Feasibility Study of China’s Carbon Tax System under the Carbon Neutrality Target—Based on the CGE Model

Abstract

:1. Introduction

2. Literature Review

2.1. Carbon Taxes and Related Theoretical Studies

2.2. The Double Dividend Effect of the Carbon Tax

3. Carbon Tax Practices Abroad

3.1. Carbon Tax Model

3.2. Carbon Tax Rate

3.3. The Carbon Tax Collection Process

3.4. Carbon Tax and Carbon Trading

3.5. Review of Foreign Carbon Tax Studies

4. CGE Model Construction

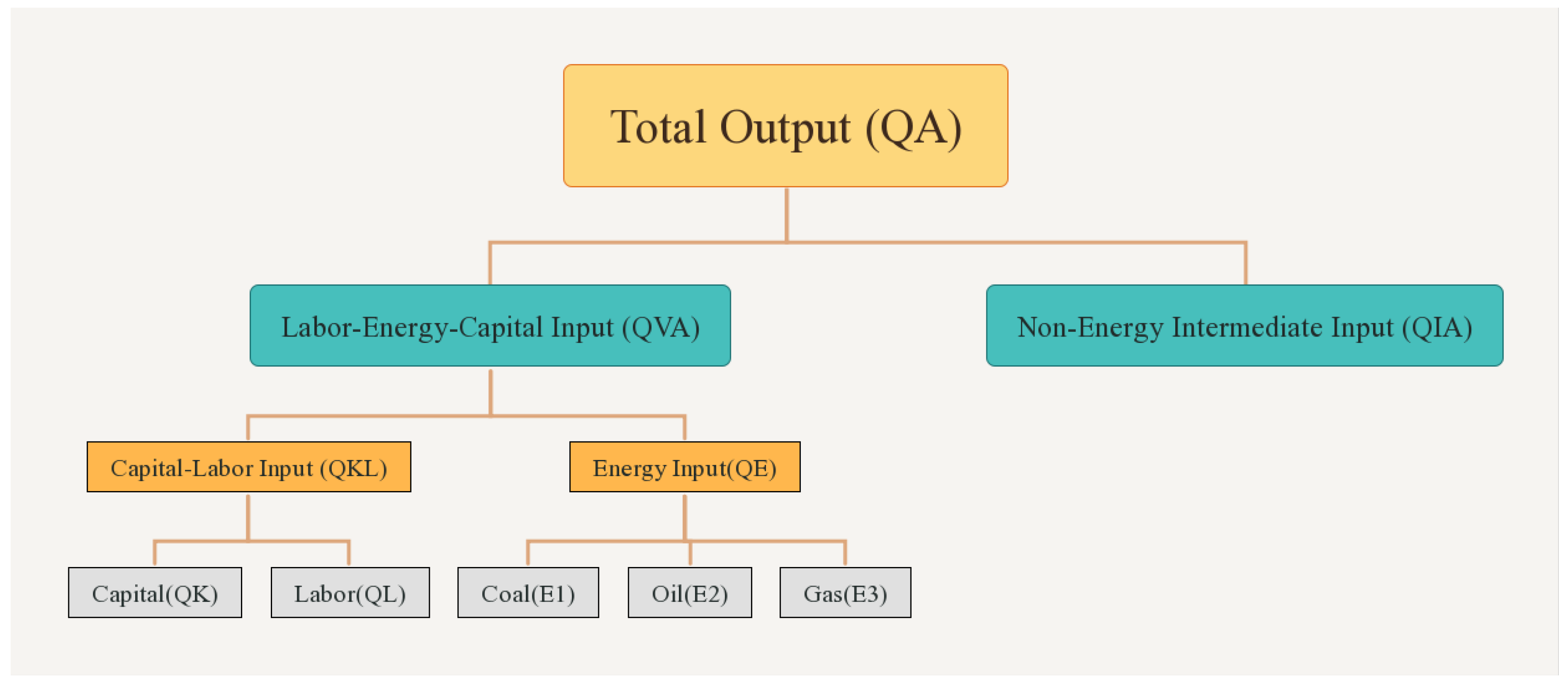

4.1. Production Modules

| Variables | Meaning | Variables | Meaning |

|---|---|---|---|

| Capital–labor inputs | Synthetic capital–labor prices | ||

| Energy inputs | Energy prices | ||

| Elasticity of the substitution coefficient between capital–energy synthesis and labor | Domestic commodity c prices | ||

| Synthetic labor–capital–energy CES production function transfer parameters | The amount of input required in sector c to produce one unit of sector a | ||

| Synthetic labor–capital–energy CES production function share parameters | Synthetic labor–capital–energy CES production function index parameters |

| Variables | Meaning | Variables | Meaning |

|---|---|---|---|

| Amount of capital input | Capital input prices | ||

| Amount of labor input | Labor input prices | ||

| Synthetic capital–labor CES production function transfer parameters | Exponential parameters of the synthetic capital–labor CES production function | ||

| Synthetic capital–labor CES production function share parameters | Coefficient of elasticity of substitution between capital and labor |

| Variables | Meaning | Variables | Meaning |

|---|---|---|---|

| Coal prices | Coal input volumes | ||

| Oil prices | Oil input volumes | ||

| Natural gas prices | Natural gas input volumes | ||

| Coal share parameter in the CES function | Oil share parameter in the CES function | ||

| Natural gas share parameter in the CES function | Elasticity of the substitution coefficient between fossil fuel energy sources |

4.2. Trade Modules

| Variables | Meaning | Variables | Meaning |

|---|---|---|---|

| Commodity i’s domestic demand prices | Commodity i’s domestic demand | ||

| Imported good i’s domestic prices | Sector i’s international market prices of imported goods | ||

| Output volume in sector i | Output prices in sector i | ||

| Commodity i’s domestic supply | Domestic price of export good i | ||

| Sector i’s international market prices of export commodities | Export volume of commodity i’s allocation | ||

| Commodity i’s domestic supply prices | Exchange rates | ||

| Commodity i’s demand domestic supply | Imports of commodity i’s demand | ||

| Export volume of commodity i’s allocation | Import tariff rates of commodity i | ||

| Commodity i’s overall transfer parameters for import supply and export allocation | Product i’s domestic supply share parameters | ||

| Product i’s share of export supply parameters | Overall rate of transfer of domestic demand for commodity i to import demand | ||

| Commodity i’s domestic demand share parameters | Commodity i’s import demand share parameters |

4.3. Income and Expenditure Modules

| Variables | Meaning | Parameters | Meaning | Description |

|---|---|---|---|---|

| Sector i’s resident labor income | Proportion of residents’ capital income | Resident capital income/total capital income (total capital income includes capital gains and depreciation) | ||

| Gross labor income of the population | Resident savings ratio coefficient | Residents’ savings divided by residents’ gross income | ||

| Residents’ capital income | Proportional coefficient of residents’ consumption of product i | Consumption of product i by the population as a proportion of total consumption | ||

| Residents’ income from abroad | Personal income tax rate | |||

| Residents’ savings | ||||

| Gross resident income | ||||

| Residents’ consumption of product i | ||||

| Variables | Meaning | Parameters | Meaning | Description |

|---|---|---|---|---|

| Sector i’s capital revenue | Proportionality factor for foreign capital investment returns | Foreign capital investment income divided by total capital receipts | ||

| Total sectoral capital receipts | Proportion of business-to-resident transfer payments | Ratio of business-to-resident transfers to business capital income | ||

| Profits earned from investments abroad | Investment ratio factor for sector i | Investment in sector i as a proportion of total investment | ||

| Corporate capital income | Tax rates paid by companies | |||

| Business-to-resident transfers | ||||

| Corporate savings | ||||

| Total investment in sector i |

| Variables | Meaning | Parameters | Meaning | Description |

|---|---|---|---|---|

| Sector i’s indirect tax revenue | Indirect tax rates for sector i | Indirect taxes on sector i/total output | ||

| Product i’s import duty income | Residents’ income tax rate | Resident income tax/resident gross income | ||

| Resident income tax | Corporates’ income tax rate | Corporate income tax/corporate capital income | ||

| Corporate income tax | Government foreign revenue share | Government foreign revenue/imports | ||

| Government revenue from abroad | Proportion of government foreign transfer payments | Government transfer income to business/total government revenue | ||

| Total government revenue | Government savings ratio | Government savings/total government revenue | ||

| Government transfers to residents | Proportion of government consumption of product i | Government consumption of product i/total consumption | ||

| Government Savings | Proportion of government transfer payments to residents | Government transfer income to residents/total government revenue | ||

| Government consumption of product i | ||||

| Government aid to foreign countries | ||||

4.4. Carbon Tax Module

4.5. Balanced Modules and Dynamic Recursion

| Variables | Meaning |

|---|---|

| Hicks Equivalent Change in resident welfare | |

| Level of utility after policy implementation | |

| Total residential consumption of goods in mid-i after policy implementation | |

| Pre-policy utility levels | |

| Consumer price of commodity i before policy implementation | |

| Amount of residential consumption of commodity i before the policy was implemented |

5. Empirical Analysis

5.1. Databases

5.2. Analysis of Simulation Results

5.2.1. Impact on Environmental Benefits

5.2.2. Impact on Economic Benefits

6. Conclusions and Policy Recommendations

6.1. Conclusions

6.2. Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhu, L. China’s Carbon Emissions Report 2015; Sustainability Science Program and Energy Technology Innovation Policy Research Group, Belfer Center Discussion Paper; Belfer Center: Cambridge, MA, USA, 2015; Volume 2, p. 8. [Google Scholar]

- Xin, J.P. General Debate of the 75th Session of the United Nations General Assembly. Available online: http://www.xinhuanet.com/politics/leaders/2020-09/22/c_1126527652.htm (accessed on 6 June 2022).

- Dong, J.; Huang, W.P. The establishment of China’s carbon tax system:International experience and policy recommendations. Int. Tax. 2017, 11, 71–76. [Google Scholar]

- Liu, L.; Zhang, Y.Q. Research on carbon tax system based on carbon emission trading market. Tax Res. 2019, 2, 46–52. [Google Scholar]

- Schweizer, U. Externalities and the Coase Theorem: Hypothesis or result? J. Inst. Theor. Econ. (JITE)/Z. Für Die Gesamte Staatswiss. 1988, 144, 245–266. Available online: http://www.jstor.org/stable/40751071 (accessed on 21 December 2022).

- Zhang, Y. Exploring the feasibility of carbon tax construction from achieving carbon neutrality target. Hainan Financ. 2022, 2, 51–58. [Google Scholar]

- Weitzman, M.L. Prices vs. quantities. Rev. Econ. Stud. 1974, 41, 477–491. [Google Scholar] [CrossRef]

- Mandell, S. Optimal mix of emissions taxes and cap-and-trade. J. Environ. Econ. Manag. 2008, 56, 131–140. [Google Scholar] [CrossRef]

- Ni, J. Research on carbon tax and carbon emission trading mechanism. Tax Res. 2016, 4, 46–50. [Google Scholar]

- Jia, X.W.; Wang, Z. Using the introduction of carbon tax as an opportunity to build a compound mechanism for carbon emission reduction in China. Tax. Res. 2021, 8, 18–21. [Google Scholar]

- Su, C.Y.; Wang, Y. International experience and inspiration of environmental protection tax—Based on the perspective of double dividend. J. Henan High. Inst. Financ. Tax. 2019, 6, 12–17. [Google Scholar]

- Tullock, G. The welfare costs of tariffs, monopolies, and theft. Econ. Inq. 1967, 5, 224–232. [Google Scholar] [CrossRef]

- Pearce, D. The role of carbon taxes in adjusting to global warming. Econ. J. 1991, 101, 938–948. [Google Scholar] [CrossRef]

- Goulder, L.H. Environmental taxation and the double dividend: A reader’s guide. Int. Tax Public Financ. 1995, 2, 157–183. [Google Scholar] [CrossRef]

- Freire-González, J.; Puig-Ventosa, I. Reformulating taxes for an energy transition. Energy Econ. 2019, 78, 312–323. [Google Scholar] [CrossRef]

- Glomm, G.; Kawaguchi, D.; Sepulveda, F. Green taxes and double dividends in a dynamic economy. J. Policy Model. 2008, 30, 19–32. [Google Scholar] [CrossRef] [Green Version]

- Lou, F. A simulation study on the impact of carbon tax levy on China’s macro economy and carbon emission reduction. Res. Quant. Econ. Technol. Econ. 2014, 10, 84–96+109. [Google Scholar]

- Yun, X.P. Research on the synergistic impact effect of energy and environmental fiscal policies based on CGE model. Econ. Issues 2019, 7, 37–44. [Google Scholar]

- Li, Y.; Shi, W.Z.; Hu, Z.Y. Research on the double dividend effect of carbon tax policy based on CGE model. Financ. Theory Pract. 2021, 42, 82–89. [Google Scholar]

- Santikarn, M.; Churie Kallhauge, A.N.; Bozcaga, M.O.; Sattler, L.; Mccormick, M.S.; Ferran Torres, A.; Conway, D.; Mongendre, L.; Inclan, C.; Mikolajczyk, S.; et al. State and Trends of Carbon Pricing. 2021. Available online: https://policycommons.net/artifacts/1806796/state-and-trends-of-carbon-pricing-2021-english/2540378/ (accessed on 21 December 2022).

- Ge, Y. The international practice of carbon tax system and its inspiration. Financ. Vert. 2021, 4, 48–55. [Google Scholar]

- World Bank. World Bank Carbon Pricing Dashboard (2021-04-01). Available online: https://carbonpricingdashboard.worldbank.org/ (accessed on 15 August 2021).

- Lu, S.L.; Bai, Y.F. The international practice of carbon tax and its implications for China’s “carbon peak” target by 2030. Int. Tax. 2021, 12, 21–28. [Google Scholar]

- Dong, R.; Li, Y.S. The international practice and inspiration of carbon taxation. Financ. Vert. 2021, 12, 32–36. [Google Scholar]

- Chen, X.D.; Lu, H.Y.; Wang, H.H. The latest progress of carbon taxation abroad and its inspiration for China. Int. Tax. 2022, 2, 59–65. [Google Scholar]

- Wen, Z.C. Feasibility and policy research and impact of the carbon tax in China. Financ. Econ. 2022, 28, 30–32. [Google Scholar]

- Xie, H.X. Research on the Policy Effects of the Introduction of the Carbon Tax in China. Master’s Thesis, Shanghai University of Finance and Economics, Shanghai, China, 2021. [Google Scholar]

- He, J.H.; Shen, K.T.; Xu, S.L. A CGE model of carbon tax and CO2 emission reduction. Quant. Econ. Res. Technol. Econ. 2022, 10, 39–47. [Google Scholar]

- Cao, J. Towards a low-carbon development path: Design of China’s carbon tax policy and analysis of CGE model. Financ. Stud. 2009, 12, 19–29. [Google Scholar]

- Li, X.Q. Simulation Analysis of Carbon Tax Effect Based on CGE Model. Master’s Thesis, Hebei University of Economics and Business, Shijiazhuang, China, 2022. [Google Scholar]

- Li, C.Y. A Study on the Simulation of China’s Carbon Market Policy Based on CGE Model. Master’s Thesis, Nanjing Forestry University, Nanjing, China, 2020. [Google Scholar]

- Guo, Z.Q. Simulation Analysis of China’s Low Carbon Economic Development Policy Based on CGE Model. Ph.D. Thesis, China University of Mining and Technology, Beijing, China, 2011. [Google Scholar]

- Li, J.Q. Carbon emission and market-based emission reduction mechanism design based on CGE model. Coal Econ. Res. 2019, 8, 52–60. [Google Scholar]

- Shi, W.Z. Research on the Double Dividend Effect of Carbon Tax Policy Based on CGE Model. Master’s Thesis, Hunan University, Changsha, China, 2021. [Google Scholar]

- Tang, J.; Zhang, L.; Yu, L.A. A study on the impact of carbon tax policy based on CGE model. J. China Univ. Pet. 2020, 1, 11–17. [Google Scholar]

- Weng, Z.X.; Ma, Z.Y.; Cai, S.F. A study on the economic and environmental impacts of China’s carbon tax policy—Based on dynamic CGE model analysis. China Price 2018, 8, 10–13. [Google Scholar]

- Pang, S.Y. Research on Carbon Taxation in China in the Context of “Double Carbon”. Master’s Thesis, China Institute of Fiscal Science, Beijing, China, 2022. [Google Scholar]

| Year | Country or Territory (Year of Introduction) |

|---|---|

| 1990–2000 | Finland (1990), Poland (1990), Norway (1991), Sweden (1991) Denmark (1992), Slovenia (1996), and Estonia (2000) |

| 2000–2010 | United Kingdom (2001), New Zealand (2007), Switzerland (2008), Liechtenstein (2008), British Columbia, Canada (2008), Iceland (2010), and Ireland (2010) |

| 2010–PRESENT | Ukraine (2011), Japan (2012), Australia (2012–2014) France (2014), Mexico (2014), Spain (2014), Portugal (2015) Alberta, Canada (2017), Chile (2017), Colombia (2017) Argentina (2018), Singapore (2019), South Africa (2019), Northwest Territories, Canada (2019), New Brunswick, Canada (2020), Luxembourg (2021), and Netherlands (2021) |

| Country and Region (of Levy Commencement) | Carbon Tax Rate (USD/Tonne CO2 e) | Emissions Covered as a Proportion of Total | |

|---|---|---|---|

| Europe | Finland (1990) | 62.3 (Fossil fuels) 72.8 (Transport fuels) | 36% |

| Sweden (1991) | 137.2 | 40% | |

| United Kingdom (2001) | 24.8 | 23% | |

| Switzerland (2008) | 101.5 | 33% | |

| France (2014) | 52.4 | 35% | |

| Asia and Africa | Japan (2012) | 2.6 | 75% |

| Singapore (2019) | 3.7 | 80% | |

| South Africa (2019) | 9.2 | 80% | |

| Americas | Mexico (2014) | 0.4–3.2 | 23% |

| Chile (2017) | 5.0 | 39% | |

| Argentina (2018) | 5.5 | 20% | |

| New Brunswick, Canada (2020) | 31.8 | 39% | |

| Carbon Tax | Carbon Trading | |||

|---|---|---|---|---|

| Top-level design | Similarities | All are market-based, low-carbon tools to combat climate change | ||

| Differences | Characteristic | Price-based policy instruments | Quantitative policy instruments | |

| Pricing criteria | Market decision | Government decision | ||

| Carbon emission levels | Government decision | Market decision | ||

| Impacts | Government perspective | Cost of carbon reduction | Relatively low cost of development and high cost of input in the subsequent collection and administration process | High upfront investment costs and technical costs to set up the system, low maintenance costs later |

| Scope of implementation | A wide range of applications suitable for most sources of CO2 emissions | A narrow range of applications suitable for large sources of CO2 emissions | ||

| Resistance to implementation | Not easy to implement in the short term, increased tax costs and burden on businesses and residents | Easily accepted, based on voluntary, spontaneous market transactions | ||

| Fairness of implementation | Relatively fair and transparent | Prone to administrative intervention, rent-seeking issues, and unfair carbon credits | ||

| Income use effects | Effective in achieving both environmental and socio-economic dividends | Dependent on whether the revenue generated is used to compensate for the negative externalities of carbon emissions | ||

| International trade and investment | There is a risk of weakening the international competitiveness of enterprises, and subsidies and tax rebates for exporters can easily lead to international trade disputes | International trading of carbon credits enriches international trade, increases the variety of transactions, and promotes international trade and investment | ||

| International coordination of climate policy | Regional in scope and capable of becoming an international policy tool | Global in nature and conducive to the international coordination of existing climate policies | ||

| Corporate perspective | Cost of carbon reduction | Carbon abatement costs are determined to facilitate companies in choosing the optimal abatement path | The cost of carbon emission reduction fluctuates with the market and is uncertain, which is not conducive to the adjustment of enterprises’ production and management decisions | |

| Technology innovation incentives | Under a single tax rate, the incentive effect is small; under a progressive tax rate, enterprises are incentivized to innovate in technology. Carbon tax revenue can also be used to promote energy efficiency and emission reduction project development and technological innovation | Some incentive exists for carbon reduction technologies, but policy effects are affected by economic cycles | ||

| Variables | Meaning | Variables | Meaning |

|---|---|---|---|

| Total output | Sectoral production activity prices | ||

| Labor–energy–capital inputs | Synthetic labor–capital–energy prices | ||

| Non-energy intermediate inputs | Non-energy factor prices | ||

| Transfer parameters of the CES production function for each sector’s output | Output CES production function share parameters by sector | ||

| Elasticity of the substitution coefficient between intermediate and value-added inputs |

| Industries | Industries | Industries |

|---|---|---|

| 1. Agricultural products 2. Forest products 3. Livestock products 4. Fishery products 5. Coal mining and washing products 6. Oil and gas extraction products 7. Refined petroleum and processed nuclear fuel products | 8. Processed coal products 9. Basic chemical materials 10. Fertilizers 11. Pesticides 12. Cement, lime, and gypsum 13. Gypsum, cement products, and similar goods 14. Building materials, such as masonry and stone | 15. Glass and glassware 16. Ceramic products 17. Refractory products 18. Water production and supply 19. Electricity and heat production and supply 20. Gas production and supply |

| Expenses | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | Total | |||

| Events | Commodities | Key elements | Residents | Companies | Government | Capital | Abroad | ||||

| Income | 1 | Events | 3,329,722 | 3,329,722 | |||||||

| 2 | Commodities | 1,966,551 | 3,601,506 | 1,990,910 | 8,584,259 | 16,143,226 | |||||

| 3 | Key elements | 1,205,169 | 1,205,169 | ||||||||

| 4 | Residents | 30,628 | 27,897 | 31,164 | 89,689 | ||||||

| 5 | Companies | 277,890 | 277,890 | ||||||||

| 6 | Government | 1,580,014 | 11,966 | 32,117 | 11,646 | 1,635,743 | |||||

| 7 | Capital | 180,564 | 169,073 | 27,943 | −13,120 | 364,460 | |||||

| 8 | Abroad | 2,689,034 | −3549 | 399 | 2,685,884 | ||||||

| Total | 4,751,734 | 6,018,756 | 304,969 | 3,794,036 | 229,087 | 59,506 | 1,990,910 | 8,582,785 | |||

| Carbon Tax Price (RMB/t) | Consumption of Coal | Consumption of Oil | Consumption of Gas | Coal Carbon Emissions | Oil Carbon Emissions | Gas Carbon Emissions |

|---|---|---|---|---|---|---|

| 20 | −7.12% | −3.25% | −6.31% | −23.21% | −12.21% | −11.15% |

| 40 | −10.21% | −4.12% | −7.28% | −23.45% | −12.45% | −11.84% |

| 60 | 21.23% | −7.21% | −9.95% | −24.08% | −13.38% | −12.21% |

| Carbon Tax Price (RMB/t) | 20 | 40 | 60 |

|---|---|---|---|

| Agriculture | 2.21% | 2.24% | 2.28% |

| Heavy industry | −8.22% | −10.33% | −14.90% |

| Light industry | −3.21% | −3.22% | −3.23% |

| Service industry | 2.78% | 2.78% | 2.79% |

| Transportation | −4.41% | −5.36% | −6.58% |

| Coal | −6.98% | −13.06% | −19.43% |

| Oil | −3.25% | −3.81% | −4.03% |

| Gas | −3.43% | −3.65% | −3.91% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gao, X.; Zhang, Y. Feasibility Study of China’s Carbon Tax System under the Carbon Neutrality Target—Based on the CGE Model. Sustainability 2023, 15, 1026. https://doi.org/10.3390/su15021026

Gao X, Zhang Y. Feasibility Study of China’s Carbon Tax System under the Carbon Neutrality Target—Based on the CGE Model. Sustainability. 2023; 15(2):1026. https://doi.org/10.3390/su15021026

Chicago/Turabian StyleGao, Xiaoyan, and Yuhao Zhang. 2023. "Feasibility Study of China’s Carbon Tax System under the Carbon Neutrality Target—Based on the CGE Model" Sustainability 15, no. 2: 1026. https://doi.org/10.3390/su15021026

APA StyleGao, X., & Zhang, Y. (2023). Feasibility Study of China’s Carbon Tax System under the Carbon Neutrality Target—Based on the CGE Model. Sustainability, 15(2), 1026. https://doi.org/10.3390/su15021026