Market Structure Analysis of Revenue of International Construction Professional Service (I-CPS): A Country-Level Analysis

Abstract

:1. Introduction

2. Research Background

2.1. I-CPS Competitiveness and Revenue Performance

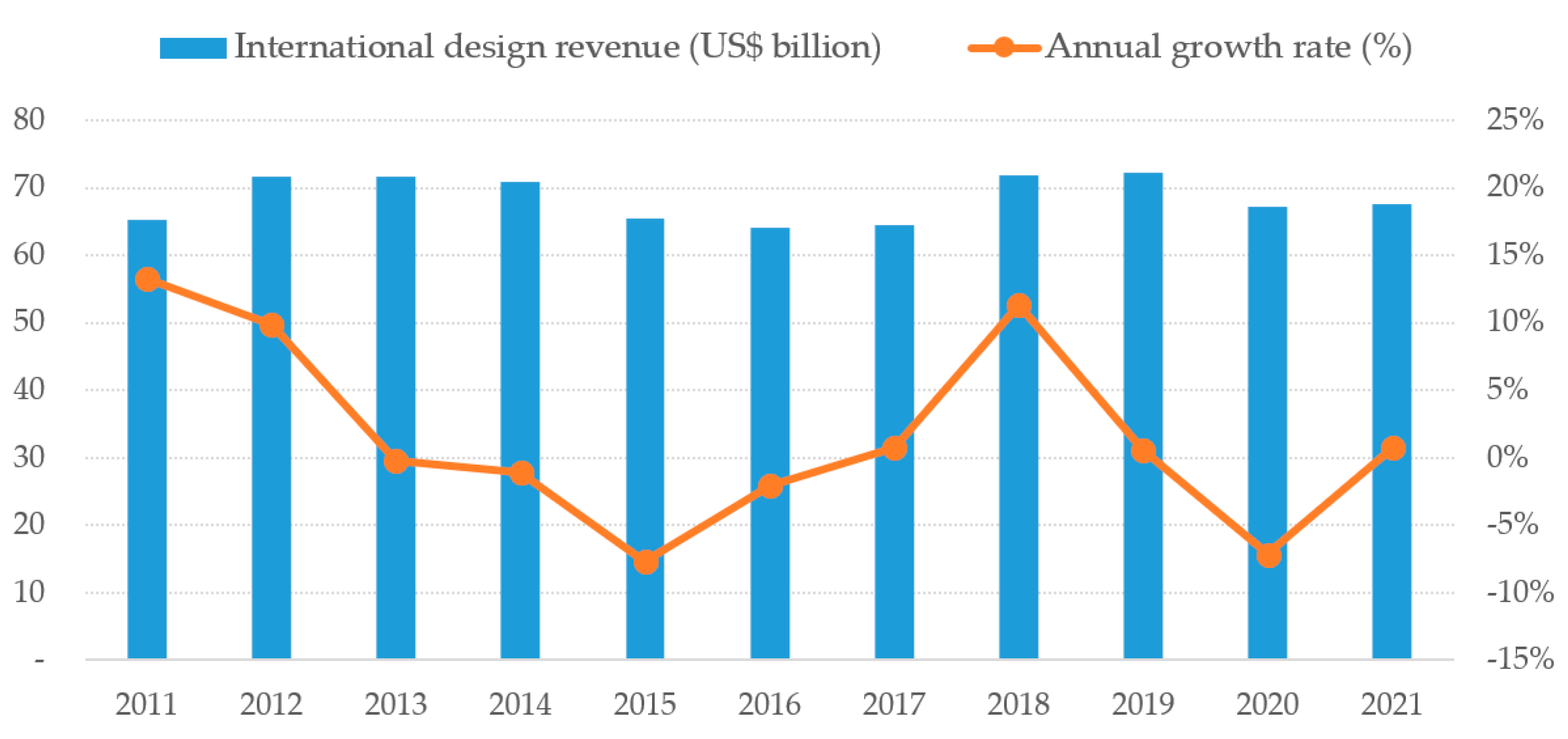

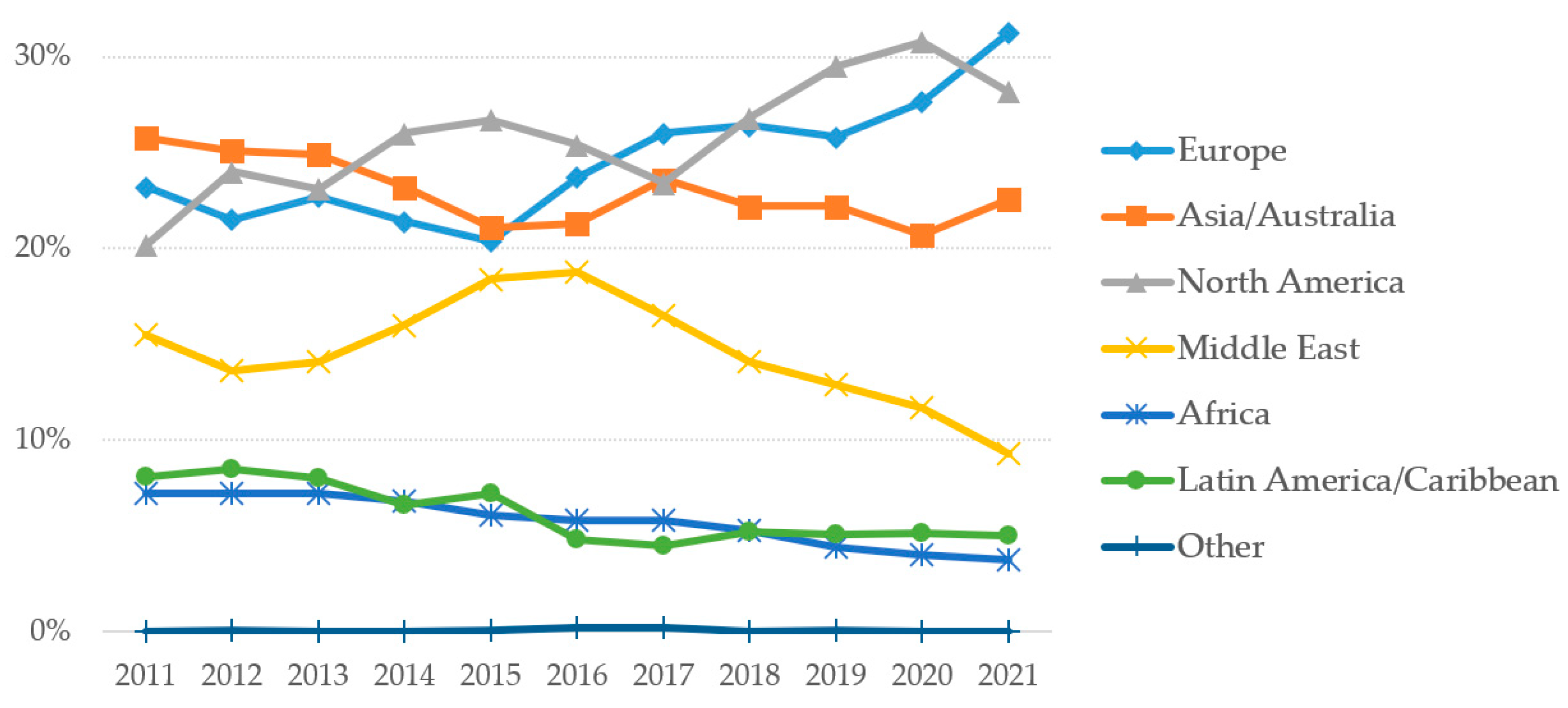

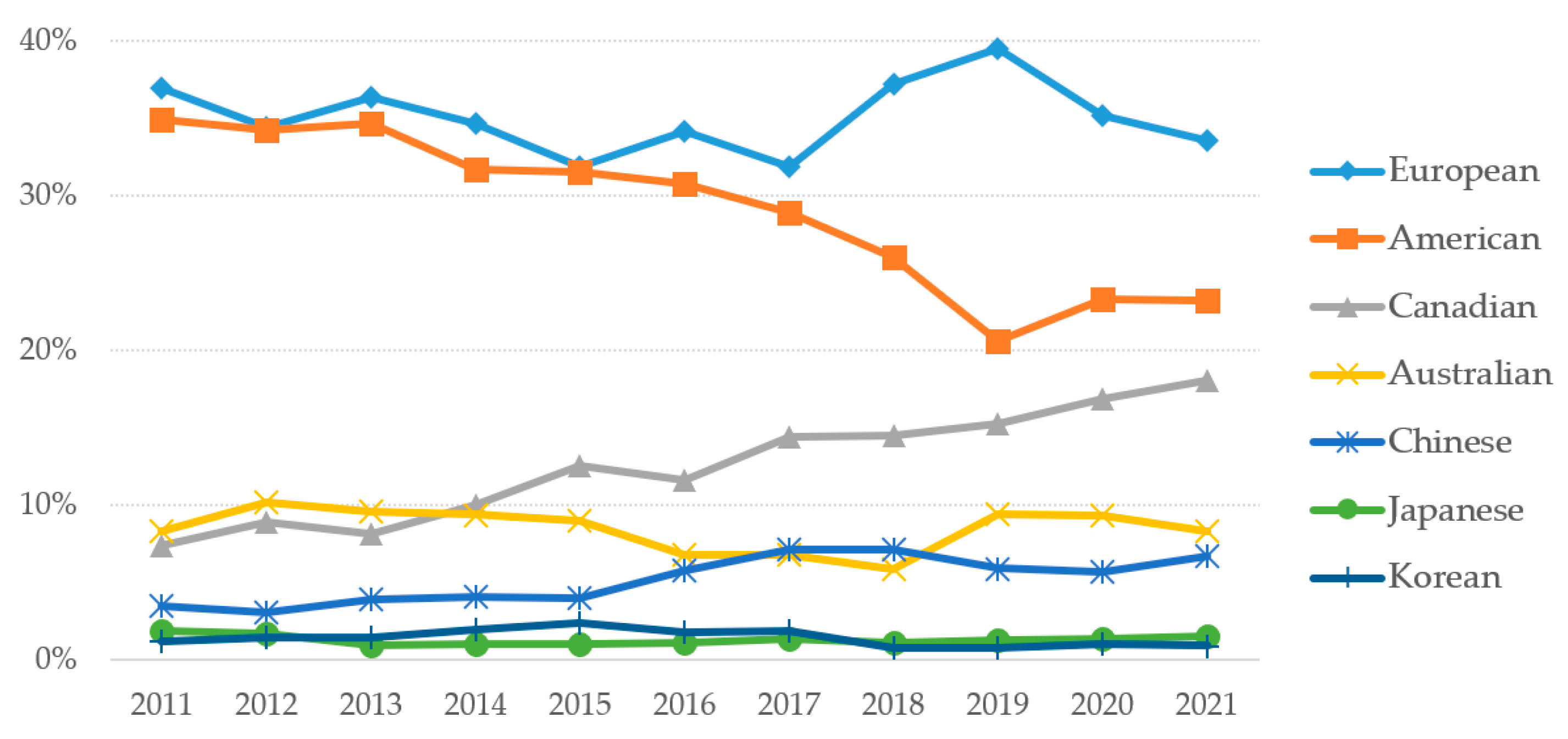

2.2. Recent Revenue Structure of TIDFs

3. Research Methodology

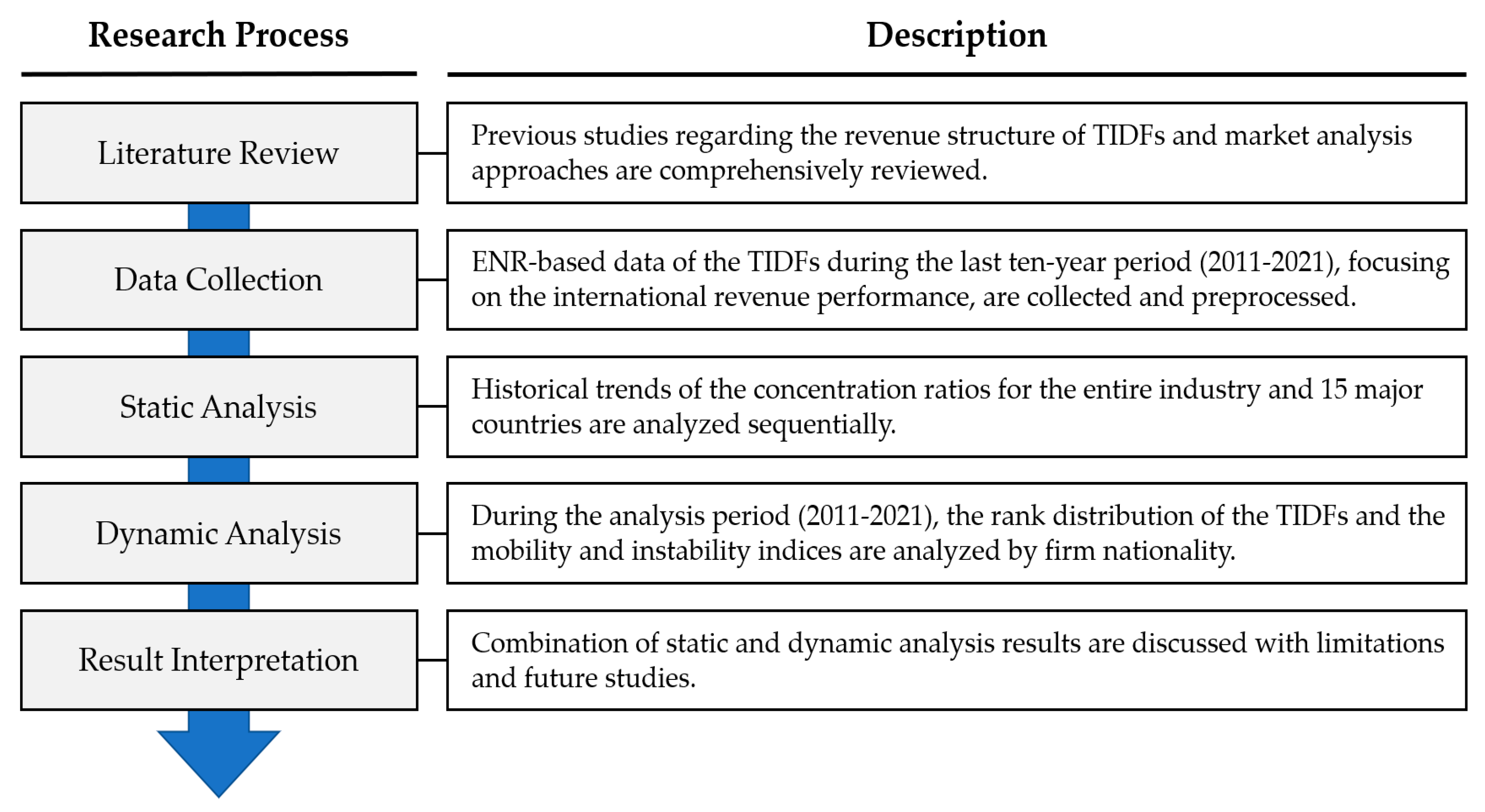

3.1. Research Process

3.2. Market Concentration

3.3. Market Mobility and Instability

3.4. Data Collection and Treatment

4. Analysis Results

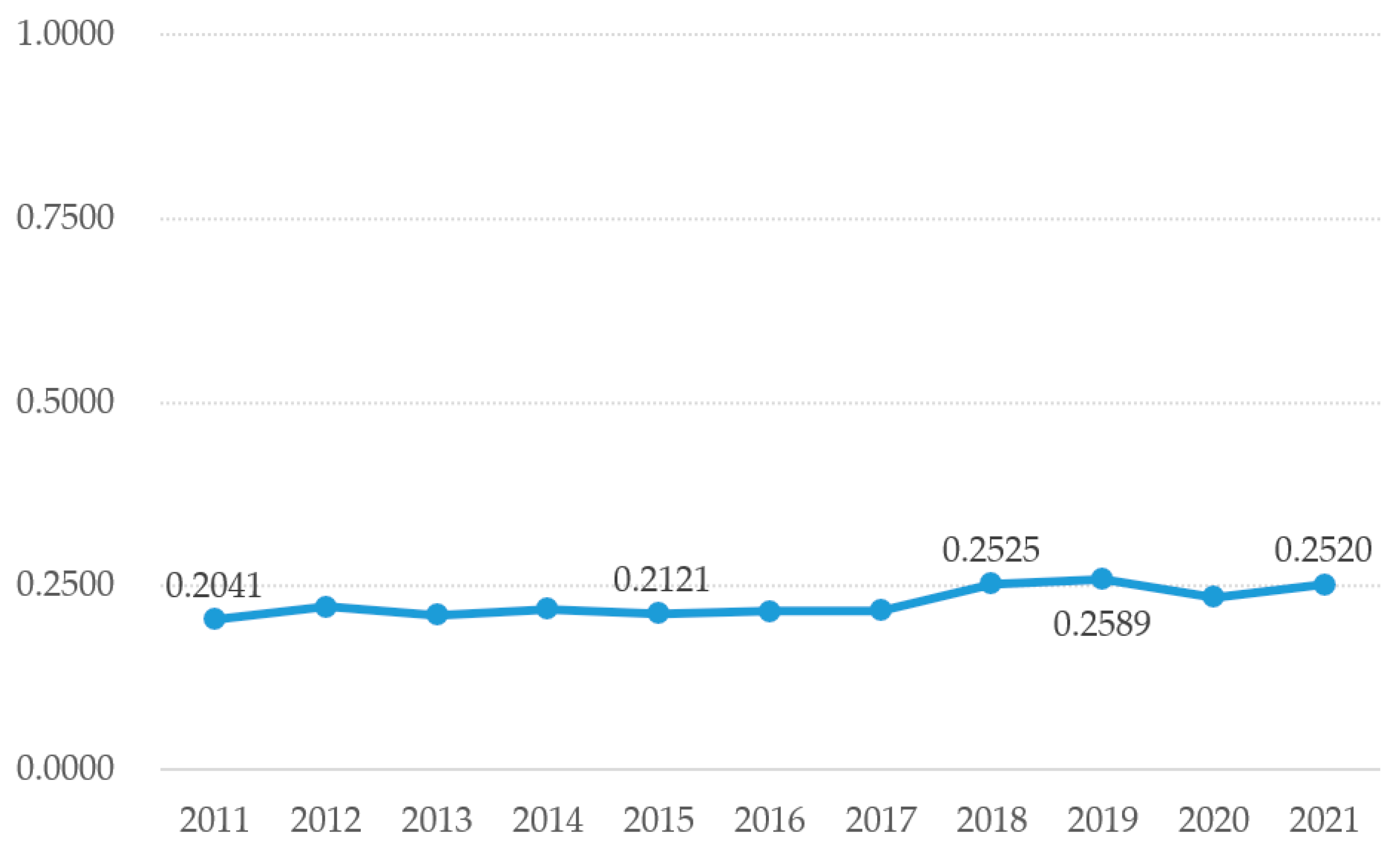

4.1. Concentration Ratios

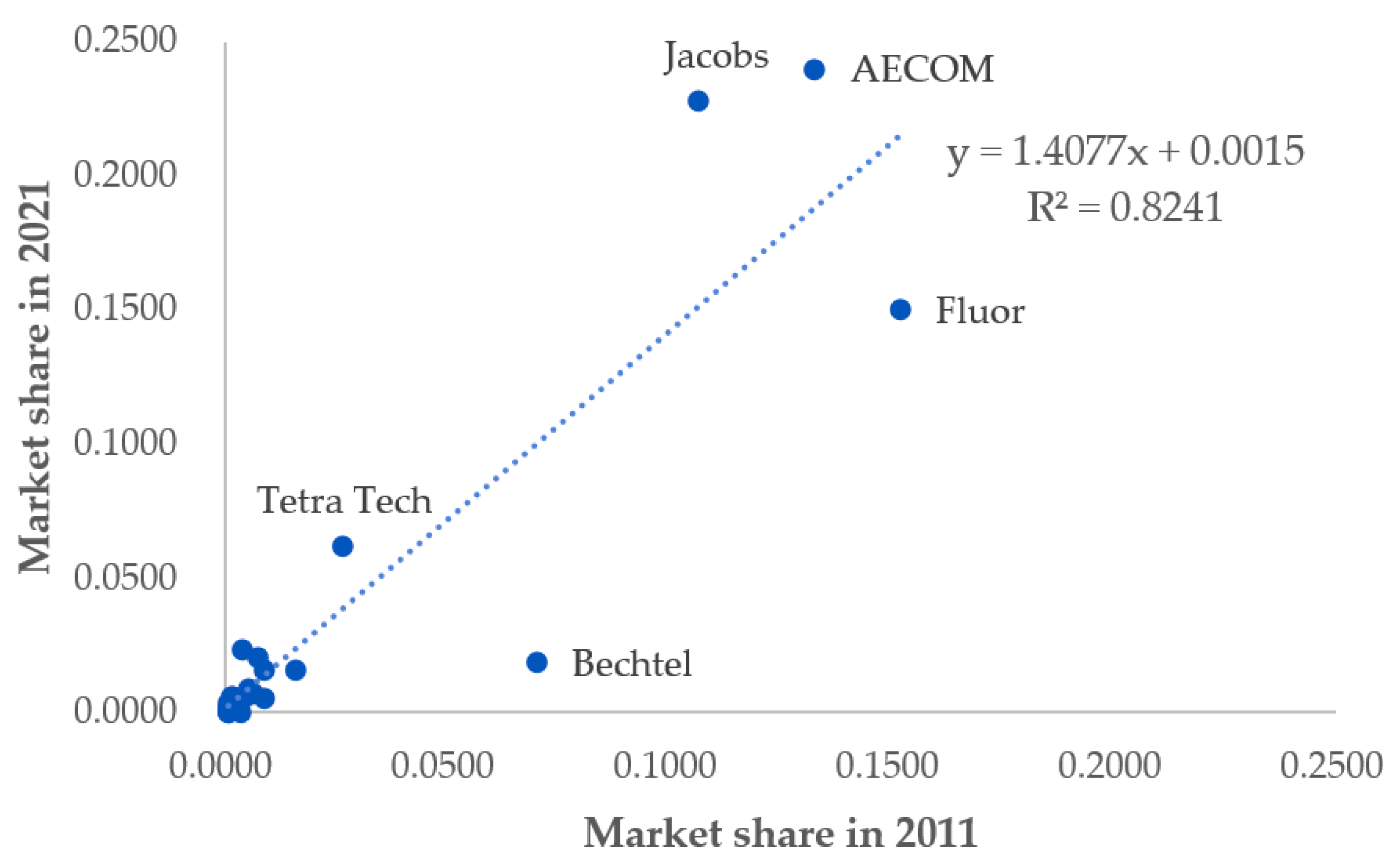

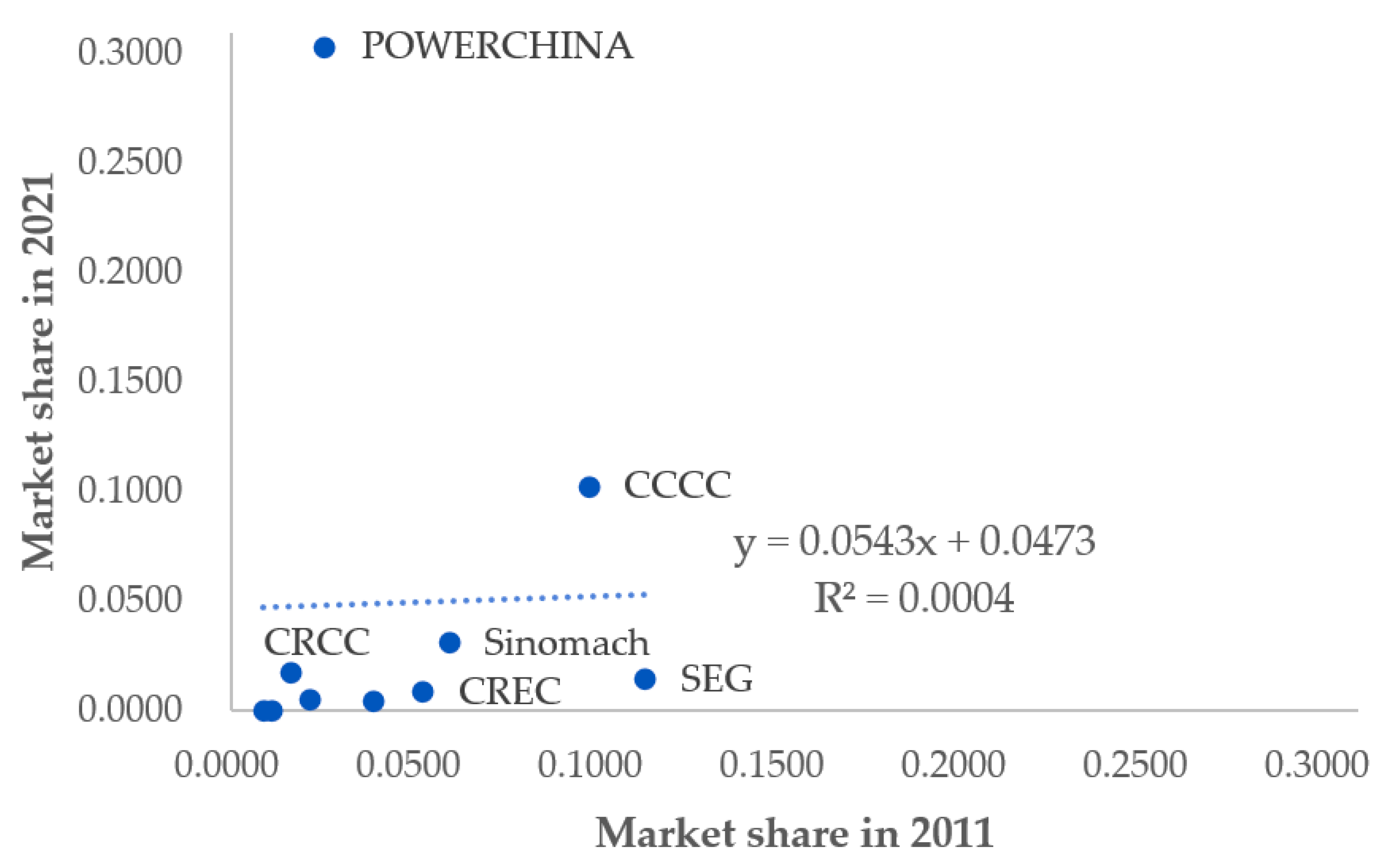

4.2. Mobility and Instability Indices

4.3. Cross-Comparison between Static and Dynamic Indices

5. Discussion and Conclusions

Funding

Data Availability Statement

Conflicts of Interest

References

- Lu, W.; Ye, K.; Flanagan, R.; Jewell, C. Nexus between contracting and construction professional service businesses: Empirical evidence from international market. J. Constr. Eng. Manag. 2014, 140, 04013049. [Google Scholar] [CrossRef]

- United Nations. International Standard Industrial Classification of All Economic Activities—Revision 4; Series M: Miscellaneous Statistical Papers, No. 4/Rev. 4, ST/ESA/STAT/SER.M/4/REV.4; United Nations: New York, NY, USA, 2008. [Google Scholar]

- World Trade Organization. Service Sectoral Classification List; WTO Document Code: MTN.GNS/W/120; World Trade Organization: Geneva, Switzerland, 1991. [Google Scholar]

- Han, S.H.; Park, S.H.; Kim, D.Y.; Kim, H.; Kang, Y.W. Causes of bad profit in overseas construction projects. J. Constr. Eng. Manag. 2007, 133, 932–943. [Google Scholar] [CrossRef]

- Lee, K.W.; Han, S.H.; Park, H.; Jeong, H.D. Empirical analysis of host-country effects in the international construction market: An industry-level approach. J. Constr. Eng. Manag. 2016, 142, 04015092. [Google Scholar] [CrossRef]

- Lu, W.; Ye, K.; Flanagan, R.; Jewell, C. Developing construction professional services in the international market: SWOT analysis of China. J. Manag. Eng. 2013, 29, 302–313. [Google Scholar] [CrossRef]

- World Trade Organization. Construction and Related Engineering Services: Background Noted by the Secretariat; S/C/W/38; World Trade Organization: Geneva, Switzerland, 1998. [Google Scholar]

- Engineering News-Record. The Top 225 International Design Firms. 2022. Available online: https://www.enr.com/ext/resources/Issues/National_Issues/2022/15-August/ENR08152022_TIDF_compressed.pdf (accessed on 15 August 2022).

- Engineering News-Record. The Top 250 International Contractors. 2022. Available online: https://www.enr.com/ext/resources/Issues/National_Issues/2022/29-August/ENR08292022_TIC250_R1_compressed.pdf (accessed on 29 August 2022).

- Jewell, C.; Flanagan, R.; Anac, C. Understanding UK construction professional services exports: Definitions and characteristics. Constr. Manag. Econ. 2010, 28, 231–239. [Google Scholar] [CrossRef]

- Jewell, C.; Flanagan, R.; Lu, W. The dilemma of scope and scale for construction professional service firms. Constr. Manag. Econ. 2014, 32, 473–486. [Google Scholar] [CrossRef]

- Engineering News-Record. The Top 200 International Design Firms. 2012. Available online: https://www.enr.com/ext/resources/static_pages/PDFs/national_toplists/Intl-Design-Firms/ENR_IDF_Top200_Overview_07232012.pdf (accessed on 23 July 2012).

- Engineering News-Record. The Top 225 International Design Firms. 2015. Available online: https://www.enr.com/ext/resources/static_pages/PDFs/national_toplists/Intl-Design-Firms/ENR_Top_225_International_Design_Firms_2015.pdf (accessed on 3 August 2015).

- Engineering News-Record. The Top 225 International Design Firms. 2019. Available online: https://www.enr.com/ext/resources/static_pages/Top-600/Top-Lists/2019/Files/ENR_2019_Top225_Intl_Design_Firms_Complete.pdf (accessed on 29 July 2019).

- Engineering News-Record. The Top 225 International Design Firms. 2020. Available online: https://www.enr.com/ext/resources/static_pages/Top-600/Top-Lists/2020/Files/ENR08032020_TIDF_combined.pdf (accessed on 10 August 2020).

- Engineering News-Record. The Top 200 International Design Firms. 2011. Available online: https://www.enr.com/ext/resources/static_pages/PDFs/national_toplists/Intl-Design-Firms/2011-Intl_Design_Global_Firms.pdf (accessed on 25 July 2011).

- Engineering News-Record. The Top 225 International Design Firms. 2013. Available online: https://www.enr.com/ext/resources/static_pages/PDFs/national_toplists/Intl-Contractors/enr_the_top_250_international_contractors_2013.pdf (accessed on 5 August 2013).

- Engineering News-Record. The Top 225 International Design Firms. 2014. Available online: https://www.enr.com/ext/resources/static_pages/PDFs/national_toplists/Intl-Contractors/2014_enr_top_250_intl_cont.pdf (accessed on 4 August 2014).

- Engineering News-Record. The Top 225 International Design Firms. 2016. Available online: https://www.enr.com/ext/resources/static_pages/Top-600/Top-Lists/2016/ENR07182016_Top225.pdf (accessed on 18 July 2016).

- Engineering News-Record. The Top 225 International Design Firms. 2017. Available online: https://www.enr.com/ext/resources/Issues/National_Issues/2017/07-July/17-Jul/ENR0717_TIDF_full.pdf (accessed on 17 July 2017).

- Engineering News-Record. The Top 225 International Design Firms. 2018. Available online: https://www.enr.com/ext/resources/static_pages/Top-600/Top-Lists/2018/Files/0716_TIDF_combined_compressed.pdf (accessed on 16 July 2018).

- Engineering News-Record. The Top 225 International Design Firms. 2021. Available online: https://www.enr.com/ext/resources/static_pages/Top-600/Top-Lists/2021/Files/ENR08022021_TIDF_compressed.pdf (accessed on 9 August 2021).

- Jiang, W.; Hu, X.; Ye, K.; Wong, J.K.W. Market structure of international construction professional services: Evidences from top design firms. J. Manag. Eng. 2016, 32, 4015033. [Google Scholar] [CrossRef]

- Lee, K.W.; Kim, D.Y. Market structure analysis of international construction revenue: A country level analysis. KSCE J. Civ. Eng. 2022, 26, 4960–4970. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Strategy: Techniques for Analyzing Industries and Competitors; Free Press: New York, NY, USA; Collier-MacMillan: London, UK, 1980. [Google Scholar]

- Gunhan, S. Factors affecting international contractors’ performance in the 21st century. Pract. Period. Struct. Des. Constr. 2020, 25, 05020011. [Google Scholar] [CrossRef]

- International Water and Sanitation Centre. Water Related Institutions in The Netherlands. 2001. Available online: https://www.ircwash.org/sites/default/files/210-01RE-17079.pdf (accessed on 23 June 2023).

- Luchtenbelt, A.W. Nederlandse Ingenieursbureaus in het Buitenland: Alleen of Samen Sterk? Een Vergelijking Tussen de Samenwerkingsverbanden Nedeco en het NWP. Master’s Thesis, Universiteit Utrecht, Utrecht, The Netherlands, 2016. Available online: https://studenttheses.uu.nl/handle/20.500.12932/22212?show=full (accessed on 23 June 2023).

- K-Water Institute. A Study on the Korea’s Water Industry Advancement to Abroad: Focusing on the Country-Customized Entry Strategy Establishment. Available online: https://www.kwater.or.kr/kiwe/resu/reportDown.do?otxt_atchfl_id=LIB20070614400049826&fileSeq=1 (accessed on 25 August 2023).

- Hoxley, M. Measuring UK construction professional service quality: The what, how, when and who. Int. J. Qual. Reliab. Manag. 2000, 17, 511–526. [Google Scholar] [CrossRef]

- Connaughton, J.; Meikle, J. The changing nature of UK construction professional service firms. Build. Res. Inf. 2013, 41, 95–109. [Google Scholar] [CrossRef]

- Murphy, R. Strategic planning in construction professional service firms: A study of Irish QS practices. Constr. Manag. Econ. 2013, 31, 151–166. [Google Scholar] [CrossRef]

- Abdul-Aziz, A.R.; Pengiran, D.N.; Law, Y.H.; Nor Azmi, H.A.C.M.; Ramayah, T. Export of Malaysia’s construction professional services. Malays. Constr. Res. J. 2013, 12, 59–81. [Google Scholar]

- Connaughton, J.; Meikle, J.; Teerikangas, S. Mergers, acquisitions and the evolution of construction professional services firms. Constr. Manag. Econ. 2015, 33, 146–159. [Google Scholar] [CrossRef]

- Hoxley, M. Are competitive fee tendering and construction professional service quality mutually exclusive? Constr. Manag. Econ. 2000, 18, 599–605. [Google Scholar] [CrossRef]

- Kissi, J.; Dainty, A.; Liu, A. Examining middle managers’ influence on innovation in construction professional services firms: A tale of three innovations. Constr. Innov. 2012, 12, 11–28. [Google Scholar] [CrossRef]

- Ugural, M.; Giritli, H. Three-way interaction model for turnover intention of construction professionals: Some evidence from Turkey. J. Constr. Eng. Manag. 2021, 147, 04021008. [Google Scholar] [CrossRef]

- Adabre, M.A.; Chan, A.P.C.; Darko, A.; Osei-Kyei, R.; Abidoye, R.; Adjei-Kumi, T. Critical barriers to sustainability attainment in affordable housing: International construction professionals’ perspective. J. Clean. Prod. 2020, 253, 119995. [Google Scholar] [CrossRef]

- Raphael, A.O.; Samuel, O.S.; Dipeolu, A.A. Evaluation of service quality gaps in construction professional service firms in Nigeria. J. Constr. Dev. Ctries. 2022, 27, 25–40. [Google Scholar] [CrossRef]

- Murphy, R.; Seriki, O. The impact of environmental turbulence on the strategic decision-making process in Irish quantity surveying (QS) professional service firms (PSFs). Constr. Manag. Econ. 2021, 39, 739–758. [Google Scholar] [CrossRef]

- Adesi, M.; Owusu-Manu, D.; Boateng, F.; Addy, M.N.; Kissi, E. The challenges of pricing quantity surveying professional services in Ghana. Front. Eng. Built Environ. 2023, 3, 77–92. [Google Scholar] [CrossRef]

- Engineering News-Record. The Top 225 International Design Firms. 2023. Available online: https://www.enr.com/ext/resources/Issues/National_Issues/2023/14-Aug/ENR08142023_TIDF_compressed.pdf (accessed on 21 August 2023).

- Han, J.G.; Park, H.P.; Ock, J.H.; Jang, H.S. An international competitiveness evaluation model in the global construction industry. KSCE J. Civ. Eng. 2015, 19, 465–477. [Google Scholar] [CrossRef]

- Sung, Y.K.; Lee, J.; Yi, J.S.; Son, J. Establishment of growth strategies for international construction firms by exploring diversification-related determinants and their effects. J. Manag. Eng. 2017, 33, 04017018. [Google Scholar] [CrossRef]

- Zhao, Z.Y.; Tang, C.; Zhang, X.; Skitmore, M. Agglomeration and competitive position of contractors in the international construction sector. J. Constr. Eng. Manag. 2017, 143, 04017004. [Google Scholar] [CrossRef]

- Ye, K.; Lu, W.; Jiang, W. Concentration in the international construction market. Constr. Manag. Econ. 2009, 27, 1197–1207. [Google Scholar] [CrossRef]

- Zhao, Z.Y.; Guo, X.L.; Chang, R.D. Market concentration and competitive intensity of the international engineering contracting industry. J. Constr. Eng. Manag. 2019, 145, 04019026. [Google Scholar] [CrossRef]

- Zilke, J.P.; Taylor, J.E. Evaluating the suitability of using international market analyses to characterize the global construction industry. J. Manag. Eng. 2015, 31, 04014078. [Google Scholar] [CrossRef]

- Baldwin, J.R.; Gorecki, P.K. Concentration and mobility statistics in Canada’s Manufacturing Sector. J. Ind. Econ. 1994, 42, 93–103. [Google Scholar] [CrossRef]

- van Kranenburg, H. Mobility and market structure in the Dutch daily newspaper market segments. J. Media Econ. 2009, 15, 107–123. [Google Scholar] [CrossRef]

- Davies, S. Choosing between concentration indices: The iso-concentration curve. Economica 1979, 46, 67–75. [Google Scholar] [CrossRef]

- Sawyer, C.M. The Economics of Industries and Firms; Croom Helm: London, UK, 1981. [Google Scholar]

- Infrastructure Intelligence. Construction Can no Longer Ignore Low Profit Margins. Available online: http://www.infrastructure-intelligence.com/article/sep-2019/construction-can-no-longer-ignore-low-profit-margins (accessed on 30 August 2023).

- Accountancy Age. The Construction Sector Is “Fragile” with “Low Margins and High Risks”, Says ICAEW. Available online: https://www.accountancyage.com/2019/03/28/the-construction-sector-is-fragile-with-low-margins-and-high-risks-says-icaew/ (accessed on 30 August 2023).

- Lu, W. Reliability of Engineering News-Record international construction data. Constr. Manag. Econ. 2014, 32, 968–982. [Google Scholar] [CrossRef]

- Dunning, J.H. The eclectic paradigm of international production: A restatement and some possible extensions. J. Int. Bus. Stud. 1988, 19, 1–31. [Google Scholar] [CrossRef]

- Dunning, J.H. Reappraising the eclectic paradigm in an age of alliance capitalism. J. Int. Bus. Stud. 1995, 26, 461–491. [Google Scholar] [CrossRef]

- OECD iLibrary. OECD Investment Policy Reviews: Egypt 2020. Chapter 7. Toward sustainable Economic Development Through Promoting and Enabling Responsible Business Conduct. Available online: https://www.oecd-ilibrary.org/sites/f7813858-en/index.html?itemId=/content/component/f7813858-en (accessed on 21 August 2023).

- Siegerink, V. Beyond the Bottom Line: Measuring the Non-Financial Performance of Firms through the Lens of the OECD Well-Being Framework. Available online: https://oecdstatistics.blog/2022/12/12/beyond-the-bottom-line-measuring-the-non-financial-performance-of-firms-through-the-lens-of-the-oecd-well-being-framework/ (accessed on 21 August 2023).

- Popescu, C.R.G. Sustainability assessment: Does the OECD/G20 inclusive framework for BEPS (Base Erosion and Profit Shifting Project) put an end to disputes over the recognition and measurement of intellectual capital? Sustainability 2020, 12, 10004. [Google Scholar] [CrossRef]

| Year | US | Canada | UK | The Netherlands | Australia | China | Spain | |

|---|---|---|---|---|---|---|---|---|

| 2011 | 0.4738 | 0.8917 | 0.7639 | 0.9746 | 0.8525 | 0.4722 | 0.8500 | |

| 2012 | 0.4670 | 0.8384 | 0.8069 | 0.9785 | 0.9039 | 0.4381 | 0.7855 | |

| 2013 | 0.4932 | 0.8783 | 0.8454 | 0.9711 | 0.8887 | 0.4790 | 0.7843 | |

| 2014 | 0.5390 | 0.9004 | 0.8418 | 1.0000 | 0.8884 | 0.5439 | 0.8473 | |

| 2015 | 0.4465 | 0.9088 | 1.0000 | 1.0000 | 0.9240 | 0.5339 | 0.8736 | |

| 2016 | 0.4930 | 1.0000 | 1.0000 | 0.9938 | 0.9173 | 0.6240 | 0.8859 | |

| 2017 | 0.5940 | 0.9698 | 1.0000 | 1.0000 | 0.9030 | 0.6321 | 0.8626 | |

| 2018 | 0.6392 | 0.9958 | 1.0000 | 1.0000 | 0.9593 | 0.6566 | 0.7984 | |

| 2019 | 0.5661 | 0.9955 | 0.9458 | 1.0000 | 0.9350 | 0.7195 | 0.8693 | |

| 2020 | 0.6585 | 1.0000 | 1.0000 | 1.0000 | 0.9246 | 0.7249 | 0.8742 | |

| 2021 | 0.6808 | 1.0000 | 1.0000 | 0.9939 | 0.9979 | 0.7858 | 0.8428 | |

| Mean | 0.5501 | 0.9435 | 0.9276 | 0.9920 | 0.9177 | 0.6009 | 0.8431 | |

| Std. dev. | 0.0792 | 0.0578 | 0.0891 | 0.0109 | 0.0368 | 0.1103 | 0.0352 | |

| Year | France | Denmark | Sweden | United Arab Emirates | Egypt | Republic of Korea | Italy | Japan |

| 2011 | 0.8862 | 1.0000 | 1.0000 | 1.0000 | 0.9923 | 0.9434 | 0.8930 | 0.8504 |

| 2012 | 0.9316 | 1.0000 | 1.0000 | 1.0000 | 0.9917 | 0.8509 | 0.8317 | 0.8733 |

| 2013 | 0.8819 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.8446 | 0.8945 | 0.7179 |

| 2014 | 0.9176 | 1.0000 | 1.0000 | 1.0000 | 0.9952 | 0.8739 | 0.9818 | 0.7308 |

| 2015 | 0.9178 | 1.0000 | 1.0000 | 1.0000 | 0.9905 | 0.8964 | 0.9575 | 0.7353 |

| 2016 | 0.9033 | 1.0000 | 1.0000 | 0.9958 | 0.9199 | 0.8530 | 0.9022 | 0.7407 |

| 2017 | 0.9246 | 1.0000 | 1.0000 | 1.0000 | 0.9030 | 0.8342 | 0.9061 | 0.7321 |

| 2018 | 0.9557 | 1.0000 | 1.0000 | 1.0000 | 0.7882 | 0.7671 | 0.8792 | 0.8158 |

| 2019 | 0.9484 | 1.0000 | 1.0000 | 1.0000 | 0.8619 | 0.7887 | 0.8351 | 0.8555 |

| 2020 | 0.9073 | 1.0000 | 1.0000 | 1.0000 | 0.8602 | 0.7933 | 0.8657 | 0.8342 |

| 2021 | 0.9052 | 1.0000 | 1.0000 | 1.0000 | 0.8101 | 0.7876 | 0.8149 | 0.8389 |

| Mean | 0.9163 | 1.0000 | 1.0000 | 0.9996 | 0.9194 | 0.8394 | 0.8874 | 0.7932 |

| Std. dev. | 0.0221 | 0.0000 | 0.0000 | 0.0012 | 0.0763 | 0.0507 | 0.0487 | 0.0582 |

| Year | 2021 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Rank | 1–10 | 11–20 | 21–40 | 41–60 | 61–80 | 81–100 | >100 | Others | |

| 2011 | 1–10 | 6 | 1 | 0 | 0 | 0 | 0 | 0 | 3 |

| 11–20 | 0 | 3 | 0 | 1 | 0 | 0 | 0 | 6 | |

| 21–40 | 1 | 3 | 3 | 1 | 0 | 1 | 0 | 11 | |

| 41–60 | 0 | 1 | 6 | 0 | 0 | 1 | 1 | 11 | |

| 61–80 | 0 | 0 | 2 | 4 | 7 | 0 | 1 | 6 | |

| 81–100 | 0 | 0 | 2 | 3 | 3 | 0 | 3 | 9 | |

| >100 | 0 | 1 | 0 | 3 | 7 | 8 | 30 | 51 | |

| Others | 3 | 1 | 7 | 8 | 3 | 10 | 90 | - | |

| Indices | US | Canada | UK | The Netherlands | Australia | China | Spain | |

|---|---|---|---|---|---|---|---|---|

| EN | 0.1268 | 0.4421 | 0.4993 | 0.0061 | 0.0499 | 0.5024 | 0.0875 | |

| EX | 0.4167 | 0.2612 | 0.6919 | 0.1297 | 0.2905 | 0.5532 | 0.7592 | |

| CNGN | 0.3494 | 0.0544 | 0.1927 | 0.3512 | 0.2406 | 0.2856 | 0.6717 | |

| CNLS | 0.0594 | 0.2353 | 0.0000 | 0.2275 | 0.0000 | 0.2348 | 0.0000 | |

| TURNE | 0.2718 | 0.3517 | 0.5956 | 0.0679 | 0.1702 | 0.5278 | 0.4234 | |

| TURNC | 0.2044 | 0.1448 | 0.0963 | 0.2893 | 0.1203 | 0.2602 | 0.3359 | |

| TURN | 0.4762 | 0.4965 | 0.6919 | 0.3572 | 0.2905 | 0.7880 | 0.7592 | |

| Indices | France | Denmark | Sweden | United Arab Emirates | Egypt | Republic of Korea | Italy | Japan |

| EN | 0.0776 | 0.0000 | 0.0000 | 0.9745 | 0.4301 | 0.5119 | 0.5626 | 0.1391 |

| EX | 0.5337 | 0.0000 | 0.0000 | 0.4991 | 0.9464 | 0.4195 | 0.5916 | 0.1556 |

| CNGN | 0.4561 | 0.0843 | 0.0455 | 0.0000 | 0.5163 | 0.3052 | 0.0323 | 0.4872 |

| CNLS | 0.0000 | 0.0843 | 0.0455 | 0.4754 | 0.0000 | 0.3975 | 0.0033 | 0.4706 |

| TURNE | 0.3057 | 0.0000 | 0.0000 | 0.7368 | 0.6883 | 0.4657 | 0.5771 | 0.1474 |

| TURNC | 0.2281 | 0.0843 | 0.0455 | 0.2377 | 0.2581 | 0.3513 | 0.0178 | 0.4789 |

| TURN | 0.5337 | 0.0843 | 0.0455 | 0.9745 | 0.9464 | 0.8170 | 0.5949 | 0.6262 |

| Firm Nationality | No. of Continuing Firms | CORSH | REGSH |

|---|---|---|---|

| USA | 35 | 0.9078 | 1.4077 |

| Canada | 3 | 0.5859 | 0.4658 |

| UK | 2 | −1.0000 | −2.5487 |

| The Netherlands | 4 | 0.6374 | 0.8314 |

| Australia | 3 | 0.9911 | 1.0817 |

| China | 10 | 0.0211 | 0.0543 |

| Spain | 6 | 0.6434 | 2.5112 |

| France | 5 | 0.9826 | 1.6071 |

| Denmark | 2 | 1.0000 | 1.6399 |

| Sweden | 2 | 1.0000 | 0.6822 |

| United Arab Emirates | 1 | n/a | n/a |

| Egypt | 3 | 0.8587 | 14.3158 |

| Republic of Korea | 4 | −0.5770 | −0.3946 |

| Italy | 2 | 1.0000 | 1.0967 |

| Japan | 5 | −0.2081 | −0.1457 |

| Firm Nationality | Market Concentration | Market Mobility | Market Instability |

|---|---|---|---|

| Canada | High | Moderate | Unstable |

| UK | High | High | Unstable |

| The Netherlands | High | Moderate | Unstable |

| Australia | High | Moderate | Stable |

| Spain | High | High | Unstable |

| France | High | High | Stable |

| Denmark | High | Moderate | Stable |

| Sweden | High | Moderate | Unstable |

| United Arab Emirates | High | High | n/a |

| Egypt | High | High | Stable |

| Republic of Korea | High | High | Unstable |

| Italy | High | High | Stable |

| Japan | High | High | Unstable |

| USA | Moderate | Moderate | Stable |

| China | Moderate | High | Unstable |

| Market Index | Concentration (ρ) | Mobility (ρ) | Instability (ρ) |

|---|---|---|---|

| Concentration | — | — | — |

| Mobility | −0.080 (0.777) | — | — |

| Instability | 0.059 (0.841) | 0.125 (0.670) | — |

| Category | Firm Nationality (No. of Continuing Firms/TIDFs) |

|---|---|

| High-static and high-dynamic | Canada (3/13), UK (2/13), The Netherlands (4/7), Spain (6/13), Sweden (2/2), United Arab Emirates (1/7), Republic of Korea (4/18), and Japan (5/15) |

| High-static and low-dynamic | Australia (3/12), France (5/10), Denmark (2/2), Egypt (3/12), and Italy (2/24) |

| Low-static and high-dynamic | China (10/47) |

| Low-static and low-dynamic | USA (35/160) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, K.-W. Market Structure Analysis of Revenue of International Construction Professional Service (I-CPS): A Country-Level Analysis. Sustainability 2023, 15, 13836. https://doi.org/10.3390/su151813836

Lee K-W. Market Structure Analysis of Revenue of International Construction Professional Service (I-CPS): A Country-Level Analysis. Sustainability. 2023; 15(18):13836. https://doi.org/10.3390/su151813836

Chicago/Turabian StyleLee, Kang-Wook. 2023. "Market Structure Analysis of Revenue of International Construction Professional Service (I-CPS): A Country-Level Analysis" Sustainability 15, no. 18: 13836. https://doi.org/10.3390/su151813836

APA StyleLee, K.-W. (2023). Market Structure Analysis of Revenue of International Construction Professional Service (I-CPS): A Country-Level Analysis. Sustainability, 15(18), 13836. https://doi.org/10.3390/su151813836