Elevating B2B Mobility with Sharing Autonomous Electric Vehicles: Exploring Prerequisite Criteria and Innovative Business Models

Abstract

:1. Introduction

2. Theoretical Background

2.1. Circular Economy and PSS Business Models

2.2. Creating New Business Model Concepts

2.3. Criteria for Changing the Ownership of Products

3. Research Methodology

3.1. Case Company

3.2. Case Study Research Procedure

- Initial literature analysis led to the formulation of the study’s purpose and the two research questions.

- With the research questions as a foundation, further literature analysis was undertaken to craft a theoretical synthesis of potential customer criteria for product sharing (Table 1) and a morphological framework for generating new business model concepts in sharing contexts (Figure 1). A model was devised to guide the empirical investigation (Figure 2).

- A protocol for the empirical investigation was established, thereby encompassing both the vehicle manufacturer and customers (Appendix A).

- Formal and informal interactions were initiated within the case company to position their endeavors concerning autonomous electric vehicles, business model innovation, sustainability, and circularity.

- An industry sector was selected for customer interactions, wherein semistructured interviews were conducted (Appendix A).

- A workshop convened with the company’s circular economy network, thereby representing crossfunctional entities aimed at identifying conceivable business model scenarios for sharing autonomous electric vehicles.

- Collected data were analyzed in alignment with the guiding model (Figure 2).

- Follow-up unstructured interviews were conducted within the case company to generate novel business model concepts (Appendix B).

- Results and conclusions were subsequently drawn, thereby shedding light on prerequisite criteria and the formulation of business model concepts for sharing autonomous electric vehicles.

3.3. Data Collection and Analysis

4. Results

4.1. Prerequisite Criteria for Sharing Autonomous Electric Vehicles in a B2B Context

4.1.1. Economic Gain

4.1.2. Service Quality

4.1.3. Trust

4.1.4. Environment

4.1.5. Accessibility

4.1.6. Social

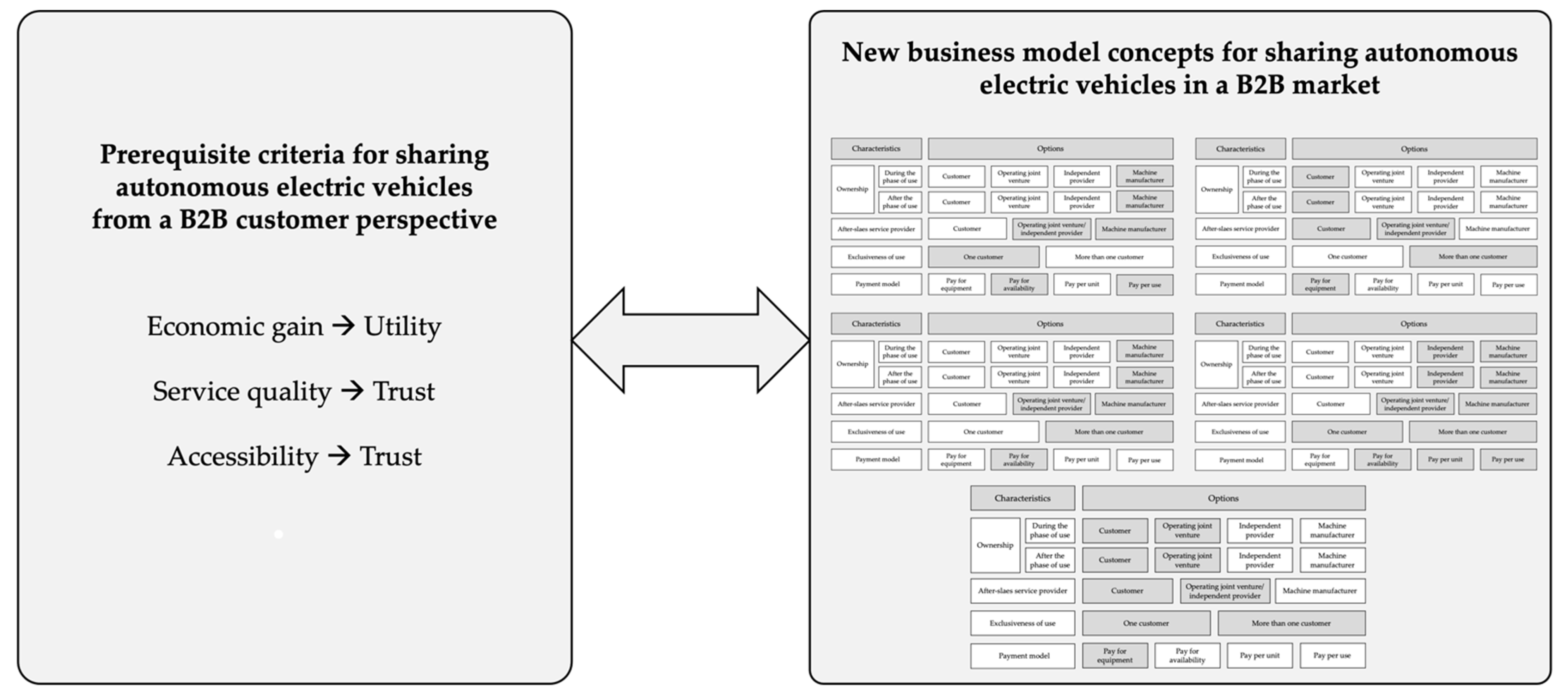

4.2. The Morphological Framework Applied to Create New Business Model Concepts for Sharing Autonomous Electric Vehicles

4.2.1. Scenario 1

4.2.2. Scenario 2

4.2.3. Scenario 3

4.2.4. Scenario 4

4.2.5. Scenario 5

5. Discussion

5.1. Prerequisite Criteria for Sharing Autonomous Electric Vehicles

5.2. Description of New Business Model Concepts for Sharing Autonomous Electric Vehicles

5.2.1. Scenario 1: Result-Oriented Characteristics

5.2.2. Scenarios 2 and 5: Product-Oriented Characteristics

5.2.3. Scenarios 3 and 4: Use-Oriented Characteristics

5.3. Theoretical Implications

5.4. Practical Implications

6. Conclusions, Limitations, and Future Work

Limitations and Suggestion for Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Interview Guide for Semistructured Interviews

- Name, role, years in the organisation.

- Tell us shortly about your organisation.

- 3.

- Do you have any thoughts in general regarding the electrification you are facing, which we are looking at in Project X? For example, have you tried an electrified machine or similar?

- How do you think it will work?

- 4.

- If you think of Project X and everything that is going to change, how do you think that your organisation will be affected?

- 5.

- Do you have previous experience in other business models than owning a machine? Feel free to give an example.

- 6.

- What do you consider as an advantage of continuing with buying and owning a machine? Compared with not owning a machine.

- What do you think is needed for you to consider changing your way of owning machines?

- What do you think is the biggest challenge with changing your way of owning a machine?

- 7.

- What would motivate you to share machines with other organisations?

- 8.

- Which criteria would you have to consider for such a business model?

- 9.

- What is important for you that the new business model offers compared to what you have today?

- 10.

- How would it affect you if you shared a machine?

- 11.

- What do you consider to be an advantage when sharing a machine?

- 12.

- What do you consider to be a disadvantage when sharing a machine?

- 13.

- If you would share a machine, would the economical factor be an important criterion for you? Could you give an example?

- 14.

- If you would share a machine, would trust be an important criterion for you? If yes, in which way?

- 15.

- If you would share a machine, would it be important for you to work ecological sustainability? If yes, why?

- 16.

- If you would share a machine, would accessibility be an important criterion for you? If yes, in which way?

- 17.

- If you would share a machine, would the social factor be an important criterion for you? Explain why/why not.

- 18.

- If you would rent a machine from your company, which will also be shared with other organisations, in which way would you prefer to pay? For example, for the number of hours used, for the access, for a result.

- Paying for a result means, for example, to pay for the amount of material transported. Is there another way in which you would prefer to pay? If yes, please explain.

- 19.

- How do you think your organisation will change until 2030?

Appendix B. Interview Guide for Unstructured Interviews

- Discuss the scenarios.

- Based on the described scenario, how do you think that the business model could look? See Figure 1.

- Go through all the characteristics of the new PSS business concept and explain how you reason.

References

- Cadez, S.; Czerny, A.; Letmathe, P. Stakeholder pressures and corporate climate change mitigation strategies. Bus. Strategy Environ. 2019, 28, 1–14. [Google Scholar] [CrossRef]

- Formas. Kunskap för Hållbar Omställning—Ett Underlag Till Sveriges Forsknings-Och Innovationspolitik 2021–2024; Forskningsrådet Formas: Stockholm, Sweden, 2019. [Google Scholar]

- Bressanelli, G.; Perona, M.; Saccani, N. Reshaping the washing machine industry through circular economy and product-service system business models. Procedia CIRP 2017, 64, 43–48. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Savaget, P.; Bocken, N.M.P.; Hultink, E.J. The Circular Economy—A new sustainability paradigm? J. Clean. Prod. 2017, 143, 757–768. [Google Scholar] [CrossRef]

- Ellen MacArthur Foundation. Towards a Circular Economy: Business Rationale for an Accelerated Transition; Ellen MacArthur Foundation: Isle of Wight, UK, 2015. [Google Scholar]

- Corvellec, H.; Stowell, A.F.; Johansson, N. Critiques of the circular economy. J. Ind. Ecol. 2022, 26, 421–432. [Google Scholar] [CrossRef]

- Transportation Emissions Worldwide—Statistics & Facts, Statista Research Department. 2023. Available online: https://www.statista.com/topics/7476/transportation-emissions-worldwide/#editorsPicks (accessed on 3 September 2023).

- Bonsu, N.O. Towards a circular and low-carbon economy: Insights from the transitioning to electric vehicles and net zero economy. J. Clean. Prod. 2020, 256, 120659. [Google Scholar] [CrossRef]

- Wolf, S.; Teitge, J.; Mielke, J.; Schutze, F.; Jaeger, C. The European Green Deal—More Than Climate Neutrality. Intereconomics 2021, 56, 99–107. [Google Scholar] [CrossRef] [PubMed]

- Committee for European Construction Equipment. The Role of Construction Equipment in Decarbonizing Europe. April 2021. Available online: https://www.cece.eu/stream/april-2021-position-paper-the-role-of-construction-equipment-in-decarbonising-europe (accessed on 6 September 2023).

- Elavarasan, R.M.; Pugazhendhi, R.; Irfan, M.; Mihet-Popa, L.; Khan, I.A.; Campana, P.E. State-of-the-art sustainable approaches for deeper decarbonization in Europe—An endowment to climate neutral vision. Renew. Sustain. Energy Rev. 2022, 159, 112204. [Google Scholar] [CrossRef]

- Pieroni, M.P.; McAloone, T.C.; Pigosso, D.C. Business model innovation for circular economy and sustainability: A review of approaches. J. Clean. Prod. 2019, 215, 198–216. [Google Scholar] [CrossRef]

- Chirumalla, K.; Reyes, L.G.; Toorajipour, R. Mapping a circular business opportunity in electric vehicle battery value chain: A multi-stakeholder framework to create a win–win–win situation. J. Bus. Res. 2022, 145, 569–582. [Google Scholar] [CrossRef]

- Massa, L.; Tucci, C.L.; Afuah, A. A critical assessment of business model research. Acad. Manag. Ann. 2017, 11, 73–104. [Google Scholar] [CrossRef]

- Foss, N.J.; Saebi, T. Fifteen years of research on business model innovation. J. Manag. 2017, 43, 200–227. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Pieroni, M.P.; Pigosso, D.C.; Soufani, K. Circular business models: A review. J. Clean. Prod. 2020, 277, 123741. [Google Scholar] [CrossRef]

- Sjödin, D.; Parida, V.; Jovanovic, M.; Visnjic, I. Value Creation and Value Capture Alignment in Business Model Innovation: A Process View on Outcome-Based Business Models. J. Prod. Innov. Manag. 2020, 37, 158–183. [Google Scholar] [CrossRef]

- Kanatli, M.A.; Karaer, Ö. Servitization as an alternative business model and its implications on product durability, profitability & environmental impact. Eur. J. Oper. Res. 2021, 301, 546–560. [Google Scholar]

- Reim, W.; Parida, V.; Örtqvist, D. Product–Service Systems (PSS) business models and tactics—A systematic literature review. J. Clean. Prod. 2015, 97, 61–75. [Google Scholar] [CrossRef]

- Roy, R. Sustainable product-service systems. Futures 2000, 32, 289–299. [Google Scholar] [CrossRef]

- Chirumalla, K.; Leoni, L.; Oghazi, P. Moving from servitization to digital servitization: Identifying the required dynamic capabilities and related microfoundations to facilitate the transition. J. Bus. Res. 2023, 158, 113668. [Google Scholar] [CrossRef]

- Tukker, A. Eight types of product–service system: Eight ways to sustainability? Experiences from SusProNet. Bus. Strategy Environ. 2004, 13, 246–260. [Google Scholar] [CrossRef]

- Barquet, A.P.B.; de Oliveira, M.G.; Amigo, C.R.; Cunha, V.P.; Rozenfeld, H. Employing the business model concept to support the adoption of product–service systems (PSS). Ind. Mark. Manag. 2013, 42, 693–704. [Google Scholar] [CrossRef]

- Kjaer, L.L.; Pigosso, D.C.A.; McAloone, T.C.; Birkved, M. Guidelines for evaluating the environmental performance of Product/Service-Systems through life cycle assessment. J. Clean. Prod. 2018, 190, 666–678. [Google Scholar] [CrossRef]

- Bech, N.M.; Birkved, M.; Charnley, F.; Kjaer, L.L.; Pigosso, D.C.A.; Hauschild, M.Z.; McAloone, T.C.; Moreno, M. Evaluating the environmental performance of a product/service-system business model for merino wool next-to-skin garments: The case of armadillo merino. Sustainability 2019, 11, 5854. [Google Scholar] [CrossRef]

- Lieder, M.; Rashid, A. Towards circular economy implementation: A comprehensive review in context of manufacturing industry. J. Clean. Prod. 2016, 115, 36–51. [Google Scholar] [CrossRef]

- Pieroni, M.d.P.; Blomsma, F.; McAloone, T.C.; Pigosso, D.C.A. Enabling circular strategies with different types of product/service-systems. In Proceedings of the 10th CIRP Conference on Industrial Product-Service Systems, Linköping, Sweden, 21–29 May 2018. [Google Scholar]

- Bocken, N.M.P.; de Pauw, I.; Bakker, C.; van der Grinten, B. Product design and business model strategies for a circular economy. J. Ind. Prod. Eng. 2016, 33, 308–320. [Google Scholar] [CrossRef]

- Andorka, S.; Rambow-Hoeschele, K. Review of Technological and Economic Considerations on Future Vehicle Design: Autonomous, Connected, Electric, and Shared Vehicles. In Proceedings of the EAI International Conference on IoT in Urban Space, Guimarães, Portugal, 21–22 November 2018; pp. 167–173. [Google Scholar]

- Thomson, L.; Kamalaldin, A.; Sjödin, D.; Parida, V. A maturity framework for autonomous solutions in manufacturing firms: The interplay of technology, ecosystem, and business model. Int. Entrep. Manag. J. 2022, 18, 125–152. [Google Scholar] [CrossRef]

- Porter, M.E.; Heppelmann, J.E. How smart, connected products are transforming competition. Harv. Bus. Rev. 2014, 92, 64–88. [Google Scholar]

- Dausch, M.; Hsu, C. Engineering service products: The case of mass-customising service agreements for heavy equipment industry. Int. J. Serv. Technol. Manag. 2006, 7, 32–51. [Google Scholar] [CrossRef]

- Kuo, T.C.; Chiu, M.C.; Hsu, C.W.; Tseng, M.L. Supporting sustainable product service systems: A product selling and leasing design model. Resour. Conserv. Recycl. 2019, 146, 384–394. [Google Scholar] [CrossRef]

- Saidani, M.; Yannou, B.; Leroy, Y.; Cluzel, F. Dismantling, remanufacturing and recovering heavy vehicles in a circular economy—Technico-economic and organisational lessons learnt from an industrial pilot study. Resour. Conserv. Recycl. 2020, 156, 104684. [Google Scholar] [CrossRef]

- Williams, E.; Das, V.; Fisher, A. Assessing the Sustainability Implications of Autonomous Vehicles: Recommendations for Research Community Practice. Sustainability 2020, 12, 1902. [Google Scholar] [CrossRef]

- Collie, B.; Rose, J.; Choraria, R.; Wegscheider, A.K. The Reimagined Car: Shared, Autonomous, and Electric; Boston Consulting Group: Boston, MA, USA, 2017. [Google Scholar]

- Kolarova, V.; Steck, F.; Bahamonde-Birke, F.J. Assessing the effect of autonomous driving on value of travel time savings: A comparison between current and future preferences. Transp. Res. Part A Policy Pract. 2019, 129, 155–169. [Google Scholar] [CrossRef]

- Taiebat, M.; Brown, A.L.; Safford, H.R.; Qu, S.; Xu, M. A review on energy, environmental, and sustainability implications of connected and automated vehicles. Environ. Sci. Technol. 2018, 52, 11449–11465. [Google Scholar] [CrossRef] [PubMed]

- Miller, S.A.; Heard, B.R. The environmental impact of autonomous vehicles depends on adoption patterns. Environ. Sci. Technol. 2016, 50, 6119–6121. [Google Scholar] [CrossRef] [PubMed]

- Al Alam, A.; Gattami, A.; Johansson, K.H. An experimental study on the fuel reduction potential of heavy duty vehicle platooning. In Proceedings of the 13th International IEEE Conference on Intelligent Transportation Systems, Funchal, Portugal, 19–22 September 2010; pp. 306–311. [Google Scholar]

- Kayikci, Y.; Kazancoglu, Y.; Lafci, C.; Gozacan, N. Exploring barriers to smart and sustainable circular economy: The case of an automotive eco-cluster. J. Clean. Prod. 2021, 314, 127920. [Google Scholar] [CrossRef]

- Xiao, L.; Liu, W.; Guo, Q.; Gao, L.; Zhang, G.; Chen, X. Comparative life cycle assessment of manufactured and remanufactured loading machines in China. Resour. Conserv. Recycl. 2018, 131, 225–234. [Google Scholar] [CrossRef]

- Pieroni, M.P.P.; McAloone, T.C.; Pigosso, D.C.A. Circular economy business model innovation: Sectorial patterns within manufacturing companies. J. Clean. Prod. 2021, 286, 124921. [Google Scholar] [CrossRef]

- Wilkinson, S.; Hojckova, K.; Eon, C.; Morrison, G.M.; Sandén, B. Is peer-to-peer electricity trading empowering users? Evidence on motivations and roles in a prosumer business model trial in Australia. Energy Res. Soc. Sci. 2020, 66, 101500. [Google Scholar] [CrossRef]

- Mostaghel, R.; Chirumalla, K. Role of customers in circular business models. J. Bus. Res. 2021, 127, 35–44. [Google Scholar] [CrossRef]

- Bardhi, F.; Eckhardt, G.M. Access-based consumption: The case of car sharing. J. Consum. Res. 2012, 39, 881–898. [Google Scholar] [CrossRef]

- Möhlmann, M. Collaborative consumption: Determinants of satisfaction and the likelihood of using a sharing economy option again. J. Consum. Behav. 2015, 14, 193–207. [Google Scholar] [CrossRef]

- Tukker, A. Product services for a resource-efficient and circular economy—A review. J. Clean. Prod. 2015, 97, 76–91. [Google Scholar] [CrossRef]

- Hamari, J.; Sjöklint, M.; Ukkonen, A. The sharing economy: Why people participate in collaborative consumption. J. Assoc. Inf. Sci. Technol. 2016, 67, 2047–2059. [Google Scholar] [CrossRef]

- Billows, G.; McNeill, L. Consumer attitude and behavioral intention toward collaborative consumption of shared services. Sustainability 2018, 10, 4468. [Google Scholar] [CrossRef]

- Akbar, P.; Hoffmann, S. Creating value in product service systems through sharing. J. Bus. Res. 2020, 121, 495–505. [Google Scholar] [CrossRef]

- Arteaga-Sánchez, R.; Belda-Ruiz, M.; Ros-Galvez, A.; Rosa-Garcia, A. Why continue sharing: Determinants of behavior in ridesharing services. Int. J. Mark. Res. 2020, 62, 725–742. [Google Scholar] [CrossRef]

- Mavlutova, I.; Kuzmina, J.; Uvarova, I.; Atstaja, D.; Lesinskis, K.; Mikelsone, E.; Brizga, J. Does Car Sharing Contribute to Urban Sustainability from User-Motivation Perspectives? Sustainability 2021, 13, 10588. [Google Scholar] [CrossRef]

- Wiersema, F. The B2B agenda: The current state of B2B marketing and a look ahead. Ind. Mark. Manag. 2013, 42, 470–488. [Google Scholar] [CrossRef]

- Chirumalla, K.; Oghazi, P.; Parida, V. Social media engagement strategy: Investigation of marketing and R&D T interfaces in manufacturing industry. Ind. Mark. Manag. 2018, 74, 138–149. [Google Scholar]

- Marcos-Cuevas, J.; Nätti, S.; Palo, T.; Baumann, J. Value co-creation practices and capabilities: Sustained purposeful engagement across B2B systems. Ind. Mark. Manag. 2016, 56, 97–107. [Google Scholar] [CrossRef]

- Chuah, S.H.W.; Tseng, M.L.; Wu, K.J.; Cheng, C.F. Factors influencing the adoption of sharing economy in B2B context in China: Findings from PLS-SEM and fsQCA. Resour. Conserv. Recycl. 2021, 175, 105892. [Google Scholar] [CrossRef]

- Melander, L.; Arvidsson, A. Introducing sharing-focused business models in the B2B context: Comparing interaction and environmental sustainability for selling, renting and sharing on industrial markets. J. Bus. Ind. Mark. 2021, 36, 1864–1875. [Google Scholar] [CrossRef]

- Kowalkowski, C.; Gebauer, H.; Kamp, B.; Parry, G. Servitization and deservitization: Overview, concepts, and definitions. Ind. Mark. Manag. 2017, 60, 4–10. [Google Scholar] [CrossRef]

- Baines, T.; Bigdeli, A.Z.; Sousa, R.; Schroeder, A. Framing the servitization transformation process: A model to understand and facilitate the servitization journey. Int. J. Prod. Econ. 2020, 221, 107463. [Google Scholar] [CrossRef]

- Kristoffersen, E.; Blomsma, F.; Mikalef, P.; Li, J. The smart circular economy: A digital-enabled circular strategies framework for manufacturing companies. J. Bus. Res. 2020, 120, 241–261. [Google Scholar] [CrossRef]

- Da Costa Fernandes, S.; Pigosso, D.C.; McAloone, T.C.; Rozenfeld, H. Towards product-service system oriented to circular economy: A systematic review of value proposition design approaches. J. Clean. Prod. 2020, 257, 12050. [Google Scholar]

- Lay, G.; Schroeter, M.; Biege, S. Service-based business concepts: A typology for business-to-business markets. Eur. Manag. J. 2009, 27, 442–455. [Google Scholar] [CrossRef]

- Kley, F.; Lerch, C.; Dallinger, D. New business models for electric cars—A holistic approach. Energy Policy 2011, 39, 3392–3403. [Google Scholar] [CrossRef]

- Tukker, A.; Tischner, U. New Business for Old Europe: Product-Service Development, Competitiveness and Sustainability; Greenleaf Publishing Ltd.: Sheffield, UK, 2006. [Google Scholar]

- Oliva, R.; Kallenberg, R. Managing the Transition from Products to Services. Int. J. Serv. Ind. Manag. 2003, 14, 160–172. [Google Scholar] [CrossRef]

- Huikkola, T.; Kohtamäki, M. Business models in servitization. In Practices and Tools for Servitization: Managing Service Transition; Kohtamäki, M., Baines, T., Rabetino, R., Bigdeli, A., Eds.; Spring Nature: Berlin/Heidelberg, Germany, 2018; pp. 61–81. [Google Scholar] [CrossRef]

- Curtis, S.K.; Mont, O. Sharing economy business models for sustainability. J. Clean. Prod. 2020, 266, 121519. [Google Scholar] [CrossRef]

- Alpi, K.M.; Evans, J.J. Distinguishing case study as a research method from case reports as a publication type. J. Med. Libr. Assoc. 2019, 107, 1–5. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods, 5th ed.; Sage Publications: London, UK, 2013. [Google Scholar]

- Vessela, W.; Robin, B. The Role of Context in Qualitative Case Study Research: Understanding Service Innovation; SAGE Research Methods: London, UK, 2022. [Google Scholar]

- Crowe, S.; Cresswell, K.; Robertson, A.; Huby, G.; Avery, A.; Sheikh, A. The case study approach. BMC Med. Res. Methodol. 2011, 11, 100. [Google Scholar] [CrossRef]

- Robson, C. Real World Research: A Resource for Social Scientists and Practitioner-Researchers, 2nd ed.; Blackwell Publisher Ltd.: Hoboken, NJ, USA, 2002. [Google Scholar]

- Eisenhardt, K.M. Building theories from case study research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Graebner, M.E. Theory building from cases: Opportunities and challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef]

- Kamalaldin, A.; Linde, L.; Sjödin, D.; Parida, V. Transforming provider-customer relationships in digital servitization: A relational view on digitalization. Ind. Mark. Manag. 2020, 89, 306–325. [Google Scholar] [CrossRef]

- Merriam, S.B. Case Study Research in Education: A Qualitative Approach; Jossey Bass: San Francisco, CA, USA, 1988. [Google Scholar]

- Patton, M.Q. Qualitative Research & Evaluation Methods; Sage Publications: Thousand Oaks, CA, USA, 2002. [Google Scholar]

- Bryman, A.; Bell, E. Business Research Methods, 3rd. Ed.; Oxford University Press: Oxford, UK, 2017. [Google Scholar]

- Hennink, M.; Kaiser, B.N. Sample sizes for saturation in qualitative research: A systematic review of empirical tests. Soc. Sci. Med. 2022, 292, 1145232022. [Google Scholar] [CrossRef] [PubMed]

- Hennink, M.; Kaiser, B.; Marconi, V. Code saturation versus meaning saturation: How many interviews are enough? Qual. Health Res. 2017, 27, 591–608. [Google Scholar] [CrossRef]

- Baker, S.; Edwards, R. How Many Qualitative Interviews Is Enough? Expert Voices and Early Career Reflections on Sampling and Cases in Qualitative Research; National Centre for Research Methods, Economic and Social Council (ESRC): London, UK, 2012. [Google Scholar]

- O’Reilly, M.; Parker, N. Unsatisfactory saturation: A critical exploration of the notion of saturated sample sizes in qualitative research. Qual. Res. J. 2012, 13, 190–197. [Google Scholar] [CrossRef]

- Guest, G.; Bunce, A.; Johnson, L. How many interviews are enough? An experiment with data saturation and variability. Field Methods 2006, 18, 59–82. [Google Scholar] [CrossRef]

- Merriam, S.B.; Tisdell, E.J. Qualitative Research: A Guide to Design and Implementation; Jossey Bass: San Francisco, CA, USA, 2015. [Google Scholar]

- Kjaer, L.L.; Pigosso, D.C.; Niero, M.; Bech, N.M.; McAloone, T.C. Product/service-systems for a circular economy: The route to decoupling economic growth from resource consumption? J. Ind. Ecol. 2019, 23, 22–35. [Google Scholar] [CrossRef]

- Tsvetkova, A.; Kulkov, I.; Busquet, C.; Kao, P.-J.; Kamargianni, M. Implications of COVID-19 pandemic on the governance of passenger mobility innovations in Europé. Transp. Res. Interdiscip. Perspect. 2022, 14, 100581. [Google Scholar] [CrossRef]

- Anderson, E.G.; Bhargava, H.K.; Boehm, J.; Parker, G. Electric Vehicles Are a Platform Business: What Firms Need to Know. Calif. Manag. Rev. 2022, 64, 135–154. [Google Scholar] [CrossRef]

| Categories of Criteria | Criterion | ||

|---|---|---|---|

| Economic gain | Economic benefits: | Cost savings: | Economic gain: |

| Arteaga-Sanchez, et al. [52] Mavlutova, et al. [53] | Möhlmann [47] Tukker [48] | Hamari, et al. [49] | |

| Bardhi and Eckhardt [46] Billows and McNeill [50] | |||

| Service quality | Service quality: Arteaga-Sanchez, et al. [52] Möhlmann [47] | ||

| Trust | Trust: Arteaga-Sanchez, et al. [52] Möhlmann [47] | Familiarity: Möhlmann [47] | |

| Environment | Environment: Arteaga-Sanchez, et al. [52] | Environmental impact: Billows and McNeill [50] | Sustainability: Hamari, et al. [49] |

| Accessibility | Access: Akbar and Hoffmann [51] | Convenient: Bardhi and Eckhardt [46] Mavlutova, et al. [53] | |

| Social | Social value: Arteaga-Sanchez, et al. [52] | Community belonging: Hamari, et al. [49] | Enjoyment of the activity: Möhlmann [47] |

| Utility | Utility: Möhlmann [47] | Individual utility: Mavlutova, et al. [53] | Perceived usefulness: Arteaga-Sanchez, et al. [52] |

| Informants and Their Job Role | Topic of Discussion | Type of Meeting | Duration |

|---|---|---|---|

| Formal and Informal Interactions at the Case Company | |||

| Research strategy manager | Exploration and coordination of the study | Weekly meetings for 4 months. Physical and online meetings | 1 h/meeting |

| Head of Equipment-As-A-Service | Investigate business models | Online meeting | 1 h |

| Research Strategy Manager AE Chief Project Manager Two Research Owners | Determine the focus | Physical meeting | 1 h |

| Head of Equipment as a Service | Discussing potential business models | Physical meeting | 1 h |

| Head of Environmental Sustainability | Company sustainable work | Online meeting | 1.5 h |

| Research owner Three researchers | Input to the business models | Online meeting | 1 h |

| Head of Emerging Technologies | Input to the business models | Physical meeting | 1 h |

| Offering and Business Model Manager | New business models for the company | Physical meeting | 1 h |

| Semistructured interviews with the customers of the case company from one sector | |||

| Process owner 1, Respondent 1 | Criteria for sharing autonomous electric vehicles | Physical meeting | 1 h 15 min |

| Process owner 2, Respondent 2 | Criteria for sharing autonomous electric vehicles | Physical meeting | 47 min |

| Process owner 3, Respondent 3 | Criteria for sharing autonomous electric vehicles | Physical meeting | 55 min |

| Process owner 4, Respondent 4 | Criteria for sharing autonomous electric vehicles | Physical meeting | 1 h 7 min |

| Process owner 5, Respondent 5 | Criteria for sharing autonomous electric vehicles | Physical meeting | 1 h 7 min |

| Workshop at the case company | |||

| Company’s CE network: 13 participates representing different functions | Discuss business model framework and identify business model scenarios | Physical meeting | 2.5 h |

| Unstructured interviews at the case company | |||

| Manager, strategy and business development, Respondent 6 | Business model scenario and new business model concepts | Physical meeting | 50 min |

| Offering and Business Model Manager, Respondent 7 | Business model scenario and new business model concepts | Physical meeting | 30 min |

| Research owner, Respondent 8 | Business model scenario and new business model concepts | Physical meeting | 45 min |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chirumalla, K.; Klaff, S.; Zako, R.; Sannö, A. Elevating B2B Mobility with Sharing Autonomous Electric Vehicles: Exploring Prerequisite Criteria and Innovative Business Models. Sustainability 2023, 15, 13757. https://doi.org/10.3390/su151813757

Chirumalla K, Klaff S, Zako R, Sannö A. Elevating B2B Mobility with Sharing Autonomous Electric Vehicles: Exploring Prerequisite Criteria and Innovative Business Models. Sustainability. 2023; 15(18):13757. https://doi.org/10.3390/su151813757

Chicago/Turabian StyleChirumalla, Koteshwar, Sara Klaff, Rania Zako, and Anna Sannö. 2023. "Elevating B2B Mobility with Sharing Autonomous Electric Vehicles: Exploring Prerequisite Criteria and Innovative Business Models" Sustainability 15, no. 18: 13757. https://doi.org/10.3390/su151813757