Two-Stage Optimization Scheduling of Virtual Power Plants Considering a User-Virtual Power Plant-Equipment Alliance Game

Abstract

:1. Introduction

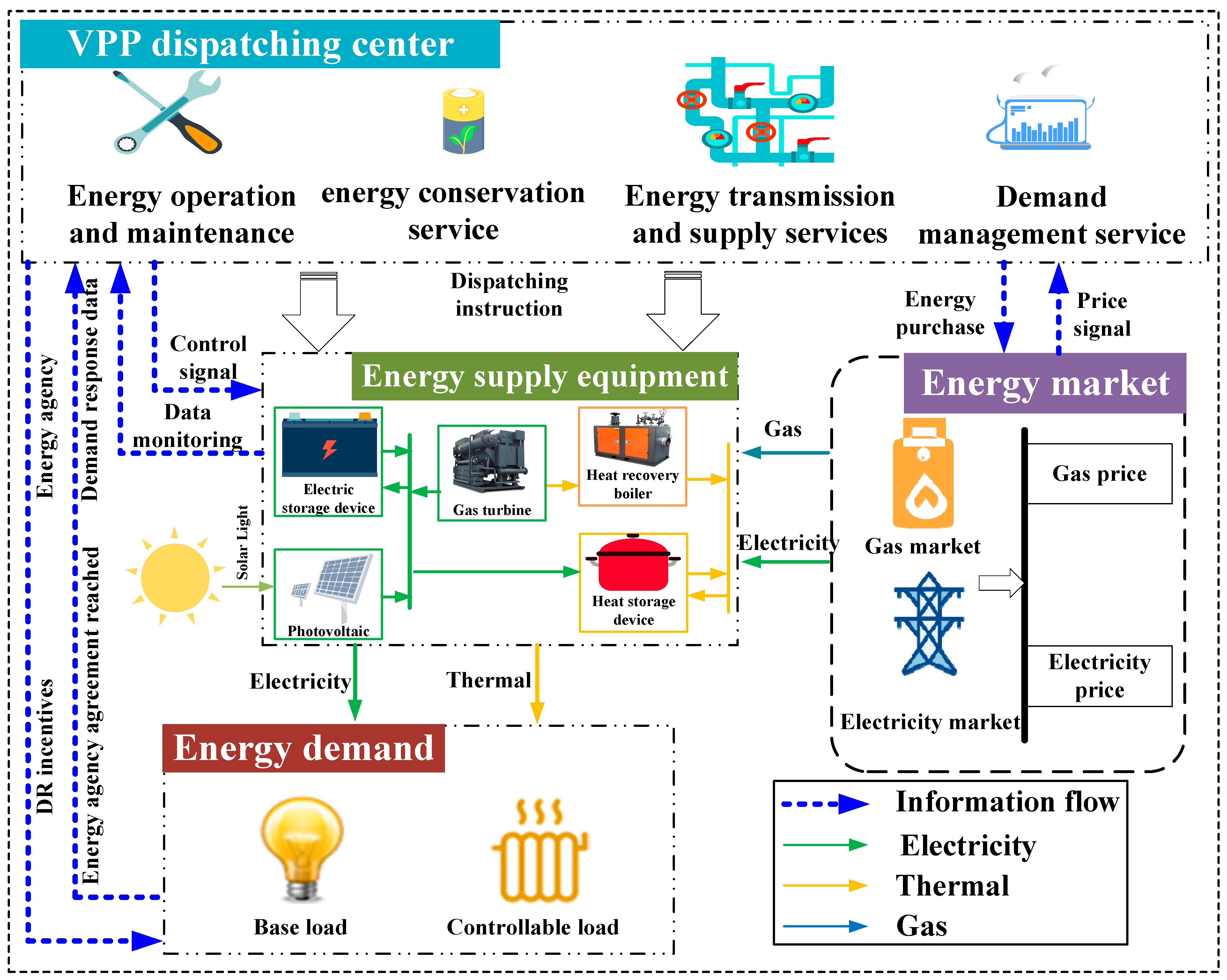

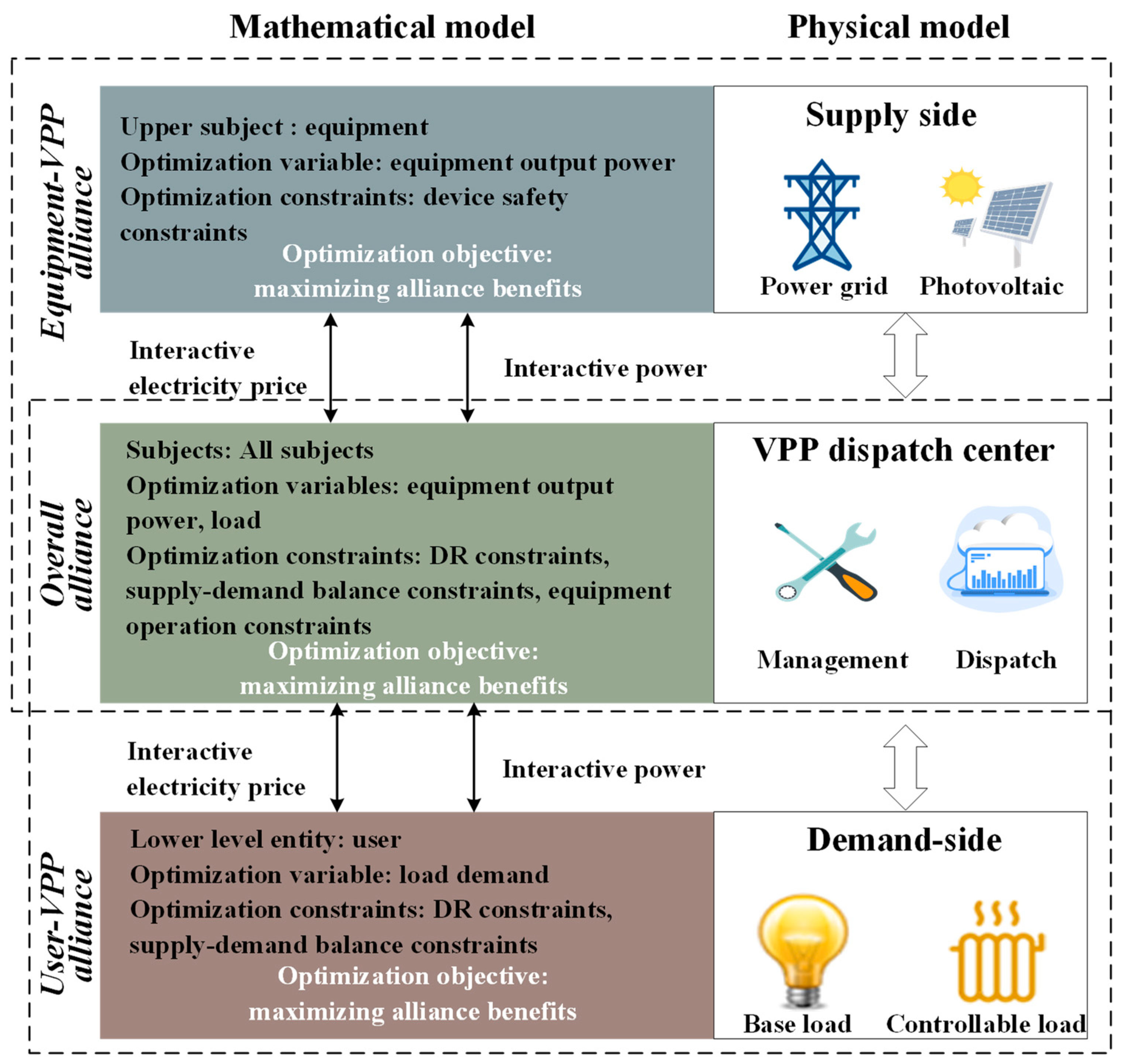

2. VPP Bi-Level Optimization Theory Based on Cooperative Games

2.1. The Alliance Structure of VPP Cooperative Games

2.1.1. The User-VPP Alliance on the Demand-Side

- (1)

- Operation mode under non-cooperative game

- (2)

- Operation mode under a cooperative game

2.1.2. The Equipment-VPP Alliance on the Supply-Side

- (1)

- Operation mode under a non-cooperative game

2.2. Optimization Framework for VPP Considering Cooperative Game of the User-VPP-Equipment Alliance

3. A Two-Stage Optimization Model for VPP Considering the User-VPP-Equipment Alliance

3.1. The First Stage: Day-Ahead Optimal Scheduling Model

3.1.1. Optimization Objective

- (1)

- Objective function 1: The best economic benefit of the VPP

- (2)

- Objective function 2: The best social benefit of the VPP

3.1.2. Constraints

- (2)

- Energy storage operation constraint

- Electric energy storage (EES)

- b.

- Thermal energy storage (TES)

- (4)

- Transmission constraints in the energy grid

- (5)

- Load Response Constraints

- Interruptible Load operational constraints

- b.

- Transferable Load operational constraints

3.2. The Second Stage: Intraday Optimal Scheduling Model

3.2.1. Optimization Objective

3.2.2. Constraints of the Second Stage

3.3. Benefit Allocation Method Considering Risk and Contribution

3.3.1. Using the Theory of Risk Contribution to Determine the Magnitude of Risk

3.3.2. Using Improved Shapley Value to Determine Comprehensive Marginal Benefits

- (1)

- Shapley value

- (2)

- Improved Shapley value considering the comprehensive marginal contribution of the VPP

3.3.3. Final Allocation Factor

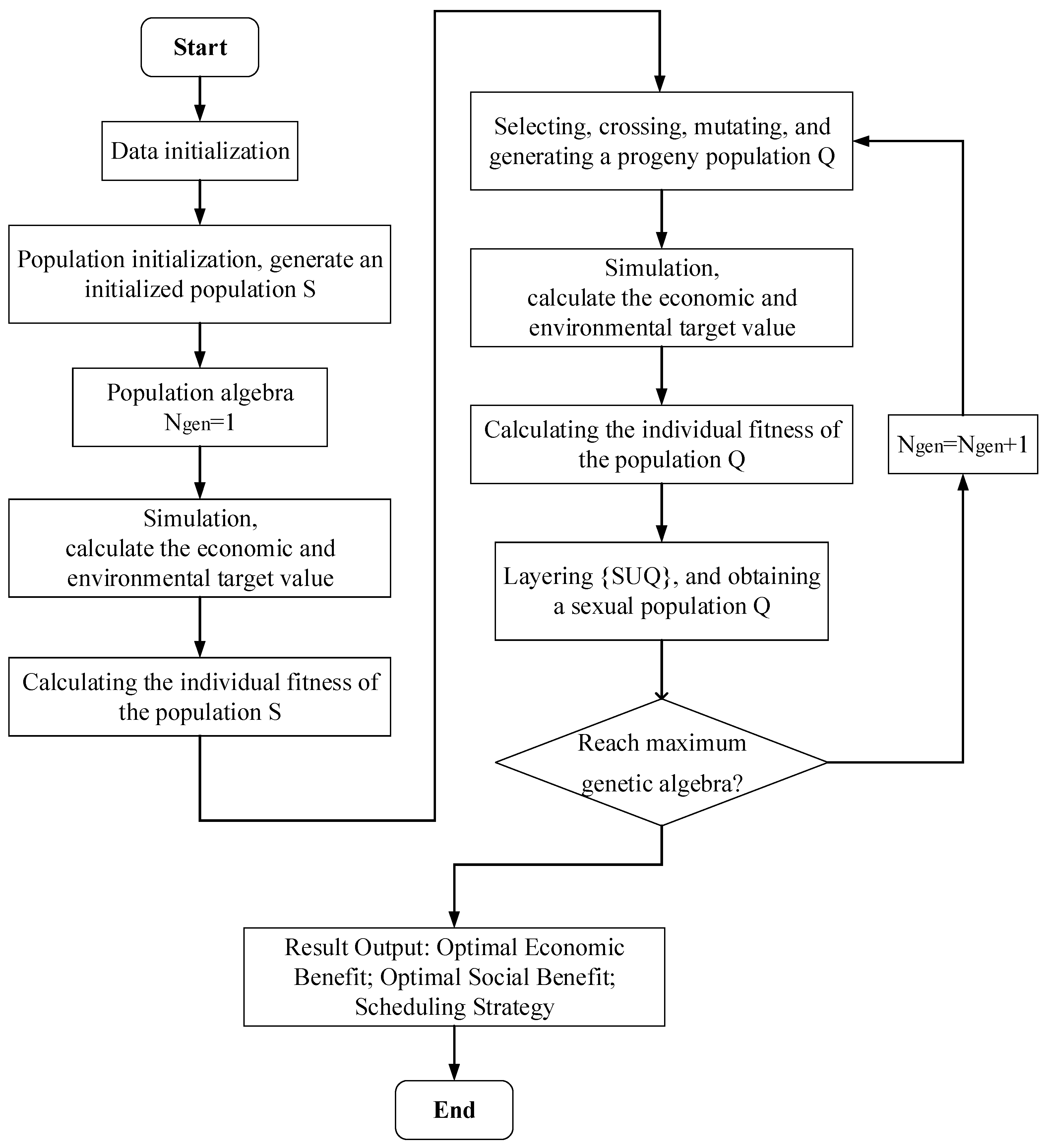

3.4. Model Solving Method

4. Data, Simulation Results, and Analysis

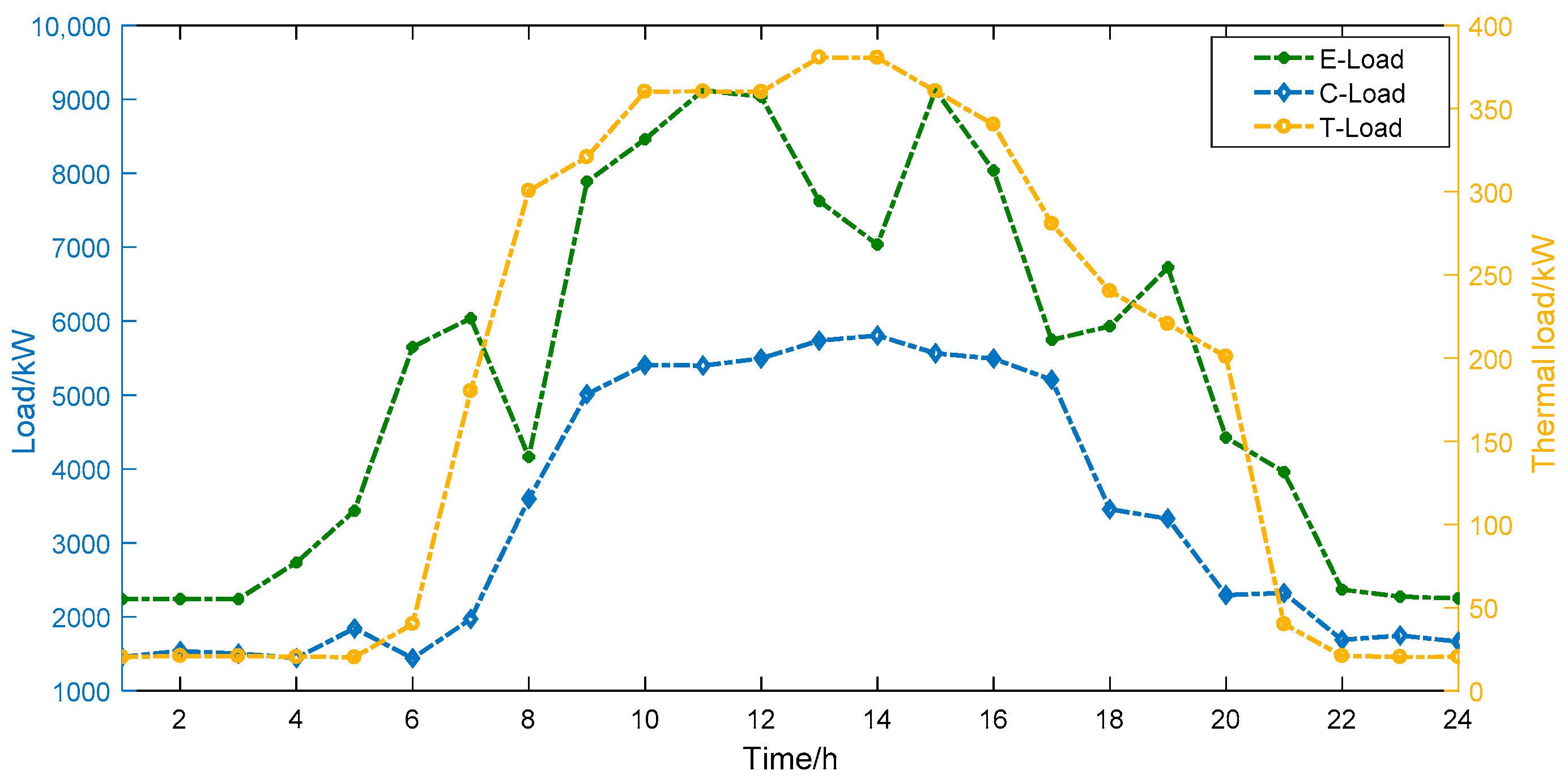

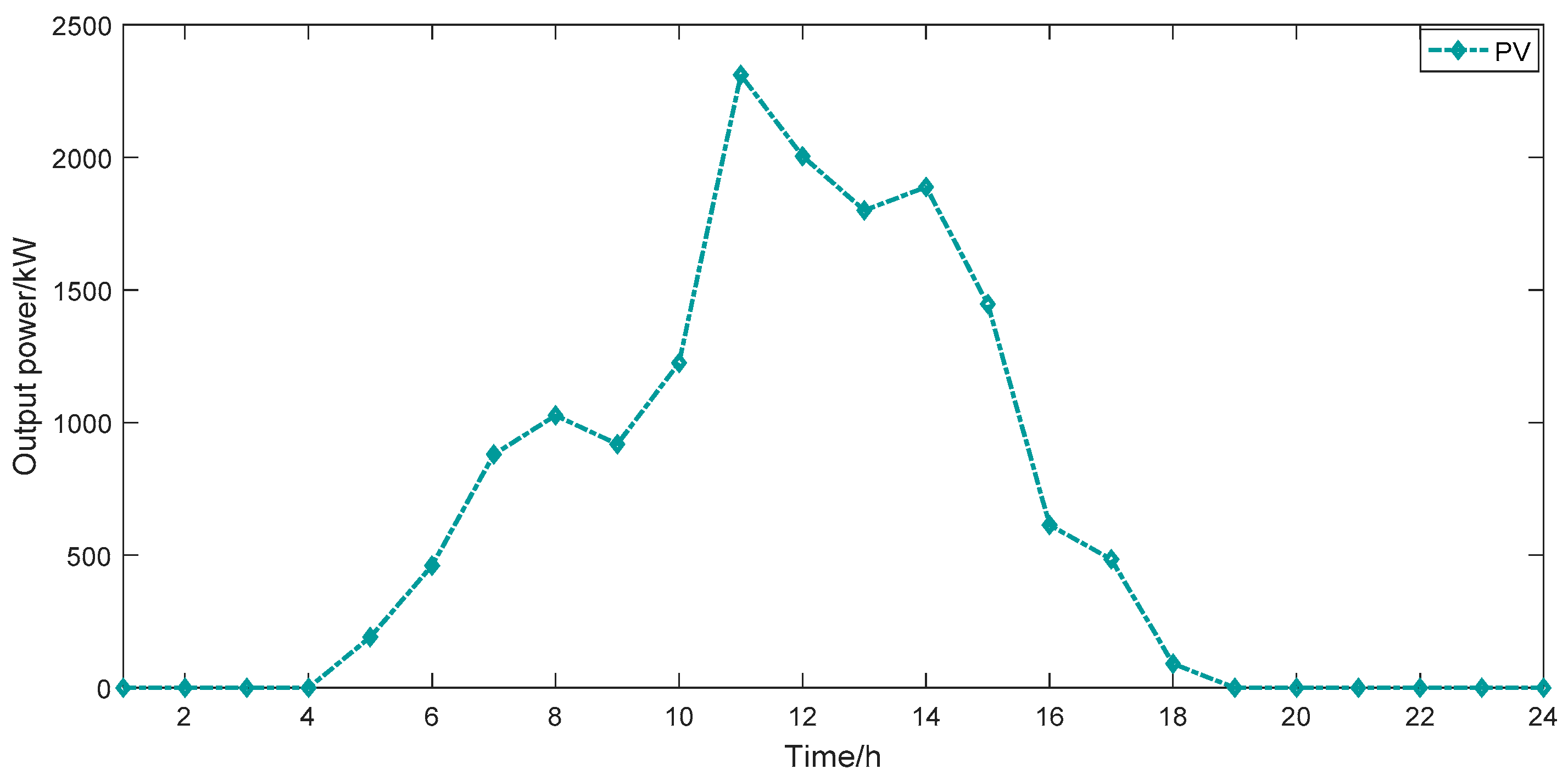

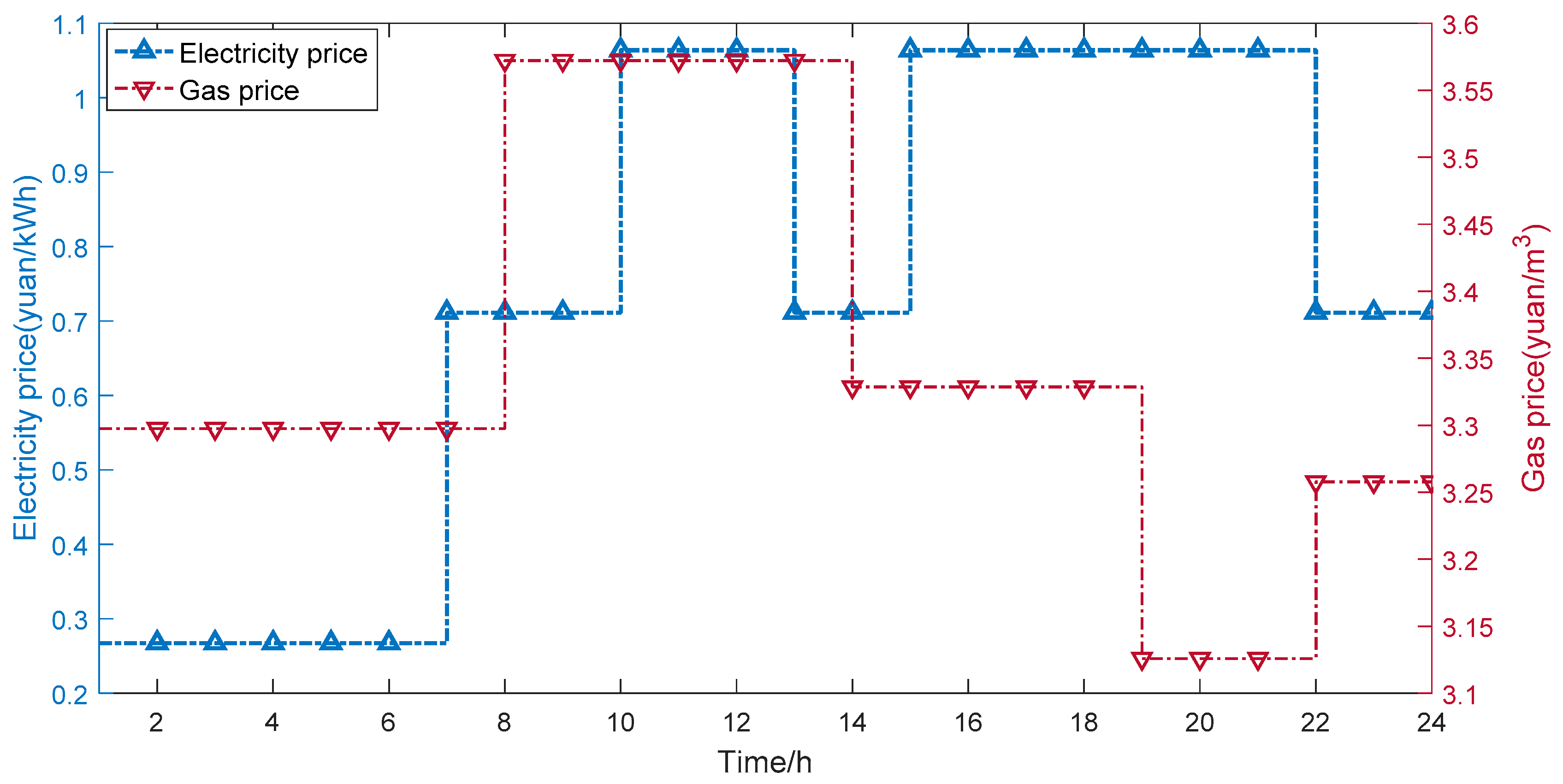

4.1. Data

4.2. Simulation Results

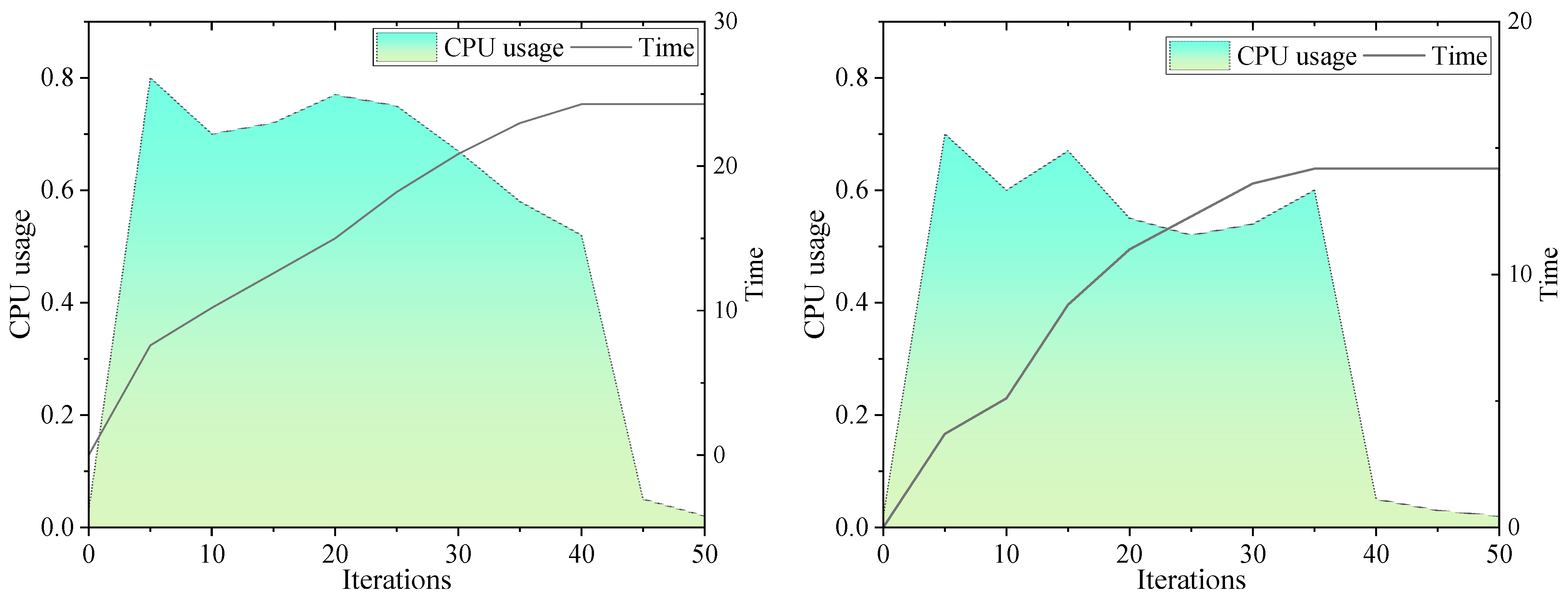

4.2.1. Operation Optimization Process

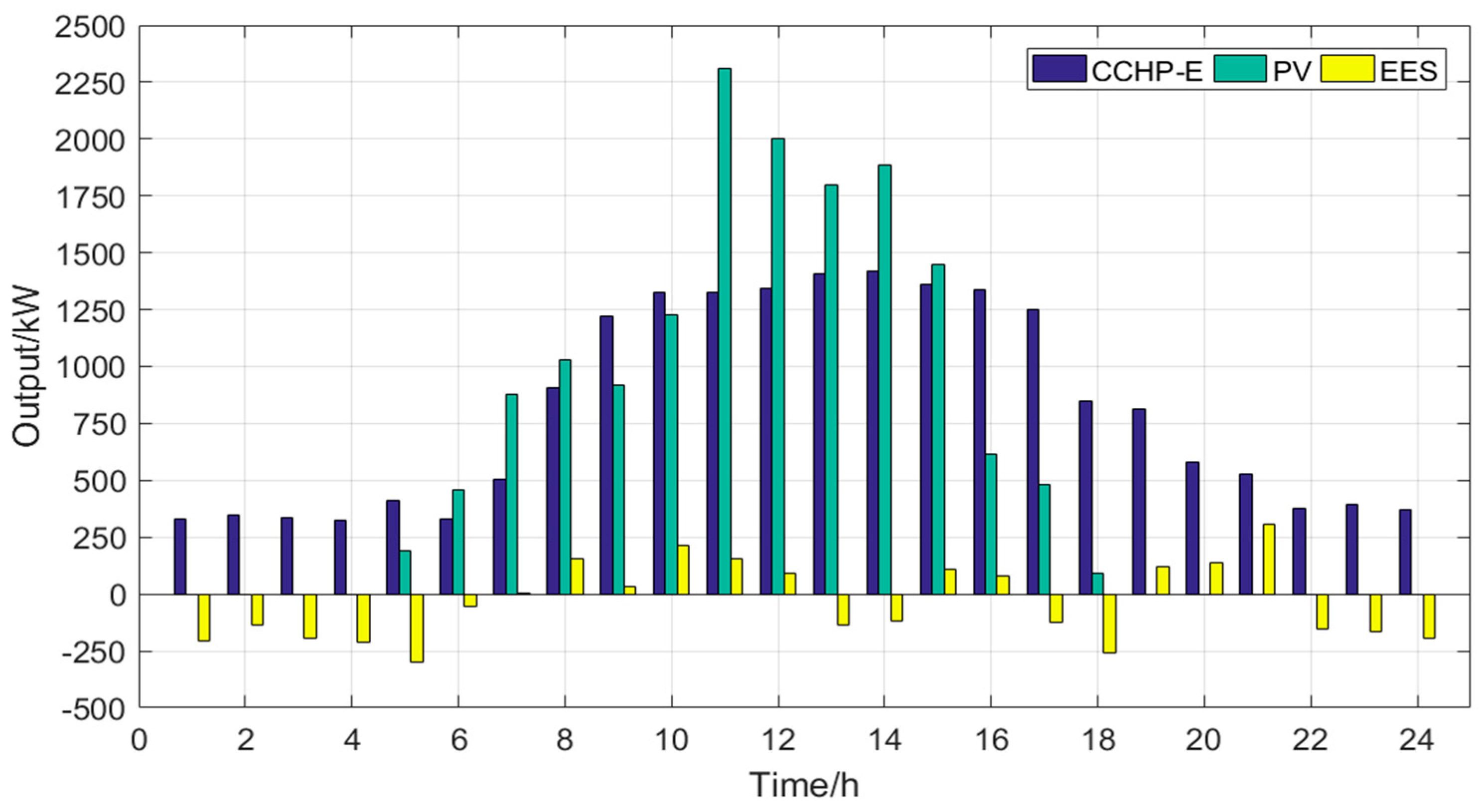

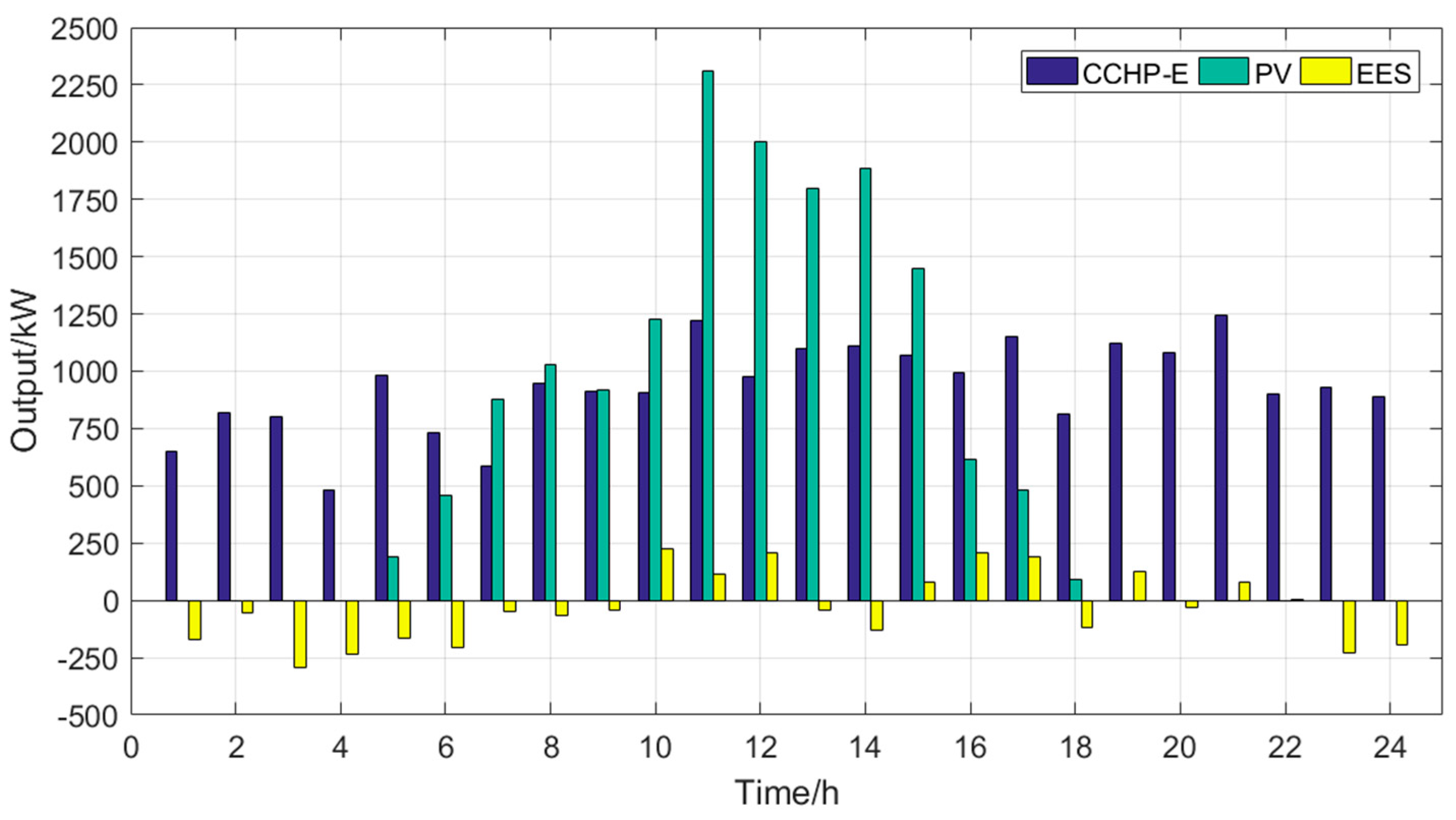

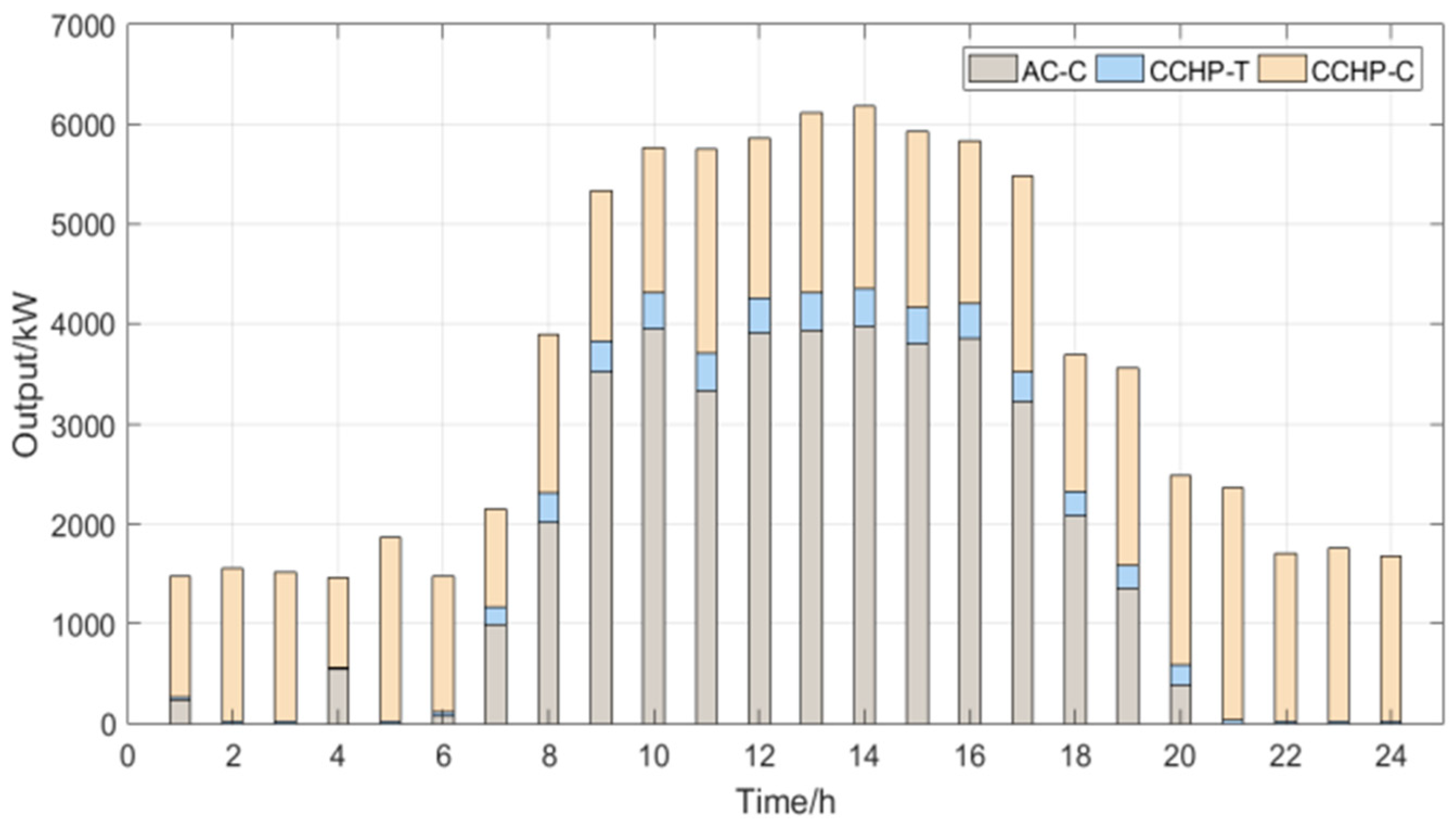

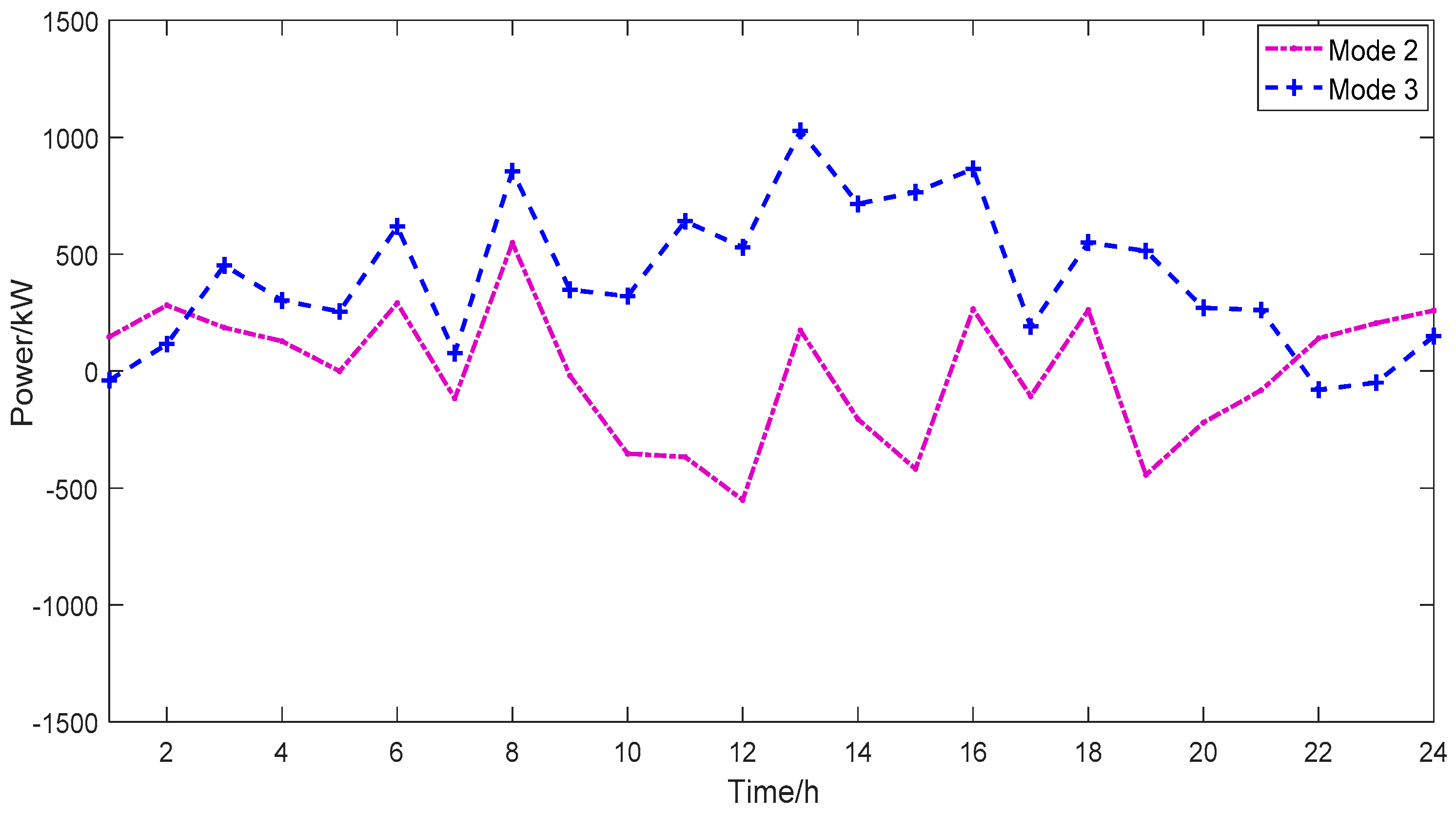

4.2.2. Operation Optimization Result

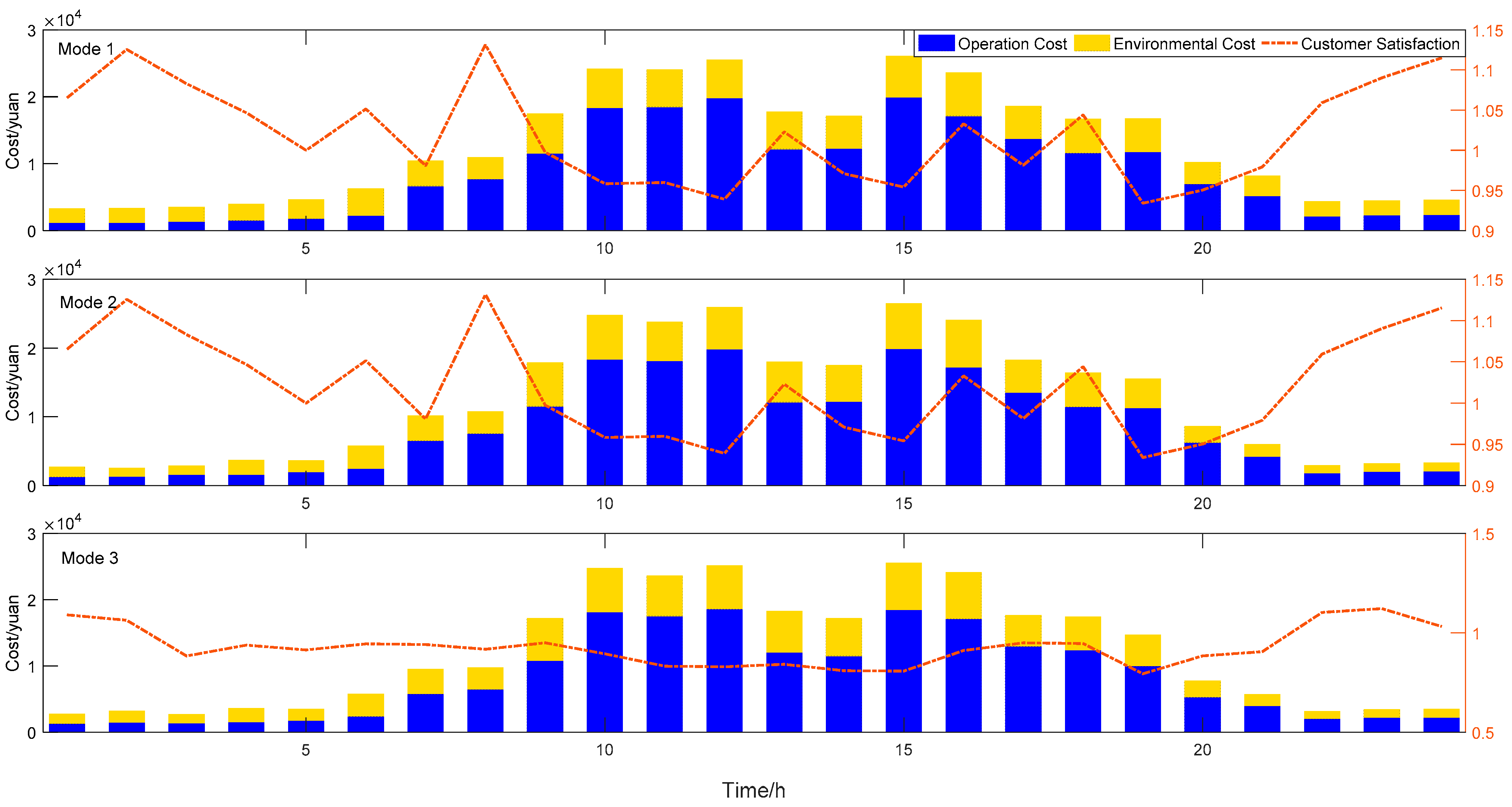

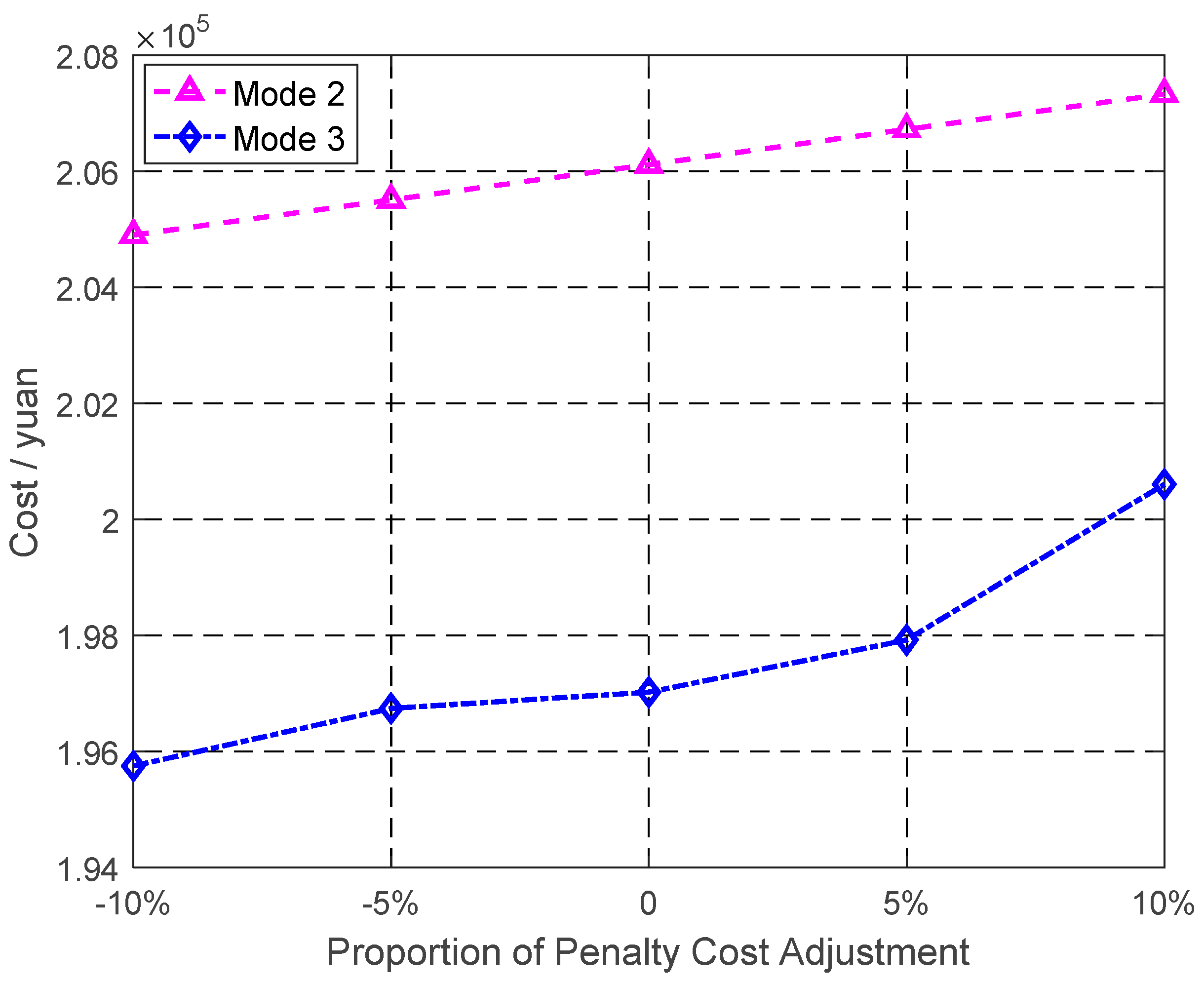

4.3. Discussion and Analysis

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| VPPs | virtual power plants | DR | demand response |

| EES | electric energy storage | TES | thermal energy storage |

| IL | interruptible load | TL | transferable load |

| PV | photovoltaic | AC | air conditioning |

| the cooperative alliance | the cost of generating electricity for the unit | ||

| the VPP electricity purchase | the photovoltaic power generation cost | ||

| the energy storage system usage cost | the operation cost of VPP system | ||

| the benchmark economic compensation of interrupting load | Cfuel | the operation cost of NG supply module | |

| the unit operation and maintenance cost of energy supply unit | the basic discharge cost of per unit mass pollutant | ||

| the punishment cost per unit mass pollutant | the punishment cost of wind abandonment | ||

| due to the deviation of actual output | the independent risk contribution of participant i | ||

| the electricity sales revenue | the VPP electricity sales revenue | ||

| the social benefit of the VPP | the social benefit of the VPP | ||

| the punishment cost of VPP participating in market scheduling | used to represent the risk evaluation function | ||

| , | the benchmark values | the maximum charge and discharge current allowed by the battery | |

| the risks brought by participant i’s participation in the alliance | the traditional electricity demand on the user side at time t | ||

| the exchange power between ET-VPP system | the exchange power between ET-VPP system and T-grid | ||

| the electricity and thermal prices on the market | interruptible load capacity | ||

| the rated power of the CHP system | the rated power of the GB system | ||

| the rated power of energy supply unit | the output power of pollutant source in the system | ||

| the electrical load power | the thermal load power | ||

| the charging power of the EES and TES | the discharging power of the EES and TES | ||

| the exchange power between ET-VPP system and E-grid and T-grid | the power of WT generators | ||

| the maximum power exchange between E-grid and ET-VPP | the maximum limits for TES energy storage and release | ||

| the minimum power of the natural T-grid to supply thermal to the system | the minimum power exchange between E-grid and ET-VPP system | ||

| the maximum of TL load migration and load migration | the active power at node | ||

| the maximum of TL load migration; is the set of non-translational periods | the maximum power of the T-grid to supply thermal to the system | ||

| the reactive power at node | the minimum and maximum reactive power at node | ||

| the upper and lower limits of the remaining TES capacity | the abandoned wind volume | ||

| the remaining capacity of the start time and the end time in a scheduling period | the output deviation | ||

| the bidding power optimized in the first stage | the benefits of VPP system operation | ||

| the number of participants in alliance i | the upper and lower limits of the remaining capacity | ||

| the remaining capacity of the start time and the end time in a scheduling period | , | the maximum successive invocation times and the minimum successive non-invocation times of IL | |

| the income of independent operation of entity i | the total revenue of alliance | ||

| the distribution of entity i in the cooperative alliance | the voltage at node | ||

| the upper and lower limits of voltage at node | the overall operational coordination revenue of the VPP cooperation alliance | ||

| the distribution value of comprehensive income | the operational coordination income of the cooperative alliance after removing i from alliance S | ||

| the comprehensive income obtained from the overall operation and coordination of the VPP cooperative alliance | , | the equivalent economic values of the comprehensive benefits obtained by entity i | |

| the punishment coefficient of wind abandonment | the punishment coefficient of output deviation () | ||

| and | the punishment coefficient of output deviation () | gas-to-electricity and gas-to- thermal efficiency of the CHP | |

| , | the internal electricity selling price and purchasing price of VPP at time t | the risk evaluation function | |

| the distribution income of the i-th VPP collaborative combination | preference factor | ||

| the actual income obtained by entity i based on the distribution of comprehensive benefit contributions | the weight of the specific gravity factor | ||

| the maximum call number of the class I IL, the class II IL, and the TL | the upper limit of the invocation times of IL in a scheduling cycle | ||

| the ratio of the total load of the class I IL, the class II IL | the efficiency of battery charging and discharging | ||

| the efficiency of TES storage and release | the collection of non-callable periods | ||

| the invocation state variable of IL | the call state variable of the class I IL, the class II IL, and the TL | ||

| the voltage phases at node and node | the low calorific value of natural gas | ||

| the amount of the pollutant produced by the unit output power of the pollutant source | the NG price |

References

- Gazijahani, F.S.; Salehi, J. IGDT-based complementarity approach for dealing with strategic decision making of price-maker VPP considering demand flexibility. IEEE Trans. Ind. Inform. 2019, 16, 2212–2220. [Google Scholar] [CrossRef]

- Peake, S. Renewable Energy-Power for a Sustainable Future; Oxford University Press: Oxford, UK, 2018. [Google Scholar]

- Pepermans, G.; Driesen, J.; Haeseldonckx, D.; Belmans, R.; D’haeseleer, W. Distributed generation: Definition, benefits and issues. Energy Policy 2005, 33, 787–798. [Google Scholar] [CrossRef]

- Johansson, P.-O.; Kriström, B. Welfare evaluation of subsidies to renewable energy in general equilibrium: Theory and application. Energy Econ. 2019, 83, 144–155. [Google Scholar] [CrossRef]

- Yu, S.; Fang, F.; Liu, Y.; Liu, J. Uncertainties of virtual power plant: Problems and countermeasures. Appl. Energy 2019, 239, 454–470. [Google Scholar] [CrossRef]

- Kumagai, J. Virtual power plants, real power. IEEE Spectr. 2012, 49, 13–14. [Google Scholar] [CrossRef]

- Chu, T.; An, X.; Zhang, W.; Lu, Y.; Tian, J. Multiple Virtual Power Plants Transaction Matching Strategy Based on Alliance Blockchain. Sustainability 2023, 15, 6939. [Google Scholar] [CrossRef]

- Kasaei, M.J.; Gandomkar, M.; Nikoukar, J. Optimal management of renewable energy sources by virtual power plant. Renew. Energy 2017, 114, 1180–1188. [Google Scholar] [CrossRef]

- Li, Q.; Wei, F.; Zhou, Y.; Li, J.; Zhou, G.; Wang, Z.; Liu, J.; Yan, P.; Yu, D. A scheduling framework for VPP considering multiple uncertainties and flexible resources. Energy 2023, 282, 128385. [Google Scholar] [CrossRef]

- Liu, J.; Yu, S.S.; Hu, H.; Trinh, H. A combinatorial auction energy trading approach for VPPs consisting of interconnected microgrids in demand-side ancillary services market. Electr. Power Syst. Res. 2023, 224, 109694. [Google Scholar] [CrossRef]

- Gulotta, F.; del Granado, P.C.; Pisciella, P.; Siface, D.; Falabretti, D. Short-term uncertainty in the dispatch of energy resources for VPP: A novel rolling horizon model based on stochastic programming. Int. J. Electr. Power Energy Syst. 2023, 153, 109355. [Google Scholar] [CrossRef]

- Zhang, T.; Qiu, W.; Zhang, Z.; Lin, Z.; Ding, Y.; Wang, Y.; Wang, L.; Yang, L. Optimal bidding strategy and profit allocation method for shared energy storage-assisted VPP in joint energy and regulation markets. Appl. Energy 2023, 329, 120158. [Google Scholar] [CrossRef]

- Yang, C.; Du, X.; Xu, D.; Tang, J.; Lin, X.; Xie, K.; Li, W. Optimal bidding strategy of renewable-based virtual power plant in the day-ahead market. Int. J. Electr. Power Energy Syst. 2023, 144, 108557. [Google Scholar] [CrossRef]

- Guo, W.; Liu, P.; Shu, X. Optimal dispatching of electric-thermal interconnected virtual power plant considering market trading mechanism. J. Clean. Prod. 2021, 279, 123446. [Google Scholar] [CrossRef]

- Wang, Y.; Wu, X.; Liu, M.; Zhang, C.; Wang, H.; Yue, Y.; Luo, X. Bidding strategy of the virtual power plant considering green certificates and carbon trading. Energy Rep. 2023, 9, 73–84. [Google Scholar] [CrossRef]

- Mei, S.; Tan, Q.; Liu, Y.; Trivedi, A.; Srinivasan, D. Optimal bidding strategy for virtual power plant participating in combined electricity and ancillary services market considering dynamic demand response price and integrated consumption satisfaction. Energy 2023, 284, 128592. [Google Scholar] [CrossRef]

- Nokandi, E.; Vahedipour-Dahraie, M.; Goldani, S.R.; Siano, P. A three-stage bi-level model for joint energy and reserve scheduling of VPP considering local intraday demand response exchange market. Sustain. Energy Grids Netw. 2023, 33, 100964. [Google Scholar] [CrossRef]

- Cao, J.; Zheng, Y.; Han, X.; Yang, D.; Yu, J.; Tomin, N.; Dehghanian, P. Two-stage optimization of a virtual power plant incorporating with demand response and energy complementation. Energy Rep. 2022, 8, 7374–7385. [Google Scholar] [CrossRef]

- Liu, H.; Wang, C.; Ju, P.; Xu, Z.; Lei, S. A bi-level coordinated dispatch strategy for enhancing resilience of electricity-gas system considering virtual power plants. Int. J. Electr. Power Energy Syst. 2023, 147, 108787. [Google Scholar] [CrossRef]

- Fang, F.; Yu, S.; Liu, M. An improved Shapley value-based profit allocation method for CHP-VPP. Energy 2020, 213, 118805. [Google Scholar] [CrossRef]

- Wang, X.; Li, B.; Wang, Y.; Lu, H.; Zhao, H.; Xue, W. A bargaining game-based profit allocation method for the wind-hydrogen-storage combined system. Appl. Energy 2022, 310, 118472. [Google Scholar] [CrossRef]

- Rahmani-Dabbagh, S.; Sheikh-El-Eslami, M.K. A profit sharing scheme for distributed energy resources integrated into a virtual power plant. Appl. Energy 2016, 184, 313–328. [Google Scholar] [CrossRef]

- Cremers, S.; Robu, V.; Hofman, D.; Naber, T.; Zheng, K.; Norbu, S. Efficient methods for approximating the Shapley value for asset sharing in energy communities. In Proceedings of the Thirteenth ACM International Conference on Future Energy Systems, Virtual, 28 June–1 July 2022. [Google Scholar]

- Wang, Y.; Liu, Z.; Cai, C.; Xue, L.; Ma, Y.; Shen, H.; Chen, X.; Liu, L. Research on the optimization method of integrated energy system operation with multi-subject game. Energy 2022, 245, 123305. [Google Scholar] [CrossRef]

- Yang, J. Transaction decision optimization of new electricity market based on virtual power plant participation and Stackelberg game. PLoS ONE 2023, 18, e0284030. [Google Scholar] [CrossRef] [PubMed]

- Wu, H.; Liu, X.; Ye, B.; Xu, B. Optimal dispatch and bidding strategy of a virtual power plant based on a Stackelberg game. IET Gener. Transm. Distrib. 2020, 14, 552–563. [Google Scholar] [CrossRef]

- Gougheri, S.S.; Dehghani, M.; Nikoofard, A.; Jahangir, H.; Golkar, M.A. Economic assessment of multi-operator virtual power plants in electricity market: A game theory-based approach. Sustain. Energy Technol. Assess. 2022, 53, 102733. [Google Scholar] [CrossRef]

- Zhou, J.; Chen, K.; Wang, W. A Power Evolution Game Model and Its Application Contained in Virtual Power Plants. Energies 2023, 16, 4373. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, Y.; Huang, Y.; Yang, J.; Ma, Y.; Yu, H.; Zeng, M.; Zhang, F.; Zhang, Y. Operation optimization of regional integrated energy system based on the modeling of electricity-thermal-natural gas network. Appl. Energy 2019, 251, 113410. [Google Scholar] [CrossRef]

- Wang, Y.; Ma, Y.; Song, F.; Ma, Y.; Qi, C.; Huang, F.; Xing, J.; Zhang, F. Economic and efficient multi-objective operation optimization of integrated energy system considering electro-thermal demand response. Energy 2020, 205, 118022. [Google Scholar] [CrossRef]

- Liu, R.; Zhao, Z.; Sun, G.; Mi, Y.; Pan, Z. Optimization strategy and profit allocation of virtual power plant considering different risk preference. Electr. Power Autom. Equip. 2021, 41, 154–161. [Google Scholar]

| Symbol | Capacity | Operation Cost |

|---|---|---|

| PV | 2.8 MW | 0.65 yuan/kWh |

| EES | 3 MWh | 0.51 yuan/kWh |

| CCHP | 8 MW | - |

| Pollutants | SO2 | NOx | CO2 | CO | |

|---|---|---|---|---|---|

| Emission | Coal (kg/t) | 18 | 8 | 1731 | 0.26 |

| Gas (kg/106 m3) | 11.6 | 0.0062 | 2.01 | 0 | |

| Environmental value (yuan/kg) | 6.1308 | 26.00 | 0.0867 | 1.00 | |

| Punishment cost (yuan/kg) | 1.00 | 2.00 | 0.01 | 0.16 | |

| Parameters | CCHP Electrical Efficiency | CCHP Thermal Efficiency | States of Charge of EES | States of Discharge of EES | EES Charge/Discharge Efficiency | Air Conditioning System Efficiency | Electrical ESS Dissipation Rate |

|---|---|---|---|---|---|---|---|

| Value | 0.243 | 0.632 | 0.9 | 0.1 | 0.9 | 0.94 | 0.021 |

| Mode 1 | Mode 2 | Mode 3 | |

|---|---|---|---|

| Operating cost | 209,039.91 | 206,117.21 | 197,026.26 |

| Environmental costs | 97,503.24 | 89,355.094 | 93,157.18 |

| Mode | Mode 1 | Mode 2 | Mode 3 |

|---|---|---|---|

| Total profit | 8561.31 | 10,345.58 | 11,088.67 |

| PV | 1802.45 | 2345.67 | 2571.95 |

| CCHP | 2120.38 | 3814.08 | 3873.96 |

| EES | 1875.28 | 2194.28 | 2276.12 |

| AC | 1763.2 | 1991.55 | 2366.64 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gao, Y.; Gao, L.; Zhang, P.; Wang, Q. Two-Stage Optimization Scheduling of Virtual Power Plants Considering a User-Virtual Power Plant-Equipment Alliance Game. Sustainability 2023, 15, 13960. https://doi.org/10.3390/su151813960

Gao Y, Gao L, Zhang P, Wang Q. Two-Stage Optimization Scheduling of Virtual Power Plants Considering a User-Virtual Power Plant-Equipment Alliance Game. Sustainability. 2023; 15(18):13960. https://doi.org/10.3390/su151813960

Chicago/Turabian StyleGao, Yan, Long Gao, Pei Zhang, and Qiang Wang. 2023. "Two-Stage Optimization Scheduling of Virtual Power Plants Considering a User-Virtual Power Plant-Equipment Alliance Game" Sustainability 15, no. 18: 13960. https://doi.org/10.3390/su151813960