Abstract

This article measures the green total factor productivity of 30 provinces (cities) in China from 2008 to 2018 based on the DEA superefficient nonexpected output model, utilizes the carbon emissions trading pilot policy as a quasi-natural experiment, and uses the multiperiod double-difference model and spatial econometric approach to test the effectiveness of carbon emissions trading policy. The results found that carbon emissions trading policies can significantly improve the GTFP of the pilot regions through three main approaches: adjusting the energy mix, improving resource misallocation, and promoting green technological innovation. The market mechanism measured by carbon price and the government administrative intervention measured by fiscal dependence will increase regional GTFP. The spatial and temporal evolution pattern analysis and DSDM show a “pollution refuge” effect in the initial stage of carbon emissions trading; however, the carbon trading pilot can form a demonstration effect in neighbouring areas and promote the improvement of GTFP in neighbouring areas afterwards. The study will help enrich the performance evaluation framework of carbon emission trading policies and further improve the institutional construction of the national carbon market.

1. Introduction

The Chinese economy has transitioned from a rapid growth phase to a high-quality development phase, and the national strategy of “ecological priority and green development” has been steadily implemented, becoming the primary way and driving force for high-quality development [1]. For both economic development and ecological construction concerning, enhancing green total factor productivity (GTFP) is a vital acting point for comprehensively promoting green development. Under these circumstances, China is actively encouraging the growth of a low-carbon economy. In 2011, China publicly proposed the formation of the carbon market over time. Seven cities—Beijing, Shanghai, Tianjin, Chongqing, Hubei, Guangdong, and Shenzhen—have implemented experimental carbon emission trading markets since 2013. The government’s work report of 2021 stresses the importance of performing a solid job of carbon peaking and carbon-neutral work, one of which is accelerating the construction of carbon markets [2]. As of the end of 2020, the pilot carbon market had traded 445 million tons of allowances, with a turnover of CNY 10.431 billion. The carbon market had been developing in China for nearly ten years, from 2011, when the carbon market construction plan was proposed, to July 2021, when online trading in the national carbon market was launched. During this period, has the carbon market effectively and genuinely contributed to a green economy? Meanwhile, compared to developed Western countries, China’s carbon market was built late, and there are problems such as lagging legislation and weak market mechanisms. Therefore, through what channels does the carbon market urge the emission control subjects to comply? Has it worked mainly through market initiative or government control? Are there spatial spillovers?

The structure of this article is as follows. Section 2 provides the relevant literature review. Section 3 expounds the theoretical analysis and hypotheses. Section 4 details the empirical model and variables. Section 5 conducts benchmark regression analysis, mechanism analysis, and government–market synergies. In Section 6, robustness tests are conducted, including dynamic analysis, placebo test, PSM-DID, and replacing the explanatory variables. In Section 7, the spatial spillover effect analysis of the carbon emission pilot areas was conducted, and further divided into static and dynamic, direct effect, and indirect effect. Section 8 concludes and proposes policy suggestions.

2. Literature Review

The existing studies broadly divide research on carbon emissions trading policies into three areas.

2.1. Research on Effectiveness of Market-Based Environmental Regulations

Fu et al. [3] used double-difference empirical evidence to conclude that China’s deployment of the sulphur dioxide trading mechanism can boost green development, but has a slight effect. Blackman et al. [4] investigated the influence of environmental legislation on green business technology innovation and pollutant emissions using environmental data from Mexico. He et al. [5] discovered that a carbon trading scheme may greatly increase the overall factor pollution control effectiveness of steel businesses in the pilot region, resulting in a green development effect. Chen et al. [6] used the frequency of phrases relating to environmental protection in the government work report to reflect the strength of the government’s environmental control, and the pollution reduction and economic growth effects of government ecological regulation were investigated. The results showed that government environmental regulation could achieve pollution reduction and green economic growth simultaneously. Tian et al. [7] utilized the double-difference approach to discover that the carbon emissions intensity of pilot regions is apparently reduced. Hu et al. [8] used a triple-difference test to find that carbon trading policies significantly negatively impacted green total factor productivity (GTFP) and firm total factor productivity (TFP).

2.2. Research on the Mechanism of Environmental Regulations

From the existing studies, many scholars have focused on the “Porter hypothesis”, which examines whether environmental law can bring environmental preservation and economic growth together through technological innovation [9]. In terms of research conclusions, there are conflicting conclusions in the previous empirical literature. Conrad and Wastl [10] and Greenstone et al. [11] argued that environmental regulation can inhibit technological innovation by increasing firms’ costs. Popp [12] and Tao Feng et al. [13] argued the opposite, i.e., reasonable environmental law can promote green technological innovation. Wan et al. [14] used the first enhancement of cleaner production standards in China in 2003 as a policy shock and found that environmental technology regulations affect China’s manufacturing industry’s green transformation mainly by improving the efficiency of energy and resource use and optimizing the energy use structure. Based on microdata from industrial enterprises, Zhu et al. [15] showed that tightening environmental rules helps to resolve factor mismatches and enhance TFP in the industrial sector, more through the impact of binding regulations on the correction of capital factor mismatches. Deng et al. [16] extended the resource mismatch model based on the price distortion effect and found that the average annual contribution of land resource mismatch to GTFP loss in Chinese urban industries was 10.05%. Chen et al. [17]. revealed that through technological impacts, low-carbon pilot towns continue to profit greatly in terms of GTFP. Furthermore, based on the synergy between market mechanisms and administrative interventions, Wu et al. [2] found that carbon markets have significant carbon emission reduction effects; however, market mechanisms, as measured by carbon prices and market liquidity, do not have significant carbon emission reduction effects.

2.3. Research on Spatial Spillover Effects of Environmental Regulations

Li et al. [18] discovered that obligatory environmental legislation had a large beneficial influence on carbon production in the region. However, there is a negative spillover effect on carbon productivity in the neighbouring regions, showing the characteristic of “proximity transfer under strict pollution control”. The direct effect of market-based environmental regulation on carbon productivity in the region is significantly positive, and there is a positive spillover effect on carbon productivity in neighbouring regions, showing the characteristic of “those who are close to the vermilion are red, and those who are close to the ink are black”. Zhang et al. [19] showed a positive spatial spillover effect of low-carbon pilot cities on TFP of neighbouring cities. Tian et al. [20] concluded that low-carbon pilot cities significantly stimulated green innovation activities of enterprises in fellow cities, and this spillover effect was more significant than the effect of the policy on pilot cities. Dong et al. [21] found that market-based carbon trading policies are functional and have a cross-border emission reduction impact, i.e., carbon trading policies can lower local carbon emissions, and pilot cities can reduce carbon emission of neighbouring areas.

In summary, most of the existing literature focuses on the role of carbon trading in reducing emissions in the pilot regions. There is controversy over whether carbon trading has promoted green economic development in the pilot regions. In terms of mechanisms, most of them focus on energy structure and industrial transformation, etc. The effect of technological innovation is inconclusive, and the impact on resource mismatch is more neglected. In addition, studies have focused on the pollution reduction effects in the places where the policies are implemented, often ignoring the spatial correlation of pollution emissions in neighbouring regions, resulting in biased policy assessments. Therefore, the existing literature related to spatial effects of carbon emissions trading policies only involves the point estimation of spatial panel data; it lacks in-depth research on its partial differential results, i.e., decomposition into direct, indirect, and total effects for analysis. Given this, this paper first verifies the effectiveness of carbon emissions trading through multiperiod DID, then examines the synergistic effects of carbon market mechanisms and government intervention mechanisms, and investigates the transmission mechanisms of the three paths of improving resource mismatch, reducing energy consumption, and promoting green technology innovation through a mediating effects model. Finally, the article conducts static and dynamic spatial Durbin regressions on GTFP and decomposes the effects to analyse its spatial spillover effects. Compared with existing studies, the marginal contributions of this paper may lie in (1) exploring the role mechanism of carbon emission trade affecting urban GTFP from the perspective of green technology innovation and the degree of capital mismatch providing a new research idea to explore the function of carbon market; (2) research on the synergy between the market and the government in carbon emissions trading, showing that China’s current carbon market still needs to be vigorously controlled by the government; (3) conducting a more in-depth analysis of the spatial spillover effect in the carbon pilot areas, which is not the result of the static SDM model shown in most existing literature, i.e., only a single promotion or inhibition effect on GTFP in neighbouring areas. In fact, it first forms a “pollution refuge” effect in the initial stage of carbon emissions trading, but the carbon trading pilot can form a demonstration of neighbouring with the national implementation of carbon trading.

3. Theoretical Foundations and Research Hypotheses

3.1. Effectiveness of Carbon Trading

The essence of carbon trading is an institutional arrangement adopted by the government to minimize the cost of emission reduction and maximize the economic benefits to society. Carbon emissions are a public good and have externalities; therefore, achieving emission reduction goals only via the voluntary activities of businesses and individuals is challenging. According to Coase’s theorem, the breakdown of property rights is the primary contributor to market failure. The precise description of property rights can help internalize external costs, and the carbon trading system treats carbon emissions as a nonpublic product [7]. The federal government divides up the whole quantity of carbon emissions among businesses through a calculation method and allows trading among them. When the carbon price is higher than the marginal cost of emission reduction for market participants, emission-controlling enterprises will choose to improve their traditional production processes and adopt cleaner production technologies to meet their own emission needs and government emission standards, and in the process, they may also acquire surplus carbon emission allowances and gain additional revenue by selling excess carbon emission allowances; conversely, emission control companies can minimize their production costs by buying up surplus allowances from other players rather than improving their production processes. Therefore, under the market mechanism, carbon trading can mobilize all participating parties to reduce emissions and bring them a win–win economic outcome while reducing the carbon emissions of the whole society [22], thus promoting a pilot regional GTFP.

Therefore,

Hypothesis 1:

Carbon trading helps to promote GTFP in the pilot areas.

3.2. Market and Government Synergies

When the carbon market mechanism is not yet fully established, local governments are incentivized to strengthen nonmarket mechanisms, such as traditional administrative intervention tools, to promote carbon reduction under the pressure of carbon reduction. Some scholars have confirmed that government intervention has a deterrent effect on green development, manifesting itself as a “government failure” [1]. Others argue that appropriate government intervention in areas such as encouraging innovation, environmental protection, public services, and infrastructure development can promote GTFP. Specifically, under the constraints of the carbon market, local governments may promote carbon emission reduction through two mechanisms: firstly, a market mechanism with carbon trading at its core (hereinafter referred to as “market mechanism”), which regulates carbon emissions through carbon trading; and secondly, administrative intervention, which induces compliance by emission-control entities through control [2].

Therefore,

Hypothesis 2:

The effectiveness of carbon trading policies stems from the synergy between the market and the government.

3.3. The Transmission Mechanism of Carbon Emissions Trading

Drawing on existing studies, the transmission mechanism is studied in three pathways. The first is the transformation of energy structure. At present, China’s energy consumption is dominated by fossil fuels such as coal; coal combustion and derivative energy production are the dominant source of carbon dioxide emissions, so priority is given to the possible optimization effect of carbon emission trading policies on energy structure. The second is to stimulate corporate technological innovation. If companies reduce their CO2 emissions through green technological advances, they can sell their carbon allowances through trading to obtain carbon revenues so that carbon trading policies may achieve emission reductions in the form of technological improvements or green technological innovations [21]. Thirdly, it improves factor mismatch. The essence of carbon emissions trading is to achieve a rational allocation of resources among participating parties through free trade and market circulation based on the attribution of carbon emission rights to commodities [22]. Does the pilot implementation of carbon emissions trading promote and accelerate the correction of factor substitution and factor mismatch? As a “justified” external intervention, does the restriction of pollution emissions create further distortion of factor inputs and “allocation inaccessibility” through cost shocks [23], or does the “environmental quid pro quo” based on factor prices optimize allocation efficiency, and thus achieve a win–win situation for both environmental protection and economic growth?

Therefore, the following hypotheses are proposed.

Hypothesis 3:

Carbon trading improves GTFP by driving a transformation in the energy mix.

Hypothesis 4:

Carbon trading increases GTFP by promoting green technology innovation.

Hypothesis 5:

Carbon trading increases GTFP by improving resource misallocation.

3.4. Spatial Spillover Effects of Carbon Emissions Trading

The current theories on environmental regulation and pollution spillover are the opposing “pollution sanctuary effect” and “pollution halo effect”. In 1979, Walter et al. [24] proposed the “pollution sanctuary” hypothesis, arguing that developed countries or regions have stricter and better environmental regulation standards, while less developed countries or regions do not pay enough attention to environmental issues, leading to the transfer of polluting industries from developed to less developed regions, making the latter a “pollution sanctuary”. The “pollution halo effect” argues that environmental rules raise the barriers to entry for foreign investment (FDI), especially for highly polluting and energy-intensive enterprises, and that the additional environmental costs can avoid polluting FDI and encourage clean FDI to enter, thus changing the direction and size of its technological spillover effects, promoting industrial eco-efficiency and bringing into play the pollution halo effect [25]. In contrast, under China’s unified environmental policy, local government discretionary space leads to disparities in regulatory intensity between areas [26], geographical spillovers are common across regions, and the spatial impacts of environmental regulation on high-quality development are mostly the result of competing regulatory policies.

Therefore,

Hypothesis 6:

There is a positive spatial spillover effect of carbon trading policies, which can increase GTFP in neighbouring regions.

4. Study Design and Data Selection

4.1. Model Construction

Due to the inconsistent timing of the launch of carbon markets in the seven pilot regions, this article utilizes the multiperiod double-difference approach to estimate the effect of carbon markets on regional GTFP, modelled as follows.

represents regional green total factor productivity. The multiperiod double-difference variable. represents whether it is a treatment group, and represents the time of policy implementation. denotes control variables. denotes urban fixed effects, denotes the time effect, and δrt denotes the interaction effect between region (East, Northeast, Central, and West regions) and year. denotes the error term. The rules for taking the values of treat are as follows: when represents Beijing, Tianjin, Shanghai, Chongqing, Guangdong, and Hubei, = 1; when represents other regions = 0. The rules for taking the value of represents Beijing, Tianjin, Shanghai, and Guangdong and ≥ 2013, or represents Chongqing and Hubei and ≥2014, = 1; otherwise = 0.

4.2. Description of Variables

4.2.1. Explained and Core Explanatory Variables

The explanatory variable is whether it is a carbon emissions trading pilot city, and the explained variable is green total factor productivity (GTFP). Based on the superefficient nonexpectation DEA-SBM model, employment, total electricity consumption, and capital stock are used as inputs; GDP is the expected output; and industrial smoke emissions, wastewater emissions, and sulphur dioxide emissions are calculated as nonexpected outputs.

Drawing on the algorithm of Shan Haojie [27], the capital stock is obtained by the perpetual inventory method of stocking the total actual fixed asset investment in each year; is the rate of GDP growth; δ is the fixed capital depreciation rate (the depreciation rate is measured separately from provincial data, using the arithmetic mean of the fixed asset growth rate from 2008–2018), to determine the 2008 base period fixed asset stock; and is the actual amount of fixed asset investment after excluding price factors.

Tone Kaoru [28] considers the problems of nonexpectation and slackness of variables based on this CCR model of DEA and improves the traditional model by proposing a nonradial and nonangular measurement model. This SBM model can take into account the bad outputs that accompany the useful outputs, i.e., the nonexpectation outputs, effectively addressing the shortcomings of DEA models in the field of environmental pollution assessment. The SBM-DEA model that takes into account nondesired variables included is

, , , , represent the input variables, desired output variables, nondesired output variables, and slack variables of the DMU, respectively.

4.2.2. Control Variables

To accurately screen the effectiveness of the policy, the econometric model introduces industrial structure, economic growth, factor endowment, environmental protection expenditure, and science and technology input as control variables. Industrial structure is calculated by dividing the yearly gross output value of secondary industry by the total regional economic production in each province (city) table. In contrast, a more industrialized industrial structure indicates a higher level of emissions. Economic growth, using the per capita GDP of each province and city, is usually accompanied by increased energy consumption, leading to more pollution emissions, while economic development can also promote technological upgrading, thereby reducing regional pollution emissions [29]. Factor endowments (capital stock to employment) and new structural economics place particular emphasis on the role and differences in endowment structure, and the optimal development path for an economy depends on the factor endowment structure of the region [30]. Environmental expenditures are emphasized over GDP. Science and technology inputs use science and technology expenditures over general budget expenditures.

4.2.3. Proxy Variables for Market Mechanisms and Administrative Intervention

① Market mechanism: two types of indicators are introduced to measure the carbon trading status, namely carbon price (price) and relative market trading size (percent). The carbon price is the daily closing price’s yearly average, and the relative market trading size is the total annual trading share of all carbon emissions in the region. ② Administrative intervention: this paper equates government control with administrative intervention. The percentage of industrial businesses’ primary business income (income) owned by China and its holding enterprises was selected to be measured. In addition, considering that the higher the government’s share in the primary distribution of the national economy, the closer the government’s relationship with market players and the stronger the control it can exercise over them; the fiscal dependency (finance) is selected for robustness tests [2].

4.2.4. Intermediate Variables

① Energy consumption, using total energy consumption over GDP. ② Green technology innovation, indicated by the ratio of green invention and utility patent applications to the overall invention patent applications in each province and city [21]. ③ Resource mismatch:, measured by the method of Chen et al. [31]

is the absolute price distortion coefficient of labour, which is often used as a proxy for the relative price distortion coefficient of labour since it cannot be directly observed:

denotes the output share of area at the moment , denotes the output-weighted labour contribution. denotes the actually used labour share of region at moment , and denotes the theoretically optimal allocation of labour share of the region at moment . reflects the extent to which the actual labour allocation deviates from the optimal allocation.

4.2.5. Substitution of Variables

① Total factor productivity (TFP): the DEA–Malmquist productivity index was used to measure the rate of change in input–output efficiency by calculating the ratio of the production frontier distance function. Based on the DEA-BCC model, the Malmquist productivity index model was used to reflect the interperiod dynamics of total factor productivity in each province and city from 2008 to 2018. The model can be described as

and denote, respectively, and, the distance functions based on variable returns to scale in the period; and denotes , the distance between the decision-making unit (DMU) in the period and the distance between the production frontier surface in the period. The output variable selected for this study is GDP, and the input variables are the number of employees and the capital stock [32].

② Carbon emissions: carbon dioxide emissions by region are calculated based on the consumption of different types of energy and the carbon emission factors of different energy sources, which are calculated as

Where is the proportion of molecules with carbon content in them, represents consumption of energy in time and area , and represents the factor of standard coal for energy source and the carbon emission factor of energy source for energy [21].

4.3. Data Sources

This article uses panel data from 2008–2018 for 30 provinces in China. Data on carbon emissions were obtained from CEADs, and data on carbon price and trading scale were obtained from CSMAR and EPS databases; other data were obtained from the statistical yearbooks of each province in previous years.

5. Empirical Results

5.1. Baseline Regression

Table 1 presents the results of the baseline regressions; the regression coefficient of the carbon trading policy on GTFP is significantly positive, demonstrating that the implementation of China’s carbon trading mechanism significantly contributed to the pilot regions’ green economic development, and neither the significance of the core explanatory variables nor the sign of the coefficients changes fundamentally when control variables are added. In addition, the decidable coefficients became larger during the process, indicating that the model’s estimation results are relatively robust. Hypothesis 1 was tested.

Table 1.

Baseline regression.

5.2. Market and Government Synergies

The green economy-boosting effect of the carbon market in the pilot regions may not necessarily come from carbon trading, given that China’s carbon market is not yet fully developed and there may be a functional shortfall in the market mechanism. If the carbon market in the pilot areas can also contribute to the green economy through command-and-control environmental regulation, such as the central environmental protection inspection policy, then the effectiveness of the government’s administrative intervention in the market should be closely correlated with this channel. The following is how the model [33] is built to test the aforementioned hypothesis:

is the relevant indicator measuring the market mechanism, specifically the carbon price and the relative market transaction size; the coefficient captures the carbon market effect in the absence of a market mechanism (e.g., a zero carbon price); the coefficient captures the heterogeneous green economy promotion effect caused by carbon trading; and the other symbols have the same meaning as above.

measures government administrative intervention, specifically the share of state-owned enterprises and fiscal dependence; and is the corresponding coefficient. × is the interaction term between the DID variable and the intensity of administrative intervention [2].

Table 2 shows the results of the correlation regressions: (i) When the market mechanism is measured by the carbon price, the coefficient θ has a substantial positive association at the 1% level. (ii) The interaction term between the DID variable and the share of main business income of SOEs is notably positive, which indicates that the stronger the government’s ability to exercise control over the market, the more significant the promotion effect of the carbon market in pilot regions. Replacing the carbon price with the relative market size, the regression coefficient of the interaction term remains positive after replacing the government dependency with the share of state-owned enterprises, and the findings remain unchanged.

Table 2.

Synergy regression.

5.3. Analysis of Conduction Mechanisms

The results of the above empirical analysis suggest that carbon trading policies are effective in increasing GTFP in the pilot regions and that their effects increase gradually over time. What effect does the introduction of carbon pricing programs have on GTFP? Based on the preceding analysis, this section constructs a mediating effects regression model [21] to investigate the mechanism of the effect of carbon emissions trading policies on GTFP:

represents mediating variables, including energy consumption intensity, green technology innovation, and degree of resource mismatch; the stepwise regression method was used to test for mediating effects.

In Table 3, the regression coefficient of the carbon trading policy on energy structure in column (2) is notably negative, demonstrating that the program’s energy structure adjustment impact is clear. Column (3) indicates that increasing the proportion of regional coal consumption decreases GTFP considerably, whereas the carbon trading regression coefficient on GTFP remains significant, demonstrating that the carbon trading policy can enhance GTFP by promoting the transformation of the energy mix, and Hypothesis 3 is verified. Column (4) and column (5) verify the mediating effect of green technology innovation, but the regression coefficient is weakly significant. This may be due to the fact that given that technological innovation itself requires a certain amount of technological accumulation, has a long payback period, and is subject to large uncertainty, and that the empirical sample in this paper has only four years of post-doc observation, even if manufacturing firms increase their innovation investment, it may be difficult for this innovation input to be effectively and fully transformed into output [14], Hypothesis 4 is verified. Column (5) shows a positive effect of green technology innovation on GTFP, suggesting that carbon trading policies can increase GTFP by improving labour mismatch in the pilot areas. The regression coefficient of carbon trading policies on labour mismatch in column (6) is notably negative; column (7) further dedicates that labour mismatch significantly reduces GTFP in the pilot areas, which indicates that carbon trading policies can increase GTFP by reducing regional factor mismatch. Thus, Hypothesis 5 is tested.

Table 3.

Intermediary effects.

6. Robustness Analysis

6.1. Parallel Trends and Analysis of Dynamic Effects

An important assumption for the use of DID is that the outcome variable satisfies the parallel trend assumption between the treatment and control groups. Therefore, this paper applies the event study approach to the parallel trend hypothesis and dynamic effects analysis. Specifically, using the 3 years prior to the start of the carbon market as the comparison benchmark, the cross-product term between the year dummy variable and the corresponding policy dummy variable is constructed for the 3 years prior to the start of the carbon market, the start year, and the 5 years after the start; the model used [2] is as follows.

In Equation (9), , , and reflect the cross-multiplication of the dummy variables with the appropriate policy dummy variables for the years preceding, during, and after the pilot region’s carbon market launch, respectively. , , and are the corresponding coefficients, and other symbols have the same meaning as in Equation (1). According to regression results in Table 4, denote that the corresponding coefficients for the 2 years before the launch of the carbon market fail the significance test, which proves that the hypothesis of parallel trend holds, and the dynamic test results show that and are both significantly positive at the 1–5% level, and the regression coefficients become larger as the number of years increases after the implementation of the policy, indicating that the promotion effect of carbon emissions trading on GTFP in the pilot regions increases year by year.

Table 4.

Dynamic analysis.

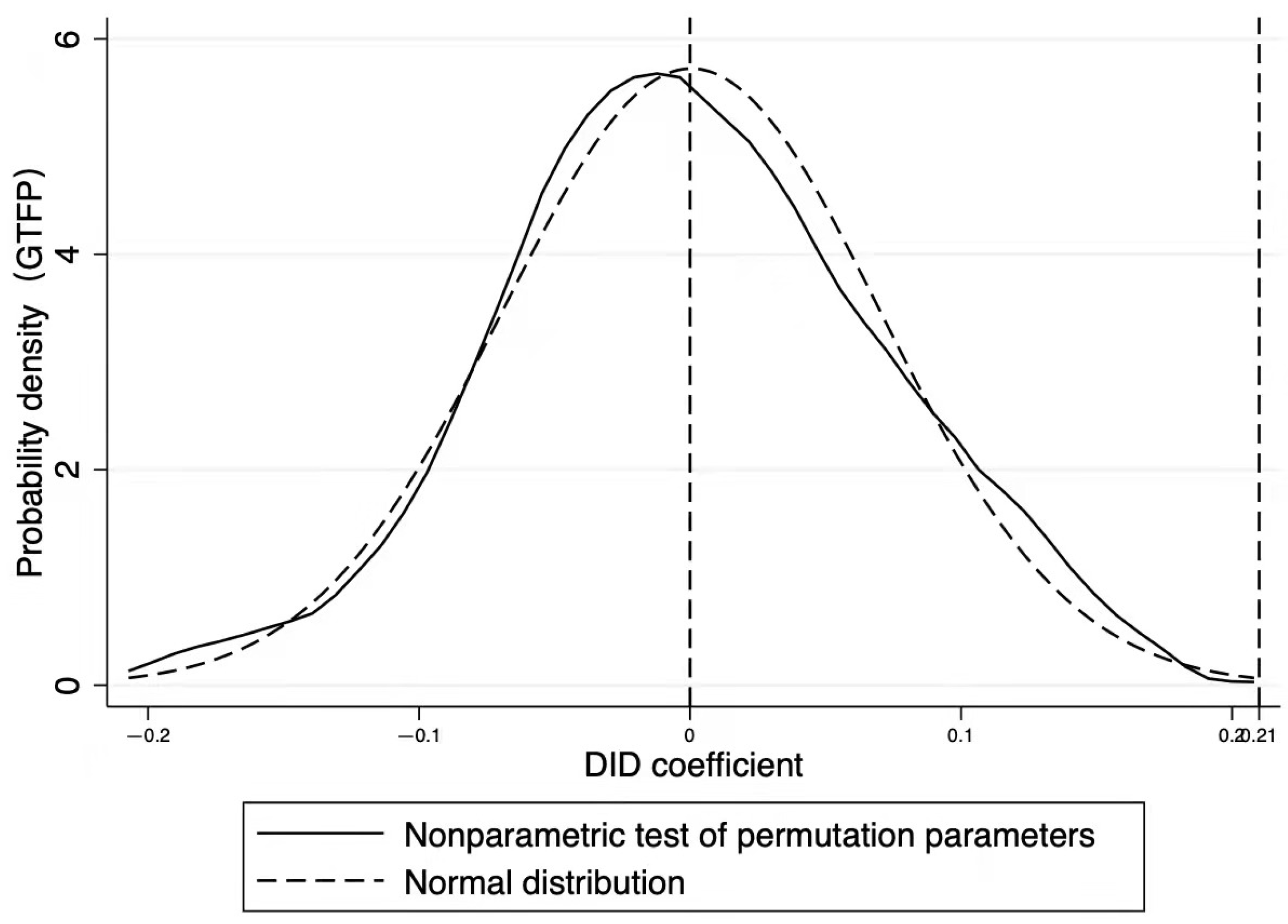

6.2. Placebo Test

When using multiyear data for empirical analysis of double differences, serial correlation may produce difficulties with standard error bias. For this reason, a placebo test was conducted using a nonreference substitution test [2]. This process was repeated 500 times to obtain DID regression coefficients for the 500 dummy treatment groups and the dummy policy time interactions. The estimated DID coefficient (0.210) in column (2) of Table 1 would be in the low tail of the distribution of the nonreference substitution test coefficients, the regression results are shown in Figure 1, so the robustness of base regression is identified.

Figure 1.

Empirical cumulative distribution of placebo test coefficients.

6.3. PSM-DID Test

The double-difference method assumes homogeneity between the experimental and control groups and further continues with the nearest-neighbour matching method for robustness testing [7]. Considering that the pilot policy effect had already appeared in 2013 and that the pilot policy might change the changes of relevant economic variables in the pilot areas, in this article, only the samples before the impact of the policy (i.e., 2008–2012) were matched with year-by-year propensity scores. According to the regression results, the multiperiod double-difference variable DID’s coefficient is considerably positive at the 5% level. Therefore, the baseline regression results of this paper are robust.

6.4. Changing the Window Period Test

Considering the issue of pre- and postpolicy timeliness, this section sets the sample to a more balanced interval of 2011–2016 for robustness regression again. The findings demonstrate that the primary regression findings of this research are resilient, since all of the key explanatory variable coefficients are significant at the 1% level.

6.5. Substitution of Explanatory Variables

In this paper, total factor (TFP) and carbon emissions are used in place of the GTFP indicator to test the sensitivity of the regression findings to the measurement indicators. Carbon trading regimes considerably cut carbon emissions and boost total factor productivity, according to the regression results, in Table 5, which are consistent with those of the benchmark regression. In addition, the result also illustrates that carbon emissions trading can achieve a win–win situation for both the economy and the environment in the pilot regions.

Table 5.

Substitution of explanatory variables.

7. Spatial Spillover Effects

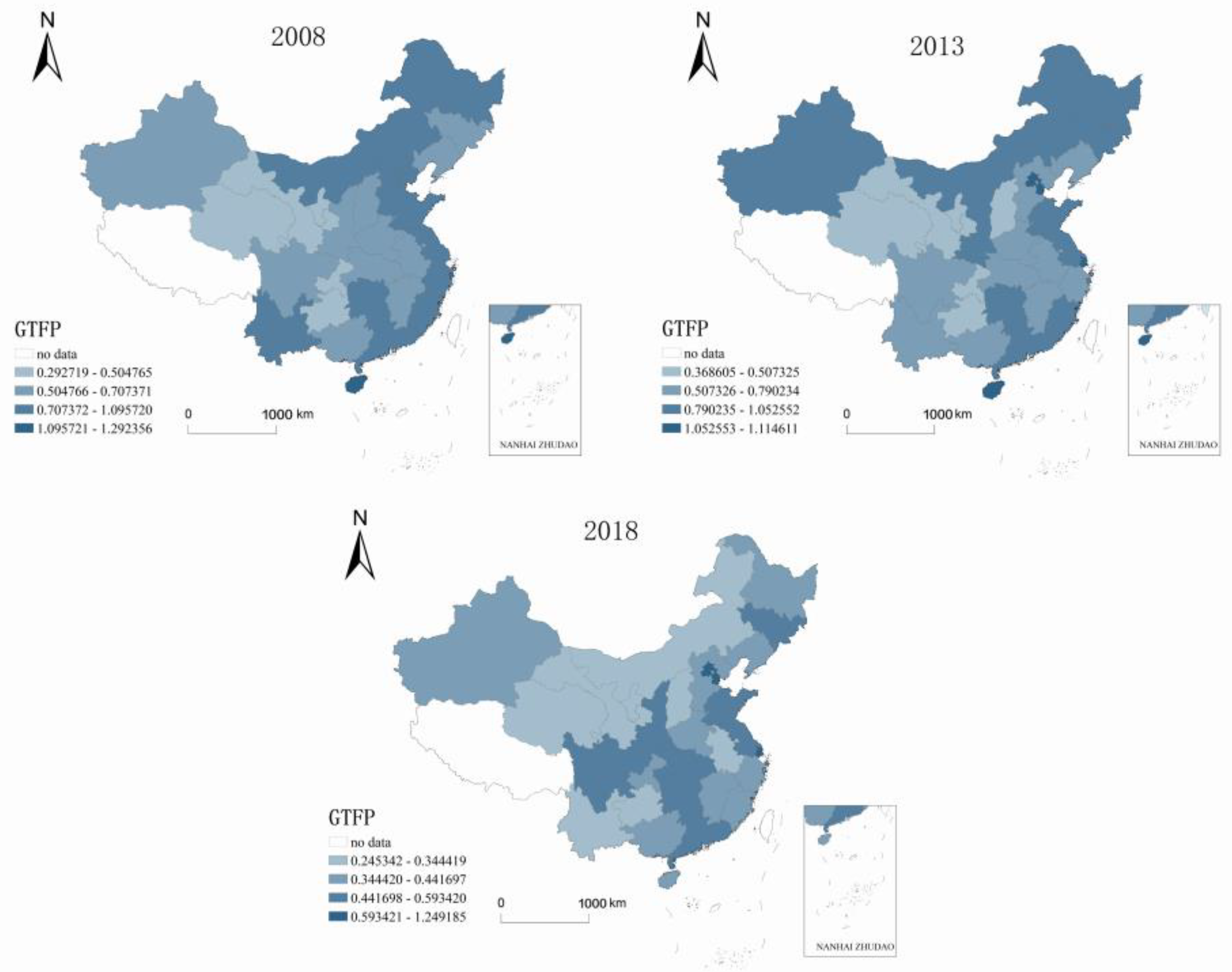

7.1. Analysis of Spatial and Temporal Patterns

In Figure 2, three cross-sectional visualizations were selected to show the GTFP evolution in 2008, 2013, and 2018, and the Jenks natural breakpoint method was used to show the GTFP evolution and reveal the GTFP spatial pattern [1]. (1) In terms of temporal evolution, the GTFP increased in most provinces from 2008 to 2018 compared to the base period. (ii) In terms of spatial pattern, the GTFP pattern is misaligned with the economic growth map, and the regions with higher GTFP are not the regions with higher economic development in the traditional sense, as shown by the fact that regions with strong economic growth, such as the Yangtze River Delta and the Pearl River Delta, are not as efficient under the constraints of factor inputs and environmental pollution, although the scale of economic output is very impressive. This means that simply increasing economic output is not a sufficient condition for promoting the green development of regional economies.

Figure 2.

Spatial distribution pattern of GTFP for the relevant years 2008–2018. Note: Produced in accordance with the standard map of the Ministry of Natural Resources, review number GS (2019) 1822, with no modifications to the base map.

7.2. Spatial Panel Model

7.2.1. Model Construction

The theoretical analysis in this paper suggests that ignoring spatial factors in the study of GTFP will cause model bias and thus affect the accuracy of the results, so a static spatial Durbin model was constructed.

In addition, the effect of environmental policy tools often takes time to play out, and the effect of heterogeneous environmental regulation tools to mitigate environmental pollution may change over time. In view of the dynamic inertia changes in the time dimension of GTFP, in order to avoid endogeneity interference, and at the same time, to test the static Durbin regression results of GTFP, the dynamic spatial Durbin model DSDM was further constructed.

is the spatial weight matrix of the model, the coefficients of the lagged one-period values of GTFP reflects the path-dependent characteristics of the GTFP [34]; the coefficients of the spatial lag term reflect the correlation between the levels of economic volatility between regions.

7.2.2. Selection of the Space Matrix

① Adjacency matrix

② Economic distance spatial weighting matrix.

This matrix assumes that cities that are more economically robust will have a more substantial impact on surrounding cities, and economically weaker cities will have a weaker impact on surrounding cities based on the consideration of spatial latitude and longitude distances. The formula [1] is

represents the spatial weights between cities. is the geospatial weight matrix. is the diagonal matrix with the mean value of the share of GDP of each city as the diagonal element. denotes , the mean value of real GDP for each year for each city. denotes the real GDP of all cities. is the base period; is the end period. is the real GDP.

7.2.3. Spatial Autocorrelation Test

The Moran index has the following form:

is the spatial weight matrix and is the spatial weight matrix for the first observation of the first region; , and. The Moran index has a range of values [1].

It can be found through Table 6 that the global Moran index largely passes the test during the period 2008–2018. GTFP has a substantial positive geographical correlation, indicating that the link between China’s carbon emission rights policy and green total factor production may be studied using a spatial econometric model.

Table 6.

Moran Index.

The Walds and LR tests both yielded significant findings at the 5% level in Table 7, showing that the SDM model could not be reduced to an SAR and SEM model. The Hausman test was positive under the W1 and W2 matrices, rejecting the assumption that the random effects could be accepted, so a two-way fixed-effect spatial Durbin model was employed.

Table 7.

LR and Wald tests.

7.3. Point Estimation Results

For all regressions in Table 8, the standard deviation squared, sigma2_e, of the random error term is significant, signifying that the model findings are suitable for further investigation. The spatial autoregressive coefficient is considerably positive, demonstrating that carbon trading has a positive geographical spillover impact. Overall, the coefficient for the inverse geographical distance weight matrix is 0.190, which is above the 0.01 significance threshold, indicating that carbon credit policies can significantly contribute to local green development. The inverse geographic-distance-squared weight matrix estimates similar results, confirming the robustness of these results. The coefficient of w x is insignificant due to the existence of feedback effects on the policy, and therefore the spatially lagged coefficients of the independent variables are not fully explanatory, and the following effect decomposition is performed to further illustrate their spatial spillover effects. The dynamic spatial Durbin regression results show that the one-period lagged coefficient of GTFP is notably positive, meaning that technological innovation does have a dynamic cumulative character in the time dimension; secondly, the spatial response coefficient of the explanatory variable is notably positive, demonstrating that the variable has a significant spatial autocorrelation.

Table 8.

Point estimates.

7.4. Decomposition of Partial Differential Effects

Lesage et al. argue that point estimates can lead to biased parameter estimates and propose a partial differential approach to compensate for this by decomposing the estimates into direct, indirect, and total effects. Taking the SPDM as an example, this can be transformed by shifting the term to and let and , which translates into

This is converted into matrix form as

denotes the th explanatory variable. The diagonal elements in the right-hand matrix indicate the average effect of a change in a provincial or municipal . The diagonal element reflects the average effect of a variable change on the explanatory variable of the city, i.e., the direct effect,. The nondiagonal line components reflect the average influence of changes in variables in one city on explanatory variables in surrounding cities, i.e., indirect effects, often known as spatial spillover effects, . [1].

The total effect of carbon trading on GTFP was decomposed into direct and indirect effects using the two types of spatial weight matrix, and the findings are displayed in Table 9. The direct effect is predicted to be 0.265 and is significant at the 0.01 level, implying that carbon trading can considerably contribute to the destination economy’s green growth. (i) The indirect effect is estimated at 0.060 and is not significant. Further, in Table 10, the negative short-term indirect effect indicates that there is a “pollution refuge” effect in the initial stage of carbon trading implementation, where stronger environmental regulations in the pilot region initially cause emission-controlled enterprises to shift their polluting industries to neighbouring regions. The long-term indirect effect is positive, indicating that with the implementation of carbon emissions trading, such as Sichuan and Fujian becoming voluntary carbon pilots, the diffusion of policy effects has led to the strengthening of environmental regulations in neighbouring regions, and the “race to the top” regulatory competition strategy has contributed to the growth of GTFP in neighbouring regions. Under the economic distance weight matrix W2, since carbon trading is predicted to have a direct impact on the green technical efficiency of 0.183 and be significant at the 0.01 level, the fact can be identified that carbon trading may have a major impact on the green growth of a destination economy. (ii) The indirect impact is assessed to be 0.345 and significant, suggesting that carbon trading can increase GTFP in neighbouring regions and demonstrating the validity of Hypothesis 6.

Table 9.

Static Durbin decomposition effects.

Table 10.

Dynamic Durbin decomposition effects.

8. Conclusions and Policy Implications

8.1. Research Conclusions

This paper adopts a multiperiod double-difference model and a spatial econometric approach to test the effectiveness, government–market synergy, impact mechanism, and spatial spillover of the carbon emissions trading policy in a quasi-natural experiment. The main conclusions lie in the following. ① Carbon trading policy can improve GTFP in the pilot regions, and its promotion effect increases year by year. ② The market mechanism, measured by both carbon price and relative size, can significantly contribute to the green development of the pilot regions, and further research finds that the stronger the administrative intervention of the government in the carbon market, the higher the regional GTFP. ③ Carbon emissions trading policies promote regional GTFP by adjusting energy structures motivating green technology innovation and improving resource mismatches. ④ Carbon emissions trading has a “local-neighbourhood” cross-border transmission effect and positive spatial spillover, thus promoting the improvement of GTFP in neighbouring areas.

8.2. Recommendations

The formal launch of the national carbon trading market calls for increased market incentive for carbon trading and the progressive establishment of market mechanisms as the dominant force in the carbon market, as well as encouraging the innovation of carbon financial products and strengthening the focus on carbon emission reduction investment and financings, such as low-carbon economy-related stocks and the scale of related instruments. Secondly, the government should give full play to the government’s regulatory and supporting role. The effectiveness of administrative intervention does not mean that more administrative intervention is better. Specifically, in the process of maturing and improving the carbon trading market, governments at all levels can reduce the transition pressure on emission control entities through policies such as tax relief and market trading subsidies. Finally, it is vital to incentivize enterprises to innovate green technologies and change structural emission reduction to technological emission reduction. Therefore, to encourage excitement for green technology innovation among social entities, local governments should provide the support and direction of financial subsidies, taxation, and other economic incentives. Nevertheless, the demonstration effect created across areas should not be disregarded when a national carbon trading market is being developed.

Author Contributions

Methodology: A.T.; Formal analysis: N.X. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data openly available in a public repository.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Tong, Y.; Liu, H.; Ma, Y. The impact of China’s tourism economy on urban green development and spatial spillover effects. J. Geogr. 2021, 76, 2504–2521. [Google Scholar]

- Wu, Y.Y.; Qi, J.; Xian, Q.; Chen, J.D. A study on the carbon emission reduction effect of China’s carbon market: A synergistic perspective of market mechanism and administrative intervention. China Ind. Econ. 2021, 8, 114–132. [Google Scholar]

- Fu, J.; SZ, X.; Cao, X. The impact of emission right trading mechanism on green development. China Popul.-Resour. Environ. 2018, 28, 12–21. [Google Scholar]

- Blackman, A.; Kildegaard, A. Clean technological change in developing-country industrial clusters: Mexican leather tanning. Environ. Econ. Policy Stud. 2010, 12, 115–132. [Google Scholar] [CrossRef]

- He, M.; Zhu, X.; Li, H. How does carbon emissions trading scheme affect steel enterprises’ pollution control performance? A quasi natural experiment from China. Sci. Total Environ. 2023, 858, 159871. [Google Scholar] [CrossRef] [PubMed]

- Chen, S.; Chen, D. Haze pollution, government governance and high-quality economic development. Econ. Res. 2018, 53, 20–34. [Google Scholar]

- Tian, G.; Yu, S.; Wu, Z.; Xia, Q. Study on the Emission Reduction Effect and Spatial Difference of Carbon Emission Trading Policy in China. Energies 2022, 15, 1921. [Google Scholar] [CrossRef]

- Hu, Y.F.; Ding, Y. Can a carbon trading mechanism balance corporate effectiveness and green efficiency? China Popul. Resour. Environ. 2020, 30, 56–64. [Google Scholar]

- Dechezleprêtre, A.; Koźluk, T.; Kruse, T.; Nachtigall, D.; De Serres, A. Do environmental and economic performance go together? a review of micro-level empirical evidence from the past decade or so. Int. Rev. Environ. Resour. Econ. 2019, 13, 1–18. [Google Scholar] [CrossRef]

- Conrad, K.; Wastl, D. The impact of environmental regulation on productivity in German industries. Empir. Econ. 1996, 20, 615–633. [Google Scholar] [CrossRef]

- Greenstone, M.; List, A.J.; Syverson, C. The Effects of Environmental Regulation on the Competitiveness of U.S. Manufacturing. NBER Work. Pap. 2012, 93, 431–435. [Google Scholar]

- Popp, D. International innovation and diffusion of air pollution control technologies: The effects of NOX and SO2 regulation in the US, Japan, and Germany. J. Environ. Econ. Manag. 2006, 51, 46–71. [Google Scholar] [CrossRef]

- Feng, T.; Yu, Z.J.; Hao, Z. Has environmental regulation achieved “increased quantity and quality” of green technology innovation: Evidence from the environmental protection target responsibility system. China Ind. Econ. 2021, 2, 136–154. [Google Scholar]

- Wan, P.; Yang, G.; Chen, L. How environmental technology standards affect the green transformation of China’s manufacturing industry—A perspective based on technological transformation. China Ind. Econ. 2021, 9, 118–136. [Google Scholar]

- Zhu, S.N.; Li, W.X. Does environmental regulation drive factor mismatch correction in the industrial sector—Empirical evidence from micro data of Chinese industrial firms. Macroecon. Res. 2021, 2, 149–161. [Google Scholar]

- Deng, C.; Zhao, H.; Xie, B. The impact of land resource mismatch on green total factor productivity of urban industries in China. J. Geogr. 2021, 76, 1865–1881. [Google Scholar]

- Cheng, J.; Yi, J.; Dai, S.; Xiong, Y. Can low-carbon city construction facilitate green growth? Evidence from China’s pilot low-carbon city initiative. J. Clean. Prod. 2019, 231, 1158–1170. [Google Scholar] [CrossRef]

- Li, X.; Yu, D.; Yu, J. Spatial spillover effects of heterogeneous environmental regulations on carbon productivity—Based on a spatial Durbin model. China Soft Sci. 2020, 4, 82–96. [Google Scholar]

- Zhang, B.; Zhou, J.; Yan, Z. Low carbon city pilot policies and total factor energy efficiency improvement—A quasi-natural experiment from three batches of pilot policy implementation. Econ. Rev. 2021, 42, 32–49. [Google Scholar]

- Tian, L.; Liu, C. “Peer” institutional pressure and corporate green innovation—The spillover effect of environmental pilot policies. Econ. Manag. 2021, 43, 156–172. [Google Scholar]

- Dong, Z.; Wang, H. An examination of the effectiveness of market-based environmental regulation policies—Empirical evidence from the perspective of carbon emissions trading policies. Stat. Res. 2021, 38, 48–61. [Google Scholar]

- Jiang, H.; Sun, M. Carbon emissions trading, industrial structure and regional emission reduction. Mod. Econ. Inq. 2021, 11, 65–73. [Google Scholar]

- Choi, J.; Kim, I. Regional total factor productivity and local employment growth: Evidence from Korea. Asia-Pac. J. Reg. Sci. 2017, 1, 511–518. [Google Scholar] [CrossRef]

- Walter, I.; Ugelow, J. Environment policies in developing countries. Amhio 1979, 8, 102–109. [Google Scholar]

- Eskelan, G.; Harrison, A.E. Moving to greener pastures? multinationals and the pollution haven hypothesis. J. Dev. Econ. 2003, 70, 1–23. [Google Scholar] [CrossRef]

- Zhang, H. A study on the strategic interaction of inter-regional environmental regulation—An explanation of the non-fully enforced universality of environmental regulation. China Ind. Econ. 2016, 7, 74–90. [Google Scholar]

- Shan, H. Re-estimation of capital stock K in China:1952–2006. Res. Quant. Econ. Technol. Econ. 2008, 25, 17–31. [Google Scholar]

- Tone, K.; Tsutsui, M. Dynamic DEA with network structure: A slacks-based measure approach. Omega 2014, 42, 124–131. [Google Scholar] [CrossRef]

- Yu, Y.; Zheng, X.; Zhang, L. Economic development level, industrial structure and carbon emission intensity: A provincial panel data analysis in China. Econ. Theory Econ. Manag. 2011, 31, 72–81. [Google Scholar]

- Xing, H.; Gu, J.; Zhang, J. The impact of synergistic agglomeration of two industries on total factor productivity of urban manufacturing industry—Based on endowment difference perspective. East China Econ. Manag. 2021, 35, 72–79. [Google Scholar]

- Chen, Y.W.; Hu, W.M. Price distortions, factor mismatches and efficiency losses: Theory and applications. Economics 2011, 10, 1401–1422. [Google Scholar]

- Huang, D. Financial development and urban total factor productivity growth—An example of 26 cities in the Yangtze River Delta urban agglomeration. Econ. Geogr. 2021, 41, 77–86. [Google Scholar]

- Liu, J.Y.; Woodward, R.T.; Zhang, Y.J. Has carbon emissions trading reduced PM2.5 in China? Environ. Sci. Technol. 2021, 55, 6631–6643. [Google Scholar] [CrossRef] [PubMed]

- Sun, H.; Zanehale, D. The impact of heterogeneous environmental regulations on urban environmental pollution—A study based on static and dynamic spatial Durbin models. East China Econ. Manag. 2021, 35, 75–82. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).