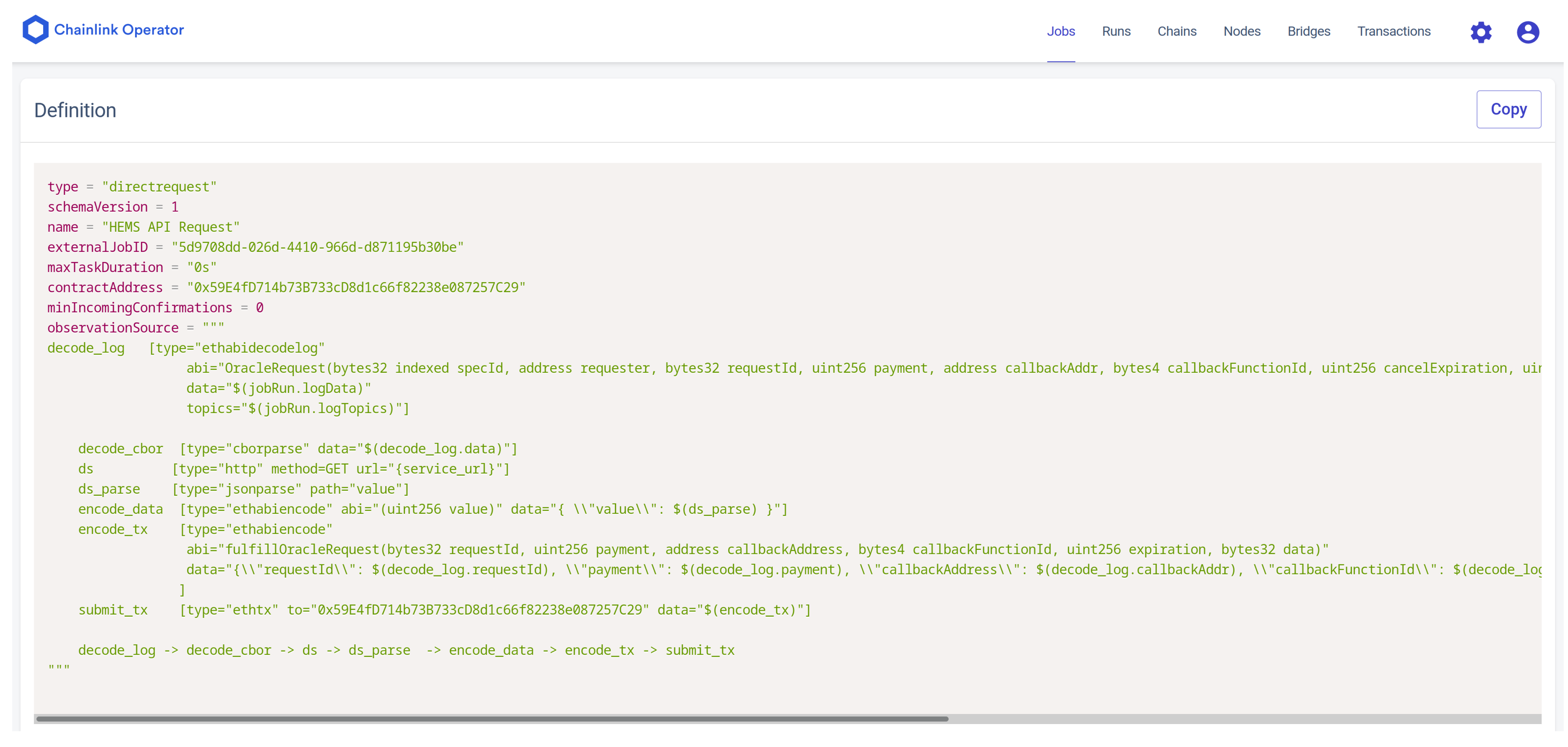

6.2.2. oracle Nodes

6.3. IoT Layer

6.3.1. Energy Data Client

6.3.2. Energy Trading Client

6.4. Use Case and Validation

6.5. Cost Analysis Results

7. Discussion and Limitations

8. Conclusions

- To support a large number of participants, there is a need to optimize the platform performance and scalability. This includes optimizing the smart contract code, data storage, and processing algorithms.

- To support real-time energy trading, different business models and trading schemes should be developed where participants trade energy in real time based on the current market conditions.

- Cybersecurity and privacy are important factors to be considered. This includes the data exchange among different participants as well as the sensors, smart meters, and networking infrastructure.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Bouhafs, F.; Mackay, M.; Merabti, M. Links to the Future: Communication Requirements and Challenges in the Smart Grid. IEEE Power Energy Mag. 2012, 10, 24–32. [Google Scholar] [CrossRef]

- Bayram, I.S.; Shakir, M.Z.; Abdallah, M.; Qaraqe, K. A survey on energy trading in smart grid. In Proceedings of the 2014 IEEE Global Conference on Signal and Information Processing (GlobalSIP), Atlanta, GA, USA, 3–5 December 2014. [Google Scholar] [CrossRef]

- Hamari, J.; Sjölint, M.; Ukkonen, A. The sharing economy: Why people participate in collaborative consumption. J. Assoc. Inf. Sci. Technol. 2015, 67, 2047–2059. [Google Scholar] [CrossRef]

- Jamil, F.; Iqbal, N.; Ahmad, S.; Kim, D. Peer-to-Peer Energy Trading Mechanism Based on Blockchain and Machine Learning for Sustainable Electrical Power Supply in Smart Grid. IEEE Access 2021, 9, 39193–39217. [Google Scholar] [CrossRef]

- Kabalci, Y.; Kabalci, E.; Padmanaban, S.; Holm-Nielsen, J.B.; Blaabjerg, F. Internet of Things Applications as Energy Internet in Smart Grids and Smart Environments. Electronics 2019, 8, 972. [Google Scholar] [CrossRef]

- Tan, S.; Wu, Y.; Xie, P.; Guerrero, J.M.; Vasquez, J.C.; Abusorrah, A. New Challenges in the Design of Microgrid Systems: Communication Networks, Cyberattacks, and Resilience. IEEE Electrif. Mag. 2020, 8, 98–106. [Google Scholar] [CrossRef]

- Wu, Y.; Wu, Y.; Guerrero, J.M.; Vasquez, J.C.; Palacios-Garcia, E.J.; Li, J. Convergence and Interoperability for the Energy Internet: From Ubiquitous Connection to Distributed Automation. IEEE Ind. Electron. Mag. 2020, 14, 91–105. [Google Scholar] [CrossRef]

- Leitao, J.; Gil, P.; Ribeiro, B.; Cardoso, A. A Survey on Home Energy Management. IEEE Access 2020, 8, 5699–5722. [Google Scholar] [CrossRef]

- Zafar, U.; Bayhan, S.; Sanfilippo, A. Home Energy Management System Concepts, Configurations, and Technologies for the Smart Grid. IEEE Access 2020, 8, 119271–119286. [Google Scholar] [CrossRef]

- Llaria, A.; Dos Santos, J.; Terrasson, G.; Boussaada, Z.; Merlo, C.; Curea, O. Intelligent Buildings in Smart Grids: A Survey on Security and Privacy Issues Related to Energy Management. Energies 2021, 14, 2733. [Google Scholar] [CrossRef]

- Chander, B.; Kumaravelan, G. Internet of Things: Foundation. In Principles of Internet of Things (IoT) Ecosystem: Insight Paradigm; Peng, S.L., Pal, S., Huang, L., Eds.; Springer International Publishing: Cham, Switzerland, 2020; pp. 3–33. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Cheng, M.; Zhou, Y.; Long, C. A Bidding System for Peer-to-Peer Energy Trading in a Grid-connected Microgrid. Energy Procedia 2016, 103, 147–152. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, J.; Long, C.; Ming, W. State-of-the-Art Analysis and Perspectives for Peer-to-Peer Energy Trading. Engineering 2020, 6, 739–753. [Google Scholar] [CrossRef]

- Soto, E.A.; Bosman, L.B.; Wollega, E.; Leon-Salas, W.D. Peer-to-peer energy trading: A review of the literature. Appl. Energy 2021, 283, 116268. [Google Scholar] [CrossRef]

- Wu, Y.; Wu, Y.; Guerrero, J.M.; Vasquez, J.C. Digitalization and decentralization driving transactive energy Internet: Key technologies and infrastructures. Int. J. Electr. Power Energy Syst. 2021, 126, 106593. [Google Scholar] [CrossRef]

- Condon, F.; Martínez, J.M.; Kim, Y.C.; Ahmed, M.A. EnergyAuction: oracle Blockchain-Based Energy Trading System for Microgrids. In Proceedings of the 2023 IEEE Conference on Power Electronics and Renewable Energy (CPERE), Luxor, Egypt, 15–17 February 2023; pp. 1–6. [Google Scholar]

- Mengelkamp, E.; Notheisen, B.; Beer, C.; Dauer, D.; Weinhardt, C. A blockchain-based smart grid: Towards sustainable local energy markets. Comput. Sci. Res. Dev. 2018, 33, 207–214. [Google Scholar] [CrossRef]

- Luo, Y.; Itaya, S.; Nakamura, S.; Davis, P. Autonomous cooperative energy trading between prosumers for microgrid systems. In Proceedings of the 39th Annual IEEE Conference on Local Computer Networks Workshops, Edmonton, AB, Canada, 8–11 September 2014. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Zhou, Y.; Cheng, M.; Long, C. Peer-to-Peer energy trading in a Microgrid. Appl. Energy 2018, 220, 1–12. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Li, Z.; Kang, J.; Yu, R.; Ye, D.; Deng, Q.; Zhang, Y. Consortium Blockchain for Secure Energy Trading in Industrial Internet of Things. IEEE Trans. Ind. Inform. 2018, 14, 3690–3700. [Google Scholar] [CrossRef]

- Aitzhan, N.Z.; Svetinovic, D. Security and Privacy in Decentralized Energy Trading through Multi-Signatures, Blockchain and Anonymous Messaging Streams. IEEE Trans. Dependable Secur. Comput. 2018, 15, 840–852. [Google Scholar] [CrossRef]

- Wang, S.; Sheng, H.; Zhang, Y.; Yang, D.; Shen, J.; Chen, R. Blockchain-Empowered Distributed Multi-Camera Multi-Target Tracking in Edge Computing. IEEE Trans. Ind. Inform. 2023, 1–10. [Google Scholar] [CrossRef]

- Cao, B.; Wang, X.; Zhang, W.; Song, H.; Lv, Z. A Many-Objective Optimization Model of Industrial Internet of Things Based on Private Blockchain. IEEE Netw. 2020, 34, 78–83. [Google Scholar] [CrossRef]

- Mihaylov, M.; Jurado, S.; Avellana, N.; Van Moffaert, K.; de Abril, I.M.; Nowé, A. NRGcoin: Virtual currency for trading of renewable energy in smart grids. In Proceedings of the 11th International Conference on the European Energy Market (EEM14), Krakow, Poland, 28–30 May 2014; pp. 1–6. [Google Scholar] [CrossRef]

- Wang, W.; Hoang, D.T.; Hu, P.; Xiong, Z.; Niyato, D.; Wang, P.; Wen, Y.; Kim, D.I. A Survey on Consensus Mechanisms and Mining Strategy Management in Blockchain Networks. IEEE Access 2019, 7, 22328–22370. [Google Scholar] [CrossRef]

- Liu, C.; Zhang, X.; Chai, K.K.; Loo, J.; Chen, Y. A survey on blockchain-enabled smart grids: Advances, applications and challenges. IET Smart Cities 2021, 3, 56–78. [Google Scholar] [CrossRef]

- Szabo, N. Formalizing and securing relationships on public networks. First Monday 1997, 2. [Google Scholar] [CrossRef]

- Caldarelli, G. Overview of Blockchain oracle Research. Future Internet 2022, 14, 175. [Google Scholar] [CrossRef]

- Xu, X.; Pautasso, C.; Zhu, L.; Lu, Q.; Weber, I. A Pattern Collection for Blockchain-Based Applications. In Proceedings of the 23rd European Conference on Pattern Languages of Programs, New York, NY, USA, 19 February 2018. [Google Scholar] [CrossRef]

- Antal, C.; Cioara, T.; Antal, M.; Mihailescu, V.; Mitrea, D.; Anghel, I.; Salomie, I.; Raveduto, G.; Bertoncini, M.; Croce, V.; et al. Blockchain based decentralized local energy flexibility market. Energy Rep. 2021, 7, 5269–5288. [Google Scholar] [CrossRef]

- Al Breiki, H.; Al Qassem, L.; Salah, K.; Habib Ur Rehman, M.; Sevtinovic, D. Decentralized Access Control for IoT Data Using Blockchain and Trusted oracles. In Proceedings of the 2019 IEEE International Conference on Industrial Internet (ICII), Orlando, FL, USA, 11–12 November 2019; pp. 248–257. [Google Scholar] [CrossRef]

- Wu, Y.; Wu, Y.; Cimen, H.; Vasquez, J.C.; Guerrero, J.M. Towards collective energy Community: Potential roles of microgrid and blockchain to go beyond P2P energy trading. Appl. Energy 2022, 314, 119003. [Google Scholar] [CrossRef]

- Pradhan, N.R.; Singh, A.P.; Verma, S.; Kavita; Wozniak, M.; Shafi, J.; Ijaz, M.F. A blockchain based lightweight peer-to-peer energy trading framework for secured high throughput micro-transactions. Sci. Rep. 2022, 12, 14523. [Google Scholar] [CrossRef]

- Appasani, B.; Mishra, S.K.; Jha, A.V.; Mishra, S.K.; Enescu, F.M.; Sorlei, I.S.; Bîrleanu, F.G.; Takorabet, N.; Thounthong, P.; Bizon, N. Blockchain-Enabled Smart Grid Applications: Architecture, Challenges, and Solutions. Sustainability 2022, 14, 8801. [Google Scholar] [CrossRef]

- Capper, T.; Gorbatcheva, A.; Mustafa, M.A.; Bahloul, M.; Schwidtal, J.M.; Chitchyan, R.; Andoni, M.; Robu, V.; Montakhabi, M.; Scott, I.J.; et al. Peer-to-peer, community self-consumption, and transactive energy: A systematic literature review of local energy market models. Renew. Sustain. Energy Rev. 2022, 162, 112403. [Google Scholar] [CrossRef]

- Frieden, D.; Tuerk, A.; Neumann, C.; d’Herbemont, S.; Roberts, J. Collective self-consumption and energy communities: Trends and challenges in the transposition of the EU framework. Compil. Integr. Community Power Energy Isl. 2020. [Google Scholar] [CrossRef]

- Chen, S.; Liu, C.C. From demand response to transactive energy: State of the art. J. Mod. Power Syst. Clean Energy 2017, 5, 10–19. [Google Scholar] [CrossRef]

- Parag, Y.; Sovacool, B.K. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 16032. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, C.; Ding, Y.; Xydis, G.; Wang, J.; Østergaard, J. Review of real-time electricity markets for integrating Distributed Energy Resources and Demand Response. Appl. Energy 2015, 138, 695–706. [Google Scholar] [CrossRef]

- Koirala, B.P.; Koliou, E.; Friege, J.; Hakvoort, R.A.; Herder, P.M. Energetic communities for community energy: A review of key issues and trends shaping integrated community energy systems. Renew. Sustain. Energy Rev. 2016, 56, 722–744. [Google Scholar] [CrossRef]

- Saad, W.; Han, Z.; Poor, H.V.; Basar, T. Game-Theoretic Methods for the Smart Grid: An Overview of Microgrid Systems, Demand-Side Management, and Smart Grid Communications. IEEE Signal Process. Mag. 2012, 29, 86–105. [Google Scholar] [CrossRef]

- Abdella, J.; Shuaib, K. Peer to Peer Distributed Energy Trading in Smart Grids: A Survey. Energies 2018, 11, 1560. [Google Scholar] [CrossRef]

- Mohanta, B.K.; Panda, S.S.; Jena, D. An Overview of Smart Contract and Use Cases in Blockchain Technology. In Proceedings of the 2018 9th International Conference on Computing, Communication and Networking Technologies (ICCCNT), Bengaluru, India, 10–12 July 2018; pp. 1–4. [Google Scholar] [CrossRef]

- Al-Breiki, H.; Rehman, M.H.U.; Salah, K.; Svetinovic, D. Trustworthy Blockchain oracles: Review, Comparison, and Open Research Challenges. IEEE Access 2020, 8, 85675–85685. [Google Scholar] [CrossRef]

- Saltini, R.; Hyland-Wood, D. Ibft 2.0: A safe and live variation of the ibft blockchain consensus protocol for eventually synchronous networks. arXiv 2019, arXiv:1909.10194. [Google Scholar]

- Fan, C.; Lin, C.; Khazaei, H.; Musilek, P. Performance Analysis of Hyperledger Besu in Private Blockchain. In Proceedings of the 2022 IEEE International Conference on Decentralized Applications and Infrastructures (DAPPS), San Francisco, CA, USA, 15–18 August 2022; pp. 64–73. [Google Scholar] [CrossRef]

- Zhao, P.; Cheng, H.; Fang, Y.; Wang, X. A Secure Storage Strategy for Blockchain Based on MCMC Algorithm. IEEE Access 2020, 8, 160815–160824. [Google Scholar] [CrossRef]

- Wang, G.; Shi, Z.; Nixon, M.; Han, S. ChainSplitter: Towards Blockchain-Based Industrial IoT Architecture for Supporting Hierarchical Storage. In Proceedings of the 2019 IEEE International Conference on Blockchain (Blockchain), Atlanta, GA, USA, 14–17 July 2019; pp. 166–175. [Google Scholar] [CrossRef]

| Reference | Survey | Implementation | Testbed | Energy Trading |

|---|---|---|---|---|

| [13] | ✕ | ✓ | ✕ | ✓ |

| [21] | ✓ | ✕ | ✕ | ✓ |

| [34] | ✓ | ✓ | ✕ | ✓ |

| [28] | ✓ | ✓ | ✕ | ✓ |

| [35] | ✕ | ✓ | ✓ | ✓ |

| [36] | ✓ | ✓ | ✕ | ✓ |

| This work | ✕ | ✓ | ✓ | ✓ |

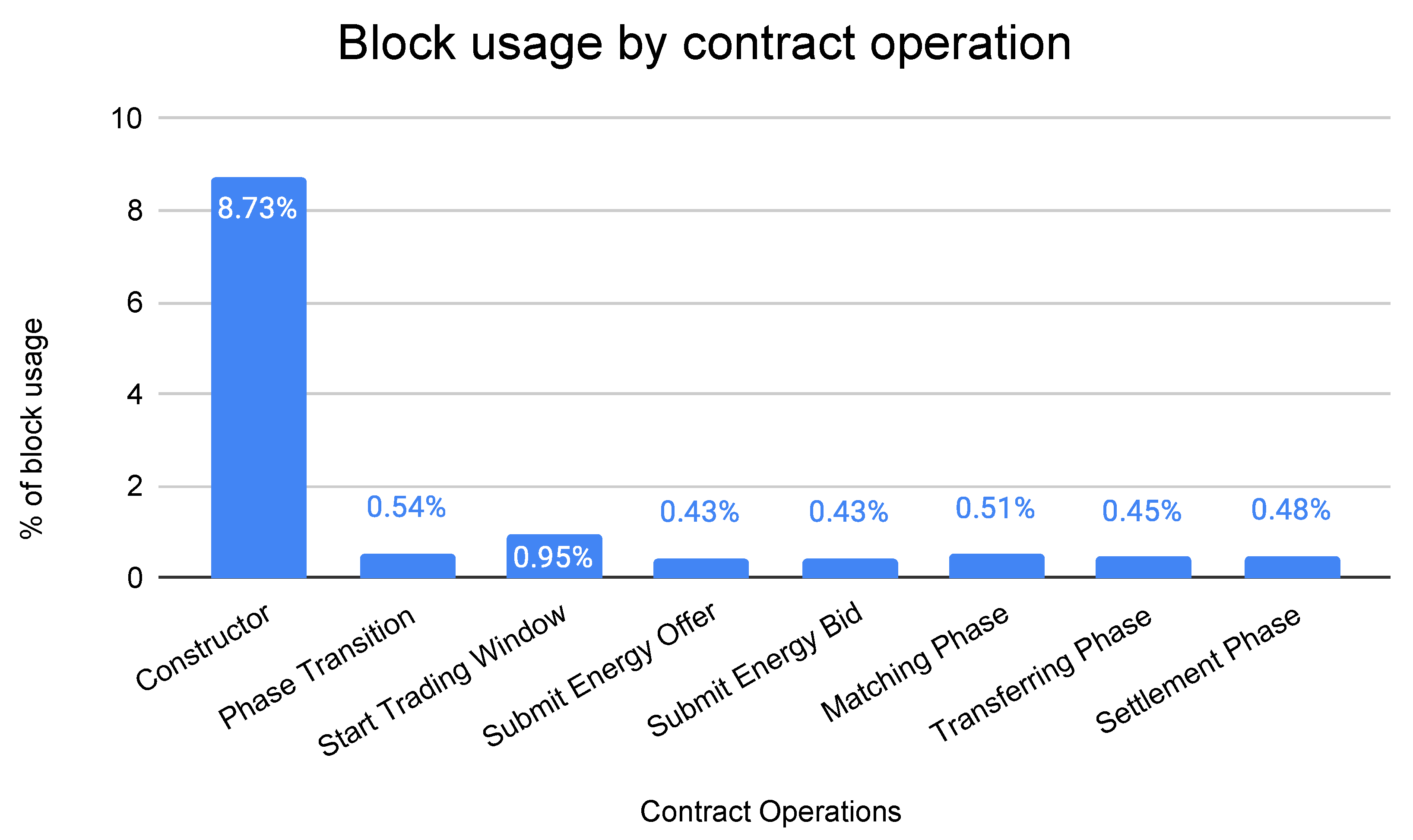

| Operation | Description |

|---|---|

| Constructor | Initialize the contract’s state variables when the smart contract is deployed. |

| Phase Transition | Update the current phase of the trading process based on a predetermined timeline or other criteria. |

| Start Trading Window | Mark the beginning of the trading phase and set the initial trading parameters, such as the duration of the trading window and the maximum amount of energy that can be traded. |

| Submit Energy Offer | Allow sellers to submit offers to sell their energy at a certain price and quantity. These offers are stored in the contract’s state variables until they are matched with a corresponding bid. |

| Submit Energy Bid | Allow buyers to submit bids to buy energy at a certain price and quantity. These bids are stored in the contract’s state variables until they are matched with a corresponding offer. |

| Matching Phase | Match the submitted offers and bids based on their price and quantity, and assign the matched pairs to a transfer list for the transferring phase. |

| Transferring Phase | Transfer the energy between the matched parties based on the agreed-upon price and quantity. This phase ensures that the energy is delivered securely and efficiently. |

| Settlement Phase | Transfer the payment between the matched parties based on the agreed-upon price and quantity, and update the state variables to reflect the completed trade. This phase ensures that the payment is made accurately and securely. |

| Contract Operation | Gas Utilization | Cost in CLP in Our System | Cost in CLP in Slow Public Ethereum | Cost in CLP in Average Public Ethereum | Cost in CLP in Fast Public Ethereum |

|---|---|---|---|---|---|

| Constructor | 2,619,703 | $0 | $81.010 | $89.112 | $97.213 |

| Phase Transition | 161,524 | $0 | $4.995 | $5.494 | $5.994 |

| Start Trading Window | 286,403 | $0 | $8.857 | $9.742 | $10.628 |

| Submit Energy Offer | 129,613 | $0 | $4.008 | $4.409 | $4.810 |

| Submit Energy Bid | 130,354 | $0 | $4.031 | $4.434 | $4.837 |

| Matching Phase | 153,400 | $0 | $4.744 | $5.218 | $5.692 |

| Transferring Phase | 134,179 | $0 | $4.149 | $4.564 | $4.979 |

| Settlement Phase | 144,247 | $0 | $4.461 | $4.907 | $5.353 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Condon, F.; Franco, P.; Martínez, J.M.; Eltamaly, A.M.; Kim, Y.-C.; Ahmed, M.A. EnergyAuction: IoT-Blockchain Architecture for Local Peer-to-Peer Energy Trading in a Microgrid. Sustainability 2023, 15, 13203. https://doi.org/10.3390/su151713203

Condon F, Franco P, Martínez JM, Eltamaly AM, Kim Y-C, Ahmed MA. EnergyAuction: IoT-Blockchain Architecture for Local Peer-to-Peer Energy Trading in a Microgrid. Sustainability. 2023; 15(17):13203. https://doi.org/10.3390/su151713203

Chicago/Turabian StyleCondon, Felipe, Patricia Franco, José M. Martínez, Ali M. Eltamaly, Young-Chon Kim, and Mohamed A. Ahmed. 2023. "EnergyAuction: IoT-Blockchain Architecture for Local Peer-to-Peer Energy Trading in a Microgrid" Sustainability 15, no. 17: 13203. https://doi.org/10.3390/su151713203

APA StyleCondon, F., Franco, P., Martínez, J. M., Eltamaly, A. M., Kim, Y.-C., & Ahmed, M. A. (2023). EnergyAuction: IoT-Blockchain Architecture for Local Peer-to-Peer Energy Trading in a Microgrid. Sustainability, 15(17), 13203. https://doi.org/10.3390/su151713203

_Lu.png)