New Approaches to Project Risk Assessment Utilizing the Monte Carlo Method

Abstract

:1. Introduction

- The 1st stage of risk management is the determination of risk factors. The content of this phase is the determination of risk factors as quantities whose possible future development could affect the economic results, the criteria of the economic efficiency of the project (profit, return on capital, and net present value), and its financial stability;

- The 2nd stage of risk management is the determination of project risk. The importance of the risk factors can basically be determined in two ways, namely expertly or by using sensitivity analysis;

- The 3rd phase determines the risk of investment projects. Project risk can be determined numerically or indirectly. In numerical form, the risk is determined using statistical characteristics (dispersion, standard deviation, coefficient of variation), which serve as a measure of risk in financial management. Project risk is indirectly determined using certain managerial characteristics, which, in their summary, provide information on a greater or lesser degree of risk.

2. Materials and Methods

- A project: the purchase of a new sheet metal ringer SIHR 6/3, 2050 × 6 mm. The amount of this investment is EUR 47,422.08;

- B project: the purchase of a new welding machine, amounting to EUR 88,000.

- Depreciation: The company primarily uses linear depreciation, and this has also been modeled for the purpose of verifying the methodology, while the value of such depreciation is expressed by the following relationship:

- The value of operating costs has been calculated according to the following relationship:whereDC Direct cost;IC Indirect cost;D Depreciations;OC Other costs.

- Revenues are calculated using the following relationship:whereR Revenue;P Price;S Sale (quantity of sales).

- The financial risk assessment model also took into account the tax burden in the form of income tax calculation. According to § 15 letter (b) of the Income Tax Act, the corporate income tax rate in Slovakia is 21% and is calculated from the tax base after the deduction of the tax loss [53]. The tax base is calculated according to this relationship:

- Profit after tax is calculated according to the relationship:whereEAT earnings after taxes;EBT earnings before taxes.

3. Results

3.1. Risk Mapping

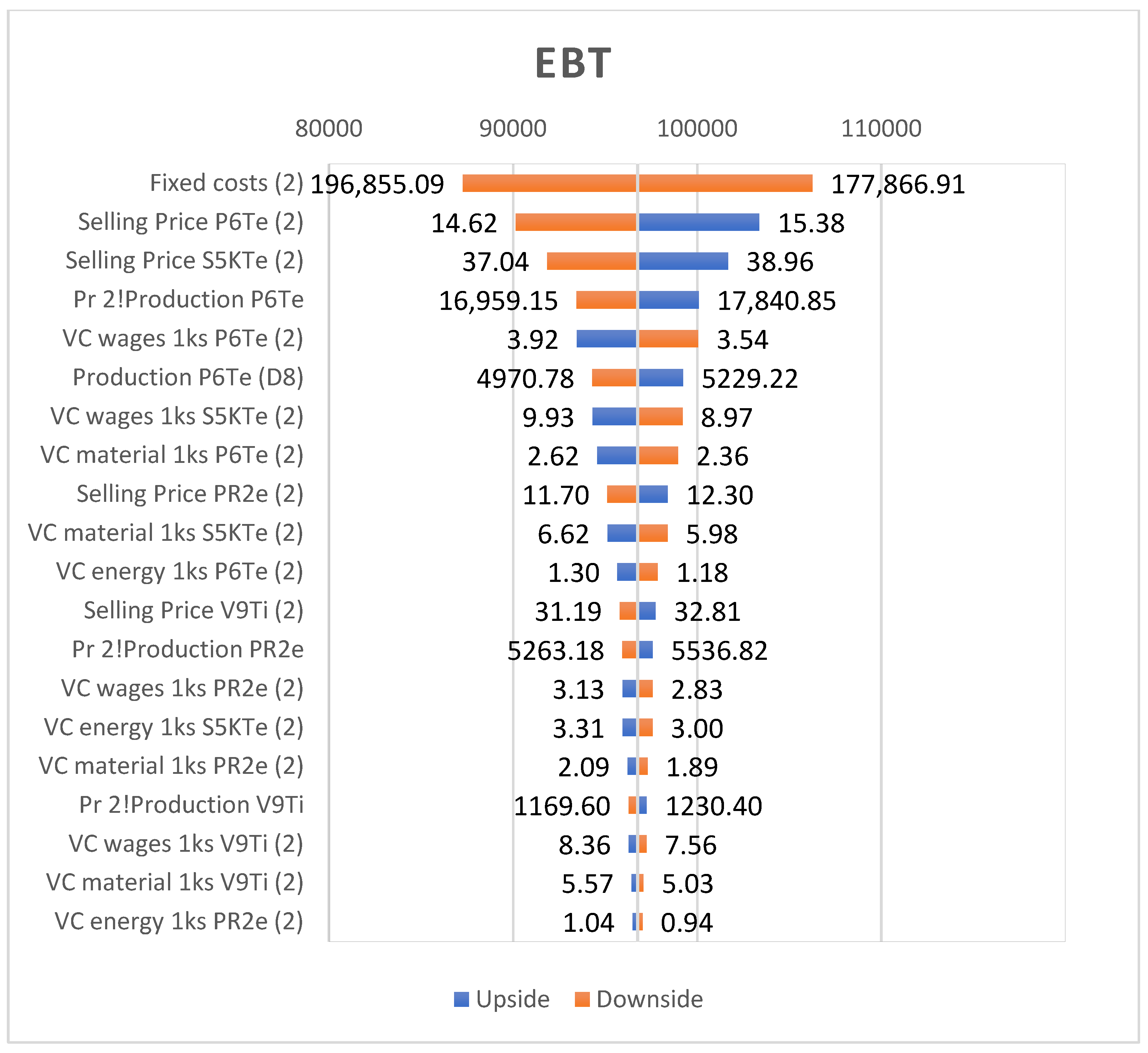

3.2. Sensitivity Analysis in the Simulation Model

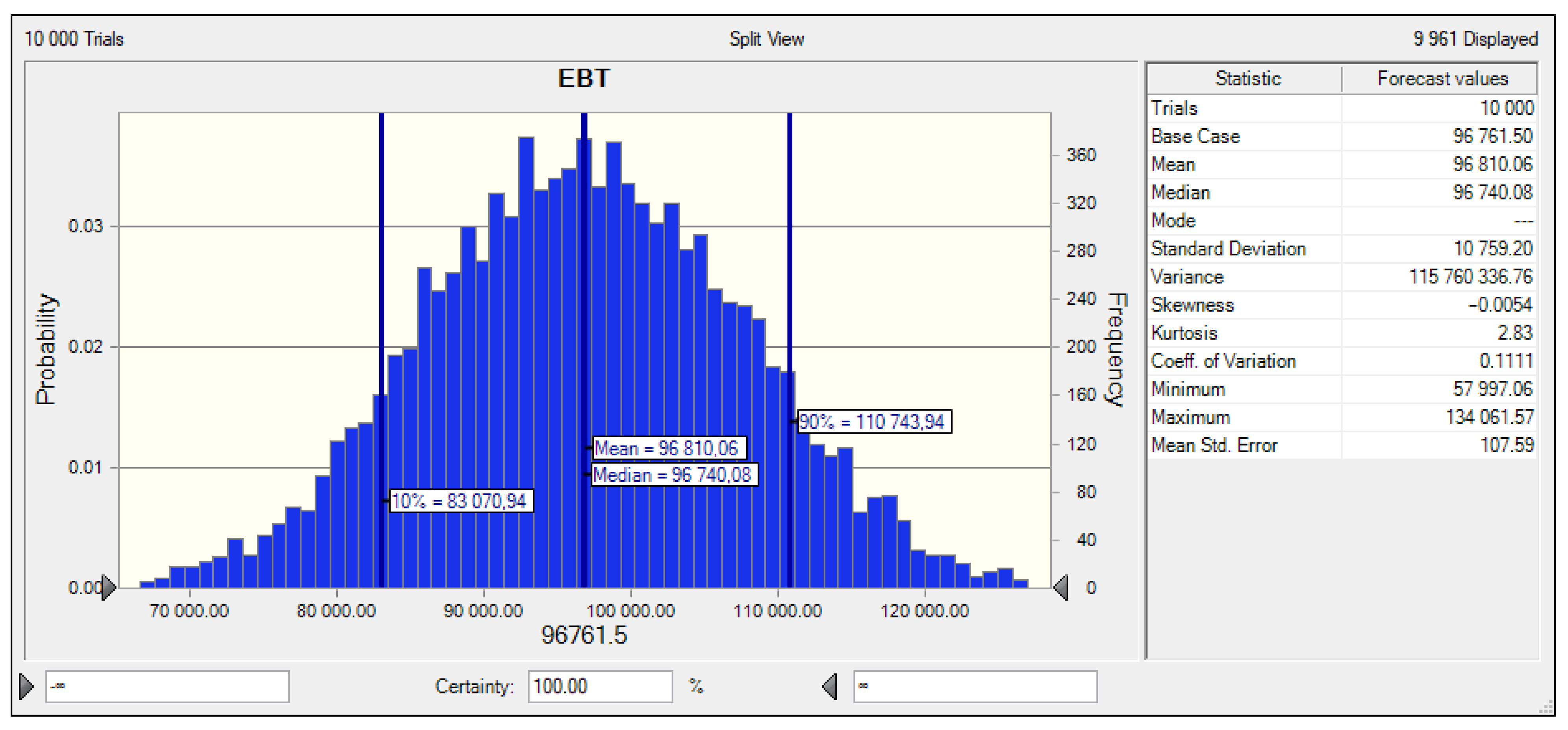

3.3. Monte Carlo Simulation

4. Discussion

- A certain first visual check of the consistency of the relationships between the risk factors and the criterion value;

- Evaluation of the significance of individual assumed risk factors in relation to the criterion value and a compilation of a certain possible list of risk factors that are unlikely to be important for further analyses;

- Detection of the possible nonlinear relationships between risk factors and the criterion value.

- The sensitivity of the model—in general, the sensitivity of the criterion quantity is to the risk factor, which results from the relationships defined in the mathematical model, e.g., how the criterion value changes when the value of the risk factor changes by 1%;

- Uncertainty of risk factor values—possible values the risk factor can reach.

- If two projects have the same average value of expected revenues, the project with a lower standard deviation is preferred;

- If two projects have the same standard deviation, the project with a higher average value of expected revenues is preferred;

- In each project, a higher mean value and a lower standard deviation are preferred;

- If the project has a higher mean value and a lower deviation than all the other projects, it is optimal;

- If the projects have a different mean value and a different deviation, the project with a lower coefficient of variation is preferred.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Liu, Y.; Failler, P.; Ding, Y. Enterprise financialization and technological innovation: Mechanism and heterogeneity. PLoS ONE 2022, 17, e0275461. [Google Scholar] [CrossRef] [PubMed]

- Li, Z.; Yang, C.; Huang, Z. How does the fintech sector react to signals from central bank digital currencies? Finance Res. Lett. 2022, 50, 103308. [Google Scholar] [CrossRef]

- Tanaka, H.; Tanaka, C. Sustainable investment strategies and a theoretical approach of multi-stakeholder communities. Green Financ. 2022, 4, 329–346. [Google Scholar] [CrossRef]

- Fabianova, J.; Kacmary, P.; Janekova, J. Operative production planning utilising quantitative forecasting and Monte Carlo simulations. Open Eng. 2019, 9, 613–622. [Google Scholar] [CrossRef]

- Vochozka, M.; Rowland, Z.; Vrbka, J. Financial analysis of an average transport company in the Czech Republic. Our Sea 2016, 63, 227–236. [Google Scholar] [CrossRef]

- Feng, Z. Financial risks from three dimensions and risk identification model of enterprise. Int. J. Manag. Sci. Eng. Manag. 2011, 6, 71–80. [Google Scholar] [CrossRef]

- Scholleova, H. Investment Controlling: How to Evaluate Investment Intentions and Manage Company Investments, 1st ed.; Grada: Praha, Czech Republic, 2009. [Google Scholar]

- Janekova, J.; Fabianova, J.; Rosova, A. Environmental and economic aspects in decision making of the investment project “wind park”. Pol. J. Manag. Stud. 2016, 13, 90–100. [Google Scholar] [CrossRef]

- Smejkal, V.; Rais, K. Řízení rizik ve firmách a jiných organizacích; Grada: Praha, Czech Republic, 2010. [Google Scholar]

- Fotr, J.; Souček, I. Podnikatelský Zámer a Investiční Rozhodování; Grada Publishing: Praha, Czech Republic, 2005; 356p. [Google Scholar]

- Bartošová, V.; Majerčák, P.; Hrašková, D. Taking Risk into Account in the Evaluation of Economic Efficiency of Investment Projects: Traditional Methods. Procedia Econ. Financ. 2015, 24, 68–75. [Google Scholar] [CrossRef]

- Kim, K.-J.; Lee, K.; Ahn, H. Predicting Corporate Financial Sustainability Using Novel Business Analytics. Sustainability 2018, 11, 64. [Google Scholar] [CrossRef] [Green Version]

- Nunes, M.; Abreu, A.; Saraiva, C. A Model to Manage Cooperative Project Risks to Create Knowledge and Drive Sustainable Business. Sustainability 2021, 13, 5798. [Google Scholar] [CrossRef]

- Larionov, A.; Nezhnikova, E.; Smirnova, E. Risk Assessment Models to Improve Environmental Safety in the Field of the Economy and Organization of Construction: A Case Study of Russia. Sustainability 2021, 13, 13539. [Google Scholar] [CrossRef]

- Chapman, C.; Ward, S. Project Risk Management. Processes, Techniques and Insights; John Wiley & Sons: Hoboken, NJ, USA, 1997. [Google Scholar]

- Bedford, T.; Cooke, R.M. Probabilistic Risk Analysis: Foundations and Methods; Cambridge University Press: Cambridge, UK, 2001. [Google Scholar]

- Value at Risk (VAR). Available online: https://www.risk.net/definition/value-at-risk-var (accessed on 29 December 2022).

- Deloach, J.W.; Temple, N. Enterprise-Wide Risk Management: Strategies for Linking Risk & Opportunity; Financial Times Management: London, UK, 2000. [Google Scholar]

- Tobisova, A.; Senova, A.; Rozenberg, R. Model for Sustainable Financial Planning and Investment Financing Using Monte Carlo Method. Sustainability 2022, 14, 8785. [Google Scholar] [CrossRef]

- Carbone, T.A.; Tippett, D.D. Project Risk Management Using the Project Risk FMEA. Eng. Manag. J. 2004, 16, 28–35. [Google Scholar] [CrossRef]

- Qin, H.; Stewart, M.G. Risk perceptions and economic incentives for mitigating windstorm damage to housing. Civ. Eng. Environ. Syst. 2020, 38, 1–19. [Google Scholar] [CrossRef]

- Valaskova, K.; Kliestik, T.; Svabova, L.; Adamko, P. Financial Risk Measurement and Prediction Modelling for Sustainable Development of Business Entities Using Regression Analysis. Sustainability 2018, 10, 2144. [Google Scholar] [CrossRef] [Green Version]

- Vicig, P. Financial risk measurement with imprecise probabilities. Int. J. Approx. Reason. 2008, 49, 159–174. [Google Scholar] [CrossRef] [Green Version]

- Sidorova, E.; Kostyukhin, Y.; Korshunova, L.; Ulyanova, S.; Shinkevich, A.; Ershova, I.; Dyrdonova, A. Forming a Risk Management System Based on the Process Approach in the Conditions of Economic Transformation. Risks 2022, 10, 95. [Google Scholar] [CrossRef]

- Bahamid, A.R.; Doh, I.S. A review of risk management process in construction projects of developing countries. IOP Conf. Series: Mater. Sci. Eng. 2017, 271, 012042. [Google Scholar] [CrossRef]

- Hertz, D.B.; Thomas, H. Risk Analysis and Its Applications; John Wiley & Sons: Hoboken, NJ, USA, 1983. [Google Scholar]

- Berkowitz, J.A. Coherent Framenwork for Stress–Testing. J. Risk 2000, 2, 1–15. [Google Scholar] [CrossRef] [Green Version]

- Savvides, S. Risk analysis in investment appraisal. Proj. Apprais. 1994, 9, 3–18. [Google Scholar] [CrossRef]

- Razavi, S.; Jakeman, A.; Saltelli, A.; Prieur, C.; Iooss, B.; Borgonovo, E.; Plischke, E.; Piano, S.L.; Iwanaga, T.; Becker, W.; et al. The Future of Sensitivity Analysis: An essential discipline for systems modeling and policy support. Environ. Model. Softw. 2020, 137, 104954. [Google Scholar] [CrossRef]

- Pesenti, S.M. Reverse Sensitivity Analysis for Risk Modelling. Risks 2022, 10, 141. [Google Scholar] [CrossRef]

- Tsanakas, A.; Millossovich, P. Sensitivity Analysis Using Risk Measures. Risk Anal. 2015, 36, 30–48. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Cont, R.; Deguest, R.; Scandolo, G. Robustness and sensitivity analysis of risk measurement procedures. Quant. Financ. 2010, 10, 593–606. [Google Scholar] [CrossRef]

- Borgonovo, E.; Plischke, E. Sensitivity analysis: A review of recent advances. Eur. J. Oper. Res. 2016, 248, 869–887. [Google Scholar] [CrossRef]

- Janekova, J.; Fabiánová, J.; Onofrejová, D.; Puškáš, E.; Buša, M. Implementation of Deviation Analysis Method in the Utilisation Phase of the Investment Project: A Case Study. Pol. J. Manag. Stud. 2017, 15, 99–109. [Google Scholar] [CrossRef]

- Hammersley, J. Monte Carlo Methods; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2013. [Google Scholar]

- Züst, S.; Huonder, M.; West, S.; Stoll, O. Life-Cycle Oriented Risk Assessment Using a Monte Carlo Simulation. Appl. Sci. 2021, 12, 8. [Google Scholar] [CrossRef]

- Di Nitto, A.; Davide, F.; Vardaci, E.; Bianco, D.; La Rana, G.; Mercogliano, D. The New Physics in LILITA_N21: An Improved Description of the Reaction 190 MeV 40Ar + 27Al. Appl. Sci. 2022, 12, 4107. [Google Scholar] [CrossRef]

- Loffredo, F.; Vardaci, E.; Bianco, D.; Di Nitto, A.; Quarto, M. Protons Interaction with Nomex Target: Secondary Radiation from a Monte Carlo Simulation with Geant4. Appl. Sci. 2022, 12, 2643. [Google Scholar] [CrossRef]

- Yang, Y.; Zhuo, W.; Zhao, Y.; Xie, T.; Wang, C.; Liu, H. Estimating Specific Patient Organ Dose for Chest CT Examinations with Monte Carlo Method. Appl. Sci. 2021, 11, 8961. [Google Scholar] [CrossRef]

- Kaiser, W.; Popp, J.; Rinderle, M.; Albes, T.; Gagliardi, A. Generalized Kinetic Monte Carlo Framework for Organic Electronics. Algorithms 2018, 11, 37. [Google Scholar] [CrossRef] [Green Version]

- Radosz, W.; Pawlik, G.; Mituś, A.C. Characterization of Monte Carlo Dynamic/Kinetic Properties of Local Structure in Bond Fluctuation Model of Polymer System. Materials 2021, 14, 4962. [Google Scholar] [CrossRef] [PubMed]

- Pawlik, G.; Mitus, A. Photoinduced Mass Transport in Azo-Polymers in 2D: Monte Carlo Study of Polarization Effects. Materials 2020, 13, 4724. [Google Scholar] [CrossRef] [PubMed]

- Lu, Z.; Zhuang, L.; Dong, L.; Liang, X. Model-Based Safety Analysis for the Fly-by-Wire System by Using Monte Carlo Simulation. Processes 2020, 8, 90. [Google Scholar] [CrossRef] [Green Version]

- Koroteev, M.; Romanova, E.; Korovin, D.; Shevtsov, V.; Feklin, V.; Nikitin, P.; Makrushin, S.; Bublikov, K.V. Optimization of Food Industry Production Using the Monte Carlo Simulation Method: A Case Study of a Meat Processing Plant. Informatics 2022, 9, 5. [Google Scholar] [CrossRef]

- Jones, H.G.; Lee, A.M. Monte Carlo Methods in Heavy Industry. J. Oper. Res. Soc. 1955, 6, 108–116. [Google Scholar] [CrossRef]

- Foa, R.; Howard, M. Use of Monte Carlo Simulation for the Public Sector: An Evidence-Based Approach to Scenario Planning. Int. J. Mark. Res. 2006, 48, 27–48. [Google Scholar] [CrossRef]

- Zhang, Y. The value of Monte Carlo model-based variance reduction technology in the pricing of financial derivatives. PLoS ONE 2020, 15, e0229737. [Google Scholar] [CrossRef]

- Mucha, V.; Páleš, M.; Sakálová, K. Calculation of the Capital Requirement Using the Monte Carlo Simulation for Non-life Insurance. J. Econ. 2016, 64, 878–893. [Google Scholar]

- Arenas, D.J.; Lett, L.A.; Klusaritz, H.; Teitelman, A.M. A Monte Carlo simulation approach for estimating the health and economic impact of interventions provided at a student-run clinic. PLoS ONE 2017, 12, e0189718. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ross, S.M.; Ghamami, S. Efficient Monte Carlo Barrier Option Pricing When the Underlying Security Price Follows a Jump-Diffusion Process. J. Deriv. 2010, 17, 45–52. [Google Scholar] [CrossRef]

- Fleming, P.J.; Schaeffer, D.; Simon, B. Efficient Monte-Carlo simulation of a product-form model for a cellular system with dynamic resource sharing. ACM Trans. Model. Comput. Simul. 1995, 5, 3–21. [Google Scholar] [CrossRef]

- Liao, G.; Hou, P.; Shen, X.; Albitar, K. The impact of economic policy uncertainty on stock returns: The role of corporate environmental responsibility engagement. Int. J. Financ. Econ. 2020, 26, 4386–4392. [Google Scholar] [CrossRef]

- Act, No. 461/2003 Coll. on Social Insurance as Amended, Act No. 580/2004 Coll. on Health Insurance as Amended. Available online: https://www.podnikajte.sk/dan-z-prijmov/sadzby-dane-z-prijmov-fyzickych-pravnickych-osob-2019-2020 (accessed on 13 April 2022).

- How Crystal Ball Calculates Sensitivity. Available online: https://docs.oracle.com/cd/E12825_01/epm.111/cb_user/frameset.htm?ch07s04s03.html (accessed on 29 December 2022).

- Koulinas, G.K.; Demesouka, O.E.; Sidas, K.A.; Koulouriotis, D.E. A TOPSIS—Risk Matrix and Monte Carlo Expert System for Risk Assessment in Engineering Projects. Sustainability 2021, 13, 11277. [Google Scholar] [CrossRef]

- An, J.; Kim, D.-K.; Lee, J.; Joo, S.-K. Least Squares Monte Carlo Simulation-Based Decision-Making Method for Photovoltaic Investment in Korea. Sustainability 2021, 13, 10613. [Google Scholar] [CrossRef]

- Rees, M. Business Risk ans Simulation Modelling in Practice Using Excel, VBA and @RISK; John Wiley & Sons Ltd.: Hoboken, NJ, USA, 2015. [Google Scholar]

- Kanupriya Indian textile sector, competitiveness, gender and the digital circular economy: A critical perspective. Natl. Account. Rev. 2022, 4, 237–250. [CrossRef]

| Group of Risk Analysis Methods | Types of Methods |

| Qualitatively | What-if method, scenario analyses, failure mode and consequence questionnaires, criticality analyzes (FMEA / FMECA), hazard and operability analysis (HAZOP), human error analysis (HEA), block reliability scheme, fault tree analysis (FTA), event tree analysis (ETA), probability risk analysis and safety assessment (PRA &PSA), survey questionnaires |

| Quantitatively | Statistical, cost and efficiency analysis, expert systems, analysis of the relative value of risk, sensitivity analyses, Monte Carlo simulations, critical point analysis; reduced standard methods, cost–benefit analysis, the Delphi method |

| Combined (qualitative and quantitative approaches) | Fault tree analysis, the Delphi method, value chain analysis |

| Qualitative methodologies used in nuclear and chemical processing plants | Preliminary hazard analysis (PHA), hazard and operability analysis (HAZOP), failure mode and consequence analysis (FMEA/FMECA) |

| Tree techniques used to quantify the probability of occurrence of accidents and other adverse events leading to loss of life or economy | Fault tree analysis (FTA), event tree analysis (ETA), cause and effect analysis (CCA), fault tree risk management (MORT), organizational safety management by assessment technique (SMORT) |

| Techniques for a dynamic system | Dynamic event logic analytical method (DYLAM), dynamic event tree analytical method (DETAM), Markov model, transition method |

| Updated (positive) risk | Market research, prospecting, test marketing, research and development, business impact analysis |

| Downside risk (negative) | Approach analysis, fault tree analysis (FTA), failure mode and consequence analysis (FMEA) |

| Both | Dependency modeling, swot analysis (strengths, weaknesses, opportunities, threats), tree and event analysis (ETA), business continuity planning, bpest analysis (business, political, economic, social, technological), real option modeling, decision making under conditions of risk and uncertainty, statistical inference, measures of central tendency and dispersion PESTLE (political, economic, social, technological, and legal environment) |

| Intuitive technique | Guided discussion (brainstorming) |

| Inductive technique (What if?) | Preliminary hazard analysis (PHA), checklists, human error analysis (HEA), hazard and operability analysis (HAZOP), criticality failure mode and consequence analysis (FMECA) |

| Deductive method (so how?) | Events and fault trees |

| Statistic | A Project | B Project |

|---|---|---|

| Base Case | 31,403.00 | 96,761.50 |

| Mean | 31,402.49 | 96,810.06 |

| Median | 31,413.23 | 96,740.08 |

| Standard Deviation | 3573.40 | 10,759.20 |

| Variance | 12,769,151.90 | 115,760,336.76 |

| Skewness | 0.0123 | −0.0054 |

| Kurosis | 2.79 | 2.83 |

| Coefficient of Variability | 0.1138 | 0.1111 |

| Minimum | 19,183.93 | 57,997.06 |

| Maximum | 43,339.7 | 139,061.57 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Senova, A.; Tobisova, A.; Rozenberg, R. New Approaches to Project Risk Assessment Utilizing the Monte Carlo Method. Sustainability 2023, 15, 1006. https://doi.org/10.3390/su15021006

Senova A, Tobisova A, Rozenberg R. New Approaches to Project Risk Assessment Utilizing the Monte Carlo Method. Sustainability. 2023; 15(2):1006. https://doi.org/10.3390/su15021006

Chicago/Turabian StyleSenova, Andrea, Alica Tobisova, and Robert Rozenberg. 2023. "New Approaches to Project Risk Assessment Utilizing the Monte Carlo Method" Sustainability 15, no. 2: 1006. https://doi.org/10.3390/su15021006