Exploring the Carbon Abatement Strategies in Shipping Using System Dynamics Approach

Abstract

:1. Introduction

2. Materials and Methods

2.1. Model Framework

2.2. Model Hypothesis

- (1)

- The calculation of carbon emissions only considers the carbon dioxide produced during the ship’s voyage.

- (2)

- The quantity of cargo and the cargo tariff remain unchanged, and the container ship is fully loaded.

- (3)

- Considers only emissions when the ship is sailing and does not consider emissions when the ship is at berth.

- (4)

- Consider only the carbon tax as well as voyage revenues as influences on shipping company earnings.

2.3. Model Setting

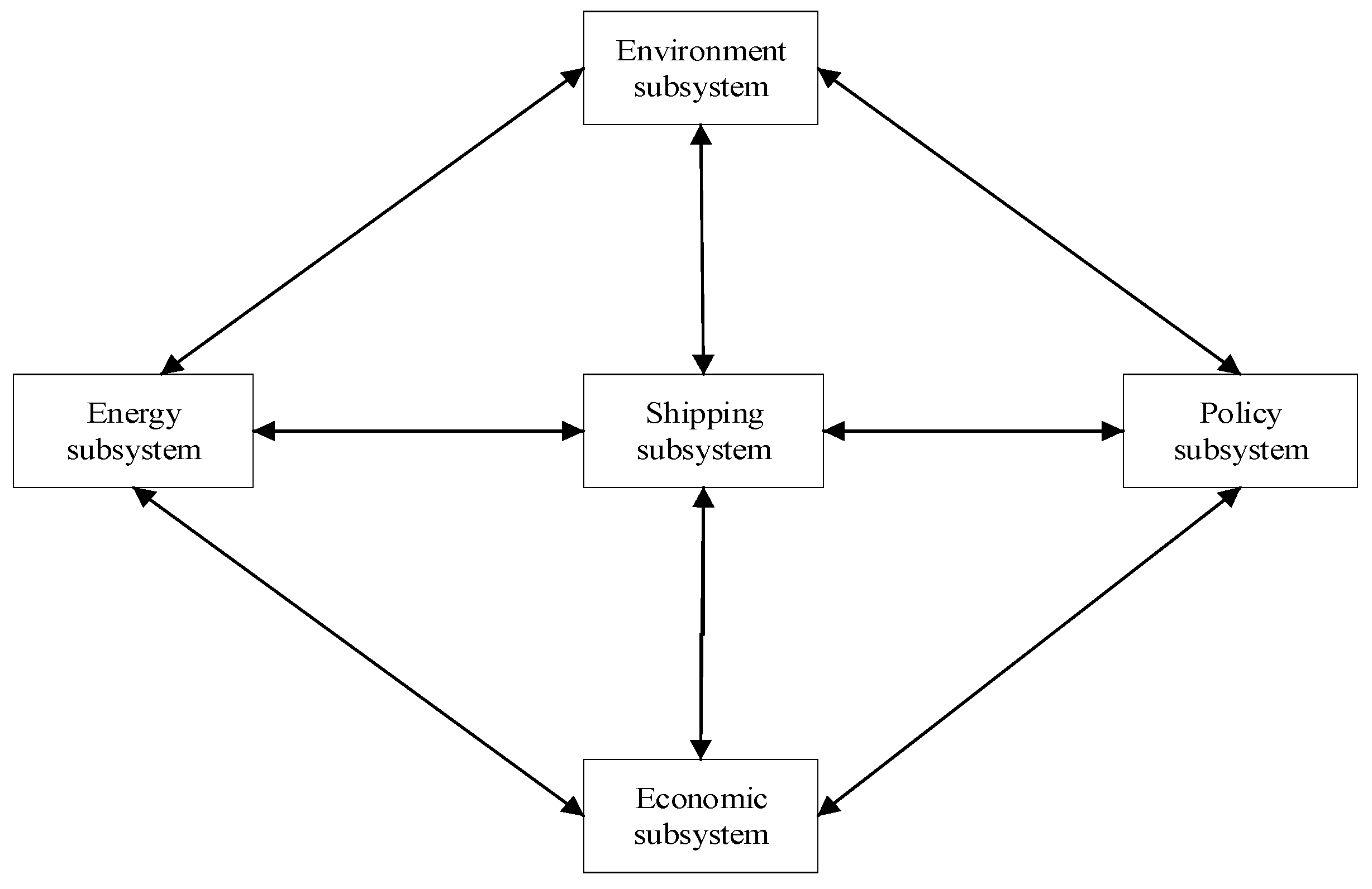

2.3.1. Creation of a Causal Diagram

- (1)

- Shipping subsystem

- (2)

- Economic subsystem

- (3)

- Energy subsystem

- (4)

- Environment subsystem

- (5)

- Policy subsystem

2.3.2. Main Feedback Loops

2.3.3. Establishment of Stock Flow Diagram

- (1)

- Total revenue of shipping companies (in Billion RMB)

- (2)

- Revenue increase (in Billion RMB)

- (3)

- Carbon tax (in Billion RMB)

- (4)

- Revenue decrease (in Billion RMB)

- (5)

- Total carbon dioxide emissions (in Million tons)

- (6)

- Annual CO2 emissions (in Million tons)

- (7)

- Emissions from every kind of fuel (in Million tons)

- (8)

- Fuel consumption (in Million tons)

- (9)

- Total energy consumption (kwh)

- (10)

- Number of shipping voyages

- (11)

- Energy consumption in shipping each voyage (kw)

- (12)

- Average operating power of the vessel (kw)

- (13)

- Operating power of ship’s main engine (kw)

- (14)

- Operating power of auxiliary engines (kw)

- (15)

- Sailing time (h)

3. Simulation Design and Model Verification

3.1. Model Design

3.1.1. Ship Speed Design

3.1.2. Fuel Composition Design

3.1.3. Scheme Design of Subsidy Coefficient

3.1.4. Carbon Tax Rate Design

3.2. Model Validation

3.2.1. Adaptive Testing

3.2.2. Sensitivity Analysis

4. Results and Discussion

4.1. Impact of Carbon Tax Rate

4.2. Combination Impact of Carbon Tax and Speed Reduction

4.3. Combination Impact of Carbon Tax and Carbon Tax Subsidy

4.4. Impact of Carbon Tax and Fuel Composition

5. Conclusions and Suggestion

- (1)

- The imposition of a carbon tax contributes to the reduction of carbon dioxide emissions from ships. Higher carbon tax rates lead to more pronounced emission reduction effects, although the overall impact on emissions may not be substantial. However, it is important to note that the carbon tax can negatively affect the total income of shipping companies.

- (2)

- Among the 13 emission reduction measures examined, scheme C2 demonstrates the most effective carbon emission reduction. This highlights that the combination of fuel composition adjustments can effectively mitigate the increase in CO2 emissions. Specifically, among the fuel composition adjustment measures, LNG proves to be the most effective transitional fuel in terms of emission reduction.

- (3)

- Slowing ship speeds effectively cuts emissions and enhances energy efficiency. This approach reduces emissions without additional financial investments in reduction measures or carbon taxes. Combining carbon tax and speed reduction produces superior results, reducing emissions while promoting economic development. Carbon taxation and subsidies together contribute to emission reduction. The tax’s impact on shipping firms outweighs subsidies, emphasizing their importance in emission policies. Altering fuel composition, particularly favoring cleaner energy sources, significantly reduces carbon emissions, outperforming the baseline scenario.

- (4)

- Combining a carbon tax, ship speed reductions, and fuel composition changes results in more significant emission reductions compared to implementing a carbon tax alone. However, there is an exception where a solitary carbon tax policy outperforms the combination of carbon tax and subsidies. These findings encourage shipping companies to consider speed reduction and fuel composition changes for effective emission reduction.

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Li, X.; Sun, B.; Guo, C.; Duo, W.; Li, Y. Speed optimization of a container ship on a given route considering voluntary speed loss and emissions. Appl. Ocean Res. 2020, 94, 101995. [Google Scholar] [CrossRef]

- IMO. The Fourth IMO GHG Study 2020. Available online: http://www.Maritimecyprus.com/wp-content/uploads/2021/03/4th-IMO-GHG-Study-2020.pdf (accessed on 10 July 2023).

- Wissner, N.; Healy, S. Raising Ambition Levels at the IMO for 2050—An Overview of the Key Issues at Stake at MEPC 80; EPRS, European Parliamentary Research Service: Brussels, Belgium, 2023. [Google Scholar]

- Pham, V.V.; Hoang, A.T.; Do, H.C. Analysis and evaluation of database for the selection of propulsion systems for tankers. AIP Conf. Proc. 2020, 2235, 020034. [Google Scholar]

- Tan, J.; Wang, R. Research on evaluation and influencing factors of regional ecological efficiency from the perspective of carbon neutrality. J. Environ. Manag. 2021, 294, 113030. [Google Scholar] [CrossRef]

- Zhou, P.; Wang, H. Carbon capture and storage—Solidification and storage of carbon dioxide captured on ships. Ocean Eng. 2014, 91, 172–180. [Google Scholar] [CrossRef]

- Chen, X.; Lin, B. Towards carbon neutrality by implementing carbon emissions trading scheme: Policy evaluation in China. Energy Policy 2021, 157, 112510. [Google Scholar] [CrossRef]

- Jimenez, V.J.; Kim, H.; Munim, Z.H. A review of ship energy efficiency research and directions towards emission reduction in the maritime industry. J. Clean. Prod. 2022, 366, 132888. [Google Scholar] [CrossRef]

- Bouman, E.A.; Lindstad, E.; Rialland, A.I.; Strømman, A.H. State-of-the-art technologies, measures, and potential for reducing GHG emissions from shipping—A review. Transp. Res. Part D Transp. Environ. 2017, 52, 408–421. [Google Scholar] [CrossRef]

- Glykas, A.; Papaioannou, G.; Perissakis, S. Application and cost-benefit analysis of solar hybrid power installation on merchant marine vessels. Ocean Eng. 2010, 37, 592–602. [Google Scholar] [CrossRef]

- Liu, J.; Song, R.; Nasreen, S.; Hoang, A.T. Analysis of the complementary property of solar energy and thermal power based on coupling model. Nat. Environ. Pollut. Technol. 2019, 18, 1675–1681. [Google Scholar]

- Hoang, A.T.; Pham, V.V. A study on a solution to reduce emissions by using hydrogen as an alternative fuel for a diesel engine integrated exhaust gas recirculation. AIP Conf. Proc. 2020, 2235, 020035. [Google Scholar]

- Joung, T.H.; Kang, S.G.; Lee, J.K.; Ahn, J. The IMO initial strategy for reducing Greenhouse Gas (GHG) emissions, and its follow-up actions towards 2050. J. Int. Mar. Saf. Environ. Aff. Ship. 2020, 4, 1–7. [Google Scholar] [CrossRef]

- Wang, Y.; Cao, Q.; Liu, L.; Wu, Y.; Liu, H.Y.; Gu, Z.Y.; Zhu, C.X. A review of low and zero carbon fuel technologies: Achieving ship carbon reduction targets. Sustain. Energy Technol. Assess. 2022, 54, 102762. [Google Scholar] [CrossRef]

- Brahim, T.; Wiese, F.; Münster, M. Pathways to climate-neutral shipping: A Danish case study. Energy 2019, 188, 116009. [Google Scholar] [CrossRef]

- Garcia, B.; Foerster, A.; Lin, J. The Shipping Sector and GHG Emissions: The Initial Strategy for a Zero-Carbon Pathway. Available online: https://law.nus.edu.sg/apcel/wp-content/uploads/sites/3/2020/06/013_2020_Jolene.pdf (accessed on 10 July 2023).

- Xing, H.; Stuart, C.; Spence, S.; Chen, H. Alternative fuel options for low carbon maritime transportation: Pathways to 2050. J. Clean. Prod. 2021, 297, 126651. [Google Scholar] [CrossRef]

- McKinlay, C.J.; Turnock, S.R.; Hudson, D.A. Route to zero emission shipping: Hydrogen, ammonia or methanol. Int. J. Hydrog. Energy 2021, 46, 28282–28297. [Google Scholar] [CrossRef]

- Xia, Z.C.; Guo, Z.J.; Wang, W.Y.; Jiang, Y. Joint optimization of ship scheduling and speed reduction: A new strategy considering high transport efficiency and low carbon of ships in port. Ocean Eng. 2021, 233, 109224. [Google Scholar] [CrossRef]

- Zhuge, D.; Wang, S.A.; Wang, D.Z.W. A joint liner ship path, speed, and deployment problem under emission reduction measures. Transp. Res. Part B Methodol. 2021, 144, 155–173. [Google Scholar] [CrossRef]

- Chen, K.; Xin, X.; Niu, X.Y.; Zeng, Q.C. Coastal Transportation System Joint Taxation-Subsidy Emission Reduction Policy Optimization Problem. J. Clean. Prod. 2019, 247, 119096. [Google Scholar] [CrossRef]

- Sheng, D.; Meng, Q.; Li, Z.C. Optimal vessel speed and fleet size for industrial shipping services under the emission control area regulation. Transp. Res. Part C Emerg. Technol. 2019, 105, 37–53. [Google Scholar] [CrossRef]

- Chang, C.C.; Wang, C.M. Evaluating the effects of green port policy: Case study of Kaohsiung harbor in Taiwan. Transp. Res. Part D Transp. Environ. 2012, 17, 185–189. [Google Scholar] [CrossRef]

- Wan, Z.; El Makhloufi, A.; Chen, Y.; Tang, J.Y. Decarbonizing the international shipping industry: Solutions and policy recommendations. Mar. Pollut. Bull. 2018, 126, 428–435. [Google Scholar] [CrossRef] [PubMed]

- Ding, S.; Zhang, M.; Song, Y. Exploring China’s carbon emissions peak for different carbon tax scenarios. Energy Policy 2019, 129, 1245–1252. [Google Scholar] [CrossRef]

- Grzelakowski, A.S.; Herdzik, J.; Skiba, S. Maritime shipping decarbonization: Roadmap to meet zero-emission target in shipping as a link in the global supply chains. Energy 2022, 15, 6150. [Google Scholar] [CrossRef]

- Zhu, M.; Yuen, F.K.; Ge, J.W.; Li, K.X. Impact of maritime emissions trading system on fleet deployment and mitigation of CO2 emission. Transp. Res. Part D Transp. Environ. 2018, 62, 474–488. [Google Scholar] [CrossRef]

- Ma, N.; Yin, G.W.; Li, H.J.; Sun, W.L.; Wang, Z.; Liu, G.; Xie, D. The optimal industrial carbon tax for China under carbon intensity constraints: A dynamic input–output optimization model. Environ. Sci. Pollut. Res. 2022, 29, 53191–53211. [Google Scholar] [CrossRef] [PubMed]

- Song, G.; Wang, Y.; Jiang, Y. Carbon emission control policy design based on the targets of carbon peak and carbon neutrality. Chin. J. Popul. Resour. Environ. 2021, 31, 55–63. [Google Scholar]

- Lin, B.; Jia, Z. The energy, environmental and economic impacts of carbon tax rate and taxation industry: A CGE based study in China. Energy 2018, 159, 558–568. [Google Scholar] [CrossRef]

- Gao, X.; Zhang, Y. Feasibility study of China’s carbon tax system under the carbon neutrality target-based on the CGE model. Sustainability 2023, 15, 1026. [Google Scholar] [CrossRef]

- Lee, T.C.; Chang, Y.T.; Lee, P.T.W. Economy-wide impact analysis of a carbon tax on international container shipping. Transp. Res. Part A Policy Pract. 2013, 58, 87–102. [Google Scholar] [CrossRef]

- Liu, J.; Bai, J.; Deng, Y.; Chen, X.H.; Liu, X. Impact of energy structure on carbon emission and economy of China in the scenario of carbon taxation. Sci. Total Environ. 2021, 762, 143093. [Google Scholar] [CrossRef]

- Fu, Y.; Huang, G.; Liu, L.R.; Zhai, M.Y. A factorial CGE model for analyzing the impacts of stepped carbon tax on Chinese economy and carbon emission. Sci. Total Environ. 2021, 759, 143512. [Google Scholar] [CrossRef] [PubMed]

- Li, Z.; Dai, H.; Sun, L.; Xie, Y.; Liu, Z.; Wang, P.; Yabar, H. Exploring the impacts of regional unbalanced carbon tax on CO2 emissions and industrial competitiveness in Liaoning province of China. Energy Policy 2018, 113, 9–19. [Google Scholar] [CrossRef]

- Guo, Z.Q.; Zhang, X.P.; Zheng, Y.H.; Rao, R. Exploring the impacts of a carbon tax on the Chinese economy using a CGE model with a detailed disaggregation of energy sectors. Energy Econ. 2014, 45, 455–462. [Google Scholar] [CrossRef]

- Rebs, T.; Brandenburg, M.; Seuring, S. System dynamics modeling for sustainable supply chain management: A literature review and systems thinking approach. J. Clean. Prod. 2019, 208, 1265–1280. [Google Scholar] [CrossRef]

- Song, L. Study on endogenous development trend of dry bulk shipping market. In Proceedings of the 5th International Conference on Computer Information Science and Application Technology (CISAT 2022), Chongqing, China, 29–31 July 2022. [Google Scholar]

- Bai, X.W.; Xu, M.Q.; Jia, H. A dynamic feedback system analysis on the mechanism of shipping freight. In Proceedings of the IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Singapore, 14–17 December 2020. [Google Scholar]

- Wang, Z.; Qin, C.H.; Liu, C.L.; Zhang, W. System Dynamics Simulation of CO2 Emissions from Typical Route Ships. IOP Conf. Ser. Mater. Sci. Eng. 2020, 740, 012199. [Google Scholar] [CrossRef]

- Geng, X.; Wen, Y.; Zhou, C.; Xiao, C. Establishment of the Sustainable Ecosystem for the Regional Shipping Industry Based on System Dynamics. Sustainability 2017, 9, 742. [Google Scholar] [CrossRef]

- Kong, Y.; Liu, J.; Chen, J. Exploring the carbon abatement measures in maritime supply chain: A scenario-based system dynamics approach. Int. J. Prod. Res. 2022, 61, 1–22. [Google Scholar] [CrossRef]

- Jing, D.Y.; Dai, L.; Hu, H.; Ding, W.Y.; Wang, Y.B.; Zhou, X.X. CO2 emission projection for Arctic shipping: A system dynamics approach. Ocean. Coast. Manag. 2021, 205, 105531. [Google Scholar] [CrossRef]

- Zhang, Y.R.; Meng, Q.; Ng, S.H. Shipping efficiency comparison between Northern Sea route and the conventional Asia Europe shipping route via Suez Canal. J. Transp. Geogr. 2016, 57, 241–249. [Google Scholar] [CrossRef]

- Winther, M.; Christensen, J.H.; Plejdrup, M.S.; Ravn, E.S.; Eriksson, Ó.F.; Kristensen, H.O. Emission inventories for ships in the arctic based on satellite sampled AIS data. Atmos. Environ. 2014, 91, 1–14. [Google Scholar] [CrossRef]

- Zhou, X.X.; Jing, D.Y.; Dai, L.; Wang, Y.B.; Guo, S.Q.; Hu, H. Evaluating the economic impacts of COVID-19 pandemic on shipping and port industry: A case study of the port of Shanghai. Ocean. Coast. Manag. 2022, 230, 106339. [Google Scholar] [CrossRef] [PubMed]

- Wen, Y.Q.; Geng, X.Q.; Wen, Y.Q.; Zhou, C.H.; Xiao, C.S. Research on system dynamics modeling for mitigation of regional vessel exhausts emissions. Environ. Sci. Technol. 2017, 40, 193–199. [Google Scholar]

- Milaković, A.-S.; Gunnarsson, B.; Balmasov, S.; Hong, S.W.; Kim, K.; Schütz, P.; Ehlers, S. Current status and future operational models for transit shipping along the Northern Sea Route. Mar. Policy 2018, 94, 53–60. [Google Scholar] [CrossRef]

- Raj, R.; Ghandeharium, S.; Kumar, A.; Geng, J.; Ma, L.W. A techno-economic study of shipping LNG to the Asia-Pacific from Western Canada by LNG carrier. J. Nat. Gas Sci. Eng. 2016, 34, 979–992. [Google Scholar] [CrossRef]

- Chang, C.-C.; Chang, C.-H. Energy conservation for international dry bulk carriers via vessel speed reduction. Energy Policy 2013, 59, 710–715. [Google Scholar] [CrossRef]

- Lindstad, E.; Eskeland, G.S.; Rialland, A.; Valland, A. Decarbonizing maritime transport: The importance of engine technology and regulations for LNG to serve as a transition fuel. Sustainability 2020, 12, 8793. [Google Scholar] [CrossRef]

- Wu, H.B.; Sun, Y.X.; Su, Y.T.; Chen, M.; Zhao, H.X.; Li, Q. Which is the best supply chain policy: Carbon tax, or a low-carbon subsidy? Sustainability 2022, 14, 6312. [Google Scholar] [CrossRef]

- Bian, J.S.; Zhao, X. Tax or subsidy? An analysis of environmental policies in supply chains with retail competition. Tour. Manag. 2020, 283, 901–914. [Google Scholar] [CrossRef]

- Wang, H.; Li, Y.; Bu, G. How carbon trading policy should be integrated with carbon tax policy—Laboratory evidence from a model of the current state of carbon pricing policy in China. Environ. Sci. Pollut. Res. 2023, 30, 23851–23869. [Google Scholar] [CrossRef]

- Zhao, X.; Wu, L.; Li, A. Research on the efficiency of carbon trading market in China. Renew. Sustain. Energy Rev. 2017, 79, 1–8. [Google Scholar] [CrossRef]

| Subsystem | Factor | Reference |

|---|---|---|

| Shipping | Number of vessels, speed, sailing time, sailing distance, shipping income, number of ships, operational power. | Jing et al. (2021) [43] Geng et al. (2017) [41] Zhang et al. (2016) [44] Winther et al. (2014) [45] |

| Energy | Total energy consumption, consumption of different fuels, utilization rate of different fuels | Kong et al. (2022) [42] Zhou et al. (2022) [46] |

| Economic | Total revenue of shipping companies, pollution loss, ship energy consumption | Wen et al. (2017) [47] Milakovic et al. (2018) [48] Geng et al. (2017) [41] |

| Policy | Carbon tax, shipping subsidy | Raj et al. (2016) [49] |

| Environment | Total carbon dioxide emissions, fuel consumption, carbon dioxide emission factor | Kong et al. (2022) [42] Jing et al. (2021) [43] Geng et al. (2017) [41] Zhang et al. (2016) [44] |

| Notation | Feedback Loop |

|---|---|

| R1 | Total revenue→Number of vessel voyages→Total energy consumption→Fuel emissions→Carbon dioxide emission→Pollution losses |

| R2 | Number of vessel voyages→Total energy consumption→Shipping cost→Total revenue→voyage growth rate |

| R3 | Carbon dioxide emission→Pollution losses→Total revenue→Number of vessel voyages |

| R4 | Carbon dioxide emission→Vessel speed→Sailing time→Total energy consumption |

| R5 | Carbon dioxide emission→Carbon tax→Fuel cost→Shipping cost→Profit margin→Number of vessel voyages→Total energy consumption |

| R6 | Carbon tax→Vessel speed→Vessel operating power→Total energy consumption→Carbon dioxide emission |

| R7 | Total revenue→voyage growth rate→Total energy consumption→Carbon dioxide emission→Carbon tax |

| Scheme | Carbon Tax Rate (Yuan/Ton) | Subsidy Coefficient | Fuel Composition | Average Speed (kn) |

|---|---|---|---|---|

| BAU | 0 | 0 | HFO 80% MDO 20% LNG 0 | 14 |

| A1 | 40 | 0 | HFO 80% MDO 20% LNG 0 | 14 |

| A2 | 50 | 0 | HFO 80% MDO 20% LNG 0 | 14 |

| A3 | 60 | 0 | HFO 80% MDO 20% LNG 0 | 14 |

| B1 | 40 | 20% | HFO 80% MDO 20% LNG 0 | 14 |

| B2 | 40 | 30% | HFO 80% MDO 20% LNG 0 | 14 |

| C1 | 40 | 0 | HFO 40% MDO 20% LNG 40% | 14 |

| C2 | 40 | 0 | HFO 0% MDO 20% LNG 80% | 14 |

| C3 | 40 | 0 | HFO 40% MDO 60% LNG 0 | 14 |

| C4 | 40 | 0 | HFO 0 MDO100% LNG 0 | 14 |

| C5 | 40 | 0 | HFO 0 MDO 60% LNG 40% | 14 |

| D1 | 40 | 0 | HFO 80% MDO 20% LNG 0 | 13 |

| D2 | 40 | 0 | HFO 80% MDO 20% LNG 0 | 15 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gao, X.; Zhu, A.; Yu, Q. Exploring the Carbon Abatement Strategies in Shipping Using System Dynamics Approach. Sustainability 2023, 15, 13907. https://doi.org/10.3390/su151813907

Gao X, Zhu A, Yu Q. Exploring the Carbon Abatement Strategies in Shipping Using System Dynamics Approach. Sustainability. 2023; 15(18):13907. https://doi.org/10.3390/su151813907

Chicago/Turabian StyleGao, Xinjia, Aoshuang Zhu, and Qifeng Yu. 2023. "Exploring the Carbon Abatement Strategies in Shipping Using System Dynamics Approach" Sustainability 15, no. 18: 13907. https://doi.org/10.3390/su151813907

APA StyleGao, X., Zhu, A., & Yu, Q. (2023). Exploring the Carbon Abatement Strategies in Shipping Using System Dynamics Approach. Sustainability, 15(18), 13907. https://doi.org/10.3390/su151813907